#Expanded Graphite Market Share

Explore tagged Tumblr posts

Text

Expanded Graphite Market - Forecast(2025 - 2031)

Expanded Graphite Market Overview

Expanded graphite market size is forecast to reach US$308.2 million by 2027, after growing at a CAGR of 7.8% during 2022-2027. Expanded graphite is layered graphite with interlayer space which is altered. Carbon nanotubes are often employed in combination with expanded graphite as flame retardant additives because they have excellent thermal conductivity, this property is creating a growth opportunity for the market growth. Also, the high thermal property makes expanded graphite ideal for the phase change material application. Moreover, the expanded graphite market is majorly driven by the growth of construction activities across the world, because it is utilized as flame retardant additives in roofing, construction materials, and more. Also, the increasing application of expanded graphite in the electronics industry is expected to fuel the growth of the expanded graphite industry during the forecast period.

COVID-19 Impact

In the year 2020, to curb the rising cases of Corona Virus there were increasingly stringent regulations imposed by the major economies of the world. As a result, there was a decline in construction activities across the world. For instance, according to European Construction Industry Federation (FIEC) in Hungary, the construction output fell by 9.1 percent in 2020, totaling €12.2 billion (US$13.82 billion), compared to 2019. Moreover, Australian infrastructure projects such as the Chatswood-Bankstown metro line, the Westconnex motorway, and other projects were halted because of the Covid-19 pandemic. Hence, due to the decline of construction output, there was a decline in the demand for the expanded graphite, this negatively impacted the market growth. Nevertheless, in the year 2021, with the ease of Covid-related regulations, the expanded graphite market growth improved. Furthermore, in the future, the impact of the Covid-19 pandemic will be phased away. This will result in the expanded graphite industry growth scenario as it was before the pre-Covid time.

Report Coverage

The report: "Expanded Graphite Market Report –Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Expanded Graphite Industry.

By Packaging Form: Coil-Form, Gasket Form, Weave Form, and Others. By Carbon Purity:85% to 89%, 90% to 94%, 95% to 99%, and 99.5% to 99.95%. By Application: Fire Retardant Additives, Graphite Foil, Sheet, Gaskets, Bearings, Molded Parts, Refractories, Greases, Atomic Vitality, Roofing, Construction Material, Rubber, Polyolefin Resin, Li-particle Battery, Thermoplastics, and Others. By Application: Building and Construction (Residential, Commercial, Industrial, and Infrastructure Development), Metallurgy, Paints and Coatings (Industrial Coating, Special Coating, and Others), Automotive (Passenger cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)), Chemical and Petrochemical, Power Generation (Electricity Generation, Atomic Energy, and Others), Electronics and Electrical (Semiconductors, Photovoltaic, Transmitters, and Others), Healthcare and Pharmaceuticals, Textile, Water and Wastewater Treatment, and Others. By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East (Saudi Arabia, UAE, Israel, and Rest of Middle East), and Africa (South Africa, Nigeria, and Rest of Africa)).

Request Sample

Key Takeaways

Asia-Pacific region dominated the expanded graphite market, owing to the growing construction activities in the region. For instance, development on the US$4,335 million Zhangzhou Development Zone Shuangyu Island Secondary Development in China started in the 2nd quarter of 2021 and will be finished in the 3rd quarter of 2025.

The Surging adoption of expanded graphite as a constituent in various applications such as coatings, rubber products, energy storage systems, and more such applications is anticipated to fuel the expanded graphite industry growth during the forecast period.

Moreover, the expanding use of expanded graphite in automotive components such as gaskets, batteries, and more is driving up the growth of the market.

However, the high temperature of the expanded graphite makes the handling process difficult, this factor is restricting the market growth.

Expanded Graphite Market Segment Analysis – By Application

The fire retardant additives held a significant share in the expanded graphite market in 2021 and is projected to grow at a CAGR of 7.6% during 2022-2027. The expanded graphite has the superior qualities of thermal conductivity which make it ideal for application in the textile industry as well as building and construction activities. Moreover, expanded graphite has beneficial properties such as lightness, resistance to heat, superior corrosion, and other similar properties because of these properties expanded graphite application as a fire-resistant additive is increasing. Thus, the application of expanded graphite as fire-retardant additives is increasing, which is propelling the growth of the expanded graphite market growth.

Inquiry Before Buying

Expanded Graphite Market Segment Analysis – By End-Use Industry

The building and construction held a significant share in the expanded graphite market in 2021 and is forecasted to grow at a CAGR of 8.3% during 2022-2027. The expanded graphite is an ecologically viable material making it ideal for application in the building and construction sector. Moreover, a tightening of the ban on dangerous fires-resistant materials, such as brominated or asbestos-based fire-resistant materials is anticipated to fuel the growth of expanded graphite materials. The increasing construction activities across the world is projected to bolster market growth. For instance, the increasing commercial building projects such as Kompass district residential and commercial development 2023, 'Gut Miteinander' community center in Jena2022, Jena high-quality offices in a historic setting 2022 are under construction in Germany. Also, as of March 2022, the construction plan has been approved for the Hub office development project in Canada valued at US$300 million, this project is expected to be completed by the end of 2026. In September 2019, construction work started on the city of Toronto Recreational Facilities accessibility upgrades projects in Canada valued at US$150 million, and this project will be completed by the start of 2025. The increase in the construction of such projects is expected to fuel the demand for expanded graphite. Hence, the growing building and construction activities across the world are projected to accelerate the market growth.

Expanded Graphite Market Segment Analysis – By Geography

Asia-Pacific held the largest share in the Expanded Graphite market in 2021 up to 41%. The growth of the Asia-Pacific economy is driven by the growth of the major sectors such as building & construction, chemicals, and metallurgy sectors. For instance, as of February 2022, major commercial construction projects in Vietnam such as Tan Son Nhat Airport 3rd Terminal will be completed by mid-2023, Asahi Tower residential area investment project in Ward 16, District 8 will be finished by 2027, and more such projects is expected to fuel the demand for expanded graphite. Moreover, according to Invest India, it has projected that by the year 2025 the chemicals and petrochemical industry of India will be valued at US$300 billion. Moreover, Major Chemical’s production in India climbed by 23.62% to 73.04 lakhs tons in 2021-22 (up to October-2021) from 59.08 lakhs tons in the previous year's similar period. The major Petrochemicals production in India climbed by 11.85% to 257.44 lakhs tons in 2021-22 (up to October-2021) from 230.15 lakhs tons in the previous year's similar period. Additionally, according to the statistics published by the United States Department of Agriculture (USDA), in 2019 the Chinese iron and steel production was 809 million metric tons, and in 2020, it was 830 million metric tons, an increase of 2.6%. Therefore, the growth of construction activities, chemicals, and metallurgy in the Asia-Pacific region is expanding the growth of the market.

Schedule a Call

Expanded Graphite Market Drivers

Growing Chemicals Industry Production

Expanded graphite is used in numerous high-temperature applications in the chemical industry, such as the manufacturing of phosphorus and calcium carbide in arc furnaces, owing to its superior insulation properties. The growing chemicals and petrochemicals sectors worldwide are expected to propel the demand for expanded graphite, which in turn will drive up the market growth. According to European Chemical Industry Council, in 2020, the Danish chemical industry saw the highest sales, which was Euro5.8 billion (US$6.6 billion), a growth of 6.5% since 2015. Moreover, according to the American Industry Council, in December 2021, the United States produced 7.9 billion pounds of main plastic resins, a 3.9 percent increase over the previous month. In addition, the U.S. Chemical Production Regional Index (U.S. CPRI) increased by 2.2 percent in December after increasing by 0.8 percent in November. Thus, the growing production of chemicals at the global level is expected to drive the growth of the market during the upcoming years.

