#ABSA submission

Explore tagged Tumblr posts

Text

Little P.Eng.: Delivering Expert Flange Design Services as per ASME Sec. VIII Div. 1, Appendix 2

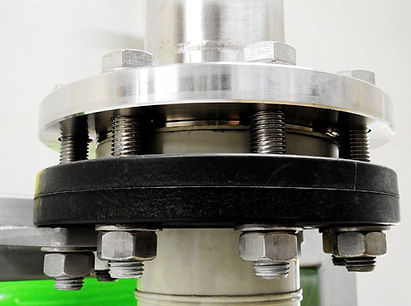

Flange design plays a critical role in ensuring the safety and integrity of pressure vessels and piping systems. When it comes to designing flanges as per ASME (American Society of Mechanical Engineers) Sec. VIII Div. 1, Appendix 2 for ABSA (Alberta Boilers Safety Association) submission, it is crucial to rely on the expertise of a trusted engineering firm. Little P.Eng. is a renowned engineering consultancy that specializes in providing comprehensive flange design services. With their deep understanding of ASME codes and regulations, they are well-equipped to assist clients in meeting ABSA requirements with precision and efficiency.

Expertise in ASME Sec. VIII Div. 1, Appendix 2:

Little P.Eng. prides itself on its extensive knowledge and experience in working with ASME codes, specifically Section VIII Division 1. Appendix 2 of this section provides detailed guidelines for flange design, including bolt loads, gasket constants, and allowable flange stresses. Compliance with these specifications is crucial for ensuring the safety and reliability of pressure vessels. The team at Little P.Eng. possesses a deep understanding of this appendix and keeps up-to-date with the latest revisions, ensuring their designs meet the most current standards.

Accurate and Reliable Flange Design:

When it comes to flange design, precision is paramount. Little P.Eng. employs highly skilled engineers who utilize advanced design software and tools to accurately calculate critical parameters such as bolt loads, gasket constants, and flange stresses. By leveraging their expertise and cutting-edge technology, they deliver robust and reliable designs that are tailored to each client's specific requirements. The team ensures that the design complies with the ASME code, meeting the stringent ABSA submission criteria.

Compliance with ABSA Requirements:

ABSA, as the regulatory authority in Alberta, Canada, mandates strict adherence to safety standards for pressure vessels and piping systems. Little P.Eng. understands the ABSA submission process and the specific requirements that need to be met. Their flange design services are customized to comply with ABSA regulations, enabling clients to obtain necessary approvals for their projects. By engaging Little P.Eng., clients can rest assured that their flange designs will undergo a thorough review process, meeting all ABSA requirements.

Collaborative Approach and Client Satisfaction:

Conclusion:

When it comes to flange design services as per ASME Sec. VIII Div. 1, Appendix 2 for ABSA submission, Little P.Eng. stands out as a reliable and experienced engineering firm. Their deep understanding of ASME codes, expertise in flange design, and commitment to compliance with ABSA requirements make them the go-to choice for clients seeking precision and reliability. By partnering with Little P.Eng., clients can ensure the safety and integrity of their pressure vessels and piping systems, while also meeting the necessary regulatory standards.

Keywords:

Flange design, ASME Sec. VIII Div. 1, Appendix 2, ABSA submission, Little P.Eng., pressure vessels, piping systems, compliance, design calculation, bolt loads, gasket constants, flange stresses, safety, engineering firm, precision, reliability, regulatory standards, ABSA requirements, client satisfaction.

Tags:

Meena Rezkallah

Little P.Eng.

safety

piping systems

engineering firm

reliability

client satisfaction

pressure vessels

Flange design

ASME Sec. VIII Div. 1

Appendix 2

ABSA submission

compliance

design calculation

bolt loads

gasket constants

flange stresses

precision

regulatory standards

ABSA requirements

Engineering Services

Pipe Stress Analysis Services

Located in Calgary, Alberta; Vancouver, BC; Toronto, Ontario; Edmonton, Alberta; Houston Texas; Torrance, California; El Segundo, CA; Manhattan Beach, CA; Concord, CA; We offer our engineering consultancy services across Canada and United States. Meena Rezkallah.

