#Semiconductor Technology Course

Explore tagged Tumblr posts

Text

Power India’s Chip Revolution – Study Semiconductor Tech at IIT Delhi

Join India’s strategic technology mission with IIT Delhi’s Executive Programme in Semiconductor Manufacturing and Technology. This cutting-edge course is tailored for engineers, technologists, and policymakers who want to play a part in making India self-reliant in chip production. Learn from top IIT faculty and industry leaders as you explore fabrication processes, cleanroom protocols, lithography, and circuit design. As the global semiconductor industry expands, this course prepares you for high-demand roles in electronics manufacturing, R&D, and semiconductor policy. It’s more than just a course—it’s your entry into a national movement.

0 notes

Text

Orbital Welding Training Program 🔧

Learn precision welding skills tailored for cleanroom and high-purity piping applications!

✅ Hands-on training course

✅ Industry-expert instructors

✅ Globally recognized certification

Upgrade your welding career and step into opportunities in semiconductor, pharmaceutical, and high-tech industries.

📩 Enroll now and start your journey toward high-demand welding roles!

🌐 www.awilli-ag.ch

#OrbitalWelding #WeldingTraining #HighPurityWelding #SkilledTrades #CleanroomPiping #SemiconductorJobs #PharmaIndustry #WeldingCareers #AwilliRecruitment

#orbital welding technology#orbital welding courses#orbital welding training#welding technology#welding automation#semiconductor#orbital welding program

0 notes

Text

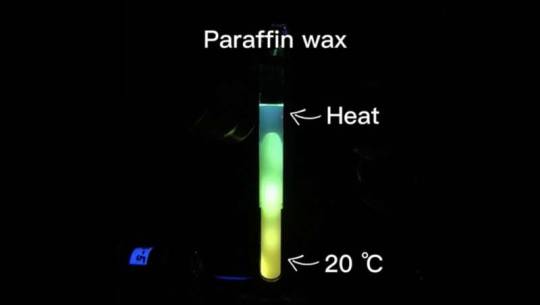

Research explores organic semiconductor materials for sustainable temperature sensors

New research into organic semiconductor materials, led by the University of St Andrews, paves the way for more sustainable temperature sensors for use in everyday technology. Thermally activated delayed fluorescence (TADF) materials, the so-called third-generation of emitters used in organic light-emitting diodes (OLEDs), have attracted significant attention over the course of the last decades as alternative emitters to noble metal-containing phosphorescent complexes used in commercialized OLEDs like those in mobile phones. However, their use in other organic electronics applications such as sensors, has been much less explored. The new research, published in Nature Communications, led by Professor Eli Zysman-Colman from the School of Chemistry, discloses an organic TADF compound used for colorimetric temperature sensing having the widest spectral and temperature range compared to other organic optical temperature probes.

Read more.

#Materials Science#Science#Semiconductors#Organic materials#Temperature#Sensors#University of St Andrews#Fluorescence#Organic light emitting diodes#OLEDs

13 notes

·

View notes

Text

Huawei is pulling no punches in its race to manufacture a new generation of processors. Huawei has collaborated with SMIC – China’s largest semiconductor foundry – to apply Deep Ultraviolet Lithography (DUV) on what was previously only possible on EUV (Extreme Ultra-Violet technology). Once again, Huawei and SMIC defied the proverbial American “experts” with creative engineering solutions.

Huawei arrived at fabricating 5nm chips with DUV even as the process is more expensive than with EUV. If Huawei had access to EUV they would be already manufacturing 2-3nm chips. That will come, in short time, as both China and Russia, under permanent US high-tech blockade, must by all means develop their own EUV technology.

Shanghai geeks are convinced that Huawei will switch on 6G networksbefore the end of the decade. Their current breathless drive is not just aimed at the smartphone front – where Huawei is peerless; the new Huawei Mate 70 Pro + is by far the absolute top smartphone in the world, running on Harmony OS. Huawei is looking at cloud computing, AI and enterprise servers – and to become no less than the core player in the AI infrastructure race.

Ditching Any Reliance on American Technology

Earlier this month, Huawei introduced the CloudMatrix 384, a system connecting 384 Ascend 910C chips. The tech word in Shanghai is that this configuration, under certain conditions, and of course consuming much more power, already outperforms Nvidia’s flagship rack system – which is powered by 72 Blackwell chips.

3 notes

·

View notes

Text

Q: How did the AI hype start? A: OpenAI became the first American company to demonstrate that if you take a snapshot of the whole known internet and all digitized books in existence without worrying too much about copyright law, you can create a model so good that its output would be almost indistinguishable from that of a DC bureaucrat with mediocre intelligence.

