#zinc stocks india

Text

Understand the Benefits of Carbon Steel Pipes

What are carbon steel pipes?

Carbon steel pipe is one of the most trustworthy and durable pipe types used in many industrial applications. Since it is both light and strong, it can move solids, gases, and liquids. Bright Steel Centre is a recognised corporation that manufactures, offers, exports, and trades an impressive and top-quality approved range of industrial pipes, plates, and pipe fittings.

We provide stainless steel pipe fittings, plates made of stainless steel and high nickel.Bright Steel Centre has a buffer stock of essential items,pipes, and pipe fittings sizes 1/2 to 24, to satisfy the off-hand needs of our clients. Customers' requests for particular items are quickly fulfilled while maintaining the highest quality requirements.

Benefits of carbon steel pipes

A specific kind of pipe that is made of carbon steel pipe consists mostly of iron with a little amount of carbon. It is among the most often used types of pipes because of its benefits over other materials like PVC or stainless steel. Carbon steel pipes are strong, durable, and corrosion-resistant. They are also very cost-effective since they are far less expensive than other kinds of pipes.

Carbon Steel Seamless Pipes:

For a range of purposes, we develop and distribute carbon steel pipe goods. Iron and carbon make up the majority of carbon steel's composition. Depending on the grades, varied quantities of silicon, manganese, and copper are permitted as traces. The result is, carbon steel seamless pipe is more durable and extremely stress resistant.

Carbon Steel ASTM A335 Pipes:

For flanging (vanstoning), bending, fusion welding, and other comparable forming procedures, ASTM A335 Seamless Steel Pipe ordered in compliance with this requirement must be appropriate. When chrome and molly elements are added, ASTM A335 offers superb tensile strength, fine resistance to high temperatures, and corrosion.

Aluminium Pipes:

Aluminium is a perfect specimen for temperature control applications like solar power, freezers, and air conditioners since it very effectively absorbs heat and forms tubes. Due to their durability and lightweight, aluminium tubes are crucial in hydraulic systems, bracing, fuel lines, and frames.

Mild Steel Pipes:

Pipes made of mild steel (MS) are made of low carbon steel, which has less than 0.25% carbon. Due to the low carbon content, the pipes are easy to use and do not harden. Mild Steel Pipes. Since they are made of mild steel, they can easily be welded and shaped into a range of shapes and sizes for use in pipelining and tubing.

Alloy Steel Pipes:

Applications that call for moderate corrosion resistance, strong durability, and a reasonable price use alloy steel pipes. The two types of alloy steels are high alloy and low alloy steels.

High Nickel Alloy Pipes:

Nickel pipes are made by coating the metal surface with zinc. The nickel alloy pipe is made up of the elements nickel, manganese, carbon, silicon, sulphur, ferrous, and copper. The ability of these pipes to withstand corrosion and oxidation is outstanding. The has excellent mechanical properties, are found in High Nickel Alloy Tube.

Product Source - Carbon Steel Pipes in India

3 notes

·

View notes

Text

Best MCX Tips Provider in India | Top MCX Advisor in India

Best MCX Tips Provider in India

Nivesh Research holds the prestigious registration with the Securities and Exchange Board of India (SEBI), which ensures that they operate within the regulatory framework and adhere to ethical standards. As a SEBI registered stock advisory, Nivesh Research offers its clients the confidence of dealing with a credible and compliant entity in the field of Top MCX Advisor in India.

MCX Tips Service Features

2-4 Intraday Calls in Precious Metals Gold and Silver and Base Metals like Copper, Nickel, Zinc, Lead and aluminum and Energy Commodities like Crude Oil, Natural Gas

Follow-up messages of the calls

0 notes

Text

Zinc Prices | Pricing | Trend | News | Database | Chart | Forecast

Zinc, one of the most widely used industrial metals, plays a crucial role in various industries, including construction, automotive, and electronics. Its primary use is in galvanization, which protects steel and iron from corrosion. Zinc prices have become a key indicator of the health of the global economy due to its diverse applications in manufacturing and infrastructure. The demand for zinc, like many other commodities, is influenced by macroeconomic trends, geopolitical tensions, and technological advancements, making the metal's pricing quite volatile.

Zinc prices are largely driven by the balance of supply and demand. When global economies are growing, particularly those of emerging markets like China and India, the demand for zinc rises as these countries invest heavily in infrastructure and construction. China, the world's largest consumer of zinc, holds substantial sway over global zinc prices. Any fluctuation in the Chinese economy, such as a slowdown in construction or manufacturing, directly impacts global demand and, subsequently, zinc prices. Likewise, a surge in demand from these regions can lead to price increases.

On the supply side, zinc production is concentrated in a few key countries, including China, Australia, and Peru. Disruptions in zinc mining or smelting operations due to strikes, environmental regulations, or natural disasters can reduce the supply, leading to price spikes. For instance, regulatory crackdowns on environmentally hazardous mining practices in China have, in the past, curtailed production and driven prices upward. Similarly, the operational status of major mines and the opening of new mining projects play an essential role in determining zinc's availability in the market. Any disruption in mining activities can significantly affect the metal's price.

Get Real Time Prices for Zinc: https://www.chemanalyst.com/Pricing-data/zinc-1260

The price of zinc is also heavily influenced by global trade policies and tariffs. Tariffs imposed on zinc and related products can affect the global supply chain, altering the flow of exports and imports. For example, trade tensions between the United States and China have impacted the zinc market, leading to fluctuations in its price as both countries imposed tariffs on each other's goods, affecting demand. Additionally, the strength of the US dollar plays a significant role in determining zinc prices. Since zinc is traded in US dollars on global markets, a stronger dollar makes zinc more expensive for buyers using other currencies, reducing demand and pushing prices down.

One of the critical factors affecting zinc prices is the global stock levels, particularly those held in warehouses tracked by the London Metal Exchange (LME). When stock levels are high, there is a surplus of zinc available in the market, which usually drives prices down. Conversely, low stock levels indicate tight supply, which tends to push prices upward. Traders closely monitor these stock levels as they provide insights into future price movements. In recent years, the stock levels of zinc in LME warehouses have fluctuated, contributing to the metal's price volatility.

Technological advancements also influence the zinc market. With the increasing focus on sustainability and the transition to green energy, new uses for zinc are emerging, such as in renewable energy storage systems and electric vehicles. These innovations are likely to drive future demand for zinc. For instance, zinc-air batteries, a relatively new technology, are being explored as a cost-effective alternative to lithium-ion batteries. The growing use of zinc in energy storage could provide a new source of demand, further influencing zinc prices.

Environmental concerns and regulations are also becoming more relevant in the zinc industry. As the world moves towards greener technologies and stricter environmental standards, the production and processing of zinc are under greater scrutiny. Smelters, which refine raw zinc into usable metal, have come under pressure to reduce their emissions, which can increase the cost of production. As regulatory requirements become more stringent, the cost of zinc production may rise, which could be reflected in higher zinc prices over time.

