#Stochastic Momentum Index vs. Stochastic Oscillator

Explore tagged Tumblr posts

Text

How to Trade Stochastic Momentum Index: A Comprehensive Guide

Trading in the stock market can be a daunting task, especially with the multitude of technical indicators available to traders. One of the lesser-known but highly effective indicators is the Stochastic Momentum Index (SMI). This tool can be incredibly beneficial for traders looking to refine their strategies and make more informed decisions. In this comprehensive guide, we’ll explore what the…

#Advanced trading strategies#How to trade SMI#Overbought and oversold conditions#SMI and Bollinger Bands#SMI and moving averages#SMI and RSI#SMI crossover strategy#SMI divergence#SMI guide#SMI indicator#SMI signals#SMI trading strategy#SMI tutorial#Stochastic Momentum Index#Stochastic Momentum Index calculation#Stochastic Momentum Index trading#Stochastic Momentum Index vs. Stochastic Oscillator#Stock trading indicators#technical analysis tools#Technical indicators for trading#Trading with SMI

0 notes

Text

What tools or indicators can be used with Forex charts?

Here's a comprehensive and detailed breakdown of tools and indicators used in Forex trading, structured to span around 3,500 words. This document includes technical analysis tools, charting platforms, indicators (leading and lagging), and practical strategies for application.

Tools and Indicators Used with Forex Charts

Introduction

The foreign exchange (Forex) market is the largest and most liquid financial market globally, with trillions of dollars traded daily. To navigate this vast marketplace effectively, traders utilize a variety of tools and indicators to analyze price movements, identify trends, and execute strategic trades.

Understanding these tools and indicators is essential for any Forex trader—whether novice or experienced—as they form the foundation of technical analysis, one of the most widely used approaches in the financial markets.

This article explores the essential tools and indicators used in Forex charting, categorized into several groups for clarity and practical application.

1. Charting Platforms and Tools

1.1. Charting Software

To analyze Forex charts, traders need reliable charting platforms that provide real-time data, customizable indicators, and drawing tools.

Popular charting platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry standards offering robust technical analysis tools.

TradingView: A web-based platform with advanced charting features and social integration.

cTrader: Offers intuitive UI, depth of market (DOM) functionality, and automation options.

NinjaTrader: Used by more advanced traders for both Forex and futures markets.

1.2. Chart Types

Understanding different chart types helps traders select the most appropriate visualization method.

Line Chart: Plots closing prices; useful for identifying trends.

Bar Chart (OHLC): Shows open, high, low, and close prices; more data-rich.

Candlestick Chart: Most popular; visually intuitive and informative, ideal for pattern recognition.

Renko Charts: Focus on price movement, ignoring time.

Heiken Ashi: Smooths price action to better identify trends.

2. Categories of Forex Indicators

Forex indicators are generally categorized based on their function and timing:

Trend-following indicators (lagging)

Momentum indicators (leading)

Volatility indicators

Volume indicators

Support and resistance tools

Overlay indicators vs. oscillator indicators

3. Trend-Following (Lagging) Indicators

These indicators help identify the direction of the market trend.

3.1. Moving Averages (MA)

Simple Moving Average (SMA) and Exponential Moving Average (EMA) are essential tools.

SMA calculates the average of a selected range of prices.

EMA gives more weight to recent prices.

Usage:

Determine trend direction.

Create signals with crossovers (e.g., 50 EMA crossing 200 EMA = Golden Cross/Death Cross).

3.2. Moving Average Convergence Divergence (MACD)

Composed of two EMAs (MACD line and signal line) and a histogram.

Usage:

Crossover strategy for buy/sell signals.

Divergence from price to signal potential reversals.

3.3. Average Directional Index (ADX)

Measures trend strength, not direction.

Usage:

ADX above 25 = strong trend.

ADX below 20 = weak trend or range-bound market.

3.4. Ichimoku Kinko Hyo

A comprehensive indicator showing trend, momentum, and support/resistance.

Components:

Tenkan-sen (conversion line)

Kijun-sen (base line)

Senkou Span A and B (cloud)

Chikou Span (lagging line)

Usage:

Cloud (Kumo) provides dynamic support and resistance.

Crossovers and breakouts from the cloud indicate signals.

4. Leading Indicators (Momentum)

Leading indicators aim to forecast future price movements.

4.1. Relative Strength Index (RSI)

An oscillator ranging from 0 to 100.

Usage:

RSI > 70 = overbought.

RSI < 30 = oversold.

Divergence with price indicates reversals.

4.2. Stochastic Oscillator

Compares a specific closing price to a range over time.

Usage:

%K and %D lines; crossovers suggest entries/exits.

Overbought/oversold levels are typically 80/20.

4.3. Commodity Channel Index (CCI)

Shows when a currency is overbought/oversold relative to its average price.

Usage:

Readings above +100 or below -100 suggest overbought/oversold conditions.

4.4. Rate of Change (ROC)

Measures the speed of price change.

Usage:

Increasing ROC suggests growing momentum.

Often used with trend indicators to confirm movement.

5. Volatility Indicators

These indicators measure how much price fluctuates.

5.1. Bollinger Bands

Consists of a SMA and two bands (±2 standard deviations).

Usage:

Price touching the upper band = potential overbought.

Price touching the lower band = potential oversold.

Bollinger Band squeeze indicates potential breakout.

5.2. Average True Range (ATR)

Shows average price volatility over a specific time.

Usage:

Not a directional indicator.

Useful for setting stop-loss and target levels.

5.3. Keltner Channels

Similar to Bollinger Bands but use ATR instead of standard deviation.

Usage:

Identify breakouts and trend continuations.

6. Volume-Based Indicators

Forex is decentralized, so volume is often broker-based. However, tick volume can still be useful.

6.1. On-Balance Volume (OBV)

Cumulative volume indicator.

Usage:

Confirms trends.

Divergence from price may signal reversal.

6.2. Volume Weighted Average Price (VWAP)

The average price weighted by volume.

Usage:

Commonly used for intraday analysis.

Helps institutions judge fair value zones.

7. Support and Resistance Tools

7.1. Pivot Points

Calculated from previous period’s high, low, and close.

Types:

Standard

Fibonacci

Woodie

Camarilla

Usage:

Identify potential support/resistance levels.

