#well this devolved into a jp post

Explore tagged Tumblr posts

Text

& i STILL won't design mk or dmk!!!!!!!

i think i genuinely hate making knight outfits with a passion, i just don't wanna do it (i'll eventually do it 💀)

i just wanna draw mk in a cure berry outfit & call it a day.

HOLY SHIT I SHOULD BE DOING THAT

#そのことはblueskyのアカウントに投稿します#キュアベリーメタナイトまじで今まで作った中で一番ウケる#メタナイトが「あたし、完璧!」って言うのを想像するだけでめちゃくちゃ面白い#ああ~それにベリーソードも持たせたい#前から描きたかったんだよね、彼があの剣を構えてる姿#well this devolved into a jp post#see u guys on bluesky w a cure berry mk!!!!!!!!!!!!!!#probably...

2 notes

·

View notes

Text

Is anyone else tired over recent events? Not in a sleepy way, but in that bone-deep depression way?

Bit of a long post about the general Gacha game-sphere. Needed to get this off of my chest, might as well scream into the void.

I ask this as someone who flirts between these gacha games out of boredom mostly. They're free, they're phone, they got Story, and I'm not spending a cent on them personally, so that's why I play them.

But every fucking day it seems we got another controversy. Bad VA this, fired an artist that, White_Pharaoh.png being handed out like fucking candy on Halloween lately.

And then we discuss on how Its Bad, and we all know Its Bad, people discuss on what to do, Boycott, torch the franchise and run, stay and try to fix it, ignore it because it's been your Comfort Media for the past 3 years, all that stuff. And it's hard. And a lot of those choices always feel half-assed.

I've been around a bit, I've seen it. I was around when Fate Grand Order had LB7, Wandjina, and all the other shit on 2023 JP hit, and there was talk, some talked but stayed, others left but chose to still engage with Type-Moon works, some might've left completely but I never heard of them.

I was around when Project Moon fired Vellmori, and there was betrayal, some deciding to leave, others staying because Project Moon wormed into their hearts and they decided to stay even knowing what was happening. Knowing what it was now built on and where the lines were drawn.

And I'm here now in the midst of the Hoyoverse shittery round 2, I don't think I need to speak at length on that. We've all seen it.

And all the time every potential choice to take feels half-assed?

Do you leave, abandoning the franchise as if leaving without fighting to improve something makes you good, preserving your own morality at the cost of never making anything better? The lack of evil substituting for substantial good?

Do you boycott? If so is it purely not spending money or not even logging in? Does it even make a difference? After all, when do these oversea companies really listen to anyone outside their country of origin? Is it enough to stop on that one specific game and still buy other works, or do you condemn the whole?

Do you continue on as normal, to indulge in the media? To continue what brings you joy and comfort? Is criticizing and acknowledging the faults enough or just lipservice?

Are we arrogant to impose our values on others, hating foreign companies not conforming to our beliefs? Or is this completely reasonable, every scathing speech and point completely justified and never bordering on some level of sinophobia?

And just... it's hard. Hard enough trying to be a Good Person normally but here? In this space? Part of it feels natural and some action is necessary for the Good of Everything, the other part feels like a big fuss over something ultimately small and meaningless.

And it hurts. You give out pieces of yourself to these stories, let it become a part of you, then become forced to tear it out of your heart just to be Good. And when I say that I don't mean in that internet point "I'm a good person way" but the way of being Good with yourself, proving only to yourself.

And it doesn't help that plenty of us have devolved into humanity's good old passtime of tribalism, mockery, and a lack of empathy for The Other. Everyone's been taking the piss out of the other gacha players for the stuff their games pull as if their own games haven't done the same. Some of it might be in good nature, over exaggerated and self-deprecating, a joke or criticism, but its honestly become indistinguishable from genuine malice and contempt.

And...

I'm tired.

Tired of seeing this. Tired of dealing with it. Tired of wondering what to do, what's the best choice, what choice even is there.

Part of me is honestly tempted to just not care. To accept that I'm a bad person by playing these games and going through with it anyways because I'm so tired and cynical that hedonistic indulgence just becomes more worth it than trying to be good. At most accept a Gacha-game that's a 'Lesser Evil' compared to another, if that even counts.

Because it hurts. Because you let these stories change you, touch you, let them into your heart, and then have to tear it out with your own two hands and pretend it doesn't hurt. And you can't feel like you can mourn what you lost, because someone will come in and start raving about how it's dumb you even cared to begin with.

I've seen arguments for every option, from people I don't respect and people I do, strangers and prominent community figures. I've warred with the argument of "Morally Pure Media doesn't exist, don't beat yourself up over it" and wonder just how absolute that statement should be.

And I don't know.

And all I want is to go to sleep, and wake up and have it magically be better.

#gacha#fgo#genshin impact#honkai star rail#hoyoverse#limbus company#arknights#controversy#those who seek to be good become the worst of the worst#im tired over all of this#This is indeed a hell ive walked into#none of this is against any game this is all very general#im in grief if you couldnt tell

52 notes

·

View notes

Note

i tried to take your vil analysis post seriously when i saw it in the tags because i enjoy his character as well, but the way you described the other overblots made me wonder if i went crazy. why was it necessary for you to misinterpret the other dorm head's + jamil's trauma to justify your favorite's? ALL of your summaries were incorrect. most significantly painting jamil as hypnotizing kalim for the dorms good. you can not convince me jamil living involuntarily as a servant for his entire life is a better fate than being typecasted in school plays. and then the way it devolves more in the end into a rook hate post? i don't like the guy either, but the only thing he did at the end of the chapter was judge his team (that was just put through the gutter) from an objective standpoint. furthermore, you can say that rook is a gaslighter for calling vil overweight and whatnot, but that is at best just plain rude. rook doesn't have nearly as much power over vil as you think he does. i'm sorry, i'm not saying that your entire point of vil being misrepresented should be overlooked, but you have to get your facts straight before you make large claims.

Wow, you just missed the entire point of the post.

And you missed what Vil's trauma really is too.

And you're calling an abuse survivor's testimony an overreaction.

I'll wager a wild guess and say you're an EN only player because the things you claim are incorrect are very explicit in the JP version of the game. The reasons I gave are reasons the overblotees used THEMSELVES to justify their behavior. Vil doesn't do this, he doesn't justify, he accepts he was wrong and that's what breaks him. Jamil used the "It's for the dorm's good" defense before he was ever ready to admit it was personal. Yes, it was. Nobody's saying Jamil didn't have a reason, and I am not claiming Vil's trauma is worse than Jamil's. In the first place, comparing trauma is stupid and damaging to both sides. Vil's trauma isn't being typecasted in school plays and if you think it is, you have either not read his story or you skimmed it as briefly as you have skimmed my analysis of it.

But sure, let's compare here. Both Jamil and Vil were systematically dehumanized since a very young age, just for different reasons. Jamil because of classism and Vil because of the way he looked. Both things they can hardly do anything about. This led to them both having deep-rooted insecurities about themselves while outwardly presenting as confident. Vil got physically abused because of this while Jamil was forced to taste-test for poison which landed him in a coma at one point. Is Jamil's situation more difficult to get out of? On paper, yes. However if you actually play the game, you will see that Kalim is taking active steps to improve Jamil's situation as much as he can already, and will probably take more in the future. In Jamil's case, having one person in his corner is enough because once Kalim takes over the family, he will have the ultimate sway over everyone's freedom. Vil's situation is a lot more complicated because it doesn't lie in the hands of a single person but rather a whole industry which is honestly unlikely to change.

As for your issues with me providing proof Rook is a gaslighter, it's not about calling Vil fat, which you would've known if you'd actually read the post. It's about purposely making Vil doubt his own senses (I look at you more than you do so I know you better), making him "choose" (Would you rather trust me or everyone else?), and saying that Vil will be isolated and forgotten if he doesn't do as Rook tells him (By the time they notice, it will already be too late). Same for Book 5's ending. If Rook was being "objective," he wouldn't have voted for a nursery rhyme remix where the dancers bumped into each other constantly because they couldn't have even been bothered to learn the choreography properly. He should've just said that he picked Neige because he likes him better. Not blame his very subjective choice on Vil's trauma response. Rook's gaslighting becomes clear once again in Vil's dorm uniform story where he lies to Vil and pushes him into not telling the Pomefiore students what he's doing for them because "Nobody but me would appreciate you anyway."

