#what is aeps cash withdrawal

Text

How to Grow Your Kirana Store’s Earnings Today?

In today’s rapidly evolving retail landscape, Kirana stores are presented with exciting opportunities to enhance their earnings and customer reach. Leveraging innovative solutions like AEPS cash withdrawal, Bharat Bill Payment Service, and online DTH recharge can transform your Kirana store into a one-stop shop for a diverse range of services. In this blog, we’ll explore these key features and guide you on how to grow your Kirana store’s earnings today!

#aeps cash withdrawal#what is aeps cash withdrawal#aadhaar enabled payment system#Bharat bill payment service for retailers#online DTH recharge#Retailer Mobile recharge portal#domestic money transfer in India

0 notes

Text

AEPS: India's Superhero of Digital Payments

Aadhaar Enabled Payment System (AEPS) is a superhero that came out of the shadows to change the game amid India's digital payment revolution. It's an innovative solution shaking hands with financial transactions across the country, not simply a mouthful of acronyms. Enter the exciting world of AEPS, where you may even flaunt your superhero costume with your Aadhaar card.

AEPS Origin: Creating a Digital Dynamo

On January 10, 2014, the AEPS narrative formally commenced, owing to the brilliant minds at the National Payments Corporation of India (NPCI). They determined it was time to harness the might of Aadhaar, the superhero identity system of India, and presto! When AEPS was founded, financial transactions would be simple.

Important Features: Not Just a Digital Wallet

AEPS is here to satisfy all your financial needs; it refuses to accept mediocrity. It is a one-stop shop for financial adventures, offering everything from cash withdrawals to balance inquiries. What's the hidden component? Your digital adventure becomes a safe and easy adventure when your Aadhaar card is integrated.

Benefits of AEPS: The All-Inclusive Festival

Imagine this: you feel excluded from the digital festivities since you don't have a standard bank account. Do not be alarmed! With its inclusion cape, AEPS swoops in and lets everyone enjoy the celebration. It's free to register, and it's as simple as ordering your favorite snack online! The AEPS service providers ensure that the fiesta is dependable and efficient in addition to being inclusive.

Transaction Charges and Limits: Unlocking the Mystery

Let's speak about numbers now. As with any superhero, AEPS has its limitations. The daily transaction limits dance to various music, and the fees follow suit. Don't worry, though; openness is the key in this situation. Similar to a financial superhero in action, understanding the norms of interaction fosters continued growth in trust.

AEPS: Digital Banking's Marvel

To put it briefly, AEPS blasted onto the Indian digital payment scene in 2014, making an impact akin to a superhero coming to the rescue. It's the most welcoming place in the financial district, not just the easiest to use. AEPS is not simply a milestone; it's the cornerstone forming India's financial future, with a dash of superhero magic, security, and inclusivity. As we advance, the ongoing development and uptake of AEPS hold the potential to be the superpower that completely transforms the world of digital banking.

0 notes

Text

Aadhaar-Enabled Financial Inclusion

Aadhaar Enabled Payment System (AEPS), developed by the National Payments Corporation of India (NPCI), is a payment system that allows customers to perform basic banking transactions like balance inquiries, cash withdrawals, and see their mini bank statements using their Aadhaar from a payRup e-shop via a PoS (microATM).

What is required from a customer for AEPS?

1. Bank account details

2.Aadhaar number;

3.Fingerprint biometrics

Benefits of the Aadhar Enabled Payment System (AEPS)

1) Financial Inclusion: AEPS is made to ensure that the underbanked and unbanked people in isolated places have access to basic banking services.

2) AEPS uses the biometric identity system of India, Aadhaar, to authenticate its transactions. And with the two-step authentication introduced by NPCI, this ensures trustworthiness and safe transactions.

3) Ease of Use: Because AEPS services are user-friendly and require just the customer’s Aadhaar, even people who are unfamiliar with standard banking procedures can carry out financial withdrawals.

To verify transactions or use the AePS facility, your fingerprint must be authenticated with your Aadhaar.

To know more about how to avail of payRup's AEPS services and earn commissions by

Visit eshop.payRup.com. Join payRup eShop now!

0 notes

Text

What is the work of AePS and how does it work?

AEPS (Aadhaar Enabled Payment System) ka kaam hota hai ki Aadhaar card ki madad se logo ko various banking transactions karne ki suvidha pradan karna. Ye transactions cash withdrawal, cash deposit, balance inquiry, fund transfer jaise hote hain. AEPS ka upyog karke log apne bank accounts se judi kai prakar ki transactions ko easily aur securely complete kar sakte hain.

