#Reduce debt burden

Explore tagged Tumblr posts

Text

How to Improve Your Debt-to-Income Ratio for a Higher Loan Amount?

When applying for a personal loan, lenders consider various factors to determine your eligibility. One of the most critical factors is your Debt-to-Income (DTI) ratio. A high DTI ratio can lower your chances of securing a loan or result in a lower loan amount.

So, how can you improve your DTI ratio and qualify for a higher personal loan amount? This guide will walk you through everything you need to know about the DTI ratio and the best strategies to improve it.

What Is Debt-to-Income (DTI) Ratio?

The Debt-to-Income (DTI) ratio is a financial metric that compares your monthly debt payments to your gross monthly income. It helps lenders assess your ability to manage additional debt.

Formula to Calculate DTI Ratio:

DTI Ratio=(Total Monthly Debt PaymentsGross Monthly Income)×100\text{DTI Ratio} = \left( \frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}} \right) \times 100DTI Ratio=(Gross Monthly IncomeTotal Monthly Debt Payments)×100

For example, if you earn ₹50,000 per month and have ₹20,000 in debt obligations, your DTI ratio is: (20,00050,000)×100=40%\left( \frac{20,000}{50,000} \right) \times 100 = 40\%(50,00020,000)×100=40%

Why Does DTI Ratio Matter for a Personal Loan?

Lenders use the DTI ratio to determine how much additional debt you can handle. A low DTI ratio shows that you have sufficient income to repay the loan, increasing your chances of approval for a higher loan amount.

Ideal DTI Ratio for Personal Loans

✔ Below 30% – Excellent, high chances of approval for a large loan amount ✔ 30% - 40% – Good, but lenders may impose some restrictions ✔ 40% - 50% – Moderate risk, may get approved but with higher interest rates ✔ Above 50% – High risk, difficult to get approval for a personal loan

If your DTI ratio is high, you must work on reducing it before applying for a personal loan.

How to Improve Your DTI Ratio for a Higher Personal Loan Amount?

To enhance your loan eligibility, you need to either increase your income or reduce your existing debts. Let’s explore some of the best ways to improve your DTI ratio.

1. Pay Off Existing Debts

Reducing your outstanding debts is the most effective way to lower your DTI ratio. Start by:

✔ Paying off high-interest debts such as credit cards ✔ Clearing small loans to free up monthly income ✔ Making extra payments to close loans faster

📌 Example: If you have a ₹5,000 monthly credit card bill and you clear it, your DTI ratio will improve, increasing your eligibility for a higher personal loan amount.

2. Increase Your Monthly Income

If reducing debt isn't an immediate option, increasing your income can help improve your DTI ratio. Consider:

✔ Taking up freelance work – Writing, designing, consulting, etc. ✔ Starting a side business – Selling products online, offering services ✔ Negotiating a salary hike – Request a raise from your employer ✔ Renting out property – Earn passive income from real estate investments

📌 Example: If your current salary is ₹50,000 and you earn an extra ₹10,000 through freelancing, your income increases to ₹60,000. This lowers your DTI ratio, making you eligible for a bigger personal loan.

3. Consolidate Your Debt with a Personal Loan

If you have multiple high-interest debts, debt consolidation can be a smart move. You can take a personal loan at a lower interest rate and repay all high-cost debts.

✔ Reduces your monthly EMI burden ✔ Lowers your overall interest rate ✔ Helps manage finances with a single EMI

📌 Example: If you are paying ₹10,000 for a credit card and ₹8,000 for another loan, a personal loan with a lower EMI of ₹12,000 can reduce your DTI ratio.

4. Extend Your Loan Tenure

If you are struggling with high EMIs, extending your loan tenure can reduce your monthly debt payments and lower your DTI ratio.

✔ Lower EMIs make it easier to manage finances ✔ Lenders consider you a low-risk borrower

📌 Example: If your current EMI is ₹15,000 on a 5-year loan, extending it to 7 years can reduce your EMI to ₹12,000, improving your DTI ratio.

5. Avoid Taking New Loans Before Applying for a Personal Loan

Applying for multiple loans at once can increase your DTI ratio, reducing your chances of approval for a high loan amount.

✔ Limit new loan applications until your current debts are under control ✔ Avoid unnecessary credit card purchases that increase your outstanding dues

📌 Example: If you plan to take a personal loan next month, avoid applying for a car loan today, as it will increase your debt burden.

6. Make Lump-Sum Payments Towards Your Debt

If you receive a bonus, tax refund, or unexpected income, consider making a lump-sum payment towards your outstanding debt.

✔ Reduces overall debt amount ✔ Improves credit score ✔ Lowers DTI ratio for a higher loan amount

📌 Example: If you owe ₹1,00,000 on a personal loan, using a ₹50,000 bonus to prepay will reduce your EMIs and improve your loan eligibility.

7. Improve Your Credit Score

A high credit score (750+) improves your credibility and increases your loan approval chances.

✔ Pay EMIs and credit card bills on time ✔ Keep credit card utilization below 30% ✔ Avoid multiple loan applications within a short period

📌 Example: A credit score of 800 with a DTI ratio below 40% can help you qualify for the highest loan amount at the lowest interest rate.

How Soon Can You Improve Your DTI Ratio?

Improving your DTI ratio depends on how quickly you can reduce debts and increase income.

✔ Short-Term Fixes (1-3 Months): Pay off small debts, make lump-sum payments, negotiate lower EMIs ✔ Mid-Term Strategies (3-6 Months): Increase income, consolidate debt, improve credit score ✔ Long-Term Plans (6-12 Months): Reduce major loans, avoid new credit, increase savings

📌 Tip: Start improving your DTI ratio at least 3-6 months before applying for a personal loan.

Final Thoughts

Your Debt-to-Income (DTI) ratio is a crucial factor in determining your personal loan eligibility. A lower DTI ratio increases your chances of securing a higher loan amount at better terms.

To improve your DTI ratio, focus on:

✔ Paying off existing debts ✔ Increasing your income through side jobs or freelancing ✔ Consolidating high-interest debts with a lower-cost loan ✔ Reducing EMIs by extending loan tenure ✔ Avoiding new loans before applying for a personal loan

By implementing these strategies, you can significantly boost your DTI ratio, making it easier to secure a higher personal loan amount with favorable interest rates.

#fincrif#personal loan online#loan apps#nbfc personal loan#finance#bank#personal loans#personal loan#loan services#personal laon#Personal loan#Debt-to-income ratio#DTI ratio improvement#Loan eligibility#Higher loan amount#Reduce debt burden#Increase income for loan#Personal loan approval#Credit score improvement#Loan EMI reduction#Debt consolidation loan#Loan repayment strategy#Monthly debt payments#Personal loan interest rate#Extend loan tenure#Lower EMI payments#Credit card debt reduction#Financial planning for loans#Improve loan eligibility#Personal loan refinancing

1 note

·

View note

Text

Things Biden and the Democrats did, this week #13

April 5-12 2024

President Biden announced the cancellation of a student loan debt for a further 277,000 Americans. This brings the number of a Americans who had their debt canceled by the Biden administration through different means since the Supreme Court struck down Biden's first place in 2023 to 4.3 million and a total of $153 billion of debt canceled so far. Most of these borrowers were a part of the President's SAVE Plan, a debt repayment program with 8 million enrollees, over 4 million of whom don't have to make monthly repayments and are still on the path to debt forgiveness.

President Biden announced a plan that would cancel student loan debt for 4 million borrowers and bring debt relief to 30 million Americans The plan takes steps like making automatic debt forgiveness through the public service forgiveness so qualified borrowers who don't know to apply will have their debts forgiven. The plan will wipe out the interest on the debt of 23 million Americans. President Biden touted how the plan will help black and Latino borrowers the most who carry the heavily debt burdens. The plan is expected to go into effect this fall ahead of the election.

President Biden and Vice-President Harris announced the closing of the so-called gun show loophole. For years people selling guns outside of traditional stores, such as at gun shows and in the 21st century over the internet have not been required to preform a background check to see if buyers are legally allowed to own a fire arm. Now all sellers of guns, even over the internet, are required to be licensed and preform a background check. This is the largest single expansion of the background check system since its creation.

