#zulutrade

Text

zulutrade

Trading spot currencies involves substantial risk and there is always the potential for loss. Your trading results may vary. Because the risk factor is high in the foreign exchange market trading, only genuine "risk" funds should be used in such trading. If you do not have the extra capital that you can afford to lose, you should not trade in the foreign exchange market.

0 notes

Text

ZuluTrade: The World's Oldest Broker-Agnostic Social Trading Platform

Founded in 2007, Headquartered in Greece, ZuluTrade is the world’s first social trading platform that leveraged the powers of the trading community and algorithmic performance ranking to connect traders with investors.

An industry leader for 17 years and winner of the Best Social Trading Solution in the Middle East and African Region (MEA) in 2024, ZuluTrade has been credited with revolutionizing copy trading by creating a “one of its kind” socially-powered broker and platform-agnostic social network. We have over one million users in 198 countries, who not only benefit by copying the trades of experienced traders, but also leverage our social trading platform to share their knowledge, ideas with a strong, irreplaceable social community.

2 notes

·

View notes

Text

Unveiling the Dynamics of Forex Trading Signal Providers in 2024

In the intricate realm of forex trading, having a reliable compass to navigate the market is indispensable. Forex trading signal providers serve as this compass, offering traders valuable insights and recommendations to capitalize on market opportunities. In this article, we delve into the evolution, leading players, and emerging trends of forex trading signal providers in 2024, shedding light on their pivotal role in shaping trading strategies.

The Essence of Forex Trading Signals

Forex trading signals act as beacons, illuminating potential trading opportunities in the vast sea of the foreign exchange market. These signals are derived from meticulous analysis of market data, encompassing technical indicators, fundamental factors, and prevailing market sentiment. By providing actionable information on entry and exit points, forex signals empower traders to make informed decisions and optimize their trading performance.

Evolution of Forex Signal Providers

The landscape of forex trading signal providers has undergone a profound transformation, propelled by technological advancements and evolving market dynamics:

Harnessing Artificial Intelligence and Machine Learning: AI and machine learning algorithms have revolutionized signal generation. By crunching vast datasets, these technologies can identify patterns and trends with remarkable accuracy, enhancing the reliability and precision of trading signals.

Real-Time Analysis and Alerts: Timeliness is crucial in forex trading, and modern signal providers leverage real-time data analysis to deliver swift alerts to traders. This enables traders to seize opportunities as they arise and stay ahead of market movements.

Customization and Personalization: Recognizing the diverse needs of traders, signal providers now offer customization options. Traders can tailor signals to their unique preferences, risk tolerance, and trading objectives, ensuring that the signals align with their individual strategies.

Enhanced Accessibility: Accessibility has been a focal point for signal providers, with the advent of user-friendly platforms and mobile apps. Traders can now access signals on-the-go, enabling them to stay connected to the market and execute trades conveniently.

Leading Forex Signal Providers in 2024

Several forex trading signal providers have established themselves as leaders in the industry, offering comprehensive services and innovative solutions:

Forexbanksignal.pro: Renowned for its in-depth market analysis and accurate signals, Trading Central is a preferred choice for professional traders. Their platform provides a wealth of technical insights and tools to support traders' decision-making process.

ForexSignals.com: With a focus on community and education, ForexSignals.com offers live trading rooms, educational resources, and real-time signals. Their collaborative platform fosters a supportive environment for traders to learn and grow together.

ZuluTrade: ZuluTrade's social trading platform allows users to follow and copy the trades of top-performing traders. This unique approach provides valuable insights and opportunities for traders of all levels to replicate successful strategies.

FXTM Signals: FXTM Signals offers a diverse range of signals based on both fundamental and technical analysis. Their user-friendly interface and seamless integration with trading platforms make it easy for traders to access actionable insights and make informed decisions.

Future Trends in Forex Trading Signals

Looking ahead, the future of forex trading signal providers is ripe with innovation and advancement:

Integration of Blockchain Technology: Blockchain technology holds the potential to enhance transparency and security in signal generation and distribution, fostering greater trust among traders.

Advanced Analytics and Predictive Tools: Continued advancements in analytics and predictive tools will enable signal providers to offer deeper insights into market trends and behaviors, empowering traders with actionable intelligence.

Regulatory Compliance: With the growing prominence of forex trading, regulatory bodies may introduce stricter guidelines for signal providers to ensure transparency and protect traders' interests.

Focus on Education and Empowerment: Education will remain paramount, with signal providers placing a greater emphasis on empowering traders with the knowledge and skills needed to succeed in the forex market.

Conclusion

In 2024, forex trading signal providers continue to play a pivotal role in empowering traders with valuable insights and recommendations. With advancements in technology and a focus on customization and accessibility, these providers are poised to revolutionize the way traders approach forex trading. Whether you're a seasoned trader or new to the game, leveraging the expertise of forex trading signal providers can help you navigate the complexities of the market and achieve your trading goals with confidence.

#forex market#forexsignals#forex education#forex#forextrading#forex trading#forex broker#forex signals#forex signal service

6 notes

·

View notes

Text

Top 10 Forex Signal Copiers for Traders in the USA in 2024

In the fast-paced world of Forex trading, signal copiers have become essential tools for traders looking to replicate the strategies of seasoned professionals. These platforms allow traders to automate their trading activities, ensuring they don’t miss out on profitable opportunities. Here’s a list of the top 10 Forex signal copiers you should consider in 2024.

1. Telegram Signal Copier (TSC)

Telegram Signal Copier (TSC) takes the crown as the leading Forex signal copier. Renowned for its reliability and ease of use, TSC allows users to seamlessly copy signals directly from Telegram channels. It offers an intuitive interface, high customization options, and robust performance, making it the go-to solution for traders worldwide.

