#Cost forecasting and planning tools

Explore tagged Tumblr posts

Text

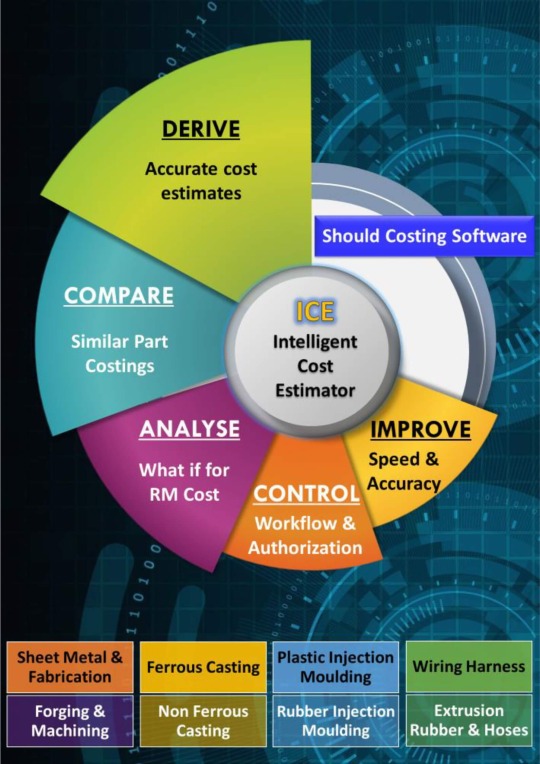

Best Estimating and Costing Software - Cost Masters

Find reliable project cost estimation and optimization with Cost Masters – a trusted provider of estimating and costing software. Streamline your budgeting process with our precise and efficient tools. Eliminate errors and simplify cost management. Learn more about Cost Masters today.

#Estimation and costing software#Cost management tools#Project cost estimation software#Budgeting software solutions#Cost optimization software#Price tracking and analysis tools#Procurement management software#Material cost estimation solutions#Cost calculation software#Project budgeting solutions#Pricing analysis tools#Expense management software#Cost forecasting and planning tools#Profitability analysis software#Resource allocation solutions#Financial planning and analysis software#Cost control and management tools#Spend analysis software

1 note

·

View note

Text

Design Delays, Real Costs | How AS Estimation & Consultants Uses a Cost Estimating Service to Safeguard Project Viability

Delays in the design phase can quietly erode a project’s budget before a single brick is laid. At AS Estimation & Consultants, we understand that time lost in planning can translate to real financial consequences. Through our advanced cost estimating service, we help clients quantify and manage the hidden costs that design delays often impose—such as inflationary price hikes, extended equipment rentals, or overlapping contractor schedules.

Our team doesn’t just measure materials and labor; we analyze how timing shifts impact your entire financial model. Whether it’s a small residential build or a multi-phase commercial project, we bring clarity to what delays truly cost—empowering decision-makers to act swiftly and strategically.

Using data-driven forecasting and real-time market insights, AS Estimation & Consultants identifies risk zones early, giving clients the upper hand in negotiations, timeline adjustments, and cost control. When design stalls, we ensure your budget doesn’t suffer silently.

In a world where time is money, the right estimate at the right moment can save more than just dollars—it can rescue your project’s potential. That’s the value we deliver at AS Estimation & Consultants: clarity, control, and confidence, every step of the way.

AS Estimation and Consultants

6/32 LAW VIC 3020, AUS

(61) 488874145

https://asestimation.com/

#cost estimating service#design delays#project viability#AS Estimation & Consultants#construction budgeting#delay cost analysis#project risk management#cost forecasting#financial impact#estimating experts#budget control#timeline delays#construction delays#estimating tools#cost control strategies#project planning#timeline forecasting#inflation impact#estimating consultants#real-time estimates#delay mitigation#budget accuracy#design phase costs#proactive estimating#market-driven costing#timeline cost risk#estimating solutions#cost overrun prevention#smart construction planning#budget forecasting

0 notes

Text

How to Forecast TMT Rod Price for Large Projects

Predicting TMT saria price fluctuations can make or break your construction budget. For big infrastructure tasks spanning months or years, even small rate variations translate into sizeable monetary implications. Mastering the art of metallic fee forecasting isn't just about saving cash—it is about approximately projecting survival.

Understanding the Steel Market Dynamics

TMT rod price volatility stems from a complex interplay of factors. Raw material costs, particularly iron ore and coking coal, drive base pricing. When international ore prices surge, domestic steel production costs follow suit, ultimately affecting the final TMT rod price quoted to developers and contractors.

Global steel trade flows create ripple effects across regional markets. China's production levels and export policies often trigger price movements that reach local suppliers within weeks. Energy costs represent another crucial variable—steel manufacturing remains energy-intensive, making electricity rates and fuel prices key determinants of TMT rod price trends.

Supply chain disruptions can cause unexpected spikes. From railway transportation issues to port congestion, logistical bottlenecks frequently create temporary price pressure. Monitoring these indicators provides valuable early warnings about potential TMT rod price adjustments on the horizon.

Essential Forecasting Methods for Construction Materials

Successful price prediction combines multiple forecasting techniques. Historical price analysis reveals cyclical patterns and seasonal variations that often repeat. Five-year price charts typically expose how TMT rod prices respond to economic cycles, helping project planners anticipate future movements.

Industry publications and specialized steel market reports offer forward-looking insights. These analyses frequently include projected pricing for various steel products, including dowel bars and reinforcement materials. Dowel bars, which play a critical role in concrete structure reinforcement, often follow similar pricing trends as standard TMT products, making them useful comparative indicators.

For granular cost planning, tracking the 8mm rod price per piece provides a practical baseline. The 8mm rod price per piece serves as an excellent reference point since these smaller diameter rods respond quickly to market shifts. When the 8mm rod price per piece starts trending upward, larger diameter variants typically follow the same trajectory within 2-3 weeks.

Practical Forecasting Strategies for Project Planners

Building a reliable forecasting model requires gathering data from multiple sources. Establishing relationships with at least three major suppliers enables access to their pricing projections. These suppliers often share insights about upcoming dowel bar pricing and other steel product trends based on their own market intelligence.

Creating a quarterly price adjustment buffer in project budgets addresses the inherent uncertainty in TMT rod price forecasting. Most successful infrastructure projects incorporate a 5-7% contingency specifically for steel price variations. This buffer proves particularly valuable when dealing with specialty items like dowel bars, which may have less predictable supply chains.

