Don't wanna be here? Send us removal request.

Text

Swinging Towards Success: Unlocking the Potential of Options Trading for Beginners

Swinging Towards Success: Unlocking the Potential of Options Trading for Beginners

In the complex world of financial markets, options trading has emerged as a popular and lucrative investment strategy. This article will provide a comprehensive guide to understanding and harnessing the potential of options trading for beginners. We will explore the benefits of options trading, delve into the fundamentals of options, discuss how to get started, and outline strategies for success. By the end of this article, you'll have a solid foundation to embark on your own options trading journey.

Benefits of Options Trading

A. Potential for higher returns

When it comes to potential returns, options trading offers unique advantages over traditional stock trading.

1. Leverage and limited risk: Options provide investors with the ability to control a larger position with a smaller investment. This leverage allows for potentially higher returns while limiting the risk to the initial investment.

2. Ability to profit in bearish or bullish markets: Unlike traditional stock trading, options trading allows investors to profit in both rising and falling markets. By utilizing various options strategies, traders can take advantage of market volatility and generate profits regardless of the market direction.

B. Portfolio diversification

1. Hedging against stock market risks: By incorporating options into their investment portfolio, beginners can hedge against stock market risks. Options can act as a form of insurance, providing protection against potential losses in a stock position.

2. Adding flexibility to investment strategies: Options trading enables beginners to explore different investment strategies and gain flexibility in their portfolio management. By utilizing options alongside traditional stock positions, investors can create a balanced and diversified portfolio that suits their financial goals.

Understanding Options

A. Basics of options

1. Call and put options: Options are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a predetermined timeframe. Call options allow investors to buy the underlying asset, while put options give investors the right to sell the underlying asset.

2. Strike price and expiration date: Options contracts have a strike price, which is the price at which the underlying asset can be bought or sold, and an expiration date, which marks the end of the options contract.

B. Types of options

1. American vs. European options: American options can be exercised at any time before the expiration date, while European options can only be exercised on the expiration date itself.

2. Stock options vs. index options: Stock options are based on individual stocks, while index options are based on broader market indexes such as the S&P 500. Each type of option has its own unique characteristics and trading strategies.

Getting Started with Options Trading

A. Setting up a trading account

1. Choosing a reliable broker: When starting with options trading, it's crucial to choose a reliable broker that offers a user-friendly platform, competitive fees, and a wide range of options contracts.

2. Understanding account requirements and fees: Beginners should familiarize themselves with the account requirements and fees associated with options trading. This includes minimum account balances, transaction fees, and margin requirements.

B. Basic trading terminology

1. Bid and ask prices: The bid price is the price at which buyers are willing to purchase an options contract, while the ask price is the price at which sellers are willing to sell. The difference between these two prices is known as the bid-ask spread.

2. Option chains and order types: Option chains provide traders with a detailed overview of available options contracts. Traders can place various types of orders, including market orders, limit orders, and stop orders, to execute their trades.

Selecting the Right Options

A. Fundamental analysis for options trading

1. Evaluating company financials and news: Beginners should evaluate the financial health and news surrounding a company before trading options. This analysis helps in understanding the potential direction of the underlying asset

2. Understanding market trends: By monitoring market trends, beginners can identify potential opportunities and determine the best options trading strategies to employ.

B. Technical analysis for options trading

1. Identifying support and resistance levels: Technical analysis involves examining historical price charts to identify support and resistance levels. These levels help traders make informed decisions about entry and exit points for options trades.

2. Using indicators and patterns: Various technical indicators and chart patterns can assist in predicting future price movements. Beginners should learn to use these tools to gain an edge in options trading.

Developing a Trading Strategy

A. Risk management and position sizing

1. Determining risk tolerance: Before initiating any options trade, it's essential to assess your risk tolerance and set appropriate risk management guidelines. This includes determining the maximum amount of capital you're willing to risk on a single trade.

2. Calculating the appropriate position size: Position sizing is a crucial aspect of options trading. Beginners should calculate their position size based on their risk tolerance and the size of their trading account.

B. Strategic approaches for options trading

1. Long vs. short options: Long options involve buying options contracts, while short options involve selling them. Each approach has its own unique risk and potential profitability.

2. Spread trading strategies: Spread trading involves simultaneously buying and selling multiple options contracts with different strike prices or expiration dates. These strategies can help beginners minimize risk and optimize potential returns.

Implementing and Monitoring Trades

A. Placing option orders

1. Market, limit, and stop orders: Traders can place different types of orders to execute their options trades. Market orders are executed immediately at the prevailing market price, while limit orders allow traders to set a specific price for execution. Stop orders are triggered when the market reaches a specific price level.

2. The importance of timing: Timing plays a crucial role in options trading. Beginners should consider the timing of their trades, keeping in mind market conditions and potential news events that may impact the price of the underlying asset.

B. Managing open positions

1. Setting profit targets and stop-loss orders: It's essential to set profit targets and stop-loss orders to manage open options positions. This helps in locking in profits and limiting potential losses.

2. Adjusting positions as market conditions change: Market conditions are constantly changing, and beginners should be prepared to adjust their positions accordingly. This may involve closing out positions or adjusting options strategies to adapt to new market trends.

Learning Resources and Continuing Education

A. Online courses and webinars

1. Reputable options trading courses: Online courses and webinars provide beginners with in-depth knowledge and practical skills to master options trading. It's important to choose reputable courses that are taught by experienced professionals.

2. Interactive educational platforms: Interactive platforms offer simulated trading environments where beginners can practice their options trading strategies without risking real money. These platforms provide a valuable learning experience and help build confidence.