2. MetaTrader Signal Copier

MetaTrader Signal Copier is a popular choice for traders who prefer to stay within the MetaTrader ecosystem. It allows users to copy signals from various sources, including MQL5’s signal marketplace, and execute trades directly in MetaTrader 4 or 5.

3. SureShotFX Copier

SureShotFX Copier is a powerful tool designed for those who want precision in their trades. With advanced risk management features and a user-friendly interface, this copier ensures that traders can replicate strategies with minimal effort.

4. ZuluTrade

ZuluTrade is a well-known social trading platform that doubles as a signal copier. It connects traders with professional signal providers, allowing them to copy trades automatically. The platform also provides comprehensive analytics to help users choose the best signal providers.

5. DupliTrade

DupliTrade is another excellent platform for copying Forex signals. It offers integration with major brokers and allows users to replicate the strategies of top traders. DupliTrade’s simplicity and efficiency make it a favorite among beginners.

6. CopyFX by RoboForex

CopyFX is RoboForex’s signal copying service, designed to cater to both beginners and experienced traders. The platform allows users to follow the trades of professional traders and offers various account types to suit different trading styles.

7. Darwinex

Darwinex combines signal copying with a unique approach to trader performance analysis. Users can invest in “Darwins,” which are algorithms based on traders’ strategies. This platform is ideal for those looking to diversify their trading portfolio.

8. FX Junction

FX Junction is a social trading network that allows users to connect with other traders and copy their trades. It offers a transparent environment where users can track performance and choose the best strategies to follow.

9. Tradeo

Tradeo is a social trading platform that integrates signal copying with a community-driven approach. Users can follow and copy trades from top traders while engaging with a vibrant community of traders.

10. Signal Start

Signal Start is a fully automated signal copying platform that offers seamless integration with multiple trading platforms. It provides a marketplace where users can choose from hundreds of signal providers, making it easy to find a strategy that fits their trading goals.

0 notes

Text

Exploring the Best Automated Trading Platform: What to Look For

In the fast-paced world of trading, automated trading platforms have become indispensable tools for both novice and experienced traders. These platforms leverage algorithms to execute trades based on pre-set criteria, enabling traders to take advantage of market opportunities without constant monitoring. But with so many options available, how do you identify the best automated trading platform for your needs? In this article, we'll explore the key features and considerations to help you make an informed decision.

What Are Automated Trading Platforms?

Automated trading platforms are software systems designed to execute trades on behalf of the user based on predetermined strategies. These platforms operate by analyzing market data, identifying potential trade opportunities, and executing orders at optimal times—all without human intervention.

Advantages of Using an Automated Trading Platform

Time Efficiency: Automated trading platforms can monitor the markets 24/7, ensuring that no opportunity is missed, even when you're not actively trading.

Emotion-Free Trading: By sticking strictly to pre-set rules, automated platforms eliminate the emotional aspect of trading, which can often lead to impulsive and irrational decisions.

Backtesting Capabilities: Most platforms offer backtesting features, allowing you to test your trading strategies against historical data to determine their effectiveness before deploying them in live markets.

Scalability: Automated trading allows for the management of multiple accounts or strategies simultaneously, which would be difficult to achieve manually.

Key Features to Look for in the Best Automated Trading Platform

When choosing an automated trading platform, it's essential to consider the following features:

Algorithm Customization: The ability to create, modify, and optimize trading algorithms is crucial for adapting to changing market conditions.

Real-Time Market Data: Access to accurate and up-to-date market data is vital for the success of any automated trading strategy.

Risk Management Tools: Look for platforms that offer advanced risk management features such as stop-loss, take-profit, and trailing stop orders.

User Interface: A user-friendly interface can make a significant difference, especially for traders who are not technically inclined.

Integration with Multiple Brokers: The platform should be compatible with various brokers to give you flexibility in your trading options.

Security: Ensure that the platform uses robust security measures to protect your data and trading activity.

Support and Resources: Comprehensive customer support and educational resources can be invaluable, particularly for those new to automated trading.

Top Automated Trading Platforms to Consider

Here are a few automated trading platforms that have gained popularity due to their features and reliability:

MetaTrader 4/5: Known for its powerful analytical tools and customizable trading algorithms, MetaTrader is a favorite among forex traders.

eToro: A social trading platform that also offers automated trading options, making it ideal for those who want to learn from or mirror the trades of experienced traders.

ZuluTrade: This platform allows traders to follow and copy the trades of top traders, providing an automated trading experience without the need for complex algorithm creation.

Interactive Brokers: Offers an extensive range of trading tools and is well-suited for professional traders looking for an automated trading solution.

AlgoTrader: A comprehensive algorithmic trading platform that supports multiple asset classes, making it a versatile choice for sophisticated traders.

How to Choose the Right Platform for You

Choosing the best automated trading platform depends on several factors, including your trading style, level of experience, and the markets you want to trade. Here are a few tips to help you decide:

Assess Your Trading Needs: Determine what you need from a platform in terms of features, asset coverage, and customization options.

Consider Your Budget: While some platforms offer free versions or trials, others may require a subscription or charge per transaction. Make sure the costs align with your trading budget.

Test the Platform: Many platforms offer demo accounts. Use these to test the platform’s features and see how comfortable you are with its interface and functionalities.

Read Reviews and Get Recommendations: Look for reviews from other traders and ask for recommendations in trading communities to get a sense of the platform’s reliability and performance.

Conclusion

Automated trading platforms can offer significant advantages, from saving time to improving trade execution. However, the key to success lies in choosing the right platform that aligns with your trading goals and preferences. By considering the features and tips outlined in this article, you can find the best automated trading platform to enhance your trading experience.