Breaking down large steel requirements into scheduled purchases helps optimize pricing. Rather than committing to total quantities upfront, phased procurement allows leveraging favorable market conditions. This approach proves especially effective when the 8mm rod price per piece indicates an upcoming favorable buying window.

Timing Your Purchases Strategically

Price seasonality offers strategic buying opportunities. TMT rod price typically softens during monsoon months when construction activity naturally slows. Conversely, prices often strengthen during peak construction seasons. Planning major purchases during historically favorable periods can yield substantial savings.

Commodity futures markets provide valuable forward indicators. While not perfectly correlated, steel futures trends generally signal the direction of physical TMT rod price movements. Monitoring these financial markets helps anticipate price shifts 30-45 days before they materialize in actual quotations.

For specialized requirements like dowel bars, maintaining flexibility in specifications helps navigate price pressures. When certain grades or dimensions see price spikes, having pre-approved alternatives keeps projects moving without budget overruns. Similarly, tracking the 8mm rod price per piece across multiple suppliers identifies which vendors respond most rapidly to market shifts.

#TMT rod forecast#Price prediction#TMT price trend#Rod cost guide#Steel rate tips#Market rate TMT#Project cost plan#Steel price check#TMT rod rates#Rod price 2025#Steel cost plan#TMT pricing tips#Rate trend TMT#Forecast TMT rod#Construction cost#Steel trend 2025#Rod price tools#Price guide TMT#TMT rate update#Rod market watch

0 notes

Text

Why Analyzing Financial Data is Crucial for Your Trucking Business

Photo by Pixabay on Pexels.com If you’re having a tough time keeping your business on track. We get it—running a trucking company is no easy feat. There’s so much to juggle: maintenance, fuel costs, routes, driver management, and on top of that, financials. It’s overwhelming, and we know the last thing you want to think about is diving into those spreadsheets and financial reports. But let me…

View On WordPress

#accounting software#avoid bankruptcy#business#business decisions#business forecasting#business growth#business strategies#business success#cash flow management#cost savings#expense tracking#financial advisor#financial analysis#financial planning#financial tools#Freight#freight industry#Freight Revenue Consultants#fuel efficiency#increase profitability#logistics#optimize routes#profit margins#QuickBooks for truckers#reduce expenses#small business trucking#Transportation#truck fleet management#trucker tips#Trucking

0 notes

Note

genuinely curious but I don't know how to phrase this in a way that sounds less accusatory so please know I'm asking in good faith and am just bad at words

what are your thoughts on the environmental impact of generative ai? do you think the cost for all the cooling system is worth the tasks generative ai performs? I've been wrangling this because while I feel like I can justify it as smaller scales, that would mean it isn't a publicly available tool which I also feel uncomfortable with

the environmental impacts of genAI are almost always one of three things, both by their detractors and their boosters:

vastly overstated

stated correctly, but with a deceptive lack of context (ie, giving numbers in watt-hours, or amount of water 'used' for cooling, without necessary context like what comparable services use or what actually happens to that water)

assumed to be on track to grow constantly as genAI sees universal adoption across every industry

like, when water is used to cool a datacenter, that datacenter isn't just "a big building running chatgpt" -- datacenters are the backbone of the modern internet. now, i mean, all that said, the basic question here: no, i don't think it's a good tradeoff to be burning fossil fuels to power the magic 8ball. but asking that question in a vacuum (imo) elides a lot of the realities of power consumption in the global north by exceptionalizing genAI as opposed to, for example, video streaming, or online games. or, for that matter, for any number of other things.

so to me a lot of this stuff seems like very selective outrage in most cases, people working backwards from all the twitter artists on their dashboard hating midjourney to find an ethical reason why it is irredeemably evil.

& in the best, good-faith cases, it's taking at face value the claims of genAI companies and datacenter owners that the power usage will continue spiralling as the technology is integrated into every aspect of our lives. but to be blunt, i think it's a little naive to take these estimates seriously: these companies rely on their stock prices remaining high and attractive to investors, so they have enormous financial incentives not only to lie but to make financial decisions as if the universal adoption boom is just around the corner at all times. but there's no actual business plan! these companies are burning gigantic piles of money every day, because this is a bubble

so tldr: i don't think most things fossil fuels are burned for are 'worth it', but the response to that is a comprehensive climate politics and not an individualistic 'carbon footprint' approach, certainly not one that chooses chatgpt as its battleground. genAI uses a lot of power but at a rate currently comparable to other massively popular digital leisure products like fortnite or netflix -- forecasts of it massively increasing by several orders of magnitude are in my opinion unfounded and can mostly be traced back to people who have a direct financial stake in this being the case because their business model is an obvious boondoggle otherwise.

934 notes

·

View notes

Text

Jonathon Azzopardi, the president of the auto parts manufacturer Laval Tool, can see clear across the US-Canada border from his desk in Windsor, Ontario, just 4 miles from Detroit. This week, that view started to look much more expensive.

On Sunday, President Donald Trump said the US would begin to place 25 percent tariffs on goods imported across the Canadian and Mexican borders, a stunning reversal of decades of free trade across North America. Both nations threatened to retaliate with their own tariffs. Then, a last-minute reprieve: Late Monday, Trump said tariffs against both nations would “pause” as both nations pledge to boost their border security. The president has also suggested that Canada might avert tariffs by becoming the 51st state, a suggestion that has horrified Canadians.

Should that 25 percent tariff go through, coupled with retaliatory tariffs from Canada, it would add near-unmanageable costs to the firm, Azzopardi says, in part because some of its products cross the US-Canada border up to seven times during production.

Even with the pause, the future is still murky—and frightening.

“The uncertainty is actually a bit worse, because we don't know what's going to happen,” says Azzopardi.

The company’s predicament demonstrates the difficulty of many in the auto business, as the Trump administration’s scattershot and threat-heavy approach to foreign policy jeopardizes the complex—and expensive—supply chains that create the vehicles Americans drive every day.

In one example from Laval Tool, US-made steel comes from Pennsylvania and is used to make components that eventually become molds for car parts, which then gets sent back to the US for processing, which is then finished back in Canada, which is then used to make a car component like a hood, which is then sent back to the US to get added to other components in a specific order.

Tariffs on Canada and Mexico could affect some $225 billion in auto-related imports, according to the consultancy AlixPartners. A quarter of the 16 million vehicles sold in the US annually come from Canada or Mexico.

Tariffs could also substantially inflate the cost of manufacturing a new vehicle—by up to $6,250, according to S&P Global Mobility. Firms will have to decide which of those costs they can bear themselves and which they’ll pass on to consumers in the form of higher prices.

