#SmartSpend

Explore tagged Tumblr posts

Text

Sold: The Forklift That Cost 41% More — and Why It Made Sense

In the forklift business, price battles are common — but they’re not always wise. We recently had a customer choose a forklift priced 41% higher than a competitor’s offer. This wasn’t about luck. It was about strategy, value, and long-term thinking. Here’s what this experience taught us — and what we want to share with fellow buyers, dealers, and business owners: 1. Total Cost of Ownership Is…

#buyingforklift#EGAN#ezbuybyegan#forkliftmalaysia#forkliftnation#forklifts#forkliftsales#lovelaughlift#smartbusiness#smartspend

0 notes

Text

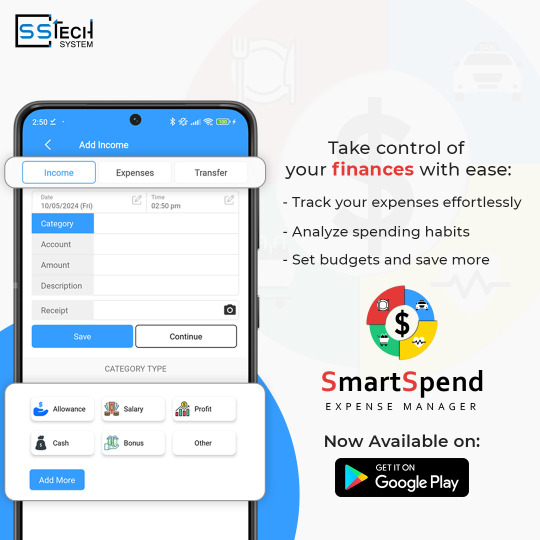

SmartSpend - Expense Manager - SSTech System

Say hello to SmartSpend: Expense Manager App, now available on the Play Store! 📱✨

Download today and start your journey to smarter spending! 💰💪

Download Now: SmartSpend - Expense Manager

#SmartSpend#ExpenseManager#FinancialFreedom#Budgeting#Savings#NowAvailable#PlayStore#MoneyManagement#sstechsystem#expensetracker#monthlyexpense#weeklyexpense#dailyexpense#playstore#downloadnow#freeapp

1 note

·

View note

Text

✧ how to actually save money as a student (without giving up your coffee) ✧

hey lovelies! ♡

now, i'm sure you've noticed by the title that this post is super important - saving money while still enjoying life! i know the struggle of wanting to be financially responsible while not completely giving up the things that make us happy.

here are my tried and true money-saving secrets:

smart shopping tricks

use student discounts everywhere (seriously, just ask!)

shop seasonal sales only

join loyalty programs at your fave stores

use cashback apps for everything

meal prep to avoid impulse food buys

little daily saves that add up

make coffee at home 4 days a week

bring cute homemade lunches

use your student gym membership

walk or bike when possible

share subscriptions with friends

money management basics

track spending in a cute budget app

automate savings (even USD 5 weekly helps!)

use the 24-hour rule for purchases

separate wants from needs

keep an emergency fund

being good with money isn't about restriction, it's about making smart choices!

pro tip: create a "treat yourself" fund - save a little each week for guilt-free splurges!

xoxo, mindy 💫

@glowettee

#moneytips#studentlife#savingmoney#financetips#budgeting#studentbudget#moneysaving#personalfinance#lifehacks#smartspending#manic pixie dream girl#lana del rey#girlblogger#girl blogger#glowettee#it girl energy

98 notes

·

View notes

Text

💰Master Your Money | The Ultimate Guide to Financial Success and Smart Spending💵✨

Master Your Money

youtube

#100 days of productivity#MasterYourMoney#FinancialSuccess#SmartSpending#WealthBuilding#DebtFree#Investing#MoneyManagement#FinancialFreedom#Budgeting#EmergencyFund#PersonalFinance#Youtube

2 notes

·

View notes

Text

The Importance of Budgeting Properly to Invest in Yourself: The Only Way to Get Ahead

In the intricate dance of life and finance, there is a fundamental principle that remains consistently true: the key to getting ahead lies in how well you invest in yourself. This investment, however, requires a robust foundation built on prudent budgeting. Imagine the power of taking control of your financial destiny, ensuring that every dollar you earn is a soldier in your army, marching towards a future of personal and professional fulfillment.

