#Claims processing software

Explore tagged Tumblr posts

Text

The Future of Claims Processing: How Smart Software is Changing Insurance

Discover the transformative potential of intelligent claims processing software and its pivotal role in revolutionizing the future of insurance. By leveraging cutting-edge automation, AI, and machine learning, these advanced tools streamline workflows, minimize manual errors, and accelerate claim settlements—enhancing efficiency and customer satisfaction. Insurers benefit from improved fraud detection, data-driven decision-making, and strengthened credibility through faster, more transparent processes. As the industry evolves, adopting innovative claims management solutions ensures a competitive edge, reduces operational costs, and delivers seamless, personalized experiences for policyholders. Embrace the future of insurance with smarter, faster, and more reliable claims processing technology.

Read more— Modernizing Insurance: The Role of Smart Claims Software

0 notes

Text

Top 5 Reasons Claims Management Software Is a Must-Have

Claim processing can be slow and error-prone, but it does not have to be. Claims management software speeds up operations, reduces errors, and improves customer satisfaction by automating processes and optimizing workflows.

Not only does this software make claims easier for customers, but it also simplifies work for companies. Customers today expect quick and hassle-free service, and claims software delivers just that by keeping everything organized and accurate.

With so many benefits, it’s no surprise that this software is transforming. But what exactly makes it a must-have?

Keep reading to find out!

Faster and Smoother Claims Processing

Healthcare claims management software creates smart processes that speed up claims processing and improve overall system efficiency. By automating the main tasks, this software reduces the burden on employees and allows insurance companies to incorporate the best practices directly. And if something changes, upgrading the system is simple, ensuring companies stay responsive.

Automation also handles tedious, repetitive duties, allowing people to focus on more vital aspects of their professions. This results in a speedier and more efficient claims process.

Making Customer Service Better

A recent study found that Millennials and Gen Z expect excellent customer service. They want to discuss their claims using the most convenient device—email, chat, text, or phone.

And when they want to speak with a person, they don’t want to wait on hold while a bot figures things out. They prefer short and easy talks. Good communication should be bidirectional, and automation can help with this. Claims processing software ensures that nothing is lost in the process.

Imagine a system in which data is easily entered by claims specialists and sent between systems instantaneously. Employees won’t waste time retyping responses, and customers won’t have to repeatedly provide the same information.

All the necessary information is available when a claim reaches underwriting. This translates into quicker settlements, quicker options, and above all—happy customers.

Making Compliance and Reporting Easy

Audits can be real headaches for insurance companies. However, with automation software, they become quite simple. The software generates accurate reports and makes the entire process go smoothly. No more stressing about yearly audits!

Insurance companies have to follow many rules set by the government to defend people. Healthcare claims management software assists by identifying claims that require more attention to comply with the law.

In a nutshell, this software reduces the stress associated with compliance and makes things much easier.

Making Sense of Data with Smart Insights

AI and advanced analytics might sound complicated, but they are really strong tools that help businesses better understand their data. With claims software, users can create detailed reports to address their most pressing issues.

Predictive analytics takes things one step further. It compiles risk data from many sources and integrates it with internal data. This provides risk managers with a comprehensive view of possible risks, allowing them to make better decisions faster and with greater accuracy than manual decision-making.

This software also identifies gaps in older systems and suggests solutions to improve workflows. It also gives important figures and reports to help teams track progress and improve their processes over time.

Making Fewer Claims and Getting Claims Right

People make mistakes, and it is normal. But when it comes to managing claims, those mistakes can slow down and cause frustration. Without automation, small errors might cause payment delays and more work.

Claims software helps by automatically verifying information. It collects data from many sources both inside and outside the firm, ensuring that everything lines up. This enables insurance teams to make the right decisions.

The software also detects faults early. If something appears to be wrong, it raises a red signal, allowing a human to intervene and analyze it. For example, it can double-check names, addresses, and claim amounts to ensure they all match. There is no confusion or missing information because all employees have access to the same data.

Unlike humans, the claims software does not become tired or distracted. This means that the data remains correct, making the overall process smoother and faster.

