#aeps banking

Text

AEPS stands for an Aadhaar-enabled payment system. Started by the national payment corporation of India to bring all sectors of society into the same financial landscape. Now anyone can perform basic banking transactions easily without going bank or ATM, using Aadhaar authentication. AEPS service empowered digital society in India. Check out along with basic banking transactions, where you can use AEPS effectively?

1 note

·

View note

Text

instagram

#OmegaSoftwares#AadhaarPay#AadhaarATM#Retail#Business#India#AEPS#DigitalBanking#EmpowerGrowth#finance#innovation#aepsservice#developmentfinance#Dombivli#dombivliwest#dombivlieast#CustomSoftwareDevelopment#thane#payout#kalyancity#bank#banking#Instagram

0 notes

Text

Sending Money Made Easy: Your Essential Guide to Domestic Money Transfers

In today's fast-paced world, the need for quick and convenient domestic money transfers has never been more crucial. It may save you time and guarantee smooth transactions whether you're paying bills, transferring money to relatives, or splitting costs with pals by being aware of how domestic money transfers operate.

Understanding Domestic Money Transfers Basics

Electronic money transfers inside the same nation are referred to as domestic money transfers. Traditional practices, such as writing checks or going in person to banks, have become less common due to technological improvements. Instead, the preferred instruments for easy transactions are now digital wallets, smartphone applications, and internet platforms.

Select the Platform wisely

Simplifying domestic money transfers starts with choosing the appropriate platform. Popular choices include banks, specialist money transfer services, and internet payment gateways. Banks provide stability and security, but their costs might be greater. Although they are easy to use, online payment methods like PayPal and Venmo might not be accepted everywhere. Money transfers are the focus of specialized businesses like MoneyGram and Western Union, which offer accessibility and ease.

Setting up Your Account

After selecting a platform, creating an account is a simple procedure. Usually, you'll have to confirm your identification, link your bank account or credit card, and submit personal information. Security protocols are used to safeguard your private data and guarantee the integrity of your transactions.

Start of a Transfer

It only takes a few clicks or taps to start a transfer once your account is set up. Input the recipient's information, such as name, contact details, and bank account information. You might be able to transfer money using merely the recipient's phone number or email address on some sites. Once you've verified the amount you want to send and looked over the transaction information, you may proceed.

Verifying and Monitoring

You should receive a confirmation email or message after starting the transfer. This attests to the fact that we have received and are handling your request. Additionally, a lot of platforms include monitoring tools that let you keep an eye on the progress of your transaction in real-time. For time-sensitive transfers, this openness provides an additional degree of confidence.

In a recap

The days of standing in huge lineups at the bank to send money domestically have changed. Nowadays, it's a simple process that just requires a few smartphone touches to finish. Domestic money transfers may be easy if you select the appropriate platform, create an account, and follow the easy instructions to start a transfer. Accept the ease of contemporary technology and manage your money with these crucial pointers for seamless transactions.

0 notes

Text

#core banking solution providers#banking solutions#enterprise solutions services#digital payment solution#financial software companies#aeps software provider#banking as a service provider

0 notes

Text

AePS ke bare me ek choti si jankari

आज मैं आपको बताने जा रहा हु एक AePS यानि आधार कार्ड से नकद निकाशी करने के बिज़नेस के बारे में

आपने डेबिट कार्ड से विभिन बैंको के एटीएम से पैसे निकलते हुए सुना होगा लेकिन NPCI यानि नेशनल पेमेंट कोरोपोरशन ऑफ़ इंडिया ने २०१६ में आधार कार्ड के नंबर लगा के आप अपने बैंक अकाउंट से नकद निकाशी कर सकते है

