#How to calculate dcf

Explore tagged Tumblr posts

Text

How Startups Are Using Financial Modelling to Attract Investors in India’s Booming Tech Ecosystem

India’s startup ecosystem is on fire. With over 100 unicorns and thousands of early-stage ventures blossoming across sectors like fintech, edtech, healthtech, SaaS, and e-commerce, the landscape is vibrant—but also fiercely competitive. In this high-stakes environment, financial modelling has emerged as a powerful tool for startups to build credibility, secure funding, and scale with confidence.

For aspiring entrepreneurs and finance professionals alike, mastering financial modelling is no longer optional. If you’re in Kolkata and looking to break into this space, enrolling in the best Financial Modelling Course in Kolkata can give you the practical skills needed to thrive in this startup-driven economy.

Why Financial Modelling Matters in a Startup's Journey

When startups approach angel investors, venture capitalists, or private equity firms, they don’t just pitch an idea—they pitch a vision backed by numbers. These numbers aren’t just pulled from thin air. They come from detailed financial models that forecast how the business will grow, scale, and generate returns.

A robust financial model communicates:

Revenue projections for the next 3–5 years

Operating expenses and burn rate

Break-even analysis

Customer acquisition cost (CAC) and lifetime value (LTV)

Unit economics

Funding requirements and expected ROI

These projections show investors that the startup’s founders understand their market, costs, and how their business will turn a profit—or at least grow fast enough to justify the investment.

The Indian Startup Boom: A Perfect Storm for Financial Modellers

India is now the third-largest startup ecosystem in the world, after the US and China. With the digital economy accelerating, investors are pouring billions into scalable tech ventures. However, investor scrutiny is higher than ever due to recent global funding slowdowns.

Now, it’s not enough to have a great pitch deck. Investors want to see clear, data-driven financial roadmaps. That’s where financial modelling steps in.

Professionals trained through the best Financial Modelling Course in Kolkata are helping startups prepare solid models that can stand up to investor due diligence. From sensitivity analysis to discounted cash flows and cohort-based revenue forecasting, the right models can turn a maybe into a yes.

How Startups Are Using Financial Models to Win Over Investors

1. Validating the Business Idea

Before seeking funding, startups use financial models to check whether the business idea is financially viable. This includes calculating how many customers are needed to reach profitability, and how long the runway is with current capital.

2. Pitch Deck Projections

Every investor pitch today includes financial projections. But not all projections are created equal. Models that reflect realistic assumptions, industry benchmarks, and multiple scenarios inspire investor trust and make the startup stand out.

3. Justifying Valuations

Startups often struggle to justify their high valuations. Solid models using DCF (Discounted Cash Flow) or Comparable Company Analysis help founders support their ask with logic and numbers.

4. Planning for Fund Utilization

Investors want to know: how exactly will the startup spend their money? Financial modelling helps allocate capital efficiently—across product development, marketing, hiring, and operations.

5. Managing Growth

As a startup scales, it needs to continuously update its models to make hiring plans, pricing decisions, and market expansion strategies. Good models aren’t static—they evolve with the business.

Real-World Example: Fintech Startup in Kolkata

Take the example of a rising fintech startup in Kolkata targeting small business lending. When preparing for their Series A round, they built a detailed financial model projecting their revenue based on user acquisition, average loan size, and default rates. They also modeled different growth scenarios: aggressive vs. conservative.

Using these models, they were able to:

Clearly demonstrate when they’d break even

Show the effect of scaling operations

Validate their ₹100 crore valuation ask

They successfully secured funding from a Mumbai-based VC firm—and credited their financial model as a major differentiator.

The Growing Demand for Financial Modelling Skills

Startups aren’t the only ones benefiting. Founders, finance teams, startup analysts, and even venture capital interns are expected to know how to build and interpret financial models.

If you're based in West Bengal and looking to enter this space, joining the best Financial Modelling Course in Kolkata can be your stepping stone. These courses teach:

Excel-based modelling techniques

Three-statement financial models

Valuation methods like DCF and EBITDA multiples

Scenario planning and Monte Carlo simulations

Fundraising and cap table modelling

With these skills, you can work in corporate finance, become a startup CFO, join a VC firm, or even start your own venture with financial clarity.

Final Thoughts

India’s startup boom is not slowing down—and as more founders chase limited capital, financial clarity will be their biggest weapon. Financial modelling is no longer just for investment bankers; it’s now a startup essential.

If you’re looking to be part of this transformation—whether as a founder, finance professional, or investor—now is the time to upskill. Enroll in the best Financial Modelling Course in Kolkata and gain the expertise to turn ideas into investor-ready opportunities.

0 notes

Text

Capital Budgeting: A Blueprint for Business Growth

In today’s highly competitive business environment, capital budgeting isn’t just a financial function—it is the cornerstone for sustained business growth. Every startup or mid-sized companies, long-term success hinges on high-stake business decisions. Here, using a cloud based accounting software or a unified business application can transform traditional budgeting into a smarter and more scalable process.

This blog explores the importance of capital budgeting and how leveraging an all in one business management software with built-in compliance management software features can change capital budgeting into a strategic instrument for business growth.

What is Capital Budgeting?

Capital budgeting refers to the structured process of evaluating major long-term investments—typically capital expenditures (CapEx)—based on their potential to generate future cash flows. These are capital intensive decisions such as setting up new facilities, acquiring new assets or expanding into new markets. Upgrading to an advanced inventory and accounting software to correctly capture CapEx becomes crucial for sustained growth.

Unlike regular operational spending, capital budgeting shapes a company’s strategic direction for years. This makes it essential to invest in professional bookkeeping and payroll services, smart compliance software, and other long-term resource planning efforts.

Why is Capital Budgeting Necessary? When Should You Start?

Companies rely on capital budgeting to answer critical strategic questions:

Should we invest in a new production facility?

Is it the right time to expand into another region or market?

How can shareholder value be maximized?

Is it time to invest in a unified business application?

Should we upgrade our cloud accounting systems or HRM & payroll automation?

Would investing in a regulatory compliance software enhance compliance and business value?

What other investments will deliver long-term value?

Capital budgeting provides a data-driven framework for such high-impact decisions thus minimizing risks and improving ROI. Integrating tools like financial management software, compliance management software, and advanced taxation software can help assess risks, feasibility and track compliance across projects. Professional GST and payroll accounting services can help startups make informed capital budgeting decisions.

Capital budgeting should be performed prior to any major investment decision, annual planning, or significant organizational pivot. Common scenarios include:

New market entry

Upgrading to an org-wide business application, accounts payable/accounts receivable systems, GST billing software or e-invoicing software

Investing in smart manufacturing software

Business expansion through company incorporation or acquisitions

Capital Budgeting Methodologies

1. Discounted Cash Flow (DCF) Methods

These methods account for the time value of money and are easily executed using SaaS accounting software or business finance software:

Net Present Value (NPV): Difference between present value of inflows and outflows.

Internal Rate of Return (IRR): Break-even discount rate at which NPV equals zero.

Profitability Index (PI): Ratio of inflows to investment; values over 1 indicate viability.

2. Payback Period Methods

It is ideal for businesses that need insights into liquidity. Tools like accounts payable/receivable software or expense management systems automate these calculations:

Payback Period: Time to recover initial investment from inflows.

