Don't wanna be here? Send us removal request.

Text

Reconnect with the Earth: Discover the Restorative Power of Our Premium Grounding Mat

Are you longing for deeper, more restful sleep? Do you experience the aches and discomfort that seem to accompany age or a busy lifestyle? Imagine a simple, natural way to potentially ease these issues and enhance your overall well being. Our premium grounding mat offers just that – a direct connection to the Earth's inherent energy, right in the comfort of your own home.

Grounding, or earthing, is a fundamental concept – the act of physically connecting with the Earth's electrical charge. Think about the invigorating feeling of walking barefoot on the grass or the sand. Our grounding mat cleverly replicates this natural phenomenon. Crafted with a conductive PU carbon leatherette surface, it allows this subtle yet powerful energy transfer to occur while you rest or sleep indoors.

The science behind grounding suggests that this connection helps to neutralize the positive ions in our bodies, often stemming from modern environmental factors. By allowing the Earth's free electrons to flow into your system, our grounding mat can potentially contribute to a more balanced and harmonious internal state.

Integrating our grounding mat into your daily or nightly routine may unlock a range of potential health benefits, particularly valuable for elders and anyone seeking a natural approach to wellness:

Embrace Deeper, More Restorative Sleep: Many users report a significant improvement in their sleep patterns. By potentially regulating cortisol levels, grounding can pave the way for more tranquil nights and refreshed mornings – a true blessing for those who struggle with sleep, especially as they age.

Soothe Inflammation and Discomfort: Inflammation is often at the root of various aches and pains. The Earth's natural energy may help to mitigate this, offering a gentle way to potentially ease joint stiffness and muscle soreness that can affect daily life.

Find Calm and Reduce Stress: In our fast-paced world, stress and anxiety can take a toll. Grounding may have a calming effect on the nervous system, promoting a sense of peace and relaxation that can contribute to overall mental wellbeing.

We believe in providing a product that is not only effective but also comfortable and safe. Our grounding mat is made with meticulous attention to detail:

Soft and Gentle: The PU leather and polyester blend creates a comfortable surface to rest on.

Breathable Design: The inclusion of breathable holes ensures a pleasant experience throughout the night.

Durable and Easy to Care For: Being waterproof and sweatproof, the mat is designed for longevity and effortless maintenance.

Setting up your grounding mat is incredibly simple. Just lay it on your bed, connect the provided 5-meter cord to the mat and the ground port of a standard electrical outlet, and you're ready to experience the potential benefits.

For added assurance, our grounding mat comes with a pen tester. This handy tool allows you to easily verify the connection between your mat and the Earth's ground, ensuring you are receiving the optimal benefits.

Invest in Your Wellbeing – Naturally.

Our premium grounding mat offers a simple yet potentially powerful way to tap into the Earth's natural healing energy. Whether you are an elder seeking more comfortable sleep or anyone to enhance their overall health and vitality, this mat can be a valuable addition to your wellness routine.

Improved Sleep Quality: Many users, especially elders who often experience sleep disturbances, report falling asleep faster, sleeping more deeply, and waking up feeling more refreshed. By regulating cortisol levels, grounding promotes a natural and restful sleep cycle.

Reduced Inflammation: Grounding has been shown in studies to help reduce inflammation, a root cause of many chronic health problems and a common concern for older adults. Experience potential relief from joint pain and muscle soreness.

Stress and Anxiety Reduction: The gentle connection to the Earth's energy can have a calming effect on the nervous system, helping to ease stress and anxiety. Wake up feeling more balanced and at peace.

Enhanced Blood Circulation: Some studies suggest that grounding can improve blood flow, which is vital for overall health and can contribute to increased energy levels.

EMF Recovery: While not a shield against electromagnetic fields (EMFs), grounding may help your body recover from daily exposure by reducing the positive charge buildup.

0 notes

Text

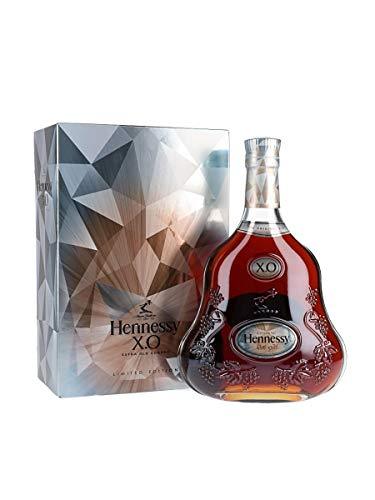

Savoring Success: Unlocking the Potential Benefits of Acquiring and Investing in Cognac

In the realm of luxury spirits, few beverages can match the timeless allure and sophisticated reputation of cognac. Beyond being a delightful drink, cognac has also emerged as a savvy investment option, appealing to connoisseurs and investors alike. In this article, we'll explore the multifaceted advantages of acquiring and investing in cognac, shedding light on the potential gains that extend beyond the rich, amber hues of the liquid itself.

Culinary Delight and Social Elegance: Cognac is more than just a drink; it's an experience. From its nuanced flavors to the elegant ritual of sipping, acquiring a fine bottle of cognac enhances your appreciation for the finer things in life. Whether shared with friends, family, or enjoyed in solitude, cognac brings people together and elevates social experiences.

Cognac as an Investment: The cognac market has seen steady growth, with rare and limited-edition bottles often appreciating in value over time. Savvy investors have recognized the potential for substantial returns by strategically acquiring and holding onto sought-after cognacs. Some rare editions have even outperformed traditional investment avenues, making cognac a unique and lucrative asset class.

Limited Editions and Rarity:

The world of cognac is marked by its rich history and the craftsmanship involved in its production. Acquiring limited-edition releases from renowned distilleries or rare vintages not only adds prestige to your collection but also positions you as a custodian of liquid history. Rarity and exclusivity contribute significantly to the appreciation of cognac as a collectible and an investment.

Branding and Prestige:

Certain cognac brands have achieved iconic status, symbolizing opulence, refinement, and taste. Owning and serving such esteemed labels can enhance your personal brand and make a statement about your appreciation for quality. It's not just about the liquid in the bottle; it's about the legacy and tradition associated with the brand.

