#force torque sensor robot

Explore tagged Tumblr posts

Text

Industrial Robot 6-axis Force Torque Sensor | AIDIN ROBOTICS

The 6-axis force torque sensor from AIDIN ROBOTICS is a high-precision solution for collaborative robots and industrial robots, designed to accurately measure forces and torques in all six degrees of freedom. This sensor is ideal for improving robotic accuracy and responsiveness, particularly in applications requiring precise control and feedback, such as assembly, grinding, and complex material handling.

Smart 6-axis Force Torque Sensor

The 6-axis force/torque sensor is an essential component in modern robotics, significantly enhancing wrist performance by detecting tool impacts, managing applied force, and accurately measuring weight. Designed to be attached to the wrist of a collaborative robot, this sensor uses an advanced electrostatic capacitance measurement method, enabling precise force control and collision detection, which are critical for tasks like object weight measurement, force regulation, and teaching applications.

Features of 6-Axis Force/Torque Sensor for Collaborative Robotics:

Next-Generation Measurement Technology: Utilizes a fringe effect-based capacitance measurement method for high-precision force and torque detection.

Integrated IMU: The sensor includes an Inertial Measurement Unit (IMU) to track and remember its position, adding another layer of spatial awareness.

Versatile Communication Options: Supports CAN, EtherCAT, and Ethernet communication protocols for seamless integration into various robotic systems.

Collaborative Robot Compatibility: Specifically designed for integration with collaborative robots, enhancing their performance and safety.

Exceptional Environmental Resistance: Built to withstand challenging environments, with excellent durability.

High-Voltage Protection: Successfully passed a 4kV discharge test, ensuring reliable operation under high electrostatic conditions.

If you are looking for a force torque sensor robot, you can find them at AIDIN Robotics.

Click here to if you are interested in AIDIN Robotics products.

View more: Industrial Robot 6-axis Force Torque Sensor

0 notes

Text

Kaa (1995) by Rajiv Desai, Charles Rosenberg, and Joseph Jones, IS Robotics (iRobot), Somerville, MA. Taking its name from Rudyard Kipling's "The Jungle Book," Kaa is a pair of serpentine arms able to grasp objects by wrapping itself around them, with force servoing giving it that extra squeeze. It has two arms, each 1ft long; a total of thirteen links with individual torque sensors. Each arm terminates in a single rounded fingertip that includes an infrared (IR) proximity sensor. The central body contains power and compute provided by three 8 bit Motorola 6811 microprocessors; one for servo control, one for behaviour control, and the other for IR control. Kaa is best known for acting as the arms of Rodney Brooks' IT (final photo).

46 notes

·

View notes

Text

Planning autonomous surface missions on ocean worlds

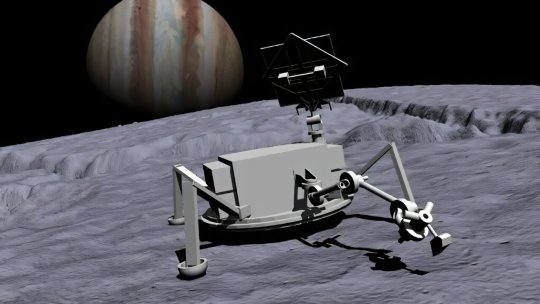

hrough advanced autonomy testbed programs, NASA is setting the groundwork for one of its top priorities—the search for signs of life and potentially habitable bodies in our solar system and beyond. The prime destinations for such exploration are bodies containing liquid water, such as Jupiter's moon Europa and Saturn's moon Enceladus.

Initial missions to the surfaces of these "ocean worlds" will be robotic and require a high degree of onboard autonomy due to long Earth-communication lags and blackouts, harsh surface environments, and limited battery life.

Technologies that can enable spacecraft autonomy generally fall under the umbrella of Artificial Intelligence (AI) and have been evolving rapidly in recent years. Many such technologies, including machine learning, causal reasoning, and generative AI, are being advanced at non-NASA institutions.

NASA started a program in 2018 to take advantage of these advancements to enable future icy world missions. It sponsored the development of the physical Ocean Worlds Lander Autonomy Testbed (OWLAT) at NASA's Jet Propulsion Laboratory in Southern California and the virtual Ocean Worlds Autonomy Testbed for Exploration, Research, and Simulation (OceanWATERS) at NASA's Ames Research Center in Silicon Valley, California.

NASA solicited applications for its Autonomous Robotics Research for Ocean Worlds (ARROW) program in 2020, and for the Concepts for Ocean worlds Life Detection Technology (COLDTech) program in 2021.

Six research teams, based at universities and companies throughout the United States, were chosen to develop and demonstrate autonomy solutions on OWLAT and OceanWATERS. These two- to three-year projects are now complete and have addressed a wide variety of autonomy challenges faced by potential ocean world surface missions.

OWLAT

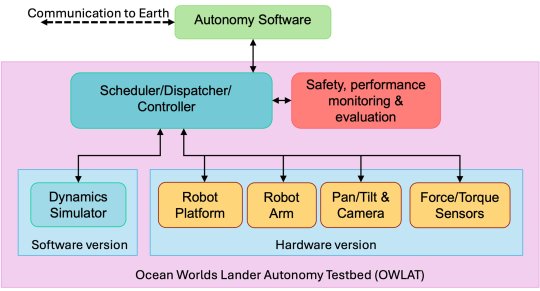

OWLAT is designed to simulate a spacecraft lander with a robotic arm for science operations on an ocean world body. Each of the OWLAT components is detailed below.

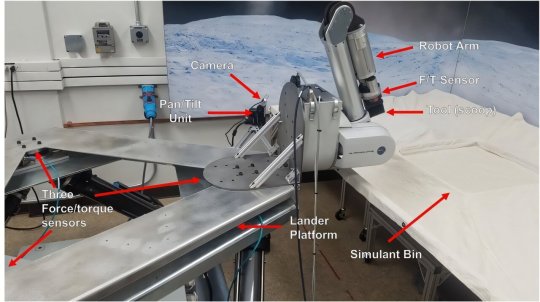

The hardware version of OWLAT is designed to physically simulate motions of a lander as operations are performed in a low-gravity environment using a six degrees-of-freedom (DOF) Stewart platform. A seven DOF robot arm is mounted on the lander to perform sampling and other science operations that interact with the environment. A camera mounted on a pan-and-tilt unit is used for perception.

The testbed also has a suite of onboard force/torque sensors to measure motion and reaction forces as the lander interacts with the environment. Control algorithms implemented on the testbed enable it to exhibit dynamics behavior as if it were a lightweight arm on a lander operating in different gravitational environments.

The team also developed a set of tools and instruments to enable the performance of science operations using the testbed. These various tools can be mounted to the end of the robot arm via a quick-connect-disconnect mechanism. The testbed workspace where sampling and other science operations are conducted incorporates an environment designed to represent the scene and surface simulant material potentially found on ocean worlds.

The software-only version of OWLAT models, visualizes, and provides telemetry from a high-fidelity dynamics simulator based on the Dynamics And Real-Time Simulation (DARTS) physics engine developed at JPL. It replicates the behavior of the physical testbed in response to commands and provides telemetry to the autonomy software.

The autonomy software module interacts with the testbed through a Robot Operating System (ROS)-based interface to issue commands and receive telemetry. This interface is defined to be identical to the OceanWATERS interface. Commands received from the autonomy module are processed through the dispatcher/scheduler/controller module and used to command either the physical hardware version of the testbed or the dynamics simulation (software version) of the testbed.

Sensor information from the operation of either the software-only or physical testbed is reported back to the autonomy module using a defined telemetry interface. A safety and performance monitoring and evaluation software module ensures that the testbed is kept within its operating bounds. Any commands causing out of bounds behavior and anomalies are reported as faults to the autonomy software module.

OceanWATERS

At the time of the OceanWATERS project's inception, Jupiter's moon Europa was planetary science's first choice in searching for life. Based on ROS, OceanWATERS is a software tool that provides a visual and physical simulation of a robotic lander on the surface of Europa.