#Meena Rezkallah#Little P.Eng.#safety#piping systems#engineering firm#reliability#client satisfaction#pressure vessels#Flange design#ASME Sec. VIII Div. 1#Appendix 2#ABSA submission#compliance#design calculation#bolt loads#gasket constants#flange stresses#precision#regulatory standards#ABSA requirements

1 note

·

View note

Text

- Position: Cleaner (12 Posts) - Salary: R131 265 per annum (Level 02) - Departments: Supply Chain Management - Location: Various centers across South Africa Application Process Interested applicants can submit their applications via email or physical delivery based on their preferred location. Submission Guidelines: - Pretoria (Head Office) - Hand-deliver: 01 Cresswell Road, Promat Building, Silverton. - Post: Private Bag X1500, Silverton, 0127. - Email: [email protected] - East London - Hand-deliver: Cnr Buxton and Oxford Street, Old Allied Building. - Email: [email protected] - Bloemfontein - Hand-deliver: Charlotte Maxeke Street, 46 ABSA Building. - Email: [email protected] - Germiston - Hand-deliver: 165 Meyer Street, Benmare Building. - Email: [email protected] - Port Shepstone - Hand-deliver: 15 Bram Fischer Road, Servamus Building, Durban. - Email: [email protected] - Polokwane - Hand-deliver: 106 Hans van Rensburg Street, Empire Place Suite 02. - Email: [email protected] - Nelspruit - Hand-deliver: 17 Henshall Street, Stats House. - Email: [email protected] - Kimberley - Hand-deliver: 36 Stockdale Street, Old De-Beers Headquarters. - Email: [email protected] - Klerksdorp - Hand-deliver: 51 Leask Street, Westend Building. - Email: [email protected] - George - Contact SAPS for detailed submission instructions. Read the full article

0 notes

Text

ABSA Bank Uganda Jobs 2022 – Fresher Legal Counsel

Job Title: Legal Counsel – ABSA Bank Uganda Jobs 2022 Organization: ABSA Bank Limited Job Location: Kampala, Uganda ABSA Bank Limited Profile: Absa Group Limited (formerly Barclays Bank UK) is a diversified standalone African financial services group, delivering an integrated set of products and services across personal and business banking, corporate and investment banking, wealth, investment management and insurance. Absa Group Limited is listed on the JSE and is one of Africa’s largest diversified financial services groups with a presence in 12 countries across the continent and around 41 000 employees. Job Summary: To provide legal support to business units while working under the supervision of a senior lawyer or manager ensuring all queries are filtered and assigned to the relevant team members. Roles and Responsibilities: Accountability: Risk and Control - Provide support to the Principal Legal Risk Owner in respect of Legal Principal Risks identified in accordance with the Group Legal principal risk framework - Support the Group Legal Risk Control Framework by collecting and analysing legal data, and preparing / editing the submissions to governance committees Accountability: Teamwork - Provide support and technical assistance to the team - Develop and deliver training initiatives to front line and operational staff Accountability: Commercial - Establish and build sound relationships with business stakeholders Accountability: Technical - Research and write Legal Opinions - Provide support for the Administration of the legal team - Participate in cross functional working groups and projects in which the Legal function is required to contribute Minimum Qualifications - Bachelor`s Degrees and Advanced Diplomas: Law (Required) How To Apply for ABSA Bank Uganda Jobs 2022 All interested and suitably qualified candidates should submit their applications through the link below. Click here to apply Deadline: Open until filled For similar Jobs in Uganda today and great Uganda jobs, please remember to subscribe using the form below: NOTE: No employer should ask you for money in return for advancement in the recruitment process or for being offered a position. Please contact Fresher Jobs Uganda if it ever happens with any of the jobs that we advertise. Facebook WhatsApp Twitter LinkedIn Read the full article

0 notes

Text

FLISP policy revised | 'No need for a home loan to obtain government subsidy'

National Minister of Human Settlements, Mmamoloko Kubayi announced that the Finance Linked Individual Subsidy (FLISP) has been delinked and is no longer just a mortgage only option.

Furthermore, partnerships were established with external role-players such as financial institutions, conveyancing attorneys and property developers, granting them access to the Housing Subsidy System (HSS) which allows them to capture and monitor the progress of applications. The result is a drastically improved turnaround time for processing these applications.

