#State Tax Incentives

Explore tagged Tumblr posts

Text

Shelving Movies for Fun and Profit

Destroying Movies for Fun and Profit

If you ask any director, screenwriter, actor, stunt performer, gaffer, editor, cameraperson or other Hollywood worker, they’ll likely tell you a variation on the same story: “My dream, ever since I was a little kid making home movies, was to one day grant Warner Bros. a deduction for a loss sustained upon the abandonment of property (reported on Form 4797).” Yes, little is more exciting for an aspiring filmmaker than the idea that—with a lot of dedication and a pinch of luck—their years of driving Lyfts and waiting tables could pay off, resulting in a star-studded line item that will be shelved forever so that a major studio can claim a tax write-off. Ah, the magic of the movies!

This practice is back in the news because the powers that be at WB have gone back to their original decision regarding the hybrid live-action/animated Looney Tunes movie Coyote vs. Acme. Despite the film testing well and generating plenty of buyer interest, a team of execs who haven’t seen the finished movie look like they’re going to “unceremoniously delete it” for tax purposes. Sorry, filmmakers, but apparently it actually looks better to stockholders if WB doesn’t actually put movies out. “Hollywood accounting” has its reputation for a reason, but it’s never been so obviously broken.

It might seem like Warner Bros. Discovery CEO David Zaslav is a true innovator of idiocy, but the man behind the permanent shelving of movies like Batgirl and Scoob! Holiday Haunt is just ramping up a long tradition of burning art to save a quick buck.

After buying up DreamWorks, Universal decided to bury the musical-comedy Larrikins instead of selling it to Netflix. Universal president Jimmy Horowitz told Tim Minchin that “It’s schmuck insurance – if someone made a lot of money out of it, we’ll look like schmucks.” That mindset certainly applies here: Coyote vs. Acme is a creation from an earlier group of WB leaders, and would naturally be on the chopping block from a spiteful new C-suite who also happens to hate movies.

Even more relevant is a case from almost 100 years ago: Charlie Chaplin literally torched the film negatives of A Woman of the Sea back in 1933, in front of multiple witnesses, so that he could claim the movie as a loss for tax purposes.

The tax code may have changed since then, but the logic remains the same: Get rid of the movie so you can avoid all the final complications and lingering expenses associated with its “useful life.” If you cut that life short, pulling off an accounting assassination, you save a little immediate cash at the low, low cost of…art. It’s always been a crass practice, more often performed by resentful new regimes or moneygrubbers who’ve found themselves attracting the gaze of Sauron’s IRS. But now shelving movies, completed films that other companies want, is picking up steam as standard practice. Actually making things is such an outdated, small-time business model. It’s far more lucrative to remove things other people made.

For example, if Disney keeps all of its movies and TV shows on Disney+, it has to pay residuals to the people who made them. They’ve also spread out the costs of a movie like Crater (which was available to watch for a mere seven weeks during the summer of 2023) over the years that the movie will ostensibly be available to the public and, therefore, creating value for Disney. Remove these movies and shows from the streamer, or better yet, remove them permanently (like Disney did with Crater), and their value can be added to an impairment charge—basically, a claim to the tax man that something a company owns has become, suddenly, worthless.

Disney recorded a $1.5 billion impairment charge last year. As Julia Rock points out, this means that Disney is claiming something pretty odd: Both “that the assets were producing so little value that it’s cheaper to destroy them than to keep them and that the assets were worth $1.5 billion.” Huh. There’s no push for anyone to justify this contradiction. The IRS isn’t asking questions. It doesn’t matter if a movie is good, or bad, or somewhere in between. It doesn’t matter if it had the potential to one day be rediscovered as a cult classic. It certainly doesn’t matter that even the worst pieces of Z-grade trash are still worth preserving as cultural artifacts. As an aside, the HBO Original Fahrenheit 451 is still streaming on Max.

And sure, you can say that you didn’t want to watch those movies anyways. Kid movies! Superheroes! Cartoons, yuck. I get it, you’re tough and cool. But one day, this will happen to something that you were looking forward to. It will happen to something that would have moved you. Something you’d have remembered fondly, something that would’ve turned your day around. But even if you’re the most jaded, anti-art, movie-hating curmudgeon, you should remember that, released or not, you’re helping pay for this scheme anyways.

“When intertwined with public funding through state and federal tax incentives, the practice of movie and television write-downs represents a troubling exploitation of taxpayer funds,” writes tax attorney Andrew Leahey. “Coupled with rapidly expanding state tax incentives, it represents a multibillion-dollar Rube Goldberg machine that culminates in a nickel being pulled from your pocket, strapped to an Acme rocket, and fired directly into the bank accounts of movie studios.”

Every loophole taken by these studios doesn’t just rob us of art. It burns the work of countless artists. It steals from our quality of life by monkeying around with our broken tax system, allowing our most powerful corporations to skip out on their bills. It picks the remaining shreds of flesh off the bones of our culture, all to further fatten a few vultures at the top.

Politicians like Texas Representative Joaquin Castro are calling for the government to “review this conduct,” but the only people who seem to have the power here are those actually creating the movies. They can boycott the guilty studios, and we can support them, but there are so few left that aren’t exploiting this practice to its most predatory extremes. Cooking the books has always been a Hollywood practice. Burning them is new.

Jacob Oller is Movies Editor at Paste Magazine. You can follow him on Twitter at @jacoboller.

For all the latest movie news, reviews, lists and features, follow @PasteMovies.

It's too bad that this Paste article was written by a Leftist, who let their biases show, ie pushing Castro, and the 'Sauron's IRS'. But otherwise, it is spot on. What the studios are doing to Intellectual Properties is a SIN. It's cruel, it's greedy and so fucking unnecessary. Just how much money do these studios and their shareholders, NEED? I better not find out that the Supernatural Planet Series was destroyed.

#Warner Bros Discovery#A Canadian Company#Universal Comcast#Paramount Global#Disney Company#Killing Art#Tax Loopholes#Wall Street#State Tax Incentives#Same Thing About To Happen In Britain#Movie Studio Expansions#Hollywood Mafia#Supernatural Planet Series#SAG-AFTRA#Academy of Motion Pictures#AMC Theaters#Has It Occurred To Studios That People Will Want To Go To Theaters Even Less In This Atmosphere?#Paste Magazine#Oscars 2024#Charlie Chaplin

0 notes

Text

Solar Water Heater Incentives: Save Money While Saving the Planet

Unlocking Solar Water Heater Incentives: Save Money While Saving the Planet

Solar water heater incentives are revolutionizing how households and businesses think about energy consumption. With rising energy costs and increasing environmental awareness, transitioning to solar-powered systems has become more attractive than ever. This comprehensive guide explores various incentives available, their benefits, and how you can leverage them to reduce costs and environmental impact.

Why Solar Water Heater Incentives Matter

Switching to solar water heaters offers significant benefits, but the initial investment can be steep. Incentives make it more affordable by reducing upfront costs and improving long-term returns. Governments and private organisations are pushing these initiatives to encourage sustainable energy adoption, driving a greener future.

Benefits of Solar Water Heater Incentives

Cost Reduction: Incentives lower the high initial costs of solar water heater installation.

Energy Savings: Decreased reliance on electricity reduces monthly utility bills.

Environmental Impact: Reducing fossil fuel dependence cuts greenhouse gas emissions.

Tax Credits and Rebates: Enjoy financial rewards through government programs.

Types of Solar Water Heater Incentives

Solar water heater incentives vary across regions and sectors, targeting homeowners, businesses, and even non-profit organisations. Let’s dive into the most common types:

Solar Water Heater Incentives

1. Federal Tax Credits

Federal governments often provide tax credits for installing solar water heating systems. In the U.S., for example, the Investment Tax Credit (ITC) allows homeowners to deduct a percentage of the system cost from their taxes.