Q: How is China involved? A: As a part of its larger effort to contain China, the U.S. government has been on a mission of stopping Chinese companies from becoming leaders in different areas of technology. It has done so by wielding control over global supply chains and protecting American tech companies from competition in the process. The U.S. blocked Huawei’s entry into the United States just as it was overtaking Apple to become the second biggest smartphone manufacturer in the world; it stopped European countries from installing Huawei manufactured 5G infrastructure when it was clearly more economical; and most recently, it passed legislation banning TikTok, a Chinese social media app that had become massively popular in United States and whose recommendation algorithm no American social media app had been able to outperform. The U.S. claim that Huawei and other Chinese tech companies are inextricably linked to China’s geopolitical strategy and put Western companies and people at heightened risk of surveillance and corporate espionage is, of course, grounded in reality. DeepSeek isn’t shy about how much data it collects on its platform, including even your keystrokes ... However, because DeepSeek is open source and can run locally on a separate device, Chairman Xi Jinping’s prying eyes can be shielded. Maintaining global technological dominance is one of the key concerns U.S. policymakers have repeatedly cited, and have identified AI as a crucial technology in maintaining that dominance. In 2018, when the U.S. government was in the process of banning Huawei, it realized that it would need to do the same with downstream technologies like semiconductor chips, the main component used in CPUs and GPUs. The severe chip shortage due to global supply chain disruptions during Covid-19 showed that advanced chips are a global supply chain bottleneck and a scarce resource. By 2022 the Biden administration had put comprehensive sanctions on China, stopping the export of these chips to the country and preventing Chinese AI companies from accessing the latest and most efficient GPUs. At the same time, it passed the CHIPS act, subsidizing national semiconductor manufacturing with over $50 billion.

6 notes

·

View notes

Text

Why Tariffs Are Good The claim that tariffs are inherently misguided and inevitably harmful does not stand up to scrutiny, especially when it comes to U.S. trade with China by Michael Lind https://www.tabletmag.com/sections/news/articles/tariffs-good-trump-china

Donald Trump is back—and so is the tariff. “It’s a beautiful word, isn’t it?” the president quipped before the joint session of Congress on Tuesday—so beautiful that he referenced tariffs 17 more times in his address. In the short time since his second inauguration on Jan. 20, Trump has imposed—and sometimes walked back or temporarily suspended—tariffs on China, Canada, and Mexico, and declared a policy of tit-for-tat “reciprocity” or retaliation for any foreign tariffs on American exports that are higher than U.S. tariffs on imports. And he has justified tariffs with multiple rationales, ranging from protecting or reshoring defense-critical American industries to pressuring America’s neighbors to take action to reduce the cross-border flow of illegal immigrants and drugs like fentanyl. In fact, he told members of Congress, tariffs were “about protecting the soul of our country.”

The chaotic and inconsistent nature of Trump’s second-term policy to date can be criticized. But when it comes to tariffs as a tool of economic statecraft in general, the gap between establishment rhetoric and actual government practice is big enough to drive a Chinese EV through.

The audiences of the dying legacy media are told that the tariff is a destructive policy revived by politicians like Trump who fail to understand elementary economics, which teaches that free trade benefits all sides all the time everywhere, with no exceptions. But from North America to Europe to Asia, developed countries are ignoring mainstream economists and their amen corner in the subsidized libertarian think tank world and slapping tariffs onto imports in favored industries like electric vehicles and renewable energy. Governments are resorting to tariffs and industrial policy, not because their prime ministers and presidents flunked Econ 101, but because they do not want their economies deindustrialized by a flood of low-priced, state-subsidized Chinese imports.

The Chinese import threat is why Canada has levied a 100% tariff on imported Chinese EVs, along with a 25% surtax on Chinese steel and Chinese aluminum. The European Union has slapped electric vehicles made in China with tariffs ranging from 7.8% to 35.3%, on top of the standard European tariff of 10% for imported automobiles. India imposes tariffs of 70%-100% on imported electric vehicles from China and other countries.

Like the leaders of Canada, the EU, and India, former president Joe Biden is not generally thought of as a disciple of the Donald Trump school. But last May, the Biden administration imposed new duties not only on Chinese EVs but also on Chinese-made steel and aluminum, semiconductors, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products. According to the Biden White House press release in May:

China’s forced technology transfers and intellectual property theft have contributed to its control of 70, 80, and even 90 percent of global production for the critical inputs necessary for our technologies, infrastructure, energy, and health care—creating unacceptable risks to America’s supply chains and economic security.

In December, the Biden administration announced new restrictions on the export of chip manufacturing to China. The Biden White House even taunted the first Trump administration for not having gone far enough with its protectionist policies: “The previous administration’s trade deal with China failed to increase American exports or boost American manufacturing as it had promised.”

The verdict of history is clear: No country ever industrialized by pursuing free trade.Share

The rehabilitation of tariffs, then, is a belated course correction in response to the rise of China, which has been driven by U.S. companies that offshored manufacturing. The Middle Kingdom has lost its position as the world’s most populous nation to India, but it has surpassed the U.S. as the world’s largest national economy. China dominates global manufacturing, accounting for a market share of around 30% of manufacturing value added in 2023. In comparison, that same year American manufacturing accounted for only 16% of the global total.