Final Words

Claims management software is the future. It simplifies operations, enhances accuracy, and keeps everything running smoothly. Stay ahead of the competition—upgrade today and make claims processing simple!

#Claims Management Software#Claims Software#Claims Processing Software#Healthcare Claims Management Software#TPA Software#Medical Claims Software

0 notes

Text

0 notes

Text

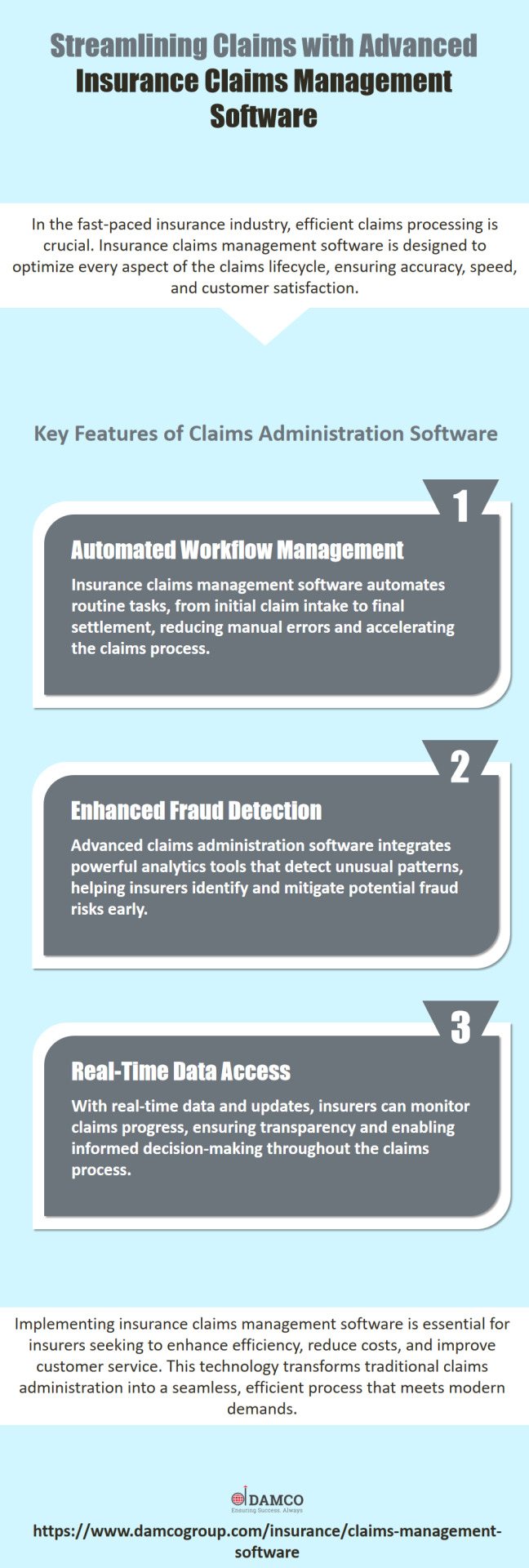

Transform your claims processing with our innovative claims administration software. Contact us today to see how we can enhance your insurance operations. Visit: https://www.damcogroup.com/insurance/claims-management-software

#insurance technology#insurance software#insurance solutions#claims management software#claims processing software#claims administration software

0 notes

Text

OMG yes

It's not that I think that it's a-ok for AI to steal everything around it willy-nilly, but I really think that the current AI problem is about AI's practical aspects than a moral issue. I mean, tools and techniques are (most of the time, exceptions apply!!) relatively neutral in their existence, we are the ones giving it meaning and value. We are the ones that decide the good (cooking) and the bad (killing) use of a knife. And we are the ones who decide when the bad use might not be that bad ('citizen killing another citizen in a street' vs 'soldier killing another soldier in a war').

To me, the AI issue is a "it's not 'we' who are giving it meaning and purpose, it's a small group of people who barely even know how it works and are only interested in the profits it may or may not bring".

