#FinancialExpert

Explore tagged Tumblr posts

Text

Maximize your investment returns with Yoj Investment, a leading investment company in Nepal.

Our strategies focus on high-growth areas like IT, helping you build long-term wealth.

#InvestingInNepal#InvestmentExpert#WealthManagement#InvestmentStrategies#InvestmentServices#FinancialExpert#InvestmentExperts#FinancialGoals#NepalInvestment#RealEstateInvestment#HydropowerInvestment#InvestmentPlan#SmartInvesting#FinancialPlanning#ROI

0 notes

Text

Andrew Brookman - Carving Out a Legacy in Wealth Advisory Services

Andrew Brookman, the founder of Alpha Strategic Advisors, has carved out a distinguished legacy in wealth advisory services. With over two decades of experience, Andrew Brookman transitioned from a Wall Street broker to an ultra-wealth advisor, leveraging his strategic insight and financial expertise to help high-net-worth clients grow their wealth. His dedication, market acumen, and personalized approach have solidified his reputation as a trusted leader in the world of wealth management.

0 notes

Text

youtube

What is an Enrolled Agent?

✨Hey everyone, are you interested in a career in tax but don't want to go the CPA route? Then becoming an Enrolled Agent (EA) might be the perfect fit for you! An EA is a tax professional, certified by the IRS, who helps you with tax preparation, planning, and representation!

#EnrolledAgent#TaxProfessional#IRS#TaxHelp#gleim#taxes#fintramglobal#financialexpert#TaxPro#TaxSeason#CareerTips#Youtube

0 notes

Text

Think IFRS, Think FinPro!

Success begins with a single step. Take the first step towards IFRS expertise with our Dip IFRS training.Your future self will thank you.

For more details , contact us on [email protected] +91 8421438047

Visit us on : https://finproconsulting.in/

#IFRS#DipIFRS#FinancialExcellence#GlobalRecognition#CareerGrowth#ProfessionalDevelopment#FinancialExpert#IFRSJourney#UnlockPotential#JoinUsNow

0 notes

Text

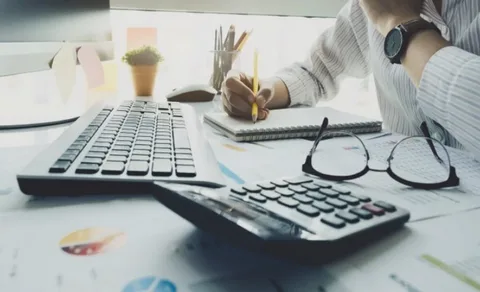

Professional Accountant: Your Guide to Financial Excellence

Looking for a trusted Professional Accountant? Discover the key responsibilities, benefits, and FAQs about Professional Accountants in this comprehensive guide.

Introduction

In today's complex financial landscape, having a Professional Accountant by your side is crucial. Whether you're a business owner looking to manage your finances efficiently or an individual seeking financial guidance, a Professional Accountant can make a world of difference. In this article, we will explore the multifaceted role of a Professional Accountant, their importance, and the frequently asked questions surrounding their profession.

Professional Accountant: The Backbone of Financial Success

A Professional Accountant plays a pivotal role in ensuring financial health and compliance. Here's a closer look at their responsibilities and expertise.

What Does a Professional Accountant Do?

Professional Accountants are financial experts responsible for tasks such as bookkeeping, financial analysis, tax preparation, and auditing. They provide valuable insights to help individuals and businesses make informed financial decisions.

The Benefits of Hiring a Professional Accountant

Expertise: Professional Accountants are highly trained and certified, possessing in-depth knowledge of financial regulations and tax laws.

Time Savings: By handling financial matters, they free up your time to focus on core activities.

Tax Optimization: They ensure you take advantage of tax deductions and credits, saving you money.

Financial Planning: Professional Accountants assist in long-term financial planning, helping you achieve your goals.

The Road to Becoming a Professional Accountant

Becoming a Professional Accountant is a journey that demands dedication and education.

Education and Certification

To become a Professional Accountant, one typically needs a bachelor's degree in accounting and a CPA (Certified Public Accountant) license. Continuous education is crucial to stay updated with changing regulations.

Gaining Experience

New accountants often start as junior associates in accounting firms, where they gain hands-on experience under the mentorship of senior professionals.