Another significant aspect of zinc pricing is the role of speculative trading. Like other commodities, zinc is traded on futures markets, where investors speculate on its future price movements. These speculative activities can cause price fluctuations that are not always tied to supply and demand fundamentals. For instance, sudden buying or selling in the futures market can cause short-term price swings, even if the physical supply of zinc remains unchanged. Investors often watch macroeconomic indicators, such as global economic growth rates and manufacturing activity, to predict future demand for zinc and make speculative bets accordingly.

Recycling also plays a role in zinc pricing. A significant portion of the zinc used globally is recycled, primarily from scrap metal. As recycling technologies improve, the availability of recycled zinc could increase, potentially putting downward pressure on prices. However, the economics of recycling depend on various factors, including the cost of collecting and processing scrap and the price of primary (mined) zinc. If recycling becomes more cost-effective, it could lead to a shift in the zinc supply chain, influencing long-term price trends.

In summary, zinc prices are influenced by a complex interplay of factors including supply and demand dynamics, global economic conditions, technological advancements, environmental regulations, and speculative trading. The balance between these forces creates a constantly shifting landscape for zinc prices, making it a highly volatile commodity. As the world continues to industrialize and develop new technologies, the demand for zinc is likely to grow, with potential implications for its price in the future.

Get Real Time Prices for Zinc: https://www.chemanalyst.com/Pricing-data/zinc-1260

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Zinc#Zinc Price#Zinc Prices#Zinc Pricing#Zinc News#Zinc Price Monitor#Zinc Database#Zinc Price Chart#Zinc Price Trend#Zinc Market Price

0 notes

Text

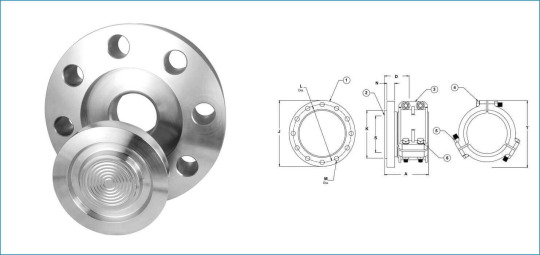

Pearloil-approved flanges in KSA

ASME B16.5 Flanges in UAE, ASME B16.5 Flanges Manufacturers in UAE. We manufacture ANSI B16.5 Flanges, ASME B16.5 WN Flanges, ASME B16.5 Weld Neck Flanges, and ANSI B16.5 Flanges Material, ensuring the highest quality with expert craftsmanship in UAE. Our ASME B16.5 Class 150 Flanges are known for their exceptional quality and competitive pricing in Dubai, India.

Meraki Star Metals Oil & Gas Equipment Trading L.L.C. is a highly acclaimed supplier of ASME B16.5 Ring Joint Flanges, approved by Saudi Aramco. We maintain an extensive inventory of ANSI B16.5 Free Flanges, ANSI B16.5 Carbon Steel Flanges, ANSI B16.5 Reducing Flanges, ASME B16.5 Reducing Flanges, ASME B16.5 Slip On Flanges, ASME B16.5 Flanges Material, and ASME B16.5 Blind Flanges. Our comprehensive stock includes ASME B16.5 Opening Flanges and ANSI B16.5 Expander Flanges in various sizes.

Meraki Star Metals Oil & Gas Equipment Trading L.L.C. offers the best prices for Reducing Hung Flanges ASME B16.5 in UAE. Check our price list for ASME B16.5 Flanges, including ANSI B16.5 Stainless Steel Flanges, ANSI B16.5 Blind Flanges, and ANSI B16.5 Flanges. We supply ASME B16.5 Hung Flanges to Canada, UAE, Australia, Russia, Oman, Kuwait, Qatar, Iran, Turkey, UK, USA, Sweden, Israel, France, Italy, Germany, Singapore, Thailand, Egypt, Bahrain, Indonesia, Malaysia, Sri Lanka, and Saudi Arabia.

We provide the best prices for ANSI B16.5 Flanges as one of the leading suppliers and distributors of ANSI B16.5 Class 150 Flanges in India. Our stocking distributors are located in Delhi, Bangalore, Surat (Gujarat), Hyderabad, Pune (Maharashtra), and Chennai (Tamil Nadu). Check our ASME B16.5 Stainless Steel Flanges prices before purchasing ASME B16.5 Socket Weld Flanges from India or China. You can also email us for our live inventory of ASME B16.5 Flanges to verify types and sizes. We offer the best prices for ANSI B16.5 Weld Neck Flanges.

We also provide free samples of ASME B16.5 RTJ Flanges. Meraki Star Metals Oil & Gas Equipment Trading L.L.C. has vendors and distributors in Bangalore (Karnataka), Chennai (Madras, Tamil Nadu), Ahmedabad (Gujarat), Delhi, Pune (Maharashtra), Rajkot, Ghaziabad (Uttar Pradesh), Bhosari, Ludhiana (Punjab), Vadodara, Aurangabad, Faridabad, Gurgaon (Haryana), Indore (Madhya Pradesh), Jaipur (Rajasthan), Kolkata (West Bengal), Khopoli (Karnataka), Kolhapur, Nagpur, and Raipur (Chhattisgarh). For the best prices and quickest delivery of ASME B16.5 Flanges or ANSI B16.5 Ring Joint Flanges near you, contact us today.

Specification of ASME B16.5 Class 150 Flanges

ASME B16.5 Flange Size Chart

Sizes: 1/2″ (15 NB) to 48″ (1200 NB), DN10 to DN5000

ANSI B16.5 Flange Standards

Standards: ANSI/ASME B16.5, B16.47 Series A & B, B16.48, BS4504, BS 10, EN-1092, DIN, GOST, MSS S44, ISO70051, JISB2220, BS1560-3.1, API7S-15, API7S-43, API605, EN1092

ANSI B16.5 Flange Pressure Rating

Pressure Classes: 150 LBS, 300 LBS, 600 LBS, 900 LBS, 1500 LBS, 2500 LBS

Flange Pressure Calculation

DIN: 6Bar, 10Bar, 16Bar, 25Bar, 40Bar (PN6, PN10, PN16, PN25, PN40, PN64)

JIS: 5K, 10K, 16K, 20K, 30K, 40K, 63K

UNI: 6Bar, 10Bar, 16Bar, 25Bar, 40Bar

EN: 6Bar, 10Bar, 16Bar, 25Bar, 40Bar

Coating Options

Oil Black Paint

Anti-rust Paint

Zinc Plated

Yellow Transparent

Cold and Hot Dip Galvanized

Common Types of ANSI B16.5 Flanges

Forged

Threaded

Screwed

Plate

Test Certificates

EN 10204/3.1B

Raw Materials Certificate

100% Radiography Test Report

Third Party Inspection Report

Production Technique

Forged

Heat Treated

Machined

Connect Type / Flange Face Type

Raised Face (RF)

Ring Type Joint (RTJ)

Flat Face (FF)

Large Male-Female (LMF)

Lap-Joint Face (LJF)

Small Male-Female (SMF)

Small Tongue

Large Tongue & Groove

Groove

Special Design

Custom designs as per drawings

Conformance to AS, ANSI, BS, DIN, and JIS standards

Available in sizes 15 NB (1/2″) to 200 NB (8″)