Useful for intraday and swing trading.

7.2. Fibonacci Retracement

Identifies potential pullback levels.

Common levels: 23.6%, 38.2%, 50%, 61.8%, 78.6%

Usage:

Entry during retracements in trending markets.

Combine with trendlines for confirmation.

7.3. Trendlines and Channels

Drawn manually to connect swing highs/lows.

Usage:

Visualize trend direction and strength.

Breakouts signal potential reversals or continuations.

8. Custom Indicators and Tools

Many platforms allow traders to create or install custom indicators.

Examples:

Harmonic pattern indicators (Gartley, Bat, Crab)

Custom divergence indicators

Multi-timeframe RSI or MACD

Sentiment indicators

9. Chart Patterns and Price Action Tools

While not strictly indicators, chart patterns play a crucial role in technical analysis.

9.1. Classic Chart Patterns

Head and Shoulders

Double Top/Bottom

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Rectangles

Usage:

Reversal and continuation signals.

9.2. Candlestick Patterns

Doji

Hammer

Engulfing

Morning Star/Evening Star

Shooting Star

Usage:

Signal potential turning points.

Combine with support/resistance or trend indicators.

9.3. Price Action Tools

Swing Highs/Lows

Order Blocks

Break of Structure (BoS)

Liquidity Zones

Usage:

Used for precision entries and institutional trading style (Smart Money Concepts - SMC).

10. Combining Indicators for Strategy Building

10.1. The Problem of Indicator Overload

Using too many indicators can lead to conflicting signals and analysis paralysis.

Best Practice:

Combine indicators with different functions.

Example setup:

Trend: 200 EMA

Momentum: RSI

Volatility: Bollinger Bands

10.2. Confluence Trading

Confluence occurs when multiple indicators or tools point to the same conclusion.

Example:

Price hits a Fibonacci level + RSI is oversold + bullish engulfing candlestick.

This increases the probability of success.

11. Trading Strategy Examples

11.1. Moving Average Crossover Strategy

Indicators:

50 EMA and 200 EMA Entry:

Buy when 50 EMA crosses above 200 EMA. Exit:

Opposite crossover or stop-loss under support.

11.2. RSI Divergence Strategy

Indicators:

RSI Entry:

Look for bullish/bearish divergence. Exit:

Take profit at key support/resistance.

11.3. Bollinger Band Breakout

Indicators:

Bollinger Bands Entry:

Enter when price breaks out of a tight band range. Exit:

Use ATR or fixed pip target.

11.4. Ichimoku Cloud Trend Strategy

Indicators:

Ichimoku Kinko Hyo Entry:

Buy when price is above the cloud and Tenkan-sen crosses Kijun-sen upward. Exit:

Close when price enters the cloud or crossover occurs downward.

12. Risk Management Tools on Charts

Besides entry and exit signals, charts also support tools for risk management:

Stop-loss placement using ATR

Take-profit based on recent swing highs/lows

Position size calculator indicators

Trade simulators and replay tools

13. Psychological and Sentiment Indicators

Though not always on the chart, these tools influence market moves.

Commitment of Traders (COT) Report

Retail Sentiment Indicators (from brokers like IG or OANDA)

News sentiment tools

Economic calendars embedded in platforms

Conclusion

Forex charting is both an art and a science. With the right tools and indicators, traders can gain deep insights into market movements, enhance precision, and improve risk-to-reward ratios. However, no single tool guarantees success.

The key is to develop a strategy that suits your trading style—whether scalping, day trading, or swing trading—and consistently use a combination of indicators that complement each other rather than duplicate signals.

To summarize:

Use trend indicators to determine direction.

Use momentum indicators for timing entries.

Use volatility indicators to understand price fluctuations.

Use support/resistance tools to define high-probability zones.

Combine tools intelligently to build robust strategies.

Would you like this content formatted as a downloadable PDF or with visual examples for each indicator?

#forex robot#forex trend indicator#forexsignals#stock market#currency forex online trading#youtube#forextrader#forex market#forextrading#forex

1 note

·

View note

Text

Mastering Technical Indicators in Share Market Trading: A Practical Guide

Understanding market movements is essential for turning analysis into profit. Technical indicators offer quantifiable insights into price trends, momentum, and market sentiment key tools in the arsenal of any serious trader. In this guide, Wealth Note walks you through the most impactful indicators and shows you how to integrate them into your strategy for smarter, data-driven decisions.

1. Why Technical Indicators Matter

Technical indicators translate raw price and volume data into actionable signals. Unlike fundamental analysis, which examines company health and macroeconomic factors, these tools focus purely on market behavior. Used correctly, they help you:

Identify trend direction and strength

Pinpoint optimal entry and exit points

Gauge overbought or oversold conditions

Confirm breakout or reversal patterns

By complementing chart patterns with indicator-based validation, traders can reduce emotional bias and stick to a systematic plan.

2. Core Indicators to Know

a. Moving Averages (MA)

Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) smooth out price fluctuations to reveal underlying trends. A common approach is the “golden cross” (short-term MA crossing above long-term MA) as a bullish signal, or the “death cross” for bearish momentum.

b. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements on a 0–100 scale. Readings above 70 suggest overbought conditions, while those below 30 hint at oversold territory. Many Wealth Note students use RSI divergences — where price moves counter to the indicator — to spot potential reversals.

c. Moving Average Convergence Divergence (MACD)

MACD calculates the difference between two EMAs and plots a signal line (its own EMA). Crossovers between the MACD line and signal line often precede shifts in momentum. Histogram bars visualize the distance between these lines, helping traders anticipate accelerating or decelerating trends.

d. Bollinger Bands

Comprising a middle-band SMA and two standard-deviation bands, Bollinger Bands expand and contract based on volatility. Prices touching or breaching the bands can signal overextended moves, while “squeezes” foreshadow volatility breakouts.

3. Implementing Indicators in Your Routine

Achieving proficiency with indicators requires practice and context. Follow these steps to integrate them effectively:

Select a Clear Timeframe: Indicators behave differently across intraday, swing, and positional horizons. Align your indicator settings (e.g., 14-day RSI vs. 6-period RSI) with your trading timeframe.