Key Feature: Covers up to 30% of installation costs.

Eligibility: System must meet specific efficiency standards.

2. State-Level Rebates

Many states offer rebates as an additional incentive. These rebates can significantly reduce installation costs and vary depending on the region.

Example: California’s Solar Thermal Rebate Program.

Tip: Check local energy department websites for details.

3. Utility Company Incentives

Several utility companies offer rebates or special rates for customers adopting solar water heating systems.

Example: Discounts on equipment or installation services.

Pro Tip: Contact your utility provider to explore options.

4. Grants for Non-Profits and Businesses

Non-profit organisations and commercial entities can benefit from grants aimed at promoting renewable energy adoption.

Noteworthy Program: U.K.’s Renewable Heat Incentive (RHI).

How to Apply: Submit a detailed proposal outlining energy savings.

5. Financing Options

Low-interest loans and leasing options make solar water heating systems more accessible. Some governments collaborate with financial institutions to provide these facilities.

Eligibility Criteria for Solar Water Heater Incentives

Understanding eligibility is crucial to maximising benefits. Here’s what you need to know:

Energy Efficiency Standards: Systems must meet local energy efficiency guidelines.

New Installations Only: Most programs do not cover retrofits.

Residential vs. Commercial: Separate incentives exist for each category.

Application Deadlines: Ensure timely submissions to avoid missing out.

Step-by-Step Guide to Claiming Incentives

Navigating the process of claiming solar water heater incentives can be daunting. Follow these steps for a hassle-free experience:

Step 1: Research Incentives in Your Area

Use online tools or consult local authorities to identify available programs.

Tip: Websites like DSIRE provide a comprehensive database of U.S. incentives.

Step 2: Choose the Right System

Ensure your chosen solar water heating system meets eligibility criteria for efficiency and quality standards.

Step 3: Hire Certified Installers

Work with licensed professionals to avoid disqualification from incentive programs.

Tip: Ask your installer about relevant certifications.

Step 4: Submit Your Application

Complete necessary paperwork and submit supporting documents, such as proof of purchase and installation.

Step 5: Monitor Approval and Reimbursement

Track your application status and follow up as needed. Reimbursements typically arrive within a few months.

Call : +91 9364896193, +91 9364896194 Jupiter solar to buy solar water heater

Top Programs Offering Solar Water Heater Incentives

1. Residential Renewable Energy Tax Credit (U.S.)

Covers 30% of installation costs.

Available for both primary and secondary residences.

2. Canada’s Greener Homes Initiative

Provides grants up to CAD 5,000.

Supports energy-efficient home upgrades.

3. Australia’s Small-Scale Technology Certificates (STCs)

Encourages renewable energy adoption.

Reduces upfront costs by offering tradable certificates.

4. European Union Renewable Energy Grants

Wide-ranging incentives under EU Green Deal.

Focused on reducing carbon footprints.

Common Misconceptions About Solar Water Heater Incentives

1. Too Complex to Apply

Many believe the process is overly complicated. In reality, most programs offer clear guidelines and support.

2. Limited Availability

Contrary to popular belief, incentives are widely available, covering diverse regions and sectors.

3. Only for Large Systems

Incentives cater to systems of all sizes, from residential to industrial setups.

Maximising Your Savings

To get the most out of solar water heater incentives, consider the following:

Bundle with Other Programs: Combine federal, state, and utility incentives.

Perform Regular Maintenance: Ensure your system operates efficiently to maximise savings.

Educate Yourself: Stay updated on new programs and eligibility changes.

Solar Water Heater Incentives

1. What is the average cost of a solar water heating system?

The cost typically ranges from $3,000 to $7,000, depending on system size and complexity.

2. How much can I save with incentives?

Savings vary but can cover 20-50% of total installation costs.

3. Are solar water heaters eligible for net metering?

No, net metering generally applies to solar photovoltaic systems, not solar water heating systems.

4. Can I apply for multiple incentives?

Yes, you can combine federal, state, and local incentives to maximise benefits.

Conclusion: Your Path to a Sustainable Future

Solar water heater incentives are a game-changer for anyone looking to adopt renewable energy. By reducing costs and offering financial rewards, these programs make sustainability more achievable for households and businesses alike. Take advantage of these opportunities to save money while contributing to a greener planet.

Ready to make the switch?

#solar water heater#solar energy#bangalore#india#solar#solar water heaters#solar water heating#bengaluru#solar heater#water#solar water heater incentives#solar energy benefits#renewable energy savings#federal tax credits#state rebates#utility company incentives#green energy#energy efficiency#solar water heater programs#sustainable living#solar water heating systems#eco-friendly energy solutions#tax credits for solar#solar incentives guide#renewable heat incentive#affordable solar options#save with solar#solar energy for homes#go green with solar#reduce energy costs

2 notes

·

View notes

Text

I dipped work a bit early to grab a Coffee and my darling dear barista bud was there. Love that dude. Truly the human embodiment of daisies stuck all in a big bushy beard. And I got a tasty little rose & lavender latte and walked about a wee bit in the sun (but not much bc charred body of fucking christ it is HOT wtf) and I got to work from home with a kitty on either side of me

Turns out my car insurance is getting cheaper (saving like $800 across the year)

And now I’m going to do some more d&d prep and listen to my silly little audiobook

Good day

Real good day

#OH AND!!!!!!!#was granted a judgment against Evil Company Of Ill Repute at work today#Like company is Bad and Shitty and is widely known to be#but in particular rolled up to my state/city a few years back with crazy tax incentives and fucked up zoning exemptions#and has been bitching and moaning for more or threatening to leave#Hate them for many reasons and I’m glad they owe mine client [large sum of US Dollars] now for [bad acts and torts]#fuckem#:^)

0 notes

Text

Where to Shoot in 2025 for Maximum Tax Incentives and Rebates

Choosing where to shoot your film isn’t just about scenery or local crew. It’s a financial strategy. States and countries around the world are offering tax credits, cash rebates, and grants to lure productions. The right location can give you back 20–40% of your qualified spend. That can mean more money on screen, less stress in post, and a real shot at breaking even. But not all incentives are…

#Film Finance#Film Location Scouting#Film Rebates#Film Tax Incentives#Global Filmmaking#Indie Filmmaking#International Film Strategy#Production Budgeting#State Film Credits

0 notes

Text

I know it is the 'correct" way to plan taxes, but it's annoying to spend a lot of effort doing my taxes and getting a $25 refund to owing $100

#i always consider my tax refund the incentive to drive me to do them#there is no incentive to do my state taxes though#except for the multiple consequences if i don't#adulting

1 note

·

View note

Text

Exploring State-Specific Tax Incentives For Small Businesses

Small businesses are the backbone of the economy, contributing to job creation and innovation. To foster growth and sustainability, many states offer a variety of tax incentives tailored specifically for small businesses. Understanding these state-specific incentives can help entrepreneurs maximize their tax benefits, improve cash flow, and reinvest in their companies. Here’s an overview of common tax incentives and how they can benefit small businesses.

Tax Credits

Many states provide tax credits designed to encourage small business growth. These credits can reduce the amount of tax owed on state income taxes, effectively lowering the overall tax burden. Common types of tax credits include:

Investment Tax Credits: Available for businesses that invest in qualified property or equipment, these credits encourage capital expenditures.

Job Creation Credits: Offered to businesses that create new jobs in specific industries or underserved areas, these credits can significantly offset payroll taxes.

Research and Development (R&D) Tax Credits: Some states incentivize innovation by providing credits for R&D activities, allowing businesses to reclaim a portion of their expenditures in this area.

Sales and Use Tax Exemptions

Several states offer sales and use tax exemptions for small businesses purchasing equipment, supplies, or materials. This incentive helps lower the initial costs associated with starting or expanding a business. For instance, states may exempt certain industries, like manufacturing or agriculture, from sales tax on machinery and raw materials. Small businesses should check their state’s specific exemptions to determine eligibility.