In 2023 China produced roughly half of the world’s crude steel. China is the world’s largest automobile maker, accounting for a third of the global total. China’s state-backed aerospace company, COMAC, threatens to take global market share from America’s Boeing and Europe’s Airbus. China is also the world’s largest commercial shipbuilder, responsible for more than half of all shipbuilding. America’s share of the global shipbuilding market is 0.10%. Yes, zero-point-10 percent. Most of the goods shipped across the oceans to and from the U.S. are in ships built in China (51%), South Korea (28%), or Japan (15%). During the COVID pandemic, Americans were shocked to learn how dependent the U.S. is on medical supplies from China, which provides around 30% of active pharmaceutical ingredients used in drugs by value and 78% of the vitamins in the U.S. A single Chinese company, DJI, controls 90% of the American drone market, including 90% of the drones used by American police departments and first responders.

China’s trade with the U.S. resembles that of a dominant manufacturing nation with a resource colony. In 2023, China’s main exports to the U.S. were broadcast equipment, computers, and office machine parts. Apart from integrated circuits, one of the few industries in which the U.S. retains an advantage, America’s main exports to China in 2023 were soybeans and crude petroleum, with the value of soybeans ($15.2 billion) twice that of silicon chip exports ($7.01 billion).

2 notes

·

View notes

Text

In the summer of 1941, the United States sought to leverage its economic dominance over Japan by imposing a full oil embargo on its increasingly threatening rival. The idea was to use overwhelming economic might to avoid a shooting war; in the end, of course, U.S. economic sanctions backed Tokyo into a corner whose only apparent escape was the attack on Pearl Harbor. Boomerangs aren’t the only weapons that can rebound.

Stephanie Baker, a veteran Bloomberg reporter who has spent decades covering Russia, has written a masterful account of recent U.S. and Western efforts to leverage their financial and technological dominance to bend a revanchist Russia to their will. It has not gone entirely to plan. Two and a half years into Russian President Vladimir Putin’s war in Ukraine, Russia’s energy revenues are still humming along, feeding a war machine that finds access to high-tech war materiel, including from the United States. Efforts to pry Putin’s oligarchs away from him have driven them closer. Moscow has faced plenty of setbacks, most recently by losing control of a chunk of its own territory near Kursk, but devastating sanctions have not been one of them.

Punishing Putin: Inside the Global Economic War to Bring Down Russia is first and foremost a flat-out rollicking read, the kind of book you press on friends and family with proselytizing zeal. Baker draws on decades of experience and shoe-leather reporting to craft the best account of the Western sanctions campaign yet. Her book is chock-full of larger-than-life characters, sanctioned superyachts, dodgy Cypriot enablers, shadow fleets, and pre-dawn raids.

More than a good tale, it is a clinical analysis of the very tricky balancing acts that lie behind deploying what has become Washington’s go-to weapon. The risky decision just after the invasion to freeze over $300 billion in central bank holdings and cut off the Russian banking system hurt Moscow, sure. But even Deputy National Security Advisor Daleep Singh, one of the architects of the Biden administration’s response, told National Security Advisor Jake Sullivan that he feared the sanctions’ “catastrophic success” could blow up global financial markets. And that was before the West decided to take aim at Russia’s massive oil and gas exports, which it did with a series of half-hearted measures beginning later that year.

The bigger reason to cherish Punishing Putin is that it offers a glimpse into the world to come as great-power competition resurges with a vengeance. The U.S. rivalry with China plays out, for now, in fights over duties, semiconductors, and antimony. As Singh tells Baker, “We don’t want that conflict to play out through military channels, so it’s more likely to play out through the weaponization of economic tools—sanctions, export controls, tariffs, price caps, investment restrictions.”

The weaponization of economic tools, as Baker writes, may have started more than a millennium ago when another economic empire was faced with problematic upstarts. In 432 B.C., Athens, the Greek power and trading state supreme, levied a strict trade embargo on the city-state of Megara, an ally of Sparta—a move that, according to some scholars, sparked the Peloponnesian War. (Athens couldn’t break the habit: Not long after, it again bigfooted a neighbor, telling Melos that the “strong do what they can, and the weak suffer what they must.”) The irony of course is that Athens, the naval superpower, eventually lost the war to its main rival thanks to a maritime embargo.

It can be tempting to leverage economic tools, but it is difficult to turn them into a precision weapon, or even avoid them becoming counterproductive. The British empire’s 19th-century naval stranglehold and love of blockades helped bring down Napoleon but started a small war with the United States in the process.

Britain was never shy about using its naval and financial might to throw its weight around, but even the pound sterling never acquired the centrality that the U.S. dollar has today in a much bigger, much more integrated system of global trade and finance. That “exorbitant privilege,” in the words of French statesman Giscard D’Estaing, enabled the post-World War II United States to take both charitable (the Marshall Plan, for starters) and punitive economic statecraft to new heights.

