#which is best demat account

Text

Are you looking for a hassle-free and convenient way to invest your hard-earned money? Look no further than Demat accounts! With the rise of technology, investing has become more accessible and straight forward than ever before. But with so many options available, it can be challenging to find the right one for you. That's why we've created this comprehensive guide to help you navigate through the best Demat accounts in India and make informed investment decisions that pay off in the long run. So sit back, relax, and let's dive into Investing Made Easy

#best demat account#best demat account in india#best demat account india#which demat account is best#best demat account in india 2022#which is best demat account#which demat account is best in india#which is the best demat account#which bank is best for demat account#demat account#what is demat account#trading account#demat#icici demat account

2 notes

·

View notes

Text

Are you looking to start investing in the Indian stock market but don't know where to begin? Look no further! Investing has been made easy with demat accounts, and we've put together a comprehensive guide on the best demat accounts available in India. Whether you're a beginner or an experienced investor, this guide will provide all the information you need to make informed decisions about your investments. So, let's get started on your journey towards financial freedom!

#best demat account#best demat account in india#best demat account india#which demat account is best#best demat account in india 2022#which is best demat account#which demat account is best in india#which is the best demat account#which bank is best for demat account#what is demat account#trading account#icici demat account#icici direct#stock market#hdfc securities#angel broking

0 notes

Text

Can govt employee invest in share market 2023

Can govt employee invest in share market?

Can govt employee invest in share market?Investing in the Share Market: A Comprehensive Guide for Government EmployeesIntroductionUnderstanding the Share MarketAssessing Your Financial GoalsInvestment Options for Government EmployeesAdvantages of Investing in the Share MarketMitigating Risks in the Share MarketTax Implications for Government…

View On WordPress

#apy comes under which section#best government investment schemes#best monthly saving scheme in india#best saving scheme#best scheme to invest money#can a government employee do business#can a government employee do trading#can a government employee invest in share market#can a government employee invest in stock market#can a govt employee do business#can government employee do business#can government employee do business in india#can government employee do intraday trading#can government employee do trading#can government employee invest in mutual funds#can government employee invest in stock market#can government employee open demat account#can government employees invest in stocks#can government employees trade in share market#can govt employee do trading#can ias invest in stock market#government investment schemes#government investment schemes with high returns#government jobs in stock market#government schemes for private employees#government sip plans#govt investment schemes#how can i show sukanya samriddhi yojana for tax exemption#i have 50000 rs where to invest#list of government investment schemes

0 notes

Link

If you’re looking to invest in the Indian stock market, a Demat account is a must-have. A Demat account, short for Dematerialized account, is an electronic account that holds all your securities in a digital format, eliminating the need for physical share certificates. With the rise of technology, many brokerage firms now offer online Demat accounts to make the process of buying and selling shares seamless. In this article, we’ll take a closer look at the best Demat account in India, and how to choose the right one for your needs.

0 notes

Text

12 Safe Investment options with high returns in India?

Investment plans typically assist you in achieving your life goals if you select them by your financial plan. Regardless of your financial goal’s duration, take your financial milestones into account while selecting a plan.

Let’s have a look at the best Indian investment opportunities listed below.

Direct Equity- Stocks: For investors who are willing to take risks, direct equity stocks are among the greatest choices. Direct equity investment is the process of purchasing listed equity equities of businesses on stock exchanges. Direct stock investments can yield either dividends or capital gains. Stock performance is influenced by a variety of factors, including firm success and market position.

A. This option has a high risk-return ratio and is among the most volatile investments.

B. Among the greatest ways to invest money to grow wealth adjusted for inflation

C. appropriate for a lengthy time frame

Having both a bank account and a Demat account is necessary to begin investing in this. A high-risk appetite is also necessary if you wish to continually invest in stocks and profit from them. Before beginning an investment, familiarize yourself with how equity stocks and markets operate.

2. Equity Mutual Funds: The main asset class of equity mutual funds is equity stocks and related instruments. These are among the greatest investment choices available in India for little individuals hoping to gain from the expansion of the equity market. With equities mutual funds, you can begin investing with as little as Rs 500 to start building well-diversified portfolios of equity companies.

Between 70 and 95 percent of the fund value may be allocated to equities stocks and similar securities by these funds. Due to their equity basis, these provide a high ratio of risk to return. Mutual funds that offer equity often fall into two categories:

a. Actively managed Mutual Fund: The fund manager is quite involved with these kinds of funds. The success of this fund is significantly influenced by the knowledge and skills of the fund management. They do research and analysis before selecting the stocks in which the fund will invest. Passive investment alternatives are seen as less risky than active funds.

b. Passively managed mutual funds: A large role is not played by the fund management in this kind of fund. The fund is predicated on a specific market portfolio or index. As an illustration, consider a fund composed of NIFTY50 stocks, etc. The performance of this fund is determined by the index’s performance.

3. Equity debt Funds: If you want to minimize volatility or don’t have a strong risk appetite, you might want to look into debt mutual funds or bond funds as investment options. These fixed-income instruments are also part of a diversified portfolio.

Debentures, corporate and government bonds, as well as other long-term fixed-income instruments, make up the amount invested in Debt Funds. Funds might have different risk profiles depending on the kind of securities they own in their portfolio. Prior to investing, you should evaluate the risk by looking up the ratings of the assets the fund owns.

If you desire the steadiness of returns with less risk, funds that hold government bonds or highly rated securities are appropriate. Therefore, you may think about debt funds when:

You avoid taking chances.

Relatively fixed returns are what you seek.

The principal’s safety comes first.

Keep in mind that all debt funds will still be subject to interest rate risk.

4. National Pension Scheme: One investing plan backed by the government that can help you protect your retirement is the National Pension System. The Pension Fund Regulatory and Development Authority (PFRDA) is in charge of regulating it.