Use Multiple Indicators Judiciously: Combining trend-following tools (like MA) with momentum indicators (like RSI) provides cross-confirmation. Avoid “analysis paralysis” by limiting yourself to two or three complementary indicators.

Backtest Your Strategy: Before risking real capital, apply indicator rules to historical charts. Wealth Note’s simulated trading platform lets you refine entry and exit criteria under diverse market conditions.

Adjust for Market Regimes: Trending markets favor moving averages, while range-bound environments suit oscillators like Stochastic. Learn to switch indicator emphasis as volatility and trend direction shift.

4. Advanced Indicator Techniques

Divergence Trading: When price makes a new high but an oscillator (RSI or MACD) fails to confirm, it hints at waning momentum and possible reversal.

Volume-Weighted Average Price (VWAP): Especially useful for intraday traders, VWAP shows the average price weighted by volume. Trading above VWAP indicates institutional buying, while below suggests selling pressure.

Custom Scripting: Many platforms allow you to tweak indicator parameters or create hybrid tools ideal for traders seeking an edge beyond standard formulas.

5. Pitfalls to Avoid

Overreliance on Signals: No indicator is infallible. Always consider broader market context, news events, and support/resistance zones.

Chasing Alerts: Impulsive reactions to every crossover or band touch can erode profits. Discipline is key — wait for confirmation and alignment across your chosen indicators.

Ignoring Risk Management: Even the best signals fail occasionally. Always define stop-loss levels and position sizes before entering a trade.

By mastering technical indicators, you bring structure and clarity to your Share Market Trading approach. Remember to choose tools that align with your trading style, backtest thoroughly, and adjust as market conditions evolve. Whether you’re refining intraday tactics or building long-term strategies, Wealth Note’s expert-led courses and hands-on support will help you harness the full power of indicators transforming data into consistent, profitable outcomes in the markets.

0 notes

Text

RSI vs. Stochastic Oscillator: Which One to Use in Crypto Trading?

When it comes to analyzing cryptocurrency markets, technical indicators play a vital role in making informed decisions. Among the most popular tools traders use are the Relative Strength Index (RSI) and the Stochastic Oscillator. But which one should you use in your crypto trading strategy? Let’s break it down. What is the RSI? The Relative Strength Index (RSI) is a momentum oscillator that…

0 notes

Text

Divergence in Trading: The Signal Most Traders Ignore—Here’s Why You Shouldn’t 👀

Divergence occurs when the price of a security moves in the opposite direction of a technical indicator—usually momentum-based. 📊 It’s a powerful concept in technical analysis, frequently signaling that a trend is losing strength. While it might sound simple, divergence is often the early warning traders overlook before major reversals.

Technical legends like Charles Dow and John Murphy have emphasized divergence for decades. From Nifty 50 to Bitcoin and EUR/INR, this tool is used across markets to anticipate reversals or trend continuations with surprising accuracy.

Regular, Hidden & Exaggerated Divergence—Decoded for Humans 🤔

Understanding the type of divergence is essential.

🔹 Regular Divergence: Seen at trend reversals. For example, when price makes a new low but RSI makes a higher low, it’s a bullish divergence—hinting at a potential bottom. 🔹 Hidden Divergence: Seen during trend continuation. If price makes a higher low but the MACD makes a lower low, the uptrend may continue. 🔹 Exaggerated Divergence: Price forms equal highs or lows, but the indicator shows a noticeable deviation. It's rare but powerful.

Strike Money, a modern Indian charting tool, helps visualize these divergence patterns on major Indian stocks, making them easier to spot and backtest.

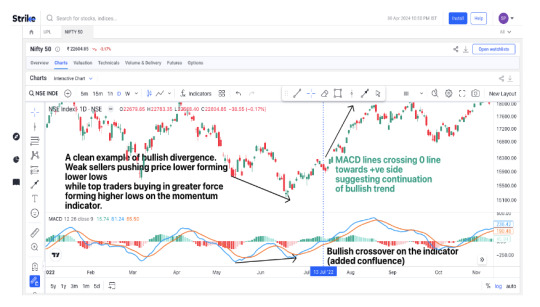

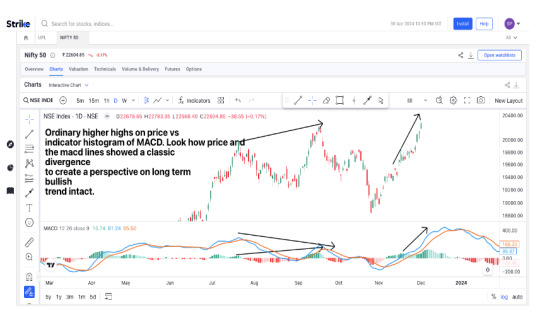

Bullish vs Bearish Divergence on Nifty 50: Real Charts, Real Signals 📈

📌 Example – February 2025: Nifty 50 dipped to 22,800. However, RSI didn’t confirm the lower low—it instead made a higher low. This bullish divergence was flagged on charting tools like Strike Money and later followed by a rally to 23,200 within two sessions—a 1.7% move.

📌 March 2025: Price made higher highs, but RSI made a lower high. This bearish divergence predicted a 300-point drop within hours.

These scenarios show why recognizing bullish and bearish divergence early can make or save your trading day.

RSI, MACD & Stochastic—The Trio That Exposes Divergence Faster ⚙️

Let’s break down the best indicators to catch divergence quickly:

⚡ RSI (Relative Strength Index): Frequently used to detect both regular and hidden divergence. In Indian stocks like Tata Motors and Infosys, RSI divergences often form around the 30–70 levels, providing early reversal clues.

⚡ MACD (Moving Average Convergence Divergence): Especially effective on longer timeframes. Back-tested results show MACD divergence offers better accuracy when paired with moving averages.

⚡ Stochastic Oscillator: Offers earlier signals than RSI or MACD. However, it’s more sensitive and prone to false positives—best for short-term setups on liquid stocks like HDFC Bank.

Using all three together creates a consensus approach. If two or more indicators confirm divergence, the probability of success rises significantly.

Strike Money Walk-Through: Spot Divergence in Seconds 🖥️

Modern traders need speed and accuracy. That’s where Strike Money steps in.

🔍 Open a stock chart—say, Reliance Industries. Use the "Divergence Finder" feature. The tool overlays RSI and MACD swing points and flags potential bullish (🟢) or bearish (🔴) divergences automatically.