The tariff pause doesn't mean the auto industry’s headache has ended. Analysts say manufacturers are responding to the uncertainty around duties by buying ahead and by moving goods across the border while they’re still tariff-free. Companies on the other side of the border are reacting to an influx of orders by cramming and paying workers overtime, and fearing that doing work now will mean less to do in the future.

Getting those products to the US quickly is more expensive right now because many companies are moving goods at once, says Paul Isley, a professor of economics at the Seidman College of Business at Grand Valley State University who forecasts business conditions in Western Michigan, where many auto suppliers and automakers are based. Then, storing that extra inventory incurs holding costs. In the US, local companies are also responding by holding off on hiring, Isley says.

“Often, uncertainty is worse than a bad plan,” says Isley.

Azzopardi says Laval Tool is trying to decide whether it should change its prices, scramble to open some kind of US subsidiary that will help it avoid some tariffs, or absorb 100 percent of the tariff costs in the hopes of maintaining relationships with major automaking clients. “For a short period of time we could stomach a couple of blows, for a couple months,” he says.

The confusion is particularly taxing for the auto industry, whose complex supply chain spans not only continental borders but the globe. Widgets are added to gadgets are connected to wires are attached to sensors, all in a specific order, all coming together to create just one component—an instrument panel, a window switch, a camshaft, a valve—that then needs to be attached to thousands of other components. Some 18,000 suppliers contribute to one auto manufacturer’s vehicles, the consultancy McKinsey has estimated.

Mexico is home to major auto manufacturing and assembly plants from most major automakers, including Volkswagen, BMW, and Ford. (Chinese automakers are also reportedly looking for factory locations in Mexico; US automakers fear they will try this backdoor to enter the American market.) It is also a hub for the assembly of labor-intensive auto components, including wire harnesses and vehicle seats. Canada, meanwhile, produces some of General Motors’ most popular trucks. It’s also the home of many tool and die operations and some of the largest auto suppliers in the world, including Magna and Linamar.

Automakers are likely spending time calculating what it will cost to move supplier, assembly, or manufacturing operations back to the US. This is not just a matter of swapping one widget for another, which means responding to tariffs could take automakers months, if not years. Any component change requires testing and calibration, says Dan Hearsch, who leads the US automotive practice at AlixPartners, an industry consultant. “Vehicles carry people’s lives,” he says. “These things have to work, and they have to last. That’s what’s at risk when [automakers] don’t do the right thing when moving production or shifting supply.”

“This is a very tough spot for the auto industry,” Hearsch says. “Other industries can move production far more easily than we can.”

In Windsor, Azzopardi feels that Canadian suppliers are, for some reason, being punished for following the free trade rules established during President Trump’s last term. “Who’s to say if this is the new normal?" he says. “It’s changing how we do business with our biggest trading partner”—the United States.

12 notes

·

View notes

Text

[Fox News] Kamala Harris is once-in-a-generation candidate and this is a once-in-a-generation moment for America

From the sidewalks of Oakland to the halls of the White House, Kamala Harris’ story is the stuff dreams are made of…the American Dream. Because where else could the daughter of immigrants rise to the highest office in the land, shattering glass ceilings all along the way? Only in America.

Of course, she had plenty of examples to show her what was possible. Coming to America from India at only 19-years-old, her mother became a celebrated biologist. Her father had come from Jamaica, studied at UC Berkeley and became a renowned economist and professor at Stanford. So, they raised her not only to see what is and what has been, but to imagine what is possible — not who we are, but who we can be.

It worked because she thrived on that possibility. It took her to Vanier College in Montreal, Howard University and the University of California College of Law, San Francisco. It drove her to organize for justice. It helped her prosecute murderers and rapists as the District Attorney’s chief of the Career Criminal Division and eventually become San Francisco’s district attorney herself, then attorney general, U.S. senator and vice president.

It gave her the moral clarity to fight the big banks who paid for their own misdeeds by foreclosing on working families. It gave her the strength to fight for students and veterans who were taken advantage of by a for-profit education company and it gave her the tools to win bringing rent relief and badly needed resources to low-income communities during the COVID-19 pandemic, to deliver student debt relief to countless American, to help create millions of new jobs and more.

Now, because it’s her time and her turn, she is zooming through and into history and nobody deserves it more. Yes, we recognize that politics is a contact sport and we know that the attacks will come. In fact, some are coming already.

But we also recognize that a lot of the folks wearing different jerseys than we are keep running the same old plays of racism, bigotry, misogyny, ignorance and hate. From birtherism 2.0 and dismissing the vice president as a DEI hire, to claiming she “became Black” and purposefully mispronouncing her name, it’s clear that the closer we get to history, the louder and sicker they become.

That’s OK. She can take it because the contrast is easy to see.

It’s not just about the prosecutor vs. the felon or even the undeniable truth vs. rapid fire lies. It’s about progress vs extremism. It’s about who we can be.

Think about the landmark legislation Vice President Harris helped marshal through Congress and into law. Think about all the executive orders to raise wages, fight climate change, protect reproductive freedom and more that she helped make reality. Now compare that to the four years of deprivation and degradation we saw under Donald J. Trump.

Of course, elections are about the future forecast. So, compare former President Donald Trump’s all but official endorsement of the plans laid out in Project 2025 to President Harris signing a real bipartisan border security bill into law, protecting a woman’s right to control her own body and make her own health care decisions, extending the child tax credit that cut child poverty in half, building on the more than 15 million jobs she already helped create.

Compare Trump’s plan to declare martial law to President Harris strengthening the middle class, growing small businesses, expanding health care, keeping medical debt off your credit report and making sure no one raises taxes on Americans who make less than $400,000 per year.

While Harris knows that affordable internet is a must not a plus for all Americans, the MAGA Republicans refuse to fund the Affordable Connectivity Program. And while they’re screaming about imagined crises, we’re talking about raising wages, closing the wealth gap, lowering the cost of childcare and making sure getting sick doesn’t mean going broke.

That’s just a hint of the differences.

Simply put, Vice President Harris is a once-in-a-generation candidate who has generated more power and energy for this country than Duke Power. It’s been less than a month since she announced her campaign for president and she’s already unifying the Democratic base, expanding our coalition, stretching the map and forcing the Republicans to short circuit.

In less than two weeks, Vice President Harris has recruited nearly 200,000 volunteers, sparked nationwide grassroots organization, secured the Democratic nomination and raised $310 million, which is twice as much as Trump raised through all of July.