Increasing Metallurgy Output

In the metallurgy industry expanded graphite is utilized during the production of metals such as iron, steel, and more because this graphite has unique electrode properties. The increased production of metals such as iron, steel, manganese, chromium, and others is boosting the need for expanded graphite. According to the United States Department of Agriculture (USDA), total global iron and steel output in 2018 was 1,250 million metric tonnes, and in 2019 it was 1,300 million metric tonnes, a 4% rise. In addition, manganese production in Australia was 3,180 thousand metric tonnes in 2019 and 3,300 thousand metric tonnes in 2020, a 3.8 percent rise. Furthermore, total chromium output worldwide in 2018 was 43,100 thousand metric tonnes, and in 2019 it was 44,000 thousand metric tonnes, a 2.0 percent rise. Thus, the increasing metal production including iron and steel, manganese, chromium, and more is anticipated to fuel the expanded graphite demand, thereby, driving the market growth during the forecast period.

Expanded Graphite Market Challenges

Lower Tensile Strength causes Inferior Performance

Even though expanded graphite sheet is commonly utilized as a sealant, flame retardant additives, and more, it still has several flaws that need to be addressed. The expanded graphite tensile and flexural strength is weaker than other sealing materials, which is a clear drawback. The expanded graphite sheet is not ideal for sealing portions making packing due to its lack of hardness. Moreover, organic solvents are not recommended for exfoliating expanded graphite because of the issues connected with them, such as their high boiling point and toxicity. Hence, these limitations associated with the tensile strength of the expanded graphite is limiting the market growth

Buy Now

Expanded Graphite Industry Outlook

Technology launches, acquisitions, and increased R&D activities are key strategies adopted by players in the expanded graphite market. Expanded graphite top 10 companies include:

GrafTech International

Nippon Kokuen Group

Yichang Xincheng Graphite

Nacional De Grafite

Asbury Carbons

Triton Minerals

SGL Group

NeoGraf Solutions

ACS Material

LKAB Minerals

Recent Developments

In January 2022, Tirupati Graphite plc, the specialist graphite firm, launched a new technology that will improve the company's main graphite and downstream specialized graphite production processes significantly. Such new graphite technologies will benefit the market growth.

In October 2021, Black Earth formed a 50:50 joint venture (JV) with India's Metachem Manufacturing to establish an expandable graphite facility in India. The new factory will serve the expanding graphite market, which is forecast to rise.

In June 2019, Leading Edge Materials developed expandable graphite in compliance with existing market products from Woxna, Sweden. The new expandable graphite can create various value-added products such as batteries, construction materials, and more.

#Expanded Graphite Market#Expanded Graphite Market Size#Expanded Graphite Industry#Expanded Graphite Market Share#Expanded Graphite top 10 companies#Expanded Graphite Market Report#Expanded Graphite Industry Outlook

0 notes

Text

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

The global expandable graphite market, particularly in coatings and textiles, is driven by innovation, sustainability, and increasing demand for fire-resistant and conductive materials. Below is a list of the leading market players making significant contributions to the market landscape:

SGL Carbon SE Known for its advanced graphite materials, SGL Carbon SE provides high-quality expandable graphite used in flame-retardant coatings and technical textiles.

GrafTech International Ltd. A global leader in graphite technology, GrafTech specializes in supplying expandable graphite for coatings requiring high thermal stability.

Nippon Graphite Industries Co., Ltd. Based in Japan, the company offers innovative solutions in expandable graphite for applications in textiles and specialty coatings.

Qingdao Guangxing Electronic Materials Co., Ltd. A Chinese manufacturer excelling in high-purity expandable graphite, primarily for fire-resistant coatings and textile applications.

Asbury Carbons With decades of experience, Asbury provides high-quality expandable graphite for advanced coating systems and technical textile manufacturing.

Qingdao Kropfmuehl Graphite Co., Ltd. Known for high-performance graphite products, the company is a significant supplier to the coatings and textiles sectors.

LKAB Minerals A European leader in industrial minerals, LKAB specializes in expandable graphite for sustainable and fire-retardant coating systems.

Xincheng Graphite Co., Ltd. A prominent player in China, offering tailor-made expandable graphite solutions for various industrial applications.

NeoGraf Solutions, LLC This U.S.-based company focuses on engineered graphite materials, including expandable graphite for coatings with enhanced fire resistance.

Imerys Graphite & Carbon A global leader in specialty materials, Imerys supplies expandable graphite for advanced fire-retardant textiles and coatings.

Shandong Jinhui Graphite Co., Ltd. One of China's largest expandable graphite producers, catering to the needs of the coatings and textiles industries.

Qingdao Braide Graphite Co., Ltd. This company specializes in supplying high-grade expandable graphite, focusing on fire-resistant applications in textiles.

Graphite Central A leading supplier of graphite products in North America, offering customizable expandable graphite solutions for niche applications.

AMG Advanced Metallurgical Group This group integrates expandable graphite into high-tech applications, including fire-retardant coatings and conductive textiles.

Yichang Xincheng Graphite Co., Ltd. A global supplier of expandable graphite, focusing on environmentally friendly and sustainable industrial solutions.

Request report sample at https://datavagyanik.com/reports/global-expandable-graphite-used-in-coatings-and-textiles-market-size-production-sales-average-product-price-market-share/

Top Winning Strategies in Expandable Graphite (Used in coatings and textiles) Market

To succeed in the highly competitive global expandable graphite market, market players are employing strategic initiatives to drive growth, innovation, and sustainability. Here are some of the most effective strategies adopted by key players:

1. Focus on Sustainability

Companies are increasingly developing eco-friendly and non-toxic expandable graphite to meet stringent environmental regulations.

Promoting sustainable solutions to cater to industries prioritizing green technologies in coatings and textiles.

2. Investment in R&D

Heavy investments in research and development to enhance the properties of expandable graphite, such as improved thermal conductivity and fire resistance.

Innovation in production technologies to create high-purity and application-specific products.

3. Expansion of Production Capacity

Key players are expanding their production facilities to meet the growing demand for expandable graphite in emerging markets.

Establishing manufacturing plants closer to major industrial hubs in Asia-Pacific and Europe.

4. Strategic Partnerships and Collaborations

Collaborating with coating and textile manufacturers to co-develop customized solutions for niche applications.

Partnering with research institutions to explore new applications of expandable graphite.

5. Market Diversification

Exploring new applications of expandable graphite in conductive textiles and fire-resistant building materials.

Diversifying the product portfolio to include expandable graphite grades for different industrial requirements.

6. Regional Market Penetration

Targeting fast-growing markets in Asia-Pacific, particularly China and India, which are significant consumers of coatings and textiles.

Strengthening distribution networks in North America and Europe to expand market reach.

7. Emphasis on Product Quality

Offering high-purity expandable graphite that meets industry-specific standards, ensuring performance in fire-retardant and conductive coatings.

Quality certifications to build customer trust and gain a competitive edge.

8. Pricing Strategies

Competitive pricing strategies to attract cost-sensitive industries without compromising on quality.

Flexible pricing models for bulk buyers, particularly in textiles and construction sectors.

9. Adoption of Advanced Manufacturing Technologies

Implementing advanced production processes to improve efficiency and reduce waste during the manufacturing of expandable graphite.