0 notes

Text

Are you looking to copy trade? We've a blog that shows some of the best options to trade through ZuluTrade

0 notes

Text

Top forex signals

In the dynamic world of forex trading, having access to reliable signals can make a significant difference. Forex signals provide insights into potential trading opportunities, including entry and exit points. Here’s a look at some of the top forex signal providers and tools that are well-regarded in the trading community.

1. MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Overview: MetaTrader platforms are popular among traders for their advanced charting tools and custom indicators. They offer a range of built-in forex signals and allow for the integration of third-party signal services.

- Features: Automated trading through Expert Advisors (EAs), custom indicators, and a vast library of trading scripts. Both MT4 and MT5 support signal subscriptions from various providers.

2. TradingView

- Overview: TradingView is renowned for its robust charting capabilities and social trading features. It provides access to a wide array of forex signals from various users and professional traders.

- Features: Real-time charts, technical analysis tools, community-generated trading ideas, and signal alerts. Users can follow experienced traders and receive their signals.

3. ZuluTrade

- Overview: ZuluTrade connects traders with signal providers and offers a platform for copying trades. It ranks signal providers based on their performance and risk levels.

- Features: Performance-based ranking, customizable risk settings, and automated trade copying. It allows users to follow top traders and automatically replicate their trades.

4. ForexSignals.com

- Overview: ForexSignals.com offers a variety of trading signals and educational resources. It provides live signals through its platform and offers expert analysis.

- Features: Live trading signals, webinars, educational resources, and a supportive trading community. It caters to both novice and experienced traders.

5. DailyForex

- Overview: DailyForex provides daily trading signals and market analysis. It offers a mix of technical and fundamental analysis to support trading decisions.

- Features: Daily signal updates, in-depth market analysis, and trading strategies. It covers major currency pairs and provides insights into market trends.

6. eToro

- Overview: eToro is a social trading platform that allows users to follow and copy the trades of successful traders. It also offers trading signals based on the activity of top traders.

- Features: Copy trading, real-time signals, and a social trading network. Users can see the performance of other traders and mirror their strategies.

7. Trade Ideas

- Overview: Trade Ideas is a sophisticated trading platform offering real-time trading signals and advanced analytics. While it's more commonly used for stock trading, it also provides forex signals.

- Features: Real-time alerts, customizable scanning, and advanced charting tools. It’s known for its artificial intelligence-driven trading signals.

8. Signal Skyline

- Overview: Signal Skyline offers professional-grade forex signals with a focus on accuracy and performance. It provides signals for a range of currency pairs and trading strategies.

- Features: High-frequency signals, detailed trade setups, and performance tracking. It caters to both short-term and long-term trading styles.

Choosing the Right Signal Provider

When selecting a forex signal provider, consider factors such as:

- Reputation: Look for providers with positive reviews and a proven track record.

- Transparency: Ensure the provider offers clear performance metrics and methodology.

- Trial Options: Use trial periods or demo accounts to evaluate signal accuracy and fit for your trading style.

In summary, top forex signal providers and tools offer a range of features to support traders in making informed decisions. By leveraging these resources, traders can gain valuable insights and improve their trading strategies.

0 notes

Text

Getting Started with Copy Trading: A Practical Guide

Forex trading can be complex and intimidating for newcomers, but copy trading offers a practical entry point. By copying the trades of experienced traders, you can bypass much of the initial learning curve and still benefit from the potential gains in the forex market. Here’s a comprehensive guide to get you started.

Setting Up Your Copy Trading Account

1. Choose a Reliable Platform

The first step is to select a reputable copy trading platform. Some of the popular ones include eToro, ZuluTrade, and Myfxbook. Ensure the platform is regulated and has positive user reviews.

2. Create an Account

Sign up for an account on your chosen platform. You'll need to provide personal information and verify your identity, a standard procedure for financial services.

3. Deposit Funds

After setting up your account, the next step is to deposit funds. Most platforms have a minimum deposit requirement, typically ranging from $200 to $500.

Finding and Evaluating Top Traders

1. Use Platform Filters

Most copy trading platforms have filters that allow you to sort traders based on various criteria like profitability, risk level, trading frequency, and more. Utilize these filters to narrow down your options.

2. Analyze Performance Metrics

Look at key performance metrics such as historical performance, drawdown, win rate, and average return per trade. These metrics will give you an insight into the trader’s consistency and risk management.

3. Review Trading Strategy

Each trader usually has a profile detailing their trading strategy. Make sure their approach aligns with your risk tolerance and financial goals.

4. Check Reviews and Ratings

Many platforms allow followers to rate and review traders. These reviews can provide additional insight into the trader's reliability and performance under various market conditions.

Managing Your Copy Trading Portfolio

1. Diversify Your Portfolio

Just like in traditional investing, diversification is key in copy trading. Instead of copying a single trader, spread your investments across multiple traders. This approach can mitigate risk and improve your chances of steady returns.

2. Monitor Performance Regularly

Keep a close eye on the performance of the traders you are copying. Forex markets are dynamic, and a trader performing well today might not do so tomorrow. Regular monitoring allows you to make timely adjustments to your portfolio.

3. Set Stop-Loss Orders

To protect your investment, set stop-loss orders. This feature automatically stops copying a trader if their losses exceed a certain amount, thereby limiting your potential losses.

4. Reinvest Profits

Consider reinvesting your profits to compound your returns over time. However, always keep a portion of your profits as a safety net. Read More

0 notes

Text

Introducing ZuluTrade: The Trading Platform That Makes You Feel Like a Forex Rockstar

Have you ever dreamt of being a financial wizard, effortlessly making money in the forex market while sipping cocktails on a tropical beach? Well, dream no more! With ZuluTrade, you can turn your fantasies into reality (minus the cocktails, unfortunately). This innovative trading platform allows you to automatically copy the trades of successful traders, giving you the chance to profit from their expertise without lifting a finger. So, grab your shades and get ready to rock the zulutrade trading platform!

