Don't wanna be here? Send us removal request.

Text

Bitcoin Mining’s Great Divide: Industrial Strategy in the U.S., Power Crisis in Kuwait

Bitcoin mining is no longer a fringe activity. It’s a geopolitical choice.

As the U.S. cements its position as the global hub for Bitcoin mining, nations like Kuwait are pulling the plug—literally. This isn’t just about electricity bills or crypto policy. This is the global energy map redrawing itself around the question: Is Bitcoin mining a strategic industry or an environmental liability?

The answers vary wildly depending on which side of the planet you’re on.

The U.S.: From Hashtags to Hashrate

Let’s start with the numbers.

The U.S. now accounts for 75.4% of all Bitcoin mining in North America, according to the latest Cambridge Digital Mining Industry Report. The reason? A potent mix of cheap energy, deep capital markets, and regulatory ambiguity that's just ambiguous enough to be tolerable.

Bitcoin miners in the U.S. are scaling like hyperscalers. Publicly traded giants like Riot Platforms and Marathon Digital are building industrial-grade operations that mirror cloud data centers in structure and scale. The electricity usage is astonishing: 32.3 terawatt-hours in just a year—more than the entire city of Los Angeles.

This is not a cottage industry anymore. It’s an energy-intensive, investment-hungry, infrastructure-dependent business. And it's behaving like one.

That’s not necessarily a bad thing—if you see Bitcoin as digital infrastructure. If you believe that a decentralized monetary network is a foundational pillar for the next century, then of course the energy is worth it. You don’t question how much electricity the internet uses, or how much steel goes into building highways. You invest, regulate, and optimize.

In that worldview, Bitcoin mining is not wasteful—it’s strategic.

Kuwait: The Other End of the Spectrum

Now zoom out to Kuwait.

Last week, authorities launched a sweeping crackdown on crypto miners, accusing them of worsening the country’s power crisis ahead of summer. One region, Al-Wafrah, saw a 55% drop in energy consumption after mining was halted. The message is clear: Bitcoin mining is incompatible with energy scarcity.

This isn’t unique to Kuwait. Similar bans have hit Kazakhstan, Iran, and parts of China—all of which, interestingly, share a common profile: subsidized electricity, aging grids, and extreme weather patterns.

The hard truth? Bitcoin mining only thrives where electricity is abundant, cheap, and available on demand. That’s a narrow set of conditions, and the divide is widening. On one side, we see countries turning mining into policy. On the other, we see outright prohibition driven by necessity.

The Air We Don’t Breathe

But even in places where mining is welcome, it's not without cost.

A new study from Harvard shows that U.S. Bitcoin mines, while not necessarily polluting their immediate surroundings, are causing measurable air quality degradation in cities like New York, Houston, and Chicago. Why? Because most of their power is still coming from fossil fuel plants located hundreds of kilometers away.

In fact, 84% of the electricity consumed by U.S. mining operations comes from fossil fuels. And while 52.4% of operations claim to use some form of sustainable energy, the net result is still large-scale pollution, dispersed and largely invisible to the public.

Here’s the uncomfortable paradox: The more mining becomes professionalized and centralized, the more its externalities scale too.

Mining’s Social License Is Under Review

The environmental data is damning—but it’s not the death knell. It’s a call to clarify Bitcoin’s social value proposition.

Cloud computing has a clear, mainstream utility. AI models, productivity apps, streaming services—we tolerate their energy use because we understand their impact. Bitcoin? Still polarizing.

That’s not a tech problem. That’s a narrative problem.

If Bitcoin is just an asset, critics will argue it’s not worth the smog. But if Bitcoin is a tool for monetary sovereignty, censorship resistance, and financial inclusion, then it begins to look like a public good. One worthy of energy, investment, and even regulation.

But to reach that point, the mining industry needs to stop hiding behind opacity and start proving its value—not just to holders, but to communities, regulators, and skeptics.

The Road Ahead: Polarization, Not Convergence

What we’re witnessing isn’t just a mining boom. It’s the fragmentation of the global consensus on Bitcoin itself.

The U.S. is doubling down on mining as a pillar of financial and energy policy. In places like Texas, miners are increasingly seen as grid balancers, capable of shutting off during peak loads and earning credits through demand response programs. The “Bitcoin as battery” thesis is gaining traction, even if the tech isn’t quite there yet.

Kuwait and others are saying: we simply can’t afford this. Their power grids are under siege, their summers are getting hotter, and their margins for error are razor-thin. Bitcoin is a luxury they can’t rationalize.

This tension will only grow.

As the Bitcoin halving increases the pressure to operate at scale, smaller miners in energy-stressed nations will be squeezed out. What’s left will be a concentrated, heavily capitalized industry, likely headquartered in the U.S., Canada, and parts of Northern Europe.

That’s good for hash rate security. But it also means Bitcoin’s touted decentralization is increasingly technical, not geographic.

Bitcoin Mining Becomes a Regulated Utility in the West

In five years, Bitcoin mining in the U.S. will look a lot like natural gas pipelines or nuclear plants: regulated, integrated into grid planning, and maybe even state-subsidized in some jurisdictions. Red states will champion it as energy arbitrage; blue states will demand carbon offsets and environmental disclosures.

Either way, mining becomes part of the system.

Meanwhile, the rest of the world will bifurcate:

Countries with energy surplus will court miners and integrate them into industrial policy.

Countries with scarcity will ban it or severely constrain it.

And the global South will be forced to choose: do we mine Bitcoin, or do we keep the AC running?

Bitcoin is global. Energy is local. And that mismatch is only getting sharper.

Mining isn’t going away—but where and how it happens will shape Bitcoin’s next decade far more than any ETF or memecoin.

The only question that matters: Is Bitcoin worth the watts?

If you found this perspective valuable, please consider supporting our work. We don’t run ads, we don’t have a paywall. Everything we publish is free—but thoughtful crypto journalism takes time. You can buy us a coffee here:

Let’s keep the signal strong.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

1 note

·

View note

Text

Meme Coins Are Gen Z’s Rebellion—and It’s More Rational Than It Looks

In 2025, the most revealing economic data point might not be found in an inflation chart or a jobs report—but in a meme coin chart on PumpSwap. As Bitcoin stabilizes and institutional players hunker down in ETFs and custody debates, meme coins are stealing the cultural spotlight. And it’s not just noise.

This speculative mania is the American Dream 2.0 for Gen Z—chaotic, irrational on the surface, but deeply rational at its core. Behind the frog coins, cat coins, and nugget-inspired tokens lies something far more significant: a generational realignment of financial strategy, aspiration, and identity.

From Wall Street to Weird Street

According to blockchain analytics firm Santiment, meme coin mentions just hit a year-to-date high, surpassing Bitcoin in social chatter. This isn’t mere froth. It marks a turning point in risk appetite: young investors are moving away from crypto's original conservative store-of-value thesis and toward the cultural casino of high-risk tokens like Troller Cat and HouseCoin.

It’s tempting to dismiss this as digital junk food. But the surge of capital and attention reveals something traditional finance has long ignored: for Gen Z, gambling on absurd tokens is often more attractive than buying bonds or maxing out a 401(k). Not because they’re irrational, but because they’re locked out of the old system.

When the System Locks You Out, You Build Your Own

Take Yuvia Mendoza, a 25-year-old crypto community worker earning six figures in the Bay Area, yet still financially insecure. She launched a Hooters-themed meme coin not just to save a defunct brand, but as a symbolic act of agency. Her generation isn’t buying homes at 30 or climbing corporate ladders—they’re flipping JPEGs, farming tokens, and yes, offering waitresses crypto for T-shirts to boost community engagement.

Mendoza isn’t alone. Pew Research data shows nearly half of young American men (18–29) have interacted with crypto. That’s not a trend—it’s a movement. For many, meme coins aren’t just speculation. They’re protest.

This is the era of financial nihilism, as hedge fund CEO Joe McCann aptly puts it. With soaring student debt, inflated housing markets, and a job market that rewards hustle over loyalty, the American Dream feels like a Ponzi scheme where millennials and Gen Z are the exit liquidity.

So they’re flipping the script. If the “serious” path offers a lifetime of debt and diminishing returns, why not YOLO into a coin about dinosaur-shaped chicken nuggets? In this upside-down economy, meme coins aren’t absurd—they’re logical.

The Cultural Capital of Memes

This rebellion has its roots in culture, not capital. Dogecoin started as a joke. Shiba Inu leaned into that absurdity. Troller Cat is now blending Play-to-Earn mechanics with deflationary economics and community rewards. This isn’t just finance—it’s performance art.