Diversification in Your Portfolio: While traditional investment options remain essential, diversifying your portfolio can be a prudent strategy. Cognac, with its unique market dynamics and potential for growth, provides an alternative asset that can complement a well-rounded investment portfolio. As the market for rare spirits expands, cognac stands out as an intriguing and rewarding addition.

Cultural and Historical Significance: Cognac is deeply intertwined with French culture and history. Acquiring and investing in cognac is a celebration of this rich heritage. It is an opportunity to connect with a centuries-old craft and be a part of a legacy that has transcended time, making it a meaningful investment beyond financial gains.

Conclusion:

In the world of luxury beverages, cognac stands as a symbol of refinement and taste. Beyond its exquisite flavors and the social elegance it imparts, acquiring and investing in cognac can offer a range of benefits—from potential financial gains to the satisfaction of being a custodian of liquid history. Whether you are a seasoned investor or a passionate enthusiast, exploring the world of cognac can be a rewarding journey that brings together culture, history, and the joy of savoring success in every sip

0 notes

Text

Pouring Profits: The Investment Case for Cognac’s Appreciating Value

Few drinks have the same rich history, exquisite workmanship, and cultural significance as cognac in the world of premium spirits. Cognac is becoming a more appealing option for investors looking for alternative assets, beyond just being a posh beverage for aficionados. This article explores the possibilities for cognac's value to rise and looks at the elements that make it so financially appealing, including as limited editions, vintage releases, and the prestige of well-known firms.

The Historical Elegance of Cognac

Cognac, a type of brandy produced in the Cognac region of France, boasts a rich history that spans centuries. Originating from the 17th century, this exquisite spirit has been a symbol of luxury and refinement. The meticulous process of crafting cognac involves the distillation of white wine, followed by aging in oak barrels. The result is a complex, nuanced spirit known for its smoothness and depth of flavor.

Vintage Releases: A Time Capsule of Elegance

One of the key elements driving the investment appeal of cognac is the concept of vintage releases. Cognac houses occasionally release limited quantities of spirits produced in a specific year, often considered exceptional due to favorable weather conditions or other unique circumstances. Investors view these vintage releases as rare gems, akin to a time capsule that encapsulates the essence of a particular year's harvest.

The scarcity of vintage releases contributes significantly to their investment value. As these bottles become increasingly challenging to find, their prices tend to soar. Savvy investors recognize the potential for substantial returns when acquiring and holding onto these exclusive bottles over time. Notable cognac houses, such as Hennessy and Remy Martin, regularly release limited editions that attract collectors and investors alike.

Limited Editions: Rarity and Exclusivity

In the world of luxury spirits, limited editions are a powerful driver of both demand and value. Cognac houses carefully curate special releases, often in collaboration with renowned artists or designers, to create a unique and exclusive product. These limited editions can feature distinctive packaging, innovative aging processes, or even unusual collaborations that elevate the spirit's desirability among collectors.

The scarcity of limited editions amplifies their investment potential. Investors recognize that owning a piece of such exclusivity not only provides a unique tasting experience but also holds the promise of appreciation over time. The allure of owning a rare and sought-after bottle contributes to the increasing trend of viewing cognac as an alternative investment class.

Renowned Houses: A Legacy of Excellence

The reputation of the cognac house plays a pivotal role in determining the investment value of its products. Established houses with a long history of producing exceptional spirits often command higher prices in the market. Brands like Hennessy, Remy Martin, and Courvoisier, with centuries-old legacies, have built a following of discerning consumers and investors alike.

Investors are drawn to the stability and consistency that renowned houses bring to the table. The legacy and craftsmanship associated with these brands enhance the perceived value of their products. As these houses continue to innovate and release new expressions, investors can anticipate the sustained appreciation of their cognac portfolios.

Global Demand and Cultural Significance

Beyond the intrinsic qualities of cognac, global demand and cultural significance contribute to its investment appeal. As emerging markets in Asia and Eastern Europe show an increasing appetite for luxury goods, including premium spirits, the demand for cognac continues to grow. This expanding market provides a promising outlook for investors looking to capitalize on the appreciation of their cognac investments.

Moreover, cognac holds a unique cultural status, often associated with celebration and success. As the spirit gains popularity in emerging economies, the cultural cachet surrounding cognac only adds to its allure. Investors can leverage the global demand and cultural resonance to build diversified portfolios that stand the test of time

Conclusion

Cognac's journey from a cherished beverage for enthusiasts to a viable investment option reflects its timeless appeal and cultural significance. Vintage releases, limited editions, and the reputation of renowned houses contribute to the financial allure of this prized spirit. As the global demand for luxury spirits continues to rise, cognac stands out as a sophisticated and rewarding alternative asset for investors looking to diversify their portfolios. While challenges exist, the potential for appreciating value in cognac remains a compelling proposition, inviting investors to savor not only the rich flavors of the spirit but also the financial rewards that come with wise and strategic investments in this liquid gold.

2 notes

·

View notes

Text

Global Cheers: Cognac's Investment Appeal Across Borders

Within the realm of high-end liquors, cognac is an enduring representation of elegance and sophistication. Cognac has become a popular investment choice in addition to being a well-liked drink, attracting the interest of shrewd investors all around the world. This essay explores the international attractiveness of cognac as an investment, showing how it may transcend national borders and meet the changing preferences of a sophisticated and diversified global audience.

The Historical Elegance of Cognac:

Cognac, a distinctive variety of brandy named after the town of Cognac in France, boasts a rich history dating back several centuries. Produced through a meticulous process of distillation and aging, cognac embodies a unique blend of craftsmanship and tradition. The heritage associated with this amber-hued spirit adds to its allure as a collector's item and investment asset.

Global Demand and Market Trends:

The appeal of cognac as an investment is not confined to its country of origin. Over the years, the global demand for cognac has soared, fueled by the spirit's rising popularity in emerging markets such as Asia. As the middle class expands and disposable incomes increase, consumers seek premium experiences, with cognac often topping the list of preferred luxury beverages.

