Text

Fear

Do you ever wake up with just a weird feeling of unease?

I think most days it’s there, I just get over it fast, because I have to get to work and get things done. Every time I walk out the door to get on my bike or on the bus to go to work or go home, I’m scared, just a little bit. Maybe that’s not the right word, maybe it’s a little bit of dread - dread of watching out for idiots blowing through stop signs, making sure no one flings open a car door while I pedal past them, dreading the invariable appearance of the Bus Man - a drunk guy who sits next to you and harasses you, the guy who gives the whole bus a 15 minute monologue while asking everyone for bus fare money. And then I worry - another form of fear. Worrying about my husband, in another country and out of work, trying to keep busy and optimistic in a shitty economy. Worrying about our future, a little worry now and then about the rest of my family, and - this is too terrifying to even contemplate so I push it way, way down - worrying about what the hell I would do if I lost my job. I suppose it would be unemployment, trying to freelance, applying for jobs, but ultimately probably needing to move.

I get on my bike, I go for a run, I do some yoga, I walk, I weave, I do what I can to keep my body and mind focused on something else. I try to just be on the bike or on the mat and not somewhere far away. Today I took my bike back out for a ride on the trail that goes through town and up north. One of these days I’ll make it to the state park it passes through, but today I just rode to a couple of shopping centers next to the trail. I finally dropped off some of the plastic bags that have been taking up space in my pantry that I can’t put in my regular recycling. I remembered how much I hate suburbs. I went into a Goodwill, a supermarket, a Walmart (to buy a new bike light), and then bought a cute little dress for $8 at Plato’s Closet. For all the nights out I don’t have. All of these places were located at the same intersection, across the street from each other, yet it took me 30 minutes of walking between them. There was no safe place to lock up my bike, so I had to tote it with me. When I left Walmart, they scanned my receipt and the barcodes of my items because I declined a plastic bag. Suburbs are hostile for humans. There’s only space for cars.

I had planned to ride my bike today, but this morning I woke up with that feeling of unease. I wanted to just stay in bed or on the couch and not take care of my bathroom that needs some rage cleaning, not vacuum, not go out on the bike and face whatever fear is attached to that. Last weekend, my 2.5 hour ride chased the fear away. I felt energized all weekend. Today, I came home with the same unease.

For the last couple of years I was struggling with post-traumatic stress, and earlier on I had depression and anxiety that could be really debilitating. Luckily, these things don’t rear their ugly heads too often these days. But when it does strike, sometimes I’m not sure how to shake it off.

0 notes

Text

May Budget: How I Did

This was my first month making a budget and tracking my expenses in multiple ways (in a notebook I carry around, in a Google Sheets doc, and in Mint). And thanks to reading The Financial Diet and following the #debtfreecommunity hashtag on Instagram, I’ve had enough momentum and interest to *mostly* stick to the plan.

As you can see, I did much better than previous months, but not as well as I planned or wanted to.

- House expenses, bills, and health were pretty predictable (although for health I spent an extra $36 to buy probiotic supplements for four months)

- For transportation, I put $10 more on my bus card than I had planned. And I had to get a Zipcar to go to a dental appointment.

- Debt - I paid a little more than I needed to, which is okay

- I stayed within my travel budget, but spent more than I hoped to - I kept having to reload my phone with international credit when I was traveling and trying to check to make sure my train was on time. And I kind of used my travel budget as an excuse to do things like buy new pajamas, a few things for the house and things for my bike while I was in Germany.

- Shopping - I didn’t want to buy anything, but I ended up buying a silicone sonic face brush for $40. I’d been having a dilemma since I wasn’t able to find the cheaper generic replacement brushes for my Clarisonic brush (and my skin does much better when I use it), so this silicone one was a good choice that is more hygienic and won’t require me to continually buy replacement parts for it. The other $13 was for my Amazon Prime subscription.

- I’m trying out different options for grocery shopping to see what’s the most efficient and cost-effective. I don’t have a car and there are only two grocery stores in walking distance to my house, so I’m experimenting ordering from Aldi once a month (although I’m not pleased about the amount of plastic bags it came with). But I’ve only eaten lunch out once and that was a $3 crunchwrap from Taco Bell and had one latte early in the month. I think I bought a little too much food again, but I���m really trying to eat everything I have at home and minimize food waste.

- I spent a little more than I intended on my cousin’s graduation gift

- My misc. expenses include $4 for website hosting, $30 for a jobs website subscription to search for side hustles, Google Storage, $18 for charity, and $40 from the ATM to use at the laundromat for the next few weeks.

