#QQQ ETF

Explore tagged Tumblr posts

Text

기술주 ETF, QQQ가 선택받는 이유

QQQ ETF는 미국 기술주의 심장과도 같은 나스닥 100을 담고 있어요. 배당이 낮다고요? 하지만 안정성과 성장성을 함께 추구하는 투자자에게 이만한 선택은 없죠. 가격, 주가 흐름, 구성 종목까지 정리해봤어요.

기술주에 투자하고 싶다면, 블로그 원문을 꼭 읽어보세요.

0 notes

Text

The #monstre #Cup & #Handle at #QQQ & #SPY #ETF apex 💢 https://www.researchgate.net/figure/fig2_281176863 #technical #graphical #analysis #Financial #Market

Stocks & #Equity

GraphicalContest rules >> https://www.researchgate.net/publication/327238561

1 note

·

View note

Text

QQQ ETF: Unraveling the Power of Tech-Driven Investing

Investors seeking exposure to the technology sector often turn to exchange-traded funds (ETFs) as a convenient and diversified investment option. One such ETF that stands out is the QQQ ETF, an investment vehicle that provides access to the performance of the tech-heavy Nasdaq-100 Index. In this article, we will explore what the QQQ ETF is, why it's a favored choice among investors, and how it differs from investing in regular stocks. As the technology sector continues to shape the investment landscape, this article aims to provide insights into the unique merits and principles of the QQQ ETF.

Demystifying the QQQ ETF: A Window to Tech Giants

The QQQ ETF, managed by Invesco, tracks the Nasdaq-100 Index and offers investors exposure to the top 100 non-financial companies listed on the Nasdaq Stock Market. This index is known for its technology-focused composition.

What Is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors with a straightforward way to invest in the Nasdaq-100 Index. It offers a diversified portfolio of tech giants, including companies like Apple, Amazon, Microsoft, and many more.

Why the QQQ ETF Holds Appeal:

Tech-Heavy Exposure: The QQQ ETF is renowned for its tech-heavy composition. It offers exposure to some of the world's most influential technology companies.

Diversification: By investing in the QQQ ETF, investors can achieve instant diversification across a broad range of tech and non-financial sectors.

Liquidity: The QQQ ETF is highly liquid, making it easy for investors to buy and sell shares on the stock market.

Growth Potential: Tech companies within the Nasdaq-100 Index are often associated with strong growth potential, attracting investors looking for capital appreciation.

Lower Risk: Diversification within the QQQ ETF can reduce stock-specific risk, offering a more balanced investment approach.

QQQ ETF vs. Regular Stocks:

Diversification vs. Single Stocks: The QQQ ETF provides diversification across multiple companies, while regular stocks represent ownership in a single company.

Sector Exposure vs. Focused Holdings: The QQQ ETF offers broad sector exposure, while regular stocks may have a more focused holding.

Liquidity vs. Specific Market Conditions: The QQQ ETF offers liquidity through its listing on stock exchanges, while regular stocks may face specific market conditions.

Risk Mitigation vs. Stock-Specific Risks: The QQQ ETF can help mitigate risks related to individual stocks, providing a safety net for investors.

Conclusion: Leveraging the Power of QQQ ETF

The QQQ ETF is a valuable tool for investors looking to gain exposure to the tech giants that dominate the Nasdaq-100 Index. It provides diversification, liquidity, and the potential for capital appreciation. As you navigate the world of technology-driven investments, consider the principles of the QQQ ETF and its role in enhancing your investment portfolio.

For more insights on the QQQ ETF, diversified investment strategies, and a host of other investment opportunities, visit Valuezai.com. It's your resource for making informed investment decisions and harnessing the power of the QQQ ETF in tech-driven investing.

0 notes

Text

Decoding ETFs: Essential Factors to Consider for Wise Investments

Written by Delvin Ever since their inception in 1993, Exchange-Traded Funds (ETFs) have transformed the investment arena, providing investors with a wide array of options to diversify their portfolios. However, given the increasing number of available ETFs, it is crucial for investors to grasp the art of evaluating them effectively. In this article, we will delve into five pivotal factors to…

View On WordPress

#Blog#Blogging#Compound Interest#dailyprompt#Decoding ETFs: Essential Factors to Consider for Wise Investments#Diversification#ETF’s#Expense Ratio#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#Generational Wealth#money#Moneymaking#Passive Income#Personal Finance#QQQ#SPY#Tax Efficiency#Wealth