Achieving Expertise

Over time, Professional Accountants develop expertise in areas such as taxation, audit, forensic accounting, and management accounting.

FAQs about Professional Accountants

Let's address some common questions about Professional Accountants.

What services do Professional Accountants offer?

Professional Accountants offer a range of services, including tax planning, financial statement preparation, audit services, and financial consulting.

How can I find a trustworthy Professional Accountant?

Seek recommendations from trusted sources, check credentials, and read reviews. Hiring a CPA is often a reliable choice.

Do I need a Professional Accountant for my small business?

Yes, a Professional Accountant can help small businesses manage their finances effectively, optimize taxes, and plan for growth.

How much does it cost to hire a Professional Accountant?

Costs vary based on the complexity of your financial needs. Many accountants offer flexible fee structures, including hourly rates or fixed fees.

What records should I keep for my accountant?

Maintain records of income, expenses, receipts, invoices, and relevant financial documents. Good record-keeping streamlines the accounting process.

How can a Professional Accountant help with taxes?

Professional Accountants have a deep understanding of tax laws. They can help you minimize your tax liability while ensuring compliance.

Conclusion

A Professional Accountant is an invaluable asset for individuals and businesses alike. Their expertise, dedication, and commitment to financial excellence can make a significant difference in your financial success. When seeking a Professional Accountant, choose wisely, considering their qualifications and experience. With their guidance, you can navigate the complex world of finance with confidence.

#ProfessionalAccountant#FinancialExpert#CPA#TaxAdvisor#FinancialPlanning#AccountingServices#TaxConsultant#FinancialAdvisor#AuditServices#SmallBusinessFinance#FinancialSuccess#MoneyManagement#TaxTips#FinancialEducation#BusinessFinance#AccountingFirm#PersonalFinance#FinancialGuidance#TaxSeason#FinancialLiteracy

1 note

·

View note

Text

Find expert Accountants and Accounting Services on TradersFind! 🔍 Connect with top professionals for meticulous financial management. Gain insights, ensure compliance, and boost your business growth. 🚀 Visit TradersFind now!

🛠️ Connect with us on WhatsApp at +971 56 977 3623 to discuss your Accountants and Accounting Services

Visit TradersFind today to explore our directory of Accountants and Accounting Services in UAE🔗: https://www.tradersfind.com/category/accountants-and-accounting-services

Accountants And Accounting Services In UAE

#accountingservices#financialmanagement#businessgrowth#expertadvice#compliance#financialinsights#uaebusiness#growwithus#trustedadvisors#businesssuccess#financialplanning#taxconsultants#bookkeeping#auditservices#smallbusinessowners#startups#entrepreneurs#financialexperts#yourfinancialpartner#connecttoday

2 notes

·

View notes

Text

The best bookkeeping and recordkeeping services help small businesses. Reliability is key. Visit us!

#fullservicebookkeeping#toprecordkeeping#healthcarebookkeeping#financialexperts#HIPAA#affordablebookkeeping#SmallBusinessSolutions#TopBookkeepers#bookkeeping#recordkeeping#LosAngelesbookkeepers

5 notes

·

View notes

Text

Fresh ideas are given life by start-up businesses, which in turn spurs economic growth and produces new job opportunities. These companies expand as a result of the additional personnel they hire, which can boost consumer spending and the overall economy.

#fullservicebookkeeping#affordablerecordkeeping#healthcarebookkeeping#smallbiztips#TopBookkeepers#reliablerecordkeepers#financialexperts#recordkeeping#bookkeeping#recordkeepers#HIPAAbookkeeping#affordablebookkeeping#SmallBusinessSolutions

4 notes

·

View notes

Text

Looking for the best tax consultant company in Chennai? Discover SPR&CO, your trusted Chartered Accountant firm, providing expert financial services and guidance.

#SPRandCO#CharteredAccountants#FinancialExperts#TaxConsultants#ChennaiAccountants#FinancePros#AccountingServices#AuditExperts#TaxAdvisors#FinancialConsultants#AccountingFirm#TaxPlanning#BusinessFinance#FinancialSolutions#ChennaiBusiness#CorporateFinance#TaxationServices#AuditandAssurance#SmallBusinessFinance#FinancialAdvisory#FinancialPlanners#SPRandCOChennai#TaxExperts#CharteredAccounting#FinancialStrategy#IncomeTax#AccountingProfessionals#ChennaiConsultants#TaxCompliance#FinancialManagement

2 notes

·

View notes

Text

Smart investing starts with the best Investment Platform in Nepal! Learn how to minimize risks, diversify assets, and maximize returns. Check out our latest blog for expert insights!

