#ap process streamlining

Explore tagged Tumblr posts

Text

Automation’s Dynamic Role in Managing Accounts Payable Workflow

In the accounts payable space, success is defined by efficiency and accuracy. This transformation has been ignited by the emergence of automated Accounts Payable (AP) solutions.

Automated AP process unravels the intricacies and inefficiencies that once burdened financial operations. It ushers in an era where efficiency is no longer an aspiration but an everyday reality. The symphony begins with the capture of invoices, as businesses embrace centralized and automated methods, dancing effortlessly through data extraction and validation techniques that leave no room for errors. Yet, amidst all this, we must not forget the challenges that arise along the way.

Integration of existing accounting systems and data security may become obstacles, but in the face of innovation and adaptability, these challenges can potentially become stepping stones to success. Across industries, from Non-Profit Organizations (NPOs) to auto care, retail, and restaurants, businesses are embracing automation to streamline their AP processes and enhance their overall financial management.

In this blog I will comprehensively unveil the challenges and strategic insights that lie at the intersection of automation and payables prowess. Welcome to the future of AP workflow, where efficiency meets ingenuity.

Challenges in Complex AP Workflows

Efforts to streamline intricate AP workflows bring to light a set of well-recognized challenges, each representing a puzzle waiting to be solved. These challenges, while formidable, offer a gateway to a more efficient and effective future. As we explore these challenges, let’s delve a bit deeper into their significance:

Integration Struggles: A noteworthy 75% of organizations concede that integration of automated AP solutions with existing systems poses a substantial hurdle. The task of weaving together different technologies and platforms is akin to assembling a complex jigsaw puzzle, requiring careful consideration and coordination.

Balance Between Automation and Expertise: Striking the delicate balance between the efficiency of automation and the nuanced expertise of human insight is no simple feat. In sectors such as construction and auto care where precision is paramount, this challenge takes center stage. It’s a tightrope walk between harnessing automation’s power and maintaining the irreplaceable touch of human judgment.

Data Security as a Bedrock: For industries handling sensitive data, the challenges are twofold, adopting automation while ensuring stringent data security measures. This issue is not just about implementing new systems; it’s about fortifying digital fortresses to safeguard invaluable information against evolving threats.

Reshaping Workflows: Embracing automation requires reshaping established workflows to fit the demands of the modern business landscape. It’s like molding clay into a new form – a gradual and deliberate process that demands creativity and a keen understanding of your organization’s needs.

Harmonizing Technology and Workforce: Implementing automation isn’t just about deploying new technology; it’s about managing change and ensuring that the human workforce adapts seamlessly. The challenge lies in nurturing a culture that embraces innovation while empowering employees to thrive in the new digital environment.

For More Information visit us at https://pathquest.com/knowledge-center/blogs/automated-ap-workflow-solutions/

0 notes

Text

Revolutionize Your Finance Function with Payables Outsourcing

Managing a finance department efficiently requires both expertise and time. One of the most impactful ways to streamline operations is through accounts payable outsourcing.

Outsourcing accounts payable tasks allows internal teams to shift their focus from administrative duties to strategic financial planning. Tasks such as invoice entry, vendor communication, and payment scheduling are managed by experienced professionals using automated tools.

This shift not only improves the speed and accuracy of the AP process but also helps reduce overhead costs. Businesses no longer need to invest heavily in training, software, or expanding in-house teams. Instead, they benefit from the efficiency of a dedicated service provider.

With real-time tracking and reporting capabilities offered by many AP outsourcing providers, businesses gain better visibility into their cash flow and financial commitments. This allows for smarter decision-making and improved budget management.

Additionally, outsourcing ensures compliance with evolving regulations and maintains a secure audit trail, reducing the risk of non-compliance and financial discrepancies.

Overall, accounts payable outsourcing is a reliable solution for finance departments seeking to enhance productivity and reduce complexity. It’s a smart investment in both performance and peace of mind.

#"#AP workflow automation#financial process streamlining#outsourced finance functions#accounts payable technology#AP department efficiency

0 notes

Text

Healthy Business Operations & Relationships - Optimise AP Process With Moolamore

Is it difficult for your small and medium-sized business to maintain a healthy cash flow and run smoothly? Are late payments causing problems with your vendors, suppliers, or creditors? Accounts payable (AP) management is an important part of any business. However, it is frequently overlooked or misused in financial management.

That is why, in today's blog, we will discuss the consequences of late payments and demonstrate how the groundbreaking Moolamore cash flow tool can optimize your accounts payable process, resulting in healthy business operations and relationships.

#optimizing accounts payable process#streamlining AP operations#improving AP efficiency#AP process optimization