This assists you in building a substantial retirement fund that you can use. As an investor who works for yourself or is salaried, you can use the NPS retirement account.

Two varieties of NPS accounts exist.

Retirement Account, Tier-I

Level II

The ability to aggressively grow your corpus is the main distinction between NPS and other provident fund investments. It uses an auto-rebalancing strategy to keep your portfolio risk-free as you become older. You can also receive a deduction for your contribution of up to Rs 2 lakhs.

The portfolio mixes you select and the duration of your investment will determine the risk-return on your NPS investment. Therefore, both risk-averse and aggressive investors can benefit from this retirement investment option.

5. Public Provided Funds: When looking for safe investment options to place their money in, PPF is one of the most well-liked and greatest options. The ideal investing plan for successfully reaching your long-term goals is the 15-year plan. The plan, which was first presented as a secure retirement investment option for independent contractors, has gained popularity among long-term investors since it offers:

Tax Effectiveness

Section 80C allows you to deduct up to Rs. 1.5 lakhs. The maturity value is tax-free as well.

Availability of liquid assets

During the first five years of the account, you are able to borrow against the accrued corpus. Partial withdrawals are permitted after five years.

A mix of Risk and Return

low-risk investment with an annual rate of return that is linked to the market.

Investment period

Minimum Investment Period of 15 Years; thereafter, accounts may be extended in 5-year increments.

6. Bank Fixed Deposit: Another well-liked investment choice in India that guarantees the security of your funds and yields consistent returns is a bank fixed deposit. A set rate of interest will be provided for a predetermined period of time when you invest a lump sum amount. You will get the principal amount plus any compound interest accrued during the term when your term expires.

When investing in a bank fixed deposit, take into account the following:

Returns on bank FDs are guaranteed. The principal sum is therefore secure.

Your FD cannot be withdrawn until it matures. You risk paying penalties and missing out on compound interest if you withdraw before the term is up.

These are among India’s most adaptable investing choices. The duration of the investment can range from seven days to ten years.

In a bank savings account, the initial interest rate will be maintained for the duration of the agreement. As a result, your deposit’s return is set until it matures.

The interest can be reinvested or received.

Upon maturity, banks also let you have your FD automatically renewed.

7. Senior Citizen Saving Scheme: The Senior Citizen Savings Scheme, often known as SCSS, is one of the investment choices that assists participants in reaching their retirement objectives by providing a steady stream of income. You can make a lump sum investment in this scheme after reaching 60. It is one of the possibilities for small savings investments. Every quarter, you will be paid a fixed interest amount.

There are two ways to create a SCSS account:

through the post office

Through Bank

Seniors find it to be a very popular investment option because of its attractive and guaranteed returns. As of Q3 FY 2022-23, the rate of returns is 7.6%. There will be a quarterly adjustment to these rates.

Here are some SCSS characteristics to be aware of:

If you are older than sixty, you can invest in it. Those who have participated in the VRS (Voluntary Retirement Scheme) and are above 55 are also eligible to apply.

Rs 1000 is the minimum investment, meaning that you must deposit an amount greater than or equal to Rs 1000.

A maximum of Rs 15 lakh can be invested. This is the maximum amount that you can invest.

Interest is given out on a quarterly basis.

The five-year maturity term has the option to be extended by an additional three years.

8. Unit Linked Insurance Plans: Because it offers both insurance and a channel for investment, a Unit Linked Insurance Plan (ULIP) might be seen as an investment choice. The policyholder pays a portion of the premiums toward the life insurance and another portion toward the funds of their choice. Given that this life insurance plan delivers market-linked returns, a prospective investor should consider the plan’s advantages and disadvantages before making an investment.

A ULIP that provides both market-linked returns and life insurance is Canara HSBC Life Insurance Invest 4G. There are eight fund alternatives available, each with a partial withdrawal option.

9. Real estate Investment: In India, real estate is a wise choice for investors. But typically, it’s a significant financial commitment. Purchasing real estate, including houses, land, and plots, is referred to as investing. One of the finest ways to fight inflation with investments is to do this. You may be able to make both regular and capital gain income by investing in this.

You can generate additional revenue by renting out the building you recently bought. This will guarantee that you receive returns each month in the form of rent. You can sell your property for more money and make a capital gain if it has appreciated in value.

There is a well-known proverb that states that “location, location, location” are the three most crucial factors in real estate. This is the main element that determines whether or not your real estate investment is successful.

Although real estate in a prime location can be pricey, it also has higher potential for appreciation and can fetch a higher rent.

10. RBI Bonds: One of the safest investment alternatives available in India are RBI Bonds. To generate funds for the advancement of various government programs, the Reserve Bank of India, or RBI, issues bonds to the general public. There is a word attached to these bonds. Money is refunded along with interest earned upon maturity.

These bonds are available for purchase from four private banks as well as all twelve national chains. The RBI will give you a certificate of holding in recognition of your debt. Upon maturity, this certificate will serve as evidence.

These are for a period of seven years.

These can be non-cumulative, in which the interest is paid out as a regular income, or cumulative, in which the money is reinvested.

11. Pradhan Mantri Vaya Vandana Yojana: Seniors, particularly individuals 60 years of age and over, have access to investing choices such as the Pradhan Mantri Vaya Vandana Yojana (PMVVY). After sixty years of age, it provides you with a steady source of income.

It has a longer validity period but still offers interest at a rate of 7.4% annually. This is the current interest rate, good through March 31, 2023.

The following are some qualities of PMVVY that could make you think about making this investment:

Pension payable on a quarterly, annual, or monthly basis

It will mature in ten years.

You can invest a maximum of Rs 9250 per month, and a minimum of Rs 1000 is required.

