I help readers generate outsized returns using dividend stocks

Don't wanna be here? Send us removal request.

Text

Walmart Is Coming for Amazon

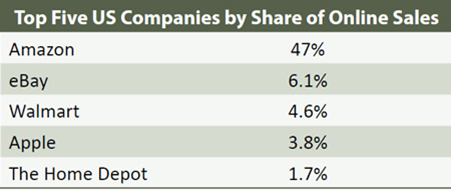

Late last year, the company overtook Apple to became the third-largest online retailer in the US. Only Amazon and eBay are larger.

Walmart is quickly growing its online presence by scooping up smaller online retailers like Jet.com, which sells everything from laptops to sunscreen—often at a healthy discount.

Walmart bought Jet in 2016 for $3.3 billion. Since then, Walmart’s online sales have shot up 78%—from $13.4 billion to $23.8 billion.

And it shows no sign of slowing down. Last quarter, Walmart’s online sales grew 43%.

We all know that Amazon is the online retail behemoth. But Walmart’s online sale are growing much faster: 40% in 2018 compared to 13% for Amazon.

And, as I’ll explain shortly, buying shares of Walmart is a great way for risk-adverse income investors to play the online shopping trend.

The Online Shopping Boom Is Just Starting

We all buy a lot of stuff online these days. But the fact is, online shopping is still in its infancy.

In the last 12 months, US online sales hit $527 billion. Sounds like a lot, but it’s still only 10% of total US retail sales. So the runway for growth is still very long here.

In the next five years, US online sales are expected to grow over 50%. By 2024, they’re expected to make up 13% of total retail sales.

A lot of this growth will come from Millennials who are currently 22–37 years old.

Last year, Millennials bought 60% of their stuff online. That’s a 47% leap from 2017. And, as Millennials get older and spend more money, this figure will only shoot higher.

That means more people spending more money online.

Walmart Wants More of Your Online Business

When it comes to online shopping, Amazon gets all the press. That’s understandable. In the past 12 months, 47% of US online sales happened on Amazon’s site.

Meanwhile, Walmart only grabbed 4.6%.

There’s a good reason for the disparity, though. Walmart entered the online shopping game well after Amazon did.

But it’s rapidly gaining ground…

More than Just the Top Online Grocer

Groceries are Walmart’s bread and butter. They made up 56% of the company’s sales last year.

For this reason, Walmart will be the top online grocer soon.

Online groceries are already a $27-billion market… that’s expected to quadruple by 2023, according to market research firm Packaged Facts.

Meanwhile, Deutsche Bank analysts expect Walmart to control 17% of the online grocery market by 2025. That’s up from 12% today.

But groceries aren’t the only thing Walmart has going for it.

There’s the Jet.com acquisition I mentioned earlier. And Bonobos, a men’s clothing site Walmart bought for $310 million in 2017. It also bought online shoe retailer ShoeBuy (now Shoes.com) for $70 million in 2016.

This all bodes well for Walmart…

Your Best Bet in a High-Growth Market

One thing is clear: Amazon and Walmart are both trying to be more like the other.

Amazon is trying to translate its online selling power into brick-and-mortar sales. That’s a big reason it bought Whole Foods in 2016.

At the same time, Walmart is trying to translate its massive, 5,300-plus physical stores into online sales.

There’s a crucial difference here, though. Amazon is moving into brick-and-mortar retail, a slow-growth market. Some would even say a dying market.

Meanwhile, Walmart is moving into the high-growth online market. So long term, its efforts look much more promising than Amazon’s.

And for income investors, it offers something Amazon definitely doesn’t…

Walmart Is an Elite Dividend Payer

I’m always on the hunt for safe and reliable dividend-paying stocks.

Walmart checks the box.

Just think back to the stock market crash late last year. The S&P 500 fell 17% from August through late December. And Amazon’s stock crashed 25%.

At the same time, Walmart only slipped 2%, as you can see in the next chart.

This makes sense. People shop at cheaper stores like Walmart when they have less money. That’s why—even during the depths of the 2008–2009 global financial crisis—Walmart sales actually grew 7.3%.

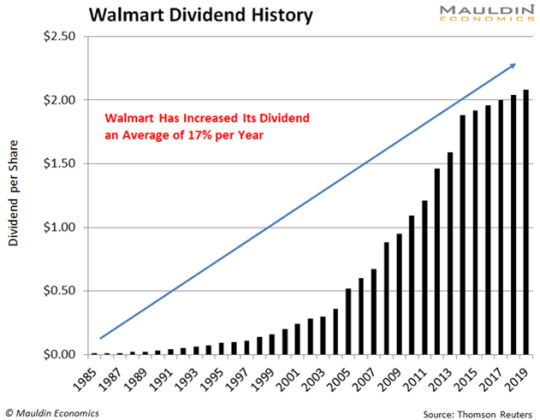

Walmart also has one of the most reliable dividends. It’s part of an elite group called the Dividend Aristocrats—companies that have increased their dividends every year for 25 years or more.

Walmart has increased its dividend an impressive 31 years in a row. You can see this in the next chart.

Walmart’s 2.2% Dividend Is Remarkably Safe

I built a proprietary tool for assessing dividend safety. It’s called the Dividend Sustainability Index (DSI).

In a nutshell, the DSI looks at three key metrics: payout ratio, debt-to-equity ratio, and free cash flow.

Walmart has a payout ratio of 72%, a debt-to-equity ratio of 69%, and growing free cash flow. In other words, its dividend passes our safety test with flying colors.

Remember, Walmart is quickly gaining ground as a top online retailer.

So, if you want to own a piece of the high-growth online shopping market—but are wary of stocks like Amazon that could quickly crash 25% when the markets get rocky—Walmart is your best bet.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

This Dividend Aristocrat Is Leading the 5G Revolution

Wireless technology has come a long way.

The first generation of wireless—called 1G—rolled out in the 1980s. The only thing you could do with it was make a phone call. And the call quality rivaled that of two tin cans connected by a string.

Since then there’s been a new generation of wireless tech about every 10 years. 1G gave way to 2G, then 3G and 4G—each generation faster and more reliable than the last.

Now we’re arriving at 5G. The rollout should be complete around June 2020.

This new technology will let phones and computers communicate 1,000X faster than 4G. It will also make everything from self-driving cars to remote surgery possible.

As with any new technology, investors are clamoring for the “best” way to profit from this trend. That means different things for different people…

The Safest Way to Profit from the 5G Revolution

Some investors are looking for that “moonshot” stock. You know, the one that might quickly shoot up 100% or more.

Of course, those kinds of wins are great. If one of my stocks shoots up 100%, I’m thrilled.

But let’s face it, they’re called moonshot stocks for a reason: They’re not all that safe. You might make a lot of money. But you might lose a lot of money, too.

That’s not what I’m after.

Instead, we’re focused on safe and reliable dividend-paying stocks. But that doesn’t mean we have to sit on the sidelines.

That’s where telecom giant AT&T (T) comes in…

The First Company to Roll Out 5G

AT&T is the second-largest wireless carrier in the US.

It was also the first provider to start rolling out 5G technology. The company expects to complete its 5G nationwide network in 2020.

AT&T will also directly benefit as other wireless providers roll out 5G.

See, around a third of Americans are AT&T customers. And all of their data will be transferred on the company’s infrastructure. So the more data transferred—the more people call, text, download YouTube videos, and do the thousands of other things we now do on our phones—the more money AT&T will make.

But that’s not the only reason to like AT&T, especially if you’re an income investor.

First off, AT&T pays a huge 6% dividend yield. That’s over three times the dividend yield on the S&P 500.

It’s also part of an elite group called the Dividend Aristocrats. These are companies that have increased their dividends for at least 25 consecutive years.