The EPA published the first ever regulations on PFAS, known as forever chemicals, in drinking water. The new rules would reduce PFAS exposure for 100 million people according to the EPA. The Biden Administration announced along side the EPA regulations it would make available $1 billion dollars for state and local water treatment to help test for and filter out PFAS in line with the new rule. This marks the first time since 1996 that the EPA has passed a drinking water rule for new contaminants.

The Department of Commerce announced a deal with microchip giant TSMC to bring billions in investment and manufacturing to Arizona. The US makes only about 10% of the world's microchips and none of the most advanced chips. Under the CHIPS and Science Act the Biden Administration hopes to expand America's high-tech manufacturing so that 20% of advanced chips are made in America. TSMC makes about 90% of the world's advanced chips. The deal which sees a $6.6 billion dollar grant from the US government in exchange for $65 billion worth of investment by TSMC in 3 high tech manufacturing facilities in Arizona, the first of which will open next year. This represents the single largest foreign investment in Arizona's history and will bring thousands of new jobs to the state and boost America's microchip manufacturing.

The EPA finalized rules strengthening clean air standards around chemical plants. The new rule will lower the risk of cancer in communities near chemical plants by 96% and eliminate 6,200 tons of toxic air pollution each year. The rules target two dangerous cancer causing chemicals, ethylene oxide and chloroprene, the rule will reduce emissions of these chemicals by 80%.

the Department of the Interior announced it had beaten the Biden Administration goals when it comes to new clean energy projects. The Department has now permitted more than 25 gigawatts of clean energy projects on public lands, surpass the Administrations goal for 2025 already. These solar, wind, and hydro projects will power 12 million American homes with totally green power. Currently 10 gigawatts of clean energy are currently being generated on public lands, powering more than 5 million homes across the West.

The Department of Transportation announced $830 million to support local communities in becoming more climate resilient. The money will go to 80 projects across 37 states, DC, and the US Virgin Islands The projects will help local Infrastructure better stand up to extreme weather causes by climate change.

The Senate confirmed Susan Bazis, Robert White, and Ann Marie McIff Allen to lifetime federal judgeships in Nebraska, Michigan, and Utah respectively. This brings the total number of judges appointed by President Biden to 193

#Thanks Biden#Joe Biden#student loans#student loan debt#debt forgiveness#gun control#forever chemicals#PFAS#climate change#green energy

3K notes

·

View notes

Text

Vedic Astro Observations - Some Nakshatra placements

I set out to study the nakshatras from Scorpio to Pisces, from Anuradha to Revati. The focus was on planetary positions, transit effects, general traits, and some unique observations gathered along the way. Every detail was recorded carefully with an eye on well-known views to ensure a clear and deep understanding.

In the study of Uttara Bhadrapada, it was found that when Rahu is in this nakshatra, it brings together a strong desire for worldly success and a deep inner insight. People with this placement often try very extreme paths early in life. For example, they may chase fame or money with great energy. Over time, Saturn’s influence helps to keep these ambitions grounded and creates a balance. Many eventually become unique helpers in their communities. Their energy is light and flexible, allowing them to take on many roles, even though they remain hard to define. Rahu seems to encourage letting go of ego and illusion, turning these people into supporters of the common good. Occasional bursts of ego or a wish to escape may appear, but Saturn usually guides the energy into healing work.

Ketu in Uttara Bhadrapada appears to mark a soul nearing the end of its karmic journey. People with this placement show clear detachment and wisdom from a young age. They often feel complete on their own, much like a lone animal that thrives independently. This placement reduces the desire for material things and naturally leads to a simpler life focused on spiritual practices, meditation, or healing. Many seem to have natural talents in spiritual arts, and life events tend to push them toward roles as guides or teachers. A tendency to spend long periods alone, in nature or in quiet prayer, is common. Ultimately, Ketu in Uttara Bhadrapada means a life of closing old chapters, forgiving past wrongs, settling old debts, and passing on hard-earned wisdom to the next generation. The legacy left behind is a gentle mark of peace in the community.

The moving planets in Uttara Bhadrapada often bring feelings of resolution and healing. For example, when Saturn moves through this nakshatra, which happens about every 30 years, relief often follows hard times. This shift can help stabilize situations after a recession or bring peace after conflicts. It is seen as a time when the hard energy of the past is gently finished. In the same way, Jupiter moving through this area often sparks new spiritual insights and boosts efforts to help others, making generosity more common. When Rahu and Ketu transit this nakshatra, it signals the end of old ways and opens the door for more caring leadership. On many occasions, these periods have marked moments of closing old chapters, such as leaving a long-held job, settling old disputes, or paying off a big debt. Practices like meditation, therapy, and inner work have helped many let go of heavy burdens. An increase in intuition and meaningful dreams is often reported during these changes. These planetary shifts serve as chances to find deep peace and satisfaction for both individuals and society.

Uttara Bhadrapada is represented by a caring animal that stands for giving and tenderness. People born under this nakshatra often have a light and calm look. Even those who seem tough on the outside may hide a sensitive heart and a pure inner nature that shows up over time. Loyalty comes naturally to them, and they tend to be devoted friends and partners. Being the last of the 27 stars, many with this placement often take on roles as elders or mentors even when still young. They seem to have a knack for understanding who is genuine and for guiding others out of dark times. In this way, Uttara Bhadrapada is like a gentle rain that soothes dry land, bringing stability, care, and guidance to a world that has experienced many hardships.

Turning to Revati, which covers 16°40′ to 30°00′ in Pisces, this nakshatra is known as the Wealthy or the Nourisher. It is seen as the final stage of the journey and appears to be the most advanced of all. Revati is ruled by Mercury and has Pushan as its deity. Pushan is a protective figure who watches over travelers and souls. He stands for prosperity, safe travel, and spiritual care. Revati is shown by either a pair of fish or a drum. The fish represent fertility and the natural flow of life at the end of the Piscean phase, while the drum shows the passing of time and the joyful end of experiences.

People born under Revati are gentle, kind, and optimistic. They have a free spirit and are often very lucky because they are not too attached to material things. This lack of attachment seems to attract abundance in money, spiritual growth, or natural talent. Their relaxed, playful, and generous nature makes them easy to be around, and many allow life to take its course without worry. This often leads to dramatic changes such as rising from humble beginnings or even being born into good fortune.

Pushan, the deity of Revati, adds to these traits by giving a sense of protection and care. Those with Revati tend to be very protective, especially toward animals, children, or anyone vulnerable. A lasting care for family and friends is common, perhaps because lessons from earlier stages have been well absorbed. Even though there may be times when the company of others is missed, there is also a strong inner strength and self-reliance. This mix of being loving and social while also standing strong on one's own is one of the interesting qualities of Revati.

Creativity and music play a big role in Revati. With Mercury’s influence and the image of the drum, people of Revati have a good sense of rhythm and clear ways of expressing themselves. Many excel in music, dance, or poetry, and even those with a naturally cheerful personality seem creatively gifted. Their intuitive skills sometimes border on the psychic, with vivid dreams or a sense of having been here before showing a deep connection with what is to come. This quality brings natural hope and trust, helping them stay positive and find help when needed. Revati shows open minds, kindness, and a spirit that does not judge.

The positions of the planets in Revati reveal many influences that shape the people born under this nakshatra. With the Sun in Revati, warm, kind, and sometimes playful personalities tend to emerge. These individuals often do well in creative or helpful work, leading through kindness rather than force. They have a strong sense of who they are without being full of themselves. Many are drawn to work with children, animals, or the arts, naturally offering gentle support and setting a good example.

The Moon in Revati enhances qualities of care, imagination, and protection. Those with the Moon here tend to be very forgiving and seem naturally lucky. Their feelings are soft and nurturing, giving them an almost magical quality. Strong bonds with animals are common, and there is little fear of exploring the mysteries of life and death. The main challenge is learning to set good limits while still remaining open and kind.