B. Books and literature

1. Recommended options trading books for beginners: There are several books available that cater specifically to options trading beginners. These books provide valuable insights and strategies to enhance trading skills.

2. Accessing market analysis and research: Beginners should explore resources that offer market analysis and research to stay updated on market trends and potential trading opportunities.

Common Mistakes to Avoid

A. Overtrading and chasing quick profits: Beginners should avoid the common pitfall of overtrading and chasing quick profits. It's important to develop a disciplined and patient approach to options trading.

B. Neglecting risk management: Risk management is crucial in options trading. Beginners should never overlook the importance of protecting their capital and managing risk appropriately.

C. Failing to adapt to changing market conditions: Market conditions are dynamic, and beginners should be prepared to adapt their trading strategies as conditions change. Flexibility is key to long-term success in options trading.

In conclusion, options trading holds immense potential for beginners looking to enter the world of financial markets. By understanding the benefits, fundamentals, and strategies involved in options trading, beginners can unlock opportunities for higher returns and diversify their investment portfolios. It's important to arm yourself with the knowledge and continue to learn and practice to navigate the complexities of options trading. Start your options trading journey today and swing towards success!

0 notes

Text

The Act of Buying and Trading Securities to Profit

Trading is the art of buying and selling securities to make a profit. It is a dynamic and ever-changing field that requires knowledge, experience, and a deep understanding of the financial markets. In this article, we will explore the world of trading, focusing on stock market swing trading and options trading, and shed light on the expertise, authority, and trust that traders like TraderPearl possess in this domain.

Trading: A Brief Overview

Trading is the process of buying and selling financial instruments, such as stocks, bonds, options, or commodities, in various markets. Traders aim to take advantage of price fluctuations and other market factors to generate profits. This can be accomplished through various strategies, including swing trading and option trading.

Stock Market Swing Trading

Swing trading is a popular trading strategy that involves capitalizing on short-term price movements within a larger trend. Swing traders typically hold their positions for a few days to a few weeks, aiming to capture ‘swings’ in the market. This strategy requires careful analysis of technical indicators, chart patterns, and market sentiment.

Option Trading

Option trading is another popular form of trading that involves the buying and selling of options contracts. An option gives the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period. Options traders can profit from the price movements of the underlying asset, as well as the volatility and time decay of the options themselves.

TraderPearl: The Experience and Expertise

TraderPearl is an experienced and knowledgeable trader who has honed her skills over many years. With a deep understanding of market dynamics, technical analysis, and risk management, she has established herself as a trusted authority in the trading community.

Authority and Trust in Trading

In the fast-paced and competitive world of trading, establishing authority and trust is crucial. TraderPearl has earned the respect of her peers through her consistent profitability and transparent approach. Through her regular market analysis, educational content, and community engagement, she has become a go-to source for traders seeking reliable information and guidance.

Why Trust Matters in Trading?

When it comes to trading, trust is everything. Traders put their hard-earned money on the line, and they need to trust that the information they rely on is accurate and reliable. TraderPearl understands the importance of trust and strives to provide her followers with the most up-to-date and trustworthy insights and strategies.

The Importance of Experience

Experience is a key factor in trading success. TraderPearl’s years of experience have allowed her to develop a deep understanding of market patterns, risk management techniques, and effective trading strategies. This experience gives her the confidence and expertise to navigate the complex and ever-changing world of trading.

Trading is a challenging and rewarding endeavor that requires expertise, authority, and trust. Traders like TraderPearl possess the knowledge and experience to navigate the markets and generate profits. Whether it's stock market swing trading or option trading, the key to success lies in understanding market dynamics, employing effective strategies, and building trust within the trading community. So, if you're looking to venture into the world of trading, remember to trust the experts and leverage their expertise to enhance your trading journey.

0 notes

Text

Trader Pearl's Insights, Chart Patterns, and Strategies for Mastering Swing Trading

Trader Pearl's Insights, Chart Patterns, and Strategies for Mastering Swing Trading

A well-liked trading technique called swing trading seeks to profit from short- to medium-term price changes that occur within a trend. Swing trading entails holding positions for a few days or weeks, in contrast to day trading, which entails completing trades in a single day. This piece will explore the realm of swing trading, going over different approaches, stressing the significance of chart patterns, and presenting Trader Pearl—a priceless tool for would-be traders.

Strategies for Swing Trading:

1. Trend Following: - Use technical analysis tools to determine the dominant trend.

- To profit from price momentum, enter trades in the trend's direction.

- For trend confirmation, use momentum indicators, trendlines, and moving averages.

2. Trading Countertrends: - Recognize overbought or oversold market circumstances.

- To identify possible reversals, use oscillators such as the stochastic oscillator and the relative strength index (RSI).

- Use caution when executing trades that deviate from the dominant trend.

3. Breakout Trading: - Determine pivotal levels of support and resistance.

- When the price breaks through these levels, suggesting a possible continuation of the trend, execute trades.

- Put risk management strategies into practice to reduce false positives.

4. Pullback Trading:- Watch for a price retracement inside an established trend.

- To ride the continuation of the trend, enter trades at advantageous levels.

- To find possible entry points, use moving averages and Fibonacci retracement levels.

Chart Patterns' Function:

1. Head and Shoulders:- Signifies a reversal in the trend.

- Once the neckline is broken, entry takes place.

2. Double Tops and Bottoms:- Indicates a possible reversal in the trend.

- Admission following verification of the design.

3. Ascending, Descending, Symmetrical Triangles: - Patterns of signal continuation.

- Entry after the triangle breaks or emerges.

Handle and Cup:- This suggests a bullish continuation.

- Entry following the formation of the handle.