The FLISP programme is a housing subsidy to assist qualifying first-time home buyers with purchasing a home. The subsidy is paid directly to the conveyancing attorney or financial institution and can be used as a deposit to buy a home, or to pay such into an existing home loan and reduce the monthly instalments.

“Households with an income between R3 501 to R22 000 may qualify for the FLISP subsidy if they meet all the criteria, such as being a first-time buyer with a financial dependent and a South African citizen. The current subsidies range from R121 626 to R27 960.00. This may also increase,” says Meyer de Waal, a conveyancing attorney of Cape Town whose mission it was over the past eight years to assist first time buyers to gain access to a home loan and assist with a FLISP subsidy application.

“Since FLISP’s inception in 2005, the approval of the subsidy was always linked to finance in the format of an approved home loan from either one of the major financial institutions such as ABSA, Standard Bank, FNB, Nedbank or SAHL.”

“The announcement by the National Minister of Human Settlements, Mmamoloko Kubayi during a virtual briefing to National Council of Provinces (NCOP) that as from 1 April 2022, the Finance Linked Individual Subsidy (FLISP) has been delinked and no longer just a mortgage is the only option, is a very welcome development,” says de Waal.

“Often in the past, we considered giving up as the barriers to entry for a first-time buyer were too difficult to overcome,” says de Waal. “We welcome Minister Kubayi’s announcement, and are glad that we persevered and today can provide a comprehensive FLISP first time buyer assistance that includes home loan and or non-mortgage linked finance application services.”

According to de Waal, partnerships in the private sector were established over the past years, and these are now the foundation of a comprehensive service to first-time buyers mortgage originators, attorneys, estate agents as well as such service to the Department of Human Settlements and the NHFC to provide comprehensive FLISP application submissions.

Establishing partnerships in the private sector to aid first time buyers

“We reached out to other industry stakeholders in the legal fraternity, such as LexisNexis and formed a partnership with them to promote FLISP applications through their extensive conveyancing attorney network,” explains de Waal.

“Through the Gawie Le Roux Institute of Law we also hosted FLISP information sessions and more combined workshops are planned.”

The Attorney Realtor Hub, through 13 branches on a national scale are also assisting their buyers and sellers with this service.

Up to 31 March 2022, only the Western Cape allows for the payment of conveyancing fees from the FLISP subsidy proceeds, says Chris Fick of Attorney Realtor Hub.

Often a buyer does not have the funds available to pay for conveyancing fees and the new FLISP policy will be expanded on a national level to accommodate the payment of conveyancing fees as well.

Estate agents

FLISP information sessions and events facilitated through the Institute for Estate Agents (IEASA) were hosted and further events are planned.

“The estate agents must have comprehensive knowledge of the subsidies available for first time buyers as this aids them in concluding a successful property transaction,” says Annette Evans of IEASA.

Technology

To accommodate the onboarding of thousands of home loan applications per month, cutting-edge Property and Fintech technology were developed in a partnership with 4Me.Tech. This same technology is now applied to aid buyers with non-mortgage-linked financial applications and a FLISP subsidy.

What changed?– the new de-linked flisp policy as from 1 april 2022

As from 1 April you no longer need a finance approval from one of the major financial institutions, explains Anele Matakane of MDW INC property & home finance services.

Now, a buyer can qualify for a first-time buyer FLISP subsidy if they have financial assistance to buy a property in the form of:

· The beneficiary’s pension/provident fund loan.

· A co-operative or community-based savings scheme, i.e. stokvel

· The Government Employees Housing Scheme.

· Any other Employer-Assisted Housing Scheme.

· An unsecured loan.

· An Instalment Sale Agreement or Rent-to-own Agreement.

“Our mortgage origination license with one of the largest mortgage origination companies provides financial assistance to up to eight traditional home loan lenders,” says Matakane.

This also includes non-mortgage finance which is a unique offering to the industry. All the property finance solutions are under one roof.

“For non-finance linked applications, we have taken hands with 4.Me.Tech to provide a one-stop-shop service to assist buyers with every type of finance solution available, all such types of finance that are now available with the National Housing Code.”

What about late applications or existing home owners?

Unfortunately, many first-time buyers did not know about the opportunity to apply for a FLISP subsidy and never applied. However, this may now change with the new policy as retrospective applications may be considered as soon as the new guidelines are made available.

