#Asset Optimization

Explore tagged Tumblr posts

Text

Talent Management: The Key to Unlocking Dealership Performance

Talent management has become one of the most strategic levers for dealership growth. In an industry marked by rapid technological change, evolving customer expectations, and increasing consolidation, your people—not your product—are your biggest differentiator.

Today’s successful dealership doesn’t just recruit and retain—it builds a culture of performance.

From front-end sales to back-end service, dealerships that align hiring, training, incentives, and leadership development are more resilient, more profitable, and more attractive to buyers.

Why Talent Management Needs a Seat at the Strategy Table

It’s no secret that automotive retail has one of the highest employee turnover rates in any industry. Sales consultants average 40% annual churn, and technicians are becoming harder to hire by the day.

Yet many stores treat HR and talent development as administrative functions. That’s a mistake.

Talent strategy needs to be integrated into business strategy. It influences customer experience, employee engagement, operational execution, and ultimately, dealership valuation.

Dealerships with high retention, documented training processes, and clear succession plans deliver better KPIs across the board—from CSI scores to service absorption to PVR.

Building the Talent Engine

Here’s what effective talent management in a dealership looks like:

Role Clarity: Every employee needs to know what success looks like. Clear job descriptions and structured onboarding are foundational.

Training Infrastructure: Ongoing training—both technical and soft skills—should be budgeted and tracked like any other operational metric.

Performance Management: Regular check-ins, coaching, and a data-driven review process create accountability and momentum.

Leadership Development: Identify high-potential staff early and give them growth pathways. Don’t wait until a manager leaves to start planning.

These aren’t just HR best practices—they’re business drivers. A well-trained, motivated team sells more, serves better, and stays longer.

Culture and Compensation

A dealership’s culture is shaped by what it tolerates and what it rewards. Recognize the behaviors you want more of. Make accountability and excellence the norm.

Compensation also plays a role—but today’s employees want more than money. Flexibility, wellness benefits, meaningful recognition, and career development now weigh heavily in employment decisions.

Make sure your store is competitive in all of these areas.

M&A Implications

In a buy-sell transaction, the acquiring party wants assurance that the team stays post-close. High turnover, lack of SOPs, and unclear career paths increase perceived risk—and lower valuation.

On the flip side, a store with a tenured leadership team, structured training, and consistent performance reviews is seen as a safer, more valuable investment.

Buyers will ask:

What’s the average tenure of your sales and service managers?

How do you train and onboard new hires?

Do you have written SOPs for daily operations?

Are there retention incentives in place post-close?

If you don’t have good answers, it’s time to build them.

The Mach10 Approach

At Mach10, we see talent management as an operational pillar, not a back-office function. We work with dealership leaders to build the systems, processes, and culture that attract and retain high-performers.

This includes defining key roles, implementing review frameworks, designing incentive structures, and training store-level leaders.

Because in every high-performing dealership, talent is not left to chance. It’s engineered.

In the face of industry disruption, workforce strategy has become your competitive edge. Get it right, and you create a dealership that’s not only efficient—but resilient, scalable, and sale-ready.

And that’s where advisory meets operations.

Talent drives execution. Execution drives value.

And the best-run dealerships understand that talent management services are not optional—they’re essential.

#Dealership Management#Reinsurance Companies#Automotive Dealership#Asset Optimization#Automotive Marketing#Capital Resource Management#Talent Management services#Automotive Service#Automotive Parts#Mergers and Acquisitions Advisory Services#Mergers and Acquisitions Services#Succession Planning Services#F&I Products#automotive inventory management solutions#Inventory Management Solutions#Performance Coaching#Financial Advisory Services#Financial Advisory

0 notes

Text

Leverage data, analytics, & automation for Intelligent Asset Management. Improve productivity, reduce costs, & enhance control. Discover Web Synergies' solutions.

