Don't wanna be here? Send us removal request.

Text

Income Tax Notice for These Transactions: What You Need to Know

When it comes to financial transactions, the Income Tax Department keeps a close eye on large monetary movements to ensure compliance with tax laws. If your transactions exceed certain thresholds, they might trigger an Income Tax Notice. This article will guide you through 10 financial transactions that could attract scrutiny from tax authorities, along with some tips to stay compliant.

Why Does the Income Tax Department Monitor These Transactions?

The government aims to curb tax evasion, money laundering, and financial fraud. Large transactions, especially those involving cash, raise red flags as they may indicate unreported income. Banks, financial institutions, and other authorities are required to report high-value transactions to the Income Tax Department. If you engage in any of these transactions, be prepared for possible inquiries.

10 Financial Transactions That Might Attract an Income Tax Notice

1. Large Cash Deposits in a Savings Account

Threshold: ₹10,00,000 in a year

Why it’s monitored: Depositing more than ₹10 lakh in your savings account within a financial year will likely be reported to the Income Tax Department.

Precaution: If your deposits are legitimate (such as from salary, business profits, or sale proceeds), keep proper documentation to justify the source.

2. High Fixed Deposits in a Year

Threshold: ₹10,00,000

Why it’s monitored: Banks are required to report fixed deposits exceeding ₹10 lakh. This is to check whether the deposits are from accounted income.

Precaution: Ensure that the deposited amount aligns with your declared income and file taxes accordingly.

3. Large Cash Deposits or Withdrawals in a Current Account

Threshold: ₹50,00,000 in a year

Why it’s monitored: Businesses often deal with large cash transactions, but deposits or withdrawals beyond ₹50 lakh in a year will be reported.

Precaution: Businesses should maintain clear financial records and ensure that cash movements are well-documented.

4. Purchase or Sale of Immovable Property

Threshold: ₹30,00,000

Why it’s monitored: If you buy or sell property worth more than ₹30 lakh, the Registrar of Properties reports the transaction to the tax authorities.

Precaution: Ensure that the property transaction is legal, properly recorded, and the amount is accurately declared in tax filings.

5. Large Cash Payments Received in Business

Threshold: ₹2,00,000

Why it’s monitored: Receiving ₹2 lakh or more in cash from clients or customers in a business transaction can trigger tax scrutiny.

Precaution: It’s best to encourage digital or cheque payments to avoid tax complications.

6. Large Investments in Shares, Mutual Funds, or Debentures in Cash

Threshold: ₹10,00,000

Why it’s monitored: If you invest ₹10 lakh or more in stocks, mutual funds, or bonds using cash, authorities may investigate the source of funds.

Precaution: Always use banking channels for investments and maintain proper records of transactions.

7. Payment of Credit Card Bills in Cash

Threshold: ₹1,00,000

Why it’s monitored: If you pay over ₹1 lakh in cash toward your credit card bill, it may be seen as an attempt to launder unreported income.

Precaution: Use bank transfers, cheques, or online payments for credit card bills.

8. Large Payments of Credit Card Bills in Any Mode

Threshold: ₹10,00,000

Why it’s monitored: If you pay more than ₹10 lakh in credit card bills (through any mode), it signals high spending and could trigger an income tax notice.

Precaution: Ensure your income tax return reflects your earnings and expenses appropriately.

9. Sale of Foreign Currency

Threshold: ₹10,00,000

Why it’s monitored: Large forex transactions could indicate international tax evasion or money laundering.

Precaution: Maintain records of all forex transactions and report foreign income, if applicable.

10. Purchase of Demand Drafts (DD) or Pay Orders

Threshold: ₹10,00,000

Why it’s monitored: If you buy DDs, pay orders, or banker's cheques worth over ₹10 lakh in a year, tax authorities might ask about the source of funds.

Precaution: Keep transaction records and ensure they align with declared income.

How Does the Income Tax Department Track These Transactions?

The Income Tax Department receives reports of high-value transactions through:

Annual Information Return (AIR): Financial institutions, stock exchanges, and registrars submit reports on large transactions.

Statement of Financial Transactions (SFT): Banks and mutual fund houses report specific transactions exceeding thresholds.

PAN & Aadhaar Linking: Your transactions are easily traceable if linked with your PAN and Aadhaar.

What Should You Do If You Receive an Income Tax Notice?

Don’t Panic – Receiving a notice doesn’t mean wrongdoing. It’s usually a request for clarification.

Check the Details – Carefully read the notice to understand what’s being questioned.

Gather Documents – Prepare bank statements, tax returns, and supporting evidence to justify your transactions.

Respond on Time – Reply within the given deadline to avoid penalties.

Consult a Tax Expert – If needed, seek help from a Chartered Accountant (CA) or tax professional.

How to Avoid Income Tax Notices for Large Transactions?

File Your Income Tax Return (ITR) Accurately: Ensure all sources of income are reported correctly.

Avoid Large Cash Transactions: Where possible, use digital transactions to maintain transparency.

Keep Proper Documentation: Maintain records for income, investments, and business transactions.

Verify Your PAN Details: Ensure that your PAN is correctly linked to all financial transactions.

Use Banking Channels for Large Payments: Bank transfers, NEFT, RTGS, and UPI payments are safer than cash.

Final Thoughts

Being aware of these financial thresholds can help you avoid unnecessary tax scrutiny and stay compliant with tax laws. If you engage in high-value transactions, always maintain proper documentation and ensure that your tax filings reflect your financial activities accurately.

By following these guidelines, you can manage your finances smoothly while staying compliant with tax regulations.

0 notes

Text

How FII and DII Activity Affects Retail Investors and Their Investment Strategy

Have you ever wondered why the stock market swings up and down so much? One big reason is the activity of big investors—Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII). These are the market’s heavyweights, and their moves can make a huge difference in stock prices. But what does this mean for you as a retail investor? Should you follow their moves, or is there a smarter way to invest? Let’s break it down in simple terms.

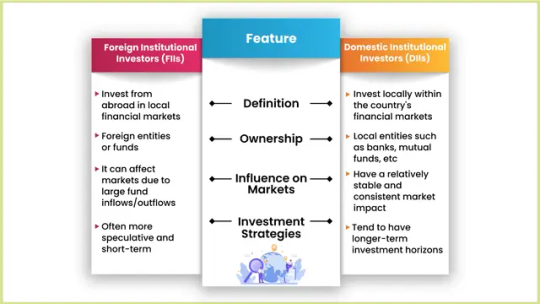

What Are FIIs and DIIs?

Before we dive deep, let’s understand what these terms mean:

Foreign Institutional Investors (FII): These are big investment funds, hedge funds, mutual funds, or pension funds from outside India that invest in our stock market. They often bring in large amounts of money, but they can also withdraw quickly based on global factors.

Domestic Institutional Investors (DII): These are investment firms, insurance companies, and mutual funds based in India that invest in Indian stocks using money collected from Indian investors. They usually have a long-term perspective and provide stability to the market.

Both FIIs and DIIs have the power to move the market, but their strategies are often different. Understanding their behavior can help retail investors make better financial decisions.

How Do FIIs and DIIs Influence the Market?

1. They Decide the Market’s Mood

Imagine the stock market like a party. When FIIs invest heavily, it’s like a flood of guests arriving, making the party (market) lively and exciting. Stocks go up, and everyone feels optimistic. But when they start leaving, panic sets in, and the market crashes. DIIs, on the other hand, act like responsible hosts who try to keep things in order, buying stocks when FIIs sell and stabilizing the market.

