A recap of finance lessons so far. Based on: Bogleheads, Morningstar classroom, and more Disclaimer: I'm not a financial professional, use at your own risk

Don't wanna be here? Send us removal request.

Text

ESG explained

🚧 This post is mostly complete but there are still some open questions 🚧 It’s unlikely this will be completed within the next month. Last updated: Dec 30 2021

With all your foundational finance knowledge set up, it might feel weird to have an index fund which includes fossil fuel or weapons. It might feel like your values are misrepresented.

ESG investing is an attempt to correct that. This post will explain the current ESG landscape.

Terminology

Before we get too far ahead of ourselves, let’s explain some terms:

ESG - Acronym for Environmental, Social, Governance

Environmental - Focus on carbon footprint, pollution, natural resources, etc

Social - Focus on employees, community, responsible supply chain

Governance - Focus on corporate transparency and accountability

SRI - Socially Responsible Investing, former buzzword for ESG

UN Sustainable Development Goals - 17 focus points introduced by the United Nations

Proxy vote - Vote filed on behalf of a shareholder

Mechanisms for ESG

ESG concepts can be applied in the following manner. We’ll revisit these more thoroughly later.

Divestment - Removing investment from a company

In the ESG context, this is by criteria like a cause (e.g. no tobacco)

Supportive - Investing more in a company

e.g. Investing more in climate change solutions or female leaders

Active ownership - Staying invested in a company to propose/vote to change its course

e.g. Engine No 1 proposed and convinced others to vote to add 3 sustainable board seats to ExxonMobil

Others that I haven’t see

ESG rating systems

One of the hardest problems in ESG is rating companies in different causes. Here are the different rating systems we’ve seen and how they compare.

Ones which use information provided by companies themselves

Bloomberg ESG Data Service

Corporate Knight Global 100

DowJownes Sustainability Index (DJSI)

Ones which don’t have public access (thus we can’t sanity check)

ISS

RepRisk

Refinitiv (fka Thomson Reuters ESG Research Data)

Ones which don’t align with personal gut checks

JUST Capital - e.g. Amazon, Exxon, Facebook

Ones which align with personal gut checks

MSCI ESG Research - e.g. Amazon, Exxon, Facebook

Sustainaltyics - e.g. Amazon, Exxon, Facebook

Ethos - e.g. Amazon, Exxon, Facebook

Sources: https://corpgov.law.harvard.edu/2017/07/27/esg-reports-and-ratings-what-they-are-why-they-matter/ + Google

Note: There are no standards on reporting yet, i.e. MSCI, Sustainalytics, Ethos have wildly different scales and how they break down their causes.

Investing in ESG

With all these different rating systems and causes, it can be quite confusing and frustrating to navigate the available fund options in ESG. i.e. What’s acceptable for one person, doesn’t necessarily mean it’s acceptable for another.

There’s also a problem with companies saying they’re green when they’re not, known as greenwashing.

With those caveats, let’s dive into applying these rating systems:

Using mutual funds and ETFs:

These are the most common investment products for ESG. They usually come in 3 versions:

Divested (and possibly supportive) - e.g. iShares’ ESG MSCI USA Leaders ETF (SUSL) (0.10% ER)

Exclusive (so strictly supportive) - e.g. Calvert’s Green Bond Fund (CGBIX) (0.48% ER)

Active ownership

Only aware of: Engine No 1′s VOTE ETF (tracks ~509 largest stocks, 0.05% ER). OPEN QUESTION: Relationship vs their hedge fund?

While the fees might seem low here, they can easily get very high very fast (e.g. Parnassus’ Endeavor Fund (PARWX) (0.94% ER)).

Additionally, it’s important to keep track of how representative your investments are to your desired benchmark (e.g. more divesting done, further you’ll be).

Additionally additionally. make sure funds aren’t in-fighting with themselves. e.g. divesting from company A in fund X and B in Y, could mean still holding A in Y and B in X.

Direct indexing:

Instead of using mutual funds and ETFs to hold stocks indirectly, we can hold stocks directly through direct indexing.

This wasn’t practical before but is now more approachable with free trading costs, fractional shares, and platforms for this.

Pros: Supports any strategy of divesting, supporting, and active ownership Cons: Cannot delegate voting to a chosen representative (maybe voter guides will become common) (unsure how time consuming this is), only really works for stock - doesn’t really exist for bonds

Platforms which support this:

OpenInvest - Fees were 0.50% (not great) but acquired by JP Morgan

Additional recent acquisitions in this space: Aperio by BlackRock, Just Invest by Vanguard

Do it by hand - Way easier said than done

OPEN QUESTION: I’m sure there are more platforms in this space but haven’t taken a deep look

What is effective

🚧 I’m still iffy on this section, take it with a grain of salt.

