#Accounting and finance assignment help

Explore tagged Tumblr posts

Text

Working Capital Optimization: Essential Help for Finance Assignments

Introduction: What is Working Capital?

Working capital constitutes a crucial principle in the field of finance, signifying the short-term liquidity position of a firm. It is defined as the difference between an organization's current assets—encompassing cash, inventory, and accounts receivable—and its current liabilities, including accounts payable and short-term debt. In essence, it denotes the financial resources available to the company to facilitate its daily operational needs. Effective working capital management ensures that a company can meet its operational needs and financial obligations, while also channeling available resources to facilitate growth in the company.

Every student or learner involved in finance studies or assignments particularly those that relate to working capital, must understand the factors that explain the working capital. Why? Working capital belongs to the most critical indicators of financial performance since they directly reflect the financial result, availability of funds for operations, and risks involved. Effective management of work capital can enhance or develop efficiency in the business hence enhancing the performance by the firm. For students, to understand these dynamics students are usually tasked to solve various numerical questions to gain insights into the practical financial operations of businesses.

By opting for finance assignment help, students can get to know more about the perspective of working capital optimization and other advanced techniques in the field. This means that one can seek working capital study assistance from professional experts, especially in complex working capital problems as opposed to what is found in textbooks and theories. This involves an opportunity for students to gain a greater understanding of the subject, hence exposing them to applicable strategies for succeeding in their assignments.

Working Capital Optimization: Issue Diagnosis in Details

Working capital optimization can be defined as the means and methods that are used in the management of the short-term assets and liabilities of a business with the aim of ensuring the operations of the firm are done in the most efficient and profitable manner. This also means that there is a fine line to be drawn between the need for liquid assets to meet short-term obligations and bringing down capital expenses.

As regards finance students, it may appear that working capital optimization is quite simple and quite basic as a subject however in a real sense, it is quite an elaborate and complicated subject that can make or break a business. In this regard, we shall look at why working capital optimization is important, how the companies achieve these goals and real cases where companies have demonstrated a working capital optimization impact.

Why Optimize Working Capital?

It is quite evident that working capital management is of great importance for all businesses as it influences many key performance metrics:

Liquidity: Sufficient working capital ensures that the company can perform its short-term obligations in terms of paying off suppliers and employees.

Profitability: Proper working capital management will minimize the capital cost incurred, therefore increasing cash flows available for financing growth and innovation.

Operational Performance: Focused and disciplined working capital management enables businesses to operate more efficiently, decrease waste, and enhance stock control.

Risk Management: Working capital management in a business alleviates the operational risk exposure – Supply Chain risks, economic downturns, and other surprises that a business may experience.

For students, such a study helps to understand the rationale behind the varying impacts of the financial decisions made in a company on its various operations.

Ways on how Working Capital can be Improved

There are various strategies that can be recommended for companies that require improvement of the working capital. These strategies are aimed at ensuring that companies maintain adequate amounts of cash, increase cash inflows, and reduce cash outflows that are unnecessary in the first place.

Inventory Management

Inventory management is one of the key components of working capital management. A firm can enhance its liquidity profile by lowering the total stock holding of unsold products by minimizing excess stocks.

Methods such as JIT manufacturing systems, where products are sourced and produced only when needed. This approach helps companies save on stockholding expenditure and overproduction.

Example: Toyota was able to change the face of the auto industry with the implementation of the manufacturing system called Just In Time (JIT), giving the extra edge of efficiency coupled with a reduction in working capital requirements.

Accounts Receivable Management

Customers paying their bills within the set timeframe is very important. For further optimization of receivables, some credit control measures are often applied such as allowing discounts for early payments or limiting credit for customers with a history of poor payments.

Another approach known as factoring helps in supplementing working capital. This involves receivables sold to a third party thus providing cash flow in a shorter time frame.

