#Expanded Graphite Market

Explore tagged Tumblr posts

Text

Expanded Graphite Market - Forecast(2025 - 2031)

Expanded Graphite Market Overview

Expanded graphite market size is forecast to reach US$308.2 million by 2027, after growing at a CAGR of 7.8% during 2022-2027. Expanded graphite is layered graphite with interlayer space which is altered. Carbon nanotubes are often employed in combination with expanded graphite as flame retardant additives because they have excellent thermal conductivity, this property is creating a growth opportunity for the market growth. Also, the high thermal property makes expanded graphite ideal for the phase change material application. Moreover, the expanded graphite market is majorly driven by the growth of construction activities across the world, because it is utilized as flame retardant additives in roofing, construction materials, and more. Also, the increasing application of expanded graphite in the electronics industry is expected to fuel the growth of the expanded graphite industry during the forecast period.

COVID-19 Impact

In the year 2020, to curb the rising cases of Corona Virus there were increasingly stringent regulations imposed by the major economies of the world. As a result, there was a decline in construction activities across the world. For instance, according to European Construction Industry Federation (FIEC) in Hungary, the construction output fell by 9.1 percent in 2020, totaling €12.2 billion (US$13.82 billion), compared to 2019. Moreover, Australian infrastructure projects such as the Chatswood-Bankstown metro line, the Westconnex motorway, and other projects were halted because of the Covid-19 pandemic. Hence, due to the decline of construction output, there was a decline in the demand for the expanded graphite, this negatively impacted the market growth. Nevertheless, in the year 2021, with the ease of Covid-related regulations, the expanded graphite market growth improved. Furthermore, in the future, the impact of the Covid-19 pandemic will be phased away. This will result in the expanded graphite industry growth scenario as it was before the pre-Covid time.

Report Coverage

The report: "Expanded Graphite Market Report –Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Expanded Graphite Industry.

By Packaging Form: Coil-Form, Gasket Form, Weave Form, and Others. By Carbon Purity:85% to 89%, 90% to 94%, 95% to 99%, and 99.5% to 99.95%. By Application: Fire Retardant Additives, Graphite Foil, Sheet, Gaskets, Bearings, Molded Parts, Refractories, Greases, Atomic Vitality, Roofing, Construction Material, Rubber, Polyolefin Resin, Li-particle Battery, Thermoplastics, and Others. By Application: Building and Construction (Residential, Commercial, Industrial, and Infrastructure Development), Metallurgy, Paints and Coatings (Industrial Coating, Special Coating, and Others), Automotive (Passenger cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)), Chemical and Petrochemical, Power Generation (Electricity Generation, Atomic Energy, and Others), Electronics and Electrical (Semiconductors, Photovoltaic, Transmitters, and Others), Healthcare and Pharmaceuticals, Textile, Water and Wastewater Treatment, and Others. By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East (Saudi Arabia, UAE, Israel, and Rest of Middle East), and Africa (South Africa, Nigeria, and Rest of Africa)).

Request Sample

Key Takeaways

Asia-Pacific region dominated the expanded graphite market, owing to the growing construction activities in the region. For instance, development on the US$4,335 million Zhangzhou Development Zone Shuangyu Island Secondary Development in China started in the 2nd quarter of 2021 and will be finished in the 3rd quarter of 2025.

The Surging adoption of expanded graphite as a constituent in various applications such as coatings, rubber products, energy storage systems, and more such applications is anticipated to fuel the expanded graphite industry growth during the forecast period.

Moreover, the expanding use of expanded graphite in automotive components such as gaskets, batteries, and more is driving up the growth of the market.

However, the high temperature of the expanded graphite makes the handling process difficult, this factor is restricting the market growth.

Expanded Graphite Market Segment Analysis – By Application

The fire retardant additives held a significant share in the expanded graphite market in 2021 and is projected to grow at a CAGR of 7.6% during 2022-2027. The expanded graphite has the superior qualities of thermal conductivity which make it ideal for application in the textile industry as well as building and construction activities. Moreover, expanded graphite has beneficial properties such as lightness, resistance to heat, superior corrosion, and other similar properties because of these properties expanded graphite application as a fire-resistant additive is increasing. Thus, the application of expanded graphite as fire-retardant additives is increasing, which is propelling the growth of the expanded graphite market growth.

Inquiry Before Buying

Expanded Graphite Market Segment Analysis – By End-Use Industry

The building and construction held a significant share in the expanded graphite market in 2021 and is forecasted to grow at a CAGR of 8.3% during 2022-2027. The expanded graphite is an ecologically viable material making it ideal for application in the building and construction sector. Moreover, a tightening of the ban on dangerous fires-resistant materials, such as brominated or asbestos-based fire-resistant materials is anticipated to fuel the growth of expanded graphite materials. The increasing construction activities across the world is projected to bolster market growth. For instance, the increasing commercial building projects such as Kompass district residential and commercial development 2023, 'Gut Miteinander' community center in Jena2022, Jena high-quality offices in a historic setting 2022 are under construction in Germany. Also, as of March 2022, the construction plan has been approved for the Hub office development project in Canada valued at US$300 million, this project is expected to be completed by the end of 2026. In September 2019, construction work started on the city of Toronto Recreational Facilities accessibility upgrades projects in Canada valued at US$150 million, and this project will be completed by the start of 2025. The increase in the construction of such projects is expected to fuel the demand for expanded graphite. Hence, the growing building and construction activities across the world are projected to accelerate the market growth.

Expanded Graphite Market Segment Analysis – By Geography

Asia-Pacific held the largest share in the Expanded Graphite market in 2021 up to 41%. The growth of the Asia-Pacific economy is driven by the growth of the major sectors such as building & construction, chemicals, and metallurgy sectors. For instance, as of February 2022, major commercial construction projects in Vietnam such as Tan Son Nhat Airport 3rd Terminal will be completed by mid-2023, Asahi Tower residential area investment project in Ward 16, District 8 will be finished by 2027, and more such projects is expected to fuel the demand for expanded graphite. Moreover, according to Invest India, it has projected that by the year 2025 the chemicals and petrochemical industry of India will be valued at US$300 billion. Moreover, Major Chemical’s production in India climbed by 23.62% to 73.04 lakhs tons in 2021-22 (up to October-2021) from 59.08 lakhs tons in the previous year's similar period. The major Petrochemicals production in India climbed by 11.85% to 257.44 lakhs tons in 2021-22 (up to October-2021) from 230.15 lakhs tons in the previous year's similar period. Additionally, according to the statistics published by the United States Department of Agriculture (USDA), in 2019 the Chinese iron and steel production was 809 million metric tons, and in 2020, it was 830 million metric tons, an increase of 2.6%. Therefore, the growth of construction activities, chemicals, and metallurgy in the Asia-Pacific region is expanding the growth of the market.

Schedule a Call

Expanded Graphite Market Drivers

Growing Chemicals Industry Production

Expanded graphite is used in numerous high-temperature applications in the chemical industry, such as the manufacturing of phosphorus and calcium carbide in arc furnaces, owing to its superior insulation properties. The growing chemicals and petrochemicals sectors worldwide are expected to propel the demand for expanded graphite, which in turn will drive up the market growth. According to European Chemical Industry Council, in 2020, the Danish chemical industry saw the highest sales, which was Euro5.8 billion (US$6.6 billion), a growth of 6.5% since 2015. Moreover, according to the American Industry Council, in December 2021, the United States produced 7.9 billion pounds of main plastic resins, a 3.9 percent increase over the previous month. In addition, the U.S. Chemical Production Regional Index (U.S. CPRI) increased by 2.2 percent in December after increasing by 0.8 percent in November. Thus, the growing production of chemicals at the global level is expected to drive the growth of the market during the upcoming years.