From campaign calls to rallies to local volunteers knocking on doors on a Saturday morning, folks are getting tuned in all across this nation like we’ve never seen before. It’s unprecedented. It’s historic.

Vice President Kamala Harris is a once-in-a-generation candidate and this is a once-in-a-generation moment for America. The choice is clear. Will we choose truth or lies? Will we choose hope or hate? Will we choose the future or be doomed to repeat the past?

Well, like the vice president says, we are not going back.

Antjuan Seawright is a Democratic political strategist, founder and CEO of Blueprint Strategy LLC and a senior visiting fellow at Third Way. Follow him on X, formerly known as Twitter @antjuansea.

11 notes

·

View notes

Text

Scaling with Confidence: Why South African Firms Choose The Finance Team

youtube

In the fast-paced world of modern business, financial leadership isn’t just about crunching numbers—it’s about crafting strategy, managing risk, and ensuring sustainable growth. For many companies in South Africa, especially small to medium enterprises (SMEs) and scaling organizations, hiring a full-time Chief Financial Officer (CFO) or financial director can be cost-prohibitive. Enter The Finance Team, a game-changer in the realm of financial leadership, offering part-time CFO services, interim financial management, and outsourced finance executives to companies that need high-level expertise—without the full-time overhead.

A Smarter Model for Financial Leadership The Finance Team was founded on a clear mission: to deliver flexible, scalable, and expert financial management solutions to South African businesses. The traditional CFO role is evolving. Today, companies demand more agility, especially in times of change or during critical growth phases. The Finance Team meets this need by offering part-time financial directors, virtual CFOs, and interim financial managers who step in exactly when needed.

This model allows businesses to plug in executive-level financial talent without a long-term commitment. Whether it’s overseeing a high-stakes project, managing a business turnaround, or providing strategic guidance during a funding round, The Finance Team’s professionals bring the experience and insight to get the job done—efficiently and effectively.

Expertise Without Compromise One of the major advantages of partnering with The Finance Team is the depth and breadth of expertise their professionals bring. These are not junior-level accountants—they are seasoned financial executives with decades of experience in a wide range of industries. From manufacturing and retail to tech startups and professional services, their team has the ability to adapt quickly and deliver results.

Their financial strategy consulting services are particularly valuable for companies navigating complex decisions like mergers and acquisitions, cash flow forecasting, or business expansion. Clients gain access to clear, actionable insights that drive decision-making and minimize risk.

Virtual CFO Services: Financial Clarity in a Digital World With the rise of remote work and digital transformation, the need for virtual CFO services has never been greater. The Finance Team has embraced this shift, offering virtual support that keeps businesses financially sharp without needing to house an executive in-office. This is particularly beneficial for SMEs in more remote areas of South Africa or those looking to cut infrastructure costs while maintaining high-level oversight.

Virtual CFOs from The Finance Team don’t just monitor finances—they provide real-time analysis, proactive planning, and leadership that aligns financial goals with broader business objectives. They can oversee finance teams, advise on tax planning, lead budgeting processes, and liaise with investors or banks—all from a remote setting.

Project Accounting and Interim Solutions There are moments in a company’s journey where additional financial muscle is crucial—during a major rollout, audit preparation, ERP implementation, or even during leadership transitions. The Finance Team’s project accounting services and interim financial managers help companies navigate these temporary but critical phases with ease.

Instead of hiring a full-time executive for a short-term need, clients can rely on The Finance Team to provide the right person, for the right project, at the right time. This lean and cost-effective approach has made them a go-to solution for businesses facing change, complexity, or growth.

Helping South African Businesses Scale with Confidence At its core, The Finance Team is a financial management consultancy committed to empowering businesses with the tools, knowledge, and leadership needed to scale. By removing the traditional constraints of hiring full-time CFOs or directors, they unlock opportunities for companies to focus on what they do best—while leaving the numbers in expert hands.

South Africa’s business landscape is dynamic, filled with both challenge and opportunity. Whether it’s navigating inflationary pressures, exploring international markets, or preparing for regulatory shifts, having a strategic financial partner can make all the difference.

Final Thoughts For companies seeking flexible financial leadership that’s both strategic and cost-efficient, The Finance Team offers a compelling solution. Their model isn’t just about filling a role—it’s about providing real value at the executive level. With services like virtual CFO, interim financial management, financial strategy consulting, and project-based accounting, they’re helping South African businesses unlock new levels of performance and profitability.

If your organization is ready to make smarter financial decisions, streamline operations, and scale confidently into the future, The Finance Team is ready to step in—and lead.

#The Finance Team#part-time CFO services#interim financial management#virtual CFO South Africa#financial strategy consulting#part-time financial director#interim financial manager#project accounting services#Youtube

2 notes

·

View notes

Text

Vigil: Space weather reporter launches in deep space

Space weather probe Vigil will be the world's first space weather mission to be permanently positioned at Lagrange point 5, a unique vantage point that allows us to see solar activity days before it reaches Earth. ESA's Vigil mission will be a dedicated operational space weather mission, sending data 24/7 from deep space.

Vigil's tools as a space weather reporter at its unique location in deep space will drastically improve forecasting abilities. From there, Vigil can see "around the corner" of the sun and observe activity on the surface of the sun days before it rotates into view from Earth. It can also watch the Sun-Earth line side-on, giving an earlier and clearer picture of coronal mass ejections (CMEs) heading toward Earth.

Radiation, plasma and particles flung towards Earth by the sun can pose a very real risk to critical infrastructure our society relies on. This includes satellites for navigation, communications and banking services as well as power grids and radio communication on the ground.

A report by Lloyd's of London estimates that a severe space weather event, caused by such an outburst of solar activity, could cost the global economy 2.4 trillion dollars over five years

ESA's response to this growing threat is Vigil, a cornerstone mission of the agency's Space Safety Program, planned for launch in 2031. Vigil's data will give us drastically improved early warnings and forecasts, which in turn help protect satellites, astronauts and critical infrastructure on the ground that we all depend on.

3 notes

·

View notes

Text

How ERP Software for Engineering Companies Improves Operational Efficiency

In today's competitive market, engineering companies are under immense pressure to deliver innovative solutions, maintain cost-efficiency, and meet tight deadlines—all while ensuring the highest standards of quality. As the engineering industry becomes more complex and digitally driven, operational efficiency has become a key metric for success. One of the most transformative tools driving this change is ERP (Enterprise Resource Planning) software.