The embargoes on Communist Cuba or revolutionary Iran were just opening acts, it turned out, for a turbocharged U.S. approach to leveraging its financial hegemony that finally flourished with the so-called war on terror and rogue states, a story well-told in books such as Juan Zarate’s Treasury Goes to War or Richard Nephew’s The Art of Sanctions.

Osama bin Laden is dead, Kabul is lost, Cuba’s still communist, and a Kim still runs North Korea, but the love of sanctions has never waned in Washington. If anything, given an aversion to casualties and a perennial quest for low-cost ways to impose its will, Washington has grown even fonder of using economic sticks with abandon. The use of sanctions rose under President Barack Obama, and again under Donald Trump; the Biden administration has not only orchestrated the unprecedented suite of sanctions on Putin’s Russia, but also taken Trump’s trade war with China even further.

Despite U.S. sanctions’ mixed record, the almighty dollar can certainly strike fear in countries that are forced to toe a punitive line they might otherwise try to skirt. Banks in third countries—say, a big French lender—could be forced to uphold Washington’s sanctions on Iran regardless of what French policy might dictate. Those so-called secondary sanctions raise hackles at times in places such as Paris and Berlin, prompting periodic calls for “financial sovereignty” from the tyranny of the greenback. But little has changed. Countries that want to continue having functioning banks have little choice but to act as the enforcers of Washington’s will.

What is genuinely surprising, as Baker chronicles, is that the growth of sanctions as the premier tool of U.S. foreign policy has not been matched by a commensurate growth in the corps of people charged with drafting and enforcing them. The Office of Foreign Assets Control, the Treasury Department’s main sanctions arm, is overworked and understaffed. A lesser-known but equally important branch, the Commerce Department’s Bureau of Industry and Security, struggles to vet a vast array of export controls and restrictions with a stagnant staff and stillborn budget. Post-Brexit Britain has faced even steeper challenges in leaping onto the Western sanctions bandwagon, having to recreate in the past few years a new body almost from scratch to enforce novel economic punishments.

Punishing Putin is not, despite the book’s subtitle, about an effort to “bring down” Russia. The sanctions—ranging from individual travel and financial bans on Kremlin oligarchs to asset forfeiture to sweeping measures intended to kneecap the ruble and drain Moscow’s coffers—are ultimately meant to weaken Putin’s ability to continue terrorizing his neighbor. In that sense, they are not working.

One of the strengths of Punishing Putin is Baker’s seeming ability to have spoken with nearly everybody important on those economic frontlines. She details the spadework that took place in Washington, London, and Brussels even before Russian tanks and missiles flew across Ukraine’s borders in February 2022, and especially in the fraught days and weeks afterward. It takes a special gift to make technocrats into action heroes.

The bulk of Baker’s wonderful book centers on the fight to sanction and undermine the oligarchs loyal to Putin who have helped prop up his kleptocracy. Perhaps, as Baker suggests, Western thinking was that whacking the oligarchs would lead to a palace coup against Putin. There was a coup, but not from the oligarchs—and it ended first with a whimper and then a mid-air bang.

There are a couple of problems with that approach, as Baker lays out in entertaining chronicles of hunts for superyachts and Jersey Island holding companies. First, it’s tricky to actually seize much of the ill-gotten billions in oligarch hands; the U.S. government is spending millions of dollars on upkeep for frozen superyachts, for example, but can’t yet turn them into money for Ukraine. And second, the offensive has not split the oligarchs from Putin: To the contrary, a Kremlin source tells Baker, “his power is much stronger because now they’re in his hands.”

At any rate, while the hunt for $60 billion or so in gaudy loot is fun to read about, the real sanctions fight is over Russia’s frozen central bank reserves—two-thirds of which are in the European Union—and the ongoing efforts to strangle its energy revenues without killing the global economy. Baker is outstanding on these big issues, whether that’s with a Present at the Creation-esque story of the fight over Russia’s reserves and the ensuing battle to seize them, or an explanation of the fiendishly complicated details of the “oil price cap” that hasn’t managed to cap Russian oil revenues much at all. More on those bigger fights would have made a remarkable book a downright stunner.

The Western sanctions on Russia, as sweeping and unprecedented as they are, have not ended Putin’s ability to prosecute the war. They have made life more difficult for ordinary Russians and brought down Russia’s energy export revenues, but they have not yet severed the sinews of war. “But, in fact, the West didn’t hit Russia with the kitchen sink,” Baker writes. Greater enforcement of sanctions, especially on energy, will be crucial to ratchet up the pressure and start to actually punish Putin, she argues. The one thing that is unlikely is that the sanctions battle will end anytime soon—not with Putin’s Russia, and not with other revisionist great powers such as China, whose one potential weakness is the asymmetric might of U.S. money.

