Text

Brazil is a country in Latin America with a population of 217 million, and a rapidly growing economy with a current GDP of USD 2.08 trillion. The country has a robust tech economy and talent pool, and has a global crypto adoption index rank of #7 as per Chainalysis 2022 index.

The penetration of credit cards in the country is 29% and their usage is widespread, though more popular in higher income segments. While debit cards are more in number, they are primarily used for cash withdrawal or utility purchases.

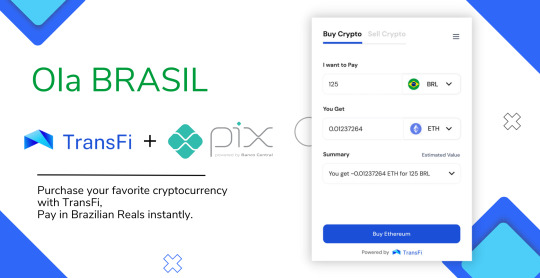

Alternate payment methods are very popular in Brazil with Boleto Bancario, Mercado Pago, Hyperwallet and Pix widely prevalent. Pix is a Brazilian bank-transfer payment method, that enables any citizen with a deposit, savings, or prepaid payment account to make payments and transfers in a few seconds, at any time, 365 days a year.

TransFi is focused on fiat-to-crypto onramp and offramp in emerging markets, with the widest suite of local payment methods in local currencies, 80%+ conversion rates, and with low fees. TransFi will be adding Pix and Boleto in Brazil to its offerings shortly, that will enable exchanges, wallets and DeFi protocols to offer their users the ability to buy and sell crypto with these popular payment methods.

0 notes

Text

Malaysia is a country in Southeast Asia with a population of 30 million (about the population of Texas), and a rapidly growing economy with a current GDP reaching close to USD 450 billion. The country has a young, vibrant, diverse and tech-savvy population, and a vibrant tech economy across e-commerce, fintech and online gaming amongst others. The tagline of Malaysia Tourism Ministry is ‘Truly Asia’, which aptly describes the culture and geography of the country in just one short phrase.

Credit cards used to be popular in Malaysia with close to 10 million cards in circulation and together with the near ubiquitous debit cards form the core of the traditional digital payment system. However, due to bottlenecks like high fees and dependency on physical ePOS machines the wider adoption could not get past beyond urban areas. Cards are also unsuitable for purchase and sale of digital assets as the success rates are very low with less than 50% due to often being declined by banks.

In recent times, digital wallets have become much more popular in Malaysia with FPX, Boost, DuitNow and Touch ‘n Go widely prevalent across the local population, where they can directly pay in the local currency Malaysian Ringgit from their bank account or e-wallet. The QR code based DuitNow and instant e-payments from bank accounts FPX, have also become very popular especially since the pandemic.

FPX, Boost, Duitnow and Touch ‘n Go are of the most popular payment methods in Malaysia. FPX is a secure online payment solution that allows users to make payments directly from their bank accounts. Using TransFi you can buy crypto with FPX seamlessly. GrabPay and Shopee Pay are also quickly gaining popularity with their support for major retailers and merchants and cab service providers.

Boost is a mobile wallet that can be used to make payments at a variety of merchants, including online stores, restaurants, and convenience stores. Touch ‘n Go is another popular mobile wallet that can be used to make payments for transportation, bills, and other goods and services. Buy your favorite crypto assets with Boost via TransFi paying with Ringgit.

DuitNow is a real-time money transfer service that allows users to transfer money between bank accounts and e-wallets using just a mobile phone number or National Registration Identity Card (NRIC) number. It is a fast and convenient way to make payments anywhere in the country. Buying crypto with Duitnow is now easier than ever.

These local payment methods offer a number of advantages over traditional payment methods, such as cash and credit cards. They are more convenient, secure, and often more affordable. As a result, they are becoming increasingly popular among Malaysian consumers. TransFi is enabling all these modern payment methods in their app to enable more Malaysians onboard into Web3 with easy user experience and convenience. We also support multiple banks in the region where users can make payments using internet banking, also sell crypto to Ringgit to receive funds in their choice of bank account.

About TransFi:

TransFi is focused on enabling fiat-to-crypto onramp and offramp in emerging markets, particularly in Asia, Latin America and Africa with the widest suite of local payment methods in local currencies, very high conversion and transaction success rates, lower barrier of entry and with lowest fees. An integration with TransFi enables exchanges, wallets and DeFi protocols to offer their users the ability to buy and sell crypto with all the popular payment methods in addition to credit and debit cards.

0 notes

Text

Philippines is a country in Southeast Asia with a population of 110 million, and a rapidly growing economy with a current GDP of USD 440 billion. The country has a young and tech-savvy population, deep into gaming, and has a global crypto adoption index rank of #2 as per Chainalysis 2022 index.

The penetration of credit cards in the country is low at less than 8% with only 8.6 million credit & charge cards in circulation. While debit cards are more in number, they are primarily used for cash withdrawal or utility purchases. Either of these is unsuited for digital assets onramp and offramp in the country

By contrast, alternate payment methods are much more popular in the Philippines with GCash, Instapay, ShopeePay and PayMaya widely prevalent across the local population. GCash is an all-in-app and the most popular payment method in the country with over 30 million users, nearly 4-times those that use credit cards.

TransFi is focused on fiat-to-crypto onramp and offramp in emerging markets, in particular Asia, with the widest suite of local payment methods in local currencies, 80%+ conversion rates, and with low fees. An integration with TransFi enables exchanges, wallets and DeFi protocols to offer their users the ability to buy and sell crypto with all the popular payment methods in the Philippines including GCash, PayMaya, Shopeepay, and local banks

1 note

·

View note