#Vendor Payment Software

Explore tagged Tumblr posts

Text

Vendor Payments Software: Streamline Vendor Payment Services

Optimize your business operations with our Vendor Payments Software. Streamline payment processes, ensure timely transactions, and improve vendor relationships with secure, efficient solutions.

0 notes

Text

A Comprehensive Guide to Implementing Vendor Payment Software

Implementing Vendor Payment Software is a strategic initiative that can streamline payment processes, enhance vendor relationships, and optimize financial management. This comprehensive guide outlines key steps and considerations for successfully implementing Vendor Payment Software in your organization.

1. Assess Business Needs and Objectives

Define Goals:

Before implementing Vendor Payment Software, clarify your organization's objectives. Identify specific goals such as improving payment efficiency, enhancing vendor relationships, reducing costs, or ensuring compliance with financial regulations.

Evaluate Current Processes:

Assess existing payment workflows, challenges, and pain points. Identify areas for improvement, such as manual data entry errors, delays in payment processing, or lack of visibility into payment status.

2. Research and Select Vendor Payment Software

Conduct Market Research:

Explore different Vendor Payment Software solutions available in the market. Consider factors such as features, scalability, integration capabilities, security protocols, and pricing models. Shortlist vendors that align with your business requirements and objectives.

Evaluate Vendor Reputation:

Research vendor credibility, customer reviews, and industry reputation. Select a vendor with a proven track record in providing reliable payment solutions and excellent customer support.

3. Engage Stakeholders and Obtain Buy-In

Build Cross-Functional Team:

Form a project team comprising stakeholders from finance, IT, procurement, and vendor management departments. Ensure representation from end-users who will interact with the software.

Communicate Benefits:

Clearly communicate the benefits of Vendor Payment Software to stakeholders. Highlight advantages such as improved efficiency, cost savings, enhanced vendor relationships, and compliance benefits. Address any concerns or resistance proactively.

4. Plan Implementation Strategy

Develop Implementation Plan:

Create a detailed implementation plan with timelines, milestones, and responsibilities. Define project scope, budget, and resource requirements. Establish clear goals and success criteria for the implementation phase.

Consider Phased Approach:

Depending on the complexity of your organization's payment processes, consider a phased implementation approach. Start with a pilot phase or prioritize critical functionalities to minimize disruption and ensure smooth adoption.

5. Customize and Configure Software

Tailor Workflows:

Customize Vendor Payment Software workflows to align with your organization's payment approval processes, vendor onboarding procedures, and payment scheduling preferences. Ensure flexibility to accommodate unique business requirements.

Integrate with Existing Systems:

Ensure seamless integration with existing accounting, ERP, and procurement systems. Configure data mappings, APIs, and authentication protocols to enable smooth data exchange and real-time synchronization.

6. Provide Training and Support

Conduct Training Programs:

Provide comprehensive training sessions for end-users and stakeholders involved in using Vendor Payment Software. Offer hands-on training on software functionalities, best practices, and troubleshooting techniques.

Develop Support Mechanisms:

Establish a support system to address user queries, technical issues, and software updates post-implementation. Provide access to helpdesk support, user guides, and online resources to facilitate ongoing assistance.

7. Ensure Data Security and Compliance

Implement Security Measures:

Adopt robust security protocols such as encryption, access controls, and data encryption to protect sensitive payment information. Ensure compliance with data protection regulations (e.g., GDPR, PCI-DSS) and industry standards.

Conduct Regular Audits:

Perform regular audits of Vendor Payment Software to monitor data integrity, user access controls, and compliance with internal policies. Implement measures to mitigate risks associated with fraud or unauthorized access.

8. Monitor Performance and Optimize Processes

Track Key Metrics:

Monitor key performance indicators (KPIs) such as payment processing time, on-time payment rates, vendor satisfaction scores, and cost savings achieved through the software. Use analytics tools to gain insights into payment trends and vendor performance.

Continuous Improvement:

Continuously evaluate and optimize payment processes based on performance metrics and user feedback. Identify opportunities for automation, process refinement, and efficiency gains to maximize the benefits of Vendor Payment Software.

9. Foster Vendor Relationships and Feedback

Engage with Vendors:

Collaborate with vendors to gather feedback on their experience with the new payment system. Solicit input on usability, payment transparency, and responsiveness to improve vendor satisfaction and strengthen partnerships.

Implement Vendor Portals:

Introduce vendor portals or self-service options within the software to enable vendors to track payment status, submit invoices electronically, and communicate directly with your finance team. Enhance transparency and efficiency in vendor interactions.