Trading Like a Pro: How ZuluTrade Works

ZuluTrade is like having a team of experienced traders at your disposal, ready to make profitable moves on your behalf. Here's how it works: once you've signed up, you can browse through a wide selection of top-performing traders and choose the ones you want to follow. These traders are ranked based on their performance, so you can easily identify the crème de la crème. Once you've made your selection, ZuluTrade will automatically replicate their trades in your own account. It's like having a personal mentor guiding you through the treacherous waters of forex trading.

But wait, there's more! ZuluTrade also offers a nifty feature called "Social Trading," which allows you to interact with other traders in the community. You can discuss strategies, share insights, and even ask questions. It's like being part of an exclusive club where everyone speaks the language of profits. So, if you're tired of trading alone in your pajamas, ZuluTrade is here to bring some socializing back into your life.

Join the ZuluTrade Revolution

In a world where trading platforms are a dime a dozen, ZuluTrade stands out as a true game-changer. With its innovative approach to copy trading and social interaction, it offers a unique experience that is both profitable and entertaining. So, whether you're a seasoned trader looking to diversify your portfolio or a newbie hoping to make your mark in the forex world, ZuluTrade has got your back. It's time to unleash your inner forex rockstar and let ZuluTrade take you to new heights of financial success. Cheers to that!

0 notes

Text

In the ever-evolving landscape of financial markets, a groundbreaking trend has emerged – social trading. This innovative approach to trading has democratized the investment landscape, allowing individuals to harness the wisdom of the crowd and leverage the expertise of seasoned traders. Social trading platforms, encompassing features such as copy trading and PAMM trading, are at the forefront of this revolution. Let’s delve into how these platforms are reshaping the way we engage with the markets and empowering traders of all levels.

Understanding the Dynamics of Social Trading

Social trading is a paradigm shift in the world of finance, transcending traditional barriers and fostering a collaborative environment. At its core, social trading enables users to observe, follow, and even replicate the trading strategies of experienced investors in real-time. This democratization of trading insights has brought financial markets closer to individuals, irrespective of their experience level.

Key Features of Social Trading Platforms

Copy Trading – Embracing the Wisdom of Experts

Copy trading, a flagship feature of social trading platforms, allows users to replicate the trades of successful and experienced investors automatically. By simply selecting a trader to follow, users can mirror their trading activity, making it an ideal option for those who may lack the time or expertise to actively manage their portfolios.

PAMM Trading – Professional Asset Management

Percentage Allocation Management Module (PAMM) trading is another integral component of social trading platforms. PAMM accounts enable users to allocate funds to experienced fund managers who then make trading decisions on their behalf. This hands-off approach to investing provides a level of professional asset management previously accessible only to institutional investors.

How to Get Started with Social Trading

Step 1: Choose a Reputable Social Trading Platform

The first step on the social trading journey is selecting a platform that aligns with your trading goals. Consider factors such as user interface, available features, security measures, and the diversity of traders on the platform. Popular social trading platforms include Exclusive Markets, eToro, ZuluTrade, and NAGA.

Step 2: Create an Account and Verify

After carefully selecting a platform, the subsequent course of action is to establish an account. This involves furnishing the necessary details and, usually, undergoing a verification procedure to guarantee adherence to regulatory benchmarks. It is imperative to comprehend that this phase holds immense significance in safeguarding both your financial resources as well as your personal information.

Step 3: Explore Traders and Strategies

Social trading platforms offer a diverse pool of traders, each with their unique strategies and risk profiles. Take the time to explore and analyse the performance statistics, risk factors, and trading styles of different traders. Look for consistency in performance over time.

Step 4: Allocate Funds and Set Parameters

For copy trading or PAMM trading, the allocation of funds is a critical decision. Determine the amount of capital you’re comfortable investing and allocate it to the selected trader or PAMM account. Additionally, set parameters such as risk tolerance and investment goals to guide the automated trading process.

Advantages of Social Trading Platforms

Accessibility and Inclusivity

One of the significant advantages of social trading platforms is their accessibility. They break down traditional barriers to entry, allowing individuals with varying levels of experience to participate in financial markets. Novice traders can learn from seasoned professionals, and experienced investors can diversify their strategies.

Diversification and Risk Management

Social trading platforms inherently promote diversification. By following multiple traders or allocating funds to different PAMM accounts, users can spread risk across various assets and trading styles. This diversification enhances risk management and reduces exposure to the volatility of any single investment.

Considerations in Social Trading

Risk Awareness and Due Diligence

While social trading platforms offer opportunities, they also come with risks. Users should be aware that past performance is not indicative of future results, and losses are possible. Conduct due diligence on the traders or fund managers you choose, considering factors such as trading history, risk management practices, and market conditions during their trading periods.

Platform Fees and Costs

Social trading platforms typically charge fees for their services. These fees may include spreads, performance fees for successful trades, or subscription fees for premium features. Understand the fee structure of the platform you choose to ensure that it aligns with your budget and trading goals.

The Future of Social Trading

As technology continues to advance, the future of social trading holds exciting possibilities. The integration of artificial intelligence and machine learning algorithms may further enhance the capabilities of these platforms. Advanced analytics and predictive tools could provide users with more comprehensive insights and personalized recommendations.

In Conclusion

The emergence of social trading platforms has brought about a fresh era of ease and cooperation in the financial markets. Through methods like copy trading or PAMM trading, regular people now have the chance to get involved with the markets in a more knowledgeable and less hands-on way. All types of trading, like any activity demand careful consideration of the risks involved. Like any endeavour it is essential to research and continuously learn. A notable transformation, in how we engage with and navigate the evolving realm is the emergence of social platforms tailored for traders. This shift is undeniably significant.