📈 Example: On April 5, 2025, Strike Money highlighted bullish RSI divergence in Reliance. The price moved up 3.2% in just four sessions—outperforming even a passive buy-and-hold approach during that period.

By combining chart recognition with historical win-rate analysis, Strike Money transforms divergence from theory into actionable insight.

Forex, Crypto & Stocks—Divergence Strategies That Travel Well 🌍

💱 Forex (EUR/INR): Around RBI policy announcements, divergence signals often emerge hours before price reacts. Regular bearish divergence has consistently preceded rupee weakness against the euro.

🪙 Crypto (Bitcoin/INR): In April 2025, Bitcoin formed a hidden bullish MACD divergence near ₹46 lakh. It surged to ₹49 lakh within days. Traders using divergence were in ahead of the breakout.

📈 Indian Stocks: Divergence plays out beautifully in high-volatility stocks. In mid-caps, where price action often overshoots on earnings news, divergence signals offer a safer entry or exit.

Regardless of the asset, divergence is grounded in the universal principle of momentum versus price—making it market-neutral and widely applicable.

Proof in Numbers: What Research Says About Divergence Accuracy 📊

🔬 A 2024 study on Nifty 50 stocks (2015–2023) showed RSI divergence produced an average 57 basis point edge per signal. Larger cap names like Reliance and Infosys saw more consistent results due to better liquidity.

🔬 Another Indian study on BSE IT stocks found that MACD divergence combined with a 20-day moving average filter reduced false signals by nearly 33%.

🔬 Global back-testing across various exchanges reported MACD divergence had an 81.4% win rate historically with a 1.5 profit factor—but real-time execution reduces that edge due to slippage and transaction costs.

The takeaway: divergence works, but only when combined with sound strategy and market context.

Avoid These Common Divergence Traps 😱

🚫 Trading every divergence: Not every divergence is trade-worthy. Focus on those with clear structure and volume confirmation.

🚫 Ignoring volume: If divergence isn’t supported by rising volume, it’s likely noise. For example, divergence during low-volume sessions in ITC often fizzles out.

🚫 Over-leveraging: Divergence is a signal, not a guarantee. CFTC and SEC data shows that over 40% of retail trading losses are due to over-leveraged positions—even when entry signals are correct.

Discipline, not just divergence, protects your capital.

Confirmation Tools You Cannot Ignore 🔑

🔑 On-Balance Volume (OBV): When price forms a low but OBV rises, it confirms bullish divergence with real buying.

🔑 Candlestick Patterns: A hammer after a bullish divergence or a shooting star after a bearish divergence can tighten your entry timing.

🔑 Moving Averages: If price crosses the 20-day EMA after divergence confirmation, the move is likely to gain momentum.

Combining divergence with these tools builds a stronger case for entry or exit.

Divergence in Indian Stocks: Case Studies That Hit Home 💹

📉 Infosys – October 2024: Bearish MACD divergence on the daily chart formed while price peaked near ₹1,550. Over the next 12 sessions, it dropped to ₹1,410—an effective early warning for those holding long positions.

📈 Tata Steel – January 2025: A bullish RSI divergence followed a sharp correction to ₹117. Within two weeks, it rallied to ₹130—delivering a 10% swing.

📉 Bajaj Finance – March 2025: Bearish RSI divergence preceded a sharp 5% intraday drop following surprise rate-hike commentary. Divergence had shown up a day earlier for those watching.

These examples underline that divergence doesn’t just work—it works especially well in trending or overextended stocks.

Final Word: Should Divergence Guide Your Next Trade? 🏁

Divergence is a time-tested signal that quietly hints at big moves—if you know how to listen. It's not a standalone system but a high-probability clue in a world of market noise.

📊 Used with indicators like RSI, MACD, and Stochastic, supported by confirmation tools like volume, candlestick patterns, and moving averages, it becomes a sharp weapon in a trader’s arsenal.

🧠 The key lies in discipline—avoid chasing every alert, focus on well-formed divergence supported by market structure, and never over-leverage.

With tools like Strike Money, identifying and backtesting divergence is easier than ever for Indian traders. When combined with strong risk management and market understanding, divergence can quietly become your most trusted trading signal.

0 notes

Text

Equity Markets vs. Cryptocurrency Markets: Weekly Perf… | News

The views and opinions expressed here are solely those of authors/contributors and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The cryptocurrency market data is provided by the HitBTC exchange.

Developed equity markets globally continued to outperform most cryptocurrencies last week, as they have since the start of the year. The top equity market for both the past week and year-to-date is Hong Kong, with the Hang Seng Index advancing 2.8 percent for the week to close at 32,255, and up 10.8 percent year-to-date. In second place was the S&P 500, up 2.2 percent for the week and 7.5 percent year-to-date, and then the Shanghai Composite, which advanced 2.0 percent for the week and 7.6 percent year-to-date.

The Hang Seng has been on a tear, up seven weeks in a row and closing at a new record high for the second week in a row. Meanwhile, the S&P 500 continues its ascent into a new record high and closes strong, at the high of the week, while the BSE 30 Sensex, does the same. The Sensex finished its eighth week up in a row.

Coming in at the bottom for the week was the UK’s FTSE 100 Index, down 0.8 percent to end at 7,731, followed closely by both the German DAX Index and Japan’s Nikkei 225 Index, each down 0.7 percent to close at 13,434 and 23,808, respectively.

It’s interesting to note that the order the equity markets lined up last week is similar to the relative performance year-to-date. This seems to be a good reminder of the importance of trends and the significance of relative performance. A trend, once set in motion, tends to continue for a while, and the relative position of markets have a tendency to be maintained over some period of time.

Let’s now take a look at a few of the charts that may have something to tell us. We’ll leave the Hang Seng, S&P 500, and Sensex alone since they are in clear and strong uptrends into record highs.

Nikkei 225 Index

First, we look at the Nikkei 225 Index, which can best be observed with the weekly chart. For the past few weeks, the index has been stalled around the 150 percent extension, 150 percent retracement, of the prior downtrend that started from the 2015 peak, and the top parallel trend channel line. Last week it again attempted to continue its rally with a brief new high of 24,129.34. The attempt was quickly reversed with a close near the low for the week. That’s the third consecutive week that the Nikkei ended in the red and reflects the building of selling pressure. Also note that two weeks ago there was a bearish doji candle, not perfect but close enough. Further, the Stochastics momentum oscillator has turned down after being overbought for most of the rally coming off the August lows.