Increasing Metallurgy Output

In the metallurgy industry expanded graphite is utilized during the production of metals such as iron, steel, and more because this graphite has unique electrode properties. The increased production of metals such as iron, steel, manganese, chromium, and others is boosting the need for expanded graphite. According to the United States Department of Agriculture (USDA), total global iron and steel output in 2018 was 1,250 million metric tonnes, and in 2019 it was 1,300 million metric tonnes, a 4% rise. In addition, manganese production in Australia was 3,180 thousand metric tonnes in 2019 and 3,300 thousand metric tonnes in 2020, a 3.8 percent rise. Furthermore, total chromium output worldwide in 2018 was 43,100 thousand metric tonnes, and in 2019 it was 44,000 thousand metric tonnes, a 2.0 percent rise. Thus, the increasing metal production including iron and steel, manganese, chromium, and more is anticipated to fuel the expanded graphite demand, thereby, driving the market growth during the forecast period.

Expanded Graphite Market Challenges

Lower Tensile Strength causes Inferior Performance

Even though expanded graphite sheet is commonly utilized as a sealant, flame retardant additives, and more, it still has several flaws that need to be addressed. The expanded graphite tensile and flexural strength is weaker than other sealing materials, which is a clear drawback. The expanded graphite sheet is not ideal for sealing portions making packing due to its lack of hardness. Moreover, organic solvents are not recommended for exfoliating expanded graphite because of the issues connected with them, such as their high boiling point and toxicity. Hence, these limitations associated with the tensile strength of the expanded graphite is limiting the market growth

Buy Now

Expanded Graphite Industry Outlook

Technology launches, acquisitions, and increased R&D activities are key strategies adopted by players in the expanded graphite market. Expanded graphite top 10 companies include:

GrafTech International

Nippon Kokuen Group

Yichang Xincheng Graphite

Nacional De Grafite

Asbury Carbons

Triton Minerals

SGL Group

NeoGraf Solutions

ACS Material

LKAB Minerals

Recent Developments

In January 2022, Tirupati Graphite plc, the specialist graphite firm, launched a new technology that will improve the company's main graphite and downstream specialized graphite production processes significantly. Such new graphite technologies will benefit the market growth.

In October 2021, Black Earth formed a 50:50 joint venture (JV) with India's Metachem Manufacturing to establish an expandable graphite facility in India. The new factory will serve the expanding graphite market, which is forecast to rise.

In June 2019, Leading Edge Materials developed expandable graphite in compliance with existing market products from Woxna, Sweden. The new expandable graphite can create various value-added products such as batteries, construction materials, and more.

#Expanded Graphite Market#Expanded Graphite Market Size#Expanded Graphite Industry#Expanded Graphite Market Share#Expanded Graphite top 10 companies#Expanded Graphite Market Report#Expanded Graphite Industry Outlook

0 notes

Text

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

The global expandable graphite market, particularly in coatings and textiles, is driven by innovation, sustainability, and increasing demand for fire-resistant and conductive materials. Below is a list of the leading market players making significant contributions to the market landscape:

SGL Carbon SE Known for its advanced graphite materials, SGL Carbon SE provides high-quality expandable graphite used in flame-retardant coatings and technical textiles.

GrafTech International Ltd. A global leader in graphite technology, GrafTech specializes in supplying expandable graphite for coatings requiring high thermal stability.

Nippon Graphite Industries Co., Ltd. Based in Japan, the company offers innovative solutions in expandable graphite for applications in textiles and specialty coatings.

Qingdao Guangxing Electronic Materials Co., Ltd. A Chinese manufacturer excelling in high-purity expandable graphite, primarily for fire-resistant coatings and textile applications.

Asbury Carbons With decades of experience, Asbury provides high-quality expandable graphite for advanced coating systems and technical textile manufacturing.

Qingdao Kropfmuehl Graphite Co., Ltd. Known for high-performance graphite products, the company is a significant supplier to the coatings and textiles sectors.

LKAB Minerals A European leader in industrial minerals, LKAB specializes in expandable graphite for sustainable and fire-retardant coating systems.

Xincheng Graphite Co., Ltd. A prominent player in China, offering tailor-made expandable graphite solutions for various industrial applications.

NeoGraf Solutions, LLC This U.S.-based company focuses on engineered graphite materials, including expandable graphite for coatings with enhanced fire resistance.

Imerys Graphite & Carbon A global leader in specialty materials, Imerys supplies expandable graphite for advanced fire-retardant textiles and coatings.

Shandong Jinhui Graphite Co., Ltd. One of China's largest expandable graphite producers, catering to the needs of the coatings and textiles industries.

Qingdao Braide Graphite Co., Ltd. This company specializes in supplying high-grade expandable graphite, focusing on fire-resistant applications in textiles.

Graphite Central A leading supplier of graphite products in North America, offering customizable expandable graphite solutions for niche applications.

AMG Advanced Metallurgical Group This group integrates expandable graphite into high-tech applications, including fire-retardant coatings and conductive textiles.

Yichang Xincheng Graphite Co., Ltd. A global supplier of expandable graphite, focusing on environmentally friendly and sustainable industrial solutions.

Request report sample at https://datavagyanik.com/reports/global-expandable-graphite-used-in-coatings-and-textiles-market-size-production-sales-average-product-price-market-share/

Top Winning Strategies in Expandable Graphite (Used in coatings and textiles) Market

To succeed in the highly competitive global expandable graphite market, market players are employing strategic initiatives to drive growth, innovation, and sustainability. Here are some of the most effective strategies adopted by key players:

1. Focus on Sustainability

Companies are increasingly developing eco-friendly and non-toxic expandable graphite to meet stringent environmental regulations.

Promoting sustainable solutions to cater to industries prioritizing green technologies in coatings and textiles.

2. Investment in R&D

Heavy investments in research and development to enhance the properties of expandable graphite, such as improved thermal conductivity and fire resistance.

Innovation in production technologies to create high-purity and application-specific products.

3. Expansion of Production Capacity

Key players are expanding their production facilities to meet the growing demand for expandable graphite in emerging markets.

Establishing manufacturing plants closer to major industrial hubs in Asia-Pacific and Europe.

4. Strategic Partnerships and Collaborations

Collaborating with coating and textile manufacturers to co-develop customized solutions for niche applications.

Partnering with research institutions to explore new applications of expandable graphite.

5. Market Diversification

Exploring new applications of expandable graphite in conductive textiles and fire-resistant building materials.

Diversifying the product portfolio to include expandable graphite grades for different industrial requirements.

6. Regional Market Penetration

Targeting fast-growing markets in Asia-Pacific, particularly China and India, which are significant consumers of coatings and textiles.

Strengthening distribution networks in North America and Europe to expand market reach.

7. Emphasis on Product Quality

Offering high-purity expandable graphite that meets industry-specific standards, ensuring performance in fire-retardant and conductive coatings.

Quality certifications to build customer trust and gain a competitive edge.

8. Pricing Strategies

Competitive pricing strategies to attract cost-sensitive industries without compromising on quality.

Flexible pricing models for bulk buyers, particularly in textiles and construction sectors.

9. Adoption of Advanced Manufacturing Technologies

Implementing advanced production processes to improve efficiency and reduce waste during the manufacturing of expandable graphite.

Leveraging automation and digitalization to optimize production.

