We combine the ingenuity of two distinct brands, privatewolfmedia.com and privatewolf.ae, to offer a unique blend of services that are designed to transform the way you do business, whether you're in the heart of the USA or the dynamic cityscape of the UAE.

Don't wanna be here? Send us removal request.

Text

How to Arrange Parental Sponsorship in the UAE

Eligibility and Requirements for Securing Family Residence Visas

In the UAE, residents with valid visas can facilitate residence visas for their relatives, providing they satisfy certain conditions. Notably, there has been a relaxation in the rules; employees can sponsor their family members regardless of their job designation as long as they earn at least AED 4,000 per month, or AED 3,000 plus accommodation. All adults over 18 years looking to sponsor their parents must also pass a mandatory health check.

Essential Criteria for Parental Sponsorship

For those living in Dubai and wishing to bring their parents to stay, a valid residency visa is required. The sponsor must meet a minimum income threshold of AED 4,000 or AED 3,000 with housing included.

It’s mandatory for sponsored family members aged 18 and older to pass a medical fitness test at recognized health centers across the UAE.

Additional Notes:

Under special approvals by the ICP, a mother may sponsor her children.

A sponsor must apply for their dependents’ visas within two months of them entering the UAE with an entry permit.

The duration of a parent’s visa is typically one year and is independent of the sponsor’s visa length.

Job roles are no longer tied to visa sponsorship eligibility.

Individuals with dormant tuberculosis are still considered fit for residence, provided they undergo treatment and regular check-ups.

Medical Fitness and Government Health Centers:

Disease Prevention & Screening Center — Abu Dhabi

Dubai Health Authority

Emirates Health Services

Useful Links:

Health conditions for a UAE residence visa — UAE Government portal

Resolution №5 of 2016 amending provisions of the Cabinet Decree №7 of 2008

Communicable Diseases Bulletin (PDF, 2.65 MB) — Department of Health — Abu Dhabi

Documenting Family Sponsorship

To sponsor a spouse or children, the sponsor must provide:

A completed application form (available online)

Copies of passports and photos of the family

Medical clearance for all family members over 18

Proof of marriage (if applicable), employment details, and accommodation

Special Conditions and Fees

Sponsoring both parents requires a deposit, and single-parent sponsorships are only permitted under specific conditions, such as a death or divorce, supported by official documents.

The cost related to sponsoring parents varies, generally falling under the family visa category. Expect to handle various fees and ensure medical insurance for parents is in place, meeting the minimum required standards.

Preparing for Visa Application

To avoid delays and ensure compliance, gather all necessary documents and understand the fees involved. Regular updates from the immigration office will keep you informed about the latest requirements and procedures.

FAQs About Family Visas in the UAE

Q1. Is it possible to sponsor your parents in the UAE?

Yes, ensure you meet the minimum salary criteria and other eligibility requirements first.

Q2. Can I sponsor my spouse in Dubai?

Absolutely, provided you fulfill the basic financial and legal prerequisites.

Q3. What are the fees involved in sponsoring my parents in the UAE?

A security deposit of AED 5000 per parent is typically required for their residency visas.

Q4. Can I apply for a parent’s visa if the rental contract isn’t in my name?

No, having a tenancy agreement in your name is crucial for visa applications.

Q5. Is it necessary for the applicant to be in the UAE during the visa process?

Yes, the applicant must be in the country to comply with the residency procedures.

By meticulously preparing and understanding the residency rules, you can effectively manage the sponsorship process and ensure your family’s smooth transition to life in the UAE.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

0 notes

Text

Navigating Your Emirates ID Status: A Comprehensive Guide

Understanding the Emirates ID

Dubbed as the lifeline for residents and citizens in the UAE, the Emirates ID card goes beyond a simple identity document. Issued by the Federal Authority for Identity and Citizenship (FAIC), it’s a legal requirement for every UAE resident and citizen to have one. What makes this ID unique? It’s packed with your vital stats — name, photo, signature, date of birth, nationality, and even your biometric data — all neatly encrypted in an electronic chip.

The Multifaceted Roles of the Emirates ID

So, why is this card so essential? Well, for starters:

It’s your golden ticket to access all government services across the UAE.

UAE citizens can flash it to vote in Federal National Council elections or zip through GCC countries as a travel document.

Fancy skipping the long queues at airports? Your Emirates ID has got you covered with access to eGates and smart gates.

From banking to renting an apartment, this card is your proof of identity.

When Will You Need Your Emirates ID?

Think of your Emirates ID as your all-access pass in the UAE. Need to apply for a loan, rent a place, or even catch a flight within the GCC? You’ll need this ID.

How to Check Your Emirates ID Status

Got an itch to know where your Emirates ID stands? You’ve got options:

Online Through FAIC Website: A few clicks on the FAIC website and entering your Emirates ID or application number will unveil your card’s status in no time.

Dial Up the FAIC Call Center: More of a talker? The FAIC call center reps are there to help you track your ID’s journey with just your Emirates ID number and a few details.

Applying for an Emirates ID? Here’s the Drill

Whether you’re a newcomer or in need of a renewal, getting your Emirates ID is straightforward:

Online via FAIC: Their website is your starting point for a new ID, renewal, or even replacing a lost one.

In-Person: Prefer doing things face-to-face? Typing centers or Amer centers are your go-to spots for application processing.

What You’ll Need

The essentials include your passport, residence visa (for expats), and a snap of your smiling face against a white backdrop. Oh, and let’s not forget the application fee.

Time Frames and Fees

Usually, it’s a waiting game of 7 to 15 days to get your Emirates ID. But if you’re in a rush, the FAIC’s Fawri service can expedite it for a fee. Speaking of fees, they range from AED 70 online to AED 175 at typing centers, depending on various factors.

Why Keep Tabs on Your Emirates ID Status?

From planning your renewal to ensuring you’re all set for your next adventure abroad, staying updated with your Emirates ID status is crucial. It’s all about keeping those potential hiccups at bay.

Making the Move to Dubai? Let Private Wolf Business Setup Be Your Guide

Considering setting up shop in Dubai? Ensure your Emirates ID ducks are in a row with Private Wolf Business Setup. From document gathering to navigating the application process, we’re here to make your transition as smooth as possible.

Frequently Asked Questions

Renewing Your Emirates ID?

Head to the FAIC’s website or your nearest typing center with your passport, valid visa, and let the renewal magic happen.

Curious About Your ID Status?

The ICA Smart Services mobile app is your go-to for real-time updates.

Lost Your Application Number?

No worries, your Emirates ID number is all you need to check your status.

Expired ID?

Don’t dilly-dally. Renewing your Emirates ID ahead of time saves you from potential fines and headaches.

Got your Emirates ID?

Then you’re armed and ready to navigate life in the UAE with ease. Whether it’s setting up a business or simply living the expat life, your Emirates ID is the key to unlocking a world of convenience.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

0 notes

Text

The Essential Role of No Objection Certificates (NOC) for Business and Employment in the UAE

In the United Arab Emirates (UAE), starting a business or navigating employment transitions often necessitates a special kind of documentation known as the No Objection Certificate (NOC). This document plays a pivotal role within the UAE’s regulatory framework, acting as a green light from authorities or current employers for individuals to proceed with certain activities. Whether you’re an aspiring entrepreneur or an expat looking to shift jobs, understanding the nuances of an NOC is crucial for a smooth experience in the Emirates.

The Significance of NOCs in the UAE:

An NOC in the UAE serves as a formal declaration from a government or private entity, indicating no objections to the requester engaging in specific actions or fulfilling certain conditions. It’s particularly vital for entrepreneurs aiming to launch their businesses in the country. Without this certificate, procuring necessary licenses, permits, or approvals can become a daunting challenge, potentially halting your venture before it even begins.

NOC Meaning and its Connection to the Kafala System:

Under the UAE’s Kafala (sponsorship) system, expatriates’ residency visas are typically sponsored by their employers. In this context, an NOC from your sponsor is often required for actions like changing jobs, starting a business, or even exiting the country. This requirement fosters transparency and ensures the protection of both the individual and the sponsor, especially from legal complications or visa violations.