AEPS kaise kaam karta hai, ye niche diye gaye steps ke through samjha ja sakta hai:

Aadhaar Authentication: Sabse pehle, user ko apna Aadhaar number aur transaction type (jaise ki withdrawal, deposit, ya balance inquiry) provide karna hota hai.

Biometric Authentication: Iske baad, user ko apna fingerprint ya iris scan karke apni identity verify karni hoti hai. Isse ensure hota hai ki transaction authorized user dwara hi ki jaa rahi hai.

Transaction Processing: Jab authentication successful hoti hai, user ka request bank ke server tak pahunchta hai. Bank server us transaction ko process karta hai aur account details ke according transaction complete hota hai.

Response: Bank server transaction ko process karne ke baad ek response generate karta hai, jo user tak pahunchta hai. Agar transaction successful hota hai, toh user ko transaction ka confirmation milta hai, aur agar koi error hota hai, toh error message diya jata hai.

AEPS ka upyog karke log bina kisi physical banking channel ke, bas Aadhaar card aur biometric authentication ke madhyam se apne bank accounts se judi transactions ko aasani se kar sakte hain. Ye especially rural areas mein banking services ke accessibility ko improve karne ke liye ek effective tool hai.

0 notes

Text

Aeps Cash Withdrawal Software

Are you thinking to start your own brand Aeps cash withdrawal business as an admin and looking for best Aeps cash withdrawal software then this is no 1.

Yes, I am talking about Ezulix Software, A leading Aeps Software Provider, Offering best standard b2b Aeps admin panel with all bank cash withdrawal services and advanced features.

For more details visit the link now.

#aeps cash withdrawal#aeps software provider#aeps software company#aeps software development#aeps cash withdrawal software

0 notes

Text

How To Do AEPS Transaction?

To perform an AEPS transaction, follow these steps:

Visit a bank or a business correspondent (BC) that offers AEPS services.

Provide your Aadhaar number and bank account details to the BC.

The BC will use a biometric device or micro-ATM to capture your fingerprint or iris scan for authentication.

Once your identity is verified, select the type of transaction (e.g., cash withdrawal, balance inquiry, fund transfer).

Enter the amount and any additional information required for the specific transaction.

Confirm the details and proceed with the transaction.

The BC will process the request and complete the transaction using the NPCI (National Payments Corporation of India) platform.

You will receive a transaction receipt as proof of the successful AEPS transaction.

1 note

·

View note

Photo

What is AEPS Distributorship?

AEPS Distributorship is an upper-level type of Franchisee in the Aadhaar-enabled payment system business that comes after Retailers. A person who is running his business as an AEPS retailer or anyone willing to start his business directly as a distributor can take AEPS Distributorship.

In this franchise segment, the person can add other AEPS retailers under his downline alongside offering cash withdrawal and other banking services powered by Aadhaar enabled payment system.

AEPS distributorship is an ideal option for those who have a vast network in the retail industry and can add multiple retailers. The number here matters since higher the number of retailers, more the earnings. If you also want to go along with this business and earn a decent commission from your downline, then join Dogma Soft Limited as an AEPS retailer.

0 notes

Text

How to start customer service point and earn upto 1 Lakh a Month?

You can bring in great earning opportunities by opening acustomer service pointfor the banks, where numerous significant tasks of banks are easily handled. You can make a decent choice of self-employment by opening aCSP center.

Let us momentarily understand whatcustomer service pointis? And the role of aCSP service provider.

What is Customer Service Point?

The rules of reserve banks opening forCSPshave bought a decent earning opportunity for many. Essential banking services such as account opening, cash deposit, cash withdrawal and many other banking services are provided at these centers.

These centers are made with the goal of reducing the overcrowding in the bank. An increase in government schemes and subsidies has made customers reach banks on a regular basis. To reduce this, banks open their mini-branches as customer service points and give good commissions to theCSP service provider.

What is the Work of CSP Provider?

Customers can visit theCSP pointAND open an account, cash deposit, cash withdrawal, IMPS/money transfer, social security transfer and AEPS/ATM transactions. Not just this, CSPs can also provide FD and RD, Aadhar seeding and loan A/c deposit in mini branch.

Including Side Hustles with CSPs

CSP providercan likewise include other services with their banking services.

For example, a CSP providercan set up a Xerox machine in theCSP center, so that customers don’t have to go around searching an Xerox shop for prints.