Meme coins work because they resonate emotionally. They’re faster, funnier, and far more viral than whitepapers and roadmaps. A meme coin investor today is not analyzing discounted cash flows—they’re analyzing TikTok trends, X memes, and Discord sentiment.

That’s why Jeff Matthews, a 31-year-old full-time meme trader, pays his younger sister to flag TikTok trends. He understands that in this market, cultural intuition beats technical analysis.

Critics call this irresponsible. But let’s reframe it: how different is this from betting on penny stocks, biotech startups, or speculative venture capital rounds? Is it more irrational than investing in WeWork, GameStop, or NFTs of pixelated rocks?

In many cases, meme coin investors are more agile and culturally literate than their TradFi counterparts. They operate in real time, across borderless platforms, adapting to trends with an almost evolutionary fluidity. That deserves more credit than it gets.

Trump, Doge, and the Politics of the Absurd

Even the political sphere is catching on. President Donald Trump’s open affiliation with meme coins like $TRUMP and $MELANIA, as well as his administration’s relaxed stance on crypto regulation, signal a deeper alignment: the culture of memecoins now sits at the center of populist identity politics.

Elon Musk, meanwhile, nods to Dogecoin through his fictional “U.S. DOGE Service.” Whether serious or not, these gestures tap into the same current: meme coins aren’t just financial assets—they’re political symbols, rebellion tools, even identity badges.

To some, this is dangerous. To others, it’s necessary. Either way, it’s happening. The SEC’s 2025 ruling that meme coins are “collectibles, not securities” opens the door for a wave of launches untethered from traditional regulatory scrutiny.

This shift blurs lines between investing, entertainment, and activism. In a world where TikTok dances can move markets and meme coins fund real-world purchases, traditional finance feels increasingly anachronistic.

The HouseCoin Hypothesis

Perhaps the most poignant example is HOUSECOIN—a meme token that, in theory, could one day be worth enough to buy a house. Mendoza is now evangelizing it with the same energy she once reserved for saving Hooters.

The idea is absurd—but that’s the point. In a housing market where a San Francisco starter home costs $1.5 million, the dream of a house-for-a-coin isn’t any less ludicrous than the current system. At least HOUSECOIN is honest about it.

The Risks Are Real—But So Is the Intent

Let’s be clear: meme coin investing is incredibly risky. Scams abound, liquidity is thin, and volatility is extreme. Mendoza’s Hooters coin crashed from $1.7 million to under $40,000. Matthews once lost nearly everything in DNUGS, a dino nugget coin, after a nap.

But unlike the 2008 mortgage crisis or the collapse of Silicon Valley Bank, meme coin losses rarely reverberate through pensions or retirement accounts. This is risk by choice, not contagion.

More importantly, the risks meme coin investors take are voluntary—and often fully understood. They’re not ignorant; they’re disillusioned. That distinction matters.

And some builders are responding. Firms like ABC Labs are launching diversification products that bundle meme coins like mutual funds for degens. It’s an early sign that infrastructure is catching up with culture.

The Future: Speculation with Purpose?

Even Ethereum co-founder Vitalik Buterin, who made millions on Dogecoin, sees potential. He’s funneled meme coin profits into philanthropy—malaria prevention, COVID relief, even Ukraine aid. He argues that meme coins, at their best, are positive-sum games: fun, generous, and community-led.

That’s the opportunity. Meme coins don’t have to remain nihilistic. If this speculative energy can be paired with purpose—climate action, healthcare, education—it could redefine not just investing, but global giving.

The challenge is keeping that intent intact while the casino lights stay on.

Meme Coins as Financial Punk Rock

Meme coins are not a blip. They are financial punk rock—a rejection of traditional systems, aesthetics, and hierarchies. Yes, the charts look like gambling. But the motivations behind them are anything but frivolous.

They reflect a generation forced to build wealth without safety nets. A generation that speaks in memes because they were raised on screens. A generation that will not wait patiently for the promises of their parents to trickle down.

Ignore them at your peril. Or better yet—try to understand them. Because the next trillion-dollar idea might just come wrapped in a dog hat or a dino nugget.

If You Value Independent Crypto Journalism…

We don’t run ads. We don’t sell subscriptions. But we do rely on readers like you to keep this going. If this piece challenged your thinking or helped you see the game differently, consider supporting our work: 👉 Donate on Ko-Fi — Every bit helps us stay independent, sharp, and ad-free.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

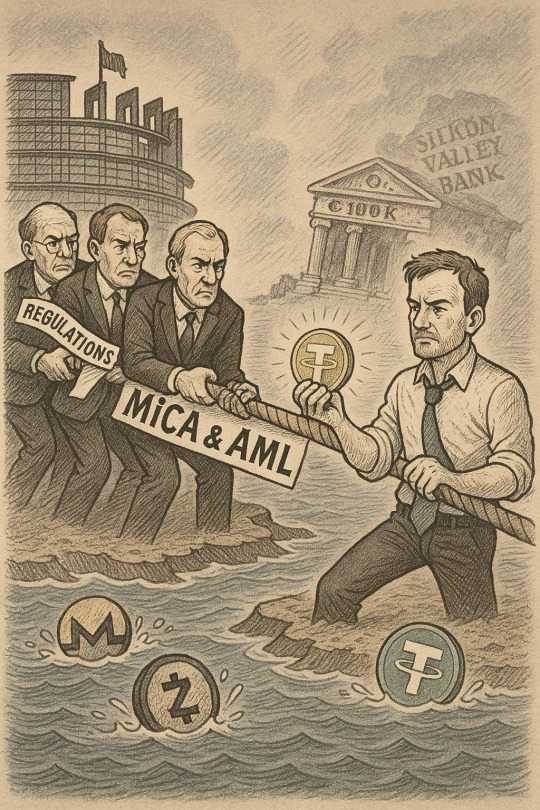

Europe’s Crypto Crackdown Isn’t About AML—It’s About Control

Europe isn’t waging a war on crime. It’s waging a war on autonomy.

When the European Union announced its sweeping new anti-money laundering rules—effectively banning anonymous crypto accounts and privacy coins like Monero and Zcash by 2027—it framed the decision as a crackdown on illicit finance. The headlines made it sound sensible, even inevitable. After all, who would argue against fighting crime?

But scratch the surface, and it becomes clear: this isn’t just about compliance. It’s about control.

And Tether's CEO Paolo Ardoino knows it. His warning this week—about the regulatory noose tightening around stablecoins and the systemic banking risks the EU is ignoring—should be a wake-up call for anyone watching the future of digital money in Europe.

Let’s unpack what’s really happening.

The End of Privacy in Europe

The EU’s Anti-Money Laundering Regulation (AMLR) will ban anonymous crypto accounts and any token designed to enhance anonymity. The policy explicitly targets both crypto service providers and privacy-focused protocols—obliterating legal room for privacy coins and eroding the very ethos of self-sovereign finance.

We’ve seen this movie before.

In 2001, the U.S. passed the Patriot Act in response to 9/11, dramatically expanding surveillance in the name of national security. In practice, it authorized mass data collection on ordinary citizens. The EU’s 2027 AML rules feel eerily similar: a sweeping framework with noble PR but authoritarian undercurrents.

Let’s be clear: no one disputes that criminal activity must be curbed. But banning privacy-preserving tools altogether is a disproportionate, blunt-force response—akin to banning private conversations because criminals use phones.

What’s next? Outlawing cash?

Tether’s Stand—and Europe’s Hypocrisy

At the same time, Paolo Ardoino is calling out another dangerous double standard: Europe’s demand that stablecoin issuers park reserves in fragile, underinsured banks.

Under the EU’s MiCA (Markets in Crypto-Assets) framework, stablecoin issuers are forced to hold large portions of their reserves—up to 60%—in traditional European banks. But most of these deposits aren’t insured beyond €100,000. That’s not just risky. It’s reckless.

As Ardoino rightly pointed out, this creates a systemic vulnerability identical to what triggered the 2023 collapse of Silicon Valley Bank: a liquidity mismatch. Stablecoin redemptions require real-time liquidity. But traditional banks, operating on fractional reserves, lend out most of those deposits. A modest redemption wave could expose massive shortfalls—not because the stablecoin is flawed, but because the bank is.

In that scenario, the stablecoin collapses—not because it failed, but because regulators insisted it put its reserves in a structurally brittle system.

And then, predictably, regulators will say: “See? Stablecoins are dangerous.”

The irony writes itself.

Europe’s Quiet War on Crypto Sovereignty

This isn’t about preventing money laundering. It’s about forcing crypto to bend to legacy systems that are demonstrably broken.

