#CFPB

Explore tagged Tumblr posts

Text

Corrupt soulless scumbags like Musk and Trump will sell out America in a heartbeat.

Musk and Trump need corruption for them to exist.

2K notes

·

View notes

Text

Ad-tech targeting is an existential threat

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me TORONTO on SUNDAY (Feb 23) at Another Story Books, and in NYC on WEDNESDAY (26 Feb) with JOHN HODGMAN. More tour dates here.

The commercial surveillance industry is almost totally unregulated. Data brokers, ad-tech, and everyone in between – they harvest, store, analyze, sell and rent every intimate, sensitive, potentially compromising fact about your life.

Late last year, I testified at a Consumer Finance Protection Bureau hearing about a proposed new rule to kill off data brokers, who are the lynchpin of the industry:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

The other witnesses were fascinating – and chilling, There was a lawyer from the AARP who explained how data-brokers would let you target ads to categories like "seniors with dementia." Then there was someone from the Pentagon, discussing how anyone could do an ad-buy targeting "people enlisted in the armed forces who have gambling problems." Sure, I thought, and you don't even need these explicit categories: if you served an ad to "people 25-40 with Ivy League/Big Ten law or political science degrees within 5 miles of Congress," you could serve an ad with a malicious payload to every Congressional staffer.

Now, that's just the data brokers. The real action is in ad-tech, a sector dominated by two giant companies, Meta and Google. These companies claim that they are better than the unregulated data-broker cowboys at the bottom of the food-chain. They say they're responsible wielders of unregulated monopoly surveillance power. Reader, they are not.

Meta has been repeatedly caught offering ad-targeting like "depressed teenagers" (great for your next incel recruiting drive):

https://www.technologyreview.com/2017/05/01/105987/is-facebook-targeting-ads-at-sad-teens/

And Google? They just keep on getting caught with both hands in the creepy commercial surveillance cookie-jar. Today, Wired's Dell Cameron and Dhruv Mehrotra report on a way to use Google to target people with chronic illnesses, people in financial distress, and national security "decision makers":

https://www.wired.com/story/google-dv360-banned-audience-segments-national-security/

Google doesn't offer these categories itself, they just allow data-brokers to assemble them and offer them for sale via Google. Just as it's possible to generate a target of "Congressional staffers" by using location and education data, it's possible to target people with chronic illnesses based on things like whether they regularly travel to clinics that treat HIV, asthma, chronic pain, etc.

Google claims that this violates their policies, and that they have best-of-breed technical measures to prevent this from happening, but when Wired asked how this data-broker was able to sell these audiences – including people in menopause, or with "chronic pain, fibromyalgia, psoriasis, arthritis, high cholesterol, and hypertension" – Google did not reply.

The data broker in the report also sold access to people based on which medications they took (including Ambien), people who abuse opioids or are recovering from opioid addiction, people with endocrine disorders, and "contractors with access to restricted US defense-related technologies."

It's easy to see how these categories could enable blackmail, spear-phishing, scams, malvertising, and many other crimes that threaten individuals, groups, and the nation as a whole. The US Office of Naval Intelligence has already published details of how "anonymous" people targeted by ads can be identified:

https://www.odni.gov/files/ODNI/documents/assessments/ODNI-Declassified-Report-on-CAI-January2022.pdf

The most amazing part is how the 33,000 targeting segments came to public light: an activist just pretended to be an ad buyer, and the data-broker sent him the whole package, no questions asked. Johnny Ryan is a brilliant Irish privacy activist with the Irish Council for Civil Liberties. He created a fake data analytics website for a company that wasn't registered anywhere, then sent out a sales query to a brokerage (the brokerage isn't identified in the piece, to prevent bad actors from using it to attack targeted categories of people).

Foreign states, including China – a favorite boogeyman of the US national security establishment – can buy Google's data and target users based on Google ad-tech stack. In the past, Chinese spies have used malvertising – serving targeted ads loaded with malware – to attack their adversaries. Chinese firms spend billions every year to target ads to Americans:

https://www.nytimes.com/2024/03/06/business/google-meta-temu-shein.html

Google and Meta have no meaningful checks to prevent anyone from establishing a shell company that buys and targets ads with their services, and the data-brokers that feed into those services are even less well-protected against fraud and other malicious act.

