Don't wanna be here? Send us removal request.

Text

#retail banking software#retail banking system#what is retail banking#retail banking solutions#digital retail banking#international retail banking#retail internet banking

0 notes

Text

#banking software companies#list of banking software companies#banking software#banking and finance software

0 notes

Text

#Digital Banking Engaging Platform#Digital Banking Engagement#Digital Engagement For Banks#Digital Engagement Banking Platform#Digital Customer Engagement Platform For Banks#Digital Engagement In Banking

0 notes

Text

#mobile banking platform providers#mobile banking platform#mobile banking technology providers#mobile banking software#mobile banking solution

0 notes

Text

#Cloud Banking Software#cloud based digital banking#cloud core banking platforms#cloud based core banking#cloud banking solutions

0 notes

Text

Finacle Corporate Banking Suite, developed by EdgeVerve, is a comprehensive software solution designed to transform how corporate banks operate. It caters to the specific needs of corporate banking, encompassing various functionalities to streamline processes and enhance customer experiences.

Here's a breakdown of what Finacle Corporate Banking Suite offers:

Advanced Architecture: Built on a cutting-edge foundation, the suite ensures scalability and agility to adapt to evolving business needs.

Comprehensive Functionality: The suite addresses a wide range of corporate banking requirements, including:

Trade finance

Lending and syndication

Payments and collections

Limits and collateral management

Treasury services

Corporate deposits and liquidity management

Online and mobile banking solutions

Tailored Experiences: The suite allows banks to create customized offerings for businesses of all sizes, from large enterprises to small and medium businesses (SMBs).

Digital Transformation: Finacle empowers banks to embrace digital technologies, providing features like:

Real-time dashboards for consolidated financial views

Multi-bank reporting and cash management capabilities

Open APIs for seamless integration with external systems

Blockchain-powered solutions for payments and trade finance

Benefits for Corporate Banks:

Increased Efficiency: Automated processes and centralized operations lead to improved efficiency and reduced costs.

Enhanced Customer Service: The suite facilitates faster turnaround times, improved transparency, and a more convenient banking experience for corporate clients.

Revenue Growth: By offering innovative solutions and a superior customer experience, banks can attract new clients and foster deeper relationships with existing ones.

Innovation: The open architecture and API capabilities enable banks to continuously innovate and adapt their offerings to meet the evolving needs of corporate clients.

Overall, Finacle Corporate Banking Suite empowers corporate banks to:

Reimagine their business model: By leveraging digital technologies, banks can create a more agile and customer-centric approach to corporate banking.

Drive growth: The suite equips banks with the tools to attract new clients, expand existing relationships, and generate new revenue streams.

Stay ahead of the curve: Finacle's focus on innovation ensures banks can adapt to the ever-changing demands of the corporate banking landscape.

#Corporate Banking Products#Commercial Banking Platform#corporate internet banking software#commercial banking software#business banking platform#Corporate Banking Services

0 notes

Text

In today's digital age, convenience and accessibility are paramount, especially when it comes to managing finances. This is where Finacle Online Banking, a solution offered by EdgeVerve, comes into play.

Benefits for Banks:

Enhanced Customer Engagement: Finacle Online Banking offers comprehensive functionality and a tailored user interface, potentially catering to retail, SME, and corporate customers. This can lead to improved customer satisfaction and loyalty.

Streamlined Operations: The solution likely boasts features that automate processes and optimize workflows within the bank, improving operational efficiency and reducing costs.

Faster Product Rollout: The cloud-native architecture might enable banks to deploy and upgrade functionalities with greater flexibility, allowing them to adapt to changing market demands and customer needs.

Openness and Collaboration: An open architecture with APIs could potentially facilitate data exchange and integration with other banking systems, fostering a more collaborative environment.

Benefits for Customers:

Improved User Experience: A tailored user interface likely translates to a user-friendly and intuitive online banking experience.

Convenience and Accessibility: Customers can manage their finances from anywhere with an internet connection, 24/7. This includes activities like viewing account balances, transferring funds, making payments, and potentially even accessing investment options (depending on the bank's offerings).

Enhanced Security: Cloud-based solutions often incorporate robust security features to protect customer data and transactions.

Overall, Finacle Online Banking is a comprehensive solution designed to bridge the gap between banks and their customers in the digital age. By offering a user-friendly platform, streamlined operations, and growth potential.