Discounted Payback Period: More realistic, factoring in the time value of money.

3. Throughput Analysis

Best suited for manufacturing, this model evaluates profit from enhanced output capacity. It emphasises on optimising revenue generation by fixing operational bottlenecks. When paired with inventory management software, fixed assets software, or purchase order management systems, it reveals operational efficiencies.

Business Benefits of Capital Budgeting

1. Informed Decision-Making

Powers prudent decision making by aligning investment with strategy—leveraging insights from accounting software for startups, payroll and tax software, and order-to-cash software.

2. Risk Mitigation

Scenario planning tools highlight operational, financial and compliance risks. Integrated with advanced tools like compliance tracking systems, GST reconciliation software, and AI-powered tax compliance platforms, risks can be detected and managed early on.

3. Efficient Resource Allocation

Rank and prioritize investment opportunities to deploy capital judiciously, using bookkeeping software, policy management software, and smart business applications.

4. Improved Cash Flow Planning

Enhances liquidity management drawing insights from accounts payable/accounts receivable software, payroll services, and e-TDS reporting tools.

5. Increased Stakeholder Confidence

Showcase transparency with audit-ready reports backed by e-invoicing software and regulatory reporting software.

6. Sustainable Financial Stability

Encourage long-term gains through data-backed, compliance-ready decisions—not guesswork.

Modernizing Capital Budgeting: From Spreadsheets to Software

Challenges with Traditional Spreadsheets

Manual data entry errors

Outdated versions during collaboration

No dynamic forecasting

Limited integration with tax filing and payroll support tools

Why Switch to a Unified Business Application

Modern business automation software transforms budgeting by offering:

Automated calculations (NPV, IRR, etc.) via smart business application

Real-time data from cloud accounting software backed by bookkeeping and payroll services

Scenario planning with insights from compliance audit software and inventory accounting systems

Regulatory readiness via tools like GST invoice matching software and document management systems

Capital Budgeting: A Blueprint for Business Growth

Capital budgeting is more than a financial metric—it's a blueprint for growth. By moving from static spreadsheets to intelligent business applications like cloud-based compliance solutions, accounting & inventory management platforms, and AI business applications, companies unlock new dimensions of efficiency and agility.

Whether you're managing form 16 filings, planning labor welfare fund contributions, or optimizing GSTR-2B vs Purchase Register matching, modern compliance automation tools empower you to make smarter, safer, and more strategic investment decisions.

1 note

·

View note

Text

Fair Market Value for ESOPs: What It Is and How to Calculate It

Understanding the Fair Market Value (FMV) of Employee Stock Ownership Plans (ESOPs) is essential for any organization offering equity compensation. Whether you're a startup founder, HR professional, or finance executive, knowing how to accurately determine FMV ensures compliance with tax regulations, builds employee trust, and reflects the true value of your company’s shares. In this in-depth guide by Xumane, we break down everything you need to know about FMV as it relates to ESOPs. We start with the basics—what fair market value means, why it matters, and how it impacts both the company and its employees. From there, we walk you through the most commonly used valuation methods such as the Discounted Cash Flow (DCF) method, Comparable Company Analysis, and Net Asset Value approach.

0 notes

Text

#discounted cash flow#cash flow#why DCF important#uses of discounted cash flow#formula of discounted cash flow#calculation of discounted cash flow

0 notes

Text

The Power of Business Valuation in Private Equity Investments

Private equity investments are built on a foundation of careful analysis and strategic thinking, with business valuation serving as the essential first step. It’s not just about determining a company’s current worth—it’s about understanding how that value can evolve and create opportunities for growth and profit. In this dynamic environment, accurate valuation becomes a critical driver informing every investment decision, from identifying promising targets to crafting winning strategies.

The Core Role of Business Valuation

Valuation is more than a financial exercise in private equity—it’s a comprehensive assessment of a company’s potential. Private equity firms use valuation to examine a target’s economic health, market position, and operational capabilities. This thorough examination reveals the proper drivers of value: innovative products, loyal customers, or a strong competitive advantage.

Valuation also helps investors separate fact from fiction. By grounding investment decisions in complex data and realistic forecasts, private equity firms can avoid the pitfalls of speculation and focus on creating sustainable value. This approach doesn’t just protect investors—it also benefits the companies themselves by setting a clear baseline for growth and improvement.

Popular Valuation Methods in Private Equity

Private equity firms draw on several trusted valuation methods, each offering a unique perspective on a company’s potential. The discounted cash flow (DCF) method calculates value based on expected future earnings, adjusted for risk and the time value of money. This method is ideal for companies with reliable cash flows and precise growth trajectories.

Meanwhile, the comparable company analysis (CCA) method evaluates how similar businesses are valued in the market, providing context for a fair purchase price. It helps private equity investors understand whether a target is priced above or below its industry peers, which can be crucial for negotiations.

Precedent transactions analysis (PTA) is another key tool, using data from recent sales of similar companies to estimate a target’s worth. This historical lens can reveal market trends and help set realistic pricing expectations. Many private equity firms blend these methods to ensure their valuations are comprehensive and reflect multiple viewpoints.

Shaping Investment Structures with Valuation

Valuation is not just a number—it’s the starting point for structuring deals that make sense for investors and sellers. A higher valuation might lead private equity firms to propose creative financing solutions, such as earn-outs or convertible debt, to balance risk and reward. These structures align interests and give both sides confidence in the deal’s long-term viability.

Private equity firms often have more leverage for investments with lower valuations to negotiate favorable terms, such as lower purchase prices or more equity control. In every scenario, valuation data shapes the deal's contours, guiding discussions about ownership, management, and exit strategies.

The influence of valuation doesn’t end when the deal closes. Post-acquisition, private equity firms use valuation findings to prioritize initiatives and identify ways to enhance operational performance. Whether streamlining processes or launching new products, these strategies are grounded in valuation insights and help create long-term value for all stakeholders.

Navigating Market Forces in Valuation

Market conditions significantly impact how private equity firms approach valuation. During periods of economic expansion, valuations tend to be higher, requiring investors to be more selective and creative to generate attractive returns. In these times, firms may focus on improving operational efficiencies or expanding product lines to unlock additional value.

In contrast, economic downturns can create opportunities for private equity investors to acquire assets at discounted prices. In these markets, rigorous valuation is even more critical—it helps firms spot hidden value and avoid overpaying for assets that may struggle to recover.

Industry dynamics also shape valuation. Rapid technological changes or evolving consumer preferences can dramatically shift a company’s prospects. By factoring these changes into their valuation models, private equity investors can build a more realistic picture of future performance and avoid surprises.

Valuation as a Strategic Imperative

At its core, valuation is a strategic advantage for private equity firms. It ensures investment decisions are based on solid data and clear thinking rather than gut feelings or short-term trends. This disciplined approach helps firms build trust with their investors and partners, laying the groundwork for successful collaborations.

Valuation also fosters a culture of accountability. By continually revisiting and refining their valuation models, private equity firms can adapt to market changes and stay focused on long-term results. This adaptability is crucial in a fast-paced industry where fierce competition and opportunities can shift overnight.

Business valuation is the compass that guides private equity firms through the complexities of investment decisions. It informs how deals are structured, risks are managed, and opportunities are realized. By mastering valuation, private equity investors can make smart decisions that drive growth, build relationships, and unlock the full potential of the companies they back. In the world of private equity, this commitment to rigorous analysis and strategic foresight defines success.