Understanding Budgeting

At its core, budgeting is the art and science of creating a plan to spend your money. This isn't merely about restricting your spending or living within your means—it's about having a clear, strategic vision of where your money should go to serve your greatest interests. A well-structured budget acts as both a shield and a sword; it protects you from financial pitfalls and empowers you to seize opportunities for growth and development.

Why Budgeting is Crucial for Personal Investment

Budgeting is the cornerstone of financial stability. Without a budget, it’s easy to fall into the trap of living paycheck to paycheck, never truly understanding where your money goes. This lack of awareness can stymie your ability to invest in yourself. On the other hand, a meticulously crafted budget illuminates your financial landscape, highlighting areas where you can reduce unnecessary expenses and redirect those funds towards meaningful personal investments. For instance, you might discover that by cutting back on daily coffee runs, you can afford an online course that could propel your career forward.

Steps to Create an Effective Budget

Creating an effective budget begins with an honest assessment of your current financial situation. Start by listing all sources of income and meticulously tracking every expense for a month. This exercise will provide a clear picture of your spending habits. Once you have this data, categorize your expenses into essentials (like rent, groceries, and utilities) and non-essentials (like dining out and entertainment). This categorization will help you identify potential savings.

With a clear understanding of your financial inflows and outflows, set realistic financial goals. These goals should include both short-term targets, such as saving for a professional development course, and long-term aspirations, like building a retirement fund. Tracking your expenses becomes crucial at this stage, as it ensures you stay aligned with your goals.

Allocating Funds for Personal Investment

Once you’ve identified areas to cut back on, it’s time to allocate funds towards investing in yourself. This might mean enrolling in a course to acquire new skills, investing in your health through a gym membership, or dedicating time and money to a hobby that brings you joy and fulfillment. Each of these investments contributes to your overall well-being and enhances your capacity to achieve long-term success.

Areas to Invest In Yourself

Investing in education and skills development can yield substantial returns. In our rapidly evolving world, continuous learning is indispensable. Consider the story of Jane, a software developer who, through meticulous budgeting, managed to allocate funds towards obtaining certifications in her field. These new skills not only made her more competent but also opened doors to career advancement and salary increases.

Health and wellness are equally critical areas for personal investment. Your physical and mental health form the bedrock upon which all other achievements are built. Allocating resources towards maintaining a healthy lifestyle—whether through a fitness regimen, nutritious diet, or mindfulness practices—ensures that you have the energy and resilience needed to pursue your goals.

Moreover, investing in personal hobbies and passions can be profoundly rewarding. These activities not only provide a much-needed respite from the daily grind but can also become additional streams of income or significant contributors to your personal growth.

Case Studies and Real-Life Examples

Consider Mike, an accountant who found his passion in photography. Through diligent budgeting, he was able to save enough to purchase a high-quality camera and attend photography workshops. What started as a hobby soon became a lucrative side business, bringing both financial rewards and personal satisfaction.

Then there's Sarah, who used to spend a considerable amount on non-essential items. By reassessing her spending habits and creating a budget, she was able to save money to attend leadership training seminars. These seminars equipped her with the skills needed to climb the corporate ladder, resulting in a significant promotion and pay raise.

Conclusion

In the journey towards personal and professional success, budgeting stands as an indispensable tool. It transforms your financial habits, enabling you to channel your resources into investments that yield the highest returns—investments in yourself. By taking control of your finances, you empower yourself to pursue continuous growth, achieve your goals, and ultimately, lead a fulfilling life. Begin your budgeting journey today, and watch as the seeds of your disciplined efforts blossom into the fruits of success and self-fulfillment.