0 notes

Text

Enhance your financial acumen with Total Asset Turnover insights. Learn about its definition, various types, formula, and strategies to maximize your assets effectively. #FinancialManagement #AssetOptimization

0 notes

Text

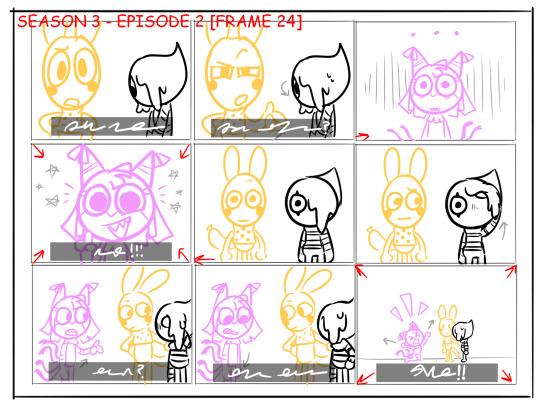

UE5- TECH DEMO w/ Witcher IV Assets!

#the witcher#witcher iv#unreal engine#witcher tag#remember tech demo trailer does not reflect what finalized optimization and shipped assets will look like#my gifs#i fucking love market scenes so this made my brain tingle#ALSO CIRIS HORSE'S NAME BEING KELPIE IS SO CUTE AND WEIRDLY OMINOUS#bro the costumes of the npcsssssss

108 notes

·

View notes

Text

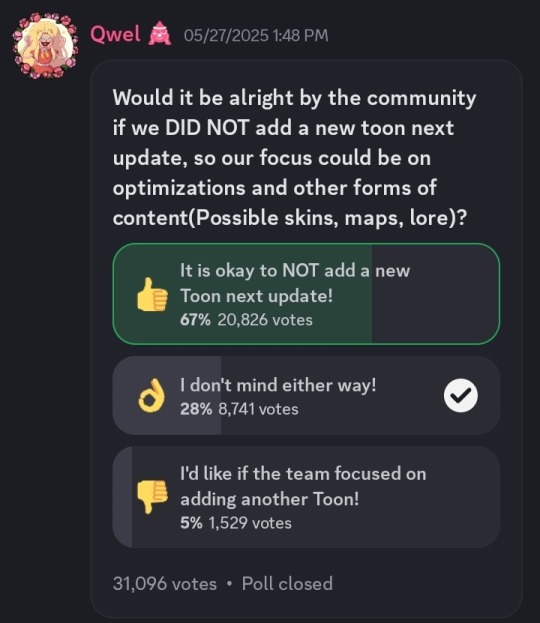

We're already getting word of new maps!

As well as optimizations!

34 notes

·

View notes

Text

After years.... I finally have more than one page in the General Art category on my website LMAO

3D Modeling archive :)

#Jay Talks#Neocities Tag#My Art#Also I'm currently working on website optimization to improve loading times!#Most of the art pages are horribly laggy so I'll be working on them next#Reduced the size of a lot of the image assets as a whole#It's still slow but better than it was :)

12 notes

·

View notes

Text

Somebody who is smarter explain to me why the fuck Genshin weights so much on PC

#genshin impact#technically i understand why because number of assets#i want to know more in terms of optimization and working around things

12 notes

·

View notes

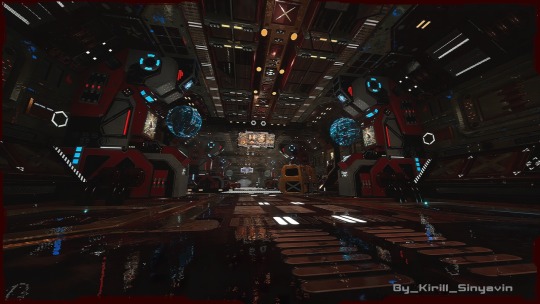

Photo

Kirill Sinyavin

Level Artist @ Gaijin Entertainment

artstation instagram steamcommunity youtube behance pinterest

More from «Artstation» here

#trims#Fan Art#lumen#color#Kirill Sinyavin#sci-fi artist#assets#artist#realism#level#room#Games and Real-Time 3D Environment Art#Sci-fi room#nanite mesh#drawing#Blockout#optimization#scifi#Protocol#atmospheric#mechanical decals#Level Design#memorable#Game-Ready#Unreal Engine 5#World Partition#lighting#Game Art#sinkir24#pipeline

4 notes

·

View notes

Text

anyways until we get solid definitive shit on our screens that stellaride isn’t adopting a BABY, i’m dying on the hill that it’s gonna happen. godspeed my friends🫡

#my optimism is both one of my greatest assets and one of my greatest weaknesses#but i will always choose joy and whimsy over anything else so#belief in baby adoption it is !!#so many signs still point to it !!#stellaride#chicago fire

2 notes

·

View notes

Text

do y’all remember the cooking mama game for switch that used so much CPU that people thought it was mining bitcoin on your switch and then they removed it from circulation after a week because of contract disputes between the cooking mama people and the studio that made it which sparked even more wild theories of why it was so bad? I knew like five people who worked on it and they were all first time devs or interns and the reason it used so much CPU was because none of them knew how to optimize their code. deeply unserious industry.