Trader Pearl: Your Passport to Expert Trading:

A comprehensive platform called [Trader Pearl] was created to give traders the information, perspective, and resources they need to trade profitably. A sample of what Trader Pearl has to offer is this:

1. Educational Resources: - Comprehensive classes that cover a range of trading topics, from basic to advanced.

- Live sessions and webinars with seasoned traders.

meetings and conversation forums.

Trading Insights and Case Studies

- Gain knowledge from seasoned traders via interviews, case studies, and insights.

- Recognize the attitude and tactics that result in successful trading.

Final Thought:

The dynamic strategy of swing trading necessitates the integration of risk management, technical analysis, and ongoing education. Incorporating chart patterns and utilizing tools such as Trader Pearl can help traders improve their abilities and raise their chances of success in the constantly changing financial markets. Recall that profitable swing trading is only one aspect of successful swing trading; another is cultivating a methodical and knowledgeable approach to the markets

0 notes

Text

A Winning Strategy

A Successful Approach?

Swing trading is a well-liked stock market trading technique that provides chances to profit on transient price changes. This seeks to investigate if swing trading may be profitable for novice and seasoned traders. Swing trading can allow traders a flexible and dynamic way to navigate the stock market because of its emphasis on capturing shorter-term trends.

The Foundations of Trading Swings

Taking advantage of price swings or variations in a stock's price within a certain time frame—usually a few days to several weeks—is known as swing trading. Swing trading is more flexible and requires less time commitment than day trading, which calls for continuous position monitoring throughout the trading day.

Finding the entry and exit points that provide the best risk-reward ratio is one of the core concepts of swing trading. To decide when to enter and exit transactions, traders utilize a variety of technical analysis tools, including moving averages, support and resistance levels, and chart patterns.

Why Using a Swing Trading Strategy Can Be Profitable

1. Making Money on Temporary Trends

Swing trading allows traders to profit from brief price changes, giving them the chance to earn from both upward and downward trends. Swing traders can aim to make regular, tiny profits by putting themselves on the correct side of the market.

2. Adaptability and Less Time Invested

Swing trading is a more laid-back kind of trading than day trading. Trades can be held for days or weeks by traders, providing or weeks, allowing them to go on vacation and engage in other activities. Swing trading is a feasible strategy for people with limited time availability because of its flexibility.

3. Steer clear of market noise

Swing trading enables traders to ignore noise in the market and concentrate on the wider picture. Based on the general direction of the market, swing traders can make better decisions by taking into account longer-term trends and eliminating short-term volatility.

Beginning Your Swing Trading Career

A thorough understanding of the stock market and the range of trading strategies available is imperative before engaging in swing trading. Beginners can start swing trading by following these steps:

Learn for Yourself: Learn about risk management techniques, technical analysis tools, and fundamental trading concepts. A solid base is essential to swing trading success.

Pick a Broker: Opt for a trustworthy brokerage platform that provides the features and tools required for swing trading. Think about things like customer service, trading platform usability, and commission costs.

Create a Trading Strategy: The key to sustaining success in trading is having a clearly defined strategy. Describe your objectives, level of risk tolerance, entry and exit requirements, and position sizing strategies.

Begin by trading paper goods: Use paper trading or virtual trading platforms to practice swing trading without risking real money. This enables you to practice and build confidence using your strategies before using real money to trade.

Put Risk Management Strategies into Practice: Establish stop-loss orders and use appropriate risk management strategies to safeguard your capital. Always be aware of the possible hazards associated with swing exchange.

Review and Adjust: Analyze your trades regularly, pinpoint areas that need work, and adjust your approach as necessary. Since the stock market is dynamic, long-term success depends on your ability to adjust to shifting circumstances.

For seasoned traders as well as novices, swing trading presents an alluring trading approach. Swing trading offers flexibility, a shorter time commitment, and the possibility of steady profits because of its emphasis on capturing short-term price movements. But it's crucial to remember that swing trading carries risks, just like any other trading strategy, and that success requires preparation, knowledge, and risk management. Swing trading can be profitable if it is done with patience, discipline, and a deep comprehension of the stock market. Are you prepared to enter the thrilling world of swing trading? Establish a solid foundation first, then progressively apply your understanding to actual trading scenarios. I hope your swing trading adventure is successful!

0 notes

Text

Advanced Option Trading Strategies for Trending Markets

Advanced Option Trading Strategies for Trending Markets!

Are you ready to take your option trading skills to the next level? In this, we will explore advanced option trading strategies specifically designed for trending markets. With the right knowledge and expertise, you can make the most out of volatile market conditions and maximize your profits. So, let's dive in and discover these powerful strategies that will elevate your trading game!

Introduction

Options trading has become increasingly popular among traders who seek to take advantage of market fluctuations and generate impressive returns. However, to succeed in options trading, it is essential to go beyond basic strategies and explore advanced techniques that are tailored to trending markets. This article aims to equip you with the knowledge and expertise necessary to navigate these markets with confidence and precision.

The Power of Options in Trending Markets

Question: How can options benefit traders in trending markets? Answer: Options offer traders the opportunity to profit from both upward and downward price movements, making them a valuable tool in trending markets. Unlike traditional stock trading, options allow you to profit from stock price movements without actually owning the shares. This flexibility provides traders with numerous strategic possibilities to capitalize on short-term trends and maximize returns.

Vertical Spreads: Riding the Trend Waves

Question: What are vertical spreads and how can they be used in trending markets? Answer: Vertical spreads involve simultaneously buying and selling options of the same underlying asset but with different strike prices. They can be either bullish or bearish, depending on market conditions. In trending markets, traders can use vertical spreads to take advantage of anticipated price movements while minimizing risk. Bullish vertical spreads such as the bull call spread involve buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy allows traders to profit as the underlying asset's price increases, while also limiting potential losses.

