Don't wanna be here? Send us removal request.

Text

How To Opt-Out Of The Washington Long Term Care Tax

What Is The Washington State Long Term Care Tax?

Washington State has a new law called the Washington Long Term Care Trust Act, which requires employees to contribute a new payroll tax called the Washington Long-Term Care Tax that will tax people's wages to pay for long-term care benefits in the future. The law is mandatory and will cost $0.58 on every $100 of wages. The new WA LTC tax will start on January 1, 2022, and is permanent. As a result, people who plan to retire in the next 10 years have to pay premiums but may never qualify for benefits. Under current law, Washington residents have one opportunity to opt-out of this tax by having a long-term care insurance (LTC) policy in place by November 1st, 2021.

Washington State Long-Term Care Tax Opt-Out

Washington residents have one chance to get out of the public long-term care program. If you buy private long-term care insurance before November 1, 2021, and your private insurance is qualified, you can get out of the public program. If you buy long-term care insurance before November 1, 2021, you can get an exemption from the premium assessment. However, the only time that it is possible to apply for this exemption is from October 1, 2021, to December 31, 2022. This means that employees have a short period of time to buy this insurance.

What Is The Washington Long-Term Care Program?

The Washington Long-Term Care Program, now known as the WA Cares Fund, is the nation’s first public state-operated long-term care insurance program. The program will be funded with a .58% payroll tax on all employee wages, and it starts on January 1, 2022. This is not a tax on employers, but employers must collect premiums through employee payroll deductions and remit proceeds to the Employment Security Department (ESD). The agency will deposit funds in a trust for the individual until they qualify for the benefit.

No Cap On Taxed Wages

The Washington Long-Term Care Program currently has no cap on wages that is subject to this tax. This includes stock-based compensation, bonuses, paid time off, and severance pay.

Which Employees Are Subject To This Tax

If you work in Washington, then you need to pay tax into the program. The only people who do not have to pay are if they are self-employed or if they work for a federally recognized tribe. The Washington Long-Term Care Program says an employee is treated as employed in Washington if: - The employee’s service is based in Washington. - The employees are not based in Washington but conduct services in Washington. - The services are directed or controlled from Washington. This may mean employers who are out of state have to pay some taxes for their employees.

Who Is Eligible To Receive The WA Cares Fund Benefits?

If you live in Washington and have paid premiums for the insurance program, you can benefit. Here are the requirements for eligibility: - An employee needs to have 10 years without interruption of 5 or more consecutive years. - 3 years within the last 6 years from the date the application for benefits is made. Also, to qualify, an employee must have worked at least 500 hours during each of the 10 years or each of 3 years, as applicable. People who plan to retire in the next 10 years have to pay premiums but may never qualify for benefits. And people who move out of state will not be able to get benefits.

What Are The Benefits Under The WA Cares Fund?

Benefits under the Washington Long-Term Care Program will become available on January 1, 2025. If eligible, and if the Department of Social and Health Services determines that an individual needs help with at least 3 Activities of Daily Living, the Program pays benefits up to $100 a day, with a lifetime limit of $36,500. Activities of Daily Living - Personal Hygiene: Bathing, grooming, oral, nail, and hair care - Continence: A person’s mental and physical ability to properly use the bathroom - Dressing: A person’s ability to select and wear the proper clothes for different occasions - Feeding: Whether a person can feed themselves or needs assistance - Mobility: A person’s ability to change from one position to the other and to walk independently

Can Employees Opt-Out Of The WA Cares Fund?

Yes, an employee may opt-out of the Washington Long-Term Care Program and its taxes and benefits if: - The employee is 18 years old or older on the date they apply for the exemption. - The employee attests that they have other long-term care insurance. To opt-out, the employee must provide identification verifying their age and must apply for exemption with ESD between October 1, 2021, and December 31, 2022. If an employee's exemption is approved, it will be effective for the quarter following approval. Once they opt out of the program, they can't re-enter. The opt-out is permanent.