Best CSP Business Correspondent:

After nailing it in AEPS,HalliPayhas now made a foray into the financial inclusion sector with India’s largest banks.

Bank of India

Bank of Baroda

SBI (State Bank of India)

Punjab National Bank

Advantage of Becoming CSP Retail Partner with HalliPay:

Trusted source of income from nationalized banks and add smart commissions to your earnings.

High Number of Walk In Customers.

Our professionals are always ready to help and give essential guidance once a customer is ready to proceed with CSP application.

Get your application directly accepted from AGM.

Eligibility & Equipment:

You should have passed intermediate. (10+2)

You should have space for opening a CSP center.

No Unpaid Loans.

You should have a printer (epson PLQ 22CS)

You should have a laptop or system.

You should have a character / Police verification certificate.

Conclusion:

If you are searching for a trustworthy business opportunity with low investment, it isn’t just lucrative yet, it also gives a rewarding experience.

While simultaneously presenting you to the country’s largest banking systems.

HalliPay CSPcan be your best approach in 2022

For more information, CALL NOW:

91 7892186561

Originally published at https://hallipay.com on November 28, 2022.

1 note

·

View note

Text

What exactly is a digital wallet?

Discover the ultimate guide to digital wallets on SoulPay's latest blog. Unveil the intricacies and functionalities of digital wallets, demystifying their importance in the digital realm. SoulPay stands out, combining a digital wallet with local Kirana-like stores, offering services from AEPS cash withdrawal, bill payments, domestic money transfer, indo-nepal money transfer to mobile recharge services. It's a one-stop solution for secure and convenient financial transactions while supporting neighborhood businesses.

0 notes

Text

Simplifying Banking with Aadhaar Enabled Payment System (AEPS)

In today's fast-paced world, managing finances should be simple, secure, and accessible to everyone, regardless of their location. That's where the Aadhaar Enabled Payment System (AEPS) steps in, transforming the way people interact with banking services, especially in areas with limited infrastructure.

AEPS, which stands for Aadhaar Enabled Payment System, is a groundbreaking solution that uses your Aadhaar card, issued by the Indian government, for authentication. With AEPS, you can perform various banking tasks securely and conveniently, all without the need for traditional banking tools like debit cards or remembering complicated PINs.

What makes AEPS so versatile is its ability to cater to a wide range of banking needs. Whether you're a farmer in a remote village needing to withdraw cash or a city dweller looking to transfer funds seamlessly, AEPS has you covered. It's as easy as visiting an AEPS-enabled outlet, verifying your identity with your Aadhaar biometrics, and accessing your funds hassle-free.

One of the standout features of AEPS is its cash withdrawal service. Imagine being able to withdraw cash anytime, anywhere, without having to trek to a distant bank branch or ATM. With AEPS, that's a reality. All you need is your Aadhaar number and biometrics, and you're good to go.

Getting started with AEPS is a breeze too. The registration process is simple and inclusive, ensuring that everyone, regardless of their background, can enjoy the benefits of banking services. Once registered, you link your Aadhaar number to your bank account, opening the door to a world of convenient transactions.

And let's not forget about security. AEPS transactions are not only convenient but also highly secure, thanks to biometric authentication. This added layer of security helps keep your financial information safe and gives you peace of mind.

#banking#finance#fintech#aeps#dmt#business ideas#financial planning#financial#income#india#digital india

0 notes

Text

Fintech Innovations in AEPS

As the financial technology (fintech) landscape continues to evolve, innovative solutions are transforming the way we engage with financial services. PayRup eShop, at the forefront of these advancements, introduces cutting-edge innovations in Aadhaar Enabled Payment System (AEPS), redefining financial transactions for users across the globe.

Key Fintech Innovations in AEPS with PayRup eShop:

Seamless Aadhaar Authentication:

PayRup eShop leverages the power of Aadhaar biometrics for secure and seamless user authentication. With advanced biometric technology, users can conveniently verify their identity, eliminating the need for traditional methods like PINs or passwords.

Anytime, Anywhere Banking:

The convenience of AEPS lies in its accessibility, and PayRup eShop takes this to the next level. Users can conduct banking transactions anytime, anywhere, breaking the barriers of physical branch visits and adhering to traditional banking hours.

Multi-Service Integration:

PayRup eShop goes beyond basic transactions, integrating multiple financial services into a single platform. Users can not only withdraw and deposit cash but also access a range of financial products and services, creating a comprehensive fintech ecosystem.visit us : https://eshop.payrup.com/

Secure Transactions with Biometric Encryption:

Security is paramount in financial transactions, and PayRup eShop ensures a high level of protection. Biometric encryption, combined with advanced security protocols, guarantees that each transaction is secure and tamper-proof.