By embracing the principles of prudent budgeting, you not only secure your financial future but also lay the groundwork for a lifetime of personal and professional enrichment. Remember, the path to getting ahead is paved with strategic investments in yourself—an endeavor that begins with the simple, yet powerful act of budgeting.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#PersonalFinance#Budgeting#InvestInYourself#FinancialFreedom#MoneyManagement#FinancialPlanning#SmartSpending#SelfInvestment#FinancialStability#BudgetTips#WealthBuilding#FinancialGoals#MoneyMatters#SelfImprovement#EconomicEmpowerment#bitcoin#financial education#financial experts#digitalcurrency#cryptocurrency#blockchain#finance#financial empowerment#globaleconomy#unplugged financial

6 notes

·

View notes

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes

Text

🌧️ Wooden Outdoor Dining Sets Last Forever?

We used to believe wooden furniture = durability. Solid. Timeless. Worth every penny.

But here's the truth: most people don’t hear until it’s too late: - Unless it’s high-quality teak or acacia, your wooden outdoor dining set won’t survive more than 1–2 years. - Exposure to sun and rain? It cracks. Warps. Grows mold. You’re left with regret and rotting wood.

We’ve seen it too many times: 💸 People spending $1,000+ on outdoor sets ⏳ Only to toss them out after a few rainy seasons

Here’s the fix: ✔ Choose hardwoods like teak or Grade-A acacia ✔ Check if it's treated for weather resistance ✔ Cover it when not in use ✔ Oil and maintain it seasonally

👉 Here's a curated list of the best wooden outdoor dining sets that last: https://furnitureguide.net/best-wooden-outdoor-Dining-set/

Because buying smart = living better, longer.

0 notes

Text

Budget Hacks That Save You $7,000 a Year

youtube

If you want to save $4,000 to $7,000 per year without making more money, this video is your definitive guide to managing money wisely. We're revealing 10 budget hacks that have helped thousands slash spending, alleviate financial stress, and create long-term savings without sacrificing what they enjoy. From implementing the 48-hour rule to prevent impulse shopping to the 30-day no eating out diet, these budget tricks are sensible, tried and tested, and easy to follow. You'll discover how to recognize emotional spending triggers, embrace reverse budgeting, and establish weekly budgets that work. These straightforward tips aren't about restraint—they're about regaining control of your finances and letting your money do the work. If you're willing to quit saying "Where did all my money go?" and begin creating a more intentional financial future, these budget hacks will guide you there, one wise choice at a time.

#budgethacks#savemoney#moneysavingtips#financialfreedom#debtfreejourney#smartspending#personalfinance#budgetingtips#frugalliving#moneyhabits#reversebudgeting#cutexpenses#weeklybudget#cashenvelope#emotionalspending#Youtube

0 notes

Text

#PersonalFinance#MoneyManagement#FinancialFreedom#BudgetTips#MoneyMatters#FrugalLiving#SmartSpending#FinancialWellness#SaveMoneyLiveBetter#DebtFreeJourney#MindfulSpending#SpendSmart#MinimalistLifestyle#IntentionalLiving#MoneyGoals#FinancialGoals#WealthBuilding#BudgetHacks#MoneyMindset#LiveWithinYourMeans#MoneySavingTips#FinanceTips#BudgetPlanner#TrackYourSpending#MoneyTalks

0 notes

Text

🌍💸 Can a country thrive during a recession, without piling on debt? YES, it can! ✅📈

🌍💸 Can a country thrive during a recession, without piling on debt? YES, it can! ✅📈

👉 Read the full article: https://thinquer.com/financial/thriving-a-country-through-recession-without-growing-debt-a-macroeconomic-growth-guide/

This eye-opening guide reveals the smartest strategies to boost growth, cut waste, grow revenue 📊—and keep borrowing at ZERO. 💼

From public-private partnerships 🤝 to digital tax tools, see how nations can bounce back stronger 💪

💬 What would YOU implement first? Drop your thoughts in the comments!