Leveraging automation and digitalization to optimize production.

10. Mergers and Acquisitions (M&A)

Acquiring smaller companies specializing in expandable graphite to strengthen market position and broaden product offerings.

Consolidation strategies to achieve economies of scale and enhance global competitiveness.

By leveraging these strategies, companies in the expandable graphite market are not only meeting current demands but are also positioning themselves for long-term growth and sustainability in the coatings and textiles industries.

Request a free sample copy at https://datavagyanik.com/reports/global-tin-di-2-Expandable Graphite (Used in coatings and textiles)-market-size-production-sales-average-product-price-market-share-import-vs-export-united-states-europe-apac-latin-america-middle-east-africa/

#Expandable Graphite (Used in coatings and textiles) Market#Expandable Graphite (Used in coatings and textiles) Production#market players#average price#revenue#top trends#market size#market share

0 notes

Text

Graphite Thermal Pads Market - Latest Innovations Drivers Dynamics And Strategic Analysis Challenges

Global Graphite Thermal Pads Market Research Report 2025(Status and Outlook)

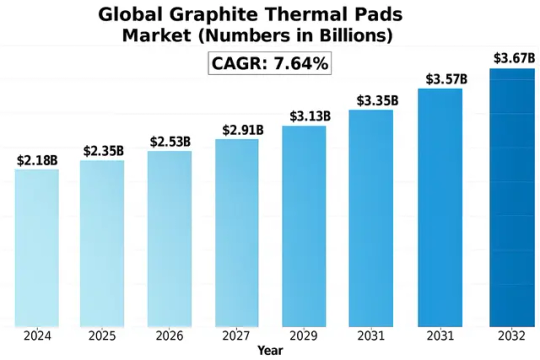

The global Graphite Thermal Pads Market size was valued at US$ 2.18 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025-2032.

Graphite thermal pads are soft, thermally conductive materials designed to enhance heat dissipation in electronic devices. These pads leverage graphite’s exceptional thermal conductivity properties (ranging between 300-1900 W/mK) while maintaining electrical insulation – making them ideal for high-performance computing, LED lighting, and telecommunications equipment.

The market growth is primarily driven by escalating demand from the consumer electronics sector, particularly smartphones and laptops requiring efficient thermal management solutions. Additionally, the rapid expansion of 5G infrastructure and data centers globally is creating substantial demand. However, the emergence of alternative materials like thermal interface greases presents competitive challenges. Key players such as Panasonic Group and Graftech are investing in product innovations, including multi-layer graphene-enhanced pads with improved thermal conductivity up to 2000 W/mK.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95881

Segment Analysis:

By Type

Composite Graphite Film Segment Leads Due to Superior Thermal Conductivity and Flexibility

The market is segmented based on type into:

Single Layer Graphite Film

Composite Graphite Film

Multilayer Graphite Film

Others

By Application

Computer Industry Segment Dominates Owing to Increasing Demand for Thermal Management Solutions in Electronics

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Sector Holds Major Share Due to Growing Demand for Compact Thermal Solutions

The market is segmented based on end user into:

Consumer Electronics

Automotive

Industrial

Medical

Others

Regional Analysis: Global Graphite Thermal Pads Market

North America The North American graphite thermal pads market is driven by high demand from the computer and telecommunications industries, particularly in the U.S. The region benefits from stringent thermal management requirements in data centers, automotive electronics, and 5G infrastructure. With an estimated market value of $120 million in 2023, the U.S. leads due to its advanced electronics manufacturing sector. Canada and Mexico are witnessing steady growth with increasing investments in renewable energy systems, where graphite thermal pads are used extensively in battery cooling applications. However, the adoption of alternative materials like silicon-based thermal interface materials (TIMs) presents competitive challenges. Local manufacturers are focusing on multilayer graphite films to cater to high-performance computing needs.

Europe Europe’s market is characterized by a strong emphasis on sustainability and energy efficiency, particularly in Germany and the UK. The EU’s push for eco-friendly electronic components has accelerated research into graphite thermal pads with lower carbon footprints. The automotive sector, especially electric vehicle (EV) production, is a major growth driver, with thermal management being critical for battery longevity. Demand is further supported by stringent regulations such as RoHS and WEEE directives. However, supply chain disruptions and raw material price volatility, particularly from Russian graphite suppliers, have impacted market stability. Companies like Panasonic and Kaneka are expanding their European production facilities to mitigate these challenges and meet rising demand from industrial automation sectors.

Asia-Pacific The fastest-growing regional market, Asia-Pacific dominates graphite thermal pad consumption, accounting for over 45% of global demand in 2023. China’s robust electronics manufacturing ecosystem and India’s expanding telecom infrastructure are primary growth contributors. Japan and South Korea play pivotal roles in technological innovation, with companies like Denka and Tanyuan focusing on high-conductivity composite graphite films for LED and semiconductor applications. However, price sensitivity in emerging economies like Indonesia and Vietnam leads to a preference for single-layer graphite pads. The region also faces challenges related to inconsistent raw material quality and intellectual property concerns, prompting stricter supplier vetting processes.

South America South America’s market remains in a development phase, with Brazil leading demand due to growing data center investments and renewable energy projects. While Argentina and Colombia show potential, economic instability and limited local manufacturing capabilities restrict growth, keeping import dependency high. Graphite thermal pad adoption in consumer electronics repair markets is rising, though penetration in industrial applications lags behind other regions. Infrastructure bottlenecks and fluctuating tariffs on imported electronic components further complicate market expansion. Nevertheless, partnerships between regional distributors and Asian suppliers are gradually improving product accessibility.

Middle East & Africa This region exhibits nascent but promising demand, particularly in the UAE and Saudi Arabia, where smart city initiatives and data center construction drive thermal management needs. South Africa serves as a gateway for graphite pad imports into sub-Saharan Africa, catering to telecommunications tower cooling applications. However, market growth is constrained by low awareness of advanced thermal solutions and budget constraints favoring traditional heat sinks. Efforts by global players like Graftech to establish local distribution networks and provide cost-optimized products are gradually boosting adoption in key industrial sectors.

List of Key Graphite Thermal Pads Companies Profiled

Panasonic Group (Japan)

Denka Company Limited (Japan)

Kaneka Corporation (Japan)

Tanyuan Technology Co., Ltd. (China)

Zhongshi Technology (Shenzhen) Co., Ltd. (China)

FRD Co., Ltd (China)

Graftech International (U.S.)

Momentive Performance Materials (U.S.)

Laird Technologies (U.K.)

The global graphite thermal pads market is experiencing robust growth driven by the increasing demand for efficient thermal management solutions in electronics. As devices become more compact and powerful, managing heat dissipation has become critical for performance and longevity. Graphite thermal pads offer superior thermal conductivity ranging from 300-1500 W/mK, significantly higher than traditional silicone pads. The consumer electronics sector, which accounts for over 40% of total demand, is witnessing particularly strong adoption in smartphones, laptops, and gaming consoles where thermal throttling impacts user experience. Moreover, the proliferation of 5G technology requires advanced thermal solutions to handle increased heat generation in infrastructure equipment.

The automotive sector has emerged as a key growth driver with the rapid adoption of electric vehicles (EVs) globally. EV battery systems and power electronics generate substantial heat during operation, requiring efficient thermal interfaces. Graphite thermal pads are increasingly preferred in battery management systems due to their electrical insulation properties combined with excellent thermal conductivity. With EV production expected to grow at over 25% CAGR through 2030, this segment offers significant opportunities for graphite thermal pad manufacturers. Furthermore, the lightweight nature of graphite pads contributes to overall vehicle weight reduction, enhancing energy efficiency – a critical factor in EV design.