User-Friendly Interface:

The user interface of PayRup eShop is designed with simplicity in mind. Whether you are a tech-savvy individual or someone new to fintech, the intuitive interface ensures a smooth and user-friendly experience.

Real-Time Transaction Tracking:

PayRup eShop provides real-time tracking of transactions, giving users instant updates on their financial activities. This transparency empowers users with visibility and control over their transactions, fostering trust in the fintech platform.

Digital Inclusion Initiatives:

PayRup eShop is committed to fostering financial inclusion. By leveraging AEPS technology, PayRup empowers individuals who may not have access to traditional banking services, bringing them into the digital financial ecosystem.

Personalized Financial Insights:

The platform goes beyond transactions by offering personalized financial insights. Users can access analytics and recommendations tailored to their financial behavior, helping them make informed decisions about their money.

Conclusion:

PayRup eShop emerges as a trailblazer in fintech, revolutionizing AEPS with a blend of advanced technology and user-centric design. Through seamless Aadhaar authentication, anytime banking, and a myriad of integrated services, PayRup eShop sets a new standard for secure, convenient, and inclusive financial transactions. Join the fintech revolution with PayRup eShop, where innovation meets financial empowerment.

Final Thoughts…

Popular bill payment facilities are available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’ payments Payrup has it all covered for our users under one roof.Curious about Refer & Earn program visit https://payrup.com/blogs/what-does-refer-earn-in-payrup-mean !

0 notes

Text

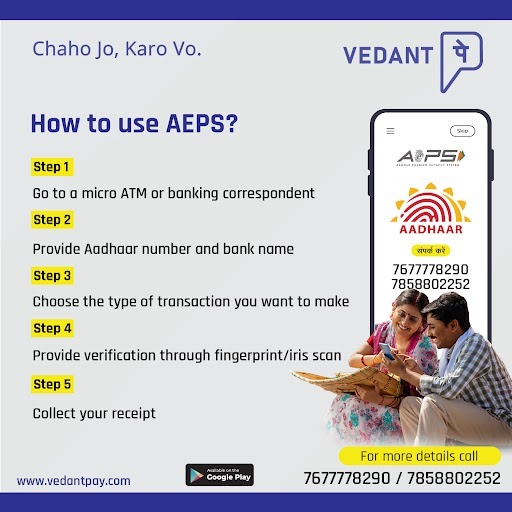

Vedant Pay | What it is and what it does?

Vedant Pay is a payment-based business vertical of Vedant Asset Ltd. Founded in 2022, it provides services similar to a bank through its mobile app, which is available on the Android platform and is coming soon for iOS. For this purpose, it has entered into agreements with Yes Bank, Bank of India, Jharkhand Rajya Gramin Bank, and Madhya Pradesh Gramin Bank. Its purpose is to provide banking services to the unbanked areas of India. With the slogan of ’Chaho Jo, Karo Wo’, it is operating in villages and semi-urban areas of Jharkhand and Madhya Pradesh. As a customer, all you have to do is to go to a Business Correspondent (B.C.) of Vedant Pay and a wide range of services will be provided to you.

SERVICES PROVIDED BY VEDANT PAY MOBILE APP

Aadhar Enabled Payment System (AEPS): Any person with a bank account and an Aadhar Card number can perform various banking functions, such as cash withdrawal up to Rupees 50,000, balance inquiry, cash deposits, fund transfers, cash withdrawals, balance inquiry, eKYC-based bank account opening, etc. For doing these activities, the bank’s ATM card is not required to be carried by the customer, as everything can be done with the help of the Aadhar Card itself.

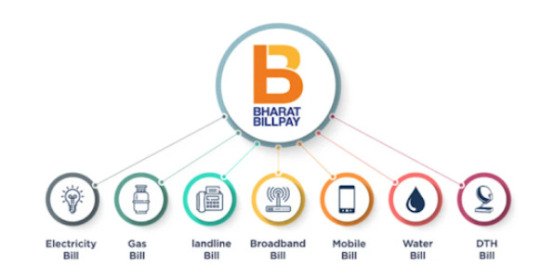

Bharat Bill Payment System (BBPS): This facility enables a customer to make utility bill payments, such as electricity bills, gas cylinder refilling, water bills, landline bills, postpaid connections, data cards, mobile data packs, etc. All these payments can either be done directly by the customer through the Vedant Pay app or with the help of our network of agents. Multiple payment modes, such as online banking, UPI, account transfer, etc. are provided in the app and instant confirmation for the success of the transaction is provided in the app. The interface of Axis Bank’s website is used for providing services of AEPS and BBPS to the customers on PC.