2. Stock Prices React to Their Moves

FIIs usually invest in high-growth stocks. When they buy, stock prices surge, and when they sell, prices drop. DIIs, however, invest in more stable companies and often buy when prices fall, providing support. This is why some stocks suddenly rise or fall without any major company news—it's often just FII and DII activity at play!

3. Market Volatility – The Rollercoaster Ride

Since FIIs react to global events, like U.S. interest rate hikes or geopolitical tensions, their buying and selling decisions can be unpredictable. This creates volatility—markets swing up and down rapidly. Retail investors often get caught in this storm, panicking when prices drop and buying when the market is already high.

4. Liquidity – More Money, More Action

FIIs bring in foreign currency, making the stock market more liquid. This means stocks are traded actively, making it easier for investors to buy and sell. However, when FIIs exit, liquidity dries up, and stock prices can become unpredictable.

5. Sector-Specific Influence

FIIs love high-growth sectors like banking, IT, and pharma. DIIs, on the other hand, prefer stable sectors like FMCG and utilities. If you see FIIs aggressively buying a certain sector, it may be trending. But remember, they can exit anytime, causing sharp declines.

What Should Retail Investors Do?

1. Follow Their Moves, But Don’t Blindly Copy

Tracking FII and DII activity is smart, but blindly following them can be risky. They have different investment horizons and risk appetites compared to individual investors. Instead, use their trends as indicators and combine them with your research.

2. Avoid Panic Selling When FIIs Exit

Many retail investors sell stocks when they see FIIs withdrawing. But DIIs often step in to balance the market. Instead of panic selling, analyze why FIIs are exiting. If it's due to external reasons (like global economic trends) rather than company fundamentals, you might be better off holding onto your investments.

3. Use DII Buying as a Confidence Signal

DIIs have a long-term outlook. If they are buying when the market is falling, it’s usually a good sign. They invest based on strong fundamentals, so following their moves can be a good strategy.

4. Diversify Your Portfolio

Since FII investments are unpredictable, don’t put all your money in FII-favored stocks. Diversifying across different sectors and assets (like mutual funds, gold, or real estate) can protect you from extreme volatility.

5. Think Long-Term

Short-term FII movements cause market ups and downs, but long-term growth depends on economic fundamentals. Focus on investing in strong companies rather than reacting to daily market movements.

Real-Life Examples

2020 Market Crash and Recovery

When COVID-19 hit, FIIs withdrew billions of dollars, causing a market crash.

DIIs and retail investors bought at lower prices, leading to a strong market recovery by the end of 2020.

FII Selling in 2022 Due to U.S. Rate Hikes

FIIs sold heavily in 2022 when the U.S. raised interest rates.

DIIs continued investing in Indian stocks, preventing a deeper crash.

Final Thoughts

FIIs and DIIs influence the market in a big way, but retail investors shouldn’t blindly follow them. While FIIs bring money and volatility, DIIs provide stability. Understanding their behavior can help you make informed investment decisions. Instead of reacting emotionally to market movements, focus on long-term wealth creation.

So, next time you see headlines about FIIs pulling out money or DIIs buying aggressively, don’t panic. Use this information wisely, stay patient, and build a strong investment portfolio that suits your goals!

0 notes

Text

The basics of investment management and its importance in wealth-building

Investment management is a key component of financial planning that involves the professional management of various assets, such as stocks, bonds, real estate, and other investments, with the goal of meeting specific financial objectives. Whether you're an individual investor or part of a large institutional entity, understanding the basics of investment management can help you achieve long-term wealth-building goals. In this blog, we'll explore the fundamental concepts of investment management and why it plays a vital role in your wealth-building journey.

What is Investment Management?

Investment management refers to the process of managing investments on behalf of individuals or organizations. The main objectives are to generate returns that meet the client's goals, such as retirement savings, education funding, or growing capital. This process involves a range of tasks including:

Asset Allocation: Deciding how to distribute investments across various asset classes (equities, bonds, real estate, etc.).

Risk Management: Balancing risk and reward, taking into account the investor’s tolerance for risk and time horizon.

Diversification: Spreading investments across different sectors, regions, and asset types to minimize risk.

Investment Selection: Picking the specific investments (stocks, bonds, funds, etc.) that align with the investor's goals.

Portfolio Monitoring and Rebalancing: Continuously reviewing and adjusting the portfolio as needed to ensure it remains aligned with the investor’s objectives.

Types of Investments in Management

Stocks: Shares of ownership in a company. Stocks offer the potential for high returns but come with greater volatility and risk.

Bonds: Debt securities issued by corporations or governments. Bonds tend to offer lower returns but come with less risk than stocks.

Mutual Funds and ETFs: Pooled investment vehicles that allow investors to invest in a diversified portfolio managed by professionals.

Real Estate: Physical properties that can generate rental income or appreciate in value over time.

Commodities: Physical assets like gold, silver, or oil that can act as a hedge against inflation or economic downturns.

Importance of Investment Management in Wealth-Building

Investment management plays a crucial role in wealth-building for several reasons:

1. Growing Your Money Over Time

The primary goal of investment management is to grow your money over time. By investing your savings in a variety of assets, you can benefit from the potential for compounding returns, which helps build wealth faster than simply saving money in a bank account. For example, investments in the stock market have historically outperformed savings accounts and bonds over the long term.

2. Achieving Financial Goals

Most people invest to achieve specific financial goals, such as retirement, buying a home, or funding education. A well-managed portfolio can help ensure that you are on track to meet these objectives. Through careful planning, investment managers can align your portfolio with your financial goals, taking into account your risk tolerance, time horizon, and income needs.

3. Risk Mitigation

Investing always involves some level of risk. However, professional investment management involves balancing and mitigating these risks. By diversifying your investments across different asset classes, sectors, and geographic regions, you reduce the impact of any single investment’s poor performance. Proper risk management ensures that your portfolio can weather economic downturns while still providing opportunities for growth.

4. Beating Inflation

Inflation erodes the purchasing power of your money over time. If your money is sitting idle in a savings account or under your mattress, it may lose value over the years. Investments, especially in stocks and real estate, have the potential to outpace inflation and help preserve and grow your wealth.

5. Taking Advantage of Expertise

Professional investment managers bring expertise and experience to the table, helping to navigate market fluctuations and capitalize on opportunities that may be difficult for individual investors to spot. Their ability to analyze trends, conduct research, and apply various strategies can help optimize the returns on your investments.

6. Tax Efficiency

Investment managers also work to ensure that your portfolio is tax-efficient. By utilizing tax-advantaged accounts, such as IRAs or 401(k)s, and strategically placing investments in tax-efficient securities, you can reduce your overall tax burden and keep more of your returns.

Key Considerations in Investment Management

While investment management is vital for building wealth, there are several key factors to keep in mind when making decisions:

Time Horizon: The length of time you expect to hold your investments affects the level of risk you should take. Long-term investors may have more leeway to ride out market fluctuations, while short-term investors may need to focus on more stable, less volatile investments.

Risk Tolerance: Everyone has different levels of comfort when it comes to risk. Understanding your own risk tolerance is essential for selecting investments that match your ability to handle market volatility.

Costs and Fees: Investment management often comes with fees, including management fees, trading fees, and other administrative costs. These can erode your returns over time, so it's important to be aware of the fees associated with any investment vehicle you choose.

Regular Monitoring and Rebalancing: The financial markets are dynamic, and economic conditions change frequently. Regular monitoring of your portfolio and making adjustments as needed ensures that your investments continue to meet your financial objectives.