AT&T has increased its dividend 34 years in a row now. That’s incredible. In fact, only 40 companies in the S&P 500 have raised their dividends longer and more consistently than AT&T.

Safer than the Competition

Over three decades of consistent dividend increases means AT&T’s dividend is certainly reliable. But it’s also safe, as I’ll show you in a moment.

That’s extremely important. If a company cuts its dividend, its share price is going to crater.

Not good.

As a general rule, the higher the dividend yield, the less safe it is. So, when I saw AT&T’s 6% dividend yield, the first thing I did was plug it into the Dividend Sustainability Index (DSI), my proprietary tool for measuring dividend safety.

The DSI looks at three key things: payout ratio; debt-to-equity ratio; and free cash flow. I’ll walk you through each one.

The payout ratio tells you how much of a company’s net income it pays out to shareholders as dividends. The lower the payout ratio, the better.

Next is the debt-to-equity ratio. No surprise, the more debt a company has, the harder it is to run a business. That includes paying the dividend.

The last thing the DSI looks at is free cash flow. This is the amount of cash the company has left after it pays expenses.

AT&T excels in all three categories. For perspective, I compared AT&T’s DSI score to three major competitors, and it blows them out of the water:

Not only does AT&T pay a higher dividend than these companies, its dividend is also safer.

Only time will tell which “moonshot” 5G stocks soar and which ones plummet. As income investors, we’re not interested in those kinds of risky gambles.

Instead, we’ll play the 5G trend by investing in safe and reliable dividend payers like AT&T.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

The Only Safe Way to Profit from Bitcoin—Even if It Goes Down to Zero

I’m a safe income guy always on the hunt for the safest and most stable dividend-paying stocks.

And I can tell you one thing. There’s always a way to “play it safe,” even with something as volatile as Bitcoin.

Here I’ll share the best way to ride Bitcoin’s current bull market without taking on a lot of risk.

Bitcoin Is Far Too Risky for Most Investors

Bitcoin is a polarizing topic. Some economists think Bitcoin’s value should be $0. Others think it’s as revolutionary as the internet.

But one thing is certain: The price of Bitcoin is incredibly volatile. This makes it a non-starter for most income investors.

Fortunately, I’ve zeroed in on a company that actually benefits from Bitcoin’s volatility. It’s a safe and stable way to profit from Bitcoin without exposing yourself to a lot of risk.

But first, let’s take a closer look at Bitcoin’s wild price swings…

Bitcoin once shot up 1,882% in a little under a year.

It went from $998 in January 2017 to $19,783 in December 2017. That’s incredible. But it didn’t last.

One year later, Bitcoin had dropped around 83% to $4,935. You can see this in the next chart.

Now we’re back in a Bitcoin bull market. Over the last six months, Bitcoin’s price has rallied over 300%.

I’m not sure about you, but most people can’t stomach that much volatility. And frankly, they shouldn’t. Buying Bitcoin is simply too risky for most investors.

That’s why we’re coming at this from a different angle…

The Low-Risk Way to Profit from Bitcoin’s Volatility

Instead of buying Bitcoin directly, we’re looking at companies that benefit from Bitcoin’s volatility.

One of the best ways to do this is through Bitcoin’s “picks-and-shovels” stocks.

The term comes from the California Gold Rush. Most of the miners who flooded into California during the 19thcentury never struck it rich. And many went broke.

But smart businessmen figured out that selling picks, shovels, and other essentials to the miners was much more profitable—and far less risky.

The same concept applies here…

In the Bitcoin universe, the best picks-and-shovels stock is CME Group (CME). The company operates the leading Bitcoin futures exchange. (It’s also one of the only exchanges of its type.)

At its simplest level, futures contracts let people bet on how much the price of something will rise or fall.

Futures contracts also act as a form of insurance. For example, say you own one bitcoin. You don’t want to sell it. But you want to protect yourself in case the price falls. You can do that through a futures contract. It lets you lock in gains and limit your losses.

With an asset like Bitcoin, where the price could go up or down dramatically, having the option to lock in gains like that is a big plus.

CME Group is the leading company offering this big plus. And that means big money for the company...

A Billion-Dollar (Plus) Record Day

When Bitcoin’s price is on a run, as it is right now, CME makes a lot more money.

See, every time someone buys or sells a CME Group Bitcoin contract, the company takes a small fee. So when trading volume goes up, so does CME’s bottom line.

And volume is on the rise. In fact, the company reported record volume on its Bitcoin futures exchange on May 13. It processed 33,700 contracts, equal to $1.35 billion.

So clearly, there’s rising demand for CME’s services.

All Volatility Is Good for This Company

Another good thing about CME is that it doesn’t just benefit from Bitcoin’s volatility. It also benefits from stock, bond, and currency volatility.

With trade war news rag dolling markets and stocks at all-time highs, now is a good time to hold companies that benefit from volatility.

CME group also pays a safe and stable 1.6% dividend. Then there’s the cherry on top: The company has a history of paying a special dividend every year. So a special dividend could more than double CME’s dividend yield.

While Bitcoin futures only make up a small part of CME’s business, the rising interest in cryptocurrencies—which are now a $350-billion market—should continue to drive interest in their platform.

So, while Bitcoin is too risky for most investors—remember that 83% price drop—you still have an opportunity to profit from Bitcoin’s bull run by investing in a safe and stable company like CME Group.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

This Tobacco Stock Is a Big Winner from E-Cigarette Bans

In late June, San Francisco banned e-cigarette sales completely. That means no brick and mortar sales. And no e-cigarette deliveries for online purchases.

Many cities already restrict vaping and e-cigarette sales. But San Francisco is the first major US city to ban sales outright.

Granted, it’s a cultural and political outlier. But other cities are already considering similar laws. So this looks like the start of a bigger trend that could weigh heavily on certain tobacco companies.

Despite this thread, tobacco companies are still a great, recession-proof investment. And there’s one tobacco stock that will benefit from the crackdown on e-cigs big time.

The 800-Pound Gorilla of E-Cigs

E-cigarettes hit the US a little over a decade ago. Now it’s a $25-billion market.

The e-cig explosion has been a big boon for certain tobacco companies.

That’s especially true for Altria Group (MO), which also makes Marlboro cigarettes. In 2018, Altria bought a 35% stake in Juul Labs, the world’s largest e-cigarette company.

Juul is the 800-pound gorilla of the e-cigarette world. It has a 70% market share. (Ironically, it’s based in downtown San Francisco.)

Juul expects sales to grow by 160% to $3.4 billion in 2019. But if other cities follow San Francisco’s lead, this figure—and Altria’s 35% cut—could shrink dramatically.

It would hurt other e-cig-dependent tobacco companies as well, like UK-based Imperial Brands (IMBBF). Imperial generates around 3% of sales from its e-cigarette line. That sounds small. But e-cigs made up 40% of the company’s sales growth over the last two years.

Then there’s British American Tobacco (BAT). The company created its own vapor brands, including Vuse and Vype. While British American’s core tobacco sales were flat in 2018, the vapor segment grew 19% over the last year.

More e-cig bans would certainly slow this rapid growth. But income investors should still take a close look at tobacco stocks…

A Catalyst for Traditional Cigarettes

Governments will likely continue to restrict vaping and e-cigarette sales. This shouldn’t be all that surprising.

E-cigarette use among minors has doubled since 2017, according to a recent survey from the National Institute on Drug Abuse. It was the largest year-over-year jump for any substance ever measured by the 44-year-old survey.

That sort of thing makes parents panic. And panicked parents can push local governments to “do something,” even if the overall public health benefit is questionable.

As Dr. Steven A. Schroeder, a professor of health at the University of California, San Francisco, put it, “It’s really smart politics but dubious public health.”

Nevertheless, more e-cig restrictions could stifle a major growth driver for tobacco companies. But that’s not the end of the world for Big Tobacco.