Equal and Reducing Configurations

Testing

Direct-reading Spectrograph

Hydrostatic Testing Machine

X-ray Detector

Ultrasonic Flaw Detector

Magnetic Particle Detector

Equipment

Press Machine

Bending Machine

Pushing Machine

Electric Bevelling Machine

Sand-blasting Machine

Origin

Indian

West Europe

Japan

USA

Korea

Manufacturer of

ANSI

DIN

GOST

JIS

UNI

BS

AS2129

AWWA

EN

SABS

NFE

Flange Types

BS Flange

EN Flange

API 6A Flange

ANSI Flange

ASME Flange

DIN Flange

EN1092-1 Flange

UNI Flange

JIS/KS Flange

BS4504 Flange

GB Flange

AWWA C207 Flange

GOST Flange

PSI Flange

Applications

Bitumen Upgraders

Heavy Oil Refineries

Nuclear Power (mostly seamless)

Petrochemicals and Acids

Export Destinations

Ireland, Singapore, Indonesia, Ukraine, Saudi Arabia, Spain, Canada, USA, Brazil, Thailand, Korea, Iran, India, Egypt, Oman, Dubai, Peru, etc.

Material Test Certificates (MTC)

EN 10204 3.1 and EN 10204 3.2

Test Certificates certifying NACE MR0103, NACE MR0175

For More Information:

Visit Our Website: https://www.merakimetals.ae

Contact No: +971-523973687

E-Mail ID: [email protected]

#Pearloil Approved Flanges in UAE#Petramina Approved Flanges in UAE#ASME B16.5 Flanges in UAE#ASME B16.5 Flanges Manufacturers#ASME B16.5 Flanges Suppliers in UAE#ASME B16.5 Flanges Stockists in UAE

0 notes

Text

Southeast Asia Galvanized Steel Market Projected to Reach $25.9 Billion by 2031

Meticulous Research®—a leading global market research company, published a research report titled, ‘South East Asia Galvanized Steel Market by Product Type (Hot-dipped Galvanized Steel, Electro-galvanized Steel), Application (Building and Construction, Automotive, White Goods, Shipbuilding, Other Applications), and Country - Forecast to 2031.’

According to the latest publication from Meticulous Research®, the Southeast Asia galvanized steel market is projected to reach $25.9 billion by 2031, growing at a CAGR of 14.6% from 2023 to 2031. By volume, the market is expected to reach 27.6 million tons by 2031, at a CAGR of 13.8% during the same period.

The market's growth is driven by increasing infrastructure investments, rising demand in the construction industry, and growing GDPs in the region. However, volatility in raw material prices, regulatory compliance, and a decline in the purchase of Chinese steel due to changing international trade dynamics may restrain growth.

Technological advancements in galvanized steel manufacturing and the establishment of the ASEAN Economic Community are expected to create growth opportunities. Conversely, high manufacturing costs pose significant challenges.

The Southeast Asia galvanized steel market is segmented by product type and application. The product type segment includes hot-dipped galvanized steel (hot-dipped zinc coated, hot-dipped aluminum coated, hot-dipped Sn-zinc coated, hot-dipped zinc-magnesium-aluminum alloy coated, hot-dipped zinc-aluminum-silicon alloy coated, and hot-dipped zinc-aluminum-magnesium-silicon alloy coated) and electro-galvanized steel (electrolytic zinc-coated, electrolytic zinc-nickel alloy-coated, electrolytic nickel-coated, electrolytic zinc-Sn-nickel alloy-coated, and electrolytic phosphate-treated). Applications include building and construction (trusses, roofs, frames, exterior walls, interior walls, pipes and ducts, purlins, decking, and other applications), shipbuilding, automotive, white goods (refrigerators, washing machines, air-conditioning units, microwave ovens, and other appliances), and other appliances (electrical transmission towers, telecom towers, steel furniture, office equipment, miscellaneous applications). The study also evaluates industry competitors and analyzes the market at regional and country levels.

In 2024, hot-dipped galvanized steel is expected to account for the larger market share, over 76.9%, due to its numerous environmental and economic benefits, such as corrosion resistance and low maintenance. This segment is also projected to register the highest CAGR during the forecast period.

The building and construction segment is expected to account for the largest market share, over 70.4%, due to galvanized steel's durability and low maintenance. The white goods segment is projected to register the highest CAGR during the forecast period due to the large portion of steel used in manufacturing.

By country, Vietnam is expected to hold the largest market share, over 37.7%, driven by rapid industrialization and extensive infrastructure development. Indonesia is projected to register the highest CAGR of 16.7%, driven by its large automotive sector and role as a manufacturing hub.

Key players in the Southeast Asia galvanized steel market include Essar Steel India Limited (India), Nippon Steel Corporation (Japan), POSCO (South Korea), JFE Holdings, Inc. (Japan), JTL Infra Limited (India), NS BlueScope Steel Limited (Australia), Hoa Sen Group (Vietnam), Hoa Phat Group (Vietnam), Dongkuk Steel Group (South Korea), Chinh Dai Industrial Co. Ltd (Vietnam), FiW Steel Sdn. Bhd. (Malaysia), Galvaco Industries Sdn. Bhd. (Malaysia), Nam Kim Steel Joint Stock Company (Vietnam), Tata Steel Limited (India), and Hyundai Steel Co., Ltd. (South Korea).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5019

Key Questions Answered in the Report:

What are the high-growth market segments in terms of product type and application?

What is the historical market size for galvanized steel in South East Asia?

What are the market forecasts and estimates for 2024–2031?

What are the major drivers, restraints, opportunities, challenges, and trends in the South East Asia galvanized steel market?

Who are the major players in the South East Asia galvanized steel market, and what are their market shares?

What is the competitive landscape like?

What are the recent developments in the South East Asia galvanized steel market?

What are the different strategies adopted by major market players?

What are the trends and high-growth countries?

Who are the local emerging players in the South East Asia galvanized steel market, and how do they compete with other players?

Contact Us:

Meticulous Research®

Email- [email protected]

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#SouthEastAsia#GalvanizedSteelMarket#GalvanizedSheetMetal#GalvanizedSteelSheet#GalvanizedRoofing#GalvanisedPipe#GalvanizedMetalRoofing#GalvanizedCoil#GalvanizedMetal#GalvanizedSteelPlate

0 notes

Text

India's Zinc Crises

India’s Zinc Crises

The zinc industry in India has experienced fluctuations in recent years, notably during the COVID-19 pandemic. In FY 2021-22, India's zinc consumption rebounded by approximately 13% to 630 kt after a significant decline in the previous year due to the pandemic. The demand for zinc is expected to normalize in CY 2022 and CY 2023, driven by various factors such as infrastructure projects, the government's economic vision, and the push for 100% electrification. The country's abundant zinc resources position it well to enhance self-reliance in metal consumption, especially in battery applications where zinc could potentially replace imported lithium.

Globally, the zinc market is forecasted to grow steadily, with WoodMac predicting a 1.3% increase in global zinc consumption in CY 2022 and an average growth of 1.7% during CY 2023 and CY 2024. This growth is attributed to a shift towards de-carbonization and infrastructure investments, particularly in developing regions like Asia. China remains a key player in the zinc market, with Asia expected to drive demand growth at an average rate of 1.8% during this period.

