#demat

Text

Invest digitally, securely, in the market

A Demat account is like a digital locker for your investments, such as shares and mutual funds, in India. It's managed by depositories like NSDL and CDSL and helps you trade and manage your investments easily. With no minimum balance required, it's a convenient way to buy, sell, and hold securities electronically. It also offers benefits like easy access to the stock market, applying for IPOs, and managing your portfolio efficiently. Just be sure to choose a reliable broker, stay updated on market trends, and understand the risks involved in trading

2 notes

·

View notes

Text

youtube

#demat account#demat#stockmarket#businessvaluation#valuation#investment advisor#company valuation#youtube#Youtube

3 notes

·

View notes

Text

Are you looking for a hassle-free and convenient way to invest your hard-earned money? Look no further than Demat accounts! With the rise of technology, investing has become more accessible and straight forward than ever before. But with so many options available, it can be challenging to find the right one for you. That's why we've created this comprehensive guide to help you navigate through the best Demat accounts in India and make informed investment decisions that pay off in the long run. So sit back, relax, and let's dive into Investing Made Easy

#best demat account#best demat account in india#best demat account india#which demat account is best#best demat account in india 2022#which is best demat account#which demat account is best in india#which is the best demat account#which bank is best for demat account#demat account#what is demat account#trading account#demat#icici demat account

2 notes

·

View notes

Text

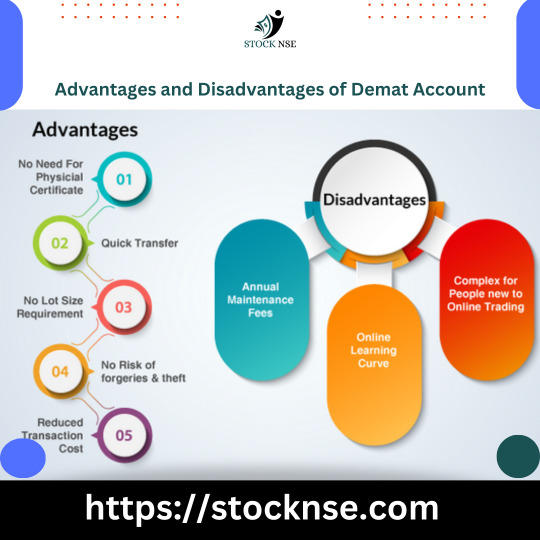

Advantages and Disadvantages of Demat Account

0 notes

Text

" Axles india limited share price 2024 "

Check the latest Axles India share price and updates today. Invest in Axles India Unlisted Share via delisted stocks. Instant delivery in Demat.

0 notes

Text

https://iepfclaim.in/how-to-convert-physical-shares-to-demat-form/

HOW TO CONVERT PHYSICAL SHARES TO DEMAT FORM?

There was once a time when the Indian Share Market followed the open outcry system where the investors had to make themselves physically present in order to carry out the buying and selling of shares. In that era, everything used to be on papers and the trading of shares could only be done in physical form i.e., with the help of the physical share certificate which was used as a proof of ownership of physically transferred shares.

With our ever-evolving technology, this process of physical trading of shares became out-dated and redundant. Gradually, this process got overshadowed by the new trends of online trading and got replaced by the technology-backed trading platforms. Now the Indian stock market has evolved to offer better features and ease of trading through online platforms.

Now, as per the new regulations laid down by the governing board i.e., Securities and Exchange Board of India (SEBI) has made it mandatory for the investors to convert their shares and securities in Demat form in order to continue investing, buying or selling of shares. These reforms in the stock market have taken place in order to ensure a smooth and efficient way of trading with the shares viz-a-viz has made it easy for the authorities to maintain a true account of all the transfers of shares.

However, not everyone holds a Demat Account. Some people are still the owners of physical shares. As it is compulsory for all the investors to hold shares in Demat form in order to continue investing and trading, the shift in trends has raised a question that “How can the investors convert their physical shares into Demat form?”.

To understand the process of Conversion/Dematerialization of Shares better, we should first take look at some important terms:

DEMATERIALIZATION

Dematerialization refers to a process by which physical share certificates of a particular company are converted into an electronic format.

DEMAT ACCOUNT

When physical shares are converted into Demat form, then they are held in electronic form. In order to hold them in electronic form, there is a requirement to open a depository account, i.e. called as a Demat Account.

DEPOSITORY PARTICIPANT

A depository participant (DP) is an agent of the depository through which the Demat Account is made, maintained and operated. A DP acts as a middle-men between the account holder and the depository. Any financial service provider, like banks, state financial corporations, stock-brokers, NBFC, etc., can get themselves registered as a DP.

DEPOSITORY

A depository in an entity that holds securities like shares, debentures, bonds, government securities, mutual fund units etc. of the investors in electronic form on behalf of the investors or security holders. For instance, in India, there are two depositories named National Securities Depository Ltd. (NSDL) and Central Depository Services (India) Ltd. (CSDL) that are registered with SEBI.

STEPS TO CONVERT YOUR PHYSICAL SHARES TO DEMAT FORM

The first step is to open the Demat Account in the depository registered with SEBI with the help of Depository Participant (DP) by submitting the application form and other KYC documents.

Thereafter, the investor/shareholder will be obligated to read and sign the terms of agreement mentioning the rights of potential account holder and the DP along with the scheduled charges for the same. A Demat account number will be provided and the Demat Account will be opened.