0 notes

Text

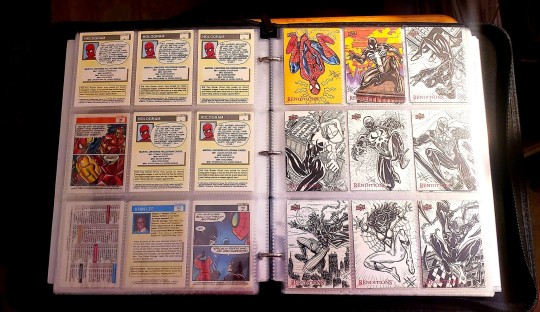

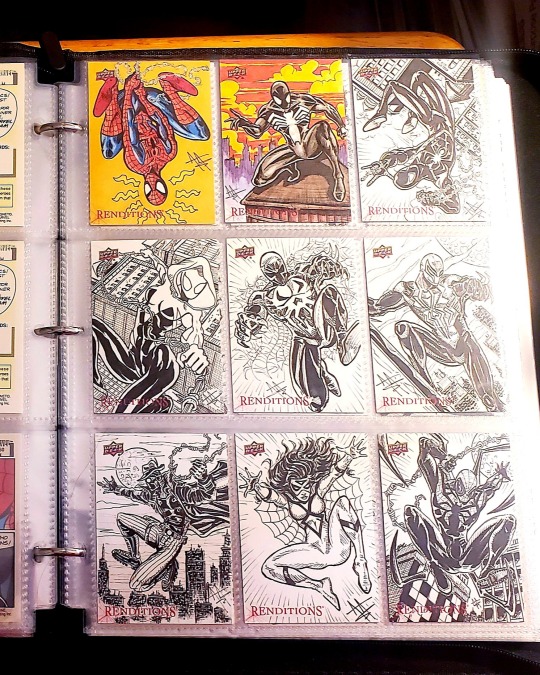

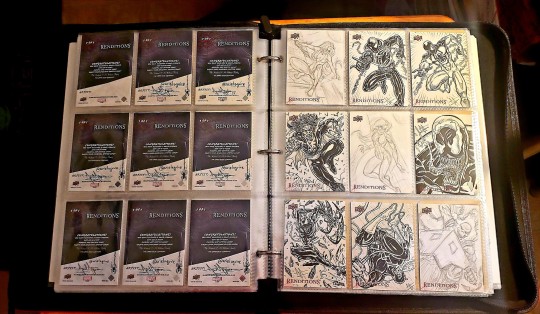

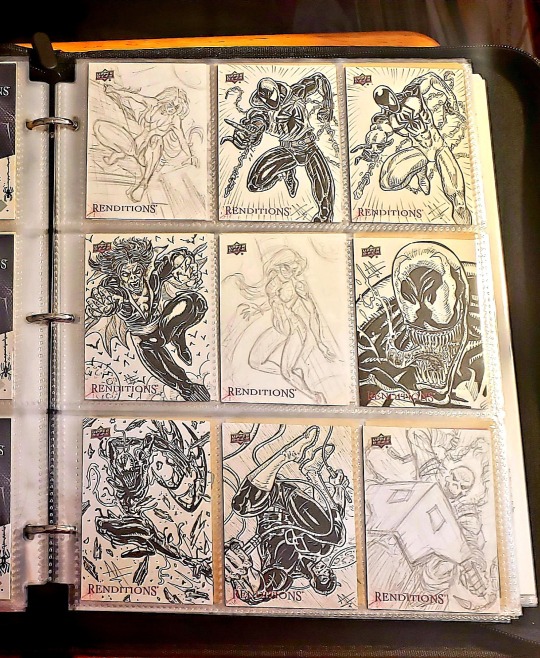

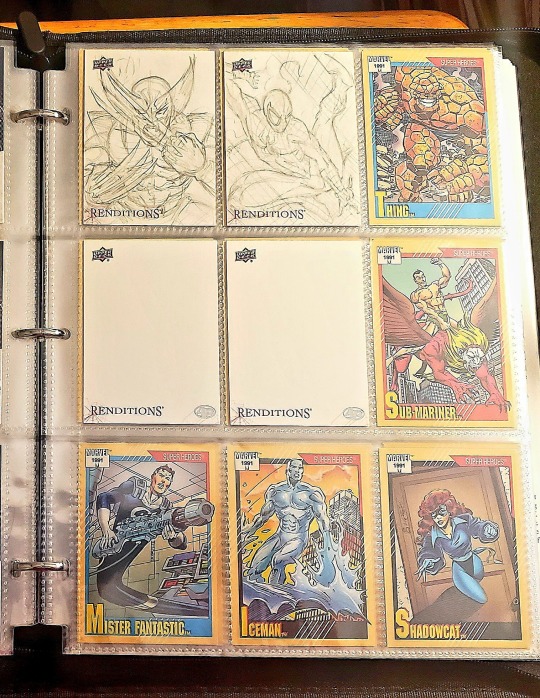

During the 20 days I had to work on this first sketch card project (due to a particularly busy schedule, with my full-time dispatcher job, another art project during all of Jan 2024, an almost month-long international trip during Feb/ Mar, and these cards being due in April), I kept my sketch cards nice n' safe in this binder, snugly between 2 of my favorite childhood sets: Marvel Universe Series I and II! Couldn’t ask for better company! 😄

As I mentioned previously, after fully completing my first 2 cards (pencil, ink, and color), I did all the rest in 3 phases to streamline the process due to my tight schedule (so I penciled ALL the rest first, then moved on to ink them all, and then colored them, which saved time).

I took these binder pix about half way, during the inking phase, where most were inked, but still a few just penciled (and you can get a sneak peek of some I haven’t posted yet!) 😊

The 2 “Artist’s Proof" cards (with the AP stamp on the lower right) in this last pic were still blank because those aren't part of the main set with the earlier deadline, which get inserted into the trading card packs, but rather are drawn (and approved!) later and kept by the artist, so I only got to those after all 3 of my sets (with back to back deadlines) were done! 😊

#arielsartwork#art#drawing#artblr#sketch#sketchcard#pencil#ink#pen#upperdeck#marvel#rendimiento#spiderman#spidey#process#spiderverse#marvel universe#trading cards#marvelcards

3 notes

·

View notes

Text

SUI Blockchain vs Ethereum: Which is Better for DApp Development?

Introduction

The blockchain landscape continues to evolve, with SUI and Ethereum standing out as prominent platforms for decentralized application (dApp) development. While Ethereum has long been a leader in this space, SUI introduces innovative features that cater to modern development needs. This article explores the distinctions between SUI and Ethereum, focusing on their suitability for dApp development.

What is SUI Blockchain Development?

SUI is a Layer 1 blockchain designed to offer high throughput and low latency, making it ideal for dApp development. It employs the Move programming language, which emphasizes safety and flexibility in smart contract creation. SUI's architecture supports parallel transaction processing, enhancing scalability and efficiency.

What is SUI Blockchain Development and How Does It Work?

SUI operates on a Delegated Proof-of-Stake (DPoS) consensus mechanism, allowing for swift transaction validation. Its object-centric model treats each asset as a distinct object, enabling parallel processing and reducing bottlenecks. This approach contrasts with Ethereum's account-based model, which processes transactions sequentially.

Why is SUI Blockchain Important?

SUI addresses several limitations found in traditional blockchains:

Scalability: Parallel processing allows SUI to handle a high volume of transactions simultaneously.

Efficiency: The Move language facilitates secure and efficient smart contract development.

Cost-Effectiveness: Predictable and low transaction fees make SUI accessible for developers and users.

What is SUI and Why It Matters Today

Developed by Mysten Labs, SUI aims to provide a scalable and developer-friendly platform for decentralized applications. Its emphasis on parallel processing and object-oriented design sets it apart from other blockchains.

Growth of Blockchain Projects Using SUI

SUI's architecture has attracted various projects, particularly in areas requiring high transaction throughput, such as gaming and decentralized finance (DeFi). Its growing ecosystem reflects its potential as a robust platform for dApp development.

Role of SUI in Decentralized Application Ecosystems

By offering a scalable and efficient environment, SUI enables developers to build complex dApps without the constraints of traditional blockchain limitations. Its support for the Move language further enhances its appeal to developers seeking flexibility and security.