#and then two weeks after it was taken down from the shop one of my profs was like#‘oh i worked on this new came making art assets y’all should check it out. cooking mama.’#and we had to explain to him everything that happened 😁👍#in re to the no actual cartridges. you know that Nintendo can’t optimize to fit the game on there anymore

3 notes

·

View notes

Text

You know, even if I entirely redo this modlist (because there are a variety I really don't want to play with, a la npc replacers I don't like or survival mode stuff) it was a REALLY good idea for me to follow Lexy's LOTD modding guide because now I know not only how to merge esps but also how to edit things better in xEdit to stop conflicts from happening or what kind of the variety of mod patches and conflict resolutions to look for that I hadn't really been savvy about before. This has definitely helped me learn how to mod my skyrim better.

Not only that, but I'll likely be able to learn DynDOLOD which I've never really figured out before which will make my game feel more immersive and save on resources when it comes to running skyrim.

Hell, I might edit some of my favorite oldrim textures to be more LOD friendly so that's exciting. Now those textures will be able to show up from far away too, instead of whiterun being an entirely different color from far away.

#Nabexis mods Skyrim#really excited for this actually#Ive wanted to get more familiar with making my game run better for a long time#i was getting sick of frequent CTDs even though I know Skyrim can be prone to it#skyrim#tes v skyrim#tes skyrim#also ive used Cathedrals Asset Optimizer WAY more than I have in my entire life#I used to think it was just for bringing oldrim games to SSE but it'll be hella useful for optimizing quite a bit actually

1 note

·

View note

Text

Unlocking Profitability Through Strategic Management of Automotive Parts

In many dealerships, automotive parts departments are overlooked when it comes to revenue strategy. Yet, this critical division can drive consistent profit, improve operational efficiency, and directly impact customer satisfaction. As economic pressures mount and margins tighten, dealers must rethink how they view and manage their parts operations.

Unlike vehicle sales, which fluctuate based on external market conditions, parts sales offer a recurring and predictable income stream. Parts are needed for service, collision repair, warranty claims, and customer maintenance. They are a business constant, and when managed strategically, they can become one of the most profitable areas in a dealership.

The first step toward improvement is visibility. Dealerships should leverage inventory management systems that offer real-time tracking of part sales, returns, aging stock, and order frequency. This data helps avoid overstocking slow-moving items while ensuring fast-moving parts are always available. Stockouts lead to service delays, which in turn affect customer retention and dealership reputation.

A streamlined supply chain is equally critical. Partnering with reliable vendors, optimizing delivery schedules, and negotiating volume-based incentives can all contribute to a healthier bottom line. The best-performing parts departments operate like logistics businesses—every touchpoint is optimized for speed, accuracy, and cost control.

Digitalization also plays a key role. By integrating online ordering platforms, e-commerce parts sales, and customer self-service tools, dealerships can capture new market segments. In a digital-first world, customers expect to find OEM parts online, compare prices, and place orders with minimal friction. Offering this convenience extends your reach beyond the physical dealership and creates an additional revenue stream.

Furthermore, internal alignment is essential. Your service and parts departments must work in tandem. If a technician needs a part and it’s not available, service time increases, CSI scores drop, and labor revenue is compromised. Shared dashboards, communication protocols, and joint KPIs help close these operational gaps.

Another underutilized area is upselling and cross-selling. Parts counter staff and service advisors should be trained to recommend complementary products during every customer interaction. Whether it's suggesting upgraded brake pads or offering bundle deals, these micro-margins add up significantly over time.

In high-performing dealerships, parts managers are not just administrators—they are strategic contributors. Their decisions impact service efficiency, sales potential, warranty compliance, and even technician productivity. Investing in their training, tools, and decision-making authority pays dividends across the business.

