#Payment Automation Software

Explore tagged Tumblr posts

Text

Did you know? ❓ 💡 Research shows that organizations using HRIS solutions experience a 35% reduction in time spent on administrative tasks and a 50% increase in the accuracy of employee data. Visit : https://www.transformify.org

#Contingent Workforce Management#Human Resource Information System#HRIS#Applicant Tracking System#HR Software#HR Management Software#Hiring Freelancers Management#Payment Automation Software#Billing Automation Software#Automated Billing Software#Payments to Freelancers

0 notes

Text

The Ultimate Guide to Building a QA Automation Strategy That Delivers Results

Building a QA automation strategy that truly delivers results goes beyond just picking tools—it's about aligning testing efforts with business goals, enhancing quality, and accelerating releases. This ultimate guide walks you through the essential steps to build a strategy that works.

Define Measurable Goals

Start by outlining what “results” mean for your team—faster releases, fewer bugs in production, improved test coverage, or all of the above. Clear KPIs drive focused automation efforts.

Assess Current QA Maturity

Evaluate your team’s existing testing processes, tools, and skills. Understanding your baseline helps identify gaps and opportunities.

Select the Right Tools & Tech Stack

Choose Test Management tools that align with your application type and team expertise. Consider scalability, integration with CI/CD, and community support.

Identify High-ROI Test Cases

Not everything should be automated. Focus on stable, frequently used, and business-critical scenarios first.

Build a Sustainable Automation Framework

Create a modular, maintainable test architecture with version control, reusable functions, and clear documentation.

Monitor, Measure, and Iterate

Use metrics to evaluate effectiveness—test execution time, pass/fail rates, defect trends—and optimize regularly.

With the right mindset and structure, your QA automation strategy can become a key driver of product quality and delivery speed.

#qa testing services#qa testing#qa services#qa testing software#online business banking#lending in banking#payment banks#software testing#qa software#test management tool#software testing process#automated system testing

0 notes

Text

RentDigi | Smarter Rental Management Software for Landlords & Property Managers

Simplify your rental business with RentDigi. Automate rent collection, tenant screening, lease management, and communication — all in one modern, digital platform.

#digital property management#online rent payments#rental software for landlords#tenant screening solutions#lease management tools#rent automation platform#property manager tools

0 notes

Text

InStep Technologies is a trusted fintech software development company delivering secure, scalable, and innovative financial solutions. We build custom fintech apps, APIs, mobile wallets, blockchain integrations, and automation tools for startups, banks, and enterprises.

#fintech software development#custom fintech solutions#financial technology apps#fintech development company#banking app development#blockchain in finance#secure payment software#finance automation tools#investment software solutions#fintech API integration

0 notes

Text

illumine Breaks Down the Real Childcare Cost by State Across the USA

Childcare is one of the biggest expenses for working families in the United States, and the numbers continue to rise every year. Whether you’re a parent searching for the best daycare option or a childcare provider trying to stay competitive, understanding the true childcare cost landscape is essential.

Here, we explore the mean price of daycare across various states of the U.S., what makes them what they are, and what can be done by parents and providers to better manage them. Backed by information from illumine — a well-known childcare management platform — this is your primer to understand how prices differ by state and what that means for the future of early childhood education.

Why Childcare Costs Are Rising in the U.S. The childcare costs in the U.S. have seen a consistent upward trend over the past decade. While inflation and cost of living contribute to this rise, several other factors also play a major role:

Labor Shortages (in the childcare industry)

Licensing and Compliance Costs

Real Estate and Facility Costs

Increased Demand for High-Quality Care

Strict Health & Safety Regulations Post-COVID

As a result, daycare centers are left balancing affordability with quality — a challenge that continues to grow each year.

National Average Daycare Cost The national average yearly cost of daycare for one child ranges from $9,000 to $22,000, depending on location, age, and kind of care, reports the Economic Policy Institute. Infant care is usually higher in cost than toddler care because more staff-to-child ratios and other requirements are involved.

Rapid summary: -Infant Daycare: $1,230/month (national average) -Toddler Daycare: $990–$1,100/month -Preschool Age (3–5 years): $800–$950/month

These figures are quite disparate state by state.