When Must the Employee Have Long-Term Care Insurance In Place To Opt-Out?

An employee who has long-term care insurance ($36,500 or more of coverage) before November 1, 2021, can apply to get an exemption from the premium assessment. Employees now know that they only have a short time to buy this insurance.

Opting Out Of The Washington State Long-Term Care Tax

After an employee’s application for exemption is processed and approved, they will receive an approval notification from ESD. The employee must provide this approval letter to their current and future employers. Employers must maintain copies of any approval letters received. If an employee does not provide their approval letter to their employer, the employer must collect and remit premiums beginning January 1, 2022. Employees will not receive a refund of any premiums that were collected before the exemption.

Employees Who Move Out Of State

Employees who move out of state will not be eligible to receive benefits under the Washington Long-Term Care Program.

Washington Long Term Care Tax Exemption

Self-employed people are not required to sign up for this but can sign up if they want. However, self-employed people need to do it by January 1, 2025, or within three years of starting their new job.

What Qualifies As Long-Term Care Insurance In Washington

According to Washington State law, long-term care insurance is an insurance policy that provides coverage for at least 12 consecutive months if you have a debilitating prolonged illness or disability. LTC insurance typically pays benefits when an insured person can no longer independently do two or more of the following activities of daily living (ADLs): - Bathe - Go to the bathroom - Eat - Dress - Transfer (such as getting out of a chair or bed) - Control their bladder or bowels (continence) Long-term care insurance may be included as a rider on some life insurance and annuity policies. However, some life insurance policy riders don’t qualify as long-term care insurance in our state according to the definition of LTC insurance. What Riders qualify for long-term care insurance? The Office of the Insurance Commissioner (OIC) considers long-term care riders to be a form of LTC insurance if they meet certain benefit requirements. To qualify as LTC in Washington state, a long-term care rider attached to a life insurance or annuity policy must cover long-term care services. If you have a rider that pays for long-term care, it is considered LTC insurance and will be subject to the same rules as other LTC insurance. Qualifying Products and Riders: - Traditional long term care policies - Long term care annuities - Annuities with Long-Term Care Riders - Life Insurance with Long-Term Care Specific Riders Which riders do not qualify for long-term care insurance? Accelerated Death Benefit Some life insurance policies have a rider called an accelerated death benefit. This does not qualify as LTC insurance in most circumstances. An accelerated death benefit is when your life insurance policy starts giving you some money from your death benefit after getting a terminal illness. Accelerated Death Benefits don't qualify mainly because their benefits are paid to the insured without requiring the funds to be used for long-term care services. The payments must be paid specifically for LTC services only. For an accelerated death benefit to qualify as long-term care insurance, the rider must meet all regulations. In addition, the word "long-term care" must be in the name of the rider. Critical Illness Rider Another kind of rider is the critical illness rider. This does not meet the definition of LTC insurance in Washington state. Like an accelerated death benefit, this converts the value of a policy or contract to cash payments if you have been diagnosed with a chronic illness. Critical Illness riders don't qualify mainly because their benefits are paid to the insured without requiring the funds to be used for long-term care services. The payments must be paid specifically for LTC services only.

What Insurance Companies Are Approved For LTC Insurance

Here is the list of insurance companies approved in Washington to provide Long-Term Care insurance. Utilize a licensed insurance agent like The Annuity Expert to help find your best options to avoid this payroll tax.

Frequently Asked Questions

Is long term care insurance required in Washington State? Washington employees must contribute a new payroll tax called the Washington Long-Term Care Tax to tax people's wages to pay for long-term care benefits. The law is mandatory and will cost $0.58 on every $100 of wages. However, employees may purchase private long-term care insurance to opt out of the payroll tax permanently. How do I opt out of Long Term Care in Washington State? An employee who has long-term care insurance ($36,500 or more of coverage) before November 1, 2021, can apply to get an exemption from the new payroll tax. How much is long term care insurance in Washington state? Premiums for LTC policies depend on the benefits selected, your age, and your health. Premiums are typically paid annually, and you can discontinue them at any time. However, there is a risk that premiums will increase over time for traditional LTC policies, as long-term care insurance companies often do not guarantee level premiums. Alternatives to traditional insurance are long-term care annuities and deferred annuities with long-term care riders.