0 notes

Text

Mastering Valuation: How Discounted Cash Flow Holds the Edge

When it comes to valuing a business or an investment, few methods command the respect and widespread use as the Discounted Cash Flow (DCF) analysis. Despite the emergence of newer valuation tools and models, DCF remains a cornerstone in finance for a reason—it provides a fundamental, intrinsic value based on the actual cash the business is expected to generate over time.

In an age where markets can be volatile and speculative, understanding why DCF still reigns supreme is essential for investors, analysts, and finance professionals alike. This blog unpacks the core mechanics of DCF, its advantages, and why it continues to be a trusted valuation method in today's complex financial environment.

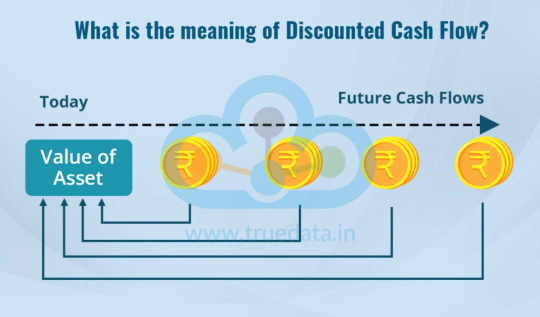

What is Discounted Cash Flow (DCF)?

At its essence, DCF is a valuation technique that estimates the present value of an investment based on its expected future cash flows. The key idea is simple: money available today is worth more than the same amount in the future due to its earning potential—this is the time value of money.

The DCF formula discounts future cash flows back to the present using a discount rate, often the company’s weighted average cost of capital (WACC). This process accounts for risk and opportunity cost, helping investors arrive at a value that reflects both potential and uncertainty.

Why DCF is So Widely Used

Intrinsic Value Focus: Unlike market-based methods that rely on peer comparisons or multiples, DCF looks inward at the company’s own fundamentals. It isn’t swayed by market sentiment or trends.

Flexibility: DCF can be tailored to virtually any company or project, regardless of industry or size, as long as reasonable cash flow projections can be made.

Forward-Looking: Instead of relying on historical data alone, DCF forces analysts to forecast future performance, encouraging a deep understanding of the business drivers.

Risk Adjustment: By adjusting the discount rate, investors can factor in different levels of risk, making the model adaptable across sectors and economic cycles.

Breaking Down the Components of DCF

To appreciate why DCF remains a vital valuation tool, it’s important to understand its main components:

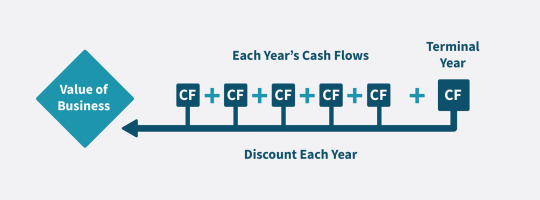

Cash Flow Projections: These are estimates of the company’s free cash flows (FCF), often forecasted over 5-10 years. Free cash flow represents the cash generated after accounting for operating expenses and capital expenditures.

Terminal Value: Since businesses often last beyond the forecast period, terminal value estimates the value of all future cash flows beyond the forecast horizon, typically calculated using a perpetuity growth model or exit multiple.

Discount Rate: This rate reflects the required return investors expect, often influenced by the risk profile of the company and market conditions.

Common Misconceptions About DCF

Many investors shy away from DCF because they view it as complicated or overly sensitive to assumptions. While it is true that small changes in inputs can significantly affect valuation, this sensitivity is a strength rather than a flaw. It forces analysts to be thorough and transparent about their assumptions.

Moreover, DCF’s complexity encourages a more disciplined investment process, one that goes beyond superficial comparisons and market hype. It demands a granular understanding of the company’s business model, competitive landscape, and growth prospects.

DCF in Today’s Market Environment

In 2025, with global markets facing inflation pressures, geopolitical tensions, and rapid technological disruptions, DCF analysis remains relevant and invaluable. Its forward-looking nature helps investors cut through noise and focus on sustainable value creation.

Recent news highlights from financial markets emphasize how volatile interest rates impact discount rates, thereby influencing valuations. For example, as central banks adjust monetary policies worldwide, companies with stable and predictable cash flows become increasingly attractive—a dynamic clearly captured in DCF models.

Additionally, sectors such as renewable energy, technology, and healthcare are seeing heightened investor interest, driven by long-term growth potential. Applying DCF analysis in these industries helps quantify that potential amid market uncertainties.

The Rise of Finance Education in the Region

With the expanding global interest in sophisticated valuation methods, the demand for finance education has surged. Professionals in regions with burgeoning financial hubs are keen to master valuation techniques like DCF.

For instance, the popularity of the online CFA course in UAE has grown remarkably, reflecting the desire among finance professionals to gain deep analytical skills that include valuation mastery. These educational programs equip candidates to confidently apply tools such as DCF in real-world scenarios, enhancing their credibility and decision-making prowess.

Practical Tips for Using DCF Effectively

To get the most out of DCF, consider these best practices:

Use Conservative Assumptions: Overly optimistic cash flow forecasts can inflate valuations. Base projections on historical data and realistic growth rates.

Stress Test Inputs: Run multiple scenarios with varying discount rates and growth assumptions to understand the range of possible valuations.

Focus on Quality of Cash Flows: Differentiate between recurring operational cash flow and one-time items.

Don’t Rely Solely on DCF: Use it in conjunction with other valuation methods to get a holistic view.

Limitations to Keep in Mind

Despite its advantages, DCF is not without limitations:

Dependence on Estimates: Future cash flows are uncertain, and errors in projections can lead to inaccurate valuations.

Terminal Value Sensitivity: Often, a large portion of valuation comes from terminal value, which can be speculative.

Complexity: Requires deep understanding and data availability, which might be challenging for some businesses.

Why DCF Remains an Authority in Valuation

The staying power of DCF comes from its grounding in finance theory and practical utility. It directly links valuation to the fundamental cash-generating capacity of the business, which is the ultimate driver of shareholder value. For finance professionals aiming to sharpen their valuation expertise, the CFA curriculum 2025 offers a deeper, more updated approach to mastering key financial concepts like DCF. With its expanded focus on practical applications and real-world case analysis, the curriculum equips candidates for roles in investment banking, equity research, and portfolio management—where valuation acumen is essential.

Final Thoughts

Discounted Cash Flow analysis is far from obsolete; in fact, it’s more relevant than ever. Its ability to adapt to various industries, incorporate risk, and provide intrinsic valuations makes it indispensable in today’s investment toolkit.

As global finance professionals increasingly embrace rigorous valuation standards, education and practical application of DCF continue to grow, especially in fast-evolving markets. Whether you are an investor, analyst, or student, mastering DCF can elevate your financial insight and decision-making.

The method’s durability proves that when it comes to valuing assets, understanding the true worth beneath market noise will always matter. DCF doesn’t just survive—it thrives as the gold standard for valuation.

0 notes

Text

How Businesses Should Handle Valuation Under the Income Tax Act

Proper Valuation Under the Income Tax Act is not just a legal requirement—it's a strategic tool for businesses to ensure compliance, avoid litigation, and drive accurate financial planning. Whether you’re a startup raising funds, a company undergoing restructuring, or a business facing scrutiny from tax authorities, getting your valuation right is essential.