Most tobacco companies still make most of their money from traditional cigarettes. In fact, traditional cigarettes accounted for 95% of all tobacco sales in 2018.

And there’s a good reason for that: Cigarettes are highly addictive. That’s one of the reasons tobacco stocks are such a great any-weather investment.

You only have to look back to the global financial crisis to see this.

US stocks fell 27% between August 2007 and August 2010. But tobacco stocks held up remarkably well.

Altria and British American, which are a good proxy for tobacco stocks, grew 7.9% over the same period, as you can see in the chart below.

This wasn’t a fluke, either.

They also grew during the 2001 recession, rising 5.5% while the overall stock market dropped 15.5%.

In other words, while vaping bans don’t bode well for certain tobacco companies, that doesn’t necessarily matter for us. Many tobacco stocks are still great, recession-resistant investments.

E-Cig Bans Can’t Touch This Company

This might sound counterintuitive, but vaping bans could actually boost a company like Universal Corporation (UVV).

That’s because this century-old Virginia-based company does one thing: sell raw tobacco leaf to major players like China National Tobacco, Altria Group, and British American Tobacco.

It doesn’t have so much as a toe in the e-cigarette market. So e-cigarette regulations can’t hurt the company. (Perversely enough, they might even help, as smokers return to traditional cigarettes if and when e-cigarettes become harder to buy.)

Investors took notice of Universal’s unique position last week. Shares jumped 4.1% after the San Francisco ban was announced.

This is part of the reason Universal Group is the best tobacco company to buy right now. And for dividend investors like us, it offers a safe 5% dividend yield.

Don’t Get Smacked on the Way Down

Here at The Weekly Profit, we’re focused on finding safe and stable dividend-paying stocks. These are companies you want to own no matter what’s happening in the economy or the market.

Frankly, most investors take on too much risk. This leaves them vulnerable when the market heads south.

That’s especially true right now. As you likely know, the stock market is near all-time highs. And the US economy is nearing the end of a decade-long expansion.

Meanwhile, several closely watched indicators are pointing to a recession in the coming months.

That’s why you should start preparing your portfolio now. After all, nothing goes up forever. And you don’t want to get smacked on the way down.

The right tobacco stocks can help. Remember, people who buy cigarettes buy them no matter what. That makes tobacco stocks very resilient.

Yes, I know tobacco companies make addictive, unhealthy products. So does Coca-Cola (KO). And Pfizer (PFE). And a slew of other companies.

My job is to help you find the best dividend-paying stocks—not to play morality cop. We’re all grown-ups here. You can decide for yourself if investing in tobacco is something you’re comfortable with.

But bear in mind, the industry’s profits are almost guaranteed. So it’s at least worth a look.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

A Recession-Proof Industry You Probably Haven’t Heard of

Recession-proof industries are unique.

They sell stuff that people buy no matter what’s happening in the economy—things like electricity, internet access, toilet paper… and now pet care?

That’s right: America is pet obsessed.

Pet ownership is up. Spending on pets is up. In fact, we actually spend more on our pets during a recession.

We’ll dig into the details in a moment… and look at three companies in a niche of this recession-proof industry that can bolster your portfolio.

Most of Us Own Pets

Around 85 million US families own a pet, according to the National Pet Owners Survey. That’s 68% of US households.

This figure has increased around 2% annually since 2011. But spending on those pets has increased almost 7% annually.

Meanwhile, spending on veterinary care is growing especially fast. From 1991 to 2015, it shot from $4.9 billion to $35 billion. For perspective, that’s three times faster than US GDP grew over the same period.

And there’s more…

Pet care spending even grew during the last two recessions: 29% during the 2001 recession and 17% during the 2008–2009 recession.

You can see this in the next chart.

This all points to a solid, recession-proof industry.

It means pet care companies enjoy predictable cash flows and sales growth, even during a recession.

It also means stable share prices for stockholders when they’re looking for it the most.

The “Dog Mom” Generation

There are demographic reasons behind the jump in pets and pet spending.

To start, US household formation is near all-time lows, according to Yardeni Research.

The main reason for this, says the Institute for Family Studies (IFS), is that millennials—born between 1980 and 2000—are marrying later. And they’re turning to pets for companionship.

Millennials make up 25% of the US population. But they own 35% of all pets, making them the largest pet-owning cohort in the country.

Aging baby boomers and empty nesters are also big pet fans.

In 2007, only 34% of adults over age 70 owned pets. But by 2016, the year boomers started turning 70, that figure had jumped to 41%.

As I write, fewer than half of the country’s 75 million baby boomers have reached their 70s. So the “dog mom” generation still has plenty of room to grow.

And these folks are spending a lot on their pets.

The Fastest Growing Area in Pet Care

Dog owners spend over $1,000 a year on Fido, on average. So companies that cater to these “dog moms” should continue to thrive.

Overall, spending on pets in the US has gone up every year since 1994. And it’s grown 4.6% annually over the last 10 years—or three-times faster than overall consumer spending.

This is good news for pet care companies. And it makes sense that they’ve done well, even during the last two recessions.

Pets are “part of the family” now. Their owners skimp on other things before downgrading to cheaper pet food or cutting back on supplies.

This is especially true for the $15 billion pet medication industry. Sure, you might skip your regular dog grooming appointment during a recession, but you’re not going skip your pet’s medication.

The booming pet medication market is proof positive of that. Pet medication sales are growing twice as fast as overall pet spending.

The pet medication market will be the highest growth area of the pet care industry for the next decade, reports market research firm Packaged Facts. It expects new products for flea and tick prevention as well as itch relief to drive sales.

And we can get a slice of that…

How to Profit from the Pet Health Market

Recession is probably not imminent. But it’s coming sooner rather than later.

That’s why my focus is recession-proof dividend-paying stocks right now. It will help you add safety and stability to your portfolio and prepare for this recession.

The pet health market is one way to do that.

One of my favorite pet health companies is PetMed Express Inc. (PETS). PetMed is a leading, nationwide pet pharmacy. The company markets over 3,000 prescription and non-prescription medications for dogs and cats directly to consumers.

PETS pays a hefty 6.7% dividend yield. It also has a low payout ratio, which is critical to dividend stocks. Shares have struggled a bit this year, but that also means they’re attractively priced right now—and a good way to take advantage of the growing pet health market.

Next on my list is Zoetis Inc. (ZTS). Zoetis used to be the animal health unit of Pfizer. The company is the largest manufacturer of anti-infectives, vaccines, and other animal health products in the world.

ZTS pays a small 0.6% dividend yield. However, with a 19% payout ratio, there’s plenty of room for the company to increase its dividend payout.

Lastly, we have Pets at Home Group PLC (PAHGF). The company operates a network of stores, pet services, and veterinary services in the United Kingdom.

The company pays a high 4.2% dividend yield. At 125%, the payout ratio is higher than I would like. But the company has very low debt and strong free cash flow. So it isn’t likely to cut the dividend, despite the high payout ratio.

Remember, this recession probably isn’t coming tomorrow. But it’s still important to buoy your portfolio now.

You want to buy recession-proof companies when you can, not when you need to. And now is the perfect time to add some dividend-paying pet health companies to your portfolio.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

The Bad News About Record-Low Unemployment

Unemployment is the lowest it’s been in 50 years.

That means most people who want to work can find a job. It also means people are making more money and buying more stuff.

All good. More people working is always positive. But a low unemployment rate is a double-edged sword.

See, the unemployment rate is cyclical. It’s always moving up or down. And at this point—3.6%—there’s almost no room for it to drop more.