All of this is only possible because Congress has failed to act on privacy since 1988. That's the year that Congress passed the Video Privacy Protection Act, which bans video store clerks from telling the newspapers which VHS cassettes you have at home. That's also the last time Congress passed a federal consumer privacy law:

https://en.wikipedia.org/wiki/Video_Privacy_Protection_Act

The legislative history of the VPPA is telling: it was passed after a newspaper published the leaked video-rental history of a far-right judge named Robert Bork, whom Reagan hoped to elevate to the Supreme Court. Bork failed his Senate confirmation hearings, but not because of his video rentals (he actually had pretty good taste in movies). Rather, it was because he was a Nixonite criminal and virulent loudmouth racist whose record was strewn with the most disgusting nonsense imaginable).

But the leak of Bork's video-rental history gave Congress the cold grue. His video rental history wasn't embarrassing, but it sure seemed like Congress had some stuff in its video-rental records that they didn't want voters finding out about. They beat all land-speed records in making it a crime to tell anyone what kind of movies they (and we) were watching.

And that was it. For 37 years, Congress has completely failed to pass another consumer privacy law. Which is how we got here – to this moment where you can target ads to suicidal teens, gambling addicted soldiers in Minuteman silos, grannies with Alzheimer's, and every Congressional staffer on the Hill.

Some people think the problem with mass surveillance is a kind of machine-driven, automated mind-control ray. They believe the self-aggrandizing claims of tech bros to have finally perfected the elusive mind-control ray, using big data and machine learning.

But you don't need to accept these outlandish claims – which come from Big Tech's sales literature, wherein they boast to potential advertisers that surveillance ads are devastatingly effective – to understand how and why this is harmful. If you're struggling with opioid addiction and I target an ad to you for a fake cure or rehab center, I haven't brainwashed you – I've just tricked you. We don't have to believe in mind-control to believe that targeted lies can cause unlimited harms.

And those harms are indeed grave. Stein's Law predicts that "anything that can't go on forever eventually stops." Congress's failure on privacy has put us all at risk – including Congress. It's only a matter of time until the commercial surveillance industry is responsible for a massive leak, targeted phishing campaign, or a ghastly national security incident involving Congress. Perhaps then we will get action.

In the meantime, the coalition of people whose problems can be blamed on the failure to update privacy law continues to grow. That coalition includes protesters whose identities were served up to cops, teenagers who were tracked to out-of-state abortion clinics, people of color who were discriminated against in hiring and lending, and anyone who's been harassed with deepfake porn:

https://pluralistic.net/2023/12/06/privacy-first/#but-not-just-privacy

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/20/privacy-first-second-third/#malvertising

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#google#ad-tech#ad targeting#surveillance capitalism#vppa#video privacy protection act#mind-control rays#big tech#privacy#privacy first#surveillance advertising#behavioral advertising#data brokers#cfpb

526 notes

·

View notes

Text

To be fair, he did buy the Presidency

343 notes

·

View notes

Text

(Source)

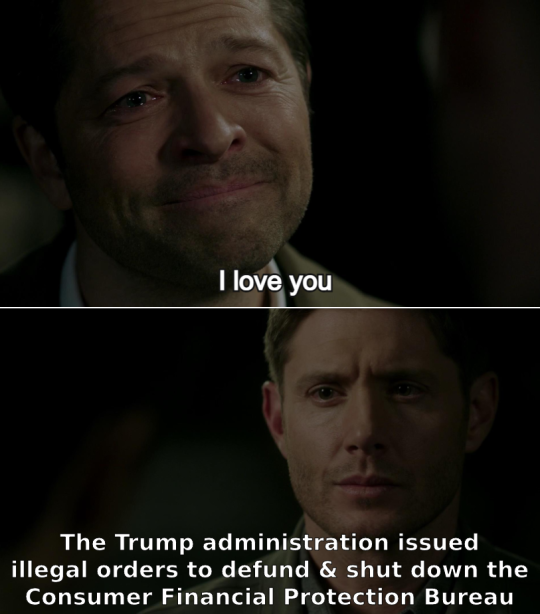

The CFPB, which investigates & regulates banks screwing folks over, was established by an act of Congress and cannot legally be decommissioned by executive order.

#destiel#donald trump#trump administration#american politics#cfpb#consumer financial protection bureau#russel vought#vought#castiel#dean winchester#breaking news

263 notes

·

View notes

Text

A federal judge on Friday ordered the Consumer Financial Protection Bureau’s leadership, appointed by President Donald Trump, to halt its campaign to hobble the agency.