In a way, since AI is an intelligence that adapts with time, training it is a bit like raising a pet, isn't it? I would prefer that my pet is raised by me and people I trust, not handed to me pre-trained by a guy who has a record of using pets to steal wallets, and being required to hand it over to that guy's pet daycare every day for 'updates in the training'. Hm-hm, wallet-stealing guy, it's not suspicious at all.

ed zitron, a tech beat reporter, wrote an article about a recent paper that came out from goldman-sachs calling AI, in nicer terms, a grift. it is a really interesting article; hearing criticism from people who are not ignorant of the tech and have no reason to mince words is refreshing. it also brings up points and asks the right questions:

if AI is going to be a trillion dollar investment, what trillion dollar problem is it solving?

what does it mean when people say that AI will "get better"? what does that look like and how would it even be achieved? the article makes a point to debunk talking points about how all tech is misunderstood at first by pointing out that the tech it gets compared to the most, the internet and smartphones, were both created over the course of decades with roadmaps and clear goals. AI does not have this.

the american power grid straight up cannot handle the load required to run AI because it has not been meaningfully developed in decades. how are they going to overcome this hurdle (they aren't)?

people who are losing their jobs to this tech aren't being "replaced". they're just getting a taste of how little their managers care about their craft and how little they think of their consumer base. ai is not capable of replacing humans and there's no indication they ever will because...

all of these models use the same training data so now they're all giving the same wrong answers in the same voice. without massive and i mean EXPONENTIALLY MASSIVE troves of data to work with, they are pretty much as a standstill for any innovation they're imagining in their heads

#ai#ai critique#capitalism#I'll forever claim that if I had my own piece of AI that I could train just with open data and my own data I'd get it#because *I* get to determine which parts of my creative process I want to engage with and which ones are chores#if you think I wouldn't get it to help me draw the same character and backgrounds 100 time in a comic you are mistaken#but I would still do or redo whatever I don't think is working up to erasing everything and redoing by hand#you know - how we already use graphic software#it's important I'd train it with my own data and transparency with its training database would be important of course#I'd even buy training data if I thought it would improve what I want and the person is willing to sell#but all of this pipe dream is conditioned to “is it possible? and feasible? in this year of our lord 2025?”#and sadly I think it's not yet - we still have a lot to do and dismantling capitalism is one of them

76K notes

·

View notes

Text

The healthcare industry is constantly striving to improve efficiency, accuracy, and patient care. While dedicated medical professionals are the heart of any hospital, Information Technology (IT) offers a powerful tool to revolutionize day-to-day operations through automation. By leveraging automation technologies like Robotic Process Automation (RPA) and Artificial Intelligence (AI), hospitals can streamline workflows, reduce errors, and empower staff to focus on what matters most: their patients.

#AI for healthcare#Patient Monitoring System#Custom RPA Solutions#AI Development Services#healthcare claims processing#Healthcare Software Development Services

0 notes

Text

Explore the World of Medical Billing: A Rewarding Career

Embarking on a career in medical billing and coding can be a rewarding choice, offering stability, competitive compensation, and flexible work arrangements. As a critical bridge between healthcare providers and insurance companies, this field ensures proper reimbursement for medical services. According to the U.S. Bureau of Labor Statistics, coding jobs are expected to increase by 9% by 2033,…

#Billing software#Certification in medical billing#Coding and billing#Healthcare administration#Healthcare industry trends#Insurance claims processing#Medical billing career#Professional development#Revenue cycle management

0 notes

Text

youtube

#claims management software#claims adjuster#claims processing#hr giger#hr software#hr payroll software#hr jobs in jaipur#hr analytics#Youtube

0 notes

Text

Home Insurance Claims and Asset Management with Leevaapp

When it comes to home insurance claims, having a comprehensive and organized home inventory is essential. Whether you’re dealing with a minor loss or a major disaster, being able to quickly and accurately document your belongings can make the process easier and faster. But managing a home inventory without the right tools can be challenging. This is where Leevaapp comes in as the best home inventory app designed to simplify the process for you.

The Importance of Home Inventory for Insurance

A thorough home inventory for insurance purposes is crucial in case you ever need to file a claim. Insurance companies often require detailed lists of the items in your home, including descriptions, purchase dates, values, and any serial numbers. It can be difficult to remember everything, especially if you're under stress after a loss. By having an up-to-date home inventory management software like Leevaapp, you can easily create a digital record of all your assets, which is invaluable when submitting claims.