- Okay, I didn’t stick to my no alcohol thing. I had a few beers with friends in Germany. And I bought a six pack last weekend.

Accomplishments this Month

- My credit score jumped over 50 points! It’s now 813, the first time it’s ever been that high.

- I opened an Ally online savings account with a 2.2% annual percentage yield.

- I applied to and reached out to my network for side hustle gigs to earn a little extra money.

- I got a new Amex card that gives cash back on groceries and such and am trying to use that as smartly as possible.

- Had a very open conversation with my husband about money in which we were both excited to geek out over spreadsheets.

Things to Work on in June

- Keep working on reducing food spending, focus on eating everything in the fridge before shopping again.

- Try to earn at least a few hundred dollars doing side work.

- Put money aside for 4th of July camping trip

- Try to ride my bike everyday and minimize bus costs.

- Gas bill will be low, but try to keep electric bill low as well.

- Do better with logging my expenses as soon as I spend money.

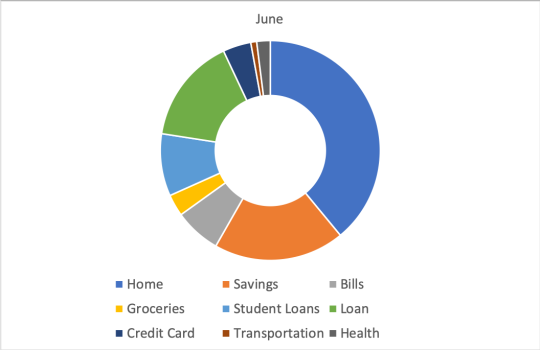

June Expenses

- I won’t have to spend on gifts, but will spend $120 to pay for my phone subscription for the next 6 months (hey, at least I’m not spending $80 a month for a cell phone like most people I know).

- I have to buy a new tail light for my bike (mine fell off while I was riding home).

- Look into buying liability insurance policy for non-car owners for when I rent a car.

1 note

·

View note

Text

Halfway through May: Update

I’ve officially been hyper-conscious about budgeting for a good two weeks and so far I haven’t lost motivation – that in itself is big for me. May is a little weird because I’m in Germany for two weeks, which is already an unusual expense; before I traveled, I put about $600 in a separate account (with a card that charges no international transaction or ATM fees), with the goal of only spending within that. Even though I have a little kitchenette in my AirBnb and am trying to do most of my meals at home with things from the supermarket, I’m still buying more pre-prepared foods than usual, and still kind of have to eat out for lunch everyday (there’s no microwave/refrigerator where my classes are held). So I’m just lumping anything I spend while on this trip under travel, even though yes, some of it is food, some has been transportation, even a little bit of shopping.

Anyway, a number of positive things and decisions have come out of this already:

I checked CreditKarma and discovered my credit score has gone up 16 points in the last few months, from 741 to 757. Yay!

I now have a pretty budget set up for the next several months in Google Sheets, and a notebook to log things on the go (writing it down makes me think even more about the purchase).

I’ve finally figured out how to set up bill pay through my bank account, after months of frustration that the utility companies’ online payments just don’t work, and resorting to sending paper checks in the mail.

I know a lot of financial guru people advise people to cut up their credit cards while they’re paying down debt – which makes sense if you’re already carrying a balance month to month and the interest is piling up and your credit is already tanked. But since I consolidated all of mine to a lower-interest loan, I’m going to still use my credit card to pay for things I’ll have to pay for each month no matter what – rent, groceries, certain bills – because I might as well get points/miles for that and keep building my credit history. If I pay my rent with my credit card, then immediately pay off the credit card, I should be fine.

When I get back to the States I’m going to apply for a credit card that gives more points for grocery stores (still one with no annual fee), and close out an older credit card that doesn’t offer much in rewards.

Each payday, I’m going to transfer the amount left over from the previous month into a high interest checking account and keep building that. I’ll have to train myself to leave the card at home and not touch it, but it’s immediately accessible for emergencies.

By October, I should have about $4,000 in an emergency fund, assuming I have no extra income and don’t stray from my budget too much. By the end of the year, that can be $6,000.

After that, I start throwing every dime I have left at debt.

