Video

youtube

Retirement Strategy in Nigeria - Rich Retirement Planning in Nigeria

https://bibiapampa.info/peaceful-retirement-planning/ for more information on How to Become Wealthy Heathy and Wise, Succeed Excel and Prosper in Life while Building Wealth and Multiple Streams of Income for a Peaceful and Rich Retirement

0 notes

Text

Top 20 Famous Female Motivational Speakers in Nigeria

20 Famous Female Motivational Speakers in Nigeria

The Rise of Female Motivational Speakers in Nigeria

What Makes Female Nigerian Motivational Speakers Stand Out?

1. Ibukun Awosika

2. Tara Fela-Durotoye

3. Bibi Apampa

4. Chimamanda Adiche

5. Nike Adeyemi

6. Joke Silva

7. Stephanie Obi

8. Olajumoke Olufunmilola Adenowo

9. Patricia Ikiriko

10. Nimi Akinkugbe

11. Ifeoma Fafunwa

12. Adesuwa Onyenokwe

13. Bolanle Olukanni

14. Bunmi George

15. Adenike Oyetunde

16. Juliet Ehimuan Chizor

17. Yetunde Odugbesan-Omede

18. Temitope Olagbegi

19. Oluwatoyin Sanni

20. Abisoye Ajayi-Akinfolarin

#motivational speaker nigeria#retirerich#retireearly#8incomestreams#business#retirement#retirementqueen#retirement business#retirement planning#motivational#inspirational#life lessons#motivation

0 notes

Video

youtube

Regret of Retirees - Challenges in Retirement

https://BibiApampa.info for more information on How to Become Wealthy Heathy and Wise, Succeed Excel and Prosper in Life while Building Wealth and Multiple Streams of Income for a Peaceful and Rich Retirement

https://bibiapampa.info/peaceful-retirement-planning/ for more information and free Training / workshop on Rich Retirement Planning with multiple income streams.

The Retirement Queen - Bibi Apampa (https://www.RetirementQueen.net ) will Prepare You for a Flourishing Rich Peaceful Early Retirement It doesn't take an age to retire it takes wisdom information and money

https://8incomestreams.co - Learn how to Build and Grow 8 Streams of Income from home

0 notes

Video

youtube

Bibi Apampa Retirement Consultant in Nigeria - Financial Advisor Nigeria

https://BibiApampa.info for more information on How to Become Wealthy Heathy and Wise, Succeed Excel and Prosper in Life while Building Wealth and Multiple Streams of Income for a Peaceful and Rich Retirement

https://bibiapampa.info/peaceful-retirement-planning/ for more information and free Training / workshop on Rich Retirement Planning with multiple income streams.

The Retirement Queen - Bibi Apampa (https://www.RetirementQueen.net ) will Prepare You for a Flourishing Rich Peaceful Early Retirement It doesn't take an age to retire it takes wisdom information and money

https://8incomestreams.co - Learn how to Build and Grow 8 Streams of Income from home

0 notes

Video

youtube

Why work with Retirement Queen Bibi Apampa - Top Retirement Consultant

https://bibiapampa.info/peaceful-retirement-planning/ for more information and free Training on Rich Retirement Planning with multiple income streams.

0 notes

Text

The Basics of Retirement Planning in Nigeria

Retirement planning can seem like a daunting task, but it's essential for ensuring a secure financial future.

Whether you're just starting your career or approaching retirement age, it's never too early or too late to start planning. In this article, we'll cover the basics of retirement planning in Nigeria to help you get on the path to a comfortable and peaceful retirement.

1. Set goals and create a plan

The first step in retirement planning is setting goals for a peaceful retirement in Nigeria with a plan.

You need to create 4 plans

*The Transition Plan – which makes your transition to retired life a pleasure

*The Wealth Building Plan – builds the peace of mind that comes from knowing you and your family won't have to worry about money during your golden years in retirement

* The Healthy and Fit for Life Plan – what you need to know for good health and healing throughout your life

* The Wisdom Plan – everything you need legally, spiritually and emotionally for a happy, serene retirement

These four plans will help you cope with the challenges of Retirement while building sustainable multiple streams of income for a wealthy, healthy, wise and peaceful retirement

2. Determine how much money you need to save to live the lifestyle you want in retirement.

It's essential to be realistic and take into account factors such as inflation, healthcare costs, and unexpected expenses. Once you have a goal in mind, create a plan to achieve it.

Set up your retirement savings account plus a personal investment plan and contribute regularly. Consistency is key when it comes to retirement planning. Even small contributions to your retirement accounts can add up over time. Start saving as early as possible to give your money more time to grow. Set up automatic contributions to your retirement accounts to ensure you are saving regularly.

3. Consider your living expenses

In retirement, where you'll live and how much it will cost.

One of your goals as you plan your retirement should be to live in your own mortgage free home. It is important so you can retire without worrying about where to live

A good Financial Retirement Plan can be broken down into three main phases:

*accumulation,

*preservation, and

*distribution.

The accumulation phase is where you build up your retirement savings, while the preservation phase involves protecting those savings and ensuring they continue to grow. The distribution phase is when you start using your retirement savings to cover your living expenses.

During the accumulation phase, it's important to determine your retirement goals and create a plan to achieve them. You'll need to consider factors such as your desired retirement lifestyle, healthcare costs, and inflation. Determine how much you need to save to meet your retirement goals, and create a plan to contribute regularly to your retirement accounts.

The preservation phase involves protecting your retirement savings and ensuring they continue to grow. This includes monitoring your investments and making adjustments as needed. It's important to maintain a diversified portfolio that balances risk and return.

The distribution phase is when you start using your retirement savings to cover your living expenses. It's essential to plan for how you'll withdraw your money, taking into account factors such as taxes and required minimum distributions. Work with a financial advisor to create a plan that ensures your retirement savings last throughout your lifetime.

4. Retirement Activity - Monitor your plan regularly incorporating what you'll be doing in retirement

Your retirement plan should be a living document that you update regularly. As your life circumstances change, such as a job change or a new child, make adjustments to your retirement plan.

