#net present value calculator

Explore tagged Tumblr posts

Text

How to Calculate Net Present Value (NPV) – Step-by-Step Guide

Free Net Present Value (NPV) Calculator to quickly calculate the present value of future cash flows. Get step-by-step calculations, understand the NPV formula, and make smart investment decisions. Try it now!"

0 notes

Text

What Are the Limitations of Using a Net Present Value Calculator?

While Net Present Value (NPV) calculators are valuable tools for assessing investment opportunities, they come with limitations. Firstly, they rely heavily on assumptions, such as future cash flows and discount rates, which may not always reflect reality accurately. Additionally, NPV calculations may overlook qualitative factors like market volatility or regulatory changes that could impact investment returns. Furthermore, NPV calculators typically require users to input precise data, yet uncertainties in forecasts can lead to unreliable results. Users must also consider the risk of using outdated or incorrect information, which could skew NPV calculations. For a more comprehensive understanding of NPV calculator limitations, consider exploring resources like Investkraft's website. They provide insightful articles and guides on investment analysis, offering practical advice on navigating the complexities of financial decision-making.

#investkraft#finance#Net Present Value#NPV Calculator#calculators#financial calculators#financial services

0 notes

Text

(Don't) Incentivise Ethical Behaviour

In the ongoing project of rescuing useful thoughts off Xwitter, here's another hot take of mine, reheated:

"Being good for a reward isn’t being good---it’s just optimal play."

The quote comes from Luke Gearing and his excellent post "Against Incentive", to which I had been reacting.

My thread was mainly intended as a fulsome nodding along to one of Luke's points. It was posted in 2021, and extended in 2023 after Sidney Icarus posed a question to it. So it is two threads.

Here they are, properly paragraphed, hopefully more cleanly expressed:

+++

(Don't) Incentivise Ethical Behaviour

This is my main problem with mechanically rewarding pro-social play: a character's ethical choice is rendered mercenary.

As Luke Gearing puts it:

"Being good for a reward isn’t being good---it’s just optimal play."

Bear in mind that I'm not saying that pro-social play can't have rewarding outcomes for players. Any decision should have consequences in the fiction. It serves the ideal of portraying a living, world to have these consequences rendered diegetic:

The townsfolk are thankful; the goblins remember your mercy; pamphlets appear, quoting from your revolutionary speech.

What I am saying is that rewarding abstract mechanical benefits (XP tickets, metacurrency points, etc) for ethical decisions stinks.

+

A subtle but absolutely essential distinction, when it comes to portraying and exploring ethics / morality, in roleplaying games.

Say you reward bonus XP for sparing goblins.

Are your players making a decisions based on how much they value life / the personhood of goblins? Or are they making a decision based on how much they want XP?

Say you declare: "If you help the villagers, the party receives a +1 attitude modifier in this village."

Are your players assisting the community because it is the right thing to do, or are they playing optimally, for a +1 effect?

+

XP As Currency

XP is the ur-example of incentive in TTRPGs. It began with D&D's gold-for-XP, and has never strayed far from that logic.

XP is still currency. Do things the GM / game designer wants you to do? Get paid.

Players use XP to buy better mechanical tools (levels, skills, abilities)---which they can then in turn use to better perform the actions that will net them XP.

Like using gold you stole from goblins to buy a sword, so you can now rob orcs.

I genuinely feel that such systems are valuable. They are models that illuminate the drives fuelling amoral / unethical behaviour.

Material gain is the drive of land-grabbing and colonialism. Logger-barons and empires do get wealthier and more privileged, as a reward for their terrible actions.

+

If you want to present an ethical choice in play, congruent to our real-life dilemmas, there is value in asking:

"Hey, if you kill the goblins you can grab their treasure, and you will get richer. There's no reward for sparing their lives, except that they are thankful."

Which is another way of asking:

"Does your commitment to the ideal of preserving life outweigh the guaranteed material incentives for taking life?"

The ethical choice is the difficult choice, precisely because it involves---as it often does, in real life---sacrificing personal growth and gain. Doling out an XP bounty for doing the right thing makes the ethical choice moot.

"I as the player am making a mechanically optimal choice, but my character is making an ethical choice!"

A cop-out. Owning your cake and eating it too. The fictional fig-leaf of empathy over a calculated a decision to make profit.

+

Sidney Icarus asks a question which I will quote here:

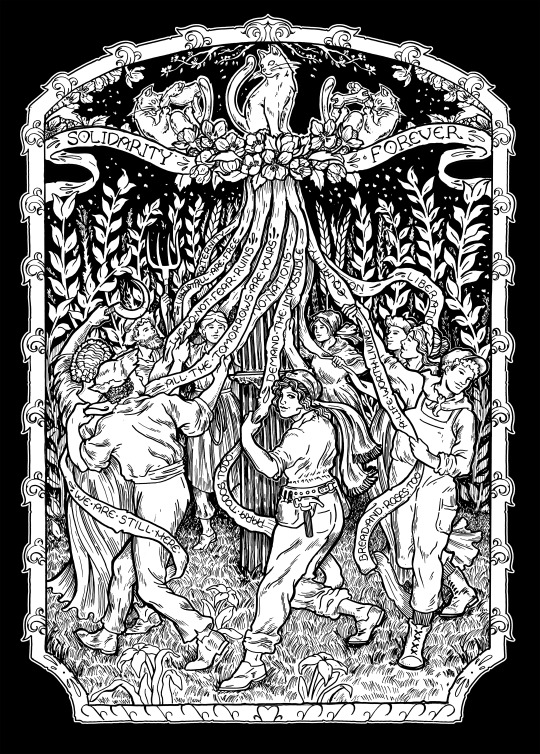

"... those who hold to their beliefs of good behaviour don't feel rewarded, and therefore feel punished. And that's not a good feeling. It's an unpleasant experience to play a game where the righteous players are in rags, and the mercenary fucks have crowns and sceptres. So, what's the design opportunity? How do we make doing the right thing feel pleasant without making it mercenary? Or, like reality, do we acknowledge that ethical acts are valuable only intrinsically and philosophically? I have no idea how to reconcile this."

I would suggest that the above dichotomy---"righteous players in rags, mercs in crowns"---is true if property is recognised as the only true incentive.

+

Friends As Property

Modern games try to solve the righteous-players-in-rags "problem" in various ways. Virtue might not net you treasure or XP, but may give you:

Contact or ally slots, which you can fill in;

Relationship meters you can watch tick up;

Favour points you can cash in later;

etc.

How different are these mechanical incentives from treasure or XP, really?

Your relationships with supposedly living, breathing beings are transformed into abilities for your character: skills you can train; powers you can reliably proc. Pump your relationship score with the orc tribe until calling on them for reinforcements becomes a once-per-month ability.

Relationships become contracts. Regard becomes debt. Put your friend in an ally slot, so they become a tool.

If this is what you want play to be---totally fine! As stated previously, games say powerful things when they portray the engines of profit and property.

But I personally don't think game designers should design employer-employee relationships and disguise these as instances of mutual aid.

+

Friends As Friends

In the OSR campaigns I'm part of, I keep forgetting to record money. Which is usually a big deal in such games, seeing as they are in the grand tradition of gold-for-XP?

In both games, my characters are still 1st-Level pukes, though it's been months.

I'm having a blast, anyway.

My GMs, by virtue of running organic, reactive worlds, have made play rewarding for me. NPCs / geographies remember the party's previous actions, and respond accordingly.

I've been given gills from a river god, after constant prayer;

I've befriended a village of monsters, where we now live;

I've parleyed with the witch of a whole forest, where we may now tread;

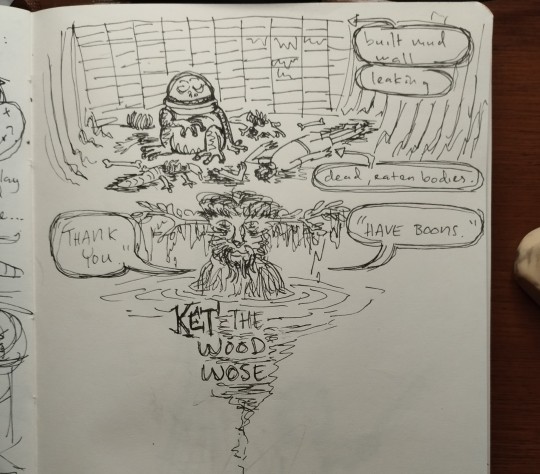

I've a boon from the touch of wood wose, after answering his summons.