10. Mergers and Acquisitions (M&A)

Acquiring smaller companies specializing in expandable graphite to strengthen market position and broaden product offerings.

Consolidation strategies to achieve economies of scale and enhance global competitiveness.

By leveraging these strategies, companies in the expandable graphite market are not only meeting current demands but are also positioning themselves for long-term growth and sustainability in the coatings and textiles industries.

Request a free sample copy at https://datavagyanik.com/reports/global-tin-di-2-Expandable Graphite (Used in coatings and textiles)-market-size-production-sales-average-product-price-market-share-import-vs-export-united-states-europe-apac-latin-america-middle-east-africa/

#Expandable Graphite (Used in coatings and textiles) Market#Expandable Graphite (Used in coatings and textiles) Production#market players#average price#revenue#top trends#market size#market share

0 notes

Text

The cogent documentary, “Surveilled,” now available on HBO, tracks journalist Ronan Farrow as he investigates the proliferation and implementation of spyware, specifically, Pegasus, which was created by the Israeli company NSO Group. The company sells its product to clients who use it to fight crime and terrorism. It is claimed that Pegasus was instrumental in helping capture Mexican drug lord, Joaquín “El Chapo” Guzman. However, there are also reports that NSO’s products are being used to target journalists, human rights activists and political dissidents.

. . .

Farrow: I put up a piece in The New Yorker this week. It was fascinating to talk to experts in the privacy law space who are really in a high state of alarm right now. The United States, under administrations from both parties, has flirted with this technology in ways that is alarming. Under the first Trump administration, they bought Pegasus. They claimed they were buying it to test it and see what our enemies were doing, and The New York Times later sued them for more information and found really persuasive evidence that the FBI wanted to operationalize that in American law enforcement investigations.

youtube

In September, the Department of Homeland Security (D.H.S.) signed a two-million-dollar contract with Paragon, an Israeli firm whose spyware product Graphite focusses on breaching encrypted-messaging applications such as Telegram and Signal. Wired first reported that the technology was acquired by Immigration and Customs Enforcement (ICE)—an agency within D.H.S. that will soon be involved in executing the Trump Administration’s promises of mass deportations and crackdowns on border crossings. A source at Paragon told me that the deal followed a vetting process, during which the company was able to demonstrate that it had robust tools to prevent other countries that purchase its spyware from hacking Americans—but that wouldn’t limit the U.S. government’s ability to target its own citizens. The technology is part of a booming multibillion-dollar market for intrusive phone-hacking software that is making government surveillance increasingly cheap and accessible. In recent years, a number of Western democracies have been roiled by controversies in which spyware has been used, apparently by defense and intelligence agencies, to target opposition politicians, journalists, and apolitical civilians caught up in Orwellian surveillance dragnets.

Now Donald Trump and incoming members of his Administration will decide whether to curtail or expand the U.S. government’s use of this kind of technology. Privacy advocates have been in a state of high alarm about the colliding political and technological trend lines.

“It’s just so evident—the impending disaster,” Emily Tucker, the executive director at the Center on Privacy and Technology at Georgetown Law, told me. “You may believe yourself not to be in one of the vulnerable categories, but you won’t know if you’ve ended up on a list for some reason or your loved ones have. Every single person should be worried.”

40 notes

·

View notes

Text

What would you want to tell the next U.S. president? FP asked nine thinkers from around the world to write a letter with their advice for him or her.

Dear Madam or Mr. President,

Congratulations on your election as president of the United States. You take office at a moment of enormous consequence for a world directly impacted by the twin challenges of energy security and climate change.

Democrats and Republicans disagree on many aspects of energy and climate policy. Yet your administration has the chance to chart a policy path forward that unites both parties around core areas of agreement to advance the U.S. national interest.

First, all should agree that climate change is real and worsening. The escalating threat of climate change is increasingly evident to anyone walking the streets of Phoenix in the summer, buying flood insurance in southern Florida, farming rice in Vietnam, or laboring outdoors in Pakistan. This year will almost certainly surpass 2023 as the warmest year on record.

Second, just as the energy revolution that made the United States the world’s largest oil and gas producer strengthened it economically and geopolitically, so will ensuring U.S. leadership in clean energy technologies enhance the country’s geostrategic position. In a new era of great-power competition, China’s dominance in certain clean energy technologies—such as batteries and cobalt, lithium, graphite, and other critical minerals needed for clean energy products—threatens America’s economic competitiveness and the resilience of its energy supply chains. China’s overcapacity in manufacturing relative to current and future demand undermines investments in the United States and other countries and distorts demand signals that allow the most innovative and efficient firms to compete in the global market.

Third, using less oil in our domestic economy reduces our vulnerability to global oil supply disruptions, such as conflict in the Middle East or attacks on tankers in the Red Sea. Even with the surge in U.S. oil production, the price of oil is set in the global market, so drivers feel the pain of oil price shocks regardless of how much oil the United States imports. True energy security comes from using less, not just producing more.

Fourth, energy security risks extend beyond geopolitics and require investing adequately in domestic energy supply to meet changing circumstances. Today, grid operators and regulators are increasingly warning that the antiquated U.S. electricity system, already adjusting to handle rising levels of intermittent solar and wind energy, is not prepared for growing electricity demand from electric cars, data centers, and artificial intelligence. These reliability concerns were evident when an auction this summer set a price nine times higher than last year’s to be paid by the nation’s largest grid operator to power generators that ensure power will be available when needed. A reliable and affordable power system requires investments in grids as well as diverse energy resources, from cheap but intermittent renewables to storage to on-demand power plants.

Fifth, expanding clean energy sectors in the rest of the world is in the national interest because doing so creates economic opportunities for U.S. firms, diversifies global energy supply chains away from China, and enhances U.S. soft power in rapidly growing economies. (In much the same way, the Marshall Plan not only rebuilt a war-ravaged Europe but also advanced U.S. economic interests, countered Soviet influence, and helped U.S. businesses.) Doing so is especially important in rising so-called middle powers, such as Brazil, India, or Saudi Arabia, that are intent on keeping their diplomatic options open and aligning with the United States or China as it suits them transactionally.

To prevent China from becoming a superpower in rapidly growing clean energy sectors, and thereby curbing the benefits the United States derives from being such a large oil and gas producer, your administration should increase investments in research and development for breakthrough clean energy technologies and boost domestic manufacturing of clean energy. Toward these ends, your administration should quickly finalize outstanding regulatory guidance to allow companies to access federal incentives. Your administration should also work with the other side of the aisle to provide the market with certainty that long-term tax incentives for clean energy deployment—which have bipartisan support and have already encouraged historic levels of private investment—will remain in place. Finally, your administration should work with Congress to counteract the unfair competitive advantage that nations such as China receive by manufacturing industrial products with higher greenhouse gas emissions. Such a carbon import tariff, as proposed with bipartisan support, should be paired with a domestic carbon fee to harmonize the policy with that of other nations—particularly the European Union’s planned carbon border adjustment mechanism.

Your ability to build a strong domestic industrial base in clean energy will be aided by sparking more domestic clean energy use. This is already growing quickly as market forces respond to rapidly falling costs. Increasing America’s ability to produce energy is also necessary to maintain electricity grid reliability and meet the growing needs of data centers and AI. To do so, your administration should prioritize making it easier to build energy infrastructure at scale, which today is the greatest barrier to boosting U.S. domestic energy production. On average, it takes more than a decade to build a new high-voltage transmission line in the United States, and the current backlog of renewable energy projects waiting to be connected to the power grid is twice as large as the electricity system itself. It takes almost two decades to bring a new mine online for the metals and minerals needed for clean energy products, such as lithium and copper.