To add your name to a list to be advised when the retrospective policy is introduced, click here to add your name and details.

Flisp calculator and flisp pre-qualification voucher before you buy

As per the new National Housing Code, a FLISP pre-qualification guarantee can be issued to a first-time buyer by the Implementation Agencies appointed by the Government.

According to Jacques Theron of 4Me.Tech, their technology enables them to issue a first-time buyer with a FLISP Voucher before they start the home buying process.

“After an applicant signs up on our online platform and answers a few qualifying questions, the technology does the rest and a FLISP Voucher is issued to provide an accurate estimate of the subsidy the home buyer can qualify for.”

The Flisp Voucher can then be validated through HSS integrations with the Department of Human Settlements or the systems of the NHFC as per a working relationship with these institutions.

Next step – what finance can one qualify for?

A FLISP Voucher is the first step to take, and the first-time buyer can then establish how much finance can be obtained to buy a home with the combination of the FLISP subsidy and the finance granted and available.

“Our online property finance pre-qualification estimator provides an outcome in real time and also provides a FLISP Subsidy Voucher that can be validated,” says Jacques Theron of 4Me.Tech.

Not only is the first-time buyer assisted to compare finance through a home loan, but also to all of the non-mortgage linked financial services that will be available as from 1 April.

“We realised a first-time buyer, with no or little experience to buy a property and shop around for the most appropriate property finance will be very confused if all the finance options are not presented on one easy to navigate platfor,” says Theron.

“The first-time buyer can also be lured to take up non-mortgage finance that he or she may not be able to afford. Once the finance is taken up and a home bought, it may land the new homeowner in financial difficulties if the monthly repayments cannot be met.”

That is why the online platform with a quick credit score and affordability self-check for the buyer was developed. The outcome is available in real time and the data extracted from a business relationship with an established credit bureau, explains Theron.

Raising finance, in any form, is a home loan or non-mortgage linked finance application, a first-time buyer will still have to comply with the strict rules of the lending practices and guidelines as per the National Credit Act.

“Up to 50% of home buyers are unsuccessful from the start due to a low or a bad credit score,” says de Waal. “If I look at the +/- 340 000 applications who were processed over the past 36 months, more than 185 000 aspiring buyers were unable to even be considered for a home loan, due to a low, thin, or bad credit score.

If a finance application is declined, a first-time buyer will not be able to receive a FLISP subsidy.”

“Thanks to a partnership with My Budget Fitness, we can enable the first-time buyer with a low, thin, or bad credit score to receive assistance to improve his or her credit score and get back to apply for finance as soon as the credit score is strong and healthy,'' says de Waal.

“This service has already been made available since 2017 to a leading financial institution that specialise in unsecured lending, as assistance for their own employees.”

“We are elated that the rent-to-own concept and installment sales were also added in the National Housing Code,” says de Waal.

The Rent2buy programme was developed in 2007 and is geared towards helping first-time buyers to get their foot in the door to own their own homes. A year or two later, installment sales were also added to aid buyers to get their foot in the door to own their own properties.

Private partnerships were established with property development companies such as Sinai Property Developers and Communicare to aid first time buyers to own their own home, and more property development companies are expected to follow and make available their stock to these types of innovative property solutions.

“We already have access to non-banking finance available for buyers who struggle to convince a traditional bank to grant them a home loan,” says de Waal.

SOURCE: www.property24.com

#real estate agents#real estate#Property#property management#property market#Property News#for sale#for rent#Consulting#coaching#life coaching#mentoring

0 notes

Text

Compliance Tips For 2018 and Beyond

STEP Engineering provides regulatory support for oil and gas infrastructure compliance. Thus, we deliver practical and cost-optimized solutions to ensure regulatory compliance and reduce the risk for the clients. Our services are geared up to help clients quantify their emissions whether they are planned or unplanned.OUR SERVICESRegulatory submission for facilities, wells, and pipelinesAB, BC, SASK Permit Approvals /Applications (AER, OGC, ECON)Well & Pipeline Abandonment (Lease Reclamation & Remediation)Audits and Reviews of Existing FacilitiesLicensee Liability Rating Reporting (LLR)Fugitive Emissions ManagementDehydrator Engineering & Operations Sheets (DEOS)/ Annual ReportingABSA Submission (including Closing Weld Procedures)BuildingAny company that has been in business for more than a few months can attest to the fact that compliance is not only a large part of being in business, it is a mobile goal that almost changes with the seasons. And the last half of 2017 put the focus on full speed compliance with the various scandals and demands that arose throughout the landscape.