“As long as Putin is sitting in the Kremlin,” Baker concludes, “the economic war will continue.”

5 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

December 30, 2023

HEATHER COX RICHARDSON

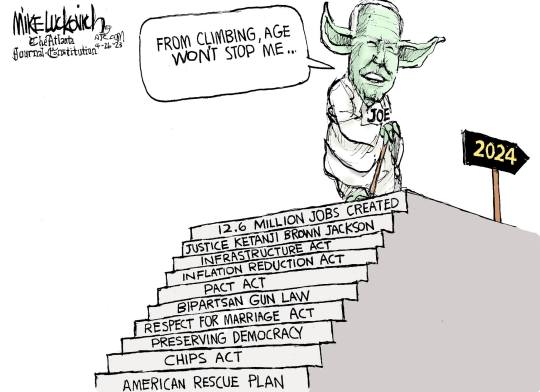

DEC 31, 2023

One day short of his first 100 days in the White House, on April 28, 2021, President Joe Biden spoke to a joint session of Congress, where he outlined an ambitious vision for the nation. In a time of rising autocrats who believed democracy was failing, he asked, could the United States demonstrate that democracy is still vital?

“Can our democracy deliver on its promise that all of us, created equal in the image of God, have a chance to lead lives of dignity, respect, and possibility? Can our democracy deliver…to the most pressing needs of our people? Can our democracy overcome the lies, anger, hate, and fears that have pulled us apart?”

America’s adversaries were betting that the U.S. was so full of anger and division that it could not. “But they are wrong,” Biden said. “You know it; I know it. But we have to prove them wrong.”

“We have to prove democracy still works—that our government still works and we can deliver for our people.”

In that speech, Biden outlined a plan to begin investing in the nation again as well as to rebuild the country’s neglected infrastructure. “Throughout our history,” he noted, “public investment and infrastructure has literally transformed America—our attitudes, as well as our opportunities.”

In the first two years of his administration, when Democrats controlled both chambers of Congress, lawmakers set out to do what Biden asked. They passed the $1.9 trillion American Rescue Plan to help restart the nation’s economy after the pandemic-induced crash; the $1.2 trillion Infrastructure Investment and Jobs Act (better known as the Bipartisan Infrastructure Law) to repair roads, bridges, and waterlines, extend broadband, and build infrastructure for electric vehicles; the roughly $280 billion CHIPS and Science Act to promote scientific research and manufacturing of semiconductors; and the Inflation Reduction Act, which sought to curb inflation by lowering prescription drug prices, promoting domestic renewable energy production, and investing in measures to combat climate change.

This was a dramatic shift from the previous 40 years of U.S. policy, when lawmakers maintained that slashing the government would stimulate economic growth, and pundits widely predicted that the Democrats’ policies would create a recession.

But in 2023, with the results of the investment in the United States falling into place, it is clear that those policies justified Biden’s faith in them. The U.S. economy is stronger than that of any other country in the Group of Seven (G7)—a political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, along with the European Union—with higher growth and faster drops in inflation than any other G7 country over the past three years.

Heather Long of the Washington Post said yesterday there was only one word for the U.S. economy in 2023, and that word is “miracle.”

Rather than cooling over the course of the year, growth accelerated to an astonishing 4.9% annualized rate in the third quarter of the year while inflation cooled from 6.4% to 3.1% and the economy added more than 2.5 million jobs. The S&P 500, which is a stock market index of 500 of the largest companies listed on U.S. stock exchanges, ended this year up 24%. The Nasdaq composite index, which focuses on technology stocks, gained more than 40%. Noah Berlatsky, writing for Public Notice yesterday, pointed out that new businesses are starting up at a near-record pace, and that holiday sales this year were up 3.1%.

Unemployment has remained below 4% for 22 months in a row for the first time since the late 1960s. That low unemployment has enabled labor to make significant gains, with unionized workers in the automobile industry, UPS, Hollywood, railroads, and service industries winning higher wages and other benefits. Real wages have risen faster than inflation, especially for those at the bottom of the economy, whose wages have risen by 4.5% after inflation between 2020 and 2023.

Meanwhile, perhaps as a reflection of better economic conditions in the wake of the pandemic, the nation has had a record drop in homicides and other categories of violent crime. The only crime that has risen in 2023 is vehicle theft.

While Biden has focused on making the economy deliver for ordinary Americans, Vice President Kamala Harris has emphasized protecting the right of all Americans to be treated equally before the law.

In April 2023, when the Republican-dominated Tennessee legislature expelled two young Black legislators, Justin Jones and Justin J. Pearson, for participating in a call for gun safety legislation after a mass shooting at a school in Nashville, Harris traveled to Nashville’s historically Black Fisk University to support them and their cause.