The industrial automation sector and data center industry are becoming major consumers of graphite thermal pads. Industrial electronics operating in harsh environments require reliable thermal management solutions that can withstand vibration, thermal cycling, and long operational hours. Similarly, data centers handling increasingly dense server configurations are adopting graphite thermal pads to manage heat loads more effectively while optimizing space. With global data center IP traffic projected to triple in the next five years, this sector alone could account for 20% of graphite thermal pad consumption by 2028.

Recent advancements in material science have led to the development of flexible hybrid graphite composites that combine the thermal properties of graphite with improved mechanical characteristics. These next-generation materials can conform to complex geometries and withstand repeated flexing, making them ideal for wearable electronics and flexible displays. The wearable technology market, projected to exceed $100 billion by 2030, represents a significant growth opportunity for innovative thermal interface solutions. Manufacturers investing in R&D to enhance the mechanical properties of graphite thermal pads while maintaining thermal performance stand to gain substantial market share.

The increasing emphasis on sustainable electronics manufacturing creates opportunities for graphite thermal pad producers. Natural graphite is a mined material, but manufacturers are developing environmentally friendly alternatives using recycled graphite and bio-based binders. These sustainable solutions align with the electronics industry’s push towards greener supply chains and circular economy principles. With major OEMs committing to carbon neutrality goals, suppliers offering certified sustainable thermal solutions can command premium pricing and secure long-term contracts. The trend towards RoHS-compliant and halogen-free materials further strengthens the position of properly formulated graphite thermal pads in the market.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95881

Key Questions Answered by the Graphite Thermal Pads Market Report:

What is the current market size of Global Graphite Thermal Pads Market?

Which key companies operate in Global Graphite Thermal Pads Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

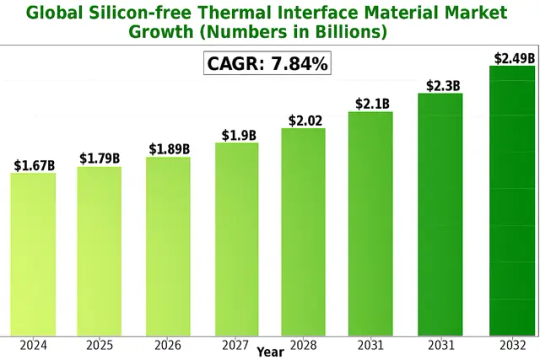

Global Silicon-free Thermal Interface Material Market : Size, Share, Growth, Trends and Forecast Opportunities

Global Silicon-free Thermal Interface Material Market size was valued at US$ 934.7 million in 2024 and is projected to reach US$ 1.59 billion by 2032, at a CAGR of 7.84% during the forecast period 2025-2032.

Silicon-free thermal interface materials are advanced heat dissipation solutions used between electronic components and heat sinks, designed specifically for applications where silicone contamination must be avoided. These materials include gaskets, graphite pads, thermal conductive pastes, adhesive tapes, films, and phase change materials that ensure efficient thermal management in sensitive electronic environments.

The market growth is primarily driven by increasing demand from the LED and computer industries, where high-performance thermal management is critical. The energy sector is emerging as a significant contributor due to expanding renewable energy installations requiring robust thermal solutions. Recent innovations in 5G infrastructure and electric vehicles are creating new opportunities, with major players like Henkel and 3M introducing silicon-free TIM formulations specifically for these high-growth applications. Asia-Pacific currently dominates the market, accounting for over 42% of global demand, largely due to concentrated electronics manufacturing in China and South Korea.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-silicon-free-thermal-interface-material-market/

Segment Analysis:

By Type

Thermal Conductive Paste Segment Leads Due to High Thermal Conductivity and Ease of Application

The global silicon-free thermal interface material market is segmented based on material type into:

Gasket

Graphite Pad

Thermal Conductive Paste

Thermal Conductive Adhesive Tape

Thermal Conductive Film

Phase Change Materials

Others

By Application

Computer Industry Segment Dominates Due to Increasing Demand for High-performance Computing Devices

The market is segmented based on application into:

LED Industry

Computer Industry

Energy Industry

Telecommunications Industry

Others

By End User

Consumer Electronics Segment Leads Due to Growing Demand for Thermal Management in Compact Devices

The market is segmented based on end user into:

Consumer Electronics

Automotive Electronics

Industrial Equipment

Aerospace and Defense

Others

Regional Analysis: Global Silicon-free Thermal Interface Material Market

North America North America dominates the silicon-free thermal interface material market, driven by robust adoption in high-performance computing, telecommunications, and electric vehicle sectors. The region’s stringent regulations regarding thermal management performance and material safety push manufacturers toward silicon-free alternatives. Leading technology firms and automotive players are increasingly demanding non-silicone TIMs to prevent contamination in sensitive applications. The U.S. holds the largest market share, supported by significant R&D investments in advanced thermal solutions and strong presence of key players like Dow, DuPont, and 3M. Market growth is further accelerated by renewable energy projects and hyperscale data center expansions requiring efficient heat dissipation.

Europe Europe demonstrates steady growth in silicon-free TIM adoption, fueled by strict REACH regulations and increasing focus on sustainable electronics manufacturing. Germany and the UK lead this transition, with automotive and industrial sectors prioritizing high-reliability thermal management solutions. The region shows particular interest in phase change materials and graphite-based solutions for electric vehicle battery cooling systems. However, higher costs compared to conventional thermal interface materials somewhat limit penetration in cost-sensitive applications. Recent collaborations between academic institutions and material science companies aim to develop next-generation bio-based thermal interface materials to meet both performance and environmental requirements.

Asia-Pacific Asia-Pacific represents the fastest-growing regional market, with China, Japan, and South Korea accounting for over 60% of regional consumption. Rapid expansion of consumer electronics manufacturing, coupled with massive investments in 5G infrastructure, drives demand for high-performance thermal solutions. While price sensitivity remains a challenge, leading manufacturers are gradually shifting from silicone-based to silicon-free alternatives to meet international quality standards for exports. India’s emerging electronics manufacturing sector presents new opportunities, though adoption rates lag behind more developed Asian markets. The region benefits from strong local supply chains and increasing government support for advanced material development in strategic industries.

South America The South American market shows moderate but consistent growth, primarily concentrated in Brazil and Argentina. Limited local production capabilities result in heavy reliance on imports, particularly from North American and Asian suppliers. Industrial and energy applications lead silicon-free TIM adoption, while consumer electronics applications remain limited by cost considerations. Political and economic instability in some countries creates supply chain challenges, though increasing foreign investments in manufacturing infrastructure may improve market accessibility. The region’s growing renewable energy sector, particularly solar power projects, offers potential growth avenues for thermal management solutions.

Middle East & Africa This region presents emerging opportunities in specific sectors like telecommunications infrastructure and oil & gas applications. The Gulf Cooperation Council countries show increasing adoption in data center cooling applications, supported by digital transformation initiatives. However, market penetration remains low compared to other regions due to limited local manufacturing and lower awareness about advanced thermal management solutions. South Africa shows potential as an emerging market, particularly for energy and industrial applications, though widespread adoption is hampered by infrastructure challenges and competing budget priorities across most African nations.

