eFinancialModels provides various industry specific financial projections template and financial modeling services. Checkout our website or easy to use, nicely formatted financial projection templates online in Excel specific to each industry and use case. Website: https://www.efinancialmodels.com/

Don't wanna be here? Send us removal request.

Text

SUM Formula in Excel – Easy to Download and Use

Are you looking for the right type of sum formula and wishing to get it applied in the right way by just changing sums and digits?

Do you want to get the right models to make your reports and presentation successful and impressive?

You will have some better options to fulfill your requirement by going online that is counted as one of the convenient ways to enhance your experience of getting everything in just a click. You will get Sum Formula in Excel that is far easier and hassle-free. You have to search for the right platform that is convenient for you and providing you with a number of added features. These sheets are easy to use and come with a number of added features. You have to go through the details, know about the points to implement and get them properly used.

Among some of the top platforms that are offering you such precise options, you will find name of eFinancial Models comes on the top. The leading web platform has carved a special niche for offering you the right type of financial models that come with a number of added features. The leading website offers you a number of financial models with added benefits. So, what you are looking for, make a contact and get the right solutions in real time manner for Sum Formula in Excel

.

0 notes

Text

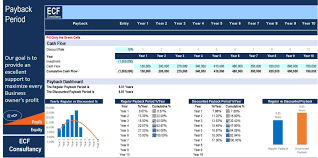

How to Calculate Payback Period – Get the Right Solutions Online at eFinancial Models

“How to Calculate Payback Period” is a common concern among people, who often look for the right solutions to create their own reports and presentations. Depending on your requirement, you can get the right solutions for payback periods. Here, you have to search for the right platform that is convenient for you and get the right solutions.

Now, you will get the right solutions in real time manner for your query, “How to Calculate Payback Period” by going online that is counted as one of the convenient ways to enhance your experience. There are a number of renowned platforms that are offering you the right solutions for your queries. You can contact from anywhere and anytime. When it comes to choose the right type of models and planning to get the right solutions for how to calculate Payback Period, you will have some better options to fulfill your requirement by reaching at eFinancial Models comes on the top. A team of dedicated professionals has been working here, who listen to your requirement and provide you with the right solutions.

eFinancial Models has carved a special niche for offering you the right solutions for all types of financial models. You can browse the site from anywhere and start getting some added benefits.

0 notes

Text

Financial Ratio Analysis Sheets – Ready to Use for Impressive Presentation

Now, you will get Financial Ratios Analysis according to your requirement and in real time manner. There are a number of reputed names in this domain offering you complete solutions for preparing some of the best presentations and reports of financial ratio analysis. Find the right one of your choice, go through the details and get precise solutions in real time manner. Here, what is more important than anything else is to find the top platform that is convenient for you, go through the details and get the right solutions in real time manner.

eFinancial Models Offers Financial Ratios Analysis

Among some of the top names in this domain from where you will get the right solutions for financial ratios analysis, you will find name of eFinancial Models comes on the top. A team of dedicated professionals has been working here, who listen to your requirement and provide you with the right solutions in real time manner. Here, professionals are welcomed to upload some of the best sheets in Excel that can be changed accordingly. For financial ratio analysis, follow the steps and get the right solutions. You will get precise solutions.

So, what you are looking for, make a contact and download the financial ratios analysis.

0 notes

Text

Budget Excel Templates for the Right Budget Sheet and Presentation

Budget Excel template are required for the complete process of creating the right reports of budget for any corporate or even organization of any size. It is a vital template that you can download to make the entire process of budgeting easier. As far as budgeting is concerned, it is a norm in any business – the business’s strategic plan that is laid out to upper management to set an expectation of the company’s performance in the budget year.

Budgeting serves as the quantitative representation of the business plan that is also used as a measure of performance. Getting the right budget Excel template is important in a number of ways as it keeps you away from worrying about drawing new templates, making power point presentation or do any other change. If you are looking for budget Excel template, you will have some better options to fulfill your requirement by going online that is counted as one of the convenient ways. You have to download the format and make some necessary changes in the sample.

E-Financial Models is a one stop reliable name offering you the right type of budget Excel template. You can create your own or transform the existing one into your desired way. Follow the right steps and you will be able to make the right budget sheet and presentation without extra efforts.