Why SUI Is a Strong Choice for Application Builders

Fast Confirmation Without Compromising Reliability

SUI's consensus mechanism ensures rapid transaction confirmation while maintaining network reliability and security.

Built-In Tools That Support Scalable App Creation

The platform provides developers with tools and frameworks that streamline the development process, facilitating the creation of scalable applications.

Object-Centric Architecture for Clear Asset Tracking

SUI's unique approach to asset management allows for precise tracking and manipulation of digital assets, enhancing transparency and control.

Friendly Environment for Developers and Auditors

The Move programming language, coupled with SUI's developer resources, creates an accessible environment for both developers and auditors, promoting secure and efficient dApp development.

Key Advantages of SUI Blockchain

Fast Transaction Speed with Low Finality Time

SUI's parallel processing capabilities enable high transaction speeds and quick finality, essential for real-time applications.

Predictable and Affordable Resource Use

The platform's fee structure offers predictability, allowing developers and users to anticipate costs accurately.

Built-in Support for Multi-Chain Communication

SUI facilitates interoperability with other blockchains, expanding the potential for cross-chain applications and collaborations.

Flexible Access Controls for Safer Projects

Developers can implement granular access controls within their applications, enhancing security and compliance.

Reduced Operational Overhead through Parallel Processing

By processing transactions concurrently, SUI reduces the operational burden on the network, improving overall efficiency.

SUI Blockchain Services Offered

End-to-End dApp Support

Comprehensive services are available to guide developers through the entire dApp development lifecycle on SUI.

Smart Contract Creation and Deployment

Expertise in developing and deploying smart contracts using the Move language ensures robust and secure applications.

Token Generation and Deployment on SUI

Services include the creation and deployment of custom tokens, facilitating various use cases within the SUI ecosystem.

SUI NFT Minting and Marketplace Setup

Support for NFT creation and the establishment of marketplaces enables developers to tap into the growing digital asset space.

DeFi Platform Configuration on SUI

Assistance in setting up decentralized finance platforms leverages SUI's capabilities for efficient financial applications.

Wallet and Key Management Solutions

Secure wallet solutions and key management services are provided to ensure the safety of digital assets.

SUI-Based Lending and Staking Modules

Development of lending and staking modules allows for the creation of financial products within the SUI network.

Features of Apps Built on SUI

Fast Execution Without Network Bottlenecks

Applications benefit from SUI's high throughput, minimizing delays and enhancing user experience.

Custom Asset Behavior With Full Transparency

Developers can define specific behaviors for digital assets, ensuring transparency and control within applications.

Smart Sharing Across Multiple Users and Apps

SUI supports seamless sharing of assets and data across users and applications, promoting interoperability.

Programmable Objects with Built-in Ownership Logic

The object-centric model allows for programmable assets with inherent ownership rules, simplifying asset management.

Gas Fee Rebates for Light User Actions

SUI's fee structure includes rebates for certain user actions, reducing costs and encouraging engagement.

Support for Confidential Transactions Using ZK Tools

Integration of zero-knowledge tools enables confidential transactions, enhancing privacy within applications.

Process of Building on SUI With Our Team

Clarity in Requirement Gathering

A thorough understanding of project requirements ensures that development aligns with client objectives.

Secure Design for Smart Contracts

Emphasis on security in smart contract design mitigates risks and promotes trust in applications.

Creating Clean Interfaces and Workflows

User-friendly interfaces and efficient workflows are developed to enhance user interaction and satisfaction.

Test Runs in Real-like Environments

Applications undergo rigorous testing in environments that simulate real-world conditions, ensuring reliability.

Continuous Updates Based on Client Feedback

Ongoing support and updates are provided, incorporating client feedback to refine and improve applications.

Platforms We Help Launch with SUI

Gaming Apps With Real-Time Asset Movement

Development of gaming applications that leverage SUI's capabilities for real-time asset interactions enhances player experiences.

Marketplaces Built Around User-Created Content

Malgo excels in creating marketplaces that empower users to generate and trade content, utilizing SUI's efficient infrastructure.

Platforms for Real-World Asset Tokenization

Services include the development of platforms that tokenize real-world assets, bridging the gap between physical and digital economies.

Borrowing and Lending Applications

Creation of decentralized borrowing and lending platforms on SUI facilitates accessible financial services.

DAO Solutions with Voting and Treasury Logic

Development of decentralized autonomous organizations (DAOs) with integrated voting and treasury management supports community governance.

Chain-Backed Loyalty and Identity Tools

Implementation of loyalty programs and identity verification tools leverages blockchain's security and transparency.

Final Thoughts

SUI presents a compelling option for dApp development, offering scalability, efficiency, and a developer-friendly environment. Its innovative features position it as a strong alternative to established platforms like Ethereum. Build secure and scalable apps with SUI blockchain experts. For those seeking to harness SUI's potential, Malgo stands out as a leading company in SUI blockchain development. They provide comprehensive services tailored to diverse application needs. The development cost depends on factors such as feature complexity, technology stack, customization requirements, and deployment preferences. Get in touch with Malgo for a detailed quote.

1 note

·

View note

Text

App Store Optimization in 2024: A Comprehensive Guide for Play Store Success with No-Code App Builders

Introduction

As the mobile app market continues to expand, standing out in the crowded Google Play Store has become more challenging than ever. App Store Optimization (ASO) is crucial for ensuring your app ranks high in search results and attracts the right audience. In 2024, mastering ASO is essential for any app developer, including those using no-code app builders. This article provides a comprehensive guide to optimizing your Play Store listing, with a focus on how no-code app builder can streamline the process.

1. Understanding ASO in 2024

App Store Optimization (ASO) is the process of improving the visibility of your app in an app store's search results. The goal is to increase organic downloads by making your app more discoverable. In 2024, ASO strategies are evolving with the latest trends in user behavior, search algorithms, and mobile technology. Whether you're building your app with a no-code app builder or through traditional development, understanding these trends is key to staying competitive.

2. Keyword Research and Optimization

Keywords are the foundation of ASO. In 2024, keyword optimization continues to play a critical role in how apps are ranked in the Play Store. Start by researching the most relevant and high-traffic keywords for your app. No-code app builders often offer integrated tools that help identify these keywords, simplifying the process for non-technical users. Be sure to include your primary keywords in the app’s title, description, and metadata.