Property Tax Abatements

To encourage investment and development, many states and local governments offer property tax abatements or exemptions to small businesses. This can be particularly beneficial for businesses relocating to or expanding in economically challenged areas. These abatements can significantly reduce the cost of operating a business and provide cash flow relief during critical growth periods.

Grants and Loan Programs

In addition to tax incentives, many states provide grants or low-interest loan programs aimed at supporting small businesses. These programs often target specific industries or economic development goals, such as promoting clean energy or revitalizing urban areas. Unlike loans, grants do not require repayment, making them an attractive option for businesses seeking funding for startup costs, expansions, or innovative projects.

Workforce Development Incentives

States often provide incentives for businesses that invest in workforce development and training programs. These incentives can include tax credits for training expenses or grants to help cover the costs of employee training. By investing in employee development, small businesses can improve productivity and retain skilled workers, ultimately benefiting their bottom line.

Specialized Incentives for Targeted Industries

Certain states develop specialized incentives for industries deemed essential for economic development, such as technology, healthcare, or renewable energy. These incentives can include tax credits, grants, or grants specifically designed for businesses in these sectors. Small businesses operating in targeted industries should investigate state-specific programs that could provide significant financial benefits.

Navigating State-Specific Incentives

To take full advantage of state-specific tax incentives, small business owners should:

Research Available Programs: Start by exploring the state’s economic development agency website or contacting local chambers of commerce for information on available incentives.

Consult with Tax Professionals: Working with tax professionals offering tax planning for companies in Fort Worth TX can provide valuable guidance and ensure compliance while maximizing available benefits.

Stay Informed: Tax incentives can change frequently, so staying informed about new programs or changes to existing ones is essential for optimizing tax strategies.

Conclusion

State-specific tax incentives play a crucial role in supporting the growth and success of small businesses. By understanding and leveraging these incentives, small business owners can reduce their tax burden, enhance cash flow, and invest in future growth. As the landscape of tax incentives continues to evolve, small businesses should proactively explore available opportunities to capitalize on the benefits that can drive their success.

0 notes

Text

If one were to count to a million, one number per second, it would take, 11 days, 13 hours, 46 minutes and 40 seconds, that is if you continuously count all 11 and half days without rest.

If one were to count to a billion, one number per second, it would take 31.7 years, if you were to count 24 hours a day. Yet if you were undertaking this you’d need to sleep occasionally. If you were to count 16 hours a day, leaving room to sleep, it would take you roughly 48 years.

There’s a thousand millions in a billion, a million millions in a trillion, a thousand billions in a trillion.

There was a point in time where both Bezzos and musk net worth was nearly a trillion dollars. If they wanted to count just one billion of those dollars by hand it would take them 48 years to accomplish.

Elon musk makes $8 million a day from government subsidies, this is prior to him eliminating any competitors from the inside with doge. The average senior, who busted their butts for 50 years paying into their social security, Medicare, state and federal taxes, makes $65 a day.

The absurdity of it all is staggering. That these men who found their niche in business, bezzos with an online bookstore, right as the internet was taking off, and musk who’s father exploited black South Africans in his jewel mines, gave Elon the capital to invest in PayPal, to which he sold, bought an existing electric car company, used the carbon credits, and federal incentives, to make hundreds of billions of dollars, both pay the bare minimum in taxes, with Tesla paying nothing 3 out of the last 5 years. You and I, people who sometimes have to scrounge change to put gas in the tank, who struggle to pay for housing, groceries, insurance, try to enjoy life, we pay almost 40% of our income to taxes, social security and Medicare/medicaid.

How the f*ck is that acceptable!? Let alone celebrated?! You think these ultra rich know what it’s like to have to make decisions on whether hey can afford lunch or if that needs to go into the gas tank to get to work to pay to live?! WTF?!

Greed, selfishness, arrogance, these are the fuel that feeds the fire that leaves the middle class stuck, struggling and frustrated. But they have convinced so many that it’s the political opposition that is the cause of their inability to get ahead, or immigrants, of people of color, or trans people, gay people, stoking division to continue hoarding wealth like some sick addiction.

There’s not an infinite amount of capital in the U.S. economy. There’s only X amount. If these greedy robber barons stockpile the majority of it, that leaves a minuscule amount for the rest.

24 hours a day counting one number per second, it would take 32 years to count 1/200 of Bezzos and musk’s fortune.

TAX THE RICH!!!!

#elon musk#doge#social security#jeff bezos#blue origin#donald trump#Tesla#politics#oligarchy#brolargarchy#maga#maga 2024#trump is a threat to democracy#traitor trump#republicans#democracy#news#the left#freedom#free speech#no kings#impeach trump#gop#gop hypocrisy#middle class#taxes#trump is a criminal#trump is a liar#us politics#us government

3K notes

·

View notes

Text

Unlocking Savings: The Role of Tax Incentive Advisors in Maximizing Business Benefits

Tax incentives can be powerful tools for businesses to minimize their tax liabilities and maximize their savings. However, navigating the complex landscape of tax laws and regulations can be daunting without expert guidance. This is where tax incentive advisors come in. In this blog post, we’ll explore the invaluable role these advisors play in helping businesses unlock savings and thrive in today’s competitive landscape. https://abbottincentives.com/

#Work Opportunity Tax Credits#Grants To Train Employees#Business Tax Credits#Local Incentive Management Experts#state incentive programs

0 notes

Note

What, precisely, is fallen London, and how can I play it? Ive been told it's a browser game, will it work on my phones browser or only my computer's?

SWEEPS EVERYTHING OFF MY DESK. SLAMS MY HANDS ON THE COUNTER. you're in luck because advertising this game is apparently my specialty.

fallen london is a free browser game that works on anything with an internet connection!! laptops, phones, tablets, the decade old 3ds you have stashed in the back of your closet- if you can open a web browser, you can run fallen london. the UI obviously differs between desktop and mobile, and desktop has the benefit of extensions that can make your life marginally easier, but that's all a strictly optional affair.

as for the game's actual contents; fallen london is a text-based horror game closely reminiscent of classic "choose your own adventure" books. you play as a new arrival to an alternate history version of victorian london that now flourishes in a deep, dark, marvelous (and more than slightly eldritch!) cavern known as "the neath", with the goal of making your name and ultimately pursuing one of the four possible ambitions that brought you here to begin with. along the way you encounter a wide variety of strange and inexplicable things, including but not limited to;

men with the faces of squid (who are not truly men)

actual real soul-stealing devils (who originate from Actual Real Hell, which is also london's next door neighbor)

snakes that are eternally bound to the realm beyond mirrors (who have an infamous feud with sapient talking cats)

treacheries of time, law, and all that which the gods hold dear (including the ability to bypass death itself)

sirens who are convinced they're dead (in a place where, as stated, death is easily bypassed)

sentient landmasses that get REALLY annoyed if you don't pay your taxes on time (and are also single and ready to mingle)

fabric that is not fabric (which is held in quite high value by certain giant bat monsters)

spiders that eat eyeballs (but are, fortunately, easily distracted by shakespeare)

genres of colors you didn't think possible (in seven fantastical flavors!)

batkissing (not canonically, but in our hearts)

batfucking (this is, somehow, marginally more canon than the above thing)

batmarriage (no.)

batdivorce (in comically large spades)

The Hat Man (who's in love with and yearns to become like a sentient island)

gay people (a lot of them)

trans people (also a lot of them)

doomed love, in all possible forms (as well as those who try and collect it)

this thing (this thing)

and last- but certainly not least-

a pitiful hope that perhaps, just perhaps, all shall one day be well. (even when you know it won't be.)