The permitting reform bill recently negotiated by Sens. Joe Manchin and John Barrasso is a good place to start, but much more needs to be done to reform the nation’s permitting system—while respecting the need for sound environmental reviews and the rights of tribal communities. In addition, reforming the way utilities operate in the United States can increase the incentives that power companies have not just to build new infrastructure but to use existing infrastructure more efficiently. Such measures include deploying batteries to store renewable energy and rewiring old transmission lines with advanced conductors that can double the amount of power they move.

Grid reliability will also require more electricity from sources that are available at all times, known as firm power. Your administration should prioritize making it easier to construct power plants with advanced nuclear technology—which reduce costs, waste, and safety concerns—and to produce nuclear power plant fuel in the United States. Doing so also benefits U.S. national security, as Russia is building more than one-third of new nuclear reactors around the world to bolster its geostrategic influence. While Russia has been the leading exporter of reactors, China has by far the most reactors under construction at home and is thus poised to play an even bigger role in the international market going forward. The United States also currently imports roughly one-fifth of its enriched uranium from Russia. To counter this by building a stronger domestic nuclear industry, your administration should improve the licensing and approval process of the Nuclear Regulatory Commission and reform the country’s nuclear waste management policies. In addition to nuclear power, your administration should also make it easier to permit geothermal power plants, which today can play a much larger role in meeting the nation’s energy needs thanks to recent innovations using technology advanced by the oil and gas sector for shale development.

Even with progress on all these challenges, it is unrealistic to expect that the United States can produce all the clean energy products it needs domestically. It will take many years to diminish China’s lead in critical mineral supply, battery manufacturing, and solar manufacturing. The rate of growth needed in clean energy is too overwhelming, and China’s head start is too great to diversify supply chains away from it if the United States relies solely on domestic manufacturing or that of a few friendly countries. As a result, diminishing China’s dominant position requires that your administration expand economic cooperation and trade partnerships with a vast number of other nations. Contrary to today’s protectionist trends, the best antidote to concerns about China’s clean technology dominance is more trade, not less.

Your administration should also strengthen existing tools that increase the supply of clean energy products in emerging and developing economies in order to diversify supply chains and counter China’s influence in these markets. For example, the U.S. International Development Finance Corp. (DFC) can be a powerful tool to support U.S. investment overseas, such as in African or Latin American projects to mine, refine, and process critical minerals. As DFC comes up for reauthorization next year, you should work with Congress to provide DFC with more resources and also change the way federal budgeting rules account for equity investments; this would allow DFC to make far more equity investments even with its existing funding. Your administration can also use DFC to encourage private investment in energy projects in emerging and developing economies by reducing the risk investors face from fluctuations in local currency that can significantly limit their returns or discourage their investment from the start. The U.S. Export-Import Bank is another tool to support the export of U.S. clean tech by providing financing for U.S. goods and services competing with foreign firms abroad.

Despite this country’s deep divisions and polarization, leaders of both parties should agree that bolstering clean energy production in the United States and in a broad range of partner countries around the world is in America’s economic and security interests.

I wish you much success in this work, which will also be the country’s success.

11 notes

·

View notes

Text

Graphite Market Analysis, Business Growing Strategies, Segmentation and Forecast 2033

According to Fact.MR's analysis, the global graphite market (グラファイトマーケット) was valued at US$ 25.9 billion in 2023 and is projected to achieve a compound annual growth rate (CAGR) of 8.5%, reaching US$ 58.6 billion by 2033.

The surge in demand for lithium-ion batteries, utilized in electric vehicles (EVs), portable electronics, and renewable energy storage, is anticipated to be a key driver for graphite demand. Graphite plays a pivotal role in these batteries, serving as an essential component in the anode material responsible for storing and releasing lithium ions during charge and discharge cycles. With the expansion of the EV market and the rise in installations of renewable energy sources, the demand for graphite is expected to maintain its upward trajectory.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.factmr.com/connectus/sample?flag=S&rep_id=7003

The global graphite market is experiencing a significant surge in demand, largely propelled by the booming popularity of lithium-ion batteries. These batteries, known for their high energy density, lightweight nature, and long lifespan, have become indispensable components in various applications ranging from consumer electronics to electric vehicles and renewable energy storage systems. As the world transitions towards a greener and more sustainable future, the demand for lithium-ion batteries continues to soar, consequently driving the growth of the graphite market.

Graphite plays a crucial role in the production of lithium-ion batteries, serving as a key component in the battery anode. Natural graphite, particularly the flake variety, is highly prized for its superior conductivity, stability, and ability to store and release electrical energy efficiently. As a result, graphite has emerged as a critical material in the manufacturing of lithium-ion batteries, with demand for high-quality graphite experiencing a sharp uptick in recent years.

One of the primary factors driving the increased demand for lithium-ion batteries is the rapid adoption of electric vehicles (EVs) worldwide. With growing concerns over environmental pollution and climate change, governments and consumers alike are increasingly embracing electric mobility as a cleaner and more sustainable alternative to traditional internal combustion engine vehicles. As a result, EV manufacturers are ramping up production to meet the rising demand, driving the need for lithium-ion batteries and, in turn, graphite.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞:

Key players in the graphite industry include Aoyu Graphite Group, Hunan Zhongke Shinzoom Technology Co., Ltd., Mitsubishi Chemical, Nippon Graphite Industries, Ltd., Qingdao Haida Graphite Co., Ltd., Shanshan Technology, and Showa Denko Materials Co. Ltd.

Graphite manufacturers are ramping up their production capacities and forging alliances with local market participants to expand their customer base and enhance profitability. For instance,

In June 2022, Mitsubishi Chemical Holdings Group (MCHG) announced plans to bolster the production capacity of natural graphite anode material at its Chinese subsidiary, Qingdao Anode Kasei, and its affiliated company, Qingdao Lingda Kasei. The capacity will increase from 2,000 tons/year to 12,000 tons/year. The new production line is slated to commence operations in the first half of fiscal 2023.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐆𝐫𝐚𝐩𝐡𝐢𝐭𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡

By Product Type :

Natural

Flakes

Amorphous

Veins

Synthetic

By Application :

Electrodes

Refractories & Foundries

Batteries

Recarburisers

Lubricants

Friction Products

Others

By Region :

North America

Latin America

Europe

East Asia

South Asia & Oceania

Middle East & Africa

As the world embarks on a transition towards a cleaner and more sustainable future, the graphite market is poised for significant growth. With the rising demand for lithium-ion batteries driving the expansion of various industries, including electric vehicles and renewable energy, graphite is set to play a pivotal role in powering the technologies of tomorrow. As such, stakeholders across the graphite supply chain must continue to innovate and collaborate to meet the evolving needs of the market and contribute to a more sustainable world.

𝐂𝐡𝐞𝐜𝐤 𝐎𝐮𝐭 𝐌𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Ultra-high Molecular Weight Polyethylene Market Carbon Capture and Storage (CCS) Market Silicon Carbide (Carborundum) Market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: [email protected]

1 note

·

View note

Text

Graphite Thermal Pads Market - Latest Innovations Drivers Dynamics And Strategic Analysis Challenges

Global Graphite Thermal Pads Market Research Report 2025(Status and Outlook)

The global Graphite Thermal Pads Market size was valued at US$ 2.18 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025-2032.

Graphite thermal pads are soft, thermally conductive materials designed to enhance heat dissipation in electronic devices. These pads leverage graphite’s exceptional thermal conductivity properties (ranging between 300-1900 W/mK) while maintaining electrical insulation – making them ideal for high-performance computing, LED lighting, and telecommunications equipment.