The AML rules outlaw privacy, while MiCA incentivizes centralization. The playbook is clear: push stablecoin issuers into regulatory chokepoints, and kill off privacy-focused alternatives. The EU isn’t regulating innovation—it’s domestifying it.

If you're a European crypto founder today, your options are narrowing:

Build only fully traceable, permissioned tokens.

Use banks that won’t insure your deposits.

Comply with rules that prioritize government visibility over user security.

Or leave.

And that’s what will happen. As with GDPR, well-meaning on paper but chilling in practice, the EU is creating a jurisdictional moat—not for innovation, but against it.

The Great Divergence: U.S. vs. Europe

The result? We’re watching a regulatory divergence unfold between the U.S. and Europe—one that could reshape the global crypto map.

In the U.S., while regulation remains messy, privacy coins aren’t yet banned, and stablecoin innovation is still (relatively) allowed to breathe. Tether, Circle, and other issuers have options. With Tether now signaling a push into U.S.-based stablecoin products, it’s clear where the wind is blowing.

Meanwhile, Europe is building a walled garden of permissioned finance—one that may comply on paper but fails in practice when innovation migrates and users vote with their wallets.

Ask yourself: if you were launching a new DeFi product, would you do it in Frankfurt or in Dubai? Lisbon or Singapore?

But What About Crime?

Of course, there’s a counterargument: crypto has been used for illicit finance, and governments have a duty to respond.

Fair. But banning tools that protect privacy doesn’t stop criminals. It just weakens protections for everyone else.

Email didn’t get banned because of spam. Encryption isn’t illegal because it can hide secrets. And cash still exists—even though it’s far more anonymous than Bitcoin.

The smarter regulatory approach is nuanced, risk-based, and proportional. Target illicit actors without criminalizing privacy. Demand transparency from intermediaries, not protocol-level surveillance.

But nuance doesn’t make headlines. Control does.

This Is a Pivotal Moment

What’s unfolding in Europe isn’t just a regulatory tweak. It’s a philosophical fork in the road:

One path leads to programmable money under state surveillance, with private wallets outlawed and stablecoins yoked to fragile banks.

The other preserves financial autonomy, where code is speech and privacy isn’t presumed guilt.

This isn’t hyperbole. It’s history repeating.

The protocols and platforms that survive will be the ones that adapt—but also the ones that resist. Tether’s defiance may not make them popular in Brussels, but they’ve correctly identified the existential threat: being forced into a financial system built for surveillance, not stability.

Europe will realize—too late—that it's neutered its crypto sector. Innovators will leave. Protocols will geofence EU users. And the next wave of stablecoin innovation will happen elsewhere.

But the privacy genie isn’t going back in the bottle.

The smartest developers know how to build around bans. The next version of Monero won’t need to be listed on Binance. It’ll live in the wallets of those who care about freedom.

And if Europe becomes hostile territory for financial autonomy?

So be it. Crypto moves.

If You Value Independent Crypto Journalism…

We don’t run ads. We don’t sell subscriptions. But we do rely on readers like you to keep this going.

If this piece challenged your thinking or helped you see the game differently, consider supporting our work:

👉 Donate on Ko-Fi — Every bit helps us stay independent, sharp, and ad-free.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Europe’s Crypto Crackdown Isn’t About AML—It’s About Control

Europe isn’t waging a war on crime. It’s waging a war on autonomy.

When the European Union announced its sweeping new anti-money laundering rules—effectively banning anonymous crypto accounts and privacy coins like Monero and Zcash by 2027—it framed the decision as a crackdown on illicit finance. The headlines made it sound sensible, even inevitable. After all, who would argue against fighting crime?

But scratch the surface, and it becomes clear: this isn’t just about compliance. It’s about control.

And Tether's CEO Paolo Ardoino knows it. His warning this week—about the regulatory noose tightening around stablecoins and the systemic banking risks the EU is ignoring—should be a wake-up call for anyone watching the future of digital money in Europe.

Let’s unpack what’s really happening.

The End of Privacy in Europe

The EU’s Anti-Money Laundering Regulation (AMLR) will ban anonymous crypto accounts and any token designed to enhance anonymity. The policy explicitly targets both crypto service providers and privacy-focused protocols—obliterating legal room for privacy coins and eroding the very ethos of self-sovereign finance.

We’ve seen this movie before.

In 2001, the U.S. passed the Patriot Act in response to 9/11, dramatically expanding surveillance in the name of national security. In practice, it authorized mass data collection on ordinary citizens. The EU’s 2027 AML rules feel eerily similar: a sweeping framework with noble PR but authoritarian undercurrents.

Let’s be clear: no one disputes that criminal activity must be curbed. But banning privacy-preserving tools altogether is a disproportionate, blunt-force response—akin to banning private conversations because criminals use phones.

What’s next? Outlawing cash?

Tether’s Stand—and Europe’s Hypocrisy

At the same time, Paolo Ardoino is calling out another dangerous double standard: Europe’s demand that stablecoin issuers park reserves in fragile, underinsured banks.

Under the EU’s MiCA (Markets in Crypto-Assets) framework, stablecoin issuers are forced to hold large portions of their reserves—up to 60%—in traditional European banks. But most of these deposits aren’t insured beyond €100,000. That’s not just risky. It’s reckless.

As Ardoino rightly pointed out, this creates a systemic vulnerability identical to what triggered the 2023 collapse of Silicon Valley Bank: a liquidity mismatch. Stablecoin redemptions require real-time liquidity. But traditional banks, operating on fractional reserves, lend out most of those deposits. A modest redemption wave could expose massive shortfalls—not because the stablecoin is flawed, but because the bank is.

In that scenario, the stablecoin collapses—not because it failed, but because regulators insisted it put its reserves in a structurally brittle system.

And then, predictably, regulators will say: “See? Stablecoins are dangerous.”

The irony writes itself.

Europe’s Quiet War on Crypto Sovereignty

This isn’t about preventing money laundering. It’s about forcing crypto to bend to legacy systems that are demonstrably broken.

The AML rules outlaw privacy, while MiCA incentivizes centralization. The playbook is clear: push stablecoin issuers into regulatory chokepoints, and kill off privacy-focused alternatives. The EU isn’t regulating innovation—it’s domestifying it.

If you're a European crypto founder today, your options are narrowing:

Build only fully traceable, permissioned tokens.

Use banks that won’t insure your deposits.

Comply with rules that prioritize government visibility over user security.

Or leave.

And that’s what will happen. As with GDPR, well-meaning on paper but chilling in practice, the EU is creating a jurisdictional moat—not for innovation, but against it.

The Great Divergence: U.S. vs. Europe

The result? We’re watching a regulatory divergence unfold between the U.S. and Europe—one that could reshape the global crypto map.

In the U.S., while regulation remains messy, privacy coins aren’t yet banned, and stablecoin innovation is still (relatively) allowed to breathe. Tether, Circle, and other issuers have options. With Tether now signaling a push into U.S.-based stablecoin products, it’s clear where the wind is blowing.

Meanwhile, Europe is building a walled garden of permissioned finance—one that may comply on paper but fails in practice when innovation migrates and users vote with their wallets.

Ask yourself: if you were launching a new DeFi product, would you do it in Frankfurt or in Dubai? Lisbon or Singapore?

But What About Crime?

Of course, there’s a counterargument: crypto has been used for illicit finance, and governments have a duty to respond.

Fair. But banning tools that protect privacy doesn’t stop criminals. It just weakens protections for everyone else.

Email didn’t get banned because of spam. Encryption isn’t illegal because it can hide secrets. And cash still exists—even though it’s far more anonymous than Bitcoin.

The smarter regulatory approach is nuanced, risk-based, and proportional. Target illicit actors without criminalizing privacy. Demand transparency from intermediaries, not protocol-level surveillance.

But nuance doesn’t make headlines. Control does.

This Is a Pivotal Moment

What’s unfolding in Europe isn’t just a regulatory tweak. It’s a philosophical fork in the road:

One path leads to programmable money under state surveillance, with private wallets outlawed and stablecoins yoked to fragile banks.

The other preserves financial autonomy, where code is speech and privacy isn’t presumed guilt.

This isn’t hyperbole. It’s history repeating.

The protocols and platforms that survive will be the ones that adapt—but also the ones that resist. Tether’s defiance may not make them popular in Brussels, but they’ve correctly identified the existential threat: being forced into a financial system built for surveillance, not stability.

Europe will realize—too late—that it's neutered its crypto sector. Innovators will leave. Protocols will geofence EU users. And the next wave of stablecoin innovation will happen elsewhere.

But the privacy genie isn’t going back in the bottle.

The smartest developers know how to build around bans. The next version of Monero won’t need to be listed on Binance. It’ll live in the wallets of those who care about freedom.