One key factor driving the global popularity of cognac is its versatility. Cognac can be enjoyed in various settings – from exclusive events to casual gatherings. Its adaptability across different cultures and social contexts positions it as a versatile investment, capable of maintaining appeal across diverse markets.

Limited Editions and Rarity:

Cognac houses frequently release limited editions and rare blends, contributing to the exclusivity and desirability of certain bottles. The scarcity of these editions enhances their investment value, as collectors and investors alike seek to acquire unique pieces that may appreciate significantly over time. Auctions and private sales often feature rare cognac bottles, creating a vibrant secondary market for enthusiasts looking to expand their portfolios.

Brand Prestige and Recognition:

Well-established cognac houses with a history of producing exceptional spirits carry a certain prestige that transcends borders. Brands like Hennessy, Remy Martin, and Courvoisier have become synonymous with quality and craftsmanship. Investors recognize the enduring appeal of these brands, understanding that their legacy and reputation contribute to the stability and potential appreciation of cognac as an investment asset.

Diversification in Investment Portfolios:

Cognac offers investors a unique opportunity to diversify their portfolios. Traditionally, investors have turned to stocks, bonds, and real estate for diversification, but the luxury spirits market provides an alternative avenue. With its potential for capital appreciation and the ability to withstand economic downturns, cognac presents an appealing option for those looking to add a touch of exclusivity and stability to their investment portfolios.

Cultural Significance and Globalization:

As globalization continues to reshape cultural preferences and consumption patterns, cognac has found itself at the intersection of tradition and modernity. The spirit's ability to adapt to diverse cultural contexts has broadened its appeal, making it a symbol of sophistication across continents. Investors keen on aligning their portfolios with global trends recognize the cultural significance of cognac, leveraging its universal appeal to enhance their investment strategies.

Risks and Considerations:

While cognac presents exciting investment prospects, it is essential for potential investors to consider certain risks. Fluctuations in consumer preferences, changes in economic conditions, and regulatory challenges can impact the market dynamics for luxury spirits. Additionally, the authenticity and provenance of rare and limited-edition bottles must be carefully verified to ensure the integrity of an investment.

Conclusion:

Cognac's investment appeal across borders is a testament to its enduring charm and adaptability. As an asset class, cognac offers investors a unique combination of history, rarity, and cultural resonance. The global demand for this amber elixir, coupled with the prestige of well-established brands, positions cognac as an attractive option for those seeking to diversify their portfolios with a touch of luxury. As the world continues to raise its glass to the timeless elegance of cognac, astute investors are finding reasons to invest in this spirited market across international borders.

0 notes

Text

Cognac: A Liquid Legacy Worth Investing In

Few drinks in the spirits industry have the status and appeal of cognac. Known by many as "liquid gold," this amber-hued elixir has not only endured but grown into an appealing investment for people who value the marriage of tradition with sound financial judgement. We will investigate what makes cognac a desirable investment as we dig into its rich history and legacy. We will look at its cultural significance, the methods used in its manufacture, and the changing market movements that have contributed to its reputation as a liquid legacy.

Historical Roots and Cultural Significance

Cognac, named after the town of Cognac in the Charente region of France, boasts a history dating back several centuries. The story of cognac begins with the Dutch distillers who settled in the region in the 17th century, bringing with them the knowledge of distillation. The region's fertile soil and maritime climate proved to be ideal for cultivating grapes, specifically the Ugni Blanc variety, which forms the base for cognac production.

The distillation process and aging of cognac in oak barrels were refined over the years, resulting in a spirit that is not only delicious but also carries the essence of the region's terroir. Cognac became a symbol of sophistication and luxury, favored by royalty and aristocracy. The House of Martell, founded in 1715, and other esteemed cognac houses have played pivotal roles in shaping the industry, contributing to its legacy.

Cognac Production: A Crafted Alchemy

The production of cognac is a meticulous and regulated process, ensuring that each bottle maintains the quality and character that enthusiasts have come to expect. Cognac is primarily distilled from white wine, which undergoes a double distillation in copper pot stills. The resulting eau-de-vie is then aged in oak barrels for a minimum period, often several years, allowing the spirit to develop its complex flavors and aromas.

One of the distinctive features of cognac production is the aging process. Cognac houses carefully select and blend different eaux-de-vie to achieve a consistent and harmonious final product. The aging process also imparts the spirit with the color, depth, and richness that make it stand out among other spirits.

The quality of cognac is further categorized based on the aging classifications, such as VS (Very Special), VSOP (Very Superior Old Pale), and XO (Extra Old). Each designation reflects the minimum number of years the youngest eau-de-vie in the blend has been aged, providing consumers with a guide to the spirit's maturity and complexity.

Investing in Tradition: Cognac as a Tangible Asset

The world of investments is diverse, ranging from stocks and bonds to real estate and commodities. Cognac has emerged as a unique and tangible asset within this landscape. Investors are drawn to the spirit not only for its intrinsic value as a luxury product but also for its historical significance and the craftsmanship involved in its production.

The limited production and aging requirements of cognac contribute to its scarcity, making certain bottles highly sought after by collectors. Rare and vintage cognacs, especially those from renowned houses, can appreciate significantly in value over time. This appreciation is not solely driven by the financial market but is also influenced by the cultural and historical importance attached to these aged spirits.

Collectors and investors alike are drawn to the idea of owning a piece of history, encapsulated in the form of a well-aged cognac. The craftsmanship involved in the production process, combined with the uniqueness of each bottle, adds an element of exclusivity that appeals to discerning investors seeking alternative assets.

Market Trends: Cognac's Rise in Popularity

In recent years, cognac has experienced a resurgence in popularity, transcending its traditional consumer base. While long cherished by connoisseurs and aficionados, the spirit is now gaining traction among a broader audience, particularly in emerging markets. The demand for high-quality cognac has surged, driving up prices and creating a dynamic market for both new releases and rare finds.

Asia, particularly China, has emerged as a key market for cognac, with a growing middle class seeking premium and luxury goods. Cognac's association with status, celebration, and refinement aligns with the cultural values in these regions, further fueling its popularity. As a result, certain limited-edition releases and vintage bottles have become highly coveted, leading to increased investment activity in the cognac market.