If you have owned this for more than three years, you can use it to offset loans up to a value of 75%.

12. Gold: In India, gold is frequently seen as the best investment choice for safeguarding a family’s legacy. However, purchasing gold as a family heirloom is now nearly impossible due to growing expenses and fees.

Alternatively, you can steadily increase your gold purchasing power over time by using investing choices like Gold ETFs. They are referred to as “paper gold” in general. It includes investments and gold stocks. In contrast to pricey gold, they can be purchased from the stock market based on your financial situation.

This is an Exchange Traded Fund (ETF), which means it is managed passively. It is a reflection of the real gold price movement of the same caliber. The NAV of the ETF will increase in tandem with rising gold rates.

0 notes

Text

Navigating Stock Market Education: Choosing the Best Course and Getting Started on Your Stock Market Journey

Embarking on a journey into the world of stocks can be both exciting and daunting, especially for beginners looking to gain a deeper understanding of the intricacies of the stock market. Fortunately, there is a plethora of stock market courses available, each offering valuable insights and knowledge to help individuals navigate the complexities of investing. As you embark on your quest for the best stock market course in Ahmedabad and begin studying stocks, it's essential to choose the right educational resources and adopt a structured approach to learning. Let's explore the options for stock market courses and outline steps to kickstart your journey into the world of stocks.

Which is the Best Stock Market Course?

When it comes to selecting the best stock market course in Ahmedabad or any other location, it's essential to consider several factors to ensure it aligns with your learning goals, preferences, and level of expertise. Here are some key aspects to keep in mind when evaluating stock market courses:

1. Curriculum and Content:

Look for courses that offer comprehensive coverage of essential topics such as stock market basics, technical and fundamental analysis, investment strategies, risk management, and portfolio construction. The course curriculum should be well-structured, easy to follow, and include practical examples and case studies to enhance learning.

2. Instructor Expertise:

Assess the credentials and experience of the course instructors or facilitators. Ideally, they should have a solid background in finance, investment management, or stock trading, along with a track record of success in the stock market. Look for courses led by industry experts who can offer valuable insights and practical knowledge.

3. Reviews and Testimonials:

Seek feedback from past participants or students who have completed the course. Positive reviews and testimonials can provide valuable insights into the course quality, relevance, and effectiveness in helping learners achieve their investment goals.

4. Mode of Delivery:

Consider the format and delivery method of the course, whether it's in-person classes, online webinars, self-paced modules, or a combination of both. Choose a format that fits your schedule, learning style, and preferences for flexibility and interactivity.

5. Cost and Value:

Evaluate the cost of the course relative to the value it offers in terms of knowledge, skills, and potential returns on investment. While cost is an important consideration, prioritize courses that provide high-quality education and actionable insights that can help you make informed investment decisions.

How Do I Start Studying Stocks?

Once you've chosen the best stock market course in Ahmedabad or your preferred location, it's time to kickstart your journey into the world of stocks. Here are some steps to help you get started on studying stocks:

1. Educate Yourself:

Begin by familiarizing yourself with the basics of stocks, including terminology, market dynamics, and investment principles. Take advantage of educational resources such as books, online articles, tutorials, and podcasts to expand your knowledge base.

2. Enroll in a Stock Market Course:

Enroll in a reputable stock market course that aligns with your learning goals and preferences. Follow the course curriculum diligently, participate actively in discussions and exercises, and seek clarification on any concepts or topics that are unclear.

3. Open a Demat Account:

To start investing in stocks, you'll need to open a Demat account with a registered stockbroker or brokerage firm. A Demat account allows you to hold and trade securities in electronic form, making it convenient and secure to buy and sell stocks.

4. Practice with Virtual Trading:

Consider using virtual trading platforms or stock market simulators to practice trading stocks with virtual money. Virtual trading provides a risk-free environment to hone your skills, test different investment strategies, and gain practical experience without risking real capital.

5. Stay Informed:

Stay updated with market news, trends, and developments by following financial news outlets, market reports, and analyst recommendations. Keep a watchful eye on stock prices, company earnings, and economic indicators that may impact the market.

6. Start Investing with Caution:

As you gain confidence and knowledge, consider starting with small investments and gradually increase your exposure to stocks. Diversify your investment portfolio across different sectors, industries, and asset classes to mitigate risk and maximize returns over the long term.

In conclusion, choosing the best stock market course in Ahmedabad or any other location is the first step towards gaining the knowledge and skills needed to navigate the stock market successfully. By selecting a reputable course, adopting a structured learning approach, and staying disciplined in your studies, you can lay a solid foundation for building wealth through stock market investing. Remember to start studying stocks with an open mind, patience, and a willingness to learn from both successes and failures along the way.

0 notes

Text

What is the difference between trading account and demat account in share market?

A trading account and a demat (dematerialized) account are two distinct components necessary for participating in the stock market. Here's how they differ:

Trading Account:

A trading account is primarily used for buying and selling securities such as stocks, bonds, commodities, currencies, and derivatives in the financial markets.

It serves as a platform provided by brokerage firms or stockbrokers that enables investors to place orders for buying and selling securities.

When investors want to execute a trade, they place orders through their trading account, specifying details such as the type of security, quantity, and price at which they wish to transact.

Trading accounts are essential for active participation in the stock market, allowing investors to enter and exit positions based on their investment strategies and market conditions.

Demat Account:

A demat account is a type of account used for holding and storing securities in an electronic or dematerialized format.

It eliminates the need for physical share certificates by converting them into electronic form, making the process of holding and transferring securities more convenient and secure.

Demat accounts hold various types of securities, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and government securities, in a digital format.

When investors buy securities through their trading account, the securities are credited to their demat account, and when they sell securities, the corresponding shares are debited from their demat account.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also download LTP Calculator app by clicking on download button.