0 notes

Text

How to Calculate the Payback Period – Follow Steps Provided by Experts

As soon as you are ready to make a decision as to the profitability of a project, the most vital thing that takes place is using the payback period method that is a very useful tool. The payback period is usually expressed in years or months and a very vital factor to measure the feasibility of a project or investment and its risk. The common question that often takes place is how to calculate payback period. You will be able to give the right answer for a question, “How long will it take to recoup the initial investment” by calculating the payback.

If the payback period is longer in comparison to acceptable, then the project is rejected. Payback period serves as a kind of break-even period; thus provides some information regarding the liquidity of the project under analysis. Determining the payback period sounds easy, but the important thing is to get the right answer for your query, “How to Calculate the payback period”.

If you are one of them looking for the right answer for your query, you will have some better options to fulfill your requirement by going online and reaching the right company that has been providing you templates for free download to calculate the payback period.

E-Financial Model is a one stop name offering you the right payback period models and providing you with the right solution for, “How to Calculate the Payback period”. Follow simple steps and you will be able to get the right solutions.

0 notes

Text

Download Templates for Payback Period on Any Financial Model

At E-Financial Models, you will get a broad range of financial models for different industries that include a Payback period section. The payback period is the time required in order that investment can repay its original costs in form of cash flow, profits, or savings. You can use payback period Excel templates that are provided in varied forms and as a reference or base to start. You have to do nothing, but just follow the steps and change formats into your own way. From this renowned web platform for various templates, you will also get information regarding the payback period and explanation on the different ways of how to calculate payback period.

Such templates are available for oil & gas financial models, private members club, Biogas, waste to energy project finance models, wind farm project financial models, Theme park & hotel development and Multiplex Cinema financial models. There are different other models available to choose from. Here, you have to create your account and start follows the steps to download the right template that you want to turn into your desired way.

E-Financial Models is upgraded with a good number of templates every minute that are easy to download and use. You have to follow the right steps and make a contact and get the right template to transform into your own.

0 notes

Text

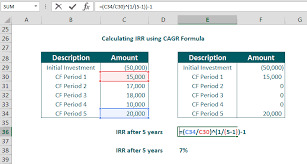

IRR Formula and Formats for Discounted Cash Flow Valuation Example

You may find a number of companies offering you the right solutions to download IRR formula in easy way or get the right discounted cash flow valuation example. Here, you have to sign up and you will get step by step guide to learn from experts. Their main motive is to help you solve your queries and provide you ready to use formats to transform into your reports.

Online search will provide you details of top platforms, from where you can get the right solutions for formats and download them in convenient way.

eFinancialModels – a One Stop Name to Download Formats for IRR Formula

Among some of the top names in this domain from where you can download IRR Formula or get the right discounted cash flow valuation example to make an impressive report, you will have some better options to fulfill your requirement by reaching at eFinancialModels comes on the top. The leading company is a one stop reliable name offering you the right solutions to download ready to use reports and transform them into your desired manner.

You have to follow steps, go through the details and get the right solutions to make your reports in impressive way. eFinancialModel has been offering you a platform for a wide range of industry-specific financial forecasting model templates in Excel that not only offers a good structure, but also the best in class financial modeling knowledge to users that include key executives, entrepreneurs, investors, and a lot more.

So, what you are looking for, follow a few simple steps and download

IRR Formula

or get the right discounted cash flow valuation example.

0 notes

Text

Easy to Download Formats for Sum Formula in Excel and DCF Method

Are you looking for the right excel sheets that are easy to download and can be turned into any formula to calculate anything or make an impressive sheet for representation?

Depending on your budget model, type of industry and the way of representing your reports and analysis, you will get the right solutions with easy to download for the following sheets that include Sum Formula in Excel, Discounted Cash flow valuation example, DCF method, terminal value formula in Excel and a lot more. You will learn from experts, “How to calculate DCF or How to Calculate Payback period”.

Go Online to Follow Easy Steps to Download Excel Format

Go online and you will find a number of top platforms that are offering easy to download options for DCF Method, terminal value formula in Excel, discounted cash flow valuation example and download formulas to calculate DCF. You can also download Excel budget spreadsheet, sum formula in Excel and IRR Formula.