Source: https://ipsnews.net/business/2024/01/09/the-rise-of-social-trading-copy-trading-and-pamm-trading/

#social trading#copy trading platform#copy trade#copytrading#pamm trading account#pamm account#pamm trading

0 notes

Text

Top 10 Forex Signals Service Providers for Accurate Trading in 2024

Choosing the best forex signals service provider is essential for traders seeking to enhance their trading strategies and achieve consistent profits. Here’s a detailed overview of the top 10 forex signals service providers for 2024, known for their reliability, accuracy, and comprehensive support.

1. Forex Bank Signal Pro

Website: https://forexbanksignal.pro/

Forex Bank Signal Pro stands out as the leading forex signals service provider for 2024. Renowned for its precise signals and real-time market analysis, this platform caters to traders of all levels. With a user-friendly interface and dedicated customer support, Forex Bank Signal Pro ensures traders have the tools needed to capitalize on trading opportunities effectively.

2. 1000pip Builder

1000pip Builder is recognized for its consistent performance and transparent signal delivery. Managed by experienced traders, the service provides daily signals via email and SMS, accompanied by detailed trade analysis and a proven track record.

3. Learn 2 Trade

Learn 2 Trade offers a comprehensive range of signals across forex, cryptocurrencies, and commodities. Their signals are based on thorough technical analysis and come with educational resources, making it a valuable resource for traders looking to deepen their trading knowledge and refine their strategies.

4. ForexSignals.com

ForexSignals.com combines accurate trading signals with a robust educational platform. With a team of expert traders and an active community, the platform provides real-time insights, live trading sessions, webinars, and extensive educational resources to support trader development.

5. Pips Alert

Pips Alert stands out for its high accuracy and detailed market analysis. Offering multiple membership plans, the service includes various signal types and a comprehensive educational platform to empower traders in making informed trading decisions.

6. MQL5

MQL5 offers a diverse selection of trading signals from multiple providers. Traders can choose signals based on performance metrics and user reviews, with access to trading robots and custom indicators for automated trading strategies.

7. FXTM Signals

FXTM Signals delivers reliable forex signals generated by professional analysts. Covering a wide range of currency pairs, the service is supported by a strong track record and supplemented with educational resources such as webinars and market analysis reports.

8. DailyForex

DailyForex provides high-quality forex signals alongside comprehensive market analysis and broker reviews. Signals are delivered via email and mobile notifications, ensuring traders stay informed and ready to capitalize on trading opportunities.

9. eToro

eToro stands out as a leading social trading platform that allows traders to replicate the trades of successful investors. While not a traditional signals provider, eToro’s CopyTrader feature enables traders to benefit from the expertise of top performers and enhance their trading strategies.

10. ZuluTrade

ZuluTrade connects traders with signal providers globally through its social trading platform. Users can follow and copy trades from top signal providers, customize their trading strategies, and leverage the platform’s intuitive interface and comprehensive performance data.

Conclusion

Selecting the right forex signals service provider is crucial for achieving success in the competitive forex market. The providers listed above offer reliability, accuracy, and robust support to help traders navigate and thrive in 2024. Forex Bank Signal Pro, with its precision and real-time market insights, stands out as our top recommendation for traders aiming to optimize their trading performance and profitability.

#forex#forex broker#forex market#forex education#forex signal service#forex signals#forex trading#forexsignals#forextrading#forex signal provider#gold#investingold#investinginyourself#investinginmyfuture#realestate#investingtips#investinginthefuture#investingforus#investinginrealestate#bitcoin#investment#investinghana#investingirls#investor#business#realestateinvesting#invest#money#investinginmemories#investinginourfuture

1 note

·

View note

Text

Social Trading Platform Market Driven by Expanding Demand for Premium Types, End Users & Application

The Insights Partner’s recently published- “Global Social Trading Platform Market Size Report | Industry & Analysis - Forecast 2028 offers a comprehensive roadmap for established and rising participants in the Social Trading Platform market. This research solution covers various aspects of the market including market size, share, and estimated revenue. In a dramatically changing business landscape, Social Trading Platform market research offers trustworthy insights on factors of influence, trends, challenges, and strategic recommendations. Based on primary and secondary research methods, this syndicate research covers the dynamics of the Social Trading Platform market.

This Market research report by The Insight Partners presents market trends, supply chain analysis, leading participants, and business growth strategies. This research covers technological progress and key developments covering various aspects of the inclusive market. It is valuable market research for existing key players as well as new entrants in the Social Trading Platform Market. Through inputs derived from experts, this research attempts to guide future investors about market details and potential returns on investment.

This report goes further into details of entire business processes and doesn’t restrict to only operational aspects. These insights cover venture economics and include tactics for capital investment, investor funding, and projections of ROIs. Net income and profit loss financial stats are crucial metrics of this Social Trading Platform market research report. With these meticulous insights companies can reduce their risks and increase the success rate in the coming decade.

The Covid-19 pandemic has triggered a tremendous transformation in the Social Trading Platform Market. More than half of global businesses suffer from supply chain breakdowns. The period marked a drop-down in revenue scales and led to the suspension of production for a certain time. This section under Social Trading Platform market research dedicated to a detailed discussion on pandemic influences and responses by businesses is intended to help companies in post-pandemic business tactics. After 2 years of disrupted supply-demand metrics, participants in the Social Trading Platform market started to reposition themselves back in competition. Key companies in this Social Trading Platform market are- eToro, A-Trade, ZuluTrade, Tornado, MetaQuotes, PrimeXBT, Pepperstone Markets Limited, Tickmill, Octa Markets Incorporated, Assetgro Fintech Pvt. Ltd (Stockgro), Public Holding, Inc., Naga Group AG, Snowball X

Market dynamics

Social Trading Platform The market is driven by combinations of multiple trends and drivers that influence the market share of key companies. This research is based on key business analysis models such as Porter’s Five Forces, PESTEL evaluation, SWOT model, and Value Chain Analysis. However, there are certain challenges ahead of Social Trading Platform market players that are discussed in this report. Comprehensive analysis of current trends and future opportunities are perks for buyers under this section.