Straddle and Strangle: Capturing Volatility in Trending Markets

Question: How can a straddle and strangle strategy help traders capture market volatility? Answer: Straddle and strangle are strategies designed to benefit from significant price movements regardless of the direction. In trending markets, where volatility is often observed, implementing straddle or strangle strategies can be highly profitable. The straddle strategy involves purchasing both a call option and a put option with the same strike price and expiration date. This allows traders to profit from large price swings, regardless of whether the price moves upwards or downwards. Similarly, the strangle strategy involves purchasing both a call option and a put option, but with different strike prices. This strategy provides traders with the potential for substantial gains if the market experiences significant volatility.

Iron Condor: Limiting Risk in Trending Markets

Question: How can an iron condor strategy help traders manage risk in trending markets? Answer: The iron condor strategy is a popular advanced options strategy that combines both bullish and bearish vertical spreads. This strategy is designed to generate profits when the underlying asset's price remains within a specific range. By simultaneously selling an out-of-the-money call option and an out-of-the-money put option, while also buying an even further out-of-the-money call option and put option, traders can limit their risk exposure. When implemented correctly, the iron condor strategy can provide traders with a consistent income stream while managing risk effectively in trending markets.

Navigating trending markets requires a deep understanding of advanced option trading strategies. By harnessing the power of vertical spreads, straddles, strangles, and iron condors, traders can increase their chances of success and maximize their profits. Always stay disciplined, continue to educate yourself, and adapt your strategies as the market evolves. With the right expertise and a focused approach, you can unlock the full potential of option trading in trending markets. Happy trading!

0 notes

Text

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

Becoming a profitable trader in the stock market is an enticing goal, but it requires more than just luck. It demands a solid understanding of trading concepts, strategies, risk management, and continuous learning. In this comprehensive guide, we will unlock the secret to becoming a profitable trader, focusing on essential strategies and tips for beginner traders. Whether you're interested in options trading, swing trading, or gaining a comprehensive understanding of the stock market, this article will provide valuable insights to help you embark on your trading journey.

1. Education: The Foundation of Successful Trading

To begin your trading journey, it is crucial to educate yourself about the fundamentals of trading. For beginners in options trading, it is essential to grasp the basics of options, including terminology, strategies, and risk management. Numerous online courses, books, and reputable trading platforms offer educational resources to help you gain a solid foundation in options trading.

If swing trading piques your interest, focus on learning technical analysis, chart patterns, and market indicators. Developing a trading plan that aligns with your risk tolerance and time commitment is essential for success in swing trading.

Furthermore, gaining knowledge about various stock market strategies, such as day trading, long-term investing, and value investing, will provide you with a diverse set of tools to approach the market. Understanding the principles behind each strategy and how they align with your trading goals is crucial.

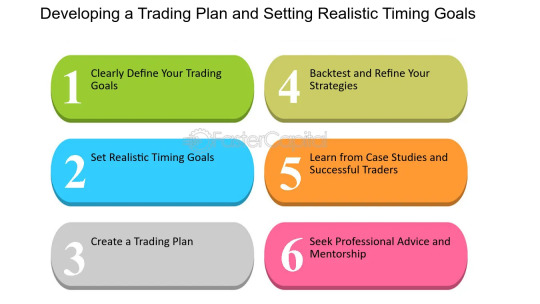

2. Develop a Trading Plan for Success

A well-defined trading plan is a secret weapon for profitable traders. Your trading plan should encompass the following elements:

- Goal Setting: Clearly define your financial goals, risk tolerance, and time commitment. Determine whether you seek short-term gains or long-term investments and how much capital you are willing to risk.

- Risk Management: Establish effective risk management strategies, such as setting stop-loss orders and determining appropriate position sizes. This ensures that potential losses are limited, and your capital is protected.

- Trading Style: Identify your preferred trading style, whether it's day trading, swing trading, or long-term investing. Each style requires different strategies and time commitments, so choose one that aligns with your personality, lifestyle, and goals.

3. Practice with Paper Trading

Before risking real money, it is advisable to practice your trading strategies using a paper trading account. Many brokerage platforms offer paper trading features that allow you to simulate trades without actual capital. This invaluable practice helps you test your strategies, refine your skills, and gain confidence in your decision-making abilities.

4. Stay Informed and Analyze the Market

To stay ahead in the market, it is essential to stay informed about market trends, news, and economic indicators. Regularly follow reliable sources such as financial news websites, industry publications, and market analysis reports to stay updated.

Additionally, I learned to analyze charts, identify patterns, and utilize technical indicators to make informed trading decisions. Technical analysis can provide valuable insights into market movements and help you identify potential entry and exit points.

5. Seek Guidance and Mentorship:

Consider seeking guidance from experienced traders or enrolling in reputable trading classes or coaching programs. Receiving guidance from professionals who have achieved success in trading can significantly accelerate your learning curve. Look for educational resources provided by established trading institutions or platforms that offer comprehensive training and mentorship.

TraderPearl, for instance, offers step-by-step knowledge in trading and provides coaching services specifically tailored for beginners. The guidance and insights from experienced traders can help you avoid common pitfalls and develop effective strategies.

Becoming a profitable trader is a journey that requires dedication, continuous learning, and disciplined execution of strategies. By investing time in education, developing a trading plan, practicing paper trading, staying informed, and seeking guidance, you can unlock the secret to becoming a profitable trader. Remember to approach trading with patience, discipline, and risk management to increase your chances of success in the dynamic world of the stock market.