There are a number of renowned names in this domain providing you with some of the best sheets. You have to download the right one of your choice, go through the details and

You will get a lot more like DCF Method, terminal value formula excel, Financial Ratios Analysis, excel budget spreadsheet, how to calculate payback period, sum formula in excel, IRR formula, discounted cash flow valuation example, and how to calculate DCF. Follow a few simple steps and you will be able to download the right format of your choice and within seconds.

#DCF Method#DCF Model#Terminal value formula excel#Discounted cash flow valuation example#How to calculate dcf#How to make a dcf

0 notes

Text

DCF Method to Terminal Value Formula Excel – Complete Solutions Online

Whether you are looking for DCF method, want to get the right solutions for terminal value formula in Excel or searching for complete solutions for financial ratios analysis, you will get the right solutions in just a click from experts, who have years of experience and proven track record. Here, the most important thing is to find the right company, where experienced professionals are working dedicatedly to provide you with the right solutions.

From DCF method to terminal value formula Excel and from financial ratios analysts to getting access to Excel budget spreadsheet, you will get precise solutions in real time manner from experts at eFinancialModels. The leading company has become the most trusted name in this domain offering you the right solutions for all your Excel sheet formats.

eFinancialModels Offers DCF Method to Terminal Value Formula Excel

eFinancialModels has been providing you with a wide range of industry-specific financial model templates in Excel. They are building a financial model with detailed financial projection that can be quite time-consuming. Keeping the same concern in mind, they have come up with the right platform to offer a wide range of industry-specific financial forecasting model templates in Excel that not only offers a good structure, but also the best in class financial modeling knowledge to users that include key executives, entrepreneurs, investors and a lot more.

Feel free to contact for DCF method to terminal value formula Excel

.

0 notes

Text

Sales Forecasting Template for SaaS Business

In this modern era, more and more activities are getting digital. With all these innovations, there’s no wonder almost everything that we do and use is paid monthly. While more press has been given to Software as a Service (SaaS) industries, these subscriptions are just around the corner, from music and movies, don’t be surprised that later our basic needs will also come in a monthly subscription. This article will attempt to elaborate forecasting template for SaaS business.

Defining SaaS Terminologies to build Subscription Forecast

Before you were able to forecast revenue and customer growth, you should initially understand these definitions.

Subscription Period: It is the length of time the customer commit to using your services. A bunch of subscription companies operates in a monthly subscription period, such as Netflix and Spotify.

New Subscribers: The number of new customers who sign up for your services in a particular month. Cancellations: These are the customers who chose to cancel their subscription to your service.

Churn: It is the percentage of customers that ultimately cancel their subscription during the month. All SaaS businesses shall pay close attention to their churn rate as this indicates whether customers are happy with your service or not. Churn rate is calculated as follows:

Churn = Cancellations during the month / Customers at the start of the month

Calculating Revenue from Subscription Services

Average Revenue per User/Customer (ARPU) : The amount you want to charge your customer each month.

Customer Lifetime Value (LTV): It is the amount of revenue expected from each customer during their lifetime with your service and expressed using the following formula:

LTV = ARPU / Churn Rate

Monthly Recurring Revenue (MRR) : This is the amount of revenue you want to make each month based on the following formula:

MRR = ARPU x (Starting Subscribers + New Subscribers)

Building a Forecast

Since you already have the basic knowledge of terminologies is SaaS industry, we will now build a sales forecasting template for a monthly subscription. Here is how it should look like.

This model is quite simple and assumes that it operates in a simple monthly subscription without any one time set up fees. Based on this model, you can adjust your ARPU level; some customers might upgrade for a high-priced subscription offered. Feel free to play with the figures to fit your terms.

Conclusion: Forecasting Template allows you to predict your desired revenue

In general, forecasting allows businesses to predict their target revenue or profit, thus making an effort to achieve what has been forecasted. Though it may be changed or altered depending on the situations, this drives the company to meet and exceed this forecast, which can be beneficial to the company and its workers.

0 notes

Text

Types of Real Estate Valuation Methods

Valuing a property is the necessary foundation before investing or buying a particular real estate. Some other reasons for real estate valuation are taxation, property insurance, and property listing. You must first establish the property cost before making related financial decisions.

There are different categories of real estate properties, such as residential, commercial, and industrial properties. Depending on your purpose and the kind of property you are evaluating, you can use various real estate valuation methods. Let’s discuss some of them below.