Divestment

Divestment has some research against it, and I’ve struggled to find content supporting it.

The rough idea is that share price is based on the company’s assets + future value in an efficient market, so someone with lesser morals will just be buying your share for a discount, then the stock price returns to normal.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3909166

That being said, if you’re don’t want to make money on something you’re morally opposed to (e.g. divest from anti-LGBTQIA+ sentiment), then this is a wonderful option.

Supportive

Calvert has put out an impact report on showing the impact of their green bonds:

https://calvertimpactcapital.org/resources/2020-impact-report

It does directly support contributing more to these factors when done with bonds. At the same time, financially, overweighting in a given sector should mean that we believe in its growth potential or that it’s undervalued. Otherwise, it’s strictly speculative. So take that with a grain of salt.

Active ownership

There seems to be tangible change occurring (at least more than divestment). For example, Engine No 1 has had an impact on both ExxonMobil and GM in the past year.

There have been activist investors for a while as well, but not so much in the retail investor space.

What does Todd do?

I’m still figuring all this out, but I wanted to put all my learnings in writing for sharing with others since I’m going to be back to being busy soon.

In talking with a friend, we concluded that the closest analogies of divestment and active ownership can be viewed as partnerships:

In some cases, we might be past the point of no return and it’s worth cutting ties (e.g. unlikely to convince a weapons manufacturer to stop making weapons)

In other cases, we see potential and think things can be improved (e.g. convincing Exxon to push into sustainable solutions)

To summarize, it will likely be a combination of both choices but still TBD on exactly where we land.

1 note

·

View note

Text

Investment philosophy/plan

Everyone’s financial situation is different (e.g. student loans, children, house, car, salary). As a result, I’m going to outline a high level framework to develop your own financial plan.

If you haven’t read through the first 2 posts, please do that first:

https://toddtalksfinance.tumblr.com/post/189855963566/why-should-you-care-about-finance

https://toddtalksfinance.tumblr.com/post/189858481446/investing-terminology-and-advanced-basics

Emergency funds

Before putting any money towards investment (or maybe even paying off debts), there should be emergency funds set up. This is cash which isn’t strongly tied to the market (e.g. savings account, money market fund, ultra-short bonds) so it can be used in an emergency without downsides (i.e. removing invested funds unexpectedly can cause unnecessary losses and cuts into compound interest via taxes).

I personally keep a 6 month buffer for my monthly expenses. If you don’t know what your monthly spending is, I suggest tracking software like You Need A Budget. Feel free to change this amount to what makes you most comfortable (e.g. 3 months, 1 year, 3 months + medical deductible).

Taxes

Investments encounter 2 kinds of taxes in their lifetime:

Taxes on dividends

Taxes when we sell an asset (capital gains/losses)

Dividends from assets held under 121 days (simplification) are called ordinary dividends, taxed using the same brackets as salaried income (e.g. 10%, 12%, 22%, etc).

Assets that are sold at/under a year are called short term capital gains/losses and receive the same tax treatment.

Assets that are sold over a year are called long term capital gains/losses and receive a 0%, 15%, and 20% tax bracket (excluding depreciation recapture, collectibles, net investment income tax).

Dividends from assets held over 121 days (simplification) are called qualified dividends and use the long term capital gains brackets.

Source: https://www.nerdwallet.com/blog/taxes/capital-gains-tax-rates/

To control which assets are sold, we can use a “Specific Identification” cost basis method (cost basis = price purchased for). Every brokerage firm is different so please look up your firm’s instructions.

There’s a lot more to say on taxes (e.g. negating gains/losses, loss offsetting salary, wash sale rule, tax loss harvesting) but I’ll leave those as independent research. I avoid routine tax loss harvesting because its drawbacks often outweigh its benefits (i.e. it's tax deferral not removal, resets qualified dividends/long term capital gains timer, carryover can rinse out in a low tax year).

Account types

There are 3 common account types:

Taxable account - Run of the mill brokerage account, no special contribution limits or tax benefits

Tax-deferred - Accounts where initial amount (principal) is contributed tax-free and then taxed on withdrawal (e.g. traditional IRA, 401(k))

Tax-free - Accounts where post-tax dollars can be contributed and the interest accrued inside is tax-free upon withdrawal (e.g. Roth IRA, Roth 401(k), 529 plan)

These latter 2 are also called tax-sheltered accounts. There’s also accounts like HSAs which are both tax-deferred and tax-free federally but are potentially taxed at the state level.

Contributing to a tax-sheltered account fully depends on your financial situation. I personally like to max out 401(k) employer matching (instant bonus to salary) and contribute fully to a Roth IRA as, in a worst case scenario, I can withdraw the principal without a penalty.

In addition to our contributions, we need to choose what assets to store in tax-sheltered accounts. I prefer 100% stocks as they’ll yield the largest total return over time but some friends prefer 100% bonds to make the dividends tax-free.

