#Estimate Your EMI

Text

In India, EMI calculators help you estimate monthly loan payments for education and home loans. This free tool allows you to compare loan options, plan your finances, and manage expectations. By entering loan amount, interest rate, and tenure, you can see how changes impact your EMI. Remember, EMI calculators provide estimates and don't account for all loan fees. Consider your overall financial situation and explore tax benefits before applying for a loan.

#best emi calculator#emi calculator#online emi calculator#emi#loans#financial calculators#Loan Planning#Manage Your Budget#loan calculator#financial tools#Estimate Your EMI#Smart Borrowing

1 note

·

View note

Note

Hii Emi! It's me again and if you're up to i have another request! Obv a Law x yn where yn joined the heart pirates only two months ago and she is pretty shy and always worried to not be helpful to the crew. Law takes pity out of her of how cute she looks but what hits his heart is how kind and gentle this girl is and that makes Law slightly worried because he knows something is different and he cannot let himself fall in love because he needs to avenge Corazon

Pairing: Law x Cute fem!reader | Word count: 1.9k | Warnings: None

Synopsis:

Welcome aboard the Polar Tang, (Y/n)!

The Heart pirates took you in with open arms without regret to this day. You are one of the kindest and most gentle people the crew ever faced, growing fond of your sweet and humble behaviour.

Over time, Law takes notice of your modesty and fights against his own emotions you awaken in him, before they become too much to handle.

Is a dark and sinister man such as him actually able to develop romantic feelings? He highly doubts it. Yet so he thought.

A/N: Kurage! Of course I'm up for it! It's Law we're talking about ఌ Avast, another fluffy OneShot, thank you for the request dear! (Sorry it took a bit longer, I was on holiday) Hope you like it!

Dividers by cafekitsune ~

„Hey (Y/n), could you grab me the tool kit from the boilers below? I must‘ve forgotten it down there.“ - „Sure thing Uni!“, as one of the newest crew members of the Heart pirates, you‘re highly determined to be of support wherever you‘re able.

Since two months aboard the Polar Tang, you learned rather quickly how kind and contributory Trafalgar‘s bunch is. Safe to say, you‘ve grown fond of them and vice versa.

They appreciate your zeal, though you do not possess the ability or skill to know the ropes around the submarine, so the mechanics assign you to simple tasks.

Besides sweating in the sub‘s belly, doing mechanical works, kitchen and laundry duty are also a great way to warm up to the general feel of being part of a crew.

After a quite dramatic rescue, where Law saved you from slave drivers, you can‘t rid the sentiment of the Surgeon of Death behaving hostile towards you.

Of course he is known for his aloof and petulant manner, but you start to recognise certain differencies in his conversations between you compared to other members.

If you ever talk to eachother that is, for it being a rare occasion. It honestly is a shame. There is still so much you want to say, so much you want to ask, yet he avoids you as soon as you enter the frame, walking a B-line to his office.

Don't get him wrong though, Law sees you, oh and how he does. The way you talk, how you behave and hold yourself. Not just captivated by your sweet and adorable appearance, it is your whole demeanor, your big heart he had the chance to behold the past two months.

This is bad, beyond grave. There is no way he actually likes yo-

Absolutely not. Everytime he passes by you, these thoughts intrude his very being, it is then where he's ought to better ignore or run from those feelings, before anything unpredictable happens. Or did it happen already?

To you, the question still remains, have you done something wrong? Aren’t you working hard enough? Whatever it is, you struggle to find the reason behind his mysterious attitude. Be that as it may, you make it your goal to reach your Captain with hard work, rather than straight up walking up to him and find a conversation.

And today is one of those days where you can prove it, to earn your superior’s attention. The Polar Tang docked at an abandoned isle floating somewhere among the waters of the Grand Line. To Law’s calculations, there is an estimated poneglyph hiding on this island. Thus the Heart pirates prepare for a day out in the field, exploring the jungles and noting everything suspicious or fascinating regarding the void century’s history.

At the coast, everybody gathers before proceeding into the thicket. The Captain calls out: “Keep your baby snail transponders ready at all times. If you detect anything remarkable, give me a call immediately.” All confirm his command with a booming ‘Aye’ and thrust their fists into the air, to commence the expedition in brimming motivation. Split up in parties, the groups divide and go seperate ways for a more efficient search.

You follow one team and hold out for mystery. The snail in your hands oogles you, it’s eyes slightly uncanny and bizarre. Yet, the resemblece to Law is immaculate. The already mentioned eyes faintly squinted in an exhausted manner, with dark circles underneath, the white fluffy hat and of course the goatee. It’s almost too accurate. Concentrating on the path before you, you take a good look around.

But to your foolhardy day dreaming, you now walk alone. Where are the others? In panic your gaze scans the area, worried you might not even find your way back to the Polar Tang. How long were you in dream land, (Y/n)? Anyway, you are on a quest, therefore you are tremendously firm about your decision to make your Captain proud.

May sound easier than done, for you tread through the dark and sinister parts of the jungle, feeling cold and uneasy as you hear an alarming rustling very near you. So you pick up the pace, close to running through the lush green thicket, almost toppling over your own feet. Anxiety fuels you with energy, motivating you to rush further into the forest’s heart.

The sun’s rays fade the deeper you go and finally you come to a stop, even unable to see your own hand before you. “Shit, where am I?”, you utter lowly to yourself, scared you might have ran a tad bit too far. A sharp and stinging spark in the distance blinds you. Curiosity gets the better of you, now following the only source of light.

Slowly approaching the inexplicable in front of you, the blinding fortunately ceased and you recognise a golden orb with strange embellishment, if you wouldn't know any better it looks close to a map, deeply engraved into the material.

