Don't wanna be here? Send us removal request.

Text

Graduating with Credit Debt is Risky

Many Students exit college with Student Loans and Credit Debt.

The question is, will you be able to afford it?

College is expensive with cost’s increasing yearly over the last decade. A heavy course load and absent finances have many students turning to credit cards and personal loans to assist with daily living expenses. Many students are setting themselves up for failure after graduation. High monthly credit interest payments coupled with a bill from the federal government is a lot to overcome monthly.

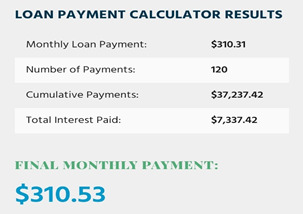

Let’s first examine college costs in 2019. 66% of the graduating class in 2019 had an average federal loan of $29,900 https://www.ticas.org. That’s is two-thirds of students. Meaning, it is likely that you, the reader falls into this majority. The current loan interest rate is 4.53% in 2020. Using a federal loan calculator, we can determine the following presuming a ten-year loan:

https://finaid.org/calculators/loanpayments/

Accepting a federal loan begins the students first Credit Profile. If we include other living expenses such as, car, phone, insurance, utilities, rent or mortgage? The student can find themselves in a big financial hole after graduation.

Credit Profile

A person’s credit profile has become the most important aspect to prospective lenders. The credit profile is based on the offset of income vs. debt; which makes up 30 percent of your credit profile. Other associated credit factors include

a new credit line, the length of credit history, and credit line payment history. Therefore, without even applying for a credit card you are inadvertently placing your future at a disadvantage. Missing a payment on a student loan can cause a credit drop of 100 points affecting 35% of an overall credit rating.

https://nationalcreditfederation.com/5-ways-student-loans-affect-credit-score/

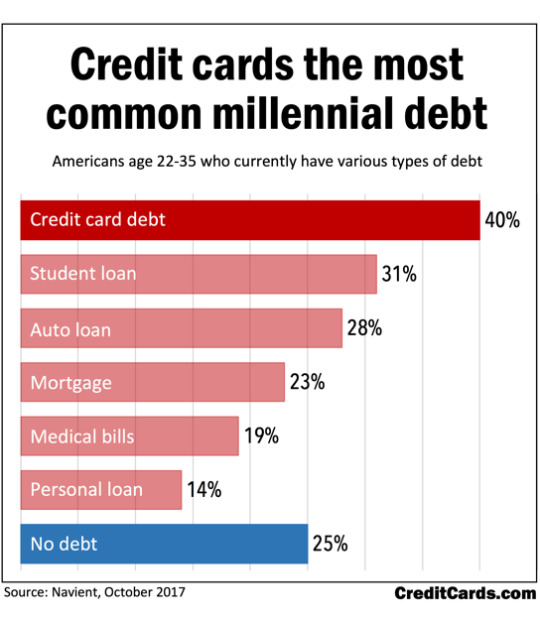

Although students have received federal loans to pay for college, a supplement for day to day costs will still be needed. This is often supplemented with credit cards and further loans. In 2009 unpaid Credit Cards were such an issue within students, that the “Credit Card Act” was placed by Congress https://www.ftc.gov/sites/. This Act requires the minimum age for credit applications raised to 21.

Interest rates for credit cards can be an overwhelming situation. The average student credit card is around 15.11% to 23.3% depending on the individual’s credit profile (creditcards). Most monthly payments barely bring down the principal and credit payments continue longer than planned. Mounting bills can bring more opportunities for missed payments. These credit blemishes can be on your credit history for up to 7 years affecting, future loans and interest rates. Many utility companies now require a credit check. Poor credit? The utility company can charge an up-front connection fee prior to service.

As you go forth into the job force remember that debt accrued during your student years will have a strong bearing on your future. All debts need to be paid to stay in front of crippling credit repercussions. Responsibility today can set you up for success in the future. If you must apply for credit to supplement your cost of living please follow these suggestions:

· Set-up automatic payments

· Read all fine print

· Keep your credit profile Parameters in line

Having too many credit cards or too high of a credit balance can be difficult to manage. Especially, when accompanied by a student loan.

About the Author

“Brennan Moore” is a current Lieutenant with Murrells Inlet Garden City Fire Rescue and a college student at Horry Georgetown Technical college. Brennan has spent many years focusing on repairing his own credit profile and mentor’s others to not make the same youthful mistakes.

Research Sources

https://nationalcreditfederation.com/5-ways-student-loans-affect-credit-score/

https://www.nerdwallet.com/article/credit-cards/facts-about-zero-percent-apr-credit-cards

https://creditcards.usnews.com/articles/average-apr

https://studentaid.gov/understand-aid/types/loans/interest-rates

https://www.investopedia.com/student-loan-debt-2019-statistics-and-outlook-4772007

1 note

·

View note