Case Study: In its attempt to improve cash flow, General Electric in the year, 2009 commenced sales of parts of its receivables and created 2 billion in capital within a year leading the firm to focus more on growth and investment avenues.

Accounts Payable Management

The payable side is much more interesting. This is about optimizing for the longest period before making any payment ta the supplier without jeopardizing any existing credit or relationships. Cash flow may be enhanced if payment terms can be adjusted without any serious penalty for longer terms.

Purchasers may utilize the assisted financial program to make early payments to their suppliers through financial institutions, while the purchaser gets extended terms to preserve working capital.

Example: Walmart has entered into extended payment terms with its suppliers to preserve its working capital for longer terms.

Cash Management

Firms need to ensure that there is an optimal cash reserve committed to the working capital requirements and also minimize cash that is idle earning no returns.

Firms utilize sweeping mechanisms, in which the excess cash is transferred to an interest-bearing account thereby making returns out of excess cash and at the same time preserving liquidity.

Example: Microsoft is well known for its cash management practices. The world’s biggest computer software company has for many years managed to keep positive working capital instead of spending it on many things and maintains generous cash reserves for investments, buying back stock, and paying dividends.

The Role of Working Capital Management

The effect of working capital optimization is not limited to the enhancement of liquidity and cash flow alone. This is capable of reinventing the potential of a company for growth and competitiveness within the industry.

Better Financial Condition: Reduction in the amounts tied up in working capital positively impacts the company's operating cycle and the balance sheet. Improvement in some of the operational ratios such as current and quick ratios is also observed. This subsequently increases the creditworthiness and the cost of borrowing reduces.

Secure Superior Position: Efficient working capital allows organizations to respond to changes in the market more effectively. For instance, they will be able to take advantage of bulk buying discounts and invest in new opportunities more quickly than its competitors.

Recovery from Impacts: When the economy is going through difficult times, the likelihood of companies that strategically manage their working capital to manage disruptions. For instance, during the most recent period when the majority of the companies were in a cash liquidity crisis due to covid19 pandemic, companies that effectively managed cash flows survived.

Long-Term Development: Firms can free up cash from operational efficiency which then allows them to seek more growth opportunities like R&D, marketing, or expansion. Optimization of working capital, therefore, becomes the initial move towards the attainment of competitive advantage in due time.

Case Example: Apple Inc.

Apple Inc. is probably the most referenced case when it comes to the optimization of working capital. This has been made possible because of the peculiarities in the businesses of Apple-it is able to maintain working capital which is negative by collecting money from customers before it pays suppliers. This offers the company a huge liquidity edge and a key reason behind its financial performance.

Due to Apple’s excellent supply chain management processes and beneficial contractual payment agreements with suppliers, the company does not require additional working capital. Such a strategy releases massive amounts of cash flow, which Apple has invested in R&D, advertising, and acquisitions. As a result, Apple has grown and become a market leader.

Expert Finance Assignment Help for MBA Students

Our finance assignment assistance service is primarily directed toward MBA students who are having a tough time comprehending and practicing difficult areas such as working capital management. We offer detailed, individualized help to students in dealing with difficult assignments, case studies, and analysis.

As for complicated financial topics including working capital optimization, our company employs seasoned financial specialists with expertise in sophisticated techniques on liquidity, cash flow, and operational efficiency management. We break down these concepts into simple steps for students to facilitate their understanding of the theory and practical aspects of the problem. Our aim is not only to assist the learners in solving practical problems but help them learn how and when to utilize these techniques when they face real financial problems.

How Our Service Makes Complex Financing Problems Simple

We use a combination of visuals, like flowcharts and financial models in order to simplify difficulties in complicated financial problems. By demonstrating the relation between the problem to its financial theory, we make sure that students never miss any important aspect of the solution. We offer tailored solutions for case studies and give in-depth information on different working capital strategies used by top companies. This helps students understand how to use these strategies in their studies.