Like a moth to the flame, you hold out your hand to grasp the devious object. However, before you can sling your fingers around it, the ball disappears and gets replaced with: "A rock? What the-" - "Don't just randomly grab a possible relic, (Y/n)-ya . ."

Surprised, you let off a small squeak and immediately turn around to find yourself cowering away from none other than your Captain, who's brows furrow at you in annoyance.

With the orb in hand, he steps even closer to you, condescendence lifting his gaze as he rumbles: "And by the by, you're supposed to be with the others."

"I lost track of them, so I went on my own.", explaining yourself with an ever growing pout, your shoulders droop in ebarrassment. Quick to throw another question, a frown pushes the corners of Law's lips down: "Why did you run further into the jungle so absentmindedly? You should have called me."

In protest, you point out that your mindless flight response wasn't for naught, implying to show Law your capability by finding this golden ball, but he doesn't give in regarding that matter. All he deftly oversees and only tells you off.

Whose fault was it though? Hiding in the bushes, observing helpless and frightened little you, not able to stay quiet? Trafalgar Law sure doesn't fit the role as a ninja, at least not today.

"Listen (Y/n)-ya, a woman like you can't just wander around in unknown territory, practically diving into danger.", he lectures you with a sour tone in his raspy voice.

Shit, is what goes through Law's mind, as he realises what slipped out of him. Aware how to misunderstand his haughty opinion, he attempts to keep it together. It is incredibely difficult for him to stay focused around you. Why? Oh how he wishes he could just rush back to his office.

Something bugs you, why did he describe you as 'a woman like you'? Thoughts spin in your head and you twiddle your thumbs and twirl a strand of your hair in insecurity. Thus you muster up the courage to ask for the Captain to clarify what he means by that bold statement.

How much it takes out of him to keep his poise. Could you stop playing with this poor man's emotions? They're barely existant in the first place and you decide to pull his heart strings like that?

Indifferent as possible, Law blinks, time seemingly slowing down around you, for he takes a felt like eternity to answer. And finally he clears it up, shifting nervously in place: "Isn't it obvious? You are . . fragile, delicate even and new to piracy. Don't take life as a pirate too lightly, that is all I'm trying to say."

In strain, you contain yourself not to snap at your superior, so you out your concern: "Are you saying I'm not capable?" - "That's not what I said. I simply indicated, that you are too much of an amateur and could get seriously hurt, if you lack the vigilance. Other pirates might take advantage of your kindness and . ."

The Captain stops mid sentence, choking on a word that almost escaped his oddly dry lips. You tilt your head in curiosity: "And?"

A sweat drop builds on his temple. It just wouldn't cross his mind, why you are being so troublesome? Shaking his head infuriatingly, he mumbles: "N-Nothing. Let's just go."

Abruptly grabbing your hand, he pulls you along, leading you out of the dark parts of the jungle. Muttering his dissatisfaction and curses in disbelief, he stops, the both of you returned to the stone path.

Though his slender hands seem rough and calloused, you are surprised by the gentle and warm touch of his skin. Even after all those tough battles he fought, all the operations he performed, his digits carefully intertwine with yours, almost scared to crush you.

So he turns around to face you and commands you harshly: "Go back to the sub, just follow back this way and you'll be there in no time." - "Aye, Captain."

Law detects a tinge of shame and disappointment in your expression. How come his heart cannot stop beating out of his chest, as he speaks: "Before you go . . you . . did a good job, finding this artifact, it's a rather important object at that. So, well done."

Did your hearing falter? Your Captain just praised you! Out of joy you flash him a smile, showing him gratitude with a subtle nod and a small hum.

The brim of Law's hat casts a shadow over his face, making it impossible for you to see his blush that is being withheld from you.

After a good minute, you two come to realise, that you are still holding hands. "Umm, Captain? Could you-", you point out with a shy chuckle and Law basically yanks his arm away in a rash move, almost a tad bit too obvious, even to you.

In irk, he shoos you: "Just go already! I have other things I must attend to!" With his jaw tensing by the sight of you playfully rolling your eyes and going about your way, he clicks his tongue and continues the path ahead of him.

One last look over his shoulder, glancing at your delicate frame in the distance, once more the beat of his heart waivers. Truly, there is a certain appeal to you he wishes to familiarise further, nevertheless, he must not.

After all, Law has a goal, his mind is set, determined to avenge Corazon. It takes his all to commit to this plan, hence there is no space . . for love? Confliction restricts the Surgeon of Death's tunnel vision, professionalism slowly but surely fading by your 'intrusion'.

He must admit, he's fighting the urge to give in to your sweetness, surrender to his own emotions towards you. You peak his interest, though to his momentary disapproval.

But what if he is able to fulfill his wish? When the world finally reaches it's well deserved state of peace and freedom. Will he earn your attention, your affection?

What if . .

#one piece#one piece law#trafalgar one piece#law x female reader#law x fem!reader#law x y/n#x reader#fanfiction#fanfic fluff#one piece request#one piece requests#Sweet Surrender

70 notes

·

View notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ₹25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

Home improvement loan

Your home is a reflection of your own personality. From interiors, decors to wall colours now customize each and every detail to your desire with our affordable and tailor-made home improvement loan offering.

Whether you want to remodel your space or make home improvements like redesigning the interiors, installing new technology, making basic repairs and regular maintenance, you can do so with Home Loan India Home Renovation Loan. Now, get ready to fulfil every big or small housing need easily.

Features & Benefits

Below are the exclusive features for Home Renovation Loans:

Affordable loan for house improvement

Easy repayment through EMIs

Competitive interest rates

High loan amount

Maximum loan tenure upto 30 years

No hidden charges are applicable

Hassle-free application with minimal documentation

Simple eligibility criteria

Interest Rates

Home Improvement Loans usually come at affordable interest rates as compared to other financing solutions such as personal loans. With Mahadev Finance Service Consultant, you can avail loan for house renovation at competitive interest rates, starting at just 9.55% per annum.

