#Overbought and oversold conditions

Explore tagged Tumblr posts

Text

Mean Reversion: Forex Trading Strategy Explained

Mean reversion is a forex trading strategy that capitalizes on the tendency of asset prices to return to their historical averages. This approach assumes that extreme price movements will revert to the mean over time, providing traders with potential profit opportunities. What is Mean Reversion? It is based on the statistical concept that prices, after deviating significantly from their average,…

#Bollinger Bands#Forex Trading#Historical Average#MACD#Mean Reversion#Overbought Conditions#Oversold Conditions#Risk Management#RSI#Trading Strategy

2 notes

·

View notes

Link

Understanding and Utilizing RSI in Stock Trading

The provided article delves deeply into the significance and utilization of the Relative Strength Index (RSI) in the realm of stock trading. RSI serves as a crucial indicator for assessing whether a stock's current price is in an overbought or oversold state. The article comprehensively explains how RSI functions, its components, formulas, interpretation strategies, and practical tips for effective application.

This article is a comprehensive guide for investors, offering insights into the RSI's mechanics and its practical value in evaluating market conditions. By clarifying the concept of overbought and oversold levels, the article empowers investors to make more informed decisions and implement better trading strategies. The explanations and application strategies provided assist traders in using RSI as a valuable tool for understanding market dynamics and anticipating potential trend reversals.

#RSI#stock market#technical indicator#trading strategies#overbought#oversold#market conditions#trend reversals#investor education#trading insights

0 notes

Text

Capitalizing on Oversold Stocks: The Art of Buying Low and Selling High

Every seasoned trader knows the timeless principle: buy low, sell high. While the concept seems straightforward, the real challenge lies in knowing when to act. An oversold stock can signal a golden opportunity—if you’re able to identify it at the right moment. But how can you tell when a stock is truly oversold and ready for a rebound?

While fundamental analysis involves examining company earnings, balance sheets, and valuations, technical analysis takes a different route—one that focuses on price action. Rather than digging through financial reports or tracking executive decisions, technical analysts rely on charts to tell the story. The belief is simple: price reflects all known information, and studying price behavior is enough to make informed trading decisions.

One of the most widely used tools in this approach is the Relative Strength Index (RSI)—a trusted indicator that helps traders spot potential reversals in oversold or overbought conditions.

Why the Buy Low, Sell High Strategy Works

The idea of buying a stock after it has declined—anticipating a bounce back—is grounded in both logic and psychology. It works when you can identify short-term undervaluation, where prices have dropped not because of fundamental weakness, but due to temporary selling pressure, market sentiment, or external events. For fundamental traders, this might mean identifying a stock trading below its book value. But for technical traders, price is the only signal that matters.

RSI: The Technical Analyst’s Go-To Indicator

This is where the RSI comes into play. The Relative Strength Index is a momentum oscillator that measures the speed and magnitude of recent price movements. It operates on a scale from 0 to 100 and helps identify whether a stock is overbought or oversold.

When the RSI crosses above 70, the stock is considered overbought. This could signal that a pullback or consolidation is near.

When the RSI drops below 30, the stock is viewed as oversold—often a cue for traders to prepare for a potential upward move.

By using RSI, traders can pinpoint key moments when sentiment has driven a stock too far in one direction and position themselves to capitalize on the reversal.

Find Full Blog: Buy Low – Sell High: Opportunities in Oversold Stocks

2 notes

·

View notes

Text

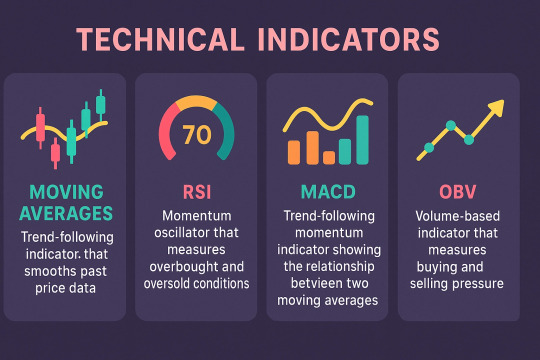

Types of Technical Indicators in Trading

Technical indicators are essential tools used by traders to analyze market trends and make informed decisions. Among the many available, some of the most widely used types include Moving Averages, Relative Strength Index (RSI), MACD, and On-Balance Volume (OBV).

Moving Averages smooth out price data to identify trend direction over a specific period. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA), which help traders determine support and resistance levels and potential entry or exit points.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are typically used to identify overbought (above 70) or oversold (below 30) conditions, signaling potential reversals.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two EMAs. It helps traders identify changes in trend strength, direction, and momentum.