Significance of Social Trading Platform Market Research:

Precise documentation of current Social Trading Platform market share, size, and revenue.

Future Revenue Projections Considering Forecast Duration.

Social Trading Platform Market segmentation and relevant segment-wise projections.

Regional Market Insights- Market size, revenue estimates, key players, mapping growth possibilities.

Competitive Landscape Analysis (Key market players and their organic strategies).

Detailed consumer analysis.

Off-the-shelf reports customization

We offer PDF and PPT formats for this report.

Social Trading Platform Market Segmentation

Based on Platform of Social Trading Platform Market Research report:

PC

Mobile

Based on End User of Social Trading Platform Market Research report:

Individual Traders

Professional Traders

Based on Asset Class of Social Trading Platform Market Research report:

Equity

Commodity

Derivatives

Crypto

Others

Based on Regions:

North America (U.S., Canada, Mexico)

Europe (U.K., France, Germany, Spain, Italy, Central & Eastern Europe, CIS)

Asia Pacific (China, Japan, South Korea, ASEAN, India, Rest of Asia Pacific)

Latin America (Brazil, Rest of Latin America)

The Middle East and Africa (Turkey, GCC, Rest of the Middle East and Africa)

Rest of the World…

0 notes

Text

About AAAFx Forex

AAAfx is a renowned forex broker that has been providing trading services to clients worldwide since 2008. With a strong emphasis on transparency, security, and customer satisfaction, AAAFx has established itself as a trusted platform for both beginner and experienced traders. In this article, we will delve into the key features and benefits of AAAFx Forex, enabling you to make an informed decision when choosing a forex broker.

Trading Platform and Tools

One of the standout features of AAAFx is its user-friendly trading platform. Powered by the popular MetaTrader 4 (MT4) software, it offers a seamless trading experience with advanced charting tools, real-time market data, and customizable indicators. The platform is available for desktop, web, and mobile devices, ensuring that traders can access their accounts anytime, anywhere.

In addition to the MT4 platform, AAAFx provides a range of trading tools to enhance your trading strategies. These include automated trading systems, such as ZuluTrade and Mirror Trader, which allow you to copy trades from successful traders. Moreover, AAAFx offers a comprehensive economic calendar and market analysis tools to help you stay updated with the latest market trends and make well-informed trading decisions.

Security and Regulation

When it comes to online trading, security is of utmost importance. AAAFx understands this and takes extensive measures to ensure the safety of its clients' funds and personal information. The broker is regulated by the Hellenic Capital Market Commission (HCMC), which ensures compliance with strict financial regulations. Additionally, client funds are held in segregated accounts with reputable European banks, providing an extra layer of protection.

Account Types and Support

AAAFx offers a variety of account types to cater to different trading preferences. Whether you are a beginner or an experienced trader, you can choose from standard accounts, Islamic accounts, or even a managed account option. The broker also provides competitive spreads and leverage options, allowing you to optimize your trading strategies.

Furthermore, AAAFx boasts a dedicated customer support team that is available 24/5 to assist you with any queries or concerns. You can reach out to them via email, live chat, or phone, ensuring prompt and efficient assistance whenever you need it.

Conclusion

In conclusion, AAAFx Forex is a reputable forex broker that offers a range of features and benefits to traders of all levels. With its user-friendly trading platform, advanced tools, and commitment to security, AAAFx provides a reliable and transparent trading environment. Whether you are new to forex trading or a seasoned investor, AAAFx is worth considering for your trading needs.

0 notes

Text

VantageFX Broker

Introduction:

In a competitive trading landscape, choosing the right broker can significantly enhance a trader's journey, offering a streamlined platform for robust trading opportunities. VantageFX Broker has been a notable player in the market, drawing attention with its tight spreads, fast execution, and a variety of trading instruments. This review aims to delve into the various aspects of Vantage FX, providing an insightful look at its offerings and operational efficiency based on user experiences and thorough analysis.

Vantagefx Trading Platform and Tools:

Vantage FX boasts a sophisticated yet user-friendly trading platform, leveraging the power of MetaTrader 4 and MetaTrader 5. This offers traders an intuitive interface, paired with powerful analytical tools and superior execution speeds. The integration of these platforms is smooth, offering both novice and seasoned traders a robust trading environment.

Additionally, traders can take advantage of the mobile trading feature, which is a boon for those who prefer to trade on the go. Vantage carves a niche for itself amidst other MetaTrader-centric brokers by presenting a myriad of additional add-ons and endorsing the integration of compatible third-party platforms and tools like TradingView. This strategic diversification has propelled Vantage into the Best in Class cadre in our 2023 assessment of the best MetaTrader brokers.Platform Synopsis:

At its core, Vantage operates as a MetaTrader broker, extending a comprehensive suite of desktop and web trading platforms encompassing MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users can download vantagefx trading apps on the mobileCharting Capabilities:

Beyond the conventional charting facilitated on MT4 and MT5, Vantage also integrates the CHARTS platform from TradingView. This integration is seamless, allowing traders to access it directly using their MetaTrader credentials, thereby expanding the graphical analysis horizon.Tool Assortment:Enhancing the MetaTrader experience, Vantage introduces the SmartTrader Tools, part of FX Blue LLP’s plethora of platform augmentations. Moreover, a continuous stream of forex news headlines from FxWire Pro and FxStreet enriches the trading milieu, making Vantage's MetaTrader offerings notably robustSocial and Copy Trading

Expanding beyond MetaTrader's inherent Signals market, Vantage brings forth three platforms dedicated to social copy trading. This ensemble of auto-trading platforms - ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade, bolsters the social trading ecosystem, albeit these platforms are not accessible to Australian tradersThis well-rounded offering makes Vantage not just a platform for trading but a conducive environment for learning, analyzing, and strategizing, significantly enriching the trader's journey from inception to execution.