More Sophisticated Techniques and Wider Scope

We introduce students to new and improved methods that they can adopt in solving questions that go beyond the basics of financial management. Among those advanced techniques include; modeling of dynamic working capital, cash conversion optimization, and enhancing working capital with financial technologies.

Apart from working capital optimization, we also offer finance assignment assistance in a wide range of subjects including but not limited to:

Corporate Finance

Risk Management

Investment Analysis

Financial Statement Analysis

Capital Budgeting

Mergers & Acquisitions

Benefits for MBA Students:

Many students ask the question: “Why should I choose your service?” The explanation is that they not only get custom-made solutions that enable them to complete their tasks in due time but also enhance their grasp of contemporary financial principles. Our specialists always give new ideas to the students to enable them to apply in their coursework assignments for top grades.

Conclusion:

Working capital management is an important aspect of financial management. This influences liquidity and profitability as well as risk factors. Students studying finance must learn the concepts to have a deeper understanding of the practical issues of business functioning. By opting for our service and getting help with finance assignments, students can learn from experts and understand important topics better. We provide sample problems, case studies, textbooks, and research papers to help students complete their assignments confidently and clearly.

Textbooks and References for Students

For students who want to undertake deeper studies in the area of working capital optimization, the is a selection of relevant textbooks and some research papers that lay a good base.

One such textbook is “Financial Management: Theory and Practice” by Eugene F. Brigham & Michael C. Ehrhardt.– This particular book attempts to explain the fundamentals of why decisions are made financially with reasonable chapters on working capital management.

Corporate Finance Jonathan Berk and Peter DeMarz– A commonly recommended textbook, which considers some of the working capital management aspects among other principles of financial management.

#Financial analysis homework help#Help with finance projects#Personal finance assignment assistance#Financial management homework help#Online finance tutoring services#Finance case study assistance#International finance assignment help#Accounting and finance assignment help#Financial modeling assignment support

0 notes

Text

Get Expert Accounting Assignment Help UK at Locus Assignment

Struggling with accounting assignments? You're not alone! Most UK students struggle with accounting coursework due to complex concepts, calculations, and tight deadlines. That's where we step in. At Locus Assignment, we offer professional accounting assignment help UK to simplify your academic life. Whether it's tax legislation, financial reports, or auditing, our experts have got you covered.

Why do students require Accounting Assignment Help UK?

Accounting is not all about numbers; it is also about business strategies, regulations, and finance systems. Students usually have difficulty with:

Complex topics: Balance sheets, cost accounting, and financial reporting may be difficult without expert advice.

Time Constraints: With assignments, exams, and working part-time, one hardly gets any time to submit on time.

Research Problems: Getting reliable sources of funds is hard and tedious.

Mathematical Precision: One calculation error can have a bearing on the entire document, influencing analysis and grades.

University Regulations: UK university formatting and citation styles are too complex.

This is why professional accounting homework aid UK is needed—it saves time, reduces anxiety, and ensures quality assignments.

What Makes Locus Assignment the Best Accounting Assignment Helper in UK

At Locus Assignment, we take pride in being the finest accounting assignment help in UK. Here's why students like to hire our services:

Expert Professionals: Our team consists of accountants, finance experts, and academic writers who have an understanding of UK university needs.

We offer 100% plagiarism-free assignments, verified with the aid of advanced detection tools.

Timely Delivery: Our timely delivery ensures that you have sufficient time to make revisions.

Reasonable Pricing: Our services are affordably priced, being student-friendly.

24/7 Support: Need a question answered at midnight? Our support team is available 24 hours a day.

By choosing Locus Assignment, you have access to high-quality solutions that suit your requirements.

Finance Assignment Help in the UK – All Areas of Finance Covered

Accounting and finance go hand in hand, and students typically need finance assignment help in the UK. Our areas of coverage include:

Financial Statement Analysis: Analysis of balance sheets, income statements, and cash flow reports.