What will you be doing in Retirement - a business? volunteer work? Travelling? It is important to plan ahead. Many individuals who retire without knowing what to do in Retirement end up sick, depressed and disappointed

Start learning, get trained and make wise investments towards what you'll be doing in retirement

6. Staying healthy and Fit is another goal that must be incorporated into your Retirement plan which is easy if you use the acronym EAT

* Eat Differently - Good diet & food choices

* Act Differently - Incorporating fitness and exercise routine into your daily schedule

* Think Differently - Lifestyle choices by avoiding stress, pollution, noise and toxic relationships

In conclusion, retirement planning in Nigeria is essential for a secure financial and peaceful future.

Determine your retirement goals, choose the right retirement accounts, contribute regularly, take advantage of employer contributions, consider your living expenses, and monitor your plan regularly. By following these basic steps, you can create a retirement plan that gives you the security and peace of mind you deserve.

Finally, remember that retirement planning is an ongoing process. Review and update your retirement plan regularly to ensure you're on track to meet your goals. And if you're behind on saving for retirement, don't panic. It's never too late to start. Work with a financial advisor or The Retirement Queen to create a plan that helps you catch up and achieve your retirement goals. With proper planning and discipline, you can retire comfortably and enjoy the fruits of your labor.

Article by Bibi Apampa The Retirement Queen Nigeria at www.RetirementQueenNigeria.com

#retirementplanning#financialeducation#financialgrowth#financialadvisor#retireyoungretirerich#retirementplan#retireearly#retirementqueen#retirementplannigeria#retirementsavings#retirement Nigeria#bibiapampa#retirementqueennigeria

https://BibiApampa.info

#retireearly#retirerich#8incomestreams#business#earnmoney#bibiapampa#retire early#retirement#retirement planning#retirement business#retirementplan#retirementqueen

0 notes

Text

Go to https://8incomestreams.co for more information

https://RetirementQueen.net

#retireearly#retirerich#8incomestreams#business#earnmoney#retirementqueennigeria#retirement business#retirementqueen

0 notes

Video

youtube

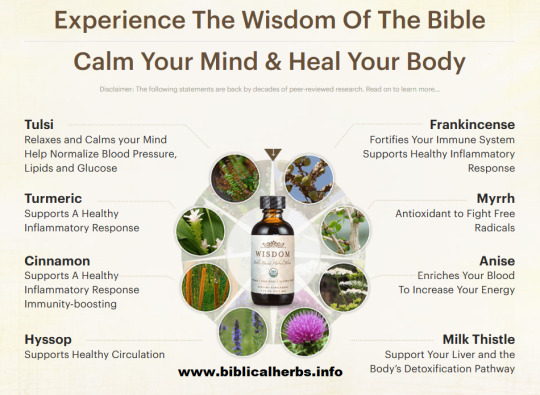

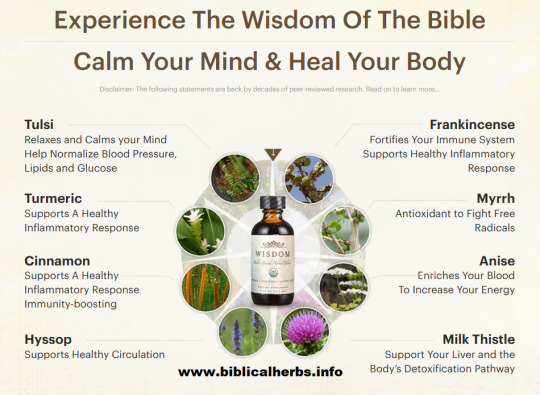

Biblical herbs - Exploring the Health Benefits of Biblical Herbs

Biblical herbs carry with them a rich heritage of wisdom and holistic health benefits. From Tulsi's calming effects to Frankincense's immune support, Cinnamon's flavor-enhancing properties, and Myrrh's antioxidant prowess, each herb offers unique advantages for our overall well-being. Exploring the potential of these ancient herbs in conjunction with modern scientific research can unlock a world of health benefits. Embrace the power of biblical herbs and embark on a journey toward a healthier, more balanced life.

Thank you for joining us today as we explored the benefits of biblical herbs in Wisdom Nutrition's supplements available at www.biblicalherbs.info

The Significance of Biblical Herbs: Biblical herbs hold a special place in history, culture, and spirituality. These herbs were not only used for culinary purposes but were also revered for their medicinal qualities. From Tulsi and Frankincense to Cinnamon and Myrrh, each herb has its unique properties and potential health benefits.

Tulsi: The Holy Basil: Tulsi, also known as Holy Basil, is a sacred herb in Hinduism and Ayurveda. It is renowned for its calming effects on the mind and body. Tulsi contains compounds that help reduce stress, promote relaxation, and improve overall mental well-being. Additionally, it may assist in normalizing blood pressure, lipids, and glucose levels, making it a valuable herb for cardiovascular health.

Frankincense: The Resin of Wellness: Frankincense has a rich history and is often associated with religious rituals. This aromatic resin offers numerous health benefits, including immune system support and promoting a healthy inflammatory response. Frankincense contains compounds that may enhance cellular health, reduce inflammation, and support overall vitality.

Cinnamon: The Spiced Healer: Cinnamon, a beloved spice, holds a prominent place among biblical herbs. It is not only a flavorful addition to dishes but also boasts impressive health benefits. Cinnamon has been linked to supporting a healthy inflammatory response, which is crucial for maintaining overall wellness. Furthermore, its immune-boosting properties make it a valuable herb for promoting a robust defense system.

Myrrh: The Ancient Antioxidant: Myrrh, with its rich aroma and historical significance, offers potent antioxidant properties. This biblical herb helps combat free radicals, which contribute to cellular damage and aging. Myrrh has been traditionally used to promote overall health, support the body's natural defense system, and aid in the rejuvenation of various bodily systems.

Turmeric: The Golden Wonder: Turmeric, a vibrant golden spice, has gained immense popularity for its health benefits in recent years. It contains a powerful compound called curcumin, known for its antioxidant and anti-inflammatory properties. Turmeric supports a healthy inflammatory response, contributes to joint health, and promotes overall well-being.

Sage: The Wisdom Herb: Sage is a biblical herb known for its medicinal and spiritual significance. It is believed to have antioxidant, anti-inflammatory, and antimicrobial properties. Sage has been used traditionally to improve digestion, enhance memory, and promote overall cognitive function.