On-Balance Volume (OBV) uses volume flow to predict price movements. A rising OBV indicates accumulation, while a falling OBV suggests distribution, providing insights into the strength of a trend.

Using these indicators together can improve trading accuracy and help develop a solid, data-driven strategy.

Explore, all the Technical Indicators in Trading.

#Types of Technical Indicators in Trading#Technical Indicators in Trading#Indicators in Trading#trading indicators#indicators in trading

2 notes

·

View notes

Text

A long-dormant Polygon whale just made waves by snapping up a rising new token, XYZVerse, fueling speculation that this sports-fueled crypto could be the next breakout to watch.

Table of Contents

XYZ aims for G.O.A.T. status: Early buyers eye 1,000x gains

Polygon fluctuates

Conclusion

After five years of silence, a major holder of Polygon tokens has resurfaced. This investor is now acquiring a new cryptocurrency linked to POL. The unexpected move has caught the attention of market watchers. The new token is showing signs of significant growth potential. Could this be a signal of shifting trends in the market?

XYZ aims for G.O.A.T. status: Early buyers eye 1,000x gains

XYZVerse (XYZ) isn’t your average memecoin, it’s fusing the high-octane world of sports with crypto’s fast-moving edge. Built for die-hard fans of football, basketball, MMA, and esports, XYZVerse is more than just a token, it’s a competitive movement powered by adrenaline and community.

With its bold “Greatest of All Time” (G.O.A.T.) vision, XYZVerse is setting its sights far beyond typical memecoin hype. It’s already turning heads, recently crowned as the Best New Meme Project on the scene.

What gives XYZ the edge? Backed by a detailed roadmap and a fired-up community, the project is geared toward lasting impact and serious growth.

The XYZ presale is heating up fast, offering early investors tokens at a steep discount:

Launch price: $0.0001

Current price: $0.003333

Next presale stage: $0.005

Final presale price: $0.02

Target listing price: $0.10

With over $13 million already raised, momentum is building rapidly. The project’s ambitious target is a 1,000x return for those who locked in early. As demand soars, each presale stage brings higher prices, so those who act soon stand to gain the most.

XYZ is already making waves before hitting major exchanges. With listings on top CEXs and DEXs on the horizon, the opportunity window is closing fast.

You might also like:How a $500 stake in XYZVerse might transform over time

Polygon fluctuates

POL (ex-MATIC POL) has experienced notable price fluctuations recently. Over the past week, the coin saw a slight decline of 3.21%, settling within the current price range of $0.22 to $0.24. However, zooming out to the monthly view, POL has demonstrated a significant rebound with a 21.93% increase. Despite this short-term growth, the coin remains down by 23.38% over the past six months, reflecting broader market volatility.

Technical indicators point to key levels that could influence POL’s trajectory. The nearest resistance level is at $0.26, with a secondary resistance at $0.28. If the price pushes beyond these thresholds, it might signal a bullish trend. On the support side, levels at $0.21 and $0.19 could provide a safety net against further declines.

The 10-day simple moving average is $0.23, slightly below the 100-day average of $0.24, suggesting a cautious short-term outlook. The Relative Strength Index (RSI) stands at 53.70, indicating that the coin is neither overbought nor oversold. Meanwhile, a high Stochastic value of 91.17 might hint at potential overbought conditions.

Market observers note that while the recent monthly gain is promising, the mixed signals from technical indicators warrant careful attention. POL’s ability to break through resistance levels or hold above support zones could set the tone for its near-term performance. As the crypto market continues to evolve, staying informed on these key metrics remains crucial for those watching POL’s journey.

Conclusion

While established coins like POL show promise, XYZVerse stands out, uniting sports fans in a community-driven ecosystem aiming for substantial growth and cultural impact.

To find more information about XYZVerse, visit the official website.

2 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Chart Chaser: A Trader’s Obsession with Technical Analysis on MintCFD

In the realm of online trading, a “Chart Chaser” is a trader who relies heavily on technical analysis. These traders obsessively study charts, patterns, and indicators to identify the optimal entry and exit points for their trades. While some traders focus on market news or economic fundamentals, Chart Chasers believe that the key insights lie within the patterns and trends shown in the data itself. For users on MintCFD, adopting the Chart Chaser approach can be rewarding, especially given the wide range of tools and various trading chart patterns available on the platform.