In light of these events, Entrepreneur magazine recently published an article with four points that leaders should think about in 2018 and in the future, which we present below.

A unified compliance strategy

Compliance does not work well as a separate department, however, that is the amount, if not most, of the companies operating their compliance programs. It's like an internal affairs department that works behind the scenes and suddenly appears when things are not right. The best option is to integrate compliance throughout the company in each department.

Compliance with rescue platforms

This is, of course, a dear point to our heart. Legacy software and programs are too cumbersome to manage modern compliance requirements, and even most modern software is too inflexible to keep track of everything. According to the article, most companies use multiple different technology providers for compliance management. That is why we create Compliance Checkpoint to be a single comprehensive, flexible and scalable solution.

Think about the future to avoid potential risks

Despite the constant demands, scandals and general problems related to compliance, most of them are completely avoidable. The key is not only to be aware of your current compliance situation, but also to consider what could change in the future, including possible regulatory movements, as well as how and where your company could expand and what that could imply.

Make your values known

Frankly, this should already be part of your corporate strategy, but if not, add it to your to-do list. Incorporating and promoting your values as part of your business culture contributes greatly to strengthening the actions you want to encourage and discourage.

STEP Engineering provides regulatory support for oil and gas infrastructure compliance. Thus, we deliver practical and cost-optimized solutions to ensure regulatory compliance and reduce the risk for the clients. Our services are geared up to help clients quantify their emissions whether they are planned or unplanned.

OUR SERVICES

Regulatory submission for facilities, wells, and pipelines

AB, BC, SASK Permit Approvals /Applications (AER, OGC, ECON)

Well & Pipeline Abandonment (Lease Reclamation & Remediation)

Audits and Reviews of Existing Facilities

Licensee Liability Rating Reporting (LLR)

Fugitive Emissions Management

Dehydrator Engineering & Operations Sheets (DEOS)/ Annual Reporting

ABSA Submission (including Closing Weld Procedures)

Building

#compliance risk management#compliance risk assessment#Fugitive Emissions Management#REGULATORY AND ENVIRONMENTAL SERVICES

0 notes

Link

STEP Provides Regulatory & Environmental Services Which Includes Compliance Risk Management & Assessment, ABSA Submission Services, Dehydrator Engineering & Operations Sheets.

0 notes

Text

PSL release Downs DC verdicts

New Post has been published on https://bestfreebettingtips.com/psl-release-downs-dc-verdicts/

PSL release Downs DC verdicts

The Premier Soccer League on Wednesday released the verdict handed down by the Disciplinary Committee regarding Mamelodi Sundowns’ fielding of Wayne Arendse.

Arendse was drafted onto Sundowns’ teamsheet beyond the prescribed deadline in their 1-1 Absa Premiership draw with Bidvest Wits over a month ago, and was subsequently fielded in the starting line-up.

READ: Pitso questions delay in Arendse DC case

Upon review of the matter, the PSL DC have since found the club and the player guilty of contravening the rules, but have reserved their sanction until defence submissions have been made by The Brazilians.

“The Premier Soccer League Disciplinary Committee has delivered verdict on matters involving Mamelodi Sundowns, Mr Wayne Arendse and Mr Pitso Mosimane,” read a statement from The League.

“In the first matter involving Mamelodi Sundowns and Wayne Arendse, the Disciplinary Committee found both the club and the player guilty of misconduct.

“This is after Mamelodi Sundowns fielded Mr. Arendse whilst he was ineligible to play in the Absa Premiership fixture against Bidvest Wits on 07 October 2018.

“Sanction will be handed down once all the parties have made submissions to the Disciplinary Committee.”

“Sanction will be handed down once all the parties have made submissions to the Disciplinary Committee.”

Get the latest Sundowns news sent to your phone!

0 notes

Text

Bosasa informs court: We are being pirated!

