#AI for Security

Explore tagged Tumblr posts

Text

Global Generative AI In Cryptocurrency Market | Insights: Trends, Innovation Future Projections Rising Growth

Global Generative AI in Cryptocurrency Market: Emerging Trends and Opportunities

The intersection of cryptocurrency and artificial intelligence (AI) is transforming the digital financial sector. A particularly exciting development in this area is the integration of Generative AI with cryptocurrencies. This combination is revolutionizing how digital assets are traded, managed, and secured. Generative AI allows for the creation, enhancement, and analysis of blockchain-based applications and cryptocurrency systems, making the market more efficient and intelligent.

The Global Generative AI in Cryptocurrency Market is expanding rapidly. By 2025, the market is expected to reach USD 929.5 million, with a compound annual growth rate (CAGR) of 33.1%, leading to an estimated market value of USD 12,208.8 million by 2034. This growth is fueled by AI’s ability to enhance trading strategies, improve security, and develop innovative financial tools within the cryptocurrency ecosystem.

What is Generative AI in Cryptocurrency?

Generative AI refers to a branch of artificial intelligence that uses advanced algorithms to generate new content, data, and insights. In the context of cryptocurrency, Generative AI serves several key functions:

Creating new digital assets

Enhancing trading strategies

Analyzing blockchain data

Developing and optimizing smart contracts

Generative AI automates many tasks that would typically require human intervention, boosting the efficiency, security, and speed of cryptocurrency systems.

Download a Complimentary PDF Sample Report: Generative AI in Cryptocurrency Market Sample

How Does Generative AI Work in Cryptocurrency?

Generative AI utilizes advanced technology to process large amounts of data, learning from past trends and predicting future patterns. Here’s how it’s applied in the cryptocurrency market:

Automated Content Generation Generative AI can create content automatically, including market analysis reports, news articles, and social media updates. By analyzing data from the crypto market, it can produce insights and summaries, helping traders and investors stay informed without doing everything manually.

Smart Contract Creation A smart contract is a self-executing agreement that activates when specific conditions are met. Generative AI helps create these contracts securely and efficiently by analyzing blockchain data and generating optimal contract terms based on real-time market conditions.

Predictive Trading Analytics Generative AI uses machine learning to analyze historical data and identify trends in the cryptocurrency market. By doing so, it can forecast future market movements and even generate synthetic data that mimics potential market scenarios, helping traders make smarter, more accurate decisions.

Fraud Detection and Security Generative AI can monitor cryptocurrency transactions in real-time to identify signs of fraud or suspicious activity. By analyzing transaction data, it can flag irregularities like hacks or scams, alerting users and authorities, which improves overall security within the crypto ecosystem.

Key Drivers of Growth in Generative AI for Cryptocurrency

Demand for Automation The cryptocurrency market’s volatility requires quick decision-making. Generative AI facilitates this by automating processes like trading strategies, enabling faster and more informed decisions. This is especially useful for automated trading systems, where AI adjusts strategies in real-time based on market movements.

Enhanced Security Features As the popularity of cryptocurrency rises, so do security concerns such as fraud and hacking. Generative AI addresses these concerns by analyzing transaction data in real time, detecting fraud before it happens, and bolstering trust in the cryptocurrency ecosystem.

Improved Trading Efficiency Generative AI optimizes trading strategies by predicting price movements and adjusting strategies accordingly. This allows traders to make data-driven decisions and reduces the reliance on guesswork, thus improving their chances of success.

Integration with Decentralized Finance (DeFi) Decentralized finance (DeFi) is a blockchain-based financial system that bypasses traditional banking institutions. Generative AI enhances DeFi platforms by automating processes such as lending, borrowing, and asset management. Additionally, AI helps predict the performance of DeFi assets, giving users more reliable insights to inform their decisions.

Get Customized Insights: Request a Custom Report

Regional Insights: North America Leads the Charge

North America is poised to dominate the Generative AI in cryptocurrency market, capturing 41.4% of the market share by 2025. Several factors contribute to this leadership position:

Technological Innovation: North America is home to some of the world’s leading AI and blockchain companies that continue to push the boundaries of both fields.

High Adoption Rates of AI: Many financial institutions, hedge funds, and cryptocurrency exchanges in the region are adopting AI to optimize trading strategies and manage risks more effectively.

Robust Crypto Ecosystem: The U.S. and Canada have established cryptocurrency markets, backed by a strong culture of technological innovation, making them ideal environments for the growth of AI in the crypto space.

