#how estimators reduce cost surprises

Explore tagged Tumblr posts

Text

How Accurate Is a Construction Cost Estimating Service?

Accuracy in construction cost estimating can mean the difference between a well-managed project and one plagued by budget overruns. For developers, contractors, and homeowners, relying on a professional construction cost estimating service is a key step toward financial predictability. But how accurate are these estimates, and what factors influence their precision?

Understanding the Nature of Estimates

First, it’s important to clarify that estimates are not final costs—they are projections based on available data, current pricing, and anticipated conditions. A professional construction cost estimating service provides a highly detailed breakdown using industry-standard methods, digital tools, and historical data. While no estimate is 100% precise, the best services often fall within 5% to 10% of the final project cost.

Factors That Affect Accuracy

The accuracy of an estimate depends on several factors:

Design Completeness: If architectural and engineering plans are incomplete, the estimator must make assumptions, increasing the margin of error.

Site Information: Geotechnical data, site access, and environmental issues influence costs. Limited site details can reduce estimate accuracy.

Scope Clarity: Vague or changing scopes create uncertainty. Clear specifications lead to better estimates.

Market Conditions: Material prices and labor rates fluctuate. Estimators use real-time databases and supplier quotes to stay current, but unexpected inflation or shortages can still affect actual costs.

Experience and Tools: Seasoned estimators using advanced estimating software are more likely to deliver accurate results, as they can account for nuances and project-specific complexities.

Types of Estimates and Their Accuracy Levels

There are different classes of estimates used at various stages of a project:

Preliminary Estimate (Conceptual Stage): Accuracy range of ±20% to 30%

Budget Estimate (Schematic Design Stage): Accuracy range of ±15% to 20%

Detailed Estimate (Final Design Stage): Accuracy range of ±5% to 10%

The closer a project is to construction-ready, the more accurate the estimate becomes. A construction cost estimating service will always indicate the level of confidence and contingencies included in their projections.

Role of Contingencies

Accurate estimates often include a contingency—a percentage added to the base estimate to account for unknown risks or changes. A good estimator uses historical data and risk analysis to set the appropriate contingency level, improving the practical accuracy of the final number.

Ongoing Adjustments for Accuracy

Professional estimating services also offer estimate updates as the design evolves. These revisions improve precision and help clients maintain control over costs as more information becomes available.

Conclusion

While no estimate can predict every variable, a construction cost estimating service provides a highly accurate foundation for budgeting and decision-making. With detailed data, risk management, and experience, estimators offer realistic financial projections that clients can trust to guide their projects from concept to completion.

#how accurate is construction estimating#accuracy of cost estimates in building projects#construction budget overrun prevention#margin of error in construction estimates#reliable construction cost forecasts#construction estimate vs actual cost#estimating contingency percentage#professional estimating services accuracy#detailed vs preliminary estimates#impact of design on cost accuracy#estimating service error margins#construction estimate confidence level#site data and cost accuracy#construction estimator precision tools#estimating accuracy levels#estimate update during design phase#what affects estimate reliability#how to get precise construction estimate#how close are construction estimates to final cost#value of accurate cost estimates#estimating for residential builds accuracy#cost estimating for commercial construction accuracy#construction estimating software accuracy#labor rate fluctuation impact on estimate#importance of contingency in estimating#contractor estimate comparison#construction quote vs estimate accuracy#budget estimates in early design#final stage construction estimate accuracy#how estimators reduce cost surprises

0 notes

Text

From Claims to Care

How RCM Efficiency Improves Patient Outcomes

Introduction In the healthcare world, clinical excellence is only half the equation. The other half—financial operations—often goes unnoticed until problems arise. Delayed reimbursements, mounting denials, and inconsistent cash flow can compromise both the quality of care and the sustainability of healthcare practices.

That’s why forward-thinking providers are turning to Humalife Healthcare, a trusted Revenue Cycle Management (RCM) partner, to bring efficiency, clarity, and control to their financial workflows—ultimately empowering better patient care.

RCM: More Than Just Billing Revenue Cycle Management isn’t just about billing and collections—it's the backbone of your entire healthcare operation. An efficient RCM system ensures:

Faster reimbursements

Lower denial rates

Improved operational planning

Better patient experience

When your revenue cycle is healthy, your organization can focus on what matters most: healing people.

The Hidden Link Between RCM and Patient Outcomes Here’s how optimized RCM directly improves patient care:

Reduced Administrative Delays Streamlined insurance verification and pre-authorization mean patients get timely access to care—without paperwork delays.

Financial Transparency Clear billing, upfront cost estimates, and fewer surprises at the front desk enhance patient trust and satisfaction.

More Time for Clinical Focus When providers are freed from financial bottlenecks, they can focus entirely on delivering quality care.

Reinvestment in Better Services Faster payments and fewer write-offs mean more funds can be reinvested into clinical infrastructure, staff training, and technology.

How Humalife Healthcare Delivers Impact At Humalife Healthcare, we integrate people, process, and technology to deliver RCM that performs. Here’s how we do it:

End-to-End Support From eligibility checks to denial appeals, we manage the entire revenue cycle with precision.

Domain Expertise Our team is trained in US and UK healthcare systems, coding standards, and payer rules.

Customized Solutions We align our processes with your workflows—no one-size-fits-all approach.

Transparency and Reporting With real-time dashboards and analytics, you stay in control and informed.

Client Win in Focus Case Study: Mid-sized Hospital in the UK Challenge: 28% of claims were being delayed due to improper coding and eligibility issues. Solution: Humalife implemented coding audits and pre-verification workflows. Result: Denials reduced by 41%, and claim cycle time improved by 35%. The finance team reported improved forecasting, and patients received faster care with less paperwork.

Conclusion In today’s healthcare economy, RCM isn’t just a back-office function—it’s a patient care enabler. At Humalife Healthcare, we help providers transform financial processes into strategic assets that power care delivery and drive sustainable growth.

Ready to Transform Your Revenue Cycle? Get in touch with Humalife Healthcare to learn how efficient RCM can enhance your care, reputation, and revenue

30 notes

·

View notes

Text

Excerpt from this story from Anthropocene Magazine:

U.S. states can decarbonize on their own for about the same price as a federal-led effort to reduce emissions by the same amount, according to a new study. The findings underline that a “coalition of the willing” could not bring the country to net-zero emissions on its own. But they also represent a hopeful vision of how climate action in the U.S. could continue despite Trump Administration rollbacks.