I need to figure out if it’s possible to get out of my cable/internet contract early (very early) to switch to a less expensive internet provider. But another big area I need to cut back on is food/grocery shopping. I’ve been going back and forth on a few different options. First, I discovered Aldi delivers to my house – the delivery fees add up to about $8.00. I added up all the same items from Stop & Shop’s online delivery service, and all told, Aldi was about $20 cheaper. Now, if I just went myself to Stop & Shop, I wouldn’t pay the $10 delivery fee, but that’s also about 40 minutes of walking, plus I have to carry/roll whatever I buy home with me, and I think I’m more tempted to buy non-essential things if I’m just browsing the store.

So this is what I’m trying for now. We’ll see how the rest of this month goes.

0 notes

Text

Facing the Numbers

April 2019

For the first time since I was 22, I find myself living on a pretty tight budget. For a few years, I had a fairly high-paying job that allowed me to save close to $20,000 – and then leave that job (which was a dead end and not teaching me any new skills) to move to Jordan to be with my husband, freelance, learn some new skills (video) and establish myself a little bit better. My income there was never stable – and I never made more than about $30,000 a year there – but somehow I never had to be that careful with expenses – we lived in a family-owned apartment and paid little rent, Layth frankly covered a lot of our bills, and with my income, I managed to pay for my master’s degree tuition, travel home once a year, buy camera equipment when needed for work, and save up for eventually moving back to the US.

In the end, my savings helped tide me over the 4 months I was looking for work in the US and pay to get set up in an apartment once I had a job. But unsurprisingly, I underestimated how much moving was really going to cost: furnishing an apartment from scratch (I had zero furniture, no dishes, no clothes hangers, nothing), paying for Zipcars to go shopping for things, stocking a pantry with all the basics, and so on – it all added up. Plus there were some other big expenses like paying my tax bill and the fees to start the process for Layth to move to the US.

My income is lower here than what I was hoping for, and the last few months I’ve been really living paycheck to paycheck, feeling more broke than I have in the last seven years. Which is pretty frustrating, feeling like I’m now so many years away from being able to do things you should be doing at this point in life: buying a house, finally paying off student debt, thinking about having a kid. On the other hand, I know people 30 years older than me in far worse shape financially, and people who’ve gone through foreclosure and multiple layoffs and they’re still somehow doing the house and kid thing, so maybe it’ll be alright.

The last few weeks I’ve started trying to think outside the box a little bit and also really take stock of where the money is even going. A couple freelance editing projects a month would help tremendously (oh, what I would give to charge $10,000 to edit a 300 page report on child marriage again for UNICEF). Because when I add up what I think I should be spending each month, I’m fine on paper. The first thing I did was get a loan and consolidate my debt – which let me massively reduce what I was paying monthly (I was making more than the minimum payments, but barely making any progress on it) with a much lower interest rate. It’s also helped me to change my mindset about it a little – instead of it being credit card debt that makes me feel awful about myself, it’s my Moving to America Loan. And I guess it’s the price I’m paying for settling for poverty wages in a developing country for a few years. Oh well.

Then I went back through my credit card statements – I had memorized the card number, set it up with Apple Pay, etc. and it was my default payment for a lot of subscriptions – and went through and canceled a whole bunch of shit: a Kindle subscription I wasn’t using, Netflix, Lynda.com (I get that for free through work now), Adobe software, Microsoft Office (again all through work now), and more things that I had and was justifying as business expenses – which came to about $1500 annually. Not a huge amount, but a chunk of change that will go towards paying down debt.

Then today I finally reconnected Mint to my accounts and wanted to cry and looked at my transactions for April. I spent at least $1000 more than I thought I did, I somehow spent over $500 on food (what the fuck?!), but also had a few one-time large purchases, like a portable AC unit and fan for summer, plus I paid to ship my bike from my mom’s house and had to buy some supplies for it (but this means I now hopefully get to commute by bike most days from now until November or so, and pay less for the bus). In May, I’ll be traveling for two weeks (which means I’m paying for an AirBnB and will have to eat a lot of pre-prepared foods/at restaurants), I have to send a graduation gift to someone, etc.

Next month my gas bill should finally be a lot less, and hopefully running the AC a few hours a day won’t run up the electric bill too much. I’ve reduced my already cheap phone bill (Mint Mobile) so I’ll pay $120 when it renews in June instead of $160 ($80 savings a year). And my next obstacle is to see if I can ditch the cable company – I foolishly signed up with them when I moved in, and I’m not sure how hard it’s going to be to get out of the contract. But if I can, I’ve found another company where I can get internet (no cable) for $50/month instead of $120 ($840 savings per year!).