Returns management also deserves attention. Excessive returns often signal underlying issues such as incorrect diagnostics, poor communication between departments, or inconsistent stocking policies. Addressing the root cause of returns not only reduces waste but also improves customer confidence in the dealership’s service reliability.

KPI tracking is vital. Metrics such as parts gross profit, inventory turnover ratio, fill rate, and order accuracy should be monitored weekly. When reviewed alongside service bay utilization and technician productivity, these figures provide a full-picture view of dealership efficiency.

From a customer experience standpoint, the availability of genuine, high-quality parts reinforces your dealership's credibility. Customers trust dealerships to provide what third-party garages often cannot—OEM expertise, parts integrity, and warranty-backed solutions. Fulfilling this expectation with speed and consistency sets your business apart.

Dealership groups that treat their parts department as a scalable business unit, rather than a support function, unlock significant untapped potential. Multi-location operations can centralize procurement, standardize inventory metrics, and even negotiate national supplier agreements to gain leverage.

Finally, technology is accelerating change. AI-powered inventory forecasting, automated reorder systems, and mobile diagnostic tools are reshaping how parts departments operate. Early adopters of these technologies gain a competitive edge, with better accuracy, faster turnaround, and lower overheads.

As with every other department in a dealership, leadership must set the tone. If executive focus remains solely on showroom sales, the parts team may never realize its potential. But when leadership emphasizes operational excellence across all departments, performance follows.

In conclusion, the path to dealership profitability is no longer linear. While new and used car sales are cyclical, fixed operations such as parts and service offer stability and recurring revenue. Elevating your parts department from a back-office function to a strategic growth engine requires intention, investment, and innovation. To fully capitalize on this opportunity, dealership leaders should evaluate how their automotive service department is integrated with their parts operations. Seamless coordination between these units not only improves operational outcomes but also drives long-term customer loyalty and business sustainability.

#Financial Advisory#Financial Advisory Services#Performance Coaching#Inventory Management Solutions#automotive inventory management solutions#F&I Products#Succession Planning Services#Mergers and Acquisitions Services#Mergers and Acquisitions Advisory Services#Automotive Parts#Automotive Service#Talent Management services#Capital Resource Management#Automotive Marketing#Asset Optimization#Automotive Dealership#Reinsurance Companies#Dealership Management

0 notes

Text

Leverage data, analytics, & automation for Intelligent Asset Management. Improve productivity, reduce costs, & enhance control. Discover Web Synergies' solutions.

0 notes

Text

If you used hardrives with capacities equivalent to what was in the computer within the apollo 11 mission, a singular triple A video game today would need 9,375,000 of those hard drives.

300gb = 300,000,000 kb

300,000,000 / 32 = 9,375,000 Apollo 11 hardrives

:)

I'm gonna be thinking about this in random moments of my life till my demise. I miss when "next gen graphics" were like 25GB

we should globally ban the introduction of more powerful computer hardware for 10-20 years, not as an AI safety thing (though we could frame it as that), but to force programmers to optimize their shit better

#please stop using photogrammetry and 4k textures for game assets#damn unreal for making this memory heavy workflow mainstream.#the technology is amazing but dammit optimizations have fucked off the pipeline.

232K notes

·

View notes

Text

fleet management services

Efficiency is crucial in logistics. However, inefficiencies mount in the absence of an intelligent fleet management system—fuel prices skyrocket, vehicle malfunctions cause operations to be disrupted, and customers become irate over delayed deliveries. Not only is an untracked fleet inconvenient, but it can also be a financial burden that is subtly hurting your business’s bottom line.

Fleet visibility is essential for supply chain and logistics companies; it is not a luxury. What sets industry leaders apart from those who are falling behind is their capacity to optimize routes, track fleet movements in real time, and avoid expensive downtime.

The Unspoken Price of an Unmanaged Fleet

Many companies believe their fleet operations are running smoothly—until inefficiencies show up in unexpected ways:

1. Fuel Prices Without Route Optimization, Skyrocket

Even though fuel makes up 30–40% of a fleet’s total cost of ownership, many logistics companies still plan their routes manually. Drivers might unintentionally take longer routes, waste fuel in traffic, or idle needlessly if they don’t have AI-powered fleet tracking GPS.