Final Thoughts: The Path to Wealth-Building

Investment management is a powerful tool for building wealth over time. By understanding the basics of investment management and making informed decisions about your investments, you can improve your chances of achieving financial independence. Whether you're just starting your investment journey or looking to refine your current strategy, taking the time to develop a solid investment plan can pay off in the long run.

Remember that the journey to wealth-building is not a sprint but a marathon. With careful planning, strategic investment choices, and a focus on your long-term goals, you can unlock the full potential of your financial future.

0 notes

Text

How FII and DII Activity Affects Retail Investors and Their Investment Strategy

Have you ever wondered why the stock market swings up and down so much? One big reason is the activity of big investors—Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII). These are the market’s heavyweights, and their moves can make a huge difference in stock prices. But what does this mean for you as a retail investor? Should you follow their moves, or is there a smarter way to invest? Let’s break it down in simple terms.

What Are FIIs and DIIs?

Before we dive deep, let’s understand what these terms mean:

Foreign Institutional Investors (FII): These are big investment funds, hedge funds, mutual funds, or pension funds from outside India that invest in our stock market. They often bring in large amounts of money, but they can also withdraw quickly based on global factors.

Domestic Institutional Investors (DII): These are investment firms, insurance companies, and mutual funds based in India that invest in Indian stocks using money collected from Indian investors. They usually have a long-term perspective and provide stability to the market.

Both FIIs and DIIs have the power to move the market, but their strategies are often different. Understanding their behavior can help retail investors make better financial decisions.

How Do FIIs and DIIs Influence the Market?

1. They Decide the Market’s Mood

Imagine the stock market like a party. When FIIs invest heavily, it’s like a flood of guests arriving, making the party (market) lively and exciting. Stocks go up, and everyone feels optimistic. But when they start leaving, panic sets in, and the market crashes. DIIs, on the other hand, act like responsible hosts who try to keep things in order, buying stocks when FIIs sell and stabilizing the market.

2. Stock Prices React to Their Moves

FIIs usually invest in high-growth stocks. When they buy, stock prices surge, and when they sell, prices drop. DIIs, however, invest in more stable companies and often buy when prices fall, providing support. This is why some stocks suddenly rise or fall without any major company news—it's often just FII and DII activity at play!

3. Market Volatility – The Rollercoaster Ride

Since FIIs react to global events, like U.S. interest rate hikes or geopolitical tensions, their buying and selling decisions can be unpredictable. This creates volatility—markets swing up and down rapidly. Retail investors often get caught in this storm, panicking when prices drop and buying when the market is already high.

4. Liquidity – More Money, More Action

FIIs bring in foreign currency, making the stock market more liquid. This means stocks are traded actively, making it easier for investors to buy and sell. However, when FIIs exit, liquidity dries up, and stock prices can become unpredictable.

5. Sector-Specific Influence

FIIs love high-growth sectors like banking, IT, and pharma. DIIs, on the other hand, prefer stable sectors like FMCG and utilities. If you see FIIs aggressively buying a certain sector, it may be trending. But remember, they can exit anytime, causing sharp declines.

What Should Retail Investors Do?

1. Follow Their Moves, But Don’t Blindly Copy

Tracking FII and DII activity is smart, but blindly following them can be risky. They have different investment horizons and risk appetites compared to individual investors. Instead, use their trends as indicators and combine them with your research.

2. Avoid Panic Selling When FIIs Exit

Many retail investors sell stocks when they see FIIs withdrawing. But DIIs often step in to balance the market. Instead of panic selling, analyze why FIIs are exiting. If it's due to external reasons (like global economic trends) rather than company fundamentals, you might be better off holding onto your investments.

3. Use DII Buying as a Confidence Signal

DIIs have a long-term outlook. If they are buying when the market is falling, it’s usually a good sign. They invest based on strong fundamentals, so following their moves can be a good strategy.

4. Diversify Your Portfolio

Since FII investments are unpredictable, don’t put all your money in FII-favored stocks. Diversifying across different sectors and assets (like mutual funds, gold, or real estate) can protect you from extreme volatility.

5. Think Long-Term

Short-term FII movements cause market ups and downs, but long-term growth depends on economic fundamentals. Focus on investing in strong companies rather than reacting to daily market movements.

Real-Life Examples

2020 Market Crash and Recovery

When COVID-19 hit, FIIs withdrew billions of dollars, causing a market crash.

DIIs and retail investors bought at lower prices, leading to a strong market recovery by the end of 2020.

FII Selling in 2022 Due to U.S. Rate Hikes

FIIs sold heavily in 2022 when the U.S. raised interest rates.

DIIs continued investing in Indian stocks, preventing a deeper crash.

Final Thoughts

FIIs and DIIs influence the market in a big way, but retail investors shouldn’t blindly follow them. While FIIs bring money and volatility, DIIs provide stability. Understanding their behavior can help you make informed investment decisions. Instead of reacting emotionally to market movements, focus on long-term wealth creation.

So, next time you see headlines about FIIs pulling out money or DIIs buying aggressively, don’t panic. Use this information wisely, stay patient, and build a strong investment portfolio that suits your goals!

0 notes

Text

The Importance of Self-Awareness in Financial Planning

Financial planning is often seen as a numbers game — budgeting, investing, saving, and managing debt. While these are certainly important components, there’s one critical aspect that many people overlook: self-awareness. Understanding yourself — your values, goals, and emotional responses to money — plays a vital role in creating a sustainable and effective financial plan.

In this blog, we’ll explore how self-awareness can enhance your financial journey, helping you make better decisions, avoid unnecessary stress, and ultimately achieve your financial goals.

1. Understanding Your Values and Priorities

Self-awareness begins with understanding your core values and what truly matters to you. Do you value security and stability, or are you more driven by freedom and experiences? Are you focused on long-term goals like retirement or short-term desires like travel or purchasing a home?

By understanding these values, you can prioritize your financial decisions accordingly. For example, if family security is a top priority, you may choose to allocate more money toward life insurance or emergency savings. If freedom and experiences are more important, you might prefer to invest in travel or pursue career paths that offer more flexibility.

When your financial plan aligns with your values, you’re more likely to stick with it, as it reflects your authentic desires. Without this alignment, financial planning may feel like a series of sacrifices or compromises, leading to frustration or burnout.

2. Recognizing Your Financial Strengths and Weaknesses

Self-awareness helps you honestly assess your financial strengths and weaknesses. Are you good at saving but struggle with spending? Do you find it hard to stick to a budget, or do you excel at organizing your finances? Recognizing where you excel can give you confidence to build upon those strengths, while identifying areas of weakness allows you to seek help or develop strategies to improve.

For example, if you’re not great at tracking your spending, you might use budgeting apps or hire a financial advisor to help. Alternatively, if you tend to be an impulse buyer, you may need to find ways to create more mindful spending habits — like waiting 24 hours before making any non-essential purchase.

The more you understand your behaviors around money, the more effectively you can shape your financial plan to work in harmony with your natural tendencies.

3. Managing Emotional Responses to Money

Money has a unique way of triggering emotional reactions. Whether it’s excitement over a large purchase, anxiety about debt, or stress about investing, your emotions can heavily influence your financial decisions. Self-awareness allows you to recognize when your emotions are taking the reins.

For instance, if you tend to make rash decisions when you’re stressed (like making impulsive stock purchases or over-spending on credit cards), being aware of these tendencies can help you pause and reconsider. Implementing emotional management techniques, such as creating a cooling-off period before making large purchases or seeking advice from a trusted person, can help you avoid emotional spending or investing mistakes.

Moreover, understanding how you feel about money can help you make choices that are in line with your well-being, rather than simply following societal norms or external pressures.