The Biden Administration pursued ambitious decarbonization policies via the Inflation Reduction Act and other initiatives, while the Trump Administration has taken a very different approach to climate policy. The situation highlights the volatility of national-level climate action in the United States, even as the American public broadly supports developing alternative energy sources, and urgent action is needed to avoid locking in fossil fuels with new infrastructure.

Enter “climate federalism,” a concept that casts U.S. states as laboratories not just of democracy but of climate action. In theory, this bottom-up approach might be more effective and durable than top-down action. In the new study, researchers sketch out what it might look like in practice.

“Ultimately the most important takeaway here is that state-led action can achieve substantial emission reductions, even without federal support, but that the world looks very different from one where there is federal coordination,” says study team member Jeremiah Johnson, an environmental engineer at North Carolina State University. “This has some important implications, not just for those states that choose to participate, but also for those who don’t.”

Johnson and his colleagues identified 23 U.S. states that are most likely to pursue net-zero emissions by 2050, based on the number of climate policies currently on the books as well as their overall political leanings. They fed publicly available energy system data into a computer model to estimate the cost of decarbonization and predict the green technologies that the states would likely turn to in their efforts.

Action by this group of states could reduce U.S. greenhouse gas emissions by about 46% by 2050, the researchers report in the journal Nature Communications. The researchers then used the same model to explore what federally coordinated action to reduce national emissions by the same amount would look like.

Federal led climate action would be about 0.7% cheaper than state action, the researchers found. “We were surprised [the state-led] emissions reductions would be achieved at costs comparable to federal actions,” Johnson says. Since only about half of U.S. states were expected to pursue net-zero emissions, “we expected to see this considerably push up the costs of achieving deep decarbonization.”

However, the mix of green technologies that would be used in a state-led decarbonization effort would be different from the federally coordinated one. The state-led effort would lean heavily on green manufacturing technologies to decarbonize industry, while the federal approach would rely more on clean energy such as solar and wind power.

The net-zero states would likely rely on electrification to reduce emissions from transportation and industry, as well as direct air capture to neutralize residual emissions. They might also purchase more electricity from neighboring states, leading to the potential for “emissions leakage.” In the state-led scenario, “we observed substantial new electricity exports from the Great Plains states into the Upper Midwest while those exporting states increased fossil fuel-based use,” Johnson says. “This would undercut the efforts of net-zero states unless their policies are designed to address this.”

The state-led scenario also leaves some cost-effective mitigation opportunities on the table, such as bioenergy with carbon capture and storage in the Southeastern United States, where states are unlikely to pursue decarbonization without federal action. Still, if state-led action is the only option, this can lead to substantial progress on climate, the study shows.

8 notes

·

View notes

Text

Heart Heist: The Zine Update 1.1 Out Now!

While work on the Complete Edition continues, Heart Heist: The Zine has also received its first major update!

Now that I understand itch's platform a bit better - as well as the scope of this project - it no longer seems correct to update the zine itself directly into the Complete Edition. I think it makes more sense to split Heart Heist into two bespoke editions: the cheap, easy to distribute, lowest-possible-barrier-of-entry Zine Edition; and a Complete Edition that is free to grow into whatever it ends up becoming. I don't want anyone who supported this project already to feel cheated out of the Complete Edition, which is why anyone who purchased (or purchases) the Zine Edition on itch will get $5 (the full price of the zine) off of the Complete Edition when it releases.

This does not mean that the zine is an unfinished version of a full game. Now it is quite the opposite - it is its own, complete thing (and has had its release stats on itch updated accordingly). It has everything you need to play, and can stand on its own. Some might come to call it a "rules-lite" version, and while I don't want to fall into the rabbit hole of definitions, it is looking very likely that the Complete Edition will have at least three more mechanics than its zine counterpart. Some players might even come to prefer one version over the other - relative simplicity and ease of use vs. mechanical depth and additional useful tools. Only time and continued development will tell.

While the Zine Edition obviously won't have everything the Complete Edition will have in it, it will still benefit from some of the updates work on the Complete Edition produces - such as the changes that released today!

Thank you for continuing to support Heart Heist!

Changelog:

Created a Google Sheet that helps automate calculating each Thief's Favor at the end of the game if you don't feel like doing math

Updated estimated play time based on additional playtesting with more groups of different players - down from 5 or 6 to 4 hours!

Added expectation of an additional 30 to 60 minutes if the entire group is new to playing Heart Heist

Added section strongly encouraging players to read their intel before meeting up to save time at the table. This section also explains that heists cannot be "spoiled," and are reusable!

The Evocative Language Update

"Stats" → "Vibes"

"Game Master" → "The Guy in the Van" (GV)

Removed unnecessary references to upcoming material meant for the Complete Edition

Rephrased explanation of "Fake It 'til you Make It" for clarity

Fixed unspecified print error on page 5

Added missing paragraph break on page 9

Fixed various typos

Removed grey sketch line from corner of Bingo.png

Fixed missing Alt Text for Bingo.png

Clarified that armor counts as a set of clothes

Specified how long it takes for a glass cutter to cut holes of various sizes

Reduced cost of the Aptitude spell from 3 to 2 Favor

Added advice for players to - at minimum - figure out how they will get in, how they will acquire the target, and how they will get back out again within their planning time limit. You'd be surprised how many groups forget one of those three things!

Added reminder for the Guy in the Van to award bonus Favor for the Dragon's Patron effect at the end of Phase 2: The Plan

Various tweaks to The Princess in the Box example heist based on continued playtesting

Added a timeline overview of the heist to The Princess in the Box

Increased margin size of The Princess in the Box intel handout for easier note taking

Updated the titles of some of the art pieces in the credits

7 notes

·

View notes

Text

Several readers were surprised to hear that Canada imposes provincial “tariffs” or trade barriers that simply act as tariffs. Canadian politicians have been promoting a marketing campaign against US-imposed tariffs, but must recognize that their own domestic policy is hurting the Canadian economy in a massive way. Canada’s tariff rate on international imports averages 1.4%, utterly disproportional in comparison to domestic trade barriers. Estimates believe that current domestic trade barriers cost the Canadian economy $32 billion annually, but these interprovincial trade taxes can surpass 14% on domestic goods.