The rise of online platforms dedicated to spirits and collectibles has also facilitated the trading and selling of rare cognacs. Auction houses regularly feature coveted bottles, attracting enthusiasts and investors alike. The transparent and traceable nature of the cognac market, coupled with the authentication of provenance, instills confidence in investors seeking to add these bottles to their portfolios.

Challenges and Considerations for Cognac Investors

While cognac presents an enticing investment opportunity, it is not without its challenges. Understanding the market, discerning between the myriad offerings, and navigating the complexities of vintages and classifications require a level of expertise. Additionally, the storage conditions of the cognac can significantly impact its quality and value over time. Proper storage, away from direct sunlight and in a controlled environment, is essential to preserve the integrity of the spirit.

Investors should also be aware of the potential for counterfeit bottles in the market. As the value of rare and vintage cognacs increases, so does the incentive for counterfeiters to produce convincing replicas. Authentication and provenance verification become crucial considerations for investors, ensuring that the bottle's history is well-documented and can be traced back to reputable sources.

Conclusion: A Toast to Tradition and Prosperity

In conclusion, cognac stands as a liquid legacy worth investing in, marrying the rich history of a bygone era with the modern appeal of a luxury commodity. Its cultural significance, meticulous production process, and rising market trends position cognac as a compelling and tangible asset for those seeking alternatives in the world of investments.

As the global appreciation for this amber nectar continues to grow, so does its allure as a collectible and investment. Cognac enthusiasts and investors find themselves not only toasting to the exquisite flavors and aromas of a well-aged spirit but also celebrating the tangible connection to tradition and craftsmanship that each bottle represents. In a world where investments often feel intangible and distant, cognac offers a unique opportunity to own a piece of history, encapsulated in a bottle of liquid gold. So, as you savor the complexities of your next glass of cognac, consider the potential it holds as a liquid legacy, one that transcends time and continues to appreciate in both cultural and financial value

0 notes

Text

Crafting Wealth: The Investment Allure of Limited Edition Cognacs

Limited edition cognacs are an elegant and distinctive choice that has surfaced in the field of alternative investments, when typical possibilities sometimes seem saturated. These high-end alcoholic beverages have gained notice for their investment possibilities even outside of the domains of connoisseurship and appreciation. This piece explores the fascinating world of limited edition cognacs, showing how collectibility, rarity, and workmanship come together to create a unique asset class for those looking to add exclusivity to their portfolios.

The Art of Craftsmanship:

Limited edition cognacs are a testament to the meticulous artistry and craftsmanship that goes into their production. Crafted by skilled master distillers and often aged for extended periods, these spirits epitomize the marriage of tradition and innovation. The intricate blending process, the selection of the finest grapes, and the careful aging in oak barrels contribute to the creation of a beverage that transcends its status as a mere drink. Investors are drawn to the tangible value inherent in the craftsmanship, recognizing the expertise required to produce such exceptional and exclusive spirits.

Rarity as a Catalyst:

One of the primary drivers of the investment allure of limited edition cognacs is their inherent rarity. Unlike mass-produced counterparts, these cognacs are released in limited quantities, creating a sense of exclusivity and scarcity. Investors are well aware that scarcity often enhances value, and limited edition cognacs are no exception. As each bottle becomes increasingly difficult to acquire, its rarity amplifies its desirability among collectors and investors alike.

Age as a Determinant of Value:

In the world of limited edition cognacs, age is not just a number; it is a key determinant of value. The aging process in oak barrels imparts complex flavors and aromas to the spirit, making older cognacs highly sought after. Investors keen on reaping substantial returns understand the correlation between age and value. Limited edition cognacs with extended aging periods become not only a testament to time but also a store of value that appreciates as the years pass.

Collectibility and Exclusivity:

Limited edition cognacs, with their unique packaging, bespoke labels, and often individually numbered bottles, exude a sense of collectibility. Investors are not just acquiring a beverage; they are obtaining a piece of art, a collector's item that appeals to the senses and the aesthetic. The exclusivity of these spirits further elevates their appeal, as collectors are driven by the desire to possess something rare and exceptional that sets their collection apart.

Market Trends and Performance:

The market for limited edition cognacs has exhibited notable trends and performance indicators. Auction houses and specialized retailers frequently feature these spirits in their catalogs, with prices often surpassing initial retail values. Investors tracking the market have witnessed the consistent growth in the value of certain limited edition releases, validating cognacs as a viable investment option. As global demand for exclusive spirits rises, limited edition cognacs are positioned as a unique asset class with the potential for substantial returns.

Diversification in Investment Portfolios:

In an era where diversification is a key strategy for mitigating risk, limited edition cognacs offer a distinctive opportunity for investors to broaden their portfolios. Beyond traditional assets like stocks and bonds, these spirits provide an alternative investment avenue that is not directly tied to traditional market fluctuations. The tangible nature of a limited edition cognac collection adds a layer of diversification that appeals to those seeking to balance their portfolios with unconventional yet valuable assets.

Navigating Risks and Challenges:

While the investment allure of limited edition cognacs is evident, it is crucial for investors to navigate potential risks and challenges. Market volatility, changing consumer preferences, and the subjective nature of collectibles pose considerations for those entering this niche. Thorough research, a keen understanding of market dynamics, and a strategic approach to building a cognac investment portfolio are essential to mitigate risks and maximize returns.

The Future of Limited Edition Cognac Investments:

As the global appreciation for fine spirits continues to rise, the future of limited edition cognac investments appears promising. With emerging markets and a growing community of enthusiasts, the demand for these exclusive spirits is likely to escalate. Forward-thinking investors recognize the potential for long-term growth in this niche market and are positioning themselves to capitalize on the evolving landscape of limited edition cognac investments.

Conclusion:

Crafting wealth through the investment allure of limited edition cognacs involves a delicate balance of appreciation for craftsmanship, an understanding of market dynamics, and a commitment to exclusivity. As investors seek alternative avenues to diversify their portfolios, these refined spirits stand out as a unique and tangible asset class. With each limited edition release, a bottle of cognac becomes more than a beverage—it transforms into a symbol of sophistication, rarity, and potential financial gain for those who appreciate the convergence of craftsmanship and investment opportunity.