I cannot count on the wood wose showing up. He is a character in the world, not a power I control. Calling on the wood wose might become a whole adventure.

Little of this stuff is codified my stats or abilities or equipment list. They are mostly all under "misc notes".

Diegetic growth. Narrative change that spirals into more play.

This is the design opportunity, to me:

How do we shape TTRPG play culture in such a way that the "misc notes" gaps in our games are as fun as the systemised bits? What kinds of orientation tools must we provide? What should we say, in our advice sections?

+

A Note About Trust

The reason why it is so hard to imagine play beyond conventional incentive structures has a lot to do with trust.

Sidney again:

One of the core issues is the "low trust table". I'm not designing just for myself but for my audience. For a product. How much can I ask purchasers and their friends to codesign this part with me?

Nerds love numbers and things we can write down in inventories or slots because they are sureties. We've learned to fear fiat or player discretion, traumatised as we are by Problem GMs or That Guys.

The reason why the poverty in Sidney's hypothetical ("righteous players are in rags") sounds so bad is because in truth it represents risk at the game table. If you don't participate in the mechanics legible to your ruleset (the XP and gear to do more game things), you risk gradually being excluded from play.

You have no assurance your fellow players will know how hold space for you; be considerate; work together to portray a living world where NPCs react in meaningful ways---in ways that will be fun and rewarding for everybody playing.

You are giving up the guarantee of mechanical relevance for the possibility of fun interactions and creative social play.

+

The "low trust table" is learned behaviour--the cruft of gamer culture and trauma.

When I game with folks new to TTRPGs, they tend to be decent, considerate. I think there's enough anecdotal evidence from folks playing with school kids / newcomers / etc to suggest my experience is not unique.

If the "low trust table" is indeed learned behaviour, it can be unlearned.

Which rules conventions, now part of the hobby mainstream, were the result of designers designing defensively---shadowboxing against terrible players and the spectre of "unfairness"?

How can we "undesign" such conventions?

Lack of trust is a problem that we have to address in play culture, not rulesets. You cannot cook a dish so good it forces diners to have good table manners.

+

This is too long already. I'll end with an observation:

Elfgames are not praxis, but doesn't this specific dilemma in the microcosm of our silly elfgames ultimately mirror real-world ethics?

To be moral is to trust in a better world; to be amoral / immoral is to hedge against the guarantee of a worse one.

+++

Further Reading

Some words from around the TTRPG community about incentive and advancement in games:

+

However, the reason there is a big debate about this is that behavioural incentives in games clearly do work, either entirely or at various levels. This applies outside gaming, as well. Why do advertising companies and retail business use "rewards" structures to convince people to buy more of their products? Why do people chase after "Likes" on social media?

A comment by Paul_T to "A Hypothesis on Behavioral Incentives" from a discussion on Story-Games.com

+

the structure and symbolism of the D&D game align with certain structures and values of patriarchy. The game is designed to last infinitely by shifting goalposts of character experience in terms of increasing amounts of gold pieces acquired; this resembles the modus operandi of phallic desire which seeks out object after object (most typically, women) in order to quench a lack which always reasserts itself.

D&D's Obsession With Phallic Desire from Traverse Fantasy

+

In short, my feeling is that rewarding players with character improvement in return for achieving goals in a specific way impedes some of the key strengths of TTRPGs for little or no benefit in return.

Incentives from Bastionland

+

When good deeds arise naturally out of the players choices, especially when players rejected other options that were more beneficial to them, it is immensely satisfying. Far more than if players are just assumed to be heroic by default. It gives agency and meaning to player choice.

Make Players Choose To Be Kind from Cosmic Orrery

+

Much has been made about 1 GP = 1 XP as the core gameplay loop driver of TSR D+D. But XP for gold retrieved also winds up being something of a de facto capitalistic outlook as well. Success is driven by accumulation of individual wealth -- by an adventuring company, even! So what's a new framework that can be used for underpinning a leftist OSR campaign?

A Spectre (7+3 HD) Is Haunting the Flaeness: Towards a Leftist OSR from Legacy of the Bieth

+

Growth should be tied to a specific experience occurring in the fiction. It is more important for a PC to grow more interesting than more skilled or capable. PCs experience growth not necessarily because they’ve gotten more skill and experience, but because they are changed in a significant way.

Cairn FAQ from Cairn RPG / Yochai Gal

+++

Thank you Ram for the Story-Games.com deep cut!

( Image sources: https://knowyourmeme.com/memes/neuron-activation https://en.wikipedia.org/wiki/Majesty:_The_Fantasy_Kingdom_Sim https://www.economist.com/sites/default/files/special-reports-pdfs/10490978.pdf https://varnam.my/34311/untold-tales-of-indian-labourers-from-rubber-plantations-during-pre-independence-malaya/ https://nobonzo.com/ )

+

PS: used with permission from Sandro, art by Maxa', a reminder to self:

253 notes

·

View notes

Text

Finch finally got a redesign that suits her more... With that, if you want to know more about my riptide oc, info below! :D

WARNING: there's A LOT of yapping

Finch, originally named Farren Van Aalsburg, stands as a 24-year-old pirate whose legacy is intertwined with the notorious ship, The Arbiter.

Known for her ruthless and calculated leadership, Finch's mere approach to piracy would send ripples of apprehension through the ranks of sailors and even unsettle the most seasoned navy officers. The very mention of her crew's arrival was often met with foreboding whispers. In taverns, pirates would share knowing smirks over their mugs of beer, while officers would exchange wary glances. They'd caution one another,

"Retribution's coming."

Farren's lineage traces back to a well-known navy captain, Heimer Van Aalsburg, praised for his adeptness in handling internal conflicts and hailed as one of the foremost strategists in naval warfare. Alongside his family, composed of Farren, her stepsister Hestia, and stepmother Alisei, they resided aboard a wonderful mahogany vessel, embarking on voyages from one port to another.

For Heimer, Farren was the centre of his universe, he couldn't have wished for a better daughter. Their connection strengthened, particularly in the wake of Farren's mother, Julith Ferin's passing when Farren was just four years old.

The bond between Farren and her younger sister was equally profound, they had an unbreakable bond from the very moment they met. However, amidst this familial setting, Alisei nursed a vicious, festering resentment, convinced that Farren overshadowed Hestia in Heimer's eyes. This animosity later culminated in a tragic incident that took place one, stormy night.

In an unfortunate turn of events, Farren finds herself overboard, her desperate attempt to grasp the ship resulting in a severe injury to her right arm. Eventually, the raging waters below are quick to swallow her.

As her consciousness returns, she kneels before a colossal leviathan. The creature presents a solemn pact: it will guide her to the nearest vessel and mend her injured arm, with the condition that she accepts the burden of becoming the guardian of the seas until her last dying breath. An oath that binds her to a life on the move, forbidding her to settle on solid ground or abandon her duty. With hesitation, she agrees.

One fateful day, Skip, a hardy half-orc fisherman, discovers a young girl ensnared in his ship's nets. Swift to lend a helping hand, he extends not only a refuge but a genuine home for the girl, determined to help navigate her through the uncertain future.

Now residing on a small isle, a mere few days were enough for her to befriend a whole flock of zebra finches, who trailed behind her like loyal companions. Considering the girl didn't remember anything, let alone her name, Skip decided that the name 'Finch' would be more than a suitable choice.

Finch grapples with a zero to no recollection of herself and her family. Her only tangible link is a gilded medallion etched with the initials 'J.H.F’ accompanied by a few fleeting memories of her father.

Finch becomes a stalwart protector, earning recognition as the island's guardian. Fueled by an unyielding commitment, she gathers a crew at the age of 16. Two years later, they embark on their first voyage.

Her five years at sea culminates in a fierce clash with the navy, leaving Finch and her childhood friend, Shelby, as the lone survivors. In the wake of the tragedy, Finch confronts a maelstrom of emotions, grappling with guilt, simmering anger, and the rekindling of a long-suppressed fear of the unforgiving ocean.