3. Optimizing Your App’s Title and Description

The title of your app is one of the most important factors in ASO. It should be concise, descriptive, and include your main keyword. In 2024, Google Play's search algorithm favors titles that clearly reflect the app's purpose and function. No-code app builders can assist in generating effective titles by suggesting relevant keywords based on the app's content.

Your app’s description is another critical component. The first few lines of the description are especially important, as they are often displayed in search results. Ensure that your description is clear, compelling, and keyword-rich. With no-code app builders, you can easily update and optimize your app’s description as you test different keywords and phrases to see what works best.

4. High-Quality Visual Assets

Visual appeal is crucial in attracting users. This includes your app icon, screenshots, and promotional videos. In 2024, users are more likely to engage with apps that have high-quality, visually appealing assets. No-code app builders make it easy to design and upload these assets, even for those without a background in graphic design. Use tools provided by your no-code platform to create professional-looking visuals that resonate with your target audience.

5. Leveraging User Reviews and Ratings

User reviews and ratings significantly impact your app’s ranking in the Play Store. Encourage satisfied users to leave positive reviews and address any negative feedback promptly. No-code app builders often include features that make it easy to integrate in-app prompts for reviews and ratings. By actively managing and responding to user feedback, you can improve your app’s reputation and ranking over time.

6. A/B Testing for Continuous Improvement

A/B testing involves comparing two versions of your app’s store listing to determine which one performs better. This could include testing different titles, descriptions, icons, or screenshots. In 2024, A/B testing remains a vital component of a successful ASO strategy. No-code app builders frequently offer built-in tools for A/B testing, allowing you to experiment with different elements of your listing without needing advanced technical skills.

7. Tracking and Analyzing Performance

Monitoring the performance of your ASO efforts is essential to ensure continued success. Use analytics tools to track your app’s rankings, downloads, and user engagement. No-code app builders often come with integrated analytics dashboards, making it easier to analyze your app’s performance and make data-driven decisions. Regularly reviewing these metrics will help you refine your ASO strategy and stay ahead of the competition.

8. Adapting to Play Store Algorithm Changes

Google frequently updates its Play Store algorithms, which can impact your app’s ranking. Staying informed about these changes is crucial for maintaining visibility. No-code app builders typically provide updates and resources to help users adapt to these changes, ensuring that your app remains optimized for the latest algorithm updates.

Conclusion

App Store Optimization is a critical component of your app’s success in the Play Store, and it’s more important than ever in 2024. By leveraging no-code app builders, you can simplify the ASO process, making it accessible even to those without technical expertise. From keyword research and visual asset creation to A/B testing and performance tracking, no-code platforms offer the tools you need to optimize your app’s Play Store listing effectively. Embrace these strategies to improve your app’s visibility, attract more users, and achieve sustained success in the competitive mobile app market.

2 notes

·

View notes

Text

Buy Verified Cash App Accounts For Sale

Buy Verified Cash App Accounts.Purchasing ensures secure transactions and streamlined money management. Buy Verified Cash App Accounts. Navigating the digital economy requires trustworthy financial tools, and verified Cash App accounts stand out as a top choice for seamless online transactions. Users gain peace of mind, With a verified status, account holders can unlock higher transaction limits and access a broader range of services, making it a must-have for those who prioritize financial security and convenience in the digital space. This advantage is essential for both personal and business users looking to optimize their online payment experience. As digital payments become the norm, having a verified Cash App account is not just a luxury—it’s a necessity for staying ahead in today’s fast-paced financial world.

Buy Verified Cash App Accounts

24 Hours Reply/Contact Email:- [email protected] WhatsApp: +44 7365-263508 Skype:- usatopvcc Telegram:- @usatopvcc

Buy Verified Cash App Accounts

Cash App Account is a digital wallet that allows users to send and receive money online. In today’s digital age, having a digital wallet has become a necessity for many people. The Cash App Account is a popular choice for its ease of use and accessibility. It allows users to quickly and securely send and receive money, as well as make payments for various services and products. Additionally, the Cash App offers a variety of features such as the Cash Card, which can be used to make purchases online and in-store, Overall, the Cash App Account is a reliable and convenient option for managing one’s finances.

The Rise Of Digital Wallets The digital wallet revolution is changing how we handle money. More people are choosing digital wallets for their convenience and security. This shift is reshaping the financial landscape, making physical wallets less necessary. Buy Verified Cash App Accounts.

Real-world Success Stories Curious about how Cash App Account has transformed lives? Dive into these Testimonials from Savvy Users and find Inspiration for Financial Growth.

Introduction To Cash App Are you tired of carrying cash around or dealing with the hassle of writing checks? Enter Cash App, the digital wallet that’s revolutionizing the way people handle their money. In this section, we’ll explore the basics of Cash App and why it’s becoming increasingly popular.

Future Of Digital Wallets And Cash App Digital wallets are becoming increasingly popular due to their convenience and ease of use. Cash App, a popular digital wallet, is expected to continue to grow in popularity as more people embrace the benefits of cashless transactions. With its user-friendly interface and innovative features, Cash App is poised to become a major player in the future of digital wallets. The Cash App has become a prominent player in the realm of digital wallets, offering users a convenient and efficient way to manage their finances. As we look towards the future of digital wallets and the Cash App, it’s essential to explore the emerging trends and predictions for its evolution.

What Is Cash App? Cash App is a peer-to-peer payment app that allows users to easily send and receive money from friends, family, or even businesses. It also offers a range of other features, including the ability to buy and sell Bitcoin, invest in stocks, and even get a debit card for making purchases.

Rising Popularity Of Digital Wallets The rise of digital wallets like Cash App is no surprise, given the convenience and security they offer. With digital wallets, users can make payments, manage their finances, and even store loyalty cards and tickets all in one place. As more people embrace digital transactions, the popularity of digital wallets continues to soar.

Setting Up Your Cash App Account Setting up your Cash App account is a straightforward process that allows you to quickly and easily start sending and receiving money. Whether you’re new to the app or looking to create a new account, the following steps will guide you through the account creation process and help you link your bank account for seamless transactions.

Cash App’s Place In The Market Cash App leads in this digital movement. It stands out by offering more than simple transactions. Users can buy, sell, and invest in cryptocurrencies too. This versatility attracts a broad user base, from young adults to seasoned investors.Buy Verified Cash App Accounts

Instant money transfers Investment options in stocks and Bitcoin Unique features like “$Cashtag” for easier payments Understanding Cash App Boosts Cash App Boosts are a valuable feature that can help users save money and get cashback on their purchases. In this section, we will delve into what Cash App Boosts are and how to activate them, so you can take full advantage of this money-saving tool.