Investment goals/horizons

We should outline our goals for our portfolio (e.g. want to have X kids, want to buy a car in the next Y years). For these goals, we should pick an asset class/mixture that aligns with our timeline. Based on historical performance, we know that:

Bonds generally perform well over 3 years and longer

Stocks generally perform well over 10 years (i.e. 10% annual increase over historical 10 year spans) but can perform poorly in shorter time frames

From this, we can choose our assets accordingly. Examples:

If something is happening in under 2 years, then it's best to use money market and ultra-short term bonds

If something is happening in 2-4 years, then it's best to lean more towards bonds

If something is happening in over 5 years, then it's best to lean more towards stocks

There's obviously more complexity that can be added to this (e.g. slowly shift portfolio from one area to another as horizon gets closer) but that’s the gist.

Reference: https://news.morningstar.com/classroom2/home.asp?colId=138&CN=COM

Dollar cost averaging

When contributing to a portfolio, my preferred method is dollar cost averaging. This is when someone contributes the same amount of money at a regular interval to their portfolio (e.g. $500 every 2 weeks). This is to prevent receiving a spot price for the entire amount (e.g. $12,000 for the entire year, all at once) which may be good or bad vs average (can’t tell until later). Instead, this technique gives the effective average price over a given time period and helps avoid market emotions/corrections.

Why use Vanguard?

Readers may have noticed that I prefer Vanguard. You are correct in that observation.

I prefer Vanguard as they’re the only brokerage company where its fund investors are company shareholders.

At all other companies, there’s a conflict between people who invest in the funds (account holders) and people who invest in the company itself (shareholders). This conflict results in situations like keeping costs low vs making a larger profit for shareholders.

By this same stroke, this is why I also like Bogleheads. Jack Bogle was the founder of Vanguard. Bogleheads is a forum/wiki of likeminded people.

Reference: https://about.vanguard.com/who-we-are/a-remarkable-history/

Selecting funds

I prefer to keep my portfolio simple with 4 large low-cost funds:

US stock index, https://investor.vanguard.com/mutual-funds/profile/VTSAX

US bond index, https://investor.vanguard.com/mutual-funds/profile/VBTLX

Int’l stock index, https://investor.vanguard.com/mutual-funds/profile/VTIAX

Int’l bond index, https://investor.vanguard.com/mutual-funds/profile/VTABX

I support you to either use this selection, use something even simpler (e.g. 3 bonds), or explore other funds.

Reference: https://www.bogleheads.org/wiki/Vanguard_four_fund_portfolio

Keep in mind that when selecting funds, we should look at total return not share price (i.e. total return = price + dividends + distributions). Websites like Google will only display share price which doesn’t include gains from dividends or distributions. Websites like Morningstar and Vanguard will accurately inform us.

Alternative investments

Outside of bonds, there are investments which also have low correlations to stocks (e.g. real estate, precious metals, art, crypto). Real estate is encompassed by index funds (wasn’t before 2016) so I don’t add any additional amounts to my portfolio. I’m on the fence about other alternatives as they don’t contribute to the economy (i.e. value comes from scarcity) which seems counter-productive to the goal of investing (i.e. providing value to derive further value).

Selecting a ratio

As covered the Investing terminology and advanced basics post, ratios with more stocks/less bonds can yield larger yet riskier returns. An aggressive portfolio would be 90/10 stocks/bonds, a conservative one would be 50/50. The end goal should be a ratio that not only makes you happy while you’re making gains but also a ratio where you won’t panic and sell if the market is down.

My current ratio is 84/16 stocks/bonds. Here are some models/tools to help you further consider this choice:

Models from Vanguard: https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations

Questionnaire from Vanguard: https://personal.vanguard.com/us/FundsInvQuestionnaire

Investment checkup from Personal Capital (requires account): https://home.personalcapital.com/page/login/app#/investment-checkup/allocation

In addition to stocks/bonds, we need to consider our US/International ratio. I like to use the ratios that Vanguard uses for their target retirement funds:

60/40 US/Int’l stocks

70/30 US/Int’l bonds

Reference: https://investor.vanguard.com/mutual-funds/profile/VTTSX

I previously thought these were based on the world market cap but have since learned stocks are ratio’d for diversification/reduced volatility: https://www.vanguard.com/pdf/ISGGEB.pdf (page 5)

Rebalancing/portfolio maintenance

As time goes on, assets will grow faster/slower than each other and drift away from our target ratio. As a result, we need to consider our strategy for correcting this drift.

Vanguard’s research concludes that in general, rebalancing is best done annually or semi-annually when assets drift 5% away from their target (i.e. stocks/bonds ratio, care less about US/Int’l ratio here).