Eligibility Criteria

Eligibility criteria for home renovation loans vary from lender to lender. With Mahadev Finance Service Consultant, you can avail loan for home interior design by fulfilling simple eligibility criteria:

Age between 21 to 65 years

Monthly income of at least ₹25,000

Minimum working experience of two years

Self-owned property

Below are the documents required for home improvement loan:

KYC documents (Id proof and Address proof)

Proof of Residence

Income documents

Property documents

Employment certificate

Estimate for renovation

How to apply for home improvement loans?

With Home loan India, applying for home improvement loans is easy. Below are the steps to apply for home renovation loan:

Step 1 – Visit our website or your nearest Mahadev Finance Service Consultant branch office

Step 2 – Check if you are eligible for our home renovation loan

Step 3 – Fill up the application form online or offline

Step 4 – Submit the required documents

Step 5 – After the verification process, loan amount will be transferred to your bank account

Understanding your timely needs, we provide a completely transparent loan starting at ₹5 Lakhs at competitive interest rates and with no hidden charges. Enjoy our simple eligibility and minimum documentation for a quick and hassle-free process with the convenience of flexible repayment tenure, no foreclosure/pre-payment charges and end-to-end doorstep service. And the best part about this loan is that the interest paid is tax-deductible.

So why dip into your hard-earned savings for your housing needs, when you can choose a smart financial solution for home renovation? To calculate the EMIs you need to pay, you can simply use our home renovation loan EMI calculator. All you have to do is enter the loan amount, tenure and interest rate.

Apply for a quick Home Renovation Loan and turn all your home improvement plans into reality.

www.homeloanindia.net

#home improvement#construction loan#home loan#home loan banks#mortgage#sbi home loan#hdfc home loan#mortgage loan#home loan in bangalore

5 notes

·

View notes

Text

Demystifying Your Finances: A Guide to Using a Home Loan Top-Up Calculator

Imagine you've finally achieved the dream of homeownership. But a few years down the line, unexpected expenses arise – home renovations, a child's education, or a medical emergency. This is where a home loan top-up can be a lifesaver. It allows you to borrow an additional amount against the equity you've built in your property.

But how much can you comfortably borrow? How will the extra amount impact your existing EMIs? This is where a home loan top-up calculator comes in.

What is a Home Loan Top-Up Calculator?

A home loan top-up calculator is a handy online tool that helps you estimate the impact of borrowing a top-up loan on your finances. It considers factors like:

Top-up amount: The amount you plan to borrow.

Current outstanding loan balance: The remaining amount on your existing home loan.

Interest rate: The rate applicable to the top-up loan (which may differ from your existing home loan rate).

Loan tenure: The duration for which you'll repay the top-up amount.

Benefits of Using a Home Loan Top-Up Calculator

Informed decision-making: By providing estimates of your future EMIs, the calculator helps you assess affordability and avoid overstretching your finances.

Financial planning: You can experiment with different loan amounts and tenures to find the combination that best suits your budget.

Compare lenders: Some calculators allow you to input interest rates offered by different lenders, giving you a quick comparison of potential costs.

Finding the Right Home Loan Top-Up Calculator

Many lenders and financial institutions offer home loan top-up calculators on their websites. These calculators are generally free and user-friendly.

Beyond the Calculator: Additional Considerations

While a home loan top-up calculator is a valuable tool, remember it provides estimates. Here are some additional factors to consider:

Processing fees: There might be processing charges associated with the top-up loan.

Prepayment charges: If you plan to prepay your existing home loan or the top-up loan, factor in any applicable charges.

Tax benefits: Interest paid on a home loan top-up used for specific purposes may be tax-deductible. It's wise to consult a tax advisor for specifics.

Conclusion

A home loan top-up calculator can be a powerful tool for making informed financial decisions. By using it effectively, you can leverage the equity in your home to meet your financial needs while ensuring your monthly repayments remain manageable. Remember, it's always a good idea to consult with a financial advisor to discuss your specific situation and determine if a home loan top-up is the right option for you.

0 notes

Text

Personal Loan Eligibility Check Online

Personal loans are nothing less than saviors in times of financial difficulties. Simple eligibility criteria, simple application process and instant disbursement of funds make it one of the most convenient loan options. At Sarathi Finance, we ensure that you do not face any obstacles at any time. We've kept our eligibility criteria to a minimum so you can easily access funds when you need them most.

An urgent need for funds may arise at any time. In such situations, having to run from pillar to post to collect donations can be stressful and have a negative impact on your health. To help and support you during these times, we have simplified and streamlined our personal loan eligibility criteria. To simplify loan processing, we have designed our personal loan eligibility differently for self-employed people and employees. Let's take a closer look at Sarathi Finance eligibility for personal loans:

Procedure to verify your eligibility for personal credit

You can visit our Personal Loans section to see our eligibility conditions and see if you meet them. This includes basic criteria such as age, employment, income, work experience, credit history, etc. If you're sure you can meet our personal loan eligibility requirements, use our eligibility calculator to determine your maximum personal loan limit. Here is a step-by-step process to check your eligibility for a personal loan:

The Sarathi Finance Advantage

View the loan eligibility calculator on our website

Enter some details in the online tool to check personal loan eligibility. This includes your monthly income, current EMI obligations and loan duration.

After entering this information, you will get the personal loan amount you are eligible for in EMI and the maximum term you can repay.

Apply for the personal loan now.

How to calculate eligibility for a personal loan?

Although the calculator does the heavy lifting for you, understanding the underlying factors can help you better manage your finances:

Assess monthly income: Analyze your total monthly income, including salary, business profits, or other sources of income.