What Are Cash App Boosts? Cash App Boosts are special rewards offered to Cash App users, providing them with discounts and cashback offers at select merchants. These boosts are designed to help users save money on everyday purchases, making it a valuable feature for anyone looking to stretch their budget.

Transition From Traditional Banking Traditional banks often involve long processes and high fees. Cash App offers a refreshing alternative. With instant transactions and lower costs, it’s becoming a preferred choice.

Sign up in minutes Minimal fees for transactions User-friendly interface What Are Verified Cash App Accounts? Verified Cash App accounts offer enhanced features. They stand out from regular accounts. Users complete a verification process. This unlocks higher transaction limits and additional services. Trust and security are central to these accounts.Buy Verified Cash App Accounts

Verification Process Verification involves confirming identity. Users provide personal information. This includes Social Security Number (SSN). A government-issued ID might be needed. The process is straightforward. It ensures safety for all users.

Benefits Of Being Verified Increased Limits: Send and receive more money weekly. Direct Deposit: Get paychecks and tax returns faster. Bitcoin Trading: Buy and sell Bitcoin effortlessly. Why Purchase A Verified Cash App Account? Exploring the digital financial world brings us to a pivotal question: Why purchase a verified Cash App account? Understanding the reasons can help you navigate the sea of online transactions with confidence.

Ease Of Access Verified Cash App accounts offer unparalleled ease of access. Users enjoy quick setup and immediate use. With verification, there’s no limit to what you can achieve. This includes sending and receiving money or investing in stocks and Bitcoin. Let’s break down the benefits:

Instant transactions: Send and receive money in moments. Direct deposits: Get paychecks up to two days early. Full features: Access all that Cash App offers without restrictions. Risks Of Unverified Accounts Understanding the risks associated with unverified Cash App accounts is crucial for users. These accounts come with potential pitfalls that can affect both your financial flexibility and security. Buy Verified Cash App Accounts.

Limitations And Restrictions Unverified Cash App accounts face several limitations:

Lower sending limits: You can send only up to $250 within any 7-day period. Receiving restrictions: You can receive up to $1,000 every 30 days. Withdrawal caps: The withdrawal limit for unverified users is restricted. Verified users enjoy higher limits and fewer restrictions, making verification a smart move for active users.

Buy Verified Cash App Accounts Buy Verified Cash App Accounts

Vulnerability To Fraud Unverified accounts are more susceptible to fraud. Here’s why:

Limited protection: Verified accounts have additional security features. Target for scammers: Scammers often target unverified accounts. No ID verification: This makes it easier for fraudsters to remain anonymous. Stay safe by verifying your account, which adds a layer of protection against potential threats.

Choosing A Reliable Seller Finding a reputable seller for verified Cash App accounts is crucial. This guide ensures you pick the best.

Research And Reviews Start by researching the seller’s reputation. Look for online feedback from other buyers. Read reviews carefully. They reveal the seller’s reliability and account quality. Check for patterns in feedback. Multiple negative reviews are a red flag. Positive reviews should be consistent and recent.

Secure Payment Methods Always ensure the seller offers secure payment options. Reliable sellers use trusted payment gateways. These protect your financial information. Look for sellers that accept credit cards or PayPal. These services offer buyer protection. Avoid sellers insisting on wire transfers or cryptocurrency payments. These are often untraceable and risky. Buy Verified Cash App Accounts.

The Legal Landscape The legal landscape surrounding financial transactions online is intricate. Buy Verified Cash App Accounts play a crucial role in ensuring seamless, secure transactions. Understanding the nuances of legality ensures users stay within the bounds of the law.

Compliance With Regulations Verified Cash App accounts must adhere to strict regulations. Financial institutions are governed by laws to prevent fraud and money laundering. Verified accounts comply with these regulations.

KYC protocols – Know Your Customer checks confirm user identity. AML standards – Anti-Money Laundering measures track suspicious activity. Transaction monitoring – Regular scrutiny of transfers for illegal activities. Setting Up Your Purchased Account Ready to take control of your finances with a verified Cash App account? Setting up your purchased account is simple. Follow these straightforward steps to start managing your money like a pro.

Activation Process Begin by activating your Cash App account. Here’s how:

Open the Cash App on your device. Enter the required details, such as your name and email. Verify your identity to ensure account security. Set a strong password to protect your account. Maximizing Savings With Boosts When it comes to maximizing savings with Cash App, one of the most effective tools at your disposal is Boosts. These are special discounts that can be applied to purchases made with your Cash Card. By strategically using Boosts, you can save money on everyday expenses and make the most of your budget.

Linking To Financial Institutions Next, link your account to your bank:

Select ‘Link Bank’ in the app menu. Use your bank’s login credentials to connect. Confirm the bank account you wish to link. Check for successful linkage in the app’s banking section. Buy Verified Cash App Accounts Buy Verified Cash App Accounts

Protecting Your Investment Protecting Your Investment when buying verified Cash App accounts is crucial. Smart account management and security measures help you safeguard your funds. With the right steps, you can ensure that your transactions remain secure and your financial data stays protected.

Regular Monitoring Regularly checking your Cash App account activity is essential. Quick detection of any unusual transactions can prevent potential losses. Set up alerts to receive instant notifications for all account activities. This way, you keep a vigilant eye on your funds. Buy Verified Cash App Accounts.

Secure Transactions Secure transactions are the backbone of any financial application. Always use strong, unique passwords for your Cash App account. Enable two-factor authentication for an added layer of security. Stick to trusted networks when making transactions to keep your data safe.

Use strong passwords: Mix letters, numbers, and symbols. Two-factor authentication: A must-have for extra security. Trusted networks only: Public Wi-Fi can compromise your account. Tracking Your Savings Keeping track of the savings you accrue through Boosts is essential for understanding the impact of these discounts on your overall spending. By monitoring how much you save on individual purchases and over time, you can gain valuable insights into your spending habits and make informed decisions to further optimize your savings.

Frequently Asked Questions How To Get A Verified Cash App Account? To verify your Cash App account, provide your full name, date of birth, and the last four digits of your SSN. Complete any additional verification steps as prompted by the app to increase your transaction limits.

Can You Buy A Cash App Account? No, you cannot buy a Cash App account legally. Creating a new account using your own details is required by Cash App’s terms of service.

How Much Can A Verified Cash App Send? A verified Cash App user can send up to $7,500 per week. This limit refreshes every seven days, allowing for regular transactions.