It is quite difficult for provinces to conduct business with one another; in fact, it is often more cost-efficient to work with international companies. Section 121 of the Constitution Act of 1867 implemented by the British Parliament states:

All Articles of the Growth, Produce, or Manufacture of any one of the Provinces shall, from and after the Union, be admitted free into each of the other Provinces.

The March 1867 stated:

All Articles of the Growth, Produce, or Manufacture of any one of the Provinces shall, from and after the Union, be admitted free into each of the other Provinces.

The act should have prevented tariffs between provinces and has been amended, but the current framework fails to prevent excessive regulation. The Supreme Court attempted to address the matter in 1921 and stated that “free” meant tariff free, but did not address regulation which in itself acts as a tariff. The wording is the only aspect that changed but it is indeed a tariff.

The Canadian Free Trade Agreement (CFTA) of 2017 attempted to reduce trade barriers between provinces but it ultimately failed to address the root issue. Certain sectors were exempt from the rules, but individual provinces could choose to opt out. It is an absolute nightmare for businesses that are often required to obtain licenses, labor certifications, and meet an array of requirements from environmental to health and safety. One province may not meet the requirements, and there are many, of another and it causes mass confusion. Transportation costs alone for interprovincial trade cost $1.6 billion annually, and we all know how well the last administration treated the nation’s truckers.

Prime Minister Mark Carney plans to eliminate these tariffs on July 1, Canada Day, amid widespread nationalist sentiments. Estimates that reducing interprovincial trade barriers could increase GDP by at least 4.4%–a massive uptick as one-third of Canadian trade is interprovincial.

4 notes

·

View notes

Text

How Much Does It Cost to Install a Skylight?

Skylights are a popular way to bring natural light into your home and enhance your living space. However, before you embark on this bright journey, it's essential to understand the costs associated with installing skylights. At Lastime Exteriors, knowledge is the key to home improvement decisions. This article will guide you through the various skylight installation costs to help you make an informed choice.

Understanding Skylights

Before addressing the costs, let’s briefly discuss skylights. Skylights are window-like installations on a home's roof that allow natural light to enter a space. They can transform dark corners into bright, inviting areas and provide ventilation and energy efficiency benefits. Depending on your needs, you can choose from various styles, including fixed, vented, and tubular skylights.

Factors Affecting Skylight Installation Costs

Skylight Type and Quality

The type of skylight you choose will significantly impact its price. People often opt for standard fixed skylights, but you might consider vented or tubular skylights if you want something more functional. Vented skylights provide airflow and can be more expensive than their fixed counterparts. High-quality materials like impact-resistant glass tend to cost more but offer better durability and insulation.

Installation Labor Costs

Labor is another substantial component of skylight installation costs. The complexity of your roof and the accessibility of the installation site will greatly influence labor costs. The labor costs may increase if your roof has a steep pitch or limited access. It’s essential to factor in the expertise of the contractors performing the installation. At Lastime Exteriors, our skilled team is committed to delivering high-quality workmanship while ensuring the process is as smooth as possible for you.

Adding Extras

People often overlook additional features that might enhance their skylights, such as blinds or shades. While these aren't mandatory, they can contribute to privacy and help control the amount of sunlight entering your home. If you decide to include these extras in your installation, budget accordingly.

Local Market Variations

Costs associated with skylight installation can vary significantly by region. In metropolitan areas where the cost of living is higher, installation costs might also be elevated. Researching the market in your locality and checking various companies such as Lastime Exteriors can help you gauge a fair price range.

Typical Cost Breakdown for Skylight Installation

Initial Purchase Costs

A standard fixed skylight costs between $150 and $3,000, depending on size and quality. Ventilated models generally cost between $300 and $2,000, while tubular skylights start at around $200 and end at around $1,500.

Installation Expenses

Labor costs can vary depending on your location and the job's complexity. On average, installation labor can range from $200 to $1,200. However, to avoid surprises, getting a detailed estimate from a reputable contractor like Lastime Exteriors is important.

Total Project Costs

Putting it all together, you might expect a total cost ranging from approximately $1,000 to $5,000 or more for a skylight installation project. For a more accurate estimate, consider contacting us at Lastime Exteriors!

While the cost of installing skylights might seem steep, the advantages they offer can make them worth every penny. Skylights can enhance the ambiance of a room, potentially reduce electricity costs by maximizing natural light, and improve air quality by providing ventilation. Furthermore, people often find that the aesthetic appeal and increased home value make skylights a great investment.

Why Choose Lastime Exteriors

At Lastime Exteriors, we prioritize customer satisfaction and quality service. Our team is dedicated to helping you choose the right type of skylight for your home while providing accurate estimates upfront. We take pride in our craftsmanship and commitment to ensuring each skylight installation meets our high standards.

Contact us if you’re considering bringing more natural light into your home. Visit Lastime Exteriors or call us at (402) 330-0911 with any questions or to schedule an appointment. You can also email [email protected] for a free estimate! Let us brighten your living spaces today!

Installing skylights can transform your home’s atmosphere, offering beauty and function. While costs vary widely based on several factors, having the right information will help you budget effectively for your project. Take the first step towards a brighter home with Lastime Exteriors!

2 notes

·

View notes

Text

Asteroid deflection strategies: Researchers unveil new scenarios

How prepared are we to deflect an asteroid heading towards Earth? This question is answered by two studies just published in Nature Communications, the result of a collaboration between Politecnico di Milano, Georgia Institute of Technology and other international institutions. The research analyzes the historical results of NASA's DART (Double Asteroid Redirection Test) mission, which hit the asteroid Dimorphos on September 26, 2022, marking the first practical demonstration of planetary defense.

The impact, observed through ground and space-based telescopes as Hubble, produced a huge amount of ejecta—fragments ejected from the surface—revealing crucial information to improve the effectiveness of future asteroid deflection missions.

The first study was conducted by a team of researchers from the Department of Aerospace Science and Technology at the Politecnico di Milano, lead by Professor Fabio Ferrari and including Paolo Panicucci and Carmine Giordano, in collaboration with the Georgia Institute of Technology. The second study, coordinated by Professor Masatoshi Hirabayashi of Georgia Tech, included contributions from Ferrari himself.

"We used Hubble Space Telescope's images and numerical simulations to quantify a viable mechanism of the ejecta evolution and successfully estimated ejected particles' mass, velocity, and size," Professor Ferrari explained.