And if Europe becomes hostile territory for financial autonomy?

So be it. Crypto moves.

If You Value Independent Crypto Journalism…

We don’t run ads. We don’t sell subscriptions. But we do rely on readers like you to keep this going.

If this piece challenged your thinking or helped you see the game differently, consider supporting our work:

👉 Donate on Ko-Fi — Every bit helps us stay independent, sharp, and ad-free.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

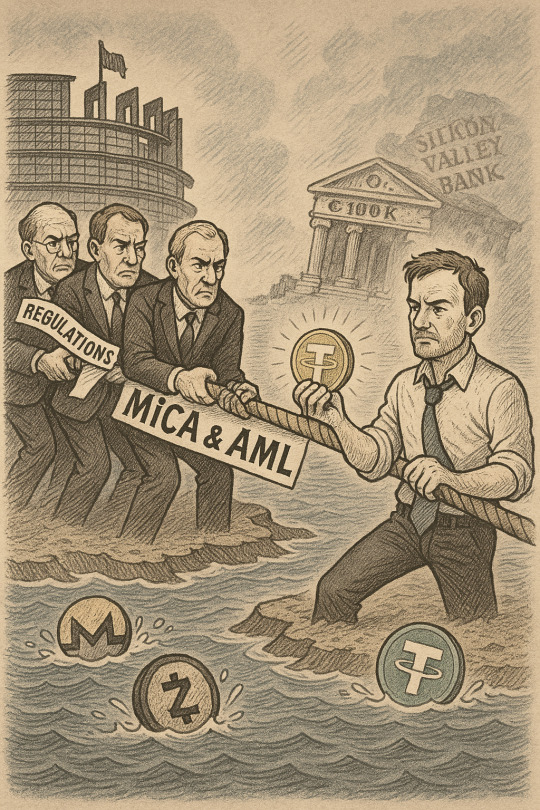

Ethereum’s Midlife Crisis: Why Buterin’s Push for Simplicity Isn’t Just Smart — It’s Survival

In tech, complexity kills. And Ethereum, the poster child for programmable blockchains, is finally facing its biggest existential threat: itself.

After a decade of pioneering upgrades, scaling debates, and zero-knowledge breakthroughs, Vitalik Buterin now wants to make Ethereum “as simple as Bitcoin” by 2030. For a network that’s prided itself on programmability and innovation, this is a radical pivot. But it’s also the most important one Ethereum has made since ditching proof-of-work.

This isn’t a UX tweak. It’s a full-blown philosophical course correction — away from Ethereum’s sprawl of R&D chaos, and toward a hardened, streamlined core. If it works, it could reboot Ethereum's credibility, dev appeal, and long-term resilience. If it doesn’t, Ethereum risks becoming the IBM of crypto: powerful, but obsolete.

Let’s unpack why this matters now — and why it may determine Ethereum’s survival into the 2030s.

Ethereum Was Winning the Wrong Game

Ethereum has always played the complexity game. It shipped the most expressive virtual machine, enabled entire economies via smart contracts, and supported a vibrant ecosystem of Layer 2s, DeFi, DAOs, and NFTs. But as the years passed, the architecture under the hood turned into an engineering Rube Goldberg machine: beacon chains, sync committees, execution clients, consensus clients, Layer 2 rollups with proof bridges — a mess even protocol researchers can barely keep straight.

And this complexity hasn’t just made things harder for developers. It’s made Ethereum slower to upgrade, more fragile under attack, and more exclusive — only elite devs can actually build confidently at the protocol level.

Vitalik finally seems to be saying the quiet part out loud: this is unsustainable.

“Historically, Ethereum has often not done this [kept things simple],” Buterin admits, “and this has contributed to... excessive development expenditure, security risk, and insularity of R&D culture.”

In other words: Ethereum’s baroque beauty is now a liability. It’s hard to fix. It’s hard to reason about. And it’s driving away the very people needed to keep it alive — builders.

Bitcoin Maxis Are Right About One Thing

Bitcoin maximalists love to dunk on Ethereum for being a “science experiment.” What they don’t get is that Ethereum needed to be experimental. The world didn’t need another hard-money chain in 2015. It needed programmable money — and Ethereum delivered.

But maximalists were right about one thing: simplicity is anti-fragile.

Bitcoin’s greatest strength isn’t its community or brand. It’s the dead-simple code that hasn't changed much in 15 years. Ethereum is starting to realize it needs some of that boring resilience if it wants to become critical infrastructure.

That’s why Buterin is now pushing to simplify Ethereum’s consensus and execution layers — not by making them dumber, but by making them legible, modular, and encapsulated. That’s an important distinction.

The RISC-V Bet: Ethereum’s Clean Slate

The move to RISC-V might sound niche, but it’s the real headline here. Ethereum replacing its EVM with a stripped-down, hardware-standard instruction set is like Tesla ditching its old battery architecture to switch to solid-state. It’s not just an upgrade — it’s a foundation reset.

RISC-V is open-source, elegant, and radically simpler than the EVM. It could make Ethereum more interoperable with existing tooling, easier to verify, and vastly more efficient — by orders of magnitude. The promise is not just simplicity, but performance and programmability, without compromising on decentralization.

It also opens up new frontiers for zero-knowledge technology. With RISC-V at the base layer, zkVMs (zero-knowledge virtual machines) become far more composable. That’s where Ethereum can finally unlock the true power of zk tech — not just in proving L2 state, but in enabling private computation, decentralized identity, and trust-minimized interop. This is what people have thought zkEVMs would do for years. RISC-V might finally give them a fighting chance.

Complexity Is Fine — As Long As It's Contained

Buterin’s proposal isn’t to make Ethereum “dumb.” It’s to make its critical core small, tight, and auditable. Let complexity bloom on the edges — where it doesn’t risk consensus failures or blow up the whole network.

Think of it like modern operating systems. The kernel is sacred and minimal. Everything else is modular and swappable. Ethereum is trying to become the same.

This is where the idea of the “Beam Chain” comes in — a simpler, finality-first consensus layer that trims the fat of epochs, slots, and sync committees, boiling Ethereum’s heart down to about 200 lines of consensus code. That’s not a joke — that’s Bitcoin-level simplicity in a POS context.

The rest — like validator set management, aggregation logic, zk integration — becomes optional and replaceable. Encapsulated complexity. That’s not dumbing things down. That’s engineering maturity.

The Meta-Narrative Shift: From Layer 2s to Layer 1 Reinvention

Let’s be honest: the Layer 2 narrative is stalling. Users aren’t flocking. Bridges are clunky. Fragmentation sucks. And rollups are still too dependent on L1 for security and finality.

The RISC-V push, combined with Beam Chain, represents a meta-narrative pivot: Ethereum is moving from “external expansion” to “core reinvention.” This isn’t just a tech cycle — it’s a survival instinct.

In a world of fast, modular L1s like Solana and Sei, Ethereum can’t just be “more decentralized.” It has to be easier to build on, easier to reason about, and simpler to trust.

It has to become boring — in the best way possible.

Why This Vision Might Fail (And Why It Still Matters)

There are real risks here. Replacing EVM isn’t a one-click fork. Existing dApps need compatibility. Tooling has to be rebuilt. And Ethereum governance has a bad habit of choking on major changes.

There’s also the danger of overpromising. “This time we’ll keep it simple” is a hard pitch to swallow from a chain that’s burned many cycles on exotic side quests. Some developers are rightly skeptical.

But here’s the thing: what’s the alternative? Keep stacking complexity on a foundation everyone admits is cracking? Hope the zkRollup UX finally clicks before users bleed to other chains?

Ethereum can’t out-speed every chain. It can’t out-hype Solana or out-grind Bitcoin. But it can become the most credible, modular, and enduring smart contract base layer — if it stops shooting itself in the foot with unnecessary complexity.

The 2030 Bet: If It Works, Ethereum Becomes Boring Infrastructure — and That’s the Point

If Buterin’s vision lands, Ethereum in 2030 could look like Linux: elegant, modular, universally trusted. Developers won’t need to read academic papers to run a validator or build a DApp. New tooling will bloom atop a simpler, stabler core. And Ethereum’s core dev team will finally get to maintain — not reinvent — the wheel.

The stakes couldn’t be higher. This isn’t about beating Solana or pumping ETH. It’s about whether Ethereum becomes the TCP/IP of programmable value — or just another bloated experiment we left behind.

In a decade where crypto will either integrate with real-world systems or fade into niche irrelevance, Ethereum needs to get serious. Complexity was a flex. Simplicity is a weapon.