Features of Leevaapp: The Ultimate Home Inventory Software

Leevaapp is an inventory management software that offers multiple features to help you manage your home inventory efficiently. It allows you to track your belongings and store important details like descriptions, images, and even receipts. The app is designed to be user-friendly and accessible, ensuring that you can update your inventory whenever needed.

Organize Your Inventory Easily: With Leevaapp, you can categorize your assets based on rooms, types, or any other criteria you prefer. Whether you're tracking your inventory home or organizing your entire household, the app helps keep everything in order.

Track and Manage Your Assets: The best inventory tracking software provides real-time updates, ensuring that your records are always up-to-date. Whether you’re at home or on the go, you can track new purchases or changes to your assets instantly.

Prepare for Insurance Claims: Having all your belongings organized in one place not only makes it easy to retrieve information when needed but also speeds up the home insurance claims process. When filing a claim, you'll have all the necessary documentation in the app, reducing the risk of delays.

Digital Asset Management Software: Beyond basic home inventory, Leevaapp also serves as a digital asset management software. You can keep a detailed digital record of each item in your home, making it easier to prove the value of your assets if needed.

Easy to Use: With Leevaapp, you don’t need to be tech-savvy to create a professional home inventory. The intuitive design ensures that anyone can use the app to manage their assets without feeling overwhelmed.

Why Choose Leevaapp for Your Home Inventory?

The home insurance claims process can be frustrating if you don't have your inventory properly documented. Leevaapp eliminates the guesswork, helping you easily compile and maintain a detailed home inventory. It ensures you're always ready for the unexpected, with your belongings tracked and protected in the app.

Additionally, with Leevaapp, you don’t just get inventory home management for insurance; you get an all-in-one asset management software that’s perfect for any homeowner. Whether you're interested in a simple home depot inventory checker or a more robust inventory management software to track everything in your house, Leevaapp meets all your needs.

Start Organizing Your Home Inventory Today

Get ahead of any potential insurance claims or asset management needs by downloading Leevaapp today. This powerful inventory tracking software is available on both iOS and Android devices, so you can manage your home inventory from anywhere.

Leeva Secure Home Inventory on the App Store

Leevaapp on Google Play

With Leevaapp, you can ensure that your home inventory is always up-to-date, organized, and ready for anything life throws at you. Take control of your home insurance claims and asset management today!

#Insurnace claim home#home insurance claims#home insurance claims process#home inventory#inventory home#home depot inventory checker#home depot inventory#home inventory software#best home inventory app#home inventory for insurance#home inventory management software#asset management software#best inventory management software#digital asset management software#inventory management software#best inventory tracking software

0 notes

Text

What Are the Reasons for Selecting the Medicare Pricer Software?

Medicare Pricer software is a powerful tool designed to streamline the complex process of calculating Medicare reimbursement rates. It offers several compelling reasons for adoption. First, it enhances the overall accuracy by automating intricate calculations based on Medicare’s fee schedules and pricing rules, reducing the risk of human errors. This efficiency not only saves time but also ensures the compliance with government federal guidelines. Second, the software also provides clear transparency by offering clear insights into the payment process, enabling the providers to understand the reimbursement structures better. Its adaptability to various claim types, including inpatient, outpatient, and skilled nursing facility claims, makes it a versatile solution for healthcare organizations.

On the other hand, the medicare Advantage claims processing is equally crucial in the modern healthcare reimbursement ecosystem. Medicare Advantage plans, offered by many private insurers, operate under different Medicare guidelines but often have unique rules. When a claim is submitted, the MA plan reviews it for better eligibility, ensuring that the services provided are covered under the patient’s benefits. The claim undergoes proper validation for accuracy and compliance with coding standards. After validation, the claim is adjudicated to determine the payment amount, factoring in deductibles, copayments, and the provider’s contract terms.