The Allure of Following Trends in Charts

Chart Chasers are drawn to technical analysis because it offers a visual and data-driven way to understand market behavior. By studying price movements, volume, and indicators, they look for recurring patterns, such as Double Bottoms, Head and Shoulders, and Moving Averages, which they believe can predict future price action. With the MintCFD trading app, traders have access to advanced charting tools that make it easy to become a Chart Chaser, allowing for in-depth analysis and strategy development.

Key Tools on the MintCFD Platform for Chart Chasers

MintCFD’s platform is rich with tools tailored for those who take a technical approach. Here are some essentials for the dedicated Chart Chaser:

Real-Time Charting Tools: MintCFD offers detailed, real-time charts that provide instant insights into price movements. For a Chart Chaser, these charts are invaluable as they capture every shift and trend in the market, allowing them to act quickly based on the latest data.

Diverse Chart Patterns: From Candlestick charts to Line charts, MintCFD provides several options, enabling traders to switch between patterns based on their trading style. For instance, Candlestick patterns are often favored by Chart Chasers because they reveal price action in detail, helping traders identify trends and reversals.

Technical Indicators: Popular indicators, such as the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are available on MintCFD to help Chart Chasers confirm their hypotheses. These indicators can signal overbought or oversold conditions, momentum changes, and potential trend reversals.

Custom Alerts: MintCFD’s alert system lets Chart Chasers set notifications based on specific price movements, helping them act on technical signals even if they’re not actively monitoring their screens. This way, they never miss a crucial trade opportunity based on their analysis.

Benefits and Pitfalls of Being a Chart Chaser

For those who love data, becoming a Chart Chaser offers unique advantages, but it also comes with some potential pitfalls. Here’s how to manage both on the MintCFD Platform:

Benefits: Technical analysis is highly data-driven, meaning decisions are based on objective data rather than emotional responses. By relying on chart patterns and indicators, Chart Chasers can create highly structured strategies with specific entry and exit points. With MintCFD’s intuitive tools, they can continuously refine their methods and explore different indicators.

Pitfalls: Focusing solely on technical analysis can lead to “analysis paralysis,” where a trader over-analyzes and hesitates to act. Additionally, ignoring market news and economic factors may leave a Chart Chaser blind to important influences. MintCFD offers market news and insights alongside technical tools, helping Chart Chasers balance their analysis with a broader context.

Master the Market on MintCFD Trading App: Stop Over-Analyzing and Start Thriving as a Chart Chaser

To succeed as a Chart Chaser without getting caught in a loop of over-analysis, it’s essential to have a plan and set clear criteria for entering and exiting trades. MintCFD’s watchlists and alert systems can help keep track of multiple assets without overwhelming yourself with constant analysis. Having a set of “go-to” indicators and patterns also helps prevent information overload.

Final Thoughts

For traders who thrive on technical data, becoming a Chart Chaser can be an exciting and rewarding journey. MintCFD is an ideal platform for these traders, with its robust charting tools, real-time indicators, and customizable alerts. While it’s easy to get caught up in the details, the best Chart Chasers know when to step back and trust their analysis. By balancing data with a disciplined approach, MintCFD users can make the most of their technical strategies and succeed in the dynamic world of trading.

Take control of your trading journey with the MintCFD Trading App

#mintcfd#cfdtrading#cryptotrading#onlinetrading#tradingstrategy#tradingsignals#forextrading#forexstrategies#cryptoinvesting#stockmarket

2 notes

·

View notes

Text

SEO-friendly : 7 Key Insights into the Meaning of Relative Strength Index in Forex Trading

The meaning of relative strength index is a crucial tool for Forex traders, helping identify overbought and oversold conditions for better decision-making. The meaning of relative strength index, often called RSI, is essential in Forex trading. It helps traders understand whether a currency pair is overbought or oversold. This insight allows for better decision-making when buying or selling…

0 notes

Text

11 COT Forex Setups to Watch as Tariffs Shake Markets

As U.S. tariff threats intensify and central bank signals grow more unpredictable, traders are leaning heavily on COT data to navigate price action. This week’s COT forex setups offer key insights into market direction across 11 major assets, combining technical indicators with policy-driven volatility. By applying a structured forex trading approach, refining your forex entry and exit strategy, and sticking to a tested forex risk management plan, you can capitalize on directional moves while protecting your capital in uncertain conditions.