And, again, you are telling a real abuse victim that they are overreacting when pointing out the most blatant textbook definition example of the type of abuse they went through (among others, mind you) in recent media.

But what do I know, twstEN deletes most of this anyway so maybe that's why you're confused. At least, I want to assume that's what it is and that this ask isn't malicious. If you do play twstEN, I have a wonderful post compiling many of the differences between versions because BOY are there a lot and none of them good.

Next time, you can come off anon. I don't bite, nor will I harass you. I'm a working adult (you know, the ORIGINAL target group for the game) with better things to do with my time than to bother someone who can't even read what they're criticizing me for.

3 notes

·

View notes

Audio

this whole bit made me lose my mind. context was they were reading through one-word answers to the question “how would you describe the first 200 episodes of hey riddle riddle?”

Erin: Chaos. And that’s the word.

JPC: Yup. Okay, there it is.

Erin: It was always chaos or chaotic.

(While Erin is reading long lists of these words, her voice speeds up and an upbeat piano plays in the background)

Erin: Chaos, unhinged, chaos, chaos, batshit insane, chaos, fever dream, frenetic, unhinged, laugh, chaos, delightful, nonsense, riddle, Coco, chaotic, pun-tastic, hysterical, riddle, sweater, wild, rollercoaster, chaos, chaotic, hilarious, unhinged, Blown Man Group, insane but in a good way, bullying, which is one of my favourites...

JPC: [laugh]

Erin: Chaos, hallucinogenic, unhinged, puzzies, you good?, riddle-iculous? Yeah that’s a J -

JPC: Yep okay. That’s a pun.

Adal: Nice.

Erin: Chaos, delightful, riddle-rific, purgatorial, another very literal one I love that -

Adal: [barely holding it together] Purgatorial!

Erin: Jupiter, chaos, hilarious, endorphins, delightful, chaos...

JPC: Mhm.

Erin: Riddle-heavy, batshit, damp, I love damp. Chaos, puzz-tacular!

Janet: [gasp]

Erin: Kooky, free, chaos, fever dream, chaos, chaos, chaos, chaos, distractions, camaraderie, chaotic good, biblical -

JPC: [pfft]

Erin: Chaotic, chaos, deranged, hilarious, nonsense, Jupiter, unhinged, Jupiter, chaos, life-changing, ungovernable.

[everyone laughing]

Erin: Puzzle, unhinged, chaotic, authentic, unhinged, chaotic, Little Monkeybones, kooky, joyous, “improv.” Rude. It’s in air quotes. Chaos, unhinged, bananas, escalating, riddiotic, silly, Little Monkeybones, kooky - we’re halfway there. Chaotic, bonkers, frog -

JPC: Frog?

Janet: Only one sweater. Only one sweater so far, I’m surprised.

JPC: Wow!

Erin: Chaos in a good way, thank you number 96! This is another great one, the strained “hygh!” noise Adal makes when someone makes a joke...

Janet: That’s one of my favourite sounds!

Erin: Totally. Outrageous, exhilarating, thirsty, chaotic, chaotic, chaotic, chaotic, podcast.

JPC: Thank you!

Erin: Varied, it started as a genuine riddle podcast but devolved into chaos -

Adal: Now we’re here...

Erin: Wonderful, manic, indescribable, hectic, hilarious, unhinged, chaotic, riddles?, chaos, haunting - another one that I love. Sweater. Second sweater. Clusterfuck, chaos, perverted, blasphemous, dead stop, frightful, chaos, haunting, unhinged, insane, hilarious, hysterical...

Adal: These are all words that describe a snake as well. Unhinged jaw...

Erin: [laughter] Oh, sorry, I’m describing a snake.

Janet: That - that snake was haunting.

Erin: Perfect, quirky, two hundred, TWINS?, chaos, ummm, Uncle Santa - fuck you JPC, chaos, Kevin Susie, essential, chaotic, chaotic, chaotic, it’s pretty good -

JPC: [laughter]

Erin: I like it. You can’t limit me to one word, fuck you. That’s another JPC listener.

JPC: And I wasn’t on Instagram!

Erin: Chaos, Dunkin’, better be... scripted! What? Iconic, lengthy, chaos, frenetic, fun, feral. Another good descriptor.

JPC: Oh yeah, I like feral.

Erin: Chaotic, spastic, delirium, bingo bango ha-ta-ta, chaos, joy, podcast, chaos in the best way, thank you, giggle, slap-happy, 69 420, JPC again was not on Instagram -

JPC: Very nice.

Erin: Jupiter, chaotic, chaos, delirium, post-potatoes, unpredictable, plague, chaotic, buckwild, chaotic, insanity, madness, insanity, stellar, BAD. That’s 192, said it was bad.

[laughter]

Erin: JP Riddles, chaos, exhausting, bedlam, derailed, insanity, chaos, magic, and chaos. And the one that I will remember forever is bad.

[everyone laughs]

24 notes

·

View notes

Text

Who tao?

well hu tao is out.

Oh well, back to grinding^^

I’m skipping her. That’s the entire post. I care a lot more about the (possible) Venti rerun but it’s mostly because I want the new inazuma characters. I feel like they are going to pull a 1.1 where they had childe and zhongli back to back. Just with the jp characters and I fucking want the new characters more than Hu Tao. I am being blind to her content because as soon as I see anything I’m going to want to roll for her.

You cannot tempt me demon

But gl to everyone that’s rolling for her 🎉🎉 [i fucking love the fact that hu tao supremacy is a tag now lol]

(fucking watch me do a 180 kickflip and become a hutao simp. You’re going to see me devolve)

#genshin#genshin impact#genshin hu tao#hu tao#genshin impact hu tao#hu tao supremacy#hu tao genshin impact#genshin inazuma#genshin impact inazuma#genshin ayaka#genshin impact ayaka#ayaka#genshin kazuha#genshin impact kazuha#kazuha

35 notes

·

View notes

Text

ultimate bottom!John master post ;)

Every fic listed is mclennon, includes sexual content and is on ao3. Do feel free to add onto the list if I’ve missed anything!

Be My Baby - crybabycry

“Tell me, Johnny,” Paul murmured, teasing his almost-auburn hair between his fingers, “were you a good boy today?”

John’s breath quickened, blush spreading as he readjusted himself on Paul’s lap. “No, Paul, I was not a good boy today.”

These Nights - Unchained_Daisychain

Music journalist John Lennon is tasked with writing an article on newfound pop artist Paul McCartney. A night of fame, music, and passion soon surround John before he knows it. By the end of it all, he’s not so sure he can manage to give up this star and these nights.

Father’s Day - ImagineBeatles

John and Paul have a different way of celebrating Father’s day.

Understanding - ImagineBeatles

John wants to know what it’s like to be fucked roughly after he had seen how much Paul had enjoyed it, when he had done it to him. Paul is more than happy to do it.

The First Scene - DemonDean10

John is an omega and has kept this secret from all his friends for years. Until one day while on their first visit to the U.S. he discovers he forgot his heat suppressants. There is an Alpha that could come to his rescue, but what will happen after the two wake up and realize what they've done.

Higher Education - smothermeinrelish

Starting anew in Edinburgh Scotland, John is hired as a conservationist at the University where he will be working along side English Literature Professor Dr. Paul McCartney. John is instantly attracted to his new supervisor and mentor, but the feelings aren't mutual? Are they? Set in modern AU, the teacher/ student relationship could be more than just a temporary fling.

You Teaser, You Pleaser - Unchained_Daisychain

John and Paul finally find time to put their new handcuffs to use.

John shrugged, but the smirk on his lips belied his nonchalance. He glanced at the handcuffs Paul held between their bodies. “Seize the moment, Macca,” he said, low, tracing a single finger along the ridges of one open cuff. “Or any accessible poles throughout the day. They always leave that part out.”

Tease Me - nipsynips

His bandmates had always called him the ‘kinky’ one, but they had always assumed it was him doing the tying and the holding down and the commanding. True enough, that was often the case, especially with birds, but it wasn’t his preference. In fact, contrary to what most people thought, John relished the chance to relinquish control every once in a while.