Once the Demat Account has been opened, the investor has to send a form called the Dematerialization Request Form (DRF) along with his physical share certificate of the company to the Depository Participant (DP). In cases where the investor holds physical shares of more than one company, then he must submit physical share certificates of all the companies along with a completed DRF form for each of the companies.

The DP will check and verify the completeness and veracity of all the documents submitted by the Investor. Meanwhile, a Dematerialisation Request Number (DRN) will be issued to the investor as an acknowledgment receipt till the time DP verifies his documents.

After verifying the documents, DP will send the request of dematerialisation to the company of which the share-holder wants to get his shares converted to Demat format.

After the approval, the physical shares will be converted to Demat form. Thereafter, the physical shares will be destroyed for the purpose of avoiding misuse or duplicity.

Once the physical shares are dematerialised, the monetary value of the physical shares will be credited to the Demat Account which can, later, be used for buying or selling with the ease of online trading.

After following the above-mentioned steps, the Physical share certificates will be said to be converted to Demat format.

0 notes

Text

More Time to Add Nominee for Mutual Funds and Demat Accounts

More Time to Add Nominee for Mutual Funds and Demat Accounts

More Time to Add Nominee for Mutual Funds and Demat AccountsWhy the Extension?What SEBI SaysHow to Add a Nominee – Step by Step1. Go to the Website2. Sign Up3. Choose Nomination4. Fill in Nominee Details5. Confirm Details6. Aadhaar e-Sign7. Finish the Process

Add Nominee for Mutual Funds and Demat Accounts– Great news for people with…

View On WordPress

#accounts#adding#deadline#demat#demat accounts#demat nomination#details#extends#folios#fund#Good#mf deadline#mf nomination#mutual#mutual fund investments#mutual funds#News#nominee#Sebi#sebi circular

0 notes

Text

Learn Everything you must know about Demat Accounts in India

With so many options on the market, it can be overwhelming to choose the best Automated Trading Software for Your Business.

0 notes

Text

Vlog 3615 my life - Le retour du démat maudit et pleins d'autres trucs légers

Salut la communauté! Dans cette nouvelle vidéo, on plonge dans un vlog haut en couleurs où je sélectionne le commentaires

Continue reading Untitled

View On WordPress

0 notes

Text

Open Motilal Oswal Demat Account and Check Account Opening, Brokerage, Margin, Intraday Charges, Features & Plans.

0 notes

Text

How to open demat and trading account online

Discover the seamless process of opening demat and trading accounts online with our comprehensive step-by-step guide. From choosing the right platform to the documentation required, learn the ins and outs of initiating your online trading journey

0 notes

Text

How Demat Apps Have Changed The Landscape Of Indian Stock Markets

The Demat app, an abbreviation for "dematerialized applications," is a mobile application that allows investors to have their securities held and managed electronically or digitally. These apps have changed how people invest in stock markets by making trading, real-time market information, portfolio monitoring, and research tools easier for investors.

These apps, as well as their ease of use and user-friendliness, have made it possible for retail investors to invest more easily in the stock market. The demat apps have affected India's market in several ways, as described below.

Changes By Demat Apps In The Stock Market

The demat apps have had a major impact on the Indian stock market. Read below to understand;

1. Real Time Trading:

The Demat apps provide real-time market information, enabling investors to make quick decisions. Users can efficiently use market movements by accessing immediate updates to the markets, stock prices, and financial news.

2. Portfolio Tracking:

The features of portfolio tracking that enable investors to monitor the performance of their investments in real time are frequently provided by Demat apps. These apps allow you to gain detailed information about the value of holdings, capital gains or losses, and overall portfolio diversification.

3. An increase in retail participation:

Demat's apps have democratized the involvement of investors in financial markets via direct stock buying and selling on their mobile phones. Previously, stock investments required physical documents, often restricted to institutional investors or high-net-worth individuals. The increased popularity of retail investors in the stock markets in India was due to the ease with which they could access these apps.

4. Paperless transactions:

Investors no longer need a physical share certificate with demat applications. The risks of handling physical documents are eliminated by holding all shares and securities electronically. This made it easier to buy, sell, and transfer securities.

5. SIPs and Mutual Funds:

Investments in SIPs and mutual funds are possible thanks to the many demat apps that, in addition to stocks, allow for mutual fund and SIP purchases. This option for diversification encourages investors to investigate other asset classes.

6. Cost-Effectiveness:

Compared to traditional brokers, online trading through demat apps frequently entails cheaper brokerage fees, making it more affordable for retail investors.

7. Mobile convenience:

Demat apps allow you to do business from anywhere. With smartphones, investors will be able to place orders, monitor positions, and manage portfolios in a more convenient and accessible way.

8. Educational resources:

To inform users on investment concepts, market trends, and business strategies, certain demat applications offer educational material and tools. This can be helpful for those who wish to enhance their knowledge of the stock market.

In general, demat applications have transformed India's stock markets by offering investors greater convenience, affordability, and accessibility. Their user-friendly interfaces and advanced features have played an important role in increasing retail participation and transforming the way people interact with the stock market. To open a hassle-free demat account, demat apps like Share India is one of the best and most reliable app and trading platform.

1 note

·

View note

Text

Open Kotak Securities Demat Account and Check Account Opening, Brokerage, Margin, Intraday Charges, Features & Plans.

0 notes