Investment Management: Diversifying the portfolio, bonds, and shares for strategic decision-making.

Corporate finance: Mergers, business valuations, and corporate growth planning.

Taxation & Auditing: Information regarding UK tax legislation and auditing practices.

Cost & Management Accounting: Budgeting, forecasting, and cost control.

Our UK finance assignment help guarantee thorough explanations and proper structuring of the answers.

How Do We Simplify Accounting Homework in the UK?

We follow a systematic process to give precise and clear assignments:

Understanding Requirements: We review guidelines to meet university requirements.

Research in Depth: Our information is obtained from credible sources.

Step-by-Step Solutions: Making complex problems simple to understand.

Proper Formatting and Citations: As per the UK university guidelines for structured assignments.

Final Proofreading: Ensuring error-free, plagiarism-free, and high-quality writing

With our UK accounting homework assistance, you not only complete your assignments but also gain something valuable.

Conclusion

Worry no more regarding accounting assignments! Locus Assignment is here to offer professional help, on-time delivery, and the best-quality work for reasonable prices. Need the best accounting assignment help UK? Click Upload Assignment now and leave your accounting assignments to us!

#Accounting Assignment Help UK#Accounting Assignment Help#Assignment Help UK#Accounting Homework in the UK#Finance Assignment Help in the UK#Best Accounting Assignment Helper in UK

0 notes

Text

Business Law Assignment Help: Unlocking Academic Success with Online Tutor Helps

#law assignment help#Business law assignment help#Commercial law assignmnet help#nursing assignment help#assignment help#childcare assignment help#economics assignment help#finance assignment help#xero assignment help#online exam help#management assignment help#accounting assignment help

0 notes

Text

Auditing Assignment Help Online By Neo Assignment Experts

Neo Assignment professionals offer high-quality Auditing Assignment Help at affordable prices. We ensure each assignment is completed to academic standards.

#Auditing Assignment Help#Commerce Assignment Help#Finance Assignment Helper#Law Assignment Helper#Economics Assignment Helper#Accounting Assignment Helper#English Essay Helper#neo assignment

0 notes

Text

PůjčkaPlus CZ emerges as the beacon of financial relief. Offering swift and hassle-free loans, it stands as the perfect solution to bridge any monetary gap. Whether facing a sudden medical emergency, car repair, or any unforeseen cost, PůjčkaPlus CZ provides the necessary funds with minimal paperwork and rapid approval.🐘🐘

Instant approval finance features:apply now..🇨🇿🇨🇿

Read.. more..

#czech republic#czech#financial planning#financial#finance and accounting#income#business#financial freedom#finance assignment help#finance news

0 notes

Text

Top 5 Facts About Financial Accounting

BookMyEssay provides expert Financial Accounting Assignment Help, offering tailored solutions for academic success. Their skilled professionals ensure accurate, timely assistance to students facing challenges in financial accounting assignments.

0 notes

Text

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

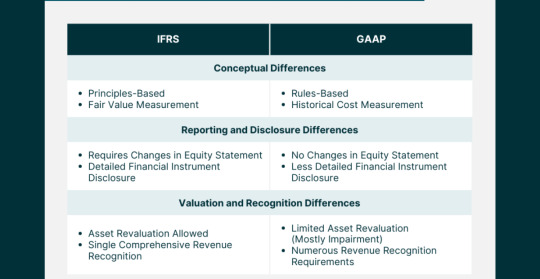

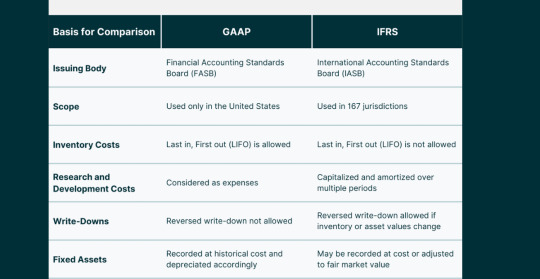

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards

Navigating divergences in global standards requires a pragmatic approach that acknowledges the unique needs of individual jurisdictions. The coexistence of multiple standards necessitates effective communication, education, and cross-border collaboration. Standard-setters can play a pivotal role in facilitating harmonization efforts, fostering a global financial reporting landscape that balances convergence with the flexibility needed to accommodate diverse economic and regulatory environments.