"We also found complex interactions of such particles with the asteroid system and solar radiation pressure, i.e., sunlight pushing ejecta particles. Understanding these processes is crucial to supporting effective design of future actions for planetary defense purposes."

The asteroid's shape can make a significant difference in its ejecta trajectory, according to the second study from Georgia Tech. Professor Masatoshi Hirabayashi's study highlights a surprising finding: it identified the impact scale and the asteroid's rounded surface lowered the asteroid push by 56% compared to when Dimorphos was tested as an entirely flat wall. Thus, sending a large impactor does not mean a big push.

"If the impact is large, more ejecta fly out of the surface but are more affected by surface tilts. This process makes the ejecta deviate from the ideal direction, reducing the asteroid push," Professor Hirabayashi explained.

"Sending multiple smaller impactors not only results in a higher asteroid push but also potentially saves operational cost and increases tactical flexibility for deflection."

Ferrari agrees with this concept, as his study analyzed the evolution of the ejecta, contributing to clarifying their role in asteroid deflection: "Understanding the impact processes and their consequences is crucial to understanding the properties of asteroids, their natural evolution and fate, and ultimately, to design mitigation actions for planetary defense purposes."

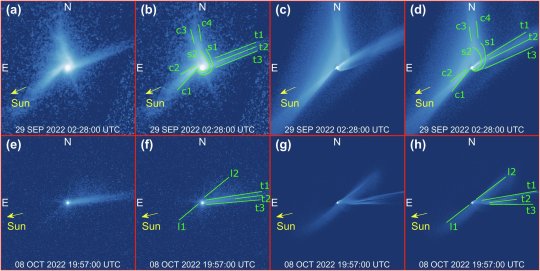

IMAGE: Time evolution of features. Credit: Nature Communications (2025). DOI: 10.1038/s41467-025-56551-0

3 notes

·

View notes

Text

How to Get a Home Repair Loan With Little Stress

Life happens. Roofs leak. Pipes burst. Walls crack. And the worst part? It always seems to happen when your wallet isn’t ready. That’s where home repair loans come in. If you’re facing urgent home fixes or even long-overdue maintenance, the right loan can help you get the job done without draining your savings — or your sanity.

Let’s walk through how you can secure a home repair loan with less stress, more confidence, and no confusing jargon.

What Are Home Repair Loans?

Home repair loans are financing options that help homeowners pay for repairs, upgrades, or improvements to their property. These can include emergency fixes like electrical repairs or long-term upgrades like kitchen remodeling. You borrow a certain amount, fix what needs fixing, and repay the loan in monthly installments.

You can apply for these loans through banks, credit unions, online lenders, or even special government programs depending on where you live.

When Do You Need One?

You might need a home repair loan if:

Your roof is damaged and insurance won’t cover the full cost.

You want to upgrade your plumbing, heating, or insulation.

You’re selling your home and need it to pass inspection.

You can’t afford the repair upfront but need to fix it right away.

If it’s something important that affects the safety, function, or value of your home — it’s a good time to consider this option.

Tips to Get a Home Repair Loan Easily

Getting a loan doesn’t have to feel like a headache. Use these simple tips to reduce stress:

1. Know Your Budget

Before you apply, estimate the total cost of repairs. Ask for quotes from contractors and figure out how much money you actually need. Don’t borrow more than you can repay.

2. Check Your Credit Score

Most lenders will review your credit. A higher score gives you better loan options with lower interest. If your score is low, look for lenders who offer home repair loans for bad credit — they do exist!

3. Compare Lenders

Don’t take the first offer you see. Compare interest rates, repayment terms, and fees. Some lenders even offer same-day approvals or “fix now, pay later” options.

4. Have Your Documents Ready

You’ll need ID, proof of income, home ownership documents, and maybe contractor estimates. Having everything prepared speeds up the process.

5. Ask Questions

Before you sign anything, ask: – Is the interest rate fixed or variable? – Are there penalties for paying it off early? – Can I delay my first payment?

The more you understand the loan terms, the less likely you’ll face surprises later.

Quick Loan, Long-Term Peace

The best part? Many home repair loans can be approved in just a few days. That means you can fix what’s broken, improve your home, and move on with your life. No more worrying about the leaking ceiling or faulty wiring.

It’s all about choosing the right loan and the right lender. Whether your need is big or small, urgent or planned, there’s a loan out there that can help.

Final Thoughts

Home repairs can be stressful — but getting a home repair loan doesn’t have to be. With a bit of research, the right paperwork, and a clear plan, you can handle home fixes without financial panic.

1 note

·

View note

Text

Custom Home Builders Florida - Neo Homes

Why Choose Custom Homes in Florida?

Growing demand for personalized homes in Florida

Florida’s unique climate and lifestyle demand tailored designs

Stats: 65% of homeowners prefer custom builds over pre-made homes (2023 data)

Real-world success: Neo Homes has built over 200 custom residences in Florida

Why Hire a Custom Home Builder in Florida?

Experience Local Building Conditions

Florida’s weather, soil, and code requirements are unique

Local builders understand how to build durable, hurricane-proof homes

Case study: Neo Homes' weather-resistant designs in coastal areas

Personalized Design and Flexibility

Builders work with you on every detail—floor plans, materials, finishes

Create a home that fits your lifestyle perfectly

Expert insight: "Personalized homes have higher satisfaction and resale value" — Neo Homes architect

