#Expanded Graphite Industry Outlook

Explore tagged Tumblr posts

Text

Expanded Graphite Market - Forecast(2025 - 2031)

Expanded Graphite Market Overview

Expanded graphite market size is forecast to reach US$308.2 million by 2027, after growing at a CAGR of 7.8% during 2022-2027. Expanded graphite is layered graphite with interlayer space which is altered. Carbon nanotubes are often employed in combination with expanded graphite as flame retardant additives because they have excellent thermal conductivity, this property is creating a growth opportunity for the market growth. Also, the high thermal property makes expanded graphite ideal for the phase change material application. Moreover, the expanded graphite market is majorly driven by the growth of construction activities across the world, because it is utilized as flame retardant additives in roofing, construction materials, and more. Also, the increasing application of expanded graphite in the electronics industry is expected to fuel the growth of the expanded graphite industry during the forecast period.

COVID-19 Impact

In the year 2020, to curb the rising cases of Corona Virus there were increasingly stringent regulations imposed by the major economies of the world. As a result, there was a decline in construction activities across the world. For instance, according to European Construction Industry Federation (FIEC) in Hungary, the construction output fell by 9.1 percent in 2020, totaling €12.2 billion (US$13.82 billion), compared to 2019. Moreover, Australian infrastructure projects such as the Chatswood-Bankstown metro line, the Westconnex motorway, and other projects were halted because of the Covid-19 pandemic. Hence, due to the decline of construction output, there was a decline in the demand for the expanded graphite, this negatively impacted the market growth. Nevertheless, in the year 2021, with the ease of Covid-related regulations, the expanded graphite market growth improved. Furthermore, in the future, the impact of the Covid-19 pandemic will be phased away. This will result in the expanded graphite industry growth scenario as it was before the pre-Covid time.

Report Coverage

The report: "Expanded Graphite Market Report –Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Expanded Graphite Industry.

By Packaging Form: Coil-Form, Gasket Form, Weave Form, and Others. By Carbon Purity:85% to 89%, 90% to 94%, 95% to 99%, and 99.5% to 99.95%. By Application: Fire Retardant Additives, Graphite Foil, Sheet, Gaskets, Bearings, Molded Parts, Refractories, Greases, Atomic Vitality, Roofing, Construction Material, Rubber, Polyolefin Resin, Li-particle Battery, Thermoplastics, and Others. By Application: Building and Construction (Residential, Commercial, Industrial, and Infrastructure Development), Metallurgy, Paints and Coatings (Industrial Coating, Special Coating, and Others), Automotive (Passenger cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)), Chemical and Petrochemical, Power Generation (Electricity Generation, Atomic Energy, and Others), Electronics and Electrical (Semiconductors, Photovoltaic, Transmitters, and Others), Healthcare and Pharmaceuticals, Textile, Water and Wastewater Treatment, and Others. By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East (Saudi Arabia, UAE, Israel, and Rest of Middle East), and Africa (South Africa, Nigeria, and Rest of Africa)).

Request Sample

Key Takeaways

Asia-Pacific region dominated the expanded graphite market, owing to the growing construction activities in the region. For instance, development on the US$4,335 million Zhangzhou Development Zone Shuangyu Island Secondary Development in China started in the 2nd quarter of 2021 and will be finished in the 3rd quarter of 2025.

The Surging adoption of expanded graphite as a constituent in various applications such as coatings, rubber products, energy storage systems, and more such applications is anticipated to fuel the expanded graphite industry growth during the forecast period.

Moreover, the expanding use of expanded graphite in automotive components such as gaskets, batteries, and more is driving up the growth of the market.

However, the high temperature of the expanded graphite makes the handling process difficult, this factor is restricting the market growth.

Expanded Graphite Market Segment Analysis – By Application

The fire retardant additives held a significant share in the expanded graphite market in 2021 and is projected to grow at a CAGR of 7.6% during 2022-2027. The expanded graphite has the superior qualities of thermal conductivity which make it ideal for application in the textile industry as well as building and construction activities. Moreover, expanded graphite has beneficial properties such as lightness, resistance to heat, superior corrosion, and other similar properties because of these properties expanded graphite application as a fire-resistant additive is increasing. Thus, the application of expanded graphite as fire-retardant additives is increasing, which is propelling the growth of the expanded graphite market growth.

Inquiry Before Buying

Expanded Graphite Market Segment Analysis – By End-Use Industry

The building and construction held a significant share in the expanded graphite market in 2021 and is forecasted to grow at a CAGR of 8.3% during 2022-2027. The expanded graphite is an ecologically viable material making it ideal for application in the building and construction sector. Moreover, a tightening of the ban on dangerous fires-resistant materials, such as brominated or asbestos-based fire-resistant materials is anticipated to fuel the growth of expanded graphite materials. The increasing construction activities across the world is projected to bolster market growth. For instance, the increasing commercial building projects such as Kompass district residential and commercial development 2023, 'Gut Miteinander' community center in Jena2022, Jena high-quality offices in a historic setting 2022 are under construction in Germany. Also, as of March 2022, the construction plan has been approved for the Hub office development project in Canada valued at US$300 million, this project is expected to be completed by the end of 2026. In September 2019, construction work started on the city of Toronto Recreational Facilities accessibility upgrades projects in Canada valued at US$150 million, and this project will be completed by the start of 2025. The increase in the construction of such projects is expected to fuel the demand for expanded graphite. Hence, the growing building and construction activities across the world are projected to accelerate the market growth.

Expanded Graphite Market Segment Analysis – By Geography

Asia-Pacific held the largest share in the Expanded Graphite market in 2021 up to 41%. The growth of the Asia-Pacific economy is driven by the growth of the major sectors such as building & construction, chemicals, and metallurgy sectors. For instance, as of February 2022, major commercial construction projects in Vietnam such as Tan Son Nhat Airport 3rd Terminal will be completed by mid-2023, Asahi Tower residential area investment project in Ward 16, District 8 will be finished by 2027, and more such projects is expected to fuel the demand for expanded graphite. Moreover, according to Invest India, it has projected that by the year 2025 the chemicals and petrochemical industry of India will be valued at US$300 billion. Moreover, Major Chemical’s production in India climbed by 23.62% to 73.04 lakhs tons in 2021-22 (up to October-2021) from 59.08 lakhs tons in the previous year's similar period. The major Petrochemicals production in India climbed by 11.85% to 257.44 lakhs tons in 2021-22 (up to October-2021) from 230.15 lakhs tons in the previous year's similar period. Additionally, according to the statistics published by the United States Department of Agriculture (USDA), in 2019 the Chinese iron and steel production was 809 million metric tons, and in 2020, it was 830 million metric tons, an increase of 2.6%. Therefore, the growth of construction activities, chemicals, and metallurgy in the Asia-Pacific region is expanding the growth of the market.

Schedule a Call

Expanded Graphite Market Drivers

Growing Chemicals Industry Production

Expanded graphite is used in numerous high-temperature applications in the chemical industry, such as the manufacturing of phosphorus and calcium carbide in arc furnaces, owing to its superior insulation properties. The growing chemicals and petrochemicals sectors worldwide are expected to propel the demand for expanded graphite, which in turn will drive up the market growth. According to European Chemical Industry Council, in 2020, the Danish chemical industry saw the highest sales, which was Euro5.8 billion (US$6.6 billion), a growth of 6.5% since 2015. Moreover, according to the American Industry Council, in December 2021, the United States produced 7.9 billion pounds of main plastic resins, a 3.9 percent increase over the previous month. In addition, the U.S. Chemical Production Regional Index (U.S. CPRI) increased by 2.2 percent in December after increasing by 0.8 percent in November. Thus, the growing production of chemicals at the global level is expected to drive the growth of the market during the upcoming years.