10. Evaluate Success and Plan for Expansion

Measure ROI:

Evaluate the return on investment (ROI) of implementing Vendor Payment Software based on cost savings, efficiency improvements, and enhanced vendor relationships. Compare actual results against initial goals and benchmarks.

Plan for Expansion:

Based on successful implementation and positive outcomes, consider expanding the use of Vendor Payment Software to other departments or regions within your organization. Scale operations to include additional functionalities or integrate with more business systems.

Conclusion

Implementing Vendor Payment Software is a strategic decision that requires careful planning, stakeholder engagement, and meticulous execution. By following this comprehensive guide, organizations can effectively streamline payment processes, enhance vendor relationships, and optimize financial management practices. Successful implementation of Vendor Payment Software not only improves operational efficiency but also positions businesses for sustained growth, compliance with regulatory requirements, and competitive advantage in the marketplace.

0 notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

2K notes

·

View notes

Text

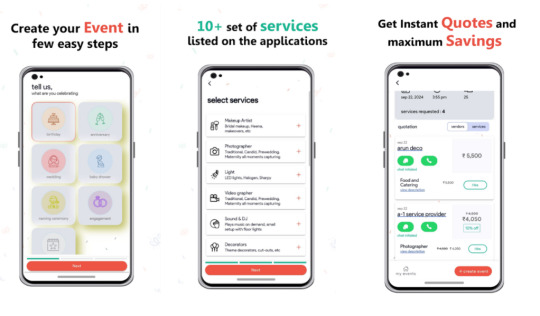

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App—the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Text

Enhancing Vendor Management Relationships through MYNDAPX

“We’re not on the same page,” “I wasn’t informed about this change,” “Our emails/calls go unanswered,” or “We’re always the last to know,” are the common statements we get to hear between a vendor and a business.

In the fast-paced world of business, the significance of strong vendor relationships cannot be overstated. They are the foundation upon which companies build their operational success and growth. Yet, managing these relationships efficiently remains a formidable challenge for many businesses. Communication gaps, inconsistencies in payments, and complexities in contracts often hinder the smooth operation of these relationships. Addressing these challenges necessitates a revolutionary approach—one that MYNDAPX offers with its cutting-edge technology aimed at streamlining processes and fostering a culture of trust and transparency.

#Vendor Management#MYNDAPX#vendor management software#vendor payment process#vendor payment system#MYNDSolution

0 notes

Text

Role of Modern Payment Gateways in the Ecommerce Industry

Technology has become ubiquitous across the industries. In any business, the role of technology is not confined to performing a particular function. It is responsible for making all the business operations efficient and streamlined.

One of the industries where the role of technology has been crucial is the ecommerce industry. From placing orders by the customer to performing the delivery by the agent, the technology has a role to play.

The payment transaction is considered to be an essential part of any business. The role of payment transactions increases manifold when the transactions are done online as it contributes an important part to the shopping journey of a buyer.

Any ecommerce marketplace platform not providing smooth transactions to the customers is going to negatively impact the sales of the business. Payment transaction methods should be business-friendly.

Buyers should be able to find the payment method of their choice and complete the purchase in a few clicks or touches of a smartphone. Similarly, the vendors and the aggregator should be able to receive their part of the amount smoothly and instantly.

The developers are leaving no stone unturned in making the ecommerce marketplace software efficient and business-friendly.

Businesses have got the luxury of integrating the ecommerce platform with the payment method of their choice.

Not just the ecommerce websites but the mobile ordering apps also provide the facility of online payment through the gateway of consumers’ choice.

The advancements in technology have led to the introduction of automatic settlement of payments between the aggregator and the vendors. As soon as the buyer makes the payment, the amount is instantly split between the aggregator and the vendor. This indicates that the multi vendor marketplace software not only keeps consumer convenience at the forefront but also boosts the experience of the sellers as well.

According to the Market Statsville Group (MSG), the global payment gateway market size is expected to grow from USD 39,118.86 million in 2022 to USD 204,011.03 million by 2033, growing at a CAGR of 16.2% from 2023 to 2033. The payment gateway market has witnessed significant growth in recent years, driven by the rapid expansion of e-commerce and digital payment solutions.

#ecommerce marketplace#hyperlocal ecommerce platform#multi vendor ecommerce#multi vendor marketplace#multi vendor marketplace platform#multi vendor ecommerce software#payment gateways

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

0 notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

551 notes

·

View notes

Text

Boost Your Planning Business with the Best Wedding and Event Software Tools

In today’s fast-paced world, planning events and weddings is more complex than ever. With countless moving parts, deadlines, vendors, and clients to manage, many professionals are turning to smart digital solutions to streamline their work. Using tools like wedding planner computer software has become a game-changer for professionals in the event industry.