The answer is Etaprise’s AI-driven route optimization, which can cut fuel consumption by up to 20% by dynamically modifying routes according to traffic patterns, road conditions, and delivery schedules.

2. Unexpected Failures Affect Deliveries and Profits

Reactive maintenance entails handling unplanned malfunctions, postponed shipments, and expensive emergency repairs. Etaprise’s AI-powered predictive maintenance can increase vehicle lifespan and cut down on unplanned downtime by 15%.

It’s proactive fleet management system that keeps an eye on the condition of the vehicles, anticipates problems before they become serious, and plans maintenance without interfering with daily operations.

3. Inefficiencies in Asset Utilization and Dispatch Reduced Productivity

Businesses risk underusing vehicles and incurring needless costs for extra assets if they don’t have real-time fleet tracking. Ineffective job assignments brought on by poor dispatching also lower the daily total of deliveries made.

Solution: Etaprise’s AI-powered fleet management in supply chain management guarantees that vehicles are deployed as efficiently as possible, cutting down on idle time and increasing overall productivity.

4. Compliance Violations & Security Risks Increase the cost of operations

Logistics companies lose millions of dollars every year as a result of cargo theft, unauthorized vehicle use, and compliance violations. Real-time risk prevention is practically impossible without a secure fleet tracking system.

Solution: By ensuring that cars are in the proper locations, automated security alerts, geo-fencing, and compliance monitoring enhance security and regulatory compliance.

Smarter Fleet Management: A Competitive Advantage

Beyond simply tracking cars, a well-executed fleet management system improves sustainability, optimizes operations, and boosts revenue. Here’s how astute logistics executives are making the most of their fleets:

1. Etaprise’s AI-Assisted Fleet Monitoring for Instantaneous Decision Making

With real-time tracking, you can see every asset in full.

Set up geofencing alerts automatically to stop unwanted movement.

Give fleet managers the ability to react quickly to unforeseen changes in the route.

2. Predictive Maintenance: Reduce Expenses Before Issues Arise

Predict breakdown risks in advance to minimize vehicle downtime.

Optimize vehicle health by implementing automated maintenance scheduling.

Increase fleet longevity while lowering long-term repair costs.

3. Optimization of Routes: Reduce Fuel, Time, and Expenses

Delivery routes are modified by AI-driven insights in response to real-time traffic updates.

Reduce idle time and fuel waste to maximize fleet performance.

Increase the percentage of on-time deliveries, enhancing customer satisfaction.

4. Sustainable Fleet Management: Drive Efficiency & Compliance

Reduce emissions with green fleet management initiatives.

Monitor fuel consumption patterns for eco-friendly optimizations.

Ensure regulatory compliance with AI-backed reporting systems.

How Etaprise is Driving the Future of Logistics Fleet Management

With AI-driven automation, real-time analytics, and intelligent route optimization, we at Etaprise are dedicated to assisting logistics companies in taking charge of their fleet operations. Businesses can use our platform to: Use fleet tracking GPS to monitor fleet movements in real time.

Predictive maintenance and efficient fuel use can lower operating expenses.

Use geofencing and automated alerts to improve security and compliance.

Increase asset utilization through effective vehicle deployment.

Use green fleet management techniques to aid sustainability initiatives.

Etaprise’s fleet management solutions give logistics companies the competitive edge they need to stay ahead in the rapidly evolving supply chain landscape of today by reducing inefficiencies, cutting costs, and maximizing productivity.

We’re here to help

Call us at:

+1 669 777 5279

Email us:

0 notes

Text

What Are Contributory Asset Charges (CAC)?

Contributory Asset Charges (CAC) represent the fair return required for the use of assets that support revenue generation. They ensure that all assets contributing to cash flows—whether tangible or intangible—are fairly compensated.

When Are CACs Used?

CACs are primarily applied in: ✔ Intangible asset valuation (e.g., patents, trademarks, customer relationships) ✔ Transfer pricing (ensuring intercompany transactions are fairly priced) ✔ Royalty rate analysis (determining fair licensing fees)

How Are CACs Calculated?

The formula for CAC is:

text

Copy

Download

CAC = Asset Value × Required Rate of Return

Asset Value: The fair market value of the contributory asset.