#online banking solution#Internet Banking Software Solutions#Internet Banking Solution Providers#internet banking software#Cloud-native internet banking solution#internet banking application software

0 notes

Text

In the fast-paced world of finance, liquidity is king. For banks, maintaining optimal cash flow and short-term assets is crucial for meeting financial obligations and seizing profitable opportunities. This is where EdgeVerve's Finacle Liquidity Management Solution steps in, offering a comprehensive toolkit to empower banks with superior liquidity control.

Key Features and Benefits:

Enhanced Visibility: Gain a real-time, consolidated view of your cash positions across various accounts and currencies. No more scrambling for scattered data – the Finacle solution provides a holistic picture for informed decision-making.

Data-Driven Forecasting: Move beyond guesswork. Leverage robust forecasting tools to predict future cash flow needs based on historical data, trends, and market fluctuations. This proactive approach ensures you're prepared for both deficits and surpluses.

Streamlined Operations: Say goodbye to manual processes. The Finacle solution automates routine tasks like account reconciliation and cash flow management, freeing up valuable time and resources for strategic planning.

Optimized Investment Strategies: Maximize returns on surplus funds. The solution helps you identify the most suitable investment options based on your risk tolerance and liquidity requirements. This ensures you're not leaving idle cash on the table.

Strategic Borrowing: When faced with temporary cash shortfalls, the Finacle solution empowers you to make informed borrowing decisions. Analyze different borrowing options, considering interest rates and terms, to secure the most cost-effective funding.

Seamless Integration: The Finacle Liquidity Management Solution integrates seamlessly with your existing Finacle core banking system. This eliminates data silos and ensures a smooth flow of information for comprehensive control.

Overall Benefits for Banks:

Reduced Risk of Liquidity Shortfalls: By proactively managing cash flow, you can avoid situations where you're unable to meet your financial obligations.

Improved Profitability: Optimize investment strategies and minimize borrowing costs, leading to a healthier bottom line.

Enhanced Operational Efficiency: Streamlined processes and automation free up resources for strategic initiatives.

Data-Driven Decision Making: Make informed decisions backed by real-time data and accurate forecasts.

The Finacle Liquidity Management Solution positions itself as a valuable asset for banks seeking to:

Gain a competitive edge through superior liquidity management.

Navigate dynamic market conditions with confidence and agility.

Enhance financial stability and achieve long-term growth.

By investing in a robust liquidity management solution, banks can unlock a new level of control and navigate the ever-evolving financial landscape with greater certainty.

#cashmanagementsuite#cashmanagementsolutions#cash and liquidity management software#cash management platforms#cash and liquidity management platform#corporate liquidity management#liquidity management in banks#what is liquidity management

0 notes

Text

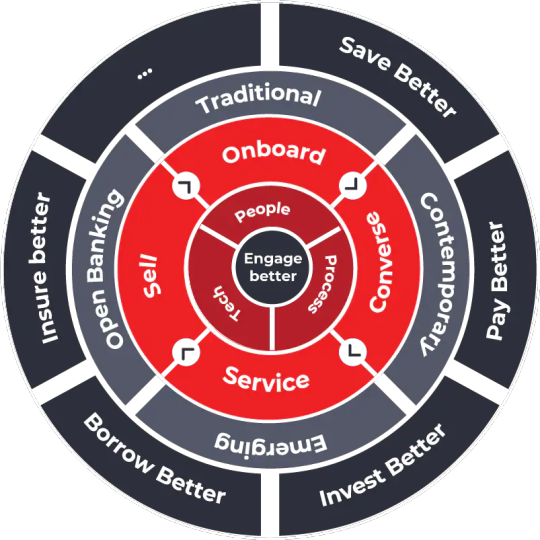

Finacle Digital Engagement Suite: Boosting Customer Experience in Banking

Empowering banks to deliver personalized experiences across all channels, Infosys's Finacle Digital Engagement Suite is an advanced omnichannel banking solution. This suite caters to retail, small, and corporate customers, aiming to improve onboarding, sales, service, and overall customer engagement.

Here's a breakdown of what the Finacle Digital Engagement Suite offers:

Omnichannel Experience: Customers can seamlessly interact with the bank through their preferred channels, be it mobile app, website, branch, or even ATMs. This ensures a consistent and convenient experience.