COT Market Sentiment

AUD – WEAK (4/5) GBP – STRONG (5/5) CAD – WEAK (5/5) EUR – STRONG (5/5) JPY – STRONG (4/5) CHF – WEAK (5/5) USD – WEAK (5/5) NZD – STRONG (4/5) GOLD – STRONG (5/5) SILVER – STRONG (4/5)

Market Analysis

GOLD

Gold is testing the upper boundary of its range after extending from the EMA200. MACD shows increased buy volume, and RSI is nearing overbought levels. Still, the broader bearish trend remains intact. This makes GOLD one of the more delicate COT forex setups—favorable for short-term trades but requiring careful trade management techniques to avoid overexposure at the top of the range.

SILVER

Silver is pushing toward its previous high. If it breaks, a strong bullish continuation may follow. MACD shows stable bullish volume, and RSI supports the momentum. This setup is bullish but still within a consolidation band. It's a prime candidate for a forex entry and exit strategy that includes conditional breakout orders, helping you plan ahead without chasing the move via Axel Private Market.

DXY

The Dollar Index is rising off its EMA200 and testing the 97.932 resistance. MACD reflects growing bullish volume, though RSI is nearing overbought. Fundamentally, Trump’s sweeping new tariff plans (35% on Canadian imports and 15–20% across others) initially boost the Dollar, but economic uncertainty could reverse that momentum. This COT forex setup is highly sensitive to news, reinforcing the need for a flexible forex risk management plan and close tracking in your trade journal for forex.

GBPUSD

The Pound is dropping sharply, supported by bearish MACD and RSI signals. The selling structure remains intact, making GBPUSD one of the cleaner setups this week. A break of recent support could accelerate the decline. Documenting the setup's development in a trade journal for forex helps you gauge similar future setups under macro pressure using tools like World Quest FX.

AUDUSD

The Aussie is gaining due to hawkish RBA commentary and risk-on sentiment. However, technicals remain bearish unless price breaks and holds above 0.65869. This mixed setup is ideal for traders using a structured forex trading approach with platforms like GFS Markets.

NZDUSD

The Kiwi is consolidating under its EMA200. MACD shows muted bullish activity, and RSI sits at oversold levels. The market is hesitant, and this setup requires caution. Stay defensive with proper forex risk management strategies through RichSmart.net.

EURUSD

The Euro continues to slide within a consolidation zone. MACD and RSI point to growing bearish momentum. A clear break below support will trigger a stronger directional move. This setup suits structured strategies with data-backed risk plans.

USDJPY

USD/JPY is rising with MACD confirming bullish strength. RSI is nearing overbought, suggesting a pullback could occur before continuation. The Yen's weakness comes after initial resilience, likely impacted by U.S. tariff threats.

USDCHF

The Franc is consolidating near the top of its range. Momentum indicators show growing bullish pressure, but price remains capped. Wait for confirmation before entry.

USDCAD

USD/CAD is reacting to tariff news targeting Canada directly. Price is climbing toward 1.37261, with bullish momentum on the rise. A cautious approach remains essential.

Market Context

While each of these technical assets provides actionable COT forex setups, it’s the combination of technical structure and geopolitical risk that determines edge. Tariff-driven moves, Fed rate speculation, and inflation fears make it critical to stay nimble and journal your logic.

Final Thoughts

This week’s 11 COT forex setups span a market gripped by tariff volatility, central bank speculation, and shifting global demand. From trending USDJPY to indecisive NZDUSD, every trade requires precision. Stick to your forex risk management plan, journal your decision-making, and execute with consistency.

0 notes

Text

How to Trade Stochastic Momentum Index: A Comprehensive Guide

Trading in the stock market can be a daunting task, especially with the multitude of technical indicators available to traders. One of the lesser-known but highly effective indicators is the Stochastic Momentum Index (SMI). This tool can be incredibly beneficial for traders looking to refine their strategies and make more informed decisions. In this comprehensive guide, we’ll explore what the…

#Advanced trading strategies#How to trade SMI#Overbought and oversold conditions#SMI and Bollinger Bands#SMI and moving averages#SMI and RSI#SMI crossover strategy#SMI divergence#SMI guide#SMI indicator#SMI signals#SMI trading strategy#SMI tutorial#Stochastic Momentum Index#Stochastic Momentum Index calculation#Stochastic Momentum Index trading#Stochastic Momentum Index vs. Stochastic Oscillator#Stock trading indicators#technical analysis tools#Technical indicators for trading#Trading with SMI

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Link

Understanding and Utilizing RSI in Stock Trading

The provided article delves deeply into the significance and utilization of the Relative Strength Index (RSI) in the realm of stock trading. RSI serves as a crucial indicator for assessing whether a stock's current price is in an overbought or oversold state. The article comprehensively explains how RSI functions, its components, formulas, interpretation strategies, and practical tips for effective application.