"What value does a fierce pirate captain, one who commands the treacherous seas yet harbours such fear, truly possess?" - Niklaus, on their last meeting.

Finch and Niklaus have a history of encounters, each one more significant than the last.

Their first meeting took place when Finch was just 16, in the midst of assembling her crew. Niklaus dangled the promise of information regarding her family, but only if she'd abandon her oath. She refused, even poking fun at him the whole time—a stance she maintained on numerous occasions.

The second encounter, at the age of 23, followed a previously mentioned, deadly battle. Niklaus presented her an offer to turn back time, still on the condition of letting go of her oath. Once again, she refused, stating he's a fool if he thinks she'll ever give it up. After a few humiliating attempts at bribing her, he gives up.

A mere few weeks later, their paths crossed once more. This time, Niklaus proposed a lasting solution to banish her deep-seated fear of the ocean in return for a future favour. He pledged to provide a specific time, place, and a duel to be won, one she'd be obliged to fulfil, that is not linked to her oath. After careful consideration, and a few conditions, Finch shook on the arrangement (and still made fun of him the entire time).

#digital art#character concept art#dnd oc#oc#original character#oc art#jrwi riptide oc#the yappening is real#skye's ocs#riptide oc

180 notes

·

View notes

Text

Last week, at a White House meeting with the C.E.O.s of Uber, Goldman Sachs, and Salesforce, Donald Trump touted “a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation.” He was referring to a provision in the tax-and-spending bill that House Republicans pushed through in May, which would establish tax-deferred investment accounts for every child born in the United States during the next four years, with the federal government contributing a thousand dollars to each. House Speaker Mike Johnson, who was also present at the White House meeting, described the proposal as “bold, transformative.”

It could more accurately be described as an effort to put lipstick on a pig. As everybody surely knows by now, the House bill—formally called the One Big Beautiful Bill Act—is stuffed with tax cuts for corporations and for the rich, and it proposes to slash funding for Medicaid, food assistance, and other programs that target low-income Americans. The proposal for new investment accounts didn’t change the bill’s highly regressive nature. According to a report by the Congressional Budget Office, over all, the bill’s provisions, including the new accounts, would reduce the financial resources of households in the bottom tenth of the income distribution by about sixteen-hundred dollars a year relative to a baseline scenario, and raise the resources of households in the top tenth by an average of about twelve thousand dollars a year. In other words, it’s a reverse-Robin Hood bill.

The new savings vehicles that Republicans are proposing also demand inspection. Johnson and other Republicans are trying to promote them as pro-family and pro-worker, and some media accounts have described them as “baby bonds.” But the proposal bears little resemblance to one of that same name which some progressive economists and elected Democrats have been promoting for years, as a way to tackle gaping wealth disparities in America. Given the way the Republican scheme is structured, it could well end up entrenching existing disparities rather than helping to eliminate them.

Endowing children with some wealth to help give them a proper start in life isn’t a new idea, of course. Rich families have been setting up trust funds, in some form or another, for centuries. But what about children in families that have little or no wealth to hand down? (According to the Federal Reserve, in 2022, the average net worth of households in the bottom ten per cent of the wealth distribution was one dollar. One.)

In 2010, the economists Darrick Hamilton, who is now at the New School, and William Darity, Jr., of Duke, outlined a plan to create interest-bearing government trust accounts for children who were born into families that fell below the median net worth. Under the Hamilton-Darity plan, the average value of these government contributions, which they described as “baby bonds,” would gradually rise to roughly twenty thousand dollars, with children from the poorest families benefitting even more. Adding in the interest that would accumulate in these accounts over the years, Hamilton and Darity calculated that some of these kids could end up with more than fifty thousand dollars by the time they reached adulthood.

Although the baby bonds would be distributed on a race-blind basis, the fact that Black, Indigenous, and Latino families were (and are) disproportionately represented in the lower reaches of the wealth distribution would have meant that the scheme would have worked to the benefit of their children—with a concomitant impact on the racial wealth gap. (In 2022, according to survey figures from the Federal Reserve, the median wealth of Black households was $44,890, compared with $285,000 for white households.) Indeed, Hamilton and Darity claimed that their proposal “could go a long way towards” eliminating the intergenerational transmission of racial advantage and disadvantage.

This proposal was never put into effect. But a version of it lived on in the form of legislation proposed by Cory Booker, the Democratic senator, in 2018, and subsequently reintroduced, in 2023, by Booker and Representative Ayanna Pressley. Under the Booker-Pressley bill, all American children at birth would be given a publicly financed investment account worth a thousand dollars, and the government would make further payments into these accounts annually depending on family income. When the owners of the accounts turned eighteen, they would be allowed to use the money for certain specified expenditures, including buying a home or helping to pay for college. “Baby Bonds are one of the most effective tools we have for closing the racial wealth gap,” Pressley commented when proposing the legislation.

On the Republican side of the aisle, some politicians and policy analysts have long supported tax-advantaged private savings accounts as a way of encouraging thrift and staving off socialistic tendencies. But it was only recently that the Party came around to the idea of seeding these accounts with public money. The Texas senator Ted Cruz promoted it under the label of “Invest America.” In the House bill, it was rebranded as a “MAGA Account,” with the acronym standing for “Money Account for Growth and Advancement.” Republicans renamed it a “Trump Account” at the last minute. “You can call it anything you like,” Cruz told Semafor. “What is powerful is enabling every child in America to have an investment account and a stake in the American free-enterprise system.”

In political terms, Cruz may be right: during COVID, direct federal payments proved popular with voters (and Trump insisted on putting his name on the checks, too). But in socioeconomic terms, the Republican proposal would be much less potent. “It’s upside down,” Darrick Hamilton told me last week. “It amounts to a further subsidy to the affluent, who can already afford to save in the first place.”

The details of the proposal confirm Hamilton’s point. Money in the new Trump accounts would have to be placed in a low-cost stock index fund, and investment gains would be allowed to accumulate tax free until the funds were used. Parents and others would be allowed to supplement the original government endowments of a thousand dollars with contributions of up to five thousand dollars a year. But poor families obviously wouldn’t have the means to provide top-ups. “That means poorer families with no savings will get $1,000 compounding over 18 years while rich families will be able to invest up to $90,000,” Stephen Nuñez, an analyst at the Roosevelt Institute, wrote in a piece about the G.O.P. plan. “That will widen the wealth gap.”

There are other issues, too. It’s far from that clear that banks or brokerages will be willing to administer the new accounts without charging hefty fees that would deplete them. Some financial experts say that most households would earn better returns by contributing to existing 529 college-savings plans. (The limits for contributions to 529 plans are higher, and in many states they aren’t subject to state taxes.) Conceivably, some of these concerns could be resolved by pooling the money in the accounts, by fiddling with the tax code, and by encouraging employers of the account holders’ parents to make additional contributions to them. (At the White House meeting last week, Michael Dell, the C.E.O. of Dell, said the company would be willing to match the government contributions.) But these are only suggestions, and it’s hard to avoid the conclusion that the entire project is largely an effort to divert attention from the true nature of the Republican economic agenda.

“You certainly would want to question the timing of the proposal,’ Hamilton said to me. However, he added, that, “with regard to the Trump Accounts, the idea of a stakeholder society is not bad. That part is valuable, if you ask me.” He said that when he was growing up, in the Bedford-Stuyvesant neighborhood of New York, and attending an élite private school, the role that inherited wealth played in determining people’s life prospects was “vivid” to him. Where Trump and the Republicans have gone wrong in promoting the stakeholder concept, he went on, is “one, by relying on saving, and, two, in the regressive structure of the program.”

To be sure, Hamilton’s “baby bonds” initiative would involve considerable costs, and that is one reason why it has never got off the ground politically. In our conversation, Hamilton cited a figure of a hundred billion dollars a year. That sounds like a large number, he conceded, but he also pointed out that it would amount to less than two per cent of over-all federal spending, and he said that it would be considerably smaller than the sums currently devoted to subsidizing private wealth accumulation by people who already have some wealth, through things like the mortgage-interest deduction and the low tax rate on capital gains.