Garlic: The Healing Bulb: Garlic, although not explicitly mentioned in biblical texts, has been widely used for its medicinal properties since ancient times. It is known for its antibacterial, antifungal, and antiviral properties. Garlic also offers cardiovascular benefits, immune support, and potential anticancer effects.

Rosemary: The Herb of Remembrance: Rosemary is a fragrant biblical herb associated with remembrance and cognitive enhancement. It contains compounds that may have antioxidant, anti-inflammatory, and antimicrobial properties. Rosemary has been used historically to support digestion, improve memory, and promote hair and skin health.

Anise: Another biblical herb, brings a unique set of benefits. It is believed to enrich your blood, potentially increasing your energy levels. This herb has been used historically for its properties related to blood circulation and overall vitality.

Hyssop: Let's now explore the benefits of Hyssop, an herb mentioned in biblical texts. Hyssop supports healthy circulation, aiding in the efficient transport of nutrients throughout the body. It has been valued for its potential to promote cardiovascular health and overall well-being.

Milk Thistle: A herb that has been used for centuries to support liver health and the body's detoxification pathway. It contains a compound called silymarin, known for its antioxidant properties and potential to promote liver function.

Conclusion: Biblical herbs carry with them a rich heritage of wisdom and holistic health benefits. From Tulsi's calming effects to Frankincense's immune support, Cinnamon's flavor-enhancing properties, and Myrrh's antioxidant prowess, each herb offers unique advantages for our overall well-being. Exploring the potential of these ancient herbs in conjunction with modern scientific research can unlock a world of health benefits. Embrace the power of biblical herbs and embark on a journey toward a healthier, more balanced life.

Thank you for joining us today as we explored the benefits of biblical herbs in Wisdom Nutrition's supplements available at www.biblicalherbs.info

0 notes

Text

Exploring the Power of Biblical Herbs: Unlocking their Health Benefits

Exploring the Power of Biblical Herbs: Unlocking their Health Benefits

Table of Contents:

Introduction

The Significance of Biblical Herbs

Tulsi: The Holy Basil

Frankincense: The Resin of Wellness

Cinnamon: The Spiced Healer

Myrrh: The Ancient Antioxidant

Turmeric: The Golden Wonder

Sage: The Wisdom Herb

Garlic: The Healing Bulb

Rosemary: The Herb of Remembrance

Anise: Enrich blood & Energy Levels

Hyssop: Healthy Circulation

Milk Thistle: Detoxification & Antioxidant

Conclusion

Introduction: Biblical herbs have been treasured for centuries for their remarkable healing properties and holistic benefits. These ancient herbs, mentioned in religious texts and historical documents, continue to captivate modern-day researchers and health enthusiasts alike. In this article, we will take a deep dive into the world of biblical herbs, shedding light on their health benefits and exploring how they can contribute to our overall well-being.

The Significance of Biblical Herbs: Biblical herbs hold a special place in history, culture, and spirituality. These herbs were not only used for culinary purposes but were also revered for their medicinal qualities. From Tulsi and Frankincense to Cinnamon and Myrrh, each herb has its unique properties and potential health benefits.

Tulsi: The Holy Basil: Tulsi, also known as Holy Basil, is a sacred herb in Hinduism and Ayurveda. It is renowned for its calming effects on the mind and body. Tulsi contains compounds that help reduce stress, promote relaxation, and improve overall mental well-being. Additionally, it may assist in normalizing blood pressure, lipids, and glucose levels, making it a valuable herb for cardiovascular health.

Frankincense: The Resin of Wellness: Frankincense has a rich history and is often associated with religious rituals. This aromatic resin offers numerous health benefits, including immune system support and promoting a healthy inflammatory response. Frankincense contains compounds that may enhance cellular health, reduce inflammation, and support overall vitality.

Cinnamon: The Spiced Healer: Cinnamon, a beloved spice, holds a prominent place among biblical herbs. It is not only a flavorful addition to dishes but also boasts impressive health benefits. Cinnamon has been linked to supporting a healthy inflammatory response, which is crucial for maintaining overall wellness. Furthermore, its immune-boosting properties make it a valuable herb for promoting a robust defense system.

Myrrh: The Ancient Antioxidant: Myrrh, with its rich aroma and historical significance, offers potent antioxidant properties. This biblical herb helps combat free radicals, which contribute to cellular damage and aging. Myrrh has been traditionally used to promote overall health, support the body's natural defense system, and aid in the rejuvenation of various bodily systems.

Turmeric: The Golden Wonder: Turmeric, a vibrant golden spice, has gained immense popularity for its health benefits in recent years. It contains a powerful compound called curcumin, known for its antioxidant and anti-inflammatory properties. Turmeric supports a healthy inflammatory response, contributes to joint health, and promotes overall well-being.

Sage: The Wisdom Herb: Sage is a biblical herb known for its medicinal and spiritual significance. It is believed to have antioxidant, anti-inflammatory, and antimicrobial properties. Sage has been used traditionally to improve digestion, enhance memory, and promote overall cognitive function.

Garlic: The Healing Bulb: Garlic, although not explicitly mentioned in biblical texts, has been widely used for its medicinal properties since ancient times. It is known for its antibacterial, antifungal, and antiviral properties. Garlic also offers cardiovascular benefits, immune support, and potential anticancer effects.

Rosemary: The Herb of Remembrance: Rosemary is a fragrant biblical herb associated with remembrance and cognitive enhancement. It contains compounds that may have antioxidant, anti-inflammatory, and antimicrobial properties. Rosemary has been used historically to support digestion, improve memory, and promote hair and skin health.

Anise: Another biblical herb, brings a unique set of benefits. It is believed to enrich your blood, potentially increasing your energy levels. This herb has been used historically for its properties related to blood circulation and overall vitality.

Hyssop: Let's now explore the benefits of Hyssop, an herb mentioned in biblical texts. Hyssop supports healthy circulation, aiding in the efficient transport of nutrients throughout the body. It has been valued for its potential to promote cardiovascular health and overall well-being.

Milk Thistle: A herb that has been used for centuries to support liver health and the body's detoxification pathway. It contains a compound called silymarin, known for its antioxidant properties and potential to promote liver function.