That’s where the trouble starts: When the unemployment rate bottoms out, like it’s doing now, it means the economy has peaked. And a recession is probably coming…

We’ve Been Here Before

Notice that every time the unemployment rate hits a low, a recession (highlighted in gray) soon follows:

Source: Federal Reserve Bank of St. Louis

It doesn’t come immediately, though.

Over the past 70 years, a recession has started an average of five months after the unemployment rate bottomed.

Source: Federal Reserve Bank of St. Louis

Also, remember that the unemployment rate lags behind the actual economy. That means it rises and falls after major shifts in the economy, not before.

That makes sense when you think about it. People don’t often lay off employees the first day business starts to slow. There’s a lag.

So the unemployment rate won’t start rising until the US has already fallen into a recession.

More Signs Flashing Red

A bottoming unemployment rate isn’t the only sign that the economy has peaked.

Like the unemployment rate bottoming, the inverted yield curve has preceded every single recession over the past 50 years.

Keep in mind, neither of these indicators means a recession is imminent. And they don’t tell us how severe the recession will be. But it’s certainly coming.

So is the market downturn.

Remember, we’re at the tail-end of the longest bull market in history. So a major pullback is not out of the question. And, since stocks fall an average of 32% in a bear market, you want to start preparing your portfolio now.

That means adding recession-proof stocks and other assets that will rise when the broader stock market falls.

This Is How You Prepare for a Recession

Dividend-paying stocks—especially in sectors like consumer staples, utilities, and defense—are some of the best ways to buoy your portfolio as we head into this recession.

Consumer staples are a great refuge when the economy hits the skids. These businesses sell things like toilet paper, laundry detergent, and dog food—things people buy no matter what’s happening in the economy.

Right now, my favorite way to invest in consumer staples is the Vanguard Consumer Staples ETF (VDC). It pays a safe and stable 2.7% dividend yield.

Utilities, of course, are about as recession-proof as it gets. People pay their power bills even when the economy tanks. So these businesses are very stable.

My top utility pick right now is the Fidelity MSCI Utilities ETF (FUTY). It pays a 2.9% dividend yield. That’s 50% higher than the yield on one-year Treasury bills.

Then there’s the defense sector, which is one of my favorite recession-proof sectors. In fact, US defense spending usually goes up during a recession.

The iShares US Aerospace & Defense ETF (ITA), which pays a 1.1% dividend yield, is a good way to invest broadly in this sector.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Clock’s Ticking on Your Chance to Profit from the Yield Curve Inversion

The markets are in the middle of a once-in-a-decade event.

And it says a lot about what you should do with your money right now.

I’m talking about a critical recession indicator called the yield curve inversion—or the Diamond Cross.

As you may recall, a Diamond Cross happens when the difference between the yield on the 10-year Treasury note and the 3-month Treasury bill is negative. This is a telltale sign that the economy is slowing.

The Diamond Cross popped up briefly in March, only to return on May 15. Last week, it was the steepest, or most severe it’s been since April 2007.

And I’m sure you remember where we landed 12 months after that…

The Crisis That Followed

By April 2008, the US was suffering through its worst economic slowdown since the Great Depression.

A lot of people were taken off guard. But investors who pay attention to the Diamond Cross shouldn’t have been surprised. That’s because the Diamond Cross has preceded every single recession over the past 50 years.

Today, we’re heading toward another recession. Just not immediately…

The Diamond Cross appeared an average of 18 months before the last three recessions, as you can see in the next chart. (Diamond Crosses are circled in red and recessions are highlighted in gray.)

I expect a similar gap this go ‘round.

Nevertheless, the Diamond Cross is a definite sign that investors are worried.

Here’s why…

These Are Strange Times

You probably know that US Treasuries are bonds issued by the US government—the safest lender on the planet. So, they’re about as “risk free” as you can get.

The US Treasury issues these bonds for different periods of time, ranging from three months to 30 years. This period is called the bond’s “maturity.”

Normally, investors demand higher yields for longer-term bonds. And for good reason.

See, you can predict short-term economic and geopolitical changes with some degree of certainty. But no one really knows what will happen in 10, 20, or 30 years.

Long-term bonds are a gamble on the unknown. So people demand higher yields.

But the Diamond Cross flips this all on its head. When it appears, like it did on May 15, it means investors are demanding higher yields for shorter-term bonds. That means they’re pessimistic about the short-term future.

Once again, this shouldn’t surprise anyone who’s been paying attention. The US economy has expanded continuously for almost nine years. That’s a long time.

Since the end of World War II, the US has hit a recession every five years, on average. So we’re long overdue.

But remember, a Diamond Cross appeared around 18 months before the last three recessions. So it’s coming, just not tomorrow.

In the meantime, I expect stocks to follow a similar pattern…

Stocks Should Climb Until September 2020

There’s an upside to all this: A Diamond Cross is always a positive sign for stocks in the short term.

Just look at how the S&P 500 rose after the last Diamond Crosses:

At the 18-month mark after the last three Diamond Crosses, the S&P 500 had returned an average of 32%. Pretty respectable. For perspective, that’s the same return on the S&P since July 2016.

At this rate, stocks should continue to climb until September 2020 or so. That said, now is not the time buy with wild abandon.

A Word of Caution

Although stocks historically rise after the Diamond Cross, you still need to be picky.

This recession is coming, folks. So is the market downturn. You want to steer clear of excessive risk.

That means buying safe and reliable dividend-paying stocks—especially in resilient industries like consumer staples, defense, and utilities.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

If You Invest in Dividend Stocks, Do This to Double Your Returns

If it seems too good to be true, it usually is. But when I say you can juice your investment returns with the click of a button, it’s the plain truth.

I’m talking about reinvesting your dividends.

It may seem like a minor thing. But if you’re not doing it, you’re leaving a lot of money on the table.

In fact, investors who reinvest their dividends can outright double their investment gains.

Let me show you how…

Reinvesting Can Make a Big Difference

Say you own 100 shares of McDonald’s Corp. (MCD).

Every quarter, McDonald’s pays a dividend of $2.00 per share. That translates to $200 in income from your 100 shares.

When this happens, you have two options:

Pocket $200 in cash or

Reinvest $200 directly into McDonald’s shares.

Hint: Choose option two.

Now, McDonald’s trades for around $200/share. So instead of pocketing $200 in cash, you get one extra share.

Then you make the same smart choice the next quarter… and the next. True, it’s only one extra share each quarter. But over time, it makes a huge difference.

That’s because reinvesting your dividends takes advantage of compound interest.

Compound interest is the interest on your initial investment, plus interest on all interest earned. This means your interest—or in this case, your reinvested dividends—earns interest, too.

In other words, those reinvested dividends make your whole investment grow much, much faster.

Reinvesting Your Dividends Can Double Your Returns

Let’s walk through an example.

Say you bought $20,000 worth of McDonald’s stock in 1998. You pocketed the dividends from half of your investment. And you reinvested the dividends from the other half.

By 2019, the first account had grown from $10,000 to $66,598. That’s a total growth of 565%, or 9.9% annually. Not too shabby.

Meanwhile, the second account—the one with the reinvested dividends—had grown from $10,000 to $120,073. That’s a total growth of 1,100%, or 13.0% annually.

Now that’s remarkable.

Your money grew almost twice as much. And the only thing you did differently was reinvest your dividends instead of taking the cash.

Reinvesting your dividends does two things:

You get more stock, which can grow in value over the long run.

For every additional share you own, you get an additional quarterly dividend.

Over time, this leads to a lot more money.

This Isn’t Limited to McDonald’s or US Stocks

Let’s look at a few other examples.

Say, 50 years ago, you invested $1,000 in the S&P 500. So did your neighbor. We’ll call him “Jim.”

Jim didn’t reinvest his dividends. But he still earned an annual return of 2.3%.

But you were smarter. You reinvested your dividends every quarter. So you earned an annual return of 5.3%. That’s more than twice as much as Jim earned.

