#FinanceBlog

Explore tagged Tumblr posts

Text

10 Best Shares To Buy Today For Long Term 📈

Looking for smart investment options? Check out our expert-picked list of the 10 Best Shares To Buy Today For Long Term. Whether you're a beginner or a seasoned investor, these stocks offer great growth potential and solid fundamentals for the future.

🔗 [lootlay.com]

Don't miss out on the top long-term stock picks—visit now!

#10BestSharesToBuyTodayForLongTerm#StockMarket#LongTermInvestment#BestStocks2025#StockMarketTips#InvestingForBeginners#ShareMarketIndia#TopStocksToBuy#FinanceBlog

2 notes

·

View notes

Text

“Be Aggressive, Not Stupid: Investing Lessons for the Fearless 20s”

If you're in your 20s and playing it too safe with money, you're probably missing out on once-in-a-lifetime compounding potential. This is the age to be aggressive — not reckless — and build wealth like the top 1%.

📊 Why Aggression Pays Off Early

1. Time > Capital

₹5,000 invested monthly at 12% CAGR becomes ₹1.5 Cr in 25 years.

₹10,000 invested monthly at 6% (safe returns) becomes only ₹94 Lakh.

2. Risk Tolerance is Highest Now

No major liabilities = freedom to make mistakes and recover.

You can afford volatility; your 40-year-old self can’t.

3. Early Volatility Builds Later Stability

Stocks, smallcaps, thematic plays — yes, they’ll shake.

But staying in the game during tough times teaches emotional discipline, the real edge in investing.

📌 Where to Be Aggressive Today

PSU Re-Rating Stocks: RVNL, BHEL, Canara Bank

Green Economy Bets: IREDA, SJVN, Waaree Renewables

Digital & Defence: Railtel, Mazagon Dock, Data Patterns

Midcap FMCG/Consumption: Varun Beverages, ITC, Zomato (for risk takers)

🚫 Where to Be Cautious

Penny stocks with no earnings

FOMO buying during rallies

High D/E companies with no real moat (you nailed this on IRFC!)

Trending “story” stocks without solid Q-o-Q growth

💥 Mindset Shift: "What if it works?"

Stop asking "What if I lose money?"

Start asking "What if this ₹500 SIP grows into ₹5 lakh someday?"

🧠 Quote of the Day:

> “The best time to go aggressive is when everyone else is playing defense.”

📎 Pro Tip:

Track your holdings like a business. Use a sheet or app. Don't just "hope" they grow — study them, rebalance monthly, and earn your returns.

✅ Your Challenge Today:

Pick one under-₹500 growth stock.

Start an SIP of ₹500/week.

Track it for 6 months.

Journal monthly: What did I learn?

#finance#blog#financeblog#investment#investors#stock market#stock trading#stock investing#aggressive#mutual funds#funds#cash for gold#goldsavings#make money online#old money#money in the bank#cashapp#pay me money#debtor#creditor#financialfreedom#financial planning#financial drain#financial modeling#internal audit services#tax savings#piggy bank

1 note

·

View note

Text

How Small Businesses Fuel Growth with Overdraft Services 🚀

Overdraft services aren’t just an emergency fix—they’re a lifeline for small businesses aiming to scale. Smart entrepreneurs use overdraft facilities to:

✅ Maintain cash flow during growth spikes ✅ Cover operational gaps without high-interest loans ✅ Invest in inventory or marketing while waiting for receivables

Want to grow without getting stuck in a cash crunch? Explore flexible solutions tailored for small businesses.

�� Let’s work together to transform your debt into a manageable journey toward financial freedom. 📞 +91 8130060135 | 🌐 www.f2fintech.com 📩 [email protected]

#businessadvice#smallbiztalk#entrepreneurmindset#startupfunding#financeblog#moneytips#cashflow#overdrafthelp#f2fintech

1 note

·

View note

Text

💸 Still broke no matter how hard you try? It might be your habits — not your hustle.