Mercury in Revati makes for clear and friendly speech. People with this placement speak with humor and clarity, often becoming excellent storytellers, writers, or advisers. A love for language, poetry, and music is evident, and advice is given with good timing and understanding. Although focus can sometimes be a challenge because of the dreamy nature of Pisces, the insights offered are both helpful and inspiring.

Venus in Revati brings a loving, kind, and artistically gifted nature. Individuals with this placement are capable of deep, heartfelt love and may make significant sacrifices for those they care about. They often show a dreamy, free spirit that adds to their charm and sometimes brings unexpected wealth. Generosity is common, and love is shared openly with both animals and friends. Caution is needed at times to avoid overlooking faults in others.

Mars in Revati shows a balance between strong drive and gentleness. Those influenced by Mars work hard for causes they care about, especially for those who are less fortunate, and rarely come across as aggressive. Their energy is channeled into caring actions and works well in rescue efforts or other forms of support. Although passion for defending the vulnerable is strong, it is usually expressed in a calm and kind way, with a preference for working together rather than engaging in conflict.

Jupiter in Revati is one of the happiest influences. As the planet of wisdom and growth, it brings a thoughtful and generous outlook. Those with Jupiter in Revati often receive unexpected good fortune or timely help when needed. A mentor-like role is taken on naturally, and there is an enjoyment of travel and learning from different cultures. The view of the world remains broad and welcoming, though caution is sometimes needed to avoid giving too much of oneself.

Saturn in Revati teaches the skill of letting go and trusting the natural flow of life. Those with Saturn here may struggle at first with setting limits or might give too much of themselves, but with time wisdom grows. This patience eventually leads to a stable and secure life, with many finding fulfilling work in healing or helping others. Later years often resemble the calm of an elder sitting quietly by a river, having learned to close old chapters and start new ones.

Rahu in Revati adds a touch of imagination and unusual ideas. People with this placement often develop unique spiritual thoughts or find new ways to blend modern tools with their faith. Their caring nature grows even stronger, and they often participate in work or creative projects that attract admiration. There is a need to be careful, however, because a tendency to get lost in fantasies can appear. This influence is strong, but it is usually balanced by the natural positive energy of Revati.

Ketu in Revati is one of the strongest spiritual influences. It often shows a soul that has already settled many worldly desires in past lives. Those with this placement tend to show detachment and are drawn to spiritual or healing work from an early age. Their intuition, which sometimes seems nearly psychic, sets them apart. They usually live a simple life that values inner wisdom over praise from others. Many are seen to leave life with a deep sense of peace, suggesting that the journey toward freedom is nearly complete.

The transit effects in Revati are usually calm and helpful. When Jupiter moves through Revati, which happens every 12 years, a wave of optimism, financial relief, and a new focus on helping others often follows. Similarly, when Saturn moves through Revati, which occurs about every 30 years, it often marks the end of hard times and brings a period of recovery. This phase may lead to peace agreements or efforts to help the environment. Eclipses during these times signal the need to close old chapters, and many end bad habits or relationships while starting fresh beginnings. These periods have often proven to be good for forgiving old hurts, finding new spiritual ideas, and allowing creative projects to grow.

In final thoughts, Revati's energy is like a spiritual sunrise. It signals that the long, dark night is ending and a new day is near. The name Revati means wealthy or prosperous, and those born under this nakshatra often experience big changes in their fortunes. They may rise from humble beginnings or be blessed with abundance. Their appearance is often gentle and attractive, with a natural sense of timing that shows in every part of life, including art. Because Revati is linked to spiritual freedom, its influence brings a calm, old-soul feel mixed with a playful, almost saintly humor. In the end, Revati stands as a symbol of completion and contentment, showing all the lessons learned through the journey of the nakshatras and gently leading into the next cycle with care and wisdom.

174 notes

·

View notes

Text

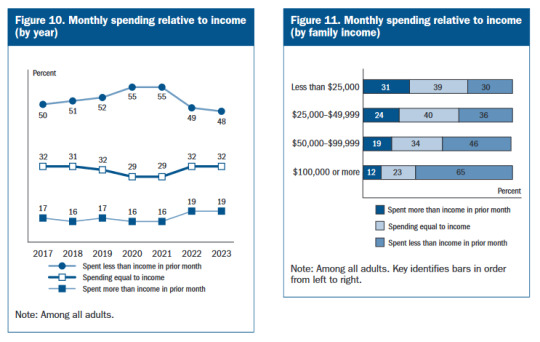

if we're like, showing graphs and stuff, this is the type that i think a lot of people on tumblr are thinking of when they think about the economy.

Only one third of people with family incomes below $50k spent less than their income each month. I would guess that a lot of people on tumblr who get aggro about this topic (and the vast majority of people on r/povertyfinance, who discuss this sort of thing a lot) fall into this earning category.

Real wage increases only matter if you got a raise (one third of workers got a raise last year, which means that 2/3rds didn't - included in the economic wellbeing report linked above). Whether or not rent is outpacing wages only matters if you're not going to be rent burdened (more than a third of renter households are cost burdened in every state and 12 million rental households spend more than half their income on rent). Employment rates lose a lot of meaning when you're working multiple jobs to make ends meet (the percentage of multiply employed workers was falling in the US from 1996 to the 2010s, when it plateaued, then it started rising slightly then collapsed in 2020 and has been rising steeply since then and it's too soon to tell if it's going to go back to the plateau or keep going up).

Four in ten adults in the US is carrying some level of medical debt (even people who are insured) and 60% of people with medical debt have cut back on food, clothes or household items; about 50% of people with medical debt have used up all their savings.

Tumblr is the broke people website and yeah, people who are working two jobs to afford $900 for one room and utilities in a three bedroom apartment are not going to feel great about the economy even if real wages are raising and inflation-adjusted rents are actually pretty stable. "The Rent is too Damn High" has been a meme for 14 years so, like, yeah. Even if it's pretty stable when adjusted for inflation it is stable and HIGH.

It's hard to feel good about the economy when you're spending the last few days of the pay period hoping nothing unexpected hits your account, and it's VERY frustrating to be told that the economy's doing well when you've had to start selling blood to buy groceries.

Sure, unemployment is low, that's neat. It's good that inflation has stabilized (it genuinely has; prices are not likely to fall back to pre-inflation rates and eventually you'll likely be paid enough to reach equilibrium, but a lot of people aren't there yet).

But, like, it costs eight thousand dollars a year out of pocket to keep my spouse alive. I'd guess that we've paid off about a third of the 40-ish thousands of dollars he's racked up since his heart attack. His medical debt is why I don't have a retirement plan beyond "I guess I'll die?" So talking about how good the economy is kind of feels like being chained in the bottom of a pit that is slowly filling with water while people on the surface talk about the fact that the rain is tapering off. Neat! That's good! But I can't really see it from where I'm standing.

Inflation really is getting better. My state just enacted a $20 minimum wage for fast food workers. The Biden administration has worked hard to reduce many kinds of healthcare costs. A lot of people have had significant portions of their student debt cancelled.

But a lot of people are still having trouble affording groceries and it doesn't seem helpful to say "your perception of the economy is decoupled from the reality of the economy" on the "can I get a few dollars for food today?" website.

560 notes

·

View notes

Text

Help My Family Rebuild Our Lives After Losing Everything in Gaza

My name is Mohaned, and I am a pharmacist from Gaza. My family and I have lost everything due to the devastating war that continues to ravage our homeland. The reality we now face is something I could never have imagined: our home, our businesses, my pharmacy—our entire lives destroyed.

Before the war, we had a modest but fulfilling life. I ran my own pharmacy, and we were able to live with dignity, working hard to provide for our children and secure a future for them. But the war took it all away in an instant. Our home was reduced to rubble. My pharmacy, which I had worked so hard to build, no longer stands. The dream I had of leaving a legacy for my children has been shattered.

Beyond the physical loss, we are burdened with significant debt. I had taken out loans to grow my business, but with everything destroyed, we are left with nothing to repay these debts. Even worse, the dangers in Gaza are constant. Living here means risking our lives every single day. We’re not only dealing with the emotional and financial loss but also the ever-present threat to our safety.