Assess existing commitments: summarize existing EMIs and financial commitments. Lenders prefer a lower debt-to-income ratio.

Check your credit score: Get your credit score from the credit reporting agencies. A value above 700 is generally considered good.

Estimate your payment capacity: Evaluate your ability to pay your loans taking into account monthly expenses.

The formula to calculate personal credit score

Although the exact formula may vary from lender to lender, a common formula for calculating the qualified personal loan amount is:

Maximum loan eligibility = (monthly income – monthly obligations) x loan term x loan multiplier

Factors Affecting Personal Loan Eligibility

Geographic Location: The region where you live plays a crucial role in deciding whether or not you qualify for a personal loan.

Income: Eligibility for a personal loan also depends on your income. The higher your income, the larger the loan amount you can qualify for.

Living Situation: If you live in your own apartment, you have a better chance of having your application approved. In fact, living in a rental property reduces your disposable income and therefore your ability to pay.

Existing loan: If you have taken out another personal loan, your chances of getting a new loan are lower than if you have no other loan to pay off.

Company: The company you work for also determines whether you benefit from a personal loan. When you work for a popular and reputable company, you come across as someone with job security.

Credit History: Your credit score and credit history have the greatest impact on your personal creditworthiness. The interest rate, term, and amount you can borrow depend on this factor.

0 notes

Text

Exploring Noida's Finest Interior Designers — Here Is What I Found

Noida, the metropolis neighboring India's capital, New Delhi, pulsates with modernity, innovation, and a burgeoning design scene. Amidst the city's gleaming skyscrapers and vibrant streets lies a treasure trove of talent in the realm of interior design waiting to be discovered. Join us on a journey as we unveil the finest interior designers Noida has to offer, and delve into the captivating world of aesthetic marvels.

I have a great story to tell. This might help people living in Noida to make the right decision for their home interiors and never regret it.

My friend Priya, a discerning connoisseur with an insatiable appetite for exquisite design, whose quest for the perfect interior designer led her on an enchanting voyage through Noida's dynamic neighborhoods. Armed with an appreciation for elegance and an eye for detail, Priya embarked on a mission to transform her living space into a sanctuary of sophistication and style.

Use their Price Calculator to get a free estimate of your home interiors

After extensive research and glowing recommendations from acquaintances, Priya stumbled upon a hidden gem nestled amidst the urban landscape of Noida: Decorpot. Decorpot Interiors is renowned for its innovative designs that seamlessly blend contemporary flair with timeless elegance.

Upon stepping into Decorpot, Priya was enveloped in an aura of creativity and inspiration. The studio's meticulously curated displays showcased a diverse range of styles, from minimalist chic to luxurious extravagance, catering to every design preference imaginable.

What set Decorpot Interiors apart, however, was their unwavering dedication to client satisfaction. Priya was impressed by the personalized attention and meticulous craftsmanship that went into every project, ensuring that each design surpassed expectations with flying colors. With flexible payment options like Easy No Cost EMI.

Collaborating closely with Decorpot Interiors' team of skilled designers, Priya embarked on a transformative journey to realize her vision. From conceptualization to execution, Decorpot Interiors' expertise and professionalism shone through, resulting in a breathtaking metamorphosis that left Priya awe-struck.

Also, Check out their amazing Interior Design Portfolio

But Decorpot Interiors was just the tip of the iceberg in Priya's exploration of Noida's flourishing design scene. Venturing further into the city's labyrinthine streets, Priya discovered an array of other design studios and boutiques, each offering its own unique perspective and aesthetic allure.

From avant-garde innovation to classic charm, Noida’s best interior designers proved to be a kaleidoscope of creativity and inspiration. And while Priya's quest may have begun as a search for the perfect interior designer, it ultimately blossomed into a celebration of Noida's vibrant design culture and the visionary individuals who define it.

In the end, Priya's journey illuminated the fact that the finest interior designers aren't merely skilled professionals, but visionary artisans who possess the rare ability to transform spaces and evoke emotion. And in Noida, a city pulsating with energy and ambition, these designers are the true custodians of aesthetic brilliance and design excellence.

Contact Decorpot Interiors Now

#home interior#interior design#interior designers in noida#home interiors#home decor#interiordecor#interiors#interior design company in noida#noida interiors

0 notes

Text

Electric Scooter Online Booking: The Convenient Way to Go Green

The shift towards sustainable transportation has never been easier, thanks to the advent of online booking for electric scooters. As more people embrace eco-friendly commuting options, the ability to purchase electric scooters online offers unmatched convenience and a seamless shopping experience. This blog explores the benefits of booking electric scooters online, the leading platforms offering these services, and tips for making the best purchase.

Why Book an Electric Scooter Online?

Booking an electric scooter online comes with several advantages that enhance the overall buying experience:

Convenience: Shop from the comfort of your home, without the need to visit multiple showrooms.

Variety: Access a wide range of models and brands, often with detailed specifications and customer reviews.

Special Deals: Benefit from exclusive online discounts, promotional offers, and financing options.

Easy Comparison: Compare different models based on features, prices, and user ratings to make an informed decision.

Home Delivery: Enjoy the convenience of doorstep delivery, often with minimal delivery charges or even free shipping.

Leading Platforms for Online Electric Scooter Booking

Several online platforms have emerged as trusted destinations for booking electric scooters in India. Here are some of the top options:

1. Manufacturer Websites

Many electric scooter manufacturers offer direct online booking options on their official websites. This ensures you get the latest models and authentic products straight from the source. Notable manufacturers with online booking include:

Ather Energy: Offers detailed product information, test ride bookings, and easy online purchase options.

Ola Electric: Known for its user-friendly booking process and extensive customer support.

Bajaj Auto: Provides a straightforward booking process for their Chetak electric scooter.