it's a game with lore as deep as the ocean, and a staggering wordcount (4.5 million!) to boot. it's not perfect, but it's something i've grown to love deeply, and in my experience? if it doesn't click for you, that's understandable. but if it clicks for you, it really does click for you. i recommend it to anyone and everyone who so much as looks its way. who knows! it may just surprise you 🦇☀️🦀🌃

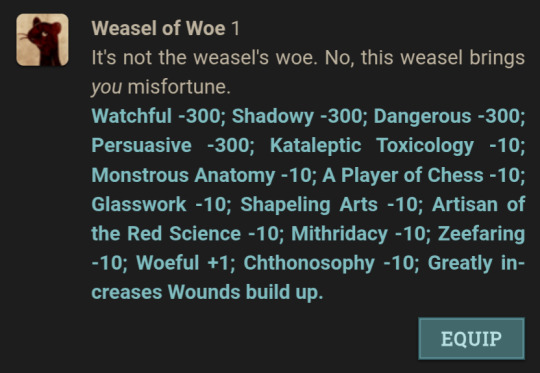

as a further incentive, here are some out-of-context items and excerpts:

as stated, you can play it right now for free at fallen london dot com. there is a subscription and a small bounty of microtransactions on offer if you want to support the development team, but at no point is this ever required, and you will be playing for years before you reach the end of stuff to accomplish. all major content updates are free and available to all players, and FOMO to this day remains virtually non-existent. as once again stated, the browser specs are non-existent. if you can run google, you can run fallen london.

so head on down!! give the neath a try!! follow admiralty orders and dump a bunch of bombs directly into the zee (underground sea) whilst accidentally waking up a giant grieving sea urchin that screams fire and violently pursues your demise!! (that's what we're all doing right now, anyway.)

if the browser game isn't for you, there's also other outlets with which to explore the universe. you can find the spinoff games Sunless Seas, Sunless Skies, and Mask of The Rose available to purchase right now on steam, and there's recently been a very successful kickstarter to adapt the game into a TTRPG. it looks very cool so far. im very very very excited for it :)

in lieu of having to come up with a conclusion for this ask, im instead going to direct you to the MoTR stupendium song (which you'll find linked below). it says far more and advertises far better than i could ever dream of. also, it's a straight bop, and "all ends/swords pens" has lived rent-free in my brain for months.

youtube

welcome to the neath, delicious friend. we hope you enjoy your stay ❤️

1K notes

·

View notes

Text

NEW PEANOR AU YYYYAAAAYYYYYYYYYY!!!!!!!!!!!!!!!!!! dm DIVINE LIBERATION AU!!!!!!!!! deets below cut as always

im gonna preface by saying idk anything about the christianity lore and im not all too interested in learning it either. i was a christian for much of the early years of my life and i dont care much to go back to that era LMFAO most of this au is js using christian imagery bc the christians lwk ate so hard w their religious imagery . neon genesis evangelion type beat . anwyays moving on.

a bit obvious but i gotta start my lore dump somewhere. dm is a priest in this au and petey is a demon

petey is a fallen angel . as in he was born an angel but he was expelled from heaven

in this au there is corruption in the heaven and hell system . god is dead type beat. but not rlly . maybe dormant? maybe god has lost faith in humankind and has gone into hibernation? god cannot exist without faith smth smth Aaanyways.

that being said petey only got expelled from heaven for reasons almost entirely out of his control. he is still graces son and im thinking grace got involved in some anti heaven stuff bc yk heavens system was becoming more and more fucked up . so i reckon when they found out they executed her and as they were in the process of executing her petey tried to protect her but obvs he couldnt be he was a kid. so they executed her and expelled petey for being a traitor . this all happens when peteys like the human equivalent of 12-14 years old maturity wise

anwyays that being said lil petey is an angel. considering when petey was his age he was still an angel . i will go more into lp later

petey is sorta in denial about falling at first bc hes scared but eventually he just leans into the demon thing bc he feels helpless (parallel to canon petey) and just causes a shit ton of trouble. his causing trouble is a way of protecting himself Essentially

eventually he causes a little Too much trouble and he gets turned into a powerless imp by the higher up demons . hes doomed to stay in that form unless hes able to corrupt a priest whos been causing a lot of trouble for the demons . Guess who this priest is.

dms accident with knight still happened (probs happened as a result of one of peteys Funny Doings but not as a direct result.) and dm copes with it by seeing it as a holy act of salvation or wahtnot. like he was saved by gods blessing and by knights sacrifice. half of this is bullshit since as i said god is in a hibernation state. so it was really just All knight. but anyways

knight was a priest before this and its the only life that dms ever known so he kinda just continues with it . he is lwk a better priest than knight was (he got a lot of secondhand religious education just from being around knight so much and hes smarter than knight) so the church just lets him take knights place essentially.

dm is just more calm and collected in this au as well . he found out pretty early on that him being too energetic got knight into trouble which made him sad so he learned to control himself a bit . there was also the threat of him being taken away from knight if he acted out too much which was the worst case scenario for him so , yeah another incentive to behave himself .

anwysays a lot of petey and dms interactions initially are pretty lighthearted . book1 and 2 core. its js petey annoying the hell out of him and dm trying to ignore him LMFAOOOOO this is how petey gets the genius idea to try and summon a clone so he can be more effective in bothering dm . this is how lil petey is created LMFAAOAOOOOO

for this au peteys denial about being related to lp in any way shape or form is waaaayyy worse bc he still has a Lot of trauma from when he was in his angelic state . and he doesnt wanna associate with angels or heaven in any capacity . so even looking at lp is hard for him.

peteys still able to go into his full demon state, but only for brief periods of time . its also super physically taxing so he has to be really careful about it or else he could abruptly change back into his imp form when hes in the middle of danger

eventually petey "corrupts" dm as in dm just acts like a Human (this is also a criticism on the inhumane standards placed on people and how oftentimes humans are shamed for acting like Humans because theyre being held to some holy standard for the promise of a perfect afterlife . using christianity as a proxy for this since christianity is the shining example of doing this a lot) . im thinking its him going against an angel or holy figure to protect petey and/or lil petey

im thinking the overarching plot of this story is intimately tied to lil petey. the plot starts off with petey trying to corrupt lil petey and turn him into a demon so that he can have a little minion .

this attempt to corrupt lp continues even after petey starts to see him more as his son because then hes like well if im a demon then my son should also be a demon . hes also starting to get scsred of what heaven might do if they find out about him . bc as far as peteys aware once heaven gets wind of lil peteys existence theyd either execute him for being an anomoly or just take him away to raise him in heaven since hes an angel. both scenarios are likely (knowing heaven) and its also literlaly the worst thing that could possibly happen. so he slike okay if i just turn lp into a demon then theres no reason for heaven to take him away .