Cost and Time Efficiency

Avoid surprises with upfront estimates and clear timelines

Experienced builders prevent costly mistakes common in custom projects

Data point: Average custom home takes 9-12 months to build in Florida

Key Features of Neo Homes - Custom Building Process

Design Phase

Collaboration with top architects and designers

3D renderings to visualize your home before construction begins

Construction Phase

Transparent project management with regular updates

Quality control from foundation to finishing touches

Quote: 98% of Neo Homes clients report high satisfaction during construction

Final Walkthrough & Satisfaction Guarantee

Walkthrough to confirm everything meets your needs

Post-build support and warranties

Strategy: Building trust through clear communication

Top Trends in Florida Custom Homes

Eco-Friendly and Energy-Efficient Builds

Use of solar, smart systems, and sustainable materials

Stats: Homes with solar reduce energy costs by up to 40%

Example: Neo Homes’ LEED-certified projects in Tampa

Modern Designs with Smart Technology

Open floor plans, large windows, and outdoor spaces

Integration of home automation for convenience and security

Expert tip: "Smart homes save time and money" — Neo Homes tech specialist

Coastal and Waterfront Custom Homes

Built to withstand storms and high humidity

Customized decks, docks, and outdoor living spaces

Case study: Waterfront mansion in Naples built by Neo Homes

How to Choose the Best Custom Home Builder in Florida

Check Experience and Reputation

Look for builders with local experience and good reviews

Verify licenses and insurance

Tip: Visit past projects and speak with owners

Review Portfolio and Client Feedback

Seek recent, high-quality projects similar to your vision

Read reviews on trusted platforms like Houzz and Google

Action: Meet with builders to gauge communication and professionalism

Understand Pricing and Contracts

Get detailed, written estimates

Clarify payment schedules and warranties

Advice: Never sign a contract without clear details on scope and costs

Conclusion: Build Your Dream Home with Neo Homes in Florida

Florida’s unique environment needs a builder who understands local details

Neo Homes offers personalized, efficient, and durable homes

Be proactive: research, ask questions, and communicate your needs clearly

Action step: Contact Neo Homes today to start your custom build journey

#custom luxury homes#custom home builders tampa#custom home builder#tampa luxury homes for sale#luxury home builders in tampa florida#custom house builder in tampa

1 note

·

View note

Text

How a Construction Cost Estimating Service Helps Minimize Project Risk

Risk is an unavoidable part of construction—but with the right tools and expertise, it can be effectively managed. One of the most proactive ways to reduce risk early in a project is by hiring a professional construction cost estimating service. From budgeting to procurement, these services create financial clarity that helps avoid delays, disputes, and cost overruns.

What Are the Main Risks in Construction?

Common project risks include:

Budget overruns

Scope creep

Material and labor shortages

Unforeseen site conditions

Poor contractor pricing

Scheduling delays

Each of these risks can lead to added costs, contractual disputes, or missed deadlines. An experienced estimator helps manage and reduce these variables from day one.

How Estimating Services Reduce Risk

Accurate Budget Forecasting By analyzing drawings, specifications, and historical cost data, estimators deliver realistic budgets that reduce the chance of surprise expenses.

Contingency Planning Estimates often include contingency percentages to account for design changes, market volatility, or hidden conditions. This buffer helps prevent budget shocks.

Detailed Takeoffs and Cost Breakdowns By providing itemized quantities and pricing for materials and labor, estimators eliminate guesswork. Contractors and clients alike benefit from clear scope alignment.

Market-Specific Cost Data Estimators use regional pricing data to ensure the estimate reflects actual market conditions—critical for preventing underbidding or underfunding.

Bid Analysis and Comparison Some services assist in reviewing contractor bids, helping clients identify errors or inflated pricing before contracts are signed.

Scenario Planning and Value Engineering Estimators can present alternative design or material choices that lower cost without sacrificing quality—adding flexibility to respond to unforeseen issues.

Who Benefits from This Risk Management?

Homeowners with tight budgets

Commercial developers with financing milestones

Government agencies with strict cost controls

General contractors managing multiple trades

Architects needing early-stage cost guidance

Conclusion

Construction cost estimating services do far more than generate numbers—they provide critical risk-reducing insights that support sound decision-making. By identifying potential financial pitfalls early, estimators help ensure projects stay on track, on budget, and on time.

#how estimators reduce construction risk#risk management with estimating service#budgeting to prevent construction delays#how to avoid construction budget overruns#estimating service with risk control#construction contingency planning#role of estimators in project risk#reducing cost overrun with estimates#estimating for better risk management#construction project risk planning#value engineering to minimize risk#estimator’s role in contract risk#avoiding change order risk#cost estimator to prevent budget shocks#minimizing scope creep with estimates#takeoffs for risk reduction#how to use estimates to avoid surprises#regional pricing and project risk#estimating for schedule protection#estimating support for tight budgets#controlling project costs with estimator#how estimates help manage construction issues#bid comparison to reduce financial risk#cost analysis for risk prevention#identifying hidden costs early#estimator’s risk management checklist#construction risk forecasting with estimate#early budgeting to lower risk#estimator insights to reduce uncertainty#smart estimating for safe projects

0 notes

Text

How to Find an Affordable ISO 14001 Certification Provider Without Compromising Quality

What Are Affordable ISO 14001 Certification Providers

Affordable ISO 14001 Certification Providers

We’ve been analyzing the future all wrong. It’s 2025, and the resurgence of the pandemic is only a footnote in history. Environmental sustainability is now not an esoteric idea but rather a vital factor underpinning all decision-making. Enterprises across the sectors are operating toward reaching Affordable ISO 14001 Certification Providers, decorate client confidence, and ensure extra effectiveness of environmental management systems. While there may be a large difference in fee-point gives available, how can you realize what the cheapest ISO 14001 certification carrier is and that it’s a reputable and high-quality one?

Here’s your guide to making a smart decision for your business.

ISO 14001 2025 – Realistic Costs

PARTY IN STYLE I want to fly from Canada to US cities in January, but it’s pricey! What do you recommend? Cost of ISO 14001 certification in 2025 The costs of ISO 14001 certification in most cases will vary from , the variation is dependent on various factors:

The size and complexity of your organisation

Number of locations

Coverage of the Environmental Management System (EMS)

Certification body or consultant chosen

Cheap does not mean getting the lowest-priced service in the market. It’s fair pricing grouped around your operational requirements—without any surprise costs later on.

What Does a Provider Fee Cover?

Make sure to ask what the whole package is when it comes to certificates before signing the dotted line.

Initial gap analysis or pre-assessment

Documentation review and support

On-site or remote audit(s)

Non-conformance guidance

Final certification issuance

Surveillance audits for ongoing compliance

Additionally, some providers may be willing to train your internal team, Affordable ISO 14001 Certification Providers which adds even more value without exceeding your budget.

Avoiding Scams: Cheap ≠ Accredited

Whereas taking a toll is vital, don’t be baited by “too great to be true” estimating. Exceptionally few of these unaccredited and uncertified offices have conducted legitimate reviews sometime recently, giving out ISO 14001 certificates. Not only does such conduct make your certification invalid and void, but it might also harm your notoriety and, more awful, bring legitimate consequences.