In summary, a trading account facilitates the buying and selling of securities in the financial markets, while a demat account serves as a digital repository for holding and managing those securities in electronic form. Both accounts are essential for investors to trade securities efficiently and securely in the share market.

0 notes

Text

This is India’s decade; we focus on the mid-caps, says Arun Chulani of First Water Capital Fund

Indian market is poised for gains in the long term and industries and businesses that will benefit from the ‘China + 1’ initiative, as well as the ‘Minus China’ movement, are the focus of Arun Chulani, Investment Advisor, First Water Capital Fund. In an interview with MintGenie, he talked about his view on the market.

Edited excerpts:

What is your view on the current market trajectory? For how long this rangebound move of the market may continue?

As a value investor, I think it is futile to try and predict the market’s short-term movements. It is far better to look at long-term themes and build conviction around a company’s intrinsic value.

Can the inflow of foreign flow sustain considering the strong gains in the dollar index and the rate hikes?

Again, to second guess what foreign investors might do and whether they will pull out their funds is of course important but while we may give credence to it, we prefer to focus on value. Of course, Uncle Sam wants some of his money back and conventional thinking might suggest that higher rates will allow some investors to better price risk and re-allocate to “perceived” more risk-free assets, which in turn might lead to outflows.

Are you positive about the domestic theme? What pockets are you bullish on?

Yes, most definitely. We are very hopeful that this is India’s decade. Much has been written about it in the press and there are multiple pockets that we would like to focus on. We are keen on industries and businesses that will benefit from the ‘China + 1’ initiative as well as the ‘Minus China’ movement. The latter are industries in which China itself is reducing its capacity – areas such as steel, chemicals, etc., as it looks to both reduce its pollution and upscale the products it focuses on. We are also keen on flexible packaging which is a relatively cheap proxy for the much fan-fared FMCG sector.

Can the mid and smallcaps outperform benchmarks? Please explain your views.

We very much focus on the mid-caps, and we believe that it is here that one can find value and companies that can create alpha. Of course on the flip side, you have to sometimes deal with opaque information and illiquidity. But with some luck and effort, one occasionally finds a diamond in the rough.

Is there more steam left in the auto stocks? What are the major challenges that the sector is still facing?

Autos are certainly an exciting space to be in, but I find them generally pricey. There is good scope for the sector but of course, there will always be risks due to high fuel prices, high input prices, and improvements in public sector transportation amongst other things.

The number of Demat accounts crossing 10 crores is a proud landmark. What factors have facilitated the rise of retail investors? Because of this, do you think the clout of FII will decrease in the Indian market?

We hope that this increase is due to a combination of factors. Ease of access, digitization, lower broker fees, and general education of making your money work. The market is one of the places where anyone with excess capital can invest and not only become an owner of some of India’s best companies but also benefit from India’s hopeful wealth creation. Of course, as the domestic investor becomes more disciplined and the GDP per capita grows, it will be more attractive for the FII.

The views expressed are the authors own. Please consult your financial advisor before making any investment decisions.

To know more information visit us on:

0 notes

Text

5paisa coupon codes & offers in 2024

5paisa is a popular online trading platform in India known for its user-friendly interface and comprehensive features, particularly suitable for beginner investors.

5Paisa is a leading online stockbroker offering discount brokerage services to retail investors in India. The Company offers mutual funds, equities, insurance, currency, initial public offerings, and non convertible debentures. 5Paisa Capital serves customers in India. Get the best discount offers, Coupon Codes and promo codes in 5Paisa.

Account Type

1. 5paisa Trading & Demat Account:- 5paisa is India's fast growing discount broker offering investing and trading services in segments including stocks, derivatives (F&O) and currency. 5paisa is member of BSE and NSE. 5paisa trading account is backed by the experience and technology developed by its parent company IIFL for over 20 years in retail broking industry.

2. Mutual Fund Account:- Online Mutual Funds Investment Account is a key offering from 5paisa. You can open just a Mutual Funds Investment Account with 5paisa for free of charges.

5paisa also offers Systematic Investment Plans (SIP), an automatic periodic investment option in stock market though mutual funds.

The 'Auto Investor' tool is available free of charge to its customer which helps with online MF advisory. This tool help in choosing the right funds based on their risk profile and return expectations.

0 notes

Text

Angel Broking Login - Find Angel one Login Method of App & Back Office

Are you an investor looking for hassle-free and convenient trading solutions? Look no further than Angel Broking - one of India's Best stockbrokers. With its advanced technology platforms, including the Angel One app and Back Office, investors can easily manage their portfolio anytime, anywhere. But how do you log in to these platforms? In this blog post, we'll guide you through the Angel Broking login process step-by-step so that you can start trading efficiently and effectively. So let's get started!

Angel One Login Process – Angel One App Login Method

The Angel One app is a powerful trading platform that provides investors with real-time market data and analytics. To access it, you'll need to follow the Angel One login process.

Firstly, download the Angel Broking app from either Google Play or the App Store. Once you have installed the app on your phone, open it up and click on "Login" at the bottom of your screen.

Next, enter your registered mobile number and password in their respective fields. If you're logging in for the first time, you will be prompted to create a new password.

After entering your details correctly, tap on "Submit." You should now be logged into your account!

The Angel One app offers several features such as Sensibull option chain integration and Spark Login technology for secure logins. With its user-friendly interface and comprehensive market analysis tools, this platform makes stock trading accessible even for beginners.

To log in to your Angel One account the app, simply follow these steps:

1. Download the Angel Broking app from the App Store or Google Play Store.

2. Open the app and click on "Login".

3. Enter your registered mobile number and click on "Send OTP".

4. Enter the OTP received on your mobile number and click on "Verify OTP".

5. Set a 6-digit trading PIN for added security.

6. Voila! You are now logged in to your Angel One account.

With this simple login process, you have access to a wide range of features like Spark Login, which allows you to log in with just one touch using fingerprint or face recognition technology.