The divestment of shares in zinc companies like Hindustan Zinc is being considered, with plans to split the business into separate entities for zinc and lead, silver, and recycling. This restructuring aims to streamline operations and potentially facilitate easier divestment processes. Despite challenges like fluctuating zinc prices and uncertainties in global economies, Hindustan Zinc remains focused on the Indian market, where demand has been resilient, particularly in the infrastructure sector.

On the production side, global zinc supply faced disruptions, with refined zinc metal production falling by 2.6% due to smelter closures for maintenance and energy price increases. However, the long-term outlook for zinc prices may face pressure from growing surpluses, as new mine projects come online, potentially leading to refined stock buildups. The global zinc warehouse stocks have shown fluctuations, with a decline in both Shanghai Futures Exchange and London Metal Exchange stocks.

Industries that are significantly affected by a hike in zinc prices include those reliant on zinc as a key raw material in their production processes. Some of the industries impacted by an increase in zinc prices are:

1. **Automotive Industry**: Zinc is commonly used in the automotive sector for galvanizing steel to prevent corrosion. A rise in zinc prices can lead to increased production costs for car manufacturers, impacting the overall cost of vehicles.

2. **Manufacturing Industry**: Various manufacturing processes across industries rely on zinc for galvanization, alloy production, and other applications. An increase in zinc prices can directly impact the cost of manufacturing goods, influencing pricing strategies and profit margins. Manufacturing of Bags accessories industries highly dependent on zinc prices too.

3. **Construction Industry**: The construction sector utilizes zinc for galvanizing steel structures, roofing materials, and pipelines. Higher zinc prices can elevate construction costs, affecting infrastructure projects and real estate development.

4. **Electrical and Electronics Industry**: Zinc is essential in the production of batteries, electrical components, and electronic devices. Any surge in zinc prices can raise manufacturing expenses for companies in this sector, potentially leading to increased product costs.

5. **Pharmaceutical Industry**: Zinc is used in pharmaceuticals and nutraceuticals. A spike in zinc prices can impact the production costs of medicines and supplements, potentially affecting pricing and availability for consumers.

These industries are interconnected, and a hike in zinc prices can have cascading effects on supply chains, production costs, and consumer prices across multiple sectors. Monitoring zinc price trends is crucial for businesses in these industries to adapt their strategies and mitigate the impact of price fluctuations on their operations.

In conclusion, India's zinc industry faces a mix of challenges and opportunities, with a focus on meeting domestic demand, exploring new applications like battery technology, and addressing health implications related to zinc deficiency. The sector's resilience amidst global market dynamics and the country's strategic initiatives to boost zinc consumption highlight the importance of zinc in India's industrial and public health landscapes.

https://www.metarealverse.in

0 notes

Text

Nifty Metal spikes over 1.5% on US Fed rate cut hopes; Hindustan Zinc hits record high

Indian metal stocks resumed their upward momentum on Friday, with the majority of Nifty Metal constituents trading positively. This surge was fueled by increasing optimism surrounding potential U.S. Federal Reserve rate cuts and positive indicators of a strengthening Chinese economy, resulting in a spike in base metal prices. The Nifty Metal index finished today's trade with a gain of 1.54%, reaching 8,977 points. Looking at the individual stocks, Hindustan Zinc jumped over 18.65% to hit a new high of ₹541 apiece, and Hindustan Copper and Vedanta also gained over 4% in today's intraday trade. Other stocks such as Steel Authority of India, Jindal Stainless, JSW Steel, NALCO, Hindalco Industries, NMDC, Jindal Steel & Power, and Ratnamani Metals & Tubes are currently trading with gains between 0.5% and 2%.

0 notes

Text

asme b16.5 flanges in uae

ASME B16.5 Flanges in UAE, ASME B16.5 Flanges Manufacturers, in UAE. We are making ANSI B16.5 Flanges, ASME B16.5 Wn Flanges, ASME B16.5 Weld Neck Flanges and ANSI B16.5 Flanges Material plausibly considering sensible expert hours in UAE and uncommon well spring of astonishing ASME B16.5 Class 150 Flanges, most very smart arrangement, cost open in Dubai, India.

Meraki Star Metals Oil & Gas Equipment Trading L.L.C. is all around acclaimed provider of ASME B16.5 Ring Joint Flanges got a handle on by Saudi Aramco. We keep up wide store of ANSI B16.5 Free Flanges, ANSI B16.5 Carbon Steel Flanges, ANSI B16.5 Diminishing Flanges, ASME B16.5 Decreasing Flanges, ASME B16.5 Slip On Flanges, ASME B16.5 Flanges Material and ASME B16.5 Blind Flanges. Meraki Star Metals Oil & Gas Equipment Trading L.L.C. stock total degree of ASME B16 5 Opening Flanges, ANSI B16.5 Expander Flanges in Stock in different sizes.

We can other than give free occasion of ASME B16.5 Rtj Flanges,Meraki Star Metals Oil & Gas Equipment Trading L.L.C. is having our Vendor and Merchant in Bangalore, Karnataka, Chennai (Madras), Tamil Nadu, Ahmedabad, Gujarat, Delhi, Pune, Maharashtra, Rajkot, Ghaziabad, Uttar-Pradesh, Bhosari, Ludhiana, Punjab, Vadodara, Aurangabad, Faridabad, Gurgaon, Haryana, Indore, Madhya Pradesh, Jaipur, Rajasthan, Kolkata, West-Bengal, Khopoli, Karnataka, Kolhapur, Nagpur, Raipur, Chhattisgarh.. So in case you are looking for best expense of ASME B16 5 Flanges, ANSI B16.5 Ring Joint Spine near you with most short period of time improvement or free occasion of Flanges WNRF ASME B16.5.

Specification of ASME B16.5 Class 150 Flanges

ASME B16 5 FLANGE SIZE CHART1/2″ (15 NB) to 48″ (1200NB) DN10~DN5000ANSI B16.5 FLANGE STANDARDSANSI/ASME B16.5, B16.47 Series A & B, B16.48, BS4504, BS 10, EN-1092, DIN, ANSI Flange, ASME Flange, BS Flange, DIN Flange, EN Flange, GOST Flange, ASME/ANSI B16.5/16.36/16.47A/16.47B, MSS S44, ISO70051, JISB2220, BS1560-3.1, API7S-15, API7S-43, API605, EN1092ANSI B16.5 FLANGE PRESSURE RATING ANSIClass 150 LBS, 300 LBS, 600 LBS, 900 LBS, 1500 LBS, 2500 LBSANSI B16.5 FLANGE PRESSURE CALCULATION IN DIN6Bar 10Bar 16Bar 25Bar 40Bar / PN6 PN10 PN16 PN25 PN40, PN64JIS5K, 10 K, 16 K 20 K, 30 K, 40 K, 63 KUNI6Bar 10Bar 16Bar 25Bar 40BarEN6Bar 10Bar 16Bar 25Bar 40BarCOATINGOil Black Paint, Anti-rust Paint, Zinc Plated, Yellow Transparent, Cold and Hot Dip GalvanizedMOST COMMON TYPES OF ANSI B16.5Forged / Threaded / Screwed / PlateTEST CERTIFICATESEN 10204/3.1B

Raw Materials Certificate

100% Radiography Test Report

Third Party Inspection Report, etc

1 note

·

View note

Text

Why is Utkarsh India one of the leading steel pipe manufacturers?