We are asking for your kindness and support to help us rebuild our lives. Your donation will help us secure a safe place, repay the debts that weigh so heavily on us, and start over. With each donation, you’re giving my family a lifeline—a chance to heal, rebuild, and find hope again. Every little bit helps us move toward a future where our children can live without fear and hardship.

Thank you from the bottom of our hearts for any support you can give.

#free palestine#free gaza#formula 1#911 abc#pokemon#mouthwashing#cats of tumblr#artists on tumblr#gravity falls#captain curly#gaza#gaza strip#save palestine#palestinian genocide#send help#help gaza#assignment help#send me dms#stanley pines

168 notes

·

View notes

Text

Musk claims otherwise, but the Trump administration’s spending is on track to surpass Biden’s

U.S. Treasury is on pace to spend 7.4% more in 2025 than last year

Elon Musk doubled down on his pledge to cut government spending by $1 trillion — an amount that would slash the federal budget deficit in half and, if implemented, put the U.S. much closer to stabilizing the growth of its debt burden relative to the size of the economy.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News during Thursday evening’s made-for-TV event — adding that he hoped to reduce overall federal spending by 15% solely through “eliminating waste and fraud,” a goal he said “seems really quite achievable.”

https://www.marketwatch.com/story/despite-musks-claims-the-trump-administrations-spending-is-on-pace-to-surpass-bidens-levels-19cdf24c

72 notes

·

View notes

Text

it’s not a metaphor, this ache.

pairing: jay x reader

wc: 3.5k+

genre: fluff, suggestive, angst

warnings: allusions to sex (not described), jay eats reader out and well that’s been detailed out somewhat…vulnerable moments between yn and jay, jay just wants to kneel for yn whenever he can he’s devoted like that

a/n: conceptual writing – just need a man to get on his knees and worship me

summary: all the times jay has gotten down on his knees for you.

one – tending to your wounds.

the tiles under your bare feet are cool, a feeling that is pleasant with the onset of spring, but jay meticulously lifts your limb and places it in his lap. his own knees resting against the floor as he carefully inspects the patch of crimson spots on your skin. nimble fingers gently maneuver your feet, unconsciously stroking the skin that he has come to love with its scratches and past wounds; and yet, he frowns at the promising little wound that will definitely scar. well, he’ll love you regardless, broken skin and all.

“i told you not to rush,” his reproval is a grunting complaint, even as he softly blows on the antiseptic he applies, “it’s going to scar now.”

his breath fans against your skin, a fleeting sensation that sends a shiver up your spine, though you don’t move away. you stay quiet, his words more comforting than painful, your feet warm in his lap, the fabric of his jeans tickling your skin. you let him patch you up, soothe the burn and place the tiniest most gentle kiss when he’s done. it’s like a reward for you, and yet you think you are debted to this man your entire life. this man that kneels for you.

the antiseptic dries, leaving behind a faint sting, but jay’s touch is steady, grounding. his thumb brushes over the bandage, as if testing its security, as if reassuring himself that he’s done everything he can.

his knees remain pressed against the tile, unmoving, like he belongs there—like this is where he has always belonged. it’s a thought you shouldn’t entertain, not when his hands still cradle your foot with such undeserved reverence. but you do. you let yourself imagine a lifetime of this, of his fingers tracing over old scars and new wounds, of the way he kneels before you without question, without hesitation, like it’s second nature.

a silence settles between you, thick and weighty, but not uncomfortable. the kind of silence that speaks volumes, filling the gaps between words neither of you dare to say out loud.

jay exhales softly, finally lifting his head to meet your gaze. his eyes are dark in the dim light, filled with something unreadable, something you don’t think you’re ready to decipher. his fingers tighten ever so slightly around your ankle, grounding himself just as much as you.

“you’ll be more careful next time?” he asks, and you know he already knows the answer.

still, you nod. it’s a harmless lie he lets you indulge in.

jay huffs, the corner of his lips twitching upward in something close to a smile, though there’s still a shadow of worry behind it. his hand gives your ankle one last squeeze before he lets go, but he doesn’t move away just yet. instead, he stays there, close, his presence a quiet reassurance.

you wonder if he knows. if he realizes that it’s not just the wounds on your skin that he tends to, but the invisible ones too. the ones that linger beneath the surface, the ones you don’t know how to heal on your own.

and maybe he does. maybe that’s why he stays.

two – apologising.

you can’t stay too mad at him, nor for too long.

jay rarely upsets you, in fact, he doesn’t really have a reason to. its in the playful moments of life that you two bicker but those can hardly be called fights. they’re anything but fights. but very rarely, moments of doubts and frustration creep up. and when they do, you’re both left trying to lift the burden of its pressure pushing down on your shoulders and those moments are tense.

your house gets reduced to the four walls they physically embody, trying to keep your emotions together before they burst at the seams and rip though your hearts in torrential waves.

jay isn’t one for conflict, he doesn’t give you a reason to be upset at him irrationally. when something’s wrong, it's both your faults, and you know it all too well. you also know that no matter what, jay is going to be the first to try and patch things up. he’ll give you plenty of time to first simmer and fester in your feelings, then he’ll approach you calmly, parting a path through the angry waves of your emotions that threaten to drown him, if not for your own hands that keep him afloat slightly begrudgingly. afterall, you love him.

when jay reaches your shore, he’s careful to step on the hot sand that is equally burning, your stubborn back leaving little to his imagination but he’d deem himself royally fucked if he lets this fester any longer.

you’d be on the bed, on the couch, sitting in your chair – it doesn’t matter; he’s already kneeling down, taking a seat right beside you. you tense at the unintentional brush of clothes, the tingling across your skin where he touches you cautiously and a preparatory sigh that escapes your lips.

jay doesn’t speak right away. he knows better than to push, to try and pry your thoughts out of you before you’re ready. instead, he waits – patient, steady, just there.

his fingers brush against your knee, barely a touch, as if testing the waters. you don’t pull away. it’s not forgiveness, not yet, but it’s something.

“i don’t like fighting with you,” he says, voice quiet, almost tentative. “i know i messed up.”

you exhale, a slow, measured breath, as if trying to keep yourself together. he’s always like this – kind, even when he shouldn’t be, even when you wish he’d argue back, give you a reason to stay mad. but jay isn’t built that way. he doesn’t fight with fire. he fights with patience, with gentle persistence, with the kind of love that makes your resolve crack at the edges. with a kind of gentleness that you’re not accustomed to.

“it’s not just you,” you murmur, because it’s true.

his hand inches closer, fingers curling lightly around yours. you don’t grip back, not yet, but you don’t pull away either. his touch lingers, grounding. but you let him pull his body closer, his head finding purchase in the curl of your lap, pressing against your waist as if would just become a part of you if he could.

your fingers tighten around his, just enough to let him know that you’re done being upset, that he’s already won you over without even trying. his lips twitch, almost a smile, but he doesn’t gloat, doesn’t tease.

he only squeezes your hand in return, as if sealing the unspoken truce between you.

three – falling apart.

jay wears his heart on his sleeves when it comes to you. still it is the carefully curated moments of happiness and adoration that he bares. the quieter, more turbulent ones, he keeps them hidden well away from you.

until he can’t anymore.

it happens on an evening like any other. the sky outside is a muted shade of blue, the kind that lingers before dusk fully settles in. the air hums with the distant sounds of life – cars rumbling past, a faint murmur of laughter from somewhere beyond your window – but inside, within the confines of your space, there is only quiet.

jay stands in the doorway, his silhouette backlit by the hallway light, shoulders slightly slumped, hands tucked into the pockets of his hoodie like he’s holding himself together. something in his posture makes you pause. the way he lingers, hesitant, as if he’s unsure whether to step forward or turn away entirely.