Hamilton didn’t mention it, but according to the Congressional Budget Office an extension of the soon-to-expire 2017 G.O.P. tax cuts, which is the primary purpose of the One Big Beautiful Bill Act, would cost nearly five hundred billion dollars next year—five times the estimated cost of his baby-bonds proposal. Given the Republicans’ dominance in Washington and the gaping budget deficit, there’s obviously no immediate prospect of the U.S. government reorienting its priorities to tackle rampant wealth inequality, in the way that Hamilton and his colleagues recommend or in some similar manner. But that doesn’t mean it wouldn’t be possible. If the commitment to levelling out wealth were broadly shared, the possibilities would be many.

19 notes

·

View notes

Text

6. [Conceptualization - Godly 16] Present an investment plan that is sure to fail.

-2 Art degree useless.

CONCEPTUALIZATION [Godly: Failure] - Congratulations, you've somehow managed to fail at failing, which means, in a strange way, that you've succeeded?

"You should invest in a youth centre."

MEGA RICH LIGHT BENDING GUY - "A youth centre, huh? What *kind* of youth centre?"

PHYSICAL INSTRUMENT [Medium: Success] - A place to train *buff kids*.

EMPATHY [Easy: Success] - A place to teach them practical skills like teamwork and self-discipline.

CONCEPTUALIZATION - Come on. Tell him what he wants to hear.

"One dedicated to instilling liberal economic values in children from low-net-worth families."

"One to inspire the future leaders of tomorrow to public service."

"You know, a regular youth centre, with basketball courts and stuff. To *really* develop their physical proficiency."

"You know, a regular youth centre, with basketball courts and stuff. To teach teamwork and other emotional skills."

MEGA RICH LIGHT BENDING GUY - "No, no, no. You've got to think *bigger* than that."

2. "One to inspire the future leaders of tomorrow to public service."

+1 Moralism

MEGA RICH LIGHT BENDING GUY - "Hmmm," the man thinks for a moment.

"I like that you're thinking about the future, but couldn't the centre have a more... economic focus?"

"One dedicated to instilling liberal economic values in children from low-net-worth families."

+1 Ultraliberalism

MEGA RICH LIGHT BENDING GUY - "Brilliant! Without children who'll be there to buy stuff in the future?"

"Yes. And if it doesn't work out, we can always re-purpose the centre as a shopping mall or private equity firm."

MEGA RICH LIGHT BENDING GUY - "When life closes a door, it opens a window, yes? What's the expected return on this?"

"Highly educated, work-ready, human capital ready to be directed toward any number of your vast interests."

"With human beings there's always a risk associated. Which is why we've got to hold onto the centre itself as a fallback."

CONCEPTUALIZATION - You're deep into ultraliberal territory now. Good work.

MEGA RICH LIGHT BENDING GUY - "Very impressive. You've got a natural eye for unusual investment opportunities."

"Thank you."

"I know."

MEGA RICH LIGHT BENDING GUY - "I don't normally do this without a formal pitch deck, but to hell with it, what's the point of being rich if you have to follow all the rules?"

"Here's a round of seed funding. This should be enough to prove out the concept and get things off the ground."

+100 real

We have already bought basically everything in the game, so on a technical level this is useless to us.

ELECTROCHEMISTRY [Medium: Success] - CHA-CHING. What'll it be? Speed? Vodka? Cigarettes?

HORRIFIC NECKTIE - *Bratan*, now's your chance to take some time off. Spend it with your good buddy, and get absolutely *wrecked* in the process.

"Hmm. Drugs do go well with money, I agree."

"I'm sorry, man, I'm an investor now -- I have to stay sober to calculate risks."

HORRIFIC NECKTIE - What is this shit?!? CALCULATING RISKS? *BRATAN*. THE RISKS YOU CANT CALCULATE ARE THE ONLY ONES WORTH TAKING!

"I'm sorry. I just don't see the ROI in that."

"I'll give it some thought."

KIM KITSURAGI - The lieutenant looks at you with horror. You've been mumbling to your necktie in a daze for several minutes.

MEGA RICH LIGHT BENDING GUY - "Ah, yes. Now you're displaying it... the *eccentricity* that becomes a wealthy individual." If the money-saint's visage weren't wrapped in physics-defying light, you would see his approval.

"Thank you for placing your unwavering *trust* in me."

"Thanks for the handout."

MEGA RICH LIGHT BENDING GUY - "Remember: it's not a *handout*, it's an investment. And I expect to see returns."

KIM KITSURAGI - The lieutenant stands there, dumbfounded. His mouth opens slightly, then closes again.

PERCEPTION (SIGHT) [Medium: Success] - Is he having a stroke?

"What do you think, Kim? Not bad, huh?"

"Kim, are you alright?"

"Kim, are you having a stroke?"

KIM KITSURAGI - "No, I am *not* having a stroke. You're just... still full of surprises. Most of them bad, but some good..."

+1 Reputation

COMPOSURE [Medium: Success] - The lieutenant has granted you an aura of legitimacy. Bathe in it, but don't let your satisfaction show. Play it cool.

MEGA RICH LIGHT BENDING GUY - "Now, was there anything else I could help you gentlemen with?"

There is not.

5. "We should get back to our investigation. Thanks for your time." [Leave.]

MEGA RICH LIGHT BENDING GUY - "The pleasure was mine. Unfortunately, I must be away soon. The next time we meet, I'll be expecting an update on my investment!"

"Farewell, friend, and may your peace of mind guide you to happiness."

A thought is triggered.

SAVOIR FAIRE - Wow, you work *hard*.

I do?

(Discard thought).

SAVOIR FAIRE - Oh, yes. You hustle. You're a provider. It's tough out there, but you keep it real and provide...

I guess I do, yeah.

What hard work do I do exactly?

SAVOIR FAIRE - Oh yeah! Like a horse. A work horse. For hard work.

What hard work do I do exactly?

SAVOIR FAIRE - Look at yourself, you're a human pedometer! You must have walked 200,000 steps down cracked asphalt, mosaic, sand, and linoleum after you re-emerged.

That is the sign of a hustler who never gives up. The world is harsh and people are evil -- you didn't make it that way. And you won't let it break you. You *ride*.

Yeah, I ride. A little.

I fuckin' ride till I die, bitch.

I'm not sure I *ride*...

SAVOIR FAIRE - Oh, you do. You *make* money. You got gills, baby, meaning those black papers with the faces of the innocences on them. You bring in the Franconegros and the Solas.

It ain't easy, but you *do* it. Day in and day out. You didn't make the rules but you won't lose! You're a cop and a sprinter and a money printer.

I mean yeah, I *did* take that bribe from that Joyce woman.

Can't say I didn't make that Siileng guy give some of his money either.

You could say I took some money from that Mañana guy too.

Oh, and then there's pawning stuff off to that suspicious Roy guy.

I guess I've made *some* gills, sure.

SAVOIR FAIRE - Oh yeah, you took that bribe *hard*. You're a killa'.

2. Can't say I didn't make that Siileng guy give some of his money either.

SAVOIR FAIRE - Can't say that -- you *shook* him. You're a killer. A shark.

3. You could say I took some money from that Mañana guy too.

SAVOIR FAIRE - You didn't log that in as a donation either -- you don't log any of that shit in, you're a straight rider.

4. Oh, and then there's pawning stuff off to that suspicious Roy guy.

SAVOIR FAIRE - Yeah, you're in the sales business. Shake 'em for shit and then pawn it off, *law officer*-style.

5. I guess I've made *some* gills, sure.

SAVOIR FAIRE - Sure, sure. And has it been easy? Is life easy? Have you *not* gone into cardiac arrest? Are you *not* about to have an anxiety attack or shoot yourself in the mouth? But you still hustle 24/7, ride or die. Now, ask yourself...

...are you *rich*?

Yes. Quite.

No, I'm actually *not*.

SAVOIR FAIRE - That's right. You work harder than *anyone*, you almost rode yourself to the grave and you're still practically a *hobo* -- why is that?

It's because of that Garte guy riding my ass!

The system is broken!

There's a market for corrupt cops out there, but the immigrant cops have price dumped it.