For companies seeking to streamline their operations, ERP software for engineering companies provides a centralized platform that integrates every function—ranging from procurement, design, production, finance, HR, and project management. In India, especially in industrial hubs like Delhi, the demand for such software is growing rapidly. Let us explore how ERP systems significantly enhance operational efficiency and why choosing the right ERP software company in India is vital for engineering enterprises.

Centralized Data Management: The Foundation of Efficiency

One of the major challenges engineering companies face is managing vast amounts of data across departments. Manual entries and siloed systems often lead to redundancies, errors, and miscommunication. With ERP software for engineering companies in India, organizations gain access to a unified database that connects all operational areas.

Real-time data availability ensures that everyone, from the design team to procurement and finance, is working with the latest information. This reduces rework, improves collaboration, and speeds up decision-making, thereby increasing efficiency.

Streamlined Project Management

Engineering projects involve numerous stages—from planning and design to execution and maintenance. Tracking timelines, resources, costs, and deliverables manually or via disparate systems often results in delays and budget overruns.

Modern engineering ERP software companies in Delhi provide robust project management modules that allow firms to plan, schedule, and monitor projects in real time. This includes milestone tracking, Gantt charts, resource allocation, and budget forecasting. Managers can gain visibility into bottlenecks early on and reallocate resources efficiently, ensuring timely delivery.

Automation of Core Processes

Automating routine tasks is one of the key advantages of implementing ERP software. From generating purchase orders and invoices to managing payroll and inventory, ERP eliminates the need for repetitive manual work. This not only saves time but also minimizes human error.

The best ERP software provider in India will offer customizable automation workflows tailored to the specific needs of engineering companies. For instance, when a material stock reaches a minimum threshold, the ERP system can automatically generate a requisition and notify the purchasing team. This ensures zero downtime due to material shortages.

Enhanced Resource Planning and Allocation

Resource planning is crucial in engineering projects where labour, materials, and machinery must be utilized efficiently. A good ERP software for engineering companies provides detailed insights into resource availability, utilization rates, and project requirements.

By analysing this data, companies can better allocate resources, avoid overbooking, and reduce idle time. This leads to significant cost savings and ensures optimal productivity across the board.

youtube

Integration with CAD and Design Tools

Many ERP solution providers in Delhi now offer integration with design and CAD software. This is particularly useful for engineering firms where design data is often needed for procurement, costing, and production.

When ERP is integrated with CAD, design changes automatically reflect across related departments. This seamless flow of information eliminates miscommunication and ensures that downstream processes such as procurement and manufacturing are aligned with the latest design specifications.

Real-time Cost and Budget Management

Keeping engineering projects within budget is a continuous challenge. Unexpected costs can arise at any stage, and without proper monitoring, they can spiral out of control. ERP software providers in India equip engineering companies with real-time budget tracking tools.

From initial cost estimation to actual expenditure, companies can monitor every aspect of the financials. Alerts can be configured for budget deviations, helping management take corrective action promptly. This financial control is a cornerstone of operational efficiency and long-term profitability.

Improved Compliance and Documentation

Engineering companies must adhere to various compliance standards, certifications, and audit requirements. Maintaining accurate documentation and audit trails is critical. ERP systems automate compliance tracking and generate necessary documentation on demand.

By partnering with trusted ERP software companies in Delhi, engineering firms can ensure they meet industry standards with minimal administrative overhead. Features like document versioning, digital signatures, and compliance checklists help organizations stay audit-ready at all times.

Scalable and Future-ready Solutions

One of the biggest advantages of working with a reputed engineering ERP software company in Delhi is access to scalable solutions. As engineering businesses grow, their operational complexities increase. Modern ERP systems are modular and scalable, allowing businesses to add new functionalities as needed without disrupting existing operations.

Moreover, cloud-based ERP solutions offer flexibility, remote access, and lower infrastructure costs. These are especially beneficial for engineering companies that operate across multiple locations or work on-site with clients.

Enhanced Customer Satisfaction

Efficient operations lead to improved delivery timelines, better quality products, and faster customer service—all of which directly impact customer satisfaction. With ERP, engineering companies can maintain accurate production schedules, meet delivery deadlines, and respond to customer queries with real-time information.

By choosing the right ERP software for engineering companies in India, firms not only improve internal operations but also build a strong reputation for reliability and professionalism among their clients.

Choosing the Right ERP Partner

With the growing number of ERP solution providers in India, selecting the right partner is crucial. Here are a few factors to consider:

Domain Expertise: Choose a vendor with experience in the engineering sector.

Customization: The software should be tailored to suit your specific workflows.

Scalability: Ensure the ERP solution grows with your business.

Support & Training: Opt for companies that provide ongoing support and employee training.

Integration Capabilities: Check whether the ERP can integrate with your existing systems, including CAD tools, financial software, etc.

Trusted ERP software companies in Delhi like Shantitechnology (STERP) stand out because they offer deep industry knowledge, scalable platforms, and dedicated customer support—making them ideal partners for engineering businesses seeking to transform operations.

youtube

Final Thoughts

In a rapidly evolving business landscape, engineering companies must adopt smart technologies to stay ahead. ERP software is not just an IT solution—it is a strategic tool that can redefine how engineering firms manage their projects, people, and performance.

From streamlining project workflows and automating routine tasks to enhancing collaboration and boosting resource efficiency, ERP solutions deliver measurable gains across the organization. For those looking to make a digital leap, partnering with a top-rated ERP software company in India can be the difference between stagnation and scalable success.

Looking for a reliable ERP partner? Shantitechnology (STERP) is among the leading ERP solution providers in Delhi, offering tailored ERP software for engineering companies to help you boost productivity, reduce costs, and grow sustainably. Contact us today to learn more!

#Engineering ERP software company#ERP software for engineering companies in India#ERP solution providers#ERP software for engineering companies#ERP software companies#ERP software providers in India#Gujarat#Maharashtra#Madhyapradesh#ERP solution providers in India#ERP for manufacturing company#Delhi#Hyderabad#ERP Software#Custom ERP#ERP software company#Manufacturing enterprise resource planning software#Bengaluru#ERP software company in India#Engineering ERP Software Company#Best ERP software provider in India#Manufacturing ERP software company#Manufacturing enterprise resource planning#ERP modules for manufacturing industry#Best ERP for manufacturing industry#India#Youtube

5 notes

·

View notes

Text

Field service businesses are undergoing a remarkable transformation, driven by cutting-edge technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). These innovations are reshaping operations, enhancing customer satisfaction, and creating a more efficient workforce. Here’s a comprehensive look at how AI and IoT are revolutionizing the field service industry.