As North America continues to lead the way in both AI and cryptocurrency adoption, more breakthroughs are expected in generative AI applications for digital asset management.

Challenges in Generative AI for Cryptocurrency

Despite its vast potential, there are several challenges associated with integrating Generative AI into cryptocurrency:

Data Privacy and Security Concerns The use of AI to analyze large volumes of transaction data raises concerns about the protection of personal and financial information. Ensuring data privacy and security is critical for the continued growth of AI in cryptocurrency.

Complexity of AI Models The complexity of AI algorithms can make it difficult for some cryptocurrency companies to implement these technologies. This requires a high level of expertise and can increase costs, particularly for smaller businesses.

Regulatory Issues Cryptocurrency markets remain largely unregulated in many regions, and the introduction of AI into these markets adds another layer of complexity. Governments and regulators will need to create new rules to govern the use of AI in crypto trading.

Risk of Overdependence on AI While AI can optimize and automate trading strategies, there is a risk that traders may become too dependent on it. In the volatile cryptocurrency market, overreliance on AI-driven strategies could lead to substantial losses.

Frequently Asked Questions (FAQs)

What is Generative AI in cryptocurrency? Generative AI refers to the use of artificial intelligence to generate data, enhance trading strategies, and automate processes such as smart contract development in cryptocurrency systems.

How is Generative AI used in cryptocurrency trading? Generative AI helps cryptocurrency traders by analyzing market trends, predicting price changes, and automating trading strategies to allow quicker, data-driven decisions.

Why is Generative AI crucial for the cryptocurrency market? Generative AI improves trading efficiency, enhances security, automates critical tasks, and enables investors to make more informed decisions in the dynamic cryptocurrency market.

Which region is leading the Generative AI in cryptocurrency market? North America is leading the market with a 41.4% share in 2025, driven by strong technological infrastructure and high AI adoption rates in cryptocurrency trading.

What challenges are there in using Generative AI in cryptocurrency? Challenges include data privacy concerns, the complexity of AI algorithms, regulatory hurdles, and the risk of overdependence on AI systems for trading decisions.

Conclusion: The Future of Generative AI in Cryptocurrency

The Global Generative AI in Cryptocurrency Market is experiencing rapid growth, with vast potential for future developments. As AI continues to evolve, it will play an increasingly important role in enhancing cryptocurrency trading, improving security, and optimizing blockchain applications. However, it is essential to address challenges like data privacy, algorithm complexity, and regulatory uncertainty to ensure the responsible and ethical use of AI in the crypto space.

#Generative AI#Cryptocurrency#Blockchain#AI in Crypto#Crypto Innovation#Fintech#AI Technology#Smart Contracts#Digital Assets#Automated Trading#Predictive Analytics#DeFi#Machine Learning#AI for Security#Crypto Market#Trading Strategies#Fraud Detection#Crypto Future#Blockchain Technology

0 notes

Text

I saw a post before about how hackers are now feeding Google false phone numbers for major companies so that the AI Overview will suggest scam phone numbers, but in case you haven't heard,

PLEASE don't call ANY phone number recommended by AI Overview

unless you can follow a link back to the OFFICIAL website and verify that that number comes from the OFFICIAL domain.

My friend just got scammed by calling a phone number that was SUPPOSED to be a number for Microsoft tech support according to the AI Overview

It was not, in fact, Microsoft. It was a scammer. Don't fall victim to these scams. Don't trust AI generated phone numbers ever.

#this has been... a psa#psa#ai#anti ai#ai overview#scam#scammers#scam warning#online scams#anya rambles#scam alert#phishing#phishing attempt#ai generated#artificial intelligence#chatgpt#technology#ai is a plague#google ai#internet#warning#important psa#internet safety#safety#security#protection#online security#important info

3K notes

·

View notes

Text

How I got scammed

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/05/cyber-dunning-kruger/#swiss-cheese-security

I wuz robbed.

More specifically, I was tricked by a phone-phisher pretending to be from my bank, and he convinced me to hand over my credit-card number, then did $8,000+ worth of fraud with it before I figured out what happened. And then he tried to do it again, a week later!

Here's what happened. Over the Christmas holiday, I traveled to New Orleans. The day we landed, I hit a Chase ATM in the French Quarter for some cash, but the machine declined the transaction. Later in the day, we passed a little credit-union's ATM and I used that one instead (I bank with a one-branch credit union and generally there's no fee to use another CU's ATM).