Organize Better with Smart Wedding Planning Tools

Staying on top of every detail is critical in this industry. That’s where event planning software for wedding planners makes a big impact. These platforms allow you to manage guest lists, plan timelines, and coordinate vendors more efficiently than ever before.

One of the best investments for any professional in this space is software for wedding planners. It’s a must-have for anyone serious about delivering seamless events. From timeline creation to payment tracking, software for wedding planners reduces manual tasks and helps planners stay ahead of schedule.

In addition, wedding planner software simplifies client communication, ensuring that everyone is on the same page from day one. This results in happier clients, better feedback, and more referrals.

Take Control of the Entire Planning Process

To manage a growing list of clients and events, professionals use wedding planning software that provides a central dashboard for all planning tasks. These tools allow planners to focus more on creativity and client experience, rather than chasing down details manually.

Manage Your Business Like a Pro

Beyond event coordination, running a successful planning business also requires solid business tools. That’s why many professionals depend on event planning business software to manage contracts, invoices, and client records securely.

Choosing the right software for event planning can make day-to-day operations smoother. It allows planners to avoid unnecessary stress and focus on delivering unforgettable experiences.

Many teams now rely on Software for planning events that offer collaboration features, calendar syncing, and reporting tools to measure performance.

Empower Teams and Manage Venues More Efficiently

For teams that work together on multiple events, using event planners software is essential. It allows seamless task delegation, timeline updates, and easy communication, helping everyone stay aligned.

When it comes to managing physical venues, Event Venue Planning Software helps visualize layouts, manage bookings, and ensure spaces are used efficiently. Whether you’re organizing seating charts or managing room availability, this tool adds tremendous value.

Use Technology to Stay Competitive

As events grow more complex, professionals are turning to event management planning software to manage logistics, technical requirements, and scheduling in one streamlined platform. This ensures that no task or deadline gets overlooked.

Many professionals prefer all in one event planning software because it includes everything from task tracking to budgeting and reporting tools. This allows planners to manage entire events from one platform without switching between systems.

The growing demand for online event planning software shows how much the industry is embracing digital tools. Cloud access, data backup, and real-time updates make these platforms ideal for modern-day planning.

With the rise of remote work and mobile access, using Digital wedding planning software has become more important than ever. These tools offer convenience, flexibility, and security, which are key to running a successful planning business.

For venue managers, event venue management software helps track bookings, manage operations, and improve customer service. It’s a vital tool for keeping operations efficient and organized, especially in high-demand seasons.

Final Thoughts

The event and wedding planning industry is moving quickly toward smarter, more efficient solutions. Whether you’re an independent planner or part of a larger team, investing in professional tools like wedding planner computer software and online event & wedding planning software can transform how you work.

Using comprehensive tools such as software for wedding planners, event planning business software, and event venue management software helps reduce stress, improve client satisfaction, and scale your business with confidence.

Frequently Asked Questions (FAQ)

1. What is wedding planner computer software?

Wedding planner computer software is a digital tool that helps wedding planners organize every aspect of a wedding. It includes features like guest list tracking, vendor coordination, budget management, and event scheduling. This software helps planners work more efficiently and deliver seamless wedding experiences.

2. How is online event & wedding planning software different from traditional planning methods?

Online event & wedding planning software offers cloud-based access, allowing planners to manage tasks, clients, and vendors from any location. Unlike traditional methods, this software provides real-time updates, automated reminders, and easier collaboration, making planning faster and more organized.

3. Who should use event planning software for wedding planners?

Event planning software for wedding planners is ideal for professional wedding coordinators, event organizers, and planning teams. It helps streamline operations, manage timelines, and ensure that no detail is missed during the planning process.

4. Is software for wedding planners useful for small businesses?

Yes, software for wedding planners is especially useful for small businesses. It helps manage client communications, organize tasks, and keep track of budgets — all in one place. Even small teams can benefit from these tools to maintain a professional and organized service.

2 notes

·

View notes

Text

AdMotion Review: Create Trending and High Conversion Movie-Style Video In 1-Click by [Arifianto Rahardi]

Welcome to my Honest Review AdMotion Review. The current world depends on video marketing social media video marketing, and running ads. The content creator and marketer compete with each other. How to promote their video, how to instant viral media, and how unique to each other. Recently launched a powerful software to help you create a cinematic video in any language, thumbnail design, create intro video, marketing video, run ads, animation, and you forget about expensive production costs, endless editing hours, and outdated video-making methods- AdMotion Create any video in 3 simple steps. TURN NORMAL VIDEO INTO HIGH-QUALITY CINEMATIC VIDEO WITHOUT HAND-FREE.