Here’s how to guarantee you are not locked in with fake providers:

Check accreditation: Make beyond any doubt the supplier is licensed with a legitimate organisation such as IAS, UKAS, or NABCB.

Check references and audits: Discover genuine client tributes or case studies.

A transparent process: Strides Healthcare If a company is legit, they should be more than open to giving you a very clear idea of what every step of the process will look like—no empty promises.

Be skeptical of one-day certification offerings. As the ISO 14001 certification process is a process, it cannot be done in a single transaction by writing a check.

How does Factocert offer the best and quickest support?

We know that small and medium-sized organisations want to see results quickly and want results in a cost-effective manner. And that’s why we’ve structured our services around a push-free, value-focused approach to ISO 14001 certification.

Here’s why Factocert is the way to go:

Industry-specific advisors—we match every engagement to your field.

Flat rate —no hidden fees, one flat rate quote

Remote-friendly practices—reduced overhead, faster/expanded development cycles

Worldwide recognition: ISO-certified and utilised by 1000+ companies.

We provide continuous compliance support by partnering with you even after certification.

When you select Factocert, you are not only selecting affordable?

Get Quotes for Your Unique Business Type

No matter if you are a factory, tech company, Affordable ISO 14001 Certification Providers or logistics or environmental services company—Factocert delivers personalized.

ISO 14001 certification quotes based on your:

Employee strength

Industry requirements

Existing management systems

Desired timeline

There is no standard pricing; instead, you can choose smart options that suit your needs.

For More Information: www.factocert.com

0 notes

Text

Healthiga: Clear and Simple Healthcare Pricing

Healthcare in the U.S. is often confusing, expensive, and unpredictable. Healthiga solves this by offering a simple platform where patients, employers, and healthcare providers can access clear, upfront pricing for medical care—before any appointments are made.

Founded by a team of physicians and technologists, Healthiga was built with one mission: to improve quality, access, affordability, and transparency in healthcare. Whether you're an individual trying to avoid surprise bills or an employer supporting your workforce, Healthiga helps you make better, smarter decisions.

Why Healthiga?

No more surprise medical bills Know what your treatment will cost before you walk into a hospital, clinic, or lab.

Compare providers easily Search and compare prices for services like MRIs, blood tests, or outpatient procedures across multiple facilities.

Understand Good Faith Estimates Healthiga helps you access and understand cost estimates so you can plan ahead confidently.

Smart tools for employers and providers From compliance support to seamless integration, Healthiga empowers businesses to offer transparent healthcare options.

Who Is It For?

Patients who want to take control of their healthcare finances.

Employers looking to offer cost-effective benefits and improve employee satisfaction.

Providers who want to reduce billing disputes and boost patient trust.

Everyone deserves to know what their care will cost. Healthiga turns that vision into reality.

Key Features

Price comparison tools Instantly find out what nearby providers charge for the same procedure or test.

Easy-to-read estimates Healthiga delivers breakdowns of costs so users can avoid hidden fees.

Simple interface Designed for real people—not just medical experts or insurance pros.

Secure and compliant Built with modern standards in healthcare privacy and transparency regulations.

By offering these features in one place, Healthiga empowers users to stop guessing and start planning.

Conclusion

Healthiga is changing how people experience healthcare—by making costs visible, decisions easier, and outcomes more predictable. With a platform that supports patients, employers, and providers alike, Healthiga is paving the way for a smarter, more transparent healthcare future.

Start with confidence—choose Healthiga and know your healthcare costs before you commit!

0 notes

Text

Comprehensive Roof and Home Inspection Services for Long-Term Property Safety

When it comes to protecting your most valuable investment—your home—nothing is more crucial than regular inspections. Roof inspection and home inspection services are essential for identifying issues early, maintaining safety, and preserving property value. At Companion Home Inspections, professional building inspectors ensure every detail is evaluated with precision. From estimating roof inspection cost to offering full-scale evaluations, we bring transparency, trust, and excellence to every inspection.

Why Roof Inspection Matters

The roof is your home’s first line of defense against the elements. Over time, wear and tear from weather, debris, and aging can cause damage that isn't visible from the ground. That’s where roof inspection services become vital. A qualified inspector can identify leaks, structural weaknesses, mold, or broken shingles early on—saving you from costly repairs in the future. Timely roof inspection also ensures your home stays energy-efficient, safe, and well-maintained year-round.

Home Inspection Services – A Complete Property Review

Home inspection services go far beyond the roof. At Companion Home Inspections, we evaluate every key area of your home—foundation, electrical systems, plumbing, HVAC, attic, walls, insulation, and more. Our comprehensive home inspection helps you make informed decisions whether you're buying, selling, or maintaining a property. With a detailed inspection report, you get a clear understanding of any repairs, safety issues, or maintenance needs.

How Roof Inspection Cost is Determined

One of the most common questions homeowners ask is about the roof inspection cost. The answer depends on several factors including roof size, accessibility, slope, age, and roofing materials. Some roofs may also require drone or infrared scanning. At Companion Home Inspections, we offer honest, upfront pricing for all roof inspection services—ensuring there are no surprises. We believe transparency is key, and our competitive rates reflect our commitment to fair and reliable service.

The Role of Certified Building Inspectors

Building inspectors play a critical role in maintaining the safety and integrity of your home. Our certified building inspectors follow industry standards to evaluate every aspect of your property. They provide detailed findings, explain the implications of any issues, and answer all your questions with clarity. This professional insight helps homeowners plan repairs, avoid hidden problems, and make confident decisions.

Why Choose Companion Home Inspections?

Companion Home Inspections is a trusted name in roof inspection and home inspection services. We bring years of experience, state-of-the-art tools, and a customer-first approach to every inspection. Our building inspectors are fully licensed, insured, and trained to meet the highest standards. Whether you need a one-time roof inspection or a full property analysis, we tailor our services to your unique needs. Our clients value our transparency, reliability, and attention to detail—and we’re proud to help protect what matters most: your home.

Benefits of Regular Inspections

Scheduling regular home and roof inspection services is more than a preventive measure—it’s a smart investment. Benefits include: - Early detection of potential issues - Reduced long-term repair costs - Increased home value - Enhanced safety and compliance - Better resale value With affordable roof inspection cost and reliable home inspection services, you can avoid unpleasant surprises and plan confidently for the future.