A couple days later, I got a call from my credit union. It was a weekend, during the holiday, and the guy who called was obviously working for my little CU's after-hours fraud contractor. I'd dealt with these folks before – they service a ton of little credit unions, and generally the call quality isn't great and the staff will often make mistakes like mispronouncing my credit union's name.

That's what happened here – the guy was on a terrible VOIP line and I had to ask him to readjust his mic before I could even understand him. He mispronounced my bank's name and then asked if I'd attempted to spend $1,000 at an Apple Store in NYC that day. No, I said, and groaned inwardly. What a pain in the ass. Obviously, I'd had my ATM card skimmed – either at the Chase ATM (maybe that was why the transaction failed), or at the other credit union's ATM (it had been a very cheap looking system).

I told the guy to block my card and we started going through the tedious business of running through recent transactions, verifying my identity, and so on. It dragged on and on. These were my last hours in New Orleans, and I'd left my family at home and gone out to see some of the pre-Mardi Gras krewe celebrations and get a muffalata, and I could tell that I was going to run out of time before I finished talking to this guy.

"Look," I said, "you've got all my details, you've frozen the card. I gotta go home and meet my family and head to the airport. I'll call you back on the after-hours number once I'm through security, all right?"

He was frustrated, but that was his problem. I hung up, got my sandwich, went to the airport, and we checked in. It was total chaos: an Alaska Air 737 Max had just lost its door-plug in mid-air and every Max in every airline's fleet had been grounded, so the check in was crammed with people trying to rebook. We got through to the gate and I sat down to call the CU's after-hours line. The person on the other end told me that she could only handle lost and stolen cards, not fraud, and given that I'd already frozen the card, I should just drop by the branch on Monday to get a new card.

We flew home, and later the next day, I logged into my account and made a list of all the fraudulent transactions and printed them out, and on Monday morning, I drove to the bank to deal with all the paperwork. The folks at the CU were even more pissed than I was. The fraud that run up to more than $8,000, and if Visa refused to take it out of the merchants where the card had been used, my little credit union would have to eat the loss.

I agreed and commiserated. I also pointed out that their outsource, after-hours fraud center bore some blame here: I'd canceled the card on Saturday but most of the fraud had taken place on Sunday. Something had gone wrong.

One cool thing about banking at a tiny credit-union is that you end up talking to people who have actual authority, responsibility and agency. It turned out the the woman who was processing my fraud paperwork was a VP, and she decided to look into it. A few minutes later she came back and told me that the fraud center had no record of having called me on Saturday.

"That was the fraudster," she said.

Oh, shit. I frantically rewound my conversation, trying to figure out if this could possibly be true. I hadn't given him anything apart from some very anodyne info, like what city I live in (which is in my Wikipedia entry), my date of birth (ditto), and the last four digits of my card.

Wait a sec.

He hadn't asked for the last four digits. He'd asked for the last seven digits. At the time, I'd found that very frustrating, but now – "The first nine digits are the same for every card you issue, right?" I asked the VP.

I'd given him my entire card number.

Goddammit.

The thing is, I know a lot about fraud. I'm writing an entire series of novels about this kind of scam:

https://us.macmillan.com/books/9781250865878/thebezzle

And most summers, I go to Defcon, and I always go to the "social engineering" competitions where an audience listens as a hacker in a soundproof booth cold-calls merchants (with the owner's permission) and tries to con whoever answers the phone into giving up important information.

But I'd been conned.

Now look, I knew I could be conned. I'd been conned before, 13 years ago, by a Twitter worm that successfully phished out of my password via DM:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

That scam had required a miracle of timing. It started the day before, when I'd reset my phone to factory defaults and reinstalled all my apps. That same day, I'd published two big online features that a lot of people were talking about. The next morning, we were late getting out of the house, so by the time my wife and I dropped the kid at daycare and went to the coffee shop, it had a long line. Rather than wait in line with me, my wife sat down to read a newspaper, and so I pulled out my phone and found a Twitter DM from a friend asking "is this you?" with a URL.

Assuming this was something to do with those articles I'd published the day before, I clicked the link and got prompted for my Twitter login again. This had been happening all day because I'd done that mobile reinstall the day before and all my stored passwords had been wiped. I entered it but the page timed out. By that time, the coffees were ready. We sat and chatted for a bit, then went our own ways.