What is AdMotion? AdMotion is a high-converting video creator app that creates cinematic videos in any language like Bollywood- just 3 simple steps without any skill and monthly fees, the AdMotion works automatically and generates Ordinary Videos into Stunning, High-Converting Cinematic Commercials Video Effortlessly in a Few Seconds. AdMotion is easy to use for your favorite social media, Video Marketing, Affiliate Marketing, Run Ads, Design Thumbnail, Intro Video, and Ready-Made templates, and does not require complicated downloads, or frustrating installations- just make seamless, professional-quality videos from your Canva Free Account in a few seconds. I believe it! You forget 100% about expensive production costs, endless editing hours, and outdated video-making methods and start a new journey with AdMotion. Grab attention, engage your audience, skyrocket your results, transform Marketing, and create cinematic video and animation start everything with AdMoton,

Overview – AdMotion Review First, a customer optimizes the products quality or benefits the site. Who is the person who built the app? Discount price: why build the app? And who is the best choice for it? Everything. That is an ideal customers quality. Don`t worry; I covered the part for an ideal person. I think you are an idealistic reader.

Read more here>>

Author/vendor – Arifianto Rahardi Product –AdMotion Launce date – 9/03/25 Official website – VISITE HERE Front-end price - $19 Business – ok Instantly Create Text Into High-Quality 4k HD Video Watch/ Create Video – Any Language Social Media Marketing – Number One passive income – ok Recurring System – OK Payment – ONE Time Local Business – High Recommend Money-Back – 30 Days Money-Back Guarantee Funnel/Tool – Automated & Done-For-You Support – Effective Niche – Any Niche of your choice

How does AdMotion Work? AdMotion review works in 3 simple steps. Set it unique to other apps. Use simple steps to generate thousands of profits every single day.

Stpe-1 Sing Up, Login & Choose Template:- The First Sing-Up & Login your Canva account and choose the template you want.

Step-2 Customize & Rebrand:- After Choosing the right template quickly upload and rebrand, replacing the video, pictures, and text to your choice.

Step-3 Publish & sell:- After a customized process ready to use your favorite social media, business, and more you want.

Why Unique AdMotion to Other App? AdMotion app has some wonderful parts that make it unique to other apps worldwide. Every time you feel cinematic videos test and grow your audience day by day, and dominate your business win competition with each other.

How can AdMotion Help You? Different software has different quality. The same AdMotion has some effective different quality. 1- Cinematic style: AdMotion automatically generates cinematic animation like Bollywood cinema that surprises any customer for a few moments.

2- Promote Video Ads: It is too easy to promote video ads. The app makes realistic videos of hypersonic quality.

3- Intro Animation Effect: This is amazing. AdMotion creates automatic intro VIDEO human-like. So the agency wants to choose a template only.

4- Outro Animation: Create a realistic and cinematic outro in a few seconds.

5- Third Animation: That is too popular for your young generation. The generation demands software that makes a video hero worldwide.

6- Call Out Animation: Users can easily promote a country, office, project, agency, and any video they want. AdMotion gives all free templates.

7- Square Video Animation: Every social media does not allow uploading all-size videos. The social media company fixed a few sizes. Don`t worry you promote square video easily.

8- Vertical Video Animation: TikTok, Instagram, Facebook short video and YouTube Short video allow vertical video. To promote an easily vertical video and grab money in your bank account.

9- Thumbnail Design: There are thousands of free templates. Log in, choose, and promote then profit.

Key Highlight – AdMotion There is an awesome key feature that helps make profits, grow an audience, and promote video seamlessly. The feature converts your audience to more leads. AdMotion Review is the world's first revolutionary software that gives you high-quality content and designs.

Why AdMotions is a Breakthrough? The video and graphic agency wants to buy software that helps them with high-speed internet, improved video compression methods, and the widespread availability of powerful computing devices. As a result, the agency built an app that provides lower costs and more production for content providers and distributors for entrepreneurs. The app provides the audience with user-friendly tools high-quality effects, and content, including professional-grade software like Adobe Premiere Pro and After Effects. Every video's quality is cinematic like a Bollywood movie. Does not require monthly fees and subscriptions. If the app doesnt work qualityful or doesn`t provide cinematic video then he money back in 30 days -announced to audience Arifianto Rahardi. The agency gives a PLR license to the audience. An audience can create unlimited video and design. Who is AdMotion's Best Choice? Every person can use the app to promote everything. The agency needs to unlock the app and the app works in 3 simple steps generate video, design, thumbnail, data upload, File upload & export, and promote any product easily with AdMotion. Now who is the best choice for it:

Digital Marker: Make your audience with awesome, high-quality unique video animations then convert lead generation to the sales page.