“hey,” you call softly, setting your book down. “come here.”

he exhales, a slow and measured thing, before finally moving. he walks toward you, each step deliberate, until he’s close enough that you can see the tension bracketing his jaw, the exhaustion settled deep in his features. he looks tired – not just physically, but in the way that seeps into the bones, that wears a person down from the inside out.

you expect him to sit beside you, to fold himself into the space next to you like he always does, but instead, he kneels. on the cold floor that could hardly be comfortable, he kneels and presses his forehead against your thigh, hands coming up to grip the fabric of your sweater like it’s the only thing anchoring him. his face is hidden in your sweater, you feel him inhale deeply. then a shuddering breath escapes his lips; his fingers tremble across your back, pulling you closer this time, digging his face deeper into your touch.

you go still, caught off guard by the quiet desperation in his touch.

“jay?” you murmur, threading your fingers through his hair. he’s warm beneath your touch, the strands soft, slightly disheveled. “what’s wrong?”

he shakes his head, a barely-there movement, but you feel it – the way he presses closer, the way his hands migrate around your waist, circling them around your frame, fingers tightening.

“i don’t know,” he admits, voice low and rough. “i just–” a pause. a breath. then, softer, “can i stay like this for a little while?”

your chest tightens.

you don’t ask any more questions, don’t press him for answers he’s not ready to give. instead, you let him stay. let him curl into you, his weight warm and solid against your side. you trace gentle patterns along his back, slow and soothing, the way he’s done for you countless times before.

time stretches, marked only by the quiet rhythm of your breathing. eventually, his grip loosens, his body relaxing ever so slightly, though he doesn’t move away.

“you don’t have to be okay all the time,” you say, barely above a whisper.

jay lets out a shaky exhale, something between a sigh and a laugh, though there’s no real amusement in it. “i know,” he murmurs, but you don’t think he really does. not yet.

so you hold him a little tighter, hoping he’ll understand it one day.

five – comforting you.

and when the tables turn, which is quite often, because you seemingly shut your mind off whenever jay’s nearby and blindly trust yourself in his hands, he’s always there to hold on to you.

he makes it that simple to let go of your reservations and fall into his embrace.

it happens naturally, like breathing, like second nature. he doesn’t ask, doesn’t pry – he simply knows. the way your shoulders slump just a little more than usual, the way your fingers twitch like they need something to hold onto but you won’t reach out first. the way your silence carries more weight on some days, heavier than words ever could.

jay notices it all.

tonight is no different. the world outside is damp with lingering rain, the scent of petrichor weaving through the half-open window. the apartment is quiet save for the soft hum of the refrigerator and the faint crackle of a candle burning on the coffee table. you’ve retired into the corner of the couch, legs tucked beneath you, hands supporting your head, body curled up into a fetal position, your gaze unfocused on the television screen playing something neither of you are really watching.

jay, from his place in the kitchen, doesn’t say anything at first. he finishes pouring a cup of tea, setting it aside for a moment before finally crossing the room. he doesn’t ask if you’re okay – he already knows the answer.

instead, he lowers himself in front of you, spine curling gently to meet your eyes that blink back at him in a naive confusion, but it's all there written for him clearly in the way they become glassy the second he offers you a gentle smile, his fingers tangling themselves in your hair. his lips press hot against your cold cheeks, a reassuring kiss that makes your eyes flutter.

you hesitate for only a second before letting yourself lean into him, burying your face against his shoulder. his arm wraps around you instantly, hand settling against your back in slow, steady strokes. he doesn’t rush you, doesn’t try to fix anything with hurried words or misplaced solutions. he just holds you, like he’s willing to carry whatever weight you can’t bear tonight.

“i don’t know why i feel like this,” you mumble, voice muffled against the fabric of his hoodie.

jay hums softly, resting his chin atop your head. “you don’t have to know,” he says simply. “you just have to let yourself feel it.”

you exhale, shuddering slightly, and he pulls you closer. there’s something about the way he does it – so naturally, without expectation or hesitation – that makes the knot in your chest loosen just a little. like it’s okay to be vulnerable here, to be seen without needing to explain.

time stretches between you, measured only by the steady rise and fall of his breathing, by the way his fingers trace slow, absentminded circles against your back. at some point, he shifts slightly, pressing another gentle kiss to the top of your head, lingering for just a second longer than necessary.

you close your eyes, breathing him in.

and just like that, the world feels a little quieter. a little easier to bear.

six – fixing the hem of your dress.

it’s also the much more intimate moments that linger in the pockets of transitional time. he brings a calm to the chaos of your daily life – a steady presence amidst the frantic rhythm of your mornings, the restless energy of your nights. a moment of composure when you’re rushing about, stressing over the final touches to your makeup, your hair, worrying over a wrinkle on your dress that refuses to smooth out no matter how many times you tug at it.

jay watches from where he sits at the edge of the bed, amused but patient. he’s already ready, dressed in his usual effortless way, the sleeves of his shirt rolled up to his elbows, his hands clasped loosely between his legs. he could offer to help, but he knows you’d only wave him off, muttering about how you have it under control.

so he waits.

and sure enough, a moment later, you huff in frustration, turning towards him with the tiniest of frowns. “this won’t smooth out,” you say, tugging at the hem of your dress again. “i should’ve worn something else.”

jay only shakes his head, standing. “come here,” he murmurs.

you hesitate, but only for a second before stepping toward him. he meets you halfway, hands already reaching for you. but not to pull you into an embrace, not yet. his knees bend of their own accord, his own dress pants rustling as he kneels before you and it takes your all to hold yourself back. his fingers find the hem of your dress, his touch featherlight as he works on the worrying patch across your thigh.

the sight alone makes something stir in your chest.

he smooths the fabric carefully, methodically, as if this is the most important thing he’s done all day. the pads of his fingers graze over the material, flattening every imperfection with quiet precision. you could do this yourself – you should do this yourself – but somehow, standing here with his hands on you, with the warmth of his palms ghosting over your thighs as he works, you feel yourself settle.

“there,” he murmurs after a moment, brushing away an invisible crease. “perfect.”

you exhale, tension easing from your shoulders, but he doesn’t get up just yet. instead, his hands shift slightly, fingers curling gently against the sides of your legs, his thumbs brushing over the smooth skin above your knees. it’s not intentional, you think, but it lingers – this moment, this closeness.

jay tilts his head up to look at you then, a small, knowing smile playing at his lips. “better?”

you nod, not trusting your voice. you nod, because you see the glint in his eyes, the way he kneels and looks up at you like his prayers to the god he worships have come true.

maybe it is intentional, the way he submits himself to your service this easily, only to have you crumble in his hold instead. then, as if sensing the shift in the air, he leans in, pressing a soft kiss against the fabric of your dress just above your knee. it’s brief, fleeting, but it sends warmth curling through your veins, your breath catching slightly, toes curling painfully.

when he finally stands, his hands find your waist, steadying you, grounding you. “you always look beautiful,” he murmurs, smoothing his palms over your sides. “wrinkles and all.”

you roll your eyes, but your heart stumbles in your chest.

and just like that, the chaos of your day feels a little less overwhelming.

seven – truly worshipping you.

if there’s one thing you know, it’s the way jay always acts like he knows exactly what he’s doing. and he probably does. every movement is deliberate, every touch measured. he moves with intent – slow, sure, devastating in his precision. every press of his lips against your bare skin is a searing touch, a promise that leaves you breathless.

you’re long gone, of course. from the second his lips found yours, from the moment his hands gripped your sides, fingers digging into the soft fabric of your dress – wrinkling it, ruining the careful smoothness he had so patiently fixed not even hours ago. but you don’t care. you couldn’t, not when jay has always been more intoxicating than the anticipation of any perfect moment.

his hands are warm, wandering, mapping out the curve of your body as if he’s relearning you all over again. there’s reverence in the way he touches you, in the way he presses his lips to your jaw, your throat, the space just below your ear where he knows you shudder. his name leaves your lips in a breathless whisper, and he hums against your skin, like he’s committing the sound to memory.

he never rushes. he never has to. because he knows exactly how to unravel you, how to coax the tension from your body with the press of his fingers, the slow drag of his mouth. he lets his hands slip lower, skimming over the fabric he had so carefully straightened earlier, only to now push it up, exposing more of you to him.