Summary

Moreover, combining the efficiency of Medicare Pricer software with robust claims processing ensures healthcare providers are reimbursed promptly and correctly. This alignment fosters financial stability for providers while maintaining compliance with Medicare regulations. By leveraging these tools, healthcare organizations can optimize their revenue cycle and focus on delivering quality care.

0 notes

Text

"Simplify Your Practice with Expert General Surgery Billing Services"

"Simplify Your Practice with Expert General Surgery Billing Services"

Streamline your revenue cycle and focus on patient care with our specialized General Surgery Billing Services. Designed to meet the unique demands of surgeons and healthcare providers, we ensure accurate claims submission, faster reimbursements, and compliance with regulatory standards.

Why Choose Us?

Expertise in healthcare services billing codes and regulations

Precise claim processing to reduce denials

Regular audits for maximum compliance

Comprehensive reporting for financial transparency

Let us handle the complexities of billing while you deliver quality care. Partner with us for stress-free revenue management in your surgical practice.

#general surgery billing services#medical billing services#healthcareclaims#claims processing#medical billing and coding#health#claims management software#healthcare

0 notes

Text

Claims management software boosts efficiency by automating claim processing, minimizing errors, and speeding up settlements. It streamlines workflows, enhances data accuracy, and improves customer experience with real-time tracking and communication. AI and analytics help detect fraud, optimize claims handling, and ensure compliance. Integration with policy and customer management systems creates a seamless, transparent process. This reduces costs and improves operations.

0 notes

Text

Integrating TPA Software With Your Existing Systems

Well, choosing the right third-party administrator is the most important decision for a self-funded organization. So, get it right and you will have a partner who streamlines your healthcare benefits, reduces costs, and enhances employee satisfaction. Sometimes it might be possible that you could get stuck with an outdated system that minimizes your time and gives you peace of mind.

Despite these high stakes, many organizations remain with third-party administrator companies and you know why? These changes feel risky. Also, the fear of disruptions, data loss, or confusion can make it seem safer. Here in this guide, we will walk you through what to look for in TPA software and how to navigate the available options for third-party administrator companies in the marketplace.

From essential features like technology and network ownership, you should be asking questions to potential providers. We will explain some of the tools by which you can make an informed choice. Also, you will know how to identify a TPA that works for you, and not against you.

Let’s get started!

1: The Cost Of Inefficiency

It seems that every day your administrative team spends untangling complicated systems and navigating multiple platforms. Also, waiting on support from third-party vendors is a day when organizations lose productivity. Many third-party administrator companies operate outdated and disjointed platforms and require administrators to log into multiple systems. This fragmented setup creates inefficiencies at every turn.

So, instead of seamless workflows, you are stuck dealing with manual processes, redundant data entry, and long waiting times for issue resolution. In the end, the result is higher administrative costs and frustrated teams. Thus, it's important to have TPA software that makes your work quite easier.

2) Employee Satisfaction

It might be possible that your employees don’t see the backend operations of your TPA, but they will certainly feel its effects. Whenever it seems that employees struggle to access care, or facing delays with claims, or experience confusion about their benefits. Then it directly impacts their satisfaction, morale, and trust in your organization.

You need to think about it- when employees need healthcare, they want simple and stress-free access. But TPA's that rely on fragmented networks create unnecessary hurdles for employees who are trying to schedule appointments or resolve billing issues. Over time, these frustrating experiences add up and it leads to employee dissatisfaction and even turnover.

3. Customization and Flexibility

Remember no two organizations are the same and why should their benefit plans be? Unfortunately, many third-party administrator companies rely on rigid solutions that don’t account for an organization’s unique needs. Also, customization requires more than just minor requirements and it requires a system that can adapt to new rules, unique plan designs, and specialized provider networks.

The Bottom Line: Why It All Matters

When it comes to choosing the right claims processing software, it means you are not just checking a box for administrative support you are choosing a strategic partner. The right TPA offers:

1: Unified Systems: However, a single easy-to-use platform for administrators, employees, and providers.

2: Expert Network Support: In-house network specialists streamline contracts and provider management.

3: Partnership-Driven Service: It provides personalized support and gives a shared commitment to your organization’s success.