We can rebalance with redirected income but it will detract from any dollar cost averaging we’re doing thus altering return/risk profile from our intention.

Depending on your financial situation, you can consider rebalancing within tax-sheltered accounts. This is a good way to avoid taxable events.

For further reading, see: https://www.vanguard.com/pdf/ISGPORE.pdf

For seeing our current allocations, we can use tools like:

Spreadsheets

Vanguard’s Portfolio Watch: https://personal.vanguard.com/us/AnalyticsPageController

Personal Capital’s Investment Checkup: https://home.personalcapital.com/page/login/app#/investment-checkup/allocation

Writing a plan

Now that we’ve got all these ideas laid out, let’s consolidate them into a document. Bogleheads and Morningstar have some templates:

Bogleheads Investment Philosophy video: https://youtu.be/rmUJeDRGi2k?t=102

https://www.bogleheads.org/wiki/Investment_policy_statement

https://im.morningstar.com/im/InvestPolicyWS.pdf

I wrote my own template, based off of those above, as a text document:

Click here for standalone version

Written 2019-02-28 Numbers omitted to avoid revealing too much personal information # Foreword This can be adjusted as per our needs. Please do put in thought and effort but also don't hinder your enjoyment of life either # Large 2019 spending: AfrikaBurn 2019 (late April): $XXX ($XXX travel, hostel, buffer) Burning Man 2019 (late August): $XXX ($XXX ticket, food + water, costumes, anything else) Thanksgiving 2019: $XXX ($XXX/travel, $XXX/hotels) # Life goals Marriage/kids (deferred): $XXX/child (distributed over 18 years) House (deferred): No longer have an accurate estimate, need to revisit College savings for children (deferred+18 years): $XXX/child (distributed over 4 years) Retirement (XXX years): No longer have an accurate estimate, need to revisit # Metholodogy > Assuming making salaried income - Update all assets to reinvest dividends - We choose funds which have large cap and low turnover to avoid nuances between mutual funds and ETFs (tax implications) - Set aside income for upcoming large expenses at 3 months ahead of event date (usually when we start planning) - This should be in a money market account (guaranteed income with trivial risk) - Continue to maintain 6 month cash emergency fund (immunization against everything going wrong (all markets tank, lose job)) - This should be in a money market (possibly municipal to optimize for taxes), ultra-short bonds (a little higher risk for higher reward), or no-penalty CD - Invest all other salaried income into assets - Fill up 401k/403b employer match first (assuming 1:1 match), then up Roth IRA first (we can recharacterize at end of year), then HSA, then possibly 401k/403b (depends on financial position/goals) - Unsure how this will work when we have multiple goals, maybe even split, maybe ratio'd, maybe invest enough principal so we guarantee goal is met on time # Investment philosophy Break down assets into portfolios to meet goals directly Don't get greedy and take on more risk than necessary for a specific goal/timeline Match/index the market, don't try to beat it. Ride the efficient frontier to maximize risk-reward tradeoffs. Keep frictional costs minimal to maximize compounded returns # Portfolio - Marriage/kids Not planning until it becomes a closer reality # Portfolio - House Not planning until it becomes a closer reality # Portfolio - College savings for children Not planning until it becomes a closer reality # Portfolio - Retirement ## Account types - Taxable - Roth IRA - Traditional IRA - HSA (triple tax-exempt federally, principal is tax-exempt in California but gains aren't (treated as income)) - Using ability to redeem expenses at any time as our withdrawal method so it's an investment vehicle -- not healthcare only, https://investorjunkie.com/38158/health-savings-account-tax-efficient-investment-alternative/ ## Investing priorities - Taxable, all assets - IRAs and HSA, stock only (so we can maximize gains without worry about taxes cutting into them) ## Asset allocation 86/14 stocks/bonds Stocks: 60/40 domestic/international; following global index -- using 2 Vanguard funds and FTSE All-World Index as benchmarks: https://investor.vanguard.com/mutual-funds/profile/VTTSX (60.1% domestic (54.1/(54.1+35.9)) https://investor.vanguard.com/mutual-funds/profile/portfolio/vtwax (57.2% domestic) https://www.google.com/search?q=FTSE+All-World+Index (only 100 stocks) > Added 2019-12-16: 40% non-US is also good for reducing volatility via Vanguard, https://www.vanguard.com/pdf/ISGGEB.pdf (page 5) Bonds: 70/30 domestic/international; following global index -- using 2 Vanguard funds as benchmarks, easier than comparing benchmarks: https://investor.vanguard.com/mutual-funds/profile/VTTSX (70% domestic (7/(7+3))) https://investor.vanguard.com/etf/profile/portfolio/bndw (47.7% domestic (looking at total bond market ETF, not North America)) ## Funds used We use separate funds for domestic/international so that we can easily adjust our foreign investment tax-efficiently via SpecId as retirement approaches Domestic stock: VTSAX Int'l stock: VTIAX Domestic bonds: VBTLX (has currency hedging baked in) Int'l bonds: VTABX All expense ratios are at most 0.11% (weighted average was 0.068% with allocation ratio) Domestic stock: VTSAX, 0.04% -- https://investor.vanguard.com/mutual-funds/profile/overview/vtsax Int'l stock: VTIAX, 0.11% -- https://investor.vanguard.com/mutual-funds/profile/overview/vtiax Domestic bonds: VBTLX, 0.05% -- https://investor.vanguard.com/mutual-funds/profile/overview/vbtlx Int'l bonds: VTABX, 0.11% -- https://investor.vanguard.com/mutual-funds/profile/overview/vtabx Additionally, turnover is very low and large-sized to avoid unnecessary taxes on dividends from mutual funds We prefer mutual funds to ETFs for investing as with the above guideline they're indistinguishable then we get perks like buying fractional shares and quicker transaction times (T+1, not ETF T+2) # Other Automate contributions whenever possible Rebalance yearly when we are out of bounds by 5% Not any sooner, Vanguard research shows 5% with monitoring annually/semi-annually is ideal, https://www.vanguard.com/pdf/icrpr.pdf Do best to perform all rebalancing in tax-sheltered accounts (e.g. IRAs, HSA) Rebalancing is best done by adding new money first, then rebalancing assets themselves Don't try to time the market Exact sub-allocations aren't as important as overall 86/14 stocks/bonds allocation Tax-treatments change for assets (e.g. qualified dividends became capital gains in 2003) so stay up to date with tax codes and adjust strategy accordingly (e.g. using tax-sheltered accounts for stocks vs bonds) # References Based on: https://youtu.be/rmUJeDRGi2k?t=102 Could also use: https://www.bogleheads.org/forum/viewtopic.php?p=852539#852539 https://www.bogleheads.org/wiki/Investment_policy_statement#Real-World_IPS