Fucking taxes, man.

I don't know. Why *am* I so poor?

SAVOIR FAIRE - The Garte-man has set himself up one of those self replicating money-structures. You should *learn* from it. Don't play the victim. Think, hustler. Think with your head.

2. The system is broken!

+1 Communism

SAVOIR FAIRE - Boohoo, *the system is broken*. *The establishment is keeping me down...* That's not the fuck-yeah attitude you're used to, what is this? Why are you so poor?

Skipping the fascist option...

4. Fucking taxes, man.

+1 Ultraliberalism

SAVOIR FAIRE - That's right! One-hundred percent. Fucking G-man's got his jam-covered sticky-fingers in your pocket, stealing from you every time you buy, sell, walk, talk, fart, so much as sneeze!

RHETORIC [Medium: Success] - Aren't taxes almost non-existent in the Gossamer State that is Revachol?

I thought there *were* no taxes.

Really? Every time I sneeze?

SAVOIR FAIRE - You and I both, but they got those *indirect modes of taxation*. Sales tax, excise duty, extraction tax, this tax that doesn't even have a name -- plus there's the stuff *people in other countries* pay for, that makes them ask for more money from *you* here! The Gossamer State's a myth. In total the Coalition Government is taking...

NINETY-EIGHT PERCENT OF ALL YOUR MONEY.

NO FUCKING WAY. I guess I'm a free market fundamentalist now. (Opt in.)

Are you sure? That seems like a pretty big number…

This isn't helping me solve my money problem, it's only making me into a free-market type. (Opt out.)

SAVOIR FAIRE - What are you not sure about?! They're *milking* your nipples till they bleed. Can't you see? Aren't you *sick and tired* of having bloody nipples?

12 notes

·

View notes

Text

🦩🌳💸Using Decision Trees in Financial Analysis🔍

Decision Trees are a powerful financial analysis tool that clarifies the expected value of capital investment opportunities. It is used in business operations where companies continuously struggle with big decisions on product development, operations management, human resources, and others. Decision Tree analysis method lets us explore the ranging elements influencing a decision.

🦩📉💸Stakeholders and Risk

Let’s say that there is a parent company investing the funds expects some investments across their portfolio of subsidiaries to fail and have hedged against that by diversifying their risk exposures. The sales manager of the company has a lot to gain in regards to increased product quality to offer to potential clients and nothing to lose if the project is not successful. However, for the plant manager that will be in charge of building the new modernized factory, failure may mean losing his job. Such a situation where there is a significant number of different stakeholder points of view introduces an undesirable element of politics in the decision-making process. To mitigate the risk of such politics leading to wrong decisions, we need to ask who bears the risk and what is the risk and look at each decision from the perspective of each stakeholder, when performing our analysis.

🦩📊💸Evaluate Investment Opportunities with Decision Trees

Decision Trees is a great laying out information tool that enables systematic analysis and leads to a more robust and rigorous decision-making process. The technique is excellent for illustrating the structure of investment decisions, and it can be crucial in the evaluation of investment opportunities. Decision Trees in financial analysis are a Net Present Value (NPV) calculation that incorporates different future scenarios based on how likely they are to occur. The cash flows for a given decision are the sum of cash flows for all alternative options, weighted based on their assigned probability.

🦩🌳💸To prepare a Decision Tree analysis, we take the following approach:

Identify the points of decision and the alternative options available at each of them.

Identify aspects of uncertainty and type or range of alternative outcomes.

Estimate the values for the analysis: *Probabilities of events and results from actions *Costs of and possible gains from various events and activities.

Analyze alternative amounts and choose a course (calculate the present value for each state).

🦩🌳💸Decision Tree Analysis is an essential tool in the decision-making process and investment analysis as it determines the value of investment opportunities and clarifies the connection between current and future decisions and uncertain circumstances which enables management to consider the available courses of action with more ease and clarity.

#economy#business#finance#investing#stakeholders#investment#analysis#risk#management#artists on tumblr#digital art#my art#artwork#illustration#drawings#design#creative#creative writing#onlyfans creator

2 notes

·

View notes

Text

New York Attorney General Letitia James asked a judge Wednesday for a partial summary judgment against Donald Trump in her $250 million lawsuit accusing the former president of widespread fraud, citing what she called a "mountain of undisputed evidence" of false and misleading financial statements.

James, in her motion, says Engoron has to answer just "two simple and straightforward questions" to make that finding.

One question is whether Trump's annual statements of his financial condition were "false or misleading," the attorney general wrote. The other question, she wrote, is whether Trump and his co-defendants repeatedly used the financial statements to conduct business transactions. "The answer to both questions is a resounding 'yes' based on the mountain of undisputed evidence cited" in the documentation submitted by James' office, the motion said. "Based on the undisputed evidence, no trial is required for the Court to determine that Defendants presented grossly and materially inflated asset values in the SFCs [financial statements] and then used those SFCs repeatedly in business transactions to defraud banks and insurers," James wrote.

In a court filing, James said evidence shows that if Trump's net worth were correctly calculated, it would be between 17% and 39% lower than what he claimed each year over the course of a decade, "which translates to the enormous sum of $1 billion or more in all but one year."

The allegedly false statements included years when Trump was in the White House, according to the filing.

James' filing comes two months before the trial is set to begin in the civil suit against the former president; the Trump Organization; and his sons, Donald Trump Jr. and Eric Trump, at New York Supreme Court in Manhattan.

James is suing the Trumps for allegedly defrauding banks, insurance companies and others with the use of false financial statements.

That trial would still take place to address other claims, even if Judge Arthur Engoron grants James' request for partial summary judgment and finds Trump and the other defendants committed fraud under New York business law.

James, in her motion, says Engoron has to answer just "two simple and straightforward questions" to make that finding.

One question is whether Trump's annual statements of his financial condition were "false or misleading," the attorney general wrote.

The other question, she wrote, is whether Trump and his co-defendants repeatedly used the financial statements to conduct business transactions.

"The answer to both questions is a resounding 'yes' based on the mountain of undisputed evidence cited" in the documentation submitted by James' office, the motion said.

"Based on the undisputed evidence, no trial is required for the Court to determine that Defendants presented grossly and materially inflated asset values in the SFCs [financial statements] and then used those SFCs repeatedly in business transactions to defraud banks and insurers," James wrote.

"Notwithstanding Defendants' horde of 13 experts, at the end of the day this is a documents case, and the documents leave no shred of doubt that Mr. Trump's SFCs do not even remotely reflect the 'estimated current value' of his assets as they would trade between well-informed market participants," the motion said.

#Trump fraud case: New York attorney general says 'mountain' of evidence justifies summary judgment#trump#Letitia James DA#New York#trump fucked up bad

13 notes

·

View notes

Text

Finance 101 for marketers

In the world of business, it is common for specialized departments to operate in their silos. One notable example is the marketing team, which often focuses on brand building, creative and customer engagement, sometimes at the expense of a deeper understanding of the broader business and commercial workings of the company. This gap can lead to misaligned strategies and lost opportunities.

These are some of the common terms that I have come across over the past decade that every marketer should have a basic understanding.

GMV (Gross Merchandise Volume): This is the total sales value of merchandise sold through a particular marketplace over a specific time period. It measures the size of a marketplace or business, but not the company's actual revenue since it doesn't account for discounts, returns, etc.

Revenue: This is the total amount of income generated by the sale of goods or services related to the company's primary operations.

COGS (Cost of Goods Sold): This refers to the direct costs attributable to the production of the goods sold. This amount includes the cost of the materials and labor directly used to create the product.

Gross Margin: A financial metric indicating the financial health of a company. It's calculated as the revenue minus the cost of goods sold (COGS), divided by the revenue. This percentage shows how much the company retains on each dollar of sales to cover its other costs.

Operating Income: This is the profit realized from a business's core operations. It is calculated by subtracting operating expenses (like wages, depreciation, and cost of goods sold) from the company’s gross income.

Ordinary Income: This typically refers to income earned from regular business operations, excluding extraordinary income which might come from non-recurring events like asset sales or investments.

Net Profit: Also known as net income or net earnings, it's the amount of income that remains after all operating expenses, taxes, interest, and preferred stock dividends have been deducted from a company's total revenue.

