Don't wanna be here? Send us removal request.

Text

Strategic Guide to Transforming Insurance Policy Administration

Explore key strategies to modernize insurance policy administration systems. This guide highlights how digital transformation streamlines operations, boosts efficiency, ensures compliance, and enhances customer experience—helping insurers stay competitive in a dynamic market.

Read more: Strategic Guide to Transforming Insurance Policy Administration

0 notes

Text

Revolutionize Claims Fraud Detection with Insurance Management Systems

Insurance fraud can undermine financial stability and erode customer trust. With a robust insurance management system, insurers can leverage advanced data, automation, and real-time alerts to identify and prevent fraud more accurately and efficiently. Transform your fraud detection process, minimize losses, and safeguard your bottom line.

Read more to discover how insurance management systems are modernizing fraud detection.

0 notes

Text

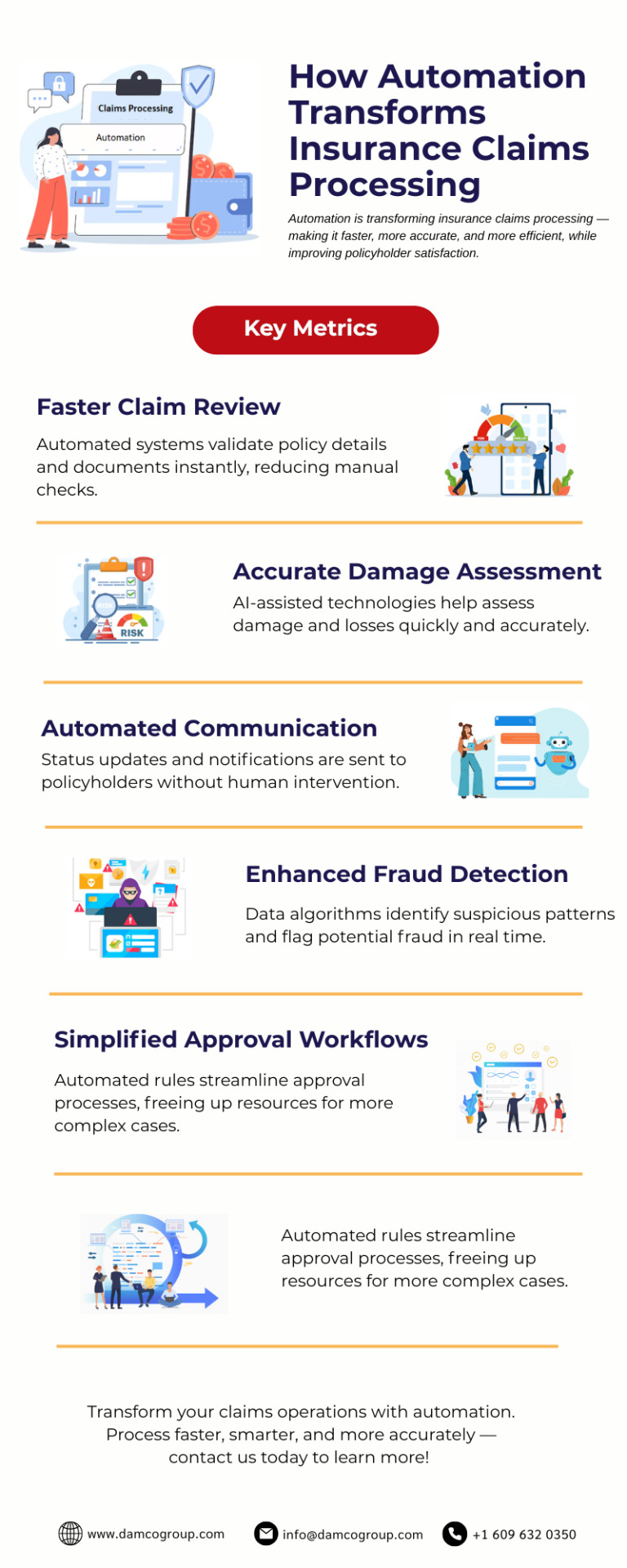

Discover how automation streamlines insurance claims processing—reducing manual tasks, minimizing errors, and delivering faster settlements.