OceanWATERS realistically simulates Europa's celestial sphere and sunlight, both direct and indirect. Because we don't yet have detailed information about the surface of Europa, users can select from terrain models with a variety of surface and material properties. One of these models is a digital replication of a portion of the Atacama Desert in Chile, an area considered a potential Earth-analog for some extraterrestrial surfaces.

JPL's Europa Lander Study of 2016, a guiding document for the development of OceanWATERS, describes a planetary lander whose purpose is collecting subsurface regolith/ice samples, analyzing them with onboard science instruments, and transmitting results of the analysis to Earth.

The simulated lander in OceanWATERS has an antenna mast that pans and tilts; attached to it are stereo cameras and spotlights. It has a 6 degree-of-freedom arm with two interchangeable end effectors—a grinder designed for digging trenches, and a scoop for collecting ground material. The lander is powered by a simulated non-rechargeable battery pack. Power consumption, the battery's state, and its remaining life are regularly predicted with the Generic Software Architecture for Prognostics (GSAP) tool.

To simulate degraded or broken subsystems, a variety of faults (e.g., a frozen arm joint or overheating battery) can be "injected" into the simulation by the user; some faults can also occur "naturally" as the simulation progresses, e.g., if components become over-stressed. All the operations and telemetry (data measurements) of the lander are accessible via an interface that external autonomy software modules can use to command the lander and understand its state. (OceanWATERS and OWLAT share a unified autonomy interface based on ROS.)

The OceanWATERS package includes one basic autonomy module, a facility for executing plans (autonomy specifications) written in the PLan EXecution Interchange Language, or PLEXIL. PLEXIL and GSAP are both open-source software packages developed at Ames and available on GitHub, as is OceanWATERS.

Mission operations that can be simulated by OceanWATERS include visually surveying the landing site, poking at the ground to determine its hardness, digging a trench, and scooping ground material that can be discarded or deposited in a sample collection bin. Communication with Earth, sample analysis, and other operations of a real lander mission, are not presently modeled in OceanWATERS except for their estimated power consumption.

Because of Earth's distance from the ocean worlds and the resulting communication lag, a planetary lander should be programmed with at least enough information to begin its mission. But there will be situation-specific challenges that will require onboard intelligence, such as deciding exactly where and how to collect samples, dealing with unexpected issues and hardware faults, and prioritizing operations based on remaining power.

Results

All six of the research teams used OceanWATERS to develop ocean world lander autonomy technology and three of those teams also used OWLAT. The products of these efforts were published in technical papers, and resulted in the development of software that may be used or adapted for actual ocean world lander missions in the future.

TOP IMAGE: Artist's concept image of a spacecraft lander with a robot arm on the surface of Europa. Credits: NASA/JPL – Caltech

CENTRE IMAGE The software and hardware components of the Ocean Worlds Lander Autonomy Testbed and the relationships between them. Credit: NASA/JPL – Caltech

LOWER IMAGE: The Ocean Worlds Lander Autonomy Testbed. A scoop is mounted to the end of the testbed robot arm. Credit: NASA/JPL – Caltech

BOTTOM IMAGE: Screenshot of OceanWATERS. Credit: NASA/JPL – Caltech

2 notes

·

View notes

Text

The Science Behind Mechanical Engineering: Exploring Fundamental Concepts

Mechanical engineering is one of the oldest and broadest branches of engineering. At its core, it revolves around the application of principles from physics, materials science, and thermodynamics to design, analyze, and manufacture mechanical systems. While many associate mechanical engineering with machines and devices, its foundation is deeply rooted in scientific principles that drive innovation and practical solutions across various industries.

1. Thermodynamics: The Study of Energy and Heat

Thermodynamics is a cornerstone of mechanical engineering. It focuses on how heat and energy interact, transfer, and convert between different forms. Understanding these processes is crucial when designing engines, heating systems, and refrigeration units.

The Laws of Thermodynamics form the backbone of this science, guiding engineers in creating energy-efficient systems.

First Law: Energy cannot be created or destroyed, only transformed. This is vital in designing systems where energy conservation is key, like power plants or automotive engines.

Second Law: Energy transfers naturally from a higher concentration to a lower one (i.e., heat flows from hot to cold), guiding the design of heat engines and refrigerators.

2. Fluid Mechanics: Understanding How Fluids Behave

Fluid mechanics is another essential area of mechanical engineering. It deals with the behavior of liquids and gases, focusing on how they move, interact, and exert forces.

Applications include designing pumps, turbines, HVAC systems, and even aerodynamic designs for cars and planes.

Bernoulli’s Principle explains how the pressure in a fluid decreases as its velocity increases, which is fundamental in understanding how airplane wings generate lift.

3. Materials Science: Choosing the Right Material for the Job

Mechanical engineers must understand the properties of different materials to ensure that the components they design can withstand the forces, stresses, and environmental conditions they’ll encounter.

Material Selection is based on mechanical properties like strength, ductility, hardness, and toughness.

For example, steel is often used in construction due to its high tensile strength, while aluminum is preferred in aerospace applications for its light weight and corrosion resistance.

4. Kinematics and Dynamics: The Study of Motion

Kinematics and dynamics focus on understanding the motion of objects, which is crucial in designing mechanisms that move, such as robotic arms, gears, and vehicles.

Kinematics involves the geometry of motion, such as calculating the velocity and acceleration of objects without considering the forces causing the motion.

Dynamics, on the other hand, examines the forces and torques that cause motion. This is essential in designing everything from simple levers to complex systems like the suspension of a car.

5. Vibration Analysis: Ensuring Stability and Longevity

Vibration analysis is vital in mechanical systems to prevent excessive wear, fatigue, and failure. Uncontrolled vibrations in machinery can lead to inefficiency or catastrophic failure.

Engineers use vibration analysis to predict how components will behave under varying loads and conditions, ensuring they are designed to operate smoothly and reliably. This is especially important in rotating machinery, such as turbines and engines.

6. Control Systems: Automating and Optimizing Mechanical Processes

Control systems are used to regulate and optimize the behavior of machines and processes, integrating mechanical engineering with electronics and computer science.

Feedback Control Systems are used in applications ranging from industrial robots to automotive cruise control, where sensors detect system output and adjust inputs to achieve the desired performance.

Conclusion

Mechanical engineering is a multidisciplinary field deeply rooted in scientific principles. From thermodynamics and fluid mechanics to material science and vibration analysis, each scientific concept plays a critical role in designing, analyzing, and improving mechanical systems. As mechanical engineering continues to evolve, the integration of cutting-edge science will remain at the forefront, driving innovation and solving complex challenges across industries.

Mechanical engineers who master these fundamental concepts will be well-equipped to create systems that are efficient, durable, and innovative—making their mark on industries ranging from aerospace to energy.

2 notes

·

View notes

Text

Industrial Robot Components Market Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast By 2033

The industrial robot components market in the United States is positioned for significant growth, featuring a forecasted Compound Annual Growth Rate (CAGR) of 13.3%. The increasing adoption of industrial robots, notably in the United States within the wider Americas region, stands out as a pivotal factor driving the heightened demand for these cutting-edge robotic technologies.

The projected value of the global industrial robot components market (産業用ロボット部品市場) is expected to reach US$ 6.3 billion in 2023. Further, a robust compound annual growth rate (CAGR) of 13.9% is anticipated, aiming to propel the market to a substantial US$ 23.2 billion by the conclusion of 2033.

Download a Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8227

In recent years, the Industrial Robot Components Market has witnessed a profound transformation driven by the integration of cutting-edge technologies. The relentless pursuit of automation and efficiency has spurred the development of innovative solutions, revolutionizing the way industrial robots are designed and operated.

Artificial Intelligence and Machine Learning Integration:

The infusion of artificial intelligence (AI) and machine learning (ML) into industrial robot components has been a game-changer. Smart sensors and advanced algorithms enable robots to adapt to changing environments, enhance decision-making capabilities, and optimize performance. This integration not only improves precision but also facilitates predictive maintenance, reducing downtime and increasing overall operational efficiency.