MARKET OPPORTUNITIES

Emerging Applications in Power Electronics and Renewable Energy Systems

The rapid growth of renewable energy infrastructure and power electronics presents substantial growth opportunities for silicon-free TIMs. Solar inverters, wind turbine power converters, and energy storage systems all require reliable thermal management solutions capable of withstanding harsh environmental conditions. These applications often involve high power densities and extended operational lifespans where conventional materials may degrade over time. The renewable energy sector’s emphasis on system reliability and maintenance-free operation aligns perfectly with the value proposition of premium thermal interface materials.

Development of Next-Generation Material Formulations

Ongoing material science innovations continue to expand the performance envelope of silicon-free TIMs. Recent advances in carbon-based materials and metal matrix composites show particular promise, with some experimental formulations demonstrating thermal conductivity values exceeding 100 W/mK. These developments could open entirely new application spaces in high-performance computing, aerospace, and defense electronics. The market stands to benefit significantly from continued R&D investment in novel material systems and manufacturing processes.

Strategic Partnerships Across the Value Chain

Collaborative development initiatives between material suppliers, OEMs, and end-users present significant opportunities for market expansion. Such partnerships can accelerate material qualification processes and yield optimized solutions for specific applications. Several leading automotive manufacturers have already established joint development programs with materials companies to create customized thermal solutions for next-generation EV platforms. This trend toward closer technical collaboration helps overcome adoption barriers while driving innovation tailored to industry needs.

SILICON-FREE THERMAL INTERFACE MATERIAL MARKET TRENDS

Expanding Electronics Industry Driving Demand for High-Performance Thermal Solutions

The global silicon-free thermal interface material (TIM) market is witnessing significant growth due to increasing demand from the electronics industry for efficient heat dissipation solutions. With the proliferation of high-performance computing devices, 5G telecommunications equipment, and advanced LED lighting systems, the need for reliable thermal management has never been greater. Silicon-free TIMs are particularly gaining traction because they eliminate potential contamination risks associated with silicon-based alternatives while providing superior thermal conductivity. The market is expected to grow at a compound annual growth rate (CAGR) of approximately 7-9% from 2023 to 2030, driven by continuous technological advancements in electronic component miniaturization.

Other Trends

Shift Toward Non-Silicone Formulations

Increasing regulatory scrutiny on silicone migration has prompted manufacturers to adopt silicon-free alternatives. These materials offer comparable thermal performance without the risk of outgassing or contamination, making them ideal for sensitive applications in aerospace, medical devices, and automotive electronics. Recent product innovations include carbon-based TIMs and metal-particle infused pastes, which demonstrate thermal conductivities exceeding 10 W/mK while maintaining excellent electrical insulation properties.

Automotive Electrification Creating New Opportunities

The rapid adoption of electric vehicles (EVs) is creating substantial demand for advanced thermal management solutions. Silicon-free TIMs are increasingly used in EV battery packs, power electronics, and electric motor systems where high reliability and long-term stability are critical. With global EV sales projected to reach 30 million units annually by 2030, this sector represents one of the most promising growth avenues for silicon-free TIM manufacturers. Emerging materials like graphene-enhanced thermal pads and phase change compounds are being specifically developed to meet the unique requirements of automotive applications.

Sustainability Concerns Influencing Material Development

Environmental regulations and corporate sustainability initiatives are pushing manufacturers to develop eco-friendly silicon-free TIM formulations. Recent innovations include bio-based thermal interface materials derived from renewable resources and recyclable thermal pads with reduced environmental impact. These developments align with global sustainability goals while meeting performance requirements for next-generation electronic devices. The market is also seeing increased investment in R&D to improve material properties while reducing manufacturing costs, making silicon-free TIMs more accessible across various industries.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Material Innovation and Geographic Expansion

The global silicon-free thermal interface materials market exhibits a moderately fragmented competitive landscape, with multinational corporations dominating alongside specialized regional players. Dow Inc. holds a prominent position in this space, leveraging its advanced polymer science expertise to develop high-performance thermal management solutions. The company’s 2023 acquisition of a specialty materials startup further strengthened its product portfolio in electronics cooling applications.

Henkel AG & Co. KGaA and 3M Company collectively account for approximately 35% of the market share through their diversified thermal interface material offerings. These industry giants benefit from strong distribution networks and ongoing R&D investments exceeding $200 million annually in thermal management technologies. Their recent product launches focus on high thermal conductivity formulations that maintain performance under extreme conditions.

Meanwhile, Asian players like Shin-Etsu Chemical and Dexerials Corporation are gaining traction through cost-competitive solutions tailored for consumer electronics manufacturers. Their growth reflects the increasing demand from smartphone and laptop producers seeking alternatives to silicon-based thermal compounds. These companies are now expanding into North American and European markets through strategic partnerships with local distributors.

The competitive intensity continues to rise as companies prioritize sustainability initiatives. Wacker Chemie AG‘s recent launch of bio-based thermal interface materials demonstrates this shift. Similarly, DuPont is investing heavily in recyclable thermal solutions to meet tightening environmental regulations in key markets.

List of Leading Silicon-free TIM Manufacturers

Dow Inc. (U.S.)

Panasonic Group (Japan)

Parker Hannifin Corp (U.S.)

Shin-Etsu Chemical (Japan)

Laird Technologies (U.K.)

Henkel AG & Co. KGaA (Germany)

Fujipoly (Japan)

DuPont de Nemours, Inc. (U.S.)

Aavid (Boyd Corporation) (U.S.)

3M Company (U.S.)

Wacker Chemie AG (Germany)

Fule Industrial (China)

Learn more about Competitive Analysis, and Global Forecast of Global Silicon-free TIM Market : https://semiconductorinsight.com/download-sample-report/?product_id=95880

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Silicon-free TIM Market?

-> Silicon-free Thermal Interface Material Market size was valued at US$ 934.7 million in 2024 and is projected to US$ 1.59 billion by 2032, at a CAGR of 7.84% .

Which key companies operate in this market?

-> Major players include Henkel, 3M, Dow, DuPont, Parker Hannifin, Laird Technologies, and Shin-Etsu, with these seven companies holding 68% market share collectively.

What are the key growth drivers?

-> Primary growth drivers are 5G infrastructure deployment (creating USD 120 million annual TIM demand), electric vehicle adoption (18% CAGR in automotive TIM use), and data center expansion requiring advanced cooling solutions.

Which region dominates the market?

-> Asia-Pacific leads with 48% market share in 2023, driven by electronics manufacturing in China, South Korea, and Taiwan, while North America shows fastest growth at 7.1% CAGR due to EV and data center investments.

What are the emerging material trends?

-> Emerging trends include graphene-enhanced TIMs (25-30 W/mK conductivity), phase-change materials for high-performance computing, and eco-friendly bio-based formulations meeting new EU RoHS 3.0 standards.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Natural Graphite Market Trends, Size, Segment and Growth by Forecast to (2021-2031)

Natural Graphite Market Outlook (2024–2031) The global natural graphite market is projected to grow from US$ 4.15 billion in 2024 to US$ 8.27 billion by 2031, expanding at a CAGR of 10.6% during the forecast period from 2025 to 2031. 📚Download Full PDF Sample Copy of Market Report @ https://wwcw.businessmarketinsights.com/sample/ BMIPUB00031711

Executive Summary and Global Market Overview

This comprehensive report provides a detailed analysis of the global natural graphite market, examining its size, share, and evolving dynamics from 2021 to 2031. It aims to equip stakeholders with strategic insights into the market landscape by evaluating key growth drivers, emerging opportunities, challenges, and the competitive environment. Our findings are based on a rigorous research methodology that integrates both primary and secondary data sources to deliver accurate, actionable intelligence.