👉 Fix these 👇 🔗 https://medium.com/@nbh1370/10-money-habits-that-secretly-keep-you-broke-992bc42eadbf?sk=4e9df86419965783441a8554332701d0 #MoneyTips #PersonalFinance #Budgeting #SmartMoney #FinanceBlog

0 notes

Text

Top 7 Mistakes to Avoid When Taking Out a Loan

Loans can be lifesavers.

#loanadvice#financialtips#moneymistakes#smartborrowing#creditscore#personalloan#financeblog#emiplanning#loanmistakes#moneytalk

0 notes

Text

What is IPO Cycle in Stock Market 2025

In this blog we will discuss What is IPO Cycle, 2024, the stock market continues to see fluctuations and innovations in Initial Public Offerings (IPOs). IPO allotment refers to the process by which shares are allocated to investors, often in cases where demand exceeds supply, requiring a lottery or proportionate distribution system. In the context of trading, an IPO provides a new security that traders can buy and sell on the stock exchange, which may see price volatility as the market establishes its perceived value. From an investment perspective, an IPO offers early entry into a company’s public journey, with potential for both high returns and risks, as the company’s growth trajectory post-IPO may vary significantly.

Understanding what is IPO cycle is essential for investors, whether they are experienced traders or new to the world of stock investments. This guide will dive deep into what is IPO, explore the types of IPO, explaintion of what is IPO cycle, what is IPO allotment, and what is IPO trading and investment.

What is IPO?

An Initial Public Offering (IPO) is the process by which a private company offers its shares to the public for the first time, allowing it to become publicly traded on a stock exchange. This transition from private to public ownership opens up new opportunities for the company to raise capital, increase visibility, and achieve various strategic objectives. For investors, an IPO offers a chance to invest in a company at the earliest stage of its public journey, often with the potential for long-term growth.

This guide will break down the IPO process, its benefits and risks, and how it impacts both the company and the stock market.

Why Do Companies Go Public?

There are several reasons companies choose to go public:

Raising Capital: IPOs allow companies to access substantial funding from a wide pool of investors. This capital is often used for scaling operations, launching new products, or entering new markets.

Increasing Credibility and Brand Awareness: Going public enhances a company’s visibility and reputation. A publicly listed company may find it easier to attract customers, partners, and talented employees.

Providing Liquidity for Existing Investors: Early investors, founders, and employees often have shares in the company. An IPO provides them with a means to cash out some or all of their holdings, generating returns on their initial investment.

Using Stock as a Currency: Once public, companies can use their stock as currency, whether as employee compensation or to acquire other businesses.

What is IPO Process

The IPO process involves several stages, with each step critical to a successful public listing.

Preparation and Due Diligence: The company prepares by conducting internal audits, financial analysis, and refining its growth strategies. The board of directors evaluates the company’s readiness to go public.

Hiring Underwriters: The company appoints investment banks or underwriters to guide the IPO process. These underwriters are responsible for helping set the IPO price, marketing the IPO, and ensuring compliance with regulatory requirements.

Filing with Regulatory Authorities: In the U.S., companies must file a registration statement (Form S-1) with the Securities and Exchange Commission (SEC). This document includes extensive information about the company’s financials, risks, and operations.

Marketing the IPO (Roadshow): The company and its underwriters conduct a “roadshow,” where they present the company’s business model, financial health, and growth potential to prospective investors. The goal is to generate interest in the IPO.

Pricing and Allotment: After the roadshow, the company sets a final IPO price based on investor interest. The shares are then allotted to institutional and retail investors who have subscribed to the IPO.

Listing on the Exchange: The IPO is launched, and the company’s shares are officially listed on the stock exchange. Investors can start trading shares as soon as the stock market opens.

Post-IPO Obligations: Once public, the company must meet certain financial reporting and compliance standards, such as quarterly earnings reports, transparency with shareholders, and regulatory disclosures.

How & What is IPO Impact the Stock Market

An IPO has several immediate and long-term effects on the stock market:

Market Sentiment and Volatility: IPOs can generate significant market interest, particularly for high-profile companies. This initial excitement can lead to heightened volatility in the company’s stock price during the first few days or weeks of trading.