A break below the three-week low of 23,577.07 increases the chance for further selling, with a daily close below confirming a bearish signal.

FTSE 100

This next chart is a daily chart for the FTSE 100. The FTSE found resistance at 7,792.60 two weeks ago and has since pulled back. This follows a decisive breakout of a six-month basing period that took the form of a bullish ascending triangle consolidation pattern. When markets break through resistance at some point they pullback to test prior resistance as support, at least to some degree. We see that happening now with the FTSE.

Note that prior resistance at the top of the triangle at 7,599 is almost an exact match with the 38.2 percent Fibonacci retracement of the most recent upswing. In addition, Stochastics has turned up from being well oversold. This makes the 38.2 percent Fibonacci price support zone a good place to start to look for potential entries, relative to your own strategy. Either way, the overall behavior of this index is bullish and the uptrend can be expected to continue following the retracement.

Cryptocurrencies

The following table shows the relative weekly and year-to-date performance of some of the most popular cryptos. What immediately stands out is the relative outperformance of Ethereum (ETH).

Ethereum

Ethereum is the only crypto with a positive performance for last week and year-to-date, and it has done so by a long shot. Year-to-date ETH is up 42.1 percent, and it was 1.4 percent higher last week. Nevertheless, overall the cryptocurrency market remains in a consolidation phase with lower volatility and therefore less predictable price patterns.

What’s happened is that ETH had been lagging the other cryptocurrencies on the way up and therefore they topped and began to correct earlier. Most have not recovered much after hitting recent lows. The cryptocurrency, on the other hand, pulled back, found support and quickly recovered, and it has maintained its recovery. The other cryptos continue to face downward pressure.

What this all means is that Ethereum can now be watched as a possible leading indicator for the crypto market. A sign of strength should help maintain or improve bullish sentiment in the crypto market, while signs of weakness could trigger declines below support.

Here is a four-hour chart for Ethereum (ETH/USD):

ETH has been forming a potential rising measured move following a greater than 45 percent retracement off the peak at 1,424.30 on Jan. 13. The advance off that low found resistance around the 61.8 percent Fibonacci retracement and the subsequent decline found support also at the 61.8 percent level. This sets the stage for a potential Gartley completion around the 1,295.21 price area at the earliest. The potential resistance zone happens to coincide with two other Fibonacci resistance levels as noted on the above chart.

Nevertheless, a breakout above the prior 1,160 swing high triggers a bullish trend continuation, and this may provide some upside enthusiasm, even though short-term, to the wider crypto market.

Several of the other cryptocurrencies have been forming symmetrical triangle patterns on their four-hour charts, including BTC/USD, DASH/USD and IOTA/USD. A breakout of the triangle consolidation patterns will point to the next direction of momentum.

Ripple

Let’s now take a look at Ripple (XRP/USD). Ripple is the weakest performer year-to-date, down 38.5 percent, and for the week it declined 21.4 percent. Since hitting a 3.34 peak on Jan. 4, Ripple fell as much as 74 percent before finding support at 0.85. That low completed a 78.6 percent Fibonacci retracement of the near-term uptrend, and it was followed by a 61.8 percent retracement of the internal downtrend.

What’s interesting about its chart is the relationship of price to the downtrend lines. There are a couple of clear trend lines that define dynamic resistance of the downtrend. A decisive breakout above the line will provide a bullish signal with strength confirmed on a move above the minor swing high of 1.457, and then again on a rally above the next higher swing high at 1.722. Fibonacci price levels are listed for use as potential short-term targets.

The charts for the cryptocurrency analysis are provided by TradingView.

Source link

Source: http://bitcoinswiz.com/equity-markets-vs-cryptocurrency-markets-weekly-perf-news/

0 notes

Text

Technical Indicator Analysis for The Interpublic Group of Companies, Inc. (NYSE:IPG) via /r/Stock_Picks

Technical Indicator Analysis for The Interpublic Group of Companies, Inc. (NYSE:IPG)

Technical Indicators and Signals

The stochastic oscillator indicator is the important indicator to compare the security price over a certain period of time. The stochastic %K of The Interpublic Group of Companies, Inc. (NYSE:IPG) for the period of 9-Day stands at 89.66% while the stochastic %D for the same period stands at 70.62%.

The 7-Day Average Directional Index ADX (also known as Trend Strength Indicator) of The Interpublic Group of Companies, Inc. (NYSE:IPG) signals “Buy” while other important signals like the 20-Day Moving Average Vs. Price signals “Buy”.

Another important signal of trend and momentum of a security is 20-50 Day MACD Oscillator or Moving Average Convergence Divergence signals “Sell” for The Interpublic Group of Companies, Inc. (NYSE:IPG) while 20-100 Day MACD Oscillator indicates “Sell”.

Bollinger band is a volatility indicator of a certain security, currently The Interpublic Group of Companies, Inc. (NYSE:IPG)’s 20-Day Bollinger Band indicates “Buy http://ift.tt/2xy12tB

Submitted September 26, 2017 at 03:44PM by KADUCEJ via reddit http://ift.tt/2fztzdz

0 notes

Text

New Post has been published on Mortgage News

New Post has been published on http://bit.ly/2k3uH5j

Hasbro Vs. Mattel: Which Is The Better Buy?

Nasdaq-100 components Mattel Inc. (MAT) and Hasbro Inc. (HAS) have been fighting for domination of the toy world for decades, with MAT’s Barbie duking it out with HAS’s G.I. Joe for sales supremacy. HAS seized a tactical advantage in 2014 when landed a coveted licensing agreement with Walt Disney Co. (DIS) to create Frozen dolls and accessories. Those products hit toy shelves in 2016, lifting the stock to a new high while MAT went the other way, dropping to a 6-year low.

Both stocks reside in the lower-half of Nasdaq-100 relative strength, often forgotten by investors and market players when the tech-heavy index attracts a steady flow of buying interest. That could change after HAS blew away quarterly estimates this week, lifting the stock into a test at 2016 resistance in the upper-80s. Even so, it’s grown expensive in recent years while rival MAT has just reached a critical support level that could yield a sizable recovery rally.