In the wake of the 2022 Dobbs v. Jackson Women’s Health Supreme Court decision overturning the 1973 Roe v. Wade decision that recognized the constitutional right to abortion, Harris became the administration’s most vocal advocate for abortion rights. “How dare they?” she demanded. “How dare they tell a woman what she can and cannot do with her own body?... How dare they try to stop her from determining her own future? How dare they try to deny women their rights and their freedoms?” She brought together civil rights leaders and reproductive rights advocates to work together to defend Americans’ civil and human rights.

In fall 2023, Harris traveled around the nation’s colleges to urge students to unite behind issues that disproportionately affect younger Americans: “reproductive freedom, common sense gun safety laws, climate action, voting rights, LGBTQ+ equality, and teaching America’s full history.”

“Opening doors of opportunity, guaranteeing some more fairness and justice—that’s the essence of America,” Biden said when he spoke to Congress in April 2021. “That’s democracy in action.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#Biden Administration#Biden's accomplishments#Election 2024#Mike Luckovich

10 notes

·

View notes

Text

Final Project - First Post

Prompt: Showcase your best photo taken in the first ten days of being in Taiwan with a short description of how it relates to Taiwanese Culture or Taiwanese Impact.

When thinking about Taiwan and Taiwanese culture, the first thing I think about is its desire for technological innovation. Before this trip, this aspect of Taiwanese culture intrigued me the most, as I have grown up with a passion for new technologies. After being here for 12 days, my interest in Taiwan's innovation increased exponentially.

The image I chose for this post was one I took from Elephant Mountain overlooking the city and Taipei 101. Taipei101 is not just one of the city's most impressive towers and sights but also a symbol of Taiwanese ambition to be a world leader in innovation. In 2004, when the Taiwanese built it, it was the tallest building and had the fastest elevators in the world. What's most impressive about this skyscraper is how they built it in one of the windiest cities on earth, which also has common earthquakes, typhoons, and storms. The world's largest and heaviest Tuned Mass Damper on the 88th floor exemplifies Taiwanese innovative engineering.

This push for technological innovation surprised me the most about Taiwanese culture. There are many programs, incentives, and an overall drive to cultivate higher education in technology. Although there is a very similar drive in the United States, I have felt an even higher emphasis on innovation in engineering while being here for two weeks.

Taiwan consistently influences the world through its support of technological advancement. Whether by constructing the tallest building in the world with the largest Tuned Mass Damper, leading the semiconductor industry, or providing outstanding STEM courses, particularly in engineering, Taiwan significantly contributes to advancing technology and, consequently, human life.

3 notes

·

View notes

Text

Shape the Future of Chip Tech with IIT Delhi's Executive Programme in Semiconductor Manufacturing

Enhance your expertise in semiconductor processes, design, and fabrication through IIT Delhi's 6-month Executive Programme. Designed for working professionals, this course offers insights into emerging technologies and industry trends, culminating in a prestigious certification.

0 notes

Text

🔥Boost Your Career with Orbital Welding Training Course! 🔧

Unlock high-demand job opportunities in top industries like semiconductors, pharma, and data centers with our expert-led Orbital Welding Training.

🎯 What You’ll Gain:

✅ Precision welding skills

✅ Industry-recognized certification

✅ Hands-on training with latest equipment

✅ Access to high-paying global jobs

🎓 No better time to upskill – start now and weld your way to success!

📩 Enroll Today | Contact us for more info:

🌐 www.awilli-ag.ch

#OrbitalWelding #WeldingTraining #SkilledTrades #WeldersWanted #CareerGrowth #TechnicalTraining #EngineeringCareers #IndustrialJobs #WorkAbroad #UpskillNow #HighTechIndustrie

#orbital welding training#orbital welding courses#orbital welding technology#welding automation#orbital welding#orbital welding program#semiconductor#advanced welding#welding technology

0 notes

Text

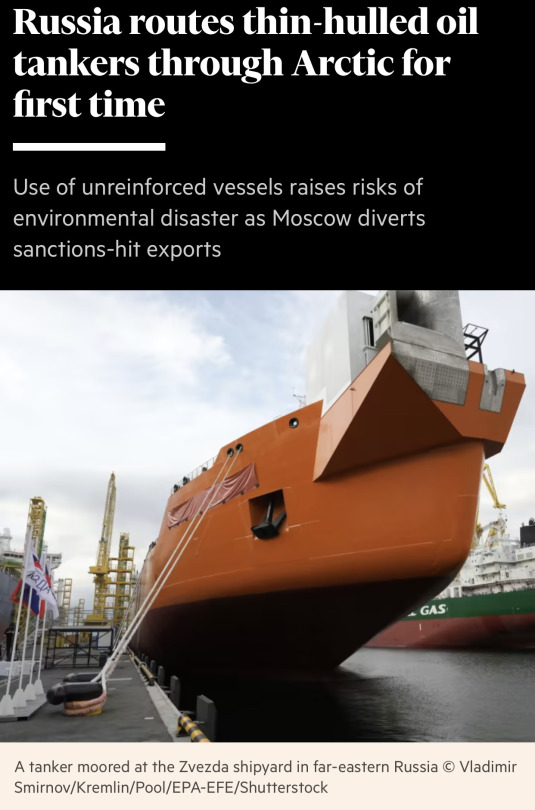

The new route Russia is using to export its oil to China. Unfortunately global warming and the melting of the icecaps only benefits Russia geopolitically. What’s the big deal? you might wonder. A 10-day reduction in transport time is huge when it comes to the velocity of capital. Power accrues to the nations that control key maritime trade routes.