State-by-State Comparison of Childcare Cost Let’s look at how childcare costs differ across the U.S., from the most expensive to the most affordable states:

Most Expensive States for Daycare:

-Massachusetts — Average annual cost: $20,913 -California — Average annual cost: $16,945 -New York — Average annual cost: $15,394 -Connecticut — Average annual cost: $14,682 -Washington, D.C. — Average annual cost: $21,678

In these states, the daycare cost often surpasses college tuition, making childcare a major budgetary burden for families.

More Affordable States for Daycare:

-Mississippi — Average annual cost: $5,436 -Alabama — Average annual cost: $6,001 -South Carolina — Average annual cost: $6,612 -Louisiana — Average annual cost: $6,960 -Kentucky — Average annual cost: $7,112

These numbers reflect the differences in cost of living, wages, and operational costs between states.

Factors That Influence Daycare Cost Though state location is a major factor in the cost of childcare, there are other factors affecting it:

1. Child’s Age: Care for infants is much more costly than care for preschoolers because of staffing requirements and licensing regulations. 2. Center Type: Private preschools or Montessori centers are more expensive than home-based or public daycare. 3. Urban/Rural Segregation: Urban areas tend to have higher daycare prices, whereas rural communities can provide cheaper care — although the choices can be limited. 4. Licensing and Accreditation: Those with national accreditations can be more expensive, but so are the better-quality services and safety precautions. 5. Extra Services: Services that provide meals, transportation, enrichment activities, or extended hours will add to the overall cost of daycare.

How High Childcare Costs Affect Families For many families, childcare costs account for 20–30% of their monthly income, far exceeding the 7% affordability benchmark set by the U.S. Department of Health and Human Services.

This has several effects:

-Reduced Workforce Participation: Many parents (especially mothers) leave the workforce because care is too expensive. -Delayed Family Planning: High daycare costs can discourage couples from having more children. -Increased Financial Strain: Families may cut back on essentials or savings to afford childcare.

What Childcare Providers Can Do Childcare centers are also feeling the pressure — they must balance offering affordable rates while covering operating costs and maintaining high-quality care.

Here are a few ways providers can adapt:

1. Adopt Digital Tools Like illumine: Using tools like illumine’s childcare management software can reduce admin workload, streamline billing, and improve communication with parents — helping centers operate more efficiently. 2. Flexible Pricing Models: Offering part-time care, sibling discounts, or sliding scale pricing can attract more families. 3. Government Programs: Leveraging subsidies and public funding can help centers lower prices for eligible families without losing revenue.

The Role of illumine in Managing Daycare Operations illumine is a leading childcare software solution that helps daycare centers digitize and simplify operations. With features like automated billing, parent communication tools, attendance tracking, and enrollment management software, illumine helps reduce costs and streamline processes.

Here’s how illumine adds value:

-Enabling contactless attendance with real-time tracking -Simplifying parent engagement with a built-in communication app -Managing waitlists and inquiries through its powerful enrollment management software -Automating invoicing and payments, saving admin hours

This digital transformation not only improves service quality but also allows providers to focus more on what matters — delivering excellent care.

Tips for Parents to Handle Childcare Costs While providers strive for efficiency, families too can take some measures to cope with the increasing childcare expense:

-Seek Subsidies and Tax Credits: Initiatives such as the Child and Dependent Care Tax Credit or state subsidies can bring much relief. -Flexible Spending Accounts (FSAs): A few employers provide FSAs that enable parents to save pre-tax dollars for childcare. -Consider Shared or Cooperative Care Models: Nanny-sharing or in-home care co-ops can offer cheaper options. -Negotiate Schedules with Employers: Flexible or work-from-home options can minimize the demand for full-time care.

What the Future Holds for Childcare in America As awareness around childcare costs continues to grow, there is increasing pressure on lawmakers, providers, and employers to find more sustainable solutions.

The future might possibly bring:

-More Government Funding -Universal Preschool Programs -Public-Private Partnerships -Expansion of Employer-Sponsored Childcare Benefits

But while policy takes shape, technology and innovative business models — like those powered by illumine — are leading the way toward more accessible, affordable, and high-quality care.