Price Discovery: During an IPO, the market determines the fair value of a company’s stock based on demand from investors. This price discovery process is crucial as it sets the baseline for future trading.

Sector Impact: If a well-known company in a specific sector goes public, it can impact the entire industry’s stocks. For example, the IPO of a major tech company might boost investor interest in other tech stocks.

Liquidity Increase: An IPO increases the stock’s liquidity, making it easier for shareholders to buy and sell shares. This improved liquidity can attract more investors and lead to a more stable long-term stock price.

Influence on Indexes: Some IPOs are large enough to eventually be included in major stock indexes (like the S&P 500), influencing the performance of these indexes and potentially drawing in more institutional investors.

Benefits and Risks of IPO

Benefits for the Company:

Access to Capital: IPOs can provide significant funding to fuel growth initiatives.

Enhanced Public Image: A publicly traded company can attract better talent, improve customer trust, and strengthen its brand.

Equity as Currency: Once public, companies can use stock for employee compensation or acquisitions, expanding growth possibilities.

Risks for the Company:

Regulatory Compliance Costs: Public companies must comply with strict regulations and reporting standards, which can be costly and time-consuming.

Pressure from Shareholders: Public companies face pressure to meet quarterly earnings expectations, potentially impacting long-term strategy.

Market Scrutiny: Increased visibility also means more scrutiny from analysts, media, and investors, which can add pressure to the company’s leadership.

Benefits for Investors:

Early Growth Opportunities: IPOs allow investors to buy shares at the early stages of a company’s public life, offering the potential for substantial returns if the company grows successfully.

Liquidity: IPOs provide liquidity to existing shareholders and give retail investors access to new investment opportunities.

Risks for Investors:

Volatility: IPO stocks are often highly volatile, particularly during the first days or months of trading.

Potential Overpricing: Companies might set high IPO prices based on demand during the roadshow, leading to a decline in value post-listing if market sentiment changes.

Lock-Up Periods: Early investors and insiders are often subject to lock-up periods, restricting their ability to sell shares for a set time. This can lead to sudden price drops once the lock-up period expires.

How to Participate in an IPO

If you’re considering investing in an IPO, here are the steps:

Research the Company: Learn about the company’s business model, financials, growth potential, and industry position.

Select a Brokerage: Most online brokers offer access to IPOs, although some may have requirements for IPO participation.

Submit an Application: Apply to buy shares through your brokerage, indicating how many shares you’d like and the price range if it’s a book-building IPO.

Wait for Allotment: Based on demand and the company’s allotment policy, you’ll either receive the shares or be informed if your application was unsuccessful.

Track the Stock’s Performance: IPO stocks can be volatile. Monitor the company’s performance and set an investment strategy aligned with your risk tolerance.

Why Do Companies Opt for an IPO?

Companies choose to go public for several reasons, including raising capital for expansion, reducing debt, improving credibility, and providing an exit strategy for early investors. In 2024, the IPO market remains a dynamic avenue for companies aiming to unlock growth potential and gain public trust.

What is IPO Cycle?

The IPO cycle is the series of stages that a company undergoes from its private beginnings to its public launch. Here’s a breakdown of the key stages in what is IPO cycle:

Preparation Phase: This involves assessing the company’s readiness to go public. During this phase, companies conduct internal audits, financial analysis, and strategic planning. It is also the time to choose investment banks to underwrite the IPO and determine the share structure.

Filing and Approval Phase: Companies must file for an IPO with regulatory bodies like the Securities and Exchange Commission (SEC) in the U.S. They provide comprehensive details about the company, financials, and intended share offerings. Once approved, the IPO enters the marketing phase.

Marketing and Roadshow: The company and its underwriters present the company’s value to potential investors, usually through roadshows. During these events, they highlight the company’s growth prospects, business model, and value proposition to attract institutional investors.

Pricing and Allotment Phase: After gauging investor interest, the company sets a final IPO price. Pricing is crucial since it impacts both the company’s funding goals and investor interest. The shares are then allotted to investors based on demand and availability.