Internet of Things (IoT) Connectivity:

The rise of Industry 4.0 has brought about a new era of connectivity, and industrial robots are no exception. IoT-enabled components allow seamless communication between robots and other machinery, creating a networked and synchronized manufacturing ecosystem. Real-time data exchange enhances production visibility, streamlines processes, and enables manufacturers to make data-driven decisions for better outcomes.

Robotic Vision Systems:

Vision systems, powered by advancements in computer vision and image processing, have significantly enhanced the perception capabilities of industrial robots. These systems enable robots to "see" and interpret their surroundings, facilitating tasks such as object recognition, quality control, and even complex assembly processes. As a result, the scope of applications for industrial robots has expanded, driving demand for more sophisticated vision-based components.

Collaborative Robotics (Cobots):

The advent of collaborative robots, or cobots, has redefined human-robot interaction on the factory floor. These robots are designed to work alongside human operators, promoting a safer and more collaborative working environment. The integration of sensitive force and torque sensors in industrial robot components ensures that cobots can operate with precision and adapt to dynamic changes in their surroundings, further contributing to the evolution of manufacturing processes.

Key Strategies of Industry Leaders

Leading manufacturers of industrial robot components, including FANUC, Denso Corporation, Kuka, Mitsubishi Electrical, ABB, Yaskawa, and Kawasaki Heavy Industries, are implementing crucial strategies for market dominance.

These industry titans are concentrating on providing high-quality and resilient components, fostering a dedicated customer base, and bolstering brand recognition. The integration of customization options not only meets diverse customer needs but also presents substantial opportunities for sustained revenue growth.

Moreover, forging enduring trade relationships directly with end-users is a strategic move aimed at driving future demand for industrial robot components. This approach positions market players to secure elevated profit margins while ensuring sustained growth in the years to come.

Segmentation of Industrial Robot Components Industry Research

By Component :

Controller

Sensor

Robot Arm/Manipulator

End Effector

Drive

Feedback Devices

By Application :

Cartesian Robots

Scara Robots

Articulated Robots

Cylindrical Robots

Delta Robots

Polar Robots

Collaborative Robots

By Region :

North America

Latin America

Europe

East Asia

South Asia & Oceania

MEA

The convergence of these emerging technologies is reshaping the landscape of the Industrial Robot Components Market. As manufacturers increasingly embrace automation and smart manufacturing practices, the demand for technologically advanced components continues to surge. The ongoing integration of AI, IoT, robotic vision, collaborative robotics, and advanced materials sets the stage for a transformative era in industrial automation, promising increased efficiency, flexibility, and innovation in manufacturing processes. As the industry adapts to these changes, stakeholders can anticipate a future where industrial robots play an even more pivotal role in driving economic growth and sustainable development.

𝐂𝐡𝐞𝐜𝐤 𝐎𝐮𝐭 𝐌𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Robot Kit Market CO2 Dosing System Market Chlorine Injection Systems Market

Contact:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Understanding the Role of 3 Axis Force Sensor in Modern Engineering and Robotics

In the realm of precision measurement and advanced robotics, the 3 axis Force Sensor has become an essential component for capturing accurate and dynamic force data across three orthogonal directions—X, Y, and Z. These sensors are widely used in applications ranging from industrial automation and robotic gripping to biomechanics and aerospace engineering. The ability to detect subtle variations in applied force helps engineers, scientists, and technicians optimize systems for performance, safety, and efficiency.

Aᅠ3 axis Force Sensor works by converting mechanical force into an electrical signal through strain gauges or piezoelectric elements embedded in its structure. The sensor measures forces along the three Cartesian axes, enabling the detection of not just the magnitude but also the direction of the applied force. This is particularly useful in robotic arms, where the sensor can help determine how much pressure is applied during gripping, assembly, or surgical procedures. The result is a much higher level of control and feedback, which enhances the functionality of intelligent systems.

When comparing sensor technologies, one of the most significant developments beyond theᅠ3 axis Force Sensor is the evolution of 6 Axis Force Sensors. These devices add the ability to detect torque (rotational forces) around each of the three axes, offering a full six degrees of freedom. While 3 axis Force Sensors are excellent for detecting linear forces, 6 Axis Force Sensors are necessary in applications that require complex interaction, such as humanoid robots, prosthetics, and virtual reality feedback systems. They provide a holistic picture of both linear and rotational forces, enabling machines to respond with even more human-like sensitivity and motion.

The compact design and robust construction of aᅠ3 axis Force Sensor make it ideal for integration into small spaces without sacrificing performance. These sensors are often made with high-strength materials such as stainless steel or titanium, ensuring reliability in challenging environments. Additionally, many models are equipped with signal conditioning circuits, digital outputs, and compatibility with data acquisition systems, making them easy to deploy in a variety of settings.

In testing and quality control environments,ᅠ3 axis Force Sensors provide real-time data that allows manufacturers to assess product strength, endurance, and safety standards. For example, in automotive crash testing, they can measure the precise force impacts on vehicle structures or dummies. In sports biomechanics, these sensors can be mounted on shoes or equipment to analyze how athletes apply force during performance, leading to better training and injury prevention.

Furthermore, the integration ofᅠ3 axis Force Sensor technology into medical devices has transformed procedures such as robotic-assisted surgery. Surgeons gain haptic feedback, enabling more delicate and controlled movements during operations. This innovation reduces risks and improves patient outcomes, especially in minimally invasive techniques.

While 3 axis Force Sensors are sufficient for many linear force measurement applications, industries pushing the boundaries of automation and precision often require the extended capabilities of 6 Axis Force Sensors. Whether it’s for delicate touch sensing in prosthetic limbs or for accurate force feedback in advanced simulation systems, both types of sensors play pivotal roles in the next generation of intelligent systems.

As industries move toward more sophisticated automation and intelligent devices, the demand for high-precision, multi-directional force measurement will continue to grow. The 3 axis Force Sensor, with its accuracy, durability, and adaptability, remains a cornerstone of modern measurement systems. Meanwhile, the broader functionality of 6 Axis Force Sensors expands the possibilities for machines to perceive and interact with the physical world in more nuanced and dynamic ways

0 notes

Text

Torque Sensors: Precision Force Measurement with Star EMBSYS Engineering

In today's technology-driven industries, precise force and motion measurement is essential for performance analysis, quality control, and predictive maintenance. Among the most critical tools used for this purpose is the torque sensor. A torque sensor, also known as a torque transducer, measures the twisting force applied to an object such as a rotating shaft or system. This measurement is crucial across multiple domains including automotive testing, robotics, aerospace, manufacturing, and power tools. Companies like Star EMBSYS have emerged as leaders in designing innovative torque sensor systems that offer accuracy, reliability, and seamless integration into modern control environments.

What is a Torque Sensor?

A torque sensor detects and quantifies rotational force. It converts the mechanical input—torque—into an electrical signal that can be read, recorded, and analyzed. Depending on the application, torque sensors can be either rotary or static (reaction) types. Rotary torque sensors are used in systems where the shaft rotates continuously, while reaction torque sensors measure torque in stationary systems.

Most torque sensors work using strain gauge technology, where strain gauges are bonded to a shaft or component that deforms slightly when torque is applied. The change in resistance of the strain gauge is proportional to the amount of torque and is converted into an output signal. This output can be analog, digital, or processed through a microcontroller.

Applications Across Industries

Torque sensors are used wherever rotational motion and force need to be measured accurately. In automotive testing, torque sensors help analyze engine performance, transmission efficiency, and steering systems. In robotics, they ensure that joints and actuators apply the correct force, enhancing both safety and control. In aerospace, torque sensors are used to verify the performance of control systems and components under dynamic load conditions.

Manufacturing industries use torque sensors for monitoring tightening processes (e.g., bolt fastening), ensuring machines apply the correct force consistently to maintain product quality. Even in the medical field, torque sensors are used in rehabilitation devices and robotic surgical systems to ensure delicate and precise force control.