The Advantages of Securing an NOC:

Obtaining an NOC can significantly benefit individuals in various scenarios, including smoother job transitions, avoidance of legal issues, lifting labor bans, and facilitating certain official processes more efficiently.

When is an NOC Imperative?

An NOC is indispensable in numerous situations, especially when altering your employment status, initiating business operations, or conducting specific official dealings in the UAE. Notably, while changing employers or starting a business in the mainland typically requires an NOC, Free Zones might offer more lenient regulations.

Issuance of NOCs:

The issuer of an NOC varies depending on its purpose, encompassing employers, government departments, utility providers, and Free Zone authorities. Each has its protocols and requirements for issuing an NOC.

Acquiring an NOC in the UAE:

The procedure for obtaining an NOC varies by its type and the issuing authority. It generally involves identifying the NOC type, gathering necessary documents, submitting an application, possibly paying a fee, and then waiting for approval and collection.

NOC’s Role in Business Establishment:

For employed individuals desiring to start a business on the mainland, an NOC from their current employer is often obligatory. This ensures that there are no conflicts with their employment contract. However, for freelancers or the unemployed, this requirement might not apply. Free Zones present an alternative with simpler processes and no NOC requirement from an employer.

Is an NOC Needed to Work in the UAE?

Typically, an NOC is not required just to work in the UAE. Its necessity arises mainly during employment status changes or specific desired actions. Initially, your employer manages the work visa application process without needing an NOC from you.

Conclusion:

The No Objection Certificate (NOC) stands as a crucial document in the UAE, smoothing the path for business endeavors and employment transitions. Its role in ensuring all parties are agreeable to the decisions made is invaluable. For those navigating the business and employment landscape in the UAE, understanding and obtaining an NOC can be the key to unlocking opportunities and overcoming bureaucratic hurdles.

Frequently Asked Questions:

Can an NOC be issued for any activity in the UAE? NOCs are generally issued for specific purposes, such as employment changes, starting a business under certain conditions, and obtaining clearances for specific transactions.

How long does it take to obtain an NOC? The time frame for receiving an NOC varies based on the issuing authority and the complexity of the request, ranging from a few days to several weeks.

Is an NOC required to cancel my UAE visa? Typically, a NOC is not mandatory for visa cancellation. However, fulfilling any outstanding obligations with your employer is necessary before complete cancellation.

Can I request an NOC for a family member in the UAE? NOCs are usually issued to individuals for their own activities, but in certain cases, an NOC from your employer may be required for family member visa applications if there’s a change in your employment.

What should I do if my employer refuses to issue an NOC? If an employer unreasonably withholds an NOC, negotiation or filing a complaint with the Ministry of Human Resources and Emiratization (MOHRE) might be options, although seeking legal advice could also be necessary.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

#NOC#No objection certificate#mainland#free zone#mainland business setup#free zone business setup#private wolf

0 notes

Text

How to Obtain a Police Clearance Certificate in Dubai

Understanding the Importance of a Police Clearance Certificate in Dubai

A Police Clearance Certificate (PCC), known as a Good Conduct Certificate in Dubai, is an official document provided by the Dubai Police. It serves as a confirmation of your criminal history in the United Arab Emirates (UAE).

The significance of the PCC lies in its ability to affirm that you maintain a clean criminal record, indicating an absence of any charges or convictions during your time in the UAE, whether as a resident or visitor.

Why Different Organizations Require a Good Conduct Certificate

Employers

In Dubai and across the UAE, many employers include a PCC as part of their pre-employment screening process. This step aids them in evaluating your suitability for a role while ensuring they hire individuals with clean backgrounds.

Immigration Authorities

When applying for a visa or residency permit in Dubai or the UAE, immigration authorities often request a PCC. This serves the purpose of verifying your criminal history to determine any potential security risks.

Other Organizations

Various institutions such as educational establishments and licensing bodies may also demand a PCC for different reasons. For instance, universities may require it for international students, while professional licensing bodies might need it before granting practice licenses.

Instances Where a Police Clearance Certificate is Necessary

Several common scenarios necessitate the acquisition of a police clearance certificate in the UAE:

Employers in Dubai frequently use PCCs during their pre-employment screening processes. Universities or educational institutions might mandate PCCs for international students enrolling in their programs. Immigration authorities in Dubai typically request PCCs when applying for visas or residency permits. Professional licensing bodies may require PCCs before granting practice licenses in various fields. During the adoption process in Dubai, authorities might request PCCs to evaluate suitability. Dubai authorities might require PCCs from owners or key personnel depending on the type of business establishment. Some banks in Dubai might request PCCs, especially for high-value accounts, when opening new accounts.

Eligibility & Documents Needed for Obtaining a PCC Certificate

Obtaining a Police Clearance Certificate (PCC) in Dubai generally does not have specific eligibility criteria. As long as you have a record in the UAE’s criminal database, you can apply for a PCC, regardless of your current residency status or criminal history (though a clean record is what the PCC verifies).

However, to apply for the PCC, you’ll need certain documents to verify your identity and residency (if applicable). These may include:

Your Passport (original and copy) UAE visa (original and copy, if applicable) Emirates ID (original and copy, if applicable) Application form Payment receipt for the PCC fee The exact requirements and application process may vary slightly depending on whether you’re applying within Dubai, another emirate in the UAE, or from your home country.

How to Get a Police Clearance Certificate

There are two primary methods to apply for a Police Clearance Certificate in Dubai: online or in person.

Online Application for the PCC

This is the preferred and generally faster method. Here’s a step-by-step guide:

Access the Application Platform

You can apply through the Dubai Police website or the Ministry of Interior’s website (https://moi.gov.ae/en/)

Register or Login

New users must register for an account using their UAE Pass. Existing users can log in with their credentials.

Select the PCC Service

Locate the “Police Clearance Certificate” or “Good Conduct Certificate” service on the platform.

Complete the Application Form

Fill out the online application form accurately, providing details such as passport information, visa details (if applicable), and reason for needing the PCC.

Attach Required Documents

Upload scanned copies of necessary documents, which may include your valid passport, Emirates ID (if applicable), a recent passport-sized photograph, and your last UAE visa copy (if applicable).

Pay the Processing Fee

Pay the processing fees associated with your PCC application online, typically using debit cards, credit cards, or e-Dirham.

Submit Your Application

Review all information, then submit your application electronically.

Track Your Application

Use the provided reference number to track your application status.

Receive Your PCC

Upon approval, you’ll receive the PCC electronically via email or download it directly from the application platform.

In-Person Application

Though online application is preferred, you can also apply in person at designated locations:

Visit a Dubai Police Service Center

Locate a nearby Dubai Police service center that handles PCC processing.

Collect Application Form

Obtain a PCC application form from the service center.

Prepare Required Documents

Gather the same documents required for the online application.

Submit Application and Pay Fees

Fill out the application form, attach your documents, and submit them to the service center representative. Pay the processing fees.

Collect Your PCC

You’ll be informed about the collection process for your PCC, which may involve receiving it directly or returning at a designated pick-up time.

Police Clearance Certificate (PCC) for Non-Residents

Non-residents can also obtain a PCC, provided they have previously spent time in Dubai as a visitor or resident. Additionally, they’ll need a fingerprint card issued by their current country’s police department, attested by the UAE Embassy there.

Required Documents for Non-Residents:

Valid Passport Fingerprint card issued by the police department in your current country of residence (mandatory) Previous UAE visa (if applicable) Two passport-sized photographs PCC application form The application process for non-residents is similar to residents. After preparing the required documents, including the attested fingerprint card, they can apply online.

Cost of PCC Certification in Dubai

The Dubai Police Clearance Certificate fee varies depending on residency status and the application method:

Residents: AED 200 (approximately USD 54.45)

Non-Residents: AED 300 (approximately USD 81.70)

Citizens (UAE Nationals): AED 100 (approximately USD 27.22)

Knowledge Fee of AED 10 (approximately USD 2.72) and an Innovation Fee of AED 10 (approximately USD 2.72) apply to all applicants.