1 note

·

View note

Photo

Deja Vu: After Fitch's Cut To US Credit Rating, A Look At The Market Fallout From S&P's 2011 Downgrade The recent downgrade of the US sovereign credit rating from AAA to AA+ by Fitch Ratings has brought back memories of a similar event occurred exactly 12 years ago. On Aug. 6, 2011, S&P made history by downgrading the U.S. credit rating from AAA to AA+ for the first time since 1941. S&P downgraded the nation’s credit rating in August 2011 after Washington avoided a default by temporarily increasing the debt ceiling, just as it did again in June of this year. Increased political polarization and a lack of action to improve the country’s financial situation led to this decision. How Did Markets React To 2011 Sovereign Credit Rating Downgrade? The U.S. credit downgrade was not the only negative news impacting the markets back then. The eurozone was in the clutches of a sovereign debt crisis, with worries of PIGS — an abbreviation for Portugal, Italy, Greece and Spain — defaults. As soon as the markets reopened on Monday, Aug. 8 following the weekend break, global stocks sold ...Full story available on Benzinga.com https://www.benzinga.com/government/23/08/33526726/deja-vu-after-fitchs-cut-to-us-credit-rating-a-look-at-the-market-fallout-from-s-ps-2011-downgrade

#credit rating#DIA#Downgrade#Fitch Ratings#GLD#Government#QQQ#rating agencies#S&P#S&P Global#SPY#U.S. credit rating downgrade#UUP#Bonds#Broad U.S. Equity ETFs#Specialty ETFs#New ETFs#Commodities#Currency ETFs#Tech#ETFs#US78467X1090#US78463V1070#US78462F1030#US73936D1072

0 notes

Text

4 Trade Ideas for Caterpillar: Bonus Idea

Caterpillar, $CAT, comes into the week at resistance with the Bollinger Bands® opening higher. It moved back over the 50 day SMA last week for the first time since January. It has a RSI moving into the bullish zone with the MACD rising and positive. There is resistance at 327 and 330 then 336 and 343.50 before 350.75 and 358. Support lower comes at 318.50 and 308.50. Short interest is low at 1.7%. The stock pays a dividend with an annual yield of 1.73% and has traded ex-dividend since April 21st.

The company is expected to report earnings next on August 4th. The May options chain shows biggest open interest the 310 and 300 put strikes and then much bigger on the call side at the 340 strike. The June chain has open interest spread from 350 to 270 on the put side and focused from 330 to 360 on the call side. The July chain has biggest open interest at the 300 put strike and then 340 then 360 call strikes. Finally, in the August chain, open interest is spread from 360 to 280 on the put side and biggest at 400 on the call side.

Trade Idea 1: Buy the stock on a move over 327 with a stop at 315.

Trade Idea 2: Buy the stock on a move over 327 and add a June 320/310 Put Spread ($3.35) while selling the July 370 Calls ($2.35).

Trade Idea 3: Buy the June/July 350 Call Calendar ($3.45) and sell the June 300 Put ($3.60).

Trade Idea 4: Buy the August 300/340/380 Call Spread Risk Reversal ($1.40).

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the May FOMC meeting in the books, equity markets showed resilience holding up in their short term rises.

Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil continues to trend lower. The US Dollar Index continues to drift to the upside in a bear flag while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to continue in consolidation while Emerging Markets consolidate in a broad range just under resistance.

The Volatility Index looks to continue moving back to normal, making the path easier for equity markets to the upside. Their charts show short term strength on both timeframes. On the shorter timeframe the IWM, the QQQ and the SPY are on the verge of breaking higher and a shift to bullish momentum. On the longer timeframe the classic “V” recovery continues to build in all 3 Index ETFs. Use this information as you prepare for the coming week and trad’em well.

16 notes

·

View notes

Link

Watch These QQQ Price Levels as Nasdaq 100 ETF Hits Another Record High

0 notes

Text

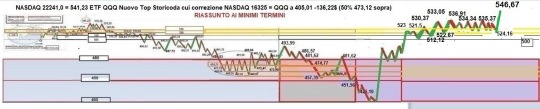

Da 405,01 a 546,67 dal 7/9-04 al 26/06-2025

+141,66$ +34,97%

Annotiamo ennesimo top storico

QQQ 546,67 = NASDAQ 22450

0 notes

Text

Entrepreneurial Growth Lessons from the QQQ ETF

Here’s a well-structured, engaging WordPress blog post (1,450 words) inspired by the NASDAQ-100 ETF (QQQ) concept from Investopedia. Content is organized with storytelling, insights, tips, and key summaries for readability. 🔍 What Is QQQ and Why Does It Matter? If you’ve ever wanted to invest in innovation without picking individual stocks, the NASDAQ-100 ETF (QQQ)—often called the “Cubes”—might…

0 notes

Text

NVDL Stock Soars in 2025: What Investors Must Know Now

NVDL Stock Soars in 2025: What Investors Must Know Now

NVDL has become one of the hottest leveraged ETFs in 2025. This 2x leveraged fund is directly tied to Nvidia (NVDA) performance, making it a favorite for those seeking high short-term gains in the booming AI and semiconductor space. But is it too risky for your portfolio?