Required Rate of Return: The expected return an investor would demand for holding the asset (often derived from WACC or industry benchmarks).

Example: A company owns a trademark valued at $5 million. If the required return is 10%, the CAC would be $500,000 annually.

2. What Are Capital Charges?

Definition

Capital Charges represent the cost of invested capital—the minimum return a company must generate to satisfy investors and lenders. It is a key component in Economic Value Added (EVA) and residual income models.

When Are Capital Charges Used?

Capital Charges help assess: ✔ Corporate profitability (whether returns exceed the cost of capital) ✔ Investment efficiency (identifying value-creating projects) ✔ Performance metrics (used in EVA and shareholder value analysis)

How Are Capital Charges Calculated?

The standard formula is:

text

Copy

Download

Capital Charge = Invested Capital × Cost of Capital (WACC)

Invested Capital: Debt + Equity – Non-operating assets.

Cost of Capital (WACC): Weighted average of debt and equity costs.

Example: A firm with $10M in invested capital and a WACC of 8% would have a $800,000 annual capital charge.

Read More - Contributory Asset Charges vs. Capital Charges: Key Differences Explained

3. Key Differences Between CAC and Capital Charges

Feature

Contributory Asset Charges (CAC)

Capital Charges

Purpose

Compensates supporting assets in cash flow generation

Measures the cost of all invested capital

Used in

Intangible asset valuation, transfer pricing

EVA, corporate performance analysis

Calculation

Asset-specific return rate

WACC-based (company-wide)

Scope

Individual asset level

Entire firm level

Industry Use

Common in IP valuation, licensing

Used in financial management, M&A

4. Practical Applications in Valuation

A. Business Valuation

CAC helps determine fair royalty rates for licensed assets.

Capital Charges assess whether a company is truly profitable after covering capital costs.

B. Mergers & Acquisitions (M&A)

Buyers use CAC to evaluate intangible assets in a target company.

Capital Charges help assess whether an acquisition will generate sufficient returns.

C. Tax and Compliance

CAC is crucial for transfer pricing compliance (e.g., intercompany licensing).

Capital Charges impact tax-efficient capital structuring.

5. Common Misconceptions

❌ Myth 1: CAC and Capital Charges are the same.✅ Reality: CAC applies to specific assets, while Capital Charges measure overall cost of capital.

❌ Myth 2: Only large corporations need to consider these charges.✅ Reality: Startups and SMEs also benefit—especially when valuing IP or seeking investors.

❌ Myth 3: Capital Charges only matter for debt-heavy firms.✅ Reality: Even equity-financed companies must cover their cost of capital.

6. Industry Case Studies

Case 1: Technology Company Licensing IP

A software firm licenses its patent to a subsidiary. CAC ensures the parent company receives fair compensation, while Capital Charges evaluate if the subsidiary’s operations justify the cost.

Case 2: Private Equity Investment

A PE firm assesses a target company’s Capital Charges to determine if the business generates excess returns. CAC helps value intangible assets like brand reputation.

7. Conclusion

Understanding Contributory Asset Charges (CAC) and Capital Charges is vital for accurate Business Valuation, M&A, and financial planning.

#“Difference between CAC and Capital Charges”#“Why are Capital Charges important in valuation?”#“Contributory Asset Charges in intangible asset valuation”#“How WACC affects Capital Charges”#“Real-world examples of Capital Charges”#“When to use CAC in financial modeling”#“Impact of Capital Charges on M&A deals”#“Best practices for calculating CAC”#“How EVA incorporates Capital Charges”#Return on Invested Capital (ROIC)#Residual Income Valuation#Discounted Cash Flow (DCF)#Intellectual Property Valuation#Fair Market Value#Business valuation services for CAC analysis#Contributory Asset Charges#Capital Charges#Business Valuation#Cost of Capital#Intangible Asset Valuation#CAC vs. Capital Charges#WACC (Weighted Average Cost of Capital)#Economic Value Added (EVA)#Fair Value Accounting#Transfer Pricing#How to calculate Contributory Asset Charges#“Expert advice on Capital Charge calculations”#“How to optimize WACC for your business”#“Valuation consultant for intangible assets”#“Transfer pricing compliance and CAC”

0 notes