An additional delivery fee of AED 100 (approximately USD 27.22) might apply for receiving a hard copy of the PCC through a service center instead of electronic delivery.

Arabic Certificate: 50 AED

English Certificate: 150 AED

For comprehensive assistance with legal requirements, especially if planning to establish a business in Dubai, consider consulting experts such as Private Wolf Business Setup.

Duration of Obtaining a PCC Certificate in Dubai

The processing time for obtaining a Dubai Police Clearance Certificate is typically 24 hours but can vary depending on residency status and other factors.

The PCC remains valid for three months from the date of issue, applicable to both residents and non-residents.

Get Your Dubai Business Up and Running Faster with Private Wolf Business Setup

Acquiring a Police Clearance Certificate in Dubai is a straightforward process, whether you’re a resident or a non-resident. This crucial document verifies your criminal background and is often required for various purposes such as employment, immigration applications, and company formation.

For assistance in meeting all legal requirements when moving your business to Dubai, consider seeking expert guidance from professionals like Private Wolf Business Setup.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

#Police clearance certificate#pcc in dubai#establish business in dubai#how to get pcc#how to get police clearance certificate#private wilf

0 notes

Text

How to start business in Dubai

Thinking of setting up shop in the vibrant heart of the UAE? You’re in the right spot! Dubai isn’t just a city of towering skyscrapers and sprawling malls; it’s a thriving hub for businesses keen on making their mark in the GCC (Gulf Cooperation Council) region and beyond. Whether you’re a Brit eyeing the Middle Eastern markets or a global entrepreneur ready to dive into new waters, Dubai’s welcoming shores are hard to resist. Let’s walk through the nuts and bolts of starting your enterprise in Dubai, making the process as breezy as an Arabian night.

Why Dubai?

Dubai’s not just about glitz and glamour; it’s a strategic gateway to the GCC market, offering a kaleidoscope of opportunities for businesses. Its central location makes it a crossroads for international flights and trade routes, while its talent-rich pool ensures you’re never short of expertise. But what really sets Dubai apart is its business-friendly environment, designed to nurture startups and established enterprises alike.

Where to Begin: Mainland vs. Free Zone

Before you leap into the business scene, you’ve got a choice to make: set up on the Dubai mainland or anchor down in one of its Free Zones. Both have their perks, but the key difference lies in ownership and operational scope. On the mainland, you’ll need a local sponsor to hold a majority share if you’re venturing into certain sectors. Meanwhile, Free Zones offer you full ownership and tax exemptions, with the slight catch of being restricted to operating within those zones, depending on your business license.

Navigating Licenses and Legalities

Your business’s nature dictates the type of license you’ll need, ranging from commercial and educational to media and ecommerce. In Dubai, your license is your gateway to operation, so getting this step right is crucial. While the process might sound daunting, it’s streamlined to support entrepreneurs, with clear guidelines and support available for those who seek it.

Choosing Your Business Structure

Dubai offers a smorgasbord of business structures, each with its own set of rules and benefits. Whether you’re flying solo as a sole proprietorship or setting up a limited liability company (LLC), the choice impacts everything from your financial liability to the way you operate. Free Zone entities enjoy special advantages but remember, some structures are exclusive to the mainland. Understanding these options is key to finding the best fit for your business dream.

The Step-by-Step Process to Launch

Identify your business type and license — Tailor this to your vision and the services or products you intend to offer.

Choose your business structure — Select one that aligns with your goals, be it a Free Zone LLC or a partnership on the mainland.

Register your company trade name — Make it unique and reflective of your brand.

Select your business space — From sleek offices to spacious warehouses, find a spot that suits your needs.

Submit your documents — Get all your paperwork in order for approval.

Register your business and get your license — With approvals in hand, you’re ready to make it official.

FAQs

How much does it cost to start a business in Dubai?

The cost varies widely based on your business type, size, and location. Starting in a Free Zone might be more budget-friendly, especially for solo entrepreneurs, while mainland ventures can require a heftier investment.

Is it easy to start a business in Dubai?

Yes, with Dubai’s business-friendly regulations and streamlined processes, setting up your business can be straightforward. The government’s online portals and dedicated agents make it even easier, guiding you every step of the way.

Is Dubai startup-friendly?

Absolutely! Dubai is keen on attracting innovative minds and startups, offering a supportive ecosystem, fast approvals, and a multitude of opportunities for growth.

Wrapping Up

Embarking on your business journey in Dubai might seem like navigating through a maze at first glance. But with the right map in hand — this guide — you’ll find the path surprisingly clear. Dubai offers a dynamic platform for entrepreneurs ready to venture into the Middle Eastern markets, with an array of options to suit various business needs. Whether you’re eyeing a spot in a bustling Free Zone or taking on the mainland markets, your entrepreneurial spirit will find a home in Dubai. Here’s to turning your business dreams into reality under the Dubai sky!

Ready to make your mark in the bustling city of Dubai? Whether you’re a seasoned entrepreneur or just starting out, Dubai’s dynamic environment is waiting for you. So, dive in, the waters are just right!

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

#business#business in dubai#start business in dubai#business setup in dubai#dubai#business setup#cost calculator#private wolf

0 notes

Text

Understanding Your UID Number in the UAE | Essential Guide

Ever landed in the UAE and been handed a document with a string of digits known as your UID number? This number might seem like just another set of numbers, but it’s your golden key in the United Arab Emirates, intricately linked to your identity as a resident or visitor. Here’s the lowdown on what the UID number is, why it’s crucial, and how you can find or consolidate it if the need arises.

The United Arab Emirates (UAE) has a unique identifier for those residing within its borders, known as the Unified Number or UID. This number, ranging from 9 to 15 digits, becomes part of your identity the moment your residence visa is issued. But what makes this number so important, and how does it affect your life in the UAE?

What Exactly is the UID Number?

The UID number acts as a personal identifier, issued by the UAE’s General Directorate of Residency and Foreigners Affairs (GDRFA) and the Federal Authority for Identity and Citizenship (ICA). This number ties directly to your visa and passport, ensuring that your identity is consistent across all official documents, no matter how your visa status may change.

Finding Your UID Number on Your Resident Visa

Your resident visa is more than just a permission slip; it contains several key numbers, including your UID. Positioned right above the visa’s file number, it’s easily spotted if you know where to look.

Quick Steps to Find Your UID Online

Need to find your UID without rummaging through your documents? The UAE makes it easy:

Head over to the GDRFA’s online service at https://gdrfad.gov.ae/en/unified-number-inquiry-service.

Fill in your details like passport number, nationality, birth date, and gender.

Crack the math puzzle provided.

Hit submit to unveil your Unified Number UAE.

Haven’t Got Your UID Yet?

If your UID is playing hide and seek, getting in touch directly can help:

Call toll-free within the UAE: 8005111 or internationally at +971 4 313 9999.

Use the contact form on the GDRFA’s website for inquiries: https://www.gdrfad.gov.ae/en/contact-information

Why Your UID Matters

The UID number isn’t just another piece of bureaucracy; it’s a cornerstone of your security and convenience in the UAE, enhancing safety, streamlining processes, and ensuring the accuracy of your personal data.

Consolidating Multiple UID Numbers

A glitch in the matrix might give you multiple UIDs, but worry not. The GDRFA can merge these into a single, streamlined identity, preventing any visa issuance hiccups.

The Unified Identity Number’s Advantages

This number is pivotal, not just for residency and ID applications but as a keystone in the UAE’s immigration system.

Private Wolf Helping Hand

Feeling overwhelmed? Private Wolf Setup has got your back, smoothing out the kinks in your transition to UAE life, from business formation to visa processing.

Frequently Asked Questions

Can a person have multiple Unified Numbers in Dubai?

Typically no, but anomalies happen. Consolidation is key.

Who issues UID numbers?

The General Directorate of Residency and Foreigners Affairs is your go-to.

Is UID the same as the visa number?

Nope, they’re different beasts. UIDs are constant; visa numbers shift.

What’s the big deal about UID?

From visas to IDs, it’s a critical cog in the UAE’s administrative machine.