and then he looks at you. really looks at you.

his eyes are dark, heavy with something unspoken, something that simmers just beneath the surface. you feel it in the way his hands tighten against your hips, in the way his breath is just a little unsteady when he exhales.

and just like that, he’s kneeling again, this time at the end of the bed that you lay on top of, naked and writhing in pleasure and ecstasy. your fingers curl themselves around his hair, his head buried in the heat of your body that only he brings about. every kiss, every moan, every little push of his head sends you into ecstasy you only yearn more of.

his hands grip your thighs, holding them for you, never letting you fend for yourself as you willingly submit yourself to his love and touches.

his touch is both firm and reverent, like he’s worshipping something sacred. he holds you like you might break, but his mouth tells a different story – hungry, insatiable, taking everything you offer and demanding more.

you can feel the way his breath stirs against your skin, hot and uneven, the sound of it mingling with your own quiet whimpers. his hands tighten on your thighs, thumbs pressing into soft flesh, keeping you steady, keeping you right where he wants you. and you let him, let yourself sink deeper into the pleasure of his touch, his lips, his tongue tracing reverent paths along your skin.

your fingers tangle in his hair, pulling, pleading. he groans at the sensation, a deep, satisfied sound that sends a shiver down your spine. he likes it when you lose yourself like this – when you let go, when you stop holding back.

“jay,” you gasp, his name breaking apart on your tongue, breathless and desperate.

he hums in response, the vibrations sending sparks of pleasure straight through you. he’s thorough, methodical, drawing out every little sound he loves, every little reaction he craves. he doesn’t stop, doesn’t waver, doesn’t let up until you’re trembling beneath him, body arching, fingers tightening against his scalp.

and when you finally come undone, when your entire body tenses and then melts beneath him, he doesn’t pull away. he stays there, pressing soft, open-mouthed kisses along your inner thighs, soothing, grounding, bringing you back down from the high he so effortlessly pulled you into.

when he finally looks up at you, his lips are slick, his expression dark with something you can’t quite name. he wipes his mouth with the back of his hand before crawling up your body, his weight pressing you into the mattress, his heat overwhelming you in the best way.

“you’re beautiful,” he murmurs against your lips, voice thick, low. “so perfect for me.”

his mouth meets yours before you can respond, stealing whatever words you might have formed. but you don’t mind. you let him take, let him press himself against you, let him remind you with every slow, burning kiss that he isn’t done with you yet.

#okay am i just projecting or what....?#enhypen imagines#enhypen jay imagines#jay enhyppen imagines#park jongseong imagines#enhypen jay angst#enhypen angst#enhypen fluff#my writings

102 notes

·

View notes

Text

Climate denial may be on the decline, but a phenomenon at least as injurious to the cause of climate protection has blossomed beside it: doomism, or the belief that there’s no way to halt the Earth’s ascendant temperatures. Burgeoning ranks of doomers throw up their hands, crying that it’s too late, too hard, too costly to save humanity from near-future extinction.

There are numerous strands of doomism. The followers of ecologist Guy McPherson, for example, gravitate to wild conspiracy theories that claim humanity won’t last another decade. Many young people, understandably overwhelmed by negative climate headlines and TikTok videos, are convinced that all engagement is for naught. Even the Guardian, which boasts superlative climate coverage, sometimes publishes alarmist articles and headlines that exaggerate grim climate projections.

This gloom-and-doomism robs people of the agency and incentive to participate in a solution to the climate crisis. As a writer on climate and energy, I am convinced that we have everything we require to go carbon neutral by 2050: the science, the technology, the policy proposals, and the money, as well as an international agreement in which nearly 200 countries have pledged to contain the crisis. We don’t need a miracle or exorbitantly expensive nuclear energy to stave off the worst. The Gordian knot before us is figuring out how to use the resources we already have in order to make that happen.

One particularly insidious form of doomism is exhibited in Kohei Saito’s Slow Down: The Degrowth Manifesto, originally published in 2020 and translated from Japanese into English this year. In his unlikely international bestseller, Saito, a Marxist philosopher, puts forth the familiar thesis that economic growth and decarbonization are inherently at odds. He goes further, though, and speculates that the climate crisis can only be curbed in a classless, commons-based society. Capitalism, he writes, seeks to “use all the world’s resources and labor power, opening new markets and never passing up even the slightest chance to make more money.”

Capitalism’s record is indeed damning. The United States and Europe are responsible for the lion’s share of the world’s emissions since the onset of the Industrial Revolution, yet the global south suffers most egregiously from climate breakdown. Today, the richest tenth of the world’s population—living overwhelmingly in the global north and China—is responsible for half of global emissions. If the super-rich alone cut their footprints down to the size of the average European, global emissions would fall by a third, Saito writes.

Saito’s self-stated goals aren’t that distinct from mine: a more egalitarian, sustainable, and just society. One doesn’t have to be an orthodox Marxist to find the gaping disparities in global income grotesque or to see the restructuring of the economy as a way to address both climate breakdown and social injustice. But his central argument—that climate justice can’t happen within a market economy of any kind—is flawed. In fact, it serves next to no purpose because more-radical-than-thou theories remove it from the nuts-and-bolts debate about the way forward.

We already possess a host of mechanisms and policies that can redistribute the burdens of climate breakdown and forge a path to climate neutrality. They include carbon pricing, wealth and global transaction taxes, debt cancellation, climate reparations, and disaster risk reduction, among others. Economies regulated by these policies are a distant cry from neoliberal capitalism—and some, particularly in Europe, have already chalked up marked accomplishments in reducing emissions.

Saito himself acknowledges that between 2000 and 2013, Britain’s GDP increased by 27 percent while emissions fell by 9 percent and that Germany and Denmark also logged decoupling. He writes off this trend as exclusively the upshot of economic stagnation following the Lehman Brothers bankruptcy in 2008. However, U.K. emissions have continued to fall, plummeting from 959 million to 582 million metric tons of carbon dioxide equivalent between 2007 and 2020. The secret to Britain’s success, which Saito doesn’t mention, was the creation of a booming wind power sector and trailblazing carbon pricing system that forced coal-fired plants out of the market practically overnight. Nor does Saito consider that from 1990 to 2022, the European Union reduced its emissions by 31 percent while its economy grew by 66 percent.

Climate protection has to make strides where it can, when it can, and experts acknowledge that it’s hard to change consumption patterns—let alone entire economic systems—rapidly. Progress means scaling back the most harmful types of consumption and energy production. It is possible to do this in stages, but it needs to be implemented much faster than the current plodding pace.

This is why Not the End of the World: How We Can Be the First Generation to Build a Sustainable Planet by Hannah Ritchie, a data scientist at the University of Oxford, is infinitely more pertinent to the public discourse on climate than Saito’s esoteric work. Ritchie’s book is a noble attempt to illustrate that environmental protection to date boasts impressive feats that can be built on, even as the world faces what she concedes is an epic battle to contain greenhouse gases.

Ritchie underscores two environmental afflictions that humankind solved through a mixture of science, smart policy, and international cooperation: acid rain and ozone depletion. I’m old enough to remember the mid-1980s, when factories and power plants spewed out sulfurous and nitric emissions and acid rain blighted forests from the northeastern United States to Eastern Europe. Acidic precipitation in the Adirondacks, my stomping grounds at the time, decimated pine forests and mountain lakes, leaving ghostly swaths of dead timber. Then, scientists pinpointed the industries responsible, and policymakers designed a cap-and-trade system that put a price on their emissions, which forced industry into action; for example, power plants had to fit scrubbers on their flue stacks. The harmful pollutants dropped by 80 percent by the end of the decade, and forests grew back.

The campaign to reverse the thinning of the ozone layer also bore fruit. An international team of scientists deduced that man-made chlorofluorocarbons (CFC) in fridges, freezers, air conditioners, and aerosol cans were to blame. Despite fierce industry pushback, more than 40 countries came together in Montreal in 1987 to introduce a staggered ban on CFCs. Since then, more countries joined the Montreal Protocol, and CFCs are now largely a relic of the past. As Ritchie points out, this was the first international pact of any kind to win the participation of every nation in the world.