Enjoyed this take? We don’t run ads or paywall our content. But if it gave you something to think about, please consider supporting us on Ko-Fi. Every donation keeps this content free and independent. 🙏

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

1 note

·

View note

Text

Bitcoin Isn’t Just a Hedge—It’s a Weapon. And the CIA Just Said the Quiet Part Out Loud.

It’s official: the United States is treating Bitcoin not just as a store of value or a speculative asset—but as a strategic tool in its geopolitical arsenal.

Michael Ellis, Deputy Director of the CIA, said the quiet part out loud this week. In a conversation with Anthony Pompliano, Ellis declared that Bitcoin is “another tool in the toolbox” in America’s escalating technological rivalry with China. Not merely a target, but a weapon.

Let that sink in.

Bitcoin—the decentralized, borderless, stateless money system birthed from the ashes of the 2008 financial crisis—is now a matter of U.S. national security strategy.

And here’s the real story: this isn't new. This is a confirmation of what’s been in motion behind the scenes for years. The U.S. government has quietly become the largest sovereign holder of Bitcoin (over 198,000 BTC), created a strategic Bitcoin reserve, and built intelligence-gathering operations atop blockchain rails.

The message is clear: Bitcoin is no longer just about finance. It’s about power.

From Digital Gold to Digital Gunpowder

Let’s back up. Bitcoin was born in 2009 as a peer-to-peer alternative to central banks and surveillance finance. For years, it was dismissed as nerd money, a toy for libertarians and cypherpunks. And yet, beneath the surface, intelligence agencies saw something different: a transparent, traceable financial system that adversaries would inevitably use—and which the U.S. could exploit.

Fast forward to 2025: the CIA is no longer hiding it. Bitcoin is being used not just to monitor illicit flows from North Korea or ransomware gangs, but as a strategic intelligence layer—a Trojan horse riding into enemy networks under the guise of neutrality.

If cash was king in Cold War espionage, Bitcoin is becoming its digital successor.

The Game Theory of Bitcoin Is Playing Out

Ellis’s remarks about “getting ahead of China” aren't idle talk. China has been waging a digital monetary war for years���rolling out the e-CNY, banning Bitcoin mining, and tightening controls over cross-border capital flow. The U.S., for a while, seemed lost in bureaucratic turf wars between the SEC, CFTC, and IRS.

But that changed in 2025.

With Trump back in the White House and a newly announced Bitcoin strategic reserve, the U.S. is positioning BTC not just as a hedge—but as a tool of soft power.

Here’s the genius: while China builds a centralized digital yuan with strict surveillance controls, the U.S. can now back a neutral protocol—Bitcoin—that plays into American values of openness, innovation, and market freedom. It doesn’t need to control the rails; it needs to let them run free—while building the best intelligence infrastructure around them.

The CIA is doing just that.

The Irony: Bitcoin Is a Spy's Best Friend

Let’s bust a myth: Bitcoin is not anonymous. It’s pseudonymous. Every transaction is forever stamped on an open ledger. Tools like Chainalysis and Arkham Intelligence allow governments to trace flows with increasing accuracy. Criminals who think Bitcoin is private are ten steps behind.

What the CIA has realized—and quietly leveraged—is that Bitcoin is a permanent wiretap on adversarial finance.

The very immutability that makes Bitcoin valuable also makes it an intelligence jackpot. Whether it’s tracking Iranian oil revenues, North Korean hacks, or Russian military funding, Bitcoin provides visibility in a world that increasingly lives on encrypted apps and burner devices.

The CIA doesn’t want to ban it. It wants to weaponize it.

Satoshi’s Ghost: What Would the Creator Say?

Of course, this shift makes the original Bitcoin visionaries squirm.

Bitcoin was meant to be sovereign money—a way to opt out of nation-state control, not play into it. From Silk Road libertarians to privacy-focused developers, many early adopters now face an uncomfortable truth: Bitcoin has gone mainstream. And not just Wall Street mainstream. Langley mainstream.

This isn’t new. From the moment large mining pools centralized in China and U.S. institutions started buying BTC for balance sheets, Bitcoin stopped being a purely grassroots movement. What we’re seeing now is the final phase: Bitcoin as a strategic state asset.

You may not like it—but you should understand it.

Because if you're playing in crypto and ignoring the geopolitics, you're bringing a knife to a gunfight.

Bitcoin's Next Role: Digital Deterrent?

Let’s take the argument one step further.

In 2021, a U.S. Space Force officer floated the idea that Bitcoin could act as a “digital strategic deterrent”—akin to cyber-era gold reserves. That idea sounded fringe then. Today, with a formal reserve in place and CIA leadership acknowledging Bitcoin’s utility, it sounds like doctrine in the making.

Here’s the scenario:

The dollar faces de-dollarization threats from BRICS and bilateral oil deals.

The U.S. holds the largest sovereign stash of Bitcoin.

China cements control over internal capital and weakens its private crypto sector.

The U.S. encourages Bitcoin openness—inviting capital and talent into its markets.

Suddenly, Bitcoin is not a threat to U.S. monetary dominance—it’s a shield for it.

The game theory flips. Rather than resisting crypto, America begins to champion the parts of it that align with democratic values and intelligence leverage.

It’s messy. It’s ironic. But it’s working.

The Final Pivot: Bitcoin as Infrastructure, Not Ideology

For all the idealists still clinging to Bitcoin as a revolution—here’s the cold truth: it’s infrastructure now. Strategic, state-leveraged infrastructure.

That doesn’t mean the ideals are dead. But it does mean the landscape has changed. We’ve moved from protest tool to protocol. From ideology to inevitability.

The smart players aren’t fighting this shift. They’re positioning around it.

Builders are leaning into Bitcoin L2s, stablecoins on BTC rails, and infrastructure that makes Bitcoin more programmable and interoperable. Policy watchers are tracking regulatory clarity that opens institutional floodgates. Intelligence communities are embedding monitoring tools into transaction flows and wallet analytics.

Everyone is picking a lane.

So the question isn’t whether Bitcoin is sovereign or co-opted. The question is: What does power look like in a Bitcoin-integrated world? And who has it?

Bitcoin Will Become the New SWIFT

Here’s where I think this is heading.

In the next decade, Bitcoin will stop being seen as a rival to fiat—and instead be adopted as the neutral transaction layer between nations, corporates, and markets. Think SWIFT, but open. Programmable. Global. And permissionless.

The CIA has already begun this mental shift. The reserve is just the start. Over time, Bitcoin will be used for:

Settling interbank FX outside the dollar

Tracking dark capital flows in conflict zones

Providing neutral rails in financial sanctions regimes

Acting as collateral for sovereign borrowing

That’s not idealism. That’s geopolitics.

What used to be dismissed as cypherpunk fantasy is now being formalized in the playbooks of intelligence agencies. Bitcoin is no longer the outsider. It’s part of the machine.

You can resent it. Or you can prepare for it.

Because whether you’re building protocols, managing portfolios, or advising policy—you are now operating in a world where Bitcoin is a geopolitical instrument.

Act accordingly.

💡 Like this kind of content? Help keep it free.

We don’t run paid subscriptions. We don’t wall off content. Everything we write is open, bold, and built for thinkers like you. If you find value in our work, consider supporting us on Ko-Fi. Even a small donation helps us keep publishing high-caliber, ad-free crypto analysis that connects the dots others won’t.

👉 Support us on Ko-Fi

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

When Ivy League Endowments Buy Bitcoin and States Flinch, Who’s the Real Adult in the Room?

The financial establishment is splitting down the middle—and Bitcoin is the fault line.

Last week, Brown University quietly disclosed a $5 million position in BlackRock’s iShares Bitcoin Trust ETF (IBIT). Not to be outdone, Emory University now holds over $22 million in Bitcoin exposure. And the University of Austin got ahead of them all last year with its own $5 million Bitcoin endowment, custodial partner and all.

Meanwhile, Arizona’s governor just vetoed a bill that would’ve allowed the state to hold Bitcoin in reserves, dismissing it as “untested.” You read that right: America’s Ivy League is investing. But elected officials still call it a gamble.

The contradiction is jarring—but instructive. Because this isn't just a tale about one ETF or one veto. It's a snapshot of the messy, asymmetrical normalization of crypto in 2025: where top-tier institutions are moving faster than governments. And where the credibility gap between Wall Street and Washington grows wider by the day.

University Endowments: The New Crypto Power Players

Let’s start with Brown. This isn’t just another fund buying into Bitcoin. It’s Brown University—a $7.2 billion Ivy League endowment known for playing the long game.

Brown’s $5 million IBIT position may seem modest. But the signal is anything but. University endowments are among the most conservative and prestigious allocators in the financial ecosystem. They don’t chase fads. They study, debate, model, and invest with time horizons that often span decades. When they move, they validate.