Does Cash App Have Commercial Accounts? Cash App currently does not offer commercial accounts; it’s designed for personal use only. Businesses should consider alternative platforms for commercial banking needs.

Conclusion Wrapping up, opting for a verified Cash App account is a wise move for seamless transactions. It boosts security and ensures credibility in your financial dealings. Remember, a trusted account is your gateway to worry-free payments and transfers. Secure one today and experience the difference in your digital finance management. Buy Verified Cash App Accounts.

2 notes

·

View notes

Text

Forge World Konor Admech Painting Guide

Leaving this here so I can look it up later. Also if anyone looks at my robot dudes and goes 'i wanna do that'.

Unless otherwise noted, paints are Citadel because that's what I have mostly. VMC = Vallejo Model Color, AP = Army Painter, RPR = Reaper

This is a deliberately streamlined process to crank through scads of skitarii; characters should get more shades and highlights in suitable colors, but the below will give you a skitarius or kataphron breacher or kastellan robot or whatever.

Prime Black

Outer Robes

Base: Night Lords Blue (2 coats)

Wash: Drakenhof Nightshade (all over)

Layer: RPR Ultramarine Blue

Highlight: RPR Ultramarine Blue (less tho)

Inner Robes

Base: Rakarth Flesh (2 coats)

Layer: Wraithbone (2 coats)

Pants

Base: VMC Black Grey

Wash: Ratling Grime Contrast

Layer: Mechanicus Std Grey

Steel

Base: AP Gun Metal

Wash: Agrax Earthshade (all over)

Layer: AP Shining Silver (sketchy)

Brass

Base: Balthasar Gold

Wash: Agrax Earthshade (all over)

Highlight: Runelord Brass (sketchy)

Leather

Base: Rhinox Hide

Wash: Agrax Earthshade (all over)

Layer: Doombull Brown (2 coats)

Wood/Gun Stocks

Base: Rhinox Hide

Wash: Agrax Earthshade (all over)

Layer: VMC Saddle Brown (2 coats)

Hoses & Wires

Base: AP Gun Metal or VMC Black Grey

Wash: Ratling Grime Contrast

Optional Colors: Khorne Red or Averland Sunset, never next to each other

Cog Mechanicus

Base: Corvus Black

White: Corax White

Wash: Tamiya Panel Liner or Nuln Oil

Glowy Shit

Base: Corax White (2 coats)

Layer: AP Matt White

Wash: Magmadroth Flame Contrast

Highlight: Fire Dragon Bright

Purity Seal Wax

Base: Screamer Pink

Wash: Druchii Violet

Highlight: Pink Horror

Purity Seal Parchment

Base: Rakarth Flesh (2 coats)

Wash: Agrax Earthshade

Highlight: Karak Stone

Basing

Base: Rhinox Hide (2 coats)

Rocks: Doombull Brown (2 coats)

Skulls: Drybrush Karak Stone, then Drybrush Screaming Skull

Layer: ‘Ardcoat (for more crackle)

Texture: Martian Ironearth but not the rocks or skulls

Wash: Agrax Earthshade

Drybrush: [TBD: insert rusty ochre color here]

Vehicle Armor

Base: AP Gun Metal (or Leadbelcher spray)

Wash: Ratling Grime Contrast

Layer: VMC Gunmetal Blue

Highlight: AP Shining Silver (sketchy)

Vehicle Armor Accent

Base: Rakarth Flesh

Wash: Agrax Earthshade

Layer: Wraithbone

Highlight: AP Matt White

6 notes

·

View notes

Text

AP management services

Streamline Your Finances with Masllp's AP Management Services: Say Goodbye to Paper Chase and Hello to Efficiency Introducing Masllp's AP Management Services: your one-stop shop for transforming your AP process from a tedious chore into a smooth, efficient operation.

Here's how we can help:

Ditch the Paper: We say goodbye to mountains of paper invoices and hello to paperless processing. No more manual data entry, lost documents, or chasing down approvals. Our secure, cloud-based platform handles everything electronically, streamlining your workflow and saving you valuable time. Boost Accuracy: Say goodbye to human error and hello to automatic data capture and verification. Our system eliminates typos, duplicates, and miscalculations, ensuring your payments are accurate and on time, every time. Optimize Workflows: We customize your AP process to fit your specific needs. From two-way PO matching to automated approvals, we help you move invoices from receipt to payment faster, improving your cash flow and vendor relationships. Gain Valuable Insights: Forget sifting through spreadsheets to find buried treasure. Our insightful reporting tools provide real-time visibility into your AP performance, allowing you to identify areas for improvement and make data-driven decisions. Free Up Your Team: Let our dedicated AP experts handle the heavy lifting. Our experienced team takes care of everything from data entry and invoice verification to vendor communication and payment processing, freeing up your internal staff to focus on more strategic tasks. But the benefits go beyond just efficiency:

Reduced Costs: Our automated processes and paperless platform save you money on printing, postage, and storage. Plus, our expertise helps you avoid late fees and payment errors, further shrinking your bottom line. Improved Vendor Relationships: Timely payments and clear communication keep your vendors happy, potentially leading to better discounts and terms. Enhanced Security: Our robust security measures protect your financial data, giving you peace of mind and ensuring compliance with industry regulations. In short, Masllp's AP Management Services are your key to achieving financial peace of mind. We take the pain out of AP, allowing you to focus on what matters most: growing your business.

Ready to ditch the paper chase and embrace the future of AP? Contact Masllp today for a free consultation and discover how we can help you streamline your finances and unlock the full potential of your business. Call to action: Visit our website, download our free ebook, or schedule a demo to learn more about how Masllp's AP Management Services can transform your business.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#AP management services

4 notes

·

View notes

Text

The CIA this week terminated a woman whose whistleblower account of being assaulted in a stairwell at the spy agency’s headquarters prompted a flood of colleagues to come forward with their own complaints of sexual misconduct. The woman’s attorney called the action a brazen retaliation.

While the CIA said that accusation was “factually inaccurate,” it wouldn’t comment further on the case and declined to explain why the 36-year-old did not make it through the agency’s clandestine officer training program known as “the Farm” and, unlike many of her classmates, was not hired into another job.

“To be clear, the CIA does not tolerate sexual assault, sexual harassment or whistleblower retaliation,” CIA spokesperson Tammy Thorp told The Associated Press, adding the agency uses “consistent processes to ensure the fair and equal treatment of every officer going through training.”