Additionally, if options trading is your thing, Sensibull Option Chain is another popular feature that gives you real-time data and analysis tools for making informed decisions.

If at any point during this process you encounter any issues or have questions about your account, don't hesitate to reach out to Angel Broking's customer care team who can assist you further.

Angel Broking Login Method – Back Office Login Process

To access and manage your investment portfolio with Angel Broking, you need to log in to the Back Office. The Back Office is a web-based portal that provides clients with access to their account details, including transaction history, contract notes, and other relevant data.

To login into the Angel Broking Back Office platform, follow these simple steps:

1. Visit the official website of Angel Broking.

2. Click on 'Login' at the top right corner of the homepage.

3. Select 'BackOffice Login' from the dropdown menu.

4. Enter your Client ID or registered Email ID in the given field.

5. Type in your password and click on 'Login'.

You can also use your Google or Facebook account credentials if you have linked them with your Angel Broking account.

Once logged in, you can view all essential information about your investments through an easy-to-navigate dashboard that displays data such as Demat Holdings Summary, Position Statement by Date Range & Scrip-wise Details along with available limits for trading purposes.

The back office login process with Angel broking is straightforward and user-friendly making it easy for customers to stay informed about their investments anytime they want!

Angel Broking offers its customers a seamless and user-friendly login process through both the Angel One app and back office login method. With the help of these methods, users can easily access their accounts and track their investments. Along with this, Angel Broking also provides various additional features like Spark Login, Sensibull Option Chain, etc., to enhance the overall trading experience for its clients.

Moreover, if you ever face any issues or have any queries related to your account or investment portfolio, you can always reach out to Angel Broking's customer care number for assistance.

Angel Broking is committed to providing top-class services to its clients while ensuring a hassle-free trading experience. So whether you are an experienced trader or just starting your investment journey, Angel Broking has got you covered with its efficient login processes and exceptional support system.

Angel Broking provides its customers with a user-friendly and secure platform to invest in the stock market. With the Angel One app, investors can easily track their portfolio and place trades on-the-go. The Back Office login process allows investors to access detailed reports of their investments and keep track of their profits.

It's important to remember that proper account security measures should always be followed when logging in to any online tradingplatform. Always use strong passwords and enable two-factor authentication for added protection.

If you encounter any issues or have questions about your account, Angel Broking offers excellent customer support through phone, email, chat or even social media channels like Twitter.

Angel Broking is a reliable choice for those looking to start investing in the Indian stock market. With easy-to-use platforms like the Angel One app and robust features such as Sensibull options chain analysis tools, it's no wonder why millions of investors choose this platform for their investment needs.

Angel Broking is a reliable and user-friendly platform that offers multiple login methods for its customers. The Angel One app provides an easy way to manage your investments on-the-go, while the Back Office Login Process allows you to track your portfolio performance and access reports. With features like Sensibull Option Chain and Spark Login, users can make informed decisions while trading in derivatives or investing in stocks.

If you encounter any issues during the login process or face any other queries related to your account, Angel Broking's customer care number is available 24/7 to provide assistance. So whether you are a beginner or an experienced trader/investor, Angel Broking has got you covered with its intuitive interface and various tools.

So what are you waiting for? Log in now using the method that suits your needs best and start exploring everything that Angel Broking has to offer!

Related - https://beststocksbroker.com/angel-broking-login/

Source - https://sites.google.com/view/angelbrokinglogin/

#angel one login#angel broking login#angleonelogin#angelone login#spark login#sensibull#angel one share price#angel one#sensibull option chain#angel broking share price#angelone share price#angel one customer care number#nse: angelone

3 notes

·

View notes

Text

How can an engineer use stock exchange to make additional money?

Earn extra income by stock exchange

Working jobs, running errands, starting a business, everything circles around one thing: making money. But have you ever thought that an engineer can also earn money from the share market. For this, students of engineering colleges need to open a free demat account. Passive sources of income are essential for short-term as well as long-term goals. Wherein a lot of people relied on fixed deposits, real estate, gold, and other investment schemes before; lately, the trend has shifted towards the share market as well.

The earnings associated with the share market often have various myths attached to it, and a lot of people thus refrain from it. However, these myths have reduced over time by knowing how stock market works, and therefore, many more people have grown interested in the stock market.

How to Earn Money In Share Market?

Investing money has always been a number one priority for a majority of people in the country, after all, “what you invest today, becomes your future tomorrow”. The stock market which was earlier perceived as a taboo has now flourished into a full industry. For instance, a lot of people invest in fixed deposits in India. A fixed deposit has the potential to generate a return of 6-8 percent per annum. Whereas when we talk about the share market, your returns in a year can go as high as 100-300 percent or even more. This is why, an engineer of the list of best engineering colleges in Jaipur can generate good money from the stock market, obviously with some rules and strategies attached to it.

How Can You Learn About The Stock Market?

Read about the various terms and jargon that are used in the stock market. Have a look around the news, videos, articles, and everything that can contribute to you knowing the market a little more. You should be well aware of certain things which include the following:

Your style of trading - There are different styles of trading that a person follows in the stock market. You should be aware of whether you are an investor or a trader. Thus, an investor is basically a person who is in the stock market for long-term goals. A trader is one who is looking to make the best out of the market in a shorter span of time. in other words, knowing which kind of traders you are, not only helps you to understand your goals better but also influences the kind of research and investment zones.

Know your goals – Students of BTech colleges should always know why they are entering the stock market and what their expectations are. Some people might have short-term goals like buying a phone, while others might be investing to save some capital for their dream house. So defined goals can further help you decide on a lot of things.