Conclusion: Biblical herbs carry with them a rich heritage of wisdom and holistic health benefits. From Tulsi's calming effects to Frankincense's immune support, Cinnamon's flavor-enhancing properties, and Myrrh's antioxidant prowess, each herb offers unique advantages for our overall well-being. Exploring the potential of these ancient herbs in conjunction with modern scientific research can unlock a world of health benefits. Embrace the power of biblical herbs and embark on a journey toward a healthier, more balanced life.

Thank you for joining us today as we explored the benefits of biblical herbs in Wisdom Nutrition's supplements available at www.biblicalherbs.info

Remember, before incorporating any new herbs or supplements into your routine, it is always advisable to consult with healthcare professionals or herbal experts to ensure they align with your specific needs and potential interactions with existing medications.

#biblical herbs#Wisdom#Nutrition#supplements#health benefits#Tulsi#Frankincense#Turmeric#Myrrh#Cinnamon#Anise#Hyssop#Milk Thistle#overall well-being#immune support#healthy#inflammatory response#antioxidant properties#ancient wisdom#modern nutrition#healthcare professional#supplements.

0 notes

Text

youtube

Retirement Planning 101: A Journey to Peace and Fulfilment in Nigeria

· Planning Your Retirement in Nigeria

· Retirement Saving Tips

· The Benefits of Early Retirement

· Best Investments for Retirement

· Finding Your Retirement Purpose

· Creating a Retirement Bucket List

· Retiring with Dignity

· Retirement Business

· Common Retirement Mistakes to Avoid

· Time Management in Retirement

· How to Make the Most of Your Retirement Years

· The Importance of Estate Planning

Retirement is not merely the end of a career; it marks the beginning of a new chapter in life—a chapter filled with peace, fulfilment, and the opportunity to pursue lifelong dreams. In Nigeria, retirement holds great significance, as it provides a chance to savour the fruits of your labour and embrace a life of tranquillity.

In this article, we will explore various aspects of retirement in Nigeria and provide valuable insights to help you plan for a fulfilling and prosperous retirement journey.

Planning Your Retirement in Nigeria: Proper retirement planning is crucial to ensure financial stability and security in your golden years. Start by evaluating your current financial situation, estimating your retirement expenses, and setting realistic goals. Consider consulting with financial advisors like the Retirement Queen Nigeria who specialize in retirement planning in Nigeria. They can guide you in creating a tailored plan that aligns with your aspirations and helps you navigate through the complexities of retirement.

Retirement Saving Tips: Saving for retirement is a long-term commitment that requires discipline and foresight. Begin saving early and make consistent contributions to your retirement fund. Explore investment options such as pension schemes, mutual funds, or individual retirement accounts. Maximize the benefits of employer-sponsored retirement plans and take advantage of any matching contributions. Be mindful of your expenses and adopt a frugal mindset to save diligently for a secure future.

The Benefits of Early Retirement: Early retirement offers numerous advantages, including the freedom to pursue personal interests and enjoy a longer period of leisure. It allows you to embark on new ventures, travel, or spend quality time with loved ones. However, early retirement requires meticulous planning and ensuring that you have sufficient funds to sustain your lifestyle over an extended period. Evaluate your financial readiness, consider the potential impact on your pension benefits, and consult with professionals to make informed decisions regarding early retirement.

Best Investments for Retirement: Choosing the right investments for retirement can provide a steady income stream and help grow your wealth. Consider diversifying your portfolio by investing in a mix of assets such as stocks, bonds, real estate, and mutual funds. Explore government pension schemes, which offer attractive returns and tax benefits. Consult with financial advisors who specialize in retirement investments in Nigeria like The Retirement Queen Nigeria to tailor an investment strategy that aligns with your risk tolerance and financial goals.

Finding Your Retirement Purpose: Retirement presents an opportunity to rediscover your passions, explore new interests, and find your sense of purpose. Reflect on your values, talents, and aspirations to identify activities that bring joy and fulfillment. Consider volunteering, mentoring, pursuing hobbies, or starting a second career that aligns with your interests. Engaging in meaningful activities enhances your overall well-being and provides a sense of purpose during retirement.

Creating a Retirement Bucket List: A retirement bucket list encompasses the experiences, goals, and adventures you wish to accomplish during your retirement years. Write down your aspirations, whether it's traveling to exotic destinations, learning a new skill, or embarking on a personal development journey. A retirement bucket list keeps you motivated, encourages you to embrace new experiences, and adds excitement to your retirement years.

Retiring with Dignity: Retiring with dignity means having the financial resources to maintain your desired lifestyle and fulfill your needs and aspirations. It involves careful planning and a commitment to financial discipline. Prioritize your retirement savings, manage debts wisely, and explore income-generating opportunities post-retirement. Consider consulting with retirement coaches like The Retirement Queen Nigeria, or experts who can provide guidance on maintaining your financial well-being and dignity throughout retirement.

Retirement Business: Starting a retirement business can be an exciting endeavor that combines passion and entrepreneurship. Assess your skills, interests, and market opportunities to identify potential business ventures. Whether it's consulting, freelance work, or establishing a small business, entrepreneurship in retirement can generate income, provide mental stimulation, and keep you actively engaged in the business world.

Common Retirement Mistakes to Avoid: Avoiding common retirement mistakes can save you from financial stress and uncertainty. Some common pitfalls include underestimating retirement expenses, failing to save enough, neglecting healthcare costs, and overlooking inflation. Another common mistake is using your gratuity to invest or start a business you know nothing about it. Please take out time to learn everything about the business before investing your money in it Plan ahead, save diligently, and seek professional advice to avoid these mistakes. Be proactive in managing your finances and continually review your retirement plan to ensure it remains on track.

Time Management in Retirement: Effective time management is crucial for a fulfilling retirement. Plan your days, set goals, and establish routines that allow you to maintain a healthy balance between leisure activities, personal pursuits, and social engagements. Prioritize activities that bring you joy, while also allowing time for relaxation and self-care. Be intentional with your time and create a harmonious retirement lifestyle that accommodates your interests and obligations.

How to Make the Most of Your Retirement Years: Retirement is an opportunity to embrace new experiences, fulfill long-held dreams, and live life to the fullest. Consider engaging in activities that bring you joy and purpose. Travel to destinations you've always wanted to explore, pursue hobbies and passions, volunteer for causes close to your heart, and spend quality time with loved ones. Prioritize your physical and mental well-being by maintaining a healthy lifestyle. Embrace the freedom retirement offers and make the most of every precious moment.