#Claims Management Software#Claims Software#Claims Processing Software#Healthcare Claims Management Software#TPA Software#Medical Claims Software

0 notes

Text

Simplify Claims Processing with Smart Claims Management Software!

🚀 Transform the way you handle claims with advanced Claims Management Software! Whether you’re a healthcare provider, insurer, or administrator, our Claims Software streamlines the process, reduces errors, and speeds up approvals. Say goodbye to manual paperwork and hello to automation and efficiency.

This technology not only enhances efficiency but also improves compliance with industry regulations, reducing the risk of audits and penalties. Whether you run a hospital, private clinic, or insurance firm, investing in a robust claims processing solution can save time, lower operational costs, and enhance patient satisfaction.

#Claims Management Software#Claims Software#Claims Processing Software#Healthcare Claims Management Software#TPA Software#Medical Claims Software

0 notes

Text

From Reactive to Proactive: How a Claims Management System Can Help You Settle Claims Faster

Policyholders value efficient claims settlements over everything else. To ensure a smooth and speedy claim settlement process, insurers must deploy a modern claims management system. Read the full blog here:

#insurance technology#insurance software#insurance solutions#claims management system#claims processing software

0 notes

Text

What are the next steps after obtaining an insurance broker license, and how can you generate potential leads using Mzapp CRM software?

Congratulations on securing your insurance broker license! The journey doesn’t end here; it’s just the beginning of building a successful insurance brokerage. Here’s how you can proceed and leverage Mzapp CRM software to find potential leads:

Steps After Getting Your Insurance Broker License

Understand Your Market: Research your target audience (individuals, businesses, or specific sectors).

Develop a Business Plan: Set goals for client acquisition, revenue, and operational processes.

Build a Network: Partner with insurance providers and attend industry events to establish your presence.

Create an Online Presence: Build a professional website and maintain active profiles on social platforms.

Offer Value-Added Services: Educate customers on policies, claims management, and risk assessments.

Using Mzapp CRM Software to Generate Leads

Lead Capture: Utilize Mzapp’s integrated forms and web tracking tools to capture inquiries from your website or social media.

Automated Follow-Ups: Set up personalized email and SMS follow-ups to nurture leads effectively.

Lead Scoring: Prioritize leads based on their interaction history, ensuring you focus on high-potential prospects.

Data-Driven Campaigns: Use analytics to identify what works and launch targeted campaigns.

Seamless Policy Management: Impress leads by showcasing how smoothly you manage policies and claims through Mzapp.

Why Choose Mzapp CRM?

Mzapp CRM simplifies lead management, streamlines operations, and provides insights into customer behavior, making it easier to convert prospects into loyal clients.

Learn more about how Mzapp can transform your insurance business here.

#Question:#What are the next steps after obtaining an insurance broker license#and how can you generate potential leads using Mzapp CRM software?#Answer:#Congratulations on securing your insurance broker license! The journey doesn’t end here; it’s just the beginning of building a successful i#Steps After Getting Your Insurance Broker License#Understand Your Market: Research your target audience (individuals#businesses#or specific sectors).#Develop a Business Plan: Set goals for client acquisition#revenue#and operational processes.#Build a Network: Partner with insurance providers and attend industry events to establish your presence.#Create an Online Presence: Build a professional website and maintain active profiles on social platforms.#Offer Value-Added Services: Educate customers on policies#claims management#and risk assessments.#Using Mzapp CRM Software to Generate Leads#Lead Capture: Utilize Mzapp’s integrated forms and web tracking tools to capture inquiries from your website or social media.#Automated Follow-Ups: Set up personalized email and SMS follow-ups to nurture leads effectively.#Lead Scoring: Prioritize leads based on their interaction history#ensuring you focus on high-potential prospects.#Data-Driven Campaigns: Use analytics to identify what works and launch targeted campaigns.#Seamless Policy Management: Impress leads by showcasing how smoothly you manage policies and claims through Mzapp.#Why Choose Mzapp CRM?#Mzapp CRM simplifies lead management#streamlines operations#and provides insights into customer behavior#making it easier to convert prospects into loyal clients.#Learn more about how Mzapp can transform your insurance business here.

1 note

·

View note