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

0 notes

Text

Common Mistakes to Avoid in Stock Market Trading for Beginners

Common Mistakes to Avoid in Stock Market Trading for Beginners

1. Understanding Risk Management Strategies

Importance of Risk Management

Risk management is like wearing a seatbelt while driving – it may not be the most thrilling part of the journey, but it can save you from a disaster. As a beginner in stock market trading, understanding and implementing risk management strategies is crucial. It helps protect your capital and prevents devastating losses that can leave you in a financial pickle.

Setting Stop Loss Orders

Stop-loss orders are like your loyal bodyguards in the stock market. They automatically sell your shares if they reach a certain price, limiting your potential losses. Think of them as the emergency exit that ensures you don't get trapped in a sinking ship. So, don't forget to set stop-loss orders when you make your trades – they can be a lifesaver!

Utilizing Position Sizing Techniques

Position sizing is all about finding the right fit. Just like Goldilocks wouldn't settle for a bed that's too big or too small, you shouldn't invest too much or too little in a single stock. Utilize position sizing techniques to determine the appropriate amount of money to allocate to each trade. This ensures that even if one stock goes south, it won't leave you crying over spilled investment milk.

2. Developing a Solid Trading Plan

Defining Investment Goals

Before diving into the stock market, it's important to know what you want to achieve. Are you looking for short-term gains or long-term growth? Do you want to build a nest egg for retirement or plan for a dream vacation? Define your investment goals and let them guide your trading decisions. This way, you won't wander in the market like a lost tourist in a foreign city.

Establishing Entry and Exit Strategies

Just like a good dance routine, successful trading requires well-timed moves. Develop a clear plan for when to enter and exit trades based on your analysis and risk tolerance. Stick to your strategy like a well-practiced dancer, knowing when to gracefully step in and confidently step out. This way, you won't be caught off guard and make impulsive decisions that may leave you stumbling.

Incorporating Timeframes and Trade Frequency

Not all traders have the same horizons or schedules, and that's perfectly fine. Choose the timeframe that aligns with your goals and lifestyle. Whether you're a day trader who thrives in the fast-paced action or a long-term investor who enjoys the stroll, find your rhythm. Avoid jumping on every bandwagon that passes by – it's better to be a patient investor than a frantic trend-chaser.

3. Avoiding Emotional Decision Making

https://lh7-us.googleusercontent.com/b55-5DVyPiidlxNpVZLNovSz15dLTVfBRfAVnDLbltkXGyiv6vCB6ZzqBZEAVD3eV9vo2lHZ78E1zfJLLYHUMxKnacH2SkfgCJN7VHUJQWq4Y2a89xP8YibtZp9ACUr9aCkwgHfqF7ZYAbS6M09iQK4

Managing Fear and Greed

Emotions can be a trader's worst enemy. Fear and greed can cloud your judgment, leading to irrational decisions. Imagine trading like a cool-headed poker player – don't let your emotions play tricks on you. Stick to your strategy, make decisions based on analysis, and don't let FOMO (Fear Of Missing Out) or reckless optimism drive your trades.

Sticking to the Trading Plan

A trading plan is like a recipe for success. Once you've crafted your plan, follow it religiously. Don't let impulsive urges or market noise derail your well-laid plans. It's easy to get lured by shiny new stocks or panic when things go south, but remember, consistency is key. Stay committed, and you'll avoid the pitfalls of emotional decision-making.

Avoiding Impulsive Trades

Impulsive trades are like impulse purchases – they often leave you with buyer's remorse. Avoid making impulsive decisions based on tips, rumors, or gut feelings. Remember that successful trading is a result of research and analysis, not impromptu gambles. Take a deep breath, evaluate the situation, and resist the urge to make hasty trades that could come back to haunt you.

4. Conducting Thorough Research and Analysis

Analyzing Financial Statements

Understanding a company's financial health is like getting to know someone before going into business with them. Dive into financial statements, like a Sherlock Holmes of the stock market, to assess the company's profitability, debts, and growth potential. Don't just rely on a company's reputation or rumors – get the facts straight before making your move.

Utilizing Technical Analysis Tools

Technical analysis is like having an X-ray vision in the stock market world. It helps identify patterns, trends, and potential price movements based on historical data. Utilize technical analysis tools, like charts and indicators, to enhance your decision-making process. But remember, even the best tools are not crystal balls – they can guide you, but they don't guarantee success.

Monitoring Market Trends and News

Keeping up with market trends and news is like knowing the latest gossip in the stock market party. Stay informed about industry news, economic indicators, and market events that can impact stock prices. It's like having an insider's advantage – you can anticipate changes and adjust your strategy accordingly. So, don't be the wallflower at the stock market party, grab your dancing shoes and stay in the know!

Remember, as a beginner in stock market trading, it's important to learn from your mistakes and continue growing. Start with a solid foundation, avoid common pitfalls, and always maintain a sense of humor – after all, the stock market can be a wild rollercoaster ride!

5. Diversifying Your Portfolio

Understanding the Importance of Diversification

When it comes to stock market trading, putting all your eggs in one basket is a surefire way to invite trouble. Diversification is like having a balanced diet for your investment portfolio. By spreading your investments across different stocks and sectors, you reduce the risk of being heavily impacted by the performance of a single stock or sector. Think of it as having a safety net to catch you if one investment goes south.

Allocating Investments Across Different Sectors

You wouldn't want to invest all your money in one industry, just like you wouldn't eat pizza for every meal. Allocating your investments across different sectors helps you take advantage of the growth potential in various industries while minimizing the risk of sector-specific downturns. Consider sectors like technology, healthcare, finance, and consumer goods to diversify your portfolio effectively.