But if you enjoy making lists and graphs like I do, I think this can be a little less painful and more like a game. Projecting out these expected reductions, I should be able to have close to $1000 left over each month. Thankfully, I already have a pretty decent retirement account set up at work, and that’s quietly running in the background. Now, on the one hand, it might make sense to throw every dime I have left at that loan, but I’ve been riding so close to the edge these past few months, I really want to just let that accumulate for a few months so that I feel like I have some cushion/ an emergency fund and then I’ll start making bigger payments.

I’m flabbergasted that I spent so much on food this month, and I seriously feel like I’ve thrown half of it away. It’s seriously appalling. When I get back, I’m going to start composting (going halfsies with a friend on a bucket of worms with some dirt). And even with New Haven’s seriously lacking grocery store options (all the shopping is in the suburbs, which requires me to rent a Zipcar for $30 for a few hours; inside the city we have three grocery stores), I think I can eat a healthy diet for $25 a week. My kitchen is well-stocked with the basics, and I’ll get my produce from farmers markets on the weekend for the next several months. And things seem to work best when I just buy a few ingredients with one or two recipes in mind for the week.

I DO NOT NEED ANY MORE CLOTHES THIS ENTIRE YEAR. I DO NOT NEED ANYMORE FACE WASH OR SHOWER GEL THIS ENTIRE YEAR. I do need new mascara and will eventually have to get more day and night cream.

I’m writing this to keep myself accountable. If I obsess over it, it might work. The end.

0 notes

Text

All Settled In + Attempting a No-Spend Month

This year is absolutely blowing by, which feels good, but also a little nerve-wracking at the same time. On the one hand, it feels like I’ve just been going to work everyday – and thankfully, this is without a doubt the only job I’ve ever had that has something resembling work-life balance and where I’m still learning a lot four months in – but I’ve also furnished a two-bedroom apartment from scratch (yes, moving was expensive) with my husband’s help, he came to visit for six weeks, and my mom also came up for a week while he was here. We got to briefly visit New York and Boston together, and I’ve gotten some hiking in. I’ve made a few friends at work who have been nice enough to invite this introvert to run a few 5k races, go on birthday excursions in the Hudson Valley, and bop around the Yale campus on the weekends. I wrote a 50 page paper for grad school (plus another 10 pager last week that felt like nothing), started a Yoga Teacher Training course and have consistently done yoga everyday for over a month now. And this Sunday I head to Germany for two weeks for grad school (only one more trip after this, and this is the start of my thesis project – wow!)

We’ve spent a lot of time making this place cozy, and it’s pretty much the only move where I’ve really gotten to think about what are the important things in life. As far as the things I’ve bought to put in my house, it’s nice – at this point in life – to prioritize quality over quantity. I got a two bedroom apartment even though I could have made do with one bedroom and saved a couple hundred dollars a month, because I wanted it to also feel like home for Layth, for my mom, or any of our friends who might come visit. I have very little clutter in my home and I’m trying to keep it that way, while also ‘decluttering’ other aspects of my life, like spending and time commitments. It would definitely help if I had some freelance work (or a raise) to get me back on track and pay off my “moving-to-America” loan, but honestly, there are already a lot of things about this place that would make it tough to leave in the future – moving is a nightmare, this is the first job I���ve ever had with actual benefits (decidedly not-crappy healthcare and pretty solid savings plan), I live in a city where I actually can rent a two bedroom apartment on my own with a modest income, and I’m close enough to take the bus, bike, or even walk to work. The work is interesting, a good mix of different things to do, I work with nice people, and unlike in news, working at a university is a totally different pace – no one’s head is ever on the chopping block for deadlines.

Last year, I was either working crazy hours or not at all, and in between was pretty much debilitated by migraines or being sick. Health has probably been my top priority (aside from the frozen pizza and cookies I ate yesterday), and I’m much better off in that regard – instead of near-daily migraines, I will now wake up with a mild migraine a few times a month (usually directly related to the amount of wine or cheese I had the day before) which can be knocked out with an Excedrin. And that’s freed up time for me to do other things, like learn how to weave, do more yoga, hell, even have the brain capacity to think outside the box about how to improve my financial situation. Other plans for the rest of this year include finally starting to compost like a responsible human and possibly getting back into playing violin.

Now that winter is over, there are farmer’s markets happening in this park (where my husband was chasing some ducks), and since my bike arrived from my mom’s house last week, I’ve been easing in to cycling to work. Aside from drivers who don’t know what to do at stop signs, it’s been a great way to start the day – my commute is just under two miles, and I almost wish it was a little longer. By the time I get to work, I wish I could just keep riding and being outdoors. In other words, life is full, and I’m thankful for that.