*

Between climate change and the new Cold War, the future doesn’t look pretty. China’s economy is imploding thanks to their reliance on a debt-fueled real estate bonanza, their misguided zero COVID policy, and Xi Jinping’s head-scratchingly bad policies (and of course, his consolidation of power). Siding with Russia was a huge mistake… Now China’s biggest export markets are trying to decouple or at least diversify away from them. Youth unemployment is so bad in China (21%, but possibly significantly higher) that the government has decided to stop publishing such data. The Philippines and Vietnam are pivoting toward the US. South Korea and Japan are putting their long, historical feud aside to join forces against China. Japanese military neutrality is over. Meanwhile a tiny island called Taiwan makes over 92% of the world’s advanced semiconductors and will likely be invaded in our lifetime. Will an (economically) weakened China make it more or less likely that Xi will invade Taiwan? (Strongmen facing a domestic crisis and loss of popular support do often start wars as a kind of “gamble for resurrection,” but Xi might have become more risk adverse as he observes Russia’s debacle in Ukraine. Plus, an amphibious invasion is logistically extremely difficult to pull off.)

Defense spending worldwide is skyrocketing, climbing back toward Cold War levels. The lines on the map are hardening, particularly in the Asian/Pacific theater and the European theater. A nuclear trifecta of Russia-China-North Korea is emerging. Yes, it is a marriage of convenience, but quite a dangerous one given that Russia will likely transfer technology (specifically, platforms to deliver nuclear warheads) to North Korea in exchange for Soviet-compatible ammunition/arms to use in Ukraine. I hate feeling like the world is a frog getting boiled but as I finish this 26-part BBC documentary on World War I, I can’t help but feel that the geopolitical situation is very unstable.

Oh, the madness of nation states! Wake me up when it’s over.

#geopolitics#political economy#trade#war#military industrial complex#cold war#new cold war#russia#China#capitalism

10 notes

·

View notes

Text

How Brazil is Preparing for the Global Transformation in Connectivity

“Brazil is following the overall trend in semiconductors: Industry 4.0 should reach more than triple its market value in Brazil within five years, and the importance and investments that this sector is gaining in a national context is evident from both government and non-governmental initiatives.”

The world is increasingly connected, and semiconductors are essential to enabling this connectivity. Specialists project the semiconductor market to become a trillion-dollar industry by 2030 (McKinsey & Co., 2022).

The term “semiconductors” covers a large amount of embedded technology that is advancing rapidly in its development. Semiconductor companies are highly innovative and rely on innovation to maintain their market share and expansion objectives.

An indicator of innovation in this sector is, of course, patents. Of the 10 largest semiconductor companies, according to a ranking published by Investopedia in April 2023, five companies filed between 2,000 to 5,000 patent families between 2019 and 2022 (Patentscope search, August 2023). Altogether, the top 10 companies filed almost 20,000 patent families in that period.

Moreover, the patent tendencies of technologies related to this business are used as an indicator of the pace of innovation at the invention stage. This also includes 5G technologies, which are essential for semiconductors. In that context, the number of declared 5G patent families filed per year jumped from slightly above 2,000 in 2017 to almost 15,000 in 2020, and this level was maintained until 2022 (Landscape Analysis of Declared 5G Patent Families provided by NGB, 2022).

Continue reading.

#brazil#brazilian politics#politics#economy#technology#mod nise da silveira#image description in alt

2 notes

·

View notes

Text

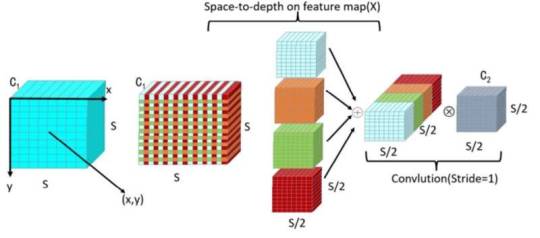

Solving long-standing challenge in semiconductor manufacturing—a refined algorithm for detecting wafer defects

Research published in the International Journal of Information and Communication Technology may soon help solve a long-standing challenge in semiconductor manufacture: the accurate detection of surface defects on silicon wafers. Crystalline silicon is the critical material used in the production of integrated circuits and in order to provide the computing power for everyday electronics and advanced automotive systems needs to be as pristine as possible prior to printing of the microscopic features of the circuit on the silicon surface. Of course, no manufacturing technology is perfect and the intricate process of fabricating semiconductor chips inevitably leads to some defects on the silicon wafers. This reduces the number of working chips in a batch and leads to a small, but significant proportion of the production line output failing. The usual way to spot defects on silicon wafers has been done manually, with human operators examining each wafer by eye. This is both time-consuming and error-prone due to the fine attention to detail required. As wafer production has ramped up globally to meet demand and the defects themselves have become harder to detect by eye, the limitations of this approach have become more apparent.