Conclusion: Understanding and Navigating Daycare Costs Daycare fees are becoming an increasing worry for providers and families. By knowing why these fees are rising and looking at digital resources and flexible care, a balance can be achieved.

Whether you’re a parent budgeting for your childcare or a centre looking to do things more economically, tools like illumine’s child care enrollment management software can be of assistance. illumine works with 3,000+ childcare services across the globe, providing the tools they need to succeed in a competitive, rapidly evolving, and future-ready environment.

To discover how illumine can assist your preschool or daycare in streamlining operations and containing costs better, visit illumine.app.

#illumine app#Automating invoicing and payments#Managing waitlists and inquiries#Simplifying parent engagement#Enabling contactless attendance#childcare management software#daycare cost#childcare costs in the U.S.

0 notes

Text

Best Practices for Handling Partial Payments on Invoices

Discover how small business owners can manage partial payments on invoices, including best practices, potential risks, and helpful tools, to improve cash flow and foster positive client relationships.

#Partial payments#Small business invoicing#Best invoicing software#Invoice payment solutions#Managing partial payments#Invoice automation

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

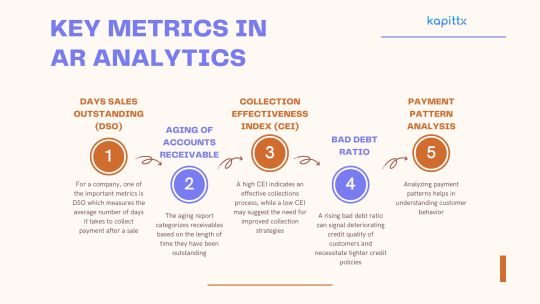

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

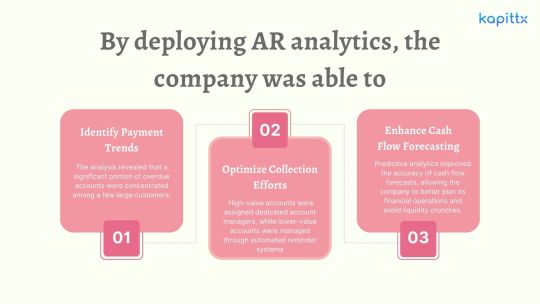

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Efficient Payroll Management Solutions for Accurate and Timely Employee Compensation

Efficient payroll management is essential for maintaining employee trust and ensuring compliance with financial regulations. Payroll software simplifies the process by automating salary calculations, tax deductions, and payment scheduling. This technology reduces errors, saves time, and provides detailed reports for compliance and transparency. A modern payroll solution integrates seamlessly with other HR functions, offering scalability and customization to meet the unique needs of businesses. Streamline your payroll process to enhance accuracy, reduce administrative burden, and ensure timely employee payments.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll Management#Payroll Software#Salary Processing#Tax Deductions#Employee Compensation#Wage Calculation#Automated Payroll#Compliance Reporting#Payment Schedules#HR Payroll Solutions

0 notes

Text

Billing Software Development Services IBR Infotech

IBR Infotech specializes in providing custom billing software development services designed to streamline your invoicing, payment processing, and transaction management. Our solutions offer seamless integration with existing systems, ensuring accurate, automated billing processes that enhance financial operations.

With a focus on user-friendly interfaces and robust security, our billing software helps businesses reduce manual errors, improve cash flow, and maintain compliance. Whether you're a small business or a large enterprise, our scalable solutions can be tailored to meet your specific needs, ensuring efficiency and accuracy across your billing cycles. Let IBR Infotech transform your billing system into a powerful tool for financial management and business growth. Read more -https://www.ibrinfotech.com/solutions/custom-billing-software-development #BillingSoftware #SoftwareDevelopment #CustomBilling #InvoicingSoftware #PaymentProcessing #TransactionManagement #AutomatedBilling #FinancialManagement #SecureBilling #BillingSolutions #ScalableSoftware #BusinessSoftware #CashFlowManagement #BillingSystem #TechSolutions #EnterpriseSoftware #BillingServices #FinancialTech #SoftwareDevelopmentServices