Wrapping Up

In a nutshell, your UID number in the UAE is more than just a number; it’s an integral part of your identity and life in this vibrant country. Whether you’re navigating residency, starting a business, or simply living the expat dream, understanding and managing your UID is key to a smooth experience in the Emirates.

This rendition avoids technical jargon, offering a reader-friendly guide to the UID number’s role and significance in the UAE, ensuring the content is accessible and engaging for all readers.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

1 note

·

View note

Text

Exploring Initial Public Offerings (IPOs): A Gateway for Businesses to Go Public

An Initial Public Offering (IPO) represents a critical juncture for businesses, marking their first sale of stock to the general public. Transitioning from a privately held entity, with a small group of shareholders including founders, family, friends, and early-stage investors like venture capitalists, to a publicly traded company signifies a notable change in the company’s financial structure and its array of stakeholders. This move allows a firm to gather equity capital from a diverse range of public investors, thereby expanding its equity base and enhancing liquidity.

Motivations Behind Going Public

There are multiple strategic, financial, and operational motivations for a company to pursue an IPO. Primarily, it serves as a conduit for raising significant funds, which can be allocated towards expansion endeavors, research and development, marketing efforts, and capital investments.

It also presents a lucrative opportunity for the company’s initial backers to realize a return on their investments, typically at a higher value, as the stock begins to trade at public market prices.

Becoming a public entity can elevate a company’s profile, adding to its prestige and trustworthiness, which can have a positive impact on sales and profits. Public companies often enjoy better credit terms from lenders due to the increased transparency required of them. Furthermore, listing on a stock exchange enhances the liquidity of the company’s shares, facilitating easier transactions for shareholders.

However, the transition to public ownership is not without its challenges. The costs linked to an IPO can be significant, and the ongoing expenses of maintaining public status, such as compliance with regulations and reporting obligations, can be burdensome. Company management may find the emphasis on share price performance to be a distraction, and the disclosure of sensitive business information could benefit competitors.

Additionally, the imposition of rigid corporate governance structures and the scrutiny faced by public companies can affect the company’s flexibility and willingness to take risks.

Despite these considerations, the benefits of accessing a broader capital pool, the ability to use shares as acquisition currency, and the prestige of being publicly traded often outweigh the negatives. The IPO process includes:

Strategic Planning

Selection of underwriters, typically investment banks.

Compliance with regulatory requirements.

Marketing of the share offering to establish demand and determine pricing.

Post-IPO, the company is subject to strict reporting and governance standards by regulatory authorities and the exchanges where its shares are traded.

Understanding the IPO Journey

Choosing Underwriters

Selecting underwriters, generally investment banks, is the initial step in an IPO. These banks guide the company through the IPO process and handle the share issuance. The choice of underwriters is based on their industry expertise, market reputation, research quality, and share distribution capabilities. Companies might choose one underwriter or form a syndicate to assist with distribution, appointing one as the lead (bookrunner) and others as co-managers.

Underwriters assess risks, set the share price, and ensure the sale of shares, entering into agreements with the company that outline their risk commitment. This phase includes drafting critical documents like the Engagement Letter, Letter of Intent, and Underwriting Agreement, detailing the service terms and commitments.

Filing the Registration Statement

Submitting a registration statement to the SEC is the next crucial step. This document provides comprehensive details about the company’s financial situation, management, insider holdings, legal issues, and intended stock symbol. The SEC reviews this to ensure all necessary information is disclosed accurately.

This phase may also involve private filings with the SEC, leading up to the distribution of the Prospectus, a key document provided to securities purchasers. During the “cooling-off” period, underwriters prepare a preliminary prospectus, known as the Red Herring Document, lacking the final date and offer price.

The IPO Roadshow

The Roadshow involves the company and underwriters presenting the investment opportunity to potential investors through a series of presentations, either in person or virtually. This is a chance to showcase the company’s strengths, business model, and growth prospects to stir interest and gauge investor demand.

The duration of the Roadshow varies, during which underwriters engage in book-building, collecting investor bids to inform the offering price.

Setting the Share Price

The final phase before launching the IPO is determining the offering price, established the night before the IPO. This price is crucial, affecting the raised capital and the company’s valuation in the public market. It is influenced by the Roadshow outcomes, prevailing market conditions, and the company’s objectives. IPOs are often priced conservatively to ensure full or excess subscription, offering investors a risk premium.

After pricing, underwriters may purchase shares to address order imbalances and stabilize the market price, protecting against significant price swings in the days following the IPO. After a 25-day quiet period, the company competes in the open market, and the IPO’s success can be evaluated through metrics like market capitalization and stock performance.

IPOs play a vital role in the financial markets, enabling private companies to access public capital and offering investors opportunities to participate in their growth. It’s a well-structured journey that demands meticulous planning, regulatory compliance, and strategic marketing to achieve a successful outcome.

Benefits of Going Public

Capital Accessibility

An IPO allows a company to amass significant funds by selling shares to the public, supporting various business requirements.

Enhanced Public Visibility

Transitioning to a public company typically brings increased media coverage and brand recognition, attracting new customers and potential partnerships.

Shareholder Liquidity

The public trading of shares offers shareholders, including founders and early investors, the flexibility to sell their stakes easily, making the company’s stock more attractive as compensation.

Company Valuation

Public companies can achieve a higher market valuation, reflecting the investment community’s perception, which is beneficial for mergers and acquisitions. The valuation process for public entities facilitates a more accurate assessment of their value. The company’s growth prospects, industry comparisons, and investor interest play into the share pricing during an IPO.

Risks and Challenges

Market Fluctuations

The equity market’s inherent volatility can impact the timing and success of an IPO. Market dynamics, influenced by global political events, economic changes, and sector-specific issues, can make stable valuations challenging, potentially affecting IPO activities.

Despite these hurdles, specific sectors may proceed with IPOs, driven by positive market signals. Companies need to stay adaptable and attuned to market trends for a smooth transition to public ownership.

Legal and Regulatory Adherence

Becoming a public entity necessitates strict compliance with legal and regulatory standards. The SEC oversees public companies, requiring detailed financial and operational disclosures. This heightened transparency can expose companies to new legal risks.

Management teams must focus on sustained profitability and managing diverse stakeholder expectations, adding complexity to business operations.

Cost Implications of Going Public

IPO-related costs include direct expenses like underwriting fees, legal and accounting services, and listing fees, alongside significant indirect costs, such as investments in infrastructure to support public company operations. Continuous expenses for regulatory compliance are critical to the long-term financial strategy. These costs can be considerable, varying with the company’s readiness and existing systems.

Decision-makers must weigh these financial considerations carefully.

Concerns Over Control Loss

IPO aspirants worry about diminished decision-making autonomy. Issuing shares with varying voting rights is a strategy to preserve control, ensuring that founders and key stakeholders retain shares with enhanced voting power.

This approach can guard against hostile takeovers but may not always be well-received by investors, particularly if it seems to dilute their influence. Companies with a predominant