((semi unrelated but this is a parallel to canon to me. this is js my personal headcanon but i think peteys so obsessed eith having lil petey turn out evil in the earlier parts of the series because for him acting evil was a self defense tactic. its a way to protect himself. so by having lil petey act evil hes essentially teaching him how to protect himself in the only way he knows how . when he was rejected by the world and left all alone he was able to stay alive by being a criminal. and past the nonchalant "u have to be evil just because" facade i truly do think it was . again petey subconsciously teaching lp to protect himself in the way that protected HIM from the world. so yeah ))

i think petey probs doesnt tell dm about any of this because dm is a priest . petey fully believes that if dm finds out about lil petey being his son and thus being technically disconnected from the heaven system he would try to alert heaven about it through some mortal means . so for a lot of the earlier parts of the plot dm thinks that lp is a little angel who just kinda comes down to earth from time to time . hes totally unaware that he and petey are related . yes they look almost the same but an angel and a demon being related is totally unprecedented . so he doesnt even consider it

petey also makes sure that lil petey keeps his mouth shut about them being related by telling him that if dm ever finds out that hes his dad then he might never see him again .

but what petey fails to realize is that dms loyalty doesnt lie with the church . it lies with knight . his loyalty is far removed from any kind of institution . so when he evtnually does find out (i reckon through some way out of peteys control) and petey basicaly begs him not to tell heaven because of systematic issues and the possibility of lp getting executed dm immediately agrees. at this point hes close enough to lp and petey by extension that hes willing to forgo his loyalty to the church which only really existed because of knight in the first place . everything he had done religion wise up until this point was bc of knight . so if hes asked to choose between what knight might have wanted vs the real tangible being that is begging him not to tell heaven then he is going to choose the real tangible being . thats his family dawg.

essentially for dm the real living thing happenign in his world is infinitely more important than the moral system that hes been taught .

plot basically then goes to heaven finding out and sending angels to try and find lp as petey and dm get up to shenanigans to hide him . i reckon hell also gets involved in it . heaven and hell are "opposites" but theyre hand in hand when it comes to their shit polarized system . and lil petey as an angel being petey the demons son goes against this system and undermines their power . so both heaven and hell arent all too happy about it .

the climax is the event where dm is "corrupted" like i mentioned above . i reckon this is the event that brings god out of hibernation . smth smth free will smth smth complete and total rejection of heaven by one of its servants for a holy purpose smth smth . you feel me ? and i reckon the angels are abt to finish them off or smth and god is like HEY. STOP THAT. 👎👎👎👎

petey does not become an angel again at the end of the plot. dm does not become an angel or a demon or anything like that . he just stays a mortal being. and he still stays loyal to religion in knights memory despite being friendly with a demon, despite defying the church for said demon. the whole point is that this polarization of identity bullshit is stupid when humanity is so diverse . theres nuance snd complexity and its literlaly impossible to categorize people into discrete identities. thats not how it works

i reckon dm doesnt stay a priest just because that would require adhering to their standards which dm does not fuck with . so he probs just goes and finds some other job while staying religious. smth smth religion is not inherently evil its only the way that its used by hateful people

holy fuck this might be one of the longest lore dumps ive ever done about an au. god bles. LMFAOOOOOOOOO

433 notes

·

View notes

Text

"Evening is approaching at the confluence of two rivers in the Bay of Bengal — the Payra and Bishkhali. Still, the fishermen at the pier in Gazimahmud village are busy preparing for the next day’s work — every boat here is now illuminated by small solar-powered devices.

“Solar power is now not only in homes, it is also at our work. Now, there is no rush to return home when it is evening,” says fisherman Altaf Hossain, who is arranging fishing nets in his boat so that he’s ready for tomorrow.

Hossain is now able to work longer hours and boost his income, and he doesn’t have to worry about his wife and kids at home at night. The children sit under a solar-powered light to study, while Hossain’s wife, Roksana Begum, does various chores.

“The sun gives us light both during the day and at night,” Begum says. “It has made our lives much easier and has changed our livelihoods.”

Gazimahmud village is about 30 kilometres away from Barguna Sadar, the southernmost district of Bangladesh. A winding road leads to this village, where the sea and two rivers meet. The people of this remote community still remember the devastation caused by the powerful Cyclone Sidr in 2007, when 30 locals died. When the storm hit, it was difficult for many to reach safety as the entire area was dark. Now, thanks to most of the houses in the village having solar power, the community feels better prepared for future disasters.

“We have more faith in solar power, because, when a storm comes, the electricity connection may be disconnected or the power may be turned off, but solar power helps us to find a safe shelter by showing us the way,” says resident Monir Hossain.

Unprecedented success

Bangladesh has implemented the world’s largest off-grid solar power programme, with 20 million people across the country benefiting, according to the World Bank.

What began as a pilot project in 2003, involving 50,000 households, ultimately reached 14% of the population within 15 years, while some 200,000 rural businesses and religious facilities benefited from the Solar Home Systems (SHS) initiative as well.

The programme, which officially ran until 2018, was implemented in partnership with the private sector. Among other measures, the state provided generous incentives, such as tax breaks, for rooftop solar installers, and also focused on ensuring financing mechanisms were in place.

Together with 56 partner organisations, the government installed 4.1 million solar systems in remote areas by 2018.

According to the World Bank, the initiative has improved health and living conditions — including by reducing the use of kerosene lamps and thereby tackling indoor air pollution — and boosted school attendance. It also led to household solar becoming “a credible electricity source”.

“The Solar Home Systems programme has shown that millions of dollars raised internationally can be efficiently leveraged to provide loans of as little as $100 in remote corners of the country, enabling a rural household to purchase a solar home system,” according to Amit Jain, a senior energy specialist at the World Bank...

To clean up its power grid and contribute to the fight against climate change, Bangladesh plans to install 4.1GW of renewable energy capacity by 2030, up from around 1.2GW today."

-via The Progress Playbook, March 10, 2025

#bangladesh#asia#solar power#solar panels#solar grid#renewable energy#green energy#solar energy#solar pv#climate change#climate action#climate resilience#natural disasters#electricity#electrification#infrastructure#good news#hope

628 notes

·

View notes

Text

“If you’re worried about the financial difficulties that come with being nonpartnering, you could always just get married platonically for tax benefits!” Respectfully, I would rather Saw (2004) my own foot off than be married, and the fact that the state uses legal and financial incentives to promote monogamous romantic relationships to the public is not enticing to me but is, in fact, an active deterrent to me. I won’t fault anyone for trying to game the system to get by, but I have no interest in feigning alloromanticism or romance favorability to gain the benefits that may come with the government giving its stamp of approval on my personal relationships.

344 notes

·

View notes

Text

Dandelion News - March 8-14

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

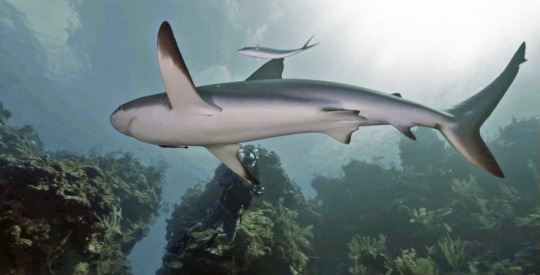

1. Caribbean reef sharks rebound in Belize with shark fishers’ help

“Caribbean reef shark populations have rebounded beyond previous levels, more than tripling at both Turneffe and Lighthouse atolls[…. The recovery] arose from a remarkable synergy among shark fishers, marine scientists and management authorities[….]”

2. Landmark Ruling on Uncontacted Indigenous Peoples’ Rights Strikes at Oil Industry

“[T]he Ecuadorian government [must] ensure any future expansion or renewal of oil operations does not impact Indigenous peoples living in voluntary isolation. [… E]ffective measures must be adopted to prevent serious or irreversible damage, which in this case would be the contact of these isolated populations,” said the opinion[….]”

3. America's clean-energy industry is growing despite Trump's attacks. At least for now

“The buildout of big solar and battery plants is expected to hit an all-time high in 2025, accounting for 81% of new power generation[….] The industry overall has boomed thanks to falling technology costs, federal tax incentives and state renewable-energy mandates.”

4. Study says endangered Asian elephant population in Cambodia is more robust than previously thought

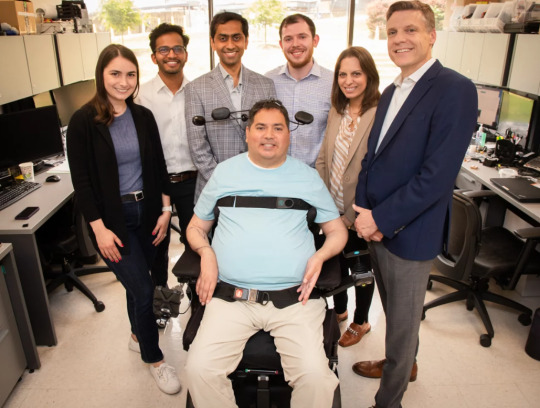

“A genetic study of Asian elephants […] reveals a larger and more robust population than previously thought, raising hopes the endangered species could slowly recover. […] “With sufficient suitable habitat remaining in the region, the population has the potential to grow if properly protected,” the report concludes.”