Personalized Engagement: The suite leverages customer data to deliver personalized recommendations and targeted content. Imagine a customer receiving loan options based on their financial profile!

Improved Customer Journeys: Whether it's onboarding a new customer or resolving an issue, the suite streamlines processes, making each touchpoint efficient and user-friendly.

Data-Driven Decisions: Banks gain valuable insights into customer behavior and preferences, allowing them to tailor their offerings and marketing strategies more effectively.

youtube

Benefits for Banks:

Increased Customer Satisfaction: Happy customers lead to brand loyalty and increased business.

Enhanced Sales and Revenue: Personalized recommendations can nudge customers towards relevant products and services.

Improved Operational Efficiency: Streamlined processes save time and resources for both customers and bank staff.

Data-Driven Growth: Customer insights empower banks to make informed decisions for future development.

Overall, the Finacle Digital Engagement Suite empowers banks to:

Become more customer-centric: By prioritizing convenience and personalization.

Stay competitive in the digital age: By offering innovative solutions that meet evolving customer expectations.

Drive business growth: Through increased customer engagement and satisfaction.

In conclusion, the Finacle Digital Engagement Suite by Infosys presents a compelling solution for banks seeking to elevate their digital presence and customer engagement. By offering a seamless omnichannel experience, personalized interactions, and data-driven insights, the suite empowers banks to:

Become customer champions: Prioritizing convenience and personalization to cultivate loyalty.

Thrive in the digital landscape: Offering cutting-edge solutions that meet ever-changing customer demands.

Fuel business growth: Through increased customer satisfaction and a data-driven approach to strategy.

If you're a bank striving to stay ahead of the curve and build stronger customer relationships, exploring the Finacle Digital Engagement Suite is a worthwhile step.

#Digital Banking Engagement Platform#Digital Customer Engagement Platform For Banks#Digital Engagement In Banking#Digital Banking Engagement Solutions#digitalbanking#Youtube

0 notes

Text

#digitalbanking#infosysfinacle#digitalbankingplatform#digitalbankingprocessing#corporate banking digital

0 notes

Text

Unlocking Efficiency with Core Banking Solutions: A Deep Dive into Infosys Finacle

Introduction

In the ever-evolving landscape of banking, technological advancements play a pivotal role in enhancing efficiency and customer satisfaction. One such technological marvel is the Core Banking Solution (CBS). In this article, we delve into the intricacies of CBS and explore how Infosys Finacle, a prominent player in the industry, is revolutionizing the banking experience.

What is Core Banking Solution?

Defining Core Banking

Core Banking Solution is the backbone of modern banking systems, providing a centralized platform for managing and processing transactions. It integrates various banking modules to streamline operations, enabling banks to offer a range of services seamlessly.

The Functionality of CBS

Infosys Finacle, a trailblazer in the fintech sector, has designed a comprehensive Core Banking Solution. It empowers banks with real-time processing capabilities, ensuring faster transactions, accurate record-keeping, and enhanced overall efficiency.

Advantages of Implementing CBS

1. Operational Efficiency

Implementing Infosys Finacle's Core Banking Solution results in a significant boost in operational efficiency. With centralized data management, banks can execute transactions promptly, reducing processing times and operational costs.

2. Customer-Centric Approach

CBS facilitates a customer-centric approach by providing a unified view of customer data. Infosys Finacle ensures that banks can personalize services, offer targeted products, and improve overall customer satisfaction.

3. Risk Mitigation

The robust architecture of Infosys Finacle's CBS contributes to effective risk management. Banks can monitor transactions in real-time, identify potential risks, and take proactive measures, thereby ensuring a secure banking environment.

Infosys Finacle: Transforming Banking Dynamics

The Evolution of Infosys Finacle

Founded on innovation and excellence, Infosys Finacle has emerged as a leader in providing cutting-edge banking solutions. Let's explore how this organization is transforming the banking landscape.

Collaborative Approach to Banking Solutions

1. Strategic Partnerships

Infosys Finacle believes in collaboration to drive innovation. By forming strategic partnerships with leading banks globally, the organization ensures a continuous exchange of ideas and expertise, fostering a culture of innovation and excellence.

2. Continuous Research and Development

In the fast-paced world of technology, Infosys Finacle stays ahead through continuous research and development. The organization invests heavily in R&D to adapt to emerging trends, ensuring that its Core Banking Solution remains at the forefront of technological advancements.