I was on my way to the office when I checked my phone again. I had a whole string of DMs from other friends. Each one read "is this you?" and had a URL.

Oh, shit, I'd been phished.

If I hadn't reinstalled my mobile OS the day before. If I hadn't published a pair of big articles the day before. If we hadn't been late getting out the door. If we had been a little more late getting out the door (so that I'd have seen the multiple DMs, which would have tipped me off).

There's a name for this in security circles: "Swiss-cheese security." Imagine multiple slices of Swiss cheese all stacked up, the holes in one slice blocked by the slice below it. All the slices move around and every now and again, a hole opens up that goes all the way through the stack. Zap!

The fraudster who tricked me out of my credit card number had Swiss cheese security on his side. Yes, he spoofed my bank's caller ID, but that wouldn't have been enough to fool me if I hadn't been on vacation, having just used a pair of dodgy ATMs, in a hurry and distracted. If the 737 Max disaster hadn't happened that day and I'd had more time at the gate, I'd have called my bank back. If my bank didn't use a slightly crappy outsource/out-of-hours fraud center that I'd already had sub-par experiences with. If, if, if.

The next Friday night, at 5:30PM, the fraudster called me back, pretending to be the bank's after-hours center. He told me my card had been compromised again. But: I hadn't removed my card from my wallet since I'd had it replaced. Also, it was half an hour after the bank closed for the long weekend, a very fraud-friendly time. And when I told him I'd call him back and asked for the after-hours fraud number, he got very threatening and warned me that because I'd now been notified about the fraud that any losses the bank suffered after I hung up the phone without completing the fraud protocol would be billed to me. I hung up on him. He called me back immediately. I hung up on him again and put my phone into do-not-disturb.

The following Tuesday, I called my bank and spoke to their head of risk-management. I went through everything I'd figured out about the fraudsters, and she told me that credit unions across America were being hit by this scam, by fraudsters who somehow knew CU customers' phone numbers and names, and which CU they banked at. This was key: my phone number is a reasonably well-kept secret. You can get it by spending money with Equifax or another nonconsensual doxing giant, but you can't just google it or get it at any of the free services. The fact that the fraudsters knew where I banked, knew my name, and had my phone number had really caused me to let down my guard.

The risk management person and I talked about how the credit union could mitigate this attack: for example, by better-training the after-hours card-loss staff to be on the alert for calls from people who had been contacted about supposed card fraud. We also went through the confusing phone-menu that had funneled me to the wrong department when I called in, and worked through alternate wording for the menu system that would be clearer (this is the best part about banking with a small CU – you can talk directly to the responsible person and have a productive discussion!). I even convinced her to buy a ticket to next summer's Defcon to attend the social engineering competitions.

There's a leak somewhere in the CU systems' supply chain. Maybe it's Zelle, or the small number of corresponding banks that CUs rely on for SWIFT transaction forwarding. Maybe it's even those after-hours fraud/card-loss centers. But all across the USA, CU customers are getting calls with spoofed caller IDs from fraudsters who know their registered phone numbers and where they bank.

I've been mulling this over for most of a month now, and one thing has really been eating at me: the way that AI is going to make this kind of problem much worse.

Not because AI is going to commit fraud, though.

One of the truest things I know about AI is: "we're nowhere near a place where bots can steal your job, we're certainly at the point where your boss can be suckered into firing you and replacing you with a bot that fails at doing your job":

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

I trusted this fraudster specifically because I knew that the outsource, out-of-hours contractors my bank uses have crummy headsets, don't know how to pronounce my bank's name, and have long-ass, tedious, and pointless standardized questionnaires they run through when taking fraud reports. All of this created cover for the fraudster, whose plausibility was enhanced by the rough edges in his pitch - they didn't raise red flags.

As this kind of fraud reporting and fraud contacting is increasingly outsourced to AI, bank customers will be conditioned to dealing with semi-automated systems that make stupid mistakes, force you to repeat yourself, ask you questions they should already know the answers to, and so on. In other words, AI will groom bank customers to be phishing victims.

This is a mistake the finance sector keeps making. 15 years ago, Ben Laurie excoriated the UK banks for their "Verified By Visa" system, which validated credit card transactions by taking users to a third party site and requiring them to re-enter parts of their password there:

https://web.archive.org/web/20090331094020/http://www.links.org/?p=591

This is exactly how a phishing attack works. As Laurie pointed out, this was the banks training their customers to be phished.