4. Setting Realistic Financial Goals

Self-awareness plays a critical role in setting financial goals that are both achievable and meaningful. It's easy to get swept up in the idea of financial success based on what others are doing or what seems “normal,” but true financial success is personal and should be based on your own goals.

When you understand your current financial situation, your lifestyle preferences, and your long-term aspirations, you can create more realistic goals. For example, if you’re passionate about early retirement, you may prioritize aggressive savings and investing. On the other hand, if work-life balance and spending on experiences are your top priorities, your goals may focus more on living in the present while saving moderately for the future.

Self-awareness helps you recognize what’s truly important to you, so you don’t waste time chasing goals that others value, but that don’t align with your own vision of financial fulfillment.

5. Building Healthy Financial Habits

Becoming self-aware allows you to identify patterns in your financial behavior that may either help or hinder your progress. For example, do you tend to procrastinate on budgeting, or do you regularly review your financial situation? Do you consistently save or spend impulsively?

By recognizing these patterns, you can implement strategies to form healthier financial habits. If you notice that you spend more when you’re stressed, you might create a “spending plan” to ensure you’re only purchasing what you truly need when under pressure. If you tend to ignore budgeting, set aside time weekly to review your finances.

The goal is to create a financial routine that supports your well-being and financial goals, making it easier to manage your money in a way that feels natural for you.

6. Increasing Financial Confidence

When you understand your financial situation, strengths, and weaknesses, it’s easier to feel confident in your decisions. Self-awareness builds this confidence by removing uncertainty and providing clarity about your priorities and how to achieve them.

Confidence in your financial plan can also help you navigate difficult situations, such as an unexpected expense or a market downturn. When you understand your emotions and tendencies, you’re better equipped to stay calm and stick to your long-term plan, instead of reacting out of fear or anxiety.

7. Adapting to Change

Life is unpredictable, and financial planning isn’t a one-size-fits-all process. Changes in income, family circumstances, or health can all impact your financial plan. Self-awareness makes it easier to adapt to these changes, as it helps you recognize when your needs, goals, or risk tolerance have shifted.

For example, if you’ve recently had a child, your financial priorities might change. Self-awareness allows you to quickly recognize that your previous plan for short-term travel savings may need to shift to a more long-term focus on saving for your child’s education or creating a larger emergency fund.

The more you know about your priorities and behaviors, the more agile you can be in adapting your financial plan when life changes unexpectedly.

Conclusion

Self-awareness is a powerful tool in financial planning. By understanding your values, strengths, weaknesses, emotions, and goals, you can create a financial plan that truly reflects your unique needs and aspirations. This awareness not only helps you make informed financial decisions but also empowers you to take control of your financial future. The better you know yourself, the more effectively you can manage your money and achieve long-term financial success.

Remember, financial planning is not just about numbers — it’s about creating a plan that supports the life you want to live. So, start with self-awareness, and let it guide you toward a financially fulfilling future.

0 notes

Text

My Goals in Finance: Navigating a Path to Financial Success

In today's ever-changing world, financial security has become more important than ever before. From managing daily expenses to investing for the future, personal finance is no longer just about getting by—it’s about building a sustainable path toward long-term wealth. For me, the journey to financial success is not only about achieving financial independence but also about creating a meaningful, purpose-driven financial life. This blog will outline my financial goals and the strategies I am implementing to achieve them.

1. Building a Strong Emergency Fund

One of the first steps in any financial journey is to create a safety net for unexpected events. Emergencies, whether they involve car repairs, medical bills, or job loss, can happen at any time. An emergency fund provides peace of mind and keeps me from relying on high-interest loans or credit cards when something unexpected comes up.

Goal: To save at least six months' worth of living expenses in a liquid, accessible account within the next 12 months.

Strategy: I plan to set aside a portion of my monthly income into a high-yield savings account. By automating this process, I’ll ensure that I am consistently contributing to my fund, even when life gets busy.

2. Eliminating Debt

Debt can be a significant barrier to achieving financial freedom. Whether it’s student loans, credit card balances, or personal loans, carrying debt means paying interest on borrowed money—money that could be better used for building wealth. One of my major financial goals is to eliminate high-interest debt as quickly as possible.

Goal: Pay off all high-interest debt within the next 18 months.

Strategy: I am focusing on the "debt snowball" method, where I pay off the smallest debt first while making minimum payments on others. Once the smallest debt is paid off, I’ll move on to the next one, gradually building momentum. Any extra income, such as bonuses or side hustle profits, will be directed toward this goal.

3. Building a Diversified Investment Portfolio

While saving and budgeting are essential, the real magic of growing wealth lies in investing. Over time, the power of compound interest can work wonders, but only if the money is invested wisely. I aim to build a diversified portfolio that includes stocks, bonds, real estate, and other assets to create multiple streams of income.

Goal: Start investing 15% of my income annually into a mix of assets, including index funds, ETFs, and real estate, to build long-term wealth.

Strategy: I am taking a balanced approach to investing, with a focus on low-cost index funds for steady growth and occasional real estate investments. I’ll be regularly reviewing my portfolio to ensure it’s properly diversified and aligned with my risk tolerance and long-term objectives.

4. Retirement Planning and Financial Independence

A major aspect of financial success is ensuring that I can retire comfortably when the time comes. Financial independence means having the ability to live without relying on earned income. By focusing on strategic retirement planning, I hope to secure a future that doesn’t rely solely on traditional employment.

Goal: Contribute the maximum allowable amount to my retirement accounts, such as 401(k) and IRA, and aim to retire early with financial independence.

Strategy: I plan to increase my retirement contributions each year as my income rises. Additionally, I will explore other passive income options, such as dividend-paying stocks, real estate income, and entrepreneurial ventures, to create multiple revenue streams for my post-retirement life.

5. Developing Financial Literacy

Understanding personal finance is one of the most important tools in achieving long-term wealth. Financial literacy allows me to make informed decisions about budgeting, investing, taxes, and wealth-building strategies. As such, I am committed to continuously learning about personal finance and staying updated on new trends and tools that can help me navigate my journey.

Goal: Read at least one book on personal finance every month and attend financial workshops or webinars regularly.

Strategy: I will make a conscious effort to read books, listen to podcasts, and engage with financial communities online to enhance my knowledge. This will help me make better decisions when it comes to managing money and growing wealth.

6. Giving Back to the Community

Financial success isn't just about accumulating wealth for personal gain. For me, it's also about using my financial resources to help others. One of my long-term goals is to be able to give back to causes that I care about—whether through charitable donations, supporting local businesses, or mentoring those who are just starting their financial journeys.

Goal: Donate at least 5% of my annual income to charity and support community initiatives.

Strategy: As I grow my wealth, I plan to set aside a portion specifically for charitable giving. This will include supporting both larger organizations and local causes that directly impact my community.

Conclusion

Navigating a path to financial success is a lifelong journey, and the road is rarely linear. There will be setbacks and challenges along the way, but the key is to remain consistent, focused, and adaptable. By setting clear financial goals, developing a strategy for achieving them, and staying committed to the process, I am confident that I can build a financially secure and meaningful future.

Ultimately, financial success is not just about having money—it’s about having the freedom to live life on my own terms, make informed choices, and contribute to the well-being of those around me. This journey is just beginning, and I’m excited to continue making progress toward achieving my goals.

0 notes

Text

The Importance of Tracking Your Expenses: A Simple Guide to Better Financial Control

Tracking your expenses is one of the simplest yet most powerful ways to take control of your finances. Whether you're looking to save more, pay off debt, or just get a clearer picture of where your money is going, keeping track of your spending can help you make smarter financial decisions. In this blog, we’ll explore why tracking expenses is crucial and how you can start doing it today.