Star EMBSYS: Advanced Torque Sensing Solutions

Star EMBSYS stands out in the torque sensing domain through its dedication to precision engineering and smart embedded integration. Leveraging years of experience in embedded systems and sensor technologies, Star EMBSYS develops torque sensors that are tailored to meet the exact demands of modern industry.

Their sensor systems combine mechanical design with intelligent electronics, including signal conditioning, filtering, and digital output capabilities. Star EMBSYS offers both rotary and reaction torque sensors with customized features such as shaft compatibility, torque range, environmental sealing, and mounting configurations. This flexibility allows seamless integration into a variety of applications, whether for field testing, laboratory research, or embedded in production lines.

Key Features of Star EMBSYS Torque Sensors

High Accuracy: Star EMBSYS sensors are designed for precision, capable of detecting even minute changes in torque for sensitive applications.

Rugged Construction: Built to withstand harsh environments including vibration, temperature variations, and dust, these sensors are ideal for industrial use.

Versatile Outputs: Sensors are available with analog (voltage/current) and digital (SPI, UART, CAN) outputs, making them easy to interface with microcontrollers and PLCs.

Custom Design Options: Star EMBSYS offers customizable solutions tailored to unique mechanical or electrical requirements.

Real-Time Monitoring: Their solutions support fast response times and continuous monitoring, which is crucial for real-time control systems.

The Future of Torque Measurement

With the ongoing shift toward smart automation and digital monitoring, torque sensors are evolving beyond simple measurement tools. Star EMBSYS is advancing in this direction by developing IoT-ready sensors that can transmit data wirelessly, support remote diagnostics, and feed into centralized control systems. These capabilities allow businesses to track machinery performance, prevent failures, and optimize operations in real time.

In conclusion, torque sensors are essential for modern engineering and process control. With companies like Star EMBSYS offering state-of-the-art solutions, industries can rely on accurate torque measurement to enhance safety, efficiency, and innovation. Their commitment to customization, integration, and precision makes them a trusted partner in the world of torque sensing technology.

Visit:- https://www.starembsys.com/torque-sensor.html

0 notes

Text

Driving Hydraulic Precision: The Rise of Smart Motion in Compact Systems

When machines move with grace, strength, and precision—all in one fluid motion—you know there’s something powerful happening behind the scenes. In today’s industrial and mobile applications, this power often comes from the seamless coordination of hydraulic and electronic components.

From hydraulic power pack portable units in field operations to linear position sensors for hydraulic cylinders in smart automation lines, modern hydraulic systems are no longer just brute-force tools. They’re intelligent, responsive, and often portable—built for both performance and precision.

If you're working with systems that need efficient energy use, compact motion control, and accuracy in variable environments, the latest tech in servo motor driven hydraulic pumps, internal gear pumps, and rotary actuators could transform your operations.

The Mobile Edge: Hydraulic Power Pack Portable

Imagine running a hydraulic system without access to grid power or permanent installations. That’s where the hydraulic power pack portable becomes indispensable. These self-contained units are built to:

Power hydraulic actuators in the field

Assist in mobile hydraulic repair

Reduce downtime with quick deployment

Fit in tight spaces without sacrificing force

Portable packs are ideal for industries like oil & gas, construction, defense, and heavy equipment servicing. With smart options using servo motor hydraulic pumps, they now offer variable speed and pressure control too.

Such flexibility is especially helpful when paired with components like rotary actuators and linear sensors that require precision control on the go.

Internal Gear Pumps: Quiet Power for Smart Machines

Whether embedded inside mobile equipment or stationary systems, internal gear pumps are becoming the go-to solution for engineers needing compact, quiet, and reliable fluid flow.

These pumps are known for:

High volumetric efficiency

Smooth and pulsation-free operation

Excellent suction characteristics

Compatibility with variable-speed servo motor drives

In systems using a servo motor driven hydraulic pump, internal gear pumps help maintain precise control while reducing energy losses. They’re a perfect match for smart hydraulic packs where performance and efficiency are both non-negotiable.

Servo Motor Driven Hydraulic Pump: Smart Power Management

The days of fixed-speed, wasteful hydraulic systems are fading fast. Enter the servo motor driven hydraulic pump—a game-changer in the hydraulic world. These pumps operate only when required, adjusting flow and pressure dynamically in real-time.

What does this mean for you?

Energy Savings: No more running pumps idle

Better Accuracy: Pressure matches load demand instantly

Reduced Noise: Ideal for quiet work environments

Lower Heat Generation: Less wear on parts

When paired with a load sensing proportional valve, these pumps deliver unmatched efficiency in heavy-duty machines. They’re also central to systems involving rotary actuators or linear position sensors, where smooth motion is critical.

Rotary Actuator: Compact Angular Control

Wherever space is tight and torque is needed, the rotary actuator becomes essential. It converts hydraulic pressure into rotary motion—perfect for turning arms, valves, or platforms in both mobile and stationary systems.

Use cases include:

Robotic joints

Vehicle turrets and pivots

Lifting and rotating platforms

Automated packaging equipment

Unlike motors, rotary actuators offer high torque from a compact body. When controlled by a servo motor drive, they can rotate to precise angles—bringing together the best of hydraulic power and digital control.

Linear Position Sensor for Hydraulic Cylinder: Data-Driven Movement

No intelligent hydraulic system is complete without feedback. That’s where the linear position sensor for hydraulic cylinder plays a vital role. These sensors tell you exactly where your cylinder piston is—at any moment—enabling closed-loop control.

Especially useful in systems with servo motor hydraulic pumps, these sensors help:

Monitor piston travel in real time

Prevent overextension or under-travel

Automate start/stop positions

Improve safety through fail-safe mechanisms

New-gen inductive linear position sensors bring non-contact, highly durable designs that work in dirty, wet, or extreme temperature environments. Their plug-and-play interface also makes them perfect for hydraulic power packs and retrofits.

Synergy in Motion: Combining Technologies

Let’s say you’re designing a compact hydraulic system for a smart agricultural harvester. It might include:

A hydraulic power pack portable unit for off-grid power

An internal gear pump for low-noise, steady flow

A servo motor driven hydraulic pump for efficient operation

A rotary actuator to control the harvesting arm

A linear position sensor to fine-tune lifting height of tools

Together, these components make a responsive, energy-efficient machine that adapts to field conditions in real-time—something impossible with older fixed-speed systems.

This modular integration is reshaping how we build systems in manufacturing, agriculture, construction, and mobile maintenance sectors.

Small Servo Motor: Big Impact in Compact Systems

When we talk about servo motor driven hydraulic pumps, small servo motors are doing a lot of heavy lifting—literally.

These motors provide:

Precise torque at variable speeds

Compact design for embedded systems

Integration with smart drives and controllers

Even a compact actuator or lift table can benefit from the responsiveness of a small servo motor—especially when paired with feedback from a linear position sensor for hydraulic cylinder.

They also reduce the overall weight and size of machines, which is crucial for mobile platforms or equipment in tight workspaces.

Load Sensing Proportional Valve: Dynamic Control Under Pressure

The brain of a smart hydraulic circuit is often the load sensing proportional valve. It adjusts the pressure and flow based on real-time demand, reducing energy waste and improving accuracy.

In systems powered by servo motor hydraulic pumps, these valves allow:

Real-time modulation of actuators

Load-adaptive pressure settings

Safe operation under varying loads

Used with rotary actuators or servo drive hydraulic pumps, they help machines adapt on the fly—saving energy, reducing wear, and improving lifecycle costs.

Why It Matters Now

Today’s industries are more mobile, more efficient, and more automated than ever. Hydraulic systems must follow suit. Whether you're building field service machines, smart conveyors, or robotic arms, integrating technologies like:

Hydraulic power pack portable

Internal gear pumps

Servo motor driven hydraulic pump

Rotary actuator

Linear position sensor for hydraulic cylinder

…can result in systems that are smarter, faster, and more efficient.

You’re no longer just building machines—you’re engineering intelligent motion.