In this article, we’ll explore how businesses should approach valuation in the context of the Income Tax Act, the key methodologies involved, and common challenges to avoid.

Understanding the Need for Valuation Under the Income Tax Act

Valuation under the Income Tax Act becomes relevant during several key business transactions, such as:

Issue of shares (Section 56(2)(viib)): Especially in startups and private companies issuing shares at a premium.

Transfer of assets or shares: Involving capital gains (Section 50CA and 50D).

Mergers, acquisitions, or restructuring: To determine fair market value (FMV) for taxation purposes.

Wealth declaration and scrutiny assessments: Where the assessing officer may question the declared value.

The objective of these valuations is to determine a fair and accurate representation of an entity's worth, ensuring that income, gains, or losses are taxed appropriately.

Key Provisions Governing Valuation Under the Income Tax Act

Valuation Under the Income Tax Act for Share Issuance – Section 56(2)(viib)

When a closely held company issues shares to a resident at a price exceeding the fair market value, the excess may be treated as income from other sources and taxed accordingly. This anti-abuse provision aims to curb the practice of laundering black money through inflated valuations.

To determine FMV, businesses can choose either:

Net Asset Value (NAV) Method

Discounted Cash Flow (DCF) Method

The choice of method must be justified with proper documentation and ideally backed by a Category I Merchant Banker valuation report.

Transfer of Shares – Section 50CA

When shares of an unlisted company are transferred for consideration lower than the FMV, the FMV is deemed to be the sale consideration for capital gains computation. This clause ensures capital gains aren’t avoided by under-reporting sale value.

The Valuation Under the Income Tax Act here must be based on recognized methods—typically involving a certified merchant banker or a chartered accountant following prescribed guidelines.

Valuation for Capital Gains – Section 50D

In scenarios where consideration is not determinable, like in barter transactions or asset exchanges, Section 50D applies. It mandates that the FMV of the asset transferred will be considered the sale value.

Acceptable Valuation Methods Under the Income Tax Act

Understanding acceptable valuation methodologies is crucial for businesses to comply with tax norms and avoid disputes. These include:

1. Net Asset Value (NAV) Method

This method calculates the value of a business based on the net assets recorded in its books. While straightforward, NAV is more suited for asset-heavy companies and may not reflect true value for tech or service-based firms.

2. Discounted Cash Flow (DCF) Method

DCF is a forward-looking method that estimates value based on projected future cash flows discounted to present value. It’s widely used in startup valuations and is accepted by tax authorities if backed by reasoned assumptions and certified reports.

3. Comparable Company Multiple (CCM) Method

Although not specifically mentioned under the Act, this method is useful during litigation or in determining arm’s length pricing for transfer pricing cases.

Compliance Tips for Valuation Under the Income Tax Act

Preparing Documentation

Ensure that all assumptions, methodologies, and calculations used in the valuation are documented thoroughly. A proper valuation report from a Category I Merchant Banker or qualified CA can be vital.

Consistency Across Reporting

The valuation used for tax purposes should align with that used for other statutory or financial reporting, like under Companies Act or FEMA, unless justifiable differences exist.

Maintain Forecast Integrity

Especially when using the DCF method, ensure your cash flow projections are realistic and based on verifiable data. Overly aggressive forecasts can lead to tax disputes and potential penalties.

Common Mistakes Businesses Make in Valuation Under the Income Tax Act

1. Ignoring Regulatory Changes

Tax provisions related to valuation are dynamic. Failing to stay updated on the latest notifications and CBDT circulars can result in non-compliance.

2. Overstating or Understating Valuation

Artificial inflation or deflation of valuation—either to attract investors or reduce tax liability—can attract heavy scrutiny under Sections 56, 50CA, and 50D.

3. Inadequate Professional Advice

Valuation is not just a number; it’s a strategic and legal exercise. Engaging qualified valuation professionals ensures accuracy and defensibility.

Consequences of Incorrect Valuation Under the Income Tax Act

Failing to adhere to proper valuation protocols can lead to:

Tax demand notices and penalties

Disallowance of share premium as income

Litigation with income tax authorities

Loss of investor confidence

In severe cases, incorrect valuation may be interpreted as a willful attempt to evade tax, inviting prosecution under relevant sections.

Best Practices for Handling Valuation Under the Income Tax Act

Engage a Registered Valuer or Category I Merchant Banker

Particularly when mandated under Section 56(2)(viib).

Conduct Periodic Valuations

Especially useful for fast-growing startups where FMV can change rapidly.

Keep Stakeholders Informed

Ensure that internal finance teams, auditors, and legal advisors are aligned.

Reconcile Valuation for Multiple Authorities

Valuation under FEMA, Companies Act, and Income Tax Act can differ; proper reconciliations should be maintained.

Conclusion

Handling Valuation Under the Income Tax Act is not merely a compliance checkbox—it’s a vital component of responsible business management. Accurate valuations protect businesses from tax pitfalls, ensure smooth investor relations, and uphold corporate credibility.

By staying updated on regulatory expectations, adopting best practices, and consulting qualified professionals, businesses can navigate the valuation landscape with confidence and clarity.

0 notes

Text

Understanding DCF Valuation: A Comprehensive Guide by CompaniesNext

Discounted Cash Flow (DCF) valuation is one of the most widely used methods for determining the intrinsic value of a business. At CompaniesNext, we aim to empower entrepreneurs, investors, and analysts with clear, actionable financial insights. In this guide, we’ll break down what DCF valuation is, why it matters, and how to perform one.

What is DCF Valuation?

DCF (Discounted Cash Flow) valuation is a financial model used to estimate the value of an investment based on its expected future cash flows. These cash flows are projected and then discounted back to their present value using a discount rate that reflects the investment’s risk.

Why Use DCF Valuation?

Accurate Reflection of Future Potential

Unlike other valuation methods, DCF focuses on the fundamentals of a business rather than market trends or comparables. It provides a more accurate view of what a company is truly worth based on its future performance.

Ideal for Long-Term Decision Making

DCF is especially useful for investors and business owners with a long-term view, as it considers the entire life cycle of a business or project.

Key Components of a DCF Model

1. Forecasted Free Cash Flows (FCFs)

Free Cash Flow is the cash a company generates after accounting for capital expenditures. It represents the cash available to investors and is the foundation of any DCF model.

2. Discount Rate

The discount rate is typically the company’s Weighted Average Cost of Capital (WACC). It reflects the opportunity cost of investing capital elsewhere at a similar risk level.

3. Terminal Value

Since it's difficult to forecast cash flows indefinitely, the terminal value estimates the business’s value beyond the forecast period. It usually accounts for a large portion of the total valuation.

Steps to Perform a DCF Valuation

Step 1: Project Free Cash Flows

Start by estimating the company’s free cash flows for the next 5–10 years based on historical performance, growth expectations, and industry trends.

Step 2: Calculate the Discount Rate

Determine the WACC by factoring in the cost of equity and the cost of debt, weighted by their respective portions in the company’s capital structure.

Step 3: Estimate the Terminal Value

Use either the Gordon Growth Model or Exit Multiple Method to estimate the terminal value.