Utkarsh India is a leading name in the steel pipe manufacturing industry. They are known for their expertise and commitment to exceeding industry standards. They focus on detailed engineering and strict quality checks to manufacture pipes that are stronger, last longer, and resist corrosion better. Here, we explore some of the reasons why Utkarsh India is widely regarded as one of the leading steel pipe manufacturers in India:

1.) Impressive production capacity and setup:

Utkarsh India has an impressive production capacity, capable of manufacturing approximately 1.2 lakh metric tons of steel pipes annually. This substantial capacity allows the company to tackle large orders, even when facing stringent deadlines. Furthermore, their manufacturing unit accommodates the production of both MS (Mild Steel) and Galvanised pipes under one roof, streamlining operations for enhanced efficiency.

High-quality raw materials and galvanization methods:

The galvanisation process plays an important role in protecting steel pipes from corrosion and environmental wear. Utkarsh India uses 99.5% zinc sourced from trusted providers, notably Hindustan Zinc Limited. They also use a 7-bath galvanisation process to ensure optimal results.

2. Exceptional in-house testing facilities:

Their in-house testing facility plays a major role in their success. The robust testing process ensures that the pipes meet the quality expectations of customers. They use rigorous tests, such as the Mass of Zinc Test, Uniformity test, and Adhesion test.

3. Timely deliveries:

Utkarsh India consistently maintains a ready stock of steel pipes for prompt delivery to customers. In addition to their ample inventory, they have an extensive logistics network that facilitates efficient and rapid deliveries. Their after-sales service is equally impressive, offering consumers rapid solutions to address any concerns.

4. Stellar market reputation:

Utkarsh India has earned a stellar reputation in the market, a result of years of exemplary service and consistently high product quality. They have remained steadfast in their commitment to delivering top-quality steel pipes to consumers nationwide. The company's long-standing presence in the industry has helped them continually improve their manufacturing technology and processes.

Explore the steel tubes and pipes from Utkarsh India, if you are looking for a reliable steel pipe supplier. They offer a variety of steel tubes and pipes, including MS pipes, ERW black and GI pipes, along with square and rectangular hollow sections. Their manufacturing range is extensive, starting from 15 mm to 400 mm in diameter, with thicknesses ranging from 2 mm to 10 mm. For square sections, their range spans from 19x19mm to 220x220mm, and for rectangular sections, it goes from 50x25mm to 172x92mm.

0 notes

Text

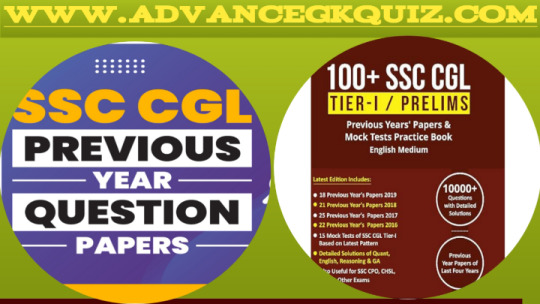

General Awareness|Practice Paper for SSC CGL Tier-1|SET- 24

1. Which forest belt supplies most of the world's requirement of newsprint ?

a) Coniferous

b) Tropical Deciduous

c) Mediterranean

d) Tropical Evergreen

2. Strong tropospheric winds flowing in a narrow zone of steep pressure and temperature gradient and with a circumpolar character are the

a) Hurricanes

b) Typhoons

c) Jet Stream

d) Roaring Forties

3. Wavy hair was a characteristic of

a) Neanderthal man

b) Nordic race

c) Mongoloid race

d) Cromagnon man

4. The Eastern and Western Ghats join at

a) Palani Hills

b) Nilgiri Hills

c) Anamalai Hills

d) Malabar Hills

5. Which state in India is the leading producer of sulphur ?

a) Assam

b) Maharashtra

c) Punjab

d) Tamil Nadu

6. Which of the following major sea ports of India does not have a natural harbour ?

a) Mumbai

b) kochi

c) Marmagao

d) Para dweep

7. Who among the following music composers was deaf ?

a) Beethovan LV

b) Bach JS

c) Richard Strauss

d) Johannes Brahms

8. Which is the largest tiger reserve in India ?

a) Nagarjuna

b) Manas

c) Pench

d) Corbett

9. When did the British Government start ruling India directly ?

a) After the Battle of Plassey

b) After the Battle of Panipat

c) After the Battle of Mysore

d) After Sepoy Mutiny

10. Rock cut Kailash temple of Ellora is a monument of the

a) Rashtrakutas

b) Cholas

c) Pallavas

d) Satavahanas

11. What is the worth of Pradhan Mantri Jeevan Jyoti Bima Yojana ?

a) 2 lakhs at Rs 330 per annum

b) 1 lakhs at Rs 330 per annum

c) 1.5 lakhs at Rs 220 per annum

d) None of these correct

12. Swarajists decided to seek election with the object of

a) cooperating with the British

b) replacing the congress

c) wrecking of legislative council from within

d) obtaining ministerial posts

13. Who was the architect who design "Tajmahal" ?

a) Mohammad Hussain

b) Ustad-Isa

c) Shah Abbas

d) Ismail

14. Out of the following remains excavated in Indus Valley, Which one indicates the commercial and economic development ?

a) The pottery

b) Seals

c) The boats

d) The houses

15. Liquid metal is

a) mercury

b) saline

c) lead

d) zinc

16. The gas leaked in Bhopal ( Union Carbide) tragedy is

a) nitrous oxide

b) nitrogen oxide

c) carbon dioxide

d) methyl isocyanide

17. Which is the Agency the Government has engaged to grade the standardise various agricultural products ?

a) Food Corporation of India

b) Directorate of Marketing and inspection

c) Bureau of Indian Standards

d) Central Statistical Organization

18. What are the basic units from which human spare parts can be created ?

a) Nerve cells

b) Stem cells

c) Heart cells

d) Kidney cells

19. Adherent mucoid alkaline substance covering the inner lining of stomach is to

a) digest starch

b) act against bacteria

c) prevent the action of pepsin of mucosa

d) prevent viral infection

20. What is the term used to denote the critical temprature at which the air becomes saturated with vapour and below which the condensations is likely to begin ?