This article is a comprehensive guide for investors, offering insights into the RSI's mechanics and its practical value in evaluating market conditions. By clarifying the concept of overbought and oversold levels, the article empowers investors to make more informed decisions and implement better trading strategies. The explanations and application strategies provided assist traders in using RSI as a valuable tool for understanding market dynamics and anticipating potential trend reversals.

#RSI#stock market#technical indicator#trading strategies#overbought#oversold#market conditions#trend reversals#investor education#trading insights

0 notes

Text

pro scalper indicator script free download

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Top Free Intraday Indicators for Quality Buy and Sell Signals

Here are some of the most widely used and trusted free indicators that intraday traders use to generate buy and sell signals.

1. VWAP (Volume Weighted Average Price)

Type: Price + Volume Indicator Best For: Institutional-level price zones and intraday support/resistance

VWAP calculates the average price of an asset throughout the day, adjusted for volume. It helps identify where most of the volume is concentrated and provides insight into whether buyers or sellers have control.

Price above VWAP: Indicates buying pressure

Price below VWAP: Indicates selling pressure

Use Case Example: If a stock is trading below VWAP all morning and then breaks above with volume, this can be a high-probability buy signal—especially during a reversal session.

2. Supertrend

Type: Trend-Following Indicator Best For: Simplified trend direction and buy/sell triggers

Supertrend is plotted on the price chart and flips between green (bullish) and red (bearish) zones. It uses Average True Range (ATR) to adjust for volatility.

Green line below price: Bullish (buy signal)

Red line above price: Bearish (sell signal)

Use Case Example: On a 5-minute chart, a flip from red to green with price closing above the Supertrend can be a potential long entry, especially if supported by momentum.

3. Relative Strength Index (RSI)

Type: Momentum Oscillator Best For: Overbought and oversold identification

RSI measures how quickly and extensively a price has moved in a short time. The values range from 0 to 100.

Below 30: Asset may be oversold (buy signal)

Above 70: Asset may be overbought (sell signal)

Use Case Example: In a flat market, RSI dropping below 30 and turning upward can suggest a short-term buy opportunity, especially when confirmed by price action near support.

4. MACD (Moving Average Convergence Divergence)

Type: Trend + Momentum Indicator Best For: Trend reversals and momentum confirmation

MACD consists of two lines—the MACD line and the signal line. Crossovers between these lines indicate potential trading opportunities.

MACD line crosses above signal line: Bullish (buy signal)

MACD line crosses below signal line: Bearish (sell signal)

Use Case Example: On a 15-minute chart, if the MACD line crosses above the signal line after a pullback, it may confirm a bullish continuation.

5. Bollinger Bands

Type: Volatility Indicator Best For: Mean-reversion and breakout signals

Bollinger Bands consist of three lines: a simple moving average (middle band), and two outer bands that adjust based on price volatility.

Price touching the lower band: Potential bounce (buy setup)

Price touching the upper band: Possible reversal (sell setup)

Use Case Example: If price contracts into a narrow range (bands squeeze) and then breaks out on high volume, this can signal a strong intraday buy or sell breakout.

6. Stochastic Oscillator

Type: Momentum Indicator Best For: Reversal zones in choppy markets

Stochastic compares the current closing price to the price range over a recent period.

Below 20: Oversold (buy signal potential)

Above 80: Overbought (sell signal potential)

Use Case Example: In a range-bound market, a crossover from below 20 to above, combined with a bullish candlestick pattern, may signal a short-term buy trade.

Combining Free Indicators for Stronger Setups

Rather than relying on one tool, the most effective approach is to combine 2–3 non-correlated indicators to validate signals.

Example Intraday Setup (5-Minute Timeframe):

VWAP: Price must be above VWAP (buy bias)

Supertrend: Indicator must be green

RSI: Should be between 50–70 for confirmation of upward momentum

Entry Rule: When all three conditions align, place a buy order on a pullback or breakout.

Exit Rule: Close position when RSI approaches 70–75 or price drops below VWAP.

Why These Indicators Are Free (and Still Valuable)

You might wonder—if they’re free, are they really good?

Yes, and here’s why:

Public domain math: Most indicators are based on formulas developed decades ago, which are no longer under license restrictions.

Built-in on most platforms: Modern trading platforms like MetaTrader, TradingView, and Thinkorswim offer these tools by default.