Listing and Trading: Finally, the company’s shares are listed on a public exchange, marking the official IPO. Trading begins as soon as the market opens, giving the public and institutional investors access to buy and sell shares.

Post-IPO Phase: After going public, the company must meet specific financial reporting and regulatory requirements. The performance of its shares also impacts investor sentiment and may affect future stock issuance.

The IPO cycle can take several months to over a year, depending on market conditions and regulatory processes. Understanding this cycle is essential for both investors and companies aiming to maximize value from an IPO.

Types of IPO

In the world of IPOs, companies have different methods for pricing and offering their shares to investors. The types of IPO primarily include the Fixed Price Offering and the Book Building Offering. Each type has its unique features, advantages, and strategies that can appeal to various types of IPO investors and cater to different company goals.

1. Fixed Price Offering

A Fixed Price Offering is one of the types of IPO where the issuing company, in collaboration with underwriters, sets a fixed price per share before the IPO is launched. This means that potential investors know the exact price they will be paying for each share at the time of application.

Key Characteristics of Fixed Price Offering:

Set Price in Advance: The company announces the price at which shares will be issued well in advance of the types of IPO. This price is based on evaluations conducted by the company and its underwriters, often taking into account factors like the company’s financials, growth prospects, and market trends.

Lower Visibility on Demand: In a fixed price offering, demand isn’t as visible to the company until after the subscription period closes. Investors have to decide whether to participate based on the set price alone.

Simplicity for Investors: Since the price is pre-determined, investors don’t need to speculate about the final price. This simplicity makes it more accessible for retail investors who may prefer clarity over the potential price fluctuations seen in other types of IPO.

Advantages and Disadvantages of Fixed Price Offering:

Advantages:

Predictability: Both the company and the investors know the exact pricing structure, which makes planning and budgeting more straightforward.

Attractiveness to Small Investors: Because of the fixed price, smaller investors may feel more comfortable participating, knowing they will pay exactly what is quoted.

Disadvantages:

Underpricing or Overpricing Risks: Since the company sets a fixed price without fully knowing demand, there’s a risk of setting a price too high (leading to low demand) or too low (leading to under-subscription and lower proceeds).

Limited Insight on Demand: Unlike book building, where demand is gauged in real-time, fixed price offerings don’t allow companies to adjust based on investor interest.

2. Book Building Offering

A Book Building Offering is another types of IPO which has more dynamic pricing method where the price of shares is determined based on demand from institutional and individual investors. Here, the company and its underwriters set a price range (often with a minimum and maximum price), and investors bid within this range.

Key Characteristics of Book Building Offering:

Price Discovery Mechanism: Unlike a fixed price IPO, this types of IPO has the final offer price is set based on the demand seen during the IPO subscription period. Investors place bids within a range, and the highest bids generally determine the final price.

Investor Bidding: Investors specify both the quantity of shares they wish to purchase and the price within the set range they are willing to pay. This bidding process provides insight into the demand for shares.

Transparency and Demand Insight: Companies get real-time feedback on investor interest, which helps in setting an accurate market-based price. This insight can help prevent significant price fluctuations after the shares start trading on the market.

Advantages and Disadvantages of Book Building Offering:

Advantages:

Accurate Market-Based Pricing: By assessing demand, the company can set a price that better reflects investor interest and market conditions, often leading to a more accurate valuation.

Attracts Large Investors: Institutional investors are often more inclined to participate in book building IPOs, as they can secure significant allocations at preferred prices.

Disadvantages:

Complexity: The process is more complex and may not be as easily understood by retail investors, as the final price is not known until after the book-building period.

Fluctuating Prices: Price discovery can lead to wide fluctuations, which may deter some risk-averse investors.

Other Types of IPO Offerings (Less Common)

While fixed price and book building are the most common, there are additional types of IPO structures that some companies might use depending on their goals and market conditions.

Dutch Auction Offering:

In a Dutch auction, investors bid on the shares by indicating both the price they are willing to pay and the quantity of shares they want to buy.

The final IPO price is determined by the lowest price at which all the offered shares can be sold.