Knowing your risk appetite - The market is volatile and so it is obvious that there are also chances of risk in the market. It is very important that you are aware of your appetite for risk. This simply means that you should know that if you are investing an amount, let’s say ₹10,000, how much loss can you bear.

Knowing your investment options - There are various investment options that one has when he/she is entering the stock market. Some of these include equities, mutual funds, SIPs, etc.

Pick a Good Stock - The stock market is equivalent to choosing the right stock. If you want to minimize your risks and increase the chances of a good return, picking the appropriate stock is essential. The right stock can help you multiply your capital without causing an opposite battle in most cases. You should choose the stocks of the companies that you can understand and have an idea about.

How to Make Money When Stock Market Goes Down?

The idea of making money in the stock market is to buy at a low price and then sell it at a higher price. So, making money when the market is showing a bullish or an uptrend, is pretty obvious. Students of best private engineering college in Jaipur can earn money even if the stock market is falling down using short-selling or doing options trading.

Short-selling if explained in simple terms is the selling of the stocks first and then purchasing. For instance, there is a company, XYZ and the share of the same has a current market price of ₹150. But you speculate that the market is looking a little bearish. Thus, you sell 100 shares of ₹150 each by borrowing it from the stockbroker.

Later the market price moved down to Rs.100/share. So now you purchase the shares, returned them to the broker after making a profit. So, in this case, your profit will be 15000-10000= ₹5000. You can sell before even purchasing the shares. This is because your concerned stockbroker does it for you and later when you purchase the shares, you are returning the shares back to the broker.

On the other hand, options trading help you to make money even when the market is falling down. Here you can either buy the Call Option at the ITM strike price or simply go for selling a put option at OTM. Both these strategies can give you a better profit and comparatively a better opportunity to make money during the bearish trend.

Source: Click Here

#best btech college in jaipur#best engineering college in jaipur#best btech college in rajasthan#b tech electrical in jaipur

0 notes

Text

Value Vs Growth Stock Investing: Which Will Work Best for Your Needs?

Discover the Differences between value & growth stock investing to choose the best strategy for your needs. Learn about free online Demat account opening in 5 min & trading brokerage charges in India, investment strategies, and top stock advisory services available for growth stocks in India. Visit us!

#trading brokerage charges in India#investment strategy#free online demat account opening in 5 mins#Growth Stocks#stock advisory services in India

0 notes

Text

Sovereign Gold Bond vs. Gold ETF: A Comprehensive Comparison for Smart Investors

Over the last few years, the concept of digital gold has arrived in a big way. It started off with gold ETFs and then came the highly popular Sovereign Gold Bond scheme. There are also other digital gold holding vehicles like international gold funds, gold futures and digital gold. In this blog, the focus would largely be on understanding the relative merits and demerits of the sovereign gold bond vs gold ETF debate, and which is more suitable and under what circumstances. Also, a comparison of gold ETF vs SGB is provided on parameters like liquidity, flexibility, charges and tax implications.

What are Sovereign Gold Bonds (SGB) all about?

SGBs or Sovereign Gold Bonds have been around in India since Nov-2015 and have been gradually gaining in heft. These SGBs are central government-backed bonds, denominated in grams of gold. The underlying holding in grams of gold is guaranteed by the central government. In addition, these sovereign gold bonds also bear an interest of 2.50% annually on the issue price, which is paid semi-annually to the investor. Investors also get an upfront discount of Rs. 50/- per gram if the payment mode is digital. SGBs are also advantageous as they do not have the hassles like storing gold, making charges, risk of loss etc.

What really stands out about the SGB is the sovereign guarantee and that the returns are pegged to the price of gold. What the government guarantees is the payment of interest at 2.50% per annum and the holding of gold in grams. Considering that gold has generally given positive returns over longer periods of time, it makes investment in SGBs relatively secure and attractive too.

The SGBs can be held either in physical form or in demat form, as part of the demat account.

Gold ETFs (Exchange Traded Funds)

Unlike SGBs that are issued by the central government, gold ETFs are issued by the mutual fund houses registered with SEBI. They are issued in the form of gold units pegged as equivalent to a certain weight in gold expressed in grams. Gold ETFs are typically closed-ended in that once the NFO period is over, the fund does not offer any purchase or sale of units. However, being Exchange Traded Funds, they are mandatorily listed on the stock exchanges and investors wanting to buy or sell gold ETFs can do so using their existing demat account and trading account.

Gold ETFs are very liquid and hence, entry & exit is hardly a problem without any price damage. You can trade in gold ETFs just as you trade in stocks. It must be noted here that gold ETF issuing mutual funds are required to maintain physical gold equivalent to the units sold with a gold custodian bank as a backing.

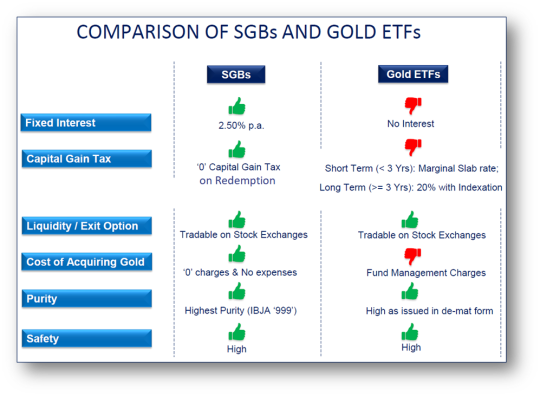

Sovereign Gold Bond VS Gold ETF

Let's compare the sovereign gold bonds and the gold ETFs on a variety of parameters like returns, risk, flexibility, liquidity, taxation, etc. This sovereign gold bond vs gold ETF comparison will allow investors to make the best choice.