The market growth is primarily driven by escalating demand from the consumer electronics sector, particularly smartphones and laptops requiring efficient thermal management solutions. Additionally, the rapid expansion of 5G infrastructure and data centers globally is creating substantial demand. However, the emergence of alternative materials like thermal interface greases presents competitive challenges. Key players such as Panasonic Group and Graftech are investing in product innovations, including multi-layer graphene-enhanced pads with improved thermal conductivity up to 2000 W/mK.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95881

Segment Analysis:

By Type

Composite Graphite Film Segment Leads Due to Superior Thermal Conductivity and Flexibility

The market is segmented based on type into:

Single Layer Graphite Film

Composite Graphite Film

Multilayer Graphite Film

Others

By Application

Computer Industry Segment Dominates Owing to Increasing Demand for Thermal Management Solutions in Electronics

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Sector Holds Major Share Due to Growing Demand for Compact Thermal Solutions

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Others

Regional Analysis: Global Graphite Thermal Pads Market

North America The North American graphite thermal pads market is driven by high demand from the computer and telecommunications industries, particularly in the U.S. The region benefits from stringent thermal management requirements in data centers, automotive electronics, and 5G infrastructure. With an estimated market value of $120 million in 2023, the U.S. leads due to its advanced electronics manufacturing sector. Canada and Mexico are witnessing steady growth with increasing investments in renewable energy systems, where graphite thermal pads are used extensively in battery cooling applications. However, the adoption of alternative materials like silicon-based thermal interface materials (TIMs) presents competitive challenges. Local manufacturers are focusing on multilayer graphite films to cater to high-performance computing needs.

Europe Europe’s market is characterized by a strong emphasis on sustainability and energy efficiency, particularly in Germany and the UK. The EU’s push for eco-friendly electronic components has accelerated research into graphite thermal pads with lower carbon footprints. The automotive sector, especially electric vehicle (EV) production, is a major growth driver, with thermal management being critical for battery longevity. Demand is further supported by stringent regulations such as RoHS and WEEE directives. However, supply chain disruptions and raw material price volatility, particularly from Russian graphite suppliers, have impacted market stability. Companies like Panasonic and Kaneka are expanding their European production facilities to mitigate these challenges and meet rising demand from industrial automation sectors.

Asia-Pacific The fastest-growing regional market, Asia-Pacific dominates graphite thermal pad consumption, accounting for over 45% of global demand in 2023. China’s robust electronics manufacturing ecosystem and India’s expanding telecom infrastructure are primary growth contributors. Japan and South Korea play pivotal roles in technological innovation, with companies like Denka and Tanyuan focusing on high-conductivity composite graphite films for LED and semiconductor applications. However, price sensitivity in emerging economies like Indonesia and Vietnam leads to a preference for single-layer graphite pads. The region also faces challenges related to inconsistent raw material quality and intellectual property concerns, prompting stricter supplier vetting processes.

South America South America’s market remains in a development phase, with Brazil leading demand due to growing data center investments and renewable energy projects. While Argentina and Colombia show potential, economic instability and limited local manufacturing capabilities restrict growth, keeping import dependency high. Graphite thermal pad adoption in consumer electronics repair markets is rising, though penetration in industrial applications lags behind other regions. Infrastructure bottlenecks and fluctuating tariffs on imported electronic components further complicate market expansion. Nevertheless, partnerships between regional distributors and Asian suppliers are gradually improving product accessibility.

Middle East & Africa This region exhibits nascent but promising demand, particularly in the UAE and Saudi Arabia, where smart city initiatives and data center construction drive thermal management needs. South Africa serves as a gateway for graphite pad imports into sub-Saharan Africa, catering to telecommunications tower cooling applications. However, market growth is constrained by low awareness of advanced thermal solutions and budget constraints favoring traditional heat sinks. Efforts by global players like Graftech to establish local distribution networks and provide cost-optimized products are gradually boosting adoption in key industrial sectors.

List of Key Graphite Thermal Pads Companies Profiled

Panasonic Group (Japan)

Denka Company Limited (Japan)

Kaneka Corporation (Japan)

Tanyuan Technology Co., Ltd. (China)

Zhongshi Technology (Shenzhen) Co., Ltd. (China)

FRD Co., Ltd (China)

Graftech International (U.S.)

Momentive Performance Materials (U.S.)

Laird Technologies (U.K.)

The global graphite thermal pads market is experiencing robust growth driven by the increasing demand for efficient thermal management solutions in electronics. As devices become more compact and powerful, managing heat dissipation has become critical for performance and longevity. Graphite thermal pads offer superior thermal conductivity ranging from 300-1500 W/mK, significantly higher than traditional silicone pads. The consumer electronics sector, which accounts for over 40% of total demand, is witnessing particularly strong adoption in smartphones, laptops, and gaming consoles where thermal throttling impacts user experience. Moreover, the proliferation of 5G technology requires advanced thermal solutions to handle increased heat generation in infrastructure equipment.

The automotive sector has emerged as a key growth driver with the rapid adoption of electric vehicles (EVs) globally. EV battery systems and power electronics generate substantial heat during operation, requiring efficient thermal interfaces. Graphite thermal pads are increasingly preferred in battery management systems due to their electrical insulation properties combined with excellent thermal conductivity. With EV production expected to grow at over 25% CAGR through 2030, this segment offers significant opportunities for graphite thermal pad manufacturers. Furthermore, the lightweight nature of graphite pads contributes to overall vehicle weight reduction, enhancing energy efficiency – a critical factor in EV design.

The industrial automation sector and data center industry are becoming major consumers of graphite thermal pads. Industrial electronics operating in harsh environments require reliable thermal management solutions that can withstand vibration, thermal cycling, and long operational hours. Similarly, data centers handling increasingly dense server configurations are adopting graphite thermal pads to manage heat loads more effectively while optimizing space. With global data center IP traffic projected to triple in the next five years, this sector alone could account for 20% of graphite thermal pad consumption by 2028.

Recent advancements in material science have led to the development of flexible hybrid graphite composites that combine the thermal properties of graphite with improved mechanical characteristics. These next-generation materials can conform to complex geometries and withstand repeated flexing, making them ideal for wearable electronics and flexible displays. The wearable technology market, projected to exceed $100 billion by 2030, represents a significant growth opportunity for innovative thermal interface solutions. Manufacturers investing in R&D to enhance the mechanical properties of graphite thermal pads while maintaining thermal performance stand to gain substantial market share.

The increasing emphasis on sustainable electronics manufacturing creates opportunities for graphite thermal pad producers. Natural graphite is a mined material, but manufacturers are developing environmentally friendly alternatives using recycled graphite and bio-based binders. These sustainable solutions align with the electronics industry’s push towards greener supply chains and circular economy principles. With major OEMs committing to carbon neutrality goals, suppliers offering certified sustainable thermal solutions can command premium pricing and secure long-term contracts. The trend towards RoHS-compliant and halogen-free materials further strengthens the position of properly formulated graphite thermal pads in the market.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95881

Key Questions Answered by the Graphite Thermal Pads Market Report:

What is the current market size of Global Graphite Thermal Pads Market?