13.3. Sustainable Reporting Paradigms

a. The Rise of Sustainable Reporting

The rise of sustainable reporting reflects a paradigm shift in the broader understanding of corporate performance. Investors, regulators, and the public increasingly recognize the importance of environmental, social, and governance (ESG) factors. Future reporting standards are likely to integrate sustainable reporting paradigms, providing a more comprehensive view of a company’s long-term value creation and societal impact.

b. Integrating ESG Metrics into Reporting Standards

Integrating ESG metrics into reporting standards requires a collaborative effort between standard-setters, regulators, and industry stakeholders. The development of clear guidelines, standardized metrics, and transparent disclosure requirements enhances the credibility of sustainable reporting. Companies embracing ESG considerations in their financial reporting contribute to a more informed and responsible investment landscape.

14. Conclusion

Financial reporting standards, whether grounded in GAAP or IFRS, serve as the bedrock of transparency, trust, and accountability in the global business landscape. The evolution of these standards reflects a journey of adaptation to changing business dynamics, regulatory landscapes, and investor expectations. While GAAP and IFRS diverge in certain philosophies and approaches, they share a common goal – to provide reliable and relevant information for decision-making.

As we navigate the complexities of GAAP vs. IFRS, it is imperative to recognize the strengths and limitations of each framework. GAAP, with its historical cost emphasis and rule-based approach, offers stability and comparability. In contrast, IFRS, operating under a principles-based approach, provides flexibility and a global perspective. Understanding the variances in revenue recognition, asset valuation, and consolidation methods is essential for investors, analysts, and companies alike.

Looking ahead, the trajectory of reporting standards involves a delicate balance – between convergence and divergence, between technological innovation and ethical considerations, and between traditional financial metrics and sustainable reporting paradigms. The future holds the promise of more standardized, adaptive, and responsible reporting standards that cater to the diverse needs of a dynamic global economy.

In conclusion, as the landscape of financial reporting continues to evolve, stakeholders must remain vigilant, adaptive, and collaborative. Whether one adheres to GAAP or IFRS, the shared commitment to integrity, transparency, and accountability ensures that financial reporting remains a cornerstone of trust in the interconnected world of business and finance.

#cfo#banking#accounting#finance#investment#personal finance#international finance assignment help service#financial management#financial markets#financial modeling#financial planning#financial dominance#financial services#financial literacy#financial drain#management#business#entrepreneur

0 notes

Text

#take my proctored exam for me#take my online exam for me#programming assignment helper#finance assignment helper#english homework helper#my assignment helper#best assignment helper#take my teas exam for me#accounting assignment helper#cheap assignment helper#assignment homework help#statistics assignment helper#best website for homework help#math sat help#my homework helpers#economics homework help#homework#math homework helper#statistics homework help#homework help#best online homework help#online homework help#online homework helper

0 notes

Text

#academic assignments#assignment services#assignmentexperts#assignment help#college#language#assignmentwriting#school#online assignment help#homework help#Take My Proctored Exam For Me#Take My Online Exam For Me#Programming Assignment Helper#Finance Assignment Helper#English Homework Helper#My Assignment Helper#Best Assignment Helper#Take My Teas Exam For Me#Accounting Assignment Helper#Cheap Assignment Helper

0 notes

Text

📊 Master Financial Accounting with Expert Assistance! 📚

Need any financial accounting Assignment Help ?

As an experienced accounts teacher, I'm here to guide you through the complexities of financial accounting assignments. Our platform offers specialized assignment writing services tailored to your needs!