And that’s it! That’s all I have to share for now. I hope these blog posts have served as a good start on your financial journey.

Further reading:

Bogleheads investment philosophy: https://www.bogleheads.org/wiki/Video:Bogleheads%C2%AE_investment_philosophy

Morningstar classroom: https://news.morningstar.com/classroom2/home.asp

0 notes

Text

Expanding on stocks, bonds, and funds terminology

This post isn’t necessary for a basic investment plan/philosophy. It’s most practical for feeling less overwhelmed when browsing/selecting funds. We’ll define more common terms so you can understand what to/not to care about. If you’d like to skip ahead, the next post is: Investment philosophy/plan.

Fund turnover

When someone leaves a mutual fund, they must be paid in cash. Depending on the size of the fund, there might not be cash on hand to pay them directly.

If there’s not enough cash available, then assets must be sold -- this event can cause a distribution of excess cash to all fund shareholders.

Turnover rate is how much/often funds buy/sell assets so it includes large unexpected sells consequently. As an investor, a turnover rate under 10% is good -- anything above that should be a consideration before investing in a fund.

Morningstar shows turnover rate on their site:

Source: https://www.morningstar.com/funds/xnas/vtsax/quote

One way to avoid turnover is to use an ETF which we’ll cover next.

ETF pros and cons

As covered in Investing terminology and advanced basics, traditional mutual funds and ETFs both operate similarly. Here’s their differences:

ETF pros:

Can pass-through securities to seller on sale, thus removing possibility for unexpected distributions/turnover

No 30 day waiting period after selling; most mutual funds disallow buying again for 30 days after selling, ETFs don’t have this

Minimum investment is price of share (e.g. $40-150) whereas mutual funds often have larger minimums (e.g. $3,000 in Vanguard)

Occasionally lower expense ratios than mutual funds

ETF cons:

Traded at a market rate during the day (can have small premium/discount (more/less expensive)) whereas mutual funds are priced/transacted at the end of the day at their Net Asset Value (NAV)

Takes 2 days to settle after transaction date (T+2) whereas mutual funds take 1 day (T+1)

Requires buying/selling full shares (e.g. if price is $50, then can’t buy $40) whereas mutual funds allow any dollar amount (e.g. can buy $40)

Note: Some brokerage firms are starting to allow fractional shares (i.e. can actually buy $40 of a $50 ETF (0.8 shares)) (e.g. Schwab, Robinhood, SoFi)

Vanguard allows converting mutual funds to ETFs but not vice versa, https://investor.vanguard.com/etf/faqs#convert

Stock investing

I don’t partake in stock investing because, according to research, I must select stocks correctly 65% of the time to beat an index fund.