Increasing Metallurgy Output

In the metallurgy industry expanded graphite is utilized during the production of metals such as iron, steel, and more because this graphite has unique electrode properties. The increased production of metals such as iron, steel, manganese, chromium, and others is boosting the need for expanded graphite. According to the United States Department of Agriculture (USDA), total global iron and steel output in 2018 was 1,250 million metric tonnes, and in 2019 it was 1,300 million metric tonnes, a 4% rise. In addition, manganese production in Australia was 3,180 thousand metric tonnes in 2019 and 3,300 thousand metric tonnes in 2020, a 3.8 percent rise. Furthermore, total chromium output worldwide in 2018 was 43,100 thousand metric tonnes, and in 2019 it was 44,000 thousand metric tonnes, a 2.0 percent rise. Thus, the increasing metal production including iron and steel, manganese, chromium, and more is anticipated to fuel the expanded graphite demand, thereby, driving the market growth during the forecast period.

Expanded Graphite Market Challenges

Lower Tensile Strength causes Inferior Performance

Even though expanded graphite sheet is commonly utilized as a sealant, flame retardant additives, and more, it still has several flaws that need to be addressed. The expanded graphite tensile and flexural strength is weaker than other sealing materials, which is a clear drawback. The expanded graphite sheet is not ideal for sealing portions making packing due to its lack of hardness. Moreover, organic solvents are not recommended for exfoliating expanded graphite because of the issues connected with them, such as their high boiling point and toxicity. Hence, these limitations associated with the tensile strength of the expanded graphite is limiting the market growth

Buy Now

Expanded Graphite Industry Outlook

Technology launches, acquisitions, and increased R&D activities are key strategies adopted by players in the expanded graphite market. Expanded graphite top 10 companies include:

GrafTech International

Nippon Kokuen Group

Yichang Xincheng Graphite

Nacional De Grafite

Asbury Carbons

Triton Minerals

SGL Group

NeoGraf Solutions

ACS Material

LKAB Minerals

Recent Developments

In January 2022, Tirupati Graphite plc, the specialist graphite firm, launched a new technology that will improve the company's main graphite and downstream specialized graphite production processes significantly. Such new graphite technologies will benefit the market growth.

In October 2021, Black Earth formed a 50:50 joint venture (JV) with India's Metachem Manufacturing to establish an expandable graphite facility in India. The new factory will serve the expanding graphite market, which is forecast to rise.

In June 2019, Leading Edge Materials developed expandable graphite in compliance with existing market products from Woxna, Sweden. The new expandable graphite can create various value-added products such as batteries, construction materials, and more.

#Expanded Graphite Market#Expanded Graphite Market Size#Expanded Graphite Industry#Expanded Graphite Market Share#Expanded Graphite top 10 companies#Expanded Graphite Market Report#Expanded Graphite Industry Outlook

0 notes

Text

Graphite Thermal Pads Market - Latest Innovations Drivers Dynamics And Strategic Analysis Challenges

Global Graphite Thermal Pads Market Research Report 2025(Status and Outlook)

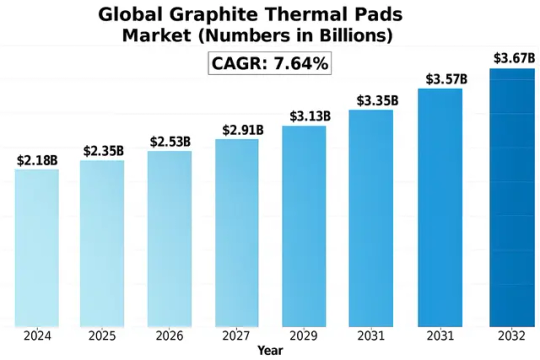

The global Graphite Thermal Pads Market size was valued at US$ 2.18 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025-2032.

Graphite thermal pads are soft, thermally conductive materials designed to enhance heat dissipation in electronic devices. These pads leverage graphite’s exceptional thermal conductivity properties (ranging between 300-1900 W/mK) while maintaining electrical insulation – making them ideal for high-performance computing, LED lighting, and telecommunications equipment.

The market growth is primarily driven by escalating demand from the consumer electronics sector, particularly smartphones and laptops requiring efficient thermal management solutions. Additionally, the rapid expansion of 5G infrastructure and data centers globally is creating substantial demand. However, the emergence of alternative materials like thermal interface greases presents competitive challenges. Key players such as Panasonic Group and Graftech are investing in product innovations, including multi-layer graphene-enhanced pads with improved thermal conductivity up to 2000 W/mK.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95881

Segment Analysis:

By Type

Composite Graphite Film Segment Leads Due to Superior Thermal Conductivity and Flexibility

The market is segmented based on type into:

Single Layer Graphite Film

Composite Graphite Film

Multilayer Graphite Film

Others

By Application

Computer Industry Segment Dominates Owing to Increasing Demand for Thermal Management Solutions in Electronics

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Sector Holds Major Share Due to Growing Demand for Compact Thermal Solutions

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Others

Regional Analysis: Global Graphite Thermal Pads Market

North America The North American graphite thermal pads market is driven by high demand from the computer and telecommunications industries, particularly in the U.S. The region benefits from stringent thermal management requirements in data centers, automotive electronics, and 5G infrastructure. With an estimated market value of $120 million in 2023, the U.S. leads due to its advanced electronics manufacturing sector. Canada and Mexico are witnessing steady growth with increasing investments in renewable energy systems, where graphite thermal pads are used extensively in battery cooling applications. However, the adoption of alternative materials like silicon-based thermal interface materials (TIMs) presents competitive challenges. Local manufacturers are focusing on multilayer graphite films to cater to high-performance computing needs.

Europe Europe’s market is characterized by a strong emphasis on sustainability and energy efficiency, particularly in Germany and the UK. The EU’s push for eco-friendly electronic components has accelerated research into graphite thermal pads with lower carbon footprints. The automotive sector, especially electric vehicle (EV) production, is a major growth driver, with thermal management being critical for battery longevity. Demand is further supported by stringent regulations such as RoHS and WEEE directives. However, supply chain disruptions and raw material price volatility, particularly from Russian graphite suppliers, have impacted market stability. Companies like Panasonic and Kaneka are expanding their European production facilities to mitigate these challenges and meet rising demand from industrial automation sectors.

Asia-Pacific The fastest-growing regional market, Asia-Pacific dominates graphite thermal pad consumption, accounting for over 45% of global demand in 2023. China’s robust electronics manufacturing ecosystem and India’s expanding telecom infrastructure are primary growth contributors. Japan and South Korea play pivotal roles in technological innovation, with companies like Denka and Tanyuan focusing on high-conductivity composite graphite films for LED and semiconductor applications. However, price sensitivity in emerging economies like Indonesia and Vietnam leads to a preference for single-layer graphite pads. The region also faces challenges related to inconsistent raw material quality and intellectual property concerns, prompting stricter supplier vetting processes.

South America South America’s market remains in a development phase, with Brazil leading demand due to growing data center investments and renewable energy projects. While Argentina and Colombia show potential, economic instability and limited local manufacturing capabilities restrict growth, keeping import dependency high. Graphite thermal pad adoption in consumer electronics repair markets is rising, though penetration in industrial applications lags behind other regions. Infrastructure bottlenecks and fluctuating tariffs on imported electronic components further complicate market expansion. Nevertheless, partnerships between regional distributors and Asian suppliers are gradually improving product accessibility.