Why Tracking Expenses is Important

Awareness of Spending Habits Tracking your expenses helps you understand your spending patterns. It reveals where your money is going, whether it’s on essentials like groceries and bills or discretionary spending like dining out, entertainment, or shopping. This awareness can help you identify areas where you can cut back and save more.

Budgeting Made Easy Creating a budget is much easier when you know exactly how much you’re spending each month. By categorizing your expenses, you can allocate a certain amount to each category and track your progress. This way, you can live within your means and avoid overspending.

Setting Financial Goals When you track your expenses, you can set specific financial goals—whether it’s building an emergency fund, saving for a vacation, or paying off credit card debt. Having a clear idea of where your money is going makes it easier to adjust your spending habits to reach these goals.

Identifying Unnecessary Costs You might be surprised by how much you spend on non-essential items. Without tracking, small purchases like coffee runs or impulse buys can go unnoticed, but over time they add up. By identifying these unnecessary costs, you can decide to cut them out and redirect that money toward more important financial priorities.

Preventing Debt Without a clear understanding of your finances, it’s easy to overspend, which can lead to debt. Tracking expenses ensures you are living within your income and avoiding the temptation to rely on credit cards or loans to cover everyday purchases.

How to Track Your Expenses

Tracking your expenses doesn’t have to be time-consuming or complicated. Here are a few simple methods you can use:

Use a Budgeting App There are many apps available today that help you track your spending automatically. Apps like Mint, YNAB (You Need A Budget), and PocketGuard sync with your bank accounts and credit cards to categorize your expenses. They provide real-time insights into your spending habits and even allow you to set budgets and goals.

Create a Manual Log If you prefer a hands-on approach, consider tracking your expenses in a notebook or spreadsheet. At the end of each day, write down everything you spent, from big bills to small purchases. Categorize your expenses (e.g., food, transportation, entertainment) to see where your money is going.

Use a Receipt-Based System If you’re not fond of entering every transaction manually, try saving your receipts. Once a week, go through your receipts and record the information in a journal, spreadsheet, or app. This method allows you to easily keep track of physical purchases while also offering a visual record of your spending.

Set Up Alerts Many banks and credit cards allow you to set up transaction alerts for every purchase you make. These notifications can help you keep track of your spending in real time, reducing the chance of forgetting about smaller purchases that add up quickly.

Review Your Statements At the end of each month, review your bank and credit card statements. Take note of any recurring charges, and identify areas where you could save money, like subscriptions you no longer use or unnecessary purchases that you didn’t even realize you were making.

Tips for Staying on Track

Be Consistent: Tracking your expenses won’t be effective if you don’t do it regularly. Make it a habit to review your spending at least once a week or at the end of every day.

Set Realistic Budgets: Don’t set yourself up for failure by creating a budget that’s too restrictive. Allow some flexibility for fun expenses while keeping your financial goals in mind.

Analyze and Adjust: Tracking expenses is about more than just recording purchases. Use the data to assess your habits and make adjustments. If you’re consistently overspending in a certain category, look for ways to cut back.

Celebrate Your Progress: Tracking your expenses is a journey, and small wins matter. Whether you’ve cut out a weekly takeaway or started saving for a rainy day, take the time to appreciate your progress.

Conclusion

Tracking your expenses is an essential step toward achieving financial stability and meeting your long-term goals. It gives you a clearer view of where your money is going, helps you budget more effectively, and can even uncover areas where you can save. Whether you choose to use an app or stick to a manual approach, the key is consistency and commitment. With a little effort, you can gain control over your finances and start making smarter money decisions today.

Remember: Financial success doesn’t happen overnight, but by tracking your expenses, you're taking a major step in the right direction!

0 notes

Text

Understanding Finance and Financial Management: A Pathway to Economic Success

In today's fast-paced and interconnected world, understanding finance and financial management has become more critical than ever before. Whether you're running a business, managing a household budget, or planning for personal financial growth, the principles of finance guide key decisions that shape both short-term and long-term outcomes. But what exactly is finance, and how does financial management help pave the way to economic success? Let’s dive in.

What is Finance?

At its core, finance is the study and management of money, investments, and other financial instruments. It involves making decisions about how money is raised and allocated, whether it's for personal use, corporate purposes, or government spending. Finance can be broken down into three main areas:

Personal Finance: This includes budgeting, saving, investing, and planning for retirement. Individuals make financial decisions based on income, expenses, and life goals, such as buying a home or paying for college education.

Corporate Finance: This deals with financial decisions made by businesses. It covers areas like capital investment, managing company profits, financing operations, and strategies to maximize shareholder value.

Public Finance: This refers to the way governments manage their revenue, spending, and budgeting to provide public goods and services, manage debt, and influence economic policies.

Each of these areas relies on sound financial principles to ensure efficient and effective use of resources, contributing to overall economic stability and growth.

The Role of Financial Management

Financial management is the practice of managing finances in a way that helps individuals or organizations achieve their financial goals. It is crucial for ensuring that resources are used optimally, risks are minimized, and financial strategies align with overarching goals. In the context of a business, financial management involves:

Budgeting and Forecasting: Establishing budgets and making financial forecasts help businesses and individuals plan for the future. By understanding expected income and expenditures, financial managers can guide decisions that lead to profitability and financial health.

Investment Decisions: Sound financial management includes deciding where to invest resources. Businesses make investment choices based on projected returns and the level of risk. Similarly, individuals must choose investments that align with their financial goals and risk tolerance.

Capital Structure: One of the critical aspects of financial management is determining how a business will raise funds. This could involve debt financing (loans, bonds) or equity financing (selling shares). A strong capital structure enables a business to maintain financial stability and growth potential.

Risk Management: Financial managers must evaluate and mitigate financial risks, including market volatility, interest rate fluctuations, and credit risk. By identifying potential threats to financial stability, businesses and individuals can take proactive steps to avoid significant losses.

Why is Financial Management Essential?

Maximizes Resources: Proper financial management ensures that money is spent wisely, whether it’s on daily expenses, capital investments, or future growth opportunities. Efficient resource allocation helps individuals and businesses reach their goals faster and with fewer financial hiccups.

Prepares for the Future: Financial management isn’t just about short-term planning; it’s also about long-term financial health. By anticipating future needs and risks, individuals and businesses can prepare better for challenges and opportunities that lie ahead.

Ensures Financial Security: With strong financial management, the risk of running out of money or facing a financial crisis is minimized. It allows for building emergency funds, preparing for unexpected situations, and fostering growth opportunities in the future.

Increases Profits and Wealth: For businesses, effective financial management directly impacts the bottom line. From controlling operational costs to making profitable investments, sound financial practices help businesses achieve sustainable profitability and growth.

Promotes Economic Growth: On a larger scale, when businesses manage finances effectively, it contributes to broader economic growth. Profitable companies are able to hire more employees, reinvest in innovation, and contribute to the economy through taxes and social contributions.

How Financial Management Contributes to Economic Success

Achieving economic success—whether at an individual or organizational level—requires a firm understanding of financial management principles. Here's how mastering financial management can pave the way for success:

Increased Financial Literacy: Understanding how money works, how investments perform, and the importance of budgeting fosters financial literacy. This knowledge empowers individuals and businesses to make informed decisions, avoid debt traps, and build wealth over time.

Better Decision-Making: Financial management equips individuals and companies with the tools and data necessary for making smart decisions. By analyzing cash flow, returns on investments, and future projections, better business strategies and personal financial choices emerge.