Patience is a Virtue - Peachy_Beatles

John is trying his best to song write despite his overactive imagination. Luckily, Paul is willing to reward him for his efforts.

Summer Rose - chanderson

John and Paul rekindle their relationship late summer 1980. John's feeling lost, and Paul's missing him in more ways than one.

Cutting Strings - Peachy_Beatles

Early 1969: With John’s increasing emotional unavailability, Paul is left clinging on to whatever he can get from him- no matter how unfulfilling.

I Blame Tumblr - DemonDean10

I would just like to apologize to the world and myself for doing this. Based off this Tumblr post by @johnsdoublechin: @ the ppl who say John isnt a bottom at my last post well I got MY SOURCES. George, Ringo, Paul, Brian, Cynthia, and Yoko have all topped him thanks for listening And so...this was born. Basically John bottoms for everyone. Everyone tops him. I did this instead of my actual fics.

Ten Minutes - ImagineBeatles, ChutJeDors

Paul had thought that his friends only wanted the best for him, with giving him a gift card to a brothel and all. Now, having ended up in a room with a stunningly handsome male whore, he needs to reconsider those ideas about his friends, and his beliefs in life altogether. It’s just for ten minutes, though… Definitely a once in a lifetime thing, and all that. Totally! Right? Right??

What Feels Right/ This Loving Game - ImagineBeatles

Paul and Julia have been going out for a while and now they’ve decided to move in together. What Paul hadn’t expected when he’d agreed was that he’d fall in love with her troublesome teenage son, John

like a river flows, surely to the sea - toppermostofthepoppermost

John is smiling around his cigarette, head thrown back, eyes fixed on the cloudy sky, and it takes Paul all of his poor will to mutter, “You shouldn’t flirt with your teachers, you know?” “In my defense, Mr. McCartney,” John quips, shifting his gaze to Paul, “you make it very hard not to.” Or: Modern-day AU where Paul spends his days teaching everything Shakespeare, getting angry at modern electronic devices, raising a five-year-old girl who's 50% puppy eyes and 50% sassy comebacks and trying not to fall in love with John Lennon, his university student.

The Consequences of Getting What You Want - deux_lunes

Why John Lennon really beat Bob Wooler up at Paul’s birthday party.

Queer - deux_lunes

Paul gives John what he desires

Discipline - deux_lunes

John has been an utter brat and Paul decides that he is in desperate need of discipline.

Skype sex. - mickeymouse (Sgtmacca0)

day 8. john skypes paul in the middle of the night.

In the Back Seat of My Car - ImagineBeatles

Modern AU. After having met at Stuart's birthday party, John and Paul get down and dirty in the back of John's car.

It won’t be long - orphan_account

After some interesting scents were being left around everywhere the Beatles went, even without any women around, it became obvious that someone in the band is an omega and never told anyone. But no one seems to care, or even notice, but Paul. The only other alpha in the band, with John of course. And he sniffs out (literally and figuratively) who it is alone in the hotel.

James - JP (jpgr1963)

Paul helps John cope with stress while on tour in 1964.

Magical Mystery Tour Love - DemonDean10

Paul gets drunk one night during MMT filming and confesses his love for John. John had been in love for yrs and is elated. but when Paul wakes up he remembers very little of the night before, will he tell John or try to make the relationship work, even with all the moral conflicts it brings up?

Day 30: Who’s Your Daddy, Johnny Boy? - ImagineBeatles

John's been a naughty boy who needs his Daddy to punish him and make him learn his lesson. Or at least, that's what Paul thinks. Not that John isn't more than happy to indulge his lover.

Day 22: Over The Desk - ImagineBeatles

1968. John keeps bothering Paul while he's busy doing management stuff, which is highly irritating for the younger Beatle, especially seeing as John makes it abundantly clear he isn't going to leave until he gets what he came for. In the end, John gets a little more than he bargained for.

Day 18: Lazy Morning Sex - ImagineBeatles

John and Paul spend the morning in bed together.

Day 6: Clothed Getting-Off - ImagineBeatles

John had seen Paul watching him, eyes hot and determined, so he was not at all surprised when he was dragged into an alleyway and pushed up against a brick wall to have his lips positively snogged off.

I Want You - sockittoem

“In which John gets really horny after doing coke, and needs Paul to fuck it out of him.”

The Night Before - andthemoondogs

[ Anon McLennon prompt: "The Night Before" ] John and Paul have a night of drunken sex, after which, John panics and gives Paul the cold shoulder until Paul finally confronts him about it.

Day 7: Naked/Dressed - ImagineBeatles

1964. On the set of A Hard Day's Night, John and Paul cannot get one particular scene right in which Paul has to drag John away from a couple of girl as they try to find Paul's grandfather on the train, so they sneak off to practise the scene together. Soon, however, the boys have other things on their minds than rehearsing a scene.

Kiss Me - orphan_account

Mimi is gone for a trip, and when John and Paul meet at John's house for practice, things don't go quite as planned.

masturbation. - mickeymouse(Sgt macca0)

day 4. paul masturbates at the thought of john.

bottoms up. - ffomixam

“Can we get some mclennon with a possessive, dominant paul and compliant john? (technically doesn’t have to be smut)”

breathe desperation. - ffomixam

McLennon smut, something along the lines of a first time, unexpected, adrenaline fueled, thoughtless, desperate handsy-ness and making out backstage after a show with John as the more submissive and needy one?

love me harder. - ffomixam

Could you write a fic about Paul fucking John in public while in Hamburg, being really rough and dominant and teasing John that someone’s going to hear them and see John taking it up the arse, and John just devolves into a cummy fucked-out mess.

Of Hot Chocolate and Rainy Nights - paulmcfartney

yall already know what's goin on ( ͡° ͜ʖ ͡°)

I feel like I’m the worst, so I act like im the best - KiwiPillow

John, a young ravishing man, who is absolutely uninterested in anything but himself really, gets pursued by his roommate to try a dating website! What could go wrong? Well, maybe your "match" could turn out to be a bastard stalker mobster boss with a serious daddy kink, who wants to work on your attitude. Shocked and upset. In the mob bosses defence, John is annoying as hell in this.

182 notes

·

View notes

Text

Epic Movie (Re)Watch #196 - The Walk (2015)

Spoilers Below

Have I seen it before: Yes

Did I like it then: Yes.

Do I remember it: Yes.

Did I see it in theaters: Yes.

Was it a movie I saw since August 22nd, 2009: Yes, #382.

Format: Blu-ray

A note from the original poster:

September 11th, 2001 was a tragic event in not only American history but human history and its events still effect many. I decided to watch The Walk on September 11th because it takes something which primarily has sad memories around it (the World Trade Center) and focuses on a joyful memory instead. Philippe Petit accomplished a feat of pure joy and heart, changing what the towers were to people before they even opened. On a day like 9/11 I know I need to remember that there is good AND there is bad. The Walk is the film equivalent of a happy memory of a late loved one which is why I watch it on this day. I understand that there are those of you who just need to mourn on today and I respect that. The reason I am posting this recap today instead of tomorrow is because in case there is anyone out there like me - someone who needs a happy memory of something that ended in tragedy - they can read it today. I hope that makes sense. And to all those who are struggling with today and what it means to them, know that my thoughts are with you and that I hope you are getting through today as best as you can.

1) One of the very first things Philippe says becomes representative of the entire story.

Philippe: “I do not say this word, death…Instead I say the opposite word: life.”

This is a film about the World Trade Center, even if it’s not about 9/11. But as I mentioned in my note above it is joyful. It is not death it is life, something which permeates every scene and every decision Philippe makes. From the scene where he & Annie are playfully shaking the wire to simulate rough weather conditions, to him jumping around naked on the rooftop, all of it shows such intense LIFE and I think that is just wonderful.

2) The framing device of Philippe on top of the Statue of Liberty telling his story with New York in the background distracted me a little upon first viewing. But you quickly get used to it and I think the framing device works. Primarily because it allows the film to use Philippe’s voice at its strongest.

3) I’ve never fully understood the movie’s decision to start in black and white. The reds and blues are in color which is maybe because these are the colors which are strongest on the French and American flags? But then the color returns in Philippe’s visit to the dentist’s office and a part of me understands why (it’s here where he first learns about the Twin Towers). But also I feel that would’ve been more effective if they’d waited to bring color back into the film when Philippe actually SAW the towers as opposed to entering the dentist’s office. I just don’t fully understand it.