VantageFx Broker Asset Coverage:

VantageFX provides a broad spectrum of trading instruments, including Forex, Indices, Commodities, and Share CFDsIn total Vantage can trade up to 57 Currency pairs, 26 Indices , 51 ETFs , 22 Commodities and 800+ Share CFDsThis diverse range of assets allows traders to diversify their portfolio, thereby managing risks while maximizing potential gainsThe extensive market coverage is indeed a highlight, catering to the varied interests of the trading community

Account Types and Customer Suppor

VantageFX offers multiple account types catering to different trader preferences, including Standard STP, Raw ECN, and Pro ECN accounts. This segmentation helps in accommodating traders with varying levels of expertise and investment capabilities. When it comes to customer support, Vantage FX provides a responsive and knowledgeable team. The support is available via live chat, email, and phone, ensuring that traders' inquiries and issues are addressed promptly.

VantageFx PAMM

In forex markets, staying ahead of the curve is essential. And now, with the innovative VantageFX PAMM Copy Trade feature, you can transform your trading experience and maximize your profits like never before. Imagine having access to the strategies of some of the most skilled and successful traders in the industry, all at your fingertips. That's precisely what VantageFX PAMM Copy Trade brings to the table. It's a game-changer, a paradigm shift in how traders can harness the wisdom of experts without having to become one themselves. Check how to invest with Vantagefx PAMM to maximize your trading profit.

Education and Research Resources:

The broker provides various educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders keen on honing their skills and staying updated with market trends. The emphasis on education and empowering traders is a commendable aspect of Vantage FX.

Fees and Spreads:

VantageFX is known for its competitive spreads, which is a significant advantage for cost-sensitive traders. The transparent fee structure with no hidden charges provides a fair trading environment, which is appreciated by its user base. At Vantage FX, the trading costs are primarily determined by the type of account you opt for, coupled with the specific Vantage entity managing your account. The broker presents three distinct account options: the spread-only Standard STP account, alongside the commission-based RAW ECN, and PRO ECN accounts. Generally, the pricing structure at Vantage aligns well with the industry norms.

Comparing Standard and Raw Accounts:

For traders utilizing the spread-only Standard account, Vantage recorded typical spreads of 1.22 pips on the EUR/USD pair (as observed in August 2021). On the other hand, the Raw account showcased average spreads of 0.15 pips, along with a commission fee of $3 per side (amounting to $6 per round turn), bringing the total to 0.75 pips during the identical timeframe.Exploring the PRO Account:

Vantage's PRO account emerges as a competitively priced offering, with a per-side commission of merely $2 (or $4 per round turn). However, the requisites for inaugurating a PRO ECN account vary across Vantage's regulating entities. For instance, under its Australian entity, traders need to qualify as a wholesale client, while under the Cayman Islands entity, an initial account funding of at least $10,000 is mandated. Meeting these varied account prerequisites renders the PRO ECN account as the most cost-effective option provided by Vantage.Incentives for Active Traders:

Vantagefx extends an active trader program, presenting rebates ranging from $2 to a lofty $8 per standard lot, contingent on your account balance and monthly trading volume. The rebate tiers commence at $10,000, escalating to the apex tier necessitating a minimum of $300,000 in equity. It's notable, however, that this program is exclusively accessible to Standard account holders, which inherently possess the highest spreads among all available account options. This arrangement is something active traders might want to weigh against the potential rebates when deciding on the account type that best fits their trading strategy and financial standing.

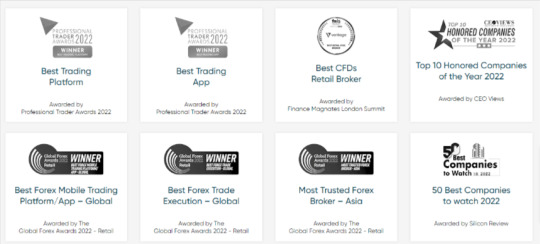

Award & Regulatory Compliance

Vantagefx Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Vantagefx is one of the best broker that obtained fews international broker licenses and strickly followed the broker's regulations and requirements.Being regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA), Vantage FX adheres to high standards of operation, ensuring a secure and trustworthy trading environmen

Conclusion:

VantageFX has made a positive impression in the trading community with its comprehensive trading environment, a wide range of assets, and strong regulatory framework. While there is always room for improvement, especially in expanding educational resources, the broker stands as a reliable choice for individuals keen on navigating the financial markets. With its client-centric approach, Vantage FX is well-positioned to continue growing its presence in the global trading arena.

Read the full article

#vantagefx#vantage fx#vantagefx broker review#vantagefx review#forex broker#vantage fx broker review#best forex broker#vantage review

0 notes

Text

Navigating the Financial World with Trading Analysis Software Services

In the complex and dynamic world of financial markets, having the right tools can make all the difference. Trading analysis software services have emerged as invaluable resources for traders, investors, and financial professionals. In this article, we'll explore the significance of trading analysis software services, what they offer, and how they empower individuals and organizations in the financial sector.

Understanding Trading Analysis Software Services

Trading analysis software services encompass a wide range of digital tools and platforms designed to assist individuals and businesses in making informed decisions in the financial markets. These services utilize cutting-edge technology and data analysis techniques to provide insights, predictions, and real-time information that can be crucial for success in trading, investing, and financial planning.

Key Components of Trading Analysis Software Services

Data Aggregation: These services gather vast amounts of financial data from various sources, including stock exchanges, news feeds, and economic indicators.