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

0 notes

Text

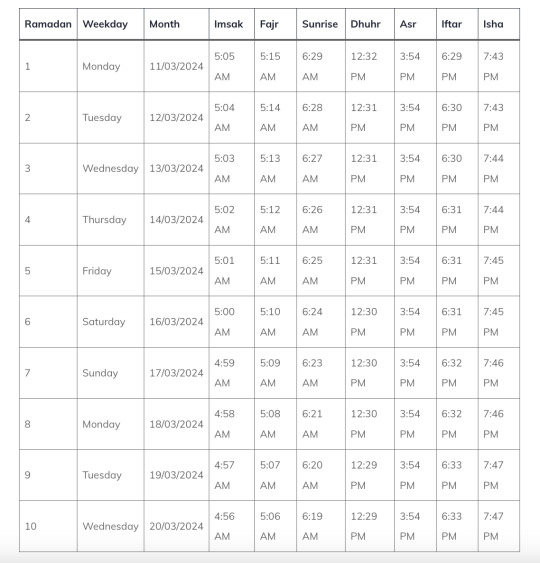

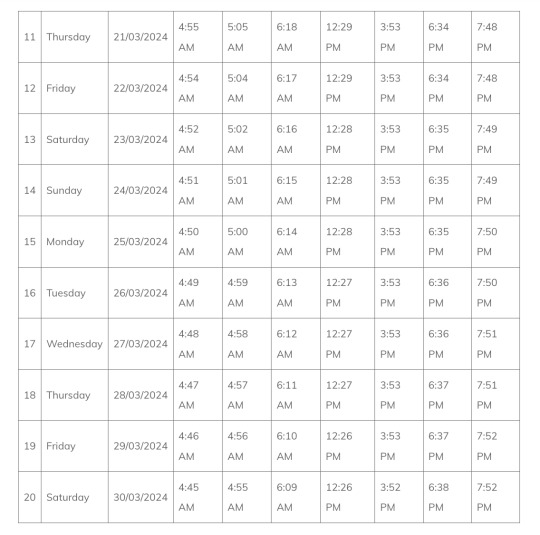

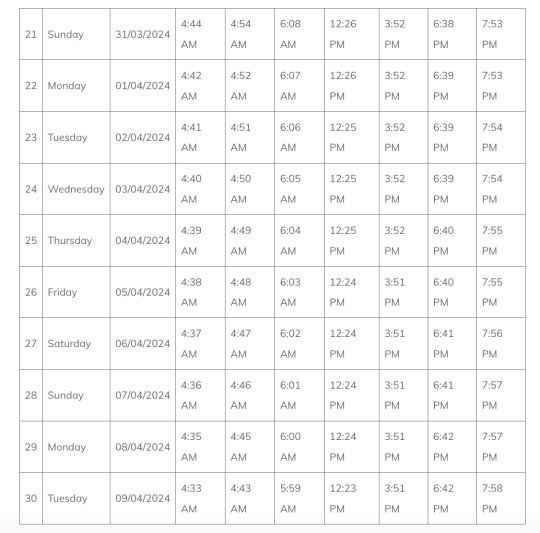

Ramadan Prayer Time Table 2024 & Understanding Ramadan: A Comprehensive Guide

An Insightful Journey Through Ramadan

Ramadan, the ninth month of the Islamic lunar calendar, marks a period of profound spiritual reflection, fasting, and community for Muslims worldwide. This guide delves into the essence, practices, and global observance of this sacred month, providing a deep understanding for both Muslims and curious non-Muslims alike.

Introduction to Ramadan

Ramadan is not just a time of abstention from food and drink from sunrise to sunset; it’s a period rich in spiritual reflection, prayer, and community. The Islamic lunar calendar, based on the moon’s phases, sets the stage for this holy month, which commemorates the revelation of the Holy Quran to Prophet Muhammad (PBUH) by the archangel Gabriel.

The Spiritual Essence of Ramadan

During Ramadan, the focus is on purifying the soul, practicing self-discipline, and dedicating oneself to prayer and reading the Quran. The last 10 days hold special significance, with the “Night of Power” or Laylat Al Qadr, considered the holiest night, when prayers are believed to be most potent.

Practices and Observances

Muslims across the globe engage in fasting, abstaining from food, drink, and other physical needs during daylight hours. This act of faith and worship is intended to cleanse the soul and foster empathy for the less fortunate. Nights are spent in prayer, and the importance of charity is emphasized, aligning with the spirit of giving and gratitude.

Cultural Impact and Working Hours

The observance of Ramadan brings about changes in daily routines and work schedules, especially in Muslim-majority countries. For instance, in the UAE, working hours are reduced, allowing more time for spiritual activities and family gatherings.

The Five Pillars of Islam and Ramadan’s Role

Fasting during Ramadan is one of the Five Pillars of Islam, essential practices that form the foundation of a Muslim’s faith and lifestyle. This section explores how Ramadan integrates into these pillars, emphasizing its significance.

Iftar and Suhoor: Traditional Meals

The pre-dawn meal (Suhoor) and the meal to break the fast (Iftar) are central to Ramadan’s daily routine. These meals are not only a time for physical nourishment but also for communal gatherings and shared gratitude.

Understanding the Islamic and Gregorian Calendars

Ramadan’s timing shifts annually due to the differences between the lunar and Gregorian calendars. This section explains the calendars’ workings and why Ramadan moves ahead by approximately 10–11 days each year.

Eid Al Fitr: The Celebration After Ramadan

The conclusion of Ramadan is marked by Eid Al Fitr, a festive time of joy, communal prayers, and generosity, where the focus shifts from fasting to feasting and giving.

Ramadan Across the Seasons

Depending on the geographical location and the time of year, the experience of fasting can vary greatly. This part explores the observance of Ramadan in different seasons and climates.

Ramadan’s Significance for Different Demographics

Special considerations are given to children, new converts, and individuals with medical conditions, highlighting the inclusivity and adaptability of Ramadan observances.

Community and Global Participation

The spirit of Ramadan extends beyond the Muslim community, inviting non-Muslims to participate in various aspects of the month, from iftar dinners to charitable acts, fostering a sense of global unity and understanding.

FAQs About Ramadan

This section addresses common questions and misconceptions about Ramadan, offering clear, informative answers to enhance understanding and respect for this holy month.

Conclusion

Ramadan is a time of spiritual renewal and community for Muslims around the world. Its observances, from fasting to feasting, reflect a deep commitment to faith, empathy, and global solidarity. Whether Muslim or non-Muslim, understanding Ramadan enriches our global tapestry of cultures and beliefs, promoting a shared respect for sacred traditions and practices.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

0 notes

Text

Setting Up a PayPal Account in UAE — Understanding PayPal Accounts

PayPal serves as a digital payment system facilitating secure money transactions among users. It enables both individuals and companies to send payments, transfer funds, and carry out electronic transactions. By linking their bank accounts, credit cards, or debit cards to their PayPal accounts, users can execute transactions smoothly. Beyond basic transactions, PayPal provides additional features such as invoicing, integration with shopping carts, and protection for both buyers and sellers.

Can You Use PayPal in the UAE?

Indeed, PayPal operates within the United Arab Emirates (UAE), offering residents a seamless method to handle transactions. Simply download the app, input your information, and connect your bank account.

PayPal in the UAE offers a trusted platform for various types of purchases, delivering peace of mind to both users and clients. It supports both online and offline payments, enables money transfers, and upholds strong digital security measures, presenting options with either variable or fixed fees.

For businesses, PayPal presents customized solutions like online invoicing and PayPal Checkout, backed by tools for reporting and resolving disputes. The convenience of payments is further improved by the personalized payment link, PayPal.Me.

PayPal’s Growth in the UAE PayPal has inaugurated its inaugural office in the MENA region in Dubai, UAE, as part of its effort to broaden its regional presence. Boasting one million customers and a 5% share in the MENA e-commerce market, PayPal’s goal is to engage 25,000 merchants by 2050. It aims to captivate the extensive internet user base and mobile subscribers in the Middle East, which amount to 110 million and 290 million, respectively.

With Cash on Delivery (COD) securing more than 80% of the e-commerce transactions in the MENA region, PayPal is set on offering a reliable online payment solution. Having maintained an impeccable security record since its inception in 1998 and exhibiting lower fraud rates compared to its competitors, PayPal is committed to safeguarding customers’ financial information.

By partnering with the logistics company Aramex, PayPal is enhancing its Shop and Ship service, facilitating hassle-free product delivery across the region. Additionally, the Central Bank of the UAE is working on launching a Central Bank Digital Currency (CBDC) as part of its Financial Infrastructure Transformation Program, aimed at simplifying electronic payments on both domestic and international scales.

How to Set Up a PayPal Account in the UAE?

To facilitate easy money transfers in the UAE, follow these steps to set up a PayPal account:

Visit the “PayPal UAE website.” Choose between a personal or business account. Fill in your credit and debit card details. Provide your Emirates ID information. Confirm your email address. After completing these steps, you’ll be able to link your bank account easily for straightforward fund withdrawals.

Advantages of Utilizing a PayPal Account in the UAE

The benefits of leveraging PayPal in the UAE include:

Broad Merchant Recognition: PayPal is accepted by a wide array of merchants around the world, facilitating smooth transactions for a variety of purchases both locally and internationally.