2. E-commerce Platforms

Major e-commerce platforms like Amazon, Flipkart, and Paytm Mall have also entered the electric scooter market, providing a variety of models with customer reviews and ratings.

Amazon India: Features a wide range of electric scooters with detailed specifications and customer feedback.

Flipkart: Offers exclusive deals and financing options, making it easier to own an electric scooter.

3. Dedicated EV Marketplaces

Specialized online marketplaces focus solely on electric vehicles, providing a curated selection of electric scooters along with expert advice and customer support.

EV Plugs: A platform dedicated to electric vehicles, offering comprehensive information and easy booking options.

BikeDekho: Provides detailed comparisons, expert reviews, and seamless booking processes for electric scooters.

How to Book an Electric Scooter Online

Booking an electric scooter online is a straightforward process. Here are some steps to help you get started:

Research: Start by researching different models and brands. Consider factors like speed, range, battery life, features, and price.

Compare: Use comparison tools available on e-commerce platforms or dedicated EV marketplaces to compare models side by side.

Read Reviews: Check customer reviews and ratings to gauge the performance and reliability of the scooters you are interested in.

Check Offers: Look for special deals, discounts, and financing options that can make your purchase more affordable.

Place Order: Once you have made your decision, follow the booking process on the platform. This usually involves selecting the model, color, and any additional accessories or insurance options.

Payment: Complete the payment process using your preferred payment method. Many platforms offer EMI options and credit card discounts.

Delivery: After booking, you will receive confirmation details and an estimated delivery date. Track your order until it arrives at your doorstep.

Tips for a Successful Online Purchase

Verify Authenticity: Ensure you are purchasing from an authorized seller or the official website to avoid counterfeit products.

Check Return Policy: Understand the return and exchange policies in case you encounter any issues with your purchase.

Warranty: Confirm the warranty details and service support available for the electric scooter.

Customer Support: Choose platforms that offer robust customer support to assist you with any queries or issues during the purchase process.

Conclusion

Booking an electric scooter online is a convenient and efficient way to join the green mobility revolution. With numerous platforms offering a wide range of options, detailed information, and attractive deals, the process has never been easier. By following the tips provided, you can ensure a smooth and satisfying purchase experience, paving the way for a sustainable and eco-friendly commuting future.

Source by: https://sites.google.com/view/sokudoindia-/electric-scooter-online-booking-the-convenient-way-to-go-green

#buy electric scooter online#buy electric scooter online india#electric scooter online booking#best electric scooter to buy

0 notes

Text

HDFC Home Loans: Your One-Stop Shop for All Mortgage Needs

Making the dream of homeownership a reality is a significant milestone. HDFC understands this and strives to be your one-stop shop for all your mortgage needs. Whether you're a first-time homebuyer or looking to refinance, HDFC offers a comprehensive suite of home loan options to suit your financial situation.

Why Choose HDFC Home Loan?

Here's what makes HDFC your ideal partner for your home loan journey:

Diverse Loan Options: HDFC caters to a wide range of requirements with loan products for purchase, construction, renovation, and even plot acquisition.

Competitive Interest Rates: HDFC offers competitive interest rates, making your home loan EMI (Equated Monthly Installment) more manageable.

Eligibility Calculator: HDFC's user-friendly online loan eligibility calculator allows you to get a quick estimate of your loan eligibility based on your income and desired loan amount.

Flexible Repayment Options: HDFC provides flexible repayment options to suit your financial circumstances.

Top-Up Loan Facility: HDFC's top-up loan facility allows you to leverage the equity built in your existing property to meet additional financial needs.

HDFC Home Loan Eligibility and Calculators

HDFC offers various tools and resources to empower you throughout your home loan journey. Here are some key resources to get you started:

HDFC Loan Eligibility Calculator: This online tool provides an initial estimate of your loan eligibility based on your income profile. It's a great way to gauge your affordability before applying for a loan.

HDFC Home Loan Eligibility: HDFC's website provides detailed information on the eligibility criteria for various home loan products. This ensures you understand the requirements before applying. And HDFC Home Loan Eligibility Calculator isn't just about crunching numbers; it's about empowerment. It's about putting the keys to your dream home in your hands and guiding you towards the path of homeownership.

HDFC Home Loan Calculator based on Salary: This calculator helps you understand the potential EMI amount based on your desired loan amount, interest rate, and loan tenure. It allows you to plan your finances effectively.

HDFC Home Loan Top Up Calculator: HDFC's top-up loan calculator estimates the eligibility for a top-up loan based on your existing home loan and property value.

0 notes

Text

Using EMI Calculators for Strategic Financial Planning

In today's fast-paced world, financial planning has become more critical than ever. With the rise of various financial tools and technologies, individuals have access to powerful resources that can help them make informed decisions about their finances. One such tool that has gained popularity in recent years is the EMI calculator. This article explores the benefits of using EMI calculators for strategic financial planning and how individuals can leverage this tool to achieve their financial goals.

Understanding EMI Calculators

EMI calculators are online tools that help individuals calculate their Equated Monthly Installments (EMIs) for loans. These calculators take into account various factors such as the loan amount, interest rate, and tenure to provide users with an estimate of their monthly payments. By using an EMI calculator, individuals can get a clear picture of their financial obligations and plan their budgets accordingly.

Benefits of Using EMI Calculators

1. Accurate Financial Planning

One of the primary benefits of using an EMI calculator is that it helps individuals plan their finances more accurately. By knowing exactly how much they need to pay each month, individuals can budget effectively and avoid any financial strain.

2. Comparison of Loan Offers

EMI calculators also allow individuals to compare different loan offers from various lenders. By entering the details of each loan offer into the calculator, individuals can easily compare the monthly EMIs and choose the offer that best suits their financial situation.