Washington Long-Term Care Quotes

Read the full article

0 notes

Text

How Much Interest Can a Fixed Index Annuity Really Earn?

Is a fixed index annuity a good investment? This guide will provide a better idea of how much interest a fixed index annuity can earn for your retirement savings. For those new to annuities, a fixed index annuity is an insurance-based retirement savings plan that allows an investor to earn interest from a fixed rate of interest and/or the positive movement of an external index without the stress of losing money to a stock market crash. Fixed index annuities is an insurance policy for retirement. This guide will answer the following questions: - How do fixed index annuities make money? - What is the average return on a fixed index annuity? - Where can I find fixed index annuity historical performance? - What is a good rate of return on an annuity? - What is the best fixed index annuity? - Do you earn interest on an annuity? - How does annuity interest work? - What are current fixed index annuity rates?

Index Annuity Average Return

Both my wife and I own a few fixed index annuities. Before I purchased the first FIA, I researched 1,000+ retirement plans to find the perfect annuity for me. I tested on myself first then proceeded with additional index annuities after my results. Fixed Index Annuity Example #1 This fixed index annuity was purchased in 2016 for $10,002.49. I chose an S&P 500 strategy to earn my interest. Since then, I have earned $4,894.63 of interest. That is a nearly 49% increase in just 5 years. I paid zero fees. I lock in every gain and can not lose money when the next stock market crash occurs. InvestmentInterestYearsReturn$10,002.09$4,894.63549%

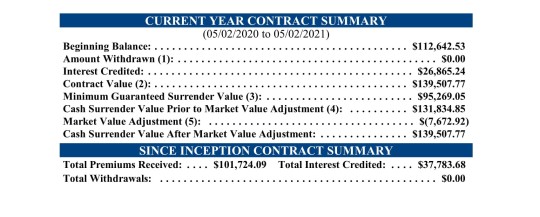

Index Annuity Example #2 After finding that my fixed index annuity can perform well, I rolled over one of my wife's old 401(k) plans to the same annuity in 2017. Over the past 4 years, my wife has earned $37,783.68 in interest. That's a 35.5% increase! She paid no fees, locked in every penny of interest, and will not lose any of her earnings. InvestmentInterestYearsReturn$101,724.09$37,783.68435.5%

Conclusion

A fixed index annuity can earn better interest than a CD or traditional fixed annuity providing the right FIA is chosen. An index annuity owner does not have topay fees in all plans. If you are interested in safely growing your retirement savings plan without paying a ton of fees, contact us. If you'd like to know how much income an annuity can pay per month, check out this guide. Read the full article

0 notes

Text

Inherited Annuity: What Are My Options?

I will be receiving an inherited annuity. What's the best way to handle this large sum of money? This guide will provide you a few options on how you can efficiently inherit the death benefit.

Qualified Vs. Nonqualified Death Benefits

- Qualified Inherited Annuities = All of the death benefits will be subject to taxes. - Nonqualified Inherited Annuities = Only the interest earned will be subject to taxes.

Nonspousal Inherited Annuity

If you're a non-spousal beneficiary, you may have the option to transfer the death benefit amount into a new inherited annuity. This method will provide a way to spread your tax liability while allowing the inheritance to continue growing. The Benefits Continuing the annuity's growth Transferring the death benefit into an inherited annuity, your assets may continue to grow, which can provide a significant boost to your inheritance over time. Spread income tax impact over time Collecting the death benefit as a lump sum payment could leave you with a significant tax burden. Utilizing an inherited annuity, your money will not be taxed until you make a withdrawal. Designating your own beneficiaries With a new inherited annuity contract, you will be able to name a new beneficiary in case of your pre-mature death.