Simplified International Transfers: Effortlessly send money to family and friends abroad with PayPal’s straightforward international transfer services.

Stringent Security Protocols: With PayPal’s advanced encryption technologies, your personal and financial information is kept secure, offering tranquility with every transaction.

Flexible Payment Methods: PayPal enables convenient transactions with a range of payment options, including credit cards, debit cards, and bank transfers, making online shopping hassle-free.

Protection for Buyers and Sellers: PayPal’s extensive buyer and seller protection policies provide a secure and fair trading environment, bolstering confidence in the platform.

Verifying Your PayPal Account in the UAE

Verifying your PayPal account in the UAE is essential for an optimized online transaction experience.

Higher Withdrawal Caps: Verification lifts restrictions, allowing for larger withdrawals from your account.

Increased Security: An additional security layer protects your assets more effectively.

Access to Protection Policies: Verification grants access to PayPal’s buyer and seller protection, assisting in resolving disputes.

Wider Payment Options: Some transactions or purchases might necessitate a verified PayPal account.

Enhanced Trust: A verified account boosts your credibility and trustworthiness in online dealings.

Verification Importance

Secures your funds

Facilitates bank account withdrawals

Raises your transactional credibility

Ensure your PayPal account in the UAE is verified to enjoy its full spectrum of benefits.

Linking Your Bank Account or Credit Card to PayPal in the UAE

Via Web:

Head to the wallet section of your PayPal account.

Click “Link a card or bank,” then choose “Link a bank account.”

Locate your bank and input your bank account details as guided.

Via App:

Tap the menu icon in the PayPal app.

Go to “Banks and Cards” and select “Banks.”

Find your bank and follow the steps to link your bank account or debit card details.

By adhering to these straightforward instructions, you can effortlessly connect your bank account or credit card to your PayPal account, ensuring fluid transactions online.

Navigating PayPal’s Currency Conversion in the UAE

When engaging in international transactions via PayPal, it automatically converts your currency to the local currency of the transaction. Notably, PayPal applies a markup to the wholesale exchange rate, potentially increasing the cost of international money transfers or purchases made in a different currency.

Transaction types vary, with fees for international money transfers, purchasing from international sellers, or converting your PayPal balance among currencies. Businesses may find these fees, including transaction fees up to 5% plus PayPal’s currency conversion fees, quickly adding up.

Strategies for Efficient Money Transfers

To optimize your transactions:

Compare exchange rates and fees to find the best deal.

Consider alternative transfer services like AirWallex for more favorable rates and transparency.

Use local payment methods such as ACH in the US or SEPA in Europe for cost savings.

Employ virtual multi-currency IBANs and local accounts to reduce PayPal fees and conversion costs.

Research is key in choosing the right service for your needs, with neobanks like Wise, Revolut, N26, and Starling offering competitive rates and features for international banking.

Understanding PayPal Fees in the UAE

Withdrawing and Transferring Funds with PayPal

To withdraw funds from the PayPal App:

Sign into the PayPal app.

Go to ‘PayPal Balance’.

Choose ‘Withdraw Funds’ and follow instructions.

For transferring funds to your bank account:

Log into PayPal Wallet via the website or app.

Select ‘Transfer Funds’ then ‘Transfer to Bank Account’.

Complete the transfer as instructed.

Verification is necessary for withdrawals, ensuring the security of your transactions.

Navigating Additional PayPal Charges

Be aware of a 4.5% currency conversion fee or a specified percentage during transactions, attributed to PayPal’s exchange rate policy. Transferring money to a bank account involves automatic conversion to local currency.

For international transactions, consider the impact of fees and exchange rates. Tools like Tipalti’s fee calculator can estimate costs, but comparing other services for their fee structures and currency options is wise.

Reducing PayPal Transaction Fees

To decrease international transaction fees:

Directly fund transactions from your PayPal account to avoid card charges.

Consolidate transactions into larger payments to benefit from capped fees.

Deduct PayPal and other payment processing fees from taxable income for potential savings.

Exploring alternative payment methods may be beneficial as your financial needs evolve, ensuring efficient and cost-effective transactions.

Ensuring PayPal Security in the UAE

PayPal is recognized for its ease of use and stringent security measures in the UAE, though users should be aware of country-specific limitations, such as withdrawal thresholds and transaction costs. It’s advisable to familiarize yourself with PayPal’s UAE-specific terms, conditions, and fees before engagement.

Despite its robust security, vigilance against scams is essential for PayPal users. Typical scams include advance fee fraud, phishing attempts, and counterfeit charity solicitations. Protect yourself by avoiding dubious links, employing antivirus software, and reporting any suspicious PayPal-related emails or links.

The PayPal Purchase Protection program further secures transactions, potentially covering the full purchase price plus shipping costs in instances of fraud.

Remember, PayPal accounts are specific to individual countries; relocating necessitates opening a new account in the destination country. Before moving, ensure all funds are withdrawn, any issues are resolved, and the existing account is closed properly.

Pros and Cons of Using PayPal in the UAE

Final Considerations

Utilizing a PayPal account in the UAE is both accessible and user-friendly, characterized by straightforward setup processes and a user-friendly interface. PayPal stands as a trustworthy payment platform for both individuals and businesses, thanks to its comprehensive security mechanisms. Nonetheless, staying informed about its fees, limitations, and benefits remains critical.

While PayPal brings convenience and a layer of security to online payments, prioritizing digital safety is always crucial. Armed with the right knowledge and practices, you can use PayPal in the UAE with confidence and peace of mind.

0 notes

Text

Forming a Limited Liability Company (LLC) in Sharjah

A Limited Liability Company (LLC) in the UAE provides its owners with limited liability, safeguarding their personal assets against the company’s debts or bankruptcy.

The most preferred business structure in the UAE, LLCs, require at least two and at most 50 shareholders to establish.

Advantages of Establishing a Limited Liability Company

Owners of an LLC risk only the amount they invest in the company, ensuring the safety of their personal assets from the company’s financial troubles. LLCs offer a versatile management structure, empowering members to select a management style that aligns with their preferences. In the UAE, LLCs benefit from significant tax advantages, with a 9% corporate tax applied only on net profits exceeding the threshold of AED 375,000.

Reasons to Establish an LLC in Sharjah, UAE

Forming an LLC in Sharjah, UAE, presents numerous benefits, appealing to entrepreneurs and investors alike.

Competitive Taxation: Sharjah boasts advantageous tax policies, ranking as one of the top tax-friendly locales globally.

Simplified Formation Process: Establishing an LLC in Sharjah is streamlined and can be accomplished within weeks.

Strategic Positioning: Its proximity to key logistics centers, like Dubai International Airport and Jebel Ali Free Zone, positions Sharjah as an ideal base for importing, exporting, and tapping into a vast network of potential clients and suppliers.

Government Support: The Sharjah government actively supports businesses with various programs and incentives aimed at fostering growth and success.

Cost-Effectiveness: Conducting business in Sharjah is notably cost-efficient, with lower expenses for office spaces, labor, and other overheads compared to other emirates, such as Dubai.

Full Ownership for Foreign Investors: Sharjah allows foreign investors to fully own commercial and industrial companies, offering them complete control over their ventures.

How to Launch an LLC Company in Sharjah?

Initiating an LLC in Sharjah, UAE, entails a detailed procedure that aligns with the local laws. Below is a step-by-step guide to navigate the setup process effectively:

Step 1: Select a Business Name

Ensure your chosen business name is distinctive and not previously registered in the UAE. Verify name availability through the Department of Economic Development (DED).

Step 2: Decide on a Business Location

Select whether to establish your LLC on the mainland or within a free zone.

Mainland: Mainland companies can conduct business across Sharjah and the UAE, offering broader activity options but at a higher complexity and cost.

Free Zone: Free zones provide certain operational liberties throughout Sharjah and the UAE but restrict physical operations to their zones. Benefits include tax exemptions, 100% foreign ownership, and simpler setup processes.

Step 3: Business Registration and Trade License Acquisition

Submit the necessary documents to the DED or the relevant free zone authority for approval. Upon document validation, you’ll receive your LLC’s trade license.