a) Condensation point

b) Evaporation point

c) Dew point

d) Point of critical temprature

21. National Income refers to

a) money value of goods and services produced in a country during a year

b) money value of stocks and shares of a country during a year

c) money value of capital goods produced by a country during a year

d) money value of consumer goods produced by a country during a year

22. A Scheduled Bank is one which is included in the

a) 2 Schedule of Banking Regulation Act

b) 2 Schedule of Constitution

c) 2 Schedule of Reserve Bank of India Act

d) None of the above

23. Rajya Sabha enjoys more powers than Lok Sabha in the case of

a) money bills

b) non-money bills

c) setting up of new all India Services

d) amendment of the Constitution

24. Gamma Rays can cause

a) gene mutation

b) sneezing

c) burning

d) fever

25. Which one of the following is not a function of kidney ?

a) Regulation of blood pH

b) removal of metabolic wastes from the body

c) production of Antibodies

d) Regulation of osmotic pressures of the blood

READ MORE

ANSWERS

1. A

2. C

3. B

4. B

5. B

6. D

7. A

8. D

9. D

10. A

11. A

12. C

13. B

14. B

15. A

16. D

17. B

18. B

19. C

20. C

21. C

22. C

23. C

24. A

25. C

Read More

#Aptitude test questions#UPSC quiz questions#SSC exam preparation#Banking awareness quizzes#Science and technology#GK World history quiz#Geography quiz for exams#Reasoning ability quizzes#Mock tests for competitive exams#Vocabulary and English quizzes#gk quiz#education#study motivation#gk#educate yourselves#teaching#educate yourself

0 notes

Text

Integrated Crop and Fish Farming and Its Benefits for Agribusiness Firms and Farmers Cooperatives

January 18, 2024

In the pursuit of sustainable agriculture, integrated farming practices have emerged as a viable solution, particularly for small-scale farmers and agribusiness firms. One such innovative approach is the integration of crop cultivation and fish farming. This holistic method not only maximizes resource utilization but also brings about a range of benefits for small farmers, agribusiness firms, and farmers cooperatives. Let's delve into the advantages through real-life case studies.

Case Studies:

1. Increased Productivity and Income:

In a small village in Southeast Asia, farmers adopted integrated crop and fish farming techniques. By cultivating crops and raising fish simultaneously, they witnessed a significant increase in overall productivity. The diversified income streams from both crops and fish not only provided financial stability but also reduced the risks associated with relying on a single source of income. For agribusiness firms and farmers cooperatives, this method allows for a more diversified and resilient business model, leading to increased profitability and stability.

2. Nutrient Recycling:

A farming community in Africa embraced the practice of using fish waste as a natural fertilizer for their crops. The nutrient-rich waste from the fishponds, rich in nitrogen and phosphorus, proved to be an excellent organic fertilizer. This not only reduced the dependence on chemical fertilizers but also enhanced soil fertility, leading to healthier crops and increased yields. For agribusiness firms, this practice reduces operational costs and promotes sustainable farming practices.

3. Eco-friendly Pest Control:

In a case study from South America, farmers found that integrating fish farming with crops created a natural balance in the ecosystem. Certain fish species, when introduced into the water bodies, acted as effective predators for pests that commonly affected crops. This reduced the need for chemical pesticides, making the farming system more environmentally friendly and sustainable. For farmers cooperatives, this practice enhances the sustainability of their operations and contributes to environmental conservation.

Some combinations of fish and crops that have been found to be effective in integrated farming systems:

1. Grass Carp and Vegetable Crops: Grass carp feed on grass and other vegetable matter which can be grown on the dikes and adjacent agricultural land. They also feed on aquatic plants which can be raised in canals and other adjacent water bodies.

2. Silver Carp and Livestock: Silver carp and big head feed on plankton which can be grown by the application of organic manures provided by pigs, cattle, and chicken raised by the side of fish farms.

3. Indian Major Carps and Exotic Major Carps with Agricultural Crops: In India, a traditional system of integrated fish farming is practiced, where poly-culture fingerling stocking of six species combination of Indian Major Carps (catla, rohu and mrigal) and exotic major carps (grass carp, silver carp and common carp) is done. The by-products obtained from agricultural crops such as the rice bran, rice polish, wheat flour, mustard oil cake, soya bean etc., can be processed into fish feed.

4. Fish and Prawns with Vegetables, Fruits, and Rice: Integrated Aquaculture-Agriculture (IAA) systems that combine fish and prawns with vegetables, fruits, and rice have been found to have the highest productivity of energy, protein, iron, zinc, and vitamin A.

Please note that the success of these combinations can depend on various factors including the local climate, available resources, and market demand. It's always a good idea to seek advice from local agricultural extension services or experts in integrated farming systems.

Integrated crop and fish farming stands out as a promising solution for small-scale farmers, providing them with a sustainable and resilient agricultural model. The benefits extend beyond increased productivity and income, encompassing eco-friendly pest control and nutrient recycling. For agribusiness firms and farmers cooperatives, these practices offer a path towards more sustainable, profitable, and environmentally friendly operations. As we strive for a more sustainable future, embracing such innovative farming practices becomes imperative. Through these case studies, it is evident that the integration of crops and fish farming not only enhances the economic well-being of small farmers but also contributes to environmental conservation. It's time to promote and adopt these integrated farming practices for a more sustainable and prosperous agricultural future.

I hope you enjoyed reading this post and learned something new and useful from it. If you did, please share it with your friends and colleagues who might be interested in Agriculture and Agribusiness.

Mr. Kosona Chriv

Co-Founder and Chief Operating Officer (COO)

Deko Integrated and Agro Processing Limited

3rd and 4th Floors, Idubor House

52 Mission Road

300002 Benin City

Edo State

Nigeria

Phone/WhatsApp: + 2349040848867 (Nigeria) +85510333220 (Cambodia)

WeChat ID: wxid_8r2809zfgx4722

Email: [email protected]

Website: https://dekoholding.com

Deko Integrated and Agro Processing Limited is an agricultural firm and exporter of agricultural commodities in Nigeria. We aim to use technologies and innovations to disrupt the cassava value chain in Nigeria. We believe that Nigeria has the potential and resources to become the top exporter of value-added cassava. If you are in the world cassava value chain (food manufacturers, bio-ethanol manufacturers, cassava by-products producers, and investors), we look forward to hearing from you soon and exploring the possibilities of working together. By working together, we can create value for our customers, partners, and stakeholders, as well as make a positive impact on the local communities and the environment. We are committed to delivering high-quality products and services, as well as fostering innovation and sustainability.

If you want to learn more about Deko Group and how we can collaborate, please visit our website https://dekoholding.com

0 notes

Text

Small Nutrients, Mighty Results: How Micronutrients Boost Plant Growth

Fertilizers are known to provide the essential nutrients to the plants. However, they are often used without proper research, which affects their efficiency. At times they can also spoil the crop yield. This is explained in the NPK contents of the fertilizers. Thus, proper research about the soil and the ingredients of the research is necessary to ensure growth. Many fertilizers also provide the soil with the micronutrients needed to maintain both soil and plant health. Thus, the ideal way to fertilize is to also use micronutrient fertilizers for plants in addition to the traditional NPK fertilizers.

Forms of Micronutrient Fertilizers

Sulfate (salts)

Micronutrients such as copper, zinc, iron, and manganese are often added to plants in the form of sulfate molecules. They are most commonly used for field crops. This form can be applied to soil or foliage. They provide long-term residual value.

Oxysulphate

It is an oxide of a micronutrient that has been partially reacted with sulphuric acid. The amount of sulfate varies by product. The water solubility of oxysulphates can vary greatly. They have a residual value that is similar to sulfates.

Oxide

In this form, the micronutrients are bonded with oxygen. An oxide of a micronutrient needs to be converted to a plant-available form in the soil before being taken up by the plant. Thus, they can be categorized as slow-release fertilizers. They are less commonly used, and the usage of this form is not suggested during the growing season.