1. Replacement Value

Replacement Value is the cost needed to buy the land and construct the property from scratch. It is a suitable valuation method when you want to buy an existing property. It can help you assess how much is the maximum price you can pay for that property. If it is higher than your Replacement value, you might be better off building the property.

Other considerations are the state of an existing property, how much it will cost to improve, and the average estimated useful life.

2. Sales Comparison

Sales Comparison uses current marketed comparable property and utilizes its multiples and ratios to compute evaluated real estate value in the same target area. This value reflects how much the market is willing to pay for the same property.

If data for comparable is available, Sales Comparison helps assess the market value of the real estate. However, be cautious in using this method and make some cost adjustments since some factors are not precisely the same between the two properties.

3. Capitalized Earnings

Another valuable method for real estate valuation is Capitalized Earnings. It is computed by dividing the Rental Income over the Gross Capitalization (Cap) Rate or Net Capitalization Rate. The Net Cap Rate considers the Operating Costs while the Gross Cap Rate does not. Since data or operating costs are not widely available, the Gross Cap Rate is widely used. Cap Rate represents the expected return of the real estate industry.

4. DCF Analysis

DCF Analysis is more comprehensive and required significant assumptions in assessing property valuation. It considers the future cash flows generated, discount rate, and the time value of money. Future cash flows are discounted to their net present value using the discount rate, commonly WACC (Weighted Average Cost of Capital).

DCF analysis requires more in-depth analysis compared to other valuation methods. Still, investors and analysts prefer to use it for investment analysis and project evaluation since DCF analysis provides the projected free cash flows in today’s money, to be generated in a given period.

It is advantageous to use two or even more real estate valuation methods to give you a comprehensive assessment of the property and a different perspective.

Real estate valuation methods must be done before investing your hard-earned money into a particular real estate.

0 notes

Text

Liquidity and Profitability Financial Ratios Cheat Sheet

Financial ratios used figures in the financial statement to interpret the data and have an in-depth analysis of business performance. Owners, investors, bankers, analysts, and other stakeholders used financial analysis to guide business decisions such as investment, capital expenditure, and funding sources.

To give an overview of the different types of financial ratios and easy reference, below are the financial ratios cheat sheet and formulas.

Liquidity and Profitability Ratios Definitions and Formulas

1. Liquidity Ratios

Liquidity ratios are used to assess a company's capacity to pay off its debt without seeking external capital. Mostly used liquidity ratios are cash ratio, quick ratio, and current ratio.

a. Cash Ratio

The cash ratio is derived by dividing the cash and cash equivalents by the current liabilities. It assesses business liquidity by using the most liquid assets.

Formula: Cash Ratio = Cash & Cash Equivalents / Current Liabilities

b. Quick Ratio(Acid-Test)

The quick ratio is more conservative compared to the current ratio. It is computed by adding cash & cash equivalents and receivables divided by current liabilities. Inventory is excluded since it takes more time to dispose of. Another way to compute is current assets – inventory divided by current liabilities.

Formula 1: Quick Ratio = (Cash + Receivables)/Current Liabilities

Formula 2: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

c. Current Ratio

The current ratio evaluates current assets' availability to pay current obligations or those payable within a year. Current assets include cash & cash equivalents, receivables, and inventory. The current ratio is computed by taking current assets then divided by current liabilities.

Formula :Current Ratio = Current Assets / Current Liabilities

2. Profitability Ratios

Profitability ratios assess a company's ability to earn profit to its capital, equity, assets, revenue, and costs. These include gross profit margin, EBITDA margin, net profit margin, ROA, and ROE.

a. Gross Profit Margin

The gross profit margin is derived by taking the gross profit then divided by net sales. It shows the business's capacity to earn a profit after deducting COGS -- or revenue costs for a service industry.

Formula: Gross Profit Margin = Gross Profit / Net Sales

b. EBITDA Margin

Production costs and operating expenses are deducted to derive Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA). The EBITDA margin is then computed by taking EBITDA divided by net sales.

Formula: EBITDA Margin = EBITDA/ Net Sales

c. Net Profit Margin

Net income is calculated by deducting COGS, administrative & marketing expenses, interest, tax, depreciation, and amortization. Net income is divided by net sales to compute for net profit margin.