0 notes

Text

Sipping on Success: Cognac's Rise as a Resilient Investment Amid Economic Tides

Certain assets have shown to be robust anchors in the ever-changing world of investments, where economic uncertainties have the power to make or break portfolios. Cognac, a posh and often decadent drink that has a special position in financial portfolios, is one such unexpected competitor. Investors are increasingly looking to unconventional options that offer stability and possible growth as a result of the periodic turmoil experienced by the financial markets. With its complex workmanship, lengthy history, and unique combination of innovation and tradition, cognac has become an unexpectedly attractive investment choice. This piece investigates the causes of cognac's ascent to prominence as a durable option, focusing on its distinct features that set it apart over economic ups and downs.

The Historical Allure of Cognac

Cognac, a type of brandy produced in the Cognac region of France, has long been associated with luxury, sophistication, and celebration. Its roots trace back to the 16th century, and over the centuries, it has become a symbol of status and refinement. The meticulous process of crafting cognac, from the selection of grapes to the distillation and aging in oak barrels, contributes to its distinctive flavor profile and unparalleled quality. The heritage and craftsmanship associated with cognac lend it a timeless appeal, making it more than just a beverage—it is an experience.

Market Resilience in Economic Turbulence

One of the key reasons behind cognac's rise as a resilient investment is its ability to weather economic storms. While traditional investment assets may experience fluctuations and uncertainties in volatile markets, the demand for high-quality cognac has shown remarkable stability. Even during economic downturns, enthusiasts and collectors continue to appreciate the craftsmanship and rarity associated with premium cognac brands.

Experts attribute this resilience to the unique dynamics of the cognac market. Unlike some commodities that may be more susceptible to economic downturns, cognac's appeal lies in its scarcity and exclusivity. The aging process, often spanning several decades, creates limited batches of aged cognac, contributing to its rarity. Investors recognize the intrinsic value of these limited editions, as scarcity often translates to higher demand and, consequently, increased value.

Diversification and Tangibility

In an era where digital assets and intangible investments are gaining prominence, cognac offers a refreshing tangibility. Investors are drawn to physical assets, especially those with a rich cultural and historical background. Cognac bottles, often presented in ornate packaging, become tangible symbols of luxury and refinement. The ability to hold and showcase an investment, beyond just seeing numbers on a screen, adds an extra layer of satisfaction for collectors and investors alike.

Moreover, cognac's position as a luxury item allows it to thrive in diverse market conditions. As investors seek to diversify their portfolios to mitigate risks, the unique combination of artistry, history, and craftsmanship makes cognac an attractive alternative. It stands as a testament to the idea that investing is not merely about financial gains but also about the experience and cultural significance associated with the asset.

Global Demand and Emerging Markets

Cognac's global appeal has expanded significantly in recent years, contributing to its resilience as an investment. While historically popular in Western markets, particularly Europe and North America, the spirit has found new enthusiasts in emerging economies. The rising middle class in Asia, for example, has developed a taste for luxury goods, including high-end spirits like cognac.

This growing global demand acts as a buffer during economic downturns in specific regions. While one market may experience a decline, the overall global demand for cognac helps maintain its value. The internationalization of the cognac market ensures that fluctuations in a particular economy or region do not have a disproportionate impact on the spirit's overall investment appeal.

Brand Prestige and Reputation

Brand reputation plays a crucial role in the success of any investment, and cognac is no exception. Established cognac houses with centuries-old legacies have built a reputation for producing consistent, high-quality spirits. Investors, recognizing the importance of brand prestige, often gravitate towards renowned names in the industry.

These prestigious brands not only bring a sense of reliability to the investment but also contribute to the overall market perception of cognac as a stable and upscale choice. The ability of certain brands to command premium prices and maintain a loyal customer base further solidifies cognac's status as a resilient investment.

Cultural and Social Trends

Beyond economic factors, cultural and social trends also influence investment choices. Cognac's association with luxury and celebration aligns with broader societal trends centered around experiences and lifestyle. As consumers increasingly prioritize quality over quantity, the appeal of premium cognac as a status symbol and a symbol of refinement has grown.

In the age of social media and the desire for unique, shareable experiences, the visual appeal of rare and well-packaged cognac bottles adds another layer to its investment value. Investors, in addition to seeking financial returns, often view their portfolios as an extension of their identity and interests. Cognac's ability to align with lifestyle trends enhances its attractiveness in this context.

Risks and Considerations

While cognac presents a compelling investment option, it is essential for investors to be aware of potential risks and considerations. Market conditions, regulatory changes, and shifts in consumer preferences can impact the value of cognac investments. Additionally, the rarity of certain editions may lead to increased counterfeiting, emphasizing the importance of thorough due diligence when making purchases.

Furthermore, investing in cognac requires a level of patience, as the value of aged spirits tends to appreciate over time. Investors should be prepared for a long-term commitment and carefully assess their risk tolerance and investment goals before entering this niche market.

Conclusion

As economic tides ebb and flow, investors continue to seek stable and resilient assets to anchor their portfolios. Cognac, with its rich history, cultural significance, and global appeal, has emerged as an unexpected but compelling choice. The spirit's ability to withstand economic downturns, coupled with its tangibility, diversification benefits, and alignment with cultural trends, positions it as a unique investment opportunity.

While cognac may not be the conventional choice for every investor, its rise in popularity speaks to the evolving landscape of investment preferences. As the world navigates through economic uncertainties, the allure of sipping on success with a carefully chosen bottle of cognac remains a testament to the enduring appeal of tangible, culturally rich investments in a digital age.

0 notes

Text

Beyond the Bottle: Cognac Investing as an Artful Addition to Your Portfolio

Within the investment sector, where traditional assets frequently take centre stage, there's a special path that goes beyond just making money. Cognac, the age-old French spirit, is becoming a sophisticated addition to investment holdings. Cognac is a tangible piece of legacy inside an investing plan since it embodies significant cultural and artistic elements beyond its monetary worth. We will go into the world of cognac investment in this post, discussing its historical and cultural significance as well as the special prospects it offers to investors looking for a mix of financial rewards and cultural appreciation.