Affiliate Marker: Promote product or service by creating unlimited cinematic videos and animation to get the best-converting sales.

eCommerce Store Owner: Create unlimited video or animation for product promotion.

Advertisers: Eyecatching videos grab new and valuable audiences easily.

Freelancer: Freelancers would demand money from clients to create movie-style videos and designs.

Social worker: instantly viral every video and grow audience in a few months- follow only 3 simple steps.

Home Business: A mother can create her world with AdMotion easily and earn massive income from large companies.

Read more here>>

AdMotion`s Positive & Negative site

Positive site: -Instant create thumbnail -High-quality cinematic video -Valuable outro video -Real animation of intro video -Image, music, file video unlimited export and import -Customize any design or thumbnail -Promote any product in any language -Provide PLR-free license -World-class effective support -30-day money-back guarantee -Humanlike and real-like video creation.

Negative site: -Depend on internet connection -Everyday post on your site -Make unique ideas.

OTO, Funnel & Bonus

Front-End Price: $14 - $24

OTO 1 Price: $27

OTO 2 Price: $47

OTO 3 Price: $54

Cinematic Movie Style Animation Templates (Worth $750) Promo Video Ads Animation Templates (Worth $750) Intro Opener Animation Templates (Worth $450) Outro Animation Templates (Worth $450) Lower Third Animation Templates (Worth $375) Call Out Animation Templates (Worth $375) Square Post Animation Templates (Worth $750) Vertical Post Animation Templates (Worth $750) Thumbnail Designs (Worth $500) YouTube Channel Designs (Worth $500)

Frequently Asked Questions (FAQ)

Are images and videos included? Yes, They have done all templates. You use this template of your choice.

How to get the app? First log in, select the template, and promote the video on social media.

Is there any passive income system? Yes, the agency gives us the utmost priority for recurring and passive income.

Are there monthly fees? No, one-time payment and auto-update are all features.

Affiliate disclaimer

Thank you for perusing my genuine audit. My fair conclusion is shared within the survey.

An affiliate disclaimer may be an explanation to advise gatherings of people that a company or person may gain a commission or other emolument on the off chance that they buy items or administrations through joins on their site, web journal, social media, or different stages. This disclaimer is basic for keeping up straightforwardness and complying with legitimate requirements, such as those set by the Government Exchange Commission (FTC) within the Joined Together States. It guarantees perusers or watchers know of any potential predisposition or budgetary motivating force behind proposals.

Ordinarily, the disclaimer is set noticeably at the start or conclusion of substance and clearly states the nature of the partner relationship. For illustration, "This post may contain partner joins, meaning I win a commission if you buy through my joins at no additional taken a toll." This builds belief with the group of onlookers while ensuring the substance

#Arifianto Rahardi#Cinematic video animation software#Create movie-style animations online#Sell animation templates instantly All-in-one animation toolkit#Sell animation templates instantly#All-in-one animation toolkit#ADmotion review#admotion features

2 notes

·

View notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

345 notes

·

View notes

Text

Netflix Cash Loophole Review 2025: The World’s First “AI” System That Pays Us Recurring Monthly Commissions

Introduction: Netflix Cash Loophole Review 2025

The money earning through the internet proves intimidating to most people. It is difficult to Choose the correct options that bring value. The recent innovation in making money online is known as the Netflix Cash Loophole. This software promotes its capability to generate earnings through brief, rapidly spreading video content sharing. But is it for real? This review explains both the operation of the Netflix Cash Loophole along with its potential worth as an opportunity.

Overview: Netflix Cash Loophole Review 2025

Vendor: Glynn Kosky

Product: Netflix Cash Loophole

Launch Date: 2025-Mar-31

Front-End Price: $17

Discount: Claim $3 OFF, Just $14 One Time

Niche: Affiliate Marketing, Make Money Online

Guarantee: 180-days money-back guarantee!

Recommendation: Highly recommended

Support: Check

What is Netflix Cash Loophole?

AI drives the operation of the financial product called Netflix Cash Loophole. Users that share viral videos will receive payments of $149 according to this system. Having either your own video content or massive following is not needed to use this system. The system allows you to begin using it through any combination of computer devices together with mobile phone and tablet screens.

The best part? It runs on autopilot. After video sharing the system will continue to generate earnings for your account. The reality proves different from the initial impression. Let’s take a closer look.