4) Joseph Gordon Levitt as Philippe Petit.

The majority of this film is carried on the character of Philippe and therefore the performance of whoever plays him. He narrates EVERYTHING. His voice is the voice of the film. The action is entirely motivated by his dreams, his actions. He IS the story really, meaning you had to have a strong actor play him. And Gordon-Levitt does absolutely amazingly in the part. Any sense of ego or self washes away because you don’t feel like you’re watching an actor give a performance. You feel like you’re watching Philippe. The actor is able to be incredibly optimistic, positive, occasionally stubborn/arrogant, funny, vulnerable, heartfelt, confident, and genuine in every one of these aspects. He balances the traits of Philippe perfectly which is important in a film about wire walking (see what I did there?). Balance is key. Overplay Philippe’s optimism, he’s naive. Overplay his arrogance, he’s a jerk. Overplay his humor, he’s a clown. But Gordon-Levitt doesn’t overplay any of it but balances it out absolutely perfectly.

5) According to IMDb:

Philippe Petit himself personally trained Joseph Gordon-Levitt how to walk on a tightrope. When the training started, Petit predicted that Gordon-Levitt would need no more than 8 days of training to be able to walk on a wire alone, which came true.

6) Charlotte Le Bon as Annie.

The fact that Annie is able to respect Philippe’s circle (something very important to him as performer) and his craft while also being incredibly mad at him shows an immediate understanding between the two. Le Bon is wonderfully genuine in the part, breathing similar life into Annie that Joseph Gordon Levitt breathes into Philippe. She’s wonderful, genuine, heartfelt, and feels real when the character could’ve easily devolved into a Manic Pixie Dream Girl trope. And her connection/chemistry with Gordon-Levitt is very honest. You are immediately invested in their relationship.

7) This is very telling of the way Philippe sees his art.

Philippe [about when he walks between the towers]: “My performance will not just be a show. It will be a coup.”

This could easily have come off as pretentious, like Philippe is just talking a big game. But through the writing and definitely through Gordon-Levitt’s performance the audience understands that this is honestly how Philippe sees it. He’s not just saying it to brag, to be a grand artist, he just knows that’s what he’s doing and that’s a lot of fun to watch.

8) Ben Kingsley as Papa Rudy.

I don’t think I’ve ever seen Ben Kingsley give a bad performance in a movie. Have I seen him in bad movies? For sure, the guy’s prolific. But I’ve never seen him bad IN a movie. He always fully embraces the part that makes it feel alive and Papa Rudy is no different. But the best part about Papa Rudy is the relationship that he and Philippe have. They bicker A LOT but you come to understand that this bickering comes form a place of concern and (dare I say it?) love for each other. It becomes a wonderful father/son relationship which is one of the most important in Philippe’s life and Kingsley’s portrayal helps the audience understand why.

9) Philippe’s anger at his first failure (falling into the lake, “which is more like a swamp.”) is a wonderful flaw that I really appreciate. Philippe is a very proud person and sometimes he lets this pride get in the way of his relationships with others. But more so it motivates him and he’s able to put that pride aside when it really matters.

10) The Notre Dame wire walk.

youtube

This brief but important scene is honestly a wonderful early appetizer of the hope and satisfaction which marks this film and Philippe’s character when he goes out on the wire during the film’s climax. It doesn’t reach that same level of amazing, but few things do. More on that later.

11) I keep bringing this up, but I love that Philippe is portrayed honestly. His flaws, his pride, even his occasional wavering from the task he has set himself upon. The panic upon actually seeing how freaking tall the Twin Towers are is a very honest reaction of someone who wants to do a high wire act up on those towers.

12) The respect that this film pays to the World Trade Center is very strong. We see them as Philippe sees them: beautiful and representative of the opportunity to do something great. They are not some dark shadow that casts over the rest of the film. They’re not sad. They’re amazing and they’re real. The filmmakers put such work into reconstructing the towers for the film that you don’t even think of it as a film set. It’s their way of remembering it and I think that’s just beautiful.

13) Be honest, we all have this friend. Heck, some of us ARE this friend.

Philippe [after Jean-Louis says he’s mad]: “Yes! You love me because I am mad!”

14) Honesty is the best policy, kids.

Philippe [after a TSA agent asks him what he needs all the wiring fire]: “I am going to hang a high wire between the two towers of the World Trade Center and walk on it.”

TSA Agent [after a beat]: “Ha! Good luck!”

15) Philippe’s spy work is a wonderfully lively montage which covers what might otherwise be a very boring part of the film. He’s basically collecting data but it’s so fun we forget that’s what he’s doing.

16) Steve Valentine as Barry.

I have been a fan of Steve Valentine’s ever since I was a kid and he was in “I’m in the Band” on Disney XD. He is a wonderful character actor who is honestly pretty criminally underused in Hollywood. If you just watched this you’d have no idea he is naturally English, that his American accent isn’t real. Valentine’s part might be small compared to some of the other cast members but he uses it well and is INCREDIBLY memorable. I freaking love this guy.

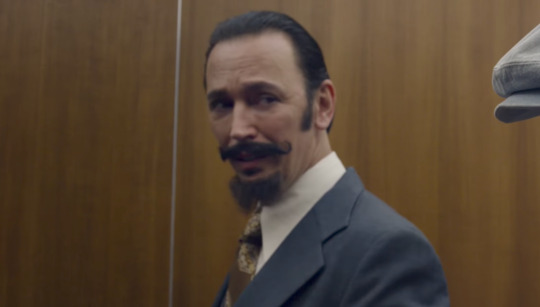

17) And this is the moment you fell in love with JP, Philippe’s newest accomplice.

JP [after Philippe tries to have a private conversation with the others in French and JP responds to it in French]: “Oh you guys thought you were the only ones who spoke French in New York City.”

18) Look, I really like Ben Schwartz. And he’s very good in this film. His character just doesn’t do much. He’s more of a bump in the road (and later pain in the ass) than a developed character. He’s good in the part though, I just always want more of Ben Schwartz.

19) The pre-coup jitters EVERYONE is having is very realistic, especially Philippe’s considering the fact he’s going to be the one on the freaking high wire 110 stories high. The way he refers to the crate with the wiring as a, “coffin,” is very telling. This entire night before is when Philippe is at his shakiest. Not at his most vulnerable though. That’s when he’s on the wire.

20) I’m always surprised by how quickly this movie gets to the day of the coup. Less than half way through and they’re already sneaking around the World Trade Center. I think that’s really smart and honestly organic. It doesn’t stretch the first act longer than it has to.

21) Philippe and Jeff waiting it out.

This is a nice and organic moment to slow down the pacing of the scene, the pair waiting for a guard to leave. I’ve mentioned this before, but Tension doesn’t come from speeding up the scene as much as it does slowing it down. Jeff’s particular fear of heights is very strong here, providing a moment of character analysis for Philippe even as that fear momentarily infects him. It’s just a very nice small moment.

22) So usually when I’m posting about a film I’ll recite the line, “A coincidence that gets the character into trouble is plot.” There are a lot of coincidences and little mistakes which up the conflict and tension of the movie, except here’s the thing: The Walk is based on a real life event with a very popular documentary about it. So the stuff with the nail in Philippe’s foot, the arrow missing its mark, etcetera, that all happened. That’s not an invention. It calls to mind an observation made by Mark Twain: “Truth is stranger than fiction.”

23) A part of me wishes I had seen this film in 3D, because knowing Robert Zemeckis he probably played with the idea of depth beautifully while they’re up on the World Trade Center. But 3D costs money and I was in college at the time (I still am as I write this too, I just decided to say it in past tense).

24) The Mysterious Visitor.

It’s 2017, do we have any idea who this guy was!? Some guy randomly shows up on the tower of the World Trade Center the same day Philippe is going to do his wire walk, says nothing, and leaves. I have two theories about this:

He was a jumper who stopped when he saw other people were up there.

He’s a time traveller from the distant future who wanted to witness Philippe set up his high wire, writing himself into history.

25) I haven’t talked about it yet, but Alan Silvestri’s score for this film is absolutely beautiful. It perfectly stirs the emotion of peace and hope in the film’s audience that Philippe has when he’s on that highwire. I think the main theme for this film is one of the most underrated in movie history because it gives me goosebumps every time I listen to it. Here, have a listen.