What make us unique?

🔹 Customized Support: Each assignment receives personalized attention, catering to your unique requirements and academic standards.

🔹 Punctual Delivery: We understand the importance of deadlines and ensure timely completion without compromising quality.

🔹 Round-the-Clock Assistance: Have queries? We're available 24/7 to provide the support you need.

🌟 Our Promise: Excellence in Every Solution

📈 Precision: Expect meticulously crafted solutions with detailed explanations and accurate calculations.

🔍 Originality: Plagiarism-free content is a priority. Every solution is authentic and unique.

📚 Comprehensive Coverage: From basic concepts to advanced topics, we cover a broad spectrum of financial accounting assignments to suit varying academic levels.

🔓 Unlock the secrets to excelling in financial accounting assignments with us! Let's embark on this journey towards academic excellence together!

#pay to do assignment#education#accountingtutor#finance#accounting#domyaccountingassignment#financial accounting#homework help#college#financial accounting assignment help

0 notes

Text

Assignment Help Germany

Germany is country which is surrounded by the Austria, Poland, Denmark, uk France and Italy. The official language of Germany is German. More than 90% of German people speak German language in their daily routine. Due to the high demand of the German education the education infrastructure of germany is improving day by day. Either you are the student studying in the Germany or studding in other country, from now you don't need to worry for the assignment completion on time. Because we have master experts for all the courses and subjects. Germany is not only good education destination for students in germany also attracting the attention of other countries in the world. Assignment Help Germany

#childcare assignment help#Assignment Help Germany#Online Assignment Help#economics assignment help#accounting assignment help#assignment help#xero assignment help#online exam help#nursing assignment help#finance assignment help#management assignment help#my assignment help

1 note

·

View note

Text

Top 6 Expert Help On Any Assignment

#English Essay Helper#Accounting Assignment Helper#Economics Assignment Helper#Law Assignment Helper#Finance Assignment Helper#Commerce Assignment Help#Auditing Assignment Help#Neo Assignment

0 notes

Text

Accounting Assignment Help

Accounting assignment help is here with expert support to assist students in accounting. It is a vast subject that deals with recording, measurement, analysis, and gathering information about financial information and transactions. Students or businesses learn about planning, controlling, evaluating, and improving performance. Students face challenges completing the accounting assignment as it needs in-depth understanding, knowledge, and practical skills. We, the team of proficient masters in the accounting field, can help you in the best way. Tutorhelp4you never miss the deadlines and provide plagiarism-free content at fundamental prices. You can ask for essay writing, case studies, dissertation writing, and more to boost your education. Call us and get customized.

#Accounting Assignment Help#Accounting Assignment#online tutoring help#college#finance#graphic design#language#logo design#marketing#notes#books#academia

0 notes

Text

Financial Accounting Assignment Help

Tired of pulling late nights struggling with financial accounting assignments? Our top-notch tutors are here for you! With extensive experience across all areas of financial accounting, we offer premier Financial Accounting Assignment Help you to master debit/credit, journal entries, T-accounts, and more. Whether it's a tricky cost accounting project or balancing financial statements, we've got you covered. Our customized approach breaks down complex concepts using real-world examples you'll easily understand. Financial accounting is our passion and our goal is your academic success! Contact us today to get help from accounting experts who are invested in your learning. With our Financial Accounting Assignment Help, you'll gain the mastery needed to conquer any problem set or analysis with flying colors. Stop stressing and start succeeding with our unmatched financial accounting support. We're the #1 choice for excel-worthy guidance that helps you ace assignments and develop real accounting skills.Reach out now to get Financial Accounting Assignment Help that works!