Middle East & Africa This region exhibits nascent but promising demand, particularly in the UAE and Saudi Arabia, where smart city initiatives and data center construction drive thermal management needs. South Africa serves as a gateway for graphite pad imports into sub-Saharan Africa, catering to telecommunications tower cooling applications. However, market growth is constrained by low awareness of advanced thermal solutions and budget constraints favoring traditional heat sinks. Efforts by global players like Graftech to establish local distribution networks and provide cost-optimized products are gradually boosting adoption in key industrial sectors.

List of Key Graphite Thermal Pads Companies Profiled

Panasonic Group (Japan)

Denka Company Limited (Japan)

Kaneka Corporation (Japan)

Tanyuan Technology Co., Ltd. (China)

Zhongshi Technology (Shenzhen) Co., Ltd. (China)

FRD Co., Ltd (China)

Graftech International (U.S.)

Momentive Performance Materials (U.S.)

Laird Technologies (U.K.)

The global graphite thermal pads market is experiencing robust growth driven by the increasing demand for efficient thermal management solutions in electronics. As devices become more compact and powerful, managing heat dissipation has become critical for performance and longevity. Graphite thermal pads offer superior thermal conductivity ranging from 300-1500 W/mK, significantly higher than traditional silicone pads. The consumer electronics sector, which accounts for over 40% of total demand, is witnessing particularly strong adoption in smartphones, laptops, and gaming consoles where thermal throttling impacts user experience. Moreover, the proliferation of 5G technology requires advanced thermal solutions to handle increased heat generation in infrastructure equipment.

The automotive sector has emerged as a key growth driver with the rapid adoption of electric vehicles (EVs) globally. EV battery systems and power electronics generate substantial heat during operation, requiring efficient thermal interfaces. Graphite thermal pads are increasingly preferred in battery management systems due to their electrical insulation properties combined with excellent thermal conductivity. With EV production expected to grow at over 25% CAGR through 2030, this segment offers significant opportunities for graphite thermal pad manufacturers. Furthermore, the lightweight nature of graphite pads contributes to overall vehicle weight reduction, enhancing energy efficiency – a critical factor in EV design.

The industrial automation sector and data center industry are becoming major consumers of graphite thermal pads. Industrial electronics operating in harsh environments require reliable thermal management solutions that can withstand vibration, thermal cycling, and long operational hours. Similarly, data centers handling increasingly dense server configurations are adopting graphite thermal pads to manage heat loads more effectively while optimizing space. With global data center IP traffic projected to triple in the next five years, this sector alone could account for 20% of graphite thermal pad consumption by 2028.

Recent advancements in material science have led to the development of flexible hybrid graphite composites that combine the thermal properties of graphite with improved mechanical characteristics. These next-generation materials can conform to complex geometries and withstand repeated flexing, making them ideal for wearable electronics and flexible displays. The wearable technology market, projected to exceed $100 billion by 2030, represents a significant growth opportunity for innovative thermal interface solutions. Manufacturers investing in R&D to enhance the mechanical properties of graphite thermal pads while maintaining thermal performance stand to gain substantial market share.

The increasing emphasis on sustainable electronics manufacturing creates opportunities for graphite thermal pad producers. Natural graphite is a mined material, but manufacturers are developing environmentally friendly alternatives using recycled graphite and bio-based binders. These sustainable solutions align with the electronics industry’s push towards greener supply chains and circular economy principles. With major OEMs committing to carbon neutrality goals, suppliers offering certified sustainable thermal solutions can command premium pricing and secure long-term contracts. The trend towards RoHS-compliant and halogen-free materials further strengthens the position of properly formulated graphite thermal pads in the market.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95881

Key Questions Answered by the Graphite Thermal Pads Market Report:

What is the current market size of Global Graphite Thermal Pads Market?

Which key companies operate in Global Graphite Thermal Pads Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Global Graphite Thermal Pads Market Analysis by Capital Investment, Industry Outlook, Growth Potential, and Forecast

Global Graphite Thermal Pads Market size was valued at US$ 2.18 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025-2032.

Graphite thermal pads are soft, thermally conductive materials designed to enhance heat dissipation in electronic devices. These pads leverage graphite’s exceptional thermal conductivity properties (ranging between 300-1900 W/mK) while maintaining electrical insulation – making them ideal for high-performance computing, LED lighting, and telecommunications equipment.

The market growth is primarily driven by escalating demand from the consumer electronics sector, particularly smartphones and laptops requiring efficient thermal management solutions. Additionally, the rapid expansion of 5G infrastructure and data centers globally is creating substantial demand. However, the emergence of alternative materials like thermal interface greases presents competitive challenges. Key players such as Panasonic Group and Graftech are investing in product innovations, including multi-layer graphene-enhanced pads with improved thermal conductivity up to 2000 W/mK.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-graphite-thermal-pads-market/

Segment Analysis:

By Type

Composite Graphite Film Segment Leads Due to Superior Thermal Conductivity and Flexibility

The market is segmented based on type into:

Single Layer Graphite Film

Composite Graphite Film

Multilayer Graphite Film

Others

By Application

Computer Industry Segment Dominates Owing to Increasing Demand for Thermal Management Solutions in Electronics

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Sector Holds Major Share Due to Growing Demand for Compact Thermal Solutions

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Others

Regional Analysis: Global Graphite Thermal Pads Market

North America The North American graphite thermal pads market is driven by high demand from the computer and telecommunications industries, particularly in the U.S. The region benefits from stringent thermal management requirements in data centers, automotive electronics, and 5G infrastructure. With an estimated market value of $120 million in 2023, the U.S. leads due to its advanced electronics manufacturing sector. Canada and Mexico are witnessing steady growth with increasing investments in renewable energy systems, where graphite thermal pads are used extensively in battery cooling applications. However, the adoption of alternative materials like silicon-based thermal interface materials (TIMs) presents competitive challenges. Local manufacturers are focusing on multilayer graphite films to cater to high-performance computing needs.

Europe Europe’s market is characterized by a strong emphasis on sustainability and energy efficiency, particularly in Germany and the UK. The EU’s push for eco-friendly electronic components has accelerated research into graphite thermal pads with lower carbon footprints. The automotive sector, especially electric vehicle (EV) production, is a major growth driver, with thermal management being critical for battery longevity. Demand is further supported by stringent regulations such as RoHS and WEEE directives. However, supply chain disruptions and raw material price volatility, particularly from Russian graphite suppliers, have impacted market stability. Companies like Panasonic and Kaneka are expanding their European production facilities to mitigate these challenges and meet rising demand from industrial automation sectors.

Asia-Pacific The fastest-growing regional market, Asia-Pacific dominates graphite thermal pad consumption, accounting for over 45% of global demand in 2023. China’s robust electronics manufacturing ecosystem and India’s expanding telecom infrastructure are primary growth contributors. Japan and South Korea play pivotal roles in technological innovation, with companies like Denka and Tanyuan focusing on high-conductivity composite graphite films for LED and semiconductor applications. However, price sensitivity in emerging economies like Indonesia and Vietnam leads to a preference for single-layer graphite pads. The region also faces challenges related to inconsistent raw material quality and intellectual property concerns, prompting stricter supplier vetting processes.

South America South America’s market remains in a development phase, with Brazil leading demand due to growing data center investments and renewable energy projects. While Argentina and Colombia show potential, economic instability and limited local manufacturing capabilities restrict growth, keeping import dependency high. Graphite thermal pad adoption in consumer electronics repair markets is rising, though penetration in industrial applications lags behind other regions. Infrastructure bottlenecks and fluctuating tariffs on imported electronic components further complicate market expansion. Nevertheless, partnerships between regional distributors and Asian suppliers are gradually improving product accessibility.