Widely tested: Since these tools are open to all, they’ve been studied and applied across millions of charts, helping traders refine their use.

Free doesn’t mean ineffective—it means accessible.

Tips for Using Intraday Indicators Responsibly

To maximize the usefulness of these tools:

Avoid overloading your chart. Stick to 2–3 indicators that complement each other.

Always use stop-loss orders. Indicators can fail—protect your capital.

Avoid trading solely on indicator signals. Always confirm with price action and volume.

Backtest before going live. Use past data to see how your setup performs across different market conditions.

Keep a trading journal. Track what indicators worked and when they failed to improve future decisions.

Things No Indicator Can Predict

Sudden market-moving news (earnings, geopolitical events)

Emotional behavior of crowds (panic selling, FOMO buying)

Flash crashes or order book imbalances

That’s why risk management and strategy discipline are even more important than the indicators themselves.

Platforms That Offer These Indicators for Free

You don’t need expensive software to use these tools. Some of the most user-friendly platforms include:

TradingView (freemium model with access to almost all popular indicators)

MetaTrader 4/5 (MT4/MT5) (free for most brokers)

Thinkorswim by TD Ameritrade (free for account holders)

Investing.com chart tools (web-based and accessible)

Final Thoughts: Consistency Over Certainty

While no indicator can promise 100% accuracy, using well-tested, free tools like VWAP, RSI, MACD, and Supertrend in combination with smart trade planning can significantly improve your intraday performance.

Indicators are not magic signals. They are guidance tools—and their effectiveness depends entirely on how consistently and wisely you apply them.

Key takeaways:

Avoid looking for a “holy grail.” Instead, aim for consistency.

Learn your indicators inside-out—know when they work and when they don’t.

Respect the market. Use indicators as a map, not as a guarantee.

By developing your skills and combining indicators with risk management, you can build a responsible and potentially profitable intraday trading strategy—even without spending a dime on tools.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex education#forex market#forex factory#forex online trading#forex news#forex ea#forex broker#forex

0 notes

Text

Thorough use of fundamental analysis and technical analysis to continue winning in stock investment

In order to achieve results in business and investment, a calm analysis based on data is essential. Fundamental analysis to determine the true value of a company, technical analysis to read market trends, and the use of screening tools to efficiently discover good stocks are essential skills for modern investors. In this article, we will explain in practice the advanced analytical methods that you can learn at Harvard and Stanford Business Schools.

Table of contents

1. Fundamental analysis that measures the intrinsic value of a company

・Predict the future with indicators of growth and competitiveness

・The health and risk of companies from the perspective of financial ratios

2. Technical analysis that foreseads market movements

・Optimize trading timing with charts and trend analysis

・Reverse and backward strategies using RSI and MACD

3. A screening tool that realizes efficient stock selection

・Filtering that integrates fundamental and technical

・Setting conditions suitable for both long-term investment and short-term trading

1. Fundamental analysis that measures the intrinsic value of a company

The true value of a company lies in numbers and strategies. Fundamental analysis is a core method for dissecting financial statements and performance indicators to determine whether a company can grow in the future.

・Predict the future with indicators of growth and competitiveness

Sales growth rate and profit growth rate are important barometers that measure the pace of a company's expansion. However, it is essential to compare the average growth rate and industry averages for the past five years without being influenced by the figures of a single year. In the analysis of competitiveness, not only market share, but also intangible assets such as the number of patent holdings and brand loyalty are included in the evaluation. If it is a technology company, the ratio of R&D investment to sales is the key, and if it is a retail industry, the trend of customer unit price is the key.

・The health and risk of companies from the perspective of financial ratios

Companies with a high ROE (return on equity) have excellent capital efficiency, but it is important to be careful to see if they are being drained by excessive debt. The debt ratio and the current ratio are used together to verify the short-term ability to pay. In addition, the discrepancy between "cash earned" and "profit on the books" is checked from the cash flow statement, and the risk of embellishment is eliminated.

2. Technical analysis that foreseads market movements

The price chart is a map that visualizes the psychology of investors. By deepening technical analysis, you can capture the turning point of group psychology.

・Optimize trading timing with charts and trend analysis

The "positive continuous" and "cross lines" of candlesticks are signals that indicate the overheating of the market. On the other hand, the moving average determines the reversal of the long-term trend by whether it is above or below the 200-day line. Applying the Dow theory, the method of calculating the trend continuation rate from the update pattern of high and low prices is also effective.