Wrap-Up: Smart Hydraulics for the Next Generation

The integration of compact power sources, feedback systems, and intelligent control is redefining what’s possible in motion control. It’s not just about moving parts anymore. It’s about moving with purpose—with control, adaptability, and precision.

Whether you’re upgrading a single machine or designing an entire platform, leveraging these technologies ensures you're not stuck in the past.

Explore, prototype, and build with confidence—because the future of hydraulics is not just powerful, it's intelligent.

0 notes

Text

Force Sensors Market Witnesses Strong Demand Across Automotive, Robotics, and Consumer Electronics Applications

The global Force Sensors Market is undergoing a significant transformation, fueled by rapid advancements in industrial automation, medical technology, and smart consumer devices. As demand for accurate, real-time data collection grows across sectors, force sensors are playing an increasingly central role in enabling precise measurement, quality assurance, and predictive monitoring capabilities.

Understanding Force Sensors and Their Applications

Force sensors are transducers that convert mechanical force—such as compression, tension, or torque—into measurable electrical signals. These devices are used in a variety of applications that require monitoring of load, pressure, or weight. Common types of force sensors include strain gauge, capacitive, piezoelectric, and optical sensors. The choice of sensor depends on the required sensitivity, environmental conditions, and industry-specific applications.

The utility of force sensors has expanded beyond traditional manufacturing to include sectors like healthcare, automotive, aerospace, robotics, and consumer electronics. As industries seek better process control and system feedback, the importance of force sensors for real-time monitoring and adaptive performance has grown exponentially.

Precision Measurement: A Key Market Driver

In manufacturing, precision is paramount. Even slight deviations in force application can result in defects, waste, and compromised product integrity. Force sensors ensure that machines apply the correct load during assembly, welding, or packaging processes. As manufacturers adopt Industry 4.0 principles, incorporating sensor feedback into their control systems enables real-time adjustments, ensuring high product quality and efficiency.

Moreover, sectors such as aerospace and automotive demand ultra-precise force measurements due to stringent safety standards. In aerospace applications, for instance, sensors monitor structural loads during testing to ensure aircraft components meet regulatory requirements. Similarly, in automotive testing and production, force sensors help evaluate braking systems, suspension forces, and steering components with exactitude.

Real-Time Monitoring Enhances Safety and Performance

Real-time monitoring through force sensors has revolutionized industries reliant on feedback-driven processes. In robotics and automation, sensors provide tactile feedback to robotic arms, allowing them to grip objects delicately without damaging them. These real-time adjustments are vital in electronics assembly, food handling, and other precision-based tasks.

In healthcare, force sensors are used in prosthetics, physical therapy equipment, and surgical robots. They measure muscle force and pressure points, enabling responsive prosthetic limbs or robotic-assisted surgeries that mimic human dexterity. The ability to gather data in real time improves diagnostic accuracy, patient outcomes, and operational safety.

Transportation systems also benefit from force sensor technology. In railways, for example, force sensors are used to monitor axle load and ensure weight is distributed evenly to prevent derailments. In smart city infrastructure, sensors in bridges and roadways monitor structural strain and traffic loads, enabling preemptive maintenance and reducing the risk of catastrophic failure.

Technological Advancements Driving Innovation

Miniaturization and advancements in materials science have allowed force sensors to become smaller, lighter, and more energy-efficient—traits crucial for wearable devices and mobile health monitoring. Flexible force sensors made from nanomaterials are now being embedded into clothing and medical patches, enabling continuous monitoring of vital signs and body movements.

Wireless sensor technologies, coupled with IoT integration, are creating networks of force sensors capable of transmitting real-time data across cloud platforms. This development is instrumental in predictive maintenance strategies, where machinery health is monitored continuously to prevent breakdowns before they occur.

Artificial intelligence and machine learning are also enhancing the role of force sensors. By analyzing sensor data, AI algorithms can detect anomalies, predict equipment failures, and optimize system performance. This fusion of sensor technology and smart analytics is unlocking new levels of efficiency and innovation across industries.

Regional Trends and Market Outlook

North America and Europe currently dominate the force sensors market, driven by their advanced manufacturing infrastructure and early adoption of industrial automation. However, the Asia-Pacific region is expected to witness the fastest growth, particularly in China, Japan, South Korea, and India. This growth is attributed to the rapid industrialization, expansion of automotive production, and increasing investment in smart manufacturing and healthcare technologies.

According to industry analysts, the global force sensors market is projected to grow at a CAGR of over 6% through 2030. The surge in demand for precision measurement and real-time control systems is likely to continue, with expanding applications in electric vehicles, smart prosthetics, and AI-enabled robotics.

Challenges and Considerations

Despite the positive outlook, certain challenges remain. High costs associated with high-precision sensors, calibration complexity, and performance issues in harsh environments can hinder widespread adoption. Moreover, ensuring compatibility with existing legacy systems during digital transformation can be a hurdle for some industries.

Data security and privacy concerns also arise, particularly in applications involving personal health monitoring or industrial control systems. Addressing these challenges requires industry-wide collaboration, robust regulatory standards, and continuous innovation in sensor design and integration technologies.

Conclusion

The force sensors market is poised for sustained growth, driven by the increasing need for accurate, real-time data across a multitude of applications. As industries continue to automate and digitize, the demand for sensors capable of delivering reliable and precise measurement will only intensify. With ongoing technological advancements and expanding use cases, force sensors are set to become indispensable components in the modern industrial and digital landscape.

0 notes

Text

MOSFET Selection Requirements in Intelligent Robots

Embodied intelligent robots usually consist of multiple subsystems, and MOSFETs, as key power switching devices, play a core role in several subsystems. Let’s break it down:

I. Main Components of Embodied Intelligent Robots

1. Main Controller/Computing Unit: The “brain” of the robot. It is usually a computing platform composed of high-performance processors (such as CPU, GPU, NPU), running operating systems, AI algorithms, path planning, decision control, etc.

2. Perception System: The “senses” of the robot.

Sensors: Cameras (vision), LiDAR/ultrasonic radar (ranging, mapping), IMU (Inertial Measurement Unit, attitude), encoders (motor position/speed), force/torque sensors, microphones (sound), touch sensors, etc.

Sensor interfaces and processing circuits: Responsible for collecting, filtering, amplifying, and analog-to-digital converting sensor signals.

3. Motion System: The “limbs” of the robot.

Actuators: The core is the motor (DC brushed motor, DC brushless motor, stepper motor, servo motor). It may also include hydraulic/pneumatic actuators (more common in industrial robots or large robots).

Drivers/power amplifiers: Convert control signals (from the main controller) into high-current/high-voltage power signals required to drive the actuators. This is where MOSFETs are most densely applied.

Mechanical structure: Joints, connecting rods, gearboxes, wheels/tracks, etc.

4. Power Management System:

Battery: Usually a lithium-ion/lithium-polymer battery pack.

Charging management circuit: Controls the battery charging process.

Voltage conversion modules: Convert the battery voltage into different voltage levels required by various parts of the system (main control, sensors, drivers, etc.) (such as 12V, 5V, 3.3V, 1.8V, etc.). DC-DC converters use a large number of MOSFETs.

Power distribution and protection: Switch control of the on-off of each power supply, overvoltage/overcurrent/undervoltage protection.

5. Communication System:

Internal communication buses: CAN, I2C, SPI, UART, Ethernet, etc., connecting the main control with various subsystems.

External communication: Wi-Fi, Bluetooth, 4G/5G, Ethernet, etc., used for interaction with the cloud, other devices, or users.

Human-computer interaction: Displays, speakers, indicator lights, touch screens, voice interaction modules, etc.

Software and algorithms: Operating systems, drivers, perception algorithms (SLAM, target detection and recognition), navigation and planning algorithms, motion control algorithms, decision-making AI, applications, etc.

II. Applications and Selection Points of MOSFETs in Intelligent Robots

The core role of MOSFETs in intelligent robots is to act as efficient, fast, and controllable electronic switches or amplifiers in various circuits, used for power control and conversion.