Formula: Net Profit Margin = Net Income / Net Sales

d. Return on Assets (ROA)

Return on assets is most relevant for asset-intensive companies such as manufacturing plants and telecom. ROA measures how effectively a company utilizes assets to earn a profit. It is computed by adding the net income + interest divided by average assets.

Formula: Return on Assets = (Net Income + Interest) / Average Assets

e. Return on Equity (ROE)

Return on equity assesses how much income is generated by the equity. It is evaluated by owners, investors, and analysts to measure how much can earn for every dollar invested. ROE is derived by taking the net income then divided by the average shareholders' equity.

Formula: Return on Equity = Net Income / Average Shareholders’ Equity

These financial ratios cheat sheet is helpful reference for definitions and formulas of liquidity and profitability ratios.

You can also compute other financial ratios, such as the efficiency ratios, growth ratios, and leverage ratios, to make your analysis more comprehensive.

0 notes

Text

Benefits of Using Break-Even Analysis in Excel

You must first comprehend the idea of breaking even before your company can realize profits. To do this, you must be able to measure the sales volume needed to cover the expenses in order to break even on the product lines and/or services of your company and how to use this knowledge to your advantage.

Break-Even Analysis is the mechanism by which the revenue necessary to cover the expenses are measured such that there is no profit or loss. When your net profits or earnings exceed your total expenditures, you can hit break-even. The break-even point that is reached is critical for the phase of financial decisions. Basically, running a Break-Even Analysis in Excel helps decide when you can expect all costs to be covered by your organization and begin to earn profit.

So below are some benefits of doing Break-Even Analysis in Excel for your business:

This analysis helps to make a choice between two action courses to make versus the purchase. If the variable cost is less than the price to be paid to a third-party supplier, manufacturing could be better than purchasing.

In order to start a new business, the initial phase is to find out the project's viability. It helps to assess whether the market concept is lucrative and also gives an actual cost estimate to better frame the pricing plan.

Break-even analysis is typically used by firms to assess the acceptable price of goods or services in order to recover the sales fluctuations and the costs incurred.

Break-even analysis offers an interpretation of profits' actions in relation to production. In planning a company's financial structure, this understanding is critical.

If the company plans to introduce a new product that requires considerable costs and capital investment, the potential of the product on the market must be discovered by break-even analysis.

The companies will easily find out and include those costs that are otherwise left out or overlooked during the implementation of the break-even report.

If the company lacks adequate funding for the project, it can only approach external sources of funds after evaluating its break-even position, which should be sufficiently high to cover expenses.

In company, Break-even Point has a wider spectrum other than only recovering the total cost by sales. A minimum break-even point for the business is considered to be ideal. These are only few points from the many benefits a break even analysis in excel can do for your business.

If you haven’t tried yet, you should start doing a break-even analysis in excel by using the many available financial model templates available in the web. Overall, this analysis greatly helps in managing your assets and finances, controlling costs and especially in creating major business decisions to your products, and business as a whole.

0 notes

Text

Payback Period Excel Templates

The payback period is a stand-alone tool to compare different investments. It is quite useful, comprehensive, and has no explicit criteria for decision-making. The payback period is typically performed in capital budgeting along with the Internal Rate of Return (IRR) and Return of Investment(ROI). This article will detailed payback period Excel Templates.

The Payback Method

The payback period is the time required for the investment to be recovered. This metric allows companies to compare several investment opportunities; the project that returns its investment in the shortest time is likely to be chosen. It is widely used when liquidity is an essential criterion to choose a project.

The Payback Period is kind of similar to Breakeven Analysis, but instead of covering fixed costs, it takes into account the time required to recoup an investment. Because of its nature, the payback period is often used initially to analyze an investment and could be understood without the need for technical knowledge.

Simple Payback Method vs. Discounted Payback Method

Simple Payback Method

The payback period is expressed in years and calculated by dividing the cumulative net cash flow from the initial cost of investment. This method identifies the break-even point between profit and paying back invested money for a given process. This payback method does not consider the time value of money.

Discounted Payback Method

This method project the payback period more accurately because it incorporates the time value of money. The projected cash flows are discounted to its present values based upon the company’s cost of capital.