While these cases instill inspiration, Ritchie’s assessment of our current crisis is a little too pat and can veer into the Panglossian. The climate crisis is many sizes larger in scope than the scourges of the 1980s, and its antidote—to Saito’s credit—entails revamping society and economy on a global scale, though not with the absolutist end goal of degrowth communism.

Ritchie doesn’t quite acknowledge that a thoroughgoing restructuring is necessary. Although she does not invoke the term, she is an acolyte of “green growth.” She maintains that tweaks to the world’s current economic system can improve the living standards of the world’s poorest, maintain the global north’s level of comfort, and achieve global net zero by 2050. “Economic growth is not incompatible with reducing our environmental impact,” she writes. For her, the big question is whether the world can decouple growth and emissions in time to stave off the darkest scenarios.

Ritchie approaches today’s environmental disasters—air pollution, deforestation, carbon-intensive food production, biodiversity loss, ocean plastics, and overfishing—as problems solvable in ways similar to the crises of the 1980s. Like CFCs and acid rain, so too can major pollutants such as black carbon and carbon monoxide be reined in. Ritchie writes that the “solution to air pollution … follows just one basic principle: stop burning stuff.” As she points out, smart policy has already enhanced air quality in cities such as Beijing (Warsaw, too, as a recent visit convinced me), and renewable energy is now the cheapest form of power globally. What we have to do, she argues, is roll renewables out en masse.

The devil is in making it happen. Ritchie admits that environmental reforms must be accelerated many times over, but she doesn’t address how to achieve this or how to counter growing pushback against green policies. Just consider the mass demonstrations across Europe in recent months as farmers have revolted against the very measures for which Ritchie (correctly) advocates, such as cutting subsidies to diesel gas, requiring crop rotation, eliminating toxic pesticides, and phasing down meat production. Already, the farmers’ vehemence has led the EU to dilute important legislation on agriculture, deforestation, and biodiversity.

Ritchie’s admonishes us to walk more, take public transit, and eat less beef. Undertaken individually, this won’t change anything. But she acknowledges that sound policy is key—chiefly, economic incentives to steer markets and consumer behavior. Getting the right parties into office, she writes, should be voters’ priority.

Yet the parties fully behind Ritchie’s agenda tend to be the Green parties, which are largely in Northern Europe and usually garner little more than 10 percent of the vote. Throughout Europe, environmentalism is badmouthed by center-right and far-right politicos, many of whom lead or participate in governments, as in Finland, Hungary, Italy, the Netherlands, Serbia, Slovakia, and Sweden. And while she argues that all major economies must adopt carbon pricing like the EU’s cap-and-trade system, she doesn’t address how to get the United States, the world’s second-largest emitter, to introduce this nationwide or even expand its two carbon markets currently operating regionally—one encompassing 12 states on the East Coast, the other in California.

History shows that the best way to make progress in the battle to rescue our planet is to work with what we have and build on it. The EU has a record of exceeding and revising its emissions reduction targets. In the 1990s, the bloc had the modest goal of sinking greenhouse gases to 8 percent below 1990 levels by 2008-12; by 2012, it had slashed them by an estimated 18 percent. More recently, the 2021 European Climate Law adjusted the bloc’s target for reducing net greenhouse gas emissions from 40 percent to at least 55 percent by 2030, and the European Commission is considering setting the 2040 target to 90 percent below 1990 levels.

This process can’t be exclusively top down. By far the best way for everyday citizens to counter climate doomism is to become active beyond individual lifestyle choices—whether that’s by bettering neighborhood recycling programs, investing in clean tech equities, or becoming involved in innovative clean energy projects.

Take, for example, “community energy,” which Saito considers briefly and Ritchie misses entirely. In the 1980s, Northern Europeans started to cobble together do-it-yourself cooperatives, in which citizens pooled money to set up renewable energy generation facilities. Many of the now more than 9,000 collectives across the EU are relatively small—the idea is to stay local and decentralized—but larger co-ops illustrate that this kind of enterprise can function at scale. For example, Belgium’s Ecopower, which forgoes profit and reinvests in new energy efficiency and renewables projects, provides 65,000 members with zero-carbon energy at a reduced price.

Grassroots groups and municipalities are now investing in nonprofit clean energy generation in the United States, particularly in California and Minnesota. This takes many forms, including solar fields; small wind parks; electricity grids; and rooftop photovoltaic arrays bolted to schools, parking lots, and other public buildings. Just as important as co-ownership—in contrast to mega-companies’ domination of the fossil fuel market—is democratic decision-making. These start-ups, usually undertaken by ordinary citizens, pry the means of generation out of the hands of the big utilities, which only grudgingly alter their business models.

Around the world, the transition is in progress—and ideally, could involve all of us. The armchair prophets of doom should either join in or, at the least, sit on the sidelines quietly. The last thing we need is more people sowing desperation and angst. They play straight into the court of the fossil fuel industry.

118 notes

·

View notes

Text

You know how you look back at past shitty connections, friends, family dynamics, and relationships and you're like "I can't believe I let them treat me that way"? I think it hits differently with disability because when you're disabled you don't always even know that you're being mistreated and/or abused in regards to it.

I know statistically disabled people are more likely to be abused but sometimes there's an additional type of abuse that's hard to identify even in hindsight because no one tells you how abusive it is.

But ableist abuse relating to your disability can look like:

Pushing you to do things beyond your limitations despite their awareness of them.

Blaming you for the "inconveniences" brought on by things beyond your control (ex: missing a movie because you had to wait for your pain meds to kick in).

Not allowing you to take breaks or antagonizing you when you do.

Bullying or making fun of things you can't help like gait, a lisp, an embarrassing symptom.

Trying to "cure" or "fix" you, often framing it as "helping" you. Sometimes they look similar and you might be able to tell by their reaction towards lack of improvement.

Holding over you the things they have to do for you (cooking, cleaning, driving, working, etc).

Giving ultimatums that demand things of you that you can't do (getting a job, keeping up with multiple chores).

Using insulting terms, language, and/or slurs that you have not permitted them to or in a context where there is intent to harm you.

Interrogating you about your disability or trying to find discrepancies between your experiences and what they've heard/read/seen about it.

Implying or saying anything along the lines of you faking, being lazy, or exaggerating. Reducing you to a hypochondriac, saying you enjoy being disabled because you seem to like having things done for you, or that you're lazy or abusing them by depending on them for things.

Asking you about it not to learn more, but to use it against you in some way.

Having a martyr complex, acting as if they're a hero for giving you the support you deserve.

Calling you a burden, implying you to be one, or treating you like one.

Acting like you owe them a debt, sometimes even demanding some kind of repayment. Keeping track of money they spend on you that you won't be able to pay back, feeling entitled to things like control, sex, a portion of government benefits, etc.

Self victimizing. They act like you being disabled causes more suffering to themselves than you.

Accusing you of being addicted to your medication. If you genuinely develop an addiction a normal response is concern not rage, finger pointing, etc. if you don't have one baseless claims are very harmful

Trying to force you to stop "depending" on things you need like medication and disability aids

Comparing you to others that are doing "better" than you. Maybe showing you inspiration porn of someone with no legs for example doing incredible things- which is great for them but the "I don't let my disability stop me so you can do anything" shit is harmful. Some of us will get very unwell if we try, and some just can't.

Trying to make others also see you as dramatic, faking, or lazy. Often embarrassing and mocking you as well.

Withholding things you need like medication or disability aids as a punishment

Saying your disability is karma or something inflicted by a divine entity/religious figure. Maybe as punishment for not praying, being queer, or something else they disagree with.

Saying that it's a result of being "promiscuous"/LGBT. For instance if you have HIV or ME/CFS that was a result of something like mononucleosis ("kissing disease").

Shaming you for things related to your disability beyond your control or expressing embarrassment over these things. including but not limited to: appearance (general but also things like say a lupus butterfly rash or weight gain/loss), having to lay down in public (ex: with POTS), inability to keep up with hygiene, etc.