Spousal Inherited Annuities

The same options apply to spousal inherited annuities, but with one additional option, spousal continuance. Spousal continuance will allow the surviving spouse to continue the deceased's annuity and avoid paying taxes at the time of death. Any withdrawals from now on will be subject to ordinary income taxes.

Things To Know

- In many cases, the IRS requires the first payment from an inherited IRA to be made by December 31 of the calendar year following the owner's death. The first payment from an inherited non-qualified annuity must be made by the first anniversary of the owner's death. - If the death benefit is paid directly to you, a new inherited annuity will no longer be an option. If you decide to open an inherited annuity, the death benefit will need to be transferred to another insurance company that will accept inherited annuity funds. - In many cases, the IRS requires you to withdraw a minimum amount each year. This is called Required Minimum Distributions (RMD) for an inherited IRA or a 72(s) payment for an inherited non-qualified contract. In some cases, a final distribution must be made from an inherited IRA annuity after 10 years.

Related Articles

- The Secure Act - How to avoid paying taxes on an inheritance. - Required Minimum Distributions (RMD). - How are annuities taxed? Read the full article

0 notes

Text

Life Insurance Without A Medical Exam

Don't want the headache of booking a doctor's appointment? Look no further. Here are the best life insurance policies that do not require a medical exam. Some plans will provide coverage up to age 85. Note*: Some policies may require an exam if previous health events are listed on the medical history report or prescription drug history.

Life Insurance Without An Exam

Read the full article

0 notes

Text

Annuities That Require Annuitization

These annuities require annuitization, which means you convert your retirement savings into an irrevocable income stream in retirement. Once you annuitize the retirement plans, there is no turning back, possibly no death benefit. If you like the idea of an income for the rest of your life, check out deferred annuities with income riders. Similar concept with more flexibility, control, income, and growth. Read the full article

0 notes

Text

Annuities That Require Annuitization

These annuities require annuitization, which means you convert your retirement savings into an irrevocable income stream in retirement. Once you annuitize the retirement plans, there is no turning back, possibly no death benefit. If you like the idea of an income for the rest of your life, check out deferred annuities with income riders. Similar concept with more flexibility, control, income, and growth. Read the full article

0 notes

Text

Annuities That Require Annuitization

These annuities require annuitization, which means you convert your retirement savings into an irrevocable income stream in retirement. Once you annuitize the retirement plans, there is no turning back, possibly no death benefit. If you like the idea of an income for the rest of your life, check out deferred annuities with income riders. Similar concept with more flexibility, control, income, and growth. Read the full article

0 notes

Text

Annuities That Help With Inflation

These are the best annuities to help with inflation. They will not only generate an income for the rest of your life but will offer the opportunity to increase your monthly retirement paycheck to keep up with the cost of living and maintaining your lifestyle. Read the full article

0 notes

Text

13 Annuities Without Fees

These are the best annuities without fees. These retirement plans will offer enhanced death benefits, lifetime income, long-term care assistance, or a combination of these features. Read the full article

0 notes

Text

Annuity Calculators

Annuity Calculators

Annuity TypeAnnuity CalculatorFixed Index AnnuityGreat American Fixed Index AnnuityThe StandardImmediate AnnuityAIGLong Term Care AnnuityGlobal AtlanticFixed AnnuityThe StandardIncome AnnuityThe StandardFixed AnnuityOceanview Life and Annuity Read the full article

0 notes

Text

Annuities With Guaranteed Income Options

These are the best annuities with guaranteed income options. The income will provide an income for a single or a married couple's lifetimes, guaranteed, even if the annuity runs out of money. This guide will help answer the following questions: - What retirement plan pays a fixed amount each month? - Can I move or rollover my retirement plan to a pension? - Which retirement plan is a pension? - Which retirement plan has no contribution limits?