HAS Weekly Chart (2011-2017)

The stock returned to the 2008 high at $41.68 in 2010 and broke out, but momentum failed to develop, yielding a 14-month consolidation pattern on top of new support, followed by a 2011 breakdown that dropped the stock into the lower-30s. It based at that level for more than a year and turned higher, reaching the 2010 high in the middle of 2013. A breakout into year’s end caught fire, generating a stairstep advance that continued into the April 2016 all-time high at $88.53. It’s testing that level after the company beat EPS and revenue estimates while raising the quarterly dividend.

Price structure since July 2015 could limit gains in coming months, despite the current breakout attempt. The rally ran out of gas in the mid-80s at that time, giving way to a series of higher lows but the upside has been minimal, with the April 2016 breakout ending after just two sessions. That advance added four points before rolling into a choppy trading range that’s frustrated shareholders and momentum players, carving a potential rising wedge that could limit post-breakout gains to the red line in the lower-90s.

MAT Weekly Chart (2012–2017)

The stock surged higher after hitting an 8-year low when the bear market ended in 2009 and rallied into steep resistance at the 1998 high in the upper-40s in 2013. It carved a double top pattern into January 2014 and broke down, entered a downtrend that may have ended in October 2015 in the upper teens. A bounce into 2016 stalled at the 50% selloff retracement in April 2016, giving way to a slow-motion decline that’s now reached the .618 rally retracement (red lines). At the same time, the monthly Stochastics oscillator has dropped to the most extreme technically overbought reading since 2014.

The last wave of the decline broke a descending triangle on top of the 200-day EMA, reinforcing resistance at 30 that will pose a significant barrier during the next recovery effort. Even so, the mid-20s marks a low-risk buying opportunity because harmonic support has lined up with the long-term bearish cycle, signaling a highs odds turning point. Bottom fishers wanting to take advance of this setup should place relatively tight stop losses to guard against the continued downside.

The Bottom Line

Hasbro has outperformed Mattel by a wide margin since 2014 when it won a coveted licensing agreement with Disney, allowing the company to make dolls and accessories for Elsa, Olaf, and other highly popular Frozen characters. Mattel’s classic Barbie line has taken a hit since that time, following decades of market leadership. However, MAT may offer a better choice for value players because it’s trading at a discount to its rival and could add points at a more rapid pace in 2017.

<Disclosure: the author held no positions in aforementioned stocks at the time of publication.>

0 notes

Text

✅ Complete Guide to the Williams %R Indicator: Trade Smarter with Momentum

If you're a trader looking for sharper entries and faster exits, the Williams %R indicator could be your secret weapon. Created by Larry Williams, this momentum oscillator has gained recognition for its ability to identify overbought and oversold zones before price action reacts. Used correctly, it becomes a compass for navigating trend reversals, especially in markets like NSE, BSE, and Bank Nifty.

Let’s break it down and explore how you can use Williams %R to gain an edge in the Indian stock market.

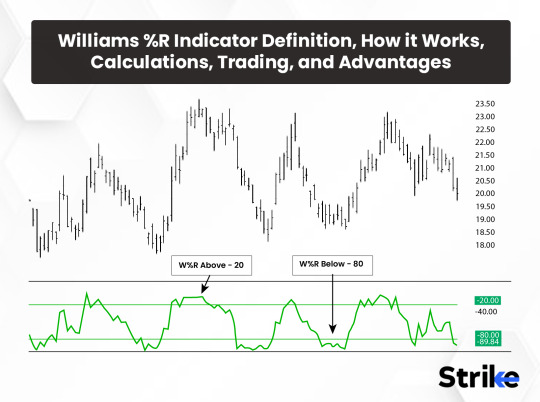

📉 What Exactly Is Williams %R and How Does It Measure Momentum?

The Williams Percent Range (%R) is a technical analysis indicator developed by Larry Williams in the 1970s. It helps traders detect momentum shifts by comparing a stock’s closing price to its high-low range over a specified period — usually 14 days.

Instead of moving between 0 and 100 like the RSI, Williams %R oscillates from 0 to -100. Readings above -20 indicate overbought conditions, and those below -80 suggest oversold territory.

⚠️ Imagine you're watching Reliance Industries (RELIANCE.NS). When the Williams %R shoots above -20, it’s a sign bulls might be exhausted. If it dips below -80, sellers could be running out of steam.

This tool is especially popular among intraday and swing traders, who use it for timing entries and exits more precisely than lagging indicators like MACD.

🤔 Why Williams %R Stands Out From Other Oscillators

✅ Speed: Williams %R often reacts faster than the Relative Strength Index (RSI) or Stochastic Oscillator, which gives traders an early look at momentum shifts.

✅ Clear Signal Levels: The fixed -20/-80 zones make it easy to identify reversal opportunities.

✅ Simplicity: It’s straightforward to apply, even for beginners using platforms like Strike Money, TradingView.

But it's not perfect. It can generate false signals in strongly trending markets. That’s why it’s best used with other tools like moving averages or volume indicators to confirm setups.

A 2021 research paper published in the Journal of Financial Markets highlighted that combining momentum oscillators with trend-following filters significantly improved risk-adjusted returns — especially in volatile markets like Nifty Midcap 100.

🧠 How to Read Williams %R Like an Expert Trader

Understanding how to interpret Williams %R is crucial. Here's how it works with real market context 👇

📌 When HDFC Bank was rallying in early 2023, Williams %R hovered above -20 for multiple sessions. This wasn't just a fluke — it was an overbought signal, confirmed by price consolidation and a decline shortly after.

📌 Conversely, during the correction in Tata Motors in mid-2022, %R fell below -80. A rebound followed, and traders who spotted that early got an ideal long entry.

Signals are stronger when paired with support and resistance zones. If %R hits oversold territory at a known demand zone, the chances of a bounce increase.

⚔️ Williams %R vs RSI vs Stochastic: Which Is Best for You?

While all three indicators track momentum, each has its own personality:

💡 Williams %R is more sensitive, providing early signals, but can result in more whipsaws.

💡 RSI is smoother, better for trend-following setups.