This strategy is universally effective. You’ll make a lot more by reinvesting your dividends in any market.

Just look at the difference in returns from the world’s eight largest stock markets since 1993:

Source: Schroders

As you can see, reinvesting dividends led to much higher returns across the board.

On average, people who invested in one of the eight major stock markets—without reinvesting their dividends—earned 4.3% annually.

Meanwhile, those who reinvested their dividends earned 7.1% annually.

Shielding Your Portfolio from the Coming Recession

You can’t fight the math.

If you’re not reinvesting your dividends, you’d better have a solid reason why. Otherwise it’s like dropping $100 bills on the sidewalk. Just waste.

I think dividend reinvestment is a good idea for all investors—and at every point in the market cycle. That’s especially true when you own safe and stable stocks.

These stocks tend to do well no matter what’s happening in the economy or the markets. So when the next recession hits—something I expect in the not-so-distant future—and the broader market suffers, you will still own quality businesses that will make it through.

Plus, if you’re reinvesting your dividends, you’re getting more of a good thing, possibly at better prices. And you’re taking advantage of the magic of compound interest.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Why Blue-Chip Dividend Stocks Aren’t as Safe as You Think

A man pulled a gun on me last week.

I was in the Ipanema neighborhood of Rio de Janeiro.

Ipanema is one of the wealthiest areas of Rio. You get iconic views of the Brazilian shore line and white sand beaches.

I was two blocks from Ipanema Beach when a man on a bike pulled in front of me.

At first, I thought he was going to sell me something. Then I saw him starting to pull a gun out of his backpack.

Fight or flight kicked in, and I started running.

In hindsight, this probably was not a good idea. But thankfully, I made it home safely.

Keeping an Eye Out for Warning Signs

I knew Rio was dangerous before visiting.

All my Brazilian friends told me not to visit because it’s so dangerous.

I figured if I stay in iconic Ipanema, I would be safe. But staying in Ipanema turned out to give me a false sense of security.

People do the same thing with investing. They convince themselves that their money is safe in a company’s stock because they took the precautions. They did their research. Everyone owns it.

But just like staying in iconic Ipanema turned out to give me a false sense of security, buying iconic “tried-and-true” stocks can yield the same result.

Take a look at Kraft Heinz.

The iconic brand lost 30% of its value in one day.

That’s despite having one of the world’s most recognizable brands, a seemingly stable business, and the backing of Warren Buffett.

Kraft Heinz had many issues. But one of the reasons the stock tanked was because management cut the company’s dividend.

And that’s a death sentence for any investment.

Bigger Can Be Better (If You Know Where to Look)

High dividend-paying stocks like Kraft Heinz (KHC) can often leave investors with regret.

And that makes sense. Many companies must pay high dividends to compensate investors for the risk of owning the company’s stock.

Some of these companies borrow money and use the debt to pay their dividend.

That’s exactly what Kraft Heinz was doing. And this strategy often ends up being a disaster for investors.

Lucky for you, I’ve spent my entire career looking for safe stocks that pay high dividends. I developed a tool that helps gauge the safety of a company’s dividend.

I call it the Dividend Sustainability Index (DSI).

How to Select the Right Dividend-Paying Stock

You must look at three key things when evaluating dividends.

The most important is the payout ratio.

The payout ratio is the percentage of net income a firm pays to its shareholders as dividends.

The lower the payout ratio, the safer the dividend payment.

The second is the debt-to-equity ratio.

The more debt a company has, the harder it gets to run a business. This includes—you guessed it—paying the dividend.

The third is free cash flow. This is the amount of cash left over after a company pays its expenses.

If any of these measures is flashing red, you know the dividend is in trouble.

A low DSI score tells me that the odds are high that a company will be forced to cut its dividend.

And that’s bad news for shareholders.

A Dividend Cut Can Wipe Out Your Profits

Kraft Heinz wasn’t the only iconic brand to tank on a dividend cut as of late.

Take a look at what happened to General Electric (GE) when it surprised investors and slashed its dividend 50% in November 2017:

GE shares were punished on the news, getting chopped over 10%.

One year and a second dividend cut later, shares have been smashed 57%.

The Dividend Sustainability Index (DSI) will keep you out of stocks like Kraft Heinz and GE. By using methods like the DSI, you can have real security with your income investments.

1 note

·

View note

Text

These Three Stocks Love Low Interest Rates

Looks like the Federal Reserve will cut interest rates soon.

Sure, the Fed announced it was leaving interest rates put last week. But I think the Fed will take this one step further and cut rates in the near future.

The Fed lowers interest rates when it thinks the economy is weak. This makes it cheaper for businesses to borrow money and employ more people.

And we’re already seeing signs of a slowing economy.

When the economy slips into a recession, which I expect to happen in the next year or so, the Federal Reserve will no doubt lower interest rates—just like it’s done after every recession since 1950.

I know this all sounds bleak.

But lower rates are actually great news for one type of stocks, which I’ll tell you about in a moment.

Low Interest Rates Are the New Normal

After years of near-zero interest rates, the Fed began raising rates in 2016. Then the stock market fell 20% at the end of 2018, and it abandoned this strategy.

It’s held rates steady ever since, as you can see in the next chart.

Right now, interest rates are less than half their long-term average of 5.2%.

John Williams, the former president of the Federal Reserve Bank of San Francisco, says this is the new normal. In recent interviews, he’s even advocated for keeping interest rates “lower for longer.”

If the economy continues to slow, as I expect it to, the logical next step is to cut interest rates. That makes now the perfect time to buy dividend-paying stocks.

Low Rates Make Dividend-Paying Stocks More Competitive

Income investors look to CDs, bonds, and dividend-paying stocks to generate income.

As a general rule, CDs and bonds are less risky than dividend-paying stocks. But there’s a tradeoff—their yields are closely linked to interest rates set by the Federal Reserve.

When interest rates are low, CD and bond yields are also low. And vice versa. When interest rates are high, CD and bond yields are high.

That’s not the case with dividend-paying stocks. This can make them more attractive than CDs or bonds in a low-interest-rate environment.

And, the lower rates dip, the more attractive they get.

Dividend-Paying Stocks Already Have an Edge

CDs currently yield around 2.5%. And the 10-year Treasury note yields 1.8%.

Now, compare that to the 3.0% yield on Vanguard High Dividend Yield Index (VHDYX), which is a good proxy for dividend-paying stocks.

But what happens if the Fed lowers interest rates, as I expect it to?

Say the yields on CDs and the 10-year Treasury note fall 1.8% and 0.9%, respectively. That would make dividend-paying stocks nearly twice as competitive.

Lower Rates Will Boost These Three Stocks Most

I’m always on the hunt for safe and stable dividend-paying stocks.

Right now, I’m focused on a handful of industries that do particularly well when interest rates are low. This includes industries that require a lot of capital and debt. Low rates make it cheaper to borrow, which helps businesses in these industries.

The best example of this is real estate investment trusts (REITs). REITs own different types of real estate—everything from commercial warehouses to apartment buildings.

With interest rates low and heading lower, I expect money to flow into REITs.

Right now, my favorite way to invest in REITs is the Vanguard Real Estate ETF (VNQ). It pays a safe and stable 4.0% dividend yield.

Like REITs, utilities also benefit from low interest rates.

See, utilities are as recession-proof as it gets. People and businesses pay their power bills no matter what’s happening in the economy or financial markets. So these businesses are very stable.

That’s why investors pour into them when interest rates are low, looking for a safe dividend yield.

My top utility pick right now is the Fidelity MSCI Utilities ETF (FUTY). FUTY pays a 2.9% dividend yield. That’s 50% higher than the yield on one-year Treasury bills.

Low interest rates also boost telecom companies, which build, own, and operate internet and other high-speed data infrastructure.