Source: https://news.morningstar.com/classroom2/course.asp?docId=2873&page=2&CN=COM

That being said, there’s 2 common non-speculative methods:

Value investing - Invest in a stock whose price is below its actual value

Growth investing - Invest in a stock which is growing rapidly or you expect to be growing soon

There’s more considerations to make for these investments (e.g. market emotions/corrections, comparing stock price to earnings/other numbers from SEC documents, considering moats). If you’d like to read more, I suggest Morningstar classroom’s stock section:

https://news.morningstar.com/classroom2/home.asp?colId=397&CN=COM

General fund terminology

Investor vs admiral vs institutional shares - Same underlying investments with larger minimum investment in exchange for lower expense ratio ETFs don’t have this distinction and Vanguard has phased out many investor funds (i.e. now many admiral funds have low minimum investment). Examples:

Investor: https://investor.vanguard.com/mutual-funds/profile/VFISX

Admiral: https://investor.vanguard.com/mutual-funds/profile/VFIRX

Institutional: https://investor.vanguard.com/mutual-funds/profile/VSBIX

ETF: https://investor.vanguard.com/etf/profile/VGSH

US/domestic vs international/foreign vs global/world - Investments inside US, outside US, or a mixture of both Global/world funds will often state their breakdown -- e.g. Vanguard Total World Stock Index Fund, VTWAX, below:

Source: https://investor.vanguard.com/mutual-funds/profile/VTWAX

Developed vs emerging - International fund with different sets of countries Developed countries are ones with “proven economies” (e.g. Japan, France, UK) Emerging countries are ones with “developing economies” (e.g. India, Brazil, Taiwain) Reference: https://investor.vanguard.com/mutual-funds/international

Balanced - Mixture of stocks and bonds in fund These will often state their breakdown -- e.g. Vanguard Balanced Index Fund, VBIAX, below:

Source: https://investor.vanguard.com/mutual-funds/profile/VBIAX

Stock fund terminology

Value vs growth vs blend - Fund that invests in value stocks, growth stocks, or a mixture of both (blend)

Large vs mid vs small cap - Fund that invests in companies with a market cap over $10B (large), between $10B and $2B (mid), or under $2B (small) As one might expect, these all move similarly but small cap sees bigger fluctuations than large cap

Comparison of VLCAX, VIMAX, and VSMAX in Morningstar (large, mid, small cap funds respectively)

These two comparisons are often used in a style box:

Source: https://investor.vanguard.com/mutual-funds/profile/portfolio/vtsax

Bond fund terminology

Short vs intermediate vs long term - Time until a bond matures (i.e. stops paying out and is cashed in, if not done sooner) Short is 1-5 years, intermediate is 5-10 years, long is over 10 years. Other timeframes include: money market (0-1 year), ultra-short (0-3 years). Reference: Summaries for VUBFX (ultra-short), VBIRX (short), VBILX (intermediate), VBLAX (long) and https://www.investopedia.com/terms/m/moneymarket.asp

Government vs corporate - Loan created by different entities Government bonds are very secure as taxes can always be raised to pay off the loan. Corporate bonds receive a rating from an independent agency to determine how likely the loan will be paid back (i.e. risk). Example ratings are: AAA, AA, A, BBB, etc. There’s additional factors that can be used to improve a rating (e.g. collateralizing a bond) but I won’t be diving any deeper. Further reading: https://news.morningstar.com/classroom2/home.asp?colId=167&CN=COM

Municipal/Tax-exempt - Government bond which has tax exemption at federal and possibly state level (depends on fund and state of residence) Yields aren’t always as high but depending on your income, it can yield more after taxes. Example: California Municipal Money Market, VCTXX, https://investor.vanguard.com/mutual-funds/profile/VCTXX

GNMA (Ginnie Mae), FNMA (Fannie Mae), FHLMC (Freddie Mac) - Federal programs for mortgages/mortgage pools (i.e. investing in these is effectively investing mortgages/real estate)

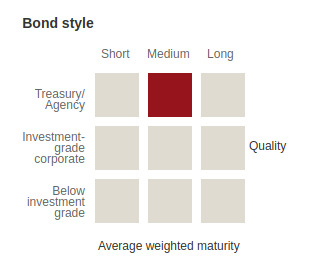

Bonds are more nuanced than stocks due to being individualized (e.g. a 20 year bond/note is different than the same 30 year version) but there’s a style box for them regardless. Investment grade means the credit rating is good enough for the maturity (time frame) that it’s a good investment. Note: Style box is colored for the majority of investments not all (i.e. 43.7% treasury bonds, 22.0% government mortage-backed, 16.4% industrial, 8.4% finance, etc).

Source: https://investor.vanguard.com/mutual-funds/profile/portfolio/vbtlx

Up next will be a post covering investing philosophy (e.g. goals/horizons, writing a plan).