This approach allows all successful bidders to pay the same price, which can encourage broader participation but is rarely used due to its complexity.

Direct Listing:

In a direct listing, a company lists its shares on a public exchange without raising new capital or working with underwriters to price the shares.

This type of listing is often chosen by companies that do not need additional funds but want to provide liquidity to their existing shareholders.

Notably used by companies like Spotify and Slack, direct listings avoid underwriting fees and provide a market-driven share price on the first trading day.

Special Purpose Acquisition Company (SPAC):

A SPAC is a company formed with the sole purpose of raising funds through an IPO to acquire a private company and bring it public.

This “alternative IPO” method has gained popularity in recent years, especially for companies that want a faster, less regulated way to go public.

SPACs offer flexibility and can be more attractive for companies in volatile or rapidly evolving sectors.

What is IPO Allotment?

IPO allotment is the process through which shares are distributed to investors who have applied for the IPO. Demand often surpasses supply, leading to oversubscription. In this case, shares are allocated based on a pre-defined basis, such as lottery or proportional allotment. Here’s a simplified look at what is IPO allotment:

Retail Allotment: Small investors are given priority, typically through a lottery system when demand is high.

Institutional Allotment: A significant portion of shares is reserved for institutional investors, who often receive a guaranteed allotment based on their order size.

Employee Allotment: Some IPOs set aside shares for employees, allowing them to benefit from the company’s growth.

The allotment process can be competitive, especially in high-demand IPOs, and often leads to disappointment among retail investors. For an investor, securing an IPO allotment is a crucial step to benefiting from potential initial price surges.

What is IPO in Trading?

In trading, an IPO represents a fresh investment opportunity, bringing new stock to the market. IPO stocks can be volatile, with prices often spiking or dropping within days of listing. Many traders aim to capitalize on these price movements, engaging in what is IPO in trading strategies.

Pre-market Trading: Some IPOs allow for pre-market trading, enabling investors to buy shares before they are officially listed.

Day Trading: IPOs are popular among day traders who aim to profit from short-term price fluctuations, capitalizing on the initial volatility that follows an IPO.

Swing Trading: Swing traders, who hold stocks for a few days to weeks, may find IPOs attractive due to the potential for substantial movements within a short timeframe.

IPO trading offers high-reward opportunities, but it also involves significant risk. For example, a highly anticipated IPO could underperform if the market sentiment is weaker than expected, resulting in rapid declines in stock prices.

CONCLUSION

The IPO cycle is an integral part of the stock market, offering a pathway for private companies to access public capital and for investors to participate in early-stage growth. From understanding what is IPO is to exploring what are the type of IPO, what is IPO allotment, what is IPO in trading, and investment strategies, this guide has covered the essentials of the IPO process in 2024. With careful research and a strategic approach, IPOs can offer unique opportunities for both traders and long-term investors. For companies, selecting the right type of IPO depends on factors like the desired level of transparency, potential investor base, and the stability of the stock market at the time of listing.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#IPOCycle#StockMarket2025#IPO2025#InitialPublicOffering#StockMarketEducation#InvestmentStrategies#FinancialMarkets#StockMarketInsights#MarketTrends2025#IPOGuide#ipoexplained#whatisipo#ipocycle#stockmarket2025#investingtips#stockmarketeducation#tradingguide#financeblog#personalfinance#investmenteducation#ismt#learnfromismt#ismtinstitute

0 notes

Text

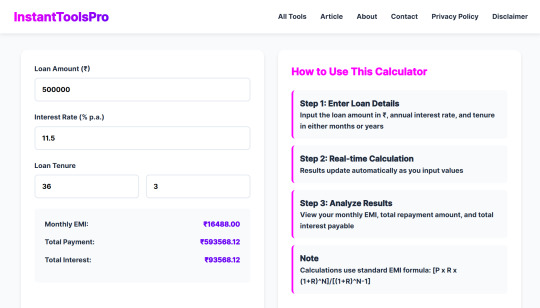

I Didn’t Realize How Expensive My ₹5 Lakh Personal Loan Would Feel—Until I Used This Simple EMI Calculator

When you’re in a crunch—wedding, emergency, or just some “life stuff” that needs cash—you think:

“Let’s just take a personal loan. We’ll figure it out.”