5. Scientists are engineering a sense of touch for people who are paralyzed

“[Engineers are] testing a system that can restore both movement and sensation in a paralyzed hand. [… A]fter more than a year of therapy and spinal stimulation, [… h]is increased strength and mobility allow him to do things like pet his dog. And when he does, he says, "I can feel a little bit of the fur."“

6. Florida is now a solar superpower. Here’s how it happened.

“In a first, Florida vaulted past California last year in terms of new utility-scale solar capacity plugged into its grid. It built 3 gigawatts of large-scale solar in 2024, making it second only to Texas. And in the residential solar sector, Florida continued its longtime leadership streak.”

7. Rare frog rediscovered after 130 years

“The researchers discovered two populations of the frog[….] "The rediscovery of A. vittatus allowed us to obtain, more than a century after its description, the first biological and ecological data on the species.” [… S]hedding light on where and how they live is the first step in protecting them.”

8. Community composting programs show promise in reducing household food waste

“The program [increased awareness and reduced household waste, and] also addressed common barriers to home composting, including pest concerns and technical challenges that had previously discouraged participants from composting independently.”

9. Pioneering Australian company marks new milestone on “mission” to upcycle end-of-life solar panels

“[…] SolarCrete – a pre-mixed concrete made using glass recovered from used solar panels – will form part of the feasibility study[….] A second stage would then focus on the extraction of high value materials[…] for re-use in PV and battery grade silicon, [… and] electrical appliances[….]”

10. Beavers Just Saved The Czech Government Big Bucks

“The aim was to build a dam to prevent sediment and acidic water from two nearby ponds from spilling over, but the project was delayed for years due to negotiations over land use[….] Not only did the industrious rodents complete the work faster than the humans had intended, they also doubled the size of the wetland area that was initially planned.”

March 1-7 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#shark#fishing#nature#ecuador#first nations#oil drilling#clean energy#solar energy#solar power#elephants#elephant#conservation#animals#science#medicine#paralyzed#florida#solar panels#frogs#endangered species#endangered#compost#community#australia#recycling#beaver#habitat restoration#beaver dam

148 notes

·

View notes

Note

why do you disbelieve in the power of the market? friedrich hayek. friedrich whats the other man. milton friedman. murray bothbard

Because the market is inefficient in a number of ways.

The first, and most traditionally socialist reason is allocation- private ownership of the means of production requires that a large amount of wealth go to those who already have wealth, so that wealth tends to concentrate, leading to vast inequality. This is an inefficient allocation of resources because someone making £25,000 a year benefits far more from an extra £1,000 than someone making £250,000 a year.

Friedman would not have any counterargument here, and would just say this is an irreconcilable difference in values. Hayek would argue that the wealth is deserved because it is 'earned'. I would argue that there is no meaningful sense in which a landlord who inherits their property is 'earning' their money, so there is no moral justification for them to have that money, certainly not one that outweighs the imperative to alleviate the poverty of their tenants.

This vast inequality, combined with systems like private schooling and billionaire financing of election campaigns, make governance much worse, as the political leadership will tend to come from the upper middle class or upper class, and will be heavily incentivised to court the support of the super-rich. This means the concerns of the poor get systematically neglected, and leftist reforms- even ones that would benefit everyone- become far harder to push though. This is in addition to concerns about general competence, which gets eroded by corruption and by the political and media leadership all coming from the same background who are benefiting from the way things currently are.

Friedman and Hayek would say that the solution to corruption is a smaller government, so that the government is less powerful and their is less incentive to corruption. I think this suffers from the same kind of 'end of politics' conceptions as many leftists- there is always going to be wrangling over the size of the state, as long as there are states, and there is always going to be the possibility of regulating industries that are not nationalised, so every industry is always going to be within the purview of corruption- the current size of the government can't change that. Hayek would say that means the government is already involved in the kind of unacceptable arbitrariness that he says is The Road To Serfdom. I, like Keynes, would say that Hayek failed to realise that the state of affairs Hayek warned about in his book is government-as-usual.

The market has huge problems with externalities- economics textbooks tend to portray these as small exceptions to the usual state of the economy, which can be easily fixed with a small tax/subsidy, but they are in fact large and omnipresent. The most obvious being climate change- an economy that decarbonised at the socially optimal rate would look very different to our current economy, including having very different prices. This means that the effect of carbon externalities is not just the price of energy being a little bit off, but all the the prices in the economy being a long way off.

And climate change is only one of these externalities- resource depletion and pandemic risk are other huge externalities, but there are uncountable smaller, but still important, externalities. Externalities are supposed to be addressed by Pigouvian taxes, so that a market system can still produce efficient outcomes, but the size of the problem, and the lobbying interest in it, makes it practically extremely difficult within a political environment that is used to giving primacy to the market (as opposed to e.g. China, which is still capitalist, but has an easier time making changes like this).

Moreover, many externalities can't be addressed within markets because they are too hard to measure in order to tax them. There are many more minor pollutants, but there are also things like human capital formation at work- companies are heavily incentivised to under-invest in training for their workforce, like the beauty and character of an area, and like the impact on surrounding infrastructure.

Friedman would argue that these externalities can be addressed by the market itself if you just expand property rights, but this is impossible because you can't give a company ownership of the air, or ownership of a stake in the health and skills of workers.

Hayek would correctly argue that the market doesn't reach an optimum anyway, as it is constantly changing, and instead the achievement of the market is in being able to dynamically respond to new circumstances, and account for information that would not be available to central planners. He would argue that non-market methods of addressing externalities would undercut this. I would argue that the size of these externalities is large enough that any concerns about how dynamic the market is are less socially consequential, and also that the sluggishness of many non-market methods to respond to changes in circumstances is not set in stone, and is a consequence, in part, of a culture of market primacy and of regulations aimed at preventing adverse impacts on market actors or, ironically, at preventing government waste.

Bothbard would sit on his bals then say ooh I sat on my bals.

An important case of externalities is land value- an acre of land in central london is very valuable not because the soil is very good quality for crops, or because of the weather conditions, but because of the easy access it provides to central London- the value is created by activities in the surrounding area, and was not compensated. This means most of the value of most properties in the UK come from externalities, amounting to an enormous misallocation of resources (in addition to the component of house prices that comes from lobbying and voting to keep house prices high).

Specifically, it is unnecessary to add housing to an existing town, which might not appreciate it, when you could just build a new town, and once built, the value of those houses would be just as high as the housing in an existing town, even though the land started out cheaper than land in an existing town. But market actors rarely have the resources to build an entire town from scratch, much less an entire city, so they are stuck adding to existing towns.

This creates problems like gentrification, where a wealthy town has to be gradually built on top of a poorer town, rather than just built somewhere else, because it can only be built gradually and the initial developments wouldn't be profitable otherwise. It leads to megacities, that have grown far past the point that any residents would like, and to regional inequality because one city will grown largest, have the highest land value, and so receive the most new developments. The market gets stuck going further and further along one path and fail to explore travel new ones.

Basically, the market can only optimise 'locally'- what increases value by the largest marginal increment right now, ignoring effect on adjacent land. Whereas planning can take a global approach, noticing that one house on its own in the middle of nowhere isn't worth very much, but once all the rest of the houses around it have been built, an entire extra town in a new location is more valuable than an extra town sized addition to an existing city that is already struggling under its own size. Admittedly this might not be a problem in the future due to increasing adoption of working from home.