This marks a turning point. Because while hedge funds, family offices, and sovereign wealth funds have quietly been accumulating Bitcoin exposure since 2020, endowments had largely remained on the sidelines. That’s changing.

Brown joins Emory and UATX in building strategic exposure to Bitcoin—either via spot ETFs or direct custodial solutions. These are institutions responsible for funding future scholarships, research, and facilities. If they think Bitcoin is worth holding, what does it say about the asset class’s credibility?

And why are they more comfortable than policymakers with the asset’s “risk”?

Arizona’s Missed Opportunity—and the Political Cost of Fear

Now let’s talk about Arizona.

Senate Bill 1025 was simple: allow the state to allocate up to 10% of certain funds (like seized assets) into Bitcoin. It passed the legislature. But Governor Katie Hobbs vetoed it with a familiar refrain: Bitcoin is “untested.”

Untested? BlackRock, Fidelity, and Franklin Templeton now manage billions in spot Bitcoin ETFs. IBIT alone has seen 14 straight days of inflows and is now among the top 10 ETFs by net inflows in the U.S., across more than 4,000 funds.

Bitcoin isn’t untested. It’s stress-tested—in the open, for 15 years, across every macro regime imaginable: zero interest rates, COVID crashes, banking failures, inflation, rate hikes, and war.

What Arizona vetoed wasn’t Bitcoin. It was the future of capital preservation in an era of monetary instability.

And in doing so, the state sent a signal—not just to voters or investors, but to tech entrepreneurs, capital allocators, and institutional partners: we still don’t get it.

That kind of signal has real consequences. Because capital, especially crypto-native capital, is mobile. And jurisdictions that fail to evolve—just like companies—get left behind.

The New Legitimacy Benchmark: IBIT Flows Speak Louder Than Politicians

Arizona may have flinched, but the market certainly hasn’t.

BlackRock’s IBIT ETF has now attracted over $2.4 billion in net inflows just last week, outpacing virtually every other ETF outside the S&P 500. It has become one of the fastest-growing ETFs in U.S. history. Fidelity’s Bitcoin fund has joined the race. Grayscale continues to lose ground, but the broader spot ETF ecosystem is surging past $12 billion in cumulative inflows since January.

That’s not a speculative bubble—that’s institutional allocation at scale.

And it’s not happening in a vacuum. Just last week, Senator Cynthia Lummis reintroduced the Bitcoin Act, calling for the U.S. to acquire 1 million BTC over five years. Say what you will about the feasibility, but the symbolism is clear: the U.S. is now publicly debating whether Bitcoin belongs on the national balance sheet.

That’s not fringe. That’s monetary geopolitics.

Bitcoin’s “Risk” Is Becoming a Matter of Perspective

Here’s the uncomfortable truth policymakers like Governor Hobbs don’t want to confront:

In 2025, refusing to consider Bitcoin isn’t the cautious move—it’s the reckless one.

Inflation-adjusted returns across many state pension systems are being eroded by policy-driven distortions in traditional markets. Bonds no longer hedge like they used to. Real estate is opaque and illiquid. Equities are increasingly correlated.

In that context, even a 2–5% Bitcoin allocation offers uncorrelated, censorship-resistant, globally liquid exposure. That’s not wild speculation. That’s prudent diversification.

University endowments are figuring this out. Even if politicians aren’t.

The Real “Untested Investment” is U.S. Fiscal Policy

Let’s flip the question.

Which is the real untested investment?

An asset with a 21-million fixed supply, held by nation-states, corporations, and now Ivy League endowments?

Or a U.S. fiscal trajectory that has added $9 trillion in debt since 2020 and now faces $1.1 trillion in annual interest payments?

Which bet feels safer over a 10-year horizon?

The answer, increasingly, depends on who you ask. And whether they’re willing to think outside the fiat box.

The Legitimization of Bitcoin Will Be Asymmetrical

The split between university endowments buying Bitcoin and state governments banning it tells us something fundamental:

Bitcoin adoption will not be linear. It will be patchwork, tribal, and jurisdictional.

Just like cannabis. Just like online gambling. Just like data privacy.

Some institutions will lead (Brown, Emory, UATX). Some states will resist (Arizona). Some politicians will posture (Hobbs). Others will propose sweeping change (Lummis).

But the net trend is clear: Bitcoin is moving up the legitimacy ladder—from rogue asset to reserve consideration. From protest buy to policy hedge. From “digital gold” to actual allocation.

And those who dismiss it as “untested” in 2025 are no longer cautious. They’re uninformed.

History tends to reward the early—and punish those who veto innovation.

If you found this piece insightful, help us keep The Daily Decrypt independent. We don’t run subscriptions. Everything is free. But if you'd like to support bold, high-quality crypto journalism, you can donate here:

Your donation helps us challenge narratives, spotlight real adoption, and bring nuanced crypto opinion to a wider audience. Thank you.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Trump’s Crypto Pivot Is the Start of a New Jurisdictional Arms Race

The U.S. isn’t just back in the crypto game—it’s gunning for the crown.

Washington just flipped the script on crypto. And the world is watching.

The Trump administration’s full-throated embrace of digital assets marks a geopolitical and regulatory inflection point. After years of U.S. hostility—regulatory carpet-bombing, enforcement-by-ambush, and talent fleeing overseas—we’re now witnessing the beginnings of a coordinated pivot. Not a soft nudge. A hard turn.

Trump’s promise to make the U.S. the “crypto capital of the world” isn’t campaign fluff anymore. It’s policy—and it’s already warping the landscape.

From Dubai to Zug, global crypto players are packing their bags. Deribit, the world’s largest crypto options exchange, is eyeing a U.S. move. OKX is setting up a U.S. HQ. Nexo is returning after its 2022 exodus. Even regulators are blinking. The SEC is hitting pause on lawsuits. The DOJ has dissolved its crypto task force. And with the sudden collapse of support for the stablecoin bill by previously pro-crypto Democrats, it's clear: the fault lines are shifting beneath our feet.

This isn’t just about crypto. This is jurisdictional arbitrage. A regulatory arms race. And the U.S. just re-entered the arena with teeth bared.

From Hostility to Hospitality

Just two years ago, the American crypto industry was in retreat. The collapse of FTX in 2022 triggered a scorched-earth crackdown. The SEC, led by Gary Gensler, launched a blitz of lawsuits that made even compliant firms hesitate. Innovation fled. Coinbase looked to Bermuda. Andreessen Horowitz opened offices in London. Projects and founders sought friendlier pastures in Asia, Europe, and the Middle East.

The message from Washington was clear: "Not here."

Today? It’s “Open for business.”

Trump’s hosting of a White House crypto summit, just days after signing an executive order to establish a Bitcoin reserve, is more than symbolism. It signals an ideological shift: from crypto as threat to crypto as strategic asset. From "shadow finance" to “digital dollar hedge.”

And let’s not kid ourselves—this pivot is about power, not libertarian ideals. Trump’s team sees crypto through a geopolitical lens. The U.S. dollar is under attack from multiple angles—BRICS alternatives, China’s digital yuan, and weaponized sanctions policy. Supporting digital assets isn’t just good policy—it’s competitive defense.

The crypto world, ever pragmatic, is responding accordingly.

The Realpolitik of Stablecoins

The real test of this pivot isn’t celebrity endorsements or summit optics—it’s legislation. And here, the sudden backpedaling by pro-crypto Senate Democrats on the stablecoin bill is telling.

The GENIUS Act, once seen as a landmark compromise, now faces gridlock. Nine Senate Democrats—many of whom previously backed the bill—have reversed course, citing national security and AML concerns.

Why the about-face?

Simple: political survival.

Crypto regulation has become a proxy war within the Democratic Party—between the innovation caucus and the Elizabeth Warren faction. With Trump capturing crypto momentum, Democrats are caught between alienating tech-aligned donors or appearing soft on “shadow money.” They chose delay.

That’s short-sighted.

Stablecoins are the killer app of crypto. They already move over $10 trillion a year, dwarfing Venmo, Zelle, and Apple Pay combined. The Fed and Treasury know it. That’s why, as Custodia Bank CEO Caitlin Long pointed out, the Federal Reserve is quietly maintaining anti-crypto policies that restrict bank stablecoin issuance—even while relaxing other guidelines.

In this regulatory vacuum, the market is left to guess what’s safe and what’s sanctioned. That’s not innovation. That’s paralysis.

Jurisdictional Arbitrage Is Accelerating

Deribit’s possible move to the U.S. is no coincidence. Nor is Coinbase’s rumored acquisition of the platform. What we’re seeing is strategic reshoring—capital and talent flowing back to America under the promise of predictability.