#Financial Accounting#Assignment Help#Tutors#Mastering Finance#Accounting#Accounting Projects#Financial Statements#academicsuccess#Accounting Experts

0 notes

Text

TaskRaccoon Premium: Chapter 1

Josh was at a dead end. For years he had put his entire focus and energy on his education and studies, above his social life, his health, and his finances. He came top of his class in History and Classics and so in his head all that hard l work had paid off, but now that he had graduated... what was next? His classmates had swanned off into internships and graduate programmes, but Josh found himself in the summer after graduating with no job, no prospects and, most importantly, no money.

Josh's parents had supported him throughout his further education, but now that he was back home they decided to treat Josh like an adult. And that meant rent. Josh balked at the suggestion, but his parents were adamant and so Josh found himself on the job hunt.

This proved trickier than Josh anticipated. Turns out the local libraries and bookshops didn't care about his top degree; they wanted experience. And as Josh lowered his sights to restaurants, cafes, even the bowling alley, he found himself receiving the same feedback.

Needing to save making cash quick, a sympathetic interviewer told Josh to pick up the odd job on TaskRaccoon - an app where Josh could choose to help people with tasks like moving furniture, watering plants, doing shopping in exchange for a small fee. It wasn't perfect, especially as Josh didn't really have the build or inclination for manual jobs, and Josh often found himself doing jobs he never expected while at school. But over time Josh felt an unexpected satisfaction with earning a buck and paying his parents. So much so that Josh had bigger aspirations - moving out of his parents place.

That, of course, required money. And while Josh worked hard with the TaskRaccoon jobs he was given, he needed something more.

On a random Tuesday afternoon, a solution seemed to land out of nowhere on Josh's TaskRaccoon app: TaskRaccoon Premium. Out of nowhere, Josh's app pop-up with a link to a Premium version of the app. It was an additional service where workers such as Josh would get a boosted fee for the same types of tasks plus, according to the app, receive "all the skills and know-how to complete the task to perfection." Josh figured that last bit was maybe the app providing how-to guides on how to complete the more common tasks, which he took as a nice freebie.

To lure users in, there was even an offer - sign-up to TaskRaccoon Premium, perform a randomly assigned task, and receive double the boosted fee. Josh had done his fair share of the most common tasks on the app already (walk my dog, assemble my shelves, do my groceries) so figured it was well worth his while to take the gamble. And so Josh bit the bullet, sign up for a Premium account, and waited to be given his first random task.

Without any pause and without any fanfare, Josh's first random task appeared: "I need someone to clean my pool". Josh groaned; it wasn't the first time he had seen a pool cleaning request but it was one he always chose to ignore because he felt he didn't have any of the right equipment and would have no idea where to start. And while this new Premium version had offered access to "skills and know-how", there only thing on the app was an address. Josh couldn't even see an option to cancel.

Josh wavered, but as he saw the blue sky outside and remembered the promise of a doubled fee, he decided to go for it. He could rake some leaves out of a pool easily enough. The address was only a 15 minute drive away, so Josh grabbed the keys to his mum's sedan and got going.

It felt good to be outside and Josh enjoyed the sunny drive. So much so that he didn't notice his mum's humble car begin to change. The front section became blockier and more basic, her touchscreen sat nav becoming an older model. The seats and interior decor became faded, and Josh had to readjust his seating position as the car seemed to somehow lift off the ground. The steering wheel grew in size and, to match it, bizarrely, so did Josh's hands. Without warning, Josh's pale hands began to darken in complexion and as they grasped the now-rough wheel Josh didn't notice the veins that ran down with now lean and well-rounded hands.

Josh pulled up to a red light, momentarily confused about how he seemed to sit above the surrounding cars. He also felt cramped in the car and realised that his seat was pushed up way too far. He, a bit embarrassingly, was the same height as his mum so he never normally had to adjust the seat, but as he pushed the seat back he realised just how much he needed to stretch out his legs. As the light turned to green, he was oblivious to his jeans riding up and becoming a loose pair of swimming shorts, revealing his now lengthy and toned legs, feathered with dark hair.