Unraveling the Core Banking Solution by Infosys Finacle

1. User-Friendly Interface

Infosys Finacle Core Banking Solution boasts a user-friendly interface, making it accessible to both customers and banking staff. The intuitive design enhances user experience, promoting seamless navigation and efficient use of the platform.

2. Scalability and Customization

One of the standout features of Infosys Finacle CBS is its scalability and customization options. Banks can tailor the solution to meet their specific needs, ensuring a flexible and adaptive system that aligns with the bank's unique requirements.

3. Integration Capabilities

Infosys Finacle understands the importance of integration in the modern banking landscape. The Core Banking Solution seamlessly integrates with various third-party applications and systems, enabling banks to create a comprehensive ecosystem that caters to diverse customer needs.

Navigating the Challenges of Implementing Core Banking Solutions

Addressing Common Concerns

While the benefits of Core Banking Solutions are evident, the implementation process comes with its own set of challenges. Infosys Finacle recognizes these challenges and offers solutions to ensure a smooth transition.

Overcoming Resistance to Change

1. Comprehensive Training Programs

Infosys Finacle provides comprehensive training programs for bank staff to familiarize them with the new Core Banking Solution. By addressing concerns and providing hands-on training, the organization helps in overcoming resistance to change.

2. Effective Change Management Strategies

Recognizing that change can be met with resistance, Infosys Finacle employs effective change management strategies. This involves clear communication, stakeholder involvement, and a phased approach to implementation, ensuring a gradual and well-managed transition.

Ensuring Data Security and Compliance

1. Robust Security Protocols

Infosys Finacle prioritizes data security and compliance. The Core Banking Solution incorporates robust security protocols to safeguard sensitive information, ensuring that banks and their customers can trust in the confidentiality and integrity of their data.

2. Adherence to Regulatory Standards

In an ever-changing regulatory landscape, Infosys Finacle ensures that its Core Banking Solution stays compliant with global and local regulatory standards. This commitment to compliance enhances the trust that banks and customers place in the platform.

The Future of Banking: A Digital Horizon

Embracing the Digital Transformation

As we look to the future, the role of Core Banking Solutions in the digital transformation of banking becomes increasingly evident. Infosys Finacle remains at the forefront, driving innovation and shaping the future of banking.

Predicting Future Trends

1. Artificial Intelligence Integration

Infosys Finacle is actively exploring the integration of artificial intelligence (AI) into its Core Banking Solution. This will bring forth advanced analytics, personalized banking experiences, and improved decision-making capabilities.

2. Blockchain Technology Adoption

Recognizing the potential of blockchain technology, Infosys Finacle is exploring its integration into the Core Banking Solution. This could revolutionize secure transactions, reduce fraud, and enhance transparency in banking operations.

Conclusion

In conclusion, Core Banking Solutions has become the cornerstone of modern banking, and Infosys Finacle stands as a beacon of innovation in this realm. The seamless integration, user-friendly interface, and commitment to security make Infosys Finacle's Core Banking Solution a game-changer. As the banking industry continues to evolve, embracing technological advancements, the partnership between banks and technology providers like Infosys Finacle will undoubtedly shape a future where banking is not just a service but a personalized, efficient, and secure experience for all.

#corebankingsolution#infosysfinacle#bankingindustry#blockchaintechnology#retailcorebanking#globalretailcorebanking

0 notes

Text

From Complexity to Simplicity: Simplifying Financial Management with Infosys Finacle Cash Management Suite

Simplify the complexities of financial management with Infosys Finacle Cash Management Suite. This article guides readers through the journey of transforming intricate financial processes into streamlined, user-friendly experiences, making it easier for businesses to manage their cash effectively.

#cashmanagementsuite#cashmanagementsolution#digitalcashmanagement#infosysfinacle#cashmanagementsolutionsbanking#cashmanagementsolutions#cashmanagementsolutionsvendors

0 notes

Text

Innovate Seamlessly: Embrace Digital Banking SaaS Today

Finacle Digital Banking SaaS offers a seamless pathway to innovation. Embrace the future of banking and stay ahead in today's dynamic landscape.