#Economy#Macroeconomics#RecessionRecovery#DebtFree#SmartSpending#PublicFinance#GrowthWithoutDebt#SustainableEconomy#FiscalPolicy#EconomicStrategy#GreenGrowth#RevenueReform#PPP#EconomicInnovation#Thinquer#DigitalGovernance#BudgetReform#NoMoreDebt#GlobalEconomy#SmartGovernance#TaxReform#FinancialResilience#SpendBetter#EcoFriendlyIndustry#BuildBackBetter#PolicyTools

0 notes

Text

HDFC Millennia vs HDFC Regalia Gold — Which Credit Card Is Right for You

If you’re thinking about getting a new credit card in 2025, two popular HDFC cards you might be looking at are the Millennia and the Regalia Gold. Both have their perks, but they’re made for different kinds of spenders. Here’s a simple way to figure out which one fits your lifestyle better.

The HDFC Millennia card is perfect if you love shopping online or ordering food often. It gives you extra reward points and cashback when you shop on sites like Amazon or order from food apps like Zomato and Swiggy. Plus, it comes with a lower annual fee, so it won’t burn a hole in your pocket.

On the other hand, the HDFC Regalia Gold is more about luxury and travel. If you’re someone who travels a lot or enjoys dining out, this card gives you airport lounge access, travel insurance, and good rewards on dining and travel spends. Yes, it costs a bit more yearly, but if you use these travel benefits, it’s definitely worth it.

So, here’s the deal: if your spending is mostly online and food delivery, go for Millennia. If you travel regularly and want those extra perks, Regalia Gold is your friend.

In the end, it’s all about what suits your everyday life. Pick the card that helps you get the most out of your money without unnecessary fees.

#HDFC#HDFCcreditcard#HDFCMillennia#HDFCRegaliaGold#CreditCardComparison#CreditCards#TravelCreditCard#CashbackCreditCard#FinanceTips#MoneyMatters#CreditCardBenefits#MillennialsFinance#TravelPerks#SmartSpending

1 note

·

View note

Text

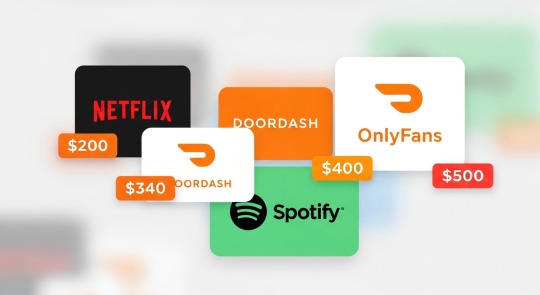

6 Money Traps That Are Quietly Draining Your Wallet

Cutting These Habits Might Save You Thousands Without Ruining Your Lifestyle

We all possess spending habits that seem innocent in the moment but quietly add up to a money pit. After watching hours and hours of personal finance programming, one thing becomes clear: individuals hold on to wantons out of habit, convenience, or comfort.

If you're wealthy and content, go ahead and spend your money as you please. But if you're in debt or struggling financially, these seemingly minor leaks may be what's keeping you trapped.

Let's examine in greater detail six prevalent spending habits that provide little long-term utility but cost you much more than you realize.

Subscription Content Platforms Services like OnlyFans aren’t inherently bad — people are free to enjoy what they want. But the monthly charges often sneak up. $9.99 here, $12.99 there… it stacks up fast. And with so much free content available elsewhere, it’s worth asking yourself: is this really worth the ongoing cost?

The same logic applies to niche subscription platforms. Always audit what you’re actually using.

Food Delivery Apps (DoorDash, Uber Eats, etc.) Convenience is expensive. A $10 in-store meal could easily be $25 with delivery charges, tip, and service fee. Charge that by the number of nights you don't feel like cooking, and you're easily burning hundreds a month.

A wiser option? Prep easy meals ahead of time or use pickup. Same food, less fee.

Trendy Wellness Products From detox teas to costly supplements that vow improved sleep or gut health, the wellness world lives on unsubstantiated claims. Although some products are worth it, some are merely costly placebos with fine marketing.

Before purchasing the next gummy miracle or subscription box, ask: is this science-based, or is it based on selling me healthy?

Fancy Coffee Every Morning A $6 latte doesn't sound like a lot — until it's every day. That's $180 a month, or more than $2,000 a year. It's not the caffeine for many, but the ritual. Yet, brewing at home can save you a little money, particularly if you can make it exactly as you prefer.