Step 4: Discount the Cash Flows

Bring all future cash flows and the terminal value to present value using the WACC. Sum them to arrive at the total enterprise value.

Limitations of DCF Valuation

While DCF is powerful, it relies heavily on assumptions. Minor changes in growth rate, discount rate, or cash flow projections can significantly affect the final valuation.

Conclusion

DCF valuation is a cornerstone of corporate finance and investment analysis. At CompaniesNext, we help businesses and investors leverage this method to make informed, forward-thinking decisions. Whether you're assessing a startup, planning a merger, or investing in a new venture, a solid DCF model is a valuable tool in your financial toolkit.

0 notes

Text

Equity Research and Valuation Course | Learn Investment Analysis Online

Master the art of evaluating stocks and making informed investment decisions with our comprehensive Equity Research and Valuation course. Designed for aspiring financial analysts, investors, and finance professionals, this course delves deep into financial statement analysis, industry research, valuation techniques, and forecasting models. Learn how to interpret company data, assess market trends, and calculate intrinsic values using proven methodologies like Discounted Cash Flow (DCF), Relative Valuation, and more. Whether you're preparing for a career in equity research or aiming to strengthen your investment skills, this program equips you with real-world knowledge and tools to excel in today's dynamic financial markets. Enroll now to build your expertise and stay ahead in the world of finance.

0 notes

Text

Medical Associates is a large for-profit group practice. Its dividends are expected to grow at a constant rate of 7% per year into the foreseeable future. The firm's last dividend (D0) was $2, and its current stock price is $23. The firm's beta coefficient is 1.6; the rate of return on 20-year T-bonds currently is 9%; the expected rate of return is 13%. The firm's target capital structure calls for 50% debt financing, the interest rate required on the business's new debt is 10%, and its tax rate is 40%. You are to write a report that answers the following: Calculate Medical Associates' cost of equity estimate using the DCF method. Next years expected dividend = $2 * 1.07 = 2.14 Current Stock Price = $ E (Rc) = 2.14/23 + .07 = .1630 = 16.3% Calculate the cost of equity estimate using CAPM. R (Rc) = .09 + (1.6 * .013) = .1108 = 11.1% On the basis of your answers to #1 & #2, what is your final estimate for the firm's cost of equity? The two approaches have produced what can be considered a range for the actual cost of equity. A more accurate estimate would be the mean of the two numbers which is 13.7%. 3. Calculate the firm's estimate for corporate cost of capital. CCC = (.5 * .137) * (1-.4) + (.5 * .163) CCC = .0411 + .0815 CCC = .1226 = 12.26% 4. Describe the four (4) steps of capital budgeting analysis. 1) Cash flow estimation phase -- the capital outlay, operating cash flows, and terminal cash flows must be estimated; basically a summary of all the capital that will be required and when it will be spent. 2) Project riskiness -- the risks involved the project must be weighed based on the probability of success. 3) The project cost of capital is assessed -- the firm's average risk is generally used to provide a premium over the risk free rate. 4) Financial attractiveness -- financial information can be plugged into different models such as the breakeven analysis or net present value to determine what the project might look like to an investor. 5. Describe how is project risk is incorporated into a capital budgeting analysis. There three different types of risks that is dependent on one's perspective. The first risk measure is the stand alone risk that is estimated as if that were your only investment. This would represent the risk of the specific project. The next perspective of risk would be the corporate risk. This type of risk includes the corporations or organization's portfolio of various project and holding risks all combined into one number. The next risk takes and even broader perspective and is known as the market risk. This perspective is used when someone has a well-diversified portfolio generally with aspirations of a beta roughly equal to one. https://www.paperdue.com/customer/paper/medical-associates-is-a-large-for-profit-84534#:~:text=Logout-,MedicalAssociatesisalargeforprofitgroup,-Length2pages Read the full article

0 notes

Text

Financial Modeling in the Age of AI: Skills Every Investment Banker Needs in 2025

In 2025, the landscape of financial modeling is undergoing a profound transformation. What was once a painstaking, spreadsheet-heavy process is now being reshaped by Artificial Intelligence (AI) and machine learning tools that automate calculations, generate predictive insights, and even draft investment memos.

But here's the truth: AI isn't replacing investment bankers—it's reshaping what they do.

To stay ahead in this rapidly evolving environment, professionals must go beyond traditional Excel skills and learn how to collaborate with AI. Whether you're a finance student, an aspiring analyst, or a working professional looking to upskill, mastering AI-augmented financial modeling is essential. And one of the best ways to do that is by enrolling in a hands-on, industry-relevant investment banking course in Chennai.

What is Financial Modeling, and Why Does It Matter?

Financial modeling is the art and science of creating representations of a company's financial performance. These models are crucial for:

Valuing companies (e.g., through DCF or comparable company analysis)

Making investment decisions

Forecasting growth and profitability

Evaluating mergers, acquisitions, or IPOs

Traditionally built in Excel, models used to take hours—or days—to build and test. Today, AI-powered assistants can build basic frameworks in minutes.

How AI Is Revolutionizing Financial Modeling

The impact of AI on financial modeling is nothing short of revolutionary:

1. Automated Data Gathering and Cleaning

AI tools can automatically extract financial data from balance sheets, income statements, or even PDFs—eliminating hours of manual entry.

2. AI-Powered Forecasting

Machine learning algorithms can analyze historical trends and provide data-driven forecasts far more quickly and accurately than static models.

3. Instant Model Generation

AI assistants like ChatGPT with code interpreters, or Excel’s new Copilot feature, can now generate model templates (e.g., LBO, DCF) instantly, letting analysts focus on insights rather than formulas.

4. Scenario Analysis and Sensitivity Testing

With AI, you can generate multiple scenarios—best case, worst case, expected case—in seconds. These tools can even flag risks and assumptions automatically.

However, the human role isn't disappearing. Investment bankers are still needed to define model logic, interpret results, evaluate market sentiment, and craft the narrative behind the numbers.

What AI Can’t Do (Yet): The Human Advantage

Despite all the hype, AI still lacks:

Business intuition

Ethical judgment

Client understanding

Strategic communication skills

This means future investment bankers need a hybrid skill set—equally comfortable with financial principles and modern tools.

Essential Financial Modeling Skills for 2025 and Beyond

Here are the most in-demand skills every investment banker needs today:

1. Excel + AI Tool Proficiency

Excel isn’t going anywhere, but it’s getting smarter. Learn to use AI-enhanced functions, dynamic arrays, macros, and Copilot features for rapid modeling.

2. Python and SQL

Python libraries like Pandas, NumPy, and Scikit-learn are used for custom forecasting and data analysis. SQL is crucial for pulling financial data from large databases.

3. Data Visualization

Tools like Power BI, Tableau, and Excel dashboards help communicate results effectively.

4. Valuation Techniques

DCF, LBO, M&A models, and comparable company analysis remain core to investment banking.

5. AI Integration and Prompt Engineering

Knowing how to interact with AI (e.g., writing effective prompts for ChatGPT to generate model logic) is a power skill in 2025.

Why Enroll in an Investment Banking Course in Chennai?

As AI transforms finance, the demand for skilled professionals who can use technology without losing touch with core finance principles is soaring.