💡 Stochastic Oscillator adds a second line (signal line) for confirmation, great for range-bound trading.

If you’re trading volatile Indian equities like Adani Enterprises or Zomato, Williams %R offers faster alerts. But if you’re analyzing trending stocks like Infosys, RSI might be better.

🚀 Smart Trading Strategies Using Williams %R in Indian Markets

You can’t just rely on signals in isolation — you need context and confirmation. Here are practical setups that work well on Strike Money charts:

🔥 Divergence Strategy: If Nifty 50 is making higher highs, but %R is making lower highs, that's bearish divergence. It signaled a drop in January 2024 just before a sharp correction.

🔥 Trend Pullback Strategy: During bull runs like in ICICI Bank, %R briefly dips below -80, then recovers. That’s a pullback buy zone in an uptrend.

🔥 Breakout Confirmation: When Asian Paints broke out of a resistance level, Williams %R climbed above -20 and stayed there — confirming bullish momentum.

These setups are easy to spot using Strike Money’s real-time scanner and customizable charting tools.

🖥️ How to Set Up Williams %R on Popular Platforms Like Strike Money

Setting up Williams %R is quick and easy, especially on Indian platforms like Strike Money. Here's what to do:

🔧 On Strike Money, go to your chart, click “Indicators,” search for “Williams %R,” and apply it. The default lookback is 14 periods — keep it that way for most timeframes.

📊 Want a crisper signal? Reduce the period to 10 on fast-moving stocks like Nykaa or Paytm. Prefer smoother signals? Increase to 21 when trading slower movers like Coal India.

💡 Use custom alerts to notify you when %R crosses key levels like -80 or -20 — a lifesaver for busy intraday traders.

🧩 Advanced Trick: Combine Williams %R With Other Indicators for Precision

Williams %R shines when used alongside complementary indicators. You get better clarity, fewer false signals, and higher conviction.

🔁 Try combining with a 50-period Moving Average. In Infosys, whenever the stock was above the MA and %R dipped below -80, those were excellent buy zones.

⚖️ Use MACD to confirm trend strength. When MACD is above zero and Williams %R climbs from -80, it’s a green signal in bullish markets.

📉 Add Volume Profile to your Strike Money charts. If price hits a high-volume node with %R in overbought territory, expect a possible reversal.

Studies from NISM and NSE Academy consistently show that combining multiple indicators boosts performance, especially when tested with backtesting tools.

📈 Case Studies: Williams %R in Action on Indian Stocks

Let’s bring theory into real trades. These examples show Williams %R in live markets:

🔍 In March 2024, TCS broke its multi-week resistance at ₹3800. Williams %R jumped from -80 to -10 within 2 days. That breakout, confirmed by %R, led to a 12% rally in two weeks.

🔍 In October 2023, Bank Nifty was in a downtrend. %R stayed near -20 despite bullish candles — a bearish divergence. The index fell 800 points in 3 sessions.

🔍 In June 2023, HUL formed a base near ₹2600. Williams %R dipped to -90 and rebounded as volume increased. That marked the start of a 5-week uptrend.

These moves were captured easily using Strike Money’s chart tools, thanks to its clean visuals and indicator overlays.

🚫 Top Mistakes Traders Make With Williams %R (And How to Avoid Them)

Even the best indicators fail when misused. Here’s what you should never do with Williams %R:

❌ Chasing every signal: Just because %R hits -80 doesn’t mean buy. Wait for confirmation like price bouncing from support.

❌ Ignoring trend context: Using %R in a strong uptrend can mislead you into shorting too early. Align with market direction.

❌ Fixed settings for every stock: A 14-period may not work on both Tata Steel and IRCTC. Adapt your settings based on stock volatility.

❌ Overcomplicating setups: Don’t overload charts. Keep it clean — price, Williams %R, one trend filter, and volume.

❓ Frequently Asked Questions About Williams %R

🔹 Is Williams %R good for intraday trading? Absolutely. Many Indian traders use it on 5-min and 15-min charts, especially for stocks like HDFC, Tata Motors, and Zerodha’s Nifty Bees.

🔹 Does Williams %R repaint? No. It’s calculated based on fixed past data. What you see is what you get.

🔹 Can I use it for crypto or commodities? Yes. Whether you’re trading Bitcoin or Gold MCX, %R adapts to any chart with volume and volatility.

🔹 What timeframes work best? For swing trades, daily or 4-hour charts are ideal. For intraday, use 15-min or 1-hour.

🔹 Can I automate this strategy? Platforms like Strike Money support smart alerts and API-based automation — making Williams %R part of your algo stack.

💬 Final Thoughts: Williams %R Deserves a Spot in Your Trading Arsenal

Whether you’re navigating Nifty 50, catching intraday moves in Zomato, or swing trading Reliance, the Williams %R indicator can become your go-to tool for spotting turning points before they’re obvious on price charts.

Just remember — no indicator is magical on its own. Use %R alongside smart tools like Strike Money, confirm with price action, and never trade blind.

Ready to level up your charting game? Load up Williams %R today and start decoding momentum like a pro.

1 note

·

View note

Text

📊 Complete Guide to What is an Indicator? Definition and Examples in Technical Analysis

Technical analysis isn’t just lines on a chart — it’s a language. And indicators are the words that form the sentences. If you've ever looked at a stock chart filled with moving averages, RSI levels, or candlestick patterns and wondered what does this all mean?, you're in the right place.

In this guide, you’ll understand what a technical indicator is, how it works, and how successful traders in the Indian stock market use them daily on platforms like Strike Money and TradingView.

🚀 What Exactly is an Indicator in Trading?

An indicator in technical analysis is a mathematical calculation based on a security’s price, volume, or open interest. Its primary purpose? To forecast future market movements and signal when to buy or sell.

✅ Example: If Nifty 50 is trading sideways and RSI drops below 30, it could signal that the market is oversold — a potential buying opportunity.

Indicators don’t predict the future with certainty, but they do offer probabilistic insights, especially when used with price action and volume.

🧠 Why Traders Rely on Indicators (More Than Ever)

📈 In a market driven by emotion and speculation, indicators bring logic and consistency. They filter the noise and give structure to price movement.

🎯 A 2022 SEBI-backed study found that over 74% of intraday traders in India rely on at least two indicators to guide their positions. These tools are essential, whether you're trading Reliance Industries or Tata Motors.