My version of a no-spend month

May hasn’t even started yet and things have already gone a little off track, but I am going to try to meticulously keep track of any spending, and buy nothing from these categories:

clothes or shoes (I don’t need anything, and if I do need clothes this year, I will try to buy secondhand first)

skincare or makeup (I do need mascara, but am sitting on tons of extra toiletries at home because it took a while for my skin to adjust to the humidity here, and I was just trying new products constantly)

alcohol (I don’t drink much, but it does add up)

Zipcar outings (these usually cost at least $30 per trip)

Ubers or Lyft rides

books (I have access to some of the best libraries in the world here)

lunches out while I’m at work

Writing this down to keep myself accountable – we’ll see how things have shaped up a month from now.

0 notes

Text

Hi There

Welcome to Feral + Frugal, the blog where I’ll be documenting the process of dragging myself through paying off debt and rebuilding my savings.

I’ve had multiple blogs through the years, and while I have another one dedicated to life and travel things, I decided I wanted a separate space to write about finances. There are a handful of people I discuss this with openly in real life, but somehow it’s easier on the internet to just share this with a bunch of strangers. And it’s really more for keeping myself accountable and tracking my progress over time.

Why the name? Well, as a recovering globe-trotting photojournalist newly transplanted back in the US after years in the Middle East, and (unwillingly) living apart from my husband as we go through immigration together, I often feel like I’m dragging myself kicking and screaming to any semblance of normal domesticity. So I feel a bit like a feral cat at times who isn’t quite used to having the same people around or predictable meals, and doesn’t quite know how to stay in the same comfortable home for very long. And frugal, because, you know, finances and it’s an alliteration.

What brought me back to the US, to a salaried job at a university with a lease on an apartment? There were a lot of things I loved about living overseas, in the particular city I lived in in the Middle East. I loved that I got to build a good relationship with my in-laws, I loved the smell of rosewater, jasmine, cooked lamb, and even the diesel fumes in downtown. I loved the call to prayer echoing off the hilltops at dusk. When my work was good, it was really good. But the stress of my work was also incredibly high, the money was completely unpredictable, I was sick constantly from the stress and pollution, and thinking hard about the life my husband and I wanted to have five or ten years from now, moving to the US finally just seemed like the best option to reach those goals.

The other day was the seventh anniversary of my college graduation - which doesn’t mean a whole lot. It feels like yesterday, and yet like a lifetime ago. But I do think back to 11 years ago when I was starting college, and 7 years ago when I graduated, and even 2 or 4 years ago when I was working - and wonder if this is where I expected myself to be. And I don’t know. Eleven years ago, I couldn’t imagine that it was even possible for me to make a living in photography, but I knew I loved it. I didn’t really even have a concept of what a newspaper photographer did, much less any of the other jobs I’ve had in this industry. I have student loan debt, but unlike many people my age, I started working in my field before I graduated, and I’ve been fortunate to use my degree every day since then. Five years ago, I knew very little about creating videos and documentaries as opposed to working with still images, and now I make documentaries for a living. And I’m thankful every day, after many years of doing repetitive, mindless editing work, and years of unpredictable freelancing, to have a creative life and a bit of stability. And eight years ago, I never thought I’d get married at 25, and never thought I’d feel so secure in a relationship - I always envisioned myself focusing on work and if I was lucky, finding someone before I was 40. But such is life.

I went to Germany for grad school recently and came home after two weeks feeling incredibly grateful for my apartment. I may not own it or be anywhere near ready to buy property - and pretty soon I’ll be wishing I was someplace with central AC - but I am thankful that I have a safe, beautiful, cozy place to come home to. I’m thankful that I live someplace where I can afford to rent a two-bedroom apartment by myself, as opposed to the shoebox-sized studio I had in DC, with plenty of space for friends and family to come stay, or to turn that second bedroom into a home office, or who knows, a nursery one day if need be.

With all that in mind, I try not to feel too badly about the less-intelligent financial choices I’ve made in the past. I certainly don’t regret my choices in education or work or places I’ve lived, because otherwise, I wouldn’t have met my husband or had a whole host of other incredibly rewarding experiences. Growing up in a pretty poor, single-parent household, I try not to beat myself up about not being more financially literate. There are emotional purchases I shouldn’t have made, but on the whole, I feel like all of this has at least led me to having a home where I enjoy spending time, and experiences traveling that allowed my husband and I to spend quality time together, or that let me be there for my family when they needed me. All I can do is do better moving forward.

0 notes