Don't wanna be here? Send us removal request.

Text

It is difficult to predict market movements in the near term. Given the rising geopolitical tensions worldwide, we suggest taking a cautious approach to investing.

Here are some important points to consider:

Portfolio Adjustments: If you need to withdraw money from your existing portfolio, especially if it is equity or high equity-oriented, consider transferring the required amount to safer schemes.

Liquidity Provision: Ensure you have liquid funds to cover six months of essential expenses. This way, you won't need to liquidate your portfolio in a down market during emergencies.

Investment Strategy: Avoid full equity investments. Instead, consider hybrid schemes like multi-asset funds or balanced advantage funds for an investment horizon of five years or more.

Avoid Speculation: Refrain from short-term speculation.

Safeguarding Investments: For existing investments, if you need money within three years, safeguard the amount.

SIPs: Continue your SIPs and consider increasing them. Top-ups can be considered if the NAV drops significantly.

Long-Term Investments: For investment horizons of five years or more, think about hybrid funds.

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#wisedecisions#sip

0 notes

Text

0 notes

Text

Boeing plane parts are meticulously supplied from various global sources, exemplifying how modern manufacturing is a collaborative effort involving multiple countries, rather than the monopoly of a single nation.

https://www.voronoiapp.com/markets/Boeing-737-American-Made-but-Globally-Sourced-4949

0 notes

Text

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#sip#wisedecisions

0 notes

Text

#udyaminvestments#mutualfunds#mutualfundssahihai#investment#udyamitsallaboutmutualfunds#investmentawareness#assetallocation#wisedecisions#sip

0 notes

Text

It's true that past returns don't guarantee future performance, analyzing historical data can still be very useful for several reasons:

1 Performance Consistency: Past data helps identify schemes that have consistently performed well over different market cycles.

This can indicate strong management and a robust investment strategy.

2 Risk Assessment: By looking at historical returns, you can gauge the volatility and risk associated with a particular scheme.

This helps in aligning your risk tolerance with your investment choices.

3 Benchmark Comparison: Historical performance allows you to compare a scheme's returns against relevant benchmarks and peer groups.

This helps in understanding how well the scheme has performed relative to others in the same category.

4 Manager Track Record: The past performance of a fund manager can provide insights into their ability to navigate different market conditions

and generate returns.

5 Investment Strategy Evaluation: Analyzing past data can help you understand the investment strategy and asset allocation of a scheme,

which can be crucial for making informed decisions.

At Udyam, we are using many platforms for analyzing schemes, which includes Morningstar and NGEN Markets.

This helps us in finding good schemes from the peer group.

While it's important to focus on future potential and investment objectives, past data provides a valuable context for making more

informed and confident investment choices. Do you have any specific schemes or categories in mind that you're looking to analyze?

Contact Us: If you have any questions or need further assistance, please feel free to reach out to us.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

0 notes

Text

youtube

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#Youtube

0 notes

Text

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#wisedecisions#investmentawareness#sip

0 notes

Text

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#wisedecisions#Tax

0 notes

Text

How does technology help?

Today, while filling the IT return, consultant asked me for capital gain in excel/CSV file. I only had a mobile phone with me as he called me after office hours. Then, I called my distributor for the file and he said he will send the same next day. If urgently needed, you can download it from your account on my website.

On logging in to the site, I found the details and clicked the button, and the file was downloaded on the phone immediately.

I forwarded the file to the tax consultant without even leaving the chair. He prepared the sheet and ask me to pay tax. Again by logging into income tax website, I made the payment via net banking.

Payment reflected in my account on income tax and return was filed.

All this was done nearly in 45 minutes.

When I visited my tax consultant, I didn't know requirements. In routine case, I need to collect the details and visit again. But today, only with the help of my phone, I was able to finish my most important work in few minutes. Earlier, I used to visit him 2 or 3 times.

Moral of the story?

You need to learn how to use a technology. Using technology is like a driving a vehicle. There is no need to know how vehicle works inside. You should just understand the functions and enjoy driving.

Learn to use your mobile, you will enjoy life.

For more comfort ask your tax consultant all required details and collect the same before visiting the tax consultant!

Uddhav Tulshibagwale

AMFI registered mutual fund distributor.

Email: [email protected]

Mobile: 844 844 0734, 982 267 2235

0 notes

Text

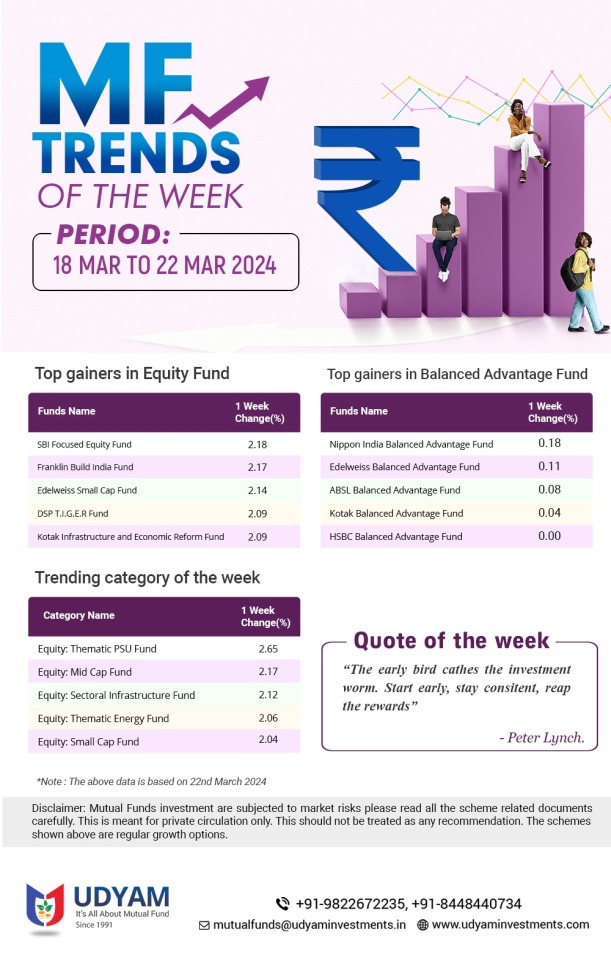

#investments #mutualfunds #udyamitsallaboutmutualfunds #mutualfundsahihai #udyaminvestments. #trending #mutualfundcategory #weekly

0 notes

Text

#investments #mutualfunds #udyamitsallaboutmutualfunds #mutualfundsahihai #udyaminvestments #trending #mutualfundcategory

0 notes

Text

#udyaminvestments#mutualfunds#investment#mutualfundssahihai#udyamitsallaboutmutualfunds#assetallocation#investmentawareness#sip#wisedecisions

0 notes

Text

This is likely the final week to fulfill all requirements for the current fiscal year due to holidays on March 23, 25, and 29, 2024. Investments in tax-saving schemes, acquisition of capital gains bonds, and settlement of any outstanding obligations for FY 2023-2024 should be concluded within this week.

0 notes

Text

#investments #mutualfunds #udyamitsallaboutmutualfunds #mutualfundsahihai #udyaminvestments

#trending #weekly #mutualfundcategory

0 notes