Further reading:

Morningstar classroom: https://news.morningstar.com/classroom2/home.asp

Vanguard mutual fund/ETF list (Google anything you’re curious about): https://investor.vanguard.com/mutual-funds/list

Next post: Investment philosophy/plan

0 notes

Text

Investing terminology and advanced basics

When starting investing, all the terminology can be overwhelming and it can be confusing as to what to pay attention to. Here’s the takeaways I would have found most practical at first.

Broad scope definitions

Brokerage account - Account used with brokerage firms (e.g. Vanguard, TD Ameritrade, Fidelity, etc) to trade stocks, bonds, CDs, etc

Stock - Ownership in a company, represented via units called “shares” Stock is also known as equity. Shares are also known as certificates. These have value due to:

Upon a company declaring bankruptcy, they sell their assets (e.g. computers, contracts) then first pay off bonds/loans (legally required) then distribute the remainder to stock shares

Enables voting power which directs company’s board of directors

In reality, stock price has additional factors but I’m skipping those for now.

Stock market/stock exchange - Physical/digital interface for people to buy/sell stock shares. Two largest ones in the US are NASDAQ and NYSE (New York Stock Exchange)

Bond - Loans with a given pay-back schedule (e.g. oversimplification: $5000 loan with $50 paid every 6 months)

Mutual fund - Investment vehicle, formed as a company or trust, which holds an agreed upon assortment of stocks, bonds, and/or other investment items (e.g. CDs) Examples:

Vanguard Total Stock Market Index [Mutual] Fund, VTSAX, https://investor.vanguard.com/mutual-funds/profile/VTSAX

Vanguard Total Bond Marked Index [Mutual] Fund, VBTLX, https://investor.vanguard.com/mutual-funds/profile/VBTLX

ETF (Exchange Traded Fund) - Stock market traded mutual fund; mutual fund formed as a company with its stock shares on a stock market exchange (e.g. NASDAQ, NYSE) I’m skipping pros/cons vs a traditional mutual fund for now. It usually doesn't make a difference in very large funds. Examples (equivalent to mutual funds above):

Vanguard Total Stock Market ETF, VTI, https://investor.vanguard.com/etf/profile/VTI

Vanguard Total Bond Market ETF, BND, https://investor.vanguard.com/etf/profile/BND

Investing costs definitions

Expense ratio - Annual rate charged for using a mutual fund/ETF. This is usually a low percentage but can get high for some funds (e.g. 1%) Examples:

VTSAX has 0.03% expense ratio, https://investor.vanguard.com/mutual-funds/profile/VTSAX

VBTLX has 0.05% expense ratio, https://investor.vanguard.com/mutual-funds/profile/VBTLX

Active management/Actively managed fund - When a person/team of persons are picking/selecting assets to invest in for a mutual fund These funds often have high expense ratios due to manual labor costs. Examples:

Vanguard Emerging Markets Select Stock Fund, VMMSX, https://investor.vanguard.com/mutual-funds/profile/VMMSX

Fidelity® Leveraged Company Stock, FLVCX, https://www.morningstar.com/funds/xnas/flvcx/quote

Passive management/Passively managed fund - When asset buying/selling is controlled by an algorithm/formula I'll explain the common formulas in a bit (keyword: "index fund"). Examples:

Vanguard Total Stock Market Index Fund, VTSAX, https://investor.vanguard.com/mutual-funds/profile/VTSAX

Vanguard Total Bond Marked Index Fund, VBTLX, https://investor.vanguard.com/mutual-funds/profile/VBTLX

Investing portfolio definitions

Portfolio - Collection of stocks, bonds, funds, etc held in a brokerage account or across all accounts

Risk - Likelihood of asset losing or gaining value Risk can also be conveyed as volatility (e.g. higher risk, more volatile). I will cover this more in depth later (keyword: "efficient frontier").

Market capitalization/market cap/mkt cap - Total value of a company's shares e.g. If Apple's shares are worth $255.82 each and there’s 4.6 billion shares total, then we can multiply them to get the market cap: $1.17 trillion Examples:

https://www.google.com/search?q=NASDAQ:+AAPL

https://www.google.com/search?q=NASDAQ:+GOOG

Stock index - Algorithm/formula to track companies based on specific features For example, the S&P 500 Index (Standard and Poor 500) tracks the largest 500 US companies (largest by market cap). It doesn't hold all stocks in equally though (e.g. not 1/500 each), it uses their market caps to determine how much of each to hold. e.g. If the S&P market cap is $25.6 trillion (total of top 500 market caps) and Apple's market cap is $1.17 trillion, then 4.5% (1.17/25.6) of the S&P money will be invested in AAPL. Examples:

S&P 500, https://en.wikipedia.org/wiki/S%26P_500_Index

Dow Jones Industrial Average (DJIA), https://en.wikipedia.org/wiki/Dow_Jones_Industrial_Average