1. Motor Drive (Motion System — Drivers)

(1) MOSFET Applications

l H-bridge drive circuit (brushed DC motor)

l Three-phase inverter (brushless DC motor/permanent magnet synchronous motor): Composed of 6 MOSFETs (one for each upper and lower bridge arm of each phase) or three co-packaged MOSFETs. By precisely controlling the switching sequence of MOSFETs (usually using Space Vector Pulse Width Modulation — SVPWM), a rotating magnetic field is generated to drive the motor. It requires high switching frequency, fast switching speed, and low loss.

(1) Common Types of MOSFETs:

l Power MOSFETs: This is the most important application. Select N-channel enhancement-mode MOSFETs with appropriate specifications according to motor power (voltage, current).

l Low on-resistance MOSFETs: Very important! On-resistance directly determines conduction loss and heat generation. Trench MOSFET or Super Junction MOSFET technologies are often used to achieve low Rds(on).

l Fast-switching MOSFETs: High switching frequency can improve control accuracy and efficiency, and reduce motor noise (audible noise). Low gate charge and Miller capacitance are required.

l Integrated modules: To simplify design, improve power density and reliability, IPM (Intelligent Power Module) or PIM (Power Integrated Module) that integrate MOSFETs, gate drivers, and protection circuits are often used.

(2) Key Parameters for Selection:

Rated voltage, rated current, on-resistance, gate charge, switching speed, thermal resistance, package.

Shanghai Leiditech has various types of MOSFETs suitable for intelligent robot motor drives.

1. Power Management System

(1) Applications of MOSFETs in Power Management Systems

l Synchronous rectification: DC-DC converters (buck/boost/buck-boost)

l Battery protection board: MOSFETs are connected in series in the battery pack charging and discharging circuit as switches. When overcharging, over-discharging, overcurrent, or short circuit is detected, the MOSFETs are turned off to cut off the circuit and protect the battery safety. It requires extremely low on-resistance (to reduce voltage drop loss), moderate switching speed, and high reliability.

l Load switches: Control the on-off of the power supply of subsystems (such as turning off unused sensor modules to save power). MOSFETs are used as controlled switches in series in the power path. It requires low on-resistance and small off-state leakage current.

(2) Common Types of MOSFETs for Power Management

l Power MOSFETs: Used for DC-DC main switches and synchronous rectification switches. They also pursue low Rds(on) and high switching speed.

l Low on-resistance MOSFETs: Crucial in synchronous rectification and load switches.

l Special battery protection MOSFETs: Usually N-channel, with extremely low on-resistance and packages suitable for protection board applications.

l Small-signal MOSFETs: May be used for control logic or auxiliary power switches.

(3) Key Parameters for Selection

Rated voltage, rated current, on-resistance, gate charge, switching speed (for switching tubes), body diode characteristics (for synchronous rectification), off-state leakage current (for load switches).

2. Sensor Interfaces and Actuator Control

(1) Functions

High-power sensor/actuator drive: Some special sensors (such as high-power laser transmitters) or actuators (such as solenoid valves, high-power LED lights) may require MOSFETs as switches to control their power supply.

Pulse signal amplification: When driving some sensors that require large current pulses (such as ultrasonic transmitters), MOSFETs may be used for power amplification.

(2) Common Types of MOSFETs:

Medium and small power MOSFETs: Usually, the requirements for switching speed are not as high as those for motor drives, and more attention is paid to on-resistance and cost.

Logic-level MOSFETs: Convenient to be directly driven by microcontroller GPIOs. For example, 2N2007.

(3) Key Parameters for Selection:

Rated voltage, rated current, on-resistance, gate threshold voltage.

Leiditech is committed to becoming a leading brand in electromagnetic compatibility solutions and component supply, providing ESD, TVS, TSS, GDT, MOV, MOSFET, Zener, inductors and other products. Leiditech has an experienced R&D team that can provide personalized customization services according to customer needs and offer the best solutions.

If you’d like to learn more or have any questions, don’t hesitate to reach out:

Visit us at [en.leiditech.com]

#MOSFET #RoboticsDesign #IntelligentRobots #PowerElectronics #MotorControl #DCtoDC #RoboticsEngineering #TechBlog #EngineeringInsights #ShanghaiLeiditech #PCBDesign #EmbeddedSystems #RobotPower #IoTDesign #ElectronicComponents #FutureOfTech

0 notes

Text

Leader of Global Robot Sensor Market | AIDIN ROBOTICS

The evolving robotic company AIDIN ROBOTICS Inc. has begun in robotics research carried out by Sungkyunkwan University's mechanical engineering department. Established on a foundation of innovation and technological excellence, AIDIN ROBOTICS is dedicated to realizing a future where people and robots seamlessly coexist and collaborate in a safe manner. At the core of AIDIN ROBOTICS’ mission is the development of advanced robot sensor technologies, building upon the extensive field sensing expertise the company has accumulated since 1995.

[Robot Sensor Market Analysis]

Global Market for 6-Axis Force/Torque Sensors for Robots

Out of the global robot sensor market worth 2.4 trillion KRW, the 6-axis force/torque sensor segment represents 25%, forming a market valued at approximately 600 billion KRW. It is projected to grow by 13% annually, reaching 1.105 trillion KRW by 2028.

Demand Forecast for 6-Axis Force/Torque Sensors Based on Industrial Processes

[1]

Based on the number of robots introduced into these processes, the global demand for 6-axis force/torque sensors in 2022 is estimated at around 90,000 units. With the global sensor market’s 13% CAGR, the worldwide demand is expected to grow to 165,000 units by 2026.

Forecast for 6-Axis Force Torque Sensor Demand in the Growing Collaborative Robot Market

While collaborative robots (cobots) are primarily being adopted by small and medium-sized manufacturers for cost-effective and safe operations with simple position control processes, future demand for competitive 6-axis force/torque sensors is expected to increase, as these sensors will enable force/torque-based operations without the need for expensive ATI sensors traditionally used in industrial robots.

As of 2020, in the domestic market, 10.3% of small and medium-sized manufacturers (3,060 out of 30,602 companies) expressed an intention to introduce robots. Of these, 34% (1,040 companies) are expected to adopt processes that require 6-axis force/torque sensors.

With the growth of the collaborative robot market, the number of companies requiring 6-axis force/torque sensors is projected to increase to 8,893 by 2026.

Expansion Strategy for EoAT+Solutions Utilizing 6-Axis Force/Torque Sensors

Expanding into solutions that integrate sensors with End-of-Arm Tooling (EoAT) is expected to generate sales for each process that uses 6-axis force/torque sensors. This would create a high value-added business, potentially 50 times more profitable than selling individual sensors alone.

In the future, most of the processes that have yet to be automated by robots involve tasks requiring skilled manual labor and the application of force. This suggests that the remaining automatable processes will largely rely on 6-axis force/torque sensors and EoAT solutions.

If you are looking for world's leading robot sensor technology company, you can find it on Aidin Robotics

Click here to contact AIDIN ROBOTICS.

View more: Leader of Global Robot Sensor Market

0 notes

Text

Shaft Torque Sensor Market Analysis, Leading Players, Future Growth, Business Prospects Research Report Foresight

Shaft Torque Sensor Market, Trends, Business Strategies 2025-2032

The global Shaft Torque Sensor Market size was valued at US$ 345.67 million in 2024 and is projected to reach US$ 534.78 million by 2032, at a CAGR of 6.78% during the forecast period 2025–2032.

Shaft torque sensors are precision measurement devices that monitor rotational force (torque) applied to rotating shafts. These components play critical roles in power transmission systems across industries by converting mechanical torque into electrical signals. The technology encompasses both contact-type sensors (using strain gauges) and non-contact variants (employing optical or magnetic measurement principles), each suited for different industrial applications.