Middle East & Africa This region exhibits nascent but promising demand, particularly in the UAE and Saudi Arabia, where smart city initiatives and data center construction drive thermal management needs. South Africa serves as a gateway for graphite pad imports into sub-Saharan Africa, catering to telecommunications tower cooling applications. However, market growth is constrained by low awareness of advanced thermal solutions and budget constraints favoring traditional heat sinks. Efforts by global players like Graftech to establish local distribution networks and provide cost-optimized products are gradually boosting adoption in key industrial sectors.

MARKET OPPORTUNITIES

Emergence of Flexible and Hybrid Graphite Composites Opens New Applications

Recent advancements in material science have led to the development of flexible hybrid graphite composites that combine the thermal properties of graphite with improved mechanical characteristics. These next-generation materials can conform to complex geometries and withstand repeated flexing, making them ideal for wearable electronics and flexible displays. The wearable technology market, projected to exceed $100 billion by 2030, represents a significant growth opportunity for innovative thermal interface solutions. Manufacturers investing in R&D to enhance the mechanical properties of graphite thermal pads while maintaining thermal performance stand to gain substantial market share.

Growing Focus on Sustainability Drives Demand for Eco-Friendly Solutions

The increasing emphasis on sustainable electronics manufacturing creates opportunities for graphite thermal pad producers. Natural graphite is a mined material, but manufacturers are developing environmentally friendly alternatives using recycled graphite and bio-based binders. These sustainable solutions align with the electronics industry’s push towards greener supply chains and circular economy principles. With major OEMs committing to carbon neutrality goals, suppliers offering certified sustainable thermal solutions can command premium pricing and secure long-term contracts. The trend towards RoHS-compliant and halogen-free materials further strengthens the position of properly formulated graphite thermal pads in the market.

GLOBAL GRAPHITE THERMAL PADS MARKET TRENDS

Growing Demand for High-Performance Thermal Management Solutions

The global graphite thermal pads market is experiencing significant growth due to increasing demand for efficient thermal management solutions in electronic devices. With the rapid advancement of high-power electronics and miniaturization of components, traditional cooling methods often fall short in managing heat dissipation effectively. Graphite thermal pads, known for their superior thermal conductivity ranging between 300-1900 W/m·K, are becoming indispensable in applications requiring lightweight, flexible, and high-performance heat transfer solutions. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 9-12% from 2023 to 2030, driven by energy efficiency requirements and the booming consumer electronics sector.

Other Trends

Expansion in Electric Vehicles and 5G Infrastructure

The automotive industry’s shift toward electric vehicles (EVs) and the global rollout of 5G networks are creating substantial opportunities for graphite thermal pads. In EV battery systems and power electronics, these pads help maintain optimal operating temperatures, improving performance and longevity. Similarly, 5G base stations generate significant heat, necessitating advanced thermal management solutions to prevent component failures. The telecommunications sector alone is expected to account for over 25% of thermal pad demand by 2027, while the automotive thermal management market continues to grow at nearly 15% annually.

Technological Advancements in Composite Materials

Material science innovations are enhancing graphite thermal pad performance through hybrid compositions combining graphene, boron nitride, or phase change materials. Manufacturers are developing multi-layer constructions that achieve directional thermal conductivity up to 40% higher than conventional pads while maintaining electrical insulation properties. Recent prototypes demonstrate thermal resistances below 0.5°C-cm²/W, making them competitive with liquid cooling systems for certain applications. These advancements are particularly impactful in data center cooling solutions where energy efficiency improvements of 10-15% can translate to millions in operational savings annually.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Innovation to Capture Expanding Thermal Management Market

The global graphite thermal pads market features a mix of established multinational corporations and specialized regional players. Panasonic Group dominates the competitive landscape, holding approximately 28% of the market share in 2023, owing to its wide product portfolio and strong distribution networks across Asia-Pacific and North America. The company’s recent introduction of high-performance multilayer graphite films has further solidified its market position.

Graftech International and Kaneka Corporation represent other key players, collectively accounting for nearly 35% of market revenue. These companies have invested heavily in R&D to develop advanced thermal solutions for 5G infrastructure and high-performance computing applications, driving their growth in recent years.

Mid-sized manufacturers like Tanyuan Technology and Zhongshi Technology are gaining traction through specialized product offerings and competitive pricing strategies. Their focus on developing custom thermal solutions for the LED and telecommunications industries has enabled them to carve out significant niche market shares.

The competitive environment is expected to intensify as companies expand their production capacities and develop next-generation materials. Denka Company Limited recently announced a $50 million investment to scale up its graphite thermal interface material production, signaling the industry’s growth potential.

List of Key Graphite Thermal Pads Companies Profiled

Panasonic Group (Japan)

Denka Company Limited (Japan)

Kaneka Corporation (Japan)

Tanyuan Technology Co., Ltd. (China)

Zhongshi Technology (Shenzhen) Co., Ltd. (China)

FRD Co., Ltd (China)

Graftech International (U.S.)

Momentive Performance Materials (U.S.)

Laird Technologies (U.K.)

Learn more about Competitive Analysis, and Global Forecast of Global Graphite Thermal Pads Market : https://semiconductorinsight.com/download-sample-report/?product_id=95881

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Graphite Thermal Pads Market?

-> Graphite Thermal Pads Market size was valued at US$ 2.18 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025-2032.

Which key companies operate in Global Graphite Thermal Pads Market?

-> Key players include Panasonic Group, Denka, Kaneka, Tanyuan Technology, Zhongshi Technology, FRD, and Graftech.

What are the key growth drivers?

-> Growth is driven by increasing demand for thermal management in electronics, 5G infrastructure expansion, and EV battery cooling applications.

Which region dominates the market?

-> Asia-Pacific accounts for over 45% market share, led by China’s electronics manufacturing sector, while North America shows fastest growth.

What are the emerging trends?

-> Emerging trends include hybrid thermal solutions, ultra-thin graphite pads for mobile devices, and sustainable manufacturing processes.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Natural Graphite Market Trends, Size, Segment and Growth by Forecast to (2021-2031)

Natural Graphite Market Outlook (2024–2031) The global natural graphite market is projected to grow from US$ 4.15 billion in 2024 to US$ 8.27 billion by 2031, expanding at a CAGR of 10.6% during the forecast period from 2025 to 2031. 📚Download Full PDF Sample Copy of Market Report @ https://wwcw.businessmarketinsights.com/sample/ BMIPUB00031711

Executive Summary and Global Market Overview

This comprehensive report provides a detailed analysis of the global natural graphite market, examining its size, share, and evolving dynamics from 2021 to 2031. It aims to equip stakeholders with strategic insights into the market landscape by evaluating key growth drivers, emerging opportunities, challenges, and the competitive environment. Our findings are based on a rigorous research methodology that integrates both primary and secondary data sources to deliver accurate, actionable intelligence.

The natural graphite industry is experiencing a fundamental shift, evolving from its traditional role in industrial applications to becoming a critical component in the global clean energy transition. This shift is primarily driven by the rapid expansion of the electric vehicle (EV) industry and the rising demand for grid-scale energy storage solutions. As lithium-ion batteries take center stage in global decarbonization efforts—particularly in the automotive and renewable energy sectors—graphite's indispensable role as the dominant anode material has elevated its strategic importance on the global stage.

Regional Insights: Asia-Pacific (APAC)

The Asia-Pacific region dominates the global natural graphite market, accounting for nearly 80% of total demand. This dominance is underpinned by surging consumption across key industries such as electric vehicles, steel manufacturing, batteries, and consumer electronics. APAC’s strong manufacturing base, coupled with favorable government policies supporting EV adoption and clean energy technologies, continues to drive robust market expansion in the region.