The woman’s termination came less than six months after she filed a federal civil rights lawsuit alleging the CIA retaliated against her for reporting what she said was a 2022 stairwell assault in Langley, Virginia, to law enforcement and testifying about it in a closed congressional hearing.

The lawsuit accused the agency of giving her harsher performance reviews and “slut shaming” her by improperly releasing her personal information during the state prosecution last year of Ashkan Bayatpour, a then-fellow CIA trainee convicted of assaulting her with a scarf.

The woman’s attorney, Kevin Carroll, told the AP that the CIA has now “unlawfully ended a young woman’s career only because she had the moral courage, lacking in her managers, to stand up and be a witness about her sexual assault.”

“The agency’s festering workplace sexual violence problem,” Carroll said, “is now harming the retention of young women who won’t put up with it any longer.”

The woman, who is not being identified because the AP does not generally identify victims of alleged sexual abuse, was credited with launching a reckoning, of sorts, at the CIA because hers was the rare allegation of sexual misconduct at the super-secret spy agency to make it into a public courtroom.

An AP investigation found the case helped embolden at least two-dozen women to come forward to authorities and Congress over the past two years with their own accounts at the CIA of sexual assaults, unwanted touching and what they contend is a campaign to keep them from speaking out.

Their accusations ranged from lewd remarks about sexual fantasies at after-work happy hours to a case in which a senior manager allegedly showed up at a subordinate’s house at night with a firearm demanding sex. Some of the alleged incidents go back years and took place as officers were on risky covert missions overseas, while others took place at CIA headquarters.

A congressional inquiry and bipartisan calls for a watchdog investigation prompted CIA Director William Burns last year to launch a series of reforms to streamline claims, support victims and more quickly discipline those behind misconduct.

It remains unclear whether the woman’s firing will prompt further action. Offices of the U.S. senators leading the inquiry, Virginia Democrat Mark Warner and Florida Republican Marco Rubio, did not respond to requests for comment.

Carroll, the woman’s attorney, said she had been given protected whistleblower status before speaking with Congress. But those familiar with the Whistleblower Protection Act cautioned that such protections can be limited, especially at the CIA.

Tom Devine, a longtime whistleblower rights advocate who is legal director for the Government Accountability Project, said CIA employees don’t have the same rights as other federal employees because of national security concerns.

“You can blow the whistle, but only within the intel community,” Devine said. “So when she went to the police, she was very much on her own. It’s an obnoxious loophole.”

1 note

·

View note

Text

Revolutionizing Business Finance: How Accounts Payable Software Transforms Efficiency

In today’s fast-paced business environment, managing financial transactions efficiently is crucial to maintaining healthy cash flow and ensuring smooth operations. One of the most critical areas in business finance is Accounts Payable (AP) — the process of managing and paying a company’s bills and invoices. Traditional manual methods of handling AP can be time-consuming, prone to errors, and inefficient. This is where Accounts Payable software steps in, revolutionizing the way companies manage their payables and boosting overall productivity.

What is Accounts Payable Software?

Accounts Payable software is a digital solution designed to automate the process of tracking, managing, and paying invoices. Instead of relying on paper invoices and manual data entry, this software centralizes invoice processing, approval workflows, and payment scheduling. By digitizing these tasks, companies can reduce the risk of errors, avoid late payments, and gain better visibility into their financial obligations.

Key Benefits of Accounts Payable Software

Streamlined Invoice Processing: The software automatically captures invoice data through optical character recognition (OCR) or direct electronic invoicing, eliminating the need for manual entry. This speeds up the entire process and reduces human errors.

Improved Accuracy and Compliance: Automation ensures that invoices are matched correctly with purchase orders and contracts, reducing the risk of duplicate payments or fraud. Additionally, the software helps maintain compliance with company policies and regulatory standards.

Faster Approval Workflows: Accounts Payable software often includes customizable approval workflows that route invoices to the appropriate stakeholders automatically. This accelerates approval times and prevents bottlenecks.

Enhanced Cash Flow Management: With real-time visibility into outstanding invoices and payment schedules, finance teams can optimize cash flow, prioritize payments, and take advantage of early payment discounts.

Cost Savings: By reducing manual labor, paper usage, and late payment penalties, companies can save significant operational costs. Automation also frees up finance staff to focus on more strategic tasks rather than repetitive data entry.

Choosing the Right Accounts Payable Software

When selecting an Accounts Payable solution, businesses should consider factors such as scalability, ease of integration with existing accounting systems, user-friendly interfaces, and strong security features. Cloud-based options offer flexibility and remote access, which is particularly valuable for companies with distributed teams.

The Future of Accounts Payable

Emerging technologies like artificial intelligence (AI) and machine learning are further enhancing Accounts Payable software capabilities. These advancements enable predictive analytics, smarter fraud detection, and more intelligent invoice processing, creating even greater efficiencies.

Accounts Payable software is no longer a luxury but a necessity for businesses aiming to streamline their financial operations and improve accuracy. By automating tedious manual processes, companies can reduce errors, save costs, and gain clearer financial insights. Investing in the right Accounts Payable solution can transform the way organizations handle their payables, paving the way for more strategic financial management and growth.

0 notes

Text

How to Identify Bottlenecks in Your Accounts Payable Workflow

Efficient accounts payable (AP) management is critical to maintaining healthy cash flow and vendor relationships. However, many businesses face delays and inefficiencies due to hidden bottlenecks within their AP workflows. These bottlenecks can lead to late payments, missed discounts, and strained supplier partnerships—affecting both profitability and reputation.

In this blog, we’ll explore how to identify bottlenecks in your accounts payable workflow and what steps you can take to resolve them.

What Are Bottlenecks in Accounts Payable?

A bottleneck in the accounts payable process is any stage or activity that slows down the entire payment cycle. These could be due to manual data entry, unclear approval hierarchies, or delays in invoice validation. Left unresolved, bottlenecks can reduce operational efficiency and increase the risk of financial errors or fraud.

Common Signs of AP Workflow Bottlenecks

Before solving bottlenecks, you need to know how to spot them. Here are a few warning signs:

Frequent late payments to vendors despite having available funds

Invoices stuck in approval stages for extended periods

Duplicate payments or missed invoices

Overreliance on manual tasks, such as data entry or email-based approvals

Lack of visibility into real-time AP status

These indicators suggest that your current workflow needs immediate attention and improvement.

Step-by-Step: How to Identify Bottlenecks

1. Map Out the Entire AP Workflow

Begin by visualizing the full AP process—from invoice receipt to final payment. Mapping the steps allows you to clearly see where delays typically occur. Include all stakeholders involved, such as procurement teams, managers, and finance departments.