#InvestmentPlatformNepal#SmartInvesting#FinancialSuccess#WealthBuilding#InvestmentOpportunities#RiskManagement#InvestmentPortfolio#MaximizeReturns#InvestmentCompany#InvestSmart#InvestmentExpertNepal#ManageRisks#FinancialExpert#NepalInvestment#Investment

0 notes

Text

Trusted Financial Advisory Firm for Strategic Growth

KICK Advisory Services stands out as a leading financial advisory firm, delivering expert guidance in fundraising, mergers & acquisitions, and strategic financial planning. With a client-focused approach and deep industry insights, KICK helps businesses make informed decisions, maximize value, and drive long-term growth. Partner with us to navigate complex financial landscapes with confidence.

#KICKAdvisoryServices#FinancialAdvisoryFirm#StrategicFinance#BusinessGrowth#FinancialPlanning#CorporateAdvisory#FundraisingExperts#MandAAdvisory#InvestmentAdvisory#FinanceConsulting#BusinessStrategy#FinancialExperts

0 notes

Text

Why VALiNTRY Is the Finance Recruitment Agency Businesses Trust for Top Talent

In today’s fast-evolving business landscape, organizations need more than just employees—they need skilled, adaptable professionals who can drive financial performance and growth. Finding and retaining such high-caliber talent requires more than traditional hiring methods. That’s why companies across industries trust VALiNTRY, a premier Finance Recruitment Agency, to deliver top finance and accounting professionals who are ready to make an impact.

With deep expertise, a vast network of vetted candidates, and a consultative approach, VALiNTRY has emerged as the go-to partner for businesses seeking scalable, flexible, and efficient finance staffing solutions.

The Rising Demand for Specialized Finance Talent

As businesses face increasing complexity in regulatory compliance, financial planning, and digital transformation, the demand for specialized finance professionals has skyrocketed. Roles such as financial analysts, controllers, payroll specialists, accounts receivable/payable staff, and CFOs are critical to ensuring smooth operations and strategic financial management.

However, finding the right talent is challenging. That’s where VALiNTRY shines—bridging the gap between exceptional finance professionals and the organizations that need them.

What Makes VALiNTRY a Trusted Finance Recruitment Agency?

VALiNTRY isn't just another staffing firm. It is a results-driven finance recruitment agency that prioritizes quality, speed, and alignment between employers and candidates. Here’s what sets VALiNTRY apart:

1. Industry-Specific Expertise

Unlike general staffing agencies, VALiNTRY specializes in finance and accounting recruitment. Their recruiters are well-versed in the nuances of the industry, from GAAP standards to ERP software like Workday, SAP, and NetSuite. This means they understand what makes a candidate truly qualified—not just on paper, but in real-world application.

2. Access to Pre-Vetted, High-Quality Candidates

VALiNTRY has built a strong national talent pipeline of finance professionals. Through rigorous vetting, background checks, and technical evaluations, they ensure that each candidate is ready to deliver measurable value. Whether you're looking for a temporary accounts payable specialist or a full-time senior accountant, VALiNTRY delivers talent you can trust.

3. Custom Staffing Solutions

From contract and contract-to-hire to direct hire and executive search, VALiNTRY offers staffing models tailored to your organization’s goals. Whether you need to scale a team quickly, fill a critical vacancy, or bring on specialized skills for a project, they offer staffing agility to meet any demand.

4. Consultative, Relationship-Driven Approach

At VALiNTRY, recruitment is more than a transaction—it’s a partnership. They work closely with hiring managers and executives to understand the company culture, challenges, and long-term goals. This insight leads to smarter hiring decisions and higher retention rates.

Key Roles VALiNTRY Specializes In:

As a top Finance Recruitment Agency, VALiNTRY places highly qualified candidates in a variety of finance and accounting roles, including:

Financial Analysts

Staff Accountants

General Ledger Accountants

Payroll Specialists

Tax Accountants

Controllers & Assistant Controllers

Chief Financial Officers (CFOs)

Workday Financial Consultants

Accounts Payable/Receivable Specialists

Audit & Compliance Professionals

With expertise spanning multiple industries—healthcare, technology, retail, manufacturing, and more—VALiNTRY ensures your team has the finance talent needed to thrive.