#NetflixCashLoophole#AIMarketing#PassiveIncome#RecurringCommissions#OnlineBusiness#MoneyMakingIdeas#FinancialFreedom#WorkFromHome#SideHustle#EntrepreneurLife#DigitalMarketing#AffiliateMarketing#WealthBuilding#InvestInYourself#HomeBasedBusiness#AIIncome#SmartInvesting#IncomeStreams#BusinessOpportunities#TechForProfit#FinancialIndependence#MakeMoneyOnline#SuccessMindset

1 note

·

View note

Text

What Is a White Label Product and How Does It Work?

It's possible that products offered by some of the most well-known corporations in the world are not as uncommon as you might think. The company that actually produces their branded products is an outsider that markets the same things under different labels. White labelling is a well-known commercial strategy that is applied to numerous consumer product categories.

What does white label mean?

The practice of producing goods and marketing them under several brand names is known as "white labelling." Although white label products may differ in terms of branding, packaging, logos, and even prices, but their fundamental architecture remains the same. Limited product customization options, such as adding a brand logo or design on a product's exterior, may be available from white label manufacturers. In exchange for large orders, they might also give retailers discounts. After a purchase, products from other white label services, such print-on-demand businesses, are shipped straight to customers.

What are white label products?

White label products are produced by a different company than the one that markets or even sells them. The benefit is that multiple businesses can handle different aspects of the product development and sales process. Depending on their area of competence and inclination, three firms can concentrate on different aspects of the product: producing, marketing, and selling. The main advantages of white label branding for businesses are the time, energy, and financial savings on production and marketing expenses.

Another significant benefit of private label brands is that if a supermarket has an exclusive agreement with a manufacturer, the company may have cheaper average transportation costs and distributional economies of scale. The shop was able to offer the product for less and still make a larger profit margin due to decreased delivery expenses.

The rise in popularity of private label products indicates that customers are becoming less devoted to their preferred established brands and more price-conscious. The rise of private label brands in several nations is negatively impacting the market share of national brands or manufacturers.

White Label Branding Examples-

Electronics Industry:

Electronics manufacturers frequently white label their goods under different brand names. For example, a manufacturer may make tablets or smartphones for businesses that rebrand and sell the products under their own name.

Beauty and Personal Care:

The beauty and personal care industries are big on white labeling. A large number of private label cosmetic firms’ contract with other manufacturers to make their goods; these manufacturers create white label products and package them under the private label brands' names.

Grocery and Retail:

Frequently found in supermarkets and big-box stores, white label products are produced by outside vendors and marketed under the supermarket's own name. These consumer goods include everything from food products like snacks and canned foods to cleaning supplies and household goods.

Payment Processing:

White label payment processing solutions are frequently provided by payment gateway providers. This makes it possible for companies to seamlessly integrate the payment gateway into their operations and provide their clients payment processing services under their own identity.

Software:

Numerous web hosting providers provide best white label solutions that can be altered and rebranded by other enterprises. Email marketing platforms offer white-label software alternatives that enable agencies to sell email marketing services under their own brand.

Financial Services:

Financial institutions sell financial services and goods to other businesses under a white label. White labeling branded credit cards, prepaid cards, and even banking solutions are examples of this, in which the partner company's branding and client experience are tailored.

Web Hosting:

White label hosting is a service that many web hosting providers provide. Because of this, resellers are able to offer web hosting packages under their own brands, with the main web hosting provider handling the setup and maintenance for the web hosting.

A huge number of people have discovered their calling in the web hosting industry, which has grown to be quite large. With over 126 million web hosting companies based there, its valuation is predicted to reach over $83 billion by 2021. White label hosting is a component of that sector. Reseller hosting is directly related to it.

It becomes an affordable option for small businesses to enter the web hosting industry and launch their own web hosting company when paired with white label reseller hosting. In order to help you resale hosting and launch your business, we will go over the steps and information you need to know in this post.

White Label Reseller Hosting: What Is It?

Finding a parent provider to purchase resources from and selling their servers, bandwidth, RAM, and other components are examples of this. You should not handle the technical specifications, server management, or maintenance on your own. It essentially lets you run your own web hosting company without having to deal with all the difficult technical aspects. Many providers also have their own reseller programs because it has become a popular choice among users.

Working of white label reseller hosting?

You need to first find a parent provider and buy a reseller plan in order to receive web hosting services if you want to engage in the white label web hosting industry and operate a reseller hosting website. Once you've selected a parent company, you can launch your hosting company.

With white label web hosting, you want to charge your clients more than you did when you bought the reseller plan and acquired the required resources from your parent provider. By doing this, you avoid having to spend any time or money on your own server setup or other resource purchases.