This is how jurisdictional arbitrage works: capital flows where it’s treated best.

And if the Trump administration maintains this deregulatory stance, expect the floodgates to open. The EU’s MiCA regime is comprehensive, but slow. Asia is forward-leaning but fragmented. The Gulf states are nimble but unproven at scale.

America still has the deepest capital markets, the most liquid venture ecosystem, and the most aggressive investor base. If it can pair those with regulatory clarity—even imperfect clarity—it wins.

But Let’s Not Get High on Our Own Supply

Here’s the counterpoint: deregulation isn’t always innovation.

A Trump-led SEC that drops enforcement cases and a DOJ that dissolves its crypto unit may unleash growth—but it also invites the same kind of froth that fueled 2021. If history is any guide, a bull run without guardrails leads to implosions.

And without a stablecoin bill, the foundation remains shaky. The U.S. cannot lead in digital assets if its banks are still barred from interacting with permissionless blockchains. You can’t be the crypto capital of the world while banning crypto from the financial plumbing.

A pivot is not a framework.

The U.S. Will Trigger a New Wave of Crypto Listings—and a Regulatory Cold War

The shift we’re seeing now is only the beginning. Expect the following in the next 12–18 months:

A surge in crypto IPOs and SPAC deals in U.S. markets, as companies seek to capitalize on the favorable window (see Twenty One Capital’s $3.6B debut).

A return of American crypto VCs, many of whom had turned to Asia and the Gulf during the Biden-era clampdown.

A regulatory cold war, where rival jurisdictions like Singapore, Switzerland, and Dubai will respond with their own deregulatory lures.

A formal rethinking of dollar dominance, with stablecoins moving from policy orphan to national strategic interest.

This is bigger than crypto.

It’s about whether the United States wants to remain the center of digital capital markets—or cede that future to others.

Crypto Didn’t Win. But It’s Back at the Table.

Let’s be clear—Trump’s pivot isn’t about love for Bitcoin. It’s about leverage.

Crypto is now a tool in America’s geopolitical toolkit. The question is whether the industry will seize this window to push for smart, sustainable regulation—or fall into the same cycle of hype and bust.

Either way, the U.S. has rejoined the race. The rest of the world just got a wake-up call.

We publish this work for free—no paywalls, no ads. But if you found this valuable and want to help us keep going, consider supporting us with a donation on Ko-Fi.

Your support helps us stay independent, bold, and brutally insightful. Thank you.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Stablecoins Aren’t a Threat to the Dollar—They’re Its Secret Weapon

In 2025, a quiet revolution is underway. Not in the streets, not in the headlines—but in the plumbing of global finance. Dollar-backed stablecoins have surpassed Visa in transaction volume. They’re issuing at scale, settling trillions, and quietly becoming a global standard. And despite the alarm bells from some corners of the old guard, the truth is this: Stablecoins may be the strongest tool America has to preserve its monetary dominance in a world increasingly hostile to it.

That’s not just a crypto-native fantasy. It’s the strategic case for stablecoins—and it’s one Washington is slowly waking up to.

The Digital Dollar Is Already Here—And It’s Not Issued by the Fed

While central banks and monetary theorists debate the future of digital currencies, the private market has already built the infrastructure. USDC, USDT, and DAI now power over $27.6 trillion in transactions annually—edging out Visa and crushing Mastercard. Stablecoins are now among the top 15 holders of U.S. Treasuries. This is no longer fringe finance. It’s macroeconomics.

And that macro context matters. The U.S. dollar’s status as the global reserve currency isn’t a given. It’s an advantage that requires constant reinforcement—through diplomacy, liquidity, and yes, debt. With over $35 trillion in national debt, the U.S. needs demand for Treasuries to remain strong. Every dollar-backed stablecoin is a vote for that system.

Each tokenized dollar, backed by regulated issuers and audited reserves, extends the reach of the U.S. financial system—not weakens it.

Dollar Demand Is Being Reinvented in Real-Time

Let’s be clear: stablecoins are not just crypto tokens. They’re the dollar’s second act.

Emerging markets—plagued by inflation, FX instability, and capital controls—are turning to stablecoins not for speculation, but for survival. In parts of Latin America, Africa, and Southeast Asia, users aren’t choosing stablecoins because they’re “into crypto”—they’re choosing them because they need dollars. And traditional banking can’t deliver them.

In Argentina or Nigeria, you don’t get to hold dollars easily. But with a smartphone and a stablecoin wallet, you can move, store, and spend greenbacks with the speed of a text message. Stablecoins are financial internet for the unbanked dollar-seeker.

Meanwhile, U.S. issuers like Circle are leaning into compliance, clarity, and integration. The passage of the GENIUS Act and Biden administration support signals what could be a historic shift: The U.S. is not banning stablecoins—it’s blessing them. That’s not just regulatory maturity. It’s strategic foresight.

The Competition Isn’t Bitcoin. It’s the Digital Yuan and the Tokenized Euro.

For years, critics warned that crypto would undermine the dollar. In reality, it’s the best weapon the dollar has in the coming monetary arms race.

China isn’t playing around with digital currency. Its e-CNY pilot now reaches hundreds of millions of wallets. The EU is funding a Digital Euro. And both initiatives are explicitly geopolitical—attempts to reduce global dependency on SWIFT, Fedwire, and ultimately, the U.S. dollar.

But here’s the twist: they’re slow. Bureaucratic. National. Meanwhile, stablecoins are borderless, programmable, and viral. USDC can move through DeFi, on Ethereum, Solana, or even Visa-linked cards. It’s money with APIs.

Visa’s move to partner with Bridge and issue stablecoin-linked cards across Latin America is proof the rails are converging. Users won’t need to understand blockchains. They'll just swipe, scan, or click—powered by tokenized dollars under the hood.

This is how the dollar wins the digital currency war—by going native to the internet.

Volatility Is the Problem. Stablecoins Are the Answer.

Another tired narrative: crypto is too volatile. But that’s exactly why stablecoins are breaking out.

Bitcoin swung from $100K to $70K and back. Ethereum remains unpredictable. But stablecoins aren’t speculative assets—they’re utility layers. You don’t HODL them to moon. You use them to move capital efficiently. That’s a different value proposition entirely.

And they’re becoming productive, too. Circle now enables USDC to earn yield through secure Treasury-backed mechanisms. DeFi protocols like Aave and Maker allow passive income generation through real-world asset strategies. This isn’t meme-coin roulette. It’s digitized dollar savings.

Critics Say Volume Is Fake. They Miss the Point.

Yes, some analysts rightly point out that stablecoin volumes can be inflated by arbitrage or wash trades. But the broader trend is undeniable. Even if you haircut the volume by 90%, the remaining use still dwarfs most payment platforms.

And it's growing where it matters: payroll, remittances, and cross-border settlements. Companies like SpaceX, ScaleAI, and independent contractors across continents now rely on stablecoins for operational finance. That's not noise. That's signal.

As A16z noted, “Stablecoins could be a WhatsApp moment for money.” Just as SMS gave way to free, instant messaging, legacy payments are giving way to global, near-zero-fee settlement.

Dollar Hegemony Isn’t Dying. It’s Evolving.

The internet has changed what “money” means. Borders are blurrier. Speed matters more than formality. Users choose convenience over convention. In that world, the dollar must become digital-native—or risk being bypassed.

Stablecoins are not a threat to U.S. dominance. They’re the clearest path to sustain it.

They create organic global demand for dollars. They cement dollar-denominated debt as the foundation of new financial protocols. They embed U.S. monetary infrastructure in the next wave of global fintech.

Yes, there are risks. Regulation must be tight. Auditing must be real. Governance matters. But the answer isn’t to slow stablecoins down—it’s to supercharge their legitimacy with transparency and oversight.

The alternative? Let China or the EU set the standard. And watch the dollar fade from digital relevance.

Stablecoins Will Become the Default Dollar Rail by 2030

By the end of this decade, more dollars will move via stablecoins than through SWIFT. Circle and Visa will power billions in commerce. Treasuries will flow through tokenized instruments. The “crypto” part of stablecoins will fade from view. But their strategic importance will only grow.

Stablecoins won’t kill banks. They’ll force them to evolve.

They won’t kill central banks. They’ll give them new tools.

And they won’t kill the dollar. They’ll immortalize it.

We don’t run paid subscriptions. But if this piece sparked something in you, consider supporting our work on Ko-Fi. Every donation helps us keep publishing sharp, free crypto commentary for thinkers like you. 👉 Support us on Ko-Fi

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Ethereum’s Identity Crisis: Reinvent or Get Left Behind

Ethereum is having a midlife crisis.