Capital markets are inefficient in terms of social welfare- if they were efficient, investors would be asking about how much the firm benefits its stakeholders- or equivalent questions phrased in terms of prices. However the questions tend instead to be about barriers to entry and ability to build a brand, and on the stock market stocks get valued based on very limited information that largely ignores anything of relevance to social welfare, and encourages short-termism, as long-term strategy is difficult to commercially trade on. This leads to an enormous degree of misinvestment, which is rarely recognised, and I am being quite heterodox in claiming that it exists. Admittedly it is very difficult to invest well, with respect for various social priorities over long timescales- but in ignoring these priorities entirely, capital markets do a far worse job than intentional economic planning, or some hybrid system would.

Friedman would reject the possibility of so much misinvestment, at least once externalities are priced into the market, so that this is reducible to just the problem with externalities. He would argue that e.g. correctly predicting that a company is overvalued given the likely increase in the price of carbon over the coming decades and the difficulty they will have in adapting their business model to lower carbon methods would allow you to beat the market- to make above-market returns. Thus, if anyone is able to predict this, it will get arbitraged out, and the market will incorporate that knowledge into its prediction- making the capital market very accurate in valuing the company.

However, making money on a prediction like this requires consistently shorting that company's stocks over decades, waiting for the market to realise it was overpriced- and when they finally do, the mispricing will be small relative to share price. This uses up a lot of liquidity, and likely manpower, for returns that are only slightly better than the market in expectation, and have a high risk, as all sorts of other things will be affecting that company's share price at the same time. This makes it very difficult to diversify and get the reliable returns that investors want. Hence why more short-term trading based on shallower financial indicators tends to be so favoured, and why mispricing can be so persistent. Bothbard would accuse a butterfly of violating the non-aggression principle for landing on his face and shoot it.

The market will fail to provide services to niche markets- e.g. a free market would not provide disability accommodations for buses, as the small increase in demand would not pay for the costs of adaptation. In theory disabled people should be much more willing to pay, so that buses could charge disabled people far more, and then this would pay for the accommodations, but disabled people don't have that kind of money. This also applies to accessibility in shops, on websites, etc. so that the market has a strong tendency to systematically exclude disabled people from every aspect of life. Similarly, the market would not provide postal service to those in remote areas.

Friedman would argue that this is efficient- the service isn't provided because the willingness to pay is exceeded by the cost of provision. But lack of universal provision causes a lot of problems- what if someone needs to receive a legal summons? You end up having to design alternative and more complicated procedures for a wide range of things, which ends up being more expensive and less just than universal provision.

Other specific examples are provision of allergen-free food, niche medicines, and lawyers for the poor.

The market similarly has a tendency to exclude poor people from every aspect of life. If someone becomes homeless, for example, it is disadvantageous to hire them, and if someone doesn't have a job, no one will rent to them. The poor also have no ability to hire lawyers if they are wrongfully evicted, or injured as a result of workplace policies, or if they are a victim of crime. In absence of state systems to protect the poor they become an underclass who can be preyed on without repercussion. This similarly applies to people fleeing domestic abuse, or who were stay-at-home partners in a marriage and don't get awarded compensation in a divorce.

The market cannot deal well with services with large fixed costs, like telecommunications, and especially information including scientific discoveries. This is because to meet their revenue requirements, private corporations need to charge at above their marginal cost, which results in an inefficient level of production. In cases like social media websites, marginal social cost may actually be negative, due to network externalities. With scientific discoveries and artistic creations, this is addressed through intellectual property, deliberately turning the market into a monopoly. I think this is a bad approach for reasons I have outlined elsewhere. I could add that intellectual property has worrying fee speech implications.

The market involves a lot of waste, like advertising, loyalty programs, keeping things secrets because they would look bad to customers- e.g. a consulting firm not letting a client know how simplistic their 'methodology' really is, and the amount of cost involved in managing transactions and protecting property rights. This could largely be dispensed with if an industry was managed through non-market approaches, e.g. if medicine was free there would be no need to wait in line to pay at the pharmacy for 20 minutes every time I have to pick it up.

This is just a pure social saving, which means that even if a non-market approach is 'inherently' less efficient, it may still be more socially efficient. Some of these costs can't be fully dispensed of- if capitalism is abolished there would still need to be police dealing with property crime, for when people steal each others' possessions. And some level of transaction processing would be necessary to ration access to resources.

Advertising is also more than just wasteful spending, but can be actively harmful, such as clothing adverts that present extremely thin bodies as an ideal. More generally, advertising works best when it is unchallenging, so it tends to reinforce existing social norms.

Many services cannot be provided well by the market due to what economists would call asymmetric information. When you hire a lawyer, you don't understand the law, so you can't judge if they are doing a good job. The same with doctors, care homes, complicated machines like cars, and builders. Where something isn't measurable to customers there is a strong incentive to cut costs until provision becomes poor enough that is is measurable to customers. So for doctors, the incentive is to deny expensive medical tests except where the patient is sophisticated enough to be able to tell that doing this is malpractice, or for a builder the incentive is to use materials of quality almost poor enough that the building will fall down. When in 25 years a hurricane hits and all of those buildings fall down you've already made your money.

Friedman would probably argue that these can be addressed by hiring your own experts- you hire a surveyor before buying a house who you hope will tell you if it is structurally unsound. But this just moves the problem one step along, because you can't tell if the surveyor is doing their job properly either- and they often don't. It also adds a bunch of costs that non-market approaches don't have to worry about when you have to keep surveying and resurveying, searching for surveyors, and surveying the reviews of surveyors. Also surveyors don't really exist for many industries, like doctors.

Hayek might argue that these are information problems any economic system has to deal with- it's always going to be difficult to judge from the outside whether a doctor is doing a good job, and capitalism, in practice, does a good enough job that the market basically functions, at least (ignoring that when doctors were less regulated they were largely quacks, and quacks persist where they can escape regulation). But that oversight of doctors doesn't have to happen on the customer (patient) level. If responsibility for assessing the quality of services is put onto the state, instead of the customer, it becomes practical to spend a lot more time seeking out qualified, competent inspectors, as well as gaining the possibility of e.g. accessing the back of house to assess the hygiene of a restaurant. This doesn't trivialise the problem, as you still need to inspect the inspectors, and keep standards up to date, etc. but it makes the information problem far more tractable for a system that leans socialist than for a market system.

Bothbard would eat a burger and then another burger and then very many burgers and then throw up.

The asymmetric information problem is a particularly big deal for the job market, as employment is where most people spend half of their waking life, yet it's very difficult to know what it will be like working somewhere until you're in, and then it's costly to leave. Employees that warn prospective employees about poor working conditions risk being punished for doing so.

In addition to natural resources being used up more than is socially optimal due to externalities of extraction not being priced in, they also get used to too quickly because markets tend to be short-termist. This is because they use the real interest rate as the market discount rate. The discount rate tells how apples today you would trade for an apple tomorrow. If there is no discounting, you care about the present and future equally. The market does not treat an apple now as equal to an apple in the future, because you could earn interest with that apple- you could plant it and have many apples in the future. So a positive discount rate makes sense- resources are less valuable in the future because if we had them now we could turn them into more resources in the future.

However this creates a problem with natural resources like water levels in certain aquifers, or cobalt ore of a certain grade, or air with a given concentration of CO2, as these replenish slowly, so if we use them all up now, we won't have any left in the future. But businesses extracting those resources are subject to the same interest rates as everyone else, so have the same incentive to extract it all now, rather than waiting for later.

Friedman would probably argue that they aren't extracted more quickly than is economically efficient, because if they will be scarcer in the future, that means their price will be higher in the future, creating an incentive to wait. Theoretically, these increasing prices and positive interest rates perfectly balance the needs of the future against the needs of the present. If the rate of growth of the price is less than the interest rate, that means extracting the resources now, then using those resources to produce further value once you have them (cobalt goes into a laptop, which is used to do accountancy, etc.) will produce more value than leaving the resources and extracting them later. However, this depends on future prices being judged accurately, even accounting accurately for low-probability high-impact scenarios. This is very difficult for capital markets to do, but it is capital markets making these decisions.