Balancing Risk and Reward

Diversification is not just about spreading your investments randomly; it's about striking the right balance between risk and reward. Investing solely in low-risk stocks may protect your capital but won't offer significant growth. On the other hand, investing only in high-risk stocks may offer potential rewards but comes with a higher chance of losing money. Find the sweet spot by diversifying across stocks with different levels of risk and potential returns.

6. Setting Realistic Expectations

Understanding the Volatility of the Stock Market

The stock market is like a wild rollercoaster ride, with ups and downs that can make your head spin. It's crucial to understand that volatility is a part of the game. Stocks can fluctuate in value due to various factors, such as economic conditions, company news, or even tweets from influential individuals. Be prepared for the occasional stomach-churning drops and thrilling surges, and you'll be better equipped to weather the storm.

Avoiding Get-Rich-Quick Mentality

We've all heard stories of overnight millionaires through stock market investments, but in reality, those are rare exceptions. Don't fall into the get-rich-quick trap. Stock market trading is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. Avoid chasing quick gains and focus on building steady and sustainable wealth over time.

Maintaining Patience and Discipline

Patience and discipline are the secret ingredients to successful stock market trading. Don't let impulsive emotions govern your investment decisions. Avoid making knee-jerk reactions based on short-term market fluctuations or panic-inducing news headlines. Stay focused on your long-term investment strategy, stick to your plan, and resist the urge to constantly tinker with your portfolio. Rome wasn't built in a day, and neither will your wealth.

7. Avoiding Chasing Tips and Rumors

Evaluating the Reliability of Information Sources

In the stock market, rumors and hot tips can spread like wildfire. While it may be tempting to jump on the bandwagon, it's crucial to evaluate the reliability of the information sources. Beware of self-proclaimed "experts" on social media or forums who claim to have inside information. Seek trusted sources, do your due diligence, and make informed decisions based on facts, not speculative rumors.

Conducting Independent Research

Instead of relying solely on tips and rumors, take charge of your investment journey by conducting independent research. Dive deep into a company's financials, understand its business model, and analyze its competitive landscape. This hands-on approach will not only give you a better understanding of your investments but will also help you make more informed decisions based on solid research.

Relying on Fundamental Analysis

When it comes to evaluating stocks, rely on the good old-fashioned fundamental analysis. Look at a company's earnings, revenue, debt, and growth prospects. Understand its competitive position in the market and its ability to generate sustainable profits. While the stock market can be influenced by short-term trends, fundamental analysis helps you focus on the underlying value of a company, enabling you to make more rational investment decisions.

8. Learning from Mistakes and Continuous Education

Analyzing Past Trades for Improvement

Nobody's perfect, and even the most seasoned investors make mistakes. The key is to learn from them. Analyze your past trades, both the good and the bad, to identify patterns and areas for improvement. Did you make impulsive decisions? Were you too focused on short-term gains? By reflecting on your past experiences, you can refine your investment strategy and become a better trader over time.

Seeking Knowledge and Expertise

The stock market is a vast and ever-evolving arena, and there's always something new to learn. Seek knowledge and expertise through books, online courses, or even by following reputable financial analysts. Stay curious, ask questions, and never stop learning. The more you know, the better equipped you'll be to navigate the complexities of the market.

Staying Updated with Market Developments

To stay ahead in the stock market game, it's essential to stay updated with market developments. Keep an eye on economic indicators, corporate earnings reports, and relevant news that can impact the companies you're invested in. Regularly review your portfolio to ensure it aligns with the evolving market conditions. By staying informed and adaptable, you'll be in a better position to make timely and profitable investment decisions.

In conclusion, stock market trading for beginners can be a challenging yet rewarding endeavor. By avoiding common mistakes and following the strategies discussed in this article, beginners can greatly enhance their trading skills and increase their chances of making informed and profitable investment decisions. Remember, successful trading takes time, patience, and continuous learning. So, keep honing your skills, staying updated with market trends, and seeking knowledge to navigate the ever-changing landscape of the stock market. With dedication and the right mindset, beginners can pave the way for a prosperous journey in stock market trading.

Frequently Asked Questions (FAQ)

1. Is stock market trading suitable for beginners?

Stock market trading can be suitable for beginners, but it requires a solid understanding of the basic principles and strategies involved. Beginners must educate themselves, develop a trading plan, and start with small investments while gaining experience and knowledge.

2. How do I manage the emotional aspect of stock market trading?

Managing emotions in stock market trading is essential. To avoid making impulsive decisions, it is crucial to stick to a well-defined trading plan, set realistic expectations, and avoid letting fear or greed drive your actions. Developing discipline and controlling emotions can significantly improve trading performance.

3. Should I rely on stock tips and rumors?

Relying solely on stock tips and rumors is not recommended. It is essential to conduct thorough research, analyze financial statements, and evaluate reliable sources of information. Making informed decisions based on fundamental and technical analysis can lead to more successful and sustainable trading outcomes.

4. How can I learn from my trading mistakes?

Learning from trading mistakes is crucial for improvement. Maintain a trading journal to record and analyze your trades, identifying patterns and areas for improvement. Continuously seek knowledge through educational resources, join trading communities, and consider seeking guidance from experienced traders to enhance your skills and avoid repeating mistakes.

0 notes

Text

Trading and Options Trading for Beginners with TraderPearl:

Trading and Options Trading for Beginners with TraderPearl:

Are you a beginner looking to enter the world of trading and option trading? Do you want to learn the ins and outs of the stock market and make informed investment decisions? Look no further than TraderPearl — the best coaching class for stock market education, option trading, and swing trading.