Sustainability: Effective financial management isn’t just about making money in the short term; it’s about building sustainable growth. A company that balances profits with social responsibility, or an individual who saves consistently for retirement, is setting up a future with economic stability.

Minimizing Financial Stress: For individuals, knowing how to manage debt, save for goals, and invest wisely can reduce financial stress and improve mental well-being. For businesses, managing cash flow and reducing unnecessary expenditures ensures a steady and predictable financial environment.

Conclusion

Understanding finance and financial management is not just reserved for the wealthy or business leaders—it's a critical skill for anyone who wants to achieve economic success. Whether you’re managing a corporate budget or planning for your personal future, mastering financial principles enables you to make informed decisions, minimize risk, and create opportunities for growth.

In an increasingly complex economic world, financial knowledge is power. By becoming financially literate and practicing good financial management, you can navigate the ever-changing landscape of personal and business finance to secure a prosperous future for yourself and contribute to broader economic success.

0 notes

Text

The Power of Personalized Financial Planning Tailoring Your Wealth Journey

In today’s fast-paced and ever-changing financial landscape, one-size-fits-all solutions just don’t cut it. As individuals face unique challenges, goals, and circumstances, personalized financial planning has become more important than ever. Gone are the days when generic advice and cookie-cutter strategies could effectively guide people toward financial success. Instead, tailored solutions that align with personal goals, values, and lifestyles are now at the forefront of wealth management.

What is Personalized Financial Planning?

Personalized financial planning involves creating a financial roadmap that is customized to fit the individual’s specific situation. Rather than relying on generic strategies, it takes into account factors like income, debt, family structure, goals, and risk tolerance. The result is a holistic plan that’s designed to help individuals navigate their financial journey and achieve their personal goals.

The Benefits of Personalized Financial Plans

Better Alignment with Life Goals: One of the greatest advantages of personalized financial planning is the focus on what truly matters to you. Whether it’s saving for a child’s education, building a retirement nest egg, or starting a business, a personalized plan keeps you aligned with your long-term vision and ensures your money is working toward your priorities.

Tailored Investment Strategies: Different people have different levels of risk tolerance, which is why one-size-fits-all investment strategies often fall short. Personalized financial plans incorporate your comfort level with risk, your time horizon, and your financial objectives to design a portfolio that suits you. Whether you're conservative, moderate, or aggressive in your approach, your plan will reflect your unique preferences.

Debt Management: Managing debt can be overwhelming, especially when dealing with student loans, mortgages, or credit card balances. A personalized financial plan provides a strategy for paying down debt effectively, with clear goals and timelines. Instead of taking a generic approach, you’ll learn how to prioritize which debts to tackle first, avoid unnecessary interest costs, and work toward a debt-free future.

Tax Efficiency: Tax laws are complicated and vary by individual circumstances. A personalized financial plan can help minimize your tax burden by identifying tax-saving opportunities, such as tax-deferred accounts or tax-efficient investment strategies. This proactive approach helps you keep more of your hard-earned money working for you.

Adaptability for Life Changes: Life is full of changes—whether it's a marriage, having children, a career change, or approaching retirement. A personalized financial plan isn’t static; it evolves as your life circumstances change. Financial advisors who focus on personalized plans will update your strategies to accommodate life’s twists and turns, ensuring you’re always on track toward achieving your goals.

How to Build a Personalized Financial Plan

Set Clear Financial Goals: The first step in creating a personalized financial plan is identifying your goals. Are you saving for retirement, purchasing a home, or planning for your children’s education? Clarifying your objectives will serve as the foundation for your financial decisions.

Assess Your Current Financial Situation: To develop a customized plan, it's essential to assess your current financial standing. This includes reviewing your income, expenses, savings, investments, and debts. Understanding where you stand helps identify areas for improvement.

Create a Budget and Savings Strategy: Building a budget and committing to a savings plan ensures you're putting money aside to achieve your goals. Whether it’s creating an emergency fund or investing in the stock market, a budget lays the groundwork for financial stability and future growth.

Invest Wisely: As part of a personalized plan, your investment strategy should be based on your goals, risk tolerance, and time horizon. Whether you prefer low-risk investments like bonds or are interested in higher-risk stocks, the key is to build a diversified portfolio that aligns with your financial objectives.

Review and Adjust Regularly: Your financial plan is not something that should be tucked away and forgotten. Regularly reviewing your plan ensures that it stays aligned with your goals and any changes in your life or financial circumstances. Adjusting your plan as needed keeps you on track to success.

Conclusion

Personalized financial planning is not just a luxury reserved for the wealthy—it’s a powerful tool for anyone looking to take control of their financial future. By crafting a strategy that takes into account your unique goals, needs, and circumstances, you’re not only better equipped to make informed decisions, but you’re also setting yourself up for lasting financial success. So, whether you're just starting out or looking to refine your strategy, consider working with a financial advisor who understands the importance of personalized planning. After all, your financial journey is uniquely yours—shouldn’t your plan be too?

0 notes

Text

Mastering Investment Planning Your Roadmap to Financial Success

Investment planning is a crucial part of securing your financial future. Whether you're a novice or an experienced investor, having a clear, strategic investment plan is essential for building wealth and achieving your financial goals. In this blog, we’ll walk you through the essentials of investment planning, from setting goals to choosing the right investment vehicles.

Why is Investment Planning Important?

Before diving into the details of how to plan for investments, let’s first understand why investment planning is so important. Effective investment planning helps you:

Achieve Financial Goals: Whether you're saving for retirement, buying a house, or funding your child's education, a well-thought-out plan can help you reach your objectives faster.

Maximize Returns: A sound investment strategy can lead to higher returns compared to traditional savings accounts or underperforming assets.

Manage Risks: Investments inherently come with risks. Having a strategy helps in balancing risk and reward based on your personal risk tolerance.

Provide Financial Security: The right investments can build long-term wealth, providing you with the financial security you need for a comfortable future.

Step 1: Assess Your Current Financial Situation

The first step in any investment plan is to understand where you currently stand financially. Here’s what you need to consider:

Income and Expenses: Track your monthly income and expenses to determine how much you can comfortably allocate to investments.

Debts: Take stock of your outstanding debts, such as credit cards, student loans, or mortgages. Prioritize paying off high-interest debt before focusing too much on investing.

Emergency Fund: Make sure you have an emergency fund that covers at least 3 to 6 months of living expenses. This will act as a safety net in case of unexpected situations.

Retirement Accounts: Check your current retirement savings to see if you’re on track with long-term goals. Make contributions to retirement accounts like a 401(k) or an IRA if you haven’t already.

Step 2: Define Your Financial Goals

Your investment strategy will vary depending on your financial goals. Some common goals include:

Short-Term Goals (1-5 years): These could include saving for a vacation, a car, or a down payment on a house.

Medium-Term Goals (5-10 years): These might involve saving for your children's education or upgrading your home.

Long-Term Goals (10+ years): Most people invest for retirement, which is typically a long-term goal.

Clearly defining your goals will help you choose the right investment tools and determine the level of risk you’re willing to take on.

Step 3: Determine Your Risk Tolerance

Every investor has a different level of comfort with risk. Some people can stomach significant fluctuations in the market, while others prefer stability. Understanding your risk tolerance is crucial for selecting the right investments.

Conservative: If you’re risk-averse, you might focus on more stable investments like bonds or dividend-paying stocks. These typically offer lower returns but less volatility.

Moderate: If you’re comfortable with some risk, you might consider a mix of stocks, bonds, and other assets.