Let’s break down everything you need to know — the history, performance, risk, comparison, and future of NVDL.

What is NVDL?

NVDL is the ticker for the GraniteShares 2x Long NVDA Daily ETF. This fund aims to deliver twice the daily return of Nvidia’s stock. That means if Nvidia goes up by 3% today, NVDL is designed to go up by 6%. Similarly, losses are also magnified.

This ETF is not for long-term holding. It’s built for active traders and short-term investors who understand how leverage works.

NVDL Performance Overview

Here’s a quick look at NVDL’s performance as of June 2025:MetricValueYTD Performance (2025)+178.3%1-Year Return+320.5%VolatilityHighExpense Ratio0.99%Daily Volume1.3M+ sharesUnderlying AssetNvidia (NVDA)Leveraged Exposure2x (Daily Compounding)

Note: Because of daily compounding, long-term returns may vary greatly based on volatility.

Why is NVDL So Popular in 2025?

AI Boom: Nvidia is powering almost every major AI product, from ChatGPT to Tesla’s Dojo supercomputer. This has caused NVDA stock to surge.

High Returns: Traders looking for higher returns are flocking to NVDL instead of NVDA.

Retail Trader Favorite: Platforms like Robinhood and Webull show NVDL among the most-held ETFs by retail investors.

Short-Term Play: Its popularity stems from quick profits over short windows — hours, days, or a few weeks.

NVDL vs NVDA: Which is Better?

FactorNVDLNVDAType2x Leveraged ETFRegular StockIdeal ForShort-Term TradersLong-Term InvestorsVolatilityVery HighModerate to HighExpense Ratio0.99%NoneRiskHighMediumReward PotentialVery High (Short-Term)High (Long-Term)

Verdict: NVDL is for experienced traders. NVDA is safer for long-term investing.

Historical Trends and Key Events

Launched: December 2022 by GraniteShares

Initial Reaction: It saw modest trading volume until Nvidia’s stock breakout in mid-2023.

2024 Surge: NVDA doubled, and NVDL rose more than 3x, gaining media attention.

2025 Growth: As of mid-2025, Nvidia’s dominance in AI and chips keeps NVDL trending upward.

Risks Associated with NVDL

NVDL is not for everyone. Let’s look at key risks:

Daily Reset: Returns are calculated daily. Holding it for longer can result in “decay,” especially in sideways markets.

High Volatility: A 5% drop in Nvidia could mean a 10% drop in NVDL in a single day.

Not for Passive Investing: This is not something to hold in a retirement or long-term growth portfolio.

Always remember: Leverage magnifies both gains and losses.

Expert Opinions

Morgan Stanley (2025 Q2 report): “Leveraged ETFs like NVDL are suitable only for disciplined investors with real-time tracking strategies.”

CNBC Commentator: “NVDL is like holding a lightning bolt. It’s powerful, but dangerous if you don’t know how to use it.”

Should You Buy NVDL?

If you’re:

Actively monitoring markets daily

Understand Nvidia’s movements

Have a stop-loss strategy

Comfortable with high risk

Then NVDL could be a strong tactical tool for short bursts of trading activity.

But if you’re:

A long-term investor

Risk-averse

New to trading

Then NVDA or a diversified tech ETF like QQQ might be safer bets.

Future Outlook for NVDL

NVDL’s future depends entirely on Nvidia’s stock performance. As AI continues to reshape industries, Nvidia is likely to remain a central player.

If Nvidia continues its growth in:

AI chips

Cloud computing partnerships

Automotive AI and robotics

Then NVDL could continue delivering big short-term returns. However, any downturn or correction in the tech market could trigger massive drawdowns in NVDL.

Final Thoughts

NVDL is one of the most exciting ETFs of 2025, but it’s also among the riskiest.

Use it smartly — as a short-term trading tool, not a core investment. Study Nvidia, set clear exit rules, and always track performance daily.

For casual or long-term investors, stick to NVDA or safer ETFs.

Disclaimer: The content provided in this article is for informational and educational purposes only and does not constitute financial, investment, or trading advice.

1 note

·

View note

Text

Navigating the Market with Expert Stock Advisory Services

In today's dynamic financial landscape, having access to reliable stock advisory services can make a significant difference in achieving consistent success. Whether you're a beginner stepping into the world of trading or a seasoned investor aiming to refine your strategies, partnering with an experienced advisor is crucial. That’s where Myspyoptions comes in.

With over 15 years of hands-on experience, Myspyoptions has become a trusted name in the financial community. Specializing in SPY and QQQ options trading, this seasoned stock market advisor has guided more than 1,000 traders toward improved financial literacy and market performance. What sets Myspyoptions apart is not just the experience, but the ability to simplify complex market concepts into clear, actionable insights.