That’s exactly what I did in 2024.

I borrowed ₹5,00,000. The EMI? ₹16,493/month.

Not gonna lie—every 5th of the month, it still stings a little. 😂

But what really hit me wasn’t the EMI… It was how little I understood the total cost of the loan before signing that paper.

The Shocking Math Behind a Simple Loan

Most banks only show you the monthly EMI. But:

They hide how much interest you’ll pay in total.

They don’t show you what happens if you extend tenure.

You can't compare offers easily.

That’s where this little gem came in: Personal Loan EMI Calculator India – 2025

Why I Actually Liked Using It:

No logins, no banners, no ads screaming at me

Shows monthly EMI, total interest, and total repayment

I could test multiple scenarios (like: what if I took ₹3L instead of ₹5L?)

I could see what changes if I choose 2 years vs 5 years

I literally shared it with my cousin before he applied for a loan, and he ended up going with a better bank offer (ICICI instead of Axis) just because he saw the difference clearly.

Real Example:

₹5,00,000 11.5% interest 36 months EMI: ₹16,488/month Interest paid: ₹93,568

He was like:

“Bro, I thought I was just paying 11.5%... not ₹90,000+ extra!”

Lesson Learned?

Don’t take loans emotionally. Take them mathematically.

And yeah… I wish I had used that EMI calculator before I signed the dotted line. 🙃

🧠 Try it yourself (even if you’re just curious): 🔗 https://instanttoolspro.com/Personal-Loan-EMI-Calculator/

#financeblog#indianfinance#tumblrdiary#personalloan#emicalculator#moneytips#budgetingindia#financialliteracy#youngadultlife#indianblogger#2025planning

0 notes

Text

Looking for professional VAT consultants in Dubai? At Risians Accounting, we help UAE businesses stay VAT-compliant with ease. From VAT registration to filing and strategic tax planning, our expert team makes the entire process simple and stress-free. Whether you're a startup or a large company, we offer personalized tax advisory services tailored to your needs.

✅ Accurate VAT filing ✅ Hassle-free tax registration ✅ Trusted by UAE businesses

👉 Let us handle your VAT while you focus on growing your business. Click here to get started today!

#VATConsultantsDubai#TaxAdvisoryUAE#UAEFinance#DubaiBusinessHelp#AccountingServicesDubai#RisiansAccounting#VATFilingUAE#TaxHelpDubai#BusinessSupportUAE#FinancialServicesDubai#DubaiTaxConsultants#VATExpertsUAE#UAEBusinessTips#FinanceBlog#DubaiAccountants

0 notes

Text

Stop Overpaying: Use These Cashback Hacks Every Shopper Should Know

Cashback isn’t just for coupon clippers or deal hunters — it’s for anyone who wants to stop overpaying for everyday stuff. Here’s how to turn your spending into savings with almost no effort.

We all have to spend money — on groceries, gas, bills, clothes, you name it. But if you’re not getting cashback when you spend, you’re basically tipping the system for no reason.

Let’s change that.

What Most People Don’t Realize About Cashback

Cashback isn’t only about the credit card in your wallet. It’s a layered system. And if you stack it the right way, you can get back 3%, 5%, even 10% on things you already buy.

No extreme couponing. No weird apps. No changing your lifestyle.

My 3 Favorite Cashback Hacks (That Actually Work)

1. Stack Cards + Portals Example: Use a 2% cashback card through a 5% shopping portal → That’s 7% back.

2. Use Apps That Track Deals Automatically Let’s be honest, nobody has time to look up every promo. Use apps like Rakuten or Capital One Shopping to handle that for you.

3. Check Before You Shop — Always Before I hit “checkout,” I always visit BestCashbackRates to compare options. Sometimes switching to a different payment method or store can literally double the cashback.