Index fund - Passive mutual fund which follows a given stock index Examples:

VOO tracks the S&P 500 stock index. We can see AAPL in its portfolio here: https://investor.vanguard.com/etf/profile/portfolio/VOO/quarter-end-holdings

VTSAX tracks entire stock market (i.e. all companies, not just top 500). https://investor.vanguard.com/mutual-funds/profile/portfolio/VTSAX/quarter-end-holdings

Both DJIA and S&P 500 represent the entire stock market quite well but I prefer VTSAX

Sector - Stock market companies can be categorized into 11 different categories (via the Global Industry Classification Standard (GICS)):

Energy

Materials

Industrials

Consumer Discretionary

Consumer Staples

Health Care

Financials

Information Technology

Telecommunication Services

Utilities

Real Estate

Explanations can be found here: https://etfdb.com/etf-education/the-10-sectors-of-the-stock-market/

These sectors change dynamically with the economy (e.g. people will spend less on luxury goods in a recession so "Consumer Discretionary" will dip).

Sector fund - Passive mutual fund which uses a stock index for all companies within a given sector. Examples:

Vanguard Energy Fund, VGENX, https://investor.vanguard.com/mutual-funds/profile/VGENX

Vanguard Health Care Fund, VGHCX, https://investor.vanguard.com/mutual-funds/profile/VGHCX

As you might have guessed, as we go from:

Stock -> sector fund -> total market index fund

That we go from: high risk -> low risk

Having a stake in a total market index fund still has a stake/representation in a company’s stock but if the starts performing poorly, then it'll have less of an effect on our portfolio. Conversely, if it performs well, then it will also have a less positive effect.

Efficient frontier/Modern portfolio theory

This is an advanced concept but I’d like to get it out of the way earlier for those who already have a portfolio.

Research has shown that holding multiple low/negatively correlating assets leads to lower risk and higher returns in the end. Lucky for us, stock and bonds have low correlation values.

We can see this in the graphs below. If there was a correlation, then they’d move up/down at similar times. However, there is no correlation so they don’t.

Source: https://www.financialsamurai.com/historical-returns-of-different-stock-bond-portfolio-weightings/

As mentioned, the research expands further to generate a graph showing the “Efficient Frontier“. It demonstrates how holding stocks and bonds at different ratios can yield better risk and reward for our portfolio. e.g. 25% stocks/75% bonds has lower risk and higher reward than 100% bonds.

Source: https://www.youngresearch.com/authors/ejsmith/risk-and-reward-an-efficient-frontier/

In addition to this graph, Vanguard has most stock/bond combinations and how much they can lose/gain in a given year (e.g. -43.1%/+54.2% for 100% stocks, -8.1%/+32.6% for 100% bonds). More practically we can look at their average returns (i.e. +10.1% for 100% stocks, +5.3% for 100% bonds). However, it’s practical to keep in mind that to receive these averages, it must be over a long time period (e.g. at least 3-5 years for bonds, at least 5-10 for stocks). https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations Using this information we can start to determine the ideal stocks/bonds ratio for our portfolio. There is even more to consider (e.g. domestic/international ratio) but I'll stop here for now as there's plenty other items I've omitted and this is a good start.

Further reading:

How stock fits into a company's financial structure: https://www.khanacademy.org/economics-finance-domain/core-finance/stock-and-bonds

How a bond really works: https://www.investopedia.com/terms/b/bond.asp#characteristics-of-bonds

Morningstar classroom: https://news.morningstar.com/classroom2/home.asp

Bogleheads investment philosophy: https://www.bogleheads.org/wiki/Video:Bogleheads%C2%AE_investment_philosophy

Next post: Expanding on stocks, bonds, and funds terminology

0 notes

Text

Why should you care about finance?

The short answer is the sooner you start caring, the more you’ll be rewarded.

To understand this, we need to first understand compound interest vs simple interest.

When money gains interest, that doesn't only get added back to your bank account but that interest itself collects interest.

Below is a graph comparing simple interest vs compound interest for $10,000 and 8% annual interest.

Simple interest only collects interest on the original amount

Compound interest collects interest on the original amount PLUS interest on the interest

As we can see from the graph, it really takes off as we let the money sit for longer.

Simple interest grew to $34,000.00 in 30 years

Compound interest grew to $100,626.57 in 30 years

That’s a difference of 3x vs 10x growth!

This ties into the second point: The sooner finances are in a growing pattern, then the more time it will have to compound and grow.

By this same rule, this is the reason we should eliminate high interest debts first then work our way down until we have no debts left.

Relevant content:

Rule #2 from https://www.bogleheads.org/wiki/Video:Bogleheads®_investment_philosophy

https://www.fool.com/knowledge-center/compound-interest.aspx

Next post: Investing terminology and advanced basics

0 notes