PPWF (Price Pocket Waterfall): This term is used to describe the breakdown of the list price of a product or service down to the net price, showing all the factors that contribute to the price erosion. The "waterfall" metaphorically illustrates how the price "falls" or reduces step by step due to various deductions like discounts, rebates, allowances, and other incentives given to customers. This analysis is important for businesses to understand their actual pricing dynamics and profitability. It helps in identifying opportunities for price optimization and controlling unnecessary discounts or allowances that erode the final price received by the company.

Net Present Value (NPV): A method used in capital budgeting and investment planning to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Internal Rate of Return (IRR): A metric used in financial analysis to estimate the profitability of potential investments. It's the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

CONQ (Cost of Non-Quality): This is the cost incurred due to providing poor quality products or services. It includes rework, returns, complaints, and lost sales due to a damaged reputation.

A&P (Advertising and Promotion): These are expenses related to the marketing and promotion of a company's products or services. It's a subset of the broader marketing expenses a company incurs.

Return on Investment (ROI): In simple terms, ROI measures the profitability of an investment. For marketing teams, this means understanding how campaigns contribute to the company's bottom line, beyond just tracking engagement metrics.

Return on Ad Spend (ROAS): ROAS specifically measures the efficiency of an advertising campaign. It assesses how much revenue is generated for every dollar spent on advertising. It's similar to ROI but focused solely on ad spend and the revenue directly generated from those ads. ROAS is exclusively used in the context of advertising and marketing. It helps businesses determine which advertising campaigns are most effective.

Customer Lifetime Value (CLV): This predicts the net profit attributed to the entire future relationship with a customer. Effective marketing strategies should aim at not only acquiring new customers but also retaining existing ones, thus maximizing CLV.

G&A (General and Administrative Expenses): These are the overhead costs associated with the day-to-day operations of a business. They include rent, utilities, insurance, management salaries, and other non-production-related costs.

2 notes

·

View notes

Text

40+ CITCO Repeated Interview Questions & Answers

CITCO Technical Questions

Q1. About CITCO company?

A: Citco is a large privately owned global hedge fund administrator. It is the world’s largest hedge funds administrator Citco was founded in 1948. Fund managing over 1$ trillion in assets under administration. The CEO of CITCO is Christopher Smeets. (Verify once)

Q2. NAV and What are the types of NAV?

A: The value of the net asset (NAV) is defined as the value of the assets of the fund minus the value of its liability. In regard to mutual funds, the term ‘net asset value’ is widely used. It is a measure to calculate the value of the assets in funds. NAV is commonly used as a per-share value calculated for a mutual fund.

Types of NAV:

Daily net asset valuation

Basic calculation of Net Asset Value Total Assets – Total Liabilities The formula for the NAV = -------------------------------- Total no of outstanding units

Q3. Difference between Mutual funds and Hedge funds

A: Mutual funds are regulated investment products offered to the public and available for daily trading. Where Hedge funds are private investments that are only available to accredited investors. Hedge funds are known for using higher-risk investing strategies with the goal of achieving higher returns for their investors.

Q4. Present Sensex value

A: Do Google for the current Sensex value

Q5. About Hedge funds in detail

A: Hedge funds are another name for investment partnerships. The meaning of the word ‘Hedge’ is protecting oneself from financial losses; thus, Hedge funds are designed to do so. Although a risk factor is always involved, it depends on the return. The more the risk, the higher the return.

Hedge funds are alternative investments done by pooling funds involving several strategies to earn high returns for the investors. Hedge funds can be used for a range of securities compared to mutual funds. Hedge funds work for long & Short positions strategies which means investing in long positions i.e., buying stocks as well as short positions which means selling stocks with the help of borrowed money and then buying again when the price is low.

Q6. Corporate actions

A: A company initiates several actions, apart from those related to its business, that have a direct implication for its shareholders. These include sharing of surplus or profits with the shareholders in the form of dividends, changes in the capital structure through the further issue of shares, buyback, mergers and acquisitions, delisting, raising debt, and others. In a company that has made a public issue of shares, the interest of the minority investors has to be protected.

Mainly there are 2 types of corporate actions.

(i) Mandatory corporate actions include

a. Dividends

b. Bonds

c. Stock Split

d. Reverse Split

e. Mergers & De-Mergers

(ii) Non-Mandatory corporate actions include

a. Right issue

b. Buyback offers

Q7. KYC (Know Your Customer) and AML (Anti Money Laundering)

A: The Know Your Customer or Know Your Client guidelines in financial services require customer identification and screening, and ensuring you understand their risk to your business. To ensure that bank services are not misused.

AML – Anti Money Laundering. AML refers to all efforts involved in preventing money laundering. Such as stopping criminals from becoming customers and monitoring transactions for suspicious activity.

Q8. Full name of CITCO

A: Citco, also known as the Citco Group of Companies and the Curacao International Trust Company (CITCO).

Q9: Working Capital

A: Working Capital also known as Net Working Capital (NWC) is the difference between a company’s current assets – Such as cash, Accounts receivable, customers unpaid bills, and inventories of raw materials and finished goods and current liabilities such as accounts payable and debts. Net Working Capital = Current Assets – Current Liabilities.

Q10. Types of Trade in Mutual Funds

A: When you buy or redeem a mutual fund, you are directly purchasing and selling with the funds. Whereas with ETFs and stocks, you are trading on the secondary market. When you initiate a trade to buy or sell mutual funds shares it will be executed at the next available net asset value. Most mutual funds fall into 4 main categories

Money market funds

Bond funds

Stock funds

Target date funds

People Also Read: The Definitive Guide To Mastering The Top 20 Most Important Questions In Freshers Job Interviews

Q11. About IR Data processor with Example

A: The investors (IR) department is a division of a business, usually a public company, whose job it is to provide investors with an accurate account of company affairs. This helps private and institutional investors make informed decisions on whether to invest in the company. (IR) Department and work to communicate with investors, shareholders, government organizations, and the overall financial community.

Q12. About Bond Market

A: The bond market refers broadly to the buying and selling of various debt instruments issued by a variety of entities. Corporations and government issue bonds to raise debt capital to fund operations. In return, they promise to pay the original investment amount plus interest.

Q13. Types of Bonds

A: Some of the common types of bonds are

Zero – Coupon bond

Floating–rate bond

Convertible bonds

Amortization bonds

Callable bonds

Puttable bonds

Payments in kind (PIK) Bonds

Principal – Protected Note (PPN)

Inflation-Protected Securities

Q14. Types of Trade

Day Trading

Position Trading

Swing Trading

Short Term & Long-Term Trading

Q15. What is Private Equity

A: Private equity is an alternative form of private financing, away from public markets, in which funds and investors directly invest in companies. Private equity firms make money by charging management and performance fees from investors in a fund.

Q16. Trade Cycle

A: A trade cycle refers to the fluctuation in economic activities especially in employment, output and income, prices, profits, etc. It has been defined by different economists. According to Mitchell, the “Business cycle is of fluctuations in the economic activities of organized communities”

Q17. What is investment and capital market

A: An investment involves putting capital in bonds, stocks, real estate property, or a business and hopes of a greater payoff in the future than what was originally put in.

Journal entry: Cash a/c --------Dr To investor a/c

Q18. Derivatives

A: A capital market is a place where buyers and sellers indulge in trade (buying/selling) of financial securities like bonds, stocks, etc. The trading is undertaken by participations such as individuals and institutions. Read full page here...

People Also Read: MNC Companies Interview Questions For B.Com, MBA, CA, IPCC, PGDM Students

General/HR Questions

Note: Some of the answers to the questions, you will find here: Click to read

Self-introduction Click to read the answer

Family Background

How many emails can you respond to and reply to in a day?

Previous job role

Why I should hire you A: Although I have no experience, I am serious and willing to learn anything. That is to be learned for the enhancement of the growth of the organization as well as the self. I am also a hardworking, dedicated, trustworthy & Self-motivated person. Finally, I am confident I’ll be the best candidate for this position.

Read full page here...

1 note

·

View note

Photo

As a Canadian, and as someone living in a country that has a UBI framework, I think a lot of people misunderstand just how basic Universal Basic Income is.