Here are the highlights of the gold ETF vs SGB debate.

1. How do SGBs and Gold ETFs compare in returns?

Remember, both SGBs and gold ETFs are linked to the price of gold. If the price of gold goes up, then the capital appreciation will benefit the SGB and also the gold ETFs. The difference lies in the interest paid. For instance, SGBs pay an additional assured interest of 2.50% per annum, but such assured returns do not exist in gold ETFs.

2. How do SGBs and Gold ETFs compare in risk?

One can argue that since both are backed by gold, there is no asset risk; however, there is a difference.

Even though SGBs do not have physical gold backing, the returns on these bonds are pegged to gold prices. And they have an explicit guarantee by the central government regarding the gold holding and the interest payable. In the case of gold ETFs, there is no explicit guarantee (sovereign or otherwise) but they do have the physical gold with the gold custodian bank.

3. How do SGBs and Gold ETFs compare in taxation?

Gold ETFs are treated as non-equity assets and hence the capital gains, if any, would be treated as short-term gains if held for less than 3 years and taxed at the marginal tax rate applicable. If the gold ETFs are held for more than 3 years, they are long-term capital gains and they attract tax at 20% with the benefit of indexation.

In the case of SGBs, the method of taxation is the same, with just one critical difference. If the SGBs are held till redemption, then any capital gains on the SGBs are fully tax-free in the hands of the investor. However, interest on gold bonds is fully taxable.

4. How do SGBs and Gold ETFs compare in costs?

Sovereign gold bonds don’t have any recurring cost of ownership. Gold ETFs on the other hand, have annual charges, including brokerage and expense ratio ranging from 0.50 – 1.00%. The costing of SGBs is a lot more transparent than Gold ETFs.

5. How do SGBs and Gold ETFs compare in liquidity?

Gold ETFs can be bought and sold in the secondary market using your existing trading and demat account with your stock broker. SGBs can be bought at the new issue period, which can be several times during the fiscal year. Outside that, SGBs are listed on the stock exchange, but the liquidity is limited.

Let’s look at the table below to quickly review the gold ETF vs SGB debate

To sum up the sovereign gold bond vs gold ETF debate, both are digital modes of holding gold and are linked to gold prices.

Among 6 key parameters viz. fixed interest, taxation, liquidity, costing, purity and safety, SGB stands out across all. On the other hand, Gold ETFs are highly liquid and do not have a maximum investment limit, allowing investors to buy as much as they want while in case of SGBs maximum investment limit for individual investors is 4kg in a Financial Year

Eventually, investors need to take a call on the gold ETF vs SGB choice based on their financial goals & risk profile; and returns, risk, liquidity, taxation, & convenience the products have to offer.

Source URL: https://www.sbisecurities.in/blog/sovereign-gold-bond-vs-gold-etf

0 notes

Text

Are NCDs the Best Kept Secret for Regular, Reliable Returns?

So, what exactly are NCDs? They are Non-Convertible Debentures or debt instruments issued by companies to raise capital from investors like you. These instruments offer fixed interest rates and specific maturity periods during which regular and fixed interest payments are made to the debenture holders. Unlike convertible debentures, NCDs cannot be converted into equity shares. They provide a steady income with interest payments distributed periodically, based on the terms of the debenture. At the end of the maturity period, the principal amount is returned to the debenture holders.

Why Choose Muthoot FinCorp Ltd.'s NCDs?

Muthoot FinCorp Ltd.'s NCDs stand out for several reasons. First and foremost, we offer higher interest rates compared to traditional fixed deposit schemes or savings accounts available in the market. With these NCDs, you stand to potentially gain higher returns on your investments.

Additionally, these NCDs provide a regular income stream through periodic interest payouts, which can be monthly, quarterly, or annually. This feature is particularly advantageous if you are seeking a reliable income source from your investments.

Furthermore, investing in Muthoot FinCorp Ltd.'s NCDs can diversify your investment portfolio. They serve as an alternative investment avenue alongside stocks, mutual funds, and other traditional options.

Investing Made Simple - How to Get Started

Now, you might be wondering, how do you kickstart your NCD investment journey with Muthoot FinCorp ONE? The process is hassle-free and can be done in just three easy steps.

Log in to Muthoot FinCorp ONE: Whether through the app or the website, access your account.

Select NCD Investments: Choose from the available NCD options.

Provide Your Details: Enter your email address, PAN, DEMAT account details, and UPI address to complete the process.

Addressing Common Queries:

Minimum & Maximum Investment

You can start investing in NCDs with as little as Rs. 10,000 and go up to Rs. 5,00,000 through UPI. If you plan to invest an amount higher than Rs. 5,00,000, a visit to the nearest Muthoot FinCorp branch would be required.

KYC Not Mandatory

There's no need for KYC completion to invest in NCDs, making the process smoother and quicker.

Multiple Applications & Cancellations

Yes, you can apply multiple times through the app or website, but only once per option. Moreover, you can cancel your application while the bidding window is open, ensuring flexibility in your investment decisions.

Non-Convertible Debentures can be your gateway to steady, reliable returns on your investments. Muthoot FinCorp Ltd.'s NCDs offer an attractive opportunity with higher interest rates, regular income, and the flexibility to align your investments with your financial goals.

Ready to take the plunge? Head over to Muthoot FinCorp ONE, explore your NCD investment options, and pave the way for a financially secure future.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

How to Trade in Stock Market- A Beginner’s Guide

If you want to multiply your income, investing in stocks is one of the best ways. The rule of thumb is to put aside some money to invest and you will see it grow in the long run. It is therefore advisable to start investing in stocks whenever you have the money to do so. As a novice, it is essential for you to get a clear understanding of the basics. Therefore, it will be good to opt for a trading course in gurgaon from a reputed institute. It is quite obvious that in your journey as a trader, you will experience both highs and lows. Therefore, it would benefit you greatly, if you are able to understand the primary and the secondary market.