Read more.

#Materials Science#Science#Semiconductors#Defects#Manufacturing#Materials processing#Silicon#Computational materials science

15 notes

·

View notes

Text

Job-Oriented VLSI Training at Takshila Institute of VLSI Technologies

In today’s highly competitive semiconductor industry, having the right skills is essential to securing a rewarding career. Job oriented VLSI training is the key to bridging the gap between academic learning and industry requirements. Among the leading names in this field, Takshila Institute of VLSI Technologies in India stands out as one of the top VLSI institutes in Bangalore, known for its focused, practical, and placement-driven approach to VLSI education.

What Makes VLSI Training Job-Oriented?

Takshila Institute of VLSI Technologies offers programs that are designed in collaboration with industry experts to meet current market demands. The training includes a deep dive into RTL design, verification using SystemVerilog, DFT (Design for Test), Physical Design, and FPGA development. Each course is structured to ensure hands-on experience through real-time projects and use of industry-grade EDA tools.

The institute emphasizes project-based learning, mock interviews, resume building, and soft skills training as part of its job-oriented approach. Students not only learn the technical aspects of VLSI but are also groomed for real-world interviews and corporate environments.

Leading VLSI Institute in Bangalore

As one of the top VLSI institutes in Bangalore, Takshila Institute of VLSI Technologies attracts learners from across India. The institute is equipped with modern labs, expert trainers, and a curriculum that keeps pace with global VLSI trends. Takshila's focus is on practical knowledge over theoretical learning, ensuring students graduate with skills that are immediately applicable in the workplace.

Takshila offers both classroom and online learning modes, catering to the needs of fresh graduates as well as working professionals. Its placement assistance cell actively works with semiconductor companies to help students secure jobs in top organizations, making it a trusted choice for VLSI aspirants.

Why Choose Takshila Institute of VLSI Technologies

The strength of Takshila Institute of VLSI Technologies lies in its commitment to delivering job-oriented VLSI training that transforms students into industry-ready professionals. With a strong network of alumni, placement support, and a reputation for academic excellence, the institute has earned its position as a leading center for VLSI education in Bangalore.

If you're looking to launch a successful career in the semiconductor industry, Takshila offers the right platform, blending technical depth, practical learning, and career readiness into one powerful training program.

0 notes

Text

Elevate Your Career with Online Design for Test and FPGA Design Training

In the rapidly evolving world of electronics and semiconductors, VLSI (Very Large Scale Integration) has become the backbone of innovation. Among the most critical aspects of this field are Design for Test (DFT) and FPGA (Field Programmable Gate Array) design, two disciplines essential for building and testing complex integrated circuits. In India, Takshila Institute of VLSI Technologies stands out as a premier destination for high-quality, industry-oriented training in these specialized domains.

Online Design for Test Training Institutes

With the growing demand for DFT experts in the semiconductor industry, many aspiring engineers seek a reliable institute that delivers practical, online learning. Takshila Institute of VLSI Technologies offers one of the most comprehensive online design for test training institutes programs in the country. The curriculum is carefully crafted by industry veterans, focusing on scan insertion, ATPG (Automatic Test Pattern Generation), boundary scan, fault modeling, and more. The online mode ensures flexibility for both students and working professionals, with live sessions, recorded lectures, hands-on labs, and personalized mentoring.

What sets Takshila apart is its ability to simulate a real-time project environment. Students get to work on actual industry-grade tools and projects, helping them gain confidence and practical skills. This makes them job-ready for various roles in the semiconductor industry, particularly in test and verification.

FPGA Design Training Institutes

FPGA design is another cornerstone of modern electronics, especially in prototyping and real-time system development. As one of the top FPGA design training institutes, Takshila Institute of VLSI Technologies delivers an in-depth program that covers the entire lifecycle of FPGA design — from RTL design using Verilog/VHDL to synthesis, simulation, and implementation on FPGA boards.

The course blends theory with practical exposure, equipping learners with hands-on experience in tools like Xilinx Vivado and Intel Quartus. This not only helps them understand the technology better but also prepares them for real-world challenges in industries such as telecommunications, defense, automotive, and more.

Why Choose Takshila Institute of VLSI Technologies

Takshila’s commitment to industry-relevant education, expert faculty, live projects, and strong placement assistance makes it a trusted name among VLSI training aspirants. Whether you're looking to enhance your career or enter the VLSI industry, Takshila Institute of VLSI Technologies offers the ideal platform through its robust online Design for Test and FPGA design training programs.

0 notes