Drawback of Payment Method

1. Though the payback period exhibit how long it takes to recoup an investment, it does not show how much is the return on investment. 2. Cash flows after the payback period becomes irrelevant, therefore ignoring the profitability of a project.

Though the payback period is pretty straightforward to calculate, it is still best to use pre-defined templates. This calculation is often included along with other templates such as startup, investments, and so on. There are many payback period excel templates you could find online, you just have to choose which one best fits your needs. Click here for more selection of financial model templates.

Conclusion: An investment with the shortest payback is likely to be accepted

If you are bound to choose with alternative investment opportunities, the quickest way to know whether to accept an investment proposal is through the payback period. Ideally, an investment with the shortest payback period is most likely to be accepted. But since profitability is ignored, this metric is best used along with ROI or other investment metrics.

0 notes

Text

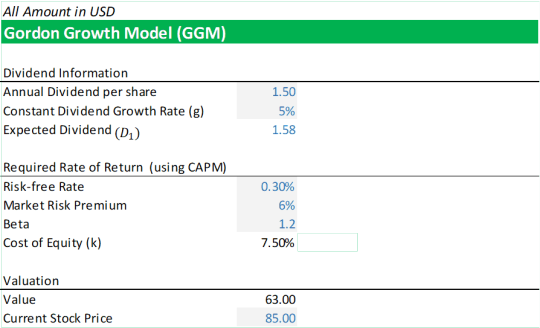

What is the Gordon Growth Model?

The Gordon Growth Model (GGM) is a model used to calculate the intrinsic stock value based on the infinite value of future dividends discounted in its present value. This model disregards the stock market price and focuses more on what value it could give in the future. GGM assumes a constant return rate for dividends, which can be used for computing the intrinsic stock value of established companies. Other assumptions for this model are that the company has stable financial leverage, and the free cash flows are paid as dividends.

Gordon growth model assumes that the business will continually pay dividends in constant growth in perpetuity. In computing the intrinsic value, the model takes the infinite future value of dividends in its present value by discounting back using the expected return rate. It is irrespective of the stock's current value and only considers the dividend payout factor, rate of return, and the expected constant growth rate. So, if the current market value is higher than the intrinsic value, it means that the stock price is overvalued and vice versa.

Some limitations, however, are that no company pay dividends at a constant growth. It does not consider that free cash flows might be used for business expansion at some point rather than distributed as dividends to its shareholders. Also, having a higher growth rate than the expected return rate would result in a negative value, while a growth rate equals to rate of return can provide an infinite value of a stock.

Gordon Growth Model Formula and Example

Shown below is the formula for the Gordon growth model:

P = D1/(r-g)

Wherein:

P = Intrinsic Value

D1 = Expected Annual Dividend per Share for the Following Year

R = Required Rate of Return

g = Constant Growth of Dividend, in perpetuity

Example:

Given that the company's stock price is trading at $55 per share, investors' expected rate of return is 8%, with an annual growth rate of 4%. The dividend to be paid per share next year is $2.

The company’s stock intrinsic value is computed as follow:

P = D1/(r-g)

P = 2/ (8%-4%)

P = $50

The intrinsic value is computed at $50, which means that the current company's stock is overvalued by $5.

Gordon growth model can compare the intrinsic value of a company to industry standard and peer's benchmark. It can also be used to evaluate the intrinsic value to its current market price, which can be a basis for investing or not in the company. However, there are limitations to this model due to its sensitivity to the discount factor and growth rate. It can either provide a negative value if the growth rate is higher than the discount rate or an infinite value of a share if the rate of return equals the growth rate. The Gordon growth model can be utilized to evaluate stock prices with other market values such as the Price to Earnings Ratio, Earnings per Share, and Book Value per Share.

0 notes

Text

Financial Modeling in Excel - Download Financial Model Templates in Excel

In this era, money runs the world. Many people strive everyday just to be able to do something. However, due to the severe competition, one can only up the other by being more efficient and creative. Both traits are highly sought after in every opportunity. As a result, many discoveries and tools became available for many to use. This not only affected the lives of people but also the way things are conducted, specifically, in running a business. It is undeniable that the emergence of tools to help run a business became a critical factor in financial success. A financial model is one of the tools that makes a difference when starting or running a business.