Josh pulled up at the designated address shortly after, a sizeable house in a nice neighbourhood. As he got of the car, he was for a moment confused by his need to climb out of the car and then felt off balance when he landed on the tarmac. Before he could interrogate any further though, he looked in surprise at the pick-up truck boot filled with pool cleaning gear. A voice in the back of Josh's mind told him to panic - why the hell did he suddenly have all this gear - but remembering that he had a job to do Josh collected the gear and approached the house. Josh stopped en route to take his jumper off to enjoy the warm sun, not noticing the way his new well-fitted tank top which hung closely to his chest and showed off his slightly more toned arms or the darker shade of his skin...

Josh carried the gear with surprising ease to the front door, and was warmly welcomed by a middle-aged women who introduced herself as Beth. Beth showed Josh to her garden where a medium-sized pool sat, clearly long overdue a clean. Josh thanked Beth, pausing a little at the vague lilt coming out of his month. Was it just him, or just his voice sound deeper...

Josh got to work. The pool needed much more than just some leaves removed but with every task, Josh found himself instinctively knowing what to do. Which pump to use, when to apply chemicals, how to get the pH levels perfect, it all just flooded into Josh's mind. And he was surprised at how flexible he was at reaching all the right places - Josh didn't love manual jobs but he almost felt like his reach had gotten better. It was hot work though and Josh removed his baseball hat and towelled his brow and face, briefly feeling unfamiliar stubble on his face and thick short locks of hair on his scalp.

It wasn't long before Josh has completed his job, a sense of pride sweeping over him as he stared into the now pristine waters. That pride however quickly morphed into confusion as he gazed at the reflection in the shimmering water. Maybe it was distorted, but there was no way that that tall, dark reflection could be him. He was shirt, slender, pale, wasn't he?

He dropped his net and stared at his hands. His suddenly thick, dark hands. Josh began to breath sharply as he noticed just how high up he was, that he was in an outfit that he had never bought, and that his short, pale self had seemingly been replaced with a tanned, lean body.

As Josh was clutching at his newly stubbled face and grasping at the space where his small paunch should be, Beth came out with a pitcher of cool lemonade. Josh spun around in panic, and before Beth could say anything he muttered "lo siento" and ran back to his car.

Josh stopped sharply outside as he stared at the beaten up pick up truck outside Beth's drive, a truck that sat where he thought his mum's sedan should be. A truck that keys in his pocket unlocked. Breathing deeply, and trying his best not to panic, he clampered into the car and pulled down the mirror, staring at the unfamiliar dark eyes that stared back at him. Dark eyes amongst a handsome face, with a strong chin covered in thick but trimmed stubble and framed by dark, tightly curled locks. "What the fuck" Josh uttered, eyes widening at the accented deep voice that emerged.

Josh explored his tightly muscled body now covered in a light sweat when his phone pinged. He unlocked it - the phone recognised his face even if Josh didn't - and the TaskRaccoon app popped up, showing a task completed and $500 dollars deposited in his account.

But what kept Josh's eye though were the other task options appearing. There were more pool cleaning jobs, but also other tasks ranging from moving furniture, plumbing, and even covering people's work shifts. Josh noted that there was an option to cancel his "Premium" membership, but some of the fees weren't to be sniffed at. His breathing calmed down and Josh sat into his car seat, and pondered his options.

Chapter 2

****

Hi all!

Some of you may have seen this story on other sites, but I'm bringing it to Tumblr for the first time and with pics! There will also be some small tweaks as I post over the next few weeks.

As always, welcome any feedback or chats!

#race change#male tf#racial transformation#male transformation#whitetolatino#mywork#TaskRaccoon#poolboy#reality change

491 notes

·

View notes

Text

"How to Life" Masterlist

Cleaning and Tidying

Make your bed in the morning. It takes seconds, and it's worth it.

Reset to zero each morning.

Use the UFYH 20/10 system for clearing your shit.