Depending on your business type, additional licenses or approvals from specific authorities may be required.

Step 4: Open a Corporate Bank Account

Create a corporate bank account in the UAE for your LLC to handle financial transactions.

Step 5: Secure Office Space and Premises Acquire a physical office space that meets the requirements of your business activity.

Step 6: Visa and Employee Registration

After registering your LLC, proceed to apply for visas for your staff, adhering to the UAE’s labor laws and hiring regulations.

Documents Required for LLC Formation in Sharjah

The necessary documents can vary based on the business scope and other factors, but generally include:

Passport and visa copy of the applicant

Passport copies of all shareholders

Company bank account statement

Any required legal approvals

Certified Lease Contract copy

License application form

Trade name certificate

To navigate the complexities of setting up a company in the UAE efficiently, consulting with a business setup specialist is advisable. Shuraa Business Setup, with over 22 years of experience, offers comprehensive support throughout the company formation process.

Cost of Establishing an LLC Company in Sharjah

The cost to set up an LLC in Sharjah fluctuates based on various elements such as the business activity type, company size, and whether you choose a mainland or free zone location.

Typically, starting costs for obtaining a business trade license are from AED 14,900*. However, additional expenses include:

Business name reservation fees

Bank account opening charges

Legal consultancy fees

Miscellaneous expenses (like office lease, visa processing fees, etc.)

For detailed insights on the LLC license costs in Sharjah, consulting a legal and business setup advisor is recommended.

Sharjah LLC Setup with Private Wolf Business Setup

Forming a Limited Liability Company in Sharjah represents a pivotal moment for entrepreneurs and investors, promising asset protection and advantageous tax conditions.

To navigate the setup process efficiently, enlisting the expertise of seasoned professionals familiar with UAE business laws is crucial.

Private Wolf Business Setup, boasting over two decades of experience and aiding over 50,000 entrepreneurs in achieving their business aspirations, stands out as a premier consultancy for business establishment in the UAE. Our in-depth understanding of local regulations and comprehensive support services can greatly facilitate your venture’s success in Sharjah.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

0 notes

Text

Dubai’s Traffic Fines System: The Complete Guide

Mastering the Black Points System Dubai implements a black point system to track traffic violations effectively. The city strategically installs cameras and radars to detect breaches of traffic laws. When drivers violate specific regulations, the Dubai Police allocate black points to their traffic records based on the offence’s severity, with each type of violation assigned a different point value. Drivers receive text message alerts for each point added, and they can view their current black point total on the Dubai Police website. Accumulating 24 black points leads to the revocation of the driver’s license and a one-year driving ban by traffic police. In cases of serious violations, authorities may also seize the vehicle.

Traffic Fines for Speeding in Dubai

In Dubai, speeding results in fines and the addition of black points to your driving record:

Speeding over the limit by 80 km/h incurs a fine of AED 3000, 23 black points, and the possibility of vehicle and license confiscation for 60 days.

Speeding over the limit by more than 60 km/h attracts an AED 3000 fine, 12 black points, and vehicle impoundment for 30 days.

Speeding less than 60 km/h over the limit results in an AED 1500 fine, 6 black points, and vehicle impoundment for 15 days. Speed-related fines not involving black points include:

AED 1000 for driving more than 50 km/h under the speed limit.

AED 700 for exceeding the speed limit by less than 40 km/h.

AED 600 for going over the speed limit by less than 30 km/h.

AED 300 for driving more than 20 km/h under the speed limit.

Penalties for Reckless Driving in Dubai

Reckless driving in Dubai, punishable by 23 black points, covers offences such as:

Causing severe injury due to reckless driving.

Endangering lives through reckless driving.

Driving a vehicle without a proper number plate.

Driving under the influence of alcohol. Drivers endangering lives face court-determined fines and two months of vehicle impoundment. Driving without a vehicle number plate attracts 23 black points, an AED 3000 fine, and 90 days of vehicle confiscation. Drunk driving carries a hefty AED 20,000 fine and 60 days of vehicle confiscation, with possible jail sentences ranging from days to months.

Penalties for Other Traffic Violations with Black Points in Dubai

Violations incurring fines and fewer than 23 black points include:

Ignoring a red light results in 12 black points, an AED 1000 fine, and vehicle confiscation for 30 days.

Blocking traffic flow with your vehicle leads to an AED 1000 fine and 6 black points.

Failing to maintain a safe distance between vehicles attracts an AED 400 fine and 4 black points.

Traffic Violations for Overtaking and Parking in Dubai

Dubai enforces strict penalties for parking and overtaking violations to ensure road safety and discipline:

Parking violations, including parking in front of fire hydrants, spaces designated for individuals with disabilities, or making sudden stops, attract fines of AED 1,000 and 6 black points each.

Stopping in a yellow box junction leads to a fine of AED 500.

Parking on the left shoulder of public roads incurs a fine of AED 1,000.

Stopping vehicles at pedestrian crossings, parking behind vehicles blocking movement, or stopping without maintaining a safe distance results in AED 500 fines each.

Improper parking carries a fine of AED 500.

Parking on pavements or stopping in a manner that endangers pedestrians results in fines of AED 400 each.

Wrongful overtaking with a light vehicle attracts a fine of AED 600 and 6 black points.

Overtaking from the road shoulder results in a fine of AED 1,000 and 6 black points.

Overtaking from a prohibited area carries a fine of AED 600.

Additional Traffic Violations and Fines in Dubai

Traffic Violations for Overtaking and Parking in Dubai

Dubai’s traffic regulations extend beyond road and vehicle safety, aiming to foster a secure environment for all. Drivers are encouraged to adhere strictly to traffic rules:

Not wearing a seatbelt results in an AED 400 fine and 4 black points.

Throwing garbage from the vehicle incurs a fine of AED 1,000 and 6 black points.

Operating a vehicle that pollutes the environment attracts an AED 1,000 fine and 6 black points.

Driving a noisy vehicle leads to an AED 2,000 fine and 12 black points.

Allowing a child under 10 years to sit in the front seat or not using a child seat for toddlers under 4 years results in a fine of AED 1,000.

Using a phone while driving incurs an AED 800 fine and 4 black points.

Jaywalking carries a fine of AED 400.

Driving with old or expired tyres results in an AED 500 fine, 4 black points, and vehicle impoundment for 7 days.

Driving without valid car registration or insurance leads to an AED 500 fine, 5 black points, and vehicle confiscation for 7 days.

Driving without lights in foggy or nighttime conditions incurs an AED 500 fine and 4 black points.

Reckless vehicle reversing attracts an AED 500 fine and 4 black points.

Riding a motorcycle without a helmet results in an AED 500 fine and 4 black points for both the driver and passenger.

Parking on pedestrian crossings incurs a fine of AED 500.

Latest Traffic Penalties in Dubai

To further enhance road safety, Dubai introduced new traffic penalties on July 6th, 2023:

Traffic Offenses with AED 10,000 Fines

Unauthorized vehicle modifications that increase noise or speed.

Operating vehicles without valid number plates.

Evading law enforcement.

Involvement in illegal activities such as street racing.

Excessive window or windshield tinting without authorization.

Traffic Offenses with AED 50,000 Fines

Riding recreational bikes on paved roads.

Reckless driving that endangers others.

Ignoring traffic signals or running red lights.

Driving with a fraudulent or illegal Dubai driving license.

Intentionally colliding with a police vehicle, which may lead to vehicle impoundment.

Underage driving (under 18 years old).

Traffic Offenses Resulting in AED 100,000 Fines

Participating in unauthorized racing activities or engaging in any conduct that endangers other vehicles, individuals, or road infrastructure can lead to severe penalties in Dubai, including vehicle impoundment and fines up to AED 100,000.

How to Pay Traffic Fines in Dubai To manage and pay for traffic violations in Dubai, the RTA website provides a straightforward platform. You can search for fines associated with your vehicle using any of the following details:

Plate details

License number

Fine number

Traffic file number

Traffic Fine Discounts in Dubai

The RTA periodically offers discounts on traffic fines. For instance, in celebration of the UAE’s 49th National Day in 2020, a 50% discount on fines incurred before December 2020 was available, including the waiver of impoundments and black points until January 2021. During 2019’s Year of Tolerance, drivers maintaining a clean record for specific periods could receive up to a 100% discount, promoting adherence to traffic laws and contributing to a 14% reduction in accidents. Note that these discounts do not apply to parking or Salik fines.