इसके लिए पूरी प्रक्रिया इस प्रकार है

सबसे पहले आपको आधार कार्ड से नकद निकाशी करने वाले सेण्टर का पता लगाना होगा| आजकल ज्यादातर डिजिटल सर्विस पॉइंट जैसे ईमित्र, csc सेण्टर, बैंक मित्र या कोई रोजगार सेण्टर पर आसानी से उपलब्ध है ये सेण्टर विभिन प्राइवेट कंपनी के पोर्टल पर अपना रजिस्ट्रेशन करते है और अपनी eKYC के माद्यम से बैंकिंग का ये पोर्टल एक्टिव करवाते है | इस तरह की बहुत सी कंपनी मार्किट में है जैसे Payrock एक प्रमुख कंपनी है

आधार से नकद निकाशी करने के लिए हमे आधार विथड्रावल सेण्टर पर जाना होगा और ओपेरटर को आधार कार्ड देना है और अमाउंट बताना है जो हम निकाशी करना चाहते है | हम Payrock कंपनी की aeps सर्विस के माध्यम से बैलेंस इन्क्वायरी, मिनी स्टेटमेंट और आधार से नकद जमा भी करवा सकते है

इस पोर्टल को उसे करके अगर आप भी अपना बिज़नेस स्टार्ट करना चाहते है तो आप इनकी ऑफिसियल वेबसाइट पर जेक रजिस्टर कर सकते है जिसका टोटल चार्ज 1700 रुपये है जिसमे आपको सबसे ज्यादा कमीशन और एक डिवाइस भी प्रोवाइड करवाया जाता है

1 note

·

View note

Text

Zambo is a AEPS Service Provider with a robust platform for Aadhaar enabled Payment System which offers all types of banking transactions.

#AEPS#AEPS Portal#AEPS Login#AEPS Agent Registration#AEPS Service Provider Company#AEPS Service Provider#Aadhar Banking Services#Aadhaar Enabled Payment System

0 notes

Text

AEPS Agent Registration: A Comprehensive Guide

To utilize the AePS facility, agents who assist customers in their transactions are obligated to register themselves on the admin portal, which is known as the AePS agent registration. However, this registration process is comparatively more complex than other services as agents have to pass through several security checks to ensure their authenticity.

1 note

·

View note

Text

#digitalpayments#cashless#UPI#financialinclusion#bankingtechnology#paymentsolution#AEPSIndia#fintechIndia#cashlesseconomy#paymentgateway#bankingsector#financialservices#IndiaFinance#AEPS#banking#fintech#India

0 notes

Text

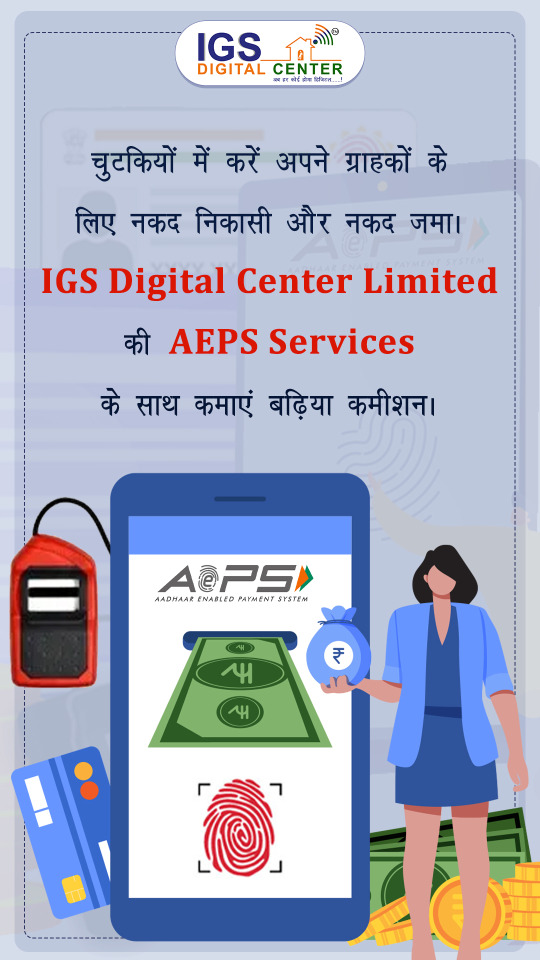

Why would people look for a bank when you have IGS Digital Center for all your banking needs? Aadhaar Enabled Payment Service (AEPS), uses Aadhaar data and biometric authentication instead of customers' signature or debit card information and allows them to withdraw, deposit and transfer cash quickly. Hence, instead of looking for an ATM or bank branch, customers can visit their nearest IGS Digital Center and do all these transactions using their Aadhaar data and biometric authentication.