The Importance of Estate Planning: Estate planning is a critical aspect of retirement that ensures the smooth transfer of your assets and the protection of your loved ones' financial well-being. Consult with estate planning professionals to create a comprehensive plan that includes a will, trusts, and powers of attorney. Consider the implications of estate taxes and plan accordingly. By addressing estate planning early on, you can secure your legacy and provide peace of mind for yourself and your family.

Retirement in Nigeria is a journey that offers opportunities for peace, fulfilment, and personal growth. Plan your retirement diligently, save wisely, and retire with dignity. Embrace the benefits of early retirement and explore new avenues for personal fulfilment. Discover your retirement purpose, consider starting a retirement business, manage your time effectively, and create a retirement bucket list that reflects your dreams and aspirations.

In conclusion, retirement in Nigeria is not just about enjoying your golden years; it's about making wise investment decisions, avoiding common retirement mistakes, maximizing your retirement years, and prioritizing estate planning. Explore the best investment options available, seek professional advice, and create a diversified portfolio that suits your needs. Learn from the mistakes of others and plan diligently to ensure a financially secure retirement. Embrace the opportunities retirement brings, make the most of your time, and remember the importance of estate planning to protect your assets and secure your legacy.

May your retirement journey in Nigeria be filled with peace, prosperity, joy, contentment, and the fulfilment of your lifelong desires.

Article by Bibi Bunmi Apampa, “The Retirement Queen” retirement wealth strategist and high-performance business coach she can be reached at http://RetirementPlanNigeria.com for the best retirement course in Nigeria

#retireearly#retirerich#8incomestreams#retirement business#retirement#retirement planning#retirement wealth#retirementplan#retirement queen#retirementnigeria#retirementplanningnigeria#Youtube

0 notes

Text

Retirement Course Nigeria

Building Retirement Wealth - The Best Pre-Retirement Course in Nigeria - Experience a Lifetime of Financial Freedom!

Lagos, Nigeria – MyRetirementWealth.com, a leading financial education company, is proud to announce the launch of their new course, Building Retirement Wealth anchored by The Retirement Queen, Bibi Apampa.

Building Retirement Wealth Workshop is the best pre-retirement course in Nigeria, designed to help Nigerians achieve financial freedom and experience a lifetime of abundance in retirement

This program is designed to equip Nigerians planning to retire in 3-7years with the knowledge and skills needed to achieve financial freedom and experience a lifetime of abundance.

At MyRetirementWealth.com, we believe that retirement should be a time to enjoy life to the fullest. Unfortunately, many people in Nigeria today face uncertainty and anxiety about their retirement due to lack of financial planning. That is why Building Retirement Wealth was created - a comprehensive course that covers everything needed to retire with confidence and multiple streams of income.

With Building Retirement Wealth, individuals will learn how to build 15 types of wealth, create, and grow multiple income streams, passive income strategies, retirement business, financial planning and investment options, and estate planning. But that is not all! The course also includes four valuable bonuses:

Workable and tested strategy to generate five to six figures extra income monthly

Personalized 5-year financial freedom plan

Support to become a published author on Amazon

Assistance to build and grow your personal brand

At MyRetirementWealth.com, it is understood that retirement can be a daunting prospect, but it does not have to be. With Building Retirement Wealth course, individuals will be equipped with the tools to create a sustainable income and retire with peace of mind. Imagine waking up every day, knowing that the financial future is secure and individuals can enjoy the retirement they deserve.

The mission is to empower Nigerians to take control of their financial future and retire with peace of mind. Building Retirement Wealth is available online at MyRetirementWealth.com.

Building Retirement Wealth also employs cutting-edge Neuro Linguistic Programming techniques to create a community aspect. This ensures that participants have the support and resources they need to succeed. The course is designed to provide a personalized and engaging experience, empowering individuals to take control of their financial future.

Experienced and certified Wealth and Business coaches with Neuro Linguistic Programmers and Sales Trainers have designed this program with the success of the workshop attendees in mind. The goal is to help create a sustainable income stream that will enable individuals to retire with confidence and enjoy the retirement deserved

Enrolling in Building Retirement Wealth is easy and convenient. The course is available online at MyRetirementWealth.com, and can access it from anywhere in Nigeria from the comfort the home. With the easy-to-follow modules, one can learn at own pace while getting the knowledge needed to retire with confidence.

"We are thrilled to launch Building Retirement Wealth, which is a game-changer for individuals planning to retire in Nigeria," said the Retirement Queen, Bibi Apampa founder of MyRetirementWealth.com. "The course is designed to provide comprehensive education and support, helping people create the life they've always dreamed of in their golden years."

The core belief is that everyone deserves a comfortable retirement, and are committed to helping you achieve it. Enrolling in Building Retirement Wealth provides a unique opportunity for individuals to take control of their retirement and secure their financial future.

Do not allow retirement to be a source of stress Do not let the fear of the unknown hold you back from the retirement you deserve. Enroll in Building Retirement Wealth today and learn how to create the dream life and experience a lifetime of financial freedom.

For more information and to enrol in Building Retirement Wealth, visit http://myretirementwealth.com.

About MyRetirementWealth.com

MyRetirementWealth.com is a leading platform for retirement wealth education and planning in Nigeria. Mission is to empower Nigerians to take control of their financial future and retire with peace of mind. Our team comprises experienced and certified Wealth and Business Coaches, with Neuro Linguistic Programmers and Sales Trainers, who are passionate about helping people achieve financial freedom and enjoy a comfortable retirement. Join today to build the retirement wealth deserved.

#retireearly#retirerich#retirement#retirement planning#retire early#retirementplan#retire nigeria#retirement wealth#retirement business#retirementqueen#retirementqueennigeria#8incomestreams#earnmoneyonline#investment#business

0 notes

Video

youtube

Best Retirement Course Nigeria - Building Retirement Wealth - Plan towards a Rich Retirement

Are You Approaching Retirement Age But Unsure Of How To Plan For Your Future?