It's fine to indulge — just keep an eye on the total cost.

Streaming Services You Never Use Netflix, Hulu, Disney+, HBO, Spotify, Apple TV, Amazon Prime… how many do you actually use every month? Most people sign up, forget, and continue to get charged.

Check your subscriptions every 2–3 months. Unsubscribe anything you haven't used. You can always subscribe again later — most sites even remember your watch history.

In-App Game Purchases Gaming's a blast — but $20 here, $50 there for skins, power-ups, or coins quick adds up. These microtransactions are engineered to circumvent your logical brain. You're not purchasing value, you're purchasing hits of dopamine.

If you're on a budget, try putting a monthly limit on it or just avoiding in-app buys altogether. Play the game — don't let the game play your wallet.

Final Thought: You Don't Have to Be Miserable to Save Cutting back isn't cutting out fun. It's spending mindfully. When you cease throwing money at things that are useless, you're opening up space for experiences and objectives that are meaningful.

Take a moment before your next click to purchase and ask: "Do I really need this… or is it habit?"

#PersonalFinance#MoneyHabits#SaveMoney#FrugalLiving#FinancialFreedom#BudgetTips#WealthBuilding#MinimalistLifestyle#MoneyMindset#SmartSpending

0 notes

Text

The 50/30/20 Rule: Simplifying Your Budget

Managing personal finances can be overwhelming, especially with the flood of budgeting tools, financial advice, and investment strategies available today. One method that continues to stand out for its simplicity and effectiveness is the 50/30/20 rule. Originally popularized by Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan,” the 50/30/20 rule has become a…

0 notes

Text

Best Budgeting Apps of 2025

In today’s fast-paced digital world, managing your money wisely is more important than ever. Whether you’re saving for a vacation, trying to reduce debt, or simply aiming for better financial control, having the best budgeting apps at your fingertips can make all the difference. These modern personal finance tools simplify everything from expense tracking to financial planning, putting you in charge of your financial future.

Why Budgeting Apps Matter in 2025

As the global economy becomes increasingly unpredictable, more people are turning to money management solutions to help stay on top of their spending. The best budgeting apps in 2025 are smarter, more intuitive, and packed with features that cater to users from all financial backgrounds. They not only help track income and expenses but also provide insights and forecasts that aid in smarter financial planning.

Let’s take a look at the best budgeting apps of 2025 that can help transform the way you manage your money.

1. Mint

A classic favorite that remains strong in 2025, Mint continues to dominate the world of personal finance tools. With real-time expense tracking, bill reminders, and customizable budgets, it’s perfect for beginners and experienced budgeters alike.

Key Features:

Automatic syncing with bank accounts

Visual budget breakdowns

Credit score monitoring

Mint excels in money management by giving a full overview of your financial picture in one place. It’s simple, effective, and free.

2. YNAB (You Need A Budget)

If you want to take control of your finances proactively, YNAB is one of the best budgeting apps to consider. It follows a zero-based budgeting approach, ensuring every dollar has a job.

Key Features:

Real-time syncing across devices

Detailed reports for smarter financial planning

Debt payoff and savings goal tracking

YNAB is ideal for those looking for disciplined money management and structured expense tracking.

#BestBudgetingApps2025#BudgetingApps#PersonalFinance#FinTech#MoneyManagement#BudgetSmart#ExpenseTracker#FinanceTips#SavingsGoals#FinancialFreedom#BudgetingForBeginners#SmartSpending#InvestInYourself#WealthBuilding#2025Finance#DigitalWallet#FinancialPlanning#AppRecommendations#MoneySavvy

0 notes

Text

Start Budgeting and Planning for Christmas Now: Your Guide to a Stress-Free Holiday Season

As the summer sun blazes and the year speeds towards its end, it might seem premature to start thinking about Christmas. Yet, as any seasoned planner knows, the key to a stress-free and joyful holiday season is starting early. By budgeting and planning for Christmas now, you can avoid the last-minute rush and financial strain that often accompany the festivities. Here’s how to get started:

1. Set Your Budget

The first step in planning for Christmas is setting a realistic budget. Consider all potential expenses, including:

Gifts: Make a list of people you plan to buy gifts for and set a spending limit for each.