Which key companies operate in Global Graphite Thermal Pads Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

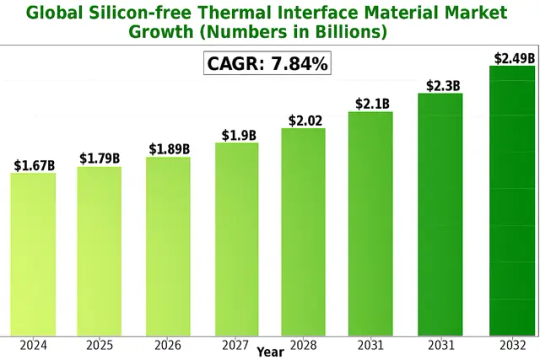

Global Silicon-free Thermal Interface Material Market : Size, Share, Growth, Trends and Forecast Opportunities

Global Silicon-free Thermal Interface Material Market size was valued at US$ 934.7 million in 2024 and is projected to reach US$ 1.59 billion by 2032, at a CAGR of 7.84% during the forecast period 2025-2032.

Silicon-free thermal interface materials are advanced heat dissipation solutions used between electronic components and heat sinks, designed specifically for applications where silicone contamination must be avoided. These materials include gaskets, graphite pads, thermal conductive pastes, adhesive tapes, films, and phase change materials that ensure efficient thermal management in sensitive electronic environments.

The market growth is primarily driven by increasing demand from the LED and computer industries, where high-performance thermal management is critical. The energy sector is emerging as a significant contributor due to expanding renewable energy installations requiring robust thermal solutions. Recent innovations in 5G infrastructure and electric vehicles are creating new opportunities, with major players like Henkel and 3M introducing silicon-free TIM formulations specifically for these high-growth applications. Asia-Pacific currently dominates the market, accounting for over 42% of global demand, largely due to concentrated electronics manufacturing in China and South Korea.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-silicon-free-thermal-interface-material-market/

Segment Analysis:

By Type

Thermal Conductive Paste Segment Leads Due to High Thermal Conductivity and Ease of Application

The global silicon-free thermal interface material market is segmented based on material type into:

Gasket

Graphite Pad

Thermal Conductive Paste

Thermal Conductive Adhesive Tape

Thermal Conductive Film

Phase Change Materials

Others

By Application

Computer Industry Segment Dominates Due to Increasing Demand for High-performance Computing Devices

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Segment Leads Due to Growing Demand for Thermal Management in Compact Devices

The market is segmented based on end user into:

Consumer Electronics

Automotive Electronics

Industrial Equipment

Aerospace and Defense

Others

Regional Analysis: Global Silicon-free Thermal Interface Material Market

North America North America dominates the silicon-free thermal interface material market, driven by robust adoption in high-performance computing, telecommunications, and electric vehicle sectors. The region’s stringent regulations regarding thermal management performance and material safety push manufacturers toward silicon-free alternatives. Leading technology firms and automotive players are increasingly demanding non-silicone TIMs to prevent contamination in sensitive applications. The U.S. holds the largest market share, supported by significant R&D investments in advanced thermal solutions and strong presence of key players like Dow, DuPont, and 3M. Market growth is further accelerated by renewable energy projects and hyperscale data center expansions requiring efficient heat dissipation.

Europe Europe demonstrates steady growth in silicon-free TIM adoption, fueled by strict REACH regulations and increasing focus on sustainable electronics manufacturing. Germany and the UK lead this transition, with automotive and industrial sectors prioritizing high-reliability thermal management solutions. The region shows particular interest in phase change materials and graphite-based solutions for electric vehicle battery cooling systems. However, higher costs compared to conventional thermal interface materials somewhat limit penetration in cost-sensitive applications. Recent collaborations between academic institutions and material science companies aim to develop next-generation bio-based thermal interface materials to meet both performance and environmental requirements.

Asia-Pacific Asia-Pacific represents the fastest-growing regional market, with China, Japan, and South Korea accounting for over 60% of regional consumption. Rapid expansion of consumer electronics manufacturing, coupled with massive investments in 5G infrastructure, drives demand for high-performance thermal solutions. While price sensitivity remains a challenge, leading manufacturers are gradually shifting from silicone-based to silicon-free alternatives to meet international quality standards for exports. India’s emerging electronics manufacturing sector presents new opportunities, though adoption rates lag behind more developed Asian markets. The region benefits from strong local supply chains and increasing government support for advanced material development in strategic industries.

South America The South American market shows moderate but consistent growth, primarily concentrated in Brazil and Argentina. Limited local production capabilities result in heavy reliance on imports, particularly from North American and Asian suppliers. Industrial and energy applications lead silicon-free TIM adoption, while consumer electronics applications remain limited by cost considerations. Political and economic instability in some countries creates supply chain challenges, though increasing foreign investments in manufacturing infrastructure may improve market accessibility. The region’s growing renewable energy sector, particularly solar power projects, offers potential growth avenues for thermal management solutions.

Middle East & Africa This region presents emerging opportunities in specific sectors like telecommunications infrastructure and oil & gas applications. The Gulf Cooperation Council countries show increasing adoption in data center cooling applications, supported by digital transformation initiatives. However, market penetration remains low compared to other regions due to limited local manufacturing and lower awareness about advanced thermal management solutions. South Africa shows potential as an emerging market, particularly for energy and industrial applications, though widespread adoption is hampered by infrastructure challenges and competing budget priorities across most African nations.

MARKET OPPORTUNITIES

Emerging Applications in Power Electronics and Renewable Energy Systems

The rapid growth of renewable energy infrastructure and power electronics presents substantial growth opportunities for silicon-free TIMs. Solar inverters, wind turbine power converters, and energy storage systems all require reliable thermal management solutions capable of withstanding harsh environmental conditions. These applications often involve high power densities and extended operational lifespans where conventional materials may degrade over time. The renewable energy sector’s emphasis on system reliability and maintenance-free operation aligns perfectly with the value proposition of premium thermal interface materials.

Development of Next-Generation Material Formulations

Ongoing material science innovations continue to expand the performance envelope of silicon-free TIMs. Recent advances in carbon-based materials and metal matrix composites show particular promise, with some experimental formulations demonstrating thermal conductivity values exceeding 100 W/mK. These developments could open entirely new application spaces in high-performance computing, aerospace, and defense electronics. The market stands to benefit significantly from continued R&D investment in novel material systems and manufacturing processes.

Strategic Partnerships Across the Value Chain

Collaborative development initiatives between material suppliers, OEMs, and end-users present significant opportunities for market expansion. Such partnerships can accelerate material qualification processes and yield optimized solutions for specific applications. Several leading automotive manufacturers have already established joint development programs with materials companies to create customized thermal solutions for next-generation EV platforms. This trend toward closer technical collaboration helps overcome adoption barriers while driving innovation tailored to industry needs.

SILICON-FREE THERMAL INTERFACE MATERIAL MARKET TRENDS

Expanding Electronics Industry Driving Demand for High-Performance Thermal Solutions

The global silicon-free thermal interface material (TIM) market is witnessing significant growth due to increasing demand from the electronics industry for efficient heat dissipation solutions. With the proliferation of high-performance computing devices, 5G telecommunications equipment, and advanced LED lighting systems, the need for reliable thermal management has never been greater. Silicon-free TIMs are particularly gaining traction because they eliminate potential contamination risks associated with silicon-based alternatives while providing superior thermal conductivity. The market is expected to grow at a compound annual growth rate (CAGR) of approximately 7-9% from 2023 to 2030, driven by continuous technological advancements in electronic component miniaturization.

Other Trends

Shift Toward Non-Silicone Formulations

Increasing regulatory scrutiny on silicone migration has prompted manufacturers to adopt silicon-free alternatives. These materials offer comparable thermal performance without the risk of outgassing or contamination, making them ideal for sensitive applications in aerospace, medical devices, and automotive electronics. Recent product innovations include carbon-based TIMs and metal-particle infused pastes, which demonstrate thermal conductivities exceeding 10 W/mK while maintaining excellent electrical insulation properties.