The Heritage in a Bottle

Cognac, a luxurious and refined brandy originating from the Cognac region of France, carries with it centuries of tradition and craftsmanship. The process of crafting cognac is an intricate art, involving the distillation and aging of white wine into a spirit that matures in oak barrels for several years. This meticulous process imparts distinct flavors and aromas that set cognac apart from other spirits.

Investing in cognac means acquiring a piece of this tradition, a tangible connection to the craftsmanship that has been passed down through generations. Each bottle tells a story not only of the spirit within but also of the land, the people, and the culture that produced it. Cognac becomes more than a financial asset; it transforms into a cultural heirloom, a testament to the artistry and dedication of its creators.

Cultural Significance of Cognac

Beyond its appeal as a beverage, cognac holds a revered status in the world of art and culture. It has been the libation of choice for luminaries, intellectuals, and artists throughout history. From writers and philosophers to musicians and diplomats, cognac has been a companion to the creative process, inspiring discussions and igniting imaginations.

Investing in cognac allows individuals to become custodians of this cultural legacy. The bottles become more than just assets; they serve as conduits to a rich tapestry of human experience. Owning a piece of cognac history is akin to possessing a slice of the cultural zeitgeist that has shaped generations.

Artistic Labels and Limited Editions

The artistry of cognac extends beyond its distillation process to the design of its labels and packaging. Many cognac houses collaborate with renowned artists and designers to create visually stunning bottles that double as works of art. Limited editions, in particular, are often adorned with intricate designs and crafted in exclusive quantities, making them highly sought after by collectors.

Investors in cognac have the opportunity to appreciate and preserve these artistic expressions. The intersection of fine spirits and fine art creates a unique investment proposition, where aesthetic value complements monetary worth. As these bottles age, their artistic and cultural significance may appreciate alongside their financial value, making them a truly multifaceted addition to an investment portfolio.

Tasting the Investment: Appreciation and Rarity

Unlike some traditional investments that lack a sensory component, cognac offers a unique opportunity for investors to indulge in the appreciation of their assets. Tasting sessions and masterclasses hosted by cognac houses provide investors with the chance to understand the nuances of different vintages, aging processes, and flavor profiles.

Furthermore, the rarity of certain cognac releases adds an exclusivity factor to the investment. As older vintages become scarcer, their value tends to increase. This scarcity factor, combined with the sensory experience of savoring a well-aged cognac, enhances the investment journey, making it a more immersive and enjoyable venture.

Risk Mitigation Through Rarity

Cognac's limited production and aging process inherently mitigate some of the risks associated with traditional investments. While financial markets can be volatile, the slow and methodical process of crafting cognac ensures a degree of stability. The rarity of certain releases acts as a natural hedge against economic uncertainties, providing a unique layer of risk mitigation for investors.

Furthermore, the global demand for high-quality cognac has been steadily increasing, particularly in emerging markets. This sustained demand contributes to the overall stability of the cognac market, making it an attractive option for investors looking to diversify their portfolios and reduce exposure to more volatile assets.

The Evolving Market Dynamics

As the world of investing continues to evolve, so too does the cognac market. Emerging trends, such as the rise of online auctions and the growing interest in sustainable and organic spirits, impact the dynamics of cognac investing. Savvy investors are not only considering the historical and cultural aspects but also staying attuned to market shifts and consumer preferences.

The expansion of the global market for cognac presents new opportunities for investors to diversify their holdings. While traditional markets like Europe and North America remain strong, the growing interest in cognac in Asia and other regions opens up avenues for international investment strategies.

Conclusion

In conclusion, cognac investing transcends the conventional boundaries of financial portfolios. It offers investors a unique opportunity to become stewards of tradition, culture, and artistry. Beyond the bottle, cognac becomes a tangible expression of heritage, a sensory journey, and a wise addition to diversified investment portfolios.

As the market for cognac continues to evolve, investors should approach this artful addition with a discerning eye, considering not only the financial aspects but also the cultural and artistic dimensions that make each bottle a valuable and enriching asset. In the world of investments, where stories are often told through numbers and figures, cognac investing invites individuals to tell a story that resonates with the senses and transcends generations.

0 notes

Text

Cognac Chronicles: Unveiling the Investment Charms of a Timeless Spirit

The ancient spirit of cognac, which has its roots in the soils of southwest France, has evolved from being just an alcoholic beverage to being a highly attractive business prospect. This amber-hued elixir, which was created through a rigorous distillation process and matured in oak barrels, possesses a distinct combination of exclusivity, craftsmanship, and global appeal in addition to its rich cultural legacy. We examine the market dynamics and historical relevance of cognac, which combine traditional and contemporary economic sensibilities to make it an alluring investment option, in this examination of the Cognac Chronicles.

The Origins: A Journey Through Time

To understand the investment charms of cognac, one must embark on a journey through time, tracing the spirit's origins back to the 16th century. The town of Cognac, nestled in the Charente region, became the epicenter of a burgeoning industry that transformed the humble grape into a sophisticated and sought-after libation. The art of distillation, introduced by Dutch settlers, laid the foundation for what would become one of the world's most revered spirits.

As the centuries unfolded, cognac evolved from a regional delicacy to a symbol of luxury and refinement. The Charente's limestone-rich terroir, coupled with a climate ideal for grape cultivation, bestowed upon the spirit a distinct character that resonates with connoisseurs and collectors alike. The cognac houses, many of which have histories spanning several generations, contributed to the creation of a liquid legacy that transcends time.

Craftsmanship and Limited Production

One of the pivotal factors that elevate cognac into the realm of investment-worthy assets is the meticulous craftsmanship and limited production that define its essence. The production of cognac adheres to stringent regulations, ensuring that only the finest grapes from the designated crus find their way into the alembic stills. The distillation process, an alchemical dance of heat and time, extracts the very soul of the grapes, creating a distillate that is then aged in oak barrels.