1. Predictive Maintenance

Traditionally, field service operations relied on reactive or scheduled maintenance, leading to downtime and unnecessary costs. AI and IoT have introduced predictive maintenance, which uses real-time data from IoT-connected devices to anticipate issues before they arise.

IoT Sensors: These devices monitor equipment health, providing data on performance, temperature, vibration, and more.

AI Analysis: AI algorithms analyze this data to predict when a failure might occur, enabling proactive repairs.

Benefits: Reduced downtime, lower maintenance costs, and extended equipment lifespan.

2. Smart Scheduling and Dispatching

Field service businesses often face challenges in managing teams and allocating resources efficiently. AI-powered tools are transforming scheduling and dispatching by automating these processes.

Dynamic Scheduling: AI considers factors like technician availability, skill sets, and location to assign tasks optimally.

Real-Time Adjustments: IoT devices provide live updates, allowing AI to reassign tasks based on changing conditions.

Benefits: Improved workforce utilization, faster response times, and enhanced customer satisfaction.

3. Enhanced Remote Support

IoT and AI are enabling technicians to diagnose and resolve issues remotely, reducing the need for on-site visits.

IoT Connectivity: Devices send real-time diagnostic data to field service teams.

AI Chatbots: AI-powered virtual assistants guide customers or technicians through troubleshooting steps.

Benefits: Cost savings, quicker problem resolution, and minimized service disruptions.

4. Inventory and Asset Management

Managing parts and tools is critical for field service efficiency. AI and IoT are streamlining inventory and asset management.

IoT-Enabled Tracking: Devices track inventory levels and asset usage in real time.

AI Optimization: AI predicts demand for parts and tools, ensuring optimal stock levels.

Benefits: Reduced inventory costs, fewer delays, and better resource planning.

5. Improved Customer Experience

Customer satisfaction is at the heart of field service businesses. AI and IoT are enhancing the customer experience by providing timely, personalized, and seamless interactions.

Proactive Communication: AI sends automated updates on service schedules and equipment status.

IoT Insights: Customers gain real-time visibility into the status of their equipment via IoT dashboards.

Benefits: Higher customer trust, loyalty, and retention.

6. Data-Driven Decision Making

The combination of AI and IoT generates vast amounts of actionable data, empowering businesses to make informed decisions.

Performance Analytics: AI identifies trends and inefficiencies in operations.

Predictive Insights: IoT data helps forecast future needs and challenges.

Benefits: Better strategic planning, resource allocation, and operational efficiency.

Conclusion

The integration of AI and IoT is revolutionizing field service businesses by improving operational efficiency, reducing costs, and delivering exceptional customer experiences. Companies that embrace these technologies are positioning themselves for long-term success in an increasingly competitive market.

By adopting AI and IoT solutions, field service businesses can move from reactive to proactive operations, paving the way for innovation and growth.

#AI#IoT#AI and IoT#field service#field service industry#field service management#fields service software

2 notes

·

View notes

Text

Optimising Revenue with Smart Dynamic Pricing for Hotels

Mastering Dynamic Pricing Strategies for Accommodations

Learn how dynamic pricing can transform your room revenue. Discover proven strategies, tools, and tips to master real-time rate optimisation.

In the ever-evolving world of hospitality, pricing is more than a number — it’s a strategy. With customer behaviour and market conditions changing in real time, static pricing models not the right choice to improve profitability. That’s where Dynamic Pricing comes in.

This blog will help you understand what dynamic pricing is, why it’s vital for Hotel Industry, and how to implement it effectively to maximise Revenue and Profitability.

What Is Dynamic Pricing?

Dynamic pricing means fluctuations in the price points depending on various factors like Seasonality, Demand Levels, Market Condition, Socio-economic situation, Weather Forecast, etc. All the other Rates are derived from the parent rate. When we fluctuate the parent rate, all the rate plans connected to the parent rate plan will update automatically.

Latest trends shows offline Travel Agents & Negotiated Corporate clients are also moving to Dynamic Pricing model.

Benefits of Dynamic Pricing

Maximise ADR over High Demand days/period

Maximise RevPAR through Occupancy over Low Demand days/period

Time saving- update only parent rate plan, all the derived rate plans will update automatically

Low probability of making a mistake while updating Price Points

Key Factors That Influence Pricing

Pricing decisions should be based on data-driven insights. Key variables include:

Demand trends (holidays, events, weather)

Booking windows (how far in advance people book)

Competitor pricing (Monitor fluctuating price points)

Inventory levels (room availability)

Market segments (Corporate vs Leisure, Groups vs FIT, Social vs Business)

Proven Dynamic Pricing Strategies for Hotels & Rentals

✅ Use Price Sensitivity to Guide Changes

Understand how price-sensitive your guests are. For example, leisure travellers are more responsive to discounts, while business travellers may prioritise convenience over cost.

✅ Set Rate differentiated Pricing

Create and Implement Retail Pricing Strategy to cater to a larger target Audience. Example:

Advance Purchase Rate with non-refundable cancellation policy at a discounted Rate for Early bookers.

Minimum LOS Rate at a discounted Rate for bookers staying for a longer stay.

Value add-ons Add Breakfast, Lunch, Dinner, Spa, etc to create a value Package

✅ Monitor Competitor Pricing

Monitoring Competitor Price Point fluctuations gives us an indication of the Market Demand Levels. Automated Rate Shopping Tool helps the Hotels to keep a close watch on Competitor Pricing behaviour.

Conclusion

Mastering dynamic pricing is about being proactive, strategic, and data-driven. When done right, it empowers you to:

Maximise RevPAR

Improve profitability during both peak and off-peak periods

Whether you’re managing a boutique hotel, a resort, or short-term rentals, embracing dynamic pricing is critical.

Need help implementing dynamic pricing for your property?

Collaborate with RedSKY Hospitality revenue management specialists or take advantage of Precium Automated Pricing Solutions to maximise your property’s Revenue potential.

#hotel revenue management#precium#revenue management#software#precium software#rate shopping software#revenue manager#revenue management system#rms#dynamic pricing

3 notes

·

View notes

Text

How a Residential Estimating Service Helps with Future Property Tax Forecasting

Property taxes represent a significant ongoing expense for homeowners and real estate investors alike. Accurate forecasting of future property tax liabilities is essential for effective financial planning and investment analysis. A residential estimating service can provide invaluable assistance in this process by helping to estimate the impact of home improvements, renovations, and property value changes on future property taxes. By integrating cost estimating expertise with local tax assessment knowledge, these services support better budget management and strategic decision-making.