The Best Annuities With Guaranteed Income

Read the full article

0 notes

Text

Annuities with Long-Term Care Benefits

The following annuities are designed primarily for long-term care, or have an enhanced long-term care benefit to help pay for nursing home, assisted living facilities, home healthcare, or terminal illness costs.

The Best Annuities for Long-Term Care Assistance

Read the full article

0 notes

Text

Can You Retire on 2 Million Dollars?

Can You Retire on 2 million dollars? This guide will tell you how to retire on 2 million dollars for the rest of your life, guaranteed. We'll provide estimates on your retirement income at different age brackets. If you are close to transitioning to retirement, check our Retirement Planning Guide. If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide. This guide will answer the following questions: - Is 2 million enough to retire? - Is 2 million enough to retire at 65? - Can I retire at 50 with 2 million dollars? - How long will 2 million last in retirement?

Is 2 Million Enough to Retire?

The average monthly Social Security Income check in 2021 is $1,543 per person. In the tables below, we'll use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off a $2,000,000 in savings. The data will be based on: - Social Security Benefits will be based on couples at $3,086 total. - Deferred annuity with an income rider providing a monthly income for life. - The starting point will be age 62 since this is the earliest age to collect SSI. How to Retire on 2 Million Dollars, Immediately AgeSSIAnnuityTotal62$3,086$8,640$11,72665$3,086$9,442$12,52870$3,086$10,266$13,352Total = Monthly Income for Life Can You Retire on 2 Million Dollars in 5 Years? AgeSSIAnnuityTotal62$3,086$12,746$15,83265$3,086$13,500$16,58670$3,086$15,044$18,130Total = Monthly Income for Life Living Off the Monthly Interest on 2 Million Dollars Some retirees like to withdraw interest from a fixed interest savings account like a fixed annuity or CD. The interest on 2 million dollars is $70,000 per year with a fixed annuity, guaranteeing 3.50% annually. That's $5,833 per month guaranteed for 7 years.

Request a Quote

Retirement Income Guides

- Is 5 Million Enough To Retire at 60? - Can I Retire at 60 with $1.5 Million? - How to Retire on 1 Million Dollars. - How To Retire on $500K. - How to Retire on $200K Inheritance. Read the full article

0 notes

Text

How to Retire on $200,000 Inheritance

How to retire on a $200,000 inheritance? This guide will tell you how to retire on 200k for the rest of your life, guaranteed. We'll provide estimates on your retirement income at different age brackets. If you are close to transitioning to retirement, check our Retirement Planning Guide. If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide. This guide will answer the following questions: - How to retire on $200k? - What to do with $200k?

How to Retire on $200K

The average monthly Social Security Income check in 2021 is $1,543 per person. In the tables below, we'll use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off $200,000 from the inheritance or retirement savings. The data will be based on: - Social Security Benefits will be based on couples at $3,086 total. - Deferred annuity with an income rider providing a monthly income for life. - The starting point will be age 62 since this is the earliest age to collect SSI. Can You Retire on $200,000 Starting Today AgeSSIAnnuityTotal62$3,086$864$3,95065$3,086$944$4,03070$3,086$1,027$4,113Total = Monthly Income for Life How to Retire on $200,000 in 5 Years? AgeSSIAnnuityTotal62$3,086$1,275$4,36165$3,086$1,350$4,43670$3,086$1,511$4,597Total = Monthly Income for Life Living Off the Monthly Interest on $200,000 Some retirees like to withdraw interest from a fixed interest savings account like a fixed annuity or CD. The interest on $200K is $7,000 per year with a fixed annuity, guaranteeing 3.50% annually. That's $583 per month guaranteed for 7 years.