Automotive Electrification Creating New Opportunities

The rapid adoption of electric vehicles (EVs) is creating substantial demand for advanced thermal management solutions. Silicon-free TIMs are increasingly used in EV battery packs, power electronics, and electric motor systems where high reliability and long-term stability are critical. With global EV sales projected to reach 30 million units annually by 2030, this sector represents one of the most promising growth avenues for silicon-free TIM manufacturers. Emerging materials like graphene-enhanced thermal pads and phase change compounds are being specifically developed to meet the unique requirements of automotive applications.

Sustainability Concerns Influencing Material Development

Environmental regulations and corporate sustainability initiatives are pushing manufacturers to develop eco-friendly silicon-free TIM formulations. Recent innovations include bio-based thermal interface materials derived from renewable resources and recyclable thermal pads with reduced environmental impact. These developments align with global sustainability goals while meeting performance requirements for next-generation electronic devices. The market is also seeing increased investment in R&D to improve material properties while reducing manufacturing costs, making silicon-free TIMs more accessible across various industries.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Material Innovation and Geographic Expansion

The global silicon-free thermal interface materials market exhibits a moderately fragmented competitive landscape, with multinational corporations dominating alongside specialized regional players. Dow Inc. holds a prominent position in this space, leveraging its advanced polymer science expertise to develop high-performance thermal management solutions. The company’s 2023 acquisition of a specialty materials startup further strengthened its product portfolio in electronics cooling applications.

Henkel AG & Co. KGaA and 3M Company collectively account for approximately 35% of the market share through their diversified thermal interface material offerings. These industry giants benefit from strong distribution networks and ongoing R&D investments exceeding $200 million annually in thermal management technologies. Their recent product launches focus on high thermal conductivity formulations that maintain performance under extreme conditions.

Meanwhile, Asian players like Shin-Etsu Chemical and Dexerials Corporation are gaining traction through cost-competitive solutions tailored for consumer electronics manufacturers. Their growth reflects the increasing demand from smartphone and laptop producers seeking alternatives to silicon-based thermal compounds. These companies are now expanding into North American and European markets through strategic partnerships with local distributors.

The competitive intensity continues to rise as companies prioritize sustainability initiatives. Wacker Chemie AG‘s recent launch of bio-based thermal interface materials demonstrates this shift. Similarly, DuPont is investing heavily in recyclable thermal solutions to meet tightening environmental regulations in key markets.

List of Leading Silicon-free TIM Manufacturers

Dow Inc. (U.S.)

Panasonic Group (Japan)

Parker Hannifin Corp (U.S.)

Shin-Etsu Chemical (Japan)

Laird Technologies (U.K.)

Henkel AG & Co. KGaA (Germany)

Fujipoly (Japan)

DuPont de Nemours, Inc. (U.S.)

Aavid (Boyd Corporation) (U.S.)

3M Company (U.S.)

Wacker Chemie AG (Germany)

Fule Industrial (China)

Learn more about Competitive Analysis, and Global Forecast of Global Silicon-free TIM Market : https://semiconductorinsight.com/download-sample-report/?product_id=95880

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Silicon-free TIM Market?

-> Silicon-free Thermal Interface Material Market size was valued at US$ 934.7 million in 2024 and is projected to US$ 1.59 billion by 2032, at a CAGR of 7.84% .

Which key companies operate in this market?

-> Major players include Henkel, 3M, Dow, DuPont, Parker Hannifin, Laird Technologies, and Shin-Etsu, with these seven companies holding 68% market share collectively.

What are the key growth drivers?

-> Primary growth drivers are 5G infrastructure deployment (creating USD 120 million annual TIM demand), electric vehicle adoption (18% CAGR in automotive TIM use), and data center expansion requiring advanced cooling solutions.

Which region dominates the market?

-> Asia-Pacific leads with 48% market share in 2023, driven by electronics manufacturing in China, South Korea, and Taiwan, while North America shows fastest growth at 7.1% CAGR due to EV and data center investments.

What are the emerging material trends?

-> Emerging trends include graphene-enhanced TIMs (25-30 W/mK conductivity), phase-change materials for high-performance computing, and eco-friendly bio-based formulations meeting new EU RoHS 3.0 standards.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

India’s Vedanta expands metals exploration

Vedanta secured four mineral blocks in the fourth round of India's critical mineral auctions. It won a vanadium and graphite block in Arunachal Pradesh and a cobalt, manganese, and iron (polymetallic) block in Karnataka. Its subsidiary Hindustan Zinc (HZL) was awarded one tungsten block in Andhra Pradesh and another in Tamil Nadu.

The company is expanding its value-added aluminium products capacity in billets, primary foundry alloys, rolled products and wire rods. Aluminium billets are used in the aerospace, defence and solar power sectors, while aluminium rolled products are used in high-speed railways, electric vehicles, pharmaceuticals and battery enclosures.

0 notes

Text

0 notes

Text

Natural Graphite Market Trends, Size, Segment and Growth by Forecast to (2021-2031)

Natural Graphite Market Outlook (2024–2031) The global natural graphite market is projected to grow from US$ 4.15 billion in 2024 to US$ 8.27 billion by 2031, expanding at a CAGR of 10.6% during the forecast period from 2025 to 2031. 📚Download Full PDF Sample Copy of Market Report @ https://wwcw.businessmarketinsights.com/sample/ BMIPUB00031711

Executive Summary and Global Market Overview

This comprehensive report provides a detailed analysis of the global natural graphite market, examining its size, share, and evolving dynamics from 2021 to 2031. It aims to equip stakeholders with strategic insights into the market landscape by evaluating key growth drivers, emerging opportunities, challenges, and the competitive environment. Our findings are based on a rigorous research methodology that integrates both primary and secondary data sources to deliver accurate, actionable intelligence.

The natural graphite industry is experiencing a fundamental shift, evolving from its traditional role in industrial applications to becoming a critical component in the global clean energy transition. This shift is primarily driven by the rapid expansion of the electric vehicle (EV) industry and the rising demand for grid-scale energy storage solutions. As lithium-ion batteries take center stage in global decarbonization efforts—particularly in the automotive and renewable energy sectors—graphite's indispensable role as the dominant anode material has elevated its strategic importance on the global stage.

Regional Insights: Asia-Pacific (APAC)

The Asia-Pacific region dominates the global natural graphite market, accounting for nearly 80% of total demand. This dominance is underpinned by surging consumption across key industries such as electric vehicles, steel manufacturing, batteries, and consumer electronics. APAC’s strong manufacturing base, coupled with favorable government policies supporting EV adoption and clean energy technologies, continues to drive robust market expansion in the region.

Natural Graphite Market Segmentation Analysis

The global natural graphite market is comprehensively segmented by type, application, end-user industry, and geography, each playing a critical role in shaping market dynamics.

By Type:

Flake Graphite

Amorphous Graphite

Vein Graphite

Among these, flake graphite holds the largest market share. It is the most commonly used type due to its critical role in lithium-ion battery anodes, refractories, and a range of industrial applications.

By Application:

Batteries

Refractories

Electrodes

Lubricants

Friction Products

Other Applications

Batteries and electrodes are the leading application segments, with batteries showing the fastest growth. The rising demand for lithium-ion batteries in electric vehicles and energy storage systems is significantly driving graphite consumption.