Real-Life Example

Last month, I booked a hotel for a weekend trip:

Credit card: 3% travel cashback

Portal bonus: 6%

Promo stack via the BestCashbackRates Hotel Portal: extra $20 rebate

💰 Total earned: $54 back — on a booking I was going to make anyway.

Start Small, Save Big

If you’re new to cashback, don’t overthink it. Just:

Use the right card

Check BestCashbackRates before shopping

Let the apps do the rest

Final Word

Cashback is the easiest way to stop overpaying. And in 2025, that extra $20–$100/month could mean groceries, gas, or a night out.

#cashbackhacks#personalfinance#smartshopping#savemoneytips#shoppinghacks#budgetlife#cashbackapps#financeblog#bestcashbackrates#creditcardtips#tumblrfinance#moneytalks#moneymoves#easycashback

0 notes

Text

Curious about how much one of South Africa’s wealthiest businessmen earns? Dive into the fascinating world of billionaire Patrice Motsepe’s salary, net worth, and financial journey on SassaLoans.co.za! This detailed breakdown covers how Motsepe built his empire, from mining mogul to philanthropist, and what his success means in rands and cents. Whether you’re seeking financial inspiration or just love reading about the ultra-wealthy, this article gives you the full picture updated and easy to understand.

#PatriceMotsepe#SouthAfrica#NetWorth#SalaryBreakdown#BillionaireLifestyle#AfricanBillionaire#FinanceBlog#WealthTalk#MoneyMatters#Inspiration#BusinessMogul#Motivation#SAWealth#EntrepreneurLife#BlackExcellence#SuccessStory#MiningIndustry#SassaLoans#FinancialFreedom

0 notes

Text

Married and Paying Student Loans? Here's What Just Changed.

The U.S. Department of Education just made a surprising move that could lower your payments — if you’re married and on the SAVE Plan.

We’ve broken it down simply here:

0 notes

Text

Want to Understand Loans Better? Start Reading These Finance Blogs

Loans have become a common part of life in India. Whether it’s for education, business, home, or even a new phone, most people have taken or are planning to take a loan. But the problem is, many jump into it without proper knowledge.

What’s the interest rate? Is there a processing fee? What about hidden charges? How does CIBIL score matter?

If these questions confuse you, the best place to start learning is through finance blogs covering loans in India.

Why Finance Blogs Matter

Let’s be real—not everyone has the time or patience to talk to bank managers or read through complicated RBI guidelines. That’s where blogs come in. Good finance blogs explain these concepts in simple language, using real examples.

They help you:

Understand loan types (secured, unsecured, personal, education, etc.)

Know how interest rates work

Learn the meaning of terms like EMI, tenure, foreclosure

Avoid scams and fake loan apps

Stay updated with the latest government schemes like Mudra, PMEGP, etc.

Reading finance blogs covering loans in India can literally save you from taking the wrong loan and falling into a debt trap.

What to Look for in a Good Finance Blog?

Not all blogs are worth your time. Some are just promoting credit cards or selling leads to loan companies. Here’s what a useful blog will offer:

✅ Honest and unbiased content ✅ Clear language (not full of jargon) ✅ Real-life loan comparisons ✅ Tips to improve CIBIL score ✅ Updates on RBI rules and loan schemes ✅ Warnings against frauds and scams

A good finance blog feels like a friend explaining things—not a salesman trying to sell you a product.

Some Topics You’ll Commonly Find

On finance blogs covering loans in India, you’ll usually find articles on:

“Best banks for personal loans in 2025”

“How to check if your loan app is fake”

“Should you prepay your loan early?”

“How to apply for Mudra loan step-by-step”

“Hidden charges banks don’t talk about”

These blogs also often review loan apps and online calculators—helping you decide what’s trustworthy and what’s not.

Where to Find These Blogs?

Some popular platforms that consistently put out solid content include:

BankBazaar Blog

Paisabazaar Blog

MoneyControl

ClearTax

Groww

Finshots (for general finance awareness)

You can also follow independent finance creators on Instagram and YouTube—they often link to their blogs in the bio.

Final Tip

Knowledge is power, especially in the world of loans. One small mistake while applying, and you could be paying more than you planned for years.