Conclusion

Your home deserves the highest level of care, and that begins with professional inspection services. Companion Home Inspections is committed to offering quality roof inspection services and complete home inspection services delivered by experienced building inspectors. With transparent roof inspection cost, detailed reports, and excellent customer service, we’re here to help you protect your home with confidence. Contact us today to schedule your inspection and secure peace of mind.

0 notes

Text

Roof Replacement 101: What Bay Area Homeowners Need to Know Before Starting

Replacing your roof is one of the biggest—and most expensive—home improvement projects you’ll tackle as a homeowner. While the process may seem overwhelming at first, a clear plan and understanding of your options can help you protect your investment and avoid headaches down the line.

Whether you live in Pleasant Hill, Fremont, or Vallejo, this guide breaks down what Bay Area homeowners should know about roof replacement, from signs it’s time to replace to choosing materials and working with a contractor you can trust.

Is It Time to Replace Your Roof?

Knowing when your roof needs to be replaced isn’t always straightforward. Here are the most common signs:

Age: If your asphalt shingle roof is 20–25 years old, it may be nearing the end of its life.

Curling, cracking, or missing shingles: These are clear signs of wear and potential water intrusion.

Leaks and water damage: Water stains on ceilings or walls often point to compromised roofing.

Moss or algae growth: While not always an emergency, persistent growth can indicate moisture problems.

Sagging: This could be a sign of structural issues beneath the surface.

If you notice one or more of these red flags, it’s smart to schedule a professional evaluation. In Contra Costa and Alameda Counties, Bay Valley Roofing is known for thorough inspections and honest feedback on whether repair or replacement is the best route.

Step-by-Step: What to Expect During a Roof Replacement

Here’s a simplified overview of the roof replacement process:

1. Inspection and Estimate

A licensed contractor will assess your roof’s condition and recommend the appropriate scope of work. They’ll consider:

Roofing material condition

Structural integrity

Attic ventilation

Local building codes and weather patterns

This is also the time to request a detailed quote and timeline.

2. Material Selection

Depending on your budget, climate, and aesthetic preferences, you’ll choose from materials like:

Asphalt shingles: Affordable and widely used

Metal roofing: Durable and energy-efficient

Tile or slate: Long-lasting and visually distinctive

Synthetic options: Mimic higher-end looks at a lower cost

Homeowners throughout Solano County often select cool roof systems that reflect more sunlight and reduce interior heat—a smart option in warmer inland areas.

3. Permitting

Your contractor will handle local permits and ensure your new roof complies with city or county codes. This is especially important in jurisdictions like Berkeley, Vallejo, and Walnut Creek, where codes may be stricter due to seismic safety and fire protection standards.

4. Tear-Off and Preparation

Crews will remove your existing roofing, inspect the decking for rot or soft spots, and make any necessary repairs to the structure before installing the new materials.

5. Installation

New underlayment, flashing, shingles, or tiles are installed following manufacturer specifications. Ventilation upgrades and drip edge details are addressed at this stage to ensure long-term durability.

6. Clean-Up and Final Walkthrough

Your contractor should clean up all debris, nails, and materials before doing a final walkthrough with you to verify the work meets your expectations.

How Much Does a Roof Replacement Cost in the Bay Area?

The cost of a roof replacement varies based on:

Roof size and pitch

Material choice

Labor costs

Permit fees

Structural repairs (if needed)

In the East Bay, homeowners can expect to pay anywhere from $12,000 to $30,000+, depending on these variables. Metal roofs and high-end tile systems fall on the higher end of that range.

Working with a reputable company like Bay Valley Roofing ensures transparent pricing, fair financing options, and no surprise charges mid-project.

Choosing the Right Roofing Contractor

A roof replacement is only as good as the crew that installs it. Here are some tips for finding a qualified roofer in Contra Costa, Alameda, or Solano County:

✅ Look for licensing and insurance

Always confirm your roofer is licensed by the California State License Board and carries liability and workers’ compensation insurance.

✅ Ask about local experience

You want a contractor who understands Bay Area weather, architecture, and permitting. Local crews are more familiar with microclimates and have working relationships with nearby building departments.

✅ Read reviews and references

Online ratings, Diamond Certified reports, and direct references give you insight into customer satisfaction and job performance.

✅ Compare estimates—wisely

Cheapest doesn’t always mean best. Choose contractors who provide detailed estimates, outline the full scope of work, and offer warranties on both materials and labor.

Roof Replacement FAQ

How long does a roof replacement take?

Most projects are completed in 1–3 days, depending on weather and roof complexity.

Do I need to be home during the work?

Not necessarily, but being available for questions or access can help the process run smoother.

Can I install a new roof over an old one?

In some cases, yes—but this isn’t always advisable. A tear-off allows for inspection and often leads to a better long-term result.

What warranties should I ask for?

Look for both manufacturer warranties on materials (often 25+ years) and workmanship warranties from your contractor (5–10 years is typical).

Final Thoughts: Plan Now, Avoid Stress Later

If your roof is showing signs of wear—or if it’s simply aged out—it’s better to act sooner rather than later. Proactive planning gives you time to budget, research materials, and hire the right contractor before an urgent repair becomes a costly emergency.

Throughout the Bay Area, from Concord to Oakland to Fairfield, homeowners turn to Bay Valley Roofing for expert guidance, efficient installations, and top-tier roofing solutions. A solid roof doesn’t just keep the rain out—it adds long-term value, safety, and peace of mind to your home.

0 notes

Text

Exploring Middlemen.asia – A Game-Changer for Legal Access in India

In a country where legal procedures often feel overwhelming, confusing, and inaccessible to the average citizen, Middlemen.asia emerges as a bold and timely solution. Launched under the WeDidIt Foundation, this non-profit digital platform is not just another legal tech initiative—it’s a movement aimed at transforming how everyday Indians engage with the justice system.

Middlemen.asia was created with a simple yet powerful mission: to make legal services more accessible, affordable, and transparent for all. For far too long, India’s legal system has been bogged down by complexity, cost, and inaccessibility—particularly for those who lack legal knowledge or financial resources. This platform seeks to dismantle those barriers and build a system where justice truly becomes a right for all, not a privilege for a few.

At the heart of Middlemen.asia is a vision for legal empowerment. It offers practical tools designed to help individuals navigate legal issues without having to wade through layers of red tape or spend months just to file a complaint. Among its most impactful features is its AI-powered lawyer matchmaking system, which intelligently connects users with verified legal professionals based on their unique issues. This is especially useful for people unfamiliar with the legal ecosystem, who often rely on word-of-mouth or fall prey to unqualified intermediaries.