What does White label Reseller Hosting include?

User-Friendly Control Panel

An essential tool for managing websites is a user-friendly control panel. You can make backend changes and, if required, provide the client access via control panel access.

Scalable

If your clientele is growing or you're in charge of a website that needs more server power, reseller hosting should allow you to increase server resources.

Integrated Billing

WHM billing software, which enables you to bill your clients and oversee their payment schedules, is included in the majority of reseller accounts. Thanks to this, making sure your clients pay you on time is no longer a burden.

Integration of Domain and Email

With reseller accounts, you can sell domain names and email account upgrades. These can elevate your services when included in your hosting packages.

Private Name Servers

Thanks to private name servers, your brand and the hosting provider whose servers you're using will become more distinct.

Website hosting always remains in demand. White label hosting allows you to give your clients the choice of operating their server without requiring you to handle any of the expensive or challenging aspects of it.

Make sure to conduct thorough research before deciding on the ideal reseller plan for your company. Locate a reputable host that can provide the ideal server environment for you and your clients.

How White Label Solution Is Better?

There are a number of reasons why white label products might be the best option for your company as a business.

No risk

There is always some risk involved in starting your own business, but part of that danger can be reduced by white labelling your products. Because you're not spending as much money on creating a new product, risk is reduced.

Therefore, you won't lose as much money if the product doesn't work out in the market as you would if you had started from begin with its development. Select a white label product from a reliable supplier to further reduce your risk.

Improved quality assurance

Lastly, you may be confident that white label products will have superior quality control than those that you would make yourself. This is because, compared to you, the white label manufacturer is probably going to have a stronger quality control procedure.

Furthermore, since the white label manufacturer probably produces labels for other businesses, it usually has a group of quality control specialists on staff who can guarantee that the product fulfills your requirements.

Quicker to launch

White label products are also preferred since it can be considerably quicker to bring a product to market with them than it is to design one from the ground up. Once more, this is because you're just rebranding an already-existing product—the production process isn't being started from scratch. Hence, white labelling can be a fantastic choice if you want to launch a product rapidly.

The time to market is the largest advantage of white labelling. It can take months, or even years, to develop a product from scratch, find a manufacturer, and bring it to market. White labelling allows you to expedite that procedure and get your goods onto the market much faster.

More adaptability

Additionally, white label products provide more freedom than creating your own product. For instance, you still have control over the product's logo, packaging, and marketing if you white label it.

This implies that you can design a special product for your brand and customize it to your target market. Furthermore, even if you have less control over the production process, you still have a great deal of influence on how your customers are shown the goods.

Affordable

White label products are popular because they are an affordable means of launching a business. Best White labelling can be a big benefit, especially for small businesses, as it eliminates the upfront expenditures associated with product development, production, and marketing.

The largest financial benefit of white labelling, is that there are no expenses associated with product development or marketing. Rather, you're simply capitalizing on the success of another company's product, allowing you to launch your firm with less overhead and more swiftly."

Lower requirements for minimum orders

also typically have lower minimum order quantities than if you were to produce the product yourself. This is so that the white label manufacturer won't have to start a new production line just to fill your little request because they already have the product in stock.

Therefore, white label products can be a terrific choice if you're just getting started and don't need many products.

Conclusion-

White label products are produced by a same business, then packaged and marketed by other businesses under different brand names. It has been profitable for big-box stores to provide white label products with their own branding.

Since the late 1990s, private label branding has become a global phenomenon that has grown gradually. White label branding offers businesses a number of advantages, including reduced production and marketing expenses, time, and energy expenditures.

Dollar2host Dollar2host.com We provide expert Webhosting services for your desired needs Facebook Twitter Instagram YouTube

4 notes

·

View notes

Text

Hire a Property Manager in LA by Stlivingla

Introduction Are you a property owner in Los Angeles looking to maximize your investment and minimize your stress? Hiring a property manager in LA can be the key to achieving both. Stlivingla offers expert property management services that cater to your specific needs, ensuring that your property is well-maintained and profitable. In this blog, we'll explore the benefits of hiring a property manager and why Stlivingla is the best choice for property management in Los Angeles. Why Hire a Property Manager in LA?

Local Expertise Los Angeles is a vast and diverse city with unique neighborhoods, each with its own rental market dynamics. A property manager with local expertise understands these nuances and can help you set the right rental rates, attract quality tenants, and navigate local regulations. Stlivingla's team has extensive knowledge of the LA rental market, ensuring your property is competitively priced and compliant with all local laws.