Today, most people depend on mobile and high-speed internet access. So, these industries are very safe.

Telecom stocks also pay high dividends. The iShares Global Communications Services ETF (IXP), for example, pays a solid 3.7% dividend yield.

When interest rates head lower, I expect investors to pile in here, too.

All told, now is a great time to buy dividend-paying stocks, especially in the three industries I just mentioned.

Once the Fed pushes interest rates even lower, investors will start pouring in. At that point, you will have missed your best chance to buy.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Buy This Pick-and-Shovel 5G Stock Before It Takes Off

Wireless technology has come a long way.

The first generation of wireless known as 1G was rolled out in the 1980s. The only thing a user could do with 1G was make a phone call.

At times, the call quality could rival that of two tin cans connected by a string.

But wireless tech has made huge advances since those early days.

About every 10 years we’ve seen a new generation of wireless—1G, 2G, 3G, and today’s 4G. Each was faster and more reliable than the previous generation.

As you may already know, we are about to see the next generation of wireless. It’s the new 5G technology, which is slated to hit the market this year.

And that creates a big opportunity for investors.

Why 5G Is So Important

To understand why 5G is such a big deal, you must understand one thing: latency.

Latency is delays in sending information from one point to the next. This is different than bandwidth, which is the volume of data being transferred, not the speed of the transfer.

The lower the latency, the faster information can race across a network.

And the 5G network has very, very, very low latency. This core attribute of 5G will revolutionize many industries.

Remote medical procedures are just one example. Low latency will enable remotely located robots to instantly mimic human movements.

This will give doctors the real-time response they need to perform surgery on a patient located anywhere in the world.

The next era of self-driving cars will also depend on 5G. The new technology will allow cars to “talk” to each other in real time.

5G will even change farming. Farm equipment company John Deere is developing 5G technology that promises to radically boost crop yields.

5G is a gamechanger. And there’s been a ton of money flowing into 5G-related companies.

Major Investment in 5G Is Already Underway

Companies have already spent over $200 billion on 5G infrastructure.

Most of this money has gone toward building 5G-ready cell towers.

That’s a lot of money, but there is much more to come. Research firm Moor Insights & Strategy expects that 5G-related IT hardware spending will reach $326 billion by 2025.

See, to achieve the speed and reliability of 5G requires lots of cell towers.

Today, the 4G network uses 25,000 cell towers across the US. Each one is 100 feet (or more) tall, and they are spaced several miles apart.

The 5G network will need 200,000 cell towers that are much smaller and spaced in a much tighter web across the US.

So in the near term, almost all 5G spending will go to building out the cell tower grid.

When it’s ready, 5G speeds will be 20 gigabytes per second. That’s 1000x faster than today’s 4G technology.

5G will make wireless bandwidth seem infinite. And the companies building the infrastructure for this new technology will be the first to profit.

Picking the Right Horse in the Race to 5G

There are a few ways to invest in the evolution to 5G.

You could buy the stock of companies that maintain and operate 5G infrastructure. These would be stable dividend companies like AT&T, Verizon, and China Mobil.

These are low-risk, limited-upside investments that will take time to bear fruit.

Things work slowly in the telecom space. We saw this play out when 4G was introduced.

To gain the benefits of the 4G network, users had to replace their 3G phones. Phones aren’t cheap, and 3G phone owners had to first be convinced that the new phones and features were worth the money. That took some time.

Instead, I recommend going the “picks and shovels” route. This means companies who build the infrastructure that supports 5G technology.

These companies are making money from their 5G investments right now.

I like to buy companies that sell the “picks and shovels” that industries need… like investing in farm machinery companies rather than agricultural businesses.

In the 5G space, this would be companies that sell the hardware, software, and services to telecom companies.

And we can leverage our bet by owning a company with exposure to the international adoption of 5G technology.

There’s only one company that fits these criteria.

Nokia Corp. (NOK)

Nokia is a Finnish multinational telecommunications company. It is the world’s third-largest telecom equipment manufacturer after Huawei and Cisco.

The company is split into two segments:

Nokia Networks (90% of sales): provides systems and software to build high capacity network infrastructure.

Nokia Technologies (10% of sales): develops consumer products and licenses technology for the Nokia brand.

Almost all of Nokia’s business comes from selling data networking and telecom equipment. That’s just what we want, because I expect those types of sales will see big growth as 5G investment ramps up.

The build out of the 5G network will be global, and Nokia is a truly international company

Even better, two of Nokia’s biggest rivals—ZTE and Huawei, were blacklisted by the US government. This will shrink NOK’s competition in this US market to pretty much just one company—Ericsson.

The investment flow into 5G from the major telecom companies has already started to climb.

In July, Nokia received a $3.5 billion contract from T-Mobile US, which was reportedly the largest 5G deal ever.

T-Mobile has about a 17% share of the US wireless market, making this a major win for NOK.

This Play Will Take Time… Be Patient

The flow of investment will not, however, hit the 5G market like a giant wave.

It will be more like a steadily rising tide. In fact, NOK management expects 5G investment to be soft in the first half of 2019.

But that’s perfect for investors. It gives us an opening to get in before the tide of money starts to rise.

The multibillion-dollar contract from T-Mobile looks like a sign of some early pump priming for more 5G spending.

The other major wireless carriers in the US aren’t going to let themselves lag behind in the race to 5G.

I think we will soon see more big 5G contracts make the headlines. As a major player in a market with limited competition, Nokia will almost certainly win a lot more US sales by the end of 2019.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

This Ultimate Formula Will Help You Avoid Dividend Cutters

Many of you probably don’t have a telephone at home.

I’m not talking about a cell phone. I’m talking about a phone plugged into the wall.

The US Health Department reports that only 6.5% of homes are landline only, and most of them are in rural areas.

One company that services these stalwart landline customers is CenturyLink (CTL). It’s not a high-growth business, but its stable customer base made it a prime target for income investors.

This was doubly true after CenturyLink spiked its annual dividend from $0.26 to $2.17 in 2008. That lifted the company’s dividend yield to a hefty 7%.

That’s more than triple the current dividend yield of the S&P 500.

Don’t get me wrong, there’s a way to earn high dividends without having to risk your neck, but CenturyLink was not the case.

Let’s look at how it all came crashing down and what we can learn from it.

Hypnotized by High Dividend Yields

From 2008 to 2013, CenturyLink began buying up smaller telecoms that were struggling due to the financial crisis. The strategy was to grow sales—and it worked. Sales ballooned 38% per year during that six-year stretch.

During those years, CenturyLink paid the coveted 7% dividend like clockwork. Although the stock price didn’t move much, it was a hot income investment.

To income investors, it all made sense. CenturyLink looked like a stable business that generously rewarded shareholders.

But if you looked under the hood, CenturyLink was a mess.

And those who missed the warning signs were punished with a devastating dividend cut in 2013.

Investors can often get suckered in by high dividend yields.

An investor looking at CenturyLink could have easily thought, “Wow, I can earn 7% with little to no risk.”

That thinking worked for a while. But in 2009, CenturyLink started piling on debt. Lots of debt.

That’s not uncommon in the telecom industry, as these businesses need a lot of capital.

But it didn’t take long to see that the debt was being mismanaged. And when a company abuses its finances, a desperate search for ways to cut costs soon follows.

And one of the first targets is a high dividend.

Spotting Ticking Dividend Time Bombs

There are a handful of ways to gauge the safety of a dividend.

One of them is to look at a company’s debt-to-equity ratio.

This ratio tells you how much of a company’s operations are being funded through debt (i.e. borrowed funds) or equity (i.e. owned funds).

The higher this figure, the worse a company’s financial position. From 2009 to 2013, CenturyLink’s debt-to-equity jumped from 77% to 117%.