Natural Graphite Market Segmentation Analysis

The global natural graphite market is comprehensively segmented by type, application, end-user industry, and geography, each playing a critical role in shaping market dynamics.

By Type:

Flake Graphite

Amorphous Graphite

Vein Graphite

Among these, flake graphite holds the largest market share. It is the most commonly used type due to its critical role in lithium-ion battery anodes, refractories, and a range of industrial applications.

By Application:

Batteries

Refractories

Electrodes

Lubricants

Friction Products

Other Applications

Batteries and electrodes are the leading application segments, with batteries showing the fastest growth. The rising demand for lithium-ion batteries in electric vehicles and energy storage systems is significantly driving graphite consumption.

By End-User Industry:

Automotive

Metallurgy

Electronics

Energy

Aerospace

Other Industries

The automotive sector, led by the global shift toward electric vehicles (EVs), has emerged as the dominant end-user, overtaking traditional industrial applications such as metallurgy and refractories.

By Geography:

North America

Europe

Asia-Pacific (APAC)

Middle East & Africa

South & Central America

The Asia-Pacific region is the largest and most influential market for natural graphite, primarily driven by China. China not only leads in natural graphite production but also controls over 90% of the global graphite processing capacity. This gives APAC a strategic advantage in both supply and consumption, especially in battery manufacturing and advanced materials sectors.

Market Drivers and Opportunities

1. Growth in Electric Vehicles (EVs):

The accelerating adoption of EVs globally is a major growth driver. Graphite is a critical raw material for lithium-ion battery anodes, and demand is projected to grow in tandem with EV production.

2. Advancements in Battery Technology:

Innovations in battery chemistry and energy storage solutions are boosting the need for high-purity natural graphite. Companies investing in advanced extraction and purification technologies are poised to capitalize on these trends.

Natural Graphite Market Report Coverage and Deliverables

The "Natural Graphite Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

Natural Graphite market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

Natural Graphite market trends, as well as market dynamics such as drivers, restraints, and key opportunities

Detailed Porter's Five Forces and SWOT analysis.

Natural Graphite market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Natural Graphite market.

Detailed company profiles

Geographical Scope of the Natural Graphite Market

The Natural Graphite market report covers five key regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. Each region exhibits distinct market dynamics influenced by industrial trends, technological developments, and strategic investments.

Asia Pacific (APAC): APAC leads global demand for natural graphite, driven by robust industrial capabilities and advancements in battery technologies. The region’s dominance is underscored by its strong presence in the electric vehicle (EV) sector and electronics manufacturing, where graphite plays a vital role.

Europe: In Europe, the natural graphite market is witnessing steady growth, propelled by the surging EV industry and increasing demand for lithium-ion batteries—the fastest-growing application segment for graphite. The region is also making strides toward sustainable and localized battery production, enhancing its graphite value chain.

North America: Natural graphite demand in North America continues to rise, largely due to rapid EV adoption and the growing need for energy storage solutions. Despite having considerable domestic graphite resources, the region remains a net importer, highlighting concerns around supply security and the push for sustainable, domestic production to support future market stability.

Middle East & Africa and South & Central America: These regions are experiencing upward growth in graphite demand, driven by strategic developments in battery materials, steel manufacturing, and advanced technologies. Countries such as Saudi Arabia, the UAE, and South Africa are actively investing in graphite production capabilities. Africa, in particular, has emerged as a key player due to its untapped natural graphite reserves, attracting global investment aimed at diversifying the supply chain.

Natural Graphite Market Report Structure and Research Methodology

The report offers comprehensive qualitative and quantitative analysis across parameters such as product type, technology, application, end user, and regional geography. The structure of the report includes:

Chapter 2 – Key Takeaways: Highlights major trends and market outlook.

Chapter 3 – Research Methodology: Details the research design, including primary and secondary data sources.

Chapter 4 – Ecosystem and Porter’s Analysis: Presents an overview of the graphite market ecosystem and competitive forces.

Chapter 5 – Market Dynamics: Covers key drivers, restraints, opportunities, and emerging trends, supported by impact analysis.

Chapter 6 – Market Overview and Forecast: Presents historical revenue data and forecasts through 2031.

Chapters 7–9 – Market Segmentation: Breaks down the market by product type, application, and end user across all five regions.

Chapter 10 – Competitive Landscape: Features a heat map and competitive analysis of key players.

Chapter 11 – Industry Landscape: Details market initiatives, strategic developments, mergers, and joint ventures.

Chapter 12 – Company Profiles: Provides in-depth profiles of leading companies, including business descriptions, financial data, product portfolios, SWOT analyses, and recent developments.

Chapter 13 – Appendix: Includes abbreviations, glossary, and disclaimers.

Recent Market Developments and Industry News

Lucid Group, Inc. (June 4, 2025): Lucid has entered a multi-year agreement with Graphite One to secure U.S.-sourced natural graphite, strengthening its domestic raw materials supply chain for EV production.

Talga Group (June 2025): Talga received final regulatory approval to develop the Nunasvaara South graphite mine in Sweden. Supported by the European Union, the project aims to supply sustainable battery anode materials, enhancing Europe’s strategic autonomy in the EV and energy storage markets.

About Us: Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications Author's Bio Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

Energy Storage Materials Market 2025–2035: Growth, Trends, and Forecast

Global Energy Storage Materials Market is about to enter a dynamic growth phase driven by the critical need for reliable, effective energy storage technologies as well as the quick worldwide move toward renewable energy. The capacity to store energy across a range of time periods is becoming more and more important as solar, wind, and other variable energy sources proliferate. Advanced developments are greatly improving energy density, safety, and overall performance, especially in lithium-ion, solid-state, and sodium-ion technologies. A noticeable shift toward long-duration storage systems that can more effectively balance the intermittency of renewable energy sources is also occurring at the same time. Nonetheless, the sector continues to encounter obstacles like high capital needs and worldwide supply chain interruptions, underscoring the necessity of ongoing innovation and cross-border cooperation.

Market Segmentation

1. By Application

Automotive: Dominant segment due to rising EV demand and electrification trends.

Grid Energy Storage: Driven by renewable energy integration and grid reliability needs.

Consumer Electronics: Consistent demand for portable power solutions.

2. By Component

Electrodes: Largest component segment; crucial for performance and capacity.

Electrolytes: Key to energy transfer and battery safety.

Separators: Ensure electrical insulation while allowing ion flow.

3. By Region

North America (U.S., Canada, Mexico): High growth due to investments, policy support, and manufacturing base.

Europe (Germany, France, Italy, Spain, U.K., Rest-of-Europe): Focus on sustainability and energy independence.

Asia-Pacific (China, Japan, South Korea, India, Rest-of-Asia-Pacific): Largest manufacturing hub; technological leadership.

Demand Drivers

Battery Material Technological Advancements: Advances in solid-state, sodium-ion, and lithium-ion chemistries are increasing energy density, cost effectiveness, and safety, which is speeding up adoption in a variety of industries.

Grid Infrastructure Modernization: Energy storage technologies that improve stability, control peak demand, and provide seamless integration of renewable energy sources are becoming more and more popular as a result of aging electrical grids.

Market Challenges

High Initial Capital Costs: Developing and expanding sophisticated storage systems requires large financial outlays, which puts obstacles in place, particularly in developing nations.

Lower Energy Density in Emerging Tech: Although there are economic and safety benefits to using newer chemistries like sodium-ion and redox flow, their lower energy output in comparison to lithium-ion limits their use in high-demand applications like electric vehicles.

Key Market Participants

• Contemporary Amperex Technology Co. Ltd. (CATL)

• LG Energy Solution Ltd.