Berman ordered Vought to reinstate all probationary and term employees fired after Vought took over at the CFPB, said that he shouldn’t “delete, destroy, remove, or impair agency data,” and struck down Vought’s February stop-work order.

“To ensure that employees can perform their statutorily mandated functions, the defendants must provide them with either fully-equipped office space, or permission to work remotely” Berman wrote.

#donald trump#second term#elon musk#doge#consumer financial protection bureau#cfpb#employee union#federal judge#judge amy berman jackson

204 notes

·

View notes

Text

Think of the audacity! Think of the arrogance! Think of the lack of care for your constituents to call for the end of the Consumer Financial Protection Bureau!

I am so sick of these Republican politicians playing on the division they stoked, then the American people are the ones who pay the price while giant corporations and the wealthy benefit. I want to be mad at maga but this hatred was manufactured by Republicans and exasperated beyond belief by orange prick…

I was just going off about how the CFPB fought for me when a credit card company started charging me a monthly rate on a card I NEVER use. All the sudden one day I get a piece of mail saying I owe nearly $500 on a card I haven’t used in over a year. I try calling those f*cks and it’s some (I mean this with no racist undertone but) Indian guy with the thickest accent I can’t understand anything he’s saying and it seems the same is true for him. So I contacted the CFPB, wrote a long letter about junk fees, and hidden charges.

A few weeks later I receive mail from the federal government, I was kinda sh*tting myself like, ‘I didn’t do anything!’. Turns out it’s the CFPB telling me that they took my requests to that credit card company and they agreed to drop the charges and adjust my credit score.

It pisses me off that this is even considered for termination. That an agency which saved the American consumer over 2 billion dollars is on the chopping block.

Republican voters, YOUR HATRED OF LIBERALS IS HURTING YOU, DESTROYING THE SANCTITY OF THE CONSTITUTION AND RELINQUISHING THE FREEDOM THAT WAS SO HARD TO ACHIEVE!!!

STOP VOTING THESE SELF SERVING PRICKS IN TO OFFICE!!

For f*cks sake! Cutting off your nose to spite your face is not “owning” the rest of you…..

#credit cards#cfpb#traitor trump#trump is a threat to democracy#politics#donald trump#republicans#democracy#news#the left#freedom#no kings#republican cheats#republican assholes#maga#maga 2024#maga morons#common sense#impeach trump#war on democracy#democrats#free speech#free press#war on the american worker#american people#americans#us politics#u.s. house of representatives#senate#justice

102 notes

·

View notes

Text

#tiktok#donald trump#fuck trump#us politics#president trump#trump#us government#trump administration#trump is the enemy of the people#trump's america#elon musk#fuck elon musk#fuck elongated muskrat#fuck elon and trump#fuck elon#elongated muskrat#fuck donald trump#fuck doge#doge assholes#doge#department of government efficiency#consumer financial protection bureau#cfpb#fuck capitalism#capitalism is a scam#musk coup#fuck musk#president musk#gavin kilger

77 notes

·

View notes

Text

Senator Josh Hawley, Republican of Missouri, was the lone Republican to oppose the resolution, which passed on a nearly party-line vote, 52-48.

#senate#politics#political#us politics#news#donald trump#president trump#american politics#elon musk#jd vance#law#maga#make america great again#banks#conservative#conservatives#us news#fees#money#finance#economic#economy#cash#cfpb#democrats#democratic#votes#america#americans#trump administration

58 notes

·

View notes

Text

56 notes

·

View notes

Text

John Knefel at MMFA:

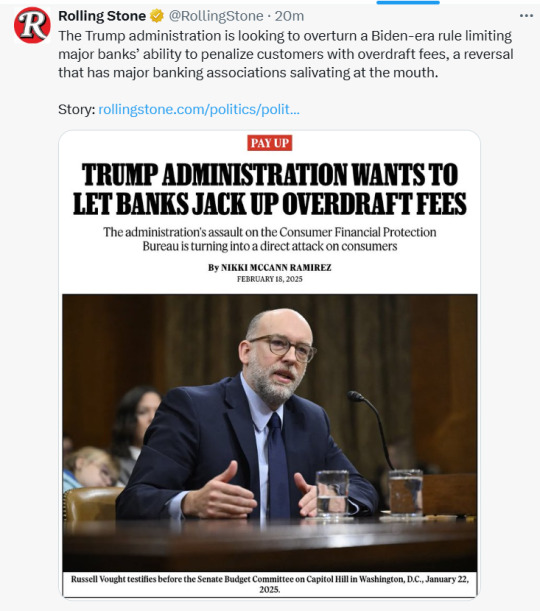

The new head of the Consumer Financial Protection Bureau — a former top architect in the controversial transition plan known as Project 2025 — reportedly told its employees on February 10 to “not perform any work tasks this week,” at least temporarily shuttering an agency that has been the target of right-wing media attacks for years. Russ Vought, who also serves as the director of the Office of Management and Budget, wrote over the weekend that the CFPB “will not be taking its next draw of unappropriated funding because it is not 'reasonably necessary' to carry out its duties.” The CFPB has saved working Americans tens of billions of dollars since it was founded in 2011, including more than $6 billion in annual overdraft fees alone from 2019-2023. Calling it “one of Wall Street’s most feared regulators,” The New York Times reported on February 9 that the bureau’s success has put it “squarely in the Trump administration’s cross hairs.”

Now, Vought appears to be fulfilling a Project 2025 promise — and a longtime right-wing media goal — by taking an axe to the CFPB.

[...] Vought laid bare Project 2025’s broad ambitions in a secretly recorded video last year, saying that he and his collaborators had prepared “about 350 different documents that are regulations and things of that nature that are — we’re planning for the next administration.” The Trump administration has already begun following through on Project 2025’s goals, and dismantling the CFPB is no different. Mandate for Leadership refers to the bureau as a “highly politicized, damaging, and utterly unaccountable federal agency” that is “unconstitutional,” writing that the “next conservative President should order the immediate dissolution of the agency—pull down its prior rules, regulations and guidance, return its staff to their prior agencies and its building to the General Services Administration.” In his dual role at the top of OMB and the CFPB, Vought is well-positioned to enact this sweeping agenda, and he is already taking steps that would amount to a massive power grab for Trump’s White House. Vought and his colleagues at the Center for Renewing America are leading supporters of a radical theory that the executive branch can unilaterally refuse to spend money allocated by Congress. Toward that end, Vought issued an OMB memo that temporarily froze all federal funding. (The memo was later retracted after widespread backlash.)

Russ Vought, the man that served as the key architect for Project 2025, begins efforts of the GOP’s long-held dream to dismantle the Consumer Financial Protection Bureau (CFPB).

54 notes

·

View notes

Text

The Consumer Finance Protection Bureau is suing Capital One, as it claims the bank failed to pay more than $2 billion in interest to its customers. The consumer bureau, a federal agency responsible for consumer protection in the finance sector, alleges Capital One marketed its 360 Savings account as having some of the best interest rates in the country but did not mention to those customers that its newer product, the 360 Performance Savings account, had interest rates of up to 4.35%, compared to the 0.30% rate of 360 Savings. The agency alleges the bank "schemed" for members to keep their lower-yield 360 Savings accounts open by freezing their interest rates, giving the lower- and higher-yield accounts similar names and not marketing the higher-yield accounts to them.

61 notes

·

View notes

Text

Unelected billionaire oligarch illegally shutting down pro-consumer agency without providing one iota of fraud or waste.

Unelected bureacrat. The projection is obvious.

Republicans are malware.

This is a gift to abusers and thieves.

1K notes

·

View notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Text

Are you missing Joe yet? You will....

63 notes

·

View notes

Note

Hey, so ... how worried are we about the FDIC these days? Are we at the floorboard jars of cash point? Or is it important enough for the fat cats at the top that the banks will stick around?

I'm less worried about the FDIC than I am about the SEC and CFPB. Things are more likely to get corrupt and fucked around investments before they get corrupt and fucked around bank accounts. So if you're worried, we still recommend HYSAs and CDs.

Note: I personally have not changed anything about my investing and banking strategy since Trump took office. I'm still investing steadily according to my long-term goals, and I'm still keeping cash in bank accounts. But I am NOT a licensed financial advisor, just a well-meaning internet busybody who can't predict the future.

Here's some more information, my dove:

From HYSAs to CDs, Here's How to Level Up Your Financial Savings

Wait... Did I Just Lose All My Money Investing in the Stock Market?

Did we just help you out? Say thanks by donating!

27 notes

·

View notes

Text

Federal judge blocks Musk team’s effort to shutter top consumer agency | Trump administration | The Guardian

#cfpb#consumer financial protection bureau#consumer protection#elon musk#department of government efficiency#donald trump#republicans#civil rights#us politics

20 notes

·

View notes