Discover the GOLDEN secrets to Pre-retirement planning to ensure you have the financial stability and security you need to enjoy your golden years go to

http://MyRetirementWealth.com

Building Retirement Wealth is a fast track course to help you Build wealth for retirement

The Retirement Wealth Academy program has SEVEN MODULES which covers a wide range of topics that are essential for achieving financial security in retirement

Introduction to Building Retirement Wealth

15 types of Wealth

Building multiple income streams

Passive Income strategies

Retirement Business

Financial Planning &Investments Options - rule of 25 & 4% rule

Estate Planning

Bonus 1 Workable and tested strategy to generate five to six figures extra income monthly: We will teach you how to create additional income streams that can provide you with sustainable cashflows every month.

Bonus 2 5-year financial freedom plan: We will work with you to create a personalized plan that will help you achieve financial freedom in five years.

Bonus 3 Become a published author on Amazon: We will provide you with the resources and support you need to write, publish, and market your own book on Amazon.

Bonus 4 Build and grow your personal brand: We will help you develop your personal brand and show you how to leverage it to create additional income streams.

Go to

http://MyRetirementWealth.com

to register today

0 notes

Text

Retirement in Nigeria - How to Build a Strong Social Circle in Retirement

Retirement in Nigeria - How to Build a Strong Social Circle in Retirement

Retirement is not just about financial security; it's also about enjoying a fulfilling and meaningful life. One key aspect of a satisfying retirement is building a strong social circle. Having a supportive network of friends and social connections can contribute to your overall well-being, happiness, and sense of belonging. In this article, we will explore practical strategies to build a strong social circle in retirement and enhance your retirement experience in Nigeria.

Join Community Groups and Organizations: Community groups and organizations are a fantastic way to meet like-minded individuals and engage in activities you enjoy. Whether it's a book club, a sports team, a hobby group, or a volunteer organization, these communities provide opportunities to connect with others who share similar interests. In Nigeria, there are various community groups that organize cultural events, charity initiatives, and social gatherings. Participating in these activities can help you forge new friendships and expand your social circle.

Attend Local Events and Workshops: Stay updated on local events, workshops, and seminars happening in your area. Attend cultural festivals, art exhibitions, music concerts, or educational workshops. These events provide a platform to meet new people and engage in conversations. Strike up conversations with fellow attendees and be open to forming connections. Building relationships through shared experiences can lead to lasting friendships.

Embrace Technology: In today's digital age, technology offers numerous opportunities to connect with others, even from the comfort of your own home. Join online communities, social media groups, or forums that cater to your interests. Engage in discussions, share experiences, and interact with fellow members. Online platforms can be a valuable tool to connect with individuals who may have similar retirement goals or hobbies.

Pursue Lifelong Learning: Retirement is the perfect time to pursue new interests and expand your knowledge. Enrol in courses, workshops, or seminars that align with your passions or areas of curiosity. Many educational institutions and organizations offer programs specifically designed for retirees. Learning alongside others creates a natural environment for building friendships and connections.

Engage in Physical Activities: Physical activities not only promote overall health but also provide opportunities for social interaction. Join fitness classes, walking groups, or sports clubs. Engaging in activities together creates a sense of camaraderie and can lead to lasting bonds. In Nigeria, you can explore activities such as traditional dance classes, group exercises, or outdoor recreational sports to meet people with shared interests.

Connect with Your Alumni Network and old school associations: Reconnect with your alma mater and tap into your alumni network. Attend reunions, alumni events, or join alumni associations. Sharing memories and experiences with former classmates can reignite old friendships and create new connections. Alumni networks often offer social events, professional networking opportunities, and mentorship programs.

Be Proactive and Open-Minded: Building a social circle in retirement requires initiative and an open mind. Be proactive in initiating conversations, reaching out to others, and attending social gatherings. Step out of your comfort zone and be open to meeting people from diverse backgrounds and age groups. Embrace new experiences and be willing to extend invitations to others. Creating a welcoming and inclusive environment can foster the growth of meaningful relationships.

Nurture Existing Relationships: Retirement is also a time to nurture and strengthen existing relationships. Reach out to old friends, colleagues, or family members with whom you've lost touch. Arrange meetups, organize reunions, or plan outings together. Investing time and effort into existing relationships can enrich your social circle and provide a sense of continuity in your retirement years.

Remember, building a social circle takes time and effort. Be patient and persistent in your efforts to connect with others. Quality friendships are built on trust, shared values, and mutual support. Foster genuine connections and invest in relationships that bring positivity and joy to your life.

In conclusion, building a strong social circle in retirement is vital for a fulfilling and enriching experience. Engage in community groups, attend local events, embrace technology, pursue lifelong learning, participate in physical activities, reconnect with your alumni network, be proactive, and nurture existing relationships. By incorporating these strategies into your retirement journey, you will create a vibrant social life that enhances your overall well-being, happiness, and sense of belonging. Embrace the opportunities that retirement in Nigeria offers and cultivate a strong social circle that brings joy and companionship to your golden years.

Article by Bibi Bunmi Apampa, “The Retirement Queen” retirement wealth strategist and high-performance business coach she can be reached at http://RetirementPlanNigeria.com for the best retirement course in Nigeria

#retirerich#retireearly#8incomestreams#retirementplan#retirement nigeria#retirementqueen#retirement planning nigeria#best retirement course

0 notes

Text

Retirement Planning 101: A Journey to Peace and Fulfilment in Nigeria

· Planning Your Retirement in Nigeria

· Retirement Saving Tips

· The Benefits of Early Retirement

· Best Investments for Retirement

· Finding Your Retirement Purpose

· Creating a Retirement Bucket List

· Retiring with Dignity

· Retirement Business

· Common Retirement Mistakes to Avoid

· Time Management in Retirement

· How to Make the Most of Your Retirement Years

· The Importance of Estate Planning

Retirement is not merely the end of a career; it marks the beginning of a new chapter in life—a chapter filled with peace, fulfilment, and the opportunity to pursue lifelong dreams. In Nigeria, retirement holds great significance, as it provides a chance to savour the fruits of your labour and embrace a life of tranquillity.

In this article, we will explore various aspects of retirement in Nigeria and provide valuable insights to help you plan for a fulfilling and prosperous retirement journey.