• Samsung SDI Co., Ltd.

• Panasonic Holdings Corporation

• Tesla, Inc.

• BYD Company Ltd.

• SK On (SK Innovation’s Battery Division)

• Northvolt AB

• Amprius Technologies, Inc.

• Envision AESC Group Ltd.

Get your hands on this Sample Report to stay up-to-date on the latest developments in Energy Storage Materials Market Market.

Take a deep dive into Advance Material Vertical. Click Here!

Future Outlook

The market for energy storage materials is expected to grow steadily through 2030, thanks to the global shift to renewable energy, rising electrification across industries, and rapid advancements in battery technologies. Innovations in lithium-ion, solid-state, and sodium-ion batteries are improving energy density, safety, and cost efficiency, making them more viable for applications ranging from electric vehicles to grid storage. North America and Asia-Pacific are expected to lead growth due to supportive policies and large-scale investments, but supply chain challenges—particularly with regard to essential raw materials like cobalt and graphite—may affect production. To overcome these obstacles and maintain long-term momentum, strategic sourcing, recycling programs, and technological innovation will be crucial.

Conclusion

The energy storage materials market is undergoing a transformative shift, fueled by the global push for clean energy, electrification, and technological innovation. Materials like lithium-ion, solid-state, and sodium-ion are at the forefront of this transition due to the increasing demand in automotive, grid, and industrial applications. The market faces obstacles like high beginning costs and supply chain weaknesses, even if it gains from robust regional investments and supporting governmental frameworks. Sustainable growth is anticipated to be fueled by further research, strategic alliances, and initiatives to source materials locally. Advanced storage materials will play a crucial role in forming a robust, low-carbon energy future as energy systems grow more decentralized and reliant on renewable energy sources.

#Energy Storage Materials Market#Energy Storage Materials Industry#Energy Storage Materials Report#advance material#chemical

0 notes

Text

Battery Coating Market 2025–2032: Innovation, Growth Drivers & Future Outlook

The battery coating industry is unlocking new performance heights for energy storage technologies. As electric vehicles (EVs), grid energy storage, and advanced electronics grow, the coating layer on battery electrodes has become a critical piece of the puzzle—offering enhanced safety, longer lifespan, and higher efficiency. With the global market projected to surge from roughly. The global battery coating market is projected to grow from USD 604.7 million in 2024 to USD 1,613.6 million by 2030, at a CAGR of 17.8%

What Are Battery Coatings?

Battery coatings are ultra-thin, engineered materials applied to electrode surfaces—anodes, cathodes, separators, or battery packs—to fortify performance. From PVDF polymers to ceramics, graphite, and metal oxides, these coatings control ion movement, enhance conductivity, and prevent degradation during charging cycles

Market Segmentation & Trends

By Battery Component:

Electrode Coatings: Fastest-growing segment—enhancing cycle life and safety in lithium-ion and next-gen batteries

Separator Coatings: Critical for preventing internal short circuits and enabling higher current densities.

Battery Pack Coatings: Add protective barriers and thermal stability to complete battery systems.

By Material:

PVDF (Polyvinylidene Fluoride): The dominant material—resistant to chemicals and heat. Key players like Arkema and Solvay are expanding PVDF capacity

Ceramics & Oxides: Used in solid-state and high-temperature battery formats.

Carbon & Graphene: Gaining traction, especially in graphene-enhanced batteries

Alumina, Polymers, Others: Important for specialty and niche applications.

By Battery Type:

Lithium-ion: Dominates both in volume and R&D focus

Graphene Batteries: Fastest-growing segment due to high energy density and charging speed

Lead-Acid, Nickel-Based: Present but overshadowed by lithium formats.

Solid-State & Sodium-Ion: Emerging formats demanding specialized coatings.

By Technology:

CVD / PECVD / ALD: Enable precision coatings at nano-scale but cost-intensive

Dry Coating (Electrode): Cutting-edge process reducing energy use by ~30% and set to scale by 2027

Growth Drivers

1. Soaring Adoption of Electric Vehicles

Sales of EVs jumped 55% in 2023, pushing demand for batteries with reliable safety and performance—fueling coating innovations .

2. Rise in Energy Storage

Utility-scale renewable energy storage deployments target 10,000 GWh by 2030, ramping demand for battery coatings .

3. Next-Gen Battery Chemistry

Solid-state, sodium-ion, and silicon–graphene chemistries require precise coatings to stabilize interfaces and extend cycle life .

4. Sustainability & Regulation

Japan, Korea, China, EU, and the U.S. are incentivizing low-emission battery technologies—fueling eco-friendly coatings and efficient production methods .

Challenges in the Road Ahead

High Costs: Technologies like ALD and CVD increase battery production costs

Material Scarcity: Specialized materials like PVDF and graphene face supply-chain pressure.

Compatibility: Coatings must match new chemistry platforms without hindering ion transport.

Substrate Limits: Solid electrolytes challenge existing coating tech

Market Leaders & Competitive Landscape

Prominent players shaping the industry include:

Arkema SA, Solvay SA – Leading PVDF capacity expansion

PPG Industries, Dürr Group, Ashland, Axalta, Targray, APV Engineered Coatings – Diverse coatings across battery formats

Xerion Advanced Battery, Mitsubishi, Ube Industries, Nano One, NEI, Forge Nano – Innovators in nano and precision coatings

These companies are accelerating R&D in nano-thin, durable, and customizable battery coatings to meet EV, electronics, and grid-storage demands.

Regional Outlook: Who’s Leading?

Asia‑Pacific: Dominates the market thanks to China, Japan, and South Korea’s strong EV and battery manufacturing base

North America: Rapid growth due to DOE funding (~USD 60 million in 2022) and rising EV/electronics demand

Europe: Growing compliance-driven demand—Europe leads in PVDF production and recycling initiatives

Looking Ahead: Strategic Opportunities

1. Scale-Up of Dry-Coating Methods

VW and Tesla are piloting dry electrode coating to slash battery cell costs and production energy by ~30%

2. Material Collaborations

PVDF giants like Arkema and Solvay are optimizing chemistries for better electrode performance and supply security

3. Nanotech Integration

Nanocoatings for stabilization—like those preventing interfacial SEI degradation—are increasingly critical for silicon‑rich and solid-state batteries

4. Sustainable Coating Solutions

Low-VOC, waterborne, and recyclable coatings are poised to meet tightening environmental standards .

Download PDF Brochure :

The battery coating market is rapidly expanding, driven by the surge in electric vehicles, energy storage systems, and next-gen battery chemistries like solid-state and graphene. These ultra-thin coatings enhance battery safety, lifespan, and performance by stabilizing electrodes and improving ion flow. Key materials include PVDF, ceramics, and graphene, while technologies like dry electrode coating and nano coatings are reshaping the industry. Major players like Arkema, Solvay, and PPG Industries are investing heavily in innovation and sustainability, making battery coatings a critical enabler in the global shift to cleaner, more efficient energy systems.

#Battery Coating#EV Batteries#Energy Storage#PVDF#Graphene Batteries#Dry Electrode Coating#Nanocoatings#Asia‑Pacific Market#Sustainable Coatings

0 notes

Text

Composites Market Size, Share, Scope, Revenue, Challenges and Future Business Opportunities till 2034: SPER Market Research

Composites are materials made by mixing two or more different substances to create a new material with better properties. A composite has a matrix, which is the part that holds everything together, and reinforcement, which adds strength or stiffness. The matrix is usually made of polymers, metals, or ceramics, while the reinforcement can be fibers like glass or carbon, or particles like ceramic or metal. This combination makes the material stronger, lighter, or more durable than the individual parts.