Understanding Property Tax Assessments

Property taxes are typically calculated based on the assessed value of a home multiplied by the local tax rate. Assessors determine this value by considering factors such as location, size, condition, and recent improvements. When a property undergoes renovations or expansions, its assessed value often increases, resulting in higher taxes.

Estimating how different project scopes will affect assessed value—and thus taxes—can be complex. This is where a residential estimating service becomes an important asset.

Linking Renovation Costs to Property Value

A residential estimating service provides detailed breakdowns of renovation and improvement costs, allowing homeowners and investors to understand the scale and investment of their projects. When combined with local market data and appraisal trends, these cost estimates help predict potential increases in assessed value.

For example, upgrading a kitchen or adding a new bathroom usually boosts a home’s market value, but the degree varies by region and property type. Estimating services analyze these nuances, giving clients realistic projections of how their improvements might influence property taxes.

Forecasting Tax Impact Before Project Initiation

Planning renovations without understanding the tax consequences can lead to unexpected financial burdens after project completion. A residential estimating service enables clients to simulate various renovation options and forecast the associated tax changes.

This foresight helps homeowners prioritize projects that provide the best balance between added value and tax impact or decide whether smaller, less intrusive improvements might be preferable to maintain manageable tax bills.

Incorporating Local Tax Rates and Policies

Tax rates, exemptions, and reassessment cycles differ widely across municipalities. A residential estimating service often collaborates with local tax experts or incorporates updated tax data to ensure forecasts reflect current policies.

This level of precision helps clients avoid surprises from tax rate increases, reassessment triggers, or expiration of exemptions tied to renovations.

Supporting Investment and Cash Flow Planning

For real estate investors, property tax forecasting is crucial to maintain positive cash flow and accurate return on investment calculations. Unexpected tax hikes can reduce profit margins or require additional capital reserves.

By providing reliable tax impact projections based on renovation costs and property valuation trends, residential estimating services allow investors to factor property tax changes into their financial models, loan applications, and budgets.

Enhancing Negotiations and Purchase Decisions

When acquiring properties that need renovation, understanding potential future tax increases can influence offer prices and investment strategies. A residential estimating service supports buyers by estimating post-renovation tax liabilities, helping to evaluate the true cost of ownership.

This insight strengthens negotiation positions and reduces the risk of overpaying for properties with hidden tax-related costs.

Planning for Long-Term Financial Stability

Homeowners preparing for long-term residence or retirement benefit from tax forecasting as part of comprehensive financial planning. Residential estimating services help project how planned improvements may affect property taxes years in advance, allowing for smarter budgeting and lifestyle decisions.

Such forward-thinking reduces stress and avoids financial surprises during retirement or fixed-income periods.

Documentation for Appeals and Exemptions

If property owners believe their assessed value or tax bills are unfairly high, having detailed cost estimates and valuation data can support appeals or applications for tax exemptions.

A residential estimating service’s documentation provides credible evidence of construction costs and property conditions, strengthening cases before local tax authorities.

Conclusion

Property tax forecasting is a complex but essential aspect of homeownership and real estate investment. A residential estimating service bridges the gap between renovation costs and tax implications, offering accurate, localized projections that enable smarter budgeting, investment decisions, and long-term financial planning.

By leveraging this expertise, homeowners and investors reduce risk, optimize their renovation strategies, and maintain better control over one of the most significant recurring property expenses.

#residential estimating service#property tax forecasting#renovation tax impact#property tax estimate#real estate tax planning#home improvement cost estimate#tax assessment forecasting#property tax budgeting#local tax rates#renovation cost analysis#real estate investment tax#property value estimate#tax increase prediction#residential renovation taxes#tax exemption planning#assessed value forecast#tax appeal documentation#renovation budgeting#property tax management#home renovation taxes#real estate cash flow#property tax risk#renovation financial planning#tax impact simulation#tax liability estimate#real estate tax strategies#property tax advice#tax rate changes#renovation cost forecast#tax budgeting tool

0 notes

Text

Predicting Employee Attrition: Leveraging AI for Workforce Stability

Employee turnover has become a pressing concern for organizations worldwide. The cost of losing valuable talent extends beyond recruitment expenses—it affects team morale, disrupts workflows, and can tarnish a company's reputation. In this dynamic landscape, Artificial Intelligence (AI) emerges as a transformative tool, offering predictive insights that enable proactive retention strategies. By harnessing AI, businesses can anticipate attrition risks and implement measures to foster a stable and engaged workforce.

Understanding Employee Attrition

Employee attrition refers to the gradual loss of employees over time, whether through resignations, retirements, or other forms of departure. While some level of turnover is natural, high attrition rates can signal underlying issues within an organization. Common causes include lack of career advancement opportunities, inadequate compensation, poor management, and cultural misalignment. The repercussions are significant—ranging from increased recruitment costs to diminished employee morale and productivity.

The Role of AI in Predicting Attrition

AI revolutionizes the way organizations approach employee retention. Traditional methods often rely on reactive measures, addressing turnover after it occurs. In contrast, AI enables a proactive stance by analyzing vast datasets to identify patterns and predict potential departures. Machine learning algorithms can assess factors such as job satisfaction, performance metrics, and engagement levels to forecast attrition risks. This predictive capability empowers HR professionals to intervene early, tailoring strategies to retain at-risk employees.

Data Collection and Integration

The efficacy of AI in predicting attrition hinges on the quality and comprehensiveness of data. Key data sources include:

Employee Demographics: Age, tenure, education, and role.

Performance Metrics: Appraisals, productivity levels, and goal attainment.

Engagement Surveys: Feedback on job satisfaction and organizational culture.

Compensation Details: Salary, bonuses, and benefits.

Exit Interviews: Insights into reasons for departure.

Integrating data from disparate systems poses challenges, necessitating robust data management practices. Ensuring data accuracy, consistency, and privacy is paramount to building reliable predictive models.

Machine Learning Models for Attrition Prediction

Several machine learning algorithms have proven effective in forecasting employee turnover:

Random Forest: This ensemble learning method constructs multiple decision trees to improve predictive accuracy and control overfitting.

Neural Networks: Mimicking the human brain's structure, neural networks can model complex relationships between variables, capturing subtle patterns in employee behavior.

Logistic Regression: A statistical model that estimates the probability of a binary outcome, such as staying or leaving.

For instance, IBM's Predictive Attrition Program utilizes AI to analyze employee data, achieving a reported accuracy of 95% in identifying individuals at risk of leaving. This enables targeted interventions, such as personalized career development plans, to enhance retention.