Aggressive: If you’re willing to take on more risk for higher potential rewards, you could focus on high-growth investments like individual stocks or real estate.

Step 4: Diversify Your Investment Portfolio

Diversification is a key principle of investment planning. It involves spreading your investments across various asset classes (stocks, bonds, real estate, etc.) to reduce risk.

Stocks: Historically, stocks offer the highest returns but also come with the most volatility.

Bonds: Bonds tend to be safer but provide lower returns. They can act as a stabilizer in your portfolio.

Real Estate: Real estate can offer both income (through rents) and long-term appreciation. It’s a solid way to diversify.

Alternative Investments: These might include commodities like gold or newer assets like cryptocurrencies. They can serve as a hedge against market volatility.

A diversified portfolio can help you manage risk by ensuring that you’re not too reliant on one particular investment.

Step 5: Choose the Right Investment Vehicles

The next step is selecting the right investment vehicles that align with your goals, time horizon, and risk tolerance. Some common investment vehicles include:

Stocks and ETFs: Great for long-term growth, but they come with higher volatility.

Mutual Funds: These funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or both.

Bonds: Typically lower-risk investments that pay interest over time.

Real Estate: Real estate investing can generate passive income and long-term capital appreciation.

Retirement Accounts: Contributing to accounts like 401(k)s or IRAs offers tax advantages while helping you save for retirement.

Robo-Advisors: These automated platforms can create a personalized portfolio based on your risk tolerance and goals.

Step 6: Monitor and Adjust Your Plan

Once you’ve made your investments, the work isn’t over. Regularly reviewing your investment portfolio and making necessary adjustments is key to staying on track.

Rebalancing: Over time, some investments may outperform others, altering your asset allocation. Rebalancing ensures that your portfolio stays aligned with your risk tolerance and goals.

Stay Informed: The investment landscape is constantly changing. Stay updated on market trends and economic developments that may impact your investments.

Avoid Emotional Decisions: The market will have its ups and downs. Avoid making impulsive decisions based on short-term market movements.

Step 7: Seek Professional Advice if Needed

If you’re unsure about where to start or need expert guidance, consider speaking with a financial advisor. A certified financial planner (CFP) or investment manager can help tailor a plan to suit your unique needs and objectives.

Conclusion

Investment planning isn’t a one-size-fits-all endeavor. It requires careful consideration of your goals, risk tolerance, and the time you have to reach those goals. By following a strategic and disciplined approach to investing, you’ll be well on your way to securing your financial future.

Remember, successful investing is about making informed decisions and staying the course. Whether you’re just starting or looking to refine your existing strategy, planning and consistency are the keys to long-term financial success.

0 notes

Text

Portfolio Management A Comprehensive Guide to Building a Winning Investment Strategy

Portfolio Management A Comprehensive Guide to Building a Winning Investment Strategy

Portfolio management is a critical component of personal finance and investment strategy. It involves the art and science of selecting, managing, and balancing investments to achieve specific financial goals. Whether you're a novice investor or a seasoned professional, understanding portfolio management principles can be the key to maximizing returns while minimizing risks. This blog will dive into the essential aspects of portfolio management, including its definition, types, and strategies.

What is Portfolio Management?

At its core, portfolio management is the process of managing a collection of investments (stocks, bonds, mutual funds, real estate, etc.) to meet an investor’s financial objectives. The goal is to optimize the portfolio’s performance in terms of risk and return based on the investor's risk tolerance, time horizon, and financial goals.

Key Components of Portfolio Management:

Risk Assessment: Understanding your tolerance for risk is essential for creating a portfolio that aligns with your comfort level and financial goals.

Asset Allocation: Diversifying investments across different asset classes (equities, bonds, cash, real estate) to mitigate risk.

Rebalancing: Regularly reviewing and adjusting the portfolio to ensure it stays in line with the investor’s objectives.

Monitoring & Reporting: Continuously tracking the portfolio’s performance and making adjustments as needed.

Types of Portfolio Management

Portfolio management can be broadly categorized into two types:

Active Portfolio Management: Active managers aim to outperform the market by actively making investment decisions, including buying and selling assets based on market trends, research, and analysis. This approach often involves higher costs due to transaction fees and research expenses. However, it offers the potential for higher returns compared to the market, if done successfully.Advantages of Active Management:

The potential to outperform the market.

Flexibility to respond to market changes.

Opportunity to exploit short-term market opportunities.

Disadvantages of Active Management:

Higher costs and fees.

Risk of underperformance compared to passive management.

Requires expertise, time, and resources.

Passive Portfolio Management: Passive management involves creating a portfolio that mirrors a specific market index or benchmark. Rather than trying to beat the market, the goal is to match its performance. This strategy usually involves lower costs since it requires fewer transactions and less research.Advantages of Passive Management:

Lower fees and expenses.

Consistent market returns.

Less time-consuming compared to active management.

Disadvantages of Passive Management:

Limited potential for outperforming the market.

Inability to take advantage of market opportunities in the short term.

Key Portfolio Management Strategies

Now that we’ve covered the basics, let’s look at some of the key strategies employed in portfolio management:

Diversification: Diversification is a critical strategy in portfolio management. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the overall risk of their portfolio. A well-diversified portfolio can help cushion against losses in one area by offsetting them with gains in another.

Risk-Return Trade-Off: Every investor faces the challenge of balancing risk and return. High-risk investments generally have the potential for higher returns, but they can also lead to substantial losses. Conversely, lower-risk investments offer more stability but may yield lower returns. Portfolio managers seek to find the optimal balance that meets the investor's goals.

Asset Allocation: Proper asset allocation is crucial in managing risk and maximizing returns. The mix of stocks, bonds, real estate, and other asset classes depends on an investor’s risk tolerance and time horizon. Younger investors with a longer time frame may lean more heavily on stocks, while older investors may prefer bonds and safer assets.

Rebalancing: Over time, a portfolio can become unbalanced due to changes in asset values. Rebalancing involves adjusting the allocation back to its original target, ensuring that the portfolio maintains its intended risk profile. Rebalancing is essential for keeping the portfolio aligned with the investor's objectives and avoiding overexposure to one asset class.

The Importance of Portfolio Management

Effective portfolio management can significantly impact your financial future. By implementing a thoughtful strategy, diversifying investments, and adjusting as needed, investors can reduce risk and improve the likelihood of achieving their financial goals.

A well-managed portfolio ensures that your investments are working for you, whether you're planning for retirement, building wealth, or saving for a specific goal like buying a house or funding education.

Conclusion

Portfolio management is a dynamic and crucial part of wealth building. Whether you take a passive or active approach, understanding the basic principles and strategies of portfolio management can help you achieve financial success. Remember that your portfolio should reflect your financial goals, risk tolerance, and time horizon—and it’s important to review and rebalance it regularly.

Investing may seem daunting at first, but with the right knowledge and strategy, you can take control of your financial future and work towards achieving your goals in a structured and deliberate way.

0 notes

Text

The Art of Wealth Management Navigating Your Financial Future…

In today’s fast-paced and ever-changing financial world, managing wealth is more than just budgeting or saving—it’s an art. Wealth management combines financial planning, investment strategies, tax considerations, and risk management to ensure a prosperous financial future. For individuals and families, navigating this landscape requires a blend of knowledge, discipline, and foresight. In this blog, we’ll explore the essentials of wealth management and how you can approach it to secure your financial well-being for years to come.