The market growth is driven by increasing automation in manufacturing, stringent quality control requirements, and rising demand for predictive maintenance solutions. While the automotive sector remains the largest end-user, emerging applications in renewable energy systems and robotics present new opportunities. Recent developments include HBM’s 2023 launch of their T40B series with improved temperature stability, reflecting ongoing technological advancements in measurement accuracy and durability.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=103293

Segment Analysis:

By Type

Non-Contact Torque Sensor Segment Leads Due to High Accuracy and Low Maintenance Needs

The market is segmented based on type into:

Non-Contact Torque Sensor

Contact Torque Sensor

By Application

Automotive and Transportation Dominates with Growing Focus on Vehicle Efficiency and Safety

The market is segmented based on application into:

Aerospace

Automation and Controls

Transportation

Manufacturing

Others

Regional Analysis: Shaft Torque Sensor Market

North America The North American shaft torque sensor market is characterized by robust demand from aerospace, manufacturing, and automotive sectors. With the U.S. accounting for approximately 40% of the regional market share, technological advancements and stringent quality standards drive adoption. Key players like FUTEK and Interface dominate this space with high-precision non-contact torque sensors, which are increasingly preferred for their durability and accuracy in harsh industrial environments. Government initiatives, including the Infrastructure Investment and Jobs Act, indirectly boost demand by modernizing industrial facilities. However, high costs of advanced sensors and competition from alternative measurement technologies present challenges for market expansion.

Europe Europe’s well-established automotive and industrial automation sectors create steady demand for torque measurement solutions. Germany leads the regional market, leveraging its strong manufacturing base and focus on Industry 4.0 integration. Regulatory frameworks such as the Machinery Directive (2006/42/EC) mandate precision in rotating machinery, directly benefiting torque sensor suppliers. The region shows increasing preference for wireless and IoT-enabled sensors, with companies like HBM and Kistler pioneering these innovations. However, market growth faces headwinds from economic uncertainties and the gradual phase-out of traditional manufacturing processes in favor of digital alternatives.

Asia-Pacific Asia-Pacific represents the fastest-growing market, with China contributing over 50% of regional demand. Rapid industrialization, expanding automotive production, and government initiatives like ‘Made in China 2025’ fuel market expansion. While cost-sensitive industries still prefer contact-type sensors, there’s growing investment in advanced non-contact variants for precision applications. Japan and South Korea remain innovation hubs, with companies like NSK developing compact torque sensors for robotics and electric vehicles. The region’s challenges include intense price competition and varying quality standards across countries, though overall growth prospects remain strong due to increasing automation adoption.

South America The South American market shows moderate growth, primarily driven by Brazil’s manufacturing and mining sectors. Economic volatility and limited industrial modernization slow adoption of high-end torque measurement solutions, with most demand concentrated in basic contact-type sensors for maintenance applications. Some growth opportunities emerge from renewable energy projects requiring torque monitoring in wind turbines. The lack of local manufacturers creates reliance on imports, making the market sensitive to currency fluctuations and trade policies. Despite these challenges, gradual infrastructure development offers long-term potential for sensor suppliers willing to navigate the region’s complexities.

Middle East & Africa This emerging market shows promise in oil & gas and construction applications, particularly in GCC countries. UAE and Saudi Arabia lead adoption of torque sensors for industrial equipment maintenance and energy applications. While the market remains small compared to other regions, increasing foreign investment in manufacturing facilities creates new opportunities. The lack of technical expertise and preference for low-cost solutions hinder adoption of advanced sensors. However, with growing focus on industrial diversification beyond oil, the region may see accelerated demand for precision measurement technologies in coming years.

List of Key Shaft Torque Sensor Companies Profiled

FUTEK Advanced Sensor Technology (U.S.)

HBM Test and Measurement (Germany)

Applied Measurements Ltd (U.K.)

Datum Electronics (U.K.)

Forsentek (China)

KA Sensors (China)

Binsfeld Engineering (U.S.)

ATO (China)

Althen Sensors (Netherlands)

S. Himmelstein and Company (U.S.)

Transducer Techniques (U.S.)

NSK (Japan)

Kistler Group (Switzerland)

The global industrial automation market has witnessed a compound annual growth rate of over 8% since 2020, creating substantial demand for torque measurement technologies. Modern manufacturing facilities increasingly integrate IIoT (Industrial Internet of Things) solutions, where shaft torque sensors play a critical role in condition monitoring and predictive maintenance. The implementation of these sensors helps reduce equipment downtime by up to 45% while improving operational efficiency, making them indispensable in smart factory environments.

In the transportation sector, regulatory bodies have mandated torque monitoring in critical systems, particularly for electric vehicle drivetrains and aircraft components. The European Union’s updated machinery directive (2023/1230) specifically requires torque verification in automotive assembly lines. Meanwhile, the aerospace sector accounts for nearly 22% of high-precision torque sensor demand due to strict FAA and EASA reliability standards for flight control systems.

The evolution of wireless torque sensing solutions presents significant opportunities, particularly for retrofitting existing machinery. Condition monitoring systems incorporating torque measurement are projected to grow at 11.2% CAGR through 2030, with predictive maintenance applications driving 68% of this demand. Recent developments in energy-harvesting sensor technologies eliminate battery replacement needs, a breakthrough expected to reduce maintenance costs by approximately 35%.

Manufacturers are increasingly adopting hybrid solutions combining contact and non-contact technologies. These systems achieve accuracy levels within ±0.25% while offering the durability of contact sensors for industrial environments, addressing a key market need recognized by 73% of equipment OEMs surveyed.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103293

Key Questions Answered by the Shaft Torque Sensor Market Report:

What is the current market size of Global Shaft Torque Sensor Market?

Which key companies operate in Global Shaft Torque Sensor Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Unitree H1: Breaking Speed Barriers in Humanoid Robotics

Envision a humanoid robot racing past all others, acrobatically flipping like a gymnast, and taking industrial applications by storm like never before. Step into the, an engineering sensation that’s not only breaking barriers—it’s pulverizing them. With a world-record 3.3 meters per second speed and 189 N.m/kg torque density, the Unitree H1 is the world’s fastest humanoid robot, with a new standard for high-performance robots. So what sets this machine apart from being game-changing? Let’s examine its breakthrough design and why it’s first choice for pioneering research.

Unmatched Speed Like No Other

Clocking in at 3.3 m/s (approximately 7.4 mph), the Unitree H1 does not walk, it runs. Achieving this blazing speed, demonstrated in untethered open-air displays, the H1 is the fastest humanoid robot in the world. From navigating complex environments to performing dynamic actions like running or flipping, the H1’s high-torque joints (up to 360 N.m) give unparalleled power and precision. This is not just a machine; it’s a force of nature, designed to dominate the toughest environments with ease.

The H1’s unencumbered mobility—cable-free or powered by an external power source—gives it a real-world edge, making it well-suited for outdoor deployment, from search-and-rescue to logistics in hostile environments.

Highlight: H1 stole the show at CES 2024 and NVIDIA GTC, with its untethered running and flipping leaving people in awe. Unlike other entries, it’s not just a prototype but a mass production-ready beast, waiting to be harnessed by researchers and industries today.

Built for Strength, Engineered for Durability

Standing at around 180 cm in height and 47 kg in weight, the H1 is a humanoid of full size with the capability to mimic human functionality. Additionally, its rugged build, powered by Unitree’s internal high-torque motors, enables it to carry out heavy-duty operations in industrial settings. For instance, from lifting payloads in manufacturing facilities to walking over rough terrain outdoors, the H1’s torque density (189 N.m/kg) delivers a strength-to-weight ratio that’s just unbeatable.

However, brute force isn’t the whole story. The H1’s force-position hybrid control also allows it to travel with dexterity, making it ideal for applications that require both strength and tact. In other words, picture it as a robot Hercules with a surgeon’s eye for precision—a combination that’s rewriting the automation playbook.

DNA shared with the G1: AI and Sensors That See the World

Even if the H1 is a monster in its own right, it leverages the technological base common to its sibling, the Unitree G1. Both the robots are endowed with 3D LiDAR and depth cameras, giving them 360° spatial awareness to facilitate free movement. While they are sidestepping barriers or surveying complex environments, these sensors pilot the H1 to move with intelligence and wit.