・Reverse and backward strategies using RSI and MACD

It is dangerous to simply interpret that the RSI is overbought at over 70% and oversold at 30%. In the phase where the MACD's histogram expands, it shows the acceleration of the trend, and when it converges, it is a sign of a change. Combine these indicators with Bollinger Bands to build a strategy that takes volatility into account.

3. A screening tool that realizes efficient stock selection

To maximize the time-effectiveness, the know-how of condition setting is the difference.

・Filtering that integrates fundamental and technical

In addition to classic conditions such as "PBR 1 time or less and ROE 8% or more", changes in institutional investors' holding ratios and insider trading data are combined. More and more professional investors are using the "Custom Indicators" function of the screening tool and applying their own developed algorithms.

・Setting conditions suitable for both long-term investment and short-term trading

Value investment focuses on dividend yields and FCF (free cash flow) growth rates. Day trading monitors the divergence rate from VWAP (to volume-weighted average price) for stocks with soaring volume.

At the end

The essence of modern investment strategies is analysis that uses data as a weapon and excludes emotions. The method introduced in this article is only a theoretical framework. In the actual market, new variables are always generated. Build your own "investment philosophy" through continuous learning and practice.

4. In-depth analysis of financial data: the essence of cash flow management

The true health of a company is reflected in the cash flow statement, not the income statement. In order to identify good companies, it is necessary to analyze the three types of cash flows together.

The basic premise is that the operating cash flow is continuously positive, but the quality is more important. Compare the depreciation expense with the figures before the addition adjustment, and grasp the cash that is actually generated in the main business. Regarding investment cash flow, we will evaluate how investment in R&D and M&A will lead to future growth, not just the amount of capital investment. In financial cash flow, we pay attention to the balance between own stock purchases and dividends.

5. The forefront of valuation methods: DCF and real options

In addition to traditional PER and PBR, understanding the advanced value evaluation methods adopted by institutional investors is the key to building a competitive advantage.

In the DCF (Discounted Cash Flow) analysis, in addition to the FCF forecast for the future, it is necessary to carefully estimate the closing price. The calculation of WACC (weighted average cost of capital) uses different beta values for each industry. By applying the real option theory, you can calculate the potential value of an unlisted subsidiary and the optional value of a patent portfolio.

6. Market psychology applied to behavioral economics

As the limits of the efficient market hypothesis are revealed, the method of exploiting the irrationality of the market created by cognitive bias is attracting attention.

The resistance and support lines formed by the anchoring effect can be stronger psychological barriers than the numerical values of technical analysis. In markets with a strong tendency to avoid losses, there is a frequent pattern of soaring volume near the lower price support line. If you combine social media sentiment analysis with VIX (phobia index), you can quantitatively measure the overheating of the market.

7. Global Macro Strategy: The correlation between exchange rates and commodity markets

In modern stock investment, the impact of exchange rate risk and commodity prices cannot be ignored.

Emerging country companies with dollar-denominated debts may have a case where the depreciation of their own currency compresses their profits. We will understand the industry-specific commodity exposure, such as the inverse correlation between crude oil prices and aviation stocks, and the linkage between gold prices and financial stocks. Understand the mechanism by which the GDP growth rate of the BRICS countries and the spread of U.S. long-term interest rates determine the flow of international funds.

8. The impact of sustainability management on investment

The impact of the ESG element on corporate value has reached a stage where it can no longer be ignored.

While the disclosure of CO2 emissions is mandatory, the ability to calculate Scope3 (emissions of the entire value chain) affects the competitiveness of companies. In order to measure the degree of response to the circular economy, we quantify the utilization rate of recycled materials for sales and measures to extend product life. In the governance evaluation, in addition to the ratio of female executives, the contents of the management's long-term incentive plan will be scrutinized.

9. Algorithmic strategy in the era of quantum computing

Next-generation technologies following AI are changing the paradigm of investment analysis.

The optimization algorithm using quantum annealing demonstrates accuracy that surpasses traditional Monte Carlo simulation. The evolution of natural language processing has made it possible to quantify changes in the tone and subtle nuances of the earnings briefing. With the blockchain analysis tool, you can track the wallet trends of institutional investors in real time.

10. Crisis response simulation and stress test

In an environment where Black Swan events become normal, building resilience is the most important issue.

We will conduct a three-stage scenario analysis assuming pandemic and geopolitical risks. In the balance sheet stress test, in addition to the liquidity coverage ratio (LCR), the potential risks of off-balance items are assessed. Based on the performance of each industry in the past crisis, we derive the optimal distribution of defensive stocks and cyclical stocks.