Anything over 80% is a red flag. And CenturyLink was well beyond that point.

There were other warning signs. CenturyLink’s net income and free cash flow were falling. These yardsticks measure how much profit the company generated (i.e. net income) and how much cash was left over to invest (i.e. free cash flow).

If a company is not making money (i.e. falling net income and free cash flow), it affects another key measure: the payout ratio. This is what happened with Kraft Heinz before it was forced to cut its dividend.

This is the most important number on the dividend safety barometer. The payout ratio is the percentage of net income a firm pays to its shareholders as dividends.

The lower the payout ratio, the safer the dividend payment.

And by 2013, the payout ratio for CenturyLink had reached an absurd 232%. That means for every $1.00 in profit the company was paying out $2.30 in dividends.

CenturyLink’s dividend was a house of cards. And it all came crashing down on February 14, 2013:

On that day, CenturyLink cut its dividend by 25%. The move sent its shares on a 23% plunge in a single day.

Keeping an Eye Out for Warning Signs

Stable and boring businesses like telecom companies are great. In fact, I love boring companies.

That’s why we have a few of them in my portfolio, which you can check here,

But anyone who says there weren’t warning signs with CenturyLink wasn’t looking hard enough.

While every company needs a good story behind it for an investment to make sense, the data better make sense as well.

For that, I developed a scoring system called the Dividend Sustainability Index (DSI).

I use the DSI to measure a company’s debt-to-equity, net income margin, free cash flow growth, and payout ratio to determine the safety of its dividend.

The higher the DSI score, the safer the dividend.

To show you how well it works, I went back and ran CenturyLink’s data through the DSI.

Here’s how the company scored before it was forced to cut its dividend:

Source: Mauldin Economics

My general rule of thumb is that a company must have a DSI score of 75% or higher to make it into my portfolio.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Trump’s Trade War Is Good for These 3 Dividend Stocks

The US v. China trade war is heating up.

Until recently, the nations appeared to be making progress.

That was until President Trump raised tariffs on $200 billion in Chinese imports from 10% to 25%.

The news sent the S&P 500 down 3% in the next two trading days. But not all stocks suffered.

That’s because some stocks actually benefit from tariffs.

I’ll show you why in a moment—and share a few stable, dividend-paying stocks set to benefit as this all plays out.

How Tariffs Work

A tariff is a tax on imported goods. Governments use them to make foreign goods less attractive and domestic goods more competitive.

Take steel, for example.

Last year, Trump slapped a 25% tariff on Chinese steel imports. At the time, Chinese steel cost $800 per ton. US steel cost $900.

Once the tariff went into effect, it raised the overall cost of Chinese steel for US buyers to $1,000 per ton.

As you’d expect, US automaker Ford Motor Company (F) buys a lot of steel. And before the tariff, it bought a lot of it from China because it was cheaper.

Now Ford buys from US companies like Nucor Corp. (NUE), the largest US steel maker.

Nucor loves the steel tariff. The company’s CEO said 2018—the year the tariffs went into effect—was “a record year for Nucor.”

Ford is less enthusiastic. The tariffs cost the car maker $750 million in 2018.

But that’s how US tariffs work. They help some domestic businesses. And hurt others.

In China, however, everyone is feeling the pressure.

A One-Sided Relationship

The US and China have the world’s two largest economies. And they trade a lot… $780-billion worth of goods in 2018.

Still, it’s a one-sided relationship. In 2018, the US bought $660-billion worth of Chinese goods. But China only bought $120-billion worth of US goods.

In other words, the US buys five times as much from China as China buys from the US. So Trump’s tariffs have put a lot of heat on China’s economy and financial markets.

The Shanghai Composite Index, a proxy for Chinese stocks fell a staggering 25.7% in 2018:

It was the worst year for Chinese stocks since the global financial crisis.

This makes sense: Modern-day America consumes more stuff than any country in history. So, US tariffs matter.

The tariffs make Chinese goods less competitive. So Chinese companies sell fewer goods to US buyers. This translates to lower overall sales, then lower earnings.

And that translates to lower stock prices for Chinese companies, as we just saw.

US stocks are not immune to trade war tensions either. However, they fell a mere 6.3% during the period that Chinese stocks dropped 25.7%.

That’s because it’s relatively easy for the US to find cheaper, non-Chinese replacements for tariffed goods. It’s a lot harder for China to find non-US buyers.

There’s simply no replacement for the endless buying power of American consumers. And remember, some US industries even benefit from tariffs…

Profiting from the Trade War

US companies that make products that compete with Chinese imports like steel, electronics, and automation equipment now have a major advantage.

The tariffs help them sell more, which means higher earnings and higher stock prices.

I’m always on the lookout for safe and stable dividend-paying stocks. When I find ones set to benefit from larger economic forces like a trade war, even better.

The American steel firm Nucor (NUE), which I mentioned earlier, is one of these companies. Nucor sells most of its steel in the US. And Trump’s tariffs have made its products more attractive to US buyers.

Nucor also boasts a 2.9% dividend yield on a low payout ratio—one of the most important indicators for dividend stocks. In short, a low payout ratio points to a stable divided.

American electronics companies like Hubbell Inc. (HUBB) also stand to benefit from the trade war.

High tariffs on cheap Chinese electronics make Hubbell’s products more competitive. The company also pays a 2.7% dividend yield on a low payout ratio. This means it’s a safe and stable stock for income investors.

The trade war should also boost US automation companies like Rockwell Automation, Inc. (ROK).

Rockwell benefits directly from US tariffs on Chinese automation equipment. Plus, the company has raised its dividend nine years in a row (which, again, is one of the key indicators the dividend is safe). With a low payout ratio, its dividend is secure.

These companies would do well even without a trade war. Their stocks are cheap. And they have strong underlying businesses that should continue to churn out profits.

That said, this trade war isn’t going away anytime soon. Last Friday, Trump followed through on his threat to raise tariffs to 25%. China is hitting back as I write…

This all bodes well for these companies.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Buffett Made a Mistake That Cost Him $4.3 Billion This Year—Here’s What Every Investor Can Learn from It

Even the best investors have bad days.

Warren Buffett is no exception. In February, he watched one of his biggest acquisitions quickly sour.

I’m talking about Kraft Heinz, an American food giant that makes everything from ketchup to Oscar Mayer hot dogs to Kool-Aid.

The stock plunged 30% in one day after it announced a 36% dividend cut and never recovered:

This caught a lot of investors by surprise. That’s because Kraft Heinz fit Buffett’s signature strategy, known as value investing, to a T.

Buffett has used this strategy to make billions of dollars. So people expected Kraft Heinz to be safe.

But the writing was on the wall well before February. Here, I’ll explain why—and how to avoid stocks with similar problems.

But first, let’s look at how Buffett got into this jam…

There’s Always Money for a Coke

Value investors like Buffett make money buying stocks that are trading for less than their intrinsic value.

Imagine, for example, that a stock is trading for $20 per share. But your research says it’s worth $25 per share. If you’re correct, and the share price rises, you make a profit.

That’s how value investing works in a nutshell.

This strategy is one of the reasons Buffett acquired an 27% stake in Kraft Heinz in 2015. It also matched his preference for easy-to-understand companies like Coca-Cola and Duracell.

In theory, people buy their products no matter what’s happening in the economy. There’s always money for a Coke, a pack of batteries, or a hot dog, even when you’re broke.

No One Drinks Kool-Aid Anymore

On the surface, Kraft Heinz looked like a stable company with a safe dividend. Finding such companies is my forte, so check out my latest special report where I reveal my favorite dividend stocks for 2019. But if you looked deeper, you’d see the company is actually dealing with many issues.

The biggest issue is that Kraft Heinz doesn’t keep up with changing consumer trends.