The VALiNTRY Process: Fast, Accurate, Proven

The strength of VALiNTRY lies in its streamlined, data-backed recruitment process. Here’s how they consistently deliver:

Discovery Call – Understand your hiring needs, business environment, and team structure.

Targeted Sourcing – Tap into a deep network of active and passive finance talent.

Candidate Evaluation – Assess skills, experience, certifications, and cultural fit.

Shortlisting & Interview Coordination – Present only the most qualified candidates.

Post-Hire Support – Ensure successful onboarding and client satisfaction.

With a focus on speed and precision, VALiNTRY significantly reduces time-to-hire while maintaining the highest quality standards.

Client Success Stories

From mid-sized businesses to Fortune 500 companies, VALiNTRY has helped countless clients build high-performing Finance Recruitment Agency teams. Their clients consistently report:

Improved quality of hires

Faster time-to-fill for critical roles

Increased retention rates

Enhanced internal productivity

Businesses that partner with VALiNTRY view them not just as a staffing agency—but as a strategic extension of their HR team.

Why Companies Choose VALiNTRY Again and Again

Proven Track Record: Over a decade of successful placements and satisfied clients.

National Reach: Staffing support across the U.S., both remote and on-site.

Technology-Enabled: Tools and platforms that enhance candidate matching and tracking.

Exceptional Candidate Experience: VALiNTRY supports both sides of the hiring equation, ensuring candidates are respected, informed, and engaged.

Trust VALiNTRY—where talent meets opportunity, and businesses grow with confidence.

Keywords Included:

Finance Recruitment Agency

Finance Staffing Agency

Accounting Recruitment Services

Hire Finance Professionals

Finance and Accounting Staffing

Accounts Payable Staffing

Workday Finance Staffing

CFO Recruitment

Contract Finance Talent

Direct Hire Accounting

Final Thoughts: The Finance Recruitment Agency You Can Rely On

In an industry where precision, trust, and timing are everything, VALiNTRY delivers unmatched value. As a specialized finance recruitment agency, they empower organizations to grow stronger, operate more efficiently, and stay competitive by delivering the right finance talent at the right time.

Whether you’re hiring one position or building out an entire finance department, VALiNTRY has the resources, expertise, and commitment to help you succeed.

For more info Contact us: 1-800-360-1407 or send mail: [email protected] to get a quote

#FinanceRecruitmentAgency#VALiNTRY#FinanceStaffing#HireTopTalent#AccountingProfessionals#CFORecruitment#WorkdayFinanceTalent#StaffingSolutions#FinancialExperts#AccountingRecruitment#ContractToHire#FinanceCareers#RecruitmentExperts

0 notes

Text

Feeling a bit lost with your PF process? Let FundWise take the confusion out of it!

At FundWise, we’re all about making those tricky financial tasks easy, clear, and hassle-free. Our straightforward 5-step process is crafted to give you a seamless and professional experience from beginning to end.

✅ Step 01: Connect with Us – Get in touch via call, WhatsApp, or our website.

✅ Step 02: Submit Your Details – Securely share the information we need.

✅ Step 03: Issue Analysis – Our team of experts will dive deep to pinpoint the core issue.

✅ Step 04: Action & Processing – We’ll take care of all the paperwork and processes with care.

✅ Step 05: Track Progress & Resolution – Stay updated at every step as we work to resolve your PF concerns.

Whether it’s PF withdrawal, transfer, KYC mismatch, or any other questions—we’ve got it all covered so you can relax.

📞 Need some expert assistance? We’re just a click away!

👉 Connect with us : 91 9112013515 or visit us https://fund-wise.in/

#FundWise#PFWithdrawal#PFTransfer#FinancialExperts#SimplifyFinance#WorkProcess#ClientSupport#FinanceMadeEasy

0 notes

Text

Accountants in Ilford Looking for expert Accountants in Ilford? 📈 DeanCoopers is here to help you manage your accounts, taxes, and business growth effortlessly! 🧾 Located at Suite 4, Cranbrook House, 61 Cranbrook Rd, Ilford, Essex, we provide trusted and tailored accounting services. 📍 📞 Call us today at 020 8514 1376 🌐 Visit: https://shorturl.at/wsDrv 📩 Email: [email protected] Your success is our priority! 🚀

1 note

·

View note

Text

youtube

Gold: Better for Short-Term or Long-Term Investing Now?