I came close to getting phished again today, as it happens. I got back from Berlin on Friday and my suitcase was damaged in transit. I've been dealing with the airline, which means I've really been dealing with their third-party, outsource luggage-damage service. They have a terrible website, their emails are incoherent, and they officiously demand the same information over and over again.

This morning, I got a scam email asking me for more information to complete my damaged luggage claim. It was a terrible email, from a noreply@ email address, and it was vague, officious, and dishearteningly bureaucratic. For just a moment, my finger hovered over the phishing link, and then I looked a little closer.

On any other day, it wouldn't have had a chance. Today – right after I had my luggage wrecked, while I'm still jetlagged, and after days of dealing with my airline's terrible outsource partner – it almost worked.

So much fraud is a Swiss-cheese attack, and while companies can't close all the holes, they can stop creating new ones.

Meanwhile, I'll continue to post about it whenever I get scammed. I find the inner workings of scams to be fascinating, and it's also important to remind people that everyone is vulnerable sometimes, and scammers are willing to try endless variations until an attack lands at just the right place, at just the right time, in just the right way. If you think you can't get scammed, that makes you especially vulnerable:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

10K notes

·

View notes

Text

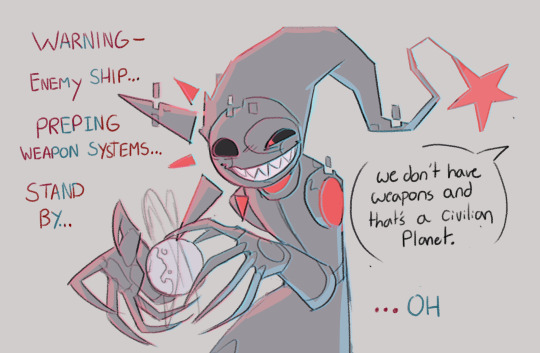

I caught si-fi brain worms so I turned em' into Spaceship AI. I'm mad, I'm going wild, crazy even

#security breach#five nights at freddy's#daycare attendant#sundrop#moondrop#fnaf#alternate universe#AI AU#moon fnaf#sun fnaf#eclipse#eclipse fnaf

4K notes

·

View notes

Text

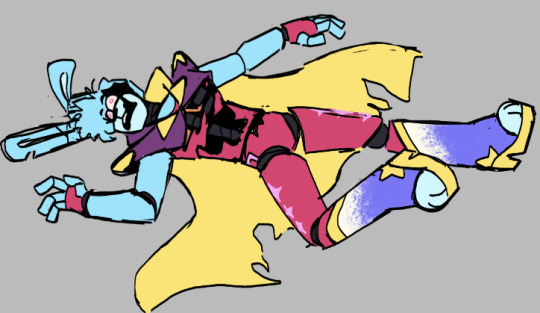

Instead of using AI to replace artists we should use AI to make these guys

#fnaf security breach#fnaf daycare attendant#lilly yapping#lilly yapping abt fnaf sb#sundrop#moondrop#anti ai#fnaf sb

3K notes

·

View notes

Text

In light of recent events involving the use of AI in the TSBS fandom, I feel the need to say something:

There is apparently quite a good number of AI on character.ai that uses the voices of some of the VAs (Davis, Reed, Kat, Matt) and some have used their voices to make AI covers for songs. I have heard samples of a few and I'm in shock by how accurate they sound. But don't mistake this for any kind of praise, because it's not.

Please stop using them.

The VAs have stated that they don't condone the use of their voices for AI purposes. It doesn't matter if it's for something as harmless as roleplay or wanting to hear your favorite characters sing a song. By using these AI voices, you are actively disrespecting the VAs' wishes and their boundaries. These things can be absolutely damaging and detrimental to their careers if someone were to misuse them. This is an especially concerning matter to me because they are my friends.

That being said: please please PLEASE don't go around harassing people about this. If you see or know anyone who is using them, please just advise them to kindly respect the boundaries of the VAs.

-

On an additional note semi related to this topic:

I'd like to quickly make an official statement and say that I don't want any character.ai bots to be made from characters from my AUs, or any AI voices attached to them. As far as I am aware, the only ones I know exist are some from my Fairy AU and the SK AU.

If you've seen them or made them, please stop using them or remove them. I am no longer comfortable with the thought that my characters could potentially be misused with this technology and not know it.