Composites aim to use the best qualities of each material while reducing their weaknesses. For example, fiberglass, a mix of glass fibers and polymer resin, is strong, corrosion-resistant, and lightweight, making it great for boatbuilding, automotive parts, and wind turbine blades.

According to SPER market research, ‘Global Composites Market Size- By Product, By Manufacturing Process, By End-User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034’ state that the Global Composites Market is predicted to reach 222.15 billion by 2034 with a CAGR of 7.46%.

Drivers:

One key factor driving growth in end-user industries is the rising demand for lightweight materials, which boosts the composites market. Composites like carbon fiber and glass fiber reinforced polymers are lighter yet stronger than steel or aluminum. This makes them appealing for automotive and aerospace uses, as lighter vehicles and aircraft lead to better fuel efficiency and lower emissions. Strict emission regulations in places like Europe and North America encourage the adoption of these lightweight materials. In construction, they enable strong but manageable structures, and in renewable energy, lighter composite blades enhance energy efficiency, especially in wind turbines.

Request a Free Sample Report: https://www.sperresearch.com/report-store/composites-market?sample=1

Restraints:

The growth of composites in industries like consumer products, marine, and recreational goods is hindered by high development and manufacturing costs. The main issues are maintenance technology, process standardization, and design consistency. In automotive and aerospace sectors, manufacturers prefer conventional designs due to the absence of standardized materials and processes. This lack of standards limits the exploration of composites. Additionally, there is a shortage of trained personnel to support the adoption of composites.

The Asia Pacific region dominates the global composites market due to major producers of glass fiber and carbon fiber in China and Japan, along with developing economies in India and China. The wind energy sector is expanding significantly, making it a key consumer of composites. Additionally, the transportation industry is growing, especially as manufacturers focus more on electric vehicles. These factors contribute to the rising demand for composites in the region. Some of the key market players are Teijin Ltd, Toray Industries, Inc, Owens Corning, PPG Industries, Inc, Huntsman Corporation LLC, SGL Group, and others.

For More Information, refer to below link: –

Composites Market Growth

Related Reports:

Carbon & Graphite Felt Market Growth, Size, Trends Analysis- By Product Type, By Purity, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Hard Coatings Market Growth, Size, Trends Analysis - By Product, By Technology, By Application, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Composites Market#Composites Market Share#Composites Market Size#Composites Market Revenue#Composites Market Demand#Composites Market Analysis#Composites Market Segmentation#Composites Market Future Outlook#Composites Market Scope#Composites Market Challenges#Composites Market Competition#Composites Market forecast

0 notes

Text

Carbon and Graphite Felt Market Size, Share, Top Key Players, Growth, Trend and Forecast Till 2032

Global Carbon and Graphite Felt Market will witness over 8% CAGR between 2023 and 2032. The increasing awareness of environmental sustainability supports market growth. Carbon and graphite felts are essential materials in energy storage and conversion technologies like fuel cells and batteries, which are pivotal in reducing greenhouse gas emissions. The rising efforts from leading companies to expand manufacturing and development activities support market growth.

Get sample copy of this research report @ https://www.gminsights.com/request-sample/detail/6144

For instance, in October 2022, SGL Carbon, a global leader in technology-driven carbon solutions, embarked on a strategic initiative to substantially boost its graphite product production capacities for the semiconductor sector by 2024. Over the course of two years, this expansion program aimed to focus on increasing purification capabilities and enhancing the precision of computer-controlled processing for graphite components and felts.

Furthermore, the expanding aerospace and automotive industries are driving up the demand for lightweight and high-performance materials, with carbon and graphite felts fitting the bill perfectly. These industries require advanced materials for thermal management and lightweight structural components. The renewable energy sector, especially wind and solar power, relies on carbon and graphite felts, further driving the carbon and graphite felt market outlook.

The overall Carbon and Graphite Felt Market is classified based on product type, purity, application, and region.

By product type, the rigid carbon segment will witness 8.5% CAGR from 2023 to 2032. Rigid carbon, characterized by its high structural integrity and thermal stability, is crucial in various industries such as aerospace, automotive, and renewable energy. It's essential for applications requiring lightweight yet durable materials, such as aircraft components and wind turbine blades. As these industries expand and seek advanced materials, the contribution of the rigid carbon segment within the carbon and graphite felt market revenue continues to rise.

By purity, the medium purity segment will register 9% CAGR from 2023 to 2032. Their versatility and moderate cost make them appealing for various applications, from thermal insulation to chemical processing. Industries such as metallurgy, semiconductors, and energy storage rely on these materials for their unique thermal and electrical properties. As these industries grow and prioritize cost-effective yet high-performance solutions, the carbon and graphite felt market demand in the medium purity segment remains robust.

Regarding the application, the chemical processing segment will observe 9.2% CAGR from 2023 to 2032. Carbon and graphite felt materials offer exceptional resistance to high temperatures, chemicals, and corrosion. They are instrumental in various chemical processes, including filtration, catalysis, and thermal insulation. As chemical processing continues to evolve and demand efficient, durable materials, carbon and graphite felt play a pivotal role, driving their increasing adoption and growth within this sector.

Browse complete summary of this research report @ https://www.gminsights.com/industry-analysis/carbon-and-graphite-felt-market

Regionally, Europe carbon and graphite felt market will showcase 8.3% CAGR from 2023 to 2032. This demand is primarily driven by the region's focus on sustainability and clean energy solutions. Carbon and graphite felts are essential in various renewable energy technologies, such as fuel cells and energy storage systems, aligning with Europe's ambitious green energy goals. Additionally, the aerospace and automotive sectors in Europe seek lightweight and high-performance materials, further bolstering the demand for carbon and graphite felts, making Europe a prominent market for these materials.

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Us:

Contact Us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

Why the Needle Coke Market is Key to Steel, EVs & Energy Storage

The global needle coke market size is expected to reach USD 9.00 billion in 2030 and is projected to grow at a CAGR of 10.9% from 2025 to 2030. Surging demand for needle coke in the manufacturing of lithium-ion battery is a key factor driving the industry growth.

Needle coke is a primary element used in the manufacturing of graphite electrodes. The utilization of graphite in batteries has expanded at a robust pace over the past few years. It is the second heaviest component in lithium-ion batteries. These batteries require up to 10 to 20 times more graphite than lithium. Growth of steel industry along with increasing demand from lithium-ion batteries in electric vehicles is likely to remain a key driving factor for market growth in this region.

Rapid increase in demand for lithium-ion batteries from the automotive industry is expected to fuel the growth of needle coke industry. In addition, rising focus on the reduction of automobile weight to improve fuel efficiency and reduce carbon emissions is anticipated to drive the industry growth further. Graphite helps in providing substantial weight reduction and enhances the efficiency of batteries.

ConocoPhillips, Asbury, Sumitomo Chemical Company, and Seadrift Coke are the major players in the market for needle coke. These companies have a strong customer base, differential product offerings, and a robust distribution network across the globe. The threat of new entrants in the market is low due to high initial investments required for setting up manufacturing units and stringent government regulations.

Needle Coke Market Report Highlights

The super-premium grade was valued at 46.9% in 2024, primarily driven by its highest purity levels, excellent crystalline structure, and optimal physical properties, such as a low coefficient of thermal expansion (CTE).

The electrode application segment led the market and accounted for the largest revenue share of 65.1% in 2024

The Silicon Metals & Ferroalloys is expected to grow at a CAGR of 10.9% from 2025 to 2030,

This demand is being fueled by the expansion of the aluminum and steel sectors, driven primarily by infrastructural development, automotive manufacturing, and increased consumer goods demand

Asia Pacific needle coke market dominated the global market and accounted for the largest revenue share of 63.5% in 2024

Curious about the Needle Coke Market? Get a FREE sample copy of the full report and gain valuable insights.