Planning Your Retirement in Nigeria: Proper retirement planning is crucial to ensure financial stability and security in your golden years. Start by evaluating your current financial situation, estimating your retirement expenses, and setting realistic goals. Consider consulting with financial advisors like the Retirement Queen Nigeria who specialize in retirement planning in Nigeria. They can guide you in creating a tailored plan that aligns with your aspirations and helps you navigate through the complexities of retirement.

Retirement Saving Tips: Saving for retirement is a long-term commitment that requires discipline and foresight. Begin saving early and make consistent contributions to your retirement fund. Explore investment options such as pension schemes, mutual funds, or individual retirement accounts. Maximize the benefits of employer-sponsored retirement plans and take advantage of any matching contributions. Be mindful of your expenses and adopt a frugal mindset to save diligently for a secure future.

The Benefits of Early Retirement: Early retirement offers numerous advantages, including the freedom to pursue personal interests and enjoy a longer period of leisure. It allows you to embark on new ventures, travel, or spend quality time with loved ones. However, early retirement requires meticulous planning and ensuring that you have sufficient funds to sustain your lifestyle over an extended period. Evaluate your financial readiness, consider the potential impact on your pension benefits, and consult with professionals to make informed decisions regarding early retirement.

Best Investments for Retirement: Choosing the right investments for retirement can provide a steady income stream and help grow your wealth. Consider diversifying your portfolio by investing in a mix of assets such as stocks, bonds, real estate, and mutual funds. Explore government pension schemes, which offer attractive returns and tax benefits. Consult with financial advisors who specialize in retirement investments in Nigeria like The Retirement Queen Nigeria to tailor an investment strategy that aligns with your risk tolerance and financial goals.

Finding Your Retirement Purpose: Retirement presents an opportunity to rediscover your passions, explore new interests, and find your sense of purpose. Reflect on your values, talents, and aspirations to identify activities that bring joy and fulfillment. Consider volunteering, mentoring, pursuing hobbies, or starting a second career that aligns with your interests. Engaging in meaningful activities enhances your overall well-being and provides a sense of purpose during retirement.

Creating a Retirement Bucket List: A retirement bucket list encompasses the experiences, goals, and adventures you wish to accomplish during your retirement years. Write down your aspirations, whether it's traveling to exotic destinations, learning a new skill, or embarking on a personal development journey. A retirement bucket list keeps you motivated, encourages you to embrace new experiences, and adds excitement to your retirement years.

Retiring with Dignity: Retiring with dignity means having the financial resources to maintain your desired lifestyle and fulfill your needs and aspirations. It involves careful planning and a commitment to financial discipline. Prioritize your retirement savings, manage debts wisely, and explore income-generating opportunities post-retirement. Consider consulting with retirement coaches like The Retirement Queen Nigeria, or experts who can provide guidance on maintaining your financial well-being and dignity throughout retirement.

Retirement Business: Starting a retirement business can be an exciting endeavor that combines passion and entrepreneurship. Assess your skills, interests, and market opportunities to identify potential business ventures. Whether it's consulting, freelance work, or establishing a small business, entrepreneurship in retirement can generate income, provide mental stimulation, and keep you actively engaged in the business world.

Common Retirement Mistakes to Avoid: Avoiding common retirement mistakes can save you from financial stress and uncertainty. Some common pitfalls include underestimating retirement expenses, failing to save enough, neglecting healthcare costs, and overlooking inflation. Another common mistake is using your gratuity to invest or start a business you know nothing about it. Please take out time to learn everything about the business before investing your money in it Plan ahead, save diligently, and seek professional advice to avoid these mistakes. Be proactive in managing your finances and continually review your retirement plan to ensure it remains on track.

Time Management in Retirement: Effective time management is crucial for a fulfilling retirement. Plan your days, set goals, and establish routines that allow you to maintain a healthy balance between leisure activities, personal pursuits, and social engagements. Prioritize activities that bring you joy, while also allowing time for relaxation and self-care. Be intentional with your time and create a harmonious retirement lifestyle that accommodates your interests and obligations.

How to Make the Most of Your Retirement Years: Retirement is an opportunity to embrace new experiences, fulfill long-held dreams, and live life to the fullest. Consider engaging in activities that bring you joy and purpose. Travel to destinations you've always wanted to explore, pursue hobbies and passions, volunteer for causes close to your heart, and spend quality time with loved ones. Prioritize your physical and mental well-being by maintaining a healthy lifestyle. Embrace the freedom retirement offers and make the most of every precious moment.

The Importance of Estate Planning: Estate planning is a critical aspect of retirement that ensures the smooth transfer of your assets and the protection of your loved ones' financial well-being. Consult with estate planning professionals to create a comprehensive plan that includes a will, trusts, and powers of attorney. Consider the implications of estate taxes and plan accordingly. By addressing estate planning early on, you can secure your legacy and provide peace of mind for yourself and your family.

Retirement in Nigeria is a journey that offers opportunities for peace, fulfilment, and personal growth. Plan your retirement diligently, save wisely, and retire with dignity. Embrace the benefits of early retirement and explore new avenues for personal fulfilment. Discover your retirement purpose, consider starting a retirement business, manage your time effectively, and create a retirement bucket list that reflects your dreams and aspirations.

In conclusion, retirement in Nigeria is not just about enjoying your golden years; it's about making wise investment decisions, avoiding common retirement mistakes, maximizing your retirement years, and prioritizing estate planning. Explore the best investment options available, seek professional advice, and create a diversified portfolio that suits your needs. Learn from the mistakes of others and plan diligently to ensure a financially secure retirement. Embrace the opportunities retirement brings, make the most of your time, and remember the importance of estate planning to protect your assets and secure your legacy.

May your retirement journey in Nigeria be filled with peace, prosperity, joy, contentment, and the fulfilment of your lifelong desires.

Article by Bibi Bunmi Apampa, “The Retirement Queen” retirement wealth strategist and high-performance business coach she can be reached at http://RetirementPlanNigeria.com for the best retirement course in Nigeria

#retirerich#retireearly#8incomestreams#investment#retirement#retirement planning#retire early#retirementplan#retirement wealth#bibiapampa#retirement nigeria#business#nigeria#retire in Nigeria

0 notes

Text

LEARN HOW TO BUILD RRETIREMENT WEALTH IN NIGERIA

Are You Approaching Retirement Age But Unsure Of How To Plan For Your Future?