The natural graphite industry is experiencing a fundamental shift, evolving from its traditional role in industrial applications to becoming a critical component in the global clean energy transition. This shift is primarily driven by the rapid expansion of the electric vehicle (EV) industry and the rising demand for grid-scale energy storage solutions. As lithium-ion batteries take center stage in global decarbonization efforts—particularly in the automotive and renewable energy sectors—graphite's indispensable role as the dominant anode material has elevated its strategic importance on the global stage.

Regional Insights: Asia-Pacific (APAC)

The Asia-Pacific region dominates the global natural graphite market, accounting for nearly 80% of total demand. This dominance is underpinned by surging consumption across key industries such as electric vehicles, steel manufacturing, batteries, and consumer electronics. APAC’s strong manufacturing base, coupled with favorable government policies supporting EV adoption and clean energy technologies, continues to drive robust market expansion in the region.

Natural Graphite Market Segmentation Analysis

The global natural graphite market is comprehensively segmented by type, application, end-user industry, and geography, each playing a critical role in shaping market dynamics.

By Type:

Flake Graphite

Amorphous Graphite

Vein Graphite

Among these, flake graphite holds the largest market share. It is the most commonly used type due to its critical role in lithium-ion battery anodes, refractories, and a range of industrial applications.

By Application:

Batteries

Refractories

Electrodes

Lubricants

Friction Products

Other Applications

Batteries and electrodes are the leading application segments, with batteries showing the fastest growth. The rising demand for lithium-ion batteries in electric vehicles and energy storage systems is significantly driving graphite consumption.

By End-User Industry:

Automotive

Metallurgy

Electronics

Energy

Aerospace

Other Industries

The automotive sector, led by the global shift toward electric vehicles (EVs), has emerged as the dominant end-user, overtaking traditional industrial applications such as metallurgy and refractories.

By Geography:

North America

Europe

Asia-Pacific (APAC)

Middle East & Africa

South & Central America

The Asia-Pacific region is the largest and most influential market for natural graphite, primarily driven by China. China not only leads in natural graphite production but also controls over 90% of the global graphite processing capacity. This gives APAC a strategic advantage in both supply and consumption, especially in battery manufacturing and advanced materials sectors.

Market Drivers and Opportunities

1. Growth in Electric Vehicles (EVs):

The accelerating adoption of EVs globally is a major growth driver. Graphite is a critical raw material for lithium-ion battery anodes, and demand is projected to grow in tandem with EV production.

2. Advancements in Battery Technology:

Innovations in battery chemistry and energy storage solutions are boosting the need for high-purity natural graphite. Companies investing in advanced extraction and purification technologies are poised to capitalize on these trends.

Natural Graphite Market Report Coverage and Deliverables

The "Natural Graphite Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

Natural Graphite market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

Natural Graphite market trends, as well as market dynamics such as drivers, restraints, and key opportunities

Detailed Porter's Five Forces and SWOT analysis.

Natural Graphite market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Natural Graphite market.

Detailed company profiles

Geographical Scope of the Natural Graphite Market

The Natural Graphite market report covers five key regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. Each region exhibits distinct market dynamics influenced by industrial trends, technological developments, and strategic investments.

Asia Pacific (APAC): APAC leads global demand for natural graphite, driven by robust industrial capabilities and advancements in battery technologies. The region’s dominance is underscored by its strong presence in the electric vehicle (EV) sector and electronics manufacturing, where graphite plays a vital role.

Europe: In Europe, the natural graphite market is witnessing steady growth, propelled by the surging EV industry and increasing demand for lithium-ion batteries—the fastest-growing application segment for graphite. The region is also making strides toward sustainable and localized battery production, enhancing its graphite value chain.

North America: Natural graphite demand in North America continues to rise, largely due to rapid EV adoption and the growing need for energy storage solutions. Despite having considerable domestic graphite resources, the region remains a net importer, highlighting concerns around supply security and the push for sustainable, domestic production to support future market stability.

Middle East & Africa and South & Central America: These regions are experiencing upward growth in graphite demand, driven by strategic developments in battery materials, steel manufacturing, and advanced technologies. Countries such as Saudi Arabia, the UAE, and South Africa are actively investing in graphite production capabilities. Africa, in particular, has emerged as a key player due to its untapped natural graphite reserves, attracting global investment aimed at diversifying the supply chain.

Natural Graphite Market Report Structure and Research Methodology

The report offers comprehensive qualitative and quantitative analysis across parameters such as product type, technology, application, end user, and regional geography. The structure of the report includes:

Chapter 2 – Key Takeaways: Highlights major trends and market outlook.

Chapter 3 – Research Methodology: Details the research design, including primary and secondary data sources.

Chapter 4 – Ecosystem and Porter’s Analysis: Presents an overview of the graphite market ecosystem and competitive forces.

Chapter 5 – Market Dynamics: Covers key drivers, restraints, opportunities, and emerging trends, supported by impact analysis.

Chapter 6 – Market Overview and Forecast: Presents historical revenue data and forecasts through 2031.

Chapters 7–9 – Market Segmentation: Breaks down the market by product type, application, and end user across all five regions.

Chapter 10 – Competitive Landscape: Features a heat map and competitive analysis of key players.

Chapter 11 – Industry Landscape: Details market initiatives, strategic developments, mergers, and joint ventures.

Chapter 12 – Company Profiles: Provides in-depth profiles of leading companies, including business descriptions, financial data, product portfolios, SWOT analyses, and recent developments.

Chapter 13 – Appendix: Includes abbreviations, glossary, and disclaimers.

Recent Market Developments and Industry News

Lucid Group, Inc. (June 4, 2025): Lucid has entered a multi-year agreement with Graphite One to secure U.S.-sourced natural graphite, strengthening its domestic raw materials supply chain for EV production.

Talga Group (June 2025): Talga received final regulatory approval to develop the Nunasvaara South graphite mine in Sweden. Supported by the European Union, the project aims to supply sustainable battery anode materials, enhancing Europe’s strategic autonomy in the EV and energy storage markets.

About Us: Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications Author's Bio Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

High Temperature Gasket Materials Market to Surge Owing to Aftermarket Service Growth

High Temperature Gasket Materials Market encompasses sealing products engineered to withstand extreme heat and chemical exposure in industries such as automotive, power generation, petrochemicals, and aerospace. These gaskets are fabricated from advanced materials—graphite, ceramic fiber, composite elastomers—offering superior thermal stability, chemical resistance, and mechanical robustness.

By minimizing leakage and extending equipment life, they address stringent safety standards and operational efficiency requirements, reducing downtime and maintenance costs. The need for reliable sealing solutions grows alongside industrial expansion, stringent emission norms, and the rising High Temperature Gasket Materials Market Demand for energy-efficient systems. Ongoing investments in research and development drive innovation in product formulations and quality assurance.

Global high temperature gasket materials market was valued at US$ 23.52 Bn in 2021 in terms of revenue, exhibiting a CAGR of 6.38 % during the forecast period (2022 to 2030).

Key Takeaways Key players operating in the High Temperature Gasket Materials Market are Auburn Manufacturing, Inc. and TEADIT International Produk. Auburn Manufacturing, Inc. focuses on custom gasket solutions and robust quality control that secures significant market share in North America. TEADIT International Produk, known for engineered graphite and elastomer composites, holds strong industry share across Europe and Asia. These market players continuously expand portfolios through strategic partnerships and acquisitions to reinforce competitive positioning.