Another standout feature is the platform’s rapid FIR filing support. For many, filing a police complaint is a stressful and confusing ordeal. Middlemen.asia simplifies the process, helping citizens draft and submit their First Information Report over the phone with the help of trained legal coordinators—ensuring faster action and reducing bureaucratic delays. This feature can be life-changing in emergencies where time and clarity are critical.

Transparency is one of the cornerstones of the platform. Through its legal fee estimator and case-tracking dashboard, users can better understand the cost and progress of their legal matters. These tools are designed to eliminate surprises and offer a clear picture of what to expect—something traditional legal setups often fail to provide. Additionally, the secure document repository allows users to store, manage, and share important legal paperwork in a safe and organized manner.

Middlemen.asia doesn’t just stop at services—it’s also a hub of education. Its legal literacy section is filled with simplified guides, FAQs, real-life case examples, and explainers that break down complex legal concepts into plain English. Whether it's understanding how to draft a rent agreement, deal with a property dispute, or respond to a builder's default, the platform equips users with the information they need to act with confidence.

Conflict resolution is another area where the platform shines. A dedicated hotline offers 24/7 assistance to help users resolve misunderstandings or disagreements with their lawyers or other parties before things escalate. This focus on early intervention saves time, money, and emotional energy—three resources that are often drained in prolonged legal disputes.

For those interested in social justice and public causes, Middlemen.asia also assists in the drafting and filing of Public Interest Litigations (PILs). It opens up pathways for concerned citizens to take action on systemic issues without needing elite legal backing. This offering empowers individuals to bring meaningful change to their communities through lawful and structured action.

The platform’s design reflects a deep understanding of the emotional and logistical burdens that come with legal challenges. Rather than viewing users as cases or files, Middlemen.asia treats them as people with real problems, emotions, and stakes. This human-centric approach ensures that support is not just fast and efficient, but also empathetic.

What makes Middlemen.asia truly revolutionary is its effort to democratize access to legal help. In a society where the legal system often feels out of reach for the poor, the uneducated, or the rural population, this platform levels the playing field. By removing unnecessary intermediaries and offering direct, streamlined services, it challenges the age-old narrative that only the wealthy or connected can find justice.

The impact of such a platform is not limited to individual users. As more people begin to understand and exercise their rights, systemic change becomes possible. Legal literacy grows. Exploitation decreases. And more citizens start demanding fairness, accountability, and due process from institutions that were once seen as distant or corrupt.

Middlemen.asia isn't just using technology to solve legal problems—it's fostering a cultural shift. It’s encouraging a new generation of Indians to be legally aware, self-reliant, and bold enough to assert their rights. It shows that you don’t have to be a lawyer to understand the law. You just need the right support, delivered in the right way.

In a country as vast and diverse as India, this kind of innovation is not just welcome—it’s essential. With its blend of smart technology, transparent processes, and empathetic service, Middlemen.asia represents the future of legal access. It bridges the gap between the system and the citizen, empowering people not just to fight legal battles, but to prevent them.

Whether you are a tenant struggling with an unfair landlord, a first-time property buyer worried about fraud, or someone looking to take collective action on a civic issue, Middlemen.asia offers tools that meet you where you are and guide you to where you need to go.

In a landscape full of legal confusion and helplessness, this platform is a breath of fresh air. It reminds us that justice doesn’t have to be a far-off ideal. With the right tools, the right information, and the right people, justice can be just a few clicks away.

0 notes

Text

Roof Repairs That Last: Protect Your Plymouth Home Today

A Small Roof Problem Today Can Become a Big Headache Tomorrow

When your roof starts to fail, your entire home is at risk. And in Plymouth, Massachusetts, with heavy snow, coastal winds, and sudden storms, even a tiny crack or missing shingle can quickly turn into leaks, rot, or interior damage.

Don’t wait for it to get worse. Quick, affordable roof repairs can save your home—and your wallet—from disaster.

Why Roof Repairs Are One of the Smartest Investments You Can Make

Every home needs a solid, weatherproof roof. But you don’t always need a full replacement. In fact, catching problems early is the best way to protect your property and avoid spending thousands later.

Whether your roof is leaking, sagging, or just looks worn out—a professional roofing specialist can restore it with lasting repairs.

Essential Roofing Repair Services in Plymouth, MA

Shingle Repairs & Replacements Fix curling, cracked, or missing shingles with durable materials that match your current roof. Protect against moisture and future damage.

Roof Leak Detection & Patch Work Not sure where the water is coming from? Experts use leak tracing techniques to find the problem fast—and fix it right the first time.

Flashing & Chimney Repairs Rusted or lifted flashing causes most hidden roof leaks. Re-sealing or replacing these areas can save thousands in water damage repairs.

Gutter & Drainage Fixes Poor drainage causes roof rot and ice dams. Clearing and regrading gutters keeps water flowing safely away from your home.

Emergency Storm Damage Repair When heavy winds or falling branches hit, you need a team that responds quickly to secure and repair your roof.

How to Know If You Need Roof Repairs

You don’t have to be a contractor to spot signs of roof trouble:

Ceiling stains or water spots

Lifted or missing shingles

Moss or mold on your roof

Granules collecting in gutters

Exposed nails or rotting fascia

Ignoring these signs can lead to structural damage, health hazards, and costly energy loss.

Why Homeowners in Plymouth Trust Local Roofing Experts

You need someone who knows what works in New England weather. Local repair pros in Plymouth understand the materials, codes, and climate-specific challenges your roof faces.

When you choose a local expert, you get:

Faster service

Better material choices

Personalized repair plans

Clear estimates—no surprises

Work that’s built to last

The Benefits of Timely Roof Repairs

Extend the life of your roof

Prevent mold, rot, and leaks

Protect insulation and reduce energy costs

Improve your home’s value and curb appeal

Gain peace of mind before the next storm hits

Ready to Repair Your Roof? Start with a Simple Inspection

You don’t have to wait for leaks to take action. A roof inspection is quick, easy, and could save you from major expenses down the road.

If you're in Plymouth, Massachusetts, and you're seeing signs of wear—now is the time to act.

A safe, dry home starts with a strong roof. Fix yours today—before the damage gets worse.

0 notes