TL;DR: I agree on principle, but identifying greed as a problem doesn't solve deeper systemic issues.

I see some armchair social theorists on here say that UBI is enough to fight more pressing social battles; that it empowers you to demand better rights as a worker, as a citizen. I've been on UBI and, well - no. UBI is enough to allow you to survive. If you want to invest in a project, if there's a worthwhile cause you want to get involved in that requires some involvement or some capital injection (even something as simple as buying supplies to fashion picketing signs) - that's on you. In Canada, UBI is calculated based on median income, which means that it isn't enough to kickstart some people's Post-Work-Era Roddenberry-Powered Magical Socialism where nobody works and everyone contributes out of sheer passion and drive.

UBI is there so you can survive, and so you can eventually have the resources and skillsets needed to contribute to Society without UBI lining your pockets. More importantly, UBI is there to ensure that there are no "bad jobs" to speak of, because even the fast food joint's janitor who's on Minimum Wage starts with better conditions than a UBI beneficiary. In Canada, a kid with no diploma who makes a living manning a Tim Hortons' cash register doesn't have to fight with the system to obtain credits related to his living conditions. The real problem has three prongs:

Welfare kings and queens who make it harder for legitimate demands of financial assistance to go through;

The corporate world that's forgotten that the very first rung past UBI needs to be 100% livable and needs to allow for at least some measure of savings to be something that can be planned for. UBI should facilitate survival, what happens when even minimum wage doesn't allow you to live right?

Slum lords who buy off properties initially set aside for Affordable Housing programs and who drive market values so far high that entry-level workers have to settle with living several hours away from their place of work.

But Sweden and Norway - Hold it. Sweden and Norway are filthy fucking rich. Sweden and Norway are Petrostates. Canada? Not so much. Year after year sees Affordable Living programs or revisions to UBI being floated that would turn it from a lifeline to an actually workable form of remuneration, but year after year sees my local politicians butt their heads against the fact that any kind of serious Social Security net can't just pay for itself; and Canadians are already sadly renowned for living in a country choked by taxes - all because our already-present pro-Social infrastructure is complex, inefficient and sadly vital for most low-income residents.

Imagine how insane implementing it would be on a per-State level, on the American side. Imagine the work that needs to be done; not just in terms of greater education, but also in the sense that there's an entire infrastructure you guys never put in place. Some of my colleagues are American expats, and their first big shock came in the form of their first tax bill on Canadian soil. Free healthcare isn't free, the load is just spread across the country's residents. It also means that UBI and Free Healthcare programs can only cover so much, seeing as even if you put the load primarily on those above a certain income level, those below it are still going to feel the pinch. God knows I do, every tax season, and even if it's for a fundamentally good cause.

So. Beyond harping that UBI is a basic right and that we all deserve to rest, ask yourself how wealthy your State is, first. Try and model the kind of help you'd be getting. Try projecting it as a deferred hit on your salary or your savings - one that you need to account for year after year, forever.

The social model where none of us work and all of us effectively play with shelter and rest being in-built facets of our social contract would require a total upheaval of our current system - and something tells me most people wouldn't like the transitional period between the two. Would people really maintain power stations or work hospitals just because it's the right thing to do?

Call me cynical, but I've been alive long enough to really, really, seriously doubt that logic. Sooner or later, someone's going to want to look out for Number One. The USSR fell for that very reason, and my own country's very pro-Social policies are rife with examples of what happens when someone with good intentions gets unfettered access to a chequebook, supposedly for the good of all. Remuneration is a great control system, in that respect, especially when we know that in an Egalitarian system, there's always going to be one or two chucklefucks who think they're more Egalitarian than the rest.

Greed is in all of us; the only thing that keeps you or me honest is our lack of power. Money, as they say, is the root of all Evil. Remove money from the equation and something else will take its place. Social status, most likely.

Then let's make all of us equal! Communism FTW!

you're likely American if you're reading this, how do you think most people will react to that kind of assertion?

even in an ideal system, the Overseer would have more power. That, right there, is enough of an imbalance for unfair treatment to surface.

Again, we've seen what happened with Soviet Russia, and I'm not saying this to be a bootlicker. Open a history book: Lenin barely managed to approximate Marx's idea of an Egalitarian state and Stalin identified the cracks in the system and pushed them wide open, priming it for collapse.

UBI needs to happen. via antiwork

#thoughts#politics#UBI#Universal Basic Income#Speaking as a Canadian#Speaking as a former beneficiary of Quebec's Welfare Credit (UBI)

181K notes

·

View notes

Text

Simplifying Paydays: Why Every Business Needs Payroll Software

In today’s fast-paced business environment, relying on manual payroll systems is not only out of date but also foolish. With increased compliance obligations, a growing workforce, and an expectation for accuracy, the urgency of considering an automated payroll process is more prevalent than ever. This is where payroll software can transform your business.

What is Payroll Software?

Where payroll is done only through human calculation it becomes a lengthy process that is riddled with possible human error and often unreported. Payroll software fundamentally alters a person's ability to carry out these tasks and calculates most aspects of payroll transparently & reliably, along with books time for things that HR and finance can now be doing that relate to analysis or administrative work.

The greatest advantage of using payroll software is the accuracy of the results. Payroll calculations that are miscalculated may result in unhappy employees or even legal penalties. Automated systems will eliminate the chances of making erroneous human mistakes, and will ensure that deductions and additions always complete accurately and independently.

Compliance management will also be crucial. Tax laws and labor legislation is always changing, and manually tracking these changes can present an appropriation of work to the people responsible. As payroll software has built-in regulatory compliance features, the software will always be state-of-the-art and move seamlessly with rule changes that affect the payroll system to notify each company. Payroll system provides the opportunity to avoid fines, audits, and financial losses.

Features of Payroll Software Include:

Automated Salary Calculations: Determines employee wage and salary numbers, including but not limited to, earnings, deductions, taxes, net pay, and more.

Tax Preparation Support: Automatically creates tax form preparation and e-filing options.

Payslip Creation: Instantly generates an excellent payslip in a very professional manner, with complete burn-down wages.

Leave and Attendance Integrations: Assists in the processing of pay amounts from leave and attendance systems.

Multi-Currency and Multi-Location: Most useful for remote and global organizations.

Secure & Encrypted Data: All sensitive information is stored with high-grade encryption and backup.

Employee Self-Service Portals: Employees can log in to view their entire payslip history, tax documents, and leave balances without HR or other involved people.

Aside from features, real value lies in efficiency and peace of mind. With payroll automation, administrative workload decreases, payroll cycles shorten, and trust is built throughout the organization. Employees are paid on time, records are current and compliance is completed with the least amount of manual input.

Conclusion

Whether you are a start-up or budding business, investing in smart payroll software is not just a cost - it is a strategy. Investing in payroll software lays an initial foundation of trust, professionalism, and operational excellence for every business on their way to success.

#smart payroll software#best payroll software#smart pay solution#smart salary pay#accurate and secure payroll#payroll software#payroll

0 notes

Text

DSCR Loan in Hawaii: Unlock New Real Estate Investment Opportunities

If you’re looking to dive into Hawaii’s booming real estate market, a DSCR loan might just be the perfect financing tool to make your investment dreams come true. But what exactly is a DSCR loan, and why is it gaining so much traction among real estate investors in Hawaii? Let’s break it down.

What Is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio. Unlike traditional home loans that scrutinize your personal income, employment history, and credit score, DSCR loans focus primarily on the property’s income-generating ability. This means lenders assess whether your rental property’s income can comfortably cover its loan payments.

In Hawaii, this approach is particularly attractive because it simplifies the approval process and opens doors for investors who might not fit conventional lending criteria but have strong rental properties.

How Does a DSCR Loan Work in Hawaii?

The key metric in DSCR loans is the ratio between the property’s net operating income (NOI) and its annual debt service (loan payments). A DSCR above 1 indicates that the property’s income is sufficient to cover its debt. For example, if a rental generates $100,000 per year and your loan payments total $80,000, your DSCR would be 1.25 ($100,000 ÷ $80,000), which is usually the minimum lenders look for.