As a leader in stock advisory services, Myspyoptions is committed to helping traders make informed decisions. Options trading, particularly in high-volume ETFs like SPY and QQQ, requires a deep understanding of market trends, volatility, and timing. This is where the insights from a skilled advisor can prove invaluable.

Whether you're looking to build a long-term investment strategy or capitalize on short-term opportunities, expert advice tailored to your financial goals is essential. Myspyoptions offers that personalized guidance, helping clients avoid common pitfalls while maximizing profit potential.

In a market where every decision counts, aligning with a knowledgeable advisor offering reliable stock advisory services can be your key to success. With a proven track record and a commitment to trader education, Myspyoptions empowers individuals to take control of their financial future with confidence.

0 notes

Text

youtube

YMAP The First European Big Tech Fund! Meet YMAP – the first European Big Tech fund, giving investors exclusive access to the fastest-growing technology giants in Europe. In this video, I break down what makes YMAP unique and why it could become the European equivalent of the Nasdaq-100. ✅ What you’ll learn: What is YMAP and how it works The top holdings in the YMAP ETF Comparison to US tech ETFs like QQQ or XLK Dividend potential and long-term growth Who should consider investing in YMAP 💬 Is Europe finally catching up to the US in tech innovation? Comment your thoughts! 📈 If you're looking for growth with European exposure, YMAP could be the tech ETF of the future. ✅ Important Links to Follow ✨Join this channel to get access to perks, emojis, badges and members-only content such as our very own dashboard and streams! https://www.youtube.com/channel/UCYVb-BeSKknuPK3L9_ZqvFg/join ✨Join my Discord with 700+ Other Like-Minded Investors and get access to a bunch of Investing Tools Which I use - https://ift.tt/eidQEVR ✨Use my Link and Promo Code for 10% off Snowball Analytics Below - https://ift.tt/gs9vJkt ✨PROMO CODE: cashflowking ✨Twitter: https://ift.tt/UyHup9f ✨Ultimate UK Income Pie on Trading 212 - https://ift.tt/0PHjF1E ✨High Yield Income Pie on Trading 212 - https://ift.tt/Emo1LIG ✨Safer Assets Pie on Trading 212 - https://ift.tt/uw9OVXb 🔗 Stay Connected With Me. 🔔𝐃𝐨𝐧'𝐭 𝐟𝐨𝐫𝐠𝐞𝐭 𝐭𝐨 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐦𝐲 𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐮𝐩𝐝𝐚𝐭𝐞𝐬. https://www.youtube.com/@CashflowKing94/?sub_confirmation=1 📩 For business inquiries: [email protected] ================================================================================ 🎬Suggested videos for you: ▶️ https://www.youtube.com/watch?v=w-N6bKTaEGg&t=29s ▶️ https://www.youtube.com/watch?v=RjTImTr0DuE ▶️ https://www.youtube.com/watch?v=k5PE9TUY-is&t=102s ▶️ https://www.youtube.com/watch?v=w5l-xnObaPo&t=127s ▶️ https://www.youtube.com/watch?v=xr8HZYcHPLA&t=873s ▶️ https://www.youtube.com/watch?v=9-x1qAUomM0&t=196s ▶️ https://www.youtube.com/watch?v=i3Ki-ZAgums&t=24s ▶️ https://www.youtube.com/watch?v=Bywx8IdL6rc&t=246s ================================================================================ ✅ About Cashflow King. Welcome to Cashflow King! I’m here to help you reveal the power of high-yield investing and achieve financial freedom through smart, cash-flow-generating investments. I focus on dividend and income investing on this channel, sharing insights on the best UK high-yield stocks, ETFs, and funds. From passive income strategies to top UK dividend shares for 2025, I provide actionable tips to help you grow your wealth. Join me for live streams, videos, and our Discord community, where we get into proven strategies to navigate the UK stock market and build a high-yield portfolio. Let’s start your journey to financial success together! For Business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Ready to build unstoppable cash flow? Subscribe for top UK dividend stocks, high-yield portfolios, and proven investing strategies! https://www.youtube.com/@CashflowKing94/?sub_confirmation=1 ============================================================================= == YMAP fund review, European growth ETF, tech sector investing Europe, YMAP vs Nasdaq, tech dividend Europe, innovation ETF EU, EU stock market exposure ================================================================================#YMAP #TechETF #EuropeanTech #BigTechEurope #ETFInvesting #DividendETF #PassiveIncome #LongTermInvesting #YMAPReview #TechGrowth via Cashflow King https://www.youtube.com/channel/UCYVb-BeSKknuPK3L9_ZqvFg June 11, 2025 at 06:00PM

#finance#dividend#cashflowking#highyield#stockmarket#incomeinvesting#financialfreedom#financialadvice#Youtube

0 notes