At the heart of every robot lies Unitree’s AI-powered motion algorithms, with autonomous task performance and real-time learning. From the G1‘s Kung Fu moves to the H1‘s rapid sprinting, the shared AI architecture allows both robots to learn from new challenges. And since Unitree is an open-source philosophy, developers around the globe can create these algorithms, meaning that the H1 is a platform for endless innovation.

Ready to see the future of robotics? More of the Unitree H1 and be a part of the revolution!

The Future Arrives—And It’s Speeding

The Unitree H1 isn’t just a robot; it’s a glimpse into a future where humanoids run, flip, and work alongside us. With its record-breaking speed, Herculean strength, and AI-driven intelligence, it’s redefining what’s possible in robotics. Whether you’re a researcher dreaming of the next breakthrough or an industry leader seeking automation solutions, the H1 is your ticket to the cutting edge.

So, what’s in store next? With Unitree breaking boundaries, the H1 is only the start. Leave your answer in the comments—how would you use the world’s fastest humanoid robot?

0 notes

Text

Robotic Machine Sensor Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to new market research, the global robotic machine sensor market was valued at USD 867 million in 2024 and is projected to reach USD 1,344 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period (2025-2032). This growth is driven by rapid automation adoption across industries, advancements in Industry 4.0 technologies, and increasing demand for precision robotics.

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

What Are Robotic Machine Sensors?

Robotic machine sensors are intelligent components that enable robots to perceive and interact with their environment. These sophisticated devices replicate human sensory capabilities, providing critical data on position, force, vision, touch, and other variables that robotic controllers use to execute precise movements and operations. The market encompasses specialized sensors including: movement sensors (accelerometers, gyroscopes), vision systems (2D/3D cameras), tactile sensors, proximity detectors, and voice recognition modules. Modern sensors increasingly incorporate AI and edge computing capabilities, transforming them from passive components into active decision-makers within automated systems.

Key Market Drivers

1. Industry 4.0 Revolution Fuels Sensor Demand

The transformation toward smart factories is accelerating sensor adoption, with modern automated production lines now incorporating 150-200 sensors per robotic cell compared to just 50-75 five years ago. Vision systems account for nearly 40% of this growth, as manufacturers implement real-time quality control across assembly lines. The automotive sector shows particularly strong adoption, where sensor-guided robotic welding now achieves placement accuracy within 0.1mm - crucial for electric vehicle battery assembly.

2. Human-Robot Collaboration Expands Applications

The rise of collaborative robots (cobots) has created new sensor requirements, particularly for force-torque detection and tactile feedback systems that ensure worker safety. Recent innovations include AI-powered skins that give robots a sense of touch across entire surfaces, enabling delicate operations in electronics manufacturing where human-like dexterity is essential. The global cobot market is projected to require over 8 million specialized sensors annually by 2026.

Market Challenges

Despite strong growth, several barriers persist. High implementation costs remain prohibitive for SMEs, with integrated robotic workcells often exceeding $250,000. Sensor reliability in extreme environments presents another hurdle - welding cells experience sensor failures every 600-800 hours due to arc glare and metal spatter. Additionally, cybersecurity risks in interconnected sensor networks have caused 35% of manufacturers to delay IIoT adoption until encryption standards improve.

Emerging Opportunities

The market presents significant growth potential in micro-manufacturing, where new nano-precision sensors enable robotic assembly of components smaller than human hair. The medical robotics sector alone will require 850,000 high-accuracy sensors by 2026. Another promising avenue is modular sensor platforms that reduce integration time from weeks to days - early adopters report 40% faster deployment and 30% lower engineering costs compared to traditional solutions.

Regional Market Insights

Asia-Pacific dominates with 45% market share, led by China's electronics manufacturing boom and Japan's leadership in precision robotics. The region grows at 8.9% CAGR, with sensor demand in South Korea's semiconductor sector increasing 22% annually.

North America maintains strong growth through aerospace and automotive investments, with U.S. facilities incorporating 50% more sensors per robot compared to conventional lines. Strict OSHA safety standards are accelerating tactile sensor adoption.

Europe shows steady expansion through Industry 4.0 initiatives, particularly in German automotive plants where vision system adoption has doubled since 2020. The EU's machine safety directives continue to drive innovation in collaborative robotics sensing.

Emerging markets demonstrate potential, with Brazil's automotive sector and the Middle East's logistics automation driving regional growth, though high technology costs remain a barrier to widespread adoption.

Competitive Landscape

Keyence and Cognex lead the vision sensor segment with 28% combined market share, recently introducing AI-enhanced pattern recognition systems that achieve 99.5% detection accuracy.

Baumer Group expanded its capabilities through strategic acquisitions, while Rockwell Automation partnered with NVIDIA to integrate advanced simulation and edge-based perception technologies.

Specialized manufacturers like ATI Industrial Automation continue innovating in force-torque sensing, recently launching a new series with 0.01N resolution for delicate assembly applications.

Market Segmentation

By Sensor Type:

Vision Systems (2D/3D cameras, LiDAR)

Force-Torque Sensors

Tactile and Proximity Sensors

Position and Motion Detectors

Environmental Sensors

Specialized Industrial Variants

By Application:

Industrial Automation

Collaborative Robotics

Autonomous Mobile Robots

Precision Manufacturing

By End-Use Industry:

Automotive and Transportation

Electronics and Semiconductors

Healthcare and Life Sciences

By Integration Level:

Standalone Sensors

Report Scope & Offerings

This comprehensive market analysis provides:

2025-2032 market size forecasts with COVID-19 impact analysis

Competitive intelligence on 12 major players (Keyence, Cognex, Baumer, Rockwell, etc.)

Technology trend analysis including AI integration, edge computing, and miniaturization

Strategic recommendations for suppliers and end-users

Download FREE Sample Report: Robotic Machine Sensor Market - View Detailed Research Report

Access Full Market Research: Complete Robotic Machine Sensor Market Analysis 2025-2032

Visit more reports :

https://www.tumblr.com/intelmarketresearch/787942687211929600/waterborne-curing-agents-market-growth-analysishttps://www.bundas24.com/blogs/52656/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://hallbook.com.br/blogs/630744/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://logcla.com/blogs/710480/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://controlc.com/a314248bhttps://justpaste.it/fyhckhttps://www.flexartsocial.com/blogs/11096/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://sidintelmarketresearch.blogspot.com/2025/07/waterborne-curing-agents-market-growth.htmlhttps://pastelink.net/gab25yi0https://penposh.com/blogs/448159/Waterborne-Curing-Agents-Market-Growth-Analysis-Market-Dynamics-Key-Playershttps://iamstreaming.org/siddheshkapshikar/blog/11027/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032https://intel24.hashnode.dev/waterborne-curing-agents-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032-1https://manage.wix.com/dashboard/feeb7ef3-a212-4275-a860-fdd6d8a9ee22/blog/posts?status=%5B%7B%22id%22%3A%22PUBLISHED%22%2C%22name%22%3A%22Published%22%7D%5D&selectedColumns=col-thumbnail%2Ccol-post%2Ccol-published%2Ccol-views%2Ccol-comments%2Ccol-likes%2Ccol-categories%2Ccol-tags%2Ccol-spacerhttps://www.pearltrees.com/sid7011/item724195739https://sites.google.com/view/intel-market-research/home/waterborne-curing-agents-market-2025

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision. International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

Robotic Collision Sensor Market: Competitive Landscape and Strategic Insights 2025–2032

MARKET INSIGHTS

The global Robotic Collision Sensor Market size was valued at US$ 234.8 million in 2024 and is projected to reach US$ 456.7 million by 2032, at a CAGR of 8.7% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the highest growth rate at 12.4% CAGR through 2032.

Robotic collision sensors are critical safety components that detect physical contact between robots and surrounding objects or humans. These sensors employ various technologies including force torque sensing, proximity detection, and tactile feedback systems to prevent equipment damage and ensure operator safety. The market comprises three primary sensor types: pneumatic collision sensors, mechanical collision sensors, and hybrid mechanical-pneumatic systems.