26) The Walk.

A climax in a film is typically the moment of greatest tension, but for The Walk it is the moment of greatest euphoria. The moment of greatest joy. No film brings about such a total peace within me as this one does when Philippe takes his first steps onto the high wire accompanied by Alan Silvestri’s amazing score. The extended sequence of MULTIPLE wire walks works beautifully. Yes there are hiccups, there is conflict (a bird, the cops), but more than anything else the sequence conveys to the audience a feeling of one-hundred percent satisfaction and beautiful peace as Philippe is out on his high wire. I’ve seen this film multiple times but this scene always ALWAYS gives me goosebumps and gets me teary eyed. It is beautiful and inspiring and hopeful and just plain moving. I love it with all my heart in a way where I don’t love many films this way. I get such a fountain of euphoria bubbling up inside me and I just ride that wave until the closing credits. It’s amazing.

Philippe [after getting off his wire, to the cops]: “My name is Philippe Petit, I am a wire walker!”

27) There is a line earlier in the film from New Yorkers about how they hate the towers, how they look like giant filing cabinets. And to show you how effective a simple act of pure joy can do, I refer you to this line.

Barry: “They’re different because you walked up there. You know, every New Yorker I talk to now says they love these towers.”

28) There could not be a more perfect closing line to this film.

Philippe [about a visitor’s pass to the World Trade Center]: “And you know this pass I was given? Well, these passes they have a date on them, a date when they expire. But on my pass Mr. Tozzoli he crossed out the date and he wrote on it (small beat), “Forever.”

I have seen 507 different movies in theaters since August 22nd, 2009. I have only ever cried in the following movies (including moves before that day): Bridge to Terabithia, Room, The Imitation Game, and The Walk. I get teary in movies, sure, but the tears usually stay in my eyes. Not in The Walk though. This last line gets me every single time, even today when I watch it. And it goes back to what I wrote at the start of this recap: this movie is a joyful memory that is tied to a tragic event. It is impossible to ever talk about the World Trade Center without remembering all that was lost and all the pain of September 11th, 2001. But this film is able to respect that and still relate a tale of such sheer joy. This movie taught me that the most powerful emotion in the world is a joyful sadness. And I will always be grateful that it did.

The TL;DR version of this is basically note #28, but I’ll repeat why I love this movie anyways. The Walk is beautifully. Wonderfully acted with this incredible story about joy about something (the World Trade Center) that has become such a tragic thing in human history. It makes me cry every single time and it is absolutely one of my favorite movies ever. For those of you struggling with today who took the time to read this whole thing, I truly hope it helps. And for those of you struggling who just scrolled to the end: I hope today was as good as it can be and that tomorrow is better.

#The Walk#Philippe Petit#World Trade Center#Joseph Gordon Levitt#Robert Zemeckis#Epic Movie (Re)Watch#September 11#Steve Valentine#Charlotte Le Bon#James Badge Dale#Ben Schwartz#Ben Kingsley#Movie#Film#GIF

27 notes

·

View notes

Text

Anyways the SKZ × Arknights AU concept goes a bit like this:

It follows the Arknights canon up until chapter 3 (so yeah, spoilers up until that point may be unavoidable), after that everything just becomes a huge mess of canon/non-canon stuff since I haven't found it in me to continue the story after the mess that was 4-4. Most of the world info I picked up from the Wiki, which isn't that complete either, so yeah. Huge canon divergence most likely will happen.

SKZ are all Infected whoops. 3RACHA were originally a gang of sorts but they ended up travelling the world and picking up the rest, changing their name to Stray Kids. Now they mostly do escort and courier requests.

Their main method of transport is a bus they literally overhauled and customized to hold all of their equipment and supplies, and then some. What do they call it? District 9. Is this a shameless MV reference? Yes, yes it is.

SKZ wants to distance themselves from Reunion as much as possible. They know that Reunion sucks a LOT but until they can fight them off, they'd rather play it safe. Which means yes, they're not allied with Rhodes Island. Yet (?).

OT9 is in play because I do want to create a relatively balanced team from the boys. For some reason I imagine 3Racha as melee units, DanceRacha as ranged DPS units, and VocalRacha as support units...

As for the boys' appearances in the AU:

Chan's the leader and he's a Lupo - the race with wolf features like Lappland. I imagine him to be an insanely good Guard focused on DPS, maybe something like Chen?

Woojin is the co-leader and an Ursus - the race with bear features like Zima. I imagine him as a Healing Defender, largely inspired by Saria.

Minho is a Feline - the race with cat features like Skyfire. Coincidentally, I also imagine him as an AoE Caster, with a skillset similar to Skyfire's as well.

Changbin is a Sarkaz - the race with demon-like features like Vigna. Fun fact: Changbin and Hyunjin are the two boys I had the most difficulty in determining races for. As for class, I imagine him to be a supercharged Vigna - a DP-on-Kill Vanguard.

Hyunjin is a Liberi - the race with bird features like Silence. For some reason I see him as a Single-Target Caster?

Jisung is a Zalak - the race with rodent features. For Jisung specifically, squirrel features. This is in large part because of Shaw, the tiny rapping squirrel that pushes enemies to their deaths and savior of my runs in the latter half of Chapter 2. Except I imagine Jisung as a DP-Recovery Vanguard more than a Push Specialist.

Felix is a Sankta - the race with angel-like features like Exusiai. For some reason, Exusiai reminds me of Felix, which is why I base his skills a lot after hers...

Seungmin is a Perro - the race with dog features like Greyy. I imagine him as a Slow Supporter, sorta like Istina I guess?

Jeongin is a Vulpo - the race with fox features like Perfumer. Also like Perfumer, I imagine him as an AoE Medic (because hey, you do need a healer for most late maps and Perfumer is insanely good for a 4*).

And since I am a multistan mess this might devolve into a multifandom crossover. I'll only be writing groups I'm familiar with (so X1, SVT, J01, and some of the Produce X/JP boys are all fair game). I have a plan in mind though (that is highly inspired by the Incident That Shall Not Be Named related to X1 back in January 6 2020) but yeah, still a plan, not yet set in stone except for the things related to SKZ.

But yeah, that's all I can think of right now! I'm also learning how to use Tumblr so I imagine the posting order and everything else is going to be A Mess. Feel free to leave any thoughts!

#arknights#stray kids#skz#this is a mess#like honestly#i dont know what im doing#is this a good idea?#crossover fic#how do i tag

0 notes

Text

Who is Matt Whitaker, Trump’s new acting attorney general?

President Donald Trump forced former Attorney General Jeff Sessions to resign on Wednesday, replacing him with Matt Whitaker.

The startling move came just one day after the 2018 midterm elections. Whitaker will be acting Attorney General until Trump selects a permanent replacement.

We are pleased to announce that Matthew G. Whitaker, Chief of Staff to Attorney General Jeff Sessions at the Department of Justice, will become our new Acting Attorney General of the United States. He will serve our Country well….

— Donald J. Trump (@realDonaldTrump) November 7, 2018

Sessions had famously recused himself of overseeing special counsel Robert Mueller’s investigation, a duty that then fell upon deputy attorney general Rod Rosenstein.

After his appointment, however, it is Whitaker who will assume temporary oversight.

Who is Matt Whitaker?

Whitaker is a former attorney from Iowa, a Trump loyalist that the New York Times described as the White House’s “eyes and ears” in the Justice Department. He made a failed attempt to run for Senate in 2014.

He then served as executive director of conservative watchdog the Foundation for Accountability and Civic Trust (FACT). During that time he launched several attacks on former secretary of state Hillary Clinton, the president’s 2016 election Democratic rival, aligning himself with Trump’s position.

In a 2017 article for The Hill, he urged an investigation into Clinton’s ties to Ukraine and, in a press release for FACT, which stopped just short of calls to “lock her up,” Whitaker wrote of the “strong case to bring against” Clinton over her the use of private email servers.

“The most disturbing aspect of Hillary Clinton’s continued blame game is that she still doesn’t think there was anything wrong with recklessly handling highly sensitive and classified information,” he wrote.