Sentiment Analysis and Employee Feedback

Understanding employee sentiment is crucial for retention. AI-powered sentiment analysis leverages Natural Language Processing (NLP) to interpret unstructured data from sources like emails, surveys, and social media. By detecting emotions and opinions, organizations can gauge employee morale and identify areas of concern. Real-time sentiment monitoring allows for swift responses to emerging issues, fostering a responsive and supportive work environment.

Personalized Retention Strategies

AI facilitates the development of tailored retention strategies by analyzing individual employee data. For example, if an employee exhibits signs of disengagement, AI can recommend specific interventions—such as mentorship programs, skill development opportunities, or workload adjustments. Personalization ensures that retention efforts resonate with employees' unique needs and aspirations, enhancing their effectiveness.

Enhancing Employee Engagement Through AI

Beyond predicting attrition, AI contributes to employee engagement by:

Recognition Systems: Automating the acknowledgment of achievements to boost morale.

Career Pathing: Suggesting personalized growth trajectories aligned with employees' skills and goals.

Feedback Mechanisms: Providing platforms for continuous feedback, fostering a culture of open communication.

These AI-driven initiatives create a more engaging and fulfilling work environment, reducing the likelihood of turnover.

Ethical Considerations in AI Implementation

While AI offers substantial benefits, ethical considerations must guide its implementation:

Data Privacy: Organizations must safeguard employee data, ensuring compliance with privacy regulations.

Bias Mitigation: AI models should be regularly audited to prevent and correct biases that may arise from historical data.

Transparency: Clear communication about how AI is used in HR processes builds trust among employees.

Addressing these ethical aspects is essential to responsibly leveraging AI in workforce management.

Future Trends in AI and Employee Retention

The integration of AI in HR is poised to evolve further, with emerging trends including:

Predictive Career Development: AI will increasingly assist in mapping out employees' career paths, aligning organizational needs with individual aspirations.

Real-Time Engagement Analytics: Continuous monitoring of engagement levels will enable immediate interventions.

AI-Driven Organizational Culture Analysis: Understanding and shaping company culture through AI insights will become more prevalent.

These advancements will further empower organizations to maintain a stable and motivated workforce.

Conclusion

AI stands as a powerful ally in the quest for workforce stability. By predicting attrition risks and informing personalized retention strategies, AI enables organizations to proactively address turnover challenges. Embracing AI-driven approaches not only enhances employee satisfaction but also fortifies the organization's overall performance and resilience.

Frequently Asked Questions (FAQs)

How accurate are AI models in predicting employee attrition?

AI models, when trained on comprehensive and high-quality data, can achieve high accuracy levels. For instance, IBM's Predictive Attrition Program reports a 95% accuracy rate in identifying at-risk employees.

What types of data are most useful for AI-driven attrition prediction?

Valuable data includes employee demographics, performance metrics, engagement survey results, compensation details, and feedback from exit interviews.

Can small businesses benefit from AI in HR?

Absolutely. While implementation may vary in scale, small businesses can leverage AI tools to gain insights into employee satisfaction and predict potential turnover, enabling timely interventions.

How does AI help in creating personalized retention strategies?

AI analyzes individual employee data to identify specific needs and preferences, allowing HR to tailor interventions such as customized career development plans or targeted engagement initiatives.

What are the ethical considerations when using AI in HR?

Key considerations include ensuring data privacy, mitigating biases in AI models, and maintaining transparency with employees about how their data is used.

For more Info Visit :- Stentor.ai

2 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Why Infor SyteLine ERP Is Ideal for Mid-Market Manufacturers & Service Providers

When electronics and other mid-market manufacturers want their ERP system to enable growth and create a new competitive advantage, they rely upon Infor Infor SyteLine, also known as CloudSuite Industrial (CSI).

When service and rental equipment providers want their ERP system to enable their growth into world-class service organizations and empower field technicians with data at their fingertips, they also rely upon Infor Infor SyteLine CSI.

We’ve all heard the horror stories of failed ERP implementations so, when manufacturers and service providers want SyteLine ERP successfully implemented—and guaranteed—they rely upon Bridging Business Technology Solutions (BBTS).

An ERP Ideal for Manufacturers

Infor SyteLine is the primary ERP we support because it’s ideal for use by discrete and process manufacturers, especially electronics manufacturers. We also guarantee the success of your Infor SyteLine implementation whether you’re commissioning an ERP system for the first time or replacing your current system, so you can cross the risk of a failed implementation off your list of worries.

SyteLine also can be customized to recognize customer-owned inventory and allocate it only to that customer so you don’t have a unique part number for the same part used by multiple customers. You can also reserve stock for specific products of the same customer or reserve any part in your inventory for a specific order until the order is released.

SyteLine delivers the same type of functionality as SAP and Oracle for a fraction of the cost and headache of implementing a tier 1 ERP system.

An ERP Ideal for Service Providers

Infor SyteLine is the primary ERP we support because it’s a perfect fit for service providers, especially those who rent equipment. We also guarantee the success of your Infor SyteLine implementation. So, whether you’re commissioning an ERP system for the first time or replacing your current system, you don’t have to worry about the disruption of a failed implementation.

Among the biggest benefits of SyteLine for service providers is no longer having to enter data multiple times into disparate systems. Working with common data means that everyone works from the same real-time information, which:

Empowers your service technicians to complete more service orders

Enables your employees to spend more time building relationships with customers

Gives your managers the tools to analyze data and find strategic growth opportunities

SyteLine delivers the same type of functionality as SAP and Oracle for a fraction of the cost and none of the headaches associated with implementing a tier 1 ERP system.

Successful Implementations, Guaranteed

The BBTS team has implemented SyteLine successfully over 165 times since 2013 with a proven ERP implementation process that begins with improving inventory control, planning and forecasting, financial close, and other business processes. SyteLine then standardizes these process best practices and ensures they are followed.

BBTS also provides post-implementation SyteLine enhancements, upgrades, business process improvements, and workflow optimization so you get the most out of your SyteLine investment.

Get Started Today

To determine if SyteLine ERP is right for you, we will connect you with one of our implementation experts as part of a process review. A successful implementation begins with understanding your core business processes, then recreating and evolving them in SyteLine.

Together, we can determine how you will benefit from SyteLine and calculate a target return on investment (ROI) to help justify the move. Contact us to learn more about SyteLine and how we are able to guarantee a successful ERP implementation when so many fail. You can also take advantage of the process review offer.

#erp software#infor#syteline#cloudsuite industrial (CSI)#manufacturing#service providers#customer owned inventory

8 notes

·

View notes