Needle Coke Market Segmentation

Grand View Research has segmented the global needle coke market report based on grade, application, and region.

Needle Coke Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Super-Premium

Premium-Grade

Intermediate Grade

Needle Coke Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Electrode

Silicon Metals & Ferroalloys

Carbon Black

Rubber Compounds

Others

Needle Coke Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

Germany

UK

Italy

Asia Pacific

China

India

Japan

Latin America

Brazil

Mexico

Middle East and Africa

Key Players in Needle Coke Market

Phillips 66

Asbury Carbon Inc.

Seadrift Coke L.P.

Sumitomo Chemical Company

Mitsubishi Chemical Corp.

JXTG Nippon Oil & Energy Corp.

Indian Oil Corporation Limited

Graftech International

Sojitz Ject Corp.

C-Chem Co., Ltd.

Baosteel Group

Order a free sample PDF of the Needle Coke Market Intelligence Study, published by Grand View Research.

0 notes

Text

High-purity and Ultra-high-purity Vein Graphite Market, Global Outlook and Forecast 2025-2032

High-purity and ultra-high-purity vein graphite refer to naturally occurring graphite deposits with exceptional carbon content and minimal impurities. These materials are essential in high-tech applications such as lithium-ion batteries, fuel cells, and advanced electronic components.

Market Size

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/288645/global-highpurity-ultrahighpurity-vein-graphite-forecast-market-2025-2032-933

The global high-purity and ultra-high-purity vein graphite market was valued at USD 14 million in 2023 and is projected to reach USD 36.40 million by 2032, growing at a CAGR of 11.20%. The North American market was estimated at USD 4.38 million in 2023, with a projected CAGR of 9.60% during the forecast period from 2025 to 2032.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

Increasing demand for high-performance batteries in the electric vehicle (EV) industry.

Rising adoption of energy storage solutions in renewable energy applications.

Growing demand for advanced electronic materials requiring high-purity graphite.

Increasing demand for high-performance batteries in the electric vehicle (EV) industry.

Rising adoption of energy storage solutions in renewable energy applications.

Growing demand for advanced electronic materials requiring high-purity graphite.

Restraints:

High processing and purification costs.

Limited availability of vein graphite deposits.

Environmental concerns related to graphite mining.

High processing and purification costs.

Limited availability of vein graphite deposits.

Environmental concerns related to graphite mining.

Opportunities:

Expanding research and development in nanotechnology applications.

Potential use in next-generation semiconductors and supercapacitors.

Growing interest in sustainable and eco-friendly material sourcing.

Expanding research and development in nanotechnology applications.

Potential use in next-generation semiconductors and supercapacitors.

Growing interest in sustainable and eco-friendly material sourcing.

Challenges:

Intense competition from synthetic graphite alternatives.

Regulatory hurdles associated with mining and processing.

Price volatility due to fluctuating supply chain dynamics.

Intense competition from synthetic graphite alternatives.

Regulatory hurdles associated with mining and processing.

Price volatility due to fluctuating supply chain dynamics.

Regional Analysis

The demand for high-purity vein graphite is experiencing substantial growth across various regions:

North America: Increasing adoption in battery technologies and electronics manufacturing.

Europe: Strong demand from the aerospace and automotive sectors.

Asia-Pacific: The largest market, driven by China and Japan’s expanding electronic and battery industries.

Rest of the World: Emerging applications in advanced ceramics and metallurgy.

North America: Increasing adoption in battery technologies and electronics manufacturing.

Europe: Strong demand from the aerospace and automotive sectors.

Asia-Pacific: The largest market, driven by China and Japan’s expanding electronic and battery industries.

Rest of the World: Emerging applications in advanced ceramics and metallurgy.

Competitor Analysis

Key players in the high-purity and ultra-high-purity vein graphite market include:

Sri Lanka Graphite PLC

Graphite One Inc.

Northern Graphite Corporation

Nacional de Grafite

Sri Lanka Graphite PLC

Graphite One Inc.

Northern Graphite Corporation

Nacional de Grafite

These companies focus on expansion, acquisitions, and technological innovations to strengthen their market position.

Global High-purity and Ultra-high-purity Vein Graphite: Market Segmentation Analysis

This report provides a deep insight into the global high-purity and ultra-high-purity vein graphite market, covering all essential aspects. It includes macro overviews, market size, competitive landscape, development trends, niche market insights, key market drivers, challenges, SWOT analysis, and value chain analysis.

FAQ Section

What is the current market size of the High-purity and Ultra-high-purity Vein Graphite market?

The market was valued at USD 14 million in 2023 and is projected to reach USD 36.40 million by 2032, growing at a CAGR of 11.20%.

Which are the key companies operating in the High-purity and Ultra-high-purity Vein Graphite market?

Major players include Sri Lanka Graphite PLC, Graphite One Inc., Northern Graphite Corporation, and Nacional de Grafite.

What are the key growth drivers in the High-purity and Ultra-high-purity Vein Graphite market?

Key growth drivers include increasing demand for EV batteries, advancements in electronic materials, and growing adoption of renewable energy storage solutions.

Which regions dominate the High-purity and Ultra-high-purity Vein Graphite market?

Asia-Pacific leads the market, followed by North America and Europe.

What are the emerging trends in the High-purity and Ultra-high-purity Vein Graphite market?

Emerging trends include advancements in nanotechnology applications, increased use in semiconductors, and a shift toward sustainable graphite sourcing.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/288645/global-highpurity-ultrahighpurity-vein-graphite-forecast-market-2025-2032-933 Table of content

Table of Contents 1 Research Methodology and Statistical Scope 1.1 Market Definition and Statistical Scope of High-purity and Ultra-high-purity Vein Graphite 1.2 Key Market Segments 1.2.1 High-purity and Ultra-high-purity Vein Graphite Segment by Type 1.2.2 High-purity and Ultra-high-purity Vein Graphite Segment by Application 1.3 Methodology & Sources of Information 1.3.1 Research Methodology 1.3.2 Research Process 1.3.3 Market Breakdown and Data Triangulation 1.3.4 Base Year 1.3.5 Report Assumptions & Caveats 2 High-purity and Ultra-high-purity Vein Graphite Market Overview 2.1 Global Market Overview 2.1.1 Global High-purity and Ultra-high-purity Vein Graphite Market Size (M USD) Estimates and Forecasts (2019-2032) 2.1.2 Global High-purity and Ultra-high-purity Vein Graphite Sales Estimates and Forecasts (2019-2032) 2.2 Market Segment Executive Summary 2.3 Global Market Size by Region 3 High-purity and Ultra-high-purity Vein Graphite Market Competitive Landscape 3.1 Global High-purity and Ultra-high-purity Vein Graphite Sales by Manufacturers (2019-2025) 3.2 Global High-purity and Ultra-high-purity Vein Graphite Revenue Market Share by Manufacturers (2019-2025) 3.3 High-purity and Ultra-high-purity Vein Graphite Market Share by Company Type (Tier 1, Tier 2, and Tier 3) 3.4 Global High-purity and Ultra-high-purity Vein Graphite Average Price by Manufacturers (2019-2025) 3.5 Manufacturers High-purity and Ultra-high-purity Vein Graphite Sales Sites, Area Served, Product Type 3CONTACT US: North Main Road Koregaon Park, Pune, India - 411001. International: +1(646)-781-7170 Asia: +91 9169162030

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

0 notes

Text

Global Stamping Fluid Market Outlook Analysis 2025-2031