Get More Insights On- High Temperature Gasket Materials Market

Get this Report in Japanese Language: 高温ガスケット材料市場

Get this Report in Korean Language: 고온 개스킷 재료 시장

#High Temperature Seals#Power Generation Gaskets#High Temperature Gasket Materials#High Temperature Gasket Materials Market#High Temperature Gasket Materials Market Trends#High Temperature Gasket Materials Market Insights#Coherent Market Insights

0 notes

Text

Global Marble Industry Analysis: Tiles, Slabs & Architectural Applications

Marble Market Growth & Trends

According to a recent report by Grand View Research, Inc., the global marble market is projected to attain a value of USD 92.23 billion by 2030, expanding at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2030. This projected growth can be attributed to the increasing consumer inclination toward premium and aesthetically pleasing construction materials. As disposable incomes rise globally, consumers are showing a stronger willingness to invest in high-end, durable, and naturally sourced materials such as marble for both residential and commercial properties.

The rising popularity of marble is primarily driven by its timeless appeal, long-lasting quality, and superior polished finish, which make it a preferred choice for interior and exterior applications. Its demand is witnessing notable growth in the interior decoration of upscale facilities, including luxury hotels, religious establishments, museums, and premium residences. As consumers and architects prioritize elegance and resilience in construction materials, marble continues to hold a strong position in the global stone flooring and cladding markets.

From a geological perspective, marble is formed through the metamorphism of limestone (primarily calcite) and is often mixed with natural impurities such as quartz, graphite, mica, and clay, which contribute to its distinct appearance and texture. Globally, several countries dominate marble production, with China, Italy, Turkey, India, and Spain being recognized as leading producers. Together, these nations account for a significant share of total global marble output.

Among them, Italy stood out as the top exporter of marble in 2022, with China and India following closely. On the demand side, the United States and China are among the largest importers of marble, reflecting the strong demand in construction and interior decoration sectors in these regions. The U.S. market, in particular, is experiencing notable growth due to its highly developed economy, robust construction activities, and emphasis on innovation and product development. Cities such as Atlanta, Augusta, Columbus, and Macon are currently seeing rapid expansion in both residential and commercial infrastructure, further driving the need for premium materials like marble.

Despite its popularity, the marble market faces several challenges. The limited availability of high-grade marble deposits, coupled with rising global demand, has raised concerns about the sustainability of natural resources. Furthermore, the quarrying and processing of marble can lead to significant environmental impacts, such as habitat destruction, deforestation, landscape alteration, and a high carbon footprint due to the energy-intensive nature of extraction and processing operations.

To address these challenges and maintain competitive advantage, key players in the marble market are adopting various strategic initiatives. These include mergers and acquisitions, joint ventures, expansion of production capacity, and development of new product lines. Additionally, companies are focusing on strengthening brand visibility and investing heavily in research and development to innovate more sustainable and efficient production techniques. Through these strategies, manufacturers aim to enhance their market positioning and secure long-term growth in an increasingly competitive and environmentally conscious market landscape.

Marble Market Report Highlights

Tiles or slabs emerged as the leading product segment, accounting for over 45% of the global market revenue in 2024. This dominance is attributed to their widespread use in flooring, wall cladding, countertops, and decorative applications across both residential and commercial projects. Their versatility, aesthetic appeal, and ease of installation make them a preferred choice among architects, builders, and homeowners.

The building and construction sector represented the largest application segment, contributing to a 8% revenue share in 2024. The growing global construction activity—particularly in luxury residential developments, commercial buildings, and institutional infrastructures—has fueled the demand for marble as a premium material for interiors and exteriors. Its durability and visual sophistication continue to drive its use in modern architectural projects.

The Asia Pacific region led the global marble market, capturing approximately 45% of the total market revenue in 2024. This regional dominance can be attributed to the presence of key marble-producing countries such as China and India, rapid urbanization, infrastructure development, and an expanding middle-class population with increasing disposable income. The region is also witnessing heightened demand from both domestic and international construction markets, further solidifying its position as the largest consumer and supplier in the global marble industry.

Get a preview of the latest developments in the Marble Market? Download your FREE sample PDF copy today and explore key data and trends

Marble Market Segmentation

Grand View Research has segmented the global marble market on the basis of product, application, and region:

Marble Product Outlook (Revenue, USD Billion, 2018 - 2030)

Tiles or Slabs

Blocks

Others

Marble Application Outlook (Revenue, USD Billion, 2018 - 2030)

Building and Construction

Statues and Monuments

Furniture

Other Applications

Marble Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia

Central & South America

Brazil

Argentina

Middle East & Africa

List of Key Players in the Marble Market

Antolini Luigi & C SpA

BC Marble Products Ltd

Levantina y Asociados de Minerales, S.A

Fox Marble

Kangli stone group

Best Cheer Stone

Kingstone Mining Holdings Limited

China Kingstone Mining Holdings Limited

Daltile

Hellenic Granite Co.

Topalidis SA

Santucci Group Srl

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Thermal Management Market Driven by Electronics Demand

Thermal management solutions encompass a diverse range of products including heat sinks, thermal interface materials, liquid cooling systems, thermo-electric modules and heat exchangers. These technologies deliver reliable heat dissipation, improved system stability and enhanced performance in critical applications spanning consumer electronics, telecommunications, data centers, electric vehicles and aerospace. As power densities rise and devices become more compact, the need for efficient thermal solutions becomes paramount to mitigate overheating risks and ensure consistent operation under demanding conditions.

Advanced materials such as graphite, phase-change composites and metal ceramics enable lightweight, high-conductivity designs that optimize thermal transfer while maintaining structural integrity. Integrated cooling strategies combining passive and active methods support energy-efficient operations and align with global sustainability targets by reducing power consumption and carbon footprint. Market research indicates that evolving market trends—including rapid digitalization and 5G infrastructure deployment—are driving significant Thermal Management Market growth and expanding market segments. Companies leverage cutting-edge market analysis and in-depth market insights to identify emerging market opportunities and address market challenges such as cost management and stringent regulatory standards. Continuous innovation in thermal management products supports higher computing performance, faster battery charging and enhanced safety protocols across various end-use industries.

The thermal management market is estimated to be valued at USD 16.84 Bn in 2025 and is expected to reach USD 33.45 Bn by 2032, growing at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2032. Key Takeaways

Key players operating in the Thermal Management Market are:

-Honeywell International Inc.

-Vertiv Holdings Co.

-Boyd Corporation

-Laird Thermal Systems

-Advanced Cooling Technologies, Inc.

These market leaders hold a significant market share through robust product portfolios, technology innovation and global reach. Honeywell International Inc. continues to expand its industry size by integrating smart thermal controls and advanced sensors into aerospace and industrial automation offerings. Vertiv Holdings Co. leverages its liquid cooling systems and data-driven analytics to address rising demand in data center infrastructures, contributing to substantial business growth. Boyd Corporation distinguishes itself with high-performance thermal materials and customized heat exchangers, while Laird Thermal Systems specializes in thermal interface materials and liquid cooling platforms. Advanced Cooling Technologies, Inc. drives its market revenue through strategic research collaborations and tailored solutions for electric vehicles and renewable energy applications. These market companies employ mergers and acquisitions, strategic partnerships and aggressive market growth strategies to strengthen their competitive positions. The collective efforts of these key players shape overall market dynamics and set the direction for future innovations in the thermal management industry. Rapid advancements in semiconductor technology, coupled with the proliferation of 5G networks and artificial intelligence applications, have created strong demand for high-efficiency thermal solutions. The accelerating adoption of electric vehicles necessitates sophisticated cooling systems to manage battery temperatures, while consumer electronics manufacturers seek compact, lightweight thermal interface materials to improve device performance and prolong battery life. This surging need is reflected in comprehensive market research reports highlighting evolving market trends toward higher power density, modular cooling architectures and multi-element thermal stacks. Enterprises are increasingly investing in thermal management solutions to optimize system reliability, reduce downtime and enhance safety standards. As digital transformation initiatives gain momentum across telecommunications, automotive, healthcare and renewable energy sectors, industry leaders recognize the critical role of thermal control in ensuring operational continuity and sustaining business growth. The growing focus on energy efficiency and stringent environmental regulations further reinforce the importance of innovative cooling technologies, driving a positive trajectory for market growth over the forecast period.