Financial modeling is the task of building a financial model. It is the process of building an abstract representation of a business’ financial situation. It is specifically designed to help represent a numerical report version of the performance of a business, project, or any other investment. It is also a skill set that is highly valued, however, very hard to master since it will take a lot of experience and substantial know-how about different industries.

Financial modeling in Excel is not as easy as it sounds. Not only will you need to invest a lot of time to hone your skills and practice to produce a good quality financial model that works according to its purpose. Money is Gold so typically, if one can avoid spending too much time on something, looking for a more efficient way is a better solution.

By using ready-made financial model templates, building a financial model became an easier task. It will also cost you less than hiring a professional to create a model from scratch and serve as a base to start with your model.

If you’re looking for a platform where you can acquire or download industry-specific or general use financial model templates, hether for business purposes or personal financing, you can visit eFinancialModels.

eFinancialModels is a platform providing a wide range of industry-specific Financial Model Templates made by financial modeling experts with vast experience in financial modeling and extensive industry know-how.

Read more about Financial Modeling in Excel to help you learn more about the significance of building a financial model, how to build a financial model, as well as what to avoid when building a financial model with this article: Financial Modeling in Excel – Significance, How To’s, and What to avoid.

0 notes

Text

What is Private Equity Waterfall Modeling?

When private equity does well, the value of an investment can grow substantially. The next question would be what to do with the proceeds realized? This is where the waterfall distribution comes into play. In this context, we will take a deep dive into how does private equity waterfall modeling works?

What is Waterfall Distribution

In private equity investments, a partnership is formed between a general partner who manages the investment and a limited partner who contributes the most in the partnership. The waterfall structure describes the distributions' flow between the partners. It has also provision for the claw back and catch-up clauses that aim to protect both the investor and managers. Ideally, the limited partner receives all the cash flows from the investments until it reaches the preferred return rate before satisfying provision for claw back and catch-up clauses. The general partner or manager will receive a profit based on the level of investment and agreed incentive or management fee.

Types of Waterfall Distribution

European Waterfall

The European Waterfall pays 100% of the investment proceeds to the limited partner until it reaches the required return and 100% investment. After that, the proceeds will be distributed on a pro-rata basis. The manager could only share profits after the capital is returned, and the preferred return has been satisfied. However, as part of managing the fund, the manager may receive an asset management fee. This waterfall is aligned with the interest of both managers and investors. However, it could take years before the fund manager could share in investment profits.

American Waterfall

The American Waterfall pays 100% of distributions to limited partner up to the preferred return, but does not require the full repayment of his capital before the general partner participates in the profits. For the manager to qualify in this share of distribution, the deal must consistently satisfy or surpass the expected level of performance. It aims to encourage the manager to maximize the return on investment.

What is a Claw back?

The claw back clause intends to protect the limited partner or investor. It takes into effect when the fund manager takes a performance fee while the deal is under performing. It requires the manager to repay any fees collected to make up for deficits.

The Catch-up Clause

The catch-up clause intends to protect the general partner or manager. It comes into play when there is a delay in the participation of profits. The fund manager is entitled to a retroactive payment of share in the net proceeds once the investment reaches a predetermined milestone.

Waterfall Modeling in Excel

In Waterfall Modeling, the profits are distributed between the general partner and limited that follow an uneven distribution. A multi-tier waterfall model can be designed according to the partnership agreement in which all equity investors will receive a preferred annual return of their invested capital. IRR models could be a three-tier waterfall with all hurdle rates measured at the project level. Suppose the distribution fall below the preferred return on the first tier, the deficiency will be carried forward to the following year and compounded annually at the preferred return rate. On the other hand, the cash flow required to meet the preferred hurdle must be determined before calculating the profit split on Tier 1. Then, the additional profit will be allocated based on the agreed profit split in this tier. Lastly, the remaining cash available from the investment will flow to the next waterfall tier. This multi-tier waterfall modeling is a bit complicated compared to other models, and for this reason, financial experts built various templates that include waterfall distribution.

Conclusion: Waterfall Model provides for fair distribution of profit between general and limited partner.

Since the investor risks his capital in the partnership, it is just right that his capital contribution and preferred return must be met before additional proceeds are distributed on a pro-rata basis. However, it is also just fair that the general partner received a management fee or other incentive to manage the investor's asset. It is just a matter of agreement and communication between the partners. A Greater profit will be achieved with a great partnership.

0 notes