Receiving Notifications for Traffic Violations

Dubai Police swiftly send notifications for any recorded violation. Additionally, the RTA website offers a service to check for any fines registered against your vehicle.

Options for Paying Traffic Fines in Installments

Since February 2019, Dubai motorists have the option to pay traffic fines in interest-free installments. This service is available for credit card holders at banks like First Abu Dhabi Bank and Noor Bank, offering plans for 3, 6, 9, or 12 months for fines of at least AED 500. Payments can be processed through the Dubai Police app, website, or at designated centers.

Driving Tips for Navigating Dubai Roads

To ensure a safe and legal driving experience in Dubai, consider the following advice:

Only drive with a valid UAE driver’s license.

Check the transferability of your home country’s driving license to a UAE license on www.dubai.ae.

Avoid driving on beaches, as it is prohibited.

Exercise caution with hand gestures to avoid misunderstandings.

Do not leave electronics and food in your car due to the heat.

It is illegal to eat, drink, or leave animals/children unattended in vehicles.

Using a mobile phone while driving is prohibited.

Respect red flashing lights indicating no entry.

Ensure your car windows are tinted within the legal limit of 30%.

Obtain a Salik card for Sheikh Zayed Road use.

Stay vigilant for police checks and speed cameras.

In emergencies, dial 999 or 112.

A UAE residency visa is necessary for license exchange, and you must be at least 18 years old to obtain a driving license.

Empowering Yourself Against Traffic Fines in Dubai

Being informed about managing traffic fines can significantly ease the process of navigating Dubai’s roads and adhering to its traffic laws. Beyond managing your traffic fines, it’s crucial to ensure your business complies with UAE laws and regulations to avoid penalties and legal issues. With the right guidance and support, you can navigate both driving and business operations successfully in the UAE.

Contact Private Wolf at +971 56 111 1640, via WhatsApp at +971 56 111 1640, or email [email protected]. Our expertise will streamline your needs.

M.Hussnain Private Wolf | facebook | Instagram | Twitter | Linkedin

0 notes

Text

Dubai E-Trader License: Your Comprehensive Guide for 2024

Dubai’s government has launched the E-Trader License to boost e-commerce and empower individuals to engage in online business via social media, websites, and other digital mediums. Aimed at small businesses and digital entrepreneurs, this license legitimizes online commercial activities across diverse platforms.

Essential Attributes of the E-Trader License

Streamlined Application

Securing an E-Trader License is straightforward, offering a seamless entry point for those looking to venture into or expand their online businesses.

Sole Proprietorship

A standout feature of the E-Trader License is its issuance to individuals, not companies, enabling sole proprietors to flourish under this license.

Broad Operational Scope

It encompasses a wide range of online businesses, from selling products on social media and websites to offering digital services.

Regulatory Compliance

Applicants must adhere to the UAE’s regulatory framework, ensuring ethical and legal online trade.

Emphasis on Digital Operations

The license caters exclusively to digital businesses, highlighting the significance of e-commerce within Dubai’s economic landscape.

Eligibility for the E-Trader License in Dubai

To qualify for the E-Trader License, applicants must:

Be at least 21 years old.

Hold valid UAE residency and an Emirates ID.

Dubai residents from GCC countries are eligible.

UAE nationals can apply without restrictions.

Certain foreign expatriates might qualify for the E-Trader License.

Have an approved business trade name.

Activities Enabled by the E-Trader License

This license grants access to a plethora of online business opportunities, such as:

E-commerce sales (clothing, electronics, crafts, etc.)

Online service provision (graphic design, consultancy, web development)

Social media sales and marketing

Online course creation and sales

Online consulting or coaching services

Digital marketing and client services

Any other digital product sales

Dubai’s E-Trader License represents a pivotal move towards fostering a robust e-commerce ecosystem, providing individuals with the tools needed to navigate and thrive in the digital marketplace.

Securing Your Dubai E-Trader License: A Guide for Entrepreneurs

The Dubai E-Trader License is an excellent pathway for entrepreneurs eager to venture into the online marketplace or leverage social media for business. Here’s how you can navigate the application process seamlessly:

Step 1: Confirm Your Eligibility

Verify that you meet the E-Trader License’s eligibility requirements, such as Dubai residency, age criteria, and intention to operate solo rather than as a company.

Step 2: Gather Required Documents

Prepare the necessary documentation, including:

A copy of your Emirates ID

Your passport copy (if needed)

Passport-sized photographs

Proof of your Dubai address (like a utility bill or tenancy agreement)

Any other documents the authorities might request

Step 3: Select a Business Name

Choose a unique and fitting name for your online business, ensuring it adheres to the Department of Economic Development (DED)’s naming conventions.

Step 4: Business Registration with DED

Proceed to register your venture with the DED. Complete the application form detailing your business activities, chosen name, and other requisite information. Then, settle the fees for the E-Trader License.

Step 5: Application Evaluation

The DED will assess your application, a process that might extend over some time. Utilize the online portal to monitor your application’s progress.

Step 6: Receive Your License

Following approval, you’ll be issued your DED E-Trader License. Ensure you follow any further instructions or rules provided.

It’s important to note that the E-Trader License is valid only within Dubai’s mainland jurisdiction and does not extend to free zones, each of which has distinct licensing requirements and procedures.

Advantages of the Dubai E-Trader License

Legal Framework for Online Businesses: It offers a sanctioned structure for running online business operations, ensuring compliance with Dubai’s regulations.

Enhances Customer Trust: A regulated license boosts your business’s credibility, attracting more customers.

Ease of Setup: The E-Trader License boasts a simpler and quicker setup process compared to other Dubai business licenses, with a user-friendly online application.

No Need for a Physical Location: This license eliminates the need for a brick-and-mortar office, ideal for purely digital operations.

Diverse Business Activities: With a wide range of permissible online business activities, it enables entrepreneurs to explore various e-commerce models.

Global Operation Capability: With an internet connection, your E-Trader business can be managed from anywhere globally, offering unparalleled flexibility.

Embarking on your entrepreneurial journey with the Dubai E-Trader License not only simplifies the process of starting an online business but also provides a robust foundation for growth and success in the digital marketplace.

Understanding the Cost of a Dubai E-Trader License

The cost to secure a Dubai E-Trader License varies widely, starting at AED 1,070 for the base fees alone. Depending on the additional services and features you opt for, the price can climb significantly higher. It’s essential to factor in the cost of mandatory membership for businesses in Dubai, which adds another AED 300 to your expenses.

Given the potential for costs to change, consulting with a Dubai business setup consultant, such as Shuraa, is advisable to ensure a smooth and informed company formation process.

Thriving Business Ideas for E-Trader License Holders

The dynamic e-commerce landscape in Dubai, combined with the straightforward process of obtaining an E-Trader License, opens up a world of opportunities for aspiring entrepreneurs. Consider launching a business in one of these trending sectors:

Clothing and Accessories: Tap into fashion trends and cater to diverse styles.

Home Goods and Furniture: Offer unique and stylish solutions for home decor.

Food and Gourmet Items: Delight foodies with specialty foods and ingredients.

Sports and Fitness Equipment: Cater to the fitness enthusiasts with the latest gear.

Sustainable and Eco-friendly Products: Meet the growing demand for green products.

Social Media Marketing and Management: Help businesses grow their online presence.

Digital Marketing Services: Offer SEO, content marketing, and more to boost online visibility.

Beauty and Wellness Services: Provide online consultations and sell wellness products.

Online Learning Platforms: Share knowledge through courses and tutorials.

Online Travel and Booking Platforms: Simplify travel planning and booking for your customers.

Laundry and Dry Cleaning: Offer convenience with online booking for laundry services.

Educational Resources and Toys: Support learning with educational materials and games.

Event Management: Plan and organize events remotely.