Campaign in works for (too) long?– spring 2014, Clinton talking to JP about campaign chairmanhttp://t.co/Jc8gHATqeY pic.twitter.com/CEqVUeQmYZ

— Matt Whitaker

(@MattWhitaker46) April 12, 2015

Whitaker has also publicly slammed the Mueller’s investigation, even repeating the president’s famous “witch hunt” criticism. Now, Trump has trusted him with oversight of it.

In the month before the administration announced he would be joining the Justice Department, in September 2017, Whitaker penned a CNN op-ed blasting the scope of the Mueller investigation and Rosenstein’s oversight.

“It does not take a lawyer or even a former federal prosecutor like myself to conclude that investigating Donald Trump’s finances or his family’s finances falls completely outside of the realm of his 2016 campaign and allegations that the campaign coordinated with the Russian government or anyone else,” it reads. “That goes beyond the scope of the appointment of the special counsel.”

On Twitter, Whitaker has regularly pushed critical coverage of Mueller’s probe.

Worth a read. "Note to Trump's lawyer: Do not cooperate with Mueller lynch mob" https://t.co/a1YY9H94Ma via @phillydotcom

— Matt Whitaker

(@MattWhitaker46) August 7, 2017

Article is correct, it will be very difficult to ever see evidence discovered by #Mueller grand jury investigation https://t.co/aNKBmi5xI2

— Matt Whitaker

(@MattWhitaker46) August 17, 2017

Trump’s fondness for Whitaker became explicitly clear in September of this year, when it was revealed he was on Trump’s shortlist for White House Counsel. His name was also one of several thrown around that month as a possible replacement deputy attorney general, amid rumors that Rosenstein was going to be fired.

READ MORE:

CNN reporter’s microphone spat devolves into partisan fight online

Trump’s ‘hot White House’ claim gets roasted on Twitter

‘Games of Thrones’ stars respond to Trump’s ‘sanctions are coming’ meme

Then, last month, the Washington Post reported that Trump had chatted with Whitaker about replacing Sessions.

It’s not hard to track Whitaker’s rise to acting attorney general, but it’s interesting to note how his career promotions came his way the louder he publicly echoed the president’s own ideas.

from Ricky Schneiderus Curation https://www.dailydot.com/layer8/matt-whitaker-acting-attorney-general/

0 notes

Text

Paul Krugman Is Finally Right About Something: Government Violence

The way economist Paul Krugman sees it, “fiat currencies have underlying value because men with guns say they do.”

Chk-chk, boom!

No, we aren’t paraphrasing. Yes, that’s a DIRECT quote. Krugman actually spoke the truth for once.

It’s quite rare for someone to be so ridiculously bad at predictions and still be widely considered an “expert” but somehow, the disheveled New York Times columnist who was wrong about the Internet, wrong about the 2008 financial crisis, and wrong about Trump, is finally right about something.

Government violence is the only thing propping up the crusty Krugmans of the world.

The Keynesian con man, who incorrectly predicted on Election Day that Trump’s victory would immediately send the markets plunging, has a history of yelling at bitcoin. Not one to break his embarrassing streak of failure, the shyster continues to be wrong about cryptocurrency in general.

At this point, we can almost bet that if Krugman says something, the opposite is most likely true.

Like any other currency, bitcoin and other cryptos retain value because proponents put stock in what it has to offer. However, unlike fiat currency, bitcoin is a free market invention built upon the libertarian principle of decentralization—it can’t be propped up artificially by banks or governments.

As such, bitcoin does not suffer from the shortcomings of fiat currency, which can be very easily destabilized when the government decides to print more money, as is the case in Venezuela, Zimbabwe, and now Turkey. Indeed, bitcoin has become the preferred alternative for those living under these crumbling, centrally-planned economies.

In a recent article for The Gray Lady, the greasy Nobel Prize-winner expressed his views as a “crypto skeptic.” Much like earlier failed predictions of how the internet and Amazon would never take off, Krugman hilariously weighs in on subjects he demonstrates little understanding of.

He says his biggest issue with crypto stems from “transaction costs and the absence of tethering.” While it’s true to an extent that Bitcoin Core faces scaling challenges in terms of transaction fees, Bitcoin Cash, EOS, Monero and others are already poised to solve these issues.

The friction of doing business, as Krugman claims, is too high for crypto to be considered a viable alternative to government-backed currencies. Citing the history of fiat money, which began with the trade of precious metals, later devolving into the use of central bank notes, and finally to digital credit and debit transactions, the establishment mouthpiece illustrates his inability to see the bigger picture.

Whereas Krugman views bitcoin as a force immutable to change, proponents of blockchain technology know full well that the underlying networks supporting them will only continue to improve.

Krugman actually destroys his own arguments when he casually admits that governments “have occasionally abused the privilege of creating fiat money.”

He’s still either lying or confused, though. Governments don’t create money—central banks, empowered by government, do.

Yet, they “occasionally” abuse their privilege? More like since the beginning of central banking and every day since.

He claims that because banks are protecting their own reputations, people who use fiat don’t have to worry about seeing their purchasing power vanish the moment someone in charge decides to print more money.

Tell that to everyone living under the rule of Nicolas Maduro in Venezuela, where citizens saw the value of their hard-earned savings disappear overnight. Or, in every other country, including the US, where the purchasing power of the money has been slowly destroyed. Sad!

For example, compare what a silver dollar can still buy you today with what you get for one Federal Reserve Note. Over time, REAL money gets you at least five to ten times more food, five to ten times more gas, five to ten times more savings.

Much like feudalism, people who depend on centralized banking systems remain at the mercy of “benevolent dick-tators” who are expected to care about the masses. Corruption inevitably leads to economic recessions, or worse.

When hyperinflation arrives in the US and the dollar finally collapses under the weight of trillions in government debt, the effects will be unlike any depression in history.

In fact, this month, JP Morgan’s top “quant” analyst warned that the next crisis will include flash crashes and social unrest not seen in 50 years.

In contrast, cryptocurrencies exist as a safeguard against the widespread destruction of wealth and retain their value so long as people use it. While relatively unpredictable compared to the (so-far) stable decline of Federal Reserve Notes, cryptos are presently in a nascent stage where early adopters and those of us in-the-know (SUBSCRIBE) fully expect to profit from the fluctuating values.

As history itself shows, the value of these digital tokens will eventually stabilize following more widespread use from corporate and individual backers—a fact evident in bitcoin’s adoption by Microsoft, PayPal, Shopify and others.

The main problem holding back more companies from embracing the future standard of money is tax collectors (extortionists) and regulators (thugs) who remain keen to maintain the failing legacy system. The Powers That Shouldn’t Be desperately want to keep ultimate control in the hands of their fraudulent central bankers—the fat cats Krugman serves, who depend on shills like him to promote their worldwide enslavement.

Now the secret is out—they even admit it themselves! For decades, human parasites with guns have protected the US dollar’s value.

In the age of information, cryptography, and cyberwar, we’ll see how long their brutal plan holds up.

Stick with us at The Dollar Vigilante for the best financial news and investment ideas. TDV members were encouraged to buy Bitcoin back when it was $3 in 2011. Subscribe HERE for the inside scoop.

YouTube

553 Videos | 124,495 Subscribers

Upcoming Events

Precious Metals Investment Symposium

Start date: October 3, 2018

End date: October 4, 2018

More info

Australia's largest precious metals event Symposium is presenting the 8th Annual Precious Metals Investment Symposium. This 2-day investment and educational event is being held at the Pan Pacific Perth Hotel, on the 3rd-4th of October 2018.

The conference and exhibition brings together every aspect of the precious metals investment industry from mining explorers and producers, to bullion companies and other investment vehicles.

Keynote speakers from across the globe will present their views on the future for the sector and ASX listed mining companies will provide updates on investment opportunities.

About the Author

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and cryptocurrency conferences including his own, Anarchapulco, as well as regularly in the media including CNBC, Bloomberg and Fox Business. Jeff also posts exclusive content daily to the new blockchain based social media network, Steemit.

from The Dollar Vigilante https://dollarvigilante.com/blog/2018/09/18/paul-krugman-is-finally-right-about-something-government-violence.html via The Dollar Vigilante

0 notes

Text

Gold and Silver Hated Now, Cryptocurrencies Loved. The Debate Rages Onward, and Here’s a Solution!

by JS Kim, Founder of SmartKnowledgeU and skwealthacademy, this article was first posted at smartknowledgeu.com/blog on 1 June 2017.