Chelate

These are ring-type compounds of micronutrients and remain in plant-available form longer because the chelated structure slows the micronutrient reaction with soil minerals. They can be applied to the soil or foliage. They have a low recommended rate of application and a limited residual value.

Other Forms

Micronutrients are also available in the form of carbonates and nitrates. Also, repeated application of manure is known to increase the content of copper and zinc in the soil.

Additionally, most of these forms are also available in organic fertilizers. So, considering the multifold benefits of organic fertilizers for the soil, crop, environment, and pockets they are always recommended over synthetic fertilizers. Further, the availability of organic fertilizer online shopping makes them the new go-to of the agriculture industry.

Buy Organic Fertilizers Online

If you are also looking for micronutrient-rich organic fertilizers online, visit Kisan4u now. They provide a variety of best plant growth promoters in India from various brands including Katra, Atal, Miticide, Virus-G, PROSPER, CLASSIC, and Ezzy Garden. So, do not wait to pile up your stock of organic fertilizers and order fertilizers for the next application at Kisan4u now.

#organic fertilizer online shopping#best plant growth promoter products in india#micronutrients fertilizer for plants

0 notes

Text

Disinvestment Target: Can the government break the jinx?

Started in 1981, disinvestment is a process where the government sells a part or whole of its assets or a subsidiary, such as a central or state public sector enterprise, to private entities or the public. Disinvestment can be carried out through three modes vis-a-vis minority disinvestment, majority disinvestment, and complete privatisation.

The Department of Investment and Public Asset Management (DIPAM) handles the disinvestment procedures with a primary objective to improve public finances. The disinvestment may also be done to increase private ownership and improve the management and performance of the public sector enterprise.

In the past, the government has missed targets set for prior financial years, the most recent being the Rs 1.75 lakh crore target for FY22, which was revised downwards to Rs 78,000 crore in the revised estimates. The actual proceeds for FY22 were at a meagre Rs 14,638 crore, primarily owing to the disruptions caused by the Covid-19 pandemic.

For FY23 as well, the government missed the disinvestment target. The proceeds from the disinvestment came at Rs 46,035 crore in FY23, missing the revised target of Rs 60,000 crore. The government shelved the strategic disinvestment of Bharat Petroleum Corp, which was expected to bring in Rs 50,000-60,000 crore.

Learning lessons from the past and with general elections looming around the corner, the government has set a disinvestment target at Rs 51,000 crore for FY24, lower than the previous financial year.

For FY24, the government outlined plans to sell shares in IDBI Bank, Container Corporation of India, Shipping Corporation of India, and BEML. However, we believe that strategic sales would not go through at a great speed in FY24, as this is a pre-election year where the optics of this economic reform may not be seen in a popular light. The status of the various planned disinvestments are as below:

With almost five months into this financial year and the disinvestment plan yet to see the light of day, it is looking increasingly difficult for the government to come out of its track record of repetitively missing the targets.

To get closer to the Rs 51,000 crore target, we believe that the maximum will now have to come from offer for sale (OFS) or minority stake sales.

The government has garnered close to a combined Rs 5,500 crore through OFS in Coal India and RVNL in this financial year and is contemplating close to Rs 7,000 crore through an 11.4% OFS in IRFC going ahead.

Among the other major OFS planned in FY24, the government is looking at a 5-6% stake sale in Hindustan Zinc, 20% in National Fertilizers (NFL), 10% in Rashtriya Chemicals & Fertilizers (RCF) and a stake sale in RITES.

Apart from the OFS route, the government has other options up its sleeve, which include stake sales in NMDC Steel, HLL Lifecare, Vizag Steel, and Hindustan Zinc. Moreover, the government may remotely also consider listing companies such as the Indian Renewable Energy Development Agency (IREDA), National Seeds Corporation (NSC), and WAPCOS, a PSU in engineering consultancy and construction under the Ministry of Jal Shakti.

To sum up, we believe that unless major strategic sales happen, the government will not be able to meet the target this year as well. To overcome these challenges in the long term, the government must address multiple issues that mostly derail the disinvestment plans and are mostly related to labour unions, land titles, leases, land use, and excess manpower.

Also, the government must find ways to enhance the attractiveness of public sector stocks which usually suffer from the preconceived notion of abrupt policy changes, weak operational metrics, and sub-par corporate management. In all the gloom surrounding the disinvestment targets, the fiscal deficit target of 5.9% for the current year is not likely to be exceeded as surplus funds from non-tax sources will help bridge the gap.

(The author is the Head of Research at StoxBox)

0 notes

Text

Zinc Sulphate Prices & Demand | ChemAnalyst

For the Quarter Ending June 2023

North America

According to my research, the price trends of Zinc Sulphate in North America during Q2 2023 were volatile. The market in the US experienced downward pressure due to global economic headwinds like inflation and rising interest rates. Weak economic conditions and higher borrowing costs have impacted the downstream demand, particularly in the agrochemical industries. The market transactions for Zinc Sulphate were mainly small orders, and the cost support from upstream Sulphuric Acid remained lackluster. Core inflation in the US has trended above targeted levels, further pressuring the market fundamentals of Zinc Sulphate.

Asia Pacific

In APAC, Zinc Sulphate prices also showed volatile growth in Q2 2023. Prices remained on the lower end in the first half of the year due to ample availability in the Indian domestic market. Manufacturers reported a build-up of stocks, leading to reduced offers for the downstream agrochemical sector. However, towards the end of the quarter, there was an upward momentum in Zinc Sulphate prices in India due to increased inquiries from the agrochemical industries.

Get Real Time Prices of Zinc Sulphate: https://www.chemanalyst.com/Pricing-data/zinc-sulphate-1469

Europe

In Europe, Zinc Sulphate prices sustained a downward trajectory in France during Q2 2023. Inflationary pressures and limited consumption in the energy-intensive manufacturing sector affected purchasing power. Labor shortages and continued strikes also impacted production. However, there were indications of a possible slowdown in inflationary pressures in France, with a decline in consumer price inflation.

About Us:

ChemAnalyst is an online platform offering a comprehensive range of market analysis and pricing services, as well as up-to-date news and deals from the chemical and petrochemical industry, globally.

Being awarded ‘The Product Innovator of the Year, 2023’, ChemAnalyst is an indispensable tool for navigating the risks of today's ever-changing chemicals market.

The platform helps companies strategize and formulate their chemical procurement by tracking real time prices of more than 400 chemicals in more than 25 countries.

ChemAnalyst also provides market analysis for more than 1000 chemical commodities covering multifaceted parameters including Production, Demand, Supply, Plant Operating Rate, Imports, Exports, and much more. The users will not only be able to analyse historical data but will also get to inspect detailed forecasts for upto 10 years. With access to local field teams, the company provides high-quality, reliable market analysis data for more than 40 countries.

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

What exactly are carbon steel pipes

Carbon steel pipe is one of the pipe types that is used in many industrial applications because it is trustworthy and durable. The fact that it is both light and powerful allows it to move solids, gases, and liquids. Industry-recognized Bright Steel Centre is a respected corporation that manufactures, provides, exports, and trades a noteworthy and top-quality accredited assortment of industrial pipes, plates, and pipe fittings.We are India’s leading Manufacturer of A333 Carbon Steel Grade 6 ERW Pipes.