Decorations: Factor in any new decorations you might need or want.

Food and Drinks: Consider the cost of holiday meals, baking, and beverages.

Travel: If you’ll be traveling, include transportation and accommodation costs.

Events and Activities: Plan for holiday parties, events, and any special outings.

2. Start Saving Now

Once you have a budget, divide the total amount by the number of weeks remaining until Christmas. This will give you a weekly savings goal. Setting aside a small amount each week can make the overall cost more manageable.

3. Track Your Spending

Keep a close eye on your spending to ensure you’re sticking to your budget. Use budgeting apps or spreadsheets to track expenses and adjust as necessary.

4. Create a Gift List

Start brainstorming gift ideas now. Creating a list early allows you to take advantage of sales throughout the year, avoiding the December rush and higher prices. Keep an eye out for deals and consider DIY gifts to add a personal touch and save money.

5. Shop Smart

Sales and Discounts: Look for sales, discount codes, and cashback offers.

Black Friday and Cyber Monday: These events can offer significant savings on gifts and other holiday necessities.

Buy in Bulk: For items like wrapping paper, cards, and non-perishable foods, buying in bulk can reduce costs.

6. Plan Your Holiday Meals

Plan your holiday menu in advance and start purchasing non-perishable items over the coming months. This spreads out the cost and reduces the last-minute grocery store rush. Consider preparing and freezing some dishes ahead of time.

7. Declutter and Sell

Take the time to declutter your home. Sell items you no longer need or use. This can free up space for new items and provide extra funds for your holiday budget.

8. Get Creative with Decorations

You don’t need to buy new decorations every year. Get creative with DIY projects using materials you already have. Involve your family in crafting unique decorations, which can also be a fun holiday activity.

9. Plan Travel Early

If you’re traveling for the holidays, book your transportation and accommodation as early as possible. Early booking can result in significant savings and more options.

10. Prepare for Unexpected Costs

No matter how well you plan, unexpected expenses can arise. Set aside a small contingency fund to cover any surprises without derailing your budget.

11. Reflect and Adjust

After the holiday season, reflect on your spending and planning process. What worked well? What could be improved next year? Adjust your plan accordingly to make next year’s holiday season even smoother.

Conclusion

Starting to budget and plan for Christmas now can transform your holiday experience from stressful to serene. By taking these steps, you’ll not only enjoy the festive season without the financial hangover but also foster habits that contribute to long-term financial stability and freedom. Remember, the goal is to create a joyful and memorable holiday for you and your loved ones, not to stress over expenses. Happy planning!

By planning ahead, you're taking control of your finances, reducing the likelihood of debt, and setting a positive example for others. Financial freedom starts with small, manageable steps, and holiday planning is a perfect opportunity to practice this. Embrace the spirit of the season with peace of mind, knowing that you’ve prepared well.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#ChristmasPlanning#HolidayBudgeting#FinancialFreedom#MoneyManagement#Christmas2024#HolidayPrep#BudgetTips#SaveMoney#DebtFreeHolidays#FinancialPlanning#SmartSpending#FestiveSeason#HolidaySavings#FamilyBudgeting#PlanAhead#ChristmasGifts#HolidayStressFree#XmasTips#ChristmasCountdown#HolidayFinanceTips#bitcoin#financial education#financial experts#cryptocurrency#financial empowerment#blockchain#digitalcurrency#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Best Cash Back Credit Cards of 2025—Ranked & Reviewed 💸

TL;DR: Looking for the best way to get paid just for spending money you were gonna spend anyway? We ranked the top cash back credit cards of 2025 for Gen Z and Millennials. From 5% categories to no-annual-fee faves, we’ve got the winners, the perks, and how to actually use them without falling into debt traps. Swipe Smart, Not Hard 💳 What if your next Starbucks run earned you money instead of…

0 notes