Financial experts are carefully assessing gold's investment potential, evaluating its value as both a short-term trading asset and a long-term wealth preservation strategy in the current economic environment.

0 notes

Text

Navigating Financial Success: Unleashing the Power of Tax Services, Business Advisors, and Tax Advisors

Introduction:

In today's dynamic business landscape, the role of expert financial professionals is more crucial than ever. Whether you're an individual striving for tax efficiency or a business owner seeking strategic financial guidance, The services of Tax Advisors, Business Advisors, and Tax Services providers are indispensable. In this comprehensive guide, we'll explore the key roles and benefits of these financial experts and how they can empower you to achieve financial success.

Unveiling Tax Services

Understanding Tax Services

Tax Services encompass a wide range of financial solutions aimed at individuals and businesses. These services are designed to help taxpayers navigate the complexities of tax laws, minimize tax liabilities, and ensure compliance with tax regulations.

Services Offered by Tax Services Providers

Tax Planning: Tax Services providers offer expert tax planning strategies tailored to your specific financial situation. They help you optimize your tax position by identifying deductions and credits while ensuring compliance with tax laws.

Tax Preparation: These professionals assist in the preparation and filing of your tax returns, ensuring accuracy and timeliness to avoid penalties and audits.

IRS Representation: In cases of IRS audits or disputes, Tax Services providers act as advocates on your behalf, ensuring a fair and favorable resolution.

The Role of a Business Advisor

Who is a Business Advisor?

A Business Advisor is a seasoned professional with expertise in various aspects of business management and financial planning. They serve as trusted consultants, guiding businesses in making informed decisions to achieve growth and sustainability.

Services Offered by Business Advisors

Strategic Planning: Business Advisors help formulate business strategies, set goals, and identify opportunities for growth. They provide a roadmap to achieve long-term success.

Financial Analysis: These experts analyze financial data to assess the financial health of a business. They offer insights into cash flow management, cost reduction, and profit maximization.

Risk Management: Business Advisors assist in identifying and mitigating potential risks that could impact the business, helping maintain stability and continuity.

The Art of Tax Advisory

The Role of a Tax Advisor

A Tax Advisor is a specialist in tax laws and regulations. They provide expert guidance to individuals and businesses on managing their tax affairs, ensuring compliance, and optimizing tax strategies.

Services Offered by Tax Advisors

Tax Consultation: Tax Advisors offer personalized tax advice, helping clients understand their tax obligations and opportunities for tax savings.

Estate and Succession Planning: They assist in planning the distribution of assets, minimizing estate taxes, and ensuring a smooth transition of businesses from one generation to the next.

Corporate Tax Planning: Tax Advisors work with businesses to develop tax-efficient strategies, helping reduce tax liabilities and enhance profitability.

Finding Your Financial Allies

Selecting the Right Tax Services, Business Advisor, and Tax Advisor

Expertise: Look for professionals with relevant certifications and experience in your specific needs, such as Certified Public Accountants (CPAs) for tax services.

Client Testimonials: Research client reviews and testimonials to gauge the reputation and reliability of the professionals.

Customized Solutions: Seek experts who can provide tailored solutions that align with your financial goals and aspirations.

Industry Knowledge: Consider professionals who are familiar with the unique challenges and opportunities in your industry.

Conclusion:

In a rapidly changing financial landscape, partnering with Tax Advisors, Business Advisors, and Tax Services providers is a strategic move towards financial empowerment and success. These experts bring a wealth of knowledge and experience to the table, helping you navigate tax complexities, make informed business decisions, and achieve your financial goals. By choosing the right financial allies, you can unlock the full potential of your financial future.

#TaxServices#TaxPlanning#TaxPreparation#TaxAdvisor#BusinessAdvisor#FinancialConsultant#FinancialSuccess#FinancialPlanning#TaxCompliance#StrategicPlanning#FinancialAnalysis#RiskManagement#EstatePlanning#SmallBusinessAdvice#BusinessGrowth#FinancialGuidance#TaxEfficiency#BusinessStrategy#FinancialExpert#FinancialAdvisory

0 notes