Learn and Earn with TraderPearl: The Best Trading Course for Beginners in Options and Swing Trading

Are you ready to embark on a journey into the world of financial markets, eager to grasp the intricacies of options and swing trading? Look no further than TraderPearl — your gateway to a comprehensive and step-by-step learning experience designed for beginners seeking to master the art of trading.

What is Options Trading?

Options trading is a popular investment strategy that involves buying and selling options contracts. Options are derivative securities that give the buyer the right but not the obligation to buy or sell an underlying asset at a specified price within a certain timeframe. Options trading allows traders to speculate on the direction of stock prices, hedge risk, and generate income. At TraderPearl, we understand that options trading can be intimidating for beginners. That’s why our expert instructors provide step-by-step teaching and guidance to help you learn the fundamentals of option trading. We break down complex concepts into simple terms, ensuring that you develop a strong foundation in this lucrative investment strategy.

The Benefits of Swing Trading

Swing trading is another popular trading strategy that aims to capture short-term price movements in stocks or other financial instruments. Unlike day trading, which involves closing out all positions by the end of the trading day, swing trading allows traders to hold positions for several days or weeks. This strategy is ideal for individuals who want to actively trade but need more time to monitor the market constantly. At TraderPearl, our swing trading class is designed to equip beginners with the skills and knowledge needed to execute successful swing trades. We cover technical analysis, chart patterns, risk management, and other essential topics to help you become a proficient swing trader. Our experienced instructors provide real-world examples and practical tips to ensure that you grasp the concepts and apply them effectively in your trading journey.

Why Choose TraderPearl?

TraderPearl stands out as the best coaching class for trading and option trading for beginners. Here’s why:

Expert Instructors: Our experienced instructors are committed to helping you succeed in the stock market through their deep understanding of trading and option strategies.

2. Step-by-Step Teaching: Our experienced instructors are committed to helping you succeed in the stock market through their deep understanding of trading and option strategies.

3. Interactive Learning:: Our seasoned instructors are dedicated to empowering you to succeed in the stock market with their deep understanding of trading and option strategies.

4. Community Support: Joining TraderPearl means becoming part of a supportive community of traders. Our student forums and social channels provide opportunities for networking, sharing insights, and seeking guidance from fellow traders and instructors.

5. Flexible Learning Options: We understand that everyone has different schedules and learning preferences. That’s why we offer both in-person and online classes, allowing you to choose the format that works best for you.

Learn and Earn with TraderPearl

At TraderPearl, education and earning go hand in hand. Our goal is to empower beginners with the knowledge and skills they need to make informed trading decisions and achieve financial independence. Whether you’re interested in option trading, swing trading, or general stock market education, we have the resources and expertise to guide you toward success. Don’t miss this opportunity to learn from the best. Join TraderPearl today and embark on your trading journey with confidence!

Trading and option trading can be complex, but with the right guidance and education, beginners can navigate the stock market with ease. TraderPearl offers the best coaching class for stock market education, option trading, and swing trading. Our expert instructors, step-by-step teaching approach, and interactive learning environment ensure that beginners receive a comprehensive and enjoyable learning experience. Join TraderPearl today and unlock your trading potential!

#tradingstrategies#TradingForBeginners#OptionsTrading#LearnAndEarn#TraderPearlEducation#StockMarketLearning#Investing101#FinancialEducation#TradingJourney#SwingTrading#TraderCommunity#TradeSmart#OptionsEducation#TradingSuccess#MarketAnalysis#TraderPearlSuccess#ProfitableTrading#TradingTips#ForexBeginner#TradingCourses#TradeWithConfidence

0 notes

Text

Trade like a Pro with Traderpearl of swing trading and option trading

Are you new to the world of stock trading and looking to learn how to trade like a professional? Look no further - Traderpearl is here to help! Traderpearl is an industry-leading educational center in Nashik that specializes in teaching individuals how to trade stocks effectively. In this article, we will provide a brief description of Traderpearl and explain the concepts of swing trading and option trading, two popular strategies for maximizing profits in the stock market. So, let's dive in and learn how to trade stocks like a pro!

Traderpearl: Your Gateway to Trading Success

Traderpearl is the best educational center in Nashik for those who want to learn stock market trading. With experienced instructors and a comprehensive curriculum, Traderpearl provides the knowledge and skills necessary to succeed in the dynamic world of trading. Whether you are a complete beginner or an experienced trader looking to enhance your strategies, Traderpearl offers courses tailored to your needs.

Swing Trading: Maximizing Profits with Short-Term Trends

Swing trading is a popular trading strategy that aims to capture short-term trends in the market. Unlike long-term investing, which focuses on holding stocks for an extended period, swing traders take advantage of price swings that can occur over a few days to several weeks. One key advantage of swing trading is the ability to generate consistent profits even in volatile market conditions. By analyzing market trends and indicators, swing traders can identify potential entry and exit points to optimize their trades. With proper risk management techniques and thorough analysis, swing trading can be a highly profitable strategy for skilled traders.

Options Trading: Leveraging Opportunities for Higher Returns

Another strategy embraced by professional traders is option trading. Options provide the opportunity to trade contracts that give individuals the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a predetermined time frame. Options trading allows investors to leverage their positions and potentially earn higher returns with less capital. This strategy is highly flexible, as it provides various strategies such as call options, put options, spreads, and more, to accommodate different market scenarios. However,

it's important to note that options trading involves a higher level of risk and requires a deeper understanding of market dynamics.