At the end

The modern investment environment has become more complex and cannot be competed with a single analytical method. The fusion of fundamental and technical, the integration of traditional knowledge and advanced technology, and the mutual verification of financial data and non-financial information - only by making full use of these can we acquire a true alpha. It can be said that the will to continue to learn is the most important asset in order to survive in a market where change is the only constant.

0 notes

Text

Proven MMI Strategies: How to Trade Fear and Greed Like a Market Veteran

In the dynamic world of stock markets, understanding investor sentiment is as important as analyzing technical charts and financial data. This is where the MMI Index, also known as the Market Mood Index, comes into play. Designed to gauge the prevailing mood of the market, this indicator helps traders and investors make more informed decisions by revealing whether the crowd is feeling greedy, fearful, or neutral.

What is the MMI Index?

The MMI Index stands for Market Mood Index, a sentiment analysis tool that measures the emotional state of market participants. It works on the principle that human emotions like fear and greed drive stock price movements. By quantifying these emotions, the index provides insights into whether the market is overheated or undervalued.

In simple terms, when the Market Mood Index shows extreme greed, it could signal that markets are due for a correction. On the other hand, when fear dominates, it might indicate potential buying opportunities for value investors.

Why is the Market Mood Index Important?

Markets are often influenced by emotions rather than logic. Even experienced traders sometimes make irrational decisions during volatile periods. The MMI Index acts as a compass, helping investors stay objective.

Here are some reasons why the Market Mood Index is becoming increasingly popular:

Identifies Market Extremes: By tracking market emotions, the index helps spot overbought and oversold conditions.

Supports Risk Management: Investors can adjust their portfolios based on whether the mood is too bullish or bearish.

Complements Technical Analysis: While technical indicators look at price and volume, the MMI Index provides a psychological perspective.

How Does the MMI Index Work?

The MMI Index typically combines various data points such as volatility, market breadth, and trading volume. Some versions may also factor in social media trends and news sentiment.

Extreme Greed (80-100): Markets are likely overbought; caution is advised.

Greed (60-79): Positive sentiment dominates, but watch for signs of reversal.

Neutral (40-59): Balanced market mood; no strong bias.

Fear (20-39): Negative sentiment; potential buying opportunities.

Extreme Fear (0-19): Markets may be oversold; contrarian investors often take interest here.

By observing these levels, traders can gauge whether to enter, exit, or hold their positions.

Benefits of Using the Market Mood Index

For retail investors and professionals alike, the Market Mood Index offers several advantages:

✅ Emotional Discipline: It discourages panic-selling during market drops and overconfidence during rallies. ✅ Better Timing: Helps in identifying ideal entry and exit points based on sentiment extremes. ✅ Enhanced Strategies: When combined with fundamental and technical analysis, the MMI Index adds a layer of sentiment-driven strategy.

Limitations to Consider

While the MMI Index is a powerful tool, it is not foolproof. Sentiment indicators can sometimes give false signals, especially during unprecedented events like pandemics or geopolitical crises. It should always be used in conjunction with other indicators and not as a standalone decision-making tool.

How to Use the MMI Index Effectively

Contrarian Approach: When the Market Mood Index shows extreme greed, consider reducing exposure. When it signals extreme fear, explore buying opportunities.

Long-term Investing: For long-term investors, the index can serve as a guide to avoid emotional pitfalls during market highs and lows.

Conclusion

The MMI Index is more than just a sentiment indicator; it is a psychological mirror of the market. By tracking the Market Mood Index, traders and investors can gain valuable insights into the emotions driving price movements. Whether you are a beginner or a seasoned investor, incorporating the MMI Index into your strategy can help you make more balanced and rational decisions in the ever-changing stock market landscape.

0 notes

Text

Which Intraday Indicators Are Actually Working for Nifty Traders in 2025?

Nifty Trading in 2025 Bollinger Bands are the right tools to help nifty intraday trading strategy because they identify volatility and breakout potential. This blog will focus on seven signals with a focus of the use of Bollinger Bands using a 20 period moving average and its bands on the standard deviation to either identify a squeeze or overbought/oversold conditions. On 5-minute Nifty charts, band squeezes indicate possible breakouts, with validation confirmed by RSI/volume. Let’s not dive much deeper but know that Bollinger Bands application, CNX enable you determine these real time to hone the Nifty intraday trading strategies. Trading setup Traders can use the middle SMA for good dynamic S/R levels for those precise and high probability trades so required from the nifty 50 market.

0 notes