Discover the GOLDEN secrets to Pre-retirement planning to ensure you have the financial stability and security you need to enjoy your golden years go to

http://MyRetirementWealth.com

Building Retirement Wealth is a fast track course to help you Build wealth for retirement

The Retirement Wealth Academy program has SEVEN MODULES which covers a wide range of topics that are essential for achieving financial security in retirement

Introduction to Building Retirement Wealth

15 types of Wealth

Building multiple income streams

Passive Income strategies

Retirement Business

Financial Planning &Investments Options - rule of 25 & 4% rule

Estate Planning

Bonus 1

Workable and tested strategy to generate five to six figures extra income monthly: We will teach you how to create additional income streams that can provide you with sustainable cashflows every month.

Bonus 2

5-year financial freedom plan: We will work with you to create a personalized plan that will help you achieve financial freedom in five years.

Bonus 3

Become a published author on Amazon: We will provide you with the resources and support you need to write, publish, and market your own book on Amazon.

Bonus 4

Build and grow your personal brand: We will help you develop your personal brand and show you how to leverage it to create additional income streams.

Go to

http://MyRetirementWealth.com to register today

0 notes

Text

Retire in Bliss: RetirementPlanningNigeria.com Launches the Best Retirement Planning Course in Nigeria

Retire in Bliss: Launching of the Best Pre Retirement Planning Course in Nigeria

Lagos, Nigeria - The sun sets on a long and fulfilling career, and a new dawn of rest and relaxation emerges. But with so many uncertainties looming in the horizon, will retirement be the dreamy escape you have always imagined? Or will it be a nightmare of financial insecurity and unfulfilled aspirations? Fortunately, RetirementPlanningNigeria.com has your back with the launch of the best retirement planning course yet, designed to help you live your best life in retirement.

The retirement planning course takes you on a journey of discovery and enlightenment, providing you with the knowledge and skills to navigate the financial terrain of retirement. From building retirement wealth, different retirement businesses you can start in retirement, Financial Planning, budgeting and investing, to insurance and estate planning, this comprehensive course has got you covered, no matter what stage of life you are in.

RetirementPlanningNigeria.com has assembled a team of seasoned experts with years of experience in retirement planning and financial management. These experts have poured their hearts and souls into creating a course that is easy to follow, yet highly informative, ensuring that you can retain what you have learned and apply it to your own unique retirement plan.

But RetirementPlanningNigeria.com goes above and beyond just providing you with a course. They understand that retirement planning can be a daunting task, which is why they offer personalized advice from their team of retirement planning experts. They are committed to helping you achieve your retirement goals, and with their expert guidance, you can retire in bliss.

"We believe that retirement should be a time of relaxation, fulfilment, and happiness," said Esther Emmanuel, CEO of RetirementPlanningNigeria.com. "We have created the best retirement planning course in Nigeria to provide you with the tools and resources you need to make your retirement dreams a reality."

With the best retirement planning course in Nigeria, you can retire in bliss, confident in the knowledge that you have a solid financial plan in place.

Enrol today at RetirementPlanningNigeria.com and take the first step towards a joyful retirement.

About RetirementPlanningNigeria.com

RetirementPlanningNigeria.com is a leading online platform for retirement planning in Nigeria. Their platform provides a range of tools and resources to help Nigerians prepare for retirement, including retirement planning calculators, investment guides, and more. With a team of retirement planning experts, RetirementPlanningNigeria.com is committed to helping Nigerians achieve their retirement goals. For more information, visit http://RetirementPlanningNigeria.com.

Contact: Esther Emmanuel

CEO, RetirementPlanningNigeria.com [email protected]

#retireearly#retirerich#retire#retirement planning#retirement#retire early#retirement business#pre-retirement#retirementnigeria#retirementplan#retirementwealth#retirementnigerianstyle#retirementqueen#retirement wealth

0 notes

Text

MyRetirementWealth.com Launches Best Retirement Planning Course in Nigeria

Best Pre Retirement Planning Training in Nigeria

Lagos, Nigeria - MyRetirementWealth.com, a leading online platform for retirement planning in Nigeria, is proud to announce the launch of its best retirement planning course. The course is designed to help Nigerians prepare for a financially secure future and make the most of their retirement years.

The retirement planning course is delivered entirely online and covers all aspects of retirement planning, building retirement wealth in Nigeria, different retirement businesses you can start in retirement, Financial Planning, budgeting, investing, insurance, estate planning, and more. The course is suitable for individuals of all ages and backgrounds, whether you are just starting to think about retirement or you are already in retirement.

"We believe that everyone deserves to have a comfortable and secure retirement," said Esther Emmanuel, CEO of MyRetirementWealth.com. "That's why we have created the best retirement planning course in Nigeria, to provide people with the knowledge and skills they need to achieve their retirement goals."

The retirement planning course is designed by a team of experts with years of experience in retirement planning and financial management. The course is delivered through a series of easy-to-follow modules, with quizzes and exercises to help participants retain what they have learned.

Participants in the course will also have access to MyRetirementWealth.com's team of retirement planning experts, who are available to answer questions and provide personalized advice.

"We know that retirement planning can be overwhelming, but we are here to help," said Esther Emmanuel. "Our team of retirement planning experts is dedicated to helping Nigerians achieve their retirement goals, and we are confident that our best retirement planning course will do just that."

The retirement planning course is available now on MyRetirementWealth.com. Enrol today to start your journey to a financially secure retirement.

About MyRetirementWealth.com

MyRetirementWealth.com is a leading online platform for retirement planning in Nigeria. The platform provides a range of tools and resources to help Nigerians prepare for retirement, including retirement planning calculators, investment guides, and more. With a team of retirement planning experts, MyRetirementWealth.com is dedicated to helping Nigerians achieve their retirement goals. For more information, visit MyRetirementWealth.com

Contact: Esther Emmanuel

CEO, MyRetirementWealth.com

#retirerich#retireearly#retirement planning#retirement#retire early#8incomestreams#retirement business#pre-retirement#retirementnigeria#retire#retirementplan#retirementwealth#retirementqueen#earnmoneyonline#nigeria

0 notes