Lawyers representing corruption accused company Bosasa, which has entered into a court battle to have its own decision to enter into voluntary liquidation set aside, claim it is being hijacked by liquidators.

The Gauteng High Court in Johannesburg heard arguments in the matter on Wednesday and Judge Joolan Ameer has reserved judgement.

Bosasa, represented by advocate Mike Hellens, SC, argued that special resolutions the company’s board of directors took on February 12, to place the company under voluntary liquidation, should be declared null and void.

Bosasa changed its name to African Global Operations (AGO) in 2017.

To try and convince Ameer that the application Bosasa chairman Joe Gumede filed on March 4 was indeed urgent, Hellens argued that provisional liquidators Cloete Murray and Ralph Lutchman had “hijacked” the company.

Decisions the liquidators took, such as the firing of certain staff, including Lindsay Watson, kicking directors out of the offices and moving ahead with the search for potential buyers for certain assets, were having an adverse effect on the company and its staff, he submitted, and the court needed to grant a declaratory order to set aside the special resolutions.

The resolutions taken, Hellens argued, were null and void because the shareholders had not been properly notified of the meeting and the incorrect section of the Companies Act of 1973, which has since been repealed, was used to enforce the resolutions.

It then follows, Hellens submitted, that the entire process and appointment of the liquidators was in effect irregular.

“We would argue to anyone…that these companies are not in liquidation,” Hellens said. “Our starting point is that if there was no resolution, there was no appointment [of the liquidators]. There is no valid resolution triggering any provision of the Companies Act,” he added.

Ameer questioned Hellens about how he could claim there was no special resolution meeting as set out in the Companies Act, when all six of the directors of Bosasa/AGO were present when they signed the resolution documents, which set out that a proper meeting was indeed held and that the directors waive the notice period requirement.

“These are seasoned directors of a financially substantial company,” the judge pointed out.

Hellens argued that the same directors, which included Bosasa chairman Joe Gumede and CEO Gavin Watson, only became aware of the irregularity in the process they followed in commencing the liquidation proceedings after the fact. They simply signed documents presented to them by an attorney.

Advocate Werner Luderitz, acting for Murray and his colleagues, argued that the application should be dismissed on the basis that the liquidators were not given appropriate time to draft responding papers, but advanced some form of argument against Hellens’ submissions.

Luderitz submitted that the 1973 version of the act was still enforceable in terms of winding up an insolvent company.

Nowhere in their papers, he argued, did Bosasa provide proof the companies were still solvent.

Luderitz also pointed out that Bosasa’s issues were an after-the-fact attempt to find technical loopholes because the liquidator they wanted to be appointed, was not initially appointed.

This is in reference to Lutchman. Luderitz told the court that Gumede had been instrumental in going to various employees and creditors to ask them to sign requisitions that supported the appointment of Lutchman.

“It was always intended by the applicant [Bosasa/AGO] that this company should be placed under liquidation,” Luderitz said. “Where the plan backfired was when the person they had in mind to be appointed was not left alone to take charge.”

Luderitz added that Gumede and Hellens had not explained where the sudden urge to relook the resolutions came from. “Mr Murray takes charge, and does his work as he is required.

“Then miraculously there is this urgent need to find some technical issue with the resolutions…that is the reason why we are here. The plan didn’t work out,” Luderitz said.

When Bosasa communicated the decision it took to be placed under voluntary liquidation in February, the company stated in a press release that the reason for this was the closure of its banking facilities by FNB and then ABSA bank.

The company was unable to find alternative banking accounts – a situation Murray described in his affidavit as a “commercial death sentence”.

Hellens did not argue this point, but maintained that the companies were solvent for reasons set out in Gumede’s founding affidavit.

This affidavit completely ignores the fact that the main sources of revenue for Bosasa/AGO, being two contracts with the Department of Correctional Services, have been cancelled.

It is not clear when Ameer will give judgment.

The post Bosasa informs court: We are being pirated! appeared first on TheFeedPost.

from WordPress https://ift.tt/2h5rP9h https://ift.tt/2Hvmu9y via IFTTT

0 notes

Link

Dehydrator Engineering & Operations Sheets

0 notes

Text

Billions stolen by apartheid regime must be recovered – Mkhwebane

BUSINESS - THE SOUTHERN TIMES

Jun 26, 2017

388 Views

Share on Facebook

Tweet on Twitter

+

By Thandisizwe Mgudlwa

CAPE TOWN – ABSA Bank, previously known as Bankorp, contributed to the killing of black people and their oppression by providing billions of rands to the apartheid regime.