‣ Get More Insights On: Thermal Management Market

‣ Get this Report in Japanese Language: 熱管理市場

‣ Get this Report in Korean Language: 열관리시장

0 notes

Text

Europe Silicon Anode Battery Market Size, Share, Trends, Segmentation And Forecast To 2027

Market Introduction

Extensive R&D investments in battery production and well-established automotive industry in Germany, high electric vehicle adoption in developed countries, and government investments to increase battery production are key driving factors for the market in this region. Government initiatives and policies to encourage the use of battery-powered vehicles are also driving factors in this region's increasing demand for silicon anode batteries. Moreover, the increased product launches is also anticipated to contribute towards the market growth.

Rising Demand and Innovations in the Europe Silicon Anode Battery Market

The Europe Silicon Anode Battery Market is rapidly gaining traction as industries seek more efficient and higher-capacity energy storage solutions. Silicon anodes offer significantly greater energy density than traditional graphite anodes, making them a game-changer in lithium-ion battery technology. This shift is being driven by the growing demand for electric vehicles (EVs), renewable energy integration, and portable electronics throughout Europe.

📚 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐂𝐨𝐩𝐲@ https://www.businessmarketinsights.com/sample/TIPRE00012811

One of the major forces propelling the Europe Silicon Anode Battery Market is the electric vehicle sector. European nations are aggressively pushing for zero-emission mobility, with countries like Germany, France, and the Netherlands setting ambitious EV adoption targets. Silicon anode batteries, with their higher energy retention and faster charging capabilities, are becoming the preferred choice for next-generation EV batteries. This trend is expected to further accelerate market growth in the coming years.

In addition to EVs, the Europe Silicon Anode Battery Market is also witnessing strong demand from the consumer electronics industry. Smartphones, laptops, and wearable devices require longer battery life and faster recharging – both of which silicon anodes can deliver. Leading tech firms across Europe are investing in R\&D to incorporate silicon-based battery technologies into their products, further solidifying the region’s position in the global battery innovation landscape.

Moreover, renewable energy storage solutions are contributing significantly to the expansion of the Europe Silicon Anode Battery Market. As solar and wind energy adoption continues to grow across Europe, there is a pressing need for efficient energy storage systems. Silicon anode batteries offer the high energy density and extended cycle life needed to store excess energy and ensure grid stability, making them ideal for residential and industrial energy storage applications.

📚𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐋𝐢𝐧𝐤 @ https://www.businessmarketinsights.com/reports/europe-silicon-anode-battery-market

Technological advancements are another key driver of the Europe Silicon Anode Battery Market. European startups and research institutions are leading the way in developing cost-effective manufacturing processes and innovative materials. These efforts are crucial in overcoming existing challenges such as silicon’s tendency to expand and degrade during charge cycles. Innovations such as nano-engineered silicon and hybrid composite anodes are paving the way for more durable and commercially viable solutions.

Furthermore, the Europe Silicon Anode Battery Market benefits from strong policy support and funding initiatives from the European Union. Programs like Horizon Europe and national-level grants are helping companies accelerate battery technology development and establish sustainable supply chains. This regulatory push is essential in ensuring Europe’s competitiveness in the global battery market.

Competitive dynamics within the Europe Silicon Anode Battery Market are also evolving, with major players such as Sila Nanotechnologies, Enevate, and Group14 Technologies expanding their footprint. Partnerships between automakers, tech companies, and battery manufacturers are fostering a collaborative ecosystem geared toward mass commercialization.

In conclusion, the Europe Silicon Anode Battery Market stands at the forefront of a technological revolution in energy storage. With growing applications across EVs, electronics, and renewable energy systems, the market is poised for robust growth. As innovation continues and investments pour in, the Europe Silicon Anode Battery Market will play a pivotal role in shaping the continent’s sustainable energy future.

The List Of Companies

Daejoo Electronic Materials Co., Ltd.

Hitachi Chemical Company, Ltd.

Huawei Technologies Co., Ltd.

NEXEON LTD.

Shin-Etsu Chemical Co., Ltd

Targray Technology International

Europe Silicon Anode Battery Regional Insights

The geographic scope of the Europe Silicon Anode Battery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Market Overview and Dynamics

The Europe silicon anode battery market was valued at US$ 7.2 million in 2019 and is projected to reach US$ 45.3 million by 2027; it is expected to grow at a CAGR of 27.1% from 2020 to 2027. In the lithium-ion battery industry, Asian rivals pose a significant challenge for European producers because they produce the commodity at meagre prices. Price is a constant threat factor for the European firms planning to set up production plants in the area. However, with successful government policies and subsidies, it is anticipated that the production of lithium-ion batteries will increase in the region during the forecast period.

Key Market Segments

The Europe silicon anode battery market is segmented on the basis of capacity, application, and country. Based on capacity, the Europe silicon anode battery market is segmented into less than 1500 mAh and 1500 mAh–2500 mAh and above 2500 mAh. Based on the application, the Europe silicon anode battery market is segmented into automobile, consumer electronics, medical devices, energy and power, industrial, and others. The consumer electronics segment is a prominent application segment in the Europe silicon anode battery market, due to its huge storage capacity and huge demand for lithium-ion with silicon anode.

Regional Insights: Understanding Market Specificities Across Europe

Understanding the regional characteristics of the Europe silicon anode battery market is essential for effective strategic planning. Market dynamics vary considerably across countries, driven by differences in consumer behavior, energy policy, technological adoption, and economic conditions.

In Western Europe, countries are prioritizing sustainable urban mobility, clean energy transitions, and smart grid development. These goals are catalyzing the demand for advanced battery solutions with high energy efficiency and durability. The regulatory environment is favorable, with governments supporting battery-powered transportation through subsidies, tax incentives, and infrastructure investments.

About Us-

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

You can see this-

Europe Building Integrated Photovoltaics Market- https://businessmarketresportsnews.blogspot.com/2025/04/europe-building-integrated_24.html

Europe Peripheral Vascular Devices Market- https://sites.google.com/view/bmi269/home

Europe Fuel Cell Vehicle Market - https://postyourarticle.com/europe-fuel-cell-vehicle-market-analysis-segments-key-players-drivers-trends-by-forecast-2022-to-2028/

0 notes

Text

Global Green Coke Market Report: Trends, Opportunities, and Forecast 2025-2032

Global Green Coke Market by Player, Region, Type, Application 2025-2032

The global Green Coke Market is experiencing robust expansion, with its valuation reaching USD 21.3 billion in 2024. According to comprehensive industry analysis, the market is projected to grow at a CAGR of 6.5%, reaching approximately USD 40 billion by 2033. This sustained growth trajectory is primarily fueled by increasing demand from aluminum smelting operations and steel production, particularly in rapidly industrializing economies where infrastructure development is accelerating.