By End-User Industry:

Automotive

Metallurgy

Electronics

Energy

Aerospace

Other Industries

The automotive sector, led by the global shift toward electric vehicles (EVs), has emerged as the dominant end-user, overtaking traditional industrial applications such as metallurgy and refractories.

By Geography:

North America

Europe

Asia-Pacific (APAC)

Middle East & Africa

South & Central America

The Asia-Pacific region is the largest and most influential market for natural graphite, primarily driven by China. China not only leads in natural graphite production but also controls over 90% of the global graphite processing capacity. This gives APAC a strategic advantage in both supply and consumption, especially in battery manufacturing and advanced materials sectors.

Market Drivers and Opportunities

1. Growth in Electric Vehicles (EVs):

The accelerating adoption of EVs globally is a major growth driver. Graphite is a critical raw material for lithium-ion battery anodes, and demand is projected to grow in tandem with EV production.

2. Advancements in Battery Technology:

Innovations in battery chemistry and energy storage solutions are boosting the need for high-purity natural graphite. Companies investing in advanced extraction and purification technologies are poised to capitalize on these trends.

Natural Graphite Market Report Coverage and Deliverables

The "Natural Graphite Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

Natural Graphite market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

Natural Graphite market trends, as well as market dynamics such as drivers, restraints, and key opportunities

Detailed Porter's Five Forces and SWOT analysis.

Natural Graphite market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Natural Graphite market.

Detailed company profiles

Geographical Scope of the Natural Graphite Market

The Natural Graphite market report covers five key regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. Each region exhibits distinct market dynamics influenced by industrial trends, technological developments, and strategic investments.

Asia Pacific (APAC): APAC leads global demand for natural graphite, driven by robust industrial capabilities and advancements in battery technologies. The region’s dominance is underscored by its strong presence in the electric vehicle (EV) sector and electronics manufacturing, where graphite plays a vital role.

Europe: In Europe, the natural graphite market is witnessing steady growth, propelled by the surging EV industry and increasing demand for lithium-ion batteries—the fastest-growing application segment for graphite. The region is also making strides toward sustainable and localized battery production, enhancing its graphite value chain.

North America: Natural graphite demand in North America continues to rise, largely due to rapid EV adoption and the growing need for energy storage solutions. Despite having considerable domestic graphite resources, the region remains a net importer, highlighting concerns around supply security and the push for sustainable, domestic production to support future market stability.

Middle East & Africa and South & Central America: These regions are experiencing upward growth in graphite demand, driven by strategic developments in battery materials, steel manufacturing, and advanced technologies. Countries such as Saudi Arabia, the UAE, and South Africa are actively investing in graphite production capabilities. Africa, in particular, has emerged as a key player due to its untapped natural graphite reserves, attracting global investment aimed at diversifying the supply chain.

Natural Graphite Market Report Structure and Research Methodology

The report offers comprehensive qualitative and quantitative analysis across parameters such as product type, technology, application, end user, and regional geography. The structure of the report includes:

Chapter 2 – Key Takeaways: Highlights major trends and market outlook.

Chapter 3 – Research Methodology: Details the research design, including primary and secondary data sources.

Chapter 4 – Ecosystem and Porter’s Analysis: Presents an overview of the graphite market ecosystem and competitive forces.

Chapter 5 – Market Dynamics: Covers key drivers, restraints, opportunities, and emerging trends, supported by impact analysis.

Chapter 6 – Market Overview and Forecast: Presents historical revenue data and forecasts through 2031.

Chapters 7–9 – Market Segmentation: Breaks down the market by product type, application, and end user across all five regions.

Chapter 10 – Competitive Landscape: Features a heat map and competitive analysis of key players.

Chapter 11 – Industry Landscape: Details market initiatives, strategic developments, mergers, and joint ventures.

Chapter 12 – Company Profiles: Provides in-depth profiles of leading companies, including business descriptions, financial data, product portfolios, SWOT analyses, and recent developments.

Chapter 13 – Appendix: Includes abbreviations, glossary, and disclaimers.

Recent Market Developments and Industry News

Lucid Group, Inc. (June 4, 2025): Lucid has entered a multi-year agreement with Graphite One to secure U.S.-sourced natural graphite, strengthening its domestic raw materials supply chain for EV production.

Talga Group (June 2025): Talga received final regulatory approval to develop the Nunasvaara South graphite mine in Sweden. Supported by the European Union, the project aims to supply sustainable battery anode materials, enhancing Europe’s strategic autonomy in the EV and energy storage markets.

About Us: Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications Author's Bio Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

High Temperature Gasket Materials Market to Surge Owing to Aftermarket Service Growth

High Temperature Gasket Materials Market encompasses sealing products engineered to withstand extreme heat and chemical exposure in industries such as automotive, power generation, petrochemicals, and aerospace. These gaskets are fabricated from advanced materials—graphite, ceramic fiber, composite elastomers—offering superior thermal stability, chemical resistance, and mechanical robustness.

By minimizing leakage and extending equipment life, they address stringent safety standards and operational efficiency requirements, reducing downtime and maintenance costs. The need for reliable sealing solutions grows alongside industrial expansion, stringent emission norms, and the rising High Temperature Gasket Materials Market Demand for energy-efficient systems. Ongoing investments in research and development drive innovation in product formulations and quality assurance.

Global high temperature gasket materials market was valued at US$ 23.52 Bn in 2021 in terms of revenue, exhibiting a CAGR of 6.38 % during the forecast period (2022 to 2030).

Key Takeaways Key players operating in the High Temperature Gasket Materials Market are Auburn Manufacturing, Inc. and TEADIT International Produk. Auburn Manufacturing, Inc. focuses on custom gasket solutions and robust quality control that secures significant market share in North America. TEADIT International Produk, known for engineered graphite and elastomer composites, holds strong industry share across Europe and Asia. These market players continuously expand portfolios through strategic partnerships and acquisitions to reinforce competitive positioning.

Get More Insights On- High Temperature Gasket Materials Market

Get this Report in Japanese Language: 高温ガスケット材料市場

Get this Report in Korean Language: 고온 개스킷 재료 시장

#High Temperature Seals#Power Generation Gaskets#High Temperature Gasket Materials#High Temperature Gasket Materials Market#High Temperature Gasket Materials Market Trends#High Temperature Gasket Materials Market Insights#Coherent Market Insights

0 notes

Text

Battery Silicon Anode Material Market 2025

Battery Silicon Anode Material refers to advanced anode materials used in lithium-ion batteries to enhance energy storage capacity. Silicon anodes offer significantly higher charge capacity compared to traditional graphite anodes, making them a crucial innovation for high-performance batteries. Despite their advantages, challenges such as volume expansion and degradation during charge cycles have led to the development of nanostructured silicon, including silicon nanowires and nanoparticles, to improve cycle stability and overall battery performance.

Get more reports of this sample : https://www.intelmarketresearch.com/download-free-sample/638/global-battery-silicon-anode-material

Market Size

The global Battery Silicon Anode Material market was valued at USD 401 million in 2023 and is projected to reach USD 4645.38 million by 2030, reflecting a robust CAGR of 41.90% during the forecast period. This significant growth is driven by the rising demand for energy-dense batteries, particularly in electric vehicles (EVs), renewable energy storage systems, and consumer electronics.

Key Statistics:

The North American market was valued at USD 104.49 million in 2023, expected to grow at a CAGR of 35.91% from 2025 to 2030.

Silicon anodes are highly sought after in the EV industry due to their higher energy density.

Advances in nanostructured silicon materials are boosting market expansion.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

High Energy Density: Silicon anodes provide much greater charge storage than graphite, making them ideal for high-performance batteries.