Furthermore, this depends on the real interest rate being the actual social discount rate. The real interest rate is theoretically an estimate of the ratio of your marginal private value of income now and your marginal private value of income later, so it can be split into two parts: part of the reason why your MPV is lower later is that you will be richer later, so extra money matters less to you. And part of the reason is that you care less about the future than you care about the present. Which means that that second part is also getting baked into the market interest rate- that the market is assuming that the future is inherently less valuable than the present. Which is a bad assumption when it comes to management of natural resources.

Furthermore, the increase in income component of why real interest rates are positive is different on a social and individual level because of lifecycle effects- people tend to get richer with age, relative to the average of their society, whereas the interest rate that determines the social usefulness of a given resource is one based on the average increase in wealth of society as a whole. That means that interest rates set by a market according to individual preferences will undervalue the future relative to the present, from a social point of view. Essentially it bakes in 'well I'll have made my fortune by then, so who cares' as a principle governing the intertemporal decisionmaking of the entire economy. I think I am being quite heterodox in pointing this out too, though it seems a pretty inescapable conclusion so perhaps this is widely recognised and just wasn't addressed in my education.

Friedman and Hayek would likely argue that this difference between individual and social time-preferences is small, and that markets setting interest rates improves their accuracy more than it hinders it. I agree that setting interest rates through central planning would be extremely difficult, but I reject that this is a small effect. A small change in interest rates can make a large difference to how economical it is to extract now vs later, so that this makes a large difference to rate of extraction. And people in the future will be making the same extract now vs extract later decisions with whatever resources they have left, so if this mispricing causes extraction to happen 1% faster than it should, that means over time we are exponentially deviating from where we should be at a rate of 1% per year.

Bothbard would sit on his bals again.

Not all activity can practically happen within the market- childrearing, for example, has traditionally happened outside of the market. But when most of the economy is a market economy, only labour within the market will award you a claim to a share of society's production- non-maket labour goes unrewarded. This has traditionally left women in the position of being completely dependent on their husbands.

Friedman, if he was on board with feminist critiques, might have argued that this could be solved by making childcare part of the market- have husbands pay their wives a wage to take care of the children (or wives pay their husbands). However for obvious reasons this doesn't usually happen, and where it does happen it doesn't happen in a court-enforceable way, leaving all the economic power still in the hands of the person in paid employment. This is a non-solution, predicated on the idea that everything can easily be brought inside of the market. Children, also, are kept out of the market and thus denied economic power, made completely dependent on their parents.

Bothbard would say who cares because children are the property of their parents and I would say die bothbard die die die and shoot him.

Markets have done a surprisingly poor job of equalising wealth around the world. One would expect that labour costs being lower in one part of the world than another would mean that the capital goes there, to take advantage of the lower wages, but raises wages in the process, until this reaches an equilibrium where wages are the same everywhere. Human capital is sometimes proposed as an explanation- education is worse in poorer countries, so people there can't actually do as good a job, and they are being paid what their labour is 'worth'. However it is clear that people in poorer countries- and even recent immigrants vs citizens in the same country, are paid very different amounts for the same work. I do not think human capital can explain most of the difference.

I do not have a confident account of why global inequality has been so persistent, but it is clear that people in the Global South are not paid what they are worth, ethically speaking, given the amount of work they do, how important it is, and even how skilled they are. Contrary to popular belief and apologia, the market has no tendency to pay people 'what they are worth', in the sense of deserving, only in the sense of marginal productivity of labour- which is a very different thing.

Hayek would reject that the wages someone deserves can be different from what someone is willing to pay them- such a distinction depends on taking a global, non-transactional view of ethics, and adopting a different meaning of 'deserving'. To Friedman, what you deserve is what is contractually obliged to you, and if you have received it, no injustice has been done to you. This approach would say that workers in the Global South don't deserve more- they are treated fairly. This treats the gigantic chasm of a power disparity between workers in the Global South and Global North as irrelevant to the moral legitimacy of the contracts, and so as being as good a reason as any for them to be underpaid. Die Hayek die die die.

So this post turned out a little longer than I was expecting. I have probably also missed quite a few things. I'm not really trying to be comprehensive here, just to cover what immediately sprang to mind. Perhaps I should split this out into several posts on @gamingavickreyauction. But don't count on it. Die Friedman die die die.

113 notes

·

View notes

Text

History tells us that all freedoms are conditional. In 1920, the Soviet Union became the first country in the world to legalize abortion, as part of a socialist commitment to women’s health and well-being. Sixteen years later, that decision was reversed once Stalin was in power and realized that birth rates were falling.

The pressure on all nations to keep up their population levels has never gone away. But in 2025, that demographic crunch is going to get even crunchier—and the casualty will be gender rights. In both the United States and the United Kingdom, the rate at which babies are being born has been plummeting for 15 years. In Japan, Poland, and Canada, the fertility rate is already down to 1.3. In China and Italy, it is 1.2. South Korea has the lowest in the world, at 0.72. Research published by The Lancet medical journal predicts that by 2100, almost every country on the planet won’t be producing enough children to sustain its population size.

A good deal of this is because women have more access to contraception, are better educated than ever, and are pursuing careers that mean they are more likely to avoid or delay having children. Parents are investing more in each child that they do have. The patriarchal expectation that women should be little more than babymakers is thankfully crumbling.

But the original dilemma remains: How do countries make more kids? Governments have responded with pleas and incentives to encourage families to procreate. Hungary has abolished income tax for mothers under the age of 30. In 2023, North Korean leader Kim Jong-Un was seen weeping on television as he urged the National Conference of Mothers to do their part to stop declining birth rates. In Italy, Premier Giorgia Meloni has backed a campaign to reach at least half a million births a year by 2033.

As these measures fail to have their intended effect, though, the pressure on women is taking a more sinister turn. Conservative pro-natalist movements are promoting old-fashioned nuclear families with lots of children, achievable only if women give birth earlier. This ideology at least partly informs the devastating clampdown on abortion access in some US states. Anyone who thinks that abortion rights have nothing to do with population concerns should note that in the summer of 2024, US Senate Republicans also voted against making contraception a federal right. This same worldview feeds into the growing backlash against sexual and gender minorities, whose existence for some poses a threat to the traditional family. The most extreme pro-natalists also include white supremacists and eugenicists.

The more concerned that nations become about birth rates, the greater the risk to gender rights. In China, for instance, the government has taken a sharply anti-feminist stance in recent years. President Xi Jinping told a meeting of the All-China Women’s Federation in 2023 that women should “actively cultivate a new culture of marriage and child-bearing.”

For now, most women are at least able to exercise some choice over if and when they have children, and how many they have. But as fertility rates dip below replacement levels, there is no telling how far some nations may go to buoy their population levels. 2025 looks to be a year in which their choice could well be taken away.

225 notes

·

View notes

Text

Tax Credits and Incentives - Abbott Incentives

Types of Tax Incentives

Tax incentives are offered by governments to individuals and businesses to encourage certain activities, such as investment, job creation, or specific industry development. Here are some of the different types of tax incentives:

Types of Tax Incentives

Tax incentives are offered by governments to individuals and businesses to encourage certain activities, such as investment, job creation, or specific industry development. Here are some of the different types of tax incentives:

Deductions: Tax deductions reduce the taxable income of individuals or businesses. They allow taxpayers to subtract certain expenses or costs from their total income before calculating the tax owed. Examples of deductions include deductions for medical expenses, charitable donations, and mortgage interest 1.

Exemptions: Tax exemptions exclude certain types of income or transactions from being subject to taxation. For example, some states offer sales tax exemptions for certain goods or services, such as groceries or prescription drugs.