This week though, Public Protector Busisiwe Mkhwebane issued a proclamation that the South African government is allowed to recover R1,125 billion in “misappropriated public funds” from ABSA Bank.

The proclamation comes after an investigation into a report on apartheid-era looting by UK-based asset recovery agency, CIEX, was submitted to the Public Protector for investigation.

According to Mkhwebane, government and the South African Reserve Bank failed to implement the Ciex report, and ordered that the Special Investigation Unit re-open the case and recover the funds.

The CIEX report alleged that R24 billion was unlawfully given out to Bankorp (which would eventually become a part of Absa) from 1985 to 1992 by the South African Reserve Bank. It then provided Absa with a further R2.25 billion in bailouts from 1992 to 1995.

CIEX was paid 600,000 British pounds for services which were never used by government, the Public Protector said.

Mkhwebane said that two investigations into the matter established that the financial aid given to Bankorp/Absa was irregular, but the correct amount attributable was R1.125 billion.

A preliminary report on the Public Protector investigation was leaked earlier in the year.

At the time Absa responded to the report, saying that the Davis Panel of experts appointed by former South African Reserve Bank governor Tito Mboweni in 2000 found that Absa’s shareholders did not derive any undue benefit from the Sarb’s intervention, and as such no claim of restitution could be pursued against Absa.

Mkhwebane said that the Reserve Bank must cooperate with SIU in the recovery of the public funds.

Meanwhile, this week the ANC Women’s League and Black First Land First called on Mkhwebane to conduct a full-scale investigation into apartheid-era state looting.

This follows the preliminary report indicating Absa owed R2.25 billion it received as part of an unlawful apartheid-era bailout.

The preliminary report which was leaked to media this past week indicates that over R24 billion was unlawfully given out to Bankorp from 1985 to 1992 by the South African Reserve Bank. It then provided Absa with a further R2.25 billion in bailouts from 1992 to 1995 according to, CIEX.

Even though, Absa was the main focus of the leaked report. The ANCWL has now urged the Public Protector to launch a full scale investigation on the CIEX report so that “all those implicated in the report be brought to book”.

“All beneficiaries of this looting must pay in full and with interests on all that they have looted”, demanded the ANCWL.

This was echoed by Black First Land First who stated it was not just Absa who was implicated in the apartheid-era’s unlawful bailout.

“A report was submitted to former president Thabo Mbeki by a private investigator in the UK, which revealed that he could trace R26 billion stolen by apartheid leaders and placed offshore,” BFLF said.

“We want that R26 billion, because [it] is going to solve a lot issues that are facing the majority, and a lot of issues that characterise the black condition – like the issues of unemployment and free education.” stated BFLF.

Both the ANCWL and BFLF have reportedly made an official submission to President Jacob Zuma.

They have appealed to the President to institute an inquiry into CIEX, and other cases related to looting of State resources by the apartheid government and Capture of State owned entities.

0 notes

Link

STEP Engineering provides regulatory support for oil and gas infrastructure compliance. Thus, we deliver practical and cost-optimized solutions to ensure regulatory compliance and reduce the risk for the clients. Our services are geared up to help clients quantify their emissions whether they are planned or unplanned.

OUR SERVICES

Regulatory submission for facilities, wells, and pipelines

AB, BC, SASK Permit Approvals /Applications (AER, OGC, ECON)

Well & Pipeline Abandonment (Lease Reclamation & Remediation)

Audits and Reviews of Existing Facilities

Licensee Liability Rating Reporting (LLR)

Fugitive Emissions Management

Dehydrator Engineering & Operations Sheets (DEOS)/ Annual Reporting

ABSA Submission (including Closing Weld Procedures)

Building and Municipal Development Permit

#Audits and Reviews of Existing Facilities#Licensee Liability Rating Reporting#Fugitive Emissions Management

0 notes

Link

Regulatory submission for facilities, wells, and pipelines

0 notes