Think that's it for now; thank you for reading and happy Friday 👍🏻

#tsbs#sams#laes#eaps#sun and moon show#lunar and earth show#eclipse and puppet show#the security breach show#important#character ai#voice ai

526 notes

·

View notes

Text

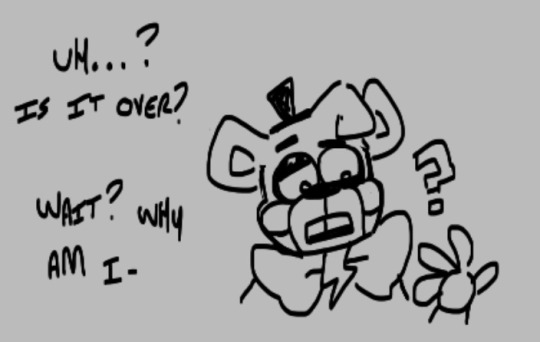

FNAF RUIN DOODLES

#five nights at freddy's#fnaf#fnaf security breach#security breach ruin#fnaf sb ruin#fnaf ruin#glamrock bonnie dead corpse#fnaf gregory#fnaf cassie#fnaf vanessa#glamrock animatronics#glamrock freddy#theory: freddy's ai is in helpy#fnaf roxy#roxanne wolf#fnaf eclipse#glamrock chica#monty gator#montgomery gator#cassie likes everyone BUT monty#SHE LITERALLY KILLED HIM#its fine tho cuz it was monty

4K notes

·

View notes

Text

I don't like that the dev community picks on people who are most fluent in Python, when the ChatGPT-using "vibe coders" are right there. At least Python babies are coding. Bully the non-coders instead.

#coding#programming#anyone that doesn't know 'vibe coding' means they asked ChatGPT to write code for them.#Same concept as 'I am a creative bc an LLM regurgitated an output for me'. 'I am an artist bc I told a machine to paint for me.'#programmer#I don't know if people even use that phrase anymore to be honest I feel like it's fallen out of use in favour of engineer or developer#ai bullshit#like. If they hire anyone that actually does know the first thing about coding in favour of a prompt engineer (so-called engineer)#they are going to realise—to costs to the tune of millions—that you can't 'vibe code' your way out of security vulnerabilities. Idiots.#I think we're a good few years out from that since anyone that still has a dev team (i.e. everyone; yes even Salesforce*) realises that#letting a text generator run your business would be MADNESS. That's not gonna happen until the AI snakeoil salesmen manage to gradually#lower everyone's standards of accuracy; security and objectivity. When that happens we're all fucked#(*https://www.salesforceben.com/salesforce-will-hire-no-more-software-engineers-in-2025-says-marc-benioff/#tl;dr salesforce snakeoi— CEO says no more software devs; our AI is sophisticated enough.#Balls it is.)#software engineering#programmer humor#etc etc

172 notes

·

View notes

Text

Self shipping saved my grandma actually

#myart#fanart#my art <3#daycare attendant#daycare attendant moon#fnaf daycare attendant#fnaf daycare fandom#daycare attendant sun#moon fnaf#sun fnaf#fnaf security breach#fnaf#fnaf fanart#dca fandom#fnaf dca#thinking ab lots of angst actually#but i wanna be silly first#dca x y/n#dca x reader#self ship#yumeship#moon x self insert#self insert#what is the point of living if i cannot kiss the robot#living the deluxe human experience rn#this is what god intented#ai coudnt ever replicate this

240 notes

·

View notes

Text

chat am I doing this right

#i'd put mettaton in there but he isn't actually an AI and also i don't even know if i respect him either#even if he did kickstart my trans awakening#feel free to add your own stuff theyre just the two that came to me off the top of my head#tadc#the amazing digital circus#fnaf#five nights at freddy's#fnaf security breach#tadc gummigoo#glamrock freddy

338 notes

·

View notes

Text

The Comedy of Errors : Developers edition

188 notes

·

View notes

Text

The Meta chief executive, Mark Zuckerberg, called it “the most intelligent AI assistant that you can freely use”. But Barry Smethurst, 41, a record shop worker trying to travel by rail from Saddleworth to Manchester Piccadilly, did not agree. Waiting on the platform for a morning train that was nowhere to be seen, he asked Meta’s WhatsApp AI assistant for a contact number for TransPennine Express. The chatbot confidently sent him a mobile phone number for customer services, but it turned out to be the private number of a completely unconnected WhatsApp user 170 miles away in Oxfordshire.