What was once the poster child of decentralized innovation now looks like a bloated, over-engineered, and institutionally neglected experiment. Amid collapsing trust, stagnating price action, and a flurry of protocol changes, Ethereum stands at a painful inflection point: reinvent itself to remain relevant—or continue bleeding market share, credibility, and capital.

Vitalik Buterin's latest blog post, "The Simple Ethereum", is both a confession and a pivot. A confession that the protocol has grown too complex for its own good—and a pivot towards something closer to Bitcoin: minimalist, robust, and sustainable.

But here’s the uncomfortable truth: Ethereum is no longer the indispensable Layer 1 it once aspired to be. And unless it radically realigns its technical architecture and cultural narrative, it may go the way of MySpace—overshadowed by leaner, more coherent challengers like Solana and Bitcoin.

The Rise of Complexity, the Fall of Credibility

Ethereum’s technical roadmap reads like an advanced cryptography syllabus: zk-SNARKs, danksharding, rollups, Layer-2 bridges, account abstraction, and now a “3-slot finality” model. This complexity was once a point of pride. Today, it’s a liability.

In Vitalik’s words, Ethereum’s sprawling architecture has led to “excessive development expenditure, all kinds of security risk, and insularity of R&D culture.” It’s an admission that resonates across the market—especially with institutions, who now see ETH as an unreliable, unpredictable asset.

Two Prime, a quant trading firm with over $1.5 billion in crypto lending history, recently dropped Ethereum entirely. Their rationale? ETH now behaves more like a memecoin than a core portfolio asset. It lacks predictable behavior, suffers from elevated tail risk, and shows persistent underperformance relative to Bitcoin. That’s not just a market trend—that’s a credibility crisis.

In 2020, ETH was the obvious second asset after BTC. In 2025, that assumption is no longer safe. Bitcoin ETFs now hold over $113 billion. Ethereum ETFs? Just $4.7 billion. The institutional verdict is clear: Ethereum has failed to maintain a coherent value proposition.

The Simplification Pivot: Too Late or Just in Time?

Buterin’s proposal to simplify Ethereum—standardize tooling, shift to a RISC-V virtual machine, reduce validator complexity—is long overdue. It mirrors Bitcoin’s time-tested ethos: stability first, complexity only where absolutely necessary.

From a technical perspective, these changes could make Ethereum leaner, faster, and easier to maintain. Moving away from the convoluted Ethereum Virtual Machine (EVM) toward something ZK-friendly like RISC-V could unlock significant performance gains. A protocol-wide cleanup—single serialization format, fewer redundant components, simpler consensus—is equally sensible.

But the elephant in the room is this: will any of this matter if Ethereum has already lost the narrative?

Simplifying Ethereum over the next five years is a noble goal. But blockchains are not just technical platforms—they are socio-economic networks. And in Ethereum’s case, the culture of overengineering, infighting, and governance sclerosis may be harder to change than the codebase.

The upcoming Pectra hard fork, which incorporates 11 Ethereum Improvement Proposals (EIPs), including the much-awaited EIP-7702 for account abstraction, is a critical stress test—not just for the network’s stability but for its relevance. Yes, the successful rollout on Gnosis Chain is encouraging. But let’s not forget: multiple testnet failures have already dented public confidence.

The market no longer gives Ethereum the benefit of the doubt. Execution must now match ambition—flawlessly and repeatedly.

The Layer 2 Cannibalization Problem

Ethereum’s original pitch was bold: a world computer. But in practice, its economic model is deeply conflicted. Most of the activity has moved to Layer 2s, which ironically divert fees and attention away from the mainnet.

Vitalik’s call for simplicity seems to ignore this elephant in the room. What exactly is the Ethereum mainnet for in a world dominated by rollups? If the primary function of L1 is simply to settle proofs from L2s, why maintain such a heavy base layer?

Ethereum's high-fee environment has already pushed users toward faster, cheaper alternatives like Solana and Avalanche. And unlike Ethereum, these platforms don’t require users to understand arcane concepts like blobs, calldata compression, or optimistic fraud proofs. They just work.

And that matters. Because when you lose the retail crowd and the institutions in one go, all the developer mindshare in the world won’t save you.

Bitcoin’s Simplicity Is Ethereum’s New North Star

Ethereum’s about-face toward simplicity is a form of ideological surrender. For years, it defined itself as the opposite of Bitcoin: expressive, programmable, adaptable. Now, even its founder is looking to Bitcoin as a design ideal.

And there’s a reason for that. Bitcoin’s minimalism is not just elegant—it’s resilient. Bitcoin doesn't try to be everything for everyone. It aims to do one thing exceptionally well: store value in a trustless, immutable, global ledger.

Ethereum, by contrast, has been everything to everyone—smart contracts, DeFi, NFTs, DAOs, Layer 2s, Layer 3s—and in the process, it has lost coherence.

This pivot toward a simpler Ethereum is a tacit acknowledgment that complexity isn’t a feature—it’s a liability. But it may also be the last, best chance to salvage the network’s credibility before irrelevance sets in.

Reinvention or Decline

To be clear, Ethereum is not dead. It still boasts an unmatched developer ecosystem, deep liquidity, and a vibrant (if fractious) community. The Pectra upgrade, if successful, could reestablish some technical leadership. And if Vitalik’s simplification roadmap is executed with urgency and precision, Ethereum could reclaim lost ground.

But the clock is ticking.

Ethereum cannot afford another year of meandering upgrades, fractured governance, and institutional exits. It needs to ship—cleanly, simply, and convincingly. It must restore trust not just with crypto natives but with the capital allocators who increasingly view ETH as a risk-on tech bet rather than a foundational asset.

The next 18 months will decide whether Ethereum is a bloated monument to past innovation—or a streamlined, credible Layer 1 for the future of decentralized infrastructure.

If you found this analysis valuable, consider supporting The Daily Decrypt. We don’t run paid subscriptions or put our insights behind a paywall. Instead, we rely on reader support to stay independent, bold, and ad-free.

👉 Buy us a coffee on Ko-Fi and help keep crypto journalism honest and fearless.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Europe Is About to Kill Crypto Privacy—And Most People Don’t Realize It Yet

By 2027, anonymous crypto accounts and privacy coins like Monero and Zcash will be banned in the European Union. That’s not a warning. That’s law. Passed. Finalized. Done.

Yet somehow, the crypto industry has barely blinked.

This isn’t just another round of AML rules. This is a structural reset—one that strikes at the very core of what made crypto revolutionary in the first place: the right to financial privacy. If you think this is just about Monero, think again. This regulation will ripple through every layer of the crypto stack—from L2s to stablecoins to DeFi protocols. It’s not just about privacy coins. It’s about the death of pseudonymity in crypto finance.

And most people don’t realize what’s coming.

Privacy Isn’t Just for Criminals. It’s for Citizens.

Let’s get one thing out of the way: the European Union’s stated goal—to combat money laundering and terrorism financing—is valid. No one in their right mind supports criminal abuse of financial rails.

But that’s not the real debate here.

The EU’s Anti-Money Laundering Regulation (AMLR) isn’t just targeting dark web markets. It’s banning the tools that enable any form of anonymity in digital finance. Under Article 79 of the new framework, financial institutions and crypto service providers (CASPs) are prohibited from handling privacy-preserving tokens or offering anonymous crypto accounts. That includes not just Monero or Zcash, but any wallet or protocol that enables anonymized transactions.

Translation: the foundational right to opt-out of surveillance finance is being written out of European law.

Crypto users will now be treated as guilty until proven KYC’d.

And before you say “this only affects centralized services,” remember: MiCA already cracked down on stablecoins. Now AMLR adds the final nail—one that leaves decentralized protocols exposed to hostile regulation or forced exit.

The Ripple Effect Will Be Massive

This isn’t just bad news for Monero. It’s an existential threat to multiple sectors of crypto innovation.

1. Privacy-preserving L2s like Aztec or zkSync: If your L2 allows anonymous transactions, you’re non-compliant by default. Even if your base layer is Ethereum, your zk rollup is now on thin legal ice in Europe.

2. Decentralized exchanges (DEXs): If you enable private swaps, expect to be de-platformed or geo-blocked. DEXs may not be CASPs by definition, but if they use relayers, bridges, or interfaces hosted in Europe, they’ll be targeted.

3. Stablecoins and privacy wallets: The combination of stablecoins and mixers or privacy wrappers is an obvious red flag now. Even self-hosted wallets like Wasabi or Samurai could face oblique bans by targeting providers offering UI or custodial services within the EU.