Lacking boundaries and acting as if they are entitled to information or intrusion of your space/belongings due to the power they hold over you and assistance they may provide.

Implying/saying you're living an extended vacation. Maybe one they say they wish they had because they have to do x y z while you "sit around"

Abandoning you solely for your disability (ex: because you can't hang out, they don't want a disabled partner, think you're faking, etc)

Note that someone doing one or two of these things a few times doesn't always mean they're abusing you (also depends on which). It's about the patterns and frequency of this behavior as well as refusal to improve once aware that they're hurting you. People who care about you don't want to hurt you and the normal response is to do their best not to repeat the action that negatively affected you

There are more examples and you can feel free to list some

✨This is about physical illnesses and disabilities, please don't derail✨

#I've experienced most of these unfortunately and it took a long time to identify some of it as abuse#chronic illness#chronic pain#disability#fibromyalgia#cfs#chronic fаtiguе ѕуndrоmе#actually disabled#spoonie#me/cfs#cfs/me#long covid#tw abuse#medical ableism#ableism#cpunk#cripplepunk

252 notes

·

View notes

Text

Elisabeth Buchwald and Tami Luhby at CNN:

Moody’s Ratings downgraded the United States’ debt on Friday, stripping the country of its last perfect credit rating. The move could rattle financial markets and push up interest rates, potentially creating an additional financial burden for Americans already struggling with tariffs and inflation. Of the three major credit rating agencies, Moody’s was the lone holdout, maintaining its outstanding rating of AAA for US debt. Moody’s held a perfect credit rating for the United States since 1917. It now ranks US creditworthiness one notch below that, at Aa1, joining Fitch Ratings and S&P, which lowered their credit ratings for US debt in 2023 and 2011, respectively. The decision to downgrade debt was influenced by “the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” Moody’s said in a statement. Moving forward, Moody’s said it expects borrowing needs to continue to grow and for it to weigh on the US economy as a whole. “The Trump administration and Republicans are focused on fixing Biden’s mess by slashing the waste, fraud, and abuse in government and passing The One, Big, Beautiful Bill to get our house back in order,” White House spokesperson Kush Desai said on Friday. “If Moody’s had any credibility, they would not have stayed silent as the fiscal disaster of the past four years unfolded.” A spokesperson for the Treasury Department did not immediately respond to CNN. Moody’s initially put the United States on notice for a potential downgrade in November, at the time citing recent events that exemplified America’s extraordinary political divide. That included America’s near-default last summer and the resulting ouster of House Speaker Kevin McCarthy, the first time in history a speaker was given the boot during a legislative session, and Congress’ inability to cement a replacement for weeks.

Stable outlook — for now, at least

Moody’s said the US is is no immediate danger of being downgraded again: The credit-rating agency considers the US outlook “stable” in part because of “its long history of very effective monetary policy led by an independent Federal Reserve.” President Donald Trump, however, has recently raised questions of whether he’d continue to respect the central bank’s independence, and has previously threatened to fire Chair Jerome Powell. Aa1 is still quite strong, despite its notch below perfect. The ratings agency noted that America’s system of governance, albeit challenged, gives Moody’s confidence that the United States still deserves a near-perfect, if not AAA, credit rating. “The stable outlook also takes into account institutional features, including the constitutional separation of powers among the three branches of government that contributes to policy effectiveness over time and is relatively insensitive to events over a short period. While these institutional arrangements can be tested at times, we expect them to remain strong and resilient,” Moody’s said. The credit-rating agency said that increasing government revenue or reducing spending could restore America’s AAA rating. Trump has taken aim at the latter through the Elon Musk-led Department of Government Efficiency, resulting in thousands of federal government workers being laid off and the gutting of the US Agency for International Development (USAID).

However, it’s unclear that such moves are changing the government’s borrowing needs. Already, the country is approaching a summer deadline for when the US could default on its debt unless the borrowing limit is raised, according to Treasury Department estimates. At the same time, Trump is pushing Congress to pass his “One Big Beautiful Bill Act.” The package would cut taxes deeply – essentially making permanent the sweeping individual income tax provisions of Trump’s 2017 Tax Cuts and Jobs Act, as well as adding several temporary tax breaks to fulfill the president’s campaign promises. It also calls for historic cuts to the nation’s safety net – particularly Medicaid and food stamps – in an effort to cut spending. But the tax revenue loss would still swamp the spending reductions. The package would add $3.3 trillion to the nation’s debt over the next decade, according to a preliminary estimate from the Committee for a Responsible Federal Budget. Annual deficits would jump from $1.8 trillion in 2024 to $2.9 trillion by 2034 as the federal government would continue to spend more than it would raise in revenue, the committee projected.

Moody’s issued a downgrade on their credit rating from the USA, from AAA to AA1. This is because of the reckless policies of the Trump Regime.

24 notes

·

View notes

Text

Also preserved on our archive

Do you have $32,000 for covid treatment? Neither did Nannette, and now her whole family is paying the price for her covid hospitalization. This is why we must mask up: You may be able to afford that cost, but you are just as likely to spread covid to dozens who cannot if you refuse to take precautions, especially when ill.

By Noah Zahn

CHEYENNE — When Nannette Hernandez got COVID in 2021, she didn’t realize how long it would take to recover. Although she was released from the hospital after only a few days of care, she is still suffering from the financial burden that has led to the loss of her job and her home.

At 45 years old, Hernandez and her son, 26, moved in with her mother when she lost her home. The three of them now live together in a mobile home south of Cheyenne. The walls and tabletops are decorated with photos of family members, many of the frames containing photos of her three grandchildren.

Papers were strewn across the coffee table in the living room: bills from the hospital, letters to the hospital, research on how to get financial assistance, one letter denying financial assistance.

Although Hernandez says she tries to keep a positive attitude, her smile faded when she said she often feels hopeless as her debt continues to grow and she is considering filing for bankruptcy.

“They garnish my wages every week, and I owe them more now today than what the judgment was for, and that’s all due to the interest,” Hernandez said. “I’m never going to get through this, you know.” Toys are neatly put away in a corner of the room, behind the couch, for when her grandchildren come to visit on her days off work.

Hernandez has a new job and has health insurance. In addition, she contributes a portion of her wages to life insurance. She said she does this so that she at least has something she can pass on to her family.

Before interest, Hernandez’s bill from Cheyenne Regional Medical Center was around $32,000 after three days of care for COVID and related pneumonia and reduced to $22,000 because she was paying uninsured and out-of-pocket. Between garnished wages and paying for insurance, Hernandez says she only sees at most $12 of her $17.30 per hour wage from working at a deli in a truck stop.

Hernandez said she now suffers from depression as a result of the stress caused by her medical debt. It is difficult for her to work full 40-hour weeks at her job.

However, her smile returned as she talked about how she gets to spend time with her grandchildren, aged 2, 4 and 8, on her days off.

“They’re my light. Oh, they’re wonderful,” she said. “… I stay happy. I don’t let it give me misery, that’s one thing. I might carry it, and I might be right here, always talking about it, but very blessed, very happy, though, still, no matter what.”

Available funding The Provider Relief Fund (PRF) was established in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to reimburse eligible health care providers for increased expenses or lost revenue attributable to COVID care.

A companion fund to the PRF is the Uninsured Funds, which made $10 billion available nationally to reimburse providers for treatment, vaccines and vaccine administration costs for care provided to uninsured individuals.

According to the U.S. Department of Health and Human Services, CRMC received $3,145,097 in Uninsured Funds for COVID treatment, accounting for nearly 30% of the Uninsured Funds received by care providers across the state. It is unclear whether these funds were what reduced Hernandez’s bill from $32,000 to $22,000. Her itemized bill notes the reduction as a discount for “self-pay, uninsured.”

Hernandez received her $22,000 bill shortly after she was released from the hospital and was summoned to court when she did not make payments. She did not appear in court, as she said she felt hopeless and afraid and knew she would be unable to pay. As a result, the court ordered the hospital to garnish 25% of her wages and any argument she had that the government should have assisted her financially was nullified.