1 note

·

View note

Text

What are the advantages of using EDHA?

As a financial service provider company EDHA Money Serves the nation with the fastest online payment solution for rural India. Here, distributors, retailers and consumers are connected with a safe and secure business chain.

#edhamoney#banking services#digital transactions#financial services#aeps#miniatm#mobile recharge#insurance#investment

0 notes

Text

How can I carry out bank transactions using AEPS?

If you did not know, you could use your Aadhaar card to conduct bank transactions. The National Payment Corporation of India (NPCI) has created an Aadhaar Enabled payment system (AEPS) for people to let them enjoy Digital India.

AEPS has enabled the masses to go to a certified AEPS service provider company and complete any financial transaction. All you need is an Aadhaar card, and you can use it for balance inquiry and for a mini statement as well. All you need to do is reach NPCI authorized retailer like Soulpay and use your Aadhaar card for money withdrawal.

0 notes

Text

What are the Recommendable Features of AEPS?

Here is the list of top features of b2b AEPS software that you can't ignore when you are looking for an AEPS software portal for admin business.

Customized Handling

Secure Banking

Support to All Banks

All in one App

Extended Cash Withdrawal Limit

UPI Collection

Fully Customized AEPS Portal

Admin Control Panel

Analytic Reporting

Service On/Off in Single Tap

24*7 Real-Time Settlement

For more details about AEPS, its benefits visit my blog now. You can also request a free demo of AEPS software.

#aeps software#aeps portal#aeps transaction#aeps company#aeps payment#aeps service#aeps through aadhaar verification#aeps banking#aadhaar banking

1 note

·

View note

Text

instagram

#ओमेगा_सॉफ्टवेअर्स#AEPS#फिनटेक#B2B#बँकिंग#सुरक्षितलेनदेन#ग्राहकसमर्थन#OmegaSoftwares#Fintech#MUMBAI#punecity#Banking#SecureTransactions#dombivlieast#KALYAN#Instagram

0 notes

Text

Simplifying Banking with Aadhaar Enabled Payment System (AEPS)

In today's fast-paced world, managing finances should be simple, secure, and accessible to everyone, regardless of their location. That's where the Aadhaar Enabled Payment System (AEPS) steps in, transforming the way people interact with banking services, especially in areas with limited infrastructure.

AEPS, which stands for Aadhaar Enabled Payment System, is a groundbreaking solution that uses your Aadhaar card, issued by the Indian government, for authentication. With AEPS, you can perform various banking tasks securely and conveniently, all without the need for traditional banking tools like debit cards or remembering complicated PINs.

What makes AEPS so versatile is its ability to cater to a wide range of banking needs. Whether you're a farmer in a remote village needing to withdraw cash or a city dweller looking to transfer funds seamlessly, AEPS has you covered. It's as easy as visiting an AEPS-enabled outlet, verifying your identity with your Aadhaar biometrics, and accessing your funds hassle-free.

One of the standout features of AEPS is its cash withdrawal service. Imagine being able to withdraw cash anytime, anywhere, without having to trek to a distant bank branch or ATM. With AEPS, that's a reality. All you need is your Aadhaar number and biometrics, and you're good to go.

Getting started with AEPS is a breeze too. The registration process is simple and inclusive, ensuring that everyone, regardless of their background, can enjoy the benefits of banking services. Once registered, you link your Aadhaar number to your bank account, opening the door to a world of convenient transactions.

And let's not forget about security. AEPS transactions are not only convenient but also highly secure, thanks to biometric authentication. This added layer of security helps keep your financial information safe and gives you peace of mind.

#banking#finance#fintech#aeps#dmt#business ideas#financial planning#financial#income#india#digital india

0 notes