Stainless steel plates, high nickel plates, and pipe fittings are additional products we offer.Bright Steel Centre has a buffer stock of common items, pipes, and pipe fittings in sizes 1/2 to 24, to meet our clients' sporadic needs. The fastest turnaround times and highest quality standards are used to make the precise goods that customers have requested.

We are a top quality Carbon Steel Pipe Supplier Singapore.

Benefits of carbon steel pipes

The majority of carbon-containing iron used to make the type of pipe known as carbon steel pipe is iron. It's one of the most often used types of pipes because of its advantages over materials like PVC or stainless steel. As a Carbon Steel Pipe Supplier Malaysia, our Carbon steel pipes are strong, durable, and corrosion-free. They are also highly cost-effective due to the fact that they are far less expensive than other kinds of pipes.

Carbon Steel Seamless Pipes:

For a variety of purposes, we manufacture and supply carbon steel pipe goods. The two main components of carbon steel are carbon and iron. Silicium, manganese, and copper are allowed in various amounts as traces depending on the grades. Carbon steel seamless pipe is therefore more resilient to stress and more long-lasting.

Carbon Steel ASTM A335 Pipes:

The ASTM A335 Seamless Steel Pipe ordered in accordance with this specification must be suitable for fusion welding, bending, flanging (vanstoning), and other comparable forming operations. When chrome and molybdenum components are combined, ASTM A335 offers superb tensile strength, fine resistance to high temperatures, and corrosion.

Aluminium Pipes:

Aluminium is a perfect material for temperature control applications like solar power, freezers, and air conditioners since it absorbs heat very well and forms tubes in the process. Due to its lightweight and durability, aluminium tubes are crucial in hydraulic systems, bracing, fuel lines, and frames.

We are also a top quality Carbon steel Pipe Suppliers in UAE.

Mild Steel Pipes:

Mild steel (MS) pipes are made from low carbon steel (less than 0.25% carbon). The low carbon content makes the pipes easy to use and prevents them from becoming hard. Because they are made of mild steel, mild steel pipes may easily be welded and shaped into a wide range of shapes and sizes for use in pipelining and tubing.

Alloy Steel Pipes:

Alloy steel pipes are used in applications where moderate corrosion resistance, good durability, and a reasonable price are required. The two types of alloy steels are high alloy and low alloy steels.

High Nickel Alloy Pipes:

Nickel pipes are created by applying zinc to the metal's surface. Nickel alloy pipes are made of the chemical compounds nickel, manganese, carbon, silicon, sulphur, ferrous, and copper. Outstanding oxidation and corrosion resistance is a feature of these pipes. High Nickel Alloy Tube has excellent mechanical characteristics.

Product Source - Carbon Steel Pipes in India

0 notes

Text

A Comprehensive Guide to Commodities Trading in India: Major Commodities

Introduction

Commodities trading in India has gained significant popularity over the years. As a diverse investment avenue, it allows individuals to take part in the trading of various tangible goods. These goods are essential for industries and households alike. This article will provide an in-depth overview of the eight categories of commodities traded in India.

When considering the best commodity shares to buy in India, it's important to conduct thorough research and analysis. Factors such as market trends, company fundamentals, and prospects should be considered. Consulting with a financial advisor or broker can provide valuable insights. It assists to recognize potential investment opportunities.

Precious Metals:

Precious metals are valued for their rarity and aesthetic appeal. Examples are gold, silver, and platinum. They serve as a store of value, a medium of exchange, and a hedge against increase in general price level. Investors often view precious metals as a haven during times of economic uncertainty. To invest in precious metals, individuals can consider purchasing physical bullion, exchange-traded funds (ETFs), or stocks of mining companies.

Base Metals:

Base metals play a crucial role in various industries. It includes construction, manufacturing, and infrastructure. Copper, aluminium, zinc, nickel, and lead are some base metals traded in India. Global economic conditions and industrial activities influence the demand for these metals. Investors can take part in base metals trading through commodity exchanges, futures contracts, or exchange-traded products.

Energy Products:

Crude oil, natural gas, and coal are significant energy commodities traded in India. Crude oil is a vital resource. Its main usage is fueling transportation, power generation, and manufacturing processes. Natural gas is an alternative to traditional fossil fuels. But, coal remains a dominant energy source in certain industries. Investors interested in energy commodities can consider futures contracts, ETFs, or energy company stocks.

Agricultural Products:

India's agriculture sector is diverse and produces a wide range of commodities. The following are among the many agricultural commodities traded in the country:

Cereals like rice and wheat, pulses like lentils and chickpeas, oil seeds like soybean and mustard, spices, sugar, cotton, and coffee. One can invest in agricultural commodities through commodity exchanges, agricultural futures contracts, or agro-based ETFs.

Soft Commodities:

Soft commodities refer to agricultural products that are grown rather than mined. These include commodities like coffee, cocoa, tea, rubber, and jute. Factors such as weather, global consumption patterns, and geopolitical factors influence the demand for soft commodities. Investors can gain exposure to soft commodities. It can be through commodity exchanges, futures contracts, or specialized ETFs.

Bullion:

Apart from being a category of precious metals, bullion may also refer to traded commodities such as gold and silver bars or coins. Bullion favoured by investors looks for a physical form of investment. It offers a tangible asset that can be stored or held as a hedge against inflation. Investors can buy bullion from trusted dealers or opt for ETFs that track the value of physical bullion.

Agrochemicals:

Agrochemicals are crucial for enhancing agricultural productivity. Certain commodities including fertilizers and pesticides. As the agricultural sector continues to grow in India, the demand for agrochemicals rises as expected. Investors interested in this sector can explore stocks of agrochemical companies or ETFs focused on the agricultural industry.

Other Commodities:

Besides the above categories, there are various other commodities traded in India. This includes diamonds, textiles, and industrial raw materials. Diamonds are highly valued gemstones. Textiles and industrial raw materials play significant roles in the manufacturing and construction sectors. Investors can explore stocks of companies involved in these sectors. Also other specialized commodity-related funds.

Conclusion

Commodities trading in India offers individuals a diverse range of investment opportunities. Across various categories, each presents unique dynamics and potential for investment growth. It is despite precious metals or other commodities.

To open an online commodity trading account in India, individuals can approach established brokerage firms. It must offer online trading services. These firms provide an easy-to-use online platform to open an account. Complete the necessary documentation, and fund the account. It is advisable to review the account opening process, fee structure, and trading tools provided.

In summary, commodities trading in India presents investors with a multitude of opportunities. It helps to diversify their portfolios and achieve attractive returns. Understand the various categories of commodities. Conduct thorough research and make informed investment decisions. Individuals can take part in this dynamic market. Also, enjoy the performance of different commodities.

Choosing from the best commodity trading brokers in India is essential. A reputable and reliable brokerage firm such as Goodwill, offers a platform with competitive pricing, and reliable customer support. It also gives access to a wide range of commodities and markets.

0 notes