Analysis Tools: Sophisticated algorithms and analytical tools are used to interpret and process the collected data, enabling users to identify patterns, trends, and potential trading opportunities.

Charting and Visualization: Interactive charts and graphs make it easier to understand market movements and patterns, helping traders make informed decisions.

Technical and Fundamental Analysis: Trading analysis software services often provide both technical and fundamental analysis, allowing users to examine price movements, indicators, and economic data.

Backtesting and Simulation: Users can test trading strategies and simulate market conditions to evaluate their potential success.

Real-Time Alerts: Many services offer real-time alerts, notifying users of significant market events or changes that may affect their portfolios.

Benefits of Trading Analysis Software Services

Efficiency: These services streamline the process of data analysis, saving users time and effort. They can quickly access information and insights that would be time-consuming to gather manually.

Informed Decision-Making: Users can make well-informed decisions based on accurate data and analysis, reducing the risk of impulsive or uninformed trading.

Risk Management: Many services offer risk assessment tools that help users manage their portfolios and minimize potential losses.

Accessibility: Trading analysis software services are typically accessible from desktops, laptops, and mobile devices, allowing users to stay connected to the markets regardless of their location.

Education and Learning: These services often provide educational resources, helping both novice and experienced traders enhance their knowledge and skills.

Types of Trading Analysis Software Services

Trading analysis software services are available in various forms to cater to different needs and preferences:

Trading Platforms: These are comprehensive software solutions that provide access to multiple financial markets, including stocks, bonds, forex, and cryptocurrencies. Examples include MetaTrader, thinkorswim, and TradingView.

Charting and Technical Analysis Tools: These services focus on providing detailed charts and technical analysis features. Traders often use them to identify trends and trading signals. Notable options include TradingView, StockCharts, and NinjaTrader.

Algorithmic Trading Platforms: These platforms are designed for algorithmic or automated trading, allowing users to develop, test, and execute trading strategies using code. Examples include MetaTrader and QuantConnect.

Social Trading Platforms: These platforms combine trading with social networking, enabling users to follow and copy the trades of experienced traders. eToro and ZuluTrade are popular examples.

News and Data Services: These services focus on delivering real-time financial news, data, and analysis. Bloomberg Terminal and Thomson Reuters Eikon are prominent in this category.

Challenges and Considerations

While trading analysis software services offer numerous advantages, there are also some challenges and considerations to keep in mind:

Cost: Many of these services come with subscription fees or usage charges, which can add up over time. Users should weigh the cost against the potential benefits.

Learning Curve: Some services can be complex and require a learning curve. Users may need time to become proficient in using all the available tools and features.

Data Accuracy: The accuracy of the data and analysis provided by these services is crucial. Users should ensure that the service they choose relies on trustworthy data sources.

Security and Privacy: Users must consider the security of their personal and financial data when using trading analysis software services, especially when dealing with online platforms.

Market Volatility: Even with advanced analysis tools, the financial markets can be highly volatile and unpredictable. Users should be aware that there are no guarantees of success in trading.

The Role of Trading Analysis Software in the Financial World

Trading analysis software services have become integral to the financial world in various ways:

Professional Traders: Professional traders and financial institutions rely on these services to execute complex strategies and manage their portfolios efficiently.

Individual Investors: Retail investors use trading analysis software to make informed investment decisions and manage their own portfolios.

Financial Advisors: Financial advisors leverage these tools to provide more comprehensive and data-driven advice to their clients.

Educational Resources: Many trading analysis software services offer educational content, webinars, and tutorials, contributing to the education of traders and investors.

Market Research: Researchers and analysts use these services to gather data, analyze trends, and produce reports on financial markets.

The Future of Trading Analysis Software Services

The future of trading analysis software services looks promising. Advancements in technology, including artificial intelligence and machine learning, are expected to further enhance the accuracy and capabilities of these tools. Additionally, the integration of blockchain technology and the growth of cryptocurrency markets have expanded the scope of trading analysis software services.

As the financial world continues to evolve, trading analysis software services will play a pivotal role in helping individuals and organizations navigate the complex and ever-changing landscape of global markets. Whether you are a seasoned trader or a newcomer to the world of finance, these tools provide the data, insights, and resources you need to make informed decisions and maximize your potential for success.

For More Info:-

web scraping services provider

web scraping service provider

paper trading softwares company

best technical analysis software service

0 notes

Text

What is Copy Trading and How Does It Work?

Copy trading is a form of automated trading that allows individuals to replicate the trades of experienced and successful traders. Essentially, it involves linking your trading account to the account of a professional trader, thereby automatically copying their trades in real-time. This enables novice traders to benefit from the expertise of seasoned traders without having to make trading decisions themselves.

Benefits of Copy Trading for Beginners :

Selection of Trader

You choose a trader whose strategy and performance align with your trading goals.

Linking Accounts

Your trading account is linked to the chosen trader's account.

Replication of Trades

Trades executed by the selected trader are automatically replicated in your account, proportional to the amount of capital you allocate.

Monitoring and Adjusting

You can monitor the performance of your copy trades and make adjustments as necessary.

Steps to Start Copy Trading

Choose a Reliable Platform

The first step is to select a reputable copy trading platform. Some popular platforms include eToro, ZuluTrade, and Myfxbook. Ensure the platform is regulated and has a good track record.

Open an Account

Register on the chosen platform and complete the necessary verification processes.

Deposit Funds

Fund your trading account with the capital you are willing to invest.

Select a Trader to Copy

Browse through the profiles of various traders, analyzing their performance, trading style, risk level, and other relevant metrics.

Allocate Funds

Decide the amount of capital you want to allocate to copying the selected trader.

Monitor and Adjust

Once you start copying a trader, regularly monitor the performance of your investments and make adjustments if necessary. Read More

0 notes