This ratio ensures lenders that your property can reliably pay back the loan through its cash flow, reducing the risk on their end and streamlining the application process for you.

Why Choose a DSCR Loan in Hawaii?

Hawaii DSCR loans come with several advantages:

No Personal Income Proof Required: Forget the piles of paperwork showing your salary or tax returns.

Faster Approval: Since lenders focus on property income, approvals can happen quicker.

Suitable for Investors: Whether you’re new or experienced, DSCR loans work well for rental properties.

Loan Amounts Up to $5 Million: Perfect for those eyeing higher-value investments.

Low Down Payment: Usually around 20%, which is reasonable for investment loans.

Cash-Out Options: Many lenders offer options for cash-out refinancing.

Of course, there are some downsides to keep in mind, like slightly higher interest rates and the need for strong property cash flow. But for many investors, the benefits far outweigh these concerns.

Interest Rates for DSCR Loans in Hawaii

Rates for DSCR loans typically range from 7.75% to 8.75%. If you’re looking into fix & flip or construction loans, expect rates between 11% and 12%. Always check with lenders for the most accurate rates based on your situation.

Where to Invest in Hawaii with a DSCR Loan?

Locations like Honolulu, Kihei, Wailuku, and Hilo offer diverse opportunities:

Honolulu is a vibrant financial hub with solid residential and commercial rents.

Kihei on Maui offers sunny vibes and competitive commercial rents.

Wailuku blends unique architectural styles with relaxed island living.

Hilo presents lush natural beauty with strong vacation rental potential.

Each city has its own rental income averages and property types, so choose what fits your investment style best.

How to Apply for a DSCR Loan?

Gather your property and financial details.

Choose a trusted DSCR loan lender.

Start your application, either online or via phone.

Provide property income and expense data.

Submit credit and financial information.

The lender reviews the property’s DSCR and your credit.

Once approved, review terms and sign your loan documents.

Final Thoughts

DSCR loans in Hawaii open exciting doors for real estate investors by focusing on property cash flow rather than personal income. While slightly higher interest rates and dependence on property cash flow exist, the streamlined process, higher loan amounts, and investor-friendly terms make these loans a valuable financing tool.

For more detailed info, check out: DSCR Loan in Hawaii: Unlocking Opportunities

FAQs

How is DSCR calculated? DSCR is the property’s net operating income divided by its total debt service (loan payments, taxes, insurance).

What’s the minimum down payment? Typically, investors need a minimum of 20%, though this can vary based on credit score and loan specifics.

#DSCRLoan#HawaiiRealEstate#RealEstateInvesting#InvestmentProperty#RentalProperty#RealEstateFinance#HawaiiLoans#PropertyInvestment#RealEstateTips#FinancialFreedom

0 notes

Text

Understanding The Role Of TSX Earnings Per Share In Market Evaluation

Highlights:

TSX Earnings Per Share is a critical metric for assessing a company's profitability.

The metric is calculated by dividing net income by the number of outstanding shares.

TSX Earnings Per Share reflects the financial performance of companies listed on the Toronto Stock Exchange.

The TSX Earnings Per Share (EPS) metric serves as an essential indicator for evaluating the profitability of companies listed on the Toronto Stock Exchange. EPS represents the portion of a company's profit allocated to each outstanding share of common stock. It provides a clear measure of financial performance, which is critical for understanding a company's ability to generate profit relative to its share count.

How TSX Earnings Per Share is Calculated

EPS is calculated by dividing a company’s net income by the total number of outstanding shares. This calculation allows investors and analysts to gauge the profitability per share, offering a straightforward snapshot of financial health. A higher EPS typically indicates a more profitable company, whereas a lower EPS may signal challenges in maintaining profitability.

Types of TSX Earnings Per Share

There are two common forms of EPS: basic EPS and diluted EPS. Basic EPS considers only the outstanding shares, while diluted EPS includes potential shares that could be issued through stock options or convertible securities. Understanding the difference between these two can provide a more comprehensive view of a company's actual earnings power.

Sector Influence on TSX Earnings Per Share

The sectors represented on the TSX can greatly influence the TSX Earnings Per Share figure for various companies. For example, the financial services sector often has relatively high EPS due to steady profit generation from loans, insurance premiums, and other financial services. Meanwhile, energy companies might experience fluctuating EPS based on commodity prices or production levels, as their earnings are more directly tied to market conditions.

The Role of TSX Earnings Per Share in Financial Reporting

EPS plays a significant role in financial reports and is often one of the first metrics looked at during earnings announcements. For companies listed on the TSX, strong EPS growth can signal healthy operational performance, while a decline in EPS might indicate issues that need to be addressed. It is also a key metric for determining dividend payouts, as companies with higher EPS often have more resources available for distributing dividends.

Impact of Share Buybacks on TSX Earnings Per Share

Share buybacks can affect the TSX Earnings Per Share metric by reducing the number of outstanding shares. This reduction increases the EPS, even if the company's net income remains unchanged. As a result, companies may utilize buybacks as a strategy to boost EPS and present themselves as more profitable, even if underlying performance has not improved.

TSX Earnings Per Share in Comparison to Industry Peers

EPS is often used to compare the profitability of companies within the same industry. By looking at the TSX Earnings Per Share for multiple companies in the same sector, a clearer picture can emerge regarding which companies are performing better relative to their competitors. However, it is important to account for different operational structures, market conditions, and business models when interpreting these comparisons.

Limitations of TSX Earnings Per Share

While EPS is a valuable tool for assessing profitability, it has certain limitations. It does not account for factors such as capital expenditures or changes in the market value of assets. Additionally, EPS can be influenced by non-recurring items, such as asset sales or restructuring charges, which may not reflect the company's core ongoing operations. Therefore, EPS should be considered alongside other financial metrics for a more complete picture of a company’s performance.

0 notes

Text

**"One Big Beautiful Bill" Cuts Safety Nets, Hurts Poor Children**

"One Big Beautiful Bill" Cuts Safety Nets, Hurts Poor Children

The recent debate around the "One Big Beautiful Bill" has exposed a troubling undercurrent in our political landscape: the stark failure to protect the most vulnerable among us. Advocates may tout the bill as a path to fiscal responsibility, but the reality is far more chilling, particularly for poor children and their families.

Projected cuts exceeding $850 billion to essential programs like Medicaid and CHIP paint a dire picture. These aren't mere numbers on a page; they represent millions of lives—countless children who may lose access to healthcare and critical services. The very safety net designed to catch our most vulnerable is being systematically dismantled, leaving families to navigate an increasingly treacherous landscape without support.

Critics have rightfully highlighted a grim reality: while the bill claims to restore accountability, it disproportionately targets low-income families, stripping away necessary health coverage that so many rely on. Medicaid expansion and the Affordable Care Act (ACA) marketplace have provided a lifeline for many of these families, and this legislation threatens to sever that connection, further deepening the chasm of inequality.

The ramifications extend beyond healthcare. The proposed cuts to food and educational programs signal a broader neglect of the needs of the poorest children in our society. Families struggling to put food on the table will find themselves without vital supports, exacerbating stressors that threaten their well-being. As one observer noted, families facing these budget cuts could see their already precarious financial situations worsen, potentially spiraling into crisis.

This isn't just about numbers; it's about people—children who may go to bed hungry, mothers who must choose between medical care and rent, and families who feel the weight of systemic neglect. We are witnessing an erosion of protections, reimagined as an act of fiscal prudence, but in truth, it is a moral failing.

Additionally, the bill's provisions targeting immigrant families further compound the injustices present. By limiting benefits based on immigration status, it perpetuates an environment of exclusion and fear, denying access to essential services for those who are already marginalized. This not only exacerbates socioeconomic divides but also tears at the very fabric of our collective humanity.

What is truly alarming is how these cuts—under the guise of reform—could destabilize local economies. Reduced access to healthcare correlates with increased strain on already burdened public health systems, which ultimately leads to higher costs for everyone. This shortsighted approach offers no real solution but instead paves the way for greater crises.

The implications are profoundly disturbing. In a society that claims to champion the value of family and children, we are witnessing a calculated withdrawal of support for those who need it most. The prioritization of fiscal metrics over human lives speaks volumes about our values and priorities.