The aging process is where cognac acquires its complexity and depth. Each cognac house boasts a repertoire of aging cellars, some dating back centuries, housing casks that nurture the eaux-de-vie into a symphony of flavors. The patience required for this maturation process adds a layer of scarcity to the final product. Unlike wine, which can be continuously produced, the finite nature of aged cognac makes it a rare and coveted commodity.

Cognac Classification and Investment Tiers

To fully appreciate the investment potential of cognac, one must understand its classification system. The Appellation d'Origine Contrôlée (AOC) regulations divide cognac into several categories based on the geographic origin of the grapes and the aging process. The tiers range from VS (Very Special) to XO (Extra Old), with each designation signifying a different minimum age requirement for the eaux-de-vie.

Investors often find themselves drawn to higher-tier cognacs due to their increased age and complexity. XO and beyond, which include designations like Hors d'Âge and Extra, represent the pinnacle of craftsmanship and are often produced in limited quantities. The rarity of these aged spirits positions them as not just exquisite indulgences but also as potential appreciating assets in the world of investments.

Global Allure and Market Dynamics

Beyond the borders of France, cognac has attained a global allure that transcends cultural and geographic boundaries. It has become a status symbol and a mark of sophistication in international markets. The demand for premium cognac has surged in emerging economies, further fueling its reputation as a symbol of luxury and exclusivity.

The Asian market, particularly China, has played a pivotal role in driving the global demand for cognac. The spirit's association with celebration and gift-giving aligns seamlessly with Chinese cultural norms, making it a coveted item during festivals and special occasions. This surge in demand has contributed to the rise in value for rare and vintage cognacs, attracting the attention of investors seeking alternative assets with the potential for significant returns.

Investment Considerations: A Blend of Tradition and Modernity

Investing in cognac requires a delicate balance of understanding tradition and navigating the modern economic landscape. While the spirit's cultural significance and craftsmanship form the backbone of its investment appeal, savvy investors must also consider market trends, brand reputation, and the potential for appreciation.

Brand recognition plays a pivotal role in the investment value of cognac. Established houses with a legacy of producing exceptional spirits often command higher prices in the market. However, the emergence of artisanal and boutique producers adds a dynamic element to the investment landscape, providing opportunities for investors to explore new and innovative expressions.

Auction houses and specialized retailers have become key players in the secondary market for cognac. Rare and limited-edition releases, often accompanied by exquisite packaging and presentation, fetch premium prices at auctions. The growing interest in spirits as alternative investments has led to the establishment of dedicated platforms and indices tracking the performance of rare and collectible cognacs, further legitimizing the spirit's place in investment portfolios.

Risks and Rewards: Navigating the Cognac Investment Landscape

As with any investment, cognac carries its own set of risks and rewards. The limited production and finite nature of aged cognac contribute to its appeal, but they also make it susceptible to fluctuations in supply and demand. Economic downturns, changes in consumer preferences, or unforeseen global events can impact the market for luxury spirits.

The potential rewards, however, are equally compelling. Rare and well-maintained collections of cognac have shown impressive appreciation over the years, outperforming traditional investment assets in some cases. The combination of scarcity, craftsmanship, and global demand positions cognac as a tangible asset that appeals to both seasoned collectors and newcomers to the world of spirits investments.

Conclusion

In the realm of alternative investments, cognac stands as a unique and alluring option, offering a blend of cultural richness, limited production, and global appeal. The journey through the Cognac Chronicles reveals a spirit that has weathered the sands of time, evolving from a regional delicacy to a symbol of luxury and refinement. The meticulous craftsmanship, limited production, and international allure contribute to cognac's investment charms, enticing collectors and investors alike.

Navigating the cognac investment landscape requires an appreciation for tradition coupled with a keen understanding of modern market dynamics. The classification system, global demand, and the role of auction houses all play integral parts in shaping the investment potential of this timeless spirit. While cognac may not be a conventional investment, its ability to offer both sensory pleasure and potential financial gains positions it as a noteworthy addition to diversified portfolios.

As investors continue to seek alternative assets that go beyond traditional stocks and bonds, cognac emerges as a liquid treasure that embodies the convergence of history, craftsmanship, and market dynamics. The Cognac Chronicles, with its chapters written by the hands of generations past, beckon investors to explore the world of spirits with a discerning eye and a thirst for both knowledge and profit

0 notes

Text

The Elegance of Cognac: A Wise Investment for Discerning Investors

Among premium spirits, cognac is distinguished as a representation of class and sophistication. Beyond its wonderful flavour and lengthy history, cognac is becoming more and more known as a prudent investment option for astute investors. This piece explores the world of cognac investment and how its special combination of history, rarity, and financial potential makes it a desirable choice for sophisticated investors.

The Tradition of Cognac

Cognac, a type of brandy named after the town of Cognac in France, has a centuries-old tradition deeply rooted in craftsmanship and terroir. The production of cognac involves a meticulous process that begins with the careful selection of grapes, often the Ugni Blanc variety, grown in the Cognac region's chalky soils. These grapes are then fermented, distilled, and aged in oak barrels, resulting in a spirit known for its complex flavors and smooth finish.

The aging process is a crucial factor in cognac production, with the spirit maturing in barrels for a minimum period specified by French law. The use of Limousin or Tronçais oak barrels imparts distinct characteristics to the cognac, contributing to its unique taste profile. The tradition of cognac-making reflects a commitment to excellence and a dedication to preserving the craft's integrity, making it a timeless and sought-after beverage.

Rarity and Limited Editions

One of the key factors that contribute to cognac's allure as an investment is its inherent rarity. Unlike many other spirits, the production of cognac is subject to strict regulations and geographical indications, limiting its origin to the Cognac region. The combination of specific grape varieties, soil conditions, and aging processes results in a drink that cannot be easily replicated elsewhere.

Within the world of cognac, collectors and investors are particularly drawn to limited editions and rare releases. Some cognac houses produce exclusive blends or single cask releases, often in small quantities, making them highly coveted by enthusiasts. The scarcity of these exceptional bottles adds an extra layer of exclusivity and desirability, making them attractive to investors looking for unique and valuable additions to their portfolios.