Time and Stress Savings Managing a property can be a full-time job. From marketing vacancies and screening tenants to handling maintenance requests and rent collection, the tasks can quickly become overwhelming. By hiring a property manager, you free up your time and reduce stress, allowing you to focus on other priorities. Stlivingla takes care of all aspects of property management, so you don't have to worry about the day-to-day operations.

Tenant Screening and Retention Finding reliable tenants is crucial for a successful rental property. A professional property manager has the tools and experience to screen potential tenants thoroughly, ensuring you get responsible and long-term renters. Stlivingla's rigorous tenant screening process includes background checks, credit checks, and rental history verification, helping you avoid problematic tenants and reduce turnover rates.

Efficient Maintenance and Repairs Regular maintenance and prompt repairs are essential to keep your property in top condition and retain tenants. Stlivingla has a network of trusted contractors and vendors, ensuring that maintenance issues are addressed quickly and cost-effectively. Our proactive approach to property maintenance helps prevent small problems from becoming costly repairs.

Financial Management Keeping track of rental income, expenses, and financial records can be complex. A property manager handles all financial aspects of your property, from rent collection and bill payments to detailed financial reporting. Stlivingla provides transparent and accurate financial management, giving you peace of mind and clarity on your property's financial performance. Why Choose Stlivingla? Stlivingla stands out as a premier property management company in Los Angeles for several reasons: Experience and Reputation: With years of experience in the LA real estate market, Stlivingla has built a solid reputation for delivering exceptional property management services. Our satisfied clients attest to our commitment to professionalism and excellence. Customized Services: We understand that every property and owner is unique. Stlivingla offers customized property management solutions tailored to your specific needs and goals, ensuring you receive the best possible service. Cutting-Edge Technology: We leverage the latest property management software and technology to streamline operations, enhance communication, and provide you with real-time access to important information about your property. Dedicated Team: Our team of property management experts is dedicated to providing top-notch service and support. From our responsive customer service to our knowledgeable property managers, Stlivingla is committed to your success. Conclusion Hiring a property manager in LA can transform your property investment experience, making it more profitable and less stressful. Stlivingla offers unparalleled property management services that cater to the unique demands of the Los Angeles rental market. Contact us today to learn more about how we can help you achieve your property management goals. Contact Stlivingla Ready to take the next step? Contact Stlivingla today to discuss your property management needs. Visit our website at www.stlivingla.com or call us at (123) 456-7890. By following these guidelines, this blog post is optimized for the keyword "Hire a Property Manager in LA" and is designed to attract potential clients searching for property management services in Los Angeles.

#boutique apartment#apartmentsforrent#hollywoodkoreatown#newly constructed apartments for rent in koreatown

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

621 notes

·

View notes

Text

Optimize Vendor Payments with Efficient Vendor Management Software

In today’s dynamic business environment, the effective handling of vendor payments plays a role in maximising cash flow, ensuring transactions, and nurturing strong relationships with suppliers. However, outdated manual vendor management procedures can be cumbersome, prone to mistakes, and consume resources. This is where vendor management software steps in, offering a solution to streamline the vendor payment workflow and unlock efficiencies.

#Vendor Management#Vendor Payments#Vendor management software#Vendor Management System#Vendor Management Service

0 notes

Text

J.P. Morgan Data Breach Affects Over 451,000 Retirement Plan Participants

In a recent regulatory filing with the Office of the Maine Attorney General on April 29, J.P. Morgan Chase Bank revealed that a staggering 451,000 individuals were impacted by a vendor-provided system data breach. According to the bank, a software issue in this system erroneously granted access to retirement plan participants' records to users who should not have had such privileges. The breach exposed sensitive personal information, including names, social security numbers, mailing addresses, payment and deduction details, as well as bank routing and account numbers for those using direct deposit. Limited Access, but Potential for Misuse J.P. Morgan stated that the "incorrect entitlements" were limited to three authorized system users who, as part of their job responsibilities, regularly access this type of information and are obligated to safeguard it. These three users were employed by J.P. Morgan customers or their agents. Over the period from August 26, 2021, to February 23, 2024, these individuals downloaded a total of 12 reports containing the sensitive data of retirement plan participants. Prompt Action and Identity Theft Protection Upon becoming aware of the software issue on February 23, J.P. Morgan promptly corrected the users' access issue, tested it, and applied a software update to resolve the problem. A spokesperson for the bank emphasized, "There is no indication of data misuse," and clarified that the breach was not part of a cyberattack. As a precautionary measure, J.P. Morgan is offering two years of identity theft protection services through Experian to all affected individuals. The bank has also made its call center available to address participants' questions and concerns regarding the data breach. Read the full article

2 notes

·

View notes