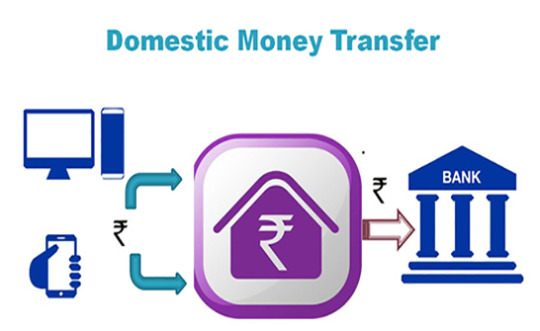

Domestic Money Transfer (DMT): With Vedant Pay, you need not have to worry if you want to transfer money to anyone. You can transfer money to another person with a bank account and an Aadhar Number in a safe and secure manner via Vedant Pay mobile app. The maximum amount transferable at once is Rupees 5000. Also, a maximum of Rupees 50,000 can be transferred through the app to one person in one day. This facility is available to customers 24 hours a day and 365 days a year, meaning that customers can make fund transfer even on Sundays and bank holidays. There is instant confirmation of transactions through SMS sent to customers. Moreover, these facilities can be availed by the customers at the doorstep of their homes, by going to any Business partner of Vedant Pay, or by visiting any branch of Fino Payments Bank or selected merchant establishments. The customer’s account can be in any scheduled commercial bank in India. A bank charge of 1% of the value is payable by the customer on each transaction.

Mobile and DTH Recharge: Now, prepaid mobile connections and Direct-to-Home can be recharged with the Vedant Pay app itself. An attractive commission can be earned by customers for doing these recharges. The latest and upcoming offers can also be availed on our app as a result of doing the recharge. All the mobile operators and DTH companies of India are supported by our app for doing recharge.

Micro ATM: The purpose of this device is to take banking to the unbanked regions of India. A small, portable, micro-ATM machine is given to the business correspondent (BC) of Vedant Pay, from which he or she can provide ATM services to the customers. Any person wanting to withdraw money goes to our BC with his ATM card. BC connects the ATM card to the mATM machine and gives it to the customer for filling in a secret 4-digit PIN and the amount to be withdrawn. After that, the retailer gives that money to the customer. Cards of Rupay, Visa, and Master, related to any scheduled commercial bank of India are acceptable on these machines. Bluetooth-based connectivity is provided on these devices. A minimal amount is chargeable as fees for the setup of the device. After that, no amount is charged to the user or customer for using this device. In this way, a robust and efficient payment solution is provided through the micro-ATM.

mPOS: Mobile Point-of-Sale (POS) works on the micro-ATM machine, whose details are mentioned above. mPOS machines are available with retailers, to whom customers not carrying cash with them come, swipe their Debit or Credit card, and make the payment of bill amount for the purchase of goods. In return for making this transaction, the retailer is charged a small amount as fees based on a fixed percentage of the amount. Debit and credit cards of all scheduled commercial banks of India are accepted in this machine.

Tour and Tickets: Vedant Pay has a tie-up with I.R.C.T.C. for providing travel booking services. We also make travel plans for our customers, based on their demands

PAN-related Services: Services related to P.A.N. cards are also provided by Vedant Pay. These include linking PAN with Aadhar Card, making applications for new PAN cards, services of ePAN, etc. For the services of insurance, travel and ticketing, and PAN card, a separate ID and password are provided to the customers, to distinguish them from other services of Vedant Pay.

BENEFITS OF VEDANT PAY

To Retailers:

They can provide quasi-banking services to their customers.

2. They can operate from a small shop or even their homes.

3. Much elaborate setup or a lot of money is not required for starting this business.

4. They can arrange a stable source of income for themselves.

5. They can connect themselves to Vedant Pay, and through that to Vedant Asset Ltd, and can avail of various incentives provided by our company from time to time.

To Customers:

They don’t need to stand in long queues outside ATM machines for receiving money, and just have to go to a Vedant Pay BC for withdrawing their money from their bank account.

2. They can avail of many services similar to a bank from our Vedant Pay app, such as opening a bank account through e-KYC, withdrawal, and deposit of money, fund transfer to their near and dear ones, balance enquiry, mini statement, etc.