Learn Stock Market Trading for Beginners

For beginners, the stock market can seem daunting. However, with the right education and guidance from Traderpearl, anyone can gain the knowledge and skills needed to succeed. Traderpearl offers beginner-friendly courses that cover the fundamentals of trading, including market analysis, risk management, and trading psychology. By enrolling in Traderpearl's beginner courses, you will gain a solid foundation in stock trading and learn how to make informed decisions based on market trends and indicators. Additionally, you will have access to experienced instructors who can answer your questions, provide guidance, and share real-world trading experiences.

traderpearl.com

When it comes to trading education in Nashik, Traderpearl stands out as the best choice. From its comprehensive curriculum to experienced instructors, Traderpearl offers everything you need to become a successful trader. Whether you are a beginner looking to learn the basics or an experienced trader seeking advanced strategies, Traderpearl has courses tailored to your specific needs. With Traderpearl's proven track record of success, you can trust that you are receiving the highest quality education and training in the industry. Don't miss out on the opportunity to learn from the best and take your trading skills to the next level with Traderpearl.

Trading stocks like a pro requires the right education, strategies, and guidance. With Traderpearl, you have access to the best educational center in Nashik, where experienced instructors will teach you the ins and outs of swing trading and option trading. Whether you are a beginner or an experienced trader, Traderpearl has the courses you need to succeed. So, why wait? Start your journey to trading success with Traderpearl today!

#tradingstrategies#india#optiontradig#swingtrading#equity#tradingtips#tradingbeginners#tradingforex#education

0 notes

Text

“Swing Trading vs. Option Trading — Quick Guide for Beginners”

Description: Are you new to trading and wondering about the difference between swing trading and option trading? In this short video, we will break down these two popular trading strategies, giving you a clear understanding of each.

📊 Swing Trading: Learn how swing trading works, its basic principles, and why it might be the right choice for you. We will cover swing trading strategies, risk management, and potential profits.

📈 Options Trading: Get details on options trading, including calls and puts. Learn how options can be used for speculation or hedging, and identify potential risks and rewards.

Whether you’re just starting out or looking to diversify your trading portfolio, understanding the basics of swing trading and options trading is important. Watch this video to see your decision-making and improve your business acumen.

#tradingstrategies#tradingtips#trading#forextrading#daytrading#cryptotrading#bitcointrading#binarytrading#swingtrading#tradingforex#tradingcards#currencytrading#stocktrading#binaryoptionstrading#disneypintrading#pintrading#fxtrading#tradingcardgame#tradingsignals#optionstrading#tradinglifestyle#tradingview#pokemontradingcardgame#cryptocurrencytrading#tradingstrategy#pokemontradingcards#tradingcard#artisttradingcard#tradingaccounts#tradinglife

0 notes

Text

Formulating Market Strategy: Key Points for TraderPearl

In the ever-changing world of stock markets, traders like TraderPearl are always on the lookout for winning strategies to deal with the complexities and make smart decisions. To help marketers like you succeed, we've compiled a list of essential product marketing strategies and key points to keep in mind. 1. Understand your risk tolerance:

Before investing in the stock market, evaluate your risk tolerance. This will help you decide your investment style, whether you are a conservative investor or a risk taker like TraderPearl. 2. Diversification is key:

Spread your investments across different sectors and asset classes to reduce risk. Diversification can help protect your portfolio during market downturns. 3. Stay informed: Follow financial reports and market trends regularly. TraderPearl's success is often attributed to its keen awareness of market development. 4. Set clear goals:

Define your financial goals and time limits. Are you looking for short-term gains or long-term wealth accumulation? Your goals will shape your business strategy. 5. Risk Management:

Use stop-loss orders to limit potential losses. TraderPearl is the owner of risk management, ensuring that no single trade can delete an important part of its portfolio. 6. Technical Analysis:

Learn the basics of technical analysis, such as charting patterns, support and barrier levels. TraderPearl often relies on these factors to make entry and exit decisions. 7. Basic analysis:

Understand the financial health of the companies you are investing in. Analyze factors such as benefits, cost levels and competitive conditions. 8. Patience Pays: Success in marketing is not a sprint but a marathon. TraderPearl's persistence in maintaining winning positions is a hallmark of its strategy. 9. Keep your feelings:

Emotional decisions can lead to destruction. Stick to your marketing plan and avoid aggressive behavior. 10. Learn from mistakes: - Mistakes are part of the learning process. Review your losses so you don't do the same thing. 11. A major accident turns: - calculate the dangerous story before entering the business. Good description supports those who can tolerate the disadvantages. 12. Stay hydrated: - Always have money for opportunities that may arise. TraderPearl is known for its ability to enter undervalued stocks. 13. Next step: - Consider the process that follows the plan. Marketing with practice can increase your chances of success. 14. Continuing education: - The product market evolves, and you do. Invest in your education and update yourself with new business techniques. 15. Beware of over-selling: - Overtrading can result in excessive work and losses. TraderPearl avoids this by carefully selecting its trades. 16. Taxation: - Understand the tax implications of your business. Effective tax planning can save you money in the long run. 17. Manage Business Journals: - Record your transactions, plans and results. This will help you identify trends and improve your decisions over time. 18. Review your portfolio regularly: - Review the performance of your portfolio periodically. Adjust your strategy as necessary to achieve your goals. 19. Long term investment: - Consider part of your portfolio for long-term investment. TraderPearl handles short-term trading and solid long-term investment strategies. 20. Network and learn from others: - Connect with other customers, attend conferences and join online forums to exchange ideas and get information. TraderPearl's success in the market is not just about luck; it is the result of a well-thought-out strategy and commitment to continuous improvement. By integrating these points into your trading strategy, you can increase your chances of achieving your financial goals and become a successful trader like TraderPearl.

#TradingStrategies#StockMarketTrading#OptionTrading#SwingTrading#WinningStrategies#TraderPearl#MarketStrategy#StockMarketStrategy#ComplexMarkets#EverchangingTrading#Please

1 note

·

View note