If you're based in South India, enrolling in an investment banking course in Chennai can set you on the path to success. Here's why:

✅ Hands-on Training

Courses now include live financial modeling projects, AI-assisted model-building, and exposure to industry-standard tools.

✅ Expert Mentors

Learn from professionals who’ve worked in top global banks, PE firms, and consultancies.

✅ Placement Support

With Chennai growing as a finance and tech hub, top employers are hiring from local programs offering real-world skills.

✅ Industry Relevance

The best courses in Chennai combine finance, analytics, and AI—helping you become job-ready in the modern investment banking world.

Whether you're a student, working professional, or career switcher, investing in the right course today can prepare you for the next decade of finance.

Case Study: Using AI in a DCF Model

Imagine you're evaluating a tech startup for acquisition. Traditionally, you’d:

Download financials

Project revenue growth

Build a 5-year forecast

Calculate terminal value

Discount cash flows

With AI tools:

Financials are extracted via OCR and organized automatically.

Forecast assumptions are suggested based on industry data.

Scenario-based DCF models are generated in minutes.

You spend your time refining assumptions and crafting the investment story.

This is what the future of financial modeling looks like—and why upskilling is critical.

Final Thoughts: Evolve or Be Left Behind

AI isn’t the end of financial modeling—it’s the beginning of a new era. In this future, the best investment bankers are not just Excel wizards—they’re strategic thinkers, storytellers, and tech-powered analysts.

By embracing this change and mastering modern modeling skills, you can future-proof your finance career.

And if you're serious about making that leap, enrolling in an investment banking course in Chennai can provide the training, exposure, and credibility to help you rise in the AI age.

0 notes

Text

How to Find Stocks That Are Undervalued?

Investing in undervalued stocks can be one of the best strategies to maximize returns. These stocks trade at prices lower than their intrinsic value, offering investors a great opportunity to buy low and potentially sell high. But how do you identify such stocks? Let’s explore how to find undervalued stocks in India and build a profitable investment portfolio.

What Are Undervalued Stocks?

An undervalued stock is one whose market price is lower than its intrinsic value. This usually happens due to temporary market inefficiencies, economic downturns, or investor panic. However, if the company's fundamentals remain strong, these stocks can offer high growth potential over time.

How to Find Stocks That Are Undervalued?

Here are the key methods to identify undervalued stocks in India:

1. Look at the Price-to-Earnings (P/E) Ratio

A low P/E ratio compared to industry peers may indicate an undervalued stock.

Example: If a stock has a P/E ratio of 10, while the industry average is 20, it might be undervalued.

2. Analyze the Price-to-Book (P/B) Ratio

A P/B ratio below 1 suggests the stock is trading below its book value, meaning it could be undervalued.

Example: If a company's assets per share are worth ₹500, but the stock is trading at ₹400, it may be undervalued.

3. Study the Debt-to-Equity Ratio

Low debt and high equity indicate financial strength.

High-debt companies are risky, while undervalued stocks should ideally have strong balance sheets.

4. Look for Strong Earnings Growth

Companies with consistent earnings growth but low stock prices could be undervalued.

Compare past earnings reports to see steady improvements in revenue and net profits.

5. Compare Dividend Yields

A higher-than-average dividend yield may indicate an undervalued stock.

Example: If the industry’s average dividend yield is 2%, but a stock offers 5%, it might be a hidden gem.

6. Use the Discounted Cash Flow (DCF) Method

The DCF model estimates a company’s future cash flows and discounts them to present value.

If the current stock price is lower than the calculated intrinsic value, it's likely undervalued.

List of Undervalued Stocks in India (2024)

Here are some potential undervalued stocks based on key valuation metrics:

Stock Name

P/E Ratio

P/B Ratio

Dividend Yield

Stock A

8.5

0.9

4.2%

Stock B

10.2

1.1

3.8%

Stock C

7.9

0.8

5.0%

Stock D

9.1

1.2

3.5%

(Note: This is for informational purposes. Do your own research before investing.)

How to Look for Undervalued Stocks Efficiently?

If you’re wondering how to find out undervalued stocks without manually analyzing each company, consider these tools:

✅ Stock Screeners

Use platforms like Screener.in, Moneycontrol, or NSE/BSE stock filters to shortlist undervalued stocks based on P/E, P/B, and debt ratios.

✅ News & Market Trends

Follow financial news and quarterly earnings reports to spot stocks undervalued due to temporary market conditions.

✅ Industry Comparisons

Compare a stock’s metrics with sector averages to check for market mispricing.

✅ Technical & Fundamental Analysis

Use technical indicators (e.g., RSI, MACD) alongside fundamental analysis for a well-rounded decision.

Conclusion: Should You Invest in Undervalued Stocks?

Investing in undervalued stocks can be highly profitable, but it requires thorough research and patience. Using financial ratios, earnings growth, and valuation metrics, you can find stocks that are undervalued and make informed investment decisions.

If you want to start investing smartly, check out our detailed guide on undervalued stocks and take your stock market journey to the next level! 🚀📈

0 notes

Text

Comprehensive Financial Analysis Tools for Microsoft Corporation (MSFT) Advanced Data Market Insights and Predictive Analytics

Microsoft Corporation (MSFT) is one of the world's largest technological firms, known for its software, cloud computing, and artificial intelligence products. Investors, analysts, and financial professionals need reliable tools to assess Microsoft's financial health, performance, and market trends. GPT Analyst offers advanced financial analysis tools that use AI and machine learning to produce precise results. This article examines the most effective financial analysis techniques for evaluating Microsoft Corporation.

1. Fundamental Analysis Tools

GPT Analyst provides Financial Analysis Tools for Microsoft Corporation (MSFT), offering in-depth data, trend analysis, and predictive insights. Our tools help investors, analysts, and businesses make informed decisions with real-time financial metrics, valuations, and market performance tracking.

Fundamental analysis determines Microsoft's intrinsic worth by examining financial statements, revenue growth, profit margins, and market position. GPT Analyst provides tools like:

Income Statement Analysis: Monitors Microsoft's income, cost of goods sold (COGS), operational expenses, and net profit to determine its overall financial health.

Balance Sheet Examination: Microsoft's liquidity and financial stability are assessed by reviewing its assets, liabilities, and shareholder equity.

Cash Flow Analysis: Analyzes operating, investing, and financing cash flows to determine how well Microsoft manages its financial resources.

Earnings Per Share (EPS) Forecasting: Uses historical data and machine learning methods to forecast Microsoft's future revenues.

2. Technical Analysis Tools

Technical analysis concentrates on price changes, stock patterns, and trading volumes. GPT Analyst offers cutting-edge tools, such as

Stock Price Trends & Patterns: Detects trends using moving averages (e.g., 50- and 200-day moving averages) and candlestick patterns.

Relative Strength Index (RSI): Measures the momentum of Microsoft's stock price to determine if it is overbought or oversold.

Bollinger Bands: Helps to predict market volatility and probable price breakouts.

Fibonacci Retracement: Forecasts support and resistance levels based on past price movements.

3. Valuation Models

Investors use valuation algorithms to analyze if Microsoft stock is overvalued or undervalued. The GPT Analyst provides:

Discounted Cash Flow (DCF) Model: Estimates Microsoft's future cash flows and discounts them to current value.

Price-to-Earnings (P/E) Ratio Analysis: Determines Microsoft's relative valuation by comparing its P/E ratio to that of its industry peers.