0 notes

Text

Discover how insurance claims management software can help insurers efficiently handle claims from submission to settlement. Automate workflows, reduce manual effort, minimize fraud, and improve policyholder satisfaction with a powerful, all-in-one solution.

0 notes

Text

Explore feature-rich CRM for insurance agents tailored to streamline policy management, automate renewals, and centralize client communications. With real-time data and smart reminders, this CRM for insurance agents helps deliver personalized service, boost retention, and drive sales efficiently.

0 notes

Text

The Future of Claims Processing: How Smart Software is Changing Insurance

Discover the transformative potential of intelligent claims processing software and its pivotal role in revolutionizing the future of insurance. By leveraging cutting-edge automation, AI, and machine learning, these advanced tools streamline workflows, minimize manual errors, and accelerate claim settlements—enhancing efficiency and customer satisfaction. Insurers benefit from improved fraud detection, data-driven decision-making, and strengthened credibility through faster, more transparent processes. As the industry evolves, adopting innovative claims management solutions ensures a competitive edge, reduces operational costs, and delivers seamless, personalized experiences for policyholders. Embrace the future of insurance with smarter, faster, and more reliable claims processing technology.

Read more— Modernizing Insurance: The Role of Smart Claims Software

0 notes

Text

Key metrics tracked by software for insurance brokers include policy conversion rates, client retention, premium collections, claims processing time, and broker productivity. By analyzing these metrics, brokers can optimize sales strategies, improve customer service, and enhance operational efficiency, ultimately driving business growth and profitability.

0 notes

Text

Acceleration Digital Transformation with AI Solutions for Insurance

Is your insurance business bogged down by traditional, paper-based workflows? If yes, then it is time to adopt AI-based insurance solutions and ride the wave of digital transformation. These solutions bring speed, efficiency, and scalability, enabling insurers to modernize operations and provide value-based customer services. Read more — AI Solutions for Insurance: Benefits, Adoption Challenges, and Use Cases