Stock market training Helps You Learn The Basics of Stock Trading

1. Primary Market

The primary market is that market where the companies share new securities and offer them to the public. The transaction happens between the buyers and the issuers.

2. Secondary Market

In the secondary market, you can buy and sell the shares that have been issued in the primary market but here the transaction happens between the buyers and the sellers. In the secondary market, either the broker or the stock exchange acts as an intermediary. When you buy and sell the share on the same day, it is called intraday trading and the trader books either a profit or a loss at the end of the day.

Steps for Stock trading for Beginners

The steps for stock trading are as follows:

1. Open a Demat Account

If you want to enter the stock market as a trader or an investor, the first step is to open a demat account. Without this, you will not be able to trade in the stock market. The demat account electronically stores the securities that you buy.

2. Get to Understand The Stock Quotes

The demand and the supply of stocks, the company profitability, the economic reports and the sentiments of the traders determine the price of the stocks. So, if you are able to gain knowledge about all these aspects, this will help you to get a better understanding of the stocks. Thus you will also understand the right prices to enter or exit.

3. Bid Price and The Ask Price

The bid price is the maximum price that you are ready to pay for a stock price and the ask price is exactly the opposite. It is the minimum price at which the seller is ready to sell the stocks. To book a profit, it is essential to decide the correct bid and the ask price. To get a good understanding of the stock market, you should pursue training from a good Stock Market Training Institute.

4. Technical Knowledge As Well As Fundamentals of The Stock

To effectively plan your trading, you will have to study fundamental and the technical analysis of the stocks. With the help of fundamental analysis, you will be able to measure the intrinsic value and evaluate the security. There are several dynamics that are taken into consideration and these include expenses, liabilities, assets and earnings. The evaluation of the stocks based on their past price and volume chart to predict the future potential of the stocks is referred to as technical analysis.

5. Know to Stop Loss

Volatility is one of the most important characteristics of the stock market. Therefore, as a beginner it is crucial for you to understand how to prevent heavy loss in the stock market. When you are executing a trade, you should set a stop price. This will help you minimize the loss. If you do not set a stop loss price, it might affect your capital greatly.

6. Contact A Professional

As we are all aware, the share market is not predictable. So, as a beginner, it would be important to take advice from a professional. You can opt for one of the best stock trading classes near me. This will help you understand the details of trading and investment.

What Should You Keep in Mind As A Stock Market Investor?

1. Have A Proper Investment Goal

Before you invest in the stock market, you will first have to decide your financial goal. You might either have a short term goal like saving for a vacation or a long term goal like funding your children’s education. The objectives will depend on your ambitions and in which life stage you are in. Mostly, the younger investors prefer long term wealth accumulation and growth. On the other hand, the people who are nearing retirement prefer capital preservation and income generation. It is important for you to be precise with your goals. It is only this that will help you achieve your goals.

2. Check Out How Much You Can Invest

This is a very important thing that you need to decide before investing. You should first check out your income sources. If your employer offers you investment options that also provide you with tax benefits, this will help you to increase your contributions. You should also have an emergency fund. You should also pay off your debts if any before you invest in the stock market. The most important thing that you have to do is to assess your budget. This will help you to get a clear understanding of how much money you can put in stocks.It is important that you understand that investing in funds does involve risks. Therefore, you should only invest if you can afford to lose.

3. Decide Your Investing Style

The relationship with money is different for different individuals. This is a very important factor that affects the risk tolerance. The investors, however, have certain investing styles that suit them. There are some who prefer the active role. They pour over the last cell of the spreadsheet meticulously. On the other hand, there are others, who prefer a set it and forget it approach. They believe that their investments will grow over time if they leave them alone. There might be some others who might simply not have the time to be active traders. It is essential for you to first understand your investment style.

Conclusion

To conclude, when investing in stocks, you can earn more if you turn your money into a growth tool by investing in the stock market and letting it work. It is however important to keep in mind that there are chances of losses in stock market investment. There are certainly ways to lower your risks. So, if you are a novice, you should refer to books, articles etc before you start investing. It is highly recommended that you talk to a professional company to get the proper guidance. You can also opt for online courses for stock market.

#course regarding stock market#best trading courses in gurgaon#stock market classes#stock market classes gurgaon#best trading courses#stock exchange courses#stock market courses#best stock market classes#best stock trading classes#stock market classes near me

0 notes

Text

what is difference between brokerage account and demat account?

A brokerage account and a demat (dematerialized) account are both essential components for investing in the stock market, but they serve different purposes and cater to different aspects of the investment process. Here's the difference between them:

Brokerage Account:

A brokerage account, also known as a trading account, is a platform provided by brokerage firms or stockbrokers that allows investors to buy and sell securities in the financial markets.

It acts as an intermediary between investors and the stock exchanges, providing access to various investment products such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and futures.

When investors want to execute a trade, they place orders through their brokerage account, specifying the type of security, quantity, and price at which they wish to buy or sell.

Demat Account:

A demat account is a type of account used to hold and store securities in an electronic or dematerialized format. It eliminates the need for physical share certificates by converting them into electronic form.

Demat accounts hold various types of securities, including stocks, bonds, ETFs, and mutual fund units, in a digital format.

When investors buy securities through their brokerage account, the securities are credited to their demat account, and when they sell securities, the corresponding shares are debited from their demat account.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

In summary, while a brokerage account facilitates the buying and selling of securities in the financial markets, a demat account serves as a digital repository for holding and storing those securities in electronic form. Investors typically need both a brokerage account and a demat account to participate in the stock market effectively: the brokerage account for trading securities, and the demat account for holding and managing those securities.

0 notes