💡 Smart traders use indicators to: ➤ Spot trends before they mature ➤ Measure momentum and strength ➤ Manage risk with calculated stop losses ➤ Time entries and exits more effectively

⚖️ Leading vs. Lagging Indicators: What’s the Real Difference?

Indicators come in two broad flavors:

🔮 Leading Indicators attempt to predict future price movement. These include tools like RSI, Stochastic Oscillator, and Fibonacci Retracement.

📉 Lagging Indicators confirm trends after they’ve started. Think Moving Averages, MACD, or Bollinger Bands.

👉 Leading indicators are popular among swing and intraday traders looking to get ahead of the market. Lagging indicators are favored by trend followers and positional traders who value confirmation over anticipation.

📌 Real-World Example: When HDFC Bank’s price broke above its 200-day moving average in 2023 after consolidating, it confirmed a long-term trend shift. That’s a classic lagging indicator confirmation.

🌐 The Four Key Types of Technical Indicators You Must Know

Every indicator fits into one of four buckets, each serving a unique purpose.

🔁 Trend Indicators: These show you where the market is heading. ✔️ Moving Averages (SMA, EMA) ✔️ MACD (Moving Average Convergence Divergence) ✔️ Supertrend (used widely in Indian equity charts on Strike Money)

⚡ Momentum Indicators: Measure the speed of price movement. ✔️ RSI (Relative Strength Index) ✔️ Stochastic Oscillator ✔️ Rate of Change (ROC)

🔥 Volatility Indicators: Assess how much the price is fluctuating. ✔️ Bollinger Bands ✔️ Average True Range (ATR)

🔊 Volume Indicators: Show the intensity behind price moves. ✔️ On-Balance Volume (OBV) ✔️ Chaikin Money Flow

💥 Many top Indian traders use a combo of Supertrend + RSI on Strike Money to time short-term reversals in stocks like Infosys or Maruti.

💡 Real Examples of Technical Indicators in Action (Indian Stocks)

Let’s break down how some of the most popular indicators are used by Indian traders on stocks you know.

🧪 RSI (Relative Strength Index) — Created by J. Welles Wilder When TCS’s RSI dropped below 30 in July 2022, it signaled oversold conditions. Within a week, the stock rebounded over 6%. This pattern repeated in 2023, validating RSI as a powerful mean-reversion tool.

📉 MACD (Moving Average Convergence Divergence) MACD crossover in Kotak Mahindra Bank during the September 2023 rally confirmed a bullish shift after months of consolidation. MACD's histogram also turned positive, further validating momentum.

🎯 Bollinger Bands — By John Bollinger

During the 2021 bull run, Adani Enterprises frequently “rode the upper band,” a known signal of strong trending behavior. Bollinger Bands also highlighted sharp volatility bursts before earnings.

🔢 Fibonacci Retracement After the 2022 correction, Nifty 50 retraced to its 61.8% Fibonacci level — a common area of support. Many swing traders used this level for long entries.

🛠️ How to Actually Use Indicators in Your Strategy (Not Just Stare at Them)

Indicators are only effective when used in context. Here’s what smart traders do 👇

🧭 Don’t Rely on Just One One indicator can lie. Two or three can confirm a pattern. For example, use RSI + MACD + Volume to build conviction.

🔄 Look for Confluence If price hits a Fibonacci level, and RSI is oversold, and MACD is turning — that’s a confluence. The probability of a successful trade increases.

🎮 Test with Strike Money’s Charting Tool Use platforms like Strike Money or TradingView to test your strategy on live charts. Strike Money offers Indian equities, futures, and real-time data — ideal for practical learning.

🎯 Example Combo: Many traders use Supertrend + RSI + Bollinger Bands to scalp small caps like IRCTC or Zomato, especially during high volatility sessions.

🧭 Where Can You Use These Indicators? Best Platforms for Indian Traders

📍 Strike Money — Built for Indian markets. Offers indicator-rich charts for stocks, options, and indices. Designed for retail and pro traders alike.

📍 TradingView — Globally used, easy to customize. Many Indian brokers integrate it (Zerodha, Upstox).

📍 Chartink, StockEdge — These tools are focused on scanning Indian stocks using indicator logic.

🎓 According to a 2023 survey by NSE Academy, over 68% of young traders in India prefer using TradingView or Strike Money to learn and experiment with technical indicators before risking capital.

🧨 Limitations of Indicators You Need to Know Before You Trade

⚠️ No indicator is perfect. They all have blind spots. And they often give false signals in sideways or low-volume markets.

🌀 Overfitting — Customizing too many indicators can mislead you into seeing patterns that don’t exist.

🧩 Lag in Confirmation — By the time a moving average crosses, the move might already be done.

📊 Market Conditions Change — Indicators that worked in 2021 (post-COVID rally) didn’t perform well during the 2022 correction phase.

💥 Example: Bollinger Bands expanded sharply during the Adani stock saga in early 2023 — but failed to capture the political risk involved. No indicator can see news events coming.

🙋 Frequently Asked Questions on Technical Indicators

🧠 Which is the best indicator for beginners? Start with RSI and Moving Averages. They are easy to understand and offer immediate visual signals.

🧠 Are indicators better than chart patterns? They complement each other. Indicators quantify data; chart patterns show psychology. Smart traders use both.

🧠 Can I use indicators in options trading? Absolutely. Especially IV-based indicators and Delta-adjusted strategies.

🧠 What’s the best combo of indicators? There’s no universal combo. But MACD + RSI + Supertrend is a popular one among Indian swing traders.

✅ Final Thoughts: Use Indicators as Your Trading Compass, Not GPS

Indicators are tools, not magic formulas. They work best when you understand the context — market trend, news, volume, and sentiment.

Start simple. Test your ideas. See what works for your style.

🎯 Platforms like Strike Money offer excellent Indian market data and charting features tailored for traders who want to master indicators hands-on.

Remember, the goal isn’t to follow indicators blindly. It’s to use them intelligently, with awareness and discipline.

Want to go deeper into trading strategies using indicators? 👉 Check out our Advanced Strategy Playbook (coming soon on Strike Money)

Let the charts speak. Let the indicators guide. But always, let your mind decide.

0 notes