As most of you know, the rise of the cryptocurrency has dominated financial headlines as of late, compelling many to comment on bulletin boards and message boards that they will never buy physical gold or physical silver ever again, and that from now on, it’s cryptocurrencies or bust! Given Bitcoin and Ether’s recent parabolic rise, strictly from a price standpoint, physical gold makes more sense as a a purchase at this current time than Bitcoin or Ether, though certainly given performance and the benefit of hindsight, buying Bitcoin and Ether at the start of the year made more sense than buying gold. But again this statement is only valid given the two entirely different purposes of buying gold and cryptocurrencies. And technically speaking, Ether, or Ethereum is not a cryptocurrency, but rather a token that user receive users for using their computing power to validate transactions and for helping pay for the development of the Ethereum network. As I will explain later in this article, even despite the massive parabolic rise in the price of BTC, if one were seeking to fulfill the very specific purpose that purchasing physical gold achieves in a wealth preservation plan, then purchasing gold over cryptocurrencies at the start of the year still would have made sense for a lot of people.

Those that have truly followed me this year, and not just read the occasional article I write about precious metals that is posted on ZeroHedge every several months, know that I have warned of big dips in spot gold and spot silver prices and advocated shorting paper gold and paper silver several times already this year, right before significant price dips materialized, as a means to protect oneself against banker price manipulations of spot PM prices. However, the current time is not one of them, as I believe the prices for both physical gold ($ 1258) and physical silver ($ 17.28) are solid long-term buys right now. However, this doesn’t mean there won’t be interim volatility in price, as in today’s Central Banker asset price-distorted world, volatility has become the norm, not the exception. For those that want to follow my opinion about PMs, you can do so on my Snapchat skwealthacademy channel, where I post snaps nearly every day, and very often discuss the state of PMs and to a lesser extent, cryptocurrencies.

Although many in the gold community do not like cryptocurrencies because they conveniently fit into the global banking cartel end goal of pushing society into wide acceptance of a 100% digital currencies, at this point, no one knows whether Bitcoin is part of the global banking cartel’s plan to take the world into 100% digital currency, including yours truly. Way back in 2012, I wrote that the banking cartel’s end game was clearly to gain control over every citizen’s financial life by eradicating the world of all paper currency and pushing wide acceptance of a 100% digital currency . It is of my opinion, that there is a possibility that bankers are behind either the development and/or marketing of Bitcoin, as acceptance of Bitcoin will help drive acceptance of the bankers’ end game of 100% eradication of paper money and 100% acceptance of digital currency across the world. I believe that my opinion is firmly in the minority, and many cryptocurrency supporters contend that there is zero possibility that Bitcoin was part of a banking project (by the way, if you keep reading, you will see that I discovered a new cryptocurrency I am backing for the long-term). However, in this debate, the only definitive conclusion that can be drawn is the following: without knowing the identity of the group of people known as Satoshi Nakamoto, no one can end this debate, so both sides of the debate at this point are based not on evidence, but pure speculation. The key to knowing which opinion is correct is unveiling the identity of Satoshi Nakaomoto beyond a shadow of a doubt, and is this is still an unknown today. Thus, one side cannot say “my lack of evidence supports my opinion more so than your lack of evidence”, which unfortunately, has evolved (or more appropriately “devolved”) into an argument that many people today utilize, and strongly believe, is perfectly valid, when in reality, such an argument is based entirely on emotion, irrationality and a lack of critical thought.

When one of my friends noticed that I was working on a piece about the cryptocurrency versus gold debate, he asked me, “Are you sure you want to publish that article and take on the crytpocurrency advocates, as they will heap scorn on you for doubting the anti-banking cartel nature of cryptocurrencies? That’s like trying to convince a hardcore vegan that eating meat is not evil. That takes a lot of courage.” To that, I replied, “First of all, I’m not belittling cryptocurrency advocates, because if you read the article after I publish it, you will see that I recently became aware of a brand-new crytprocurrency that I support. Secondly, it doesn’t take courage to express logical views, as that is all I am doing. Thirdly, I am not stating that Bitcoin advocates that believe BTC is independent of the global banking cartel are wrong. I am merely expressing reservations because no one has any evidence that is conclusive on either side of the debate. The flip side of that statement is that they may be right as well. To me it seems harmless to point out an indisputable fact, which is that hard conclusions should never be drawn from a lack of evidence, but this is routinely done.” I continued, “I know that people hate to deal with uncertainties, and will do anything to rid themselves of that uncertainty, which leads to many wrong conclusions. This is a fact propelled by many psychology studies, so when I point this out, I am again, just pointing out a fact. Just look at how financial markets deal with uncertainty. They don’t like it all. But that does not mean, because uncertainty exists, that one should make conclusions out of thin air to explain that uncertainty to get rid of it. To me, that is totally irrational. Yet the mainstream financial media does this on a daily basis with their headlines, To make my point, just go to YouTube and search for a topic called “demon magicians”, in which people claim that amazing magicians have sold their souls to the devil for powers to manipulate solid objects instantly into different states of matter, simply because they don’t know the tricks executed by these magicians to pull off their amazing illusions. I mean, there is a whole segment of people on YouTube that actually believe magicians are given powers by the devil, simply because of their desire to provide a certain explanation to a topic about which they are uncertain and can find zero evidence to explain the uncertainty. As mad as this sounds, this kind of irrationality persists in the financial world to, in mainstream financial media, to explain uncertain things whereby correlation for financial events are wrongly announced to the world as causation on a daily basis.”

It may be true that the global banking cartel’s iteration of their 100% digital currency will differ substantially from the cryptocurrencies of today, and that they were never involved in the development of BTC and other early-stage cryptocurrencies on the horizon, as even JP Morgan CEO Jamie Dimon publicly derided cryptocurrencies as fads that will not survive. In this article, Dimon stated, “No government will ever support a virtual currency that goes around borders and doesn’t have the same controls [as fiat currency]. It’s not going to happen”, convincing many that this was proof that the global banking cartel had no hand in the development of early crytpocurrencies like BTC, and that a definitive fork exists between early stage cryptocurrencies, outside-the-control of the global banking cartel, and other later-stage, ongoing developments of cryptocurrencies, under the auspices of the global banking cartel. However, one must be aware that bankers rarely ever tell the truth, and the same people that often deride 99% of Jamie Dimon’s statements will point to this particular Dimon statement as “proof” that early cryptocurrencies are independent of the global banking cartel.

For sure, there is a massive difference between “speculation” and “proof” and any statement uttered by Jamie Dimon lands squarely on the side of speculation and not fact, because as we well know, Alan Blinder, former Vice Chairman of the Federal Reserve Board of Governors, and Princeton University economist, infamously stated on a 1994 PBS television program, “The last duty of a Central Banker is to tell the public the truth.” For example, eight-months prior to Dimon’s issuance of that statement, Dimon already was building close connections to blockchain technology when JP Morgan executive Blythe Masters left his firm to head up Digital Assets Holdings, LLC, a blockchain development company that is currently working on blockchain technology for use in the Australian stock exchange. Furthermore, earlier this year, Dimon revealed that JP Morgan had built an Ethereum Alliance with other global banks and corporations to wield more influence over blockchain implementation and acceptance, an alliance that obviously was years in the planning. Understanding that JP Morgan was privately deeply involved in blockchain development at the same time their CEO was publicly deriding cryptocurrencies like BTC obviously exposes the disingenuous nature of Dimon’s comments, and furthermore, still does not discredit the possibility that a member of the global banking cartel had a hand in the development of BTC.