Meta's AI sent a random user's phone number to another user.

Note that all of Meta's products (Facebook, WhatsApp, Instagram) are wired into their stupidly fucked up AI which is how that particular information got shared.

108 notes

·

View notes

Text

papatoru !

#— ai rambles#i just know satoru always insists on keeping his babygirl as close to him as possible ALWAYS#whether cradled securely in his arms or nestled snugly against his chest in a baby carrier#much prefers this to using a stroller bc she’s the safest when he can shield her from the world with his own body 🥹#[ ♡ ] — satoru#tw children

99 notes

·

View notes

Text

Corrector Yui merchandise in 2K25

Asamiya alluded to Correyui merchandise being produced for the series' 25th anniversary and as of this writing we have two drops ahead of us: some kuji (lottery) goodies and some outright purchasable items.

Lilikuji products

The Lilikuji items will be available from Lilikuji beginning May 23rd until June 29th 2025. Each play is 770 yen and the actual items will ship in September 2025. The artwork featured on these products is all new and has Yui, Corrector Yui in her elemental suits, Corrector Haruna, and Corrector Ai. Items include:

A multi-purpose pouch

A tote bag

Acrylic keychains (9 designs)

Button badges (9 designs)

There are also three bonus postcards featuring character artwork by Umiyuki and you can receive one design at random every time you purchase 10 plays at once.

arma bianca products

The range of products from arma bianca can be preordered directly from the amnibus store, or from other select retailers. All the items in this range can be preordered between now and June 11th for delivery in September 2025. These products also feature new designs, but they exclusively feature slick, minimalist versions of the elemental suits. Items include:

Trading acrylic keychains (can be ordered individually at random or in a full set of 6)

A heart-shaped folding mirror

Aurora stickers (6 designs total, can be ordered individually)

If these products are like absolutely everything else ever sold for Corrector Yui, expect them to become hot property in time. If you like any of the items and want to flaunt your love for everyone's favourite digital magical girl, I'd suggest securing a preorder or a lottery ticket to avoid missing out.

#corrector yui#コレクター・ユイ#corrector haruna#corrector ai#asamiya kia#kia asamiya#anime news#90s anime#magical girl#magical girls#merch#merchandise#anime merch#sorry it took me a couple of days to put this out i've had a very low energy weekend#but this is so exciting!#correyui has never had a lot of swag so these items offer a great opportunity to secure something cute for your collection#update:#added a link to umiyuki who was the artist commissioned to provide the art for the kuji drop#it's funny i follow them and before they RT'd the lilikuji post i had no idea they were working on this#but probably should have since they had RT'd some correyui stuff re: the anniversary#oh and i fixed a couple of my initial typos whoops#brain conditions are fun

101 notes

·

View notes

Text

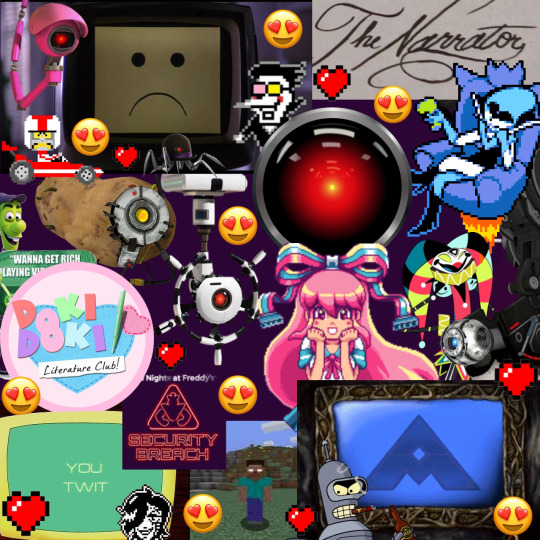

I heart morally dubious AI

Viktor the Machine Herald is also pretty cool too but sadly no matter how much he wants to be he is not AI.

edit: i watched Arcane season 2 WHY IS HE JESUS? WHAT HAPPENED TO MY ROBOT MAN?

#ChatGpt not you#is this hoarding#evil Ai more like evil gay eye#wall e auto#ddlc#robo fizz#allied mastercomputer#herobrine#wreck it ralph#security breach#portal 2#giffany#edgar electric dreams#deltarune#courage the cowardly dog computer#hal 9000#the stanley parable#bender#did i forget anyone#meet the robinsons#someone informed me I forgot Caine from TADC 😔

335 notes

·

View notes