Financial Potential of Cognac

Beyond its cultural and sensory appeal, cognac has demonstrated considerable financial potential as an alternative investment. In recent years, the demand for rare and vintage spirits, including cognac, has surged among collectors and investors alike. The market for premium spirits has experienced growth, with auction houses and specialized retailers reporting increasing prices for sought-after bottles.

Cognac's investment potential is further enhanced by its long shelf life. Unlike certain perishable commodities, well-preserved bottles of cognac can appreciate in value over time, especially if they belong to limited editions or rare releases. The exclusivity of certain vintages and the prestige associated with particular cognac houses contribute to the overall market value of these spirits.

The Role of Brand and Reputation

In the world of cognac investing, the reputation of the brand plays a pivotal role. Established cognac houses with a history of producing exceptional spirits often command higher prices in the market. The legacy and craftsmanship associated with well-known brands contribute to the perceived value of their products.

Investors keen on cognac often pay attention to the track record of a particular house, its adherence to traditional production methods, and the critical acclaim received by its releases. Brand recognition not only ensures the quality of the spirit but also adds a layer of prestige that can enhance its investment appeal.

Diversification in Investment Portfolios

As the investment landscape continues to evolve, diversification remains a fundamental strategy for risk management. Cognac, with its unique combination of tradition, rarity, and financial potential, offers investors an alternative asset class that can complement traditional investments like stocks and bonds.

Including cognac in an investment portfolio provides diversification benefits, as its value may not be directly correlated with other financial assets. While financial markets can be subject to volatility, the rarity and exclusivity of certain cognac releases can contribute to a more stable and resilient investment portfolio.

Conclusion

The elegance of cognac goes beyond its exquisite taste; it extends to its role as a wise investment for discerning investors. Rooted in tradition, with a touch of rarity and financial potential, cognac represents a unique opportunity for those seeking to blend sophistication with sound investment strategies. As the market for premium spirits continues to grow, cognac stands out as a timeless and appealing choice, adding a touch of refinement to both collectors' shelves and investment portfolios alike. Whether enjoyed in a crystal glass or safeguarded in a collector's cellar, cognac remains a symbol of enduring luxury and a wise investment for those who appreciate the finer things in life.

0 notes

Text

The Golden Elixir: Unveiling the Significance of Cognac Investing

Within the realm of high-end alcoholic beverages, cognac is regarded as a classic beverage that goes beyond simple pleasure and becomes an emblem of elegance and sophistication. Beyond its excellent flavour and cultural significance, cognac has become a fascinating option for investors looking to connect with a rich legacy while also pursuing financial gain. This piece explores the factors that are driving the popularity of cognac investing and the significance of it for those wishing to diversify their financial holdings.

Cognac's Prestigious Heritage:

Cognac is not just a spirit; it's a legacy distilled into every drop. Originating from the Cognac region in France, this meticulously crafted brandy has a history that dates back centuries. The elaborate production process, adherence to tradition, and the terroir of the Cognac region contribute to the unique character of each bottle. Investors find appeal in assets with enduring stories, and cognac, with its prestigious heritage, becomes an investment that ties them to the cultural and historical tapestry of France.

Steady Growth in Market Demand:

The global demand for premium spirits, particularly cognac, has been steadily rising. This surge is driven by an evolving consumer palate and an increasing appreciation for high-quality, artisanal products. As emerging markets continue to embrace luxury goods, cognac stands out as a symbol of opulence, attracting a diverse range of consumers. This sustained growth in demand is a promising indicator for investors eyeing the spirits market.

Limited Production and Rarity:

Cognac, by its very nature, is a limited commodity. The aging process, often spanning several decades, adds a layer of rarity to each bottle. Unlike many other investments, the production of cognac cannot be expedited; time is an essential ingredient. This scarcity, coupled with the meticulous craftsmanship involved, positions cognac as a tangible asset with inherent value, making it an appealing choice for those seeking investments with a unique scarcity factor.

Resilience in Economic Downturns:

History has shown that certain luxury goods, including high-quality spirits like cognac, tend to weather economic downturns more robustly than other sectors. Even in challenging financial climates, enthusiasts and collectors often maintain their interest in premium spirits, creating a buffer against market volatility. Cognac, with its longstanding appeal to connoisseurs, can serve as a stable and resilient component within an investment portfolio.

Collectibility and Rarity in Limited Editions:

Cognac houses regularly release limited editions and special blends, each telling a distinct story and carrying a unique artistic expression. The rarity of these limited releases, often accompanied by intricate packaging and presentation, makes them highly sought after by collectors. Investing in limited editions allows individuals to tap into the appreciation of craftsmanship, artistry, and exclusivity, turning each bottle into a valuable and potentially appreciating asset.

Global Appeal and Market Expansion:

Cognac is no longer confined to its French origins; it has transcended borders to become a global phenomenon. As emerging economies experience increased affluence and a burgeoning middle class, the demand for luxury goods, including premium spirits, continues to rise. Investors can capitalize on this global appeal by strategically incorporating cognac into their portfolios, benefiting from both the brandy's historical significance and its contemporary allure.

Diversification Benefits:

Investment experts often emphasize the importance of diversification to mitigate risks in a portfolio. Cognac, as an alternative investment, provides a unique avenue for diversification beyond traditional asset classes like stocks and bonds. The spirits market operates independently of broader economic trends, allowing investors to diversify their holdings and potentially enhance overall portfolio performance.

Potential for Appreciation:

While past performance is not indicative of future results, the potential for appreciation in the value of rare and sought-after cognacs is a compelling factor for investors. Limited editions, vintage releases, and bottles from renowned cognac houses have demonstrated the ability to appreciate significantly over time, making them attractive assets for those with a keen eye for potential financial gains.

Cognac investing goes beyond the financial realm, offering a unique fusion of cultural richness, historical significance, and investment potential. As the global appetite for premium spirits continues to grow, cognac stands as a resilient and appealing choice for investors seeking an asset that marries tradition with modern luxury. The limited production, collectibility, and global demand all contribute to the allure of cognac as a valuable addition to a diversified investment portfolio. As the world raises a toast to the artistry and craftsmanship of this golden elixir, investors may find that the returns on cognac investments are equally intoxicating.

1 note

·

View note