3. Quick and Convenient

EMI calculators are quick and convenient to use. With just a few clicks, individuals can get an estimate of their monthly payments, saving them time and effort.

4. Helps in Financial Goal Setting

By using an EMI calculator, individuals can set realistic financial goals. Whether it's buying a house, a car, or funding higher education, knowing the EMI amount can help individuals plan their finances accordingly.

How to Use an EMI Calculator

Using an EMI calculator is simple. Users need to enter the loan amount, interest rate, and tenure into the calculator. The calculator will then provide them with an estimate of their monthly EMI. Users can also adjust the parameters to see how changes in the loan amount, interest rate, or tenure affect the EMI amount.

Tips for Strategic Financial Planning Using EMI Calculators

1. Set a Realistic Budget: Use the EMI calculator to determine a budget that aligns with your financial goals and income.

2. Compare Loan Offers: Use the calculator to compare different loan offers and choose the one with the most favorable terms.

3. Consider Prepayment Options: Some loans allow for prepayment. Use the EMI calculator to see how making extra payments can reduce your overall interest burden.

4. Plan for Contingencies: Factor in unexpected expenses when planning your budget using the EMI calculator.

Conclusion

In conclusion, EMI calculators are valuable tools that can help individuals make informed decisions about their finances. By using these calculators, individuals can accurately plan their budgets, compare loan offers, and set realistic financial goals. By leveraging the power of EMI calculators, individuals can achieve their financial aspirations and secure a better financial future.

0 notes

Text

An EMI calculator helps estimate your monthly loan payment before you borrow. It considers loan amount, interest rate and tenure to show you the financial commitment. This allows you to compare loans and plan your finances accordingly. There are EMI calculators for home, car, education and personal loans. You can easily find them online and enter loan details to calculate your EMI. Remember to consider processing fees, prepayment charges and other costs besides EMI before finalizing a loan.

#investkraft#loans#financial calculators#emi calculator#emi#online emi calculator#best emi calculator#emi calculator in india

2 notes

·

View notes

Text

Empower Your Financial Planning with a Personal Loan EMI Calculator

In today's dynamic financial landscape, personal loans have become a popular choice for individuals seeking quick access to funds for various purposes such as home renovations, education expenses, or debt consolidation. However, before committing to a personal loan, it's crucial to understand the financial implications, including the monthly repayment amount, known as Equated Monthly Installment (EMI). This is where a Personal Loan EMI Calculator becomes indispensable.

A Personal Loan EMI Calculator is a user-friendly online tool designed to provide borrowers with an accurate estimation of their monthly loan repayment obligations. It operates on a simple input-output mechanism, requiring users to input essential details such as the loan amount, interest rate, and tenure. With just a few clicks, the calculator generates the EMI, allowing individuals to plan their finances accordingly.

The significance of a Personal Loan EMI Calculator lies in its ability to empower borrowers with financial clarity and foresight. By obtaining a clear understanding of the monthly repayment amount, borrowers can assess their affordability and make informed decisions regarding the loan amount and tenure. This tool serves as a proactive measure to prevent financial strain and ensure responsible borrowing practices.

Moreover, a Personal Loan EMI Calculator facilitates efficient comparison shopping among different lenders and loan products. By inputting varying interest rates and tenures, borrowers can evaluate the impact on their EMIs and choose the most favorable option that aligns with their financial goals and constraints.

In conclusion, a Personal Loan EMI Calculator is not just a tool; it's a financial companion that empowers individuals to take control of their financial journey. By leveraging this convenient tool, borrowers can navigate the complexities of personal loans with confidence, ensuring sound financial planning and management.

0 notes

Text

youtube

Watch the 2024 American Climate Leadership Awards for High School Students now: https://youtu.be/5C-bb9PoRLc

The recording is now available on ecoAmerica's YouTube channel for viewers to be inspired by student climate leaders! Join Aishah-Nyeta Brown & Jerome Foster II and be inspired by student climate leaders as we recognize the High School Student finalists. Watch now to find out which student received the $25,000 grand prize and top recognition!

#ACLA24#ACLA24HighSchoolStudents#youtube#youtube video#climate leaders#climate solutions#climate action#climate and environment#climate#climate change#climate and health#climate blog#climate justice#climate news#weather and climate#environmental news#environment#environmental awareness#environment and health#environmental#environmental issues#environmental education#environmental justice#environmental protection#environmental health#high school students#high school#youth#youth of america#school

18K notes

·

View notes

Text

Get Personal Loan for Medical Emergency

The need for immediate funds to cover medical emergencies is crucial. In such situations, obtaining a personal loan online can provide a lifeline, offering quick access to financial support to address pressing healthcare needs. This article explores the process of get personal loan online for medical emergencies, highlighting the benefits, considerations, and steps to secure financial assistance during times of need.

Understanding the Need for Medical Loans:

Medical emergencies can strike unexpectedly, catching individuals and families off guard. While health insurance may cover a portion of medical expenses, out-of-pocket costs such as deductibles, copayments, and uncovered treatments can quickly accumulate. In such circumstances, securing additional funds through a personal loan online can bridge the financial gap and ensure timely access to essential healthcare services.

Benefits of Getting a Personal Loan Online for Medical Emergencies:

Speedy Access to Funds: Online lending platforms offer rapid processing and approval of loan applications, allowing borrowers to access funds quickly. In the case of medical emergencies, time is of the essence, and the ability to receive financial assistance promptly can make a significant difference in securing necessary treatments and interventions.

Minimal Documentation: Compared to traditional lending institutions, online lenders often require minimal documentation for loan approval. Borrowers can submit necessary documents electronically, streamlining the application process and expediting loan disbursal.