Price-to-Book (P/B) Ratio: Compares the company's stock price to its book value.

Enterprise Value (EV) Metrics: Assesses Microsoft's whole value, including debt and equity.

4. Risk Assessment & Market Sentiment Tools

Understanding market risks and sentiment is critical in making financial decisions. GPT Analyst offers:

Beta Analysis: Calculates Microsoft's stock volatility in proportion to the whole market.

News Sentiment Analysis: Uses artificial intelligence to detect positive or negative emotion in news stories, earnings calls, and analyst reports.

Market Correlation Tools: Examines how Microsoft's stock compares to broader indices such as the S&P 500 and Nasdaq.

Financial Stress Testing: Predicts how Microsoft will perform in various economic scenarios.

Conclusion

Microsoft Corporation (MSFT) evaluation needs a combination of basic, technical, and risk analysis methods. GPT Analyst provides a comprehensive set of AI-powered financial research tools to assist investors make informed decisions. These tools, whether used to examine financial statements, stock movements, or market dangers, provide significant insights into Microsoft's financial performance and investment opportunities.

1 note

·

View note

Text

Cracking the Code: How to Determine the Accurate Value of Your Business

As a business owner, knowing the accurate value of your company is crucial for making informed decisions about its future. Whether you're looking to sell, merge, or attract investors, a precise valuation is essential. However, determining the value of a business can be a complex and daunting task.

In this article, we'll crack the code on business valuation, exploring the key methods, factors, and best practices to help you determine the accurate value of your business.

Why Accurate Valuation Matters

Accurate business valuation is critical for various reasons:

Mergers and Acquisitions: A precise valuation helps you negotiate a fair price for your business.

Investment and Funding: Accurate valuation attracts investors and helps you secure the right funding.

Strategic Decision-Making: Knowing your business's value informs decisions about expansion, restructuring, or divestment.

Tax Planning: Accurate valuation helps minimize tax liabilities and maximize benefits.

Key Valuation Methods

There are several business valuation methods, each with its strengths and weaknesses. The most common methods include:

Discounted Cash Flow (DCF) Analysis: Estimates future cash flows and discounts them to their present value.

Comparable Company Analysis (CCA): Compares your business to similar companies in the industry.

Precedent Transaction Analysis (PTA): Analyzes recent transactions involving similar businesses.

Asset-Based Valuation: Calculates the value of your business's assets, such as property, equipment, and inventory.

Factors Affecting Business Valuation

Several factors influence business valuation, including:

Financial Performance: Revenue growth, profitability, and cash flow.

Industry and Market Trends: Competitive landscape, market size, and growth prospects.

Management Team and Operations: Leadership, organizational structure, and operational efficiency.

Intangible Assets: Patents, trademarks, copyrights, and brand reputation.

Regulatory Environment: Compliance with laws, regulations, and industry standards.

Best Practices for Accurate Valuation

To ensure accurate business valuation, follow these best practices:

Seek Professional Advice: Engage a qualified business appraiser or valuation expert.

Gather Comprehensive Data: Collect financial statements, industry reports, and market research.

Use Multiple Valuation Methods: Apply a combination of methods to ensure a robust valuation.

Consider Both Tangible and Intangible Assets: Account for all assets, including intellectual property and brand value.

Stay Up-to-Date with Industry Trends: Monitor market developments and adjust your valuation accordingly.

Conclusion

Determining the accurate value of your business is a complex process that requires careful consideration of various factors and methods. By understanding the key valuation methods, factors, and best practices outlined in this article, you'll be better equipped to crack the code on business valuation and make informed decisions about your company's future. Remember to seek professional advice, gather comprehensive data, and use multiple valuation methods to ensure a robust and accurate valuation.

0 notes

Text

Valuation Methods for Businesses: A Comprehensive Guide

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/12-Valuation-Methods-for-Businesses_-A-Comprehensive-Guide-iamge-by-Chalirmpoj-Pimpisarn-from-Getty-Images.jpg

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: Chalirmpoj-Pimpisarn-from-Getty-Images

Valuing a business is an essential aspect of financial strategy, whether you’re considering selling, seeking investment, or simply understanding the worth of your organization. Different methods apply depending on the nature of the business, the industry it operates in, and the intended outcome of the valuation. In this article, we’ll explore the key valuation methods for businesses and provide insights into how to choose the right one for your needs.

Why Business Valuation Matters

Business valuation is crucial for several reasons. For owners, it offers a clear picture of the company’s financial health. Investors and potential buyers rely on accurate valuations to make informed decisions. It’s also important in situations like mergers, acquisitions, or when dealing with financial disputes. Knowing which valuation methods for businesses apply can make the difference between a successful deal and a missed opportunity.

Common Valuation Methods for Businesses

Let’s dive into some of the most widely used methods:

1. Market Capitalization

Market capitalization is one of the simplest valuation methods for businesses, typically used for publicly traded companies. It is calculated by multiplying the current share price by the total number of outstanding shares. While this method provides a quick snapshot of a company’s value, it may not fully reflect the actual worth, especially if the company is privately held or has fluctuating stock prices.

2. Comparable Company Analysis (CCA)

This method compares a business to similar companies in the same industry. By analyzing the market values of these peer companies, you can estimate your company’s worth. This approach is particularly effective when there are multiple competitors with available financial data. While Business Viewpoint Magazine, one of the best magazines in India, often discusses industry-specific trends, CCA remains relevant across all sectors.

3. Discounted Cash Flow (DCF) Analysis

The DCF method is considered one of the most detailed and precise valuation methods for businesses. It projects future cash flows and discounts them to present value using a discount rate. This approach is particularly useful for companies with predictable cash flow streams. By evaluating long-term revenue generation, DCF provides a comprehensive understanding of what a business is worth today based on its future potential.

4. Asset-Based Valuation

In asset-based valuation, the value of a business is determined by its net assets. There are two common approaches within this method: the going concern method and the liquidation method. The going concern method assumes the business will continue operating, valuing its assets at market value. In contrast, the liquidation method assumes the business will close, and assets are valued based on their likely sale price in liquidation. This method can be useful for asset-heavy companies or those facing financial difficulties.

5. Earnings Multiplier

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/12.2-Earnings-Multiplier-Image-by-ijeab-stock-from-iJeab.jpg

The earnings multiplier method is closely related to the price-to-earnings (P/E) ratio used in stock markets. It adjusts the P/E ratio to account for differences in earnings growth, risk, and other factors. By multiplying a company’s earnings by the adjusted P/E ratio, you can estimate the business’s value. This method is often discussed in leading publications like Business Viewpoint Magazine, which emphasizes how earnings potential can influence a company’s perceived market worth.

Choosing the Right Valuation Method

Each business has unique characteristics that may make one method more suitable than another. When deciding which valuation methods for businesses to use, consider the following factors:

Industry: Some industries may favor specific valuation methods. For example, asset-heavy industries like manufacturing might prefer asset-based valuations, while tech companies with high growth potential might favor DCF analysis.

Size and Scale: Smaller companies may benefit from simpler methods like market capitalization or asset-based approaches, while larger corporations may require more complex valuations like DCF.

Financial Health: A business with a steady cash flow may opt for earnings-based methods, while a struggling company might lean toward liquidation valuation.