3. They only need to have a bank account linked with Aadhar, a Credit card or Debit-cum-ATM card, and/or Aadhar Card to fulfill their cash-related needs through Vedant Pay.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibänk#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia

1 note

·

View note

Text

Aadhaar-Based Banking

Aadhaar Enabled Payment System (AEPS), developed by the National Payments Corporation of India (NPCI), is a payment system that allows customers to perform basic banking transactions like balance inquiries, cash withdrawals, and see their mini bank statements using their Aadhaar from a payRup e-shop via a PoS (microATM).

What is required from a customer for AEPS?

1. Bank account details

2.Aadhaar number;

3.Fingerprint biometrics

Benefits of the Aadhar Enabled Payment System (AEPS)

1) Financial Inclusion: AEPS is made to ensure that the underbanked and unbanked people in isolated places have access to basic banking services.

2) AEPS uses the biometric identity system of India, Aadhaar, to authenticate its transactions. And with the two-step authentication introduced by NPCI, this ensures trustworthiness and safe transactions.

3) Ease of Use: Because AEPS services are user-friendly and require just the customer’s Aadhaar, even people who are unfamiliar with standard banking procedures can carry out financial withdrawals.

To verify transactions or use the AePS facility, your fingerprint must be authenticated with your Aadhaar.

To know more about how to avail of payRup's AEPS services and earn commissions byVisit eshop.payRup.com. Join payRup eShop now!

0 notes

Text

What are the Recommendable Features of AEPS?

Here is the list of top features of b2b AEPS software that you can't ignore when you are looking for an AEPS software portal for admin business.

Customized Handling

Secure Banking

Support to All Banks

All in one App

Extended Cash Withdrawal Limit

UPI Collection

Fully Customized AEPS Portal

Admin Control Panel

Analytic Reporting

Service On/Off in Single Tap

24*7 Real-Time Settlement

For more details about AEPS, its benefits visit my blog now. You can also request a free demo of AEPS software.

#aeps software#aeps portal#aeps transaction#aeps company#aeps payment#aeps service#aeps through aadhaar verification#aeps banking#aadhaar banking

1 note

·

View note

Text

What is FINTECH-AS-A-SERVICE: Future of Financial Solutions

Fintech refers to the innovation of technology to improve and automate financial transaction services. Fintech startups have been disrupting the traditional banking industry by offering innovative and user-friendly digital solutions. One of the latest trends in fintech is the emergence of Fintech as a Service (FaaS), which allows businesses to integrate financial services into their platforms.

FAAS provides a wide range of services including AEPS balance check & AEPS cash withdrawal, an online recharge portal for retailers, online DTH recharge, BBPS service, online flight ticket booking, Micro ATM services, and assistance with money transfers from India to Nepal.

Read More at- https://www.soulpay.in/blogs/what-is-fintech-as-a-service-future-of-financial-solutions/

#fintech service#fintech#consumer#retailer business idea#Soulpay#digitalvypari#ticketbooking#flightbooking#business ideas

0 notes

Text

Highlighted Points of Aadhaar Withdrawal?

AEPS or Aadhaar Enabled Payment System is a payment service that uses Aadhaar card details for authentication and enables transactions through Aadhaar-linked bank accounts. AEPS cash withdrawal is a service provided by banks where customers can withdraw cash using their Aadhaar card and biometric authentication. Some key points about AEPS cash withdrawal are:

AEPS cash withdrawal is a secure and convenient way to withdraw cash without the need for a physical debit card or PIN.

To avail of AEPS cash withdrawal services, customers need to link their Aadhaar card to their bank account.

The biometric authentication is done through fingerprint recognition or iris scan, which ensures secure and accurate identification of the customer.

AEPS cash withdrawal can be availed at any AEPS-enabled bank branch or business correspondent (BC) outlet.

The maximum amount that can be withdrawn through AEPS cash withdrawal is Rs.10,000 per transaction.

AEPS cash withdrawal charges are usually lower than charges for using an ATM or visiting a bank branch.

AEPS cash withdrawal can be used by anyone who has an Aadhaar card and a linked bank account, making it a useful service for people who do not have access to traditional banking facilities.

Overall, AEPS cash withdrawal is a convenient and secure way for customers to withdraw cash using their Aadhaar card and biometric authentication.

If you are looking for the best AEPS service provider company in India to start your own AEPS business, you can choose Ezulix software as the No 1 AEPS company in India.

#aeps cash withdrawal#aeps cash withdrawal meaning#aeps cash withdrawal limit#aeps service#aeps service provider#aeps company

1 note

·

View note