People don’t want prepackaged foods like Oscar Mayer hot dogs anymore. Instead, they want simpler, healthier foods with fewer processed ingredients.

This has weakened demand for the company’s core products. (When was the last time you saw someone drinking Kool-Aid?)

In fact, the company’s sales flatlined from 2015 to 2018. Earnings rose slightly, but this came from cutting costs, not growing sales. Still, Kraft Heinz kept raising its dividend.

This was a major red flag.

How to Spot an At-Risk Dividend

When a company’s dividend rises faster than its earnings, it increases a closely watched indicator called the payout ratio.

The payout ratio is the percentage of net income a company pays to shareholders as dividends. The lower the payout ratio, the safer the dividend payment.

In Kraft Heinz’s case, the payout ratio has been rising for three years. Over that period, it has averaged 94%. That means the company immediately paid out almost every dollar it made.

Again, this is a major red flag. If a company pays out all of its profits in dividends, there’s nothing left over to reinvest in the business.

With Kraft Heinz, sales were already struggling. Add in the rising payout ratio, and more investors should have been wary.

Instead, they were hypnotized by Buffett’s blessing and the company’s (former) 5.5% dividend yield.

Then the inevitable payday came. February’s big dividend cut sent shares down 30% in one day. This cost Buffett’s Berkshire Hathaway a paper loss of over $4.3 billion.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

Social Security in the Red? Here’s Another Source of Government-Backed Income

We’ve recently got some bad news about Social Security.

A new report says the program will cost more than it takes in by 2020. By 2035, its back-up trust fund will also run dry.

This makes sense: America is greying.

We’re having fewer children, living longer, and wages are growing at a slower pace.

That means there are fewer workers, those workers are making less money, and they’re supporting more retirees.

When Social Security was introduced in 1935, there were 42 workers for every retiree. Today, there are only 2.9.

And that number is set to drop to 1 within the next decade.

This means the government will have no choice but to cut Social Security benefits. There is, however, a far more stable government-backed system that can boost your retirement plans.

I’m talking about the global defense industry. Here I’ll show you the safest and most profitable way to tap into it.

Profiting Off the World’s Largest Employer

The US military is a behemoth. It employs 2.2 million active military personnel.

The US Department of Defense, which manages the military, is the largest employer on the planet. Its workforce equals the entire population of Nevada in size.

No surprise, it takes a ton of cash to keep this machine running.

The US military budget is nearly $700 billion this year alone. That’s more than twice the military budgets of China, Russia, Saudi Arabia, and India combined.

But here’s the kicker: The US spends 90% of its military budget on US companies. That means billions of dollars flow into publicly traded US companies every year.

And it happens no matter what…

Defense Spending Is Recession Proof

When the economy slows—as I expect it to in the next 18 months or so—people spend less and businesses scale back.

Consider the global financial crisis, for example. Between 2008 and 2009, US consumer spending fell 8.2% and domestic investment plunged 30.1%.

At the same time, the US hiked military spending by 12.2%.

This was not an anomaly. Defense spending grew during five of the six last recessions.

You can see this in the next chart, which tracks US defense spending since the 1970s (recessions are highlighted in grey).

There’s a good reason for this.

A solid 70% of the US economy relies on consumer spending. That means everything from people buying groceries to paying their energy bills. During a recession, consumers feel the pinch and spend less.

The defense industry, however, is immune to this.

There’s no shortage of reasons to spend money on the military. From countering threats abroad (both real and imagined), to supporting veterans and defense-linked jobs, it’s politically toxic to cut military spending. No one wants to touch that hot potato.

This makes defense spending unusually stable. It also means companies that benefit from it earn very stable profits.

Safe and Secure Defense Industry Dividends

Dividend-paying stocks are my specialty. These are often the stocks of boring yet stable businesses. Stability is why they can pay dividends every quarter.

And, while the defense industry is certainly stable, it’s not known for its dividends.

Consider the iShares US Aerospace & Defense ETF (ITA), for instance. The ETF holds a basket of large defense stocks. But it only pays a 1.0% dividend yield. That’s only half of the 1.9% dividend yield on the S&P 500.

Nevertheless, there are individual defense stocks that pay great dividends. But you have to dig.

Let’s take a look at some of the best options.

Of these, Lockheed Martin Corp. (LMT), which makes a wide range of aircraft, naval ships, missile systems, and other defense-related gismos, enjoys the most stability from government spending.

The company is basically an unofficial wing of the US military. It also has the second-highest dividend yield on the list.

BAE Systems plc (BAESY), a UK-based defense and aerospace company, relies a bit less on US government spending. But its dividend yield is almost twice as high as Lockheed Martin’s.

If you’re looking for reliable income from the defense sector, I think buying individual companies is the way to go.

If and when Social Security dries up, you’ll be glad you’re collecting safe and reliable dividend payments from the recession-proof defense industry.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

0 notes

Text

This Stock Is as Safe as Coca Cola but Pays a 6.4% Dividend

I bet you’ve never heard of Pat Munroe.

And unless you’re from the Florida Panhandle, I imagine you haven’t heard of Quincy, Florida, either.

But the two can teach us a lot about investing.

See, in the early 1920s, Munroe was a banker in Quincy.

One thing Munroe noticed was no matter how hard the times, the people of his small town always seemed to have money to buy a Coca-Cola.

So he started buying shares of the company. Not long after, he was telling everyone in town to buy shares of Coca-Cola.

He’d even underwrite bank loans backed by Coca-Cola stock.

When shares crashed 50% during a conflict with the sugar industry, Pat kept telling people to buy Coca-Cola.

And then the Great Depression hit.

Keeping Your Eye on the Long-Run

From September 1929 to July 1932, the Dow Jones Industrial Average lost 89% of its value. But something remarkable happened.

Even though unemployment was near 20% in 1931, Coca-Cola sales fell a mere 2.3%.

As Munroe had learned early on, people would spend their last nickel on a Coca-Cola.

And since the company had $6.5 million in cash—over $100 million in today’s dollars—and no debt prior to the crash, Coca-Cola had no problem paying its dividend.

For the people of Quincy, that meant they could keep their heads above water.

Once the economy recovered, Munroe and his town continued to buy shares of Coca-Cola.

And Coca-Cola shares continued to surge.

By the late 1940s, Quincy, Florida became the richest town per capita in the entire United States.

Munroe’s sage advice in the 1920s had minted 67 “Coca-Cola Millionaires” in Quincy, Florida.

And many of these early investors still hold their shares today.

At least I hope they still do; a single share with dividends reinvested bought pre-Great Depression would be worth over $10 million today.

There are a few lessons to be learned here.

The first is investors should focus on well-capitalized companies that pay steady dividends. When reinvested, these slow-growth companies can earn investors big money over the long haul.

Second, you want to buy into companies that can sell their products no matter what’s happening in the economy.

Lucky for you, I found a company that does just that.

Smartphones: The Opiate of the Masses

While soft drink sales are stagnating, there is a new guilty pleasure for the public: smartphones.

It’s no secret that people are addicted to their phones.

Whether they’re strolling down the sidewalk, driving a car, or out to dinner with friends, just about everyone seems glued to their phones.

Internet addiction has already infiltrated society. That’s a fact.

And the companies who provide the underlying infrastructure for these phones are sure to keep profiting, even in a bear market.

There’s only one company that pays a dividend over 6.4% and supplies smartphone infrastructure.

That company is AT&T Inc. (T).

AT&T Inc. (T): an All-Weather Dividend of 6.4%

AT&T is the second-largest wireless carrier in the US.

The company connects more than 100 million devices, including over 80 million prepaid phones.

All in all, its wireless business accounts for 43% of AT&T’s sales.

The company also has a consumer and entertainment segment. This area brings in 32% of sales and includes its DirectTV satellite television business and WarnerMedia.