Understanding Wealth Management: More Than Just Investments

Wealth management isn’t solely about growing your money. While investing plays a significant role, the broader scope of wealth management includes planning for retirement, managing debt, tax optimization, estate planning, and insurance. It’s a holistic approach that takes into account your personal goals, financial aspirations, and risk tolerance.

At its core, wealth management is about understanding where you stand financially, identifying where you want to go, and developing a detailed strategy to bridge the gap. To truly navigate your financial future, it’s important to work with a trusted advisor who can help customize your financial plan based on your unique needs.

The Pillars of Effective Wealth Management

1. Financial Planning: Setting Clear Goals

The first step in wealth management is financial planning. Without a clear vision of what you want to achieve, you risk wandering aimlessly. Start by asking yourself essential questions:

What are my short-term and long-term financial goals?

Do I want to save for retirement, buy a home, or fund my children’s education?

How much risk am I willing to take to achieve these goals?

Once you have defined your financial goals, the next step is to create a comprehensive plan. This includes budgeting, forecasting future expenses, and allocating resources to match your objectives. Financial planning is not a one-time event—it should be revisited regularly to adjust to life changes such as a new job, marriage, or a change in family dynamics.

2. Investment Strategies: Growing Your Wealth

Investing is at the heart of wealth management. While many may think investing is about picking stocks or mutual funds, successful investors know it’s about building a diversified portfolio aligned with your goals and risk tolerance. A good investment strategy takes into account factors like:

Time horizon: How soon will you need to access your funds?

Risk tolerance: How much volatility can you comfortably manage?

Asset allocation: How should your investments be divided among stocks, bonds, real estate, and other assets?

In a well-managed portfolio, diversification is key to reducing risk. Spreading investments across different asset classes and industries helps safeguard against market fluctuations and increases the likelihood of achieving sustainable returns over time.

3. Tax Optimization: Keeping More of What You Earn

Taxes can significantly erode your wealth if not carefully managed. Tax optimization strategies help you minimize tax liabilities, making it possible for you to keep more of your hard-earned money. Some strategies include:

Investing in tax-advantaged accounts like IRAs or 401(k)s

Making charitable contributions to reduce taxable income

Taking advantage of tax-loss harvesting to offset capital gains

By working with a financial advisor or tax specialist, you can develop a tax-efficient strategy that maximizes your returns and minimizes your tax burden.

4. Risk Management: Protecting Your Wealth

Managing risk is crucial in preserving your wealth. From unexpected medical bills to loss of income or natural disasters, life can throw curveballs at any moment. Having the right insurance coverage (health, life, disability, property) and an emergency fund to cover unforeseen expenses can provide a safety net.

Furthermore, risk management in wealth management also involves reviewing your investment portfolio to ensure it is balanced and that your risk exposure is in line with your financial goals. Regular portfolio rebalancing is essential to maintaining your desired level of risk.

5. Estate Planning: Ensuring Legacy and Protection

Estate planning is often overlooked, but it’s an essential part of wealth management. Creating a will, setting up trusts, and designating beneficiaries ensures that your assets are distributed according to your wishes after your passing. It also helps minimize estate taxes and legal fees.

In addition to securing your wealth for future generations, estate planning can also protect your wealth in case of unexpected incapacity, by setting up powers of attorney and healthcare directives.

Building a Partnership with a Wealth Manager

While managing your wealth is a complex process, you don’t have to do it alone. A wealth manager or financial advisor can be an invaluable partner in your journey. They provide guidance and expertise, helping you navigate various financial challenges, optimize your investments, and mitigate risks.

The best wealth managers take a personalized approach. They will work with you to understand your financial goals, risk tolerance, and timeline before creating a tailored strategy. Regular check-ins and portfolio reviews ensure that your plan remains aligned with your life changes and market conditions.

The Importance of Staying Informed and Disciplined

Wealth management is an ongoing process, and staying informed is key to making sound decisions. The financial landscape is constantly changing, so it’s important to stay up to date on market trends, economic shifts, and new financial tools or strategies that may benefit your portfolio.

But equally important is discipline. Wealth management isn’t about chasing the latest financial trends or quick fixes—it’s about making informed, deliberate decisions and staying the course through the ups and downs of the market.

Conclusion: Navigating a Secure Financial Future

The art of wealth management is about more than just numbers—it’s about crafting a comprehensive, forward-thinking plan that enables you to achieve your personal and financial goals. By setting clear objectives, diversifying your investments, optimizing your taxes, and managing risks, you create a strong foundation for your future. Whether you’re just starting to build wealth or you’re looking to refine your financial strategies, wealth management is an ongoing, dynamic process. With the right guidance and discipline, you can navigate your financial future with confidence.

Remember, it’s not just about how much you have—it’s about how well you manage it.

#spending#financial planning#financial growth#investment#wealth management#financial services#management

0 notes

Text

Financial Management The Key to Personal and Business Success…

In today’s fast-paced world, financial management plays a crucial role in determining the success of both individuals and businesses. Whether you're looking to build personal wealth or ensure the sustainability of your company, understanding the basics of finance and implementing effective financial strategies can make a significant difference. In this blog post, we’ll dive into the key principles of financial management, explain why it matters, and provide actionable steps to improve your financial health.

What is Financial Management?

At its core, financial management is the process of planning, organizing, directing, and controlling financial resources to achieve specific objectives. In a personal context, it involves budgeting, investing, saving for the future, and managing debt. For businesses, it extends to managing cash flow, capital investment decisions, risk management, and ensuring profitability. Good financial management ensures that resources are used efficiently, goals are met, and financial risks are minimized.

Why Financial Management Matters

Helps You Achieve Your Goals Whether you're saving for a down payment on a house, building a retirement fund, or growing your business, financial management is essential to making your goals a reality. A solid financial plan provides direction and clarity on how to allocate your resources effectively to reach your milestones.

Improves Cash Flow and Profitability For businesses, managing finances properly ensures you have sufficient cash flow to meet daily operational expenses, pay employees, and reinvest in growth opportunities. It also helps you keep track of profits and identify areas where you can cut costs or improve efficiency.

Reduces Financial Stress Financial mismanagement is one of the leading causes of stress, both personally and professionally. With a well-structured approach to budgeting and financial planning, individuals and businesses can reduce anxiety and build financial stability over time.

Mitigates Financial Risks Proper financial management helps anticipate potential financial pitfalls—be it a market downturn, unexpected expenses, or poor investment decisions. Risk management strategies, like diversifying investments or purchasing insurance, provide a buffer against uncertain situations.

Key Principles of Financial Management

Budgeting and Planning Effective budgeting allows you to allocate your income to specific expenses, savings, and investments. This ensures that you live within your means while working toward your goals. For businesses, a financial plan involves forecasting future revenue, expenses, and capital requirements.

Cash Flow Management Cash flow is the lifeblood of any business. Without proper management, even the most profitable company can face liquidity issues. Maintaining a positive cash flow requires regular monitoring of income and expenses, minimizing unnecessary costs, and ensuring timely collection of receivables.

Investment and Capital Allocation Making informed investment decisions is crucial for both individuals and businesses. This can involve choosing the right asset classes (stocks, bonds, real estate, etc.) for your risk profile or deciding which business projects or expansions will yield the best returns on investment.

Risk Management In personal finance, this means understanding and managing risks like market volatility, inflation, or unexpected expenses. For businesses, risk management may involve insurance, hedging strategies, or building an emergency fund to weather financial downturns.

Financial Reporting and Analysis Regularly reviewing financial statements—such as balance sheets, income statements, and cash flow statements—helps track performance and identify areas for improvement. Both individuals and businesses should understand their financial position and adjust strategies accordingly.

Practical Tips for Personal Financial Management