#billing software development#custom billing software#invoicing software solutions#payment processing software#transaction management system#automated billing#secure billing software#financial management software#billing system integration#custom invoicing software#user-friendly billing system#billing software for businesses#financial operations software#automated invoicing solutions

0 notes

Text

Streamlining Business Operations with Smart Invoicing Tools

As a small business owner, managing daily tasks efficiently has always been a top priority for me. One of the most time-consuming aspects of running my business used to be invoicing. It felt like a constant struggle to create professional invoices, keep track of payments, and stay organized. But recently, I came across a tool that has completely transformed the way I handle invoicing.

This tool is incredibly easy to use, and it has streamlined my entire billing process. Now, I can create professional invoices in just a few clicks, track payments effortlessly, and even automate recurring payments. What used to take hours is now completed in minutes, giving me more time to focus on what truly matters—growing my business and connecting with customers.

Having the right tools to simplify operations is a game-changer for any business, whether you’re just starting out or are already established. Tools like these not only save time but also reduce stress, helping you stay organised and productive.

If invoicing has ever been a challenge for you, I highly recommend exploring software that can make the process efficient and hassle-free. It’s made a huge difference for me, and I believe it can do the same for you!

#invoicing solution for small businesses#automate payments#Reliable Invoicing#GST Calculator#invoicing software

0 notes

Text

Simplifying My Business Operations with the Right Tools

As the owner of Anais Fashions, I know firsthand how demanding it can be to manage a small business. Between curating stylish collections, connecting with customers, and handling daily operations, there’s always a lot on my plate. One of the biggest challenges I faced was managing invoices efficiently—it used to take up so much of my time.

Recently, I started using a tool designed to simplify invoicing, and it’s been a total game-changer for my business. It allows me to create professional invoices quickly and track payments seamlessly, which has helped me stay organized and stress-free. Not only does it save me time, but it also ensures my records are accurate and up to date, which is crucial for a business like mine.

As someone who loves sharing tips and good experiences, I want to encourage fellow small business owners to explore tools that can make their lives easier. Whether it’s for invoicing, inventory, or customer management, the right tools can free up your time so you can focus on growing your business and doing what you love. Running a business is hard work, but smart solutions can make it a whole lot easier!

1 note

·

View note

Text

Ticket-Based Parking: Reliable Access Control and Revenue Management Manage parking operations efficiently with Parkomax’s ticket-based solution, offering robust access control, revenue tracking, and a smooth flow for vehicles entering and exiting your facility.

#Ticket-based parking system#Parking management solutions#Automated parking entry#Ticket-based access control#Parking payment integration#Parking revenue management#Vehicle tracking system#Parking control software#Secure parking management#Efficient parking operations

0 notes

Text

#Housecall Pro review#Home service business software#Business management software#Field service management#Scheduling software for service businesses#Invoicing and payment processing tools#Customer management software#Marketing tools for service pros#Home service industry solutions#Business software for plumbers#HVAC business management#Landscaping business software#Electrical service software#Service business automation#Small business technology solutions#Streamlining business operations#Growing a service business#Software for service professionals#Home service scheduling tools#Best software for service businesses

0 notes

Text

#Ordering and Payment Solution#Supply Chain Management Software#Supply Chain Management System#Minivend Driver App#automate credit card payments#Ecommerce Website#Online Accounting Software#Supplier and Distributor Management Solutions#supply chain management software provider

0 notes

Text

#zoho#zoho crm#zoho partner#zoho creator#automation#payment management#razorpay#software#business#technology#crm

1 note

·

View note

Text

Marg ERP: Easy Invoicing and Billing Software Marg ERP Limited offers user-friendly invoicing and billing software, simplifying financial processes for businesses. With features like automated invoicing, inventory management and GST compliance, it streamlines operations. Marg ERP ensures efficient tracking of sales, purchases, and payments, enhancing business productivity and financial management.

#inventory software#billing software#billing solutions#inventory management#bussiness#pos software#business#management#technology#Invoicing software#automated invoicing#erp solution#GST compliance#sales tracking#payment tracking#business productivity

0 notes