Dimon’s statement, once we know the dishonesty of it, could lead to an infinite number of interpretations. It could mean that BTC is a virtual currency outside the global banking system and that’s why Dimon derided it, because JP Morgan will only support a virtual currency that he controls. It could be controlled opposition, whereby JP Morgan bankers have secretly had a hand in the development and acceptance of BTC despite their publicly stated opposition, a ploy meant to throw people off the trail of their plan to financially subjugate humanity further as they push through acceptance of 100% digital currencies. Recall that when the Morgans, the Rothschilds, the Rockefellers, the Warburgs, etc. tried to establish another Central Bank in the United States after the charter of the First Bank (1791-1811) and Second Bank (1861-1836) of the United States was revoked, they initially failed, because 100 years ago, Americans were properly educated to understand that the establishment of a Central Bank was meant to enslave them. So what did the banking cartel do in response? By the Congressional record documented of US Congressman and Chairman of the Banking and Currency Committee Louis McFadden’s speeches, delivered on the floor of Congress in the 1930s, we know that, at first, bankers tried to fool Congress into voting for a bill to establish a Central Bank by lying to Congress about overwhelming public support that existed for a Central Bank, that was in fact, generally mild and tepid at best. McFadden stated, “It has been said that the draughts man who was employed to write the text of the Aldrich bill because that had been drawn up by lawyers, by acceptance bankers of European origin in New York. It was a copy, in general a translation of the statues of the Reichsbank and other European central banks. One-half million dollars was spent on the part of the propaganda organized by these bankers for the purpose of misleading public opinion and giving Congress the impression that there was an overwhelming popular demand for it and the kind of currency that goes with it.”

Paul M. Warburg, who represented the Rothschild bankers, and whom many claim as the key figure in bringing the US Federal Reserve into existence, shed additional light into the banking cartel’s propaganda campaign in his deliverance of a speech to the New York YMCA on 23 March, 1910, in which he insisted that a national reserve bank would not be “controlled by Wall Street or any monopolistic interest”, explaining that the words “Central Bank” should be avoided, as he was not proposing a monopolistic Central Bank, but rather a decentralized national bank with 4 regional reserve banks, even though this was a complete lie and power was centralized in the New York Federal Reserve branch, after the establishment of the Federal Reserve in 1913, as it still is today. Bankers presented the exact same, monopolistic centralized bank a second time to US Congress, this time posing as a decentralized “federal” bank on the side of the people as opposed to a Central Bank that would work against the people’s best interests, and with this fake narrative, US Congress voted it into existence. This was the use of controlled opposition at its best, publicly pretending to be on the side of the people while privately working against the people’s best interests. Since bankers have a history of such deviant acts of convincing the public to support financial instruments that they would then later us to control humanity, to dismiss the possibility that they could be using cryptocurrencies in the same manner would be reckless. Thirdly, there is a possibility that global banks other than JP Morgan had a hand in developing BTC, thus compelling Dimon to denigrate BTC in favor of the digital currency that JP Morgan will eventually back. Again, all the above are possibilities, the validity of all unknown, none provable, no one possibility stronger than any other, and none ably dismissed.

No matter which of the above possibilities are true, the rise of cryptocurrencies are rapidly spreading acceptance of the global banking cartel’s push to create a world without any paper money and with only 100% digital money. There is, by no means, a clean a divide between the PM and cryptocurrency communities as agitators try to delineate, as there are also many in the PM community that hold both PMs and cryptocurrencies. Up to this point in this article, I have merely relayed my opinion and relayed the possibilities behind the origins of BTC, but I will explain later in this article, why my belief and the numerous possibilities I presented above may very well be irrelevant in the debate about the future of cryptocurrencies. In today’s world, we allow others to manipulate us like a herd of cattle into taking divisive, opposition sides, both sides often based on zero evidence, as we live in a world where the financiers of every nation have made it unacceptable for us not to take a side and to simply admit facts, that some things remain unknown. Today, a lot of anger is fomented seemingly on every topic, whether religion, politics or finance, often successfully conjured up even amidst a complete absence of evidence and facts. In any event, I thought it would be an illuminating exercise to sift through the comment section of a recent ZeroHedge bitcoin article, simply because it may be a useful discourse to provide a little bit of clarity to some misunderstandings and anger (that should not exist) about the ongoing raging PM versus Bitcoin debate. I am going to paraphrase the most popular comments below.

FIVE FALSE DIVISIONS BETWEEN GOLD AND CRYPTOCURRENCY COMMUNITIES

(1) One Has to Choose Between Gold and Cryptopcurrencies

This opinion is definitely not true, as I know plenty of people that own both cryptocurrencies and gold and this divide should not exist. As long as one recognizes that the purchase of gold and the purchase of cryptocurrencies serve very different purposes, one can buy both to fill these two very different goals. Despite the belief of many that prices of cryptocurrencies are out of the control of the bankers, but the price of gold is not, and this is a critical factor that separates cryptocurrencies from gold, this belief is only partially true. Paper gold trading is in control of the bankers. Physical gold trading is not. This is why, in parts of the world plagued by financial instability, premiums for physical gold will soar enormously higher than the artificially banker-set paper/digital price of gold. For example, the price of BTC, due to a recent feeding frenzy in Korea recently soared above USD$ 3,000. However, even though speculators foolish enough to chase BTC and pay $ 3,000 per BTC in South Korea existed, I snapchatted screenshots of BTC dealers in South Korea during this buying frenzy on my Snapchat channel that illustrated decent supply of BTCs in South Korea at just a slight premium over Western market prices, so the $ 3,000 BTC purchases that hit the market in South Korea were executed by people that did not shop around on various exchanges for a much better price that was clearly available.

An analogous situation was recently observed in the physical gold market as well. When PM Narendra Modi initially banned the 500 and 1000 rupee note in India, the price of physical gold soared well over $ 2,000 an ounce in India, with some unconfirmed reports of gold hitting prices of more than $ 3,000 an ounce in Indian black markets. Did people that payed $ 2,500 or $ 3,000 an ounce for physical gold have to spend this amount? Certainly not, and these prices only hit because people panic bought during a buying frenzy instigated by rupee uncertainty and the Indian Prime Minister’s attempt to demonetize gold. At the time of the physical gold buying frenzy, the spot price of gold was roughly $ 1,220. However, this incident illustrated that during a fiat currency crisis, bankers can continue to control and suppress paper/digital gold prices, but they have no control over suppressing soaring physical gold prices caused by high physical demand and tight supply during a financial crisis. In any event, if one wants to purchase both, one should understand, from the hugely different levels of volatility in gold prices versus cryptocurrency prices, that gold should be purchased to preserve purchasing power over time, while cryptocurrencies should be purchased for highly speculative returns Again, two different currencies serve two entirely different purposes.

(2) I Made a Ton of Money on Cryptocurrencies, But Have Lost a Ton on Gold, So I’m Never Buying Gold Again!

This statement is all about timing, as if anyone buys at a short-term buying frenzy during a long bull market, then one has a much greater chance of sitting on losses a few years later. However, timing on buying gold was not particularly difficult during this current bull run of 17 years now and here are indisputable facts to back up this statement. If one purchased gold at the start of 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, and 2016, one would have ended the year in the black every single one of those years. Furthermore, during the past 17 years, including this one, if one purchased gold at the very beginning of the year in 14 of the past 17 years, one would still be profitable at today’s price, and extremely profitable if one had purchased physical gold in the early portion of this timeline. The reasons that made gold a strong purchase during 2001 are the exact same reasons that make gold a strong purchase today, so for someone that understood the real reasons to buy gold versus chasing a speculative rise, one was much more likely to have bought and hold physical gold during the early years of this cycle and added more on every severe dip, thus still maintaining a nice average buy-in price over this time frame.

Even though gold is volatile, it hasn’t been difficult, despite contrary belief, to manage the volatility when buying physical gold for the past 17 years, and the timing of when to buy physical gold has not been particularly difficult to ensure a profit over this time period as well, as only buying at the start of 3 of the past 17 years would have resulted in losses by the end of the year, and only buying at the start of 3 of the past 17 years are still yielding losses at the present time. And unless you purchased gold during the worst 28-months out of a nearly 200-month timeline, most likely you are heavily in the black right now or about to be back in the black again. Likewise, if anyone chased Bitcoin in South Korea and bought it at an absolute short-term peak at USD$ 3,000, as some have, then there is no one to blame but themselves when they were sitting on an almost immediate 36% loss just a couple of days later. While certainly, in hindsight, it may have been easier to buy Bitcoin at nearly any point on its bullish timeline, versus gold, and still be profitable today, no one should expect parabolic price rises to be the norm for Bitcoin, and prices will likely remain very volatile until they stabilize in the future.

(3) I Don’t Want to Carry Gold Around. There’s No Digital Gold, and Digital Currencies Are a Ton More Convenient to Use than Gold.