Request a Quote

Retirement Income Guides

- Is 5 Million Enough To Retire at 60? - Can You Retire on 2 Million Dollars? - Can I Retire at 60 with $1.5 Million? - How to Retire on 1 Million Dollars. - How To Retire on $500K. Read the full article

0 notes

Text

Can I Retire at 60 With $500K?

Can I retire at age 60 with $500k? This guide will show you how to retire on $500k, step-by-step. We'll provide estimates on your retirement income at different age brackets. If you are close to transitioning to retirement, check our Retirement Planning Guide. If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide. This guide will answer the following questions: - Can I retire with $500k? - How long with $500,000 last in retirement?

How to Retire on $500,000

The average monthly Social Security Income check in 2021 is $1,543 per person. In the tables below, we'll use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off a $1,000,000 in savings. The data will be based on: - Social Security Benefits will be based on couples at $3,086 total. - Deferred annuity with an income rider providing a monthly income for life. - The starting point will be age 62 since this is the earliest age to collect SSI. How to Retire on 500K, Starting Immediately AgeSSIAnnuityTotal62$3,086$2,160$5,24665$3,086$2,360$5,44670$3,086$2,567$5,653Total = Monthly Income for Life How to Retire on 500k in 5 Years AgeSSIAnnuityTotal62$3,086$3,334$6,42065$3,086$3,637$6,72370$3,086$3,941$7,027Total = Monthly Income for Life

Living Off the Interest on $500,000

Some retirees like to withdraw interest from a fixed interest savings account like a fixed annuity or CD. The interest on a million dollars is $17,500 per year with a fixed annuity, guaranteeing 3.50% annually*. That’s $1,458.33 per month guaranteed for 7 years.

Request a Quote

Retirement Income Guide

- Is 5 Million Enough To Retire at 60? - Can I Retire at 60 with $1.5 Million? - Can You Retire on 2 Million Dollars? - How to Retire on 1 Million Dollars. - How to Retire on $200K. Read the full article

0 notes

Text

Annuities With Extra Liquidity

The best annuities that offer more liquidity than standard annuity products. These retirement plans will over more access to your money without penalties to you. Features include cumulative penalty-free withdrawals and return of premium. Read the full article

0 notes

Text

How To Retire on $300K.

This guide will show you how to retire on $300k, step-by-step. We'll provide estimates on your retirement income at different age brackets. If you are close to transitioning to retirement, check our Retirement Planning Guide. If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide. This guide will answer the following questions: - Can I retire with $300K? - How long will $300,000 last in retirement? - How much money do you need to live comfortably for the rest of your life?

How to Retire on $300K.

The average monthly Social Security Income check in 2021 is $1,543 per person. In the tables below, we'll use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off a $1,000,000 in savings. The data will be based on: - Social Security Benefits will be based on couples at $3,086 total. - Deferred annuity with an income rider providing a monthly income for life. - The starting point will be age 62 since this is the earliest age to collect SSI. How to Retire on $300,000 Immediately AgeSSIAnnuityTotal62$3,086$4,320$7,40665$3,086$4,721$7,80770$3,086$5,133$8,219Total = Monthly Income for Life How to Retire on $300,000 in 5 Years AgeSSIAnnuityTotal62$3,086$6,373$9,45965$3,086$6,750$9,83670$3,086$7,522$10,608Total = Monthly Income for Life

Living Off the Interest on $300,000

Some retirees like to withdraw interest from a fixed interest savings account like a fixed annuity or CD. The interest on a million dollars is $21,000 per year with a fixed annuity, guaranteeing 3.50% annually*. That’s $1,750 per month guaranteed for 7 years.

Request a Quote

Retirement Income Guides

- Is 5 Million Enough To Retire at 60? - Can You Retire on 2 Million Dollars? - Can I Retire at 60 with $1.5 Million? - How to Retire on 1 Million Dollars. - How To Retire on $500K. - How to Retire on $200K. *I may make a commission by clicking on a link within this page. Read the full article

0 notes