#infosysfinacle#digitalbankingsolutions#finacledigitalbanking#saasbankingsoftware#digitaltransformationsolution

0 notes

Text

Transforming Banking Futures: Unveiling Finacle Dynamic Service Portfolio

Transform your banking and finance operations with cutting-edge software solutions. Explore our comprehensive suite of services tailored for the banking and finance sector at Infosys Finacle. From core banking systems to digital transformation tools, our innovative software empowers financial institutions to drive efficiency, enhance customer experiences, and stay ahead in today's dynamic market. Unlock the potential of your institution with our banking and finance software solutions.

#infosysfinacle#bankingservices#bankingsoftware#bankingtechnology#banking and finance software#list of banking software companies

0 notes

Text

Navigating the Future: Unlocking Integrated Banking Solutions

Dive into a new era of financial innovation with our Integrated Banking Solutions. Picture a world where banking is not just a service but a personalized, seamless experience. Our approach combines advanced technology, robust security measures, and intuitive interfaces to bring you a comprehensive suite of banking solutions. From real-time transaction monitoring to intelligent financial planning tools, we've redefined the landscape of banking services. Whether you're an individual seeking a user-friendly banking app or a business in need of streamlined financial management, our integrated solutions cater to your unique needs.

Embrace the future of finance and enjoy the freedom to navigate, transact, and grow with confidence. Integrated Banking Solutions—it's not just banking; it's a financial evolution.

0 notes

Text

Revolutionizing Banking Experiences: Unleashing the Power of Infosys Finacle Digital Banking Platform

In the ever-evolving landscape of finance, embracing cutting-edge technologies is imperative, and at the forefront of this digital revolution stands Infosys Finacle, a trailblazer in providing a robust Digital Banking Platform. Designed to redefine the banking experience, Infosys Finacle's platform seamlessly integrates technology to empower financial institutions with innovative solutions.

Infosys Finacle's Digital Banking Platform serves as a comprehensive suite, addressing the dynamic needs of modern banking. It facilitates enhanced customer engagement through intuitive interfaces, personalized services, and real-time interactions. Leveraging advanced analytics, the platform empowers banks using Infosys Finacle to gain actionable insights into customer behavior, enabling targeted product offerings and strategic decision-making.

One hallmark of Infosys Finacle's platform is its agility in adapting to the rapidly changing financial services landscape. Whether it's facilitating secure mobile banking, enabling frictionless digital payments, or ensuring compliance with evolving regulations, Infosys Finacle stands as a stalwart ally for banks navigating the digital realm.

Moreover, Infosys Finacle's Digital Banking Platform goes beyond conventional banking, fostering financial inclusivity. With features like open APIs and modular architecture, it enables banks to seamlessly integrate with third-party services, creating an ecosystem that extends beyond traditional banking boundaries.

In essence, Infosys Finacle Digital Banking Platform is not merely a technological solution but a catalyst for transformation, enabling financial institutions to stay ahead in a digital era and deliver unparalleled customer experiences. As the financial landscape continues to evolve, Infosys Finacle remains committed to pioneering advancements that redefine the future of banking.

0 notes

Text

Cloud-Powered Revolution: Finacle on Cloud Unleashes Next-Gen Banking Transformation

Unlocking unparalleled efficiency and agility in banking operations, Infosys Finacle introduces "Finacle on Cloud" – a transformative solution that combines the power of cutting-edge banking technology with the flexibility of cloud computing. This innovative offering from Infosys Finacle redefines the banking landscape, empowering financial institutions to seamlessly migrate their core banking operations to the cloud.

Finacle on Cloud is a testament to Infosys Finacle's commitment to driving digital transformation in the financial sector. By harnessing the scalability and accessibility of cloud infrastructure, financial institutions can experience a paradigm shift in their operational dynamics. This solution enhances cost-effectiveness and ensures rapid deployment, enabling banks to stay ahead in today's dynamic market.

Infosys Finacle Finacle on Cloud is a comprehensive and secure platform, providing banks with the tools needed to adapt to evolving customer expectations. The cloud-based architecture facilitates real-time updates, robust security protocols, and unparalleled scalability, ensuring that financial institutions can navigate the complexities of the modern banking landscape with ease.

In embracing Finacle on Cloud, banks elevate their operational efficiency and position themselves at the forefront of technological innovation, reinforcing Infosys Finacle's reputation as a trailblazer in the financial technology domain.

0 notes