So before signing any loan document, make it a habit to read a couple of finance blogs covering loans in India. You’ll feel more confident, more aware, and way more in control of your financial decisions.

0 notes

Text

Want to track sales performance in real time? Discover how Bicxo provides actionable insights, empowering you to make quick, data-driven decision that elevate team performance. Click on the link to Know more

To read the full case study click on this link

For a free demo visit our website to know more about our epm software

#BiCXO#FinancialData#Finance#BusinessIntelligenceTools#BusinessSuccess#financeblog#financeprofessionals#financialplanning#finance#bi#businessintelligence#data#data warehouse

0 notes

Text

A Deep Dive into International Accounting Standards (IAS)

📘 New Blog Alert: International Accounting Standards – A Comprehensive Guide for Businesses and Investors 🌍 Learn how IAS (International Accounting Standards) shape the financial landscape for businesses and investors worldwide. This comprehensive guide explains the importance of IAS in ensuring global consistency, financial transparency, and smooth cross-border operations.

🔍 Key Insights:

Simplifying Global Compliance: How IAS streamlines tax and financial reporting across countries.

Boosting Investor Confidence: Why IAS ensures reliable and comparable financial data.

Facilitating International Business: The impact of IAS on multinational corporations and cross-border transactions.

💡 Whether you're a business owner, financial professional, or investor, this guide will help you understand how IAS makes global accounting practices more transparent, standardized, and accessible. 🌐

🔗 Read More: International Accounting Standards: A Comprehensive Guide for Businesses and Investors

#IAS#AccountingStandards#GlobalFinance#InvestorGuide#BusinessInsights#FinancialTransparency#Accounting#GlobalCompliance#FinanceBlog

0 notes

Text

🚨 What the Latest Interest Rate Hikes Mean for Your Money 🚨

💡 Interest rate hikes are shaking up finances everywhere! Here’s a quick breakdown of how they might affect YOU:

👉 Loans and Mortgages: Borrowing costs are rising—homebuyers, car buyers, and credit card users, take note! 👉 Savings Accounts: Good news for savers—higher interest means better returns on your savings and CDs. 👉 Investments: Markets are volatile, but smart diversification can help you stay ahead. 👉 Debt Management: Now’s the time to tackle high-interest debt and fine-tune your financial strategy.

✨ Stay ahead of the curve with actionable insights and tips.

Read the full blog here: [https://moneymatters78.blogspot.com/2024/12/what-latest-interest-rate-hikes-mean.html]

💬 Let us know how interest rate hikes are impacting your money in the comments below!

#MoneyMatters#InterestRates#PersonalFinance#SavingsTips#DebtManagement#Investing#FinancialFreedom#EconomicTrends#BudgetingTips#MoneyTips#FinanceBlog#SmartMoneyMoves#MortgageRates#WealthBuilding#FinancialPlanning

1 note

·

View note

Text

Being a small business owner, I've navigated the world of commercial liability insurance for years to protect my company and team. Understanding the true worth of your insurance book of business can be tough—but I've cracked the code!

In my latest guide, I share invaluable tips and strategies to help you assess how much your insurance book is worth, whether you're looking to sell, buy, or simply understand its value better. 📈💼

Here's what you'll learn: 🔑 Key factors affecting your insurance book's value, like growth, profitability, and client retention. 📊 Different valuation methods: revenue multiplier and EBITDA multiplier. 🛡️ Strategies to enhance your book's value through operational efficiency and customer loyalty. 📈 Typical EBITDA multiples for insurance agencies and what they mean for your business's valuation.

Whether you're a seasoned owner or just starting out, this guide will equip you with the knowledge to make informed decisions about your insurance agency's future. Don't miss out—click the link below to unlock the secrets to maximizing your insurance book's value! 🚀

#smallbusinessownerlife#insuranceagency#businessvaluation#EBITDA#InsuranceBusiness#entrepreneurship#finance#financetips#financialliteracy#financialplanning#financeblogger#financeblog#insurance#business#businessgrowth#businessowner#Businessman#businesssuccess

0 notes