Flexibility in Loan Amounts: Personal loans online typically offer flexibility in loan amounts, allowing borrowers to borrow according to their specific needs and financial circumstances. Whether it's a small amount for immediate medical expenses or a larger sum for extensive treatments, borrowers can tailor the loan amount to meet their requirements.

Convenient Application Process: Applying for a personal loan online is convenient and user-friendly, with borrowers able to complete the entire process from the comfort of their homes or mobile devices. This convenience eliminates the need for physical visits to banks or lending institutions, saving time and effort, particularly during stressful medical situations.

Repayment Options: Online lending platforms often provide flexible repayment options, allowing borrowers to choose repayment tenures and EMIs (Equated Monthly Installments) that suit their financial capabilities. This flexibility enables borrowers to manage loan repayments effectively while prioritizing healthcare expenses.

Steps to Get a Personal Loan Online for Medical Emergencies:

Research Lending Platforms: Begin by researching reputable online lending platforms that offer personal loan for medical emergency. Compare interest rates, loan terms, and customer reviews to identify a platform that meets your requirements.

Determine Loan Amount and Tenure: Assess your medical expenses and determine the amount of funds needed to cover immediate healthcare needs. Additionally, consider the repayment tenure that aligns with your financial situation and preferences.

Complete Online Application: Fill out the online loan application form provided by the chosen lending platform, providing accurate personal and financial information. Be prepared to upload necessary documents, such as identification proof, income documents, and medical bills or treatment estimates.

Await Approval and Disbursal: Once the application is submitted, the lending platform will assess your eligibility and creditworthiness. Upon approval, the loan amount will be disbursed directly to your bank account, providing immediate access to funds for medical expenses.

Utilize Funds Responsibly: Use the disbursed funds to cover medical expenses as needed, ensuring that the funds are allocated appropriately and responsibly. Keep track of expenses and prioritize healthcare needs to make the most of the loan amount.

Conclusion:

Getting a personal loan online for medical emergencies offers a practical and efficient solution to address pressing healthcare needs. By leveraging the benefits of online lending platforms, individuals and families can access quick financial support to cover unexpected medical expenses and ensure timely access to essential treatments and interventions. However, it's essential to research lending platforms, assess loan terms, and utilize funds responsibly to navigate the process effectively and secure financial stability during medical crises.

0 notes

Text

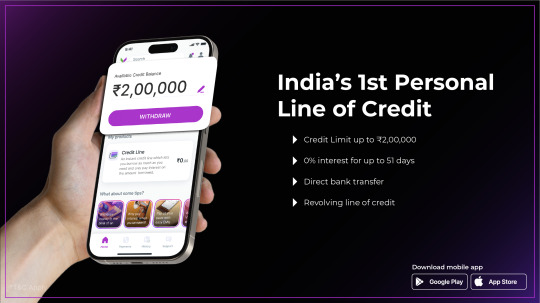

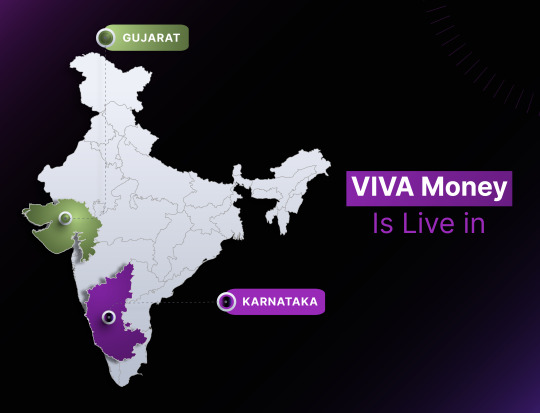

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes

Text

Understanding Your Eligibility with the ICICI Personal Loan Eligibility Calculator

Financial aspirations, from dream vacations to home renovations, often require a helping hand. An ICICI personal loan can be the perfect solution, offering a quick and convenient way to access funds. However, navigating loan eligibility and understanding the factors considered by the ICICI Personal Loan Eligibility Calculator can feel like deciphering a code. Fear not! This blog empowers you to understand the key factors that determine your eligibility for an ICICI personal loan, allowing you to approach the loan application process with confidence.

The ICICI bank Personal Loan Eligibility Calculator: A Tool for Informed Decisions

The ICICI Personal Loan Eligibility Calculator, available on the ICICI Bank website, is a valuable resource for anyone considering an ICICI personal loan. This user-friendly tool provides an estimate of your eligibility based on the information you enter. Here are some key factors considered by the calculator:

Minimum Age: You must be at least 21 years old (at the time of application) to be eligible for an ICICI personal loan. The upper age limit can vary depending on your employment status and the loan tenure you choose.

Employment Status: Salaried individuals, self-employed professionals, and even non-professionals can apply for ICICI personal loans. The minimum salary requirements will vary depending on your employment category.

Net Monthly Income: Your net monthly income plays a crucial role in determining your loan eligibility and repayment capacity. The calculator considers your net income after taxes and deductions to estimate the loan amount you can potentially qualify for.

Existing Debt Obligations: Existing debt obligations, such as EMIs (Equated Monthly Installments) for other loans or credit card payments, factor into the calculation. The calculator considers your existing debt commitments to assess your affordability for an additional loan repayment.

Credit Score: While not directly factored into the calculator's initial estimate, a healthy credit score (generally above 750) can significantly improve your chances of loan approval and potentially lead to a better interest rate.

Beyond the Calculator: Additional Considerations for Eligibility

While the ICICI Personal Loan Eligibility Calculator provides valuable insights, additional factors influence your loan approval:

Work Experience: A minimum work experience requirement (typically 1-2 years) might be necessary, depending on your employment category.

Employer Reputation: For salaried individuals, the reputation and stability of your employer can be a factor.

Loan Purpose: While ICICI personal loans offer flexibility, the purpose of your loan might be considered in specific situations.