2. Track Key Performance Metrics

Use metrics to quantify performance at each step. Some important AP KPIs include:

Invoice processing time

Average cost per invoice

Number of invoices processed per employee

Rate of on-time payments

A sudden spike or drop in these numbers often reveals where the process is breaking down.

3. Analyze Approval Delays

Approval stages are common bottlenecks in AP workflows. If invoices often wait for managerial approval, it may be time to review your hierarchy or introduce automated reminders to speed up the process.

4. Evaluate Data Entry and Validation Steps

Manual data entry is not only time-consuming but also error-prone. If your team spends excessive time inputting data from invoices, this stage becomes a productivity drag. Consider using invoice scanning tools or OCR technology to automate data capture.

5. Seek Feedback from Your AP Team

Sometimes, the best insights come from those working directly with the system. Ask your accounts payable staff where they experience the most delays or confusion. Their feedback can guide process improvement initiatives.

How Workflow Automation Solves Bottlenecks

Implementing workflow automation tools like Cflow can eliminate common AP bottlenecks by:

Automating invoice routing and approvals

Reducing manual data entry through integration

Providing real-time visibility into pending tasks

Ensuring compliance with company policies and audit trails

Automation enables finance teams to work smarter, not harder—resulting in faster processing times and fewer errors.

youtube

Final Thoughts

Bottlenecks in the accounts payable workflow aren’t always obvious—but their impact is clear. By carefully mapping your processes, tracking KPIs, and leveraging automation, you can identify and resolve inefficiencies before they disrupt operations. A streamlined AP process not only ensures timely payments but also builds trust with vendors and supports long-term financial stability.

SITES WE SUPPORT

Smart Process Hub - Wix

SOCIAL LINKS

Facebook Twitter LinkedIn

0 notes

Text

Accounts Payable Property Management Presented by EXO Edge

EXO Edge offers expert solutions in accounts payable property management, helping real estate firms streamline invoice processing, improve payment accuracy, and maintain vendor trust. With automation, compliance controls, and scalable support, EXO Edge ensures efficient AP operations tailored to the unique needs of property management businesses.

0 notes

Text

Manual vs Automated Accounts Payable: Which Is Better?

Managing accounts payable (AP) is a crucial part of any business’s financial operations. As companies grow, the pressure to handle invoices quickly, accurately, and efficiently becomes more intense. Traditionally, AP has been handled manually, but with the rise of automation tools like Cflow, many businesses are transitioning to automated systems. In this blog, we’ll break down the key differences between manual and automated accounts payable and help you decide which method suits your business better.

What Is Manual Accounts Payable?

Manual accounts payable is the traditional method of handling invoice processing using paper-based or spreadsheet-driven systems. This includes physically receiving invoices, manually entering data into accounting software, routing documents for approval via email or in person, and manually issuing payments.

Common Challenges with Manual AP:

Human Errors: Manual data entry is prone to mistakes, which can lead to incorrect payments or missed deadlines.

Time-Consuming: Processing each invoice manually takes up a lot of time, especially as the volume increases.

Lack of Visibility: It’s difficult to track invoice statuses and approval stages in real time.

High Processing Costs: Manual processes require more personnel and resources, increasing operational costs.

What Is Automated Accounts Payable?

Automated accounts payable uses software solutions to streamline and digitize the entire AP process. From invoice capture and data extraction to approval workflows and payment processing, automation tools like Cflow help businesses reduce manual effort and improve efficiency.

Key Features of AP Automation:

Automated Invoice Capture: Scans and extracts data from invoices automatically.

Custom Workflows: Routes invoices to the right approvers without manual intervention.

Real-Time Tracking: Offers visibility into invoice status and payment timelines.

Integration: Connects seamlessly with ERP and accounting systems.

Manual vs Automated Accounts Payable: A Side-by-Side Comparison

FeatureManual APAutomated APSpeedSlow and time-consumingFast and streamlinedAccuracyProne to human errorsHigh accuracy with data validationCostHigher due to manual laborLower with reduced processing timeScalabilityDifficult to scaleEasily handles high volumesVisibilityLimited tracking and reportingFull real-time visibilitySecurityPaper-based vulnerabilitiesSecure digital records

Why Automation Is the Better Choice

While manual AP processes may work for very small businesses, they quickly become inefficient and risky as a company scales. Automated accounts payable solutions offer:

Improved Efficiency: Reduce invoice processing time by up to 70%.

Better Compliance: Ensures adherence to approval hierarchies and audit trails.

Cost Savings: According to industry reports, automation can reduce AP costs by 60–80%.

Employee Productivity: Free up finance teams to focus on strategic tasks.

When to Switch to Automated AP

If your team is overwhelmed by invoice volumes, facing frequent payment delays, or struggling with errors and compliance issues, it’s time to consider AP automation. Tools like Cflow offer an easy-to-implement solution that scales with your business and integrates with your existing systems.

youtube

Final Thoughts

In the debate of manual vs automated accounts payable, automation clearly leads in terms of efficiency, accuracy, cost-effectiveness, and scalability. While manual processes might seem manageable initially, the long-term benefits of AP automation make it the smarter investment for growth-oriented businesses.

SITES WE SUPPORT

Process Optimizers - Wix

SOCIAL LINKS

Facebook Twitter LinkedIn

1 note

·

View note

Text

Expert Account Payable Outsourcing Services – Centelli

If your payables are accumulating or vendor relationships are tense, it’s time to consider our dependable Accounts Payable Outsourcing Services.

We streamline your vendor / supplier invoice processing and AP accounts on your behalf.

No more fragmented AP workflows

No more time-intensive tasks & headache

Impeccable records, tracking & reporting

Gain better control over your payables

Improve DPO & cash flow cycle

Stronger supplier relationships

Our US GAAP and IFRS accounting team members integrate smoothly into your workflows while upholding the highest delivery standards. Skilled in multiple marketing-leading accounting software, they effortlessly adapt to your preferred system.

So, you use your time and resources in other critical tasks while leaving your AP function in good hands. Experience the flexibility and cost savings of up to 60% compared to an in-house department.

Hire us and simplify your payables management! We service businesses across US, UK, EU, India, UAE and beyond. Contact Now!

#Account Payable Services#Outsourcing Services#Outsource AP#Finance Accounting#Payroll Services#Accounting Firm#Centelli#Atlanta#USA

0 notes