0 notes

Text

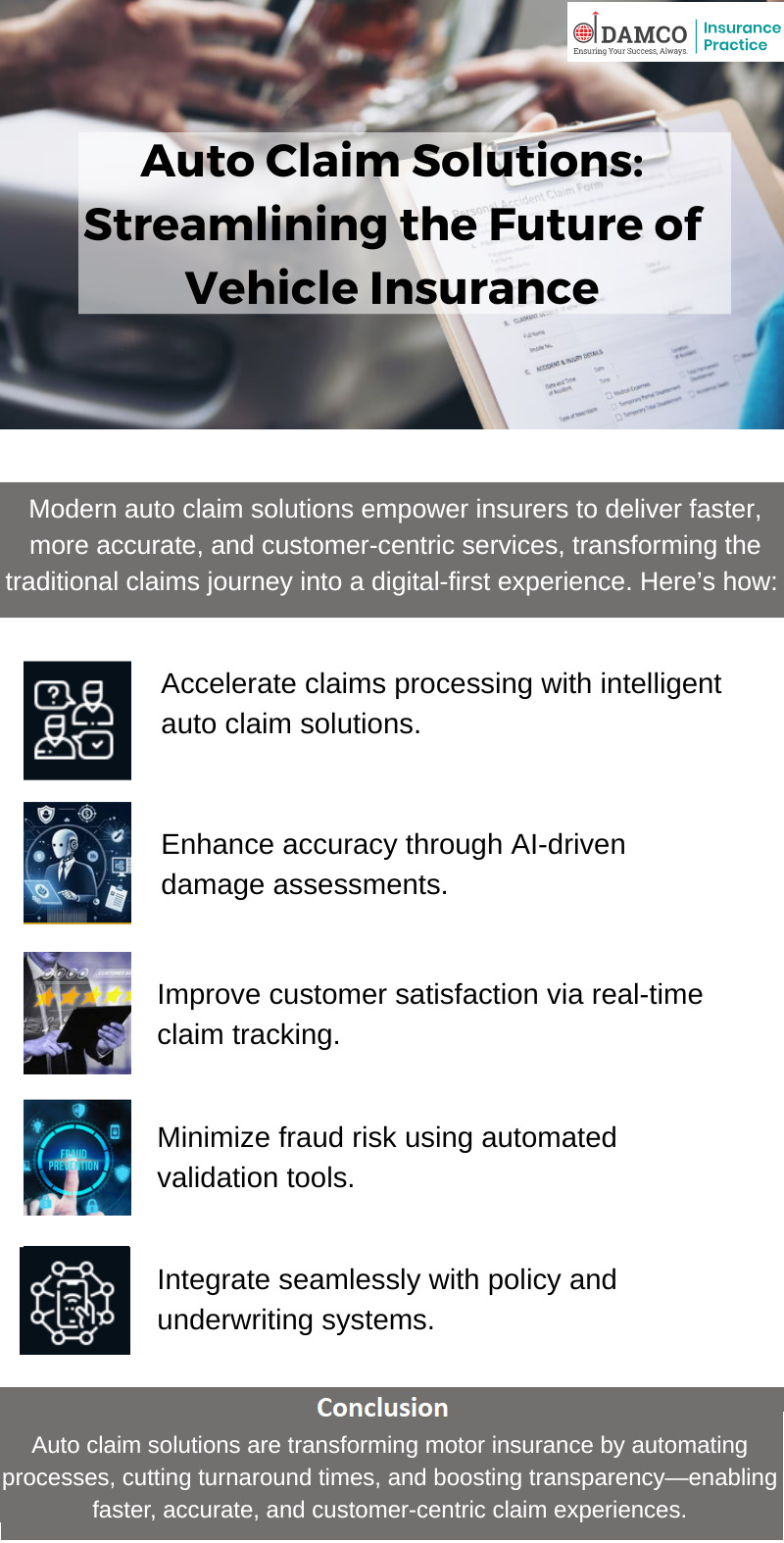

Auto Claim Solutions: Streamlining the Future of Vehicle Insurance

Discover how auto claim solutions are reshaping vehicle insurance by automating workflows, accelerating claim settlements, and enhancing customer satisfaction. From AI-powered assessments to seamless integrations, insurers can now deliver faster, smarter, and more reliable claims experiences. Explore advanced auto claim solutions and drive your insurance operations forward today!

0 notes

Text

Discover how insurance CTOs can successfully lead AI adoption with a strategic, scalable approach. This blog outlines key considerations—from aligning AI with business goals to addressing implementation challenges—helping insurers unlock efficiency, innovation, and competitive advantage in a rapidly evolving digital landscape.

0 notes

Text

Redefining Brokerage with AI-Powered Insurance Broker Management Software

AI-powered insurance broker management software is transforming brokerage by automating processes, improving client engagement, and delivering data-driven insights. This technology enhances efficiency and accuracy, enabling brokers to provide personalized service and stay competitive in today’s fast-evolving insurance market.

Read more: How AI-Powered Insurance Broker Management Software is Redefining Modern Brokerage

0 notes

Text

Discover the essential features that modern policy software must offer to drive growth, efficiency, and customer satisfaction in the insurance industry. This insightful blog by Damco Group explores how the right technology empowers insurers to streamline policy lifecycles, enhance compliance, and stay competitive in a dynamic market.

0 notes

Text

Explore Damco’s Auto Insurance Claims Management Solutions designed to streamline claims processing, reduce settlement time, and enhance customer satisfaction. Leverage AI-powered automation and advanced analytics to optimize your auto claims workflow.

0 notes

Text

In a competitive insurance landscape, adopting advanced insurance underwriting software is no longer optional but essential. It empowers insurers with efficiency, compliance, and agility, ultimately leading to better risk management and improved profitability.

0 notes

Text

Discover how artificial intelligence is revolutionizing insurance fraud detection by boosting speed, accuracy, and decision-making. Learn how insurers can harness advanced algorithms to detect fraudulent patterns early, accelerate claims processing, and enhance overall operational efficiency.

0 notes

Text

Discover how next-gen insurance quoting software is using AI and data analytics to deliver faster, more accurate quotes. From personalized customer experiences to real-time risk assessments, learn how technology is setting new industry standards. Read the full blog to explore the future of insurance quoting.

0 notes

Text

Managing policies is a time-consuming task that involves hefty paperwork. Policy administration systems help insurers streamline policy management. Check the infographics now!

0 notes