Market Conditions: The current economic environment can heavily influence which method yields the most accurate results. During periods of volatility, methods that focus on long-term potential, such as DCF, might be more appropriate.

The Role of External Resources

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/12.3-The-Role-of-External-Resourcesv-Image-by-Worawee-Meepians-Images.jpg

Understanding business valuation often requires external expertise. Financial analysts, investment bankers, and valuation consultants can help navigate the complexities of these methods. Publications like Business Viewpoint Magazine often provide in-depth case studies and expert opinions, making it easier to grasp how these methods are applied in real-world scenarios.

Limitations of Valuation Methods

No single valuation method provides a complete picture. Each has its strengths and weaknesses. For instance, market capitalization might be too simplistic for large, diversified companies, while asset-based valuation may overlook the future earnings potential of a high-growth business. The key is to use multiple methods when possible and cross-check results to arrive at a more accurate figure.

Additionally, external factors such as market conditions, investor sentiment, and industry trends can heavily impact the outcome of a valuation. Keeping abreast of these trends by following respected sources like Business Viewpoint Magazine is crucial for making informed decisions.

Conclusion

Understanding the various valuation methods for businesses is critical for any entrepreneur, investor, or financial professional. From market capitalization and DCF to asset-based and earnings multiplier methods, each provides a different perspective on what a business is worth. The key is to choose the method that best aligns with the business’s unique characteristics, industry, and financial health.

By staying informed and utilizing expert resources, you can ensure a well-rounded approach to business valuation, leading to better decisions and more successful outcomes.

#valuation#property#value#finance#business#businessvaluation#stocks#consultoria#consultoriafinanceira#estateagents#startup

0 notes

Text

Beyond the CFA Curriculum: How Excel, Python & Power BI Shape Real Finance Careers

The journey to becoming a Chartered Financial Analyst (CFA) is one of discipline, dedication, and deep academic effort. Anyone who has dived into Level I, II, or III knows the rigor involved—from valuation methods to ethical standards, the CFA curriculum leaves no stone unturned. But as finance keeps evolving, something becomes increasingly clear: mastering what's in the CFA books is only half the battle.

Today’s finance world doesn’t operate in spreadsheets alone. It's powered by data, driven by automation, and shaped by decisions that must be made in real time. That's why technical tools like Excel, Python, and Power BI are no longer "nice-to-have" skills; they’re must-haves.

The Real-World Gap Between Theory and Tools

Let’s be honest—passing CFA exams makes you well-versed in the “what” and “why” of finance. You can interpret financial statements, dissect a discounted cash flow model, or calculate portfolio risk. But when it comes to building that DCF model for a real-world client or analyzing thousands of rows of historical stock data? That’s where the tools come in.

That gap between academic theory and practical application is where many CFA candidates get stuck. The good news is, learning tools like Excel, Python, and Power BI can bridge that gap beautifully.

Excel: The Unsung Hero in Financial Modeling

If you've spent any time in finance, you already know this: Excel is still king. But there's a difference between using Excel and knowing how to use it well. Anyone can punch numbers into cells. What sets professionals apart is the ability to build dynamic financial models, use nested functions, create data-driven dashboards, and run powerful simulations.

In fact, many CFA candidates find that pairing their knowledge of financial concepts with advanced Excel skills helps them apply what they’ve learned in real-life scenarios—faster and more accurately. And employers recognize this. The ability to use Excel isn’t just assumed anymore; it’s expected at an advanced level.

Python: The Modern Analyst’s Secret Weapon

Python may sound intimidating if you’ve never coded before. But don’t worry—it’s not about becoming a developer. It’s about automating repetitive tasks, working with large datasets, and running analysis that would take hours (or days!) in Excel.

With Python, you can scrape financial data from websites, backtest investment strategies, and run Monte Carlo simulations with just a few lines of code. Plus, Python libraries like Pandas, NumPy, and Matplotlib make it easy to clean data, run statistical tests, and visualize trends in ways Excel just can’t match.

Python is especially valuable for those eyeing roles in asset management, risk analytics, fintech, and research. It brings a data science edge to your CFA knowledge—and that’s a serious edge in today's hiring landscape.

Power BI: Visualizing What Matters Most

Numbers tell a story, but they need a good narrator. That’s where Power BI shines.

Power BI is a business intelligence tool that helps you create interactive dashboards and data visualizations from multiple sources. Unlike Excel charts, which are static and often limited in scope, Power BI allows for live data connections and real-time updates. You can create a dashboard tracking portfolio performance, visualize client exposure across industries, or build a heat map showing global asset allocations—all with just a few clicks.

For CFA candidates and charterholders who want to transition into client-facing roles, strategic planning, or leadership, Power BI adds a whole new layer to your skill set. It’s not just about crunching the numbers—it's about showing what they mean in a way anyone can understand.

Why This Matters More Than Ever

Let’s not forget the world we’re living in. Finance is moving faster than ever, driven by automation, machine learning, and cloud-based systems. Even small firms are now investing in tech-savvy analysts who can do more than just build models—they want professionals who can interact with data, pull insights, and make decisions in real time.

This trend is visible across markets, especially in fast-growing urban centers. For instance, there's been a notable rise in demand for professionals blending finance and tech in emerging hubs. One can see this reflected in the rising interest among young professionals in the CFA course Chennai, where candidates are looking beyond textbooks and toward hands-on technical fluency. The need to be future-ready is driving this evolution.

Learning These Tools Is More Accessible Than You Think

The beauty of Excel, Python, and Power BI is that you don’t need to master them overnight. Start small. Try using Excel to build a three-statement financial model from scratch. Learn a few Python commands to clean a CSV file of stock data. Use Power BI to visualize your CFA study plan progress. You’ll be surprised how quickly you can go from beginner to proficient with consistent practice.

There are countless free and paid resources available—YouTube tutorials, online coding platforms, and interactive dashboards—all designed to make learning feel less like a chore and more like an investment in your future.

A Skill Set That Future-Proofs Your Career

The financial job market is competitive, no doubt. But the ones who stand out aren’t necessarily those with the most credentials—they’re the ones who can connect the dots between finance and functionality.

When you pair the depth of knowledge from the CFA program with hands-on technical skills, you don’t just become a better analyst—you become a problem solver, a decision-maker, and in many cases, a leader. You become the kind of professional companies actively seek out.

What’s more, these tools make your job easier. Instead of spending hours manually calculating, you’re automating. Instead of sending spreadsheets, you’re presenting visual dashboards. Instead of reacting to data, you’re anticipating it.

And that changes everything.

Conclusion: Finance Has Evolved, and So Should You

Let’s face it—finance is no longer just about balance sheets and income statements. It's about combining the analytical mind of a CFA with the technical savvy of a data professional.

Learning Excel, Python, and Power BI isn't about adding buzzwords to your résumé. It’s about making your CFA knowledge truly actionable. It’s about being ready for the roles of tomorrow, today.

That’s why so many forward-looking professionals are exploring blended learning paths. For example, the CFA Training Program in Chennai has seen growing participation from candidates who recognize that financial expertise alone won’t cut it in a digitally transforming world.

So if you’re serious about excelling in finance, don’t just stop at the books. Learn the tools that bring those concepts to life—and you’ll go far beyond what’s printed on the exam page.

0 notes