Optimizing Your Chances for Loan Approval:

Here are some tips to increase your chances of securing an ICICI personal loan:

Maintain a Healthy Credit Score: A good credit score demonstrates responsible financial management and can significantly enhance your loan application.

Reduce Existing Debt: If possible, try to reduce your existing debt obligations before applying for a personal loan. This improves your debt-to-income ratio and strengthens your application.

Choose a Suitable Loan Tenure: A longer loan tenure might lead to a lower EMI, but it also means paying more interest in the long run. Choose a tenure that balances affordability with repayment speed.

Provide Accurate Information: Ensure all information entered into the calculator and the loan application is accurate and complete.

Conclusion

The ICICI Personal Loan Eligibility Calculator is a valuable tool for getting a preliminary idea of your eligibility for an ICICI personal loan. Understanding the factors considered by the calculator, including your age, employment status, income, existing debt, and credit score, empowers you to approach the loan application process with informed preparation. Remember, maintaining a healthy credit score, managing debt effectively, and choosing a suitable loan tenure can significantly improve your chances of securing an ICICI personal loan and achieving your financial goals. So, explore the calculator, optimise your financial profile, and embark on your journey to financial empowerment with ICICI Bank!

0 notes

Text

Home Loan EMI Calculator: Know Your Home Loan EMI

Are you thinking of purchasing a house with the help of a home loan? But high property prices and therefore the unavailability of funds becomes a hindrance in buying a house. Access to finance within the kind of home loans has come as a boon for the common man. However, home loans, or any type of credit, comes with plenty of responsibilities attached to it. One must have a transparent idea of his/her finances before borrowing a hefty amount. Availing a home loan requires prior planning. This is because it includes a relatively long tenure and can weigh on household finances for an extended time. An honest idea to calculate your EMI amount before signing on the line. A great tool like the Home Loan EMI Calculator can assist you out with this.

What is Home Loan EMI?

Before getting to understand the home loan EMI calculator, it’s important to know the basic information about what’s home loan EMI because if you don’t know the thing that you’re calculating then it’ll be a complete wastage of your time to find out about the calculator. EMI, the short form for Equated Monthly Instalments, is a fixed monthly amount that you simply pay per month to return the borrowed amount from the lender. Since a lot of individuals cannot pay the complete amount in one move to buy their dream home, they choose the simple EMI facility which may be a flexible repayment option.

Calculate Home Loan Eligibility

Home Loan EMI Calculator

Now you’ve known about the Home Loan EMI, it’s time to introduce you with the much-talked-about home loan EMI Calculator. This calculator helps you in estimating your EMI amount with the help of a couple of basic details. Like all other calculators, it develops on the inputs that you just give to it. In the case of a home loan EMI calculator, it only needs three inputs – loan amount, rate of interest, and tenure. As soon as you feed all these details into it, you’ll get the specified output because of the EMI amount. The process of using it is so handy that it is often used by anyone.

Home Loan EMI Calculator Formula

EMI Amount can be ascertained with the following numerical equation:

EMI Amount = [P x R x (1+R) ^N]/[(1+R) ^N-1], where, P, R, and N is the variable, which implies the EMI value will change each time you change any of the 3 factors.

Here,

P, Stands for the ‘Principal Amount’. The principal sum is the first loan amount given to you by the bank, on which the premium will be determined.

R represents the rate of interest set by the bank.

N implies the number of years for which the loan has been taken. Since EMIs are paid each month, the duration is determined in the number of months.

Factors determining Home Loan EMI

Principal- The principal is the loan amount that you benefit from the loan specialist. It is straightforwardly proportional to your EMIs – lower principal will bring down your regularly scheduled payments and vice versa.

The rate of interest- The rate of interest is the rate at which the moneylender offers you the loan. It is additionally straightforwardly proportional to the estimation of your loan EMIs.

Tenure- The tenure is the time within which you repay your loan. The tenure is conversely relative to your home loan EMIs – longer tenure makes the regularly scheduled payments less expensive and vice versa.

youtube

Benefits of Home Loan EMI Calculator

Simplicity and Speed: You don’t need different values filled with complexities to use the Home Loan EMI Calculator, actually there are only three simple details that you simply need. Simplicity is the best feature of it and you’ll get the results in a flash which makes the entire process of EMI calculation smooth and hassle-free.

Finance Management: Once you have a transparent assessment of the EMI amount, you’ll be better prepared to create some changes in your monthly spending in order that you can put aside that EMI amount from your monthly income. The EMI calculator helps you in financially empowering you by providing you with the authentic results.

Endless Flexibility: You’ll be able to use the calculator for as many times as you would like with different values till the time you got the right combination of right EMI and tenure aligning perfectly together with your monthly income. This endless flexible feature of the EMI calculator makes it a requirement to use before finalizing the loan amount. Remember that choosing a short tenure will fetch the higher EMIs and the other way around.

#home#homeloan#homefirstindia#welcome home#dream#loan against property#family#financial planning#Youtube

0 notes

Text

youtube

Watch the American Climate Leadership Awards 2024 now: https://youtu.be/bWiW4Rp8vF0?feature=shared

The American Climate Leadership Awards 2024 broadcast recording is now available on ecoAmerica's YouTube channel for viewers to be inspired by active climate leaders. Watch to find out which finalist received the $50,000 grand prize! Hosted by Vanessa Hauc and featuring Bill McKibben and Katharine Hayhoe!

#ACLA24#ACLA24Leaders#youtube#youtube video#climate leaders#climate solutions#climate action#climate and environment#climate#climate change#climate and health#climate blog#climate justice#climate news#weather and climate#environmental news#environment#environmental awareness